|

|

市場調査レポート

商品コード

1424575

位置情報サービス(LBS)・リアルタイム位置情報システム(RTLS)の世界市場:提供別、位置タイプ別、技術別、用途別、業界別、地域別 - 予測(~2028年)Location-based Services and Real-Time Location Systems Market by Offering, Location Type, Technology, Application, Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 位置情報サービス(LBS)・リアルタイム位置情報システム(RTLS)の世界市場:提供別、位置タイプ別、技術別、用途別、業界別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月02日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の位置情報サービス(LBS)・リアルタイム位置情報システム(RTLS)の市場規模は、2023年の247億米ドルから2028年までに604億米ドルに達し、予測期間にCAGRで19.6%の成長が見込まれています。

RFID、Wi-Fi、UWB、BLEなどの一次RTLS技術とIR、超音波、GPSなどの二次位置測位技術が統合されたハイブリッドLBS・RTLSプラットフォームの採用が拡大しており、ゲートウェイ、IRセンサー、超音波マイク、環境センサーなどのハードウェア製品に対する需要は予測期間に安定して増加する見込みです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 提供、サービス、位置タイプ、用途、技術、業界、地域 |

| 対象地域 | 北米、欧州、中東・アフリカ、ラテンアメリカ |

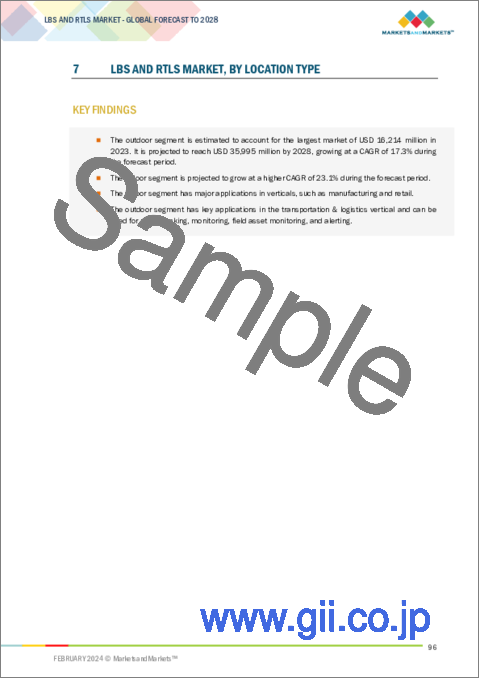

「位置タイプ別では、屋内セグメントが予測期間にもっとも高いCAGRで成長する見込みです。」

屋内測位は、磁場、音響信号、電波、相互接続型デバイスによって収集された感覚情報などのさまざまな方法を使用して、限られた空間内のデータ、物体、または個人を追跡することを含みます。この技術により、リアルタイムのデータモニタリングが容易になり、来訪者の行動や選好の可視化が可能になります。以前はGPSが同様の目的で利用されていましたが、強固な壁による信号干渉を克服するために屋内位置測位技術の登場が必要となっています。GPSと異なり、屋内ナビゲーションには普遍的な標準方式がありません。例えば、Googleは位置情報の追跡にWi-Fi技術を採用していますが、BroadcomのチップはWi-Fi、Bluetooth、NFCを使った屋内位置情報システムをサポートしています。AppleはBluetooth Low Energy(BLE)ベースの技術であるiBeaconを導入し、iPhoneやその他のiOSデバイスに位置情報ベースの情報やサービスを提供しています。屋内ナビゲーションシステムの開発は、閉ざされた空間におけるGPSの限界に対処し、高精度の位置特定を実現することを目指しています。

屋内測位技術は、大きく2つのカテゴリに分類できます。無線周波数(RF)ベースの技術と非無線周波数(NRF)ベースの技術です。従来の屋内測位技術には、主にWi-Fi、RFID、ZigBee、超音波、Bluetooth、UWB、セルラーネットワーク、IRなどがあります。Wi-FiやBluetoothなどの無線信号の屋内ナビゲーションへの利用は、個人向け無線通信技術の登場と個人向け通信機器の普及により増加しています。

「用途別では、トラッキング・ナビゲーションセグメントが予測期間に最大の市場規模を占める見込みです。」

LBS・RTLS技術は、運転支援、乗客情報、車両管理などのトラッキング・ナビゲーション用途で使用されています。LBSはドライバーを支援しリアルタイムの交通情報を提供するために、車両ナビゲーションシステムで広く使用されています。例えば、GPSナビゲーションソフトウェアアプリのWaze(Google所有)は、交通情報や道路情報をクラウドから取得し、ドライバーにリアルタイムのナビゲーションサポートを提供しています。

LBSと追跡技術は現在、車両管理とロジスティクス追跡に広く使われています。近年では、カーナビゲーションや車両管理以外の用途も登場しています。例えば、運転支援や乗客案内向けに、利用可能な路上駐車スペースの検索、安全警告、マルチモーダルなどのアプリケーションが導入されています。より健康的で、より環境にやさしく(CO2排出が少なく)、より活動的な移動様式を推進するためにLBSを利用する研究もあります。追跡とナビゲーション向けのLBS・RTLSプラットフォームのその他の例としては、視覚障害者のナビゲーション、落下検知、単独作業者の保護などがあります。

当レポートでは、世界の位置情報サービス(LBS)・リアルタイム位置情報システム(RTLS)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- LBS・RTLS市場の企業にとっての機会

- 北米のLBS・RTLS市場:提供別、国別

- アジア太平洋のLBS・RTLS市場:提供別、主要国別

- LBS・RTLS市場:位置タイプ別

- LBS・RTLS市場:用途別

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- LBS・RTLS市場の略歴

- エコシステム分析

- ケーススタディ分析

- バリューチェーン分析

- 関税と規制情勢

- LBS・RTLSデバイスに関連する料金

- 規制機関、政府機関、その他の組織

- 特許分析

- 技術分析

- 衛星、マイクロ波、赤外線リモートセンシング

- OTDOA、E-OTD

- RFID、NFC

- コンテキストアウェア技術

- Wi-Fi/WLAN、UWB、BT/BLE、ビーコン、A-GPS

- その他の技術

- 価格分析

- 主要企業の平均販売価格の動向:提供別

- 主要企業の参考価格分析:製品別

- ポーターのファイブフォース分析モデル

- 顧客のビジネスに影響を与える動向と混乱

- 主なステークホルダーと購入基準

- 主な会議とイベント

- LBS・RTLS市場の技術ロードマップ

- 短期ロードマップ(2023年~2025年)

- 中期ロードマップ(2026年~2028年)

- 長期ロードマップ(2029年~2030年)

- LBS・RTLSを実装するためのベストプラクティス

- 現在と新規のビジネスモデル

- サブスクリプションベースサービス

- データの収益化

- サービスとしての位置情報モデル

- ハードウェアとソフトウェアのバンドル

- ブロックチェーン対応の位置情報サービス

- 業界固有のソリューション

- LBS・RTLS市場で使用されるツール、フレームワーク、技法

- HSコード分析

- 電子集積回路とその部品の輸出シナリオ

- 電子集積回路とその部品の輸入シナリオ

第6章 LBS・RTLS市場:提供別

- イントロダクション

- プラットフォーム

- サービス

- ハードウェア

第7章 LBS・RTLS市場:位置タイプ別

- イントロダクション

- 屋外

- 屋内

第8章 LBS・RTLS市場:用途別

- イントロダクション

- 追跡・ナビゲーション

- マーケティング・広告

- 位置情報ベースソーシャルネットワーク

- 位置情報ベースヘルスモニタリング

- その他の用途

第9章 LBS・RTLS市場:業界別

- イントロダクション

- 輸送・ロジスティクス

- 小売

- 政府

- 製造

- 観光・ホスピタリティ

- 医療

- メディア・エンターテインメント

- その他の業界

第10章 LBS・RTLS市場:技術別

- イントロダクション

- 衛星、マイクロ波、赤外線リモートセンシング

- OTDOA、E-OTD

- RFID、NFC

- コンテキストアウェア技術

- Wi-Fi/無線LAN

- UWB

- BT/BLE

- その他の技術

- A-GPS

- ビーコン

- ZigBee

- 超音波

第11章 LBS・RTLS市場:地域別

- イントロダクション

- 北米

- 北米のLBS・RTLS市場の促進要因

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州のLBS・RTLS市場の促進要因

- 欧州の不況の影響

- 英国

- ドイツ

- イタリア

- フランス

- スペイン

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のLBS・RTLS市場の促進要因

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 韓国

- 東南アジア

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのLBS・RTLS市場の促進要因

- 中東・アフリカの不況の影響

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのLBS・RTLS市場の促進要因

- ラテンアメリカの不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

第12章 競合情勢

- 概要

- 主要企業戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオと動向

- LBS・RTLS市場:製品ベンチマーク

- 主要LBS・RTLSプロバイダーの評価と財務指標

第13章 企業プロファイル

- 主要企業

- CISCO

- IBM

- MICROSOFT

- ORACLE

- ERICSSON

- QUALCOMM

- TOMTOM

- ZEBRA TECHNOLOGIES CORP.

- ESRI

- その他の企業

- TELDIO

- HERE TECHNOLOGIES

- UBISENSE

- APPLE

- SECURITAS HEALTHCARE

- GE HEALTHCARE

- CENTRAK

- IDENTEC GROUP

- INFOR

- TELETRACKING TECHNOLOGIES

- MYSPHERA

- HPE ARUBA NETWORKING

- KDDI CORPORATION

- NTT DOCOMO

- AIRISTA FLOW

- LEANTEGRA

- SEWIO NETWORKS

- QUUPPA

- NAVIGINE

- LIVING MAP

第14章 隣接市場

- 隣接市場のイントロダクション

- 制限

- 位置情報アナリティクス市場

- 屋内位置情報市場

第15章 付録

MarketsandMarkets forecasts that the LBS and RTLS market size is projected to grow from USD 24.7 billion in 2023 to USD 60.4 billion by 2028, at a CAGR of 19.6% during the forecast period. With the growing adoption of hybrid LBS and RTLS platforms-wherein primary RTLS technologies, such as RFID, Wi-Fi, UWB, and BLE, are integrated with secondary location positioning technologies, such as IR, ultrasound, and GPS-the demand for gateways, IR sensors, ultrasound microphones, environmental sensors, and other hardware Offerings is expected to increase steadily during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD Million/ Billion |

| Segments | Offering, Service, Location type, Application, Technology, Vertical, Region |

| Regions covered | North America, Europe, MEA, LATAM |

"By location type, the Indoor segment is expected to grow with the highest CAGR during the forecast period."

Indoor positioning involves the tracking of data, objects, or individuals within a confined space using various methods such as magnetic fields, acoustic signals, radio waves, or sensory information collected by interconnected devices. This technology facilitates real-time data monitoring, enabling the visualization of visitor behavior and preferences. In the past, GPS was utilized for similar purposes, but the advent of indoor location positioning technologies became necessary to overcome signal interference caused by solid walls. Unlike GPS, indoor navigation lacks a universal standard method. For instance, Google employs Wi-Fi technology for location tracking, while the Broadcom chip supports indoor location systems using Wi-Fi, Bluetooth, and NFC. Apple introduced iBeacon, a Bluetooth Low Energy (BLE)-based technology, to offer location-based information and services to iPhones and other iOS devices. The development of indoor navigation systems aims to achieve highly accurate localization, addressing the limitations of GPS in enclosed spaces..

Indoor positioning technologies can be classified into two broad categories: Radio Frequency (RF)-based and Non-Radio Frequency (NRF)-based technologies. Conventional indoor localization technologies mainly include Wi-Fi, RFID, Zigbee, ultrasonic, Bluetooth, UWB, cellular network, and IR. The use of wireless signals, such as Wi-Fi and Bluetooth, for indoor navigation is rising, owing to the advent of personal wireless communication technologies and the proliferation of personal communication devices.

"By application, the tracking and navigation segment is expected to hold the largest market size during the forecast period."

LBS and RTLS technologies are used in the tracking and navigation application for driver assistance, passenger information, and vehicle management. LBSs are widely used in vehicle navigation systems to assist drivers and provide real-time traffic information. For instance, Waze, a GPS navigation software app (owned by Google), crowdsources traffic and road information to give drivers real-time navigation support.

LBS and tracking techniques are now widely used for vehicle management and logistics tracking. In recent years, applications beyond car navigation and vehicle management have emerged. For instance, applications to find available on-street parking spaces, safety warnings, and multimodal have been introduced for driver assistance and passenger guidance. Some studies use LBSs to promote healthier, greener (lower CO2 emissions), and more active mobility behaviors. Some other examples of LBS and RTLS platforms for tracking and navigation include navigation for the visually impaired, fall detection, and lone worker protection.

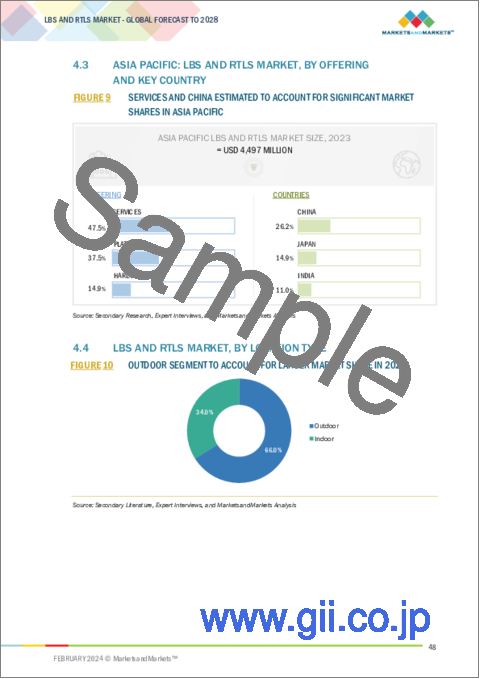

"Asia Pacific is expected to grow with the highest CAGR during the forecast period."

The Asia Pacific LBS and RTLS market is experiencing robust growth, driven by factors such as a burgeoning population, technological advancements, and significant economic expansion in key countries like China, India, Australia, Japan, Singapore, and Hong Kong. The region's diverse landscape offers substantial opportunities for LBS and RTLS. With the adoption of advanced technologies like indoor positioning and the increasing demand for personalized healthcare solutions, the Asia Pacific market is positioned as a major player in the global LBS and RTLS landscape. This growth is characterized by dynamic developments in various industries and a surge in innovative applications. In rapidly growing economies such as China and India, the growing demand to improve supply chain operations and the government's efforts to standardize LBS and RTLS technologies drive the market's growth.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company: Tier 1-62%, Tier 2-23%, and Tier 3-15%

- By Designation: C-Level Executives-38, Director Level-30%, and Others-32%

- By Region: North America-40%, Europe-15%, APAC-35%, Middle East and Africa -5%, Latin America - 5%

The major players in the LBS and RTLS market are Cisco (US), Google (US), IBM (US), Microsoft (US), Oracle (US), Ericsson (Sweden), Qualcomm (US), TomTom (Netherlands), Zebra Technologies (US), ESRI (US), Teldio (Canada), HERE (Netherlands), Ubisense (UK), Apple (US), etc. These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the LBS and RTLS market.

Research Coverage

The report segments the global LBS and RTLS market based on offerings classified into Platform, Service, and Hardware. By Service, the market has been segmented into Deployment and Integration, Application Support and Maintenance, Consulting and Training. By Location type, the market has been segmented into Outdoor and Indoor. By Application, the market has been segmented into Tracking and navigation, Marketing and advertising, Location-Based Social Networks, Location-Based Health Monitoring, and Other Applications. By Technology, the market has been segmented into Satellite, Microwave, and Infrared Remote Sensing, OTDOA and E-OTD, RFID and NFC, Context-aware technologies, Wi-Fi/WLAN, Ulta Wide Band, Bluetooth/BLE, and Others. By Vertical, the market has been segmented into Transportation & Logistics, Retail, Government, Manufacturing, Healthcare & Life Sciences, Tourism & Hospitality, Media & Entertainment, and Other Verticals. The market has been segmented by region into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Key benefits of the report

The report would help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall LBS and RTLS market and the subsegments. This report would help stakeholders understand the competitive landscape and gain insights to position their businesses better and plan suitable go-to-market strategies. The report would help stakeholders understand the market's pulse and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for UWB-based real-time location systems, Rising need for geo-marketing), restraints (High installation and maintenance costs, Data security concerns), opportunities (Growing use of BLE and UWB for indoor proximity services, Rising focus on IoT in healthcare ), and challenges (System irreconcilability and lack of standardization).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the LBS and RTLS market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the LBS and RTLS market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the LBS and RTLS market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cisco (US), Google (US), IBM (US), Microsoft (US), Oracle (US), Ericsson (Sweden), Qualcomm (US), TomTom (Netherlands), Zebra Technologies (US), ESRI (US), Teldio (Canada), HERE (Netherlands), Ubisense (UK), Apple (US), etc.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 LBS AND RTLS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE): REVENUE OF SOLUTIONS/SERVICES OF LBS AND RTLS MARKET

- FIGURE 4 LBS AND RTLS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, SUPPLY-SIDE ANALYSIS

- 2.4 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON LBS AND RTLS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 5 LBS AND RTLS MARKET, 2021-2028 (USD MILLION)

- FIGURE 6 LBS AND RTLS MARKET, REGIONAL SHARE, 2023

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN LBS AND RTLS MARKET

- FIGURE 7 GROWING NEED FOR ADVANCED LOCATION TRACKING TECHNOLOGIES TO DRIVE MARKET

- 4.2 NORTH AMERICA: LBS AND RTLS MARKET, BY OFFERING AND COUNTRY

- FIGURE 8 SERVICES AND US TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN NORTH AMERICA

- 4.3 ASIA PACIFIC: LBS AND RTLS MARKET, BY OFFERING AND KEY COUNTRY

- FIGURE 9 SERVICES AND CHINA ESTIMATED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN ASIA PACIFIC

- 4.4 LBS AND RTLS MARKET, BY LOCATION TYPE

- FIGURE 10 OUTDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- 4.5 LBS AND RTLS MARKET, BY APPLICATION

- FIGURE 11 TRACKING & NAVIGATION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 LBS AND RTLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for UWB-based real-time location systems

- 5.2.1.2 Rising need for geo-marketing

- 5.2.1.3 Increasing competitiveness

- 5.2.1.4 Growing demand for location-based and real-time systems and services in various industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs

- 5.2.2.2 Data security concerns

- 5.2.2.3 Negative feedback from end users

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of BLE and UWB for indoor proximity services

- 5.2.3.2 Rising focus on IoT in healthcare

- 5.2.3.3 Growing use of 5G for location-based services

- 5.2.3.4 Rising demand for real-time location systems in emerging regions

- 5.2.4 CHALLENGES

- 5.2.4.1 System irreconcilability and lack of standardization

- 5.3 BRIEF HISTORY OF LBS AND RTLS MARKET

- 5.3.1 2000-2010

- 5.3.2 2011-2020

- 5.3.3 2021-PRESENT

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 13 LBS AND RTLS MARKET ECOSYSTEM

- TABLE 4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 USE CASE 1: KESKO INCREASED ITS AVERAGE SALES USING NAVIGINE'S INDOOR NAVIGATION SYSTEM

- 5.5.2 USE CASE 2: UBER USED TOMTOM'S TRAFFIC DATA AND MAP APIS TO FACILITATE SMOOTH JOURNEYS

- 5.5.3 USE CASE 3: BING MAPS HELPED SOLIDARITY ACHIEVE SOUND, REAL-TIME REPORTING

- 5.5.4 USE CASE 4: GOOGLE MAPS PLATFORM HELPED IBIBO GROUP OFFER INTELLIGENT TRAVELER SERVICES

- 5.5.5 USE CASE 5: BOUMAN MENTAL HEALTHCARE ADOPTED AIRISTA FLOW RTLS TO DEVELOP MOBILE EMERGENCY ALERTING SYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 14 VALUE CHAIN ANALYSIS

- 5.7 TARIFF AND REGULATORY LANDSCAPE

- 5.7.1 TARIFF RELATED TO LBS AND RTLS DEVICES

- TABLE 5 TARIFF RELATED TO ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.1.2 Canada

- 5.7.2.2 Europe

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 South Korea

- 5.7.2.3.2 China

- 5.7.2.3.3 India

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 UAE

- 5.7.2.4.2 KSA

- 5.7.2.4.3 Bahrain

- 5.7.2.5 Latin America

- 5.7.2.5.1 Brazil

- 5.7.2.5.2 Mexico

- 5.7.2.1 North America

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 DOCUMENT TYPE

- TABLE 10 PATENTS FILED, 2014-2023

- 5.8.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 15 LIST OF MAJOR PATENTS IN LBS AND RTLS MARKET

- 5.8.4 LIST OF MAJOR PATENTS

- TABLE 11 LIST OF PATENTS IN LBS AND RTLS MARKET, 2022-2023

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 SATELLITE, MICROWAVE, AND INFRARED REMOTE SENSING

- 5.9.2 OTDOA AND E-OTD

- 5.9.3 RFID AND NFC

- 5.9.4 CONTEXT-AWARE TECHNOLOGIES

- 5.9.5 WI-FI/WLAN, UWB, BT/BLE, BEACONS, AND A-GPS

- 5.9.6 OTHER TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- FIGURE 16 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- TABLE 12 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING (USD PER MONTH)

- 5.10.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY OFFERING

- TABLE 13 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY OFFERING

- 5.11 PORTER'S FIVE FORCES MODEL

- TABLE 14 PORTER'S FIVE FORCES MODEL

- FIGURE 17 LBS AND RTLS MARKET: PORTER'S FIVE FORCES MODEL

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.13.2 BUYING CRITERIA

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.14 KEY CONFERENCES & EVENTS

- TABLE 17 LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.15 TECHNOLOGY ROADMAP FOR LBS AND RTLS MARKET

- 5.15.1 SHORT-TERM ROADMAP (2023-2025)

- 5.15.2 MID-TERM ROADMAP (2026-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES TO IMPLEMENT LBS AND RTLS

- 5.16.1 SCALABILITY

- 5.16.2 INTEGRATION WITH EXISTING SYSTEMS

- 5.16.3 DATA SECURITY AND PRIVACY

- 5.16.4 ACCURACY AND RELIABILITY

- 5.16.5 USER TRAINING AND ACCEPTANCE

- 5.16.6 POWER EFFICIENCY

- 5.16.7 REAL-TIME ANALYTICS AND REPORTING

- 5.16.8 REGULATORY COMPLIANCE

- 5.16.9 CONTINUOUS MONITORING AND IMPROVEMENT

- 5.16.10 COST CONSIDERATIONS

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.17.1 SUBSCRIPTION-BASED SERVICES

- 5.17.2 DATA MONETIZATION

- 5.17.3 LOCATION-AS-A-SERVICE MODEL

- 5.17.4 HARDWARE AND SOFTWARE BUNDLES

- 5.17.5 BLOCKCHAIN-ENABLED LOCATION SERVICES

- 5.17.6 INDUSTRY-SPECIFIC SOLUTIONS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN LBS AND RTLS MARKET

- FIGURE 21 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN LBS AND RTLS MARKET

- 5.19 HS CODE ANALYSIS

- 5.19.1 EXPORT SCENARIO OF ELECTRONIC INTEGRATED CIRCUITS AND PARTS THEREOF

- FIGURE 22 EXPORT OF ELECTRONIC INTEGRATED CIRCUITS AND PARTS THEREOF, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.19.2 IMPORT SCENARIO OF ELECTRONIC INTEGRATED CIRCUITS AND PARTS THEREOF

- FIGURE 23 IMPORT OF ELECTRONIC INTEGRATED CIRCUITS AND PARTS THEREOF, BY KEY COUNTRY, 2015-2022 (USD BILLION)

6 LBS AND RTLS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 24 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERINGS: LBS AND RTLS MARKET DRIVERS

- TABLE 18 LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 19 LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 PLATFORMS

- 6.2.1 GROWING NEED TO ENHANCE FEATURES OF LOCATION-BASED AND REAL-TIME LOCATION PLATFORMS TO FUEL MARKET GROWTH

- TABLE 20 PLATFORMS: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 21 PLATFORMS: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 GROWING DEMAND FOR MODERN INFORMATION SERVICES TO BOLSTER MARKET

- TABLE 22 SERVICES: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 23 SERVICES: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 25 LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.3.2 DEPLOYMENT & INTEGRATION

- TABLE 26 DEPLOYMENT & INTEGRATION: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 DEPLOYMENT & INTEGRATION: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 APPLICATION SUPPORT & MAINTENANCE

- TABLE 28 APPLICATION SUPPORT & MAINTENANCE: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 APPLICATION SUPPORT & MAINTENANCE: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4 CONSULTING & TRAINING

- TABLE 30 CONSULTING & TRAINING: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 CONSULTING & TRAINING: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 HARDWARE

- 6.4.1 INCREASING USE OF EMBEDDED SENSORS AND LONG-LASTING INTERNAL BATTERIES TO FUEL MARKET

- TABLE 32 HARDWARE: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 HARDWARE: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 LBS AND RTLS MARKET, BY LOCATION TYPE

- 7.1 INTRODUCTION

- FIGURE 25 INDOOR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 LOCATION TYPES: LBS AND RTLS MARKET DRIVERS

- TABLE 34 LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 35 LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- 7.2 OUTDOOR

- 7.2.1 RISING DEMAND FOR OUTDOOR POSITIONING SYSTEMS IN COMPANIES TO ACCELERATE MARKET GROWTH

- TABLE 36 OUTDOOR: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 OUTDOOR: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 INDOOR

- 7.3.1 INCREASING NEED TO ACCURATELY TRACK INVENTORY TO BOOST MARKET

- TABLE 38 INDOOR: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 INDOOR: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 LBS AND RTLS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 26 LOCATION-BASED HEALTH MONITORING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 8.1.1 APPLICATIONS: LBS AND RTLS MARKET DRIVERS

- TABLE 40 LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 41 LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 TRACKING & NAVIGATION

- 8.2.1 WAYFINDING APPS TO AID INDOOR NAVIGATION

- TABLE 42 TRACKING & NAVIGATION: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 TRACKING & NAVIGATION: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 MARKETING & ADVERTISING

- 8.3.1 INCREASE IN EFFECTIVENESS OF ONLINE ADVERTISEMENTS TO FOSTER MARKET GROWTH

- TABLE 44 MARKETING & ADVERTISING: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 MARKETING & ADVERTISING: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 LOCATION-BASED SOCIAL NETWORKS

- 8.4.1 GROWING POPULARITY OF SOCIAL NETWORKING APPS TO DRIVE MARKET

- TABLE 46 LOCATION-BASED SOCIAL NETWORKS: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 LOCATION-BASED SOCIAL NETWORKS: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 LOCATION-BASED HEALTH MONITORING

- 8.5.1 RISING NEED FOR ASSISTIVE SYSTEMS TO BOOST DEMAND FOR LOCATION-BASED HEALTH MONITORING

- TABLE 48 LOCATION-BASED HEALTH MONITORING: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 49 LOCATION-BASED HEALTH MONITORING: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 OTHER APPLICATIONS

- TABLE 50 OTHER APPLICATIONS: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 OTHER APPLICATIONS: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 LBS AND RTLS MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 27 HEALTHCARE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 9.1.1 VERTICALS: LBS AND RTLS MARKET DRIVERS

- TABLE 52 LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 53 LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 TRANSPORTATION & LOGISTICS

- 9.2.1 RISING NEED TO TRACK BUSINESS ASSETS AND REDUCE COSTS TO PROPEL MARKET

- TABLE 54 TRANSPORTATION & LOGISTICS: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 TRANSPORTATION & LOGISTICS: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.2 TRANSPORTATION & LOGISTICS: LBS AND RTLS USE CASES

- 9.3 RETAIL

- 9.3.1 GROWING IMPORTANCE OF IMPROVING CUSTOMER EXPERIENCE TO BOOST MARKET

- TABLE 56 RETAIL: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 RETAIL: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.2 RETAIL: LBS AND RTLS USE CASES

- 9.4 GOVERNMENT

- 9.4.1 RISING NEED TO MONITOR DEVELOPMENT AND ALLOCATION OF RESOURCES TO ACCELERATE MARKET GROWTH

- TABLE 58 GOVERNMENT: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 GOVERNMENT: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.2 GOVERNMENT: LBS AND RTLS USE CASES

- 9.5 MANUFACTURING

- 9.5.1 RISING NEED TO STREAMLINE OPERATIONS AND INCREASE STAFF SECURITY TO BOOST MARKET

- TABLE 60 MANUFACTURING: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 MANUFACTURING: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.2 MANUFACTURING: LBS AND RTLS USE CASES

- 9.6 TOURISM & HOSPITALITY

- 9.6.1 INCREASING USE OF LOCATION-BASED AND REAL-TIME LOCATION SYSTEMS TO ENHANCE CUSTOMER EXPERIENCE

- TABLE 62 TOURISM & HOSPITALITY: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 TOURISM & HOSPITALITY: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6.2 TOURISM & HOSPITALITY: LBS AND RTLS USE CASES

- 9.7 HEALTHCARE

- 9.7.1 INCREASING ADOPTION OF LOCATION-BASED AND REAL-TIME LOCATION SOLUTIONS TO DRIVE MARKET GROWTH

- TABLE 64 HEALTHCARE: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 65 HEALTHCARE: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7.2 HEALTHCARE: LBS AND RTLS USE CASES

- 9.8 MEDIA & ENTERTAINMENT

- 9.8.1 PERSONAL LOCATION INTELLIGENCE AND LOCATION ANALYTICS TO DRIVE MARKET

- TABLE 66 MEDIA & ENTERTAINMENT: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 MEDIA & ENTERTAINMENT: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8.2 MEDIA & ENTERTAINMENT: LBS AND RTLS USE CASES

- 9.9 OTHER VERTICALS

- TABLE 68 OTHER VERTICALS: LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 OTHER VERTICALS: LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 LBS AND RTLS MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.1.1 TECHNOLOGIES: LBS AND RTLS MARKET DRIVERS

- 10.2 SATELLITE, MICROWAVE, AND INFRARED REMOTE SENSING

- 10.2.1 INCREASING DEMAND FOR THEMATIC MAPPING AND GEOGRAPHIC INTELLIGENCE TO PROPEL MARKET GROWTH

- 10.3 OTDOA AND E-OTD

- 10.3.1 RISING NEED FOR LOCATION TRACKING, PARTICULARLY IN CELLULAR NETWORKS, TO DRIVE MARKET

- 10.4 RFID AND NFC

- 10.4.1 SPIKE IN DEMAND FOR TRACKING, TRACING, MONITORING, AND EMERGENCY MANAGEMENT APPLICATIONS TO ACCELERATE MARKET GROWTH

- 10.5 CONTEXT-AWARE TECHNOLOGIES

- 10.5.1 SURGE IN USE OF SMARTPHONES AND SOCIAL NETWORKING PLATFORMS TO OPEN NEW AVENUES FOR CONTEXTUAL ADVERTISING

- 10.6 WI-FI/WLAN

- 10.6.1 NEED FOR APPROXIMATING LOCATION BASED ON KNOWN RADIO PROPAGATION CHARACTERISTICS TO DRIVE MARKET

- 10.7 UWB

- 10.7.1 ABILITY TO TRANSMIT EXTREMELY LARGE AMOUNTS OF DATA TO PROPEL MARKET GROWTH

- 10.8 BT/BLE

- 10.8.1 INFORMED DECISION-MAKING AND ENHANCED OPERATIONAL CONTROL TO PROPEL MARKET

- 10.9 OTHER TECHNOLOGIES

- 10.9.1 A-GPS

- 10.9.2 BEACONS

- 10.9.3 ZIGBEE

- 10.9.4 ULTRASOUND

11 LBS AND RTLS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 28 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 70 LBS AND RTLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 71 LBS AND RTLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: LBS AND RTLS MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 29 NORTH AMERICA: LBS AND RTLS MARKET SNAPSHOT

- TABLE 72 NORTH AMERICA: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: LBS AND RTLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: LBS AND RTLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Easy availability of indoor and outdoor location technologies to drive market

- TABLE 84 US: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 85 US: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 86 US: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 87 US: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 88 US: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 89 US: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 90 US: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 91 US: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 92 US: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 93 US: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Rising infrastructural developments and investments to boost market

- TABLE 94 CANADA: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 95 CANADA: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 96 CANADA: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 97 CANADA: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 98 CANADA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 99 CANADA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 100 CANADA: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 101 CANADA: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 102 CANADA: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 103 CANADA: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: LBS AND RTLS MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 104 EUROPE: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 105 EUROPE: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 107 EUROPE: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 108 EUROPE: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 109 EUROPE: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 111 EUROPE: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 113 EUROPE: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 114 EUROPE: LBS AND RTLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 115 EUROPE: LBS AND RTLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Growing adoption of smartphones to bolster market growth

- TABLE 116 UK: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 117 UK: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 118 UK: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 119 UK: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 120 UK: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 121 UK: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 122 UK: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 123 UK: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 124 UK: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 125 UK: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Growing demand for smart infrastructure systems to accelerate market growth

- TABLE 126 GERMANY: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 127 GERMANY: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 128 GERMANY: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 129 GERMANY: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 130 GERMANY: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 131 GERMANY: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 132 GERMANY: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 133 GERMANY: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 134 GERMANY: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 135 GERMANY: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Surging demand for advanced technologies to fuel growth

- 11.3.6 FRANCE

- 11.3.6.1 Increasing investments by government to propel market

- 11.3.7 SPAIN

- 11.3.7.1 Increasing investments by major vendors to drive market

- 11.3.8 NORDICS

- 11.3.8.1 Growing adoption of advanced technologies to boost market

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: LBS AND RTLS MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 30 ASIA PACIFIC: LBS AND RTLS MARKET SNAPSHOT

- TABLE 136 ASIA PACIFIC: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: LBS AND RTLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: LBS AND RTLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Growing demand for location-based services in various industries to boost market

- TABLE 148 CHINA: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 149 CHINA: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 150 CHINA: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 151 CHINA: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 152 CHINA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 153 CHINA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 154 CHINA: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 155 CHINA: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 156 CHINA: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 157 CHINA: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Rising adoption of GPS-enabled solutions to fuel market growth

- TABLE 158 JAPAN: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 159 JAPAN: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 160 JAPAN: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 161 JAPAN: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 162 JAPAN: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 163 JAPAN: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 164 JAPAN: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 165 JAPAN: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 166 JAPAN: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 167 JAPAN: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 Rising demand for accurate navigation and mapping services to drive market

- 11.4.6 AUSTRALIA & NEW ZEALAND

- 11.4.6.1 Increasing need for location intelligence services to accelerate market growth

- 11.4.7 SOUTH KOREA

- 11.4.7.1 Expansion of IoT ecosystem and development of advanced 5G infrastructure to drive market

- 11.4.8 SOUTHEAST ASIA

- 11.4.8.1 Growing need for digitization to propel market growth

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 168 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY GCC COUNTRY, 2017-2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: LBS AND RTLS MARKET, BY GCC COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 GCC COUNTRIES

- 11.5.3.1 UAE

- 11.5.3.1.1 Technological advancements and ongoing digital transformation initiatives to boost market

- 11.5.3.2 KSA

- 11.5.3.2.1 Government initiatives and technological improvements to accelerate market growth

- 11.5.3.3 Rest of GCC countries

- 11.5.3.1 UAE

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Rising demand for asset tracking and increasing mobile phone penetration to fuel market growth

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: LBS AND RTLS MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 182 LATIN AMERICA: LBS AND RTLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: LBS AND RTLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: LBS AND RTLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: LBS AND RTLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: LBS AND RTLS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: LBS AND RTLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: LBS AND RTLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: LBS AND RTLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: LBS AND RTLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: LBS AND RTLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: LBS AND RTLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Growing emphasis on digitalization and adoption of advanced technologies to fuel market growth

- 11.6.4 MEXICO

- 11.6.4.1 Need for operational efficiency to trigger market growth

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY LBS AND RTLS PROVIDERS

- 12.3 REVENUE ANALYSIS

- FIGURE 31 HISTORICAL REVENUE ANALYSIS, 2020-2022

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 32 MARKET SHARE ANALYSIS, 2022

- TABLE 194 LBS AND RTLS MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 33 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 12.5.5 COMPANY FOOTPRINT

- TABLE 195 OVERALL COMPANY FOOTPRINT

- TABLE 196 OFFERING FOOTPRINT

- TABLE 197 VERTICAL FOOTPRINT

- TABLE 198 REGIONAL FOOTPRINT

- 12.6 STARTUP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 34 COMPANY STARTUP/SME EVALUATION MATRIX, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 199 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 200 COMPETITIVE BENCHMARKING

- 12.7 COMPETITIVE SCENARIO AND TRENDS

- 12.7.1 PRODUCT LAUNCHES

- TABLE 201 LBS AND RTLS MARKET: PRODUCT LAUNCHES, 2020-2023

- 12.7.2 DEALS

- TABLE 202 LBS AND RTLS MARKET: DEALS, 2020-2023

- 12.8 LBS AND RTLS MARKET: PRODUCT BENCHMARKING

- 12.8.1 PROMINENT LBS AND RTLS VENDORS

- TABLE 203 COMPARATIVE ANALYSIS OF PROMINENT LBS AND RTLS VENDORS

- 12.9 VALUATION AND FINANCIAL METRICS OF KEY LBS AND RTLS PROVIDERS

- FIGURE 35 VALUATION AND FINANCIAL METRICS OF KEY LBS AND RTLS VENDORS

13 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats)**

- 13.1 MAJOR PLAYERS

- 13.1.1 CISCO

- TABLE 204 CISCO: COMPANY OVERVIEW

- FIGURE 36 CISCO: COMPANY SNAPSHOT

- TABLE 205 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 CISCO: PRODUCT LAUNCHES

- TABLE 207 CISCO: DEALS

- 13.1.2 GOOGLE

- TABLE 208 GOOGLE: COMPANY OVERVIEW

- FIGURE 37 GOOGLE: COMPANY SNAPSHOT

- TABLE 209 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 GOOGLE: PRODUCTS LAUNCHES

- TABLE 211 GOOGLE: DEALS

- 13.1.3 IBM

- TABLE 212 IBM: COMPANY OVERVIEW

- FIGURE 38 IBM: COMPANY SNAPSHOT

- TABLE 213 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 IBM: DEALS

- 13.1.4 MICROSOFT

- TABLE 215 MICROSOFT: COMPANY OVERVIEW

- FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

- TABLE 216 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 MICROSOFT: PRODUCT LAUNCHES

- TABLE 218 MICROSOFT: DEALS

- 13.1.5 ORACLE

- TABLE 219 ORACLE: COMPANY OVERVIEW

- FIGURE 40 ORACLE: COMPANY SNAPSHOT

- TABLE 220 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 ORACLE: PRODUCT LAUNCHES

- TABLE 222 ORACLE: DEALS

- 13.1.6 ERICSSON

- TABLE 223 ERICSSON: BUSINESS OVERVIEW

- FIGURE 41 ERICSSON: COMPANY SNAPSHOT

- TABLE 224 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 ERICSSON: OTHERS

- 13.1.7 QUALCOMM

- TABLE 226 QUALCOMM: BUSINESS OVERVIEW

- FIGURE 42 QUALCOMM: COMPANY SNAPSHOT

- TABLE 227 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 QUALCOMM: PRODUCT LAUNCHES

- 13.1.8 TOMTOM

- TABLE 229 TOMTOM: COMPANY OVERVIEW

- FIGURE 43 TOMTOM: COMPANY SNAPSHOT

- TABLE 230 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 TOMTOM: PRODUCT LAUNCHES

- TABLE 232 TOMTOM: DEALS

- 13.1.9 ZEBRA TECHNOLOGIES CORP.

- TABLE 233 ZEBRA TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 44 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 234 ZEBRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ZEBRA TECHNOLOGIES: DEALS

- 13.1.10 ESRI

- TABLE 236 ESRI: COMPANY OVERVIEW

- TABLE 237 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 ESRI: PRODUCT LAUNCHES

- TABLE 239 ESRI: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 TELDIO

- 13.2.2 HERE TECHNOLOGIES

- 13.2.3 UBISENSE

- 13.2.4 APPLE

- 13.2.5 SECURITAS HEALTHCARE

- 13.2.6 GE HEALTHCARE

- 13.2.7 CENTRAK

- 13.2.8 IDENTEC GROUP

- 13.2.9 INFOR

- 13.2.10 TELETRACKING TECHNOLOGIES

- 13.2.11 MYSPHERA

- 13.2.12 HPE ARUBA NETWORKING

- 13.2.13 KDDI CORPORATION

- 13.2.14 NTT DOCOMO

- 13.2.15 AIRISTA FLOW

- 13.2.16 LEANTEGRA

- 13.2.17 SEWIO NETWORKS

- 13.2.18 QUUPPA

- 13.2.19 NAVIGINE

- 13.2.20 LIVING MAP

14 ADJACENT MARKETS

- 14.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 240 ADJACENT MARKETS AND FORECASTS

- 14.2 LIMITATIONS

- 14.3 LOCATION ANALYTICS MARKET

- TABLE 241 LOCATION ANALYTICS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 242 LOCATION ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 243 SOLUTIONS: LOCATION ANALYTICS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 244 SOLUTIONS: LOCATION ANALYTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 245 GEOCODING & REVERSE GEOCODING: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 246 GEOCODING & REVERSE GEOCODING: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 247 DATA INTEGRATION & ETL: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 248 DATA INTEGRATION & ETL: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 249 REPORTING & VISUALIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 250 REPORTING & VISUALIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 251 THEMATIC MAPPING & SPATIAL ANALYSIS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 252 THEMATIC MAPPING & SPATIAL ANALYSIS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 253 OTHER SOLUTIONS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 254 OTHER SOLUTIONS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 255 LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 256 LOCATION ANALYTICS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 257 ON-PREMISES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 258 ON-PREMISES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 259 CLOUD: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 260 CLOUD: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 261 LOCATION ANALYTICS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 262 LOCATION ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 263 SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 264 SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 265 LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 266 LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 267 PROFESSIONAL SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 268 PROFESSIONAL SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 269 CONSULTING SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 270 CONSULTING SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 271 DEPLOYMENT & INTEGRATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 272 DEPLOYMENT & INTEGRATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 273 TRAINING, SUPPORT, AND MAINTENANCE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 274 TRAINING, SUPPORT, AND MAINTENANCE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 275 MANAGED SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 276 MANAGED SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 277 LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2017-2022 (USD MILLION)

- TABLE 278 LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2023-2028 (USD MILLION)

- TABLE 279 INDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 280 INDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 281 OUTDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 282 OUTDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 283 LOCATION ANALYTICS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 284 LOCATION ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 285 RISK MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 286 RISK MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 287 EMERGENCY RESPONSE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 288 EMERGENCY RESPONSE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 289 CUSTOMER EXPERIENCE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 290 CUSTOMER EXPERIENCE MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 291 SUPPLY CHAIN PLANNING & OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 292 SUPPLY CHAIN PLANNING & OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 293 SALES & MARKETING OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 294 SALES & MARKETING OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 295 LOCATION SELECTION & OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 296 LOCATION SELECTION & OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 297 OTHER APPLICATIONS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 298 OTHER APPLICATIONS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 299 LOCATION ANALYTICS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 300 LOCATION ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 301 RETAIL & ECOMMERCE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 302 RETAIL & ECOMMERCE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 303 MANUFACTURING: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 304 MANUFACTURING: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 305 GOVERNMENT & DEFENSE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 306 GOVERNMENT & DEFENSE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 307 MEDIA & ENTERTAINMENT: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 308 MEDIA & ENTERTAINMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 309 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 310 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 311 ENERGY & UTILITIES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 312 ENERGY & UTILITIES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 313 TELECOMMUNICATIONS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 314 TELECOMMUNICATIONS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 315 BFSI: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 316 BFSI: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 317 IT/ITES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 318 IT/ITES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 319 HEALTHCARE & LIFE SCIENCES: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 320 HEALTHCARE & LIFE SCIENCES: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 321 AGRICULTURE: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 322 AGRICULTURE: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 323 OTHER VERTICALS: LOCATION ANALYTICS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 324 OTHER VERTICALS: LOCATION ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.4 INDOOR LOCATION MARKET

- TABLE 325 INDOOR LOCATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 326 INDOOR LOCATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 327 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 328 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 329 INDOOR LOCATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 330 INDOOR LOCATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 331 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 332 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 333 INDOOR LOCATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 334 INDOOR LOCATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 335 INDOOR LOCATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 336 INDOOR LOCATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 337 INDOOR LOCATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 338 INDOOR LOCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS