|

|

市場調査レポート

商品コード

1546634

殺菌剤の世界市場:タイプ別、作用機序別、剤型別、塗布方法別、作物タイプ別、地域別 - 2029年までの予測Fungicides Market by Type (Chemical and Biological), Mode of Action (Contact and Systemic), Formulation (Liquid and Dry), Mode of Application (Foliar Spray, Seed Treatment, and Soil Treatment), Crop Type and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 殺菌剤の世界市場:タイプ別、作用機序別、剤型別、塗布方法別、作物タイプ別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月22日

発行: MarketsandMarkets

ページ情報: 英文 329 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の殺菌剤の市場規模は2024年に239億米ドルと予測され、予測期間中のCAGRは6.2%と見込まれており、2029年には323億米ドルに達すると予測されています。

作物に被害を与える植物病原性生物はいくつかあり、真菌は世界的に作物損失の主な原因となっています。殺菌剤市場は今後数年間、有望な速度で成長すると予測されています。この成長の原動力は、気候条件の変化と、高価値作物、特に果物・野菜に対する需要の高まりです。食糧農業機関(Food and Agricultural Organization)は、人間の栄養補給に不可欠な168種類の作物を襲う数百種類の真菌病を特定しており、これらの病害による潜在的脅威は気候変動によって高まるばかりです。気温の上昇は真菌病原体の新たな変異を促進し、嵐や竜巻などの異常気象は胞子をより広い地域に拡散させる。例えば2022年には、気候変動によってアイルランドで茎さび病が大発生しましたが、この病原菌の空気中の胞子は他の地域から飛来したものであり、気象パターンの変化と気温上昇によって引き起こされる広範なリスクを浮き彫りにしています。殺菌剤市場は今後数年間、有望な速度で成長すると予測されています。殺菌剤市場の主な参入企業には、Syngenta Group(スイス)、BASF SE(ドイツ)、Bayer AG(ドイツ)、FMC Corporation(米国)、UPL Ltd.(インド)などがあります。(インド)などです。BASFが提供する一般的な殺菌剤には、F 500、Xemium、Revysol、Pavectoなどがあります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | タイプ別、作用機序別、剤型別、塗布方法別、作物タイプ別、地域別 |

| 対象地域 | 北米、アジア太平洋、南米、欧州、その他の企業 |

当レポートでは、世界の殺菌剤市場について調査し、タイプ別、作用機序別、剤型別、塗布方法別、作物タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ指標

- 市場力学

- 生成AIが殺菌剤市場に与える影響

第6章 業界の動向

- イントロダクション

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 価格分析

- 特許分析

- ケーススタディ分析

- 貿易分析

- 主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

第7章 殺菌剤市場(タイプ別)

- イントロダクション

- 生物学的殺菌剤

- 化学殺菌剤

第8章 殺菌剤市場(剤型別)

- イントロダクション

- 液体

- ドライ

第9章 殺菌剤市場(作用機序別)

- イントロダクション

- 接触殺菌剤

- 全身性殺菌剤

第10章 殺菌剤市場(塗布方法別)

- イントロダクション

- 種子処理

- 土壌処理

- 葉面散布

- その他

第11章 殺菌剤市場(作物タイプ別)

- イントロダクション

- シリアル・穀物

- 油糧種子・豆類

- 果物・野菜

- その他

第12章 殺菌剤市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- セグメント収益分析

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品/サービス分析

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- BASF SE

- BAYER AG

- CORTEVA

- SYNGENTA GROUP

- FMC CORPORATION

- UPL

- SUMITOMO CHEMICAL CO., LTD.

- NIPPON SODA CO, LTD.

- NUFARM

- NISSAN CHEMICAL CORPORATION

- AMERICAN VANGUARD CORPORATION

- KUMIAI CHEMICAL INDUSTRY CO., LTD

- GOWAN COMPANY

- ALBAUGH LLC

- KOPPERT

- その他の企業(スタートアップ/中小企業)

- SIPCAM OXON SPA

- CERTIS USA L.L.C.

- BIOBEST GROUP NV

- STK BIO-AG TECHNOLOGIES

- VERDESIAN LIFE SCIENCES

- VIVE CROP PROTECTION

- CRYSTAL CROP PROTECTION LTD.

- ATTICUS, LLC

- SCIMPLIFY

- BOTANO HEALTH

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 FUNGICIDES MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019-2023

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 FUNGICIDES MARKET SNAPSHOT, 2024 VS. 2029

- TABLE 5 FUNGICIDES MARKET: ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY TYPE, 2023 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE (ASP) TREND OF FUNGICIDES, BY TYPE, 2019-2023 (USD/KG)

- TABLE 8 CHEMICAL FUNGICIDES: AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2019-2023 (USD/KG)

- TABLE 9 BIOLOGICAL FUNGICIDES: AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2019-2023 (USD/KG)

- TABLE 10 KEY PATENTS PERTAINING TO FUNGICIDES MARKET, 2014-2024

- TABLE 11 EXPORT VALUE OF HS CODE 380892, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 12 IMPORT VALUE OF HS CODE 380892, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 13 FUNGICIDES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 PORTER'S FIVE FORCES IMPACT ON FUNGICIDES MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF APPLICATION

- TABLE 21 KEY BUYING CRITERIA, BY MODE OF APPLICATION

- TABLE 22 FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 23 FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 24 FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 25 FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 26 BIOLOGICAL FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 27 BIOLOGICAL FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 BIOLOGICAL FUNGICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 29 BIOLOGICAL FUNGICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 30 BIOLOGICAL FUNGICIDES MARKET, BY SUBTYPE, 2019-2023 (USD MILLION)

- TABLE 31 BIOLOGICAL FUNGICIDES MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 32 BIOLOGICAL FUNGICIDES MARKET, BY MICROBIAL, 2019-2023 (USD MILLION)

- TABLE 33 BIOLOGICAL FUNGICIDES MARKET, BY MICROBIAL, 2024-2029 (USD MILLION)

- TABLE 34 BIOLOGICAL FUNGICIDES MARKET, BY BIOCHEMICAL, 2019-2023 (USD MILLION)

- TABLE 35 BIOLOGICAL FUNGICIDES MARKET, BY BIOCHEMICAL, 2024-2029 (USD MILLION)

- TABLE 36 CHEMICAL FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 CHEMICAL FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 CHEMICAL FUNGICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 39 CHEMICAL FUNGICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 40 CHEMICAL FUNGICIDES MARKET, BY SUBTYPE, 2019-2023 (USD MILLION)

- TABLE 41 CHEMICAL FUNGICIDES MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 42 FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 43 FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 44 LIQUID FUNGICIDES MARKET, BY SUBTYPE, 2019-2023 (USD MILLION)

- TABLE 45 LIQUID FUNGICIDES MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 46 LIQUID FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 LIQUID FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 DRY FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 49 DRY FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 50 DRY FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 DRY FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 53 FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 54 CONTACT FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 55 CONTACT FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 SYSTEMIC FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 SYSTEMIC FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 59 FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 60 SEED TREATMENT: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 SEED TREATMENT: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 SOIL TREATMENT: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 63 SOIL TREATMENT: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 FOLIAR SPRAY: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 FOLIAR SPRAY: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 OTHER MODES OF APPLICATION: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 OTHER MODES OF APPLICATION: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 69 FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 70 CEREALS & GRAINS: FUNGICIDES MARKET, BY SUBTYPE, 2019-2023 (USD MILLION)

- TABLE 71 CEREALS & GRAINS: FUNGICIDES MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 72 CEREALS & GRAINS: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 73 CEREALS & GRAINS: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 74 OILSEEDS & PULSES: FUNGICIDES MARKET, BY SUBTYPE, 2019-2023 (USD MILLION)

- TABLE 75 OILSEEDS & PULSES: FUNGICIDES MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 76 OILSEEDS & PULSES: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 77 OILSEEDS & PULSES: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 78 FRUITS & VEGETABLES: FUNGICIDES MARKET, BY SUBTYPE, 2019-2023 (USD MILLION)

- TABLE 79 FRUITS & VEGETABLES: FUNGICIDES MARKET, BY SUBTYPE, 2024-2029 (USD MILLION)

- TABLE 80 FRUITS & VEGETABLES: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 FRUITS & VEGETABLES: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 OTHER CROP TYPES: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 OTHER CROP TYPES: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 85 FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 FUNGICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 87 FUNGICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 88 FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 89 FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 90 FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 91 FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 92 FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 93 FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 94 FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 95 FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 96 FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 97 FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 98 FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 99 FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: FUNGICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: FUNGICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 103 NORTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 105 NORTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 106 NORTH AMERICA: FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 112 NORTH AMERICA: FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 114 US: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 115 US: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 116 CANADA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 117 CANADA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 118 MEXICO: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 119 MEXICO: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 120 EUROPE: FUNGICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 121 EUROPE: FUNGICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 EUROPE: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 123 EUROPE: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 124 EUROPE: FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 125 EUROPE: FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 126 EUROPE: FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 127 UROPE: FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 128 EUROPE: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 129 EUROPE: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 EUROPE: FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 131 EUROPE: FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 132 EUROPE: FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 133 EUROPE: FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 134 GERMANY: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 135 GERMANY: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 136 UK: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 137 UK: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 138 FRANCE: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 139 FRANCE: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 140 SPAIN: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 141 SPAIN: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 142 ITALY: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 143 ITALY: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 144 RUSSIA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 145 RUSSIA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 146 REST OF EUROPE: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 147 REST OF EUROPE: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 148 ASIA PACIFIC: FUNGICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 149 ASIA PACIFIC: FUNGICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 150 ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 151 ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 152 ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 153 ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 154 ASIA PACIFIC: FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 155 ASIA PACIFIC: FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 156 ASIA PACIFIC: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 157 ASIA PACIFIC: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 158 ASIA PACIFIC: FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 159 ASIA PACIFIC: FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 160 ASIA PACIFIC: FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 161 ASIA PACIFIC: FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 162 CHINA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 163 CHINA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 164 INDIA: FUNGICIDES MARKET, BY TYPE, 2019-2023(USD MILLION)

- TABLE 165 INDIA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 166 JAPAN: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 167 JAPAN: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 168 AUSTRALIA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 169 AUSTRALIA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 170 INDONESIA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 171 INDONESIA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AMERICA: FUNGICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 175 SOUTH AMERICA: FUNGICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 176 SOUTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 177 SOUTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 178 SOUTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 179 SOUTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 180 SOUTH AMERICA: FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 181 SOUTH AMERICA: FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 182 SOUTH AMERICA: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 183 SOUTH AMERICA: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 184 SOUTH AMERICA: FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 185 SOUTH AMERICA: FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 186 SOUTH AMERICA: FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 187 SOUTH AMERICA: FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 188 BRAZIL: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 189 BRAZIL: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 ARGENTINA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 191 ARGENTINA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 192 REST OF SOUTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 194 ROW: FUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 195 ROW: FUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 196 ROW: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 197 ROW: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 198 ROW: FUNGICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 199 ROW: FUNGICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 200 ROW: FUNGICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 201 ROW: FUNGICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 202 ROW: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 203 ROW: FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 204 ROW: FUNGICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 205 ROW: FUNGICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 206 ROW: FUNGICIDES MARKET, BY MODE OF ACTION, 2019-2023 (USD MILLION)

- TABLE 207 ROW: FUNGICIDES MARKET, BY MODE OF ACTION, 2024-2029 (USD MILLION)

- TABLE 208 MIDDLE EAST: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 209 MIDDLE EAST: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 210 AFRICA: FUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 211 AFRICA: FUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 212 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN FUNGICIDES MARKET, 2020-2024

- TABLE 213 FUNGICIDES MARKET: DEGREE OF COMPETITION

- TABLE 214 FUNGICIDES MARKET: TYPE FOOTPRINT

- TABLE 215 FUNGICIDES MARKET: FORMULATION FOOTPRINT

- TABLE 216 FUNGICIDES MARKET: MODE OF APPLICATION FOOTPRINT

- TABLE 217 FUNGICIDES MARKET: REGION FOOTPRINT

- TABLE 218 FUNGICIDES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 219 FUNGICIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023

- TABLE 220 FUNGICIDES MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-AUGUST 2024

- TABLE 221 FUNGICIDES MARKET: DEALS, JANUARY 2020-AUGUST 2024

- TABLE 222 FUNGICIDES MARKET: EXPANSIONS, JANUARY 2020-AUGUST 2024

- TABLE 223 BASF SE: COMPANY OVERVIEW

- TABLE 224 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 BASF SE: PRODUCT LAUNCHES

- TABLE 226 BASF SE: DEALS

- TABLE 227 BASF SE: EXPANSIONS

- TABLE 228 BAYER AG: COMPANY OVERVIEW

- TABLE 229 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 BAYER AG: PRODUCT LAUNCHES

- TABLE 231 BAYER AG: DEALS

- TABLE 232 BAYER AG: EXPANSIONS

- TABLE 233 CORTEVA: COMPANY OVERVIEW

- TABLE 234 CORTEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 CORTEVA INC: PRODUCT LAUNCHES

- TABLE 236 CORTEVA: DEALS

- TABLE 237 SYNGENTA GROUP: COMPANY OVERVIEW

- TABLE 238 SYNGENTA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 SYNGENTA GROUP: PRODUCT LAUNCHES

- TABLE 240 SYNGENTA GROUP: DEALS

- TABLE 241 FMC CORPORATION: COMPANY OVERVIEW

- TABLE 242 FMC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 FMC CORPORATION: PRODUCT LAUNCHES

- TABLE 244 FMC CORPORATION: DEALS

- TABLE 245 UPL: COMPANY OVERVIEW

- TABLE 246 UPL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 UPL: PRODUCT LAUNCHES

- TABLE 248 UPL: DEALS

- TABLE 249 SUMITOMO CHEMICALS CO., LTD: COMPANY OVERVIEW

- TABLE 250 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 SUMITOMO CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 252 SUMITOMO CHEMICAL CO., LTD.: DEALS

- TABLE 253 SUMITOMO CHEMICAL CO., LTD.: EXPANSIONS

- TABLE 254 NIPPON SODA CO. LTD.: COMPANY OVERVIEW

- TABLE 255 NIPPON SODA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 NIPPON SODA CO., LTD.: PRODUCT LAUNCHES

- TABLE 257 NUFARM: COMPANY OVERVIEW

- TABLE 258 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 NUFARM: PRODUCT LAUNCHES

- TABLE 260 NUFARM: DEALS

- TABLE 261 NISSAN CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 262 NISSAN CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 NISSAN CHEMICAL CORPORATION: PRODUCT LAUNCHES

- TABLE 264 NISSAN CHEMICAL CORPORATION: DEALS

- TABLE 265 NISSAN CHEMICAL CORPORATION: EXPANSIONS

- TABLE 266 AMERICAN VANGUARD CORPORATION: COMPANY OVERVIEW

- TABLE 267 AMERICAN VANGUARD CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 268 AMERICAN VANGUARD CORPORATION: DEALS

- TABLE 269 KUMIAI CHEMICAL INDUSTRY CO., LTD: COMPANY OVERVIEW

- TABLE 270 KUMIAI CHEMICAL INDUSTRY CO., LTD: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 271 KUMIAI CHEMICAL INDUSTRY CO., LTD: PRODUCT LAUNCHES

- TABLE 272 GOWAN COMPANY: COMPANY OVERVIEW

- TABLE 273 GOWAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 GOWAN COMPANY: PRODUCT LAUNCHES

- TABLE 275 GOWAN COMPANY: DEALS

- TABLE 276 GOWAN COMPANY: EXPANSIONS

- TABLE 277 ALBAUGH LLC: COMPANY OVERVIEW

- TABLE 278 ALBAUGH LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 ALBAUGH LLC: PRODUCT LAUNCHES

- TABLE 280 ALBAUGH LLC: DEALS

- TABLE 281 KOPPERT: COMPANY OVERVIEW

- TABLE 282 KOPPERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 KOPPERT: DEALS

- TABLE 284 KOPPERT: EXPANSIONS

- TABLE 285 SIPCAM OXON SPA: COMPANY OVERVIEW

- TABLE 286 SIPCAM OXON SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 SIPCAM OXON SPA: DEALS

- TABLE 288 SIPCAM OXON SPA: EXPANSIONS

- TABLE 289 CERTIS USA L.L.C.: COMPANY OVERVIEW

- TABLE 290 CERTIS USA L.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 CERTIS USA L.L.C.: PRODUCT LAUNCHES

- TABLE 292 CERTIS USA L.L.C.: DEALS

- TABLE 293 CERTIS USA L.L.C.: OTHER DEVELOPMENTS

- TABLE 294 BIOBEST GROUP NV: COMPANY OVERVIEW

- TABLE 295 BIOBEST GROUP NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 BIOBEST GROUP NV: PRODUCT LAUNCHES

- TABLE 297 BIOBEST GROUP NV: DEALS

- TABLE 298 STK BIO-AG TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 299 STK BIO-AG TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 STK BIO-AG TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 301 VERDESIAN LIFE SCIENCES: BUSINESS OVERVIEW

- TABLE 302 VERDESIAN LIFE SCIENCES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 VIVE CROP PROTECTION: COMPANY OVERVIEW

- TABLE 304 CRYSTAL CROP PROTECTION LTD.: COMPANY OVERVIEW

- TABLE 305 ATTICUS, LLC: COMPANY OVERVIEW

- TABLE 306 SCIMPLIFY: COMPANY OVERVIEW

- TABLE 307 BOTANO HEALTH: COMPANY OVERVIEW

- TABLE 308 ADJACENT MARKETS

- TABLE 309 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 310 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 311 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 312 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 313 LIST OF PLANT PRODUCTS REGISTERED AS BIOPESTICIDES

- TABLE 314 BIORATIONAL PESTICIDES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 315 BIORATIONAL PESTICIDES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 316 AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 317 AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 318 AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 319 AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

List of Figures

- FIGURE 1 FUNGICIDES MARKET SEGMENTATION

- FIGURE 2 FUNGICIDES MARKET: RESEARCH DESIGN

- FIGURE 3 FUNGICIDES MARKET: DEMAND-SIDE CALCULATION

- FIGURE 4 FUNGICIDES MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- FIGURE 5 FUNGICIDES MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 CHEMICAL FUNGICIDES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 LIQUID FORMULATIONS TO HOLD LARGER SHARE DURING FORECAST PERIOD

- FIGURE 9 SYSTEMIC FUNGICIDES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 FUNGICIDES MARKET, BY CROP TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 FUNGICIDES MARKET SHARE (2023) AND CAGR (2024-2029), BY REGION

- FIGURE 13 INCREASING AGRICULTURAL PRODUCTIVITY DEMANDS AND ADOPTION OF ADVANCED FARMING PRACTICES TO DRIVE MARKET

- FIGURE 14 CHEMICAL FUNGICIDES SEGMENT & CHINA TO ACCOUNT FOR LARGEST SHARES IN 2024

- FIGURE 15 US TO ACCOUNT FOR LARGEST SHARE (BY VALUE) IN 2024

- FIGURE 16 CHEMICAL FUNGICIDES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 17 LIQUID SEGMENT TO DOMINATE MARKET DURING REVIEW PERIOD

- FIGURE 18 SYSTEMIC SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING STUDY PERIOD

- FIGURE 19 FOLIAR SPRAY TO ACCOUNT FOR LARGEST MARKET SHARE DURING STUDY PERIOD

- FIGURE 20 CEREALS & GRAINS TO ACCOUNT FOR LARGEST MARKET SHARE DURING STUDY PERIOD

- FIGURE 21 GLOBAL AGRICULTURAL FUNGICIDES & BACTERICIDES USE LAND, 2018-2022 (KT)

- FIGURE 22 GLOBAL AGRICULTURAL LAND AREA (2017-2021)

- FIGURE 23 AREA HARVESTED UNDER FRUITS AND VEGETABLES, 2018-2022 (MILLION HECTARES)

- FIGURE 24 FUNGICIDES MARKET DYNAMICS

- FIGURE 25 ADOPTION OF GEN AI IN FUNGICIDE PRODUCTION PROCESS

- FIGURE 26 FUNGICIDES MARKET: TRENDS/DISRUPTING IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 FUNGICIDES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 KEY STAKEHOLDERS IN FUNGICIDES MARKET ECOSYSTEM

- FIGURE 29 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023

- FIGURE 30 AVERAGE SELLING PRICE TREND OF FUNGICIDES, BY TYPE, 2019-2023 (USD/KG)

- FIGURE 31 CHEMICAL FUNGICIDES: AVERAGE SELLING PRICE TREND, BY REGION (USD/KG)

- FIGURE 32 BIOLOGICAL FUNGICIDES: AVERAGE SELLING PRICE TREND, BY REGION (USD/KG)

- FIGURE 33 PATENTS GRANTED FOR FUNGICIDES MARKET, 2014-2024

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FUNGICIDES MARKET, 2014-2024

- FIGURE 35 EXPORT VALUE FOR HS CODE 380892, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 36 IMPORT VALUE OF HS CODE 380892, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 37 FUNGICIDES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF APPLICATION

- FIGURE 39 KEY BUYING CRITERIA, BY MODE OF APPLICATION

- FIGURE 40 INVESTMENT & FUNDING SCENARIO OF FEW MAJOR PLAYERS

- FIGURE 41 FUNGICIDES MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 42 FUNGICIDES MARKET, BY FORMULATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 43 FUNGICIDES MARKET, BY MODE OF ACTION, 2024 VS. 2029 (USD MILLION)

- FIGURE 44 FUNGICIDES MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 45 FUNGICIDES MARKET, BY CROP TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 46 SPAIN PROJECTED TO RECORD HIGHEST CAGR IN FUNGICIDES MARKET

- FIGURE 47 ASIA PACIFIC: FUNGICIDES MARKET SNAPSHOT

- FIGURE 48 SOUTH AMERICA: FUNGICIDES MARKET SNAPSHOT

- FIGURE 49 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 50 FUNGICIDES MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 51 RANKING OF TOP FIVE PLAYERS IN FUNGICIDES MARKET, 2023

- FIGURE 52 FUNGICIDES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 COMPANY FOOTPRINT

- FIGURE 54 FUNGICIDES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 COMPANY VALUATION OF FEW MAJOR PLAYERS

- FIGURE 56 EV/EBITDA OF KEY COMPANIES

- FIGURE 57 BRAND/PRODUCT/SERVICE ANALYSIS, BY KEY BRAND

- FIGURE 58 BASF SE: COMPANY SNAPSHOT

- FIGURE 59 BAYER AG: COMPANY SNAPSHOT

- FIGURE 60 CORTEVA: COMPANY SNAPSHOT

- FIGURE 61 SYNGENTA GROUP: COMPANY SNAPSHOT

- FIGURE 62 FMC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 UPL LTD: COMPANY SNAPSHOT

- FIGURE 64 SUMITOMO CHEMICALS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 NIPPON SODA CO. LTD: COMPANY SNAPSHOT

- FIGURE 66 NUFARM: COMPANY SNAPSHOT

- FIGURE 67 NISSAN CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 AMERICAN VANGUARD CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 KUMIAI CHEMICAL INDUSTRY CO., LTD: COMPANY SNAPSHOT

The global fungicides market is estimated at USD 23.9 billion in 2024 and is projected to reach USD 32.3 billion by 2029, at a CAGR of 6.2% during the forecast period. There are several plant pathogenic organisms that cause crop damage; fungi are a primary cause of crop loss globally. The fungicides market is projected to grow at a promising rate in the coming years. This growth is driven by the changing climate conditions and the rising demand for high-value crops, particularly for fruits & vegetables. The Food and Agricultural Organization has identified hundreds of fungal diseases that strike 168 crops integral to human nutrition, with the potential threat from these diseases only rising with climate change. Higher temperatures favor the new variation of fungal pathogens, and extreme weather events such as storms and tornadoes can spread spores over larger geographic areas. For example in 2022, climatic change caused a severe outbreak of stem rust in Ireland, whose airborne spores of the pathogen have come from other regions, underscoring broader risks induced by shifting weather patterns and rising temperatures. The fungicides market is projected to grow at a promising rate in the coming years. Major players in the fungicides market include Syngenta Group (Switzerland), BASF SE (Germany), Bayer AG (Germany), FMC Corporation (US), and UPL Ltd. (India). Some popular fungicides offered by BASF include F 500, Xemium, Revysol, and Pavecto. Syngenta Group offers Amistar, Bravo, Orondis, and Revus. In the recent years, major players largely invested in the research and development activities for the launch of novel fungicide products across the globe, which further boosts the market growth. In May 2024, Syngenta Group announced a major boost in its fungicides portfolio with the launch of its patented ADEPIDYN technology globally featuring the active ingredient pydiflumetofen. The advanced fungicide is available to farmers in more than 55 countries currently.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Type, Mode of Action, Formulation, Mode of Application, Crop Type and Region |

| Regions covered | North America, Asia Pacific, South America, Europe, and RoW |

- FIGURE 1 GLOBAL PESTICIDE USE, BY CATEGORY, 2021 (MILLION TONS)

Source: FAO (2024)

"Rising demand for agricultural production to drive the fungicides market globally"

An increase in agricultural production, arising from the increased demand for food on a global scale, essentially increases the application of fungicides to protect crops and enhance yields. According to the State of Food Security and Nutrition in the World report published by FAO, global food production will need to grow by 70% in 2050 to cater to the increasing population. A 2022 study published in Springer Nature examined the impact of foliar fungicides on soybean yields in the north-central United States. The study highlighted that fungicides are more beneficial in high-yield environments, offering sufficient yield increases to offset their costs when soybean prices are average or higher. Nonetheless, it emphasized the ongoing importance of disease scouting and resistance management.

"In 2023, chemical fungicides stood as the major segment within the type segment of the fungicides market. "

Chemical fungicides are biocidal materials that can kill or prevent fungi and their pathogenic spores from growing. Chemical fungicides can be used to control plant fungal infections such as rusts, mildews, and blights. Fungicide activity can be both systemic and contact. Continuous research and development have led to the launch of new targeted chemicals which help to increase the market share of chemical fungicides. For instance, in February 2024, Scientists at the University of California discovered a new chemical fungicide, ebselen, that holds huge potential for fighting some of the most devastating crop diseases in the world. Not only did this new breed of fungicide stop the effects of fungal infections in apples, grapes, strawberries, tomatoes, and roses, but it also enhanced symptoms of already existing fungal infections in rice. In June 2024, BASF launched its new rice fungicide in China under the trade name Cevya, containing 400g/L mefentrifluconazole. This new product incorporates the active ingredient Revysol, mefentrifluconazole, which has good preventive and controlling effects on rice false smut.

"Within the formulation segment, liquid formulation holds the highest share."

Liquid formulations holds maximum share in the fungicides market due to wide usage and versatility. They are preferred for the ease of application, better coverage of large acres, and the possibility of mixing with other agricultural chemicals. Some active ingredients - Difenoconazole, Fludioxonil, Pydiflumetofen, and Hexaconazole - are dominant in fungicides as they are water-based. Liquid fungicides help achieve a high active content, which is required in commercial formulations as they aid with spray drifting. Companies such as BASF (Germany), Bayer (Germany), Syngenta (Basal), FMC Corporation (US), and UPL (India) provide various liquid-based fungicides targeting different diseases and crops. Due to the increasing demand for organic crops, some companies are also focusing on introducing biofungicides. In June 2024, Rovensa Next launched a new biofungicide called Milarum in Brazil. In August 2023, FMC India, a leading agricultural science company, launched the latest ENTAZIA TM biofungicide. Both are liquid-form products that bring extra versatility and value to their applications.

"In 2023, Asia Pacific holds the highest market share in the global fungicides market."

Asia-Pacific holds the largest share of fungicides in the market due to massive agricultural production, cultivation of diverse crops, and increasing demand for effective disease management solutions. The demand for better fungicides as a disease control measure and a means of yield maximization is, therefore, likely to be high in this region characterized by extensive farming and diversified crops. Many companies are investing in the development of new products in the Asia-Pacific region. For example, In June 2024, BASF introduced its new rice fungicide, Cevya, in China. Earlier, in August 2023, FMC Corporation (US), a leader in agricultural sciences, launched ENTAZIATM biofungicide in India, a groundbreaking biological crop protection product formulated with Bacillus subtilis. These innovations highlight the region's growing role in the fungicides market.

The Break-up of Primaries:

By Company Type: Tire 1- 35%, Tire 2- 40%, Tire 3- 25%

By Designation: CXOs - 30%, Managers - 50%, Executives - 20%

By Region: North America - 25%, Europe - 25%, Asia Pacific - 30%, South America - 10%, RoW - 10%

Key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), NIPPON SODA CO, LTD. (Japan), Gowan Company (US), American Vanguard Corporation (US), Koppert (Netherlands), KUMIAI CHEMICAL INDUSTRY CO., LTD. (Japan), Albaugh LLC (US), and Sipcam Oxon Spa (Italy).

Research Coverage:

The report segments the fungicides market based on type, crop type, mode of application, mode of action, formulation, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the fungicides market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, key strategies, Contracts, partnerships, and agreements. New product launches, mergers and acquisitions, and recent developments associated with the fungicides market. Competitive analysis of upcoming startups in the fungicides market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall fungicides market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (rising temperature and changing climate conditions lead to outbreak of crop diseases, Increaisng launches of novel fungicide products, and rise in agricultural production) restraints (growing resistance to fungicides and fungicide residue problems) opportunities (application of biofungicides to boost demand and integration of fungicides in precision agriculture) and challenges (stringent regulations on use of certain chemical fungicides and low awareness of biological fungicides among farmers).

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the fungicides market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the fungicides market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the fungicides market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), Nissan Chemical Corporation (Japan), NIPPON SODA CO, LTD. (Japan), Gowan Company (US), American Vanguard Corporation (US), Koppert (Netherlands), KUMIAI CHEMICAL INDUSTRY CO., LTD. (Japan), Albaugh LLC (US), Sipcam Oxon Spa (Italy), Certis USA L.L.C. (US), BioWorks, Inc. (US), STK Bio-AG (Israel), Verdesian Life Sciences (US), Vive Crop Protection (Canada), Crystal Crop Protection Ltd. (India), Atticus, LLC (US), Scimplify (India), and Botano Health (Israel) in the fungicides market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 MARKET DEFINITION

- 1.2 MARKET SCOPE

- 1.2.1 MARKET SEGMENTATION

- 1.2.2 INCLUSIONS & EXCLUSIONS

- 1.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY/VALUE UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR PLAYERS IN FUNGICIDES MARKET

- 4.2 ASIA PACIFIC: FUNGICIDES MARKET, BY TYPE & COUNTRY

- 4.3 FUNGICIDES MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- 4.4 FUNGICIDES MARKET, BY TYPE AND REGION

- 4.5 FUNGICIDES MARKET, BY FORMULATION AND REGION

- 4.6 FUNGICIDES MARKET, BY MODE OF ACTION AND REGION

- 4.7 FUNGICIDES MARKET, BY MODE OF APPLICATION AND REGION

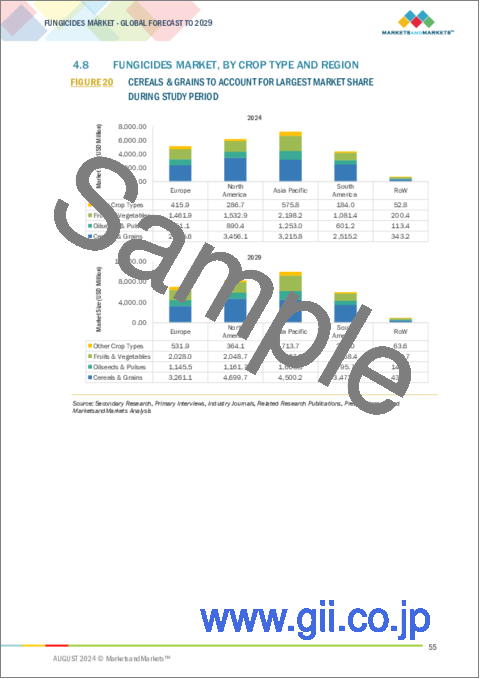

- 4.8 FUNGICIDES MARKET, BY CROP TYPE AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACRO INDICATORS

- 5.2.1 DECREASE IN CROPLAND AREA

- 5.2.2 RISING DEMAND FOR HIGH-VALUE AND INDUSTRIAL CROPS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Outbreak of crop diseases due to rising temperatures and changing climatic conditions

- 5.3.1.2 Innovation and technological advancements

- 5.3.2 RESTRAINTS

- 5.3.2.1 Fungicide residue problems

- 5.3.2.2 Regulatory hurdles

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Integration of fungicides with precision agriculture

- 5.3.3.2 Introduction of new biological fungicide products

- 5.3.4 CHALLENGES

- 5.3.4.1 Long approval periods for fungicide products

- 5.3.4.2 Growing resistance to fungicides

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FUNGICIDES MARKET

- 5.4.1 USE OF GEN AI IN FUNGICIDES MARKET

- 5.4.2 CASE STUDY ANALYSIS

- 5.4.2.1 Innovative AI-powered R&D platform helped Syngenta and Enko boost new products' effectiveness and support global sustainability objectives

- 5.4.2.2 FMC collaborated with Optibrium to accelerate crop protection with AI-powered discovery

- 5.4.2.3 Iktos and Bayer collaborated to advance crop protection with AI-driven molecular design

- 5.4.3 IMPACT OF GEN AI/AI ON FUNGICIDES MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 REGISTRATION

- 6.3.3 FORMULATION & MANUFACTURING

- 6.3.4 DISTRIBUTION

- 6.3.5 MARKETING & SALES

- 6.3.6 POST-SALE SERVICES

- 6.4 ECOSYSTEM ANALYSIS

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Nano-encapsulation technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Drone-based spraying

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Variable rate technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.6.2 CHEMICAL FUNGICIDES: AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 PATENT ANALYSIS

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 STREAMLINING FUNGICIDE PRODUCTION WITH SIEMENS OPCENTER INTEGRATION

- 6.8.2 INNOVATIVE CO-FORMULATION OF DUAL FUNGICIDES: BATTELLE'S DEVELOPMENT OF STABLE SUSPO-EMULSION

- 6.8.3 LAUNCH OF NATURAL PLANT PROTECTION HELPED STREAMLINE AND OPTIMIZE RESEARCH, DEVELOPMENT, AND MANUFACTURING OF UPL'S BIOLOGICALLY DERIVED AGRICULTURAL SOLUTIONS

- 6.9 TRADE ANALYSIS

- 6.9.1 EXPORT SCENARIO FOR HS CODE 380892

- 6.9.2 IMPORT SCENARIO FOR HS CODE 380892

- 6.10 KEY CONFERENCES & EVENTS

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.1.1 Product registration for pesticides in US

- 6.11.2.2 Canada

- 6.11.2.2.1 Pesticide regulations in Canada

- 6.11.2.1 US

- 6.11.3 EUROPE

- 6.11.3.1 Data requirements for plant protection products

- 6.11.3.2 UK

- 6.11.3.3 Germany

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 China

- 6.11.4.2 Australia

- 6.11.4.2.1 Approval of active constituents for use in Australia

- 6.11.4.3 India

- 6.11.4.3.1 Data requirements for technical ingredients

- 6.11.5 SOUTH AMERICA

- 6.11.5.1 Brazil

- 6.11.5.2 Argentina

- 6.11.6 ROW

- 6.11.6.1 South Africa

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 INVESTMENT AND FUNDING SCENARIO

7 FUNGICIDES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 BIOLOGICAL FUNGICIDES

- 7.2.1 LOW COSTS AND HEAT-WITHSTANDING ABILITY OF BIOLOGICAL FUNGICIDES TO DRIVE MARKET

- 7.2.2 MICROBIALS

- 7.2.2.1 Remarkable control efficacy against numerous plant diseases to boost market

- 7.2.2.2 Fungal-based microbials

- 7.2.2.3 Bacterial-based microbials

- 7.2.2.4 Other microbials

- 7.2.3 BIOCHEMICALS

- 7.2.3.1 Ability to control in vitro and in vivo fungal pathogens to propel market growth

- 7.2.3.2 Plant-derived biochemicals

- 7.2.3.3 Essential oils

- 7.2.3.4 Chitosan

- 7.2.3.5 Alginates

- 7.2.3.6 Other biochemicals

- 7.2.4 MACROBIALS

- 7.2.4.1 Natural and sustainable approach for disease control to fuel market growth

- 7.3 CHEMICAL FUNGICIDES

- 7.3.1 USE OF CHEMICAL FUNGICIDES IN INDUSTRIAL AGRICULTURE TO BOLSTER MARKET GROWTH

- 7.3.2 TRIAZOLE

- 7.3.2.1 Role in providing robust and reliable disease management solutions for modern agriculture to foster growth

- 7.3.3 STROBILURINS

- 7.3.3.1 Ability to control fungal pathogens to drive market

- 7.3.4 DITHIOCARBAMATES

- 7.3.4.1 Rising need to develop alternatives that address both fungicidal and nutritional needs in agriculture to accelerate market growth

- 7.3.5 CHLORONITRILES

- 7.3.5.1 Broad-spectrum protection against wide range of diseases to fuel market growth

- 7.3.6 PHENYLAMIDES

- 7.3.6.1 Effectiveness against oomycete pathogens to drive market

- 7.3.7 BENZIMIDAZOLES

- 7.3.7.1 Ban on carbendazim due to its high toxicity to impact market growth

- 7.3.8 CARBOXAMIDES

- 7.3.8.1 Prevent fungi from fully utilizing oxygen and producing energy by inhibiting respiratory enzyme

- 7.3.9 OTHER CHEMICAL FUNGICIDES

8 FUNGICIDES MARKET, BY FORMULATION

- 8.1 INTRODUCTION

- 8.2 LIQUID

- 8.2.1 HIGH STABILITY AND HYDROLYTIC SOLUBILITY TO DRIVE MARKET

- 8.2.2 SUSPENSION CONCENTRATES

- 8.2.2.1 Ease of use and effectiveness to boost market

- 8.2.3 EMULSIFIABLE CONCENTRATES

- 8.2.3.1 Advantages such as non-abrasiveness and minimal visible residues to fuel market growth

- 8.2.4 SOLUBLE LIQUID FLOWABLE

- 8.2.4.1 Multi-site protection from fungal infections to accelerate market growth

- 8.3 DRY

- 8.3.1 ABILITY TO BE USED IN INACCESSIBLE AREAS, SUCH AS CRACKS AND CREVICES, TO PROPEL MARKET GROWTH

- 8.3.2 WETTABLE POWDER (WP)

- 8.3.2.1 Non-phytotoxicity and handling ease to foster market growth

- 8.3.3 WATER-DISPERSIBLE GRANULES

- 8.3.3.1 Improved application efficiency and effectiveness to boost demand for water-dispersible granules

9 FUNGICIDES MARKET, BY MODE OF ACTION

- 9.1 INTRODUCTION

- 9.2 CONTACT FUNGICIDES

- 9.2.1 LOW COST, MINIMAL RESIDUAL EFFECT, AND MULTI-SITE MODE OF ACTION TO DRIVE MARKET

- 9.3 SYSTEMIC FUNGICIDES

- 9.3.1 CURATIVE DISEASE CONTROL, INTERNAL PROTECTION, AND TRANSLOCATION TO HIDDEN PLANT PARTS TO DRIVE MARKET

10 FUNGICIDES MARKET, BY MODE OF APPLICATION

- 10.1 INTRODUCTION

- 10.2 SEED TREATMENT

- 10.2.1 INCREASING DEMAND FOR EFFECTIVE AND COST-EFFECTIVE DISEASE CONTROL MEASURES AGAINST SEED-BORNE PATHOGENS TO DRIVE MARKET

- 10.3 SOIL TREATMENT

- 10.3.1 SOIL TREATMENT WITH FUNGICIDES TO ENHANCE CROPS' ABILITY TO FIGHT AGAINST FUNGAL INFESTATION

- 10.4 FOLIAR SPRAY

- 10.4.1 FOLIAR TREATMENTS TO HELP BOOST NATURAL DISEASE RESISTANCE

- 10.5 OTHER MODES OF APPLICATION

11 FUNGICIDES MARKET, BY CROP TYPE

- 11.1 INTRODUCTION

- 11.2 CEREALS & GRAINS

- 11.2.1 INCREASE IN PRODUCTION LEVELS OF CEREALS IN MAJOR EXPORTING COUNTRIES TO DRIVE MARKET

- 11.2.2 CORN

- 11.2.2.1 Demand for corn-based ethanol production to bolster market growth

- 11.2.3 WHEAT

- 11.2.3.1 Fungicides to help wheat crops improve plant health, increase stability, and protect yield

- 11.2.4 RICE

- 11.2.4.1 Rising demand for gluten-free products and introduction of new rice-based products to drive market

- 11.2.5 OTHER CEREALS & GRAINS

- 11.3 OILSEEDS & PULSES

- 11.3.1 SURGING DEMAND FOR OILSEEDS & PULSES IN DEVELOPING COUNTRIES TO PROPEL MARKET GROWTH

- 11.3.2 SOYBEAN

- 11.3.2.1 Shift in dietary preferences toward plant-based protein products to fuel market growth

- 11.3.3 SUNFLOWER

- 11.3.3.1 Fungicides integral to maintaining healthy sunflower crops, ensuring high yields and quality

- 11.3.4 OTHER OILSEEDS & PULSES

- 11.4 FRUITS & VEGETABLES

- 11.4.1 SIGNIFICANT RISE IN FRUIT AND VEGETABLE PRODUCTION TO PROPEL MARKET GROWTH

- 11.4.2 POME FRUITS

- 11.4.2.1 Surging demand for high-level preventive control of numerous pome fruit diseases to fuel market growth

- 11.4.3 CITRUS FRUITS

- 11.4.3.1 Increasing production to drive demand for fungicides

- 11.4.4 LEAFY VEGETABLES

- 11.4.4.1 Increasing need for effective fungicide control of Downey mildew in leafy vegetables to aid market growth

- 11.4.5 BERRIES

- 11.4.5.1 Rising production of berries to spike market growth

- 11.4.6 ROOT & TUBER VEGETABLES

- 11.4.6.1 Infestation of fungal diseases in root and tuber vegetables to drive fungicide usage

- 11.4.7 OTHER FRUITS & VEGETABLES

- 11.5 OTHER CROP TYPES

12 FUNGICIDES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Agricultural innovations and process improvements in farming sector to boost market

- 12.2.2 CANADA

- 12.2.2.1 Introduction of new biological fungicide products to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Rising demand for organic produce to accelerate market growth

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Product innovation and investments to accelerate market growth

- 12.3.2 UK

- 12.3.2.1 Increased yield and reduced cost of labor to foster market growth

- 12.3.3 FRANCE

- 12.3.3.1 Government initiatives to drive demand for biological fungicide products

- 12.3.4 SPAIN

- 12.3.4.1 Prevalence of Botrytis disease in Spain leading to demand for new fungicides

- 12.3.5 ITALY

- 12.3.5.1 New product developments and launches to fuel market growth

- 12.3.6 RUSSIA

- 12.3.6.1 Decline in price of active ingredients from China and sanctions to impact market growth

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Government regulations to boost demand for advanced fungicide solutions

- 12.4.2 INDIA

- 12.4.2.1 Surging demand for broad-spectrum disease control and enhanced crop resilience to fuel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Adoption of advanced agricultural practices to propel market growth

- 12.4.4 AUSTRALIA

- 12.4.4.1 Increasing consumption of fungicides and growing export of grain crops to boost market

- 12.4.5 INDONESIA

- 12.4.5.1 Government initiatives aimed at achieving food self-sufficiency to accelerate market growth

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Focus on developing fungicidal mixture products to boost market

- 12.5.2 ARGENTINA

- 12.5.2.1 Advanced agricultural practices to drive growth

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 ROW

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Rising export and consumption of organic produce likely to drive application of biofungicides

- 12.6.2 AFRICA

- 12.6.2.1 Launch of innovative fungicides to drive market

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 SEGMENTAL REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.4.1 MARKET RANKING ANALYSIS

- 13.4.2 BASF SE (GERMANY)

- 13.4.3 BAYER AG (GERMANY)

- 13.4.4 SYNGENTA GROUP (SWITZERLAND)

- 13.4.5 CORTEVA (US)

- 13.4.6 SUMITOMO CHEMICAL CO., LTD. (JAPAN)

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Type footprint

- 13.5.5.3 Formulation footprint

- 13.5.5.4 Mode of application footprint

- 13.5.5.5 Region footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT/SERVICE ANALYSIS

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 BASF SE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BAYER AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 CORTEVA

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SYNGENTA GROUP

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 FMC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 UPL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.7 SUMITOMO CHEMICAL CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.7.4 MnM view

- 14.1.8 NIPPON SODA CO, LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.4 MnM view

- 14.1.9 NUFARM

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.4 MnM view

- 14.1.10 NISSAN CHEMICAL CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.10.4 MnM view

- 14.1.11 AMERICAN VANGUARD CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.4 MnM view

- 14.1.12 KUMIAI CHEMICAL INDUSTRY CO., LTD

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.12.4 MnM view

- 14.1.13 GOWAN COMPANY

- 14.1.13.1 Business overview

- 14.1.13.2 Product/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.13.3.3 Expansions

- 14.1.13.4 MnM view

- 14.1.14 ALBAUGH LLC

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Deals

- 14.1.14.4 MnM view

- 14.1.15 KOPPERT

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Expansions

- 14.1.15.4 MnM view

- 14.1.1 BASF SE

- 14.2 OTHER PLAYERS (SMES/STARTUPS)

- 14.2.1 SIPCAM OXON SPA

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Expansions

- 14.2.2 CERTIS USA L.L.C.

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.3.3 Other developments

- 14.2.3 BIOBEST GROUP NV

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.4 STK BIO-AG TECHNOLOGIES

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.5 VERDESIAN LIFE SCIENCES

- 14.2.5.1 Business overview

- 14.2.5.2 Product/Solutions/Services offered

- 14.2.6 VIVE CROP PROTECTION

- 14.2.7 CRYSTAL CROP PROTECTION LTD.

- 14.2.8 ATTICUS, LLC

- 14.2.9 SCIMPLIFY

- 14.2.10 BOTANO HEALTH

- 14.2.1 SIPCAM OXON SPA

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 CROP PROTECTION CHEMICALS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 BIORATIONAL PESTICIDES MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.5 AGROCHEMICALS MARKET

- 15.5.1 MARKET DEFINITION

- 15.5.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS