|

|

市場調査レポート

商品コード

1788511

過酢酸の世界市場:グレード別、用途別、最終用途産業別、形状別、地域別 - 2030年までの予測Peracetic Acid Market by Grade, Application, End-use Industry (Healthcare, Food & Beverage, Water Treatment, Pulp & Paper, Other End-use Industries ), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 過酢酸の世界市場:グレード別、用途別、最終用途産業別、形状別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月07日

発行: MarketsandMarkets

ページ情報: 英文 271 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

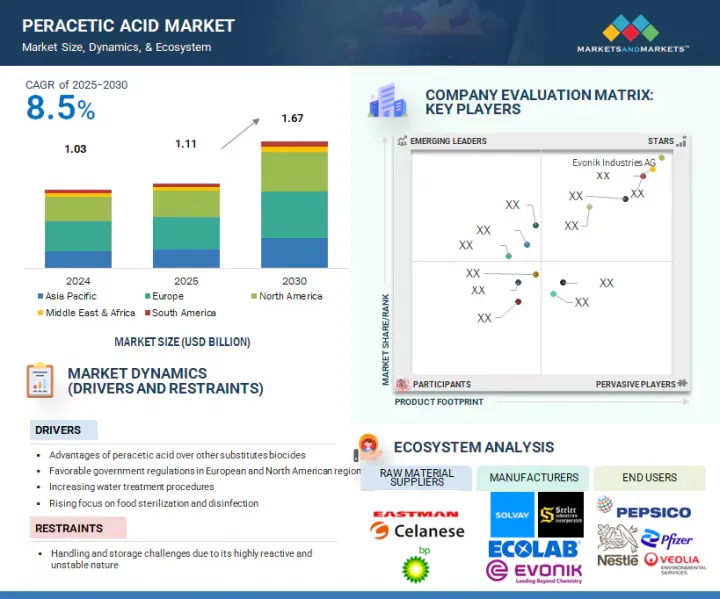

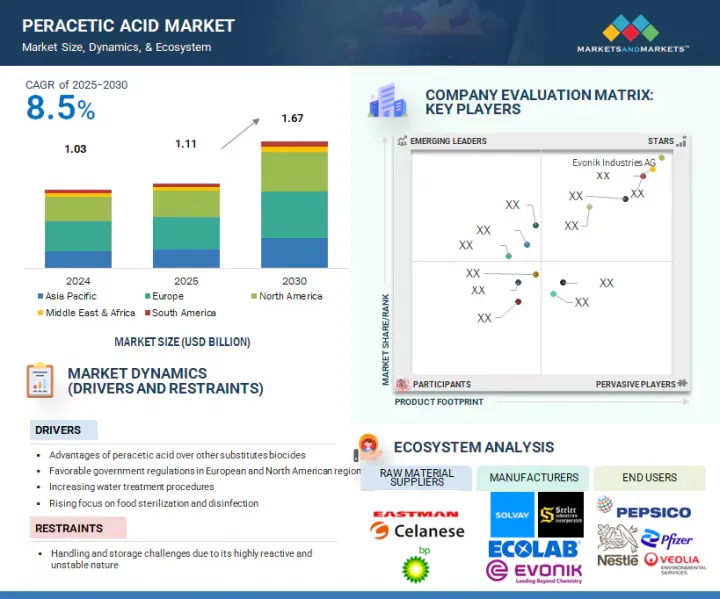

過酢酸の市場規模は、2025年の11億1,000万米ドルから8.5%のCAGRで拡大し、2030年には16億7,000万米ドルに達すると予測されています。

2025年の過酢酸市場は、欧州が金額ベースで最大のシェアを占めると推定されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル)および数量(キロトン) |

| セグメント | グレード別、用途別、最終用途産業別、形状別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

過酢酸は、その強力な酸化特性、抗菌効果、環境に優しい性質から、多くの用途で非常に効率的な選択肢を提供しています。医療分野では、幅広い病原体を根絶する能力があるため、滅菌や消毒によく利用されています。食品・飲料業界では、機器の洗浄や表面の消毒に不可欠で、食品の安全性と衛生規則の遵守を保証します。急速な工業化と都市化に伴い、過酢酸のニーズはヘルスケア、食品加工、水処理、農業などの産業で高まっています。さらに、アジア太平洋などのインフラ整備が進み、環境衛生や廃水消毒への応用が促進され、市場の拡大が進んでいます。

欧州地域では、ロシアが予測期間中に過酢酸市場で最も高い成長を遂げると予測されています。この拡大は、主に食品加工、ヘルスケア、水処理産業への投資増加によって促進されています。特に規制要件の強化に伴い、衛生や微生物汚染に対する懸念が高まっているため、過酢酸のような強力な殺生物剤の使用が加速しています。さらに、政府が公衆衛生インフラの強化や廃水処理能力の向上に力を入れていることも、市場の成長をさらに後押ししています。継続的な産業成長と持続可能な消毒オプションへの注目の高まりにより、ロシアは様々な最終用途分野で過酢酸の大きな需要が見込まれます。

北米は世界の過酢酸市場で2番目に大きな部分を占めました。同地域の堅調な市場プレゼンスは、食品・飲料加工、ヘルスケア、医薬品、水処理などの必須セクターにおける過酢酸の広範な応用によるものです。米国では、非塩素系消毒剤としての効率性と、FDA、EPA、USDAなどの組織による厳しい規制ガイドラインの遵守により、過酢酸が大幅に使用されています。さらに、食品安全、感染予防、持続可能な衛生オプションへの注目の高まりが、この地域全体の過酢酸需要を後押しし続けています。

アジア太平洋では、2025年に中国が過酢酸の最大市場になると思われます。この重要な役割は、国の強固な産業基盤、食品加工産業の開発、ヘルスケアと廃水処理施設への投資の増加によって促進されます。中国では、特に食品・飲料や製薬分野での衛生と環境安全に関する規制が厳しく、過酢酸の消毒剤としての利用が増加しています。さらに、都市の急速な成長と市場開拓により、持続可能で効果的な衛生ソリューションへのニーズが高まっており、市場はさらに拡大しています。公衆衛生と環境保護に重点を置く国家では、過酢酸のニーズは複数の最終用途部門にわたって堅調に推移する可能性が高いです。

当レポートでは、世界の過酢酸市場について調査し、グレード別、用途別、最終用途産業別、形状別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済見通し

第6章 業界動向

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 価格分析

- 貿易分析

- 技術分析

- ケーススタディ分析

- 規制状況

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIによる過酢酸への影響

- 2025年の米国関税が過酢酸市場に与える影響

第7章 過酢酸市場(グレード別)

- イントロダクション

- 5%未満

- 5~15%

- 15%以上

第8章 過酢酸市場(用途別)

- イントロダクション

- 消毒剤

- 殺菌剤

- 消毒剤

- その他

第9章 過酢酸市場(最終用途産業別)

- イントロダクション

- ヘルスケア

- 食品・飲料

- 水処理

- パルプ・紙

- その他

第10章 過酢酸市場(形状別)

- イントロダクション

- 液体

- 安定化

- 粉末

- オンサイト生成

第11章 過酢酸市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- 南米

- ブラジル

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析、2024年

- 収益分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SOLVAY

- EVONIK INDUSTRIES AG

- ECOLAB INC.

- MITSUBISHI GAS CHEMICAL COMPANY

- ARXADA AG

- JUBILANT LIFE SCIENCES(JUBILANT PHARMOVA LIMITED)

- NATIONAL PEROXIDE LIMITED

- KEMIRA OYJ

- SEELER INDUSTRIES INC.

- AIREDALE CHEMICAL

- その他の企業

- SEITZ GMBH

- BELINKA PERKEMIJA

- THAI PEROXIDE LIMITED(ADITYA BIRLA CHEMICALS)

- CHRISTEYNS

- PROMOX

- ACURO ORGANICS LIMITED

- STOCKMEIER GROUP

- KERSIA GROUP

- NOVADAN APS

- HYDRITE CHEMICAL CO.

- EVOQUA WATER TECHNOLOGIES LLC.

- BIOSAFE SYSTEMS

- LUBRIZOL

- CHEMTEX SPECIALITY LIMITED

- VIROX TECHNOLOGIES INC.

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 PERACETIC ACID MARKET: DEFINITION AND INCLUSIONS, BY GRADE

- TABLE 2 PERACETIC ACID MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- TABLE 3 PERACETIC ACID MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 4 PERACETIC ACID: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END USERS (%)

- TABLE 6 KEY BUYING CRITERIA FOR PERACETIC ACID

- TABLE 7 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 8 ROLES OF COMPANIES IN PERACETIC ACID ECOSYSTEM

- TABLE 9 AVERAGE SELLING PRICE OF PERACETIC ACID OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE TREND OF PERACETIC ACID, BY REGION, 2022-2030 (USD/KG)

- TABLE 11 IMPORT DATA RELATED TO HS CODE 291539-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT DATA RELATED TO HS CODE 291539-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 13 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 PERACETIC ACID MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 20 PERACETIC ACID MARKET: FUNDING/INVESTMENT SCENARIO

- TABLE 21 PERACETIC ACID MARKET: PATENT STATUS, 2014-2024

- TABLE 22 PERACETIC ACID MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 23 PATENTS BY ECOLAB USA INC., 2024

- TABLE 24 TOP 10 PATENT OWNERS IN US, 2014-2024

- TABLE 25 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 PERACETIC ACID MARKET, BY GRADE, 2020-2024 (USD MILLION)

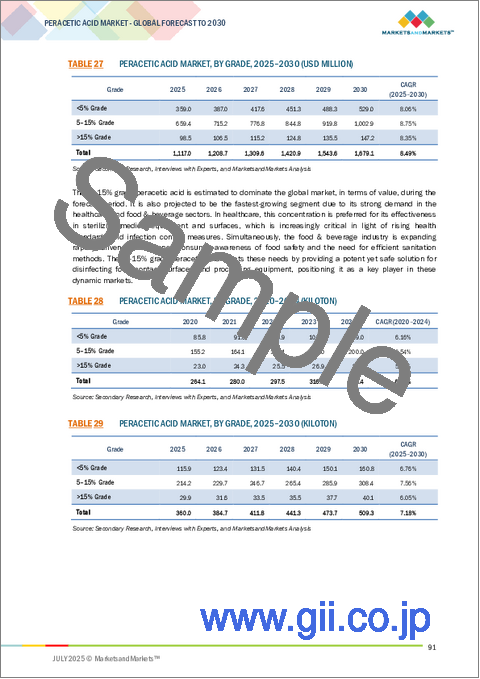

- TABLE 27 PERACETIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 28 PERACETIC ACID MARKET, BY GRADE, 2020-2024 (KILOTON)

- TABLE 29 PERACETIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 30 <5% GRADE: PERACETIC ACID MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 <5% GRADE: PERACETIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 <5% GRADE: PERACETIC ACID MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 33 <5% GRADE: PERACETIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 5-15% GRADE: PERACETIC ACID MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 5-15% GRADE: PERACETIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 5-15% GRADE: PERACETIC ACID MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 37 5-15% GRADE: PERACETIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 >15% GRADE: PERACETIC ACID MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 >15% GRADE: PERACETIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 >15% GRADE: PERACETIC ACID MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 41 >15% GRADE: PERACETIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 43 PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 45 PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 46 COMPARISON OF DISINFECTANTS

- TABLE 47 PERACETIC ACID MARKET IN DISINFECTANT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 PERACETIC ACID MARKET IN DISINFECTANT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 PERACETIC ACID MARKET IN DISINFECTANT, BY REGION, 2020-2024 (KILOTON)

- TABLE 50 PERACETIC ACID MARKET IN DISINFECTANT, BY REGION, 2025-2030 (KILOTON)

- TABLE 51 PERACETIC ACID MARKET IN STERILANT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 PERACETIC ACID MARKET IN STERILANT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 PERACETIC ACID MARKET IN STERILANT, BY REGION, 2020-2024 (KILOTON)

- TABLE 54 PERACETIC ACID MARKET IN STERILANT, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 TYPICAL SANITIZERS FOR FOOD INDUSTRY

- TABLE 56 PERACETIC ACID MARKET IN SANITIZER, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 PERACETIC ACID MARKET IN SANITIZER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 PERACETIC ACID MARKET IN SANITIZER, BY REGION, 2020-2024 (KILOTON)

- TABLE 59 PERACETIC ACID MARKET IN SANITIZER, BY REGION, 2025-2030 (KILOTON)

- TABLE 60 PERACETIC ACID MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 PERACETIC ACID MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 PERACETIC ACID MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2024 (KILOTON)

- TABLE 63 PERACETIC ACID MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (KILOTON)

- TABLE 64 PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 65 PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 66 PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 67 PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 68 PERACETIC ACID MARKET IN HEALTHCARE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 PERACETIC ACID MARKET IN HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 PERACETIC ACID MARKET IN HEALTHCARE, BY REGION, 2020-2024 (KILOTON)

- TABLE 71 PERACETIC ACID MARKET IN HEALTHCARE, BY REGION, 2025-2030 (KILOTON)

- TABLE 72 PERACETIC ACID MARKET IN FOOD & BEVERAGE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 PERACETIC ACID MARKET IN FOOD & BEVERAGE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 PERACETIC ACID MARKET IN FOOD & BEVERAGE, BY REGION, 2020-2024 (KILOTON)

- TABLE 75 PERACETIC ACID MARKET IN FOOD & BEVERAGE, BY REGION, 2025-2030 (KILOTON)

- TABLE 76 PERACETIC ACID MARKET IN WATER TREATMENT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 PERACETIC ACID MARKET IN WATER TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 PERACETIC ACID MARKET IN WATER TREATMENT, BY REGION, 2020-2024 (KILOTON)

- TABLE 79 PERACETIC ACID MARKET IN WATER TREATMENT, BY REGION, 2025-2030 (KILOTON)

- TABLE 80 PERACETIC ACID MARKET IN PULP & PAPER, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 PERACETIC ACID MARKET IN PULP & PAPER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 PERACETIC ACID MARKET IN PULP & PAPER, BY REGION, 2020-2024 (KILOTON)

- TABLE 83 PERACETIC ACID MARKET IN PULP & PAPER, BY REGION, 2025-2030 (KILOTON)

- TABLE 84 PERACETIC ACID MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 PERACETIC ACID MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 PERACETIC ACID MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2024 (KILOTON)

- TABLE 87 PERACETIC ACID MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (KILOTON)

- TABLE 88 PERACETIC ACID MARKET IN AGRICULTURE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 PERACETIC ACID MARKET IN AGRICULTURE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 PERACETIC ACID MARKET IN AGRICULTURE, BY REGION, 2020-2024 (KILOTON)

- TABLE 91 PERACETIC ACID MARKET IN AGRICULTURE, BY REGION, 2025-2030 (KILOTON)

- TABLE 92 PERACETIC ACID MARKET IN WINERIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 PERACETIC ACID MARKET IN WINERIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 PERACETIC ACID MARKET IN WINERIES, BY REGION, 2020-2024 (KILOTON)

- TABLE 95 PERACETIC ACID MARKET IN WINERIES, BY REGION, 2025-2030 (KILOTON)

- TABLE 96 PERACETIC ACID MARKET IN BREWERIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 PERACETIC ACID MARKET IN BREWERIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 PERACETIC ACID MARKET IN BREWERIES, BY REGION, 2020-2024 (KILOTON)

- TABLE 99 PERACETIC ACID MARKET IN BREWERIES, BY REGION, 2025-2030 (KILOTON)

- TABLE 100 PERACETIC ACID MARKET IN LAUNDRIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 PERACETIC ACID MARKET IN LAUNDRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 PERACETIC ACID MARKET IN LAUNDRIES, BY REGION, 2020-2024 (KILOTON)

- TABLE 103 PERACETIC ACID MARKET IN LAUNDRIES, BY REGION, 2025-2030 (KILOTON)

- TABLE 104 PERACETIC ACID MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 PERACETIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 PERACETIC ACID MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 107 PERACETIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 108 ASIA PACIFIC: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (KILOTON)

- TABLE 111 ASIA PACIFIC: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 112 ASIA PACIFIC: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 115 ASIA PACIFIC: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 116 ASIA PACIFIC: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 119 ASIA PACIFIC: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 120 ASIA PACIFIC: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 123 ASIA PACIFIC: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 124 CHINA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 125 CHINA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 CHINA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 127 CHINA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 128 INDIA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 129 INDIA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 INDIA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 131 INDIA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 132 JAPAN: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 133 JAPAN: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 JAPAN: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 135 JAPAN: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 136 SOUTH KOREA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 137 SOUTH KOREA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH KOREA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 139 SOUTH KOREA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 140 NORTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (KILOTON)

- TABLE 143 NORTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 144 NORTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 147 NORTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 148 NORTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 149 NORTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 150 NORTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 151 NORTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 152 NORTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 153 NORTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 NORTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 155 NORTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 156 US: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 157 US: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 US: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 159 US: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 160 CANADA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 161 CANADA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 CANADA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 163 CANADA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 164 MEXICO: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 165 MEXICO: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 MEXICO: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 167 MEXICO: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 168 EUROPE: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (USD MILLION)

- TABLE 169 EUROPE: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 170 EUROPE: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (KILOTON)

- TABLE 171 EUROPE: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 172 EUROPE: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 173 EUROPE: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 EUROPE: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 175 EUROPE: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 176 EUROPE: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 177 EUROPE: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 178 EUROPE: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 179 EUROPE: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 180 EUROPE: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 181 EUROPE: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 EUROPE: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 183 EUROPE: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 184 GERMANY: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 185 GERMANY: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 GERMANY: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 187 GERMANY: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 188 UK: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 189 UK: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 UK: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 191 UK: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 192 FRANCE: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 193 FRANCE: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 FRANCE: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 195 FRANCE: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 196 ITALY: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 197 ITALY: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 ITALY: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 199 ITALY: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 200 RUSSIA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 201 RUSSIA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 RUSSIA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 203 RUSSIA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 204 SOUTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (KILOTON)

- TABLE 207 SOUTH AMERICA: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 208 SOUTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 209 SOUTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 210 SOUTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 211 SOUTH AMERICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 212 SOUTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 213 SOUTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 214 SOUTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 215 SOUTH AMERICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 216 SOUTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 219 SOUTH AMERICA: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 220 BRAZIL: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 221 BRAZIL: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 222 BRAZIL: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 223 BRAZIL: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 224 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY GRADE, 2020-2024 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 228 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 231 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 232 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 235 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 236 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 239 MIDDLE EAST & AFRICA: PERACETIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 240 UAE: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 241 UAE: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 242 UAE: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 243 UAE: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 244 SAUDI ARABIA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 245 SAUDI ARABIA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 246 SAUDI ARABIA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 247 SAUDI ARABIA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 248 SOUTH AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 249 SOUTH AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 250 SOUTH AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 251 SOUTH AFRICA: PERACETIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 252 OVERVIEW OF STRATEGIES ADOPTED BY KEY PERACETIC ACID MANUFACTURERS

- TABLE 253 PERACETIC ACID MARKET: DEGREE OF COMPETITION

- TABLE 254 PERACETIC ACID MARKET: REGION FOOTPRINT

- TABLE 255 PERACETIC ACID MARKET: GRADE FOOTPRINT

- TABLE 256 PERACETIC ACID MARKET: APPLICATION FOOTPRINT

- TABLE 257 PERACETIC ACID MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 258 PERACETIC ACID: KEY STARTUPS/SMES

- TABLE 259 PERACETIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 260 PERACETIC ACID MARKET: PRODUCT LAUNCHES, 2020-2024

- TABLE 261 PERACETIC ACID MARKET: DEALS, 2020-2024

- TABLE 262 SOLVAY: COMPANY OVERVIEW

- TABLE 263 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 265 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 EVONIK INDUSTRIES AG: DEALS

- TABLE 267 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 268 ECOLAB INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 270 MITSUBISHI GAS CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 271 ARXADA AG: COMPANY OVERVIEW

- TABLE 272 ARXADA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 ARXADA AG: PRODUCT LAUNCHES

- TABLE 274 ARXADA AG: DEALS

- TABLE 275 JUBILANT LIFE SCIENCES (JUBILANT PHARMOVA LIMITED): COMPANY OVERVIEW

- TABLE 276 JUBILANT LIFE SCIENCES (JUBILANT PHARMOVA LIMITED): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 NATIONAL PEROXIDE LIMITED: COMPANY OVERVIEW

- TABLE 278 NATIONAL PEROXIDE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 KEMIRA OYJ: COMPANY OVERVIEW

- TABLE 280 KEMIRA OYJ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 SEELER INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 282 SEELER INDUSTRIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 AIREDALE CHEMICALS: COMPANY OVERVIEW

- TABLE 284 AIREDALE CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 SEITZ GMBH: COMPANY OVERVIEW

- TABLE 286 BELINKA PERKEMIJA: COMPANY OVERVIEW

- TABLE 287 THAI PEROXIDE LIMITED (ADITYA BIRLA CHEMICALS): COMPANY OVERVIEW

- TABLE 288 CHRISTEYNS: COMPANY OVERVIEW

- TABLE 289 PROMOX: COMPANY OVERVIEW

- TABLE 290 ACURO ORGANICS LIMITED: COMPANY OVERVIEW

- TABLE 291 STOCKMEIER GROUP: COMPANY OVERVIEW

- TABLE 292 KERSIA GROUP: COMPANY OVERVIEW

- TABLE 293 NOVADAN APS: COMPANY OVERVIEW

- TABLE 294 HYDRITE CHEMICAL CO.: COMPANY OVERVIEW

- TABLE 295 EVOQUA WATER TECHNOLOGIES LLC.: COMPANY OVERVIEW

- TABLE 296 BIOSAFE SYSTEMS: COMPANY OVERVIEW

- TABLE 297 LUBRIZOL: COMPANY OVERVIEW

- TABLE 298 CHEMTEX SPECIALITY LIMITED: COMPANY OVERVIEW

- TABLE 299 VIROX TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 300 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 301 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 302 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 303 WATER TREATMENT CHEMICALS MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 304 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 305 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 306 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 307 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 308 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 309 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 310 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 311 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 312 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 313 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 314 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 315 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 316 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 319 MIDDLE EAST & AFRICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 320 SOUTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 321 SOUTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 322 SOUTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 323 SOUTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

List of Figures

- FIGURE 1 PERACETIC ACID MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PERACETIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2) - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE AND SHARE OF MAJOR PLAYERS

- FIGURE 5 PERACETIC ACID MARKET SIZE ESTIMATION, BY VOLUME

- FIGURE 6 PERACETIC ACID MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4: TOP-DOWN

- FIGURE 8 PERACETIC ACID MARKET: DATA TRIANGULATION

- FIGURE 9 PERACETIC ACID MARKET: SUPPLY-SIDE FORECAST

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 11 DISINFECTANT ESTIMATED TO BE LARGEST APPLICATION OF PERACETIC ACID MARKET IN 2024

- FIGURE 12 EUROPE TO LEAD PERACETIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 13 5-15% GRADE SEGMENT TO DRIVE PERACETIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 14 WATER TREATMENT TO BE FASTEST-GROWING END-USE INDUSTRY OF PERACETIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 15 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

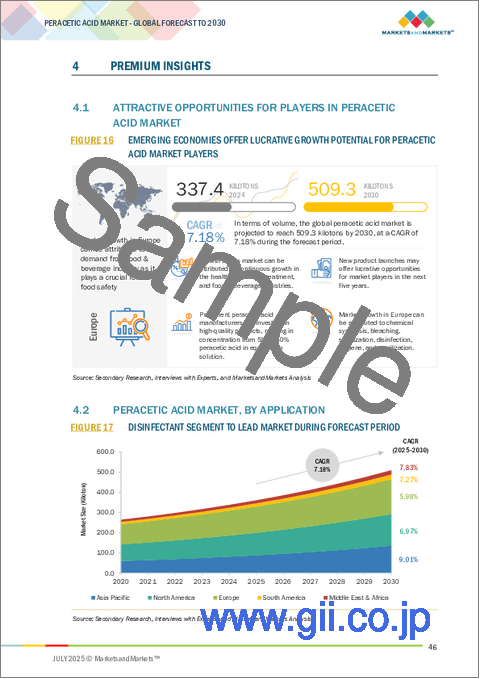

- FIGURE 16 EMERGING ECONOMIES OFFER LUCRATIVE GROWTH POTENTIAL FOR PERACETIC ACID MARKET PLAYERS

- FIGURE 17 DISINFECTANT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 DISINFECTANT SEGMENT AND GERMANY ACCOUNTED FOR LARGEST SHARES OF EUROPEAN PERACETIC ACID MARKET IN 2024

- FIGURE 19 FOOD & BEVERAGE APPLICATION LED PERACETIC ACID MARKET ACROSS ALL REGIONS EXCEPT ASIA PACIFIC IN 2024

- FIGURE 20 INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PERACETIC ACID MARKET

- FIGURE 22 PERACETIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR PERACETIC ACID

- FIGURE 25 PERACETIC ACID MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 TRENDS IN END-USE INDUSTRIES IMPACTING BUSINESS OF PERACETIC ACID MANUFACTURERS

- FIGURE 27 TRENDS IN END-USE INDUSTRIES IMPACTING BUSINESS OF PERACETIC ACID MANUFACTURERS

- FIGURE 28 AVERAGE SELLING PRICE OF PERACETIC ACID OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PERACETIC ACID, BY REGION, 2022-2030

- FIGURE 30 IMPORT DATA FOR HS CODE 291539-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 291539-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 PATENTS REGISTERED RELATED TO PERACETIC ACID, 2014-2024

- FIGURE 33 TOP PATENT OWNERS, 2014-2024

- FIGURE 34 LEGAL STATUS OF PATENTS FILED FOR PERACETIC ACID, 2014-2024

- FIGURE 35 MAJOR PATENTS FILED IN US JURISDICTION, 2014-2024

- FIGURE 36 PERACETIC ACID MARKET: IMPACT OF AI/GEN AI

- FIGURE 37 5-15% GRADE SEGMENT TO BE FASTEST-GROWING PERACETIC ACID GRADE DURING FORECAST PERIOD

- FIGURE 38 DISINFECTANT SEGMENT TO LEAD PERACETIC ACID MARKET BETWEEN 2025 AND 2030

- FIGURE 39 WATER TREATMENT TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 40 EUROPE TO LEAD PERACETIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: PERACETIC ACID MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: PERACETIC ACID MARKET SNAPSHOT

- FIGURE 43 EUROPE: PERACETIC ACID MARKET SNAPSHOT

- FIGURE 44 SOLVAY LED PERACETIC ACID MARKET IN 2024

- FIGURE 45 PERACETIC ACID MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 46 PERACETIC ACID MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 47 PERACETIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 48 PERACETIC ACID MARKET: STARTUPS/SMES EVALUATION MATRIX, 2024

- FIGURE 49 PERACETIC ACID MARKET: EV/EBITDA OF KEY PLAYERS

- FIGURE 50 PERACETIC ACID MARKET: COMPANY VALUATION OF KEY PLAYERS

- FIGURE 51 PRODUCT COMPARISON OF KEY PLAYERS

- FIGURE 52 SOLVAY: COMPANY SNAPSHOT

- FIGURE 53 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 54 ECOLAB: COMPANY SNAPSHOT

- FIGURE 55 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 56 JUBILANT LIFE SCIENCES (JUBILANT PHARMOVA LIMITED): COMPANY SNAPSHOT

- FIGURE 57 NATIONAL PEROXIDE LIMITED: COMPANY SNAPSHOT

- FIGURE 58 KEMIRA OYJ: COMPANY SNAPSHOT

The peracetic acid market size is projected to reach USD 1.67 billion by 2030 at a CAGR of 8.5% from USD 1.11 billion in 2025. Europe is estimated to account for the largest share in terms of value of the peracetic acid market in 2025.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Grade, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Peracetic acid offers a highly efficient option in numerous applications because of its potent oxidizing characteristics, antimicrobial effectiveness, and eco-friendly nature. In the medical field, it is commonly utilized for sterilization and disinfection due to its capacity to eradicate a wide range of pathogens. In the food & beverage industry, it is essential for cleaning equipment and disinfecting surfaces, guaranteeing food safety and adherence to hygiene regulations. With the rapid pace of industrialization and urbanization, the need for peracetic acid increases in industries like healthcare, food processing, water treatment, and agriculture. Moreover, infrastructural advancements in areas such as Asia Pacific are boosting its application in environmental sanitation and wastewater disinfection, aiding its ongoing market expansion.

"Russia, in Europe is forecasted to be the fastest-growing peracetic acid market during the forecast period."

In the Europe region, Russia is anticipated to experience the highest growth in the peracetic acid market during the forecast period. This expansion is mainly fueled by rising investments in the nation's food processing, healthcare, and water treatment industries. Increasing worries about sanitation and microbial contamination, particularly following tougher regulatory requirements, have sped up the use of potent biocidal agents such as peracetic acid. Moreover, the government's emphasis on enhancing public health infrastructure and increasing wastewater treatment capacity is further aiding market growth. Due to continuous industrial growth and an increasing focus on sustainable disinfection options, Russia is anticipated to experience significant demand for peracetic acid in various end-use sectors.

"North America is likely to account for the second-largest share of peracetic acid market in terms of value."

North America represented the second-largest portion of the global peracetic acid market. The area's robust market presence is due to the extensive application of peracetic acid in essential sectors like food & beverage processing, healthcare, pharmaceuticals, and water treatment. The US has experienced significant use of peracetic acid because of its efficiency as a non-chlorinated disinfectant and adherence to stringent regulatory guidelines from organizations like the FDA, EPA, and USDA. Additionally, the increasing focus on food safety, infection prevention, and sustainable sanitation options continues to boost the demand for peracetic acid throughout the area.

"China is projected to be the largest market of peracetic acid in Asia Pacific during the forecast period."

In the Asia Pacific area, China will be the biggest market for peracetic acid in 2025. This prominent role is fueled by the nation's strong industrial foundation, developing food processing industry, and increasing investments in healthcare and wastewater treatment facilities. China's stringent regulations concerning hygiene and environmental safety, especially within the food & beverage and pharmaceutical sectors, have led to a rise in the usage of peracetic acid as a favored disinfectant. Moreover, the swift rate of urban growth and industrial development has increased the need for sustainable and effective sanitation solutions, further enhancing the market. With the nation focusing on public health and environmental safeguards, the need for peracetic acid is likely to stay robust across multiple end-use sectors.

Interviews:

- By Company Type: Tier 1 - 33%, Tier 2 - 40%, and Tier 3 - 27%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 36%, Europe - 23%, Asia Pacific - 27%, Middle East & Africa - 10% and South America - 4%

The key players profiled in the report include Solvay (Belgium), Evonik Industries AG (Germany), Ecolab Inc. (US), MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan), Enviro Tech Chemical Services (US), Jubilant Life Sciences (Jubilant Pharmova Limited) (India), National Peroxide Limited (India), Kemira OYJ (Finland), Seeler Industries Inc. (US), and Airedale Chemical (UK), among others.

Research Coverage

This report segments the market for peracetic acid based on grade, application, end-use industry, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for peracetic acid.

Reasons to Buy this Report

This report provides insights on the following pointers:

- Analysis of key drivers (Advantages of peracetic acid over other substitutes biocides, favorable government regulations in European and North American regions, increasing water treatment procedures, rising focus on food sterilization and disinfection), opportunities (High growth potential in Asia Pacific), and restraints (Handling and storage challenges due to its highly reactive and unstable nature).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the peracetic acid market.

- Market Development: Comprehensive information about markets - the report analyzes the peracetic acid market across varied regions.

- Market Diversification: Exclusive information about the new products & services, untapped geographies, recent developments, and investments in the peracetic acid market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Solvay (Belgium), Evonik Industries AG (Germany), Ecolab Inc. (US), MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan), and Enviro Tech Chemical Services (US) in the peracetic acid market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PERACETIC ACID MARKET

- 4.2 PERACETIC ACID MARKET, BY APPLICATION

- 4.3 PERACETIC ACID MARKET IN EUROPE, BY APPLICATION AND COUNTRY

- 4.4 PERACETIC ACID MARKET, BY APPLICATION

- 4.5 PERACETIC ACID MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advantages of peracetic acid over substitute biocides

- 5.2.1.2 Favorable government regulations in European and North American regions

- 5.2.1.3 Increasing demand for water treatment procedures

- 5.2.1.4 Rising focus on food sterilization and disinfection

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and low awareness about benefits

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in Asia Pacific

- 5.2.3.2 Emerging applications across various industries

- 5.2.3.3 Potential substitute for biocides

- 5.2.4 CHALLENGES

- 5.2.4.1 High reactivity and corrosiveness of product

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 INTRODUCTION

- 5.5.2 GDP TRENDS AND FORECAST

- 5.5.3 TRENDS AND FORECAST OF GLOBAL FOOD & BEVERAGE INDUSTRY

- 5.5.4 TRENDS AND FORECAST OF HEALTHCARE INDUSTRY

- 5.5.5 TRENDS AND FORECAST OF PULP & PAPER INDUSTRY

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 PERACETIC ACID MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE OF PERACETIC ACID AMONG KEY PLAYERS, BY APPLICATION, 2024

- 6.4.2 AVERAGE SELLING PRICE TREND OF PERACETIC ACID, BY REGION, 2022-2030

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 291539)

- 6.5.2 EXPORT SCENARIO (HS CODE 291539)

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Stabilized formulations for enhanced safety and efficacy

- 6.6.1.2 Advanced application systems for precision delivery

- 6.6.1.3 Eco-friendly and sustainable production methods

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Electrochemical generation systems for on-site production

- 6.6.2.2 Microencapsulation for controlled-release applications

- 6.6.2.3 Hybrid oxidation processes for enhanced pathogen inactivation

- 6.6.1 KEY TECHNOLOGIES

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 ENDOSCOPE STERILIZATION AT CLINICAL SCALE

- 6.7.2 POULTRY CHILLER ANTIMICROBIAL INTERVENTION

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 REACH: Ensuring safe use of chemicals

- 6.8.2.2 ISO 15883: Standards for washer-disinfectors

- 6.8.2.3 Global Harmonized System (GHS) for classification and labeling

- 6.8.2.4 FDA and EFSA: Food contact and processing approvals

- 6.8.2.5 WHO guidelines for water disinfection

- 6.8.2.6 Industry-specific regulatory frameworks

- 6.8.2.7 Sustainability and environmental considerations

- 6.9 KEY CONFERENCES & EVENTS DURING 2025

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 TOP APPLICANTS

- 6.11.3 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON PERACETIC ACID

- 6.13 IMPACT OF 2025 US TARIFF ON PERACETIC ACID MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 US

- 6.13.4.2 Europe

- 6.13.4.3 Asia Pacific

- 6.13.5 IMPACT ON PERACETIC ACID MARKET

7 PERACETIC ACID MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 <5% GRADE

- 7.2.1 APPLICATIONS FOR FOOD CONTACT SURFACES, DISINFECTING EQUIPMENT, AND FINAL RINSE FOR FRUITS AND VEGETABLES TO DRIVE MARKET

- 7.3 5-15% GRADE

- 7.3.1 ADVANTAGE IN RAPID DISINFECTION APPLICATIONS TO DRIVE MARKET

- 7.4 >15% GRADE

- 7.4.1 HIGH LEVEL DISINFECTION APPLICATIONS TO DRIVE MARKET

8 PERACETIC ACID MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 DISINFECTANT

- 8.2.1 DEMAND FOR DISINFECTING MEDICAL SUPPLIES TO DRIVE MARKET

- 8.3 STERILANT

- 8.3.1 ADOPTION BY FOOD INDUSTRY TO DRIVE MARKET

- 8.4 SANITIZER

- 8.4.1 APPROVAL BY REGULATORY BODIES ACROSS REGIONS TO DRIVE MARKET

- 8.5 OTHER APPLICATIONS

9 PERACETIC ACID MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 HEALTHCARE

- 9.2.1 STERILIZATION OF MEDICAL DEVICES TO DRIVE MARKET

- 9.3 FOOD & BEVERAGE

- 9.3.1 GROWING HEALTH CONSCIOUSNESS IN EUROPE TO DRIVE MARKET

- 9.4 WATER TREATMENT

- 9.4.1 STRINGENT REGULATIONS BY WATER TREATMENT AUTHORITIES TO DRIVE MARKET

- 9.5 PULP & PAPER

- 9.5.1 USE FOR SLIME CONTROL AND AS BLEACHING AGENT TO DRIVE MARKET

- 9.6 OTHER END-USE INDUSTRIES

- 9.6.1 AGRICULTURE

- 9.6.2 WINERIES

- 9.6.3 BREWERIES

- 9.6.4 LAUNDRIES

10 PERACETIC ACID MARKET, BY FORM

- 10.1 INTRODUCTION

- 10.2 LIQUID

- 10.2.1 STANDARD COMMERCIAL FORM WIDELY USED IN DISINFECTION AND SANITATION

- 10.3 STABILIZED

- 10.3.1 ENHANCED SHELF LIFE AND SAFETY

- 10.4 POWDERED

- 10.4.1 SOLID PRECURSORS OFFERING SAFER TRANSPORT AND ON-DEMAND ACTIVATION

- 10.5 ON-SITE GENERATED

- 10.5.1 CUSTOM PREPARATION AT LARGE FACILITIES TO REDUCE STORAGE RISKS

11 PERACETIC ACID MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Government initiatives for industrial growth to drive market

- 11.2.2 INDIA

- 11.2.2.1 Growing domestic pharmaceutical sector and global investments to drive market

- 11.2.3 JAPAN

- 11.2.3.1 Well-established end-use industries to drive market

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Implementation of stringent wastewater treatment regulations and expansion of food & beverage industry to drive market

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Presence of major manufacturers to drive market

- 11.3.2 CANADA

- 11.3.2.1 Treatment of industrial and drinking water to drive market

- 11.3.3 MEXICO

- 11.3.3.1 Infrastructural developments to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Growing food & beverage sector to drive market

- 11.4.2 UK

- 11.4.2.1 Demand for sustainable and quality products to propel market

- 11.4.3 FRANCE

- 11.4.3.1 Requirement for disinfection to drive market

- 11.4.4 ITALY

- 11.4.4.1 Government subsidy for purchase of safe biocide products to drive market

- 11.4.5 RUSSIA

- 11.4.5.1 The increasing focus on modernization and sustainability within Russia's industrial landscape to drive market

- 11.4.1 GERMANY

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Easy availability of raw materials to boost market

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 UAE

- 11.6.1.1 Wastewater treatment and desalination of water to drive market

- 11.6.2 SAUDI ARABIA

- 11.6.2.1 Increasing population and expansion of healthcare sector to drive market

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Favorable government initiatives to drive market

- 11.6.1 UAE

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Grade footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 End-use industry footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 SOLVAY

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses & competitive threats

- 13.1.2 EVONIK INDUSTRIES AG

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 ECOLAB INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses & competitive threats

- 13.1.4 MITSUBISHI GAS CHEMICAL COMPANY

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses & competitive threats

- 13.1.5 ARXADA AG

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product Launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 JUBILANT LIFE SCIENCES (JUBILANT PHARMOVA LIMITED)

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses & competitive threats

- 13.1.7 NATIONAL PEROXIDE LIMITED

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Right to win

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses & competitive threats

- 13.1.8 KEMIRA OYJ

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Right to win

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses & competitive threats

- 13.1.9 SEELER INDUSTRIES INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.9.3.1 Right to win

- 13.1.9.3.2 Strategic choices

- 13.1.9.3.3 Weaknesses & competitive threats

- 13.1.10 AIREDALE CHEMICAL

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM View

- 13.1.10.3.1 Right to win

- 13.1.10.3.2 Strategic choices

- 13.1.10.3.3 Weaknesses & competitive threats

- 13.1.1 SOLVAY

- 13.2 OTHER PLAYERS

- 13.2.1 SEITZ GMBH

- 13.2.2 BELINKA PERKEMIJA

- 13.2.3 THAI PEROXIDE LIMITED (ADITYA BIRLA CHEMICALS)

- 13.2.4 CHRISTEYNS

- 13.2.5 PROMOX

- 13.2.6 ACURO ORGANICS LIMITED

- 13.2.7 STOCKMEIER GROUP

- 13.2.8 KERSIA GROUP

- 13.2.9 NOVADAN APS

- 13.2.10 HYDRITE CHEMICAL CO.

- 13.2.11 EVOQUA WATER TECHNOLOGIES LLC.

- 13.2.12 BIOSAFE SYSTEMS

- 13.2.13 LUBRIZOL

- 13.2.14 CHEMTEX SPECIALITY LIMITED

- 13.2.15 VIROX TECHNOLOGIES INC.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 WATER TREATMENT CHEMICALS

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 WATER TREATMENT CHEMICALS MARKET, BY REGION

- 14.3.3.1 Asia Pacific

- 14.3.3.2 Europe

- 14.3.3.3 North America

- 14.3.3.4 Middle East & Africa

- 14.3.3.5 South America

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS