|

|

市場調査レポート

商品コード

1257381

バイオ肥料の世界市場:種類別 (窒素固定、リン酸塩可溶化・可動化、カリウム可溶化・可動化)・適用方式別 (土壌処理、種子処理)・形状別・作物の種類別・地域別の将来予測 (2028年まで)Biofertilizers Market by Type (Nitrogen-Fixing, Phosphate Solubilizing & Mobilizing, Potassium Solubilizing & Mobilizing), Mode of Application (Soil Treatment, Seed Treatment), Form, Crop Type and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バイオ肥料の世界市場:種類別 (窒素固定、リン酸塩可溶化・可動化、カリウム可溶化・可動化)・適用方式別 (土壌処理、種子処理)・形状別・作物の種類別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月04日

発行: MarketsandMarkets

ページ情報: 英文 295 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバイオ肥料の市場規模は、2022年に28億米ドル、2028年には52億米ドルに達し、予測期間のCAGRは10.9%に達すると予想されています。

バイオ肥料は、有機農業の実践で一般的に使用されており、作物保護と土壌肥沃度の点で有用であることが判明しています。バイオ肥料は、保水力を高め、土壌の肥沃度を高め、土壌の構造と質感を改善します。バイオ肥料は主に、作物の収穫量を増やし、大気中の窒素を固定し、無機化合物を有機化合物に変換するために使用されます。

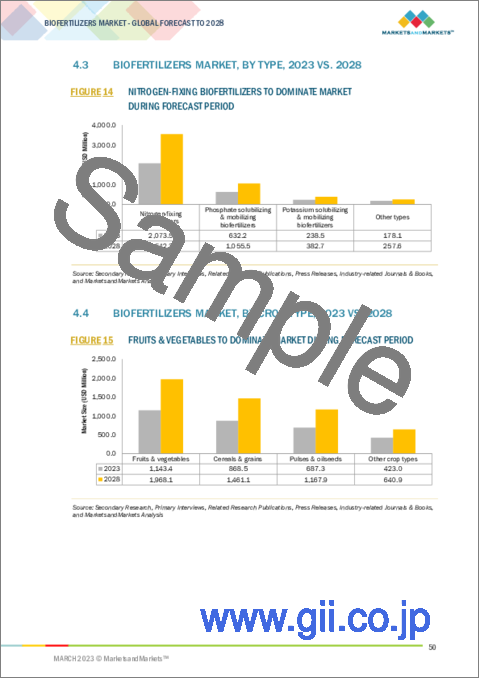

"種類別では、窒素固定バイオ肥料の分野が2022年に最大の市場シェアを獲得する"

窒素固定バイオ肥料は世界中で広く使用されています。主に、エンドウ・ダイズ・ササゲなどのマメ科の作物に多く使用されています。マメ科の作物には、根粒菌などの微生物が非常に有効です。根粒菌は、窒素ガスをアンモニアに変換し、それをアミノ酸などの有機物に変換して作物をよりよく成長させます。また、点滴灌漑やスプリンクラーなどの高度な農業技術の採用が進んでいることも、この分野の成長を促進する大きな要因の1つです。

"作物の種類別では、2022年に果物・野菜分野が最大の市場シェアを占める"

果物や野菜の主要な生産地・輸出地でバイオ肥料の使用が促進される主な要因として、果物の生産量の増加や、高品質の果物、投入コストの減少、土壌の有機含有量の増加などが想定されます。イチゴ、リンゴ、ブドウ、ポモグレネート、オレンジ、トウガラシ、パプリカ、トマト、唐辛子などの果物の生産量の増加が、市場をさらに促進しています。

"適用方式別では、土壌処理の分野が2022年に最大の市場シェアを占める"

植物の生産量を高め、食糧生産に対する需要の高まりを満たすために、土壌処理法によるバイオ肥料の使用が、農業実践の不可欠な要素となっています。土壌処理法は、化学肥料の使用量を減らし、また土壌の質を20~30%向上させるのに役立ちます。微生物相を改善するため、土壌処理法の場合、耕した土壌に特定の細菌、真菌、その他の微生物、更には藻類や原生動物を加えます。

"予測期間中、北米市場が最大の市場シェアを獲得する"

北米は、バイオ肥料の最大市場です。これは、同地域の果物や野菜の生産量が多いことに起因しています。北米では、小麦・大麦・トウモロコシ・トマト・ブドウ・仁果類・核果などの主要栽培国・輸出国であり、そのためバイオ肥料の利用も増加しています。また、有機栽培の作物に対する需要も、この地域のバイオ肥料市場の成長を後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- バイオ肥料市場に影響を与えるマクロ経済指標

- 人口増加と多様な食品の需要

- 有機農場面積の増加

- 果物と野菜の生産量の増加

- 市場力学

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 価格動向分析

- 市場マッピングとエコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ

- 主な会議とイベント

- 関税・規制状況

- 規制の枠組み

- 主な利害関係者と購入基準

第7章 バイオ肥料市場:種類別

- イントロダクション

- 窒素固定バイオ肥料

- リン酸塩可溶化・可動化バイオ肥料

- カリウム可溶化・可動化バイオ肥料

- その他の種類

第8章 バイオ肥料市場:作物の種類別

- イントロダクション

- 穀物

- 豆類・油糧種子

- 果物・野菜

- その他の種類の作物

第9章 バイオ肥料市場:適用方式別

- イントロダクション

- 土壌処理

- 種子処理

- その他の適用方式

第10章 バイオ肥料市場:形状別

- イントロダクション

- 液体バイオ肥料

- 担体ベースのバイオ肥料

第11章 バイオ肥料市場:微生物別

- イントロダクション

- リゾビウム

- アゾスピリルム

- アゾトバクター

- 他の種類の微生物

第12章 バイオ肥料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- スペイン

- 英国

- ロシア

- オランダ

- その他の欧州

- アジア太平洋

- 日本

- その他のアジア太平洋

- 南米

- アルゼンチン

- その他の南米

- その他の地域 (RoW)

- アフリカ

- 中東

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業の企業収益分析 (2020年~2022年)

- 企業評価クアドラント (主要企業)

- スタートアップ/中小企業の評価クアドラント (その他の企業)

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第14章 企業プロファイル

- 主要企業

- NOVOZYMES

- UPL

- CHR. HANSEN HOLDING A/S

- SYNGENTA

- T. STANES AND COMPANY LIMITED

- LALLEMAND INC.

- RIZOBACTER ARGENTINA S.A.

- VEGALAB SA

- IPL BIOLOGICALS LIMITED

- KIWA BIO-TECH PRODUCT GROUP COOPERATION

- SYMBORG

- KAN BIOSYS

- MAPLETON AGRI BIOTECH PT LTD

- SEIPASA

- AGRILIFE

- その他の企業

- MANIDHARMA BIOTECH PVT LTD

- BIOMAX NATURALS

- JAIPUR BIO FERTILIZERS

- VALENT BIOSCIENCES

- AUMGENE BIOSCIENCES

- AGRINOS

- CRIYAGEN

- LKB BIOFERTILIZER

- VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTD

- NUTRAMAX LABORATORIES, INC

第15章 隣接・関連市場

- イントロダクション

- 調査の限界

- 農業用生物製剤市場

- 接種剤市場

第16章 付録

The biofertilizer market is expected to be valued USD 2.8 billion in 2022 and USD 5.2 billion by 2028, with a CAGR of 10.9% over the forecast period. Biofertilizers are commonly used in organic farming practises. Biofertilizers have been found to be helpful in terms of crop protection and soil fertility. They increase water retention capacity, boost soil fertility, and improve soil structure and texture. They are primarily used to increase crop yield, fix atmospheric nitrogen, and transform inorganic compounds into organic compounds.

"The nitrogen-fixing biofertilizers segment is expected to be gain largest market share in 2022."

Nitrogen fixing biofertilizers are majorly used across the globe. These biofertilizers helps the plant bodies to fix the atmospheric nitrogen. These are mostly used in the leguminous crops such as peas, soybean, cowpea, etc. Microorganism such as rhizobium bacteria is highly beneficial in legume crops. Rhizobium converts dinitrogen gas into ammonia, which is then converted into organic substances such as amino acids for the better growth of crops. Apart from this, growing adoption of advanced agricultural techniques such as drip irrigation and sprinklers is also one of the major factors which is driving the growth of the segment.

"The fruits and vegetables segment is projected to accounted for the largest market share in 2022"

The primary factors anticipated to promote the use of biofertilizers in the major producing and exporting regions for fruits and vegetables include increased fruit output, high-quality fruits, decreased input costs, and increased soil organic content. The increase in the production of fruits such as strawberries, apples, grapes, pomogrenates, oranges, capsicum, bell pepper, tomato, chilli, etc. is further propelling the market.

"The soil treatment segment is forecasted to occupy for the largest market share in 2022."

In order to boost plant output and satisfy the rising demand for food production, the use of biofertilizers by soil treatment method has become an essential component of agricultural practise. The soil treatment method assist in raising crop output, reduces the use of chemical fertilisers, improves soil fertility, produces better outcomes, and enhances soil quality by 20 to 30%. To improve the microbiome, certain bacteria, fungus, and other microorganisms are added to ploughed soil in soil treatment method. These species include algae and protozoa.

"North American market is projected to gain largest market share during the forecast period."

North America is the largest market for the biofertilizers. This is due to the higher production of fruits and vegetables in the region. In North American region wheat, barley, corn maize, tomatoes, grapes, pome fruits and stone fruits are the majorly cultivated crops. These crops are also exported to different parts of the world in large quantities. This has led to the increase in the utilization of biofertilizers. The demand for the organically grown crops has also fueled the growth of the biofertilizers market in the region.

Break-up of Primaries:

- By Company type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C level - 35%, Director level - 25%, Others - 40%

- By Geography: North America- 40%, Asia Pacific - 30%, Europe -20%, South America- 5% and RoW 5%

Some Leading players profiled in this report:

- Novozymes (Denmark)

- UPL (India)

- Chr. Hansen Holding A/S (Denmark)

- Syngenta (Switzerland)

- T.Stanes and Company Limited (India)

- Lallemand Inc. (Canada)

- Rizobacter Argentina S.A. (Argentina)

- Vegalab SA (Switzerland)

Research Coverage:

This research report categorizes the biofertilizers market by type (nitrogen-fixing biofertilizers, phosphate solubilizing & mobilizing biofertilizers, potassium solubilizing & mobilizing biofertilizers and other types), by crop type (cereals & grains, pulses & oilseeds, fruits & vegetables, other crop types), by mode of application (soil treatment, seed treatment), by form (liquid and carrier-based), and region (North America, Europe, Asia Pacific, South America, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the biofertilizers market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions; key strategies; partnerships, agreements; new product launches, mergers and acquisitions, and recent developments associated with the biofertilizers market. Competitive analysis of upcoming startups in the biofertilizers market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall biofertilizers market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growth in organic food industry, initiatives by government agencies and increase in awareness pertaining to need for sustainability in modern agriculture, hazards of using chemical fertilizers and increase in environmental concerns, increase in usage of biofertilizers in ranch and private farms, adoption of precision farming and protected agriculture, provision of range of phytohormones, macronutrients, and micronutrients), restraints (environmental and technological constraints, poor infrastructure and high initial investment, absence of well-constructed marketing routes and surrounding infrastructure), opportunities (new target markets: asia pacific & africa, increase in the production and yield of crops, increase in the utilization of liquid biofertilizers and fertigation method), and challenges (lack of awareness and low adoption rate of biofertilizers, unfavourable regulatory standards, supply of counterfeit and less-effective products) influencing the growth of the biofertilizers market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the biofertilizers market

- Market Development: Comprehensive information about lucrative markets - the report analyses the biofertilizers market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the biofertilizers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Novozymes (Denmark), UPL (India), Chr. Hansen Holding A/S (Denmark), Syngenta (Switzerland), T.Stanes and Company Limited (India), and Lallemand Inc. (Canada) among others in the biofertilizers market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 BIOFERTILIZERS: MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS

- 1.6.1 CURRENCY (VALUE UNIT)

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.6.2 VOLUME UNIT

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BIOFERTILIZERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BIOFERTILIZERS MARKET SIZE ESTIMATION - SUPPLY SIDE

- 2.2.2 BIOFERTILIZERS MARKET SIZE ESTIMATION - DEMAND SIDE

- FIGURE 4 BIOFERTILIZERS MARKET: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 5 BIOFERTILIZERS MARKET: TOP-DOWN APPROACH

- 2.3 GROWTH RATE FORECAST ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 BIOFERTILIZERS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 7 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 BIOFERTILIZERS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 BIOFERTILIZERS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BIOFERTILIZERS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BIOFERTILIZERS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR BIOFERTILIZERS MARKET PLAYERS

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.2 EUROPE: BIOFERTILIZERS MARKET, BY KEY FUNCTION AND COUNTRY

- FIGURE 13 FRANCE AND CEREALS & GRAINS SEGMENTS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN 2022

- 4.3 BIOFERTILIZERS MARKET, BY TYPE, 2023 VS. 2028

- FIGURE 14 NITROGEN-FIXING BIOFERTILIZERS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 BIOFERTILIZERS MARKET, BY CROP TYPE, 2023 VS. 2028

- FIGURE 15 FRUITS & VEGETABLES TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028

- FIGURE 16 SOIL TREATMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 BIOFERTILIZERS MARKET, BY FORM, 2023 VS. 2028

- FIGURE 17 LIQUID FORM TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 BIOFERTILIZERS MARKET, BY APPLICATION AND REGION, 2023 VS. 2028

- FIGURE 18 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS INFLUENCING BIOFERTILIZERS MARKET

- 5.2.1 POPULATION GROWTH AND DEMAND FOR DIVERSE FOOD PRODUCTS

- FIGURE 19 POPULATION GROWTH TREND, BY REGION, 1950-2050 (MILLION)

- 5.2.2 INCREASE IN ORGANIC FARM AREA

- FIGURE 20 ORGANIC FARM AREA GROWTH TREND, BY KEY COUNTRY, 2016-2019 ('000 HA)

- 5.2.3 INCREASE IN PRODUCTION OF FRUITS & VEGETABLES

- FIGURE 21 AREA HARVESTED UNDER FRUITS, VEGETABLES, AND OTHER HIGH-VALUE CROPS, 2015-2019 (MILLION HA)

- 5.3 MARKET DYNAMICS

- FIGURE 22 MARKET DYNAMICS: BIOFERTILIZERS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Growth in organic food industry

- FIGURE 23 ORGANIC RETAIL SALES, 2016-2019 (USD MILLION)

- FIGURE 24 ORGANIC RETAIL SALES, 2017 VS 2018 (USD MILLION)

- FIGURE 25 SHARE OF ORGANIC FRESH PRODUCE SALES AND VOLUME 1ST QUARTER, 2021

- 5.3.1.2 Increase in awareness of need for sustainable in modern agriculture methods

- 5.3.1.3 Hazards of using chemical fertilizers and increase in environmental concerns

- 5.3.1.4 Increase in usage of biofertilizers in ranch and private farms

- FIGURE 26 GROWTH TRENDS OF ORGANIC PRODUCERS, 2016-2019

- 5.3.1.5 Adoption of precision farming and protected agriculture

- 5.3.1.6 Provision of range of phytohormones, macronutrients, and micronutrients

- 5.3.2 RESTRAINTS

- 5.3.2.1 Environmental and technological constraints

- 5.3.2.2 Poor infrastructure and high initial investment

- 5.3.2.3 Absence of well-constructed marketing routes and surrounding infrastructure

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 New target markets: Asia Pacific & Africa

- 5.3.3.2 Increase in production and yield of crops

- 5.3.3.3 Increase in utilization of liquid biofertilizers and fertigation method

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of awareness and low adoption rate of biofertilizers

- 5.3.4.2 Unfavorable regulatory standards

- 5.3.4.3 Supply of counterfeit and less-effective products

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 27 VALUE CHAIN ANALYSIS OF BIOFERTILIZERS MARKET

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL AND MEDIUM ENTERPRISES (SME)

- 6.3.3 END USERS

- 6.3.4 KEY INFLUENCERS

- FIGURE 28 BIOFERTILIZERS MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 TECHNOLOGICAL ADVANCEMENTS FOR LIQUID BIO-FERTILIZERS

- 6.5 PRICE TREND ANALYSIS

- 6.5.1 AVERAGE SELLING PRICES, BY TYPE

- FIGURE 29 GLOBAL AVERAGE SELLING PRICES, BY TYPE

- TABLE 3 BIOFERTILIZERS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 4 BIOFERTILIZERS: AVERAGE SELLING PRICE (ASP), BY TYPE, 2020-2022 (USD/TON)

- 6.6 MARKET MAPPING AND ECOSYSTEM ANALYSIS

- 6.6.1 SUPPLY-SIDE ANALYSIS

- 6.6.2 DEMAND-SIDE ANALYSIS

- FIGURE 30 BIOFERTILIZERS MARKET MAPPING

- TABLE 5 BIOFERTILIZERS MARKET: SUPPLY CHAIN ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.8 TRADE ANALYSIS

- TABLE 6 EXPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 7 IMPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 8 EXPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 9 IMPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 10 EXPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2019

- TABLE 11 IMPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2019

- 6.9 PATENT ANALYSIS

- FIGURE 32 PATENTS GRANTED FOR BIOFERTILIZERS MARKET, 2012-2022

- FIGURE 33 REGIONAL ANALYSIS OF PATENT GRANTED FOR BIOFERTILIZERS MARKET, 2012-2022

- TABLE 12 PATENTS PERTAINING TO BIOFERTILIZERS, 2020-2022

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 BIOFERTILIZERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 THREAT OF NEW ENTRANTS

- 6.11 CASE STUDIES

- TABLE 14 IDENTIFICATION OF MARKET OPPORTUNITIES FOR BIOFERTILIZERS IN NORTH AMERICA

- TABLE 15 HIGH ADOPTION OF ORGANIC GROWTH STRATEGIES BY KEY PLAYERS

- 6.12 KEY CONFERENCES AND EVENTS

- TABLE 16 KEY CONFERENCES AND EVENTS IN BIOFERTILIZERS MARKET, 2023

- 6.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 REGULATORY FRAMEWORK

- 6.14.1 NORTH AMERICA

- 6.14.1.1 US

- 6.14.1.2 Canada

- 6.14.2 EUROPE

- 6.14.2.1 Spain

- 6.14.2.2 Italy

- 6.14.3 ASIA PACIFIC

- 6.14.3.1 China

- 6.14.3.2 Australia

- TABLE 21 ENVIRONMENTAL STUDY ISSUES TO BE CONSIDERED IN APPLICATION

- 6.14.3.3 India

- 6.14.4 SOUTH AMERICA

- 6.14.4.1 Brazil

- 6.14.1 NORTH AMERICA

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPE

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPE

- 6.15.2 BUYING CRITERIA

- TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 BIOFERTILIZERS MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 24 RHIZOBACTERIA USED IN PRODUCTION OF BIOFERTILIZERS, AND THEIR IMPACT ON PLANT PRODUCTIVITY

- FIGURE 36 NITROGEN-FIXING BIOFERTILIZERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 25 BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 26 BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 27 BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 28 BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- 7.2 NITROGEN-FIXING BIOFERTILIZERS

- 7.2.1 NITROGEN-FIXING BIOFERTILIZERS TO ENHANCE AGRICULTURAL PRODUCTIVITY

- TABLE 29 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 32 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

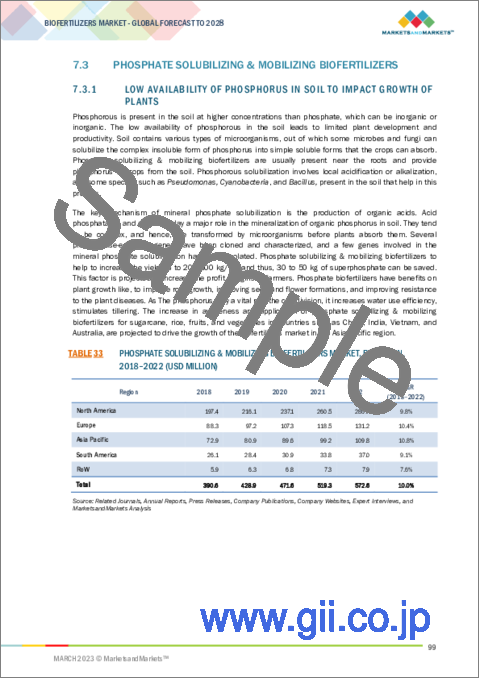

- 7.3 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS

- 7.3.1 LOW AVAILABILITY OF PHOSPHORUS IN SOIL TO IMPACT GROWTH OF PLANTS

- TABLE 33 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 36 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 7.4 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS

- 7.4.1 HIGHER ADOPTION OF CARRIER-BASED POTASH SOLUBILIZING BIOFERTILIZERS FOR BETTER YIELDS

- TABLE 37 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 40 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 7.5 OTHER TYPES

- TABLE 41 OTHER BIOFERTILIZERS TYPES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 OTHER BIOFERTILIZER TYPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 OTHER BIOFERTILIZERS TYPES MARKET, BY REGION, 2018-2022 (KT)

- TABLE 44 OTHER BIOFERTILIZER TYPES MARKET, BY REGION, 2023-2028 (KT)

8 BIOFERTILIZERS MARKET, BY CROP TYPE

- 8.1 INTRODUCTION

- FIGURE 37 CEREALS & GRAINS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 45 BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 46 BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 8.2 CEREALS & GRAINS

- 8.2.1 SUSTAINABLE BENEFITS OF BIOFERTILIZERS TO DRIVE DEMAND FOR CEREAL CROPS

- TABLE 47 CEREALS & GRAINS: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 CEREALS & GRAINS: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 PULSES & OILSEEDS

- 8.3.1 TECHNOLOGICAL ADVANCEMENTS TO ENHANCE PULSE PRODUCTION QUALITY

- TABLE 49 PULSES AND OILSEEDS: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 PULSES AND OILSEEDS: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 FRUITS & VEGETABLES

- 8.4.1 STRINGENT REGULATIONS TO INCREASE USE OF BIOLOGICAL INPUTS

- TABLE 51 FRUITS & VEGETABLES: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 FRUITS & VEGETABLES: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 OTHER CROP TYPES

- TABLE 53 OTHER CROP TYPES: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 OTHER CROP TYPES: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION

- 9.1 INTRODUCTION

- FIGURE 38 SOIL TREATMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 55 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 56 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 9.2 SOIL TREATMENT

- 9.2.1 CONVENTIONAL AGRICULTURAL PRACTICES TO ENCOURAGE SOIL TREATMENT WITH USE OF BIOFERTILIZERS IN ASIA PACIFIC

- TABLE 57 SOIL TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 SOIL TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 SEED TREATMENT

- 9.3.1 SEED TREATMENT TO IMPROVE UPTAKE OF NUTRIENTS

- TABLE 59 SEED TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 SEED TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 OTHER MODES OF APPLICATION

- 9.4.1 FOLIAR TREATMENT TO PROVIDE FASTER RESULTS FOR NUTRITIONAL DEFICIENCIES

- TABLE 61 OTHER MODES OF APPLICATION: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 OTHER MODES OF APPLICATION: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 BIOFERTILIZERS MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 39 LIQUID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 63 BIOFERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 64 BIOFERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.2 LIQUID BIOFERTILIZERS

- 10.2.1 INCREASE IN TOLERANCE LIMITS OF LIQUID BIOFERTILIZERS TO DRIVE DEMAND

- TABLE 65 LIQUID: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 LIQUID: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 CARRIER-BASED BIOFERTILIZERS

- 10.3.1 LOW SHELF LIFE TO INHIBIT MARKET GROWTH

- TABLE 67 CARRIER-BASED: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 CARRIER-BASED: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 BIOFERTILIZERS MARKET, BY MICROORGANISM

- 11.1 INTRODUCTION

- 11.2 RHIZOBIUM

- 11.3 AZOSPIRILLUM

- 11.4 AZOTOBACTER

- 11.5 OTHER TYPES OF MICROORGANISM

12 BIOFERTILIZERS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 40 SPAIN IS PROJECTED TO WITNESS HIGHEST GROWTH RATE AMONG COUNTRY-LEVEL MARKETS

- TABLE 69 BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 72 BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: REGIONAL SNAPSHOT

- 12.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 42 NORTH AMERICA: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 73 NORTH AMERICA: BIOFERTILIZERS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: BIOFERTILIZERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 78 NORTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 79 NORTH AMERICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: BIOFERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: BIOFERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Strengthening supply channels of organic products for food industries to drive demand for biofertilizers

- TABLE 85 US: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 86 US: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 87 US: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 88 US: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Rise in organic farmlands to encourage biofertilizer manufacturers to increase production capacity

- TABLE 89 CANADA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 90 CANADA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 91 CANADA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 92 CANADA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Rise in exports of fruits & vegetables to increase adoption of biofertilizers among small organic producers

- TABLE 93 MEXICO: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 94 MEXICO: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 MEXICO: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 96 MEXICO: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- FIGURE 43 EUROPE: BIOFERTILIZERS MARKET SNAPSHOT

- 12.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 44 EUROPE: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 97 EUROPE: BIOFERTILIZERS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 98 EUROPE: BIOFERTILIZERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 99 EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 100 EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 102 EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 103 EUROPE: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 104 EUROPE: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 105 EUROPE: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 106 EUROPE: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: BIOFERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 108 EUROPE: BIOFERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Early adoption of EU agricultural standards and policies to drive growth of nitrogen-fixing biofertilizers market

- TABLE 109 GERMANY: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 110 GERMANY: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 111 GERMANY: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 112 GERMANY: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Need for sustainable crop production to encourage farmers to opt for organic practices

- TABLE 113 FRANCE: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 114 FRANCE: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 115 FRANCE: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 116 FRANCE: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.4 ITALY

- 12.3.4.1 Government initiatives to provide financial support to farmers

- TABLE 117 ITALY: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 118 ITALY: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 119 ITALY: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 120 ITALY: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.5 SPAIN

- 12.3.5.1 Increase in R&D activities to provide innovative products

- TABLE 121 SPAIN: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 122 SPAIN: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 123 SPAIN: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 124 SPAIN: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.6 UK

- 12.3.6.1 Increased awareness pertaining to need for sustainable farming practices

- TABLE 125 UK: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 126 UK: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 127 UK: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 128 UK: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.7 RUSSIA

- 12.3.7.1 Increased focus on production capacity of biofertilizers among agri-input players

- TABLE 129 RUSSIA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 130 RUSSIA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 131 RUSSIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 132 RUSSIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.8 NETHERLANDS

- 12.3.8.1 Biological inputs to witness increase in application in greenhouse cultivation

- TABLE 133 NETHERLANDS: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 134 NETHERLANDS: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 135 NETHERLANDS: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 136 NETHERLANDS: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.9 REST OF EUROPE

- 12.3.9.1 High focus on increasing production capacity of biofertilizers among agri-input players

- TABLE 137 REST OF EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 140 REST OF EUROPE: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.10 ASIA PACIFIC

- 12.3.11 RECESSION IMPACT ANALYSIS

- FIGURE 45 ASIA PACIFIC: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 141 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 146 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 147 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.11.1 India

- TABLE 153 INDIA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 154 INDIA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 155 INDIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 156 INDIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.12 JAPAN

- 12.3.12.1 Increase in focus on rice production using both traditional and modern practices to drive demand

- TABLE 157 JAPAN: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 158 JAPAN: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 159 JAPAN: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 160 JAPAN: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.12.2 China

- TABLE 161 CHINA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 162 CHINA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 163 CHINA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 164 CHINA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.12.3 Thailand

- TABLE 165 THAILAND: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 166 THAILAND: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 167 THAILAND: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 168 THAILAND: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.12.4 Australia

- TABLE 169 AUSTRALIA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 170 AUSTRALIA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 171 AUSTRALIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 172 AUSTRALIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.12.5 Indonesia

- TABLE 173 INDONESIA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 174 INDONESIA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 175 INDONESIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 176 INDONESIA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.13 REST OF ASIA PACIFIC

- 12.3.13.1 Increasing awareness regarding sustainable farming practices to drive market

- TABLE 177 REST OF ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.14 SOUTH AMERICA

- 12.3.15 RECESSION IMPACT ANALYSIS

- FIGURE 46 SOUTH AMERICA: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 181 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 186 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 187 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (MILLION)

- TABLE 189 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 192 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.15.1 Brazil

- TABLE 193 BRAZIL: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 194 BRAZIL: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 195 BRAZIL: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 196 BRAZIL: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.16 ARGENTINA

- 12.3.16.1 High market penetration with help of local companies

- TABLE 197 ARGENTINA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 198 ARGENTINA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 199 ARGENTINA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 200 ARGENTINA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.17 REST OF SOUTH AMERICA

- 12.3.17.1 Biofertilizers to be used as agricultural solutions for enhancing crop productivity

- TABLE 201 REST OF SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.18 ROW

- 12.3.19 RECESSION IMPACT ANALYSIS

- FIGURE 47 ROW: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 205 ROW: BIOFERTILIZERS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 206 ROW: BIOFERTILIZERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 207 ROW: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 208 ROW: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 209 ROW: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 210 ROW: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 211 ROW: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 212 ROW: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 213 ROW: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 214 ROW: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 215 ROW: BIOFERTILIZERS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 216 ROW: BIOFERTILIZERS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.20 AFRICA

- TABLE 217 AFRICA: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 218 AFRICA: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 219 AFRICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 220 AFRICA: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 12.3.21 MIDDLE EAST

- TABLE 221 MIDDLE EAST: BIOFERTILIZERS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 222 MIDDLE EAST: BIOFERTILIZERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 223 MIDDLE EAST: BIOFERTILIZERS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 224 MIDDLE EAST: BIOFERTILIZERS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- TABLE 225 BIOFERTILIZERS MARKET: DEGREE OF COMPETITION

- 13.4 COMPANY REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 49 BIOFERTILIZERS MARKET, COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 13.5.5 PRODUCT FOOTPRINT

- TABLE 226 BIOFERTILIZERS: TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 227 BIOFERTILIZERS: FORM FOOTPRINT OF KEY PLAYERS

- TABLE 228 BIOFERTILIZERS: MODE OF APPLICATION FOOTPRINT OF KEY PLAYERS

- TABLE 229 BIOFERTILIZERS: REGION FOOTPRINT OF KEY PLAYERS

- TABLE 230 BIOFERTILIZERS: OVERALL FOOTPRINT OF KEY PLAYERS

- 13.6 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 50 BIOFERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (OTHER PLAYERS)

- 13.6.5 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 231 DETAILED LIST OF OTHER PLAYERS

- TABLE 232 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- 13.7 COMPETITIVE SCENARIO

- 13.7.1 PRODUCT LAUNCHES

- TABLE 233 BIOFERTILIZERS MARKET: PRODUCT LAUNCHES, 2018-2022

- 13.7.2 DEALS

- TABLE 234 BIOFERTILIZERS MARKET: DEALS, 2018- 2022

- 13.7.3 OTHERS

- TABLE 235 BIOFERTILIZERS MARKET: OTHERS, 2018-2022

14 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 14.1 KEY PLAYERS

- 14.1.1 NOVOZYMES

- TABLE 236 NOVOZYMES: BUSINESS OVERVIEW

- FIGURE 51 NOVOZYMES: COMPANY SNAPSHOT

- TABLE 237 NOVOZYMES: PRODUCT LAUNCHES

- TABLE 238 NOVOZYMES: DEALS

- TABLE 239 NOVOZYMES: OTHERS

- 14.1.2 UPL

- TABLE 240 UPL: BUSINESS OVERVIEW

- FIGURE 52 UPL: COMPANY SNAPSHOT

- TABLE 241 UPL: DEALS

- 14.1.3 CHR. HANSEN HOLDING A/S

- TABLE 242 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 53 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 243 CHR. HANSEN HOLDING A/S: DEALS

- 14.1.4 SYNGENTA

- TABLE 244 SYNGENTA- BUSINESS OVERVIEW

- FIGURE 54 SYNGENTA: COMPANY SNAPSHOT

- TABLE 245 SYNGENTA: PRODUCT LAUNCHES

- TABLE 246 SYNGENTA: DEALS

- 14.1.5 T. STANES AND COMPANY LIMITED

- TABLE 247 T. STANES AND COMPANY LIMITED: BUSINESS OVERVIEW

- FIGURE 55 T. STANES AND COMPANY LIMITED: COMPANY SNAPSHOT

- 14.1.6 LALLEMAND INC.

- TABLE 248 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 249 LALLEMAND INC.: PRODUCT LAUNCHES

- 14.1.7 RIZOBACTER ARGENTINA S.A.

- TABLE 250 RIZOBACTER ARGENTINA S.A: BUSINESS OVERVIEW

- TABLE 251 RIZOBACTER ARGENTINA S.A.: DEALS

- TABLE 252 RIZOBACTER ARGENTINA S.A.: OTHERS

- 14.1.8 VEGALAB SA

- TABLE 253 VEGALAB SA: BUSINESS OVERVIEW

- TABLE 254 VEGALAB SA: DEALS

- 14.1.9 IPL BIOLOGICALS LIMITED

- TABLE 255 IPL BIOLOGICALS LIMITED: BUSINESS OVERVIEW

- 14.1.10 KIWA BIO-TECH PRODUCT GROUP COOPERATION

- TABLE 256 KIWA BIO-TECH PRODUCT GROUP COOPERATION: BUSINESS OVERVIEW

- TABLE 257 KIWA BIO-TECH PRODUCT GROUP COOPERATION: DEALS

- TABLE 258 KIWA BIO-TECH PRODUCT GROUP COOPERATION: OTHERS

- 14.1.11 SYMBORG

- TABLE 259 SYMBORG: BUSINESS OVERVIEW

- TABLE 260 SYMBORG: PRODUCT LAUNCHES

- TABLE 261 SYMBORG: OTHERS

- 14.1.12 KAN BIOSYS

- TABLE 262 KAN BIOSYS: BUSINESS OVERVIEW

- 14.1.13 MAPLETON AGRI BIOTECH PT LTD

- TABLE 263 MAPLETON AGRI BIOTECH PT LTD: BUSINESS OVERVIEW

- 14.1.14 SEIPASA

- TABLE 264 SEIPASA: BUSINESS OVERVIEW

- TABLE 265 SEIPASA: DEALS

- TABLE 266 SEIPASA: OTHERS

- 14.1.15 AGRILIFE

- TABLE 267 AGRILIFE: BUSINESS OVERVIEW

- 14.2 OTHER PLAYERS

- 14.2.1 MANIDHARMA BIOTECH PVT LTD

- TABLE 268 MANIDHARMA BIOTECH PVT LTD: BUSINESS OVERVIEW

- 14.2.2 BIOMAX NATURALS

- TABLE 269 BIOMAX NATURALS: BUSINESS OVERVIEW

- 14.2.3 JAIPUR BIO FERTILIZERS

- TABLE 270 JAIPUR BIO FERTILIZERS: BUSINESS OVERVIEW

- 14.2.4 VALENT BIOSCIENCES

- TABLE 271 VALENT BIOSCIENCES: BUSINESS OVERVIEW

- 14.2.5 AUMGENE BIOSCIENCES

- TABLE 272 AUMGENE BIOSCIENCES: BUSINESS OVERVIEW

- 14.2.6 AGRINOS

- 14.2.7 CRIYAGEN

- 14.2.8 LKB BIOFERTILIZER

- 14.2.9 VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTD

- 14.2.10 NUTRAMAX LABORATORIES, INC

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 273 ADJACENT MARKETS

- 15.2 RESEARCH LIMITATIONS

- 15.3 AGRICULTURAL BIOLOGICALS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 274 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- 15.4 INOCULANTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 275 INOCULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS