|

|

市場調査レポート

商品コード

1642245

超音波市場:技術別、ディスプレイ別、携帯性別、用途別、コンポーネント別、エンドユーザー別、地域別 - 2030年までの予測Ultrasound Market by Technology (2D,3D,Doppler,CEU,HIFU, ESWL), Display (Colour, B/W), Portability (Trolly, Compact,POC), Component (Linear, Phased array, Workstation), Application (OB/GYN, Cardiology, Ortho), Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 超音波市場:技術別、ディスプレイ別、携帯性別、用途別、コンポーネント別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年01月22日

発行: MarketsandMarkets

ページ情報: 英文 420 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の超音波の市場規模は、2024年の93億2,000万米ドルから2030年には138億7,000万米ドルに達し、予測期間中のCAGRは6.8%で成長すると予測されています。

超音波市場の成長は、心血管疾患、がん、筋骨格系障害などの慢性疾患の有病率の上昇など、さまざまな主要な要因によってもたらされます。これらは高度な診断装置を必要とします。早期診断や非侵襲的な選択肢に対する需要の高まりも、超音波技術の採用を後押ししています。AIの統合、3D/4Dイメージング、ポータブル機器など、超音波自体の進歩により、臨床現場においてより身近で汎用性の高いものとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | ディスプレイ別、携帯性別、用途別、コンポーネント別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東&アフリカ |

診断用超音波が超音波市場で最大のシェアを占めるのは、幅広い病状に対してリアルタイムで非侵襲的なイメージングを提供できるからです。産科、心臓病学、筋骨格系イメージング、救急医療など幅広い用途で使用されていることが、その優位性に寄与しています。この技術により、精度が高く、コストが非常に低く、電離放射線を使用しないため、臨床医は日常的な診断にこの技術を使用することが多いです。例えば、改良された超音波技術-3D/4DイメージングやAIベースのツールは、この用途が成長軌道を維持していることを非常に改善しています。

病院は、患者数が多く、診療科が多様化していることに加え、幅広い専門領域の中で高度な画像診断が要求されるため、この超音波業界で最大の市場シェアを占めています。産科、循環器科、救急医療、筋骨格系の画像診断は、超音波技術を統合した病院内での主要な用途です。慢性疾患の増加や、早期診断・早期治療が重視される病院では、超音波診断装置の需要が高まっています。さらに重要なことは、リアルタイムイメージング、非侵襲性、精度の向上といった超音波の高度な機能性が、病院にとって超音波技術の重要性を高め、超音波技術の主要な消費者となっていることです。

アジア太平洋は、慢性疾患人口の増加、高齢化、ヘルスケアインフラ基盤の拡大などの要因により、超音波市場で最も高い成長率を報告しています。早期かつ正確な診断に対する需要の高まりは、超音波の手頃な価格と非侵襲的な性質と相まって、この地域全体での採用をさらに増加させています。さらに、ヘルスケア市場拡大への政府の取り組み、医療への投資の増加、診断センターの拡張、病院数の増加が、アジア太平洋におけるこの市場の急成長を牽引しています。技術の進歩やポータブル超音波診断装置の普及により、アジア太平洋ではより幅広いアクセスや導入が容易になっています。

当レポートでは、世界の超音波市場について調査し、ディスプレイ別、携帯性別、用途別、コンポーネント別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 特許分析

- 貿易データ分析

- 2024年~2025年の主な会議とイベント

- アンメットニーズと主な問題点

- エコシステム分析

- 生成AIが超音波市場に与える影響

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ケーススタディ分析

- 規制分析

- 投資と資金調達のシナリオ

- 価格分析

- 償還シナリオ

第6章 超音波市場、技術別

- イントロダクション

- 診断用超音波

- 治療用超音波

第7章 超音波市場、ディスプレイ別

- イントロダクション

- カラー超音波

- 白黒超音波

第8章 超音波市場、携帯性別

- イントロダクション

- トロリー/カート型超音波システム

- コンパクト/ハンドヘルド超音波システム

- POC超音波装置

第9章 超音波市場、用途別

- イントロダクション

- 放射線科/一般画像診断

- 心臓病学

- 産婦人科

- 泌尿器科

- 血管

- 整形外科および筋骨格

- 疼痛管理

- 小児科

- その他

第10章 超音波市場、コンポーネント別

- イントロダクション

- トランスデューサー/プローブ

- ワークステーション

- その他

第11章 超音波市場、エンドユーザー別

- イントロダクション

- 病院、外科センター、診断センター

- 産科センター

- 外来センター

- 調査・学術機関

- その他

第12章 超音波市場、地域別

- イントロダクション

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 質の高いヘルスケアシステムの成長が市場を牽引

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:診断用超音波市場(主要企業)、2023年

- 企業評価マトリックス:治療用超音波市場(スタートアップ/中小企業)、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- GE HEALTHCARE

- PHILIPS HEALTHCARE

- CANON MEDICAL SYSTEMS CORPORATION

- SIEMENS HEALTHINEERS AG

- FUJIFILM CORPORATION

- HOLOGIC, INC.

- SAMSUNG ELECTRONICS CO., LTD.

- MINDRAY MEDICAL INTERNATIONAL LIMITED

- ESAOTE SPA

- CHISON MEDICAL TECHNOLOGIES CO., LTD.

- NEUSOFT MEDICAL SYSTEMS CO., LTD.

- KONICA MINOLTA, INC

- CLARIUS

- MEDGYN PRODUCTS, INC.

- PROMED TECHNOLOGY CO., LTD.

- その他の企業

- WHITE EAGLE SONIC TECHNOLOGIES, INC.

- SHENZHEN RICSO TECHNOLOGY CO., LTD.

- YOUKEY MEDICAL

- SIUI

- TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING

- BUTTERFLY NETWORK, INC.

- ALPINION MEDICAL SYSTEMS

- EDAN INSTRUMENTS, INC.

- SHENZHEN LANDWIND INDUSTRY CO., LTD.

- ECHONOUS INC.

- MOBISANTE, INC.

- SHENZHEN WISONIC MEDICAL TECHNOLOGY CO., LTD.

- SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT CO., LTD.

- SONOSCAPE MEDICAL CORP.

- CURA HEALTHCARE

第15章 付録

List of Tables

- TABLE 1 ULTRASOUND MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 RECENT PRODUCT LAUNCHES IN ULTRASOUND MARKET

- TABLE 4 COMPARISON BETWEEN AVERAGE SELLING PRICE OF ULTRASOUND AND REFURBISHED MEDICAL EQUIPMENT

- TABLE 5 ULTRASOUND MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 7 KEY BUYING CRITERIA, BY END USER

- TABLE 8 LIST OF MAJOR PATENT INNOVATIONS AND PATENT REGISTRATIONS, 2022-2024

- TABLE 9 IMPORT DATA FOR HS CODE 9018, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 9018, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 ULTRASOUND MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 12 ULTRASOUND MARKET: CURRENT UNMET NEEDS

- TABLE 13 ULTRASOUND MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 14 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 15 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 16 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 17 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 18 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 AVERAGE SELLING PRICE OF ULTRASOUND, BY REGION, 2021-2023 (USD THOUSAND)

- TABLE 25 AVERAGE SELLING PRICE OF TOP 3 APPLICATIONS, BY KEY PLAYER, 2023 (USD)

- TABLE 26 US: MAJOR CPT CODES FOR ULTRASOUND, 2023

- TABLE 27 ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 28 DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 29 DIAGNOSTIC ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: DIAGNOSTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 31 EUROPE: DIAGNOSTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: DIAGNOSTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 33 LATIN AMERICA: DIAGNOSTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 34 MIDDLE EAST & AFRICA: DIAGNOSTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 35 2D ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: 2D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 37 EUROPE: 2D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: 2D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 39 LATIN AMERICA: 2D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 40 MIDDLE EAST & AFRICA: 2D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 41 3D & 4D ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: 3D & 4D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 43 EUROPE: 3D & 4D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: 3D & 4D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 45 LATIN AMERICA: 3D & 4D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 46 MIDDLE EAST & AFRICA: 3D & 4D ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 47 DOPPLER ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: DOPPLER ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 49 EUROPE: DOPPLER ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: DOPPLER ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 51 LATIN AMERICA: DOPPLER ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 52 MIDDLE EAST & AFRICA: DOPPLER ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 53 CONTRAST-ENHANCED ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: CONTRAST-ENHANCED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 55 EUROPE: CONTRAST-ENHANCED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: CONTRAST-ENHANCED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 57 LATIN AMERICA: CONTRAST-ENHANCED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 58 MIDDLE EAST & AFRICA: CONTRAST-ENHANCED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 59 THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 60 THERAPEUTIC ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: THERAPEUTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 62 EUROPE: THERAPEUTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: THERAPEUTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 64 LATIN AMERICA: THERAPEUTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: THERAPEUTIC ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 66 HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 68 EUROPE: HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 70 LATIN AMERICA: HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 72 EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 74 EUROPE: EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 76 LATIN AMERICA: EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 77 MIDDLE EAST & AFRICA: EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 78 ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 79 ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (UNITS)

- TABLE 80 COLOR ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 81 COLOR ULTRASOUND MARKET, BY REGION, 2022-2030 (UNITS)

- TABLE 82 NORTH AMERICA: COLOR ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 83 EUROPE: COLOR ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: COLOR ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 85 LATIN AMERICA: COLOR ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: COLOR ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 87 BLACK & WHITE ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 88 BLACK & WHITE ULTRASOUND MARKET, BY REGION, 2022-2030 (UNITS)

- TABLE 89 NORTH AMERICA: BLACK & WHITE ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 90 EUROPE: BLACK & WHITE ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

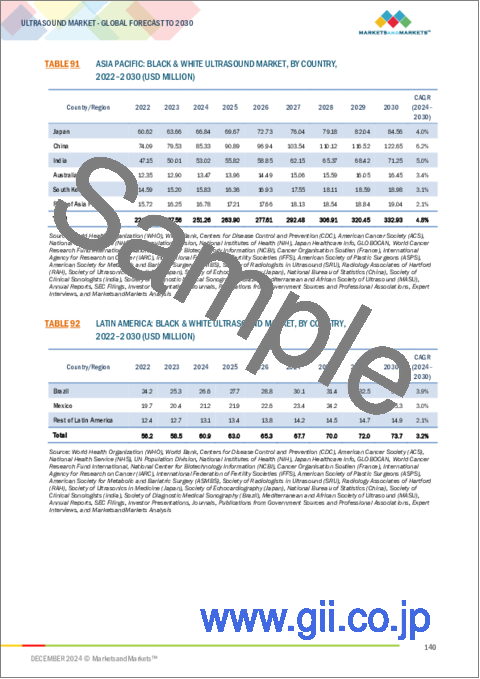

- TABLE 91 ASIA PACIFIC: BLACK & WHITE ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 92 LATIN AMERICA: BLACK & WHITE ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: BLACK & WHITE ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 94 ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 95 ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (UNITS)

- TABLE 96 TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 97 TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY REGION, 2022-2030 (UNITS)

- TABLE 98 NORTH AMERICA: TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 99 EUROPE: TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 101 LATIN AMERICA: TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: TROLLEY/CART-BASED ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 103 COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 104 COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY REGION, 2022-2030 (UNITS)

- TABLE 105 NORTH AMERICA: COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 106 EUROPE: COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: COMPACT/HANDHELD ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 110 POC ULTRASOUND SYSTEMS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 111 POC ULTRASOUND SYSTEMS MARKET, BY REGION, 2022-2030 (UNITS)

- TABLE 112 NORTH AMERICA: POC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 113 EUROPE: POC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: POC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 115 LATIN AMERICA: POC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: POC ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 117 ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 118 ULTRASOUND MARKET FOR RADIOLOGY/GENERAL IMAGING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: ULTRASOUND MARKET FOR RADIOLOGY/GENERAL IMAGING APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 120 EUROPE: ULTRASOUND MARKET FOR RADIOLOGY/GENERAL IMAGING APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ULTRASOUND MARKET FOR RADIOLOGY/GENERAL IMAGING APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 122 LATIN AMERICA: ULTRASOUND MARKET FOR RADIOLOGY/GENERAL IMAGING APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR RADIOLOGY/GENERAL IMAGING APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 124 ULTRASOUND MARKET FOR CARDIOLOGY APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: ULTRASOUND MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 126 EUROPE: ULTRASOUND MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: ULTRASOUND MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: ULTRASOUND MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR CARDIOLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 130 ULTRASOUND MARKET FOR OB/GYN APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: ULTRASOUND MARKET FOR OB/GYN APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 132 EUROPE: ULTRASOUND MARKET FOR OB/GYN APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ULTRASOUND MARKET FOR OB/GYN APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: ULTRASOUND MARKET FOR OB/GYN APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR OB/GYN APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 136 ULTRASOUND MARKET FOR UROLOGY APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: ULTRASOUND MARKET FOR UROLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 138 EUROPE: ULTRASOUND MARKET FOR UROLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ULTRASOUND MARKET FOR UROLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 140 LATIN AMERICA: ULTRASOUND MARKET FOR UROLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR UROLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 142 ULTRASOUND MARKET FOR VASCULAR APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: ULTRASOUND MARKET FOR VASCULAR APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 144 EUROPE: ULTRASOUND MARKET FOR VASCULAR APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ULTRASOUND MARKET FOR VASCULAR APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: ULTRASOUND MARKET FOR VASCULAR APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR VASCULAR APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 148 ULTRASOUND MARKET FOR ORTHOPEDIC & MUSCULOSKELETAL APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: ULTRASOUND MARKET FOR ORTHOPEDIC & MUSCULOSKELETAL APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 150 EUROPE: ULTRASOUND MARKET FOR ORTHOPEDIC & MUSCULOSKELETAL APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ULTRASOUND MARKET FOR ORTHOPEDIC & MUSCULOSKELETAL APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 152 LATIN AMERICA: ULTRASOUND MARKET FOR ORTHOPEDIC & MUSCULOSKELETAL APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR ORTHOPEDIC & MUSCULOSKELETAL APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 154 ULTRASOUND MARKET FOR PAIN MANAGEMENT APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: ULTRASOUND MARKET FOR PAIN MANAGEMENT APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 156 EUROPE: ULTRASOUND MARKET FOR PAIN MANAGEMENT APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: ULTRASOUND MARKET FOR PAIN MANAGEMENT APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 158 LATIN AMERICA: ULTRASOUND MARKET FOR PAIN MANAGEMENT APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR PAIN MANAGEMENT APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 160 GLOBAL MORTALITY RATE OF NEONATES, CHILDREN, AND ADOLESCENTS IN 2022

- TABLE 161 ULTRASOUND MARKET FOR PEDIATRIC APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 162 NORTH AMERICA: ULTRASOUND MARKET FOR PEDIATRIC APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 163 EUROPE: ULTRASOUND MARKET FOR PEDIATRIC APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: ULTRASOUND MARKET FOR PEDIATRIC APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 165 LATIN AMERICA: ULTRASOUND MARKET FOR PEDIATRIC APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR PEDIATRIC APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 167 ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 168 NORTH AMERICA: ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 169 EUROPE: ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 173 ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 174 ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 175 ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 177 EUROPE: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 181 ULTRASOUND MARKET FOR CURVILINEAR/CONVEX ARRAY PROBES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 182 ULTRASOUND MARKET FOR LINEAR ARRAY PROBES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 183 ULTRASOUND MARKET FOR PHASED ARRAY PROBES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 184 ULTRASOUND MARKET FOR OTHER PROBES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 185 ULTRASOUND MARKET FOR WORKSTATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: ULTRASOUND MARKET FOR WORKSTATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 187 EUROPE: ULTRASOUND MARKET FOR WORKSTATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: ULTRASOUND MARKET FOR WORKSTATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: ULTRASOUND MARKET FOR WORKSTATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR WORKSTATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 191 ULTRASOUND MARKET FOR OTHER COMPONENTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 192 NORTH AMERICA: ULTRASOUND MARKET FOR OTHER COMPONENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 193 EUROPE: ULTRASOUND MARKET FOR OTHER COMPONENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: ULTRASOUND MARKET FOR OTHER COMPONENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: ULTRASOUND MARKET FOR OTHER COMPONENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: ULTRASOUND MARKET FOR OTHER COMPONENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 197 ULTRASOUND MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 198 ULTRASOUND MARKET FOR HOSPITALS, SURGICAL CENTERS, AND DIAGNOSTIC CENTERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 199 ULTRASOUND MARKET FOR MATERNITY CENTERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 200 ULTRASOUND MARKET FOR AMBULATORY CENTERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 201 ULTRASOUND MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 202 ULTRASOUND MARKET FOR OTHER END USERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 203 ULTRASOUND MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 204 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 205 EUROPE: ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 206 EUROPE: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 207 EUROPE: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 208 EUROPE: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 209 EUROPE: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 210 EUROPE: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 211 EUROPE: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 212 EUROPE: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 213 EUROPE: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 214 EUROPE: ULTRASOUND MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 215 GERMANY: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 216 GERMANY: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 217 GERMANY: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 218 GERMANY: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 219 GERMANY: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 220 GERMANY: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 221 GERMANY: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 222 FRANCE: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 223 FRANCE: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 224 FRANCE: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 225 FRANCE: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 226 FRANCE: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 227 FRANCE: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 228 FRANCE: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 229 UK: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 230 UK: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 231 UK: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 232 UK: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 233 UK: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 234 UK: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 235 UK: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 236 ITALY: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 237 ITALY: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 238 ITALY: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 239 ITALY: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 240 ITALY: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 241 ITALY: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 242 ITALY: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 243 SPAIN: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 244 SPAIN: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 245 SPAIN: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 246 SPAIN: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 247 SPAIN: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 248 SPAIN: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 249 SPAIN: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 250 REST OF EUROPE: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 251 REST OF EUROPE: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 252 REST OF EUROPE: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 253 REST OF EUROPE: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 254 REST OF EUROPE: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 255 REST OF EUROPE: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 256 REST OF EUROPE: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 257 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 258 NORTH AMERICA: ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 259 NORTH AMERICA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 260 NORTH AMERICA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 261 NORTH AMERICA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 262 NORTH AMERICA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 263 NORTH AMERICA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 264 NORTH AMERICA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 265 NORTH AMERICA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 266 NORTH AMERICA: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 267 NORTH AMERICA: ULTRASOUND MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 268 POCUS ULTRASOUND CPT CODES (2021)

- TABLE 269 US: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 270 US: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 271 US: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 272 US: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 273 US: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 274 US: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 275 US: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 276 CANADA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 277 CANADA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 278 CANADA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 279 CANADA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 280 CANADA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 281 CANADA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 282 CANADA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 283 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 284 ASIA PACIFIC: ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 285 ASIA PACIFIC: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 286 ASIA PACIFIC: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 287 ASIA PACIFIC: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 288 ASIA PACIFIC: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 289 ASIA PACIFIC: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 290 ASIA PACIFIC: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 291 ASIA PACIFIC: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 292 ASIA PACIFIC: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 293 ASIA PACIFIC: ULTRASOUND MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 294 CHINA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 295 CHINA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 296 CHINA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 297 CHINA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 298 CHINA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 299 CHINA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 300 CHINA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 301 JAPAN: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 302 JAPAN: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 303 JAPAN: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 304 JAPAN: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 305 JAPAN: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 306 JAPAN: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 307 JAPAN: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 308 INDIA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 309 INDIA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 310 INDIA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 311 INDIA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 312 INDIA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 313 INDIA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 314 INDIA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 315 AUSTRALIA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 316 AUSTRALIA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 317 AUSTRALIA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 318 AUSTRALIA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 319 AUSTRALIA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 320 AUSTRALIA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 321 AUSTRALIA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 322 SOUTH KOREA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 323 SOUTH KOREA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 324 SOUTH KOREA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 325 SOUTH KOREA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 326 SOUTH KOREA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 327 SOUTH KOREA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 328 SOUTH KOREA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 329 REST OF ASIA PACIFIC: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 330 REST OF ASIA PACIFIC: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 331 REST OF ASIA PACIFIC: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 332 REST OF ASIA PACIFIC: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 333 REST OF ASIA PACIFIC: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 334 REST OF ASIA PACIFIC: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 335 REST OF ASIA PACIFIC: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 336 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 337 LATIN AMERICA: ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 338 LATIN AMERICA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 339 LATIN AMERICA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 340 LATIN AMERICA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 341 LATIN AMERICA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 342 LATIN AMERICA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 343 LATIN AMERICA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 344 LATIN AMERICA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 345 LATIN AMERICA: ULTRASOUND MARKET FOR TRANSDUCERS/PROBES, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 346 LATIN AMERICA: ULTRASOUND MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 347 BRAZIL: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 348 BRAZIL: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 349 BRAZIL: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 350 BRAZIL: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 351 BRAZIL: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 352 BRAZIL: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 353 BRAZIL: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 354 MEXICO: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 355 MEXICO: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 356 MEXICO: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 357 MEXICO: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 358 MEXICO: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 359 MEXICO: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 360 MEXICO: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 361 REST OF LATIN AMERICA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 362 REST OF LATIN AMERICA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 363 REST OF LATIN AMERICA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 364 REST OF LATIN AMERICA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 365 REST OF LATIN AMERICA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 367 REST OF LATIN AMERICA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 368 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 369 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 370 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 371 MIDDLE EAST & AFRICA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 372 MIDDLE EAST & AFRICA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 373 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 376 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 377 MIDDLE EAST & AFRICA: TRANSDUCERS/PROBES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 378 MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY END USER, 2022-2030 (USD MILLION)

- TABLE 379 GCC COUNTRIES: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 380 GCC COUNTRIES: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 381 GCC COUNTRIES: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 382 GCC COUNTRIES: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 383 GCC COUNTRIES: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 384 GCC COUNTRIES: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 385 GCC COUNTRIES: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 386 REST OF MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 387 REST OF MIDDLE EAST & AFRICA: DIAGNOSTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 388 REST OF MIDDLE EAST & AFRICA: THERAPEUTIC ULTRASOUND MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 389 REST OF MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY DISPLAY, 2022-2030 (USD MILLION)

- TABLE 390 REST OF MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY PORTABILITY, 2022-2030 (USD MILLION)

- TABLE 391 REST OF MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 392 REST OF MIDDLE EAST & AFRICA: ULTRASOUND MARKET, BY COMPONENT, 2022-2030 (USD MILLION)

- TABLE 393 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN ULTRASOUND MARKET

- TABLE 394 ULTRASOUND MARKET: DEGREE OF COMPETITION

- TABLE 395 ULTRASOUND MARKET: REGION FOOTPRINT

- TABLE 396 ULTRASOUND MARKET: TECHNOLOGY FOOTPRINT

- TABLE 397 ULTRASOUND MARKET: DISPLAY FOOTPRINT

- TABLE 398 ULTRASOUND MARKET: PORTABILITY FOOTPRINT

- TABLE 399 ULTRASOUND MARKET: COMPONENT FOOTPRINT

- TABLE 400 ULTRASOUND MARKET: APPLICATION FOOTPRINT

- TABLE 401 ULTRASOUND MARKET: END-USER FOOTPRINT

- TABLE 402 ULTRASOUND EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 403 ULTRASOUND MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-NOVEMBER 2024

- TABLE 404 ULTRASOUND MARKET: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 405 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 406 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 407 GE HEALTHCARE: PRODUCT LAUNCHES, APPROVALS, AND UPGRADES, JANUARY 2021-NOVEMBER 2024

- TABLE 408 GE HEALTHCARE: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 409 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2021-NOVEMBER 2024

- TABLE 410 PHILIPS HEALTHCARE: COMPANY OVERVIEW

- TABLE 411 PHILIPS HEALTHCARE: PRODUCTS OFFERED

- TABLE 412 PHILIPS HEALTHCARE: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-NOVEMBER 2024

- TABLE 413 PHILIPS HEALTHCARE: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 414 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 415 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 416 CANON MEDICAL SYSTEMS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 417 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 418 CANON MEDICAL SYSTEMS CORPORATION: EXPANSIONS, JANUARY 2021-NOVEMBER 2024

- TABLE 419 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 420 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 421 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2024

- TABLE 422 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 423 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2021-NOVEMBER 2024

- TABLE 424 FUJIFILM CORPORATION: COMPANY OVERVIEW

- TABLE 425 FUJIFILM CORPORATION: PRODUCTS OFFERED

- TABLE 426 FUJIFILM CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 427 FUJIFILM CORPORATION: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 428 FUJIFILM CORPORATION: EXPANSIONS, JANUARY 2021-NOVEMBER 2024

- TABLE 429 HOLOGIC, INC.: COMPANY OVERVIEW

- TABLE 430 HOLOGIC, INC.: PRODUCTS OFFERED

- TABLE 431 HOLOGIC, INC.: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 432 HOLOGIC, INC.: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 433 HOLOGIC, INC.: EXPANSIONS, JANUARY 2021-NOVEMBER 2024

- TABLE 434 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 435 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 436 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 437 SAMSUNG ELECTRONICS CO., LTD.: DEALS, JANUARY 2021-MARCH 2024

- TABLE 438 SAMSUNG ELECTRONICS CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2024

- TABLE 439 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 440 MINDRAY MEDICAL INTERNATIONAL LIMITED: PRODUCTS OFFERED

- TABLE 441 MINDRAY MEDICAL INTERNATIONAL LIMITED: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 442 MINDRAY MEDICAL INTERNATIONAL LIMITED: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 443 ESAOTE SPA: COMPANY OVERVIEW

- TABLE 444 ESAOTE SPA: PRODUCTS OFFERED

- TABLE 445 ESAOTE SPA: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 446 ESAOTE SPA: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 447 CHISON MEDICAL TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 448 CHISON MEDICAL TECHNOLOGIES CO., LTD.: PRODUCTS OFFERED

- TABLE 449 CHISON MEDICAL TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 450 CHISON MEDICAL TECHNOLOGIES CO., LTD.: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 451 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 452 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 453 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 454 KONICA MINOLTA, INC.: COMPANY OVERVIEW

- TABLE 455 KONICA MINOLTA, INC.: PRODUCTS OFFERED

- TABLE 456 CLARIUS: COMPANY OVERVIEW

- TABLE 457 CLARIUS: PRODUCTS OFFERED

- TABLE 458 CLARIUS: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 459 CLARIUS: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 460 MEDGYN PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 461 MEDGYN PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 462 PROMED TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 463 PROMED TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 464 WHITE EAGLE SONIC TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 465 SHENZHEN RICSO TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 466 YOUKEY MEDICAL: COMPANY OVERVIEW

- TABLE 467 SIUI: COMPANY OVERVIEW

- TABLE 468 TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING: COMPANY OVERVIEW

- TABLE 469 BUTTERFLY NETWORK, INC.: COMPANY OVERVIEW

- TABLE 470 ALPINION MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 471 EDAN INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 472 SHENZHEN LANDWIND INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 473 ECHONOUS INC.: COMPANY OVERVIEW

- TABLE 474 MOBISANTE, INC.: COMPANY OVERVIEW

- TABLE 475 SHENZHEN WISONIC MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 476 SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 477 SONOSCAPE MEDICAL CORP.: COMPANY OVERVIEW

- TABLE 478 CURA HEALTHCARE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ULTRASOUND MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 ULTRASOUND MARKET: RESEARCH DATA

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 8 ULTRASOUND MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 9 ULTRASOUND MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 ULTRASOUND MARKET, BY TECHNOLOGY, 2024 VS. 2030 (USD MILLION)

- FIGURE 14 ULTRASOUND MARKET, BY DISPLAY, 2024 VS. 2030 (USD MILLION)

- FIGURE 15 ULTRASOUND MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 16 ULTRASOUND MARKET, BY END USER, 2024 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF ULTRASOUND MARKET

- FIGURE 18 INCREASING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET GROWTH

- FIGURE 19 EUROPE TO DOMINATE DURING FORECAST PERIOD

- FIGURE 20 HOSPITALS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 22 ULTRASOUND MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 ULTRASOUND MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ULTRASOUND MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 ULTRASOUND MARKET: PORTER'S FIVE FORCES

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR END USERS

- FIGURE 27 KEY BUYING CRITERIA, BY END USER

- FIGURE 28 PATENT ANALYSIS FOR ULTRASOUND MARKET (JANUARY 2013-DECEMBER 2024)

- FIGURE 29 ULTRASOUND MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 31 INVESTMENT & FUNDING SCENARIO, 2018-2022

- FIGURE 32 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 33 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 34 AVERAGE SELLING PRICE OF ULTRASOUND, BY REGION, 2021-2023 (USD)

- FIGURE 35 AVERAGE SELLING PRICE FOR TOP 3 APPLICATIONS, BY KEY PLAYER (2023)

- FIGURE 36 EUROPE: ULTRASOUND MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: ULTRASOUND MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN ULTRASOUND MARKET, 2021-2023 (USD BILLION)

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ULTRASOUND MARKET (2023)

- FIGURE 40 TOP FIVE COMPANIES COLLECTIVELY ACCOUNT FOR 73-77% MARKET SHARE OF GLOBAL DOPPLER ULTRASOUND MARKET

- FIGURE 41 RANKING OF KEY PLAYERS IN ULTRASOUND MARKET, 2023

- FIGURE 42 DIAGNOSTIC ULTRASOUND MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 43 ULTRASOUND MARKET: COMPANY FOOTPRINT

- FIGURE 44 THERAPEUTIC ULTRASOUND MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 ULTRASOUND MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 48 GE HEALTHCARE: COMPANY SNAPSHOT (2023)

- FIGURE 49 PHILIPS HEALTHCARE: COMPANY SNAPSHOT (2023)

- FIGURE 50 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 51 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2023)

- FIGURE 52 FUJIFILM CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 53 HOLOGIC, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 54 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 55 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY SNAPSHOT (2023)

- FIGURE 56 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 57 KONICA MINOLTA, INC.: COMPANY SNAPSHOT (2023)

The global ultrasound market is projected to reach USD 13.87 billion by 2030 from USD 9.32 billion in 2024, growing at a CAGR of 6.8% during the forecast period. The growth of the ultrasound market is driven by various key factors, including increasing prevalence rates of chronic diseases, such as cardiovascular conditions, cancer, and musculoskeletal disorders. These require sophisticated diagnostic equipment. Increasing demand for early diagnosis and non-invasive options also fuels adoption of the ultrasound technology. Advances in ultrasound itself, including AI integration, 3D/4D imaging, and portable equipment, make it more accessible and versatile in the clinical practice.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Segments | Technology, Display, Portability, Component, Application, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

"Diagnostic Ultrasound to register largest market share in 2023"

Diagnostic ultrasound accounts for the largest share of the ultrasound market because it is capable of providing real-time, non-invasive imaging for a wide range of medical conditions. Its broad usage in obstetrics, cardiology, musculoskeletal imaging, and emergency care is contributing to its dominance. With this technology, it boasts such high accuracy, very low cost, and ionizing radiation-free; clinicians often turn to this for routine diagnostics. Improved ultrasound technology-3D/4D imaging, for instance, and AI-based tools have improved it so much that the use has remained on the growth track.

"Hospitals segment held the largest share of ultrasound equipment market in 2023, by End-user."

Hospitals have the largest market share in this ultrasound industry due to its high volume of patients and diversified departments, along with the requirements of advanced imaging diagnostics within a wide spectrum of specializations. Obsterics, cardiology, emergency care, and musculoskeletal imaging are key applications within the hospital setup that have integrated ultrasound technology. The increased cases of chronic diseases and hospital emphasis on earlier diagnosis and treatment create high demand for ultrasound systems. More importantly, the advanced functionalities of ultrasound, such as real-time imaging, non-invasiveness, and increased accuracy, make it of more importance to hospitals, thereby becoming their main consumers of ultrasound technology.

"Asia Pacific to register highest growth rate in the market during the forecast period."

The Asia-Pacific region is reporting the highest growth rate in the ultrasound market, with factors such as an increasingly prevalent chronic disease population, an aged population, and a widening healthcare infrastructure base. Growth in demand for early and accurate diagnoses coupled with the affordability of ultrasound and its non-invasive nature has further increased adoption across the region. Additionally, growing government efforts to expand the healthcare market, increasing investments in health, diagnostic center expansions, and increase in hospital numbers are leading the rapid growth of this market in the Asia-Pacific region. Technology advancement and the greater availability of portable ultrasound equipment facilitate wider accessibility and adoption in Asia-Pacific.

A number of drivers were responsible for the upswing, including:

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 40%, Tier 30%, and Tier 3 30%

- By Designation: C-level-- 55%, Director-level-27%, and Others-18%

- By Region: North America-35%, Europe-32%, Asia Pacific-25%, Latin America-6% , Middle East & Africa-2%

Prominent players in this market are Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), FUJIFILM Corporation (Japan), Hologic Inc.(US), Samsung Electronics Co., Ltd (South Korea), Esaote SPA (Italy), Chison Medical Technologies Co., Ltd (China), MobiSante Inc (US), Clarius (Canada), MedGyn Products, Inc (US), Promed Technology (China), Neusoft Corporation (China) among others.

Research Coverage

The ultrasound equipment market has been segmented based on technology, display, component, portability, application, end-user, and region. Key factors for the growth of the market include driving forces, restraints, opportunities, and challenges among the stakeholders. The study also looks into the competition of the leading players within the market. The further division of the market can be seen in micro-markets to gain insight into the growth trends, prospects, and contributions to the overall market. It highlights future revenue growth prospects for various market segments across five major regions.

Key Benefits of Buying the Report:

The report would be useful for new market entrants in the ultrasound market as it gives detailed information about the market. This helps get a good understanding of any investment opportunities. The report provides in-depth insight into key and smaller players which helps in doing strong risk assessment for investment decisions. This report segments the market precisely both by end-users and by regions for the purpose of attaining focused insights in the specific market segments. Additionally, it draws out the major trends, challenges, growth drivers, and opportunities to support the strategic decision-making process through adequate analysis.

The report provides the insights on the following pointers:

Analysis of the key drivers, restraints, opportunities, and challenges influencing the rise of the ultrasound market. The rise of point-of-care diagnostics and expanding healthcare infrastructure further boosts market growth. Additionally, favorable reimbursement policies and the need for early detection support ultrasound adoption.

Product Development/Innovation: The report includes emerging technologies in the domain, ongoing R&D activities, and recent product and service launches in the market for ultrasound market.

Market Development: It has elaborated about the new product development and unexplored markets, latest developments, and investment in the ultrasound market.

Market Diversification: Detailed insight into new product launches, unexplored markets, recent developments, and investments made in the ultrasound market.

Competitive Assessment: Detailed assessment of market share, service offerings leading strategies of key players such as Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), FUJIFILM Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Customer-based market estimation

- 2.2.1.3 Approach 3: Top-down approach

- 2.2.1.4 Approach 4: Primary interviews

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION & MARKET BREAKDOWN

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 STUDY ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS/MARKET FORECASTING METHODOLOGY

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ULTRASOUND MARKET OVERVIEW

- 4.2 ULTRASOUND MARKET, BY REGION, 2022-2030

- 4.3 EUROPE: ULTRASOUND MARKET, BY REGION AND END USER, 2023

- 4.4 GEOGRAPHIC SNAPSHOT OF ULTRASOUND MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases

- 5.2.1.2 Rising patient preference for minimally invasive surgeries

- 5.2.1.3 Rising technological advancements in ultrasound devices

- 5.2.1.4 Growing public and private investments, funding, and grants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursements

- 5.2.2.2 High operating costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing applications of therapeutic ultrasound

- 5.2.3.2 Growth in emerging markets

- 5.2.3.3 Development of POC ultrasound devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing end-user preference for refurbished equipment

- 5.2.4.2 Shortage of skilled sonographers

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ENDOSCOPIC ULTRASOUND

- 5.3.2 WIRELESS AND PORTABLE SYSTEMS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.5.3 END USERS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 PATENT ANALYSIS

- 5.9 TRADE DATA ANALYSIS

- 5.9.1 IMPORT DATA

- 5.9.2 EXPORT DATA

- 5.10 KEY CONFERENCES & EVENTS, 2024-2025

- 5.11 UNMET NEEDS AND KEY PAIN POINTS

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 IMPACT OF GEN AI ON ULTRASOUND MARKET

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Contrast-enhanced ultrasound (CEUS)

- 5.15.1.2 Portable and handheld ultrasound devices

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Elastography

- 5.15.2.2 Fluoroscopy

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 PET/CT

- 5.15.1 KEY TECHNOLOGIES

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 LARGE-DIAMETER LUMEN-APPOSING METAL STENTS FOR WALLED-OFF NECROSIS

- 5.16.2 PRENATAL DIAGNOSIS OF HYPOPHOSPHATASIA CONGENITAL USING ULTRASONOGRAPHY

- 5.16.3 POSTOPERATIVE PERIRECTAL ABSCESS DRAINAGE

- 5.17 REGULATORY ANALYSIS

- 5.17.1 NORTH AMERICA

- 5.17.1.1 US

- 5.17.1.2 Canada

- 5.17.2 EUROPE

- 5.17.3 ASIA PACIFIC

- 5.17.3.1 Japan

- 5.17.3.2 China

- 5.17.3.3 India

- 5.17.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17.1 NORTH AMERICA

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 PRICING ANALYSIS

- 5.19.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.19.2 AVERAGE SELLING PRICE FOR TOP 3 APPLICATIONS, BY KEY PLAYER

- 5.20 REIMBURSEMENT SCENARIO

6 ULTRASOUND MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 DIAGNOSTIC ULTRASOUND

- 6.2.1 2D ULTRASOUND

- 6.2.1.1 Growing demand for minimally invasive surgeries to increase use of 2D ultrasound

- 6.2.2 3D & 4D ULTRASOUND

- 6.2.2.1 Improved diagnosis with 3D ultrasound technology to boost market growth

- 6.2.3 DOPPLER ULTRASOUND

- 6.2.3.1 Growing applications in cardiology and vascular to drive market growth

- 6.2.4 CONTRAST-ENHANCED ULTRASOUND

- 6.2.4.1 Enhanced diagnostic imaging with advanced ultrasound systems to boost demand

- 6.2.1 2D ULTRASOUND

- 6.3 THERAPEUTIC ULTRASOUND

- 6.3.1 HIGH-INTENSITY-FOCUSED ULTRASOUND

- 6.3.1.1 Advancing cancer treatment with HIFU to fuel growth

- 6.3.2 EXTRACORPOREAL SHOCKWAVE LITHOTRIPSY

- 6.3.2.1 Enhancing urolithiasis treatment with advanced ESWL techniques and technologies to propel market

- 6.3.1 HIGH-INTENSITY-FOCUSED ULTRASOUND

7 ULTRASOUND MARKET, BY DISPLAY

- 7.1 INTRODUCTION

- 7.2 COLOR ULTRASOUND

- 7.2.1 GROWING DEMAND FOR COLOR ULTRASOUND TO SUPPORT MARKET GROWTH

- 7.3 BLACK & WHITE ULTRASOUND

- 7.3.1 ENHANCED DIAGNOSTIC PRECISION WITH B/W ULTRASOUND TO DRIVE DEMAND

8 ULTRASOUND MARKET, BY PORTABILITY

- 8.1 INTRODUCTION

- 8.2 TROLLEY/CART-BASED ULTRASOUND SYSTEMS

- 8.2.1 IMPROVED PATIENT EXPERIENCE WITH TROLLEY-BASED ULTRASOUND SYSTEMS TO DRIVE MARKET GROWTH

- 8.3 COMPACT/HANDHELD ULTRASOUND SYSTEMS

- 8.3.1 GROWING NUMBER OF TRAUMA/EMERGENCY CASES TO FUEL MARKET GROWTH

- 8.4 POC ULTRASOUND DEVICES

- 8.4.1 IMPROVED OPERATIONAL AND CLINICAL EFFICACY TO BOOST DEMAND FOR POC ULTRASOUND DEVICES

9 ULTRASOUND MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 RADIOLOGY/GENERAL IMAGING

- 9.2.1 GROWING NUMBER OF CHRONIC DISEASES LEADING TO INCREASED USE OF THIS APPLICATION

- 9.3 CARDIOLOGY

- 9.3.1 RISING PREVALENCE OF CARDIOVASCULAR DISEASE ACROSS MAJOR HEALTHCARE MARKETS TO DRIVE GROWTH

- 9.4 OB/GYN

- 9.4.1 WIDE ADOPTION OF AI IN ULTRASOUND IN FIELD OF OB/GYN TO BOOST MARKET

- 9.5 UROLOGY

- 9.5.1 WIDE USE OF ULTRASOUND IN DIAGNOSIS AND TREATMENT OF VARIOUS UROLOGICAL DISORDERS TO DRIVE MARKET

- 9.6 VASCULAR

- 9.6.1 VASCULAR APPLICATIONS SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- 9.7 ORTHOPEDIC & MUSCULOSKELETAL

- 9.7.1 RISING PREVALENCE OF OSTEOARTHRITIS TO DRIVE MARKET GROWTH

- 9.8 PAIN MANAGEMENT

- 9.8.1 GROWING ADOPTION OF PORTABLE ULTRASOUND FOR PAIN MANAGEMENT TO SUPPORT GROWTH

- 9.9 PEDIATRIC

- 9.9.1 GROWING USE OF PEDIATRIC ULTRASOUND TO COMBAT NEONATAL MORTALITY TO SPUR GROWTH

- 9.10 OTHER APPLICATIONS

10 ULTRASOUND MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 TRANSDUCERS/PROBES

- 10.2.1 CURVILINEAR/CONVEX ARRAY PROBES

- 10.2.1.1 Enhanced diagnosis with curvilinear and convex array ultrasound probes to boost market

- 10.2.2 LINEAR ARRAY PROBES

- 10.2.2.1 High-resolution power with linear array ultrasound systems to drive demand

- 10.2.3 PHASED ARRAY PROBES

- 10.2.3.1 Advanced imaging capabilities to drive market growth

- 10.2.4 OTHER PROBES

- 10.2.1 CURVILINEAR/CONVEX ARRAY PROBES

- 10.3 WORKSTATIONS

- 10.3.1 INCREASE IN DIAGNOSTIC PROCEDURES TO PROPEL DEMAND FOR WORKSTATIONS

- 10.4 OTHER COMPONENTS

11 ULTRASOUND MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 HOSPITALS, SURGICAL CENTERS, AND DIAGNOSTIC CENTERS

- 11.2.1 INCREASING PREVALENCE OF CANCER TO BOOST MARKET GROWTH

- 11.3 MATERNITY CENTERS

- 11.3.1 INCREASED ADOPTION OF ADVANCED ULTRASOUND SYSTEMS FOR OB/GYN APPLICATIONS TO DRIVE MARKET GROWTH

- 11.4 AMBULATORY CENTERS

- 11.4.1 INCREASING NUMBER OF SURGERIES TO PROPEL MARKET GROWTH

- 11.5 RESEARCH & ACADEMIC INSTITUTES

- 11.5.1 GROWING NUMBER OF RESEARCH GRANTS TO BOOST MARKET GROWTH

- 11.6 OTHER END USERS

12 ULTRASOUND MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 EUROPE

- 12.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.2.2 GERMANY

- 12.2.2.1 Growing healthcare expenditures and grants to drive market

- 12.2.3 FRANCE

- 12.2.3.1 Increasing population and rising number of centers to drive market

- 12.2.4 UK

- 12.2.4.1 Increasing prevalence of chronic diseases to contribute to market growth

- 12.2.5 ITALY

- 12.2.5.1 Increased availability of reimbursement coverage for diagnostic procedures to drive market

- 12.2.6 SPAIN

- 12.2.6.1 Growing focus on cancer research to support market growth

- 12.2.7 REST OF EUROPE

- 12.3 NORTH AMERICA

- 12.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.3.2 US

- 12.3.2.1 Rise in cancer prevalence to drive market

- 12.3.3 CANADA

- 12.3.3.1 New product launches & conferences to drive market

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Increasing acquisitions and partnerships to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Established healthcare infrastructure and research facilities to drive market

- 12.4.4 INDIA

- 12.4.4.1 Government initiatives to drive market

- 12.4.5 AUSTRALIA

- 12.4.5.1 Growing healthcare spending and increasing investments in research to drive market

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Well-developed healthcare system and conferences to drive market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Greater purchasing power and favorable demographic conditions to drive market

- 12.5.3 MEXICO

- 12.5.3.1 Increased medical tourism and better government healthcare initiatives to drive market

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 GROWING QUALITY HEALTHCARE SYSTEMS TO DRIVE MARKET

- 12.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 12.6.3 GCC COUNTRIES

- 12.6.3.1 Developments in investment approach to drive market

- 12.6.4 REST OF MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ULTRASOUND MARKET

- 13.3 REVENUE ANALYSIS, 2019-2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.4.1 RANKING OF KEY MARKET PLAYERS

- 13.5 COMPANY EVALUATION MATRIX: DIAGNOSTIC ULTRASOUND MARKET (KEY PLAYERS), 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Technology footprint

- 13.5.5.4 Display footprint

- 13.5.5.5 Portability footprint

- 13.5.5.6 Component footprint

- 13.5.5.7 Application footprint

- 13.5.5.8 End-user footprint

- 13.6 COMPANY EVALUATION MATRIX: THERAPEUTIC ULTRASOUND MARKET (STARTUPS/SMES), 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES & APPROVALS

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 GE HEALTHCARE

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches, approvals, and upgrades

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 PHILIPS HEALTHCARE

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches & approvals

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 CANON MEDICAL SYSTEMS CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 SIEMENS HEALTHINEERS AG

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 FUJIFILM CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 HOLOGIC, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 SAMSUNG ELECTRONICS CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Other developments

- 14.1.8 MINDRAY MEDICAL INTERNATIONAL LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 ESAOTE SPA

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.10 CHISON MEDICAL TECHNOLOGIES CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 NEUSOFT MEDICAL SYSTEMS CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.12 KONICA MINOLTA, INC

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.13 CLARIUS

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.14 MEDGYN PRODUCTS, INC.

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.15 PROMED TECHNOLOGY CO., LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.1 GE HEALTHCARE

- 14.2 OTHER COMPANIES

- 14.2.1 WHITE EAGLE SONIC TECHNOLOGIES, INC.

- 14.2.2 SHENZHEN RICSO TECHNOLOGY CO., LTD.

- 14.2.3 YOUKEY MEDICAL

- 14.2.4 SIUI

- 14.2.5 TELEMED, MEDICAL IMAGING EQUIPMENT DESIGN & MANUFACTURING

- 14.2.6 BUTTERFLY NETWORK, INC.

- 14.2.7 ALPINION MEDICAL SYSTEMS

- 14.2.8 EDAN INSTRUMENTS, INC.

- 14.2.9 SHENZHEN LANDWIND INDUSTRY CO., LTD.

- 14.2.10 ECHONOUS INC.

- 14.2.11 MOBISANTE, INC.

- 14.2.12 SHENZHEN WISONIC MEDICAL TECHNOLOGY CO., LTD.

- 14.2.13 SHENZHEN BIOCARE BIO-MEDICAL EQUIPMENT CO., LTD.

- 14.2.14 SONOSCAPE MEDICAL CORP.

- 14.2.15 CURA HEALTHCARE

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS