|

|

市場調査レポート

商品コード

1812622

企業資産管理(EAM)の世界市場:資産クラス別、用途別 - 予測(~2030年)Enterprise Asset Management Market by Asset Class, Application - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 企業資産管理(EAM)の世界市場:資産クラス別、用途別 - 予測(~2030年) |

|

出版日: 2025年09月13日

発行: MarketsandMarkets

ページ情報: 英文 261 Pages

納期: 即納可能

|

概要

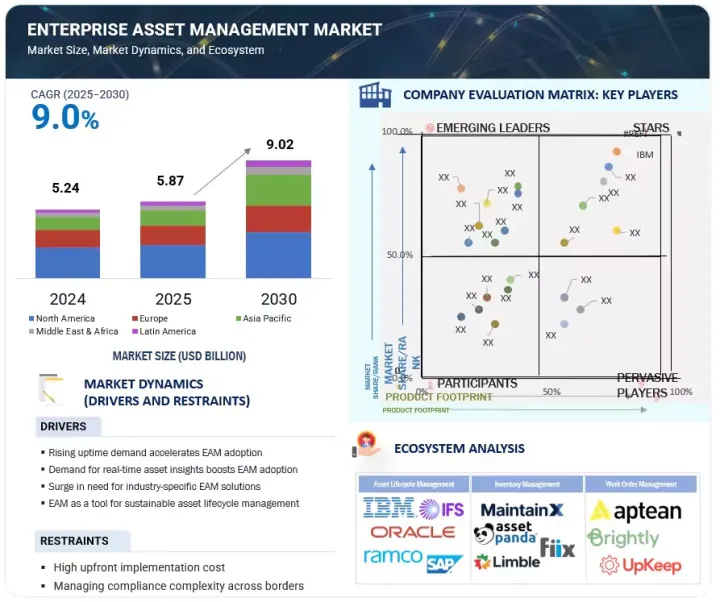

世界の企業資産管理(EAM)市場は急速に拡大しており、市場規模は2025年の約58億7,000万米ドルから2030年までに90億2,000万米ドルに達すると予測され、CAGRで9.0%の成長が見込まれます。

資産集約型産業における規制遵守と安全管理に対する需要の高まりが、EAMソリューションの採用を促進すると予測されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 提供、用途、展開タイプ、資産クラス、組織規模、業界 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

エネルギー、医療、輸送の各部門は、設備の安全性、環境基準、業務報告に関する厳しいコンプライアンス要件に直面しています。EAMソリューションは、組織が正確な監査証跡を維持し、検査を追跡し、資産が規制基準を満たしていることを確認し、法的リスクを低減し、ステークホルダーの信頼を向上させるのに役立ちます。

一方、大きな抑制要因となっているのが、多様なレガシーシステムやサイロ化した業務からのデータ統合です。多くの企業、特に老朽化したインフラを持つ企業は、複数のプラットフォーム、手動の記録、時代遅れの設備モニタリングシステムからのデータを統合するのに苦労しています。この複雑性がEAMの採用を遅らせ、予測分析やリアルタイムモニタリングなどの先進の機能を活用する能力を制限しています。これらの要因は、規制上のニーズがいかに採用を促進するかを浮き彫りにする一方で、統合のハードルがシームレスな導入の障壁となっています。

「組織規模別では、中小企業セグメントが予測期間にもっとも高いCAGRで成長する見込みです。」

この成長の促進要因は、クラウドベースのデジタルEAMソリューションの採用の増加であり、これらのソリューションは拡張性があり、コスト効率が高く、展開が容易なオプションを中小企業に提供しています。中小企業では、設備利用の最適化、ダウンタイムの削減、業務効率の向上を目的とした資産管理への投資が増加していますが、限られたリソースに合わせたソリューションが必要です。サブスクリプションベースのモジュール式EAMが提供されているため、中小企業は多額の先行投資をすることなく、予知保全、リアルタイムモニタリング、アナリティクスなどの先進の機能を利用することができます。

さらに、中小企業におけるデジタルトランスフォーメーション、規制遵守、持続可能性の取り組みの推進が、EAMソリューションの需要をさらに促進しており、このセグメントは予測期間に市場でもっとも急成長する組織カテゴリとなっています。

「製造業界セグメントが予測期間に最大の市場シェアを占める見込みです。」

製造は、機械、生産ライン、工業設備に大きく依存する資産集約的な部門であり、ダウンタイムや非効率性が生産高や収益性に直接影響する可能性があります。EAMソリューションは、メーカーが資産利用を最適化し、設備の性能をモニタリングし、計画外のダウンタイムを削減するための予防的な保守戦略を実施するのに役立ちます。インダストリー4.0とスマートファクトリー構想の台頭により、メーカーはコネクテッドデバイス、デジタルツイン、オートメーションシステムからのリアルタイムデータを統合するIoT対応EAMプラットフォームの採用を増やしています。

これらの機能により、予測的考察、品質管理の改良、生産サイクル全体にわたるワークフローの合理化が実現されます。例えば2024年6月、Godrej & BoyceはHxGN EAMを導入し、設備の稼働率を60%から95%に向上させ、労働者稼働率を70%改良し、在庫コストを45%削減しました。これらの改良により業務効率が向上し、生産性の向上、コスト削減、長期的な収益性の向上につながっています。さらに、製造部門における厳格な安全規制や環境規制の遵守が、堅牢な資産管理ソリューションへのニーズをさらに高めています。

当レポートでは、世界の企業資産管理(EAM)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 企業資産管理(EAM)市場の企業にとって魅力的な機会

- 企業資産管理(EAM)市場:サービス別(2025年・2030年)

- 企業資産管理(EAM)市場:用途別(2025年・2030年)

- 企業資産管理(EAM)市場:展開タイプ別(2025年・2030年)

- 企業資産管理(EAM)市場:組織規模別(2025年・2030年)

- 企業資産管理(EAM)市場:資産クラス別(2025年・2030年)

- 企業資産管理(EAM)市場:業界別(2025年・2030年)

- 企業資産管理(EAM)市場:地域のシナリオ

第5章 市場の概要と産業動向(定量的な影響を持つ戦略的促進要因)

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- エコシステム分析

- サプライチェーン分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 主要規制:地域別

- 価格設定の分析

- 平均販売価格:地域別(2021年~2024年)

- 参考価格:主要企業別(2024年)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- ケーススタディ分析

- ケーススタディ1:HUNGRANA、資産管理にSAP EAMを活用

- ケーススタディ2:RIYADH AIRPORT COMPANY、IBM MAXIMOで空港資産管理を変革

- ケーススタディ3:ヘキサゴンのHXGN EAMによるシームレスなMALARTAGの鉄道網の移行

- ケーススタディ4:L'OREAL、CMMSの採用によりリアルタイムの資産可視化を実現

- ケーススタディ5:APTEAN EAMによる6ヶ月でのエンジニアリングチームの900%の成長の促進

- 主な会議とイベント(2025年~2026年)

- 投資と資金調達のシナリオ

- 企業資産管理(EAM)市場におけるAI/生成AIの影響

- ケーススタディ分析

- カスタマービジネスに影響を与える動向/破壊

第6章 企業資産管理(EAM)市場:提供別(市場規模と予測、~2030年)

- イントロダクション

- ソリューション

- サービス

第7章 企業資産管理(EAM)市場:用途別(市場規模と予測、~2030年)

- イントロダクション

- 資産ライフサイクル管理

- 経営管理

- 保守管理

- コンプライアンス・安全性

- 報告・アナリティクス

- その他の用途

第8章 企業資産管理(EAM)市場:展開タイプ別(市場規模と予測、~2030年)

- イントロダクション

- クラウド

- オンプレミス

第9章 企業資産管理(EAM)市場:資産クラス別(市場規模と予測、~2030年)

- イントロダクション

- 線形資産

- 生産設備

- フリート・動産

- 固定資産/施設資産/インフラ

- その他の資産

第10章 企業資産管理(EAM)市場:企業規模別(市場規模と予測、~2030年)

- イントロダクション

- 大企業

- 中小企業

第11章 企業資産管理(EAM)市場:業界別(市場規模と予測、~2030年)

- イントロダクション

- 製造

- エネルギー・公益事業

- 石油・ガス

- 輸送・ロジスティクス

- 医療・ライフサイエンス

- 政府・公共部門

- その他の業界

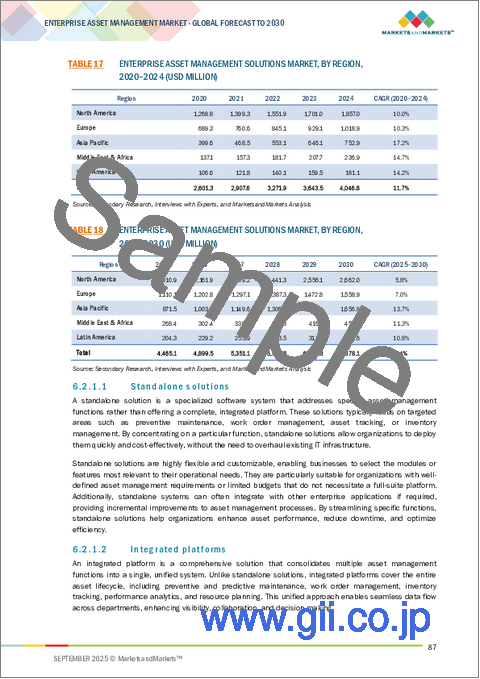

第12章 企業資産管理(EAM)市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 北米の企業資産管理(EAM)市場の促進要因

- 米国

- カナダ

- 欧州

- 欧州の企業資産管理(EAM)市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋の企業資産管理(EAM)市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの企業資産管理(EAM)市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカの企業資産管理(EAM)市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要企業

- IBM

- SAP

- ORACLE

- IFS

- HEXAGON AB

- TRIMBLE

- APTEAN

- SERVICENOW

- HITACHI ENERGY

- RAMCO

- その他の企業

- ACCRUENT

- MAINTAINX

- EMAINT

- LLUMIN

- CENTRALSQUARE

- ABS GROUP

- UPKEEP

- ASSETWORKS

- ASSET PANDA

- ASSET INFINITY

- EZMAINTAIN

- KLOUDGIN

- LIMBLE CMMS

- IPS INTELLIGENT PROCESS SOLUTION

- EPROMIS SOLUTIONS

第15章 隣接市場/関連市場

- イントロダクション

- 関連市場

- 制限事項

- 人材管理

- ワークフォースマネジメント