|

|

市場調査レポート

商品コード

1756518

ビルオートメーションシステムの世界市場:オファリング別、通信技術別、用途別、地域別 - 2030年までの予測Building Automation System Market by Facility Management Systems, Security & Access Control, Fire Protection Systems, Building Energy Management Software, Building Automation System Services, Residential, Industrial, Commercial - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ビルオートメーションシステムの世界市場:オファリング別、通信技術別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月20日

発行: MarketsandMarkets

ページ情報: 英文 273 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ビルオートメーションシステムの市場規模は、2025年に1,017億4,000万米ドルと評価され、2030年には1,911億3,000万米ドルに達すると予測されており、予測期間中のCAGRは13.4%と予測されています。

高度な監視技術と生体認証技術のニーズ、IoT技術とデータ分析のビルオートメーションシステムへの統合が、ビルオートメーションシステムの需要を促進する要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、通信技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

照明制御用の占有センサーセグメントは、予測期間中、ビルオートメーションシステム市場で最大の市場シェアを占めると予測されています。エネルギーコストの上昇と環境への懸念が、ビル管理者にエネルギー効率の高いソリューションの採用を促しており、占有センサーーは人の存在を検知することで不要な照明の使用を削減します。また、スマートビルやオートメーションシステムへの注目が高まっていることも需要を後押ししており、占有センサーーはHVACやセキュリティシステムとシームレスに統合され、性能を最適化します。さらに、エネルギー効率を向上させるために既存の建物を改修する傾向が強まっていることも、新旧両方の建物へのセンサー設置を後押ししています。

ビルオートメーションシステムにおける照明制御の業務用途の成長は、相互に関連する複数の要因によって推進されています。エネルギーコストの高騰により、企業は消費量と運用経費を削減するために照明制御を導入するようになります。居住者の快適性と生産性が重視されるようになったことで、居住者と昼光に合わせて調整する適応型照明の使用が推進されています。さらに、環境意識の高まりと企業の持続可能性目標が、環境に優しい照明制御への投資を企業に促し、最新の商業ビルオートメーションシステムにおける照明制御の役割を確固たるものにしています。

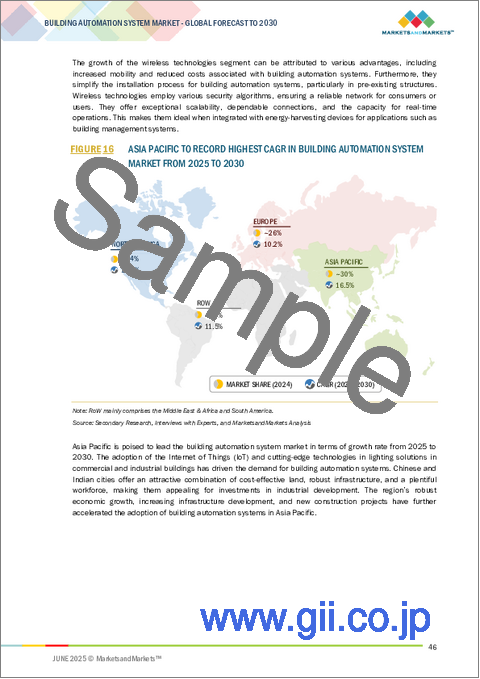

アジア太平洋のビルオートメーションシステム市場では、インドが予測期間中に最も高い成長率を記録します。インドにおけるビルオートメーションシステム(BAS)の成長は、急速な都市化、エネルギー需要の増加、建物の運用効率化ニーズの高まりによって推進されています。政府がスマートシティとインフラの近代化に力を入れていることから、エネルギー管理を強化し、環境への影響を低減する自動化システムの採用が強く支持されています。オフィス、モール、ホスピタリティを含むインドの商業不動産セクターは大幅に拡大しており、照明、HVAC、セキュリティの運用を最適化するインテリジェント・システムの需要を促進しています。

当レポートでは、世界のビルオートメーションシステムの市場について調査し、オファリング別、通信技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 特許分析

- 貿易分析

- 価格分析

- 関税と規制状況

- 2025年~2026年の主な会議とイベント

- AI/生成AIがビルオートメーションシステム市場に与える影響

- 2025年の米国関税がビルオートメーションシステム市場に与える影響

第6章 ビルオートメーションシステム市場(オファリング別)

- イントロダクション

- 施設管理システム

- セキュリティおよびアクセス制御システム

- 防火システム

- ビルエネルギー管理ソフトウェア

- BASサービス

- その他

第7章 ビルオートメーションシステム市場(通信技術別)

- イントロダクション

- 無線技術

- 有線技術

第8章 ビルオートメーションシステム市場(用途別)

- イントロダクション

- 住宅

- 商業

- 工業

第9章 ビルオートメーションシステム市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- JOHNSON CONTROLS

- SCHNEIDER ELECTRIC

- HONEYWELL INTERNATIONAL INC.

- SIEMENS

- CARRIER

- ROBERT BOSCH GMBH

- LEGRAND

- HUBBELL

- ABB

- TRANE TECHNOLOGIES PLC

- その他の企業

- LUTRON ELECTRONICS CO., INC.

- CRESTRON ELECTRONICS, INC.

- HITACHI, LTD.

- DELTA INTELLIGENT BUILDING TECHNOLOGIES(CANADA)INC.

- BECKHOFF AUTOMATION

- LENNOX INTERNATIONAL INC.

- HLI SOLUTIONS, INC.

- ACUITY INC.

- DIALIGHT

- CISCO SYSTEMS, INC.

- ROCKWELL AUTOMATION

- SNAP ONE, LLC

- SIGNIFY HOLDING

- EMERSON ELECTRICCO.

- LEVITON MANUFACTURING CO., INC.

- MITSUBISHI ELECTRIC CORPORATION

- HUAWEI TECHNOLOGIES CO., LTD.

- BEIJER ELECTRONICS

- BAJAJ ELECTRICALS INDIA

第12章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 BUILDING AUTOMATION SYSTEM MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 BUILDING AUTOMATION SYSTEM MARKET: RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN BUILDING AUTOMATION SYSTEM ECOSYSTEM

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 7 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 8 PATENTS APPLIED AND GRANTED, 2013-2022

- TABLE 9 TOP 20 PUBLISHED PATENT OWNERS, 2013-2022

- TABLE 10 IMPORT DATA FOR HS CODE 8415-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 8415-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 AVERAGE SELLING PRICE TREND OF FACILITY MANAGEMENT SYSTEMS OFFERED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 13 PRICING RANGE OF HVAC CONTROL SYSTEMS, BY REGION, 2024 (USD)

- TABLE 14 MFN TARIFF FOR HS CODE 8415-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 STANDARDS RELATED TO BUILDING AUTOMATION SYSTEMS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR BUILDING AUTOMATION SYSTEMS

- TABLE 22 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 23 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

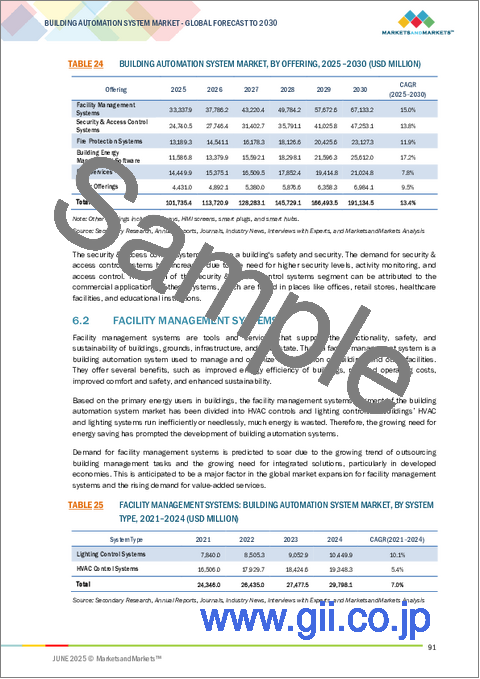

- TABLE 24 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 25 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 26 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 27 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 28 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 38 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 39 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR LIGHTING CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR LIGHTING CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR LIGHTING CONTROL SYSTEMS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR LIGHTING CONTROL SYSTEMS, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR HVAC CONTROL SYSTEMS, BY HVAC COMPONENT, 2021-2024 (USD MILLION)

- TABLE 44 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR HVAC CONTROL SYSTEMS, BY HVAC COMPONENT, 2025-2030 (USD MILLION)

- TABLE 45 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR HVAC CONTROL SYSTEMS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 FACILITY MANAGEMENT SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR HVAC CONTROL SYSTEMS, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 48 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 49 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 VIDEO SURVEILLANCE SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 VIDEO SURVEILLANCE SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 VIDEO SURVEILLANCE SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 VIDEO SURVEILLANCE SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION MARKET FOR HARDWARE, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 64 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION MARKET FOR HARDWARE, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 65 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR ACCESS CONTROL SYSTEMS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 66 SECURITY & ACCESS CONTROL SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR ACCESS CONTROL SYSTEMS, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 68 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 69 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 FIRE PROTECTION SYSTEMS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 80 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 BUILDING ENERGY MANAGEMENT SOFTWARE: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 BAS SERVICES: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 100 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 OTHER OFFERINGS: BUILDING AUTOMATION SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 BUILDING AUTOMATION SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 110 BUILDING AUTOMATION SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 111 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 112 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 114 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 115 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 116 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 117 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 118 RESIDENTIAL: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 120 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 121 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 122 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 123 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 COMMERCIAL: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 126 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 127 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 128 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 129 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 INDUSTRIAL: BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 145 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 148 ROW: BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 149 BUILDING AUTOMATION SYSTEM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, FEBRUARY 2021-MAY 2025

- TABLE 150 BUILDING AUTOMATION SYSTEM MARKET: DEGREE OF COMPETITION, 2024

- TABLE 151 BUILDING AUTOMATION SYSTEM MARKET: REGION FOOTPRINT

- TABLE 152 BUILDING AUTOMATION SYSTEM MARKET: OFFERING FOOTPRINT

- TABLE 153 COMMUNICATION TECHNOLOGY FOOTPRINT

- TABLE 154 BUILDING AUTOMATION SYSTEM MARKET: APPLICATION FOOTPRINT

- TABLE 155 BUILDING AUTOMATION SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 156 BUILDING AUTOMATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 157 BUILDING AUTOMATION SYSTEM MARKET: PRODUCT LAUNCHES, FEBRUARY 2021-MAY 2025

- TABLE 158 BUILDING AUTOMATION SYSTEM MARKET: DEALS, FEBRUARY 2021-MAY 2025

- TABLE 159 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 160 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 162 JOHNSON CONTROLS: DEALS

- TABLE 163 JOHNSON CONTROLS: EXPANSIONS

- TABLE 164 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 165 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 167 SCHNEIDER ELECTRIC: DEALS

- TABLE 168 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 169 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 170 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 171 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 173 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 174 SIEMENS: COMPANY OVERVIEW

- TABLE 175 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 SIEMENS: PRODUCT LAUNCHES

- TABLE 177 SIEMENS: DEALS

- TABLE 178 SIEMENS: OTHER DEVELOPMENTS

- TABLE 179 CARRIER: COMPANY OVERVIEW

- TABLE 180 CARRIER: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 181 CARRIER: PRODUCT LAUNCHES

- TABLE 182 CARRIER: DEALS

- TABLE 183 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 184 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ROBERT BOSCH GMBH: DEALS

- TABLE 186 LEGRAND: COMPANY OVERVIEW

- TABLE 187 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 LEGRAND: PRODUCT LAUNCHES

- TABLE 189 LEGRAND: DEALS

- TABLE 190 HUBBELL: COMPANY OVERVIEW

- TABLE 191 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 HUBBELL: PRODUCT LAUNCHES

- TABLE 193 HUBBELL: DEALS

- TABLE 194 ABB: COMPANY OVERVIEW

- TABLE 195 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 ABB: PRODUCT LAUNCHES

- TABLE 197 ABB: DEALS

- TABLE 198 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

- TABLE 199 TRANE TECHNOLOGIES PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 TRANE TECHNOLOGIES PLC: PRODUCT LAUNCHES

- TABLE 201 TRANE TECHNOLOGIES PLC: DEALS

List of Figures

- FIGURE 1 BUILDING AUTOMATION SYSTEM MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 BUILDING AUTOMATION SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY DATA FROM PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 SECONDARY AND PRIMARY RESEARCH

- FIGURE 8 BUILDING AUTOMATION SYSTEM MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

- FIGURE 9 BUILDING AUTOMATION SYSTEM MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (DEMAND SIDE)

- FIGURE 10 BUILDING AUTOMATION SYSTEM MARKET: BOTTOM-UP APPROACH

- FIGURE 11 BUILDING AUTOMATION SYSTEM MARKET: TOP-DOWN APPROACH

- FIGURE 12 BUILDING AUTOMATION SYSTEM MARKET: DATA TRIANGULATION

- FIGURE 13 FACILITY MANAGEMENT SYSTEMS TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 14 COMMERCIAL SEGMENT TO DOMINATE BUILDING AUTOMATION SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 15 WIRELESS TECHNOLOGIES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO RECORD HIGHEST CAGR IN BUILDING AUTOMATION SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 17 RISING FOCUS ON CONSTRUCTING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS TO FOSTER MARKET GROWTH

- FIGURE 18 HVAC CONTROL SYSTEMS SEGMENT TO HOLD LARGER SHARE OF MARKET FOR FACILITY MANAGEMENT SYSTEMS IN 2025

- FIGURE 19 ACCESS CONTROL SYSTEMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 20 INDIA TO EXHIBIT HIGHEST CAGR IN BUILDING AUTOMATION SYSTEM MARKET BETWEEN 2025 AND 2030

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 IMPACT ANALYSIS: DRIVERS

- FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 25 IMPACT ANALYSIS: CHALLENGES

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 32 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 33 PATENTS APPLIED AND ISSUED, 2013-2022

- FIGURE 34 NUMBER OF PATENTS PUBLISHED EACH YEAR, 2013-2022

- FIGURE 35 JURISDICTION ANALYSIS, 2013-2022

- FIGURE 36 TOP 10 PATENT OWNERS, 2013-2022

- FIGURE 37 IMPORT DATA FOR HS CODE 8415-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 38 EXPORT DATA FOR HS CODE 8415-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 AVERAGE SELLING PRICE OF FACILITY MANAGEMENT SYSTEMS OFFERED BY KEY PLAYERS, BY SYSTEM TYPE, 2024

- FIGURE 40 IMPACT OF AI/GEN AI ON BUILDING AUTOMATION SYSTEM MARKET

- FIGURE 41 FACILITY MANAGEMENT SYSTEMS TO DOMINATE BUILDING AUTOMATION SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 42 WIRELESS TECHNOLOGIES SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 43 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 44 BUILDING ENERGY MANAGEMENT SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FOR INDUSTRIAL DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO CAPTURE LARGEST SHARE OF BUILDING AUTOMATION SYSTEM MARKET IN 2030

- FIGURE 46 NORTH AMERICA: BUILDING AUTOMATION SYSTEM MARKET SNAPSHOT

- FIGURE 47 EUROPE: BUILDING AUTOMATION SYSTEM MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: BUILDING AUTOMATION SYSTEM MARKET SNAPSHOT

- FIGURE 49 INDIA TO REGISTER HIGHEST CAGR IN ASIA PACIFIC BUILDING AUTOMATION SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 50 SOUTH AMERICA TO REGISTER HIGHER CAGR IN ROW BUILDING AUTOMATION SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 51 MARKET SHARE ANALYSIS OF COMPANIES OFFERING BUILDING AUTOMATION SYSTEMS, 2024

- FIGURE 52 BUILDING AUTOMATION SYSTEM MARKET: REVENUE ANALYSIS OF FIVE KEY COMPANIES, 2020-2024

- FIGURE 53 BUILDING AUTOMATION SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 BUILDING AUTOMATION SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 55 BUILDING AUTOMATION SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 57 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 59 SIEMENS: COMPANY SNAPSHOT

- FIGURE 60 CARRIER: COMPANY SNAPSHOT

- FIGURE 61 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 62 LEGRAND: COMPANY SNAPSHOT

- FIGURE 63 HUBBELL: COMPANY SNAPSHOT

- FIGURE 64 ABB: COMPANY SNAPSHOT

- FIGURE 65 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

The building automation system market was valued at USD 101.74 billion in 2025 and is projected to reach USD 191.13 billion by 2030; it is expected to register a CAGR of 13.4% during the forecast period. The need for advanced surveillance and biometric technologies and the integration of IoT technologies and data analytics into building automation systems are the factors driving the demand for building automation systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By connectivity, offering, application, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Occupancy sensors segment for lighting controls is expected to hold a significant share of the building automation system market during the forecast period."

The occupancy sensors segment for lighting controls is accounted to hold the largest market share of the building automation system market during the forecast period. Rising energy costs and environmental concerns push building managers to adopt energy-efficient solutions, with occupancy sensors reducing unnecessary lighting usage by detecting human presence. The increasing focus on smart buildings and automation systems supports demand, as occupancy sensors integrate seamlessly with HVAC and security systems for optimized performance. Additionally, the growing trend of retrofitting existing buildings to improve energy efficiency drives sensor installations in both new and old structures.

"Commercial application segment for lighting controls is expected to hold a significant share in the building automation system market during the forecast period."

The growth of commercial applications for lighting controls in building automation systems is propelled by multiple interconnected factors. Escalating energy costs drive businesses to implement lighting controls to reduce consumption and operational expenses. Growing emphasis on occupant comfort and productivity drives the use of adaptive lighting that adjusts to occupancy and daylight. Additionally, heightened environmental awareness and corporate sustainability goals encourage companies to invest in eco-friendly lighting controls, solidifying their role in modern commercial building automation systems.

"India is expected to grow at the highest CAGR during the forecast period."

India will register the highest growth rate in the building automation system market for the Asia Pacific region in the forecasted year. The growth of building automation systems (BAS) in India is being propelled by rapid urbanization, increasing energy demand, and the rising need for operational efficiency in buildings. With the government's focus on smart cities and infrastructure modernization, there is strong support for adopting automated systems that enhance energy management and reduce environmental impact. India's commercial real estate sector, including offices, malls, and hospitality, is expanding significantly, driving the demand for intelligent systems to optimize lighting, HVAC, and security operations.

Extensive primary interviews were conducted with key industry experts in the building automation system market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 30%, Tier 2 - 50%, Tier 3 - 20%

- By Designation- C-level Executives - 25%, Directors - 35%, Others - 20%

- By Region - North America - 35%, Asia Pacific - 25%, Europe - 30%, RoW - 10%

The building automation system market is dominated by a few globally established players, such as Kapsch Honeywell International Inc. (US), Carrier (US), Siemens (Germany), Johnson Controls (US), and Schneider Electric (France).

The study includes an in-depth competitive analysis of these key players in the building automation system market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the building automation system market and forecasts its size by application (residential, commercial, industrial), offering (Facility Management Systems, Security & Access Control, Fire Protection Systems, Building Energy Management Software, BAS Services, and Other Offerings), connectivity (Wired Technologies, Wireless Technologies). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across regions (North America, Europe, Asia Pacific, RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the building automation system ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (High emphasis on constructing energy-efficient buildings, incorporation of advanced surveillance and biometric technologies into building automation systems, integration of IoT technologies and data analytics into building automation systems, development of wireless protocols and wireless sensor network technology for building automation systems, growing need to enhance occupant comfort, productivity, security, and safety in residential, commercial, and industrial sectors ), restraint (technical complexities associated with installation and maintenance and shortage of skilled professionals, difficulties in customizing building automation systems), opportunities (Increasing investments by governments and various stakeholders in establishment of smart cities, government-led initiatives to enhance energy efficiency and comply with green building standards, integration of building automation systems with renewable energy sources), challenges (Lack of standardized communication protocols, need to keep systems up-to-date with rapid technological advancements)

- Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product launches in the building automation system market

- Market Development: Comprehensive information about lucrative markets - the report analyses the building automation system market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the building automation system market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Honeywell International Inc. (US), Carrier (US), Siemens (Germany), Johnson Controls (US), and Schneider Electric (France) among others in the building automation system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BUILDING AUTOMATION SYSTEM MARKET

- 4.2 BUILDING AUTOMATION SYSTEM MARKET FOR FACILITY MANAGEMENT SYSTEMS, BY SYSTEM TYPE

- 4.3 BUILDING AUTOMATION SYSTEM MARKET FOR SECURITY & ACCESS CONTROL SYSTEMS, BY SYSTEM TYPE

- 4.4 BUILDING AUTOMATION SYSTEM MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High emphasis on constructing energy-efficient buildings

- 5.2.1.2 Incorporation of advanced surveillance and biometric technologies into building automation systems

- 5.2.1.3 Integration of IoT technologies and data analytics into building automation systems

- 5.2.1.4 Development of wireless protocols and wireless sensor network technology for building automation systems

- 5.2.1.5 Growing need to enhance occupant comfort, productivity, security, and safety in residential, commercial, and industrial sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical complexities associated with installation and maintenance and shortage of skilled professionals

- 5.2.2.2 Difficulties in customizing building automation systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments by governments and various stakeholders in establishment of smart cities

- 5.2.3.2 Government-led initiatives to enhance energy efficiency and comply with green building standards

- 5.2.3.3 Integration of building automation systems with renewable energy sources

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized communication protocols

- 5.2.4.2 Need to keep systems up-to-date with rapid technological advancements

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 AI-driven analytics

- 5.6.1.2 Digital twin technology in building automation

- 5.6.1.3 IP-based building automation systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Cloud-based fire protection systems

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Thermal cameras in access control systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.2 THREAT OF NEW ENTRANTS

- 5.7.3 THREAT OF SUBSTITUTES

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 BARGAINING POWER OF SUPPLIERS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 KEY BUYING CRITERIA

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 IVY LEAGUE UNIVERSITY PARTNERED WITH BUILDINGS IOT TO INSTALL LEGACY BUILDING SYSTEMS

- 5.9.2 SANTA CLARA-BASED SOFTWARE COMPANY PARTNERED WITH BUILDINGS IOT TO INCREASE OPERATIONAL EFFICIENCY

- 5.9.3 HIPPODROME PARIS-LONGCHAMP UTILIZED LOYTEC'S LDALI-ME204-U DALI CONTROLLERS TO STREAMLINE LIGHTING CONTROL AND ENHANCE EFFICIENCY

- 5.10 PATENT ANALYSIS

- 5.10.1 DOCUMENT TYPE

- 5.10.2 PUBLICATION TREND

- 5.10.3 JURISDICTION ANALYSIS

- 5.10.4 TOP PATENT OWNERS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 8415)

- 5.11.2 EXPORT SCENARIO (HS CODE 8415)

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF FACILITY MANAGEMENT SYSTEMS OFFERED BY KEY PLAYERS, BY SYSTEM TYPE, 2024

- 5.12.2 PRICING RANGE OF HVAC CONTROL SYSTEMS, BY REGION, 2024

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGIONAL REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF AI/GEN AI ON BUILDING AUTOMATION SYSTEM MARKET

- 5.16 IMPACT OF 2025 US TARIFF ON BUILDING AUTOMATION SYSTEM MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATIONS

- 5.16.5.1 Residential

- 5.16.5.2 Commercial

- 5.16.5.3 Industrial

6 BUILDING AUTOMATION SYSTEM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 FACILITY MANAGEMENT SYSTEMS

- 6.2.1 LIGHTING CONTROL SYSTEMS

- 6.2.1.1 Occupancy sensors

- 6.2.1.1.1 Low energy usage and enhanced lighting control features to foster segmental growth

- 6.2.1.2 Daylight sensors

- 6.2.1.2.1 Reduction in intensity of artificial lighting to accelerate segmental growth

- 6.2.1.3 Relays

- 6.2.1.3.1 Use to control multiple lighting groups with single control signal to drive market

- 6.2.1.4 Timers

- 6.2.1.4.1 Efficient operation and automation attributes to contribute to segmental growth

- 6.2.1.5 Dimming actuators

- 6.2.1.5.1 Ability to prolong life of lighting sources and provide flexible lighting to spur demand

- 6.2.1.6 Switch actuators

- 6.2.1.6.1 Energy conservation or emergency illumination attributes to boost segmental growth

- 6.2.1.7 Blind/Shutter actuators

- 6.2.1.7.1 Adoption to control daylight levels and regulate temperature to fuel segmental growth

- 6.2.1.8 Transmitters

- 6.2.1.8.1 Use to help electronic equipment communicate in lighting control systems to expedite segmental growth

- 6.2.1.9 Receivers

- 6.2.1.9.1 Ability to control motors, fans, and other lighting devices to bolster segmental growth

- 6.2.1.1 Occupancy sensors

- 6.2.2 HVAC CONTROL SYSTEMS

- 6.2.2.1 Sensors

- 6.2.2.1.1 Rising adoption to ensure efficient operation of HVAC systems to drive market

- 6.2.2.2 Smart thermostats

- 6.2.2.2.1 Increasing use to sense and regulate temperature at desired level to contribute to segmental growth

- 6.2.2.3 Control valves

- 6.2.2.3.1 Ability to regulate the fluid flow in HVAC systems to accelerate segmental growth

- 6.2.2.3.2 Three-way valves

- 6.2.2.4 Heating & cooling coils

- 6.2.2.4.1 Rising adoption to maintain temperature depending on system specifications to drive market

- 6.2.2.5 Dampers

- 6.2.2.5.1 Ability to regulate flow of hot or cold air in HVAC systems to contribute to segmental growth

- 6.2.2.5.2 Low-leakage dampers

- 6.2.2.5.3 Parallel- and opposed-blade dampers

- 6.2.2.5.4 Round dampers

- 6.2.2.6 Actuators

- 6.2.2.6.1 Use as conduit between HVAC controls and mechanical systems to foster segmental growth

- 6.2.2.6.2 Hydraulic

- 6.2.2.6.3 Pneumatic

- 6.2.2.6.4 Electric

- 6.2.2.7 Pumps & fans

- 6.2.2.7.1 Ability to cater to efficiency and energy-saving needs to boost segmental growth

- 6.2.2.8 Smart vents

- 6.2.2.8.1 Focus on maintaining balance between energy efficiency and comfort by sensing temperature and humidity to drive market

- 6.2.2.1 Sensors

- 6.2.1 LIGHTING CONTROL SYSTEMS

- 6.3 SECURITY AND ACCESS CONTROL SYSTEMS

- 6.3.1 VIDEO SURVEILLANCE SYSTEMS

- 6.3.1.1 Hardware

- 6.3.1.1.1 Cameras

- 6.3.1.1.1.1 Rising focus on detecting infrared energy and capturing HD videos to bolster segmental growth

- 6.3.1.1.2 Monitors

- 6.3.1.1.2.1 Growing emphasis on providing excellent image quality, minimal battery consumption, and portability to drive market

- 6.3.1.1.3 Storage systems

- 6.3.1.1.3.1 Increasing development of products capable of handling multiple video surveillance streams to fuel segmental growth

- 6.3.1.1.4 Accessories

- 6.3.1.1.4.1 Ability to link different devices and elevate video surveillance functionalities to augment segmental growth

- 6.3.1.1.1 Cameras

- 6.3.1.2 Software/Video analytics

- 6.3.1.2.1 Optimization of security operations and analysis of extensive video footage to expedite segmental growth

- 6.3.1.3 Services

- 6.3.1.3.1 High remote access to video surveillance systems with emergence of IoT to boost segmental growth

- 6.3.1.1 Hardware

- 6.3.2 ACCESS CONTROL SYSTEMS

- 6.3.2.1 Enhanced security through user identification based on unique physiological or behavioral traits to drive market

- 6.3.1 VIDEO SURVEILLANCE SYSTEMS

- 6.4 FIRE PROTECTION SYSTEMS

- 6.4.1 SENSORS & DETECTORS

- 6.4.1.1 Use to detect fire incidents at initial stages to accelerate segmental growth

- 6.4.1.1.1 Smoke detectors

- 6.4.1.1.2 Flame detectors

- 6.4.1.1.3 Others

- 6.4.1.1 Use to detect fire incidents at initial stages to accelerate segmental growth

- 6.4.2 FIRE SPRINKLERS

- 6.4.2.1 Ability to provide automatic fire suppression and enhance safety to fuel segmental growth

- 6.4.3 FIRE ALARMS

- 6.4.3.1 Adoption to warn occupants about occurrence of fire breakouts to contribute to segmental growth

- 6.4.4 EMERGENCY LIGHTING, VOICE EVACUATION & PUBLIC ALERT DEVICES

- 6.4.4.1 Focus on ensuring safety by providing illumination, instructions, and timely alerts during critical situations to drive market

- 6.4.1 SENSORS & DETECTORS

- 6.5 BUILDING ENERGY MANAGEMENT SOFTWARE

- 6.5.1 OPTIMIZATION OF ENERGY CONSUMPTION AND REDUCTION OF COSTS TO BOOST DEMAND

- 6.6 BAS SERVICES

- 6.6.1 WIDESPREAD AVAILABILITY OF SERVICE PROVIDERS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.6.2 INSTALLATION & MAINTENANCE

- 6.6.3 TRAINING

- 6.7 OTHER OFFERINGS

7 BUILDING AUTOMATION SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 WIRELESS TECHNOLOGIES

- 7.2.1 NEED FOR IDEAL RETROFIT-FRIENDLY SOLUTIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.2.2 ZIGBEE

- 7.2.3 ENOCEAN

- 7.2.4 Z-WAVE

- 7.2.5 WI-FI

- 7.2.6 BLUETOOTH

- 7.2.7 THREAD

- 7.2.8 INFRARED

- 7.3 WIRED TECHNOLOGIES

- 7.3.1 IDEAL FOR COMMERCIAL AND RESIDENTIAL APPLICATIONS DUE TO LOW POWER CONSUMPTION AND COSTS TO SPUR DEMAND

- 7.3.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

- 7.3.3 KONNEX (KNX)

- 7.3.4 LONWORKS

- 7.3.5 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

- 7.3.6 MODBUS

8 BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 RISING NUMBER OF INTERNET OF THINGS (IOT)-EQUIPPED SMART HOMES TO DRIVE MARKET

- 8.2.2 DIY HOME AUTOMATION

- 8.3 COMMERCIAL

- 8.3.1 RISING DEMAND FOR ENERGY EFFICIENCY AND SMART INFRASTRUCTURE TO BOOST SEGMENTAL GROWTH

- 8.3.2 OFFICE BUILDINGS

- 8.3.3 RETAIL & PUBLIC ASSEMBLY BUILDINGS

- 8.3.4 HOSPITALS & HEALTHCARE FACILITIES

- 8.3.5 AIRPORTS & RAILWAY STATIONS

- 8.4 INDUSTRIAL

- 8.4.1 INCREASING FOCUS ON ACHIEVING ENERGY AND COST SAVINGS TO AUGMENT SEGMENTAL GROWTH

9 BUILDING AUTOMATION SYSTEM MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Government-led initiatives aimed at conserving energy and reducing operational expenses to drive market

- 9.2.2 CANADA

- 9.2.2.1 Strong commitment to transition toward low-carbon economy to bolster market growth

- 9.2.3 MEXICO

- 9.2.3.1 Growing emphasis on constructing environmentally friendly buildings to fuel market growth

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 UK

- 9.3.1.1 Technological advancements and rising infrastructure development to bolster market growth

- 9.3.2 GERMANY

- 9.3.2.1 Presence of energy efficiency regulations and increasing demand for HVAC and lighting control systems to augment market growth

- 9.3.3 FRANCE

- 9.3.3.1 Need to adhere to regulatory compliance and energy efficiency initiatives to expedite market growth

- 9.3.4 ITALY

- 9.3.4.1 Heightened demand for building automation systems in commercial and healthcare facilities to fuel market growth

- 9.3.5 REST OF EUROPE

- 9.3.1 UK

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Rapid urbanization, economic growth, and development of smart cities to boost market growth

- 9.4.2 JAPAN

- 9.4.2.1 Commitment to sustainability and presence of strict environmental regulations to foster market growth

- 9.4.3 INDIA

- 9.4.3.1 Growing adoption in commercial and industrial sectors and surge in construction activities to augment market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Increasing emphasis on energy conservation and initiatives to promote building automation systems to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 ROW

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Increased construction activities and need for energy-efficient building solutions to fuel market growth

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Rapid urbanization and increasing construction activities to expedite market growth

- 9.5.1 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Offering footprint

- 10.5.5.4 Communication technology footprint

- 10.5.5.5 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 JOHNSON CONTROLS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 SCHNEIDER ELECTRIC

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product Launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 HONEYWELL INTERNATIONAL INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 SIEMENS

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 CARRIER

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 ROBERT BOSCH GMBH

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 LEGRAND

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 HUBBELL

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.9 ABB

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 TRANE TECHNOLOGIES PLC

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.1 JOHNSON CONTROLS

- 11.2 OTHER PLAYERS

- 11.2.1 LUTRON ELECTRONICS CO., INC.

- 11.2.2 CRESTRON ELECTRONICS, INC.

- 11.2.3 HITACHI, LTD.

- 11.2.4 DELTA INTELLIGENT BUILDING TECHNOLOGIES (CANADA) INC.

- 11.2.5 BECKHOFF AUTOMATION

- 11.2.6 LENNOX INTERNATIONAL INC.

- 11.2.7 HLI SOLUTIONS, INC.

- 11.2.8 ACUITY INC.

- 11.2.9 DIALIGHT

- 11.2.10 CISCO SYSTEMS, INC.

- 11.2.11 ROCKWELL AUTOMATION

- 11.2.12 SNAP ONE, LLC

- 11.2.13 SIGNIFY HOLDING

- 11.2.14 EMERSON ELECTRICCO.

- 11.2.15 LEVITON MANUFACTURING CO., INC.

- 11.2.16 MITSUBISHI ELECTRIC CORPORATION

- 11.2.17 HUAWEI TECHNOLOGIES CO., LTD.

- 11.2.18 BEIJER ELECTRONICS

- 11.2.19 BAJAJ ELECTRICALS INDIA

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS