|

|

市場調査レポート

商品コード

1822297

膜の世界市場:材料別、技術別、用途別、地域別 - 2030年までの予測Membranes Market by Material (Polymeric, Ceramic), Technology (Reverse Osmosis, Ultrafiltration, Microfiltration, Nanofiltration), Application (Water & Wastewater Treatment, Industrial Processing), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 膜の世界市場:材料別、技術別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月15日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

概要

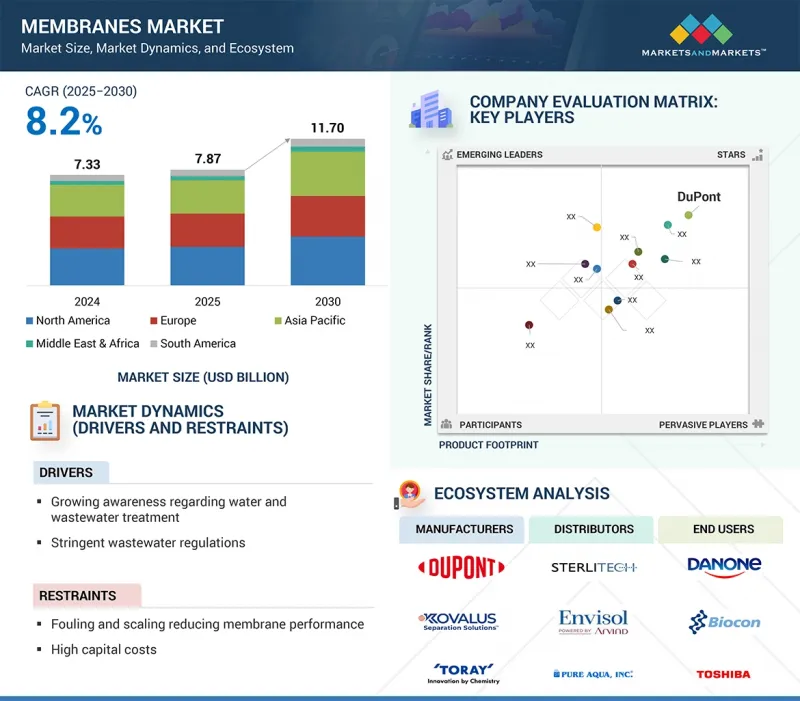

膜の市場規模は、2025年の78億7,000万米ドルから2030年には117億米ドルに達すると予想され、CAGRは8.2%になると見込まれています。

廃水処理に対する需要の高まりは、膜が効果的に汚染物質を除去し、厳しい廃棄基準を満たし、排水や処理水の再利用に伴うリスクを低減するのに役立つため、膜の使用に拍車をかけています。急速な工業化と都市化は、廃水生産の増加と汚染レベルの上昇につながり、持続可能な水管理と資源回収のための膜ろ過のような高度処理技術の採用や継続を促しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 1,000平方メートル、金額(100万米ドル) |

| セグメント | 材料別、技術別、用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

さらに、リサイクルと再利用による水不足の解消に注力することで、世界の自治体部門と産業部門の両方で膜の需要が高まると予想されます。

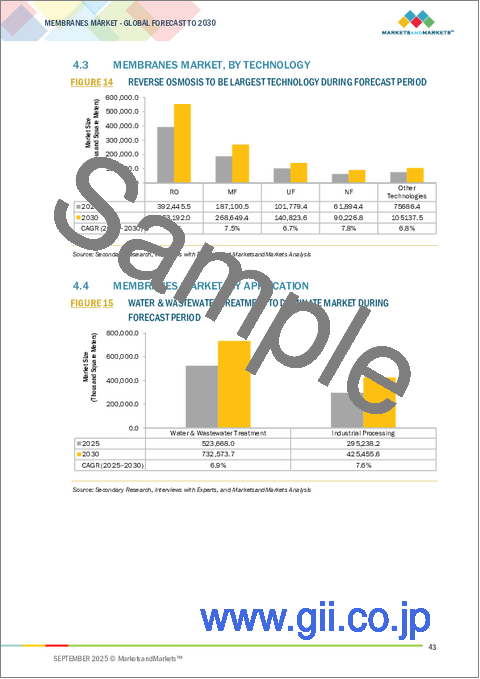

金額ベースでは、精密ろ過は、水・廃水処理システム、医薬品・医療品、食品・飲料などで幅広く使用されているため、膜市場で第2位のシェアを占めています。精密ろ過には、少ないエネルギー消費で懸濁物質、細菌、高分子を効果的かつ効率的に除去できるという、その用途に有益な独自の特徴があります。必要なエネルギーが低いため、精密ろ過は他の多くの治療方法と比べて比較的安価です。水質に関する規制基準の高まりと、浄化された廃液に対する業界全体の需要の高まりは、世界中で精密ろ過の採用が増加している主な理由の1つです。

高分子膜は、大幅なカスタマイズと柔軟な生産オプションを提供し、最もコスト効率が高く、高い耐薬品性を持つため、膜市場で2番目に急成長しているセグメントです。これらの膜は、優れた選択性と耐久性を提供する様々なポリマーを使用しており、水処理、医薬品、食品開発用途で一般的となっています。高分子化学の進歩により、耐ファウリング性が向上し、透過性が高まり、厳しい環境規制をクリアできるようになっています。また、持続可能な液体ろ過ソリューションへの注目と需要も高まっています。これらの動向は、予測期間を通じて高分子メンブレンフィルターの使用増加の機会を生み出すと予想されます。

アジア太平洋は、急速な工業化、都市化、中国、インド、東南アジアにおける清潔な水と廃水処理ソリューションの需要増加により、膜市場シェアを独占し、最も急成長している地域です。さらに、政府の強力なイニシアチブ、インフラへの設備投資、技術の継続的な進歩により、アジア太平洋は市場成長を増幅し、膜技術を採用し革新する機会を提供しています。

当レポートでは、世界の膜市場について調査し、材料別、技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界動向

- イントロダクション

- 主要な利害関係者と購入基準

- バリューチェーン分析

- エコシステム/市場マップ

- 貿易分析

- 価格分析

- 規制状況

- AI/GEN AIの影響

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ケーススタディ分析

- 2025~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- 2025年の米国関税の影響- 概要

第7章 膜市場(材料別)

- イントロダクション

- ポリマー

- セラミック

- その他

第8章 膜市場(技術別)

- イントロダクション

- 逆浸透

- 限外濾過

- マイクロフィルトレーション

- ナノ濾過

- その他

第9章 膜市場(用途別)

- イントロダクション

- 水・廃水処理

- 工業処理

第10章 膜市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- ドイツ

- フランス

- 英国

- イタリア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- DUPONT

- TORAY INDUSTRIES, INC.

- HYDRANAUTICS(A NITTO DENKO GROUP COMPANY)

- KOVALUS SEPARATION SOLUTIONS

- PALL CORPORATION

- VEOLIA

- PENTAIR

- ASAHI KASEI CORPORATION

- LG CHEM

- MANN+HUMMEL

- SOLVENTUN

- BEIJING ORIGINWATER TECHNOLOGY CO., LTD.

- その他の企業

- ALSYS

- APPLIED MEMBRANES, INC.

- AQUAPORIN

- AXEON WATER TECHNOLOGIES

- GEA GROUP AKTIENGESELLSCHAFT

- LANXESS

- LENNTECH B.V.

- MEMBRANE SOLUTIONS(NANTONG)

- MEMBRANIUM

- MERCK KGAA

- PARKER-HANNIFIN CORP

- PERMIONICS

- SYNDER FILTRATION, INC.

- SCINOR WATER AMERICA, LLC

- TOYOBO CO., LTD.