|

|

市場調査レポート

商品コード

1436836

殺鼠剤の世界市場:タイプ別、使用法別、最終用途別、げっ歯類タイプ別、地域別 - 予測(~2029年)Rodenticides Market by Type (Anticoagulants, Non-Coagulants), Mode of Application (Pellets, Spray, and Powder), End Use (Agriculture, Warehouses, Urban Centers), Rodent Types (Rats, Mice, Chipmunks, Hamsters) & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 殺鼠剤の世界市場:タイプ別、使用法別、最終用途別、げっ歯類タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年02月23日

発行: MarketsandMarkets

ページ情報: 英文 309 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の殺鼠剤の市場規模は、2024年に58億米ドル、2029年までに77億米ドルに達し、予測期間にCAGRで5.9%の成長が見込まれています。

気候パターンの変動は、げっ歯類の行動や分布を変化させる可能性があり、その結果、さまざまな地域で殺鼠剤の需要の変動を促しています。異常気象の発生、気温や降水量の変化などの気候の要素が、げっ歯類の個体数や人間環境内での相互作用に直接影響を与える可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 米ドル、キロトン |

| セグメント | タイプ別、使用法別、最終用途別、げっ歯類タイプ別、地域別 |

| 対象地域 | 北米、欧州、南米、アジア太平洋、その他の地域 |

「気候変動がげっ歯類の侵入の増加につながる」

気候はげっ歯類の行動、繁殖パターン、分布に直接影響します。気温が高くなると、特定のげっ歯類の繁殖率が加速し、その種が繁殖する地域で個体数が急増する可能性があります。逆に、洪水や干ばつのような異常気象はげっ歯類の生息地を破壊し、特定の地域への移動や集中を促します。このようなげっ歯類の個体数の変動は、害虫駆除策としての殺鼠剤の需要を変化させる可能性があります。気候変動はげっ歯類が媒介する疾病の頻度や地理的拡大に影響を与える可能性があります。気温の上昇や降水量の変化は、ハンタウイルスやレプトスピラ症など、げっ歯類が媒介する疾患の感染を促す環境を助長する可能性があります。

「2023年、殺鼠剤市場のげっ歯類タイプセグメントでは、ラットが突出した市場シェアを占めています。」

ラットは世界中に生息しており、都市部、郊外、農村部に居住しています。幅広い生息環境に適応する能力により多様な生態系で繁栄し、ありふれた尽きることのない害虫種として確立されています。ヒメネズミ(Rattus norvegicus)やクロネズミ(Rattus rattus)のように、人為的に新しい地域に持ち込まれたため、侵入種とみなされるラットもいます。これらの侵入ラットは、在来の野生生物を駆逐し、生態系の撹乱を引き起こし、生物多様性を危険にさらす可能性があります。

「タイプセグメントでは、抗凝固剤がもっとも大きなシェアを占めています。」

抗凝固剤系殺鼠剤は、げっ歯類の血液凝固機構を破壊することで、げっ歯類の個体数管理に高い効果を示します。この破壊は内出血をもたらし、最終的にげっ歯類を死に至らしめます。このようなメカニズムにより、げっ歯類の侵入を根絶する高い有効率が保証されます。抗凝固剤系殺鼠剤はしばしば遅効性を示し、げっ歯類が致死効果に遭遇する前に複数回服用する可能性があります。この特性は、特に仕掛けに対する消極性やその他の殺鼠剤に対する抵抗性が懸念される場合に、その効力を高めます。その他の殺鼠剤とは対照的に、抗凝固剤は捕食動物のような標的としていない種に対する二次中毒のリスクが低いです。

「欧州の殺鼠剤市場は予測期間を通じて安定した成長を維持すると予測されます。」

欧州では、殺鼠剤市場は予測期間を通じて安定した成長を維持すると予測されています。規制遵守要件、公衆衛生上の懸念、技術の進歩、害虫の圧力の増大が、一体となって欧州の殺鼠剤市場の成長を促進しています。French National Medicine Academyは、パリのラットの生息数の多さを明示しており、1人当たり1.5~1.75匹と推定され、世界的にもっともラットが蔓延している都市の1つとなっています。この憂慮すべき蔓延は、ラットがもたらす潜在的な健康リスクと、ラットが人間に感染させる疾患についての懸念を促しています。都市化は、都市におけるげっ歯類の個体数の急増において重要な役割を果たしています。これは、以前は不毛の地であった場所が都市中心部へと開発されたことで、巣穴に住むラットが新たに建設された環境にアクセスできるようになったためです。

当レポートでは、世界の殺鼠剤市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 殺鼠剤市場の企業にとって魅力的な機会

- アジア太平洋の殺鼠剤市場:タイプ別、主要国別

- 殺鼠剤市場:タイプ別

- 殺鼠剤市場:使用法別

- 殺鼠剤市場:最終用途別

- 殺鼠剤市場:げっ歯類タイプ別

第5章 市場の概要

- マクロ経済指標

- 地域全体の急速な都市化

- 屋外農業生産における殺鼠剤使用の増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業の動向

- イントロダクション

- バリューチェーン分析

- 研究・製品開発

- 製造

- 流通

- マーケティング・販売

- 販売後サービス

- 技術分析

- 自動リセット罠

- 高速おびき寄せ技術

- 特許分析

- 生態系分析/市場マップ

- デマンドサイド

- サプライサイド

- 貿易分析

- 価格分析

- 主要企業の平均販売価格の動向:使用法別

- 主要企業の平均販売価格の動向:タイプ別

- 主要企業の平均販売価格の動向:地域別

- 顧客のビジネスに影響を与える動向/混乱

- 主な会議とイベント

- 関税と規制情勢

- 規制機関、政府機関、その他の組織

- 規制情勢

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第7章 殺鼠剤市場:タイプ別

- イントロダクション

- 非抗凝固剤

- ブロメタリン

- コレカルシフェロール

- ストリキニーネ

- リン化亜鉛

- 抗凝固剤

- 第一世代抗凝固剤

- 第二世代抗凝固剤

第8章 殺鼠剤市場:使用法別

- イントロダクション

- ペレット

- スプレー

- 粉末

第9章 殺鼠剤市場:最終用途別

- イントロダクション

- 農業分野

- 倉庫

- 都心

第10章 殺鼠剤市場:げっ歯類タイプ別

- イントロダクション

- ラット

- マウス

- シマリス

- ハムスター

- その他のげっ歯類

第11章 殺鼠剤市場:地域別

- イントロダクション

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- ロシア

- ポーランド

- オランダ

- その他の欧州

- アジア太平洋

- 景気後退の影響

- 中国

- インド

- 日本

- オーストラリア

- タイ

- インドネシア

- その他のアジア太平洋

- 南米

- 景気後退の影響

- ブラジル

- エクアドル

- チリ

- その他の南米

- その他の地域

- 景気後退の影響

- 南アフリカ

- タンザニア

- ケニア

- アラブ首長国連邦

- その他の地域

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業戦略/有力企業

- ブランド/製品の分析

- セグメント収益の分析

- 主要企業の年間収益 vs. 成長

- 主要企業のEBIT/EBITDA

- 世界の主要市場参入企業のスナップショット

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2022年)

- 企業の評価マトリクス:スタートアップ/中小企業(2022年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- BASF SE

- BAYER AG

- SYNGENTA AG

- UPL

- NEOGEN CORPORATION

- ANTICIMEX

- ECOLAB

- RENTOKIL INITIAL PLC

- SENESTECH, INC.

- ROLLINS, INC.

- LIPHATECH, INC.

- JT EATON & C0., INC.

- PELGAR INTERNATIONAL

- BELL LABORATORIES INC.

- ABELL PEST CONTROL

- スタートアップ/SME/その他の企業

- FORT PRODUCTS LIMITED

- IMPEX EUROPA S.L.

- TRULY NOLEN OF AMERICA, INC.

- FUTURA GMBH

- BIOGUARD PEST SOLUTIONS

- SOUTHERN SUBURBS PEST CONTROL

- ARDENT, LLC.

- DR PESTCONTROL

- NATIVE PEST MANAGEMENT

- PECOPP

第14章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 害虫防除市場

- 市場の定義

- 市場の概要

- 農薬市場

- 市場の定義

- 市場の概要

第15章 付録

The global market for rodenticides is estimated at USD 5.8 billion in 2024 and is projected to reach USD 7.7 billion by 2029, at a CAGR of 5.9% during the forecast period. Variations in climate patterns have the potential to alter rodent behavior and distribution, consequently prompting fluctuations in the demand for rodenticides across various regions. Climatic elements such as extreme weather occurrences or shifts in temperature and precipitation can directly impact rodent populations and their interactions within human environments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) and Volume (KiloTons) |

| Segments | By Type, Mode of Application, End Use, Rodent Types, and Region |

| Regions covered | North America, Europe, South America, Asia Pacific, and RoW |

"Climatic variations lead to increase in rodent infestation."

Climate directly affects the behavior, breeding patterns, and distribution of rodents. Warmer temperatures may accelerate the reproductive rates of certain rodent species, leading to population booms in regions where they thrive. Conversely, extreme weather events like floods or droughts can disrupt rodent habitats, prompting migrations or concentration in specific areas. These fluctuations in rodent populations can drive changes in the demand for rodenticides as pest control measures. Climate changes can impact the frequency and geographic spread of diseases transmitted by rodents. Elevated temperatures and shifts in precipitation can foster environments conducive to the transmission of illnesses carried by rodents, including hantavirus and leptospirosis.

"In 2023, rats stood as the prominent market share within the rodent type segment of rodenticides market. "

Rats are present across the globe, residing in urban, suburban, and rural settings. Their ability to adapt to a wide range of habitats enables them to flourish in diverse ecosystems, establishing them as a prevalent and enduring pest species. Some rat species, like the brown rat (Rattus norvegicus) and the black rat (Rattus rattus), are considered invasive species due to human-induced introductions to new regions. These invasive rats have the potential to outcompete indigenous wildlife, leading to disturbances in ecosystems and endangering biodiversity.

"Within the type segment, the anticoagulants segment holds the most substantial share."

Anticoagulant rodenticides exhibit high effectiveness in managing rodent populations by disrupting the blood clotting mechanism in rodents. This disruption results in internal bleeding, ultimately leading to the demise of the rodents. Such a mechanism guarantees a high efficacy rate in eradicating rodent infestations. Anticoagulant rodenticides often exhibit a delayed onset of action, implying that rodents might ingest multiple doses before encountering lethal effects. This attribute enhances their efficacy, especially in scenarios where bait shyness or resistance to other rodenticides is a concern. In contrast to other varieties of rodenticides, anticoagulants present a low risk of secondary poisoning to non-target species, such as predators and scavengers.

"The rodenticides market in Europe is anticipated to maintain consistent growth throughout the forecast period."

In Europe, the rodenticides market is expected to sustain steady growth over the forecast period. The combination of regulatory compliance requirements, public health concerns, technological advancements, and increasing pest pressure drives the growth of the rodenticide market in Europe. The French National Medicine Academy has highlighted Paris's significant rat population, estimated to be between 1.5 to 1.75 rats per person, placing it among the most infested cities globally. This alarming prevalence has prompted concerns about the potential health risks posed by rats and the diseases they can transmit to humans. Urbanization plays a key role in the surge of rodent populations in cities, as the development of previously barren areas into urban centers provides rats residing in burrows with access to these newly constructed environments.

The Break-up of Primaries:

By Value Chain: Demand side - 41%, Supply side- 59%

By Designation: CXOs - 33%, Managers - 25%, Executives - 42%

By Region: North America - 24%, Europe - 29%, APAC - 30%, RoW - 17%

Key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), UPL ( India), Neogen Corporation ( US), Anticimex ( Sweden), Ecolab (US), Rentokil Initial plc ( UK), Senestech, Inc. ( US), Rollins, Inc. ( US), Liphatech, Inc. (US), JT Eaton & Co., Inc. (US), PelGar International (UK), Bell Laboratories Inc. (US) and Abell Pest Control ( Canada).

Research Coverage:

The report segments the rodenticides market based on type, mode of application, end use, rodent types, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the rodenticides market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, key strategies, Contracts, partnerships, and agreements. New product launches, mergers and acquisitions, and recent developments associated with the rodenticides market. Competitive analysis of upcoming startups in the rodenticides market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall rodenticides market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (Increase in concerns about vector-based disease outbreaks and public health initiatives, Impact of climate change on rodent proliferation, Displacement of rodents due to urbanization and, Increase in damage due to rodent attacks), restraints (Stringent regulations and ban on the use of rodenticides in developed countries and Increase in the use of mechanical methods for rodent control), opportunities (Increase in government initiatives and support of public corporations for rodent control, Growth opportunities in Asia Pacific and South America and Increase in demand for rodent pest control services from the hospitality and tourism sectors)

and challenges (Increase in resistance to conventional rodenticides, Capital investments for equipment, and, High toxicity of rodenticides).

- Product Development/Innovation: Detailed insights on, research & development activities, and new product launches in the rodenticides market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the rodenticides market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the rodenticides market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), UPL ( India), Neogen Corporation ( US), Anticimex ( Sweden), Ecolab (US), Rentokil Initial plc ( UK), Senestech, Inc. ( US), Rollins, Inc. ( US), Liphatech, Inc. (US), JT Eaton & Co., Inc. (US), PelGar International (UK), Bell Laboratories Inc. (US) and Abell Pest Control ( Canada), Fort Products Limited (UK), Impex Europa S.L. ( Spain), Truly Nolen of America, Inc. (US), Futura GmbH (Germany), BioGuard Pest Solutions (US), Southern Suburbs Pest Control (Australia), Ardent, LLC. (US), Dr Pest Control (India), Native Pest Management (US), and Pecopp (India) in the rodenticides market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET SEGMENTATION

- 1.2.2 INCLUSIONS & EXCLUSIONS

- 1.2.3 REGIONS COVERED

- 1.2.4 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2023

- 1.4 VOLUME UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RODENTICIDES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary insights

- 2.1.2.2 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 RODENTICIDES MARKET: DEMAND-SIDE CALCULATION

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Market size estimation: Supply side

- FIGURE 3 RODENTICIDES MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- FIGURE 4 SUPPLY-SIDE ANALYSIS: RODENTICIDES MARKET

- 2.3 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION ON RODENTICIDES MARKET

- 2.6.1 RECESSION MACRO INDICATORS

- FIGURE 6 INDICATORS OF RECESSION

- FIGURE 7 GLOBAL INFLATION RATE, 2011-2022

- FIGURE 8 GLOBAL GDP, 2011-2022 (USD TRILLION)

- FIGURE 9 RECESSION INDICATORS AND THEIR IMPACT ON RODENTICIDES MARKET

- FIGURE 10 RODENTICIDES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 RODENTICIDES MARKET SNAPSHOT, 2024 VS. 2029

- FIGURE 11 RODENTICIDES MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 RODENTICIDES MARKET, BY END USE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 RODENTICIDES MARKET, BY RODENT TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 RODENTICIDES MARKET SHARE, BY REGION, 2023 (BY VALUE)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RODENTICIDES MARKET

- FIGURE 16 IMPACT OF CLIMATE CHANGE ON RODENT PROLIFERATION TO DRIVE GROWTH

- 4.2 ASIA PACIFIC: RODENTICIDES MARKET, BY TYPE AND KEY COUNTRY

- FIGURE 17 ANTICOAGULANTS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.3 RODENTICIDES MARKET, BY TYPE

- FIGURE 18 ANTICOAGULANTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 RODENTICIDES MARKET, BY MODE OF APPLICATION

- FIGURE 19 PELLETS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING STUDY PERIOD

- 4.5 RODENTICIDES MARKET, BY END USE

- FIGURE 20 URBAN CENTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 RODENTICIDES MARKET, BY RODENT TYPE

- FIGURE 21 MICE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 MACROECONOMIC INDICATORS

- 5.1.1 RAPID URBANIZATION ACROSS REGIONS

- FIGURE 22 URBAN POPULATION AS PERCENTAGE OF TOTAL POPULATION, 2012-2022

- 5.1.2 INCREASE IN RODENTICIDE USAGE IN OUTDOOR AGRICULTURAL PRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 FACTORS IMPACTING RODENTICIDES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in concerns about vector-based disease outbreaks and public health initiatives

- 5.2.1.2 Impact of climate change on rodent proliferation

- 5.2.1.3 Increase in damage due to rodent attacks

- TABLE 3 PRE-HARVEST LOSSES IN RICE CROPS DUE TO RODENTS IN SOUTHEAST ASIAN COUNTRIES

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations and ban on rodenticide use in developed countries

- 5.2.2.2 Increase in use of mechanical methods for rodent control

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in government initiatives and support of public corporations for rodent control

- 5.2.3.2 Increase in demand for rodent pest control services from hospitality and tourism sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in resistance of rodent species to conventional rodenticides

- 5.2.4.2 High toxicity of rodenticides posing risks to non-target organisms

- TABLE 4 CLASSIFICATION OF RODENTICIDES BASED ON TOXICITY WITH EXAMPLES

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTION

- 6.2.4 MARKETING & SALES

- 6.2.5 POST-SALE SERVICES

- FIGURE 24 VALUE CHAIN ANALYSIS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 AUTOMATIC RESETTING TRAPS

- 6.3.2 SPEED BAITING TECHNOLOGY

- 6.4 PATENT ANALYSIS

- FIGURE 25 PATENTS GRANTED FOR RODENTICIDES MARKET, 2014-2024

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED FOR RODENTICIDES MARKET, 2014-2024

- TABLE 5 LIST OF MAJOR PATENTS, 2014-2024

- 6.5 ECOSYSTEM ANALYSIS/MARKET MAP

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- TABLE 6 RODENTICIDES MARKET ECOSYSTEM

- FIGURE 27 RODENTICIDES MARKET MAP

- 6.6 TRADE ANALYSIS

- TABLE 7 EXPORT VALUE OF RODENTICIDES, BY KEY COUNTRY, 2022 (USD MILLION)

- TABLE 8 IMPORT VALUE OF RODENTICIDES, BY KEY COUNTRY, 2022 (USD MILLION)

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MODE OF APPLICATION

- TABLE 9 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY MODE OF APPLICATION, 2023 (USD/KG)

- 6.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- TABLE 10 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY TYPE, 2019-2023 (USD/KG)

- 6.7.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION

- TABLE 11 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS FOR RODENTICIDE PELLETS, BY REGION, 2019-2023 (USD/KG)

- TABLE 12 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS FOR RODENTICIDE SPRAYS, BY REGION, 2019-2023 (USD/KG)

- TABLE 13 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS FOR RODENTICIDE POWDER, BY REGION, 2019-2023 (USD/KG)

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 REVENUE SHIFT FOR RODENTICIDES MARKET

- 6.9 KEY CONFERENCES & EVENTS

- TABLE 14 RODENTICIDES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY LANDSCAPE

- 6.10.2.1 North America

- 6.10.2.1.1 US

- 6.10.2.1.2 Canada

- 6.10.2.2 Europe

- 6.10.2.2.1 Confederation of European Pest Management Association (CEPA)

- 6.10.2.2.2 European Food Safety Authority (EFSA)

- 6.10.2.2.3 European Committee for Standardization (CEN)

- 6.10.2.2.4 Biocidal Product Regulation (BPR)

- 6.10.2.2.5 Commission Implementing Regulation (EU) 2017/1376

- 6.10.2.3 Asia Pacific

- 6.10.2.3.1 China

- 6.10.2.3.1.1 New Chemical Substance Registration (China REACH)

- 6.10.2.3.1.2 Standardization Administration of China (SAC)

- 6.10.2.3.1.3 Regulation Pesticide Administration (RPA)

- 6.10.2.3.2 India

- 6.10.2.3.2.1 Insecticides Act

- 6.10.2.3.2.2 Central Insecticides Board (CIB)

- 6.10.2.3.2.3 Insecticide Rules

- 6.10.2.3.1 China

- 6.10.2.4 South America

- 6.10.2.4.1 Brazil

- 6.10.2.4.1.1 Regulatory scope

- 6.10.2.4.1.2 Regulatory progress

- 6.10.2.4.1.3 Authorities and competencies

- 6.10.2.4.1 Brazil

- 6.10.2.5 Rest of the World

- 6.10.2.5.1 South Africa

- 6.10.2.5.2 UAE

- 6.10.2.1 North America

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 RENTOKIL USED IOT SOLUTIONS TO INCREASE ITS CUSTOMER BASE AND IMPROVE CUSTOMER RETENTION

- 6.11.2 UK CENTRE FOR ECOLOGY & HYDROLOGY (UKCEH) IMPLEMENTED PREDATORY BIRD MONITORING SCHEME (PBMS) TO EXAMINE DEAD PREDATORY BIRDS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

- 6.13.2 BUYING CRITERIA

- FIGURE 30 BUYING CRITERIA FOR TOP THREE MODES OF APPLICATION

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE MODES OF APPLICATION

7 RODENTICIDES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 31 ANTICOAGULANTS SEGMENT TO DOMINATE RODENTICIDES MARKET BY 2029

- TABLE 21 RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 22 RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.2 NON-ANTICOAGULANTS

- TABLE 23 ACUTE TOXICITY OF NON-ANTICOAGULANT RODENTICIDES

- TABLE 24 NON-ANTICOAGULANT RODENTICIDES: CHEMICAL CLASS AND DAYS OF FEEDING REQUIRED

- TABLE 25 NON-ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 NON-ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 NON-ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 28 NON-ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.2.1 BROMETHALIN

- 7.2.1.1 Development of resistance in rodents toward anticoagulant rodenticides to lead to increased use of bromethalin

- 7.2.2 CHOLECALCIFEROL

- 7.2.2.1 Minimal risk of secondary poisoning to create opportunities for cholecalciferol

- 7.2.3 STRYCHNINE

- 7.2.3.1 Effectiveness of strychnine in US and Europe to drive its popularity

- 7.2.4 ZINC PHOSPHIDE

- 7.2.4.1 Popularity of zinc phosphide as most preferred active ingredient for rodenticide fumigation in warehouses to drive market

- 7.3 ANTICOAGULANTS

- TABLE 29 ACUTE TOXICITY OF ANTICOAGULANT RODENTICIDES

- TABLE 30 ANTICOAGULANT RODENTICIDES: CHEMICAL CLASS AND DAYS OF FEEDING NEEDED

- TABLE 31 ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 34 ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.1 FIRST-GENERATION ANTICOAGULANTS

- TABLE 35 FIRST-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 FIRST-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 FIRST-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 38 FIRST-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.1.1 Warfarin

- 7.3.1.1.1 Use of warfarin as anti-clotting drug for coronary artery disease to drive growth

- 7.3.1.2 Chlorophacinone

- 7.3.1.2.1 Chlorophacinone is widely used in warehouses and farm fields for effective rodent control

- 7.3.1.3 Diphacinone

- 7.3.1.3.1 Growth opportunities for diphacinone manufacturers to spur its demand

- 7.3.1.4 Coumatetralyl

- 7.3.1.4.1 Popularity of coumatetralyl-based rodenticides to drive demand

- 7.3.1.1 Warfarin

- 7.3.2 SECOND-GENERATION ANTICOAGULANTS

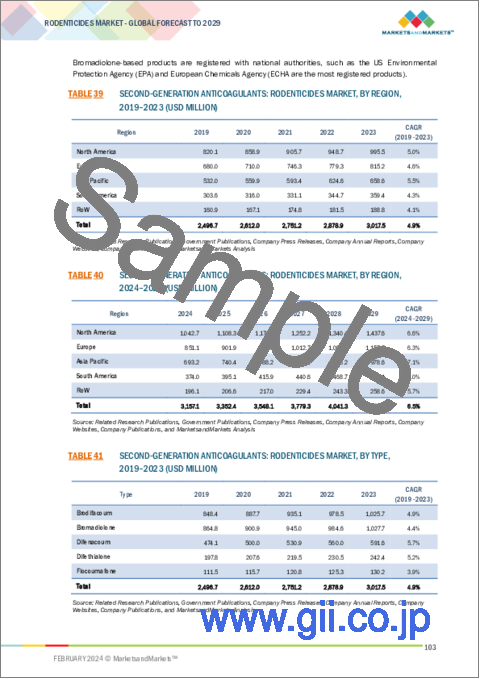

- TABLE 39 SECOND-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 SECOND-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 SECOND-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 42 SECOND-GENERATION ANTICOAGULANTS: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.2.1 Brodifacoum

- 7.3.2.1.1 Increased resistance of rodents to first-generation anticoagulants to encourage use of brodifacoum

- 7.3.2.2 Bromadiolone

- 7.3.2.2.1 Bromadiolone rodent bait is used for effective control of rodent population

- 7.3.2.3 Difenacoum

- 7.3.2.3.1 Use of difenacoum as preferred rodenticide for effective control against house mice to drive demand

- 7.3.2.4 Difethialone

- 7.3.2.4.1 Demand for comprehensive control of rats and mice to boost need for difethialone

- 7.3.2.5 Flocoumafen

- 7.3.2.5.1 Large-scale spread of rodents to drive popularity of flocoumafen

- 7.3.2.1 Brodifacoum

8 RODENTICIDES MARKET, BY MODE OF APPLICATION

- 8.1 INTRODUCTION

- FIGURE 32 PELLETS SEGMENT TO DOMINATE RODENTICIDES MARKET BY 2029

- TABLE 43 RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 44 RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (KT)

- TABLE 46 RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (KT)

- 8.2 PELLETS

- 8.2.1 URBAN AREAS TO WITNESS INCREASED USE OF PELLETS

- TABLE 47 PELLETS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 PELLETS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 PELLETS: RODENTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 50 PELLETS: RODENTICIDES MARKET, BY REGION, 2024-2029 (KT)

- 8.3 SPRAY

- 8.3.1 INEFFECTIVENESS OF BAITS AND CONTACT POISONS TO DRIVE DEMAND FOR SPRAY

- TABLE 51 SPRAY: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 SPRAY: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 SPRAY: RODENTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 54 SPRAY: RODENTICIDES MARKET, BY REGION, 2024-2029 (KT)

- 8.4 POWDER

- 8.4.1 POWDER-BASED RODENTICIDES OFFER LONG SHELF LIFE AND ARE USED IN INDOOR LOCATIONS

- TABLE 55 POWDER: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 POWDER: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 POWDER: RODENTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 58 POWDER: RODENTICIDES MARKET, BY REGION, 2024-2029 (KT)

9 RODENTICIDES MARKET, BY END USE

- 9.1 INTRODUCTION

- FIGURE 33 URBAN CENTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 59 RODENTICIDES MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 60 RODENTICIDES MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 61 URBAN CENTERS: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 62 URBAN CENTERS: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.2 AGRICULTURAL FIELDS

- 9.2.1 DAMAGE CAUSED BY RODENTS ON CULTIVATED CROPS TO BOOST USE OF RODENTICIDES ON AGRICULTURAL FIELDS

- TABLE 63 AGRICULTURAL FIELDS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 AGRICULTURAL FIELDS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 WAREHOUSES

- 9.3.1 HIGH SUSCEPTIBILITY OF WAREHOUSES TO RODENT ATTACKS TO DRIVE APPLICATION OF RODENTICIDES IN WAREHOUSES

- TABLE 65 WAREHOUSES: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 WAREHOUSES: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 URBAN CENTERS

- TABLE 67 URBAN CENTERS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 URBAN CENTERS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4.1.1 Residential

- 9.4.1.1.1 Rising awareness regarding sanitation and hygiene among people to drive demand for rodenticides

- 9.4.1.1 Residential

- FIGURE 34 MOST URBANIZED REGIONS, 2020

- TABLE 69 RESIDENTIAL: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 RESIDENTIAL: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4.1.2 Commercial

- 9.4.1.2.1 Rodenticides to see increased application in commercial sector

- 9.4.1.2 Commercial

- TABLE 71 COMMERCIAL: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 COMMERCIAL: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

10 RODENTICIDES MARKET, BY RODENT TYPE

- 10.1 INTRODUCTION

- FIGURE 35 MICE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 73 GLOBAL CROP DAMAGE BY RODENTS ACROSS REGIONS

- TABLE 74 RODENTICIDES MARKET, BY RODENT TYPE, 2019-2023 (USD MILLION)

- TABLE 75 RODENTICIDES MARKET, BY RODENT TYPE, 2024-2029 (USD MILLION)

- 10.2 RATS

- 10.2.1 EXTENSIVE CROP DAMAGE CAUSED BY NORWAY AND ROOF RATS TO DRIVE NEED FOR RODENTICIDES

- TABLE 76 RATS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 77 RATS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 MICE

- 10.3.1 GROWTH OF DANGEROUS AND DESTRUCTIVE HOUSE MICE TO ENCOURAGE USE OF RODENTICIDES

- TABLE 78 MICE: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 MICE: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 CHIPMUNKS

- 10.4.1 POTENTIAL HEALTH RISKS CAUSED BY CHIPMUNKS TO DRIVE USE OF RODENTICIDES

- TABLE 80 CHIPMUNKS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 CHIPMUNKS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 HAMSTERS

- 10.5.1 INCREASED DAMAGE TO FIELD CROPS CAUSED BY HAMSTERS TO SPUR LARGE-SCALE ADOPTION OF RODENTICIDES

- TABLE 82 HAMSTERS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 HAMSTERS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 OTHER RODENTS

- TABLE 84 OTHER RODENTS: RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 85 OTHER RODENTS: RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

11 RODENTICIDES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 36 CHINA AND INDIA TO WITNESS SIGNIFICANT MARKET GROWTH DURING FORECAST PERIOD

- TABLE 86 GLOBAL RODENTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 87 GLOBAL RODENTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 GLOBAL RODENTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 89 GLOBAL RODENTICIDES MARKET, BY REGION, 2024-2029 (KT)

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT

- FIGURE 37 NORTH AMERICAN RODENTICIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 90 NORTH AMERICA: RODENTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: RODENTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 93 NORTH AMERICA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 95 NORTH AMERICA: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 97 NORTH AMERICA: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 99 NORTH AMERICA: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (KT)

- TABLE 103 NORTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (KT)

- TABLE 104 NORTH AMERICA: RODENTICIDES MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 105 NORTH AMERICA: RODENTICIDES MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: RODENTICIDES MARKET, BY URBAN CENTER, 2019-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: RODENTICIDES MARKET, BY URBAN CENTER, 2024-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: RODENTICIDES MARKET, BY RODENT TYPE, 2019-2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: RODENTICIDES MARKET, BY RODENT TYPE, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Increase in rodent infestation in residential areas to drive market

- TABLE 110 US: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 111 US: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 112 US: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 113 US: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Warmer winters threatening pest infestation

- TABLE 114 CANADA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 115 CANADA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 116 CANADA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 117 CANADA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Increase in urbanization and rise in temperature to contribute to growth of rodents

- TABLE 118 MEXICO: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 119 MEXICO: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 120 MEXICO: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 121 MEXICO: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT

- FIGURE 39 EUROPEAN RODENTICIDES MARKET: RECESSION IMPACT ANALYSIS

- TABLE 122 EUROPE: RODENTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 123 EUROPE: RODENTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 124 EUROPE: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 125 EUROPE: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 126 EUROPE: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 127 EUROPE: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 128 EUROPE: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 129 EUROPE: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 130 EUROPE: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 131 EUROPE: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 132 EUROPE: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 133 EUROPE: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 134 EUROPE: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (KT)

- TABLE 135 EUROPE: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (KT)

- TABLE 136 EUROPE: RODENTICIDES MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 137 EUROPE: RODENTICIDES MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 138 EUROPE: RODENTICIDES MARKET, BY URBAN CENTER, 2019-2023 (USD MILLION)

- TABLE 139 EUROPE: RODENTICIDES MARKET, BY URBAN CENTER, 2024-2029 (USD MILLION)

- TABLE 140 EUROPE: RODENTICIDES MARKET, BY RODENT TYPE, 2019-2023 (USD MILLION)

- TABLE 141 EUROPE: RODENTICIDES MARKET, BY RODENT TYPE, 2024-2029 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Rapid increase in infestation of rodents and advancements in rodent control technology to propel market growth

- TABLE 142 GERMANY: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 143 GERMANY: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 144 GERMANY: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 145 GERMANY: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Improper waste management and densely populated structures to create favorable conditions for rodent proliferation

- TABLE 146 FRANCE: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 147 FRANCE: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 148 FRANCE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 149 FRANCE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Stringent regulations regarding maintenance of hygiene to accelerate market growth

- TABLE 150 UK: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 151 UK: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 152 UK: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 153 UK: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Rise in temperature and urbanization to help rodent infestation

- TABLE 154 SPAIN: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 155 SPAIN: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 SPAIN: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 157 SPAIN: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.6 ITALY

- 11.3.6.1 Increase in accumulation of trash to promote spread of rodents

- TABLE 158 ITALY: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 159 ITALY: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 160 ITALY: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 161 ITALY: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.7 RUSSIA

- 11.3.7.1 Rapid urbanization and increase in rodent control service companies to accelerate growth

- TABLE 162 RUSSIA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 163 RUSSIA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 164 RUSSIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 165 RUSSIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.8 POLAND

- 11.3.8.1 Excessive waste disposed of by restaurants and contaminated garbage to contribute to rise in rodent attacks

- TABLE 166 POLAND: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 167 POLAND: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 168 POLAND: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 169 POLAND: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.9 NETHERLANDS

- 11.3.9.1 Unprecedented rise in population of rodents to drive market

- TABLE 170 NETHERLANDS: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 171 NETHERLANDS: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 172 NETHERLANDS: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 173 NETHERLANDS: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.3.10 REST OF EUROPE

- TABLE 174 REST OF EUROPE: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 175 REST OF EUROPE: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 176 REST OF EUROPE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 177 REST OF EUROPE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- 11.4.1 RECESSION IMPACT

- FIGURE 41 ASIA PACIFIC RODENTICIDES MARKET: RECESSION IMPACT ANALYSIS

- TABLE 178 ASIA PACIFIC: RODENTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 179 ASIA PACIFIC: RODENTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 180 ASIA PACIFIC: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 181 ASIA PACIFIC: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 182 ASIA PACIFIC: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 183 ASIA PACIFIC: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 184 ASIA PACIFIC: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 185 ASIA PACIFIC: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 186 ASIA PACIFIC: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 187 ASIA PACIFIC: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 188 ASIA PACIFIC: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 189 ASIA PACIFIC: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 190 ASIA PACIFIC: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (KT)

- TABLE 191 ASIA PACIFIC: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (KT)

- TABLE 192 ASIA PACIFIC: RODENTICIDES MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 193 ASIA PACIFIC: RODENTICIDES MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 194 ASIA PACIFIC: RODENTICIDES MARKET, BY URBAN CENTER, 2019-2023 (USD MILLION)

- TABLE 195 ASIA PACIFIC: RODENTICIDES MARKET, BY URBAN CENTER, 2024-2029 (USD MILLION)

- TABLE 196 ASIA PACIFIC: RODENTICIDES MARKET, BY RODENT TYPE, 2019-2023 (USD MILLION)

- TABLE 197 ASIA PACIFIC: RODENTICIDES MARKET, BY RODENT TYPE, 2024-2029 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Need for increased rodent control to accelerate market growth

- TABLE 198 CHINA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 199 CHINA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 200 CHINA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 201 CHINA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Higher living standards and intolerance toward rodents to create growth opportunities for pest control providers

- TABLE 202 INDIA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 203 INDIA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 204 INDIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 205 INDIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 High population of rodents in metropolitan cities to support market growth

- TABLE 206 JAPAN: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 207 JAPAN: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 208 JAPAN: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 209 JAPAN: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4.5 AUSTRALIA

- 11.4.5.1 Extreme summers in Australia to support breeding of rodents

- TABLE 210 AUSTRALIA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 211 AUSTRALIA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 212 AUSTRALIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 213 AUSTRALIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4.6 THAILAND

- 11.4.6.1 Growth of tourist industry and increase in government subsidies on rodenticides to propel market

- TABLE 214 THAILAND: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 215 THAILAND: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 216 THAILAND: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 217 THAILAND: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4.7 INDONESIA

- 11.4.7.1 Large-scale damage to oil palm fruits caused by rats to boost market

- TABLE 218 INDONESIA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 219 INDONESIA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 220 INDONESIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 221 INDONESIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 222 REST OF ASIA PACIFIC: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT

- FIGURE 42 SOUTH AMERICAN RODENTICIDES MARKET: RECESSION IMPACT ANALYSIS

- TABLE 226 SOUTH AMERICA: RODENTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 227 SOUTH AMERICA: RODENTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 228 SOUTH AMERICA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 229 SOUTH AMERICA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 230 SOUTH AMERICA: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 231 SOUTH AMERICA: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 232 SOUTH AMERICA: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 233 SOUTH AMERICA: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 234 SOUTH AMERICA: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 235 SOUTH AMERICA: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 236 SOUTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 237 SOUTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 238 SOUTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (KT)

- TABLE 239 SOUTH AMERICA: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (KT)

- TABLE 240 SOUTH AMERICA: RODENTICIDES MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 241 SOUTH AMERICA: RODENTICIDES MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 242 SOUTH AMERICA: RODENTICIDES MARKET, BY URBAN CENTER, 2019-2023 (USD MILLION)

- TABLE 243 SOUTH AMERICA: RODENTICIDES MARKET, BY URBAN CENTER, 2024-2029 (USD MILLION)

- TABLE 244 SOUTH AMERICA: RODENTICIDES MARKET, BY RODENT TYPE, 2019-2023 (USD MILLION)

- TABLE 245 SOUTH AMERICA: RODENTICIDES MARKET, BY RODENT TYPE, 2024-2029 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Increase in population and residential spaces to foster market growth

- TABLE 246 BRAZIL: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 247 BRAZIL: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 248 BRAZIL: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 249 BRAZIL: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.5.3 ECUADOR

- 11.5.3.1 Establishment of rodent control programs to widen growth prospects

- TABLE 250 ECUADOR: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 251 ECUADOR: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 252 ECUADOR: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 253 ECUADOR: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.5.4 CHILE

- 11.5.4.1 Public hygiene projects initiated by government to boost market

- TABLE 254 CHILE: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 255 CHILE: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 256 CHILE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 257 CHILE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.5.5 REST OF SOUTH AMERICA

- TABLE 258 REST OF SOUTH AMERICA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 259 REST OF SOUTH AMERICA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 260 REST OF SOUTH AMERICA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 261 REST OF SOUTH AMERICA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.6 REST OF THE WORLD

- 11.6.1 RECESSION IMPACT

- FIGURE 43 REST OF THE WORLD RODENTICIDES MARKET: RECESSION IMPACT ANALYSIS

- TABLE 262 REST OF THE WORLD: RODENTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 263 REST OF THE WORLD: RODENTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 264 REST OF THE WORLD: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 265 REST OF THE WORLD: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 266 REST OF THE WORLD: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 267 REST OF THE WORLD: NON-ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 268 REST OF THE WORLD: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 269 REST OF THE WORLD: FIRST-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 270 REST OF THE WORLD: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 271 REST OF THE WORLD: SECOND-GENERATION ANTICOAGULANT RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 272 REST OF THE WORLD: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 273 REST OF THE WORLD: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 274 REST OF THE WORLD: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (KT)

- TABLE 275 REST OF THE WORLD: RODENTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (KT)

- TABLE 276 REST OF THE WORLD: RODENTICIDES MARKET, BY END USE, 2019-2023 (USD MILLION)

- TABLE 277 REST OF THE WORLD: RODENTICIDES MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 278 REST OF THE WORLD: RODENTICIDES MARKET, BY URBAN CENTER, 2019-2023 (USD MILLION)

- TABLE 279 REST OF THE WORLD: RODENTICIDES MARKET, BY URBAN CENTER, 2024-2029 (USD MILLION)

- TABLE 280 REST OF THE WORLD: RODENTICIDES MARKET, BY RODENT TYPE, 2019-2023 (USD MILLION)

- TABLE 281 REST OF THE WORLD: RODENTICIDES MARKET, BY RODENT TYPE, 2024-2029 (USD MILLION)

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Poor waste management practices and rising awareness among residents regarding rodenticides to cause surge in demand

- TABLE 282 SOUTH AFRICA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 283 SOUTH AFRICA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 284 SOUTH AFRICA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 285 SOUTH AFRICA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.6.3 TANZANIA

- 11.6.3.1 Government initiatives for public health to drive market

- TABLE 286 TANZANIA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 287 TANZANIA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 288 TANZANIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 289 TANZANIA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.6.4 KENYA

- 11.6.4.1 Increase in crop loss to cause surge in rodenticides

- TABLE 290 KENYA: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 291 KENYA: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 292 KENYA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 293 KENYA: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.6.5 UAE

- 11.6.5.1 Focus of Dubai's pest control standards on sustainability to boost market

- TABLE 294 UAE: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 295 UAE: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 296 UAE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 297 UAE: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

- 11.6.6 OTHERS IN ROW

- TABLE 298 OTHERS IN ROW: RODENTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 299 OTHERS IN ROW: RODENTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 300 OTHERS IN ROW: RODENTICIDES MARKET, BY ANTICOAGULANT, 2019-2023 (USD MILLION)

- TABLE 301 OTHERS IN ROW: RODENTICIDES MARKET, BY ANTICOAGULANT, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- TABLE 302 RODENTICIDES MARKET: INTENSITY OF COMPETITIVE RIVALRY (COMPETITIVE)

- 12.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.4 BRAND/PRODUCT ANALYSIS

- FIGURE 44 BRAND/PRODUCT ANALYSIS FOR KEY RODENTICIDE BRANDS

- 12.5 SEGMENTAL REVENUE ANALYSIS

- FIGURE 45 SEGMENTAL REVENUE ANALYSIS FOR TOP FIVE PLAYERS, 2020-2022

- 12.6 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH

- FIGURE 46 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 12.7 KEY PLAYERS' EBIT/EBITDA

- FIGURE 47 EBIT/EBITDA, 2022 (USD BILLION)

- 12.8 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 48 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 12.9 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 49 COMPANY VALUATION OF KEY PLAYERS

- FIGURE 50 FINANCIAL METRICS OF KEY COMPANIES (EV/EBITDA)

- 12.10 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2022

- 12.10.1 STARS

- 12.10.2 EMERGING LEADERS

- 12.10.3 PERVASIVE PLAYERS

- 12.10.4 PARTICIPANTS

- FIGURE 51 RODENTICIDES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 12.10.5 COMPANY FOOTPRINT

- TABLE 303 OVERALL COMPANY FOOTPRINT

- TABLE 304 TYPE FOOTPRINT

- TABLE 305 MODE OF APPLICATION FOOTPRINT

- TABLE 306 REGIONAL FOOTPRINT

- 12.11 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2022

- 12.11.1 PROGRESSIVE COMPANIES

- 12.11.2 STARTING BLOCKS

- 12.11.3 RESPONSIVE COMPANIES

- 12.11.4 DYNAMIC COMPANIES

- FIGURE 52 RODENTICIDES MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES) 2022

- 12.11.5 COMPETITIVE BENCHMARKING

- TABLE 307 DETAILED LIST OF KEY START-UPS/SMES

- TABLE 308 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.12 COMPETITIVE SCENARIO

- 12.12.1 PRODUCT LAUNCHES

- TABLE 309 RODENTICIDES MARKET: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2023

- 12.12.2 DEALS

- TABLE 310 RODENTICIDES MARKET: DEALS, JANUARY 2020-NOVEMBER 2023

13 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent developments & MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 BASF SE

- TABLE 311 BASF SE: COMPANY OVERVIEW

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- TABLE 312 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 313 BASF SE: PRODUCT LAUNCHES

- 13.1.2 BAYER AG

- TABLE 314 BAYER AG: COMPANY OVERVIEW

- FIGURE 54 BAYER AG: COMPANY SNAPSHOT

- TABLE 315 BAYER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 316 BAYER AG: PRODUCT LAUNCHES

- TABLE 317 BAYER AG: DEALS

- 13.1.3 SYNGENTA AG

- TABLE 318 SYNGENTA AG: COMPANY OVERVIEW

- FIGURE 55 SYNGENTA AG: COMPANY SNAPSHOT

- TABLE 319 SYNGENTA AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 320 SYNGENTA AG: PRODUCT LAUNCHES

- TABLE 321 SYNGENTA AG: DEALS

- 13.1.4 UPL

- TABLE 322 UPL: COMPANY OVERVIEW

- FIGURE 56 UPL: COMPANY SNAPSHOT

- TABLE 323 UPL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 324 UPL: DEALS

- 13.1.5 NEOGEN CORPORATION

- TABLE 325 NEOGEN CORPORATION: COMPANY OVERVIEW

- FIGURE 57 NEOGEN CORPORATION: COMPANY SNAPSHOT

- TABLE 326 NEOGEN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.6 ANTICIMEX

- TABLE 327 ANTICIMEX: COMPANY OVERVIEW

- FIGURE 58 ANTICIMEX: COMPANY SNAPSHOT

- TABLE 328 ANTICIMEX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 329 ANTICIMEX: DEALS

- 13.1.7 ECOLAB

- TABLE 330 ECOLAB: COMPANY OVERVIEW

- FIGURE 59 ECOLAB: COMPANY SNAPSHOT

- TABLE 331 ECOLAB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.8 RENTOKIL INITIAL PLC

- TABLE 332 RENTOKIL INITIAL PLC: COMPANY OVERVIEW

- FIGURE 60 RENTOKIL INITIAL PLC: COMPANY SNAPSHOT

- TABLE 333 RENTOKIL INITIAL PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 334 RENTOKIL INITIAL PLC: PRODUCT LAUNCHES

- TABLE 335 RENTOKIL INITIAL PLC: DEALS

- 13.1.9 SENESTECH, INC.

- TABLE 336 SENESTECH, INC.: COMPANY OVERVIEW

- FIGURE 61 SENESTECH, INC.: COMPANY SNAPSHOT

- TABLE 337 SENESTECH, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 338 SENESTECH, INC.: PRODUCT LAUNCHES

- TABLE 339 SENESTECH, INC: DEALS

- 13.1.10 ROLLINS, INC.

- TABLE 340 ROLLINS, INC.: COMPANY OVERVIEW

- FIGURE 62 ROLLINS, INC.: COMPANY SNAPSHOT

- TABLE 341 ROLLINS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 342 ROLLINS, INC.: DEALS

- 13.1.11 LIPHATECH, INC.

- TABLE 343 LIPHATECH, INC.: COMPANY OVERVIEW

- TABLE 344 LIPHATECH, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 345 LIPHATECH, INC.: PRODUCT LAUNCHES

- TABLE 346 LIPHATECH, INC.: DEALS

- 13.1.12 JT EATON & C0., INC.

- TABLE 347 JT EATON & CO., INC.: COMPANY OVERVIEW

- TABLE 348 JT EATON & CO., INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.13 PELGAR INTERNATIONAL

- TABLE 349 PELGAR INTERNATIONAL: COMPANY OVERVIEW

- TABLE 350 PELGAR INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 351 PELGAR INTERNATIONAL: PRODUCT LAUNCHES

- 13.1.14 BELL LABORATORIES INC.

- TABLE 352 BELL LABORATORIES INC.: COMPANY OVERVIEW

- TABLE 353 BELL LABORATORIES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 354 BELL LABORATORIES INC.: PRODUCT LAUNCHES

- 13.1.15 ABELL PEST CONTROL

- TABLE 355 ABELL PEST CONTROL: COMPANY OVERVIEW

- TABLE 356 ABELL PEST CONTROL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 357 ABELL PEST CONTROL: DEALS

- 13.2 START-UPS/SMES/OTHER PLAYERS

- 13.2.1 FORT PRODUCTS LIMITED

- TABLE 358 FORT PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 359 FORT PRODUCTS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.2 IMPEX EUROPA S.L.

- TABLE 360 IMPEX EUROPA S.L.: COMPANY OVERVIEW

- TABLE 361 IMPEX EUROPA S.L.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.3 TRULY NOLEN OF AMERICA, INC.

- TABLE 362 TRULY NOLEN OF AMERICA, INC.: COMPANY OVERVIEW

- TABLE 363 TRULY NOLEN OF AMERICA, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.4 FUTURA GMBH

- TABLE 364 FUTURA GMBH: COMPANY OVERVIEW

- TABLE 365 FUTURA GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.5 BIOGUARD PEST SOLUTIONS

- TABLE 366 BIOGUARD PEST SOLUTIONS: COMPANY OVERVIEW

- TABLE 367 BIOGUARD PEST SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.6 SOUTHERN SUBURBS PEST CONTROL

- 13.2.7 ARDENT, LLC.

- 13.2.8 DR PESTCONTROL

- 13.2.9 NATIVE PEST MANAGEMENT

- 13.2.10 PECOPP

- *Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 368 MARKETS ADJACENT TO RODENTICIDES MARKETS

- 14.2 LIMITATIONS

- 14.3 PEST CONTROL MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 369 PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 14.4 CROP PROTECTION CHEMICALS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 370 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS