|

|

市場調査レポート

商品コード

1869555

ビルディングインフォメーションモデリング(BIM)の世界市場:提供別、展開タイプ別、プロジェクトライフサイクル別、エンドユーザー別、業界別、地域別 - 予測(~2030年)Building Information Modeling Market By Offering, Deployment Type, Project Lifecycle, End User, Vertical, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ビルディングインフォメーションモデリング(BIM)の世界市場:提供別、展開タイプ別、プロジェクトライフサイクル別、エンドユーザー別、業界別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月25日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

概要

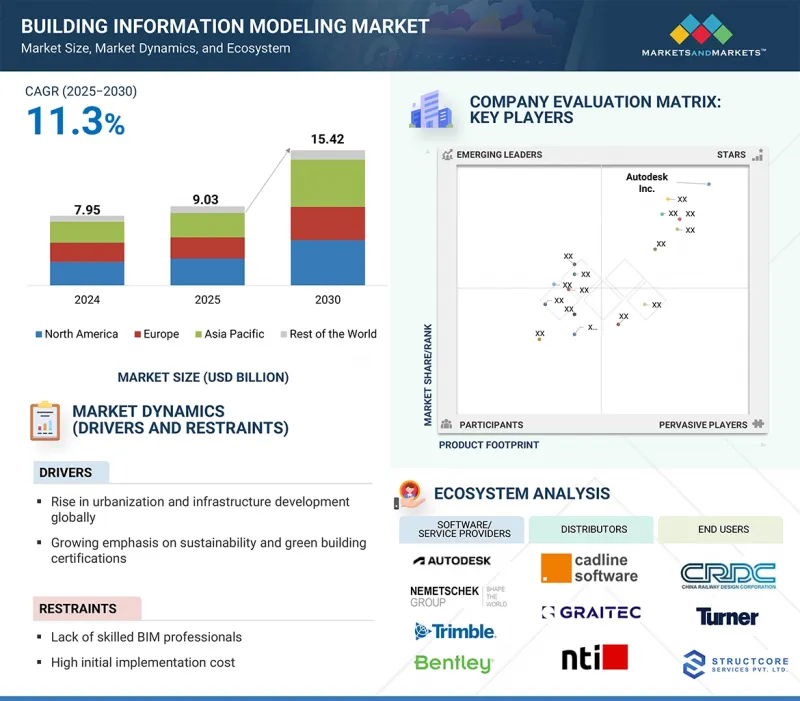

世界のビルディングインフォメーションモデリング(BIM)の市場規模は、2025年の90億3,000万米ドルから2030年までに154億2,000万米ドルに達すると予測され、予測期間にCAGRで11.3%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 提供、展開タイプ、プロジェクトライフサイクル、エンドユーザー、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

BIM市場は、建設プロジェクトにおける効率的な計画、コスト管理、リスク低減への需要の高まりにより、勢いを増しています。BIMが持つ、持続可能性目標の支援、リアルタイムデータ統合の実現、モジュラー建設などの動向との整合性といった能力が、その採用を促進しています。政府の義務化や、IoT、デジタルツイン、クラウド、AIなどの技術との統合が、さらなる成長を加速させています。これらの要因により、BIMは建設部門におけるデジタルトランスフォーメーションの重要なイネーブラーとして確立されつつあります。

「プロジェクトライフサイクルセグメントにおいて、建設前段階が2025年に最大の市場シェアを占めると予測されます。」

建設前段階は、プロジェクト成功の基盤構築において極めて重要な役割を担うため、BIM市場を牽引すると見込まれています。BIMはこの段階で、物理的な建設が始まる前に、詳細な設計可視化、干渉検出、コスト推計、スケジュール策定を可能にすることで大きな価値をもたらします。これによりステークホルダーは設計上の潜在的な矛盾を特定し、リソース配分を最適化し、手戻りや遅延の可能性を低減できます。プロジェクトを予算内で期日通りに完了させる必要性が高まる中、AEC企業は計画の精度向上とステークホルダー間の連携強化のために、建設前段階でBIMを活用するケースが増加しています。さらに、建設前段階における5D/6D BIMの統合は、コストや持続可能性に関する意思決定をさらに強化し、BIM採用の重要な段階となっています。

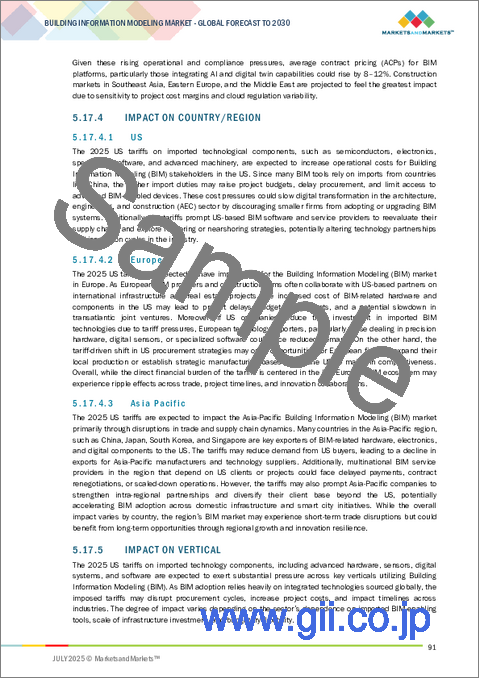

「クラウド展開タイプセグメントがビルディングインフォメーションモデリング市場においてもっとも高いCAGRを記録すると予測されます。」

クラウド展開タイプは、その拡張性、コスト効率、リモートアクセスのしやすさから、BIM市場においてもっとも高いCAGRを示すと予測されます。建設チームが複数の場所で活動するケースが増える中、クラウドベースBIMソリューションはリアルタイムコラボレーション、シームレスなデータ共有、集中型のプロジェクト管理を可能にします。これらのプラットフォームは、大規模なオンプレミスインフラの必要性を低減するため、特に中小企業にとって魅力的です。さらに、IoT、AI、デジタルツインといった先進技術との統合は、クラウド環境においてよりシームレスに行われ、さらなる採用を促進します。データセキュリティと接続性が向上するにつれて、クラウドベースBIMへの移行は大幅に加速する見込みです。加えて、クラウド展開は自動更新とストレージ拡張性をサポートし、チームが常に最新のデータとモデルで作業することを保証します。AEC業界におけるリモートワークやハイブリッドワークモデルの増加傾向は、クラウドベースBIMプラットフォームへの需要をさらに強化しています。

「インドが世界のビルディングインフォメーションモデリング市場においてもっとも高いCAGRを記録すると予測されます。」

インドは、急速な都市化、インフラ開発の急増、デジタル建設手法を推進する政府施策の増加により、世界のBIM市場においてもっとも高いCAGRを記録すると予測されます。Smart Cities MissionやPM Gati Shaktiなどのプログラムは、大規模プロジェクトの効率的な計画と実行に対する需要を促進しており、BIMはそこで重要な役割を果たしています。さらに、AEC専門業者の間での認知度の向上や、不動産・交通部門の拡大、クラウドベース/モバイルBIMソリューションの普及が市場成長を後押ししています。持続可能性、コスト効率、技術的近代化への推進が、国内の公共/民間建設プロジェクトにおけるBIMの導入をさらに促進しています。国際的な建設企業の参入の増加や、地元のソフトウェアプロバイダーやスタートアップの台頭は、競争力のある価格設定と地域特化型ソリューションを通じてBIMの採用を加速させています。インドの教育機関や業界団体もBIMトレーニングを重視しており、スキルギャップの解消と主流ワークフローへの統合の加速に寄与しています。こうした支援的なエコシステムにより、インドは今後数年間におけるBIMの高成長市場としての地位を確立します。

当レポートでは、世界のビルディングインフォメーションモデリング(BIM)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- ビルディングインフォメーションモデリング市場の企業にとって魅力的な成長機会

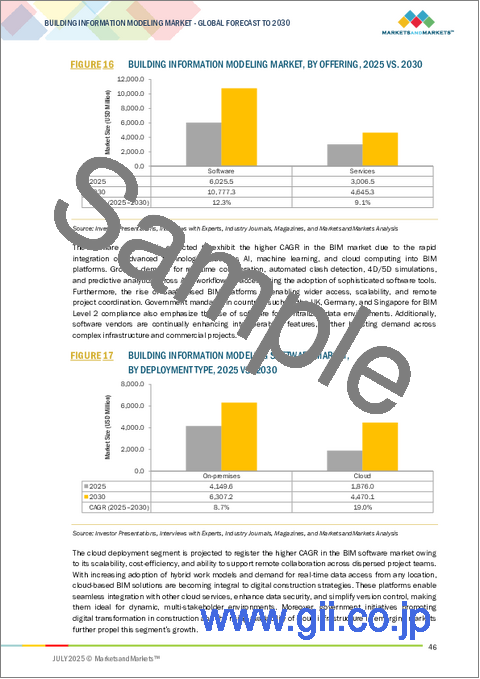

- ビルディングインフォメーションモデリング市場:提供タイプ別(2021年~2030年)

- ビルディングインフォメーションモデリング市場:プロジェクトライフサイクル別

- ビルディングインフォメーションモデリング市場:業界別

- ビルディングインフォメーションモデリング市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- ビルディングインフォメーションモデリングソフトウェアの参考価格分析

- ビルディングインフォメーションモデリングソフトウェアの価格分析:地域別(2024年)

- サプライチェーン分析

- エコシステムマッピング

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 特許分析

- 主な会議とイベント

- ケーススタディ

- 関税と規制情勢

- 関税データ

- 規制機関、政府機関、その他の組織

- 標準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ビルディングインフォメーションモデリング市場に対するAIの影響

- 2025年の米国関税の影響 - ビルディングインフォメーションモデリング市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 垂直方向への影響

第6章 ビルディングインフォメーションモデリング市場:用途別

- イントロダクション

- 計画・モデリング

- 建設・設計

- 資産管理

- ビルディングシステム分析・メンテナンススケジューリング

第7章 ビルディングインフォメーションモデリングソフトウェア市場:展開タイプ別

- イントロダクション

- オンプレミス

- クラウド

第8章 ビルディングインフォメーションモデリング市場:エンドユーザー別

- イントロダクション

- AEC専門業者

- コンサルタント・施設管理者

- その他のエンドユーザー

第9章 ビルディングインフォメーションモデリング市場:プロジェクトライフサイクル別

- イントロダクション

- 建設前

- 建設

- 運用

第10章 ビルディングインフォメーションモデリング市場:業界別

- イントロダクション

- 建築

- 工業

- 土木インフラ

- 石油・ガス

- ユーティリティ

- その他の業界

第11章 ビルディングインフォメーションモデリング市場:提供タイプ別

- イントロダクション

- ソフトウェア

- 設計・モデリングソフトウェア

- 建設シミュレーション・スケジューリング

- コスト見積り・数量拾い

- 施設・資産管理ソフトウェア

- 持続可能性・エネルギー分析ソフトウェア

- その他のソフトウェアタイプ

- サービス

- 実装・統合サービス

- ソフトウェアサポート・メンテナンス

- トレーニング・認定

- モデリング・文書化サービス

- コンサルティング・アドバイザリーサービス

- その他のサービス

第12章 ビルディングインフォメーションモデリング市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- 南米

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業の評価と財務指標

- 製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合情勢と動向

- 製品の発売

- 取引

- 拡張

第14章 企業プロファイル

- 主要企業

- AUTODESK INC.

- NEMETSCHEK GROUP

- BENTLEY SYSTEMS, INCORPORATED

- TRIMBLE INC.

- DASSAULT SYSTEMES

- SCHNEIDER ELECTRIC

- ASITE

- HEXAGON AB

- PROCORE TECHNOLOGIES, INC.

- ARCHIDATA INC.

- その他の企業

- ACCA SOFTWARE S.P.A.

- PINNACLE INFOTECH

- ANGULERIS

- AFRY AB

- BECK TECHNOLOGY

- COMPUTERS AND STRUCTURES, INC.

- ASUNI SOFT

- 4M

- SIERRASOFT

- SAFE SOFTWARE INC.

- FARO

- GEO-PLUS

- CYPE INGENIEROS S.A.

- MAGICAD GROUP

- REVIZTO SA