|

|

市場調査レポート

商品コード

1648506

ポイントオブケア診断の世界市場:製品別、購入方式別、技術別、サンプル別、エンドユーザー別 - 予測(~2029年)Point of Care Diagnostics Market by Product (Glucose, Infectious Disease, Pregnancy), Purchase Mode, Technology (Biochemistry, MDx ), Sample, End User - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ポイントオブケア診断の世界市場:製品別、購入方式別、技術別、サンプル別、エンドユーザー別 - 予測(~2029年) |

|

出版日: 2025年01月28日

発行: MarketsandMarkets

ページ情報: 英文 578 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のポイントオブケア診断の市場規模は、2024年の150億5,000万米ドルから2029年までに226億3,000万米ドルに達すると推定され、CAGRで8.5%の成長が見込まれます。

POC検査の主な促進要因の1つは、政府の取り組みと資金援助です。世界的に、政府はこれらの技術が医療へのアクセスを改善し、コストを下げ、患者の転帰を向上させるために不可欠であると考えています。多くの政府は、POC検査ソリューションの開発と採用に注力するために、規制上のインセンティブを伴う助成金の支給に加えて財政支援も行っています。適切な医療施設が不足している発展途上国では、政府はPOCデバイスの多用を奨励し、恵まれない人々への検査を分散化しています。このような支援策はPOC診断の採用を加速させ、診断企業に新たな市場機会をもたらしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 米ドル |

| セグメント | 製品、購入方式、技術、サンプル、エンドユーザー |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

「製品別では、感染症検査製品セグメントが市場でもっとも速い成長率を示す見込みです。」

感染症検査製品は、主に世界中での感染症の高い有病率により、ポイントオブケア診断市場でもっとも速い成長が見込まれています。地元の診療所や農村部の保健センター向けの、迅速かつ正確で分散型の医療診断ソリューションに対する需要の高まりが、このセグメントの需要を促進しています。より高速な分子診断や強化されたイムノアッセイプラットフォームを含む改良された技術は、POC検査の速度と精度の効率を向上させます。さらに、公衆衛生への取り組みが増加し、感染症に対するPOCソリューションの認知度が高まるにつれて、これらの製品の採用が大幅に増加しています。

「サンプル別では、血液サンプルセグメントが予測期間に市場で最大の市場シェアを占めます。」

血液サンプルがポイントオブケア診断市場で最大の市場シェアを占めます。血液サンプルの重要な役割は、糖尿病、心血管疾患、感染症、代謝異常などの幅広い疾患を検出することにあります。血液ベースの検査は正確で信頼性が高く、結果が出るまでの所要時間が長いと考えられています。このような理由から、これらは、臨床およびベッドサイド環境の両方でもっとも適したサンプルタイプです。また、血液ベースのPOCデバイスの効率は、最小のサンプル量で正確な結果をもたらす技術の進歩によって向上しています。さらに、慢性疾患や感染症は増加の一途をたどっており、血液ベースの検査を必要とする迅速で便利な診断ソリューションに対する高い需要が伴っています。

「アジア太平洋:もっとも急成長しているポイントオブケア診断の市場」

アジア太平洋は、複数の要因によりPOC市場が大きく成長しています。疾病の早期発見、予防、定期的な健康診断を促進する政府の取り組みが主な促進要因であり、健康診断の普及とタイムリーな介入を促す数多くの取り組みがあります。こうした取り組みと地域全体の医療費の増加により、診断ソリューションへのアクセシビリティと需要が高まっています。インドや中国などでは糖尿病などの慢性疾患が増加しており、迅速で正確な診断機器に対する需要も高まっています。早期診断と早期管理による公衆衛生の向上により、この地域でもPOC診断の採用に取り組む医療機関が増えています。

当レポートでは、世界のポイントオブケア診断市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ポイントオブケア診断市場の概要

- ポイントオブケア診断市場:製品別(2024年・2029年)

- ポイントオブケア診断市場:購入方式別(2024年・2029年)

- ポイントオブケア診断市場:技術別(2024年・2029年)

- ポイントオブケア診断市場:サンプル別(2024年・2029年)

- ポイントオブケア診断市場:エンドユーザー別(2024年・2029年)

- ポイントオブケア診断市場:地理的成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格:製品別

- グルコースモニタリングテストストリップの平均販売価格:主要企業別

- 平均販売価格:地域別

- バリューチェーン分析

- サプライチェーン分析

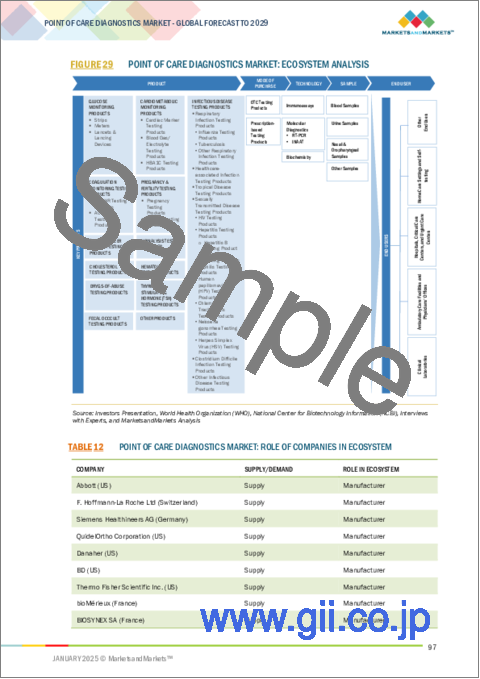

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- HSコード3822の輸入データ

- HSコード3822の輸出データ

- 主な会議とイベント(2025年~2026年)

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ポイントオブケア診断市場に対するAIの影響

- イントロダクション

- ポイントオブケア診断市場におけるAIの市場可能性

- AIのユースケース

- AIを導入している主要企業

- ポイントオブケア診断市場におけるAIの将来

- 規制情勢

- 規制分析

- 規制機関、政府機関、その他の組織

- ケーススタディ分析

第6章 ポイントオブケア診断市場:製品別

- イントロダクション

- 血糖モニタリング製品

- 心血管代謝モニタリング製品

- 感染症検査製品

- 凝固モニタリング製品

- 妊娠・生殖検査製品

- 腫瘍/がんマーカー検査製品

- 尿検査製品

- コレステロール検査製品

- 血液検査製品

- 薬物乱用検査製品

- 甲状腺刺激ホルモン検査製品

- 便潜血検査製品

- その他の製品

第7章 ポイントオブケア診断市場:購入方式別

- イントロダクション

- 処方ベース検査製品

- OTC検査製品

第8章 ポイントオブケア診断市場:技術別

- イントロダクション

- 生化学

- 免疫アッセイ

- 分子診断

第9章 ポイントオブケア診断市場:サンプル別

- イントロダクション

- 血液サンプル

- 鼻腔・咽頭スワブ

- 尿サンプル

- その他のサンプル

第10章 ポイントオブケア診断市場:エンドユーザー別

- イントロダクション

- 在宅ケア環境、自己検査

- 臨床検査室

- 病院、集中治療センター、救急治療センター

- 外来診療施設、医師の診療所

- その他のエンドユーザー

第11章 ポイントオブケア診断市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- GCC諸国

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2021年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- ABBOTT

- F. HOFFMANN-LA ROCHE LTD.

- NOVA BIOMEDICAL

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ABBOTT

- SIEMENS HEALTHINEERS AG

- F. HOFFMANN-LA ROCHE LTD

- DANAHER

- QUIDELORTHO CORPORATION

- BD

- THERMO FISHER SCIENTIFIC INC.

- BIOMERIEUX

- BIOSYNEX SA

- EKF DIAGNOSTICS HOLDINGS PLC

- TRINITY BIOTECH

- WERFEN

- NOVA BIOMEDICAL

- SEKISUI DIAGNOSTICS

- BODITECH MED INC.

- その他の企業

- GRIFOLS, S.A.

- LIFESCAN IP HOLDINGS, LLC

- PTS DIAGNOSTICS

- EUROLYSER DIAGNOSTICA GMBH

- RESPONSE BIOMEDICAL

- ALFA SCIENTIFIC DESIGNS, INC.

- BTNX INC.

- ASCENSIA DIABETES CARE HOLDINGS AG

- FLUXERGY

- PRECISION BIOSENSOR, INC.

- ACON LABORATORIES, INC.

- MENARINI DIAGNOSTICS S.R.L

- ORASURE TECHNOLOGIES, INC.

- MANKIND PHARMA

第14章 付録

List of Tables

- TABLE 1 POINT OF CARE DIAGNOSTICS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 POINT OF CARE DIAGNOSTICS MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 3 POINT OF CARE DIAGNOSTICS MARKET: RISK ASSESSMENT

- TABLE 4 PROJECTED INCREASE OF CANCER PATIENTS, BY REGION, 2022 VS. 2035 VS. 2045

- TABLE 5 GLOBAL DIABETES ESTIMATES (AGES 20-79) BY REGION, 2021 VS. 2030 VS. 2045 (IN THOUSANDS)

- TABLE 6 PRODUCT WAIVERS, BY KEY PLAYER, 2021-2024

- TABLE 7 AVERAGE SELLING PRICE OF POINT OF CARE TESTS, BY PRODUCT, 2022-2024

- TABLE 8 AVERAGE SELLING PRICE OF GLUCOSE MONITORING TEST STRIPS, BY KEY PLAYER, 2022-2024

- TABLE 9 AVERAGE SELLING PRICE OF GLUCOSE MONITORING TEST STRIPS, BY REGION, 2022-2024

- TABLE 10 AVERAGE SELLING PRICE OF INFECTIOUS DISEASE TESTING PRODUCTS, BY REGION, 2022-2024

- TABLE 11 AVERAGE SELLING PRICE OF CARDIOMETABOLIC MONITORING PRODUCTS, BY REGION, 2022-2024

- TABLE 12 POINT OF CARE DIAGNOSTICS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 13 POINT OF CARE DIAGNOSTICS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2022-2023

- TABLE 14 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS (HS CODE 3822), BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 15 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS (HS CODE 3822), BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 16 POINT OF CARE DIAGNOSTICS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 POINT OF CARE DIAGNOSTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY (%)

- TABLE 19 KEY BUYING CRITERIA, BY TECHNOLOGY

- TABLE 20 EUROPE: CLASSIFICATION OF IVD DEVICES

- TABLE 21 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 22 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 23 AUSTRALIA: CLASSIFICATION OF IVD MEDICAL DEVICES

- TABLE 24 NORTH AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 REST OF THE WORLD: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 30 DIABETES-RELATED HEALTH EXPENDITURE PER PERSON, 2021 VS. 2030 VS. 2045 (USD)

- TABLE 31 POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 32 POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 33 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 34 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 35 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 36 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 37 KEY GLUCOSE MONITORING STRIPS AVAILABLE WORLDWIDE

- TABLE 38 POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING STRIPS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING STRIPS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 40 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING STRIPS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING STRIPS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING STRIPS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 43 KEY GLUCOSE MONITORING METERS AVAILABLE WORLDWIDE

- TABLE 44 POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING METERS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING METERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 46 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING METERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 47 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING METERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 48 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING METERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 49 KEY GLUCOSE MONITORING LANCETS & LANCING DEVICES AVAILABLE WORLDWIDE

- TABLE 50 POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING LANCETS & LANCING DEVICES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 51 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING LANCETS & LANCING DEVICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 52 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING LANCETS & LANCING DEVICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 53 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING LANCETS & LANCING DEVICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 54 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING LANCETS & LANCING DEVICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 55 KEY CARDIOMETABOLIC MONITORING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 56 POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 57 POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 59 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 60 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 61 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 62 POINT OF CARE DIAGNOSTICS MARKET FOR CARDIAC MARKER TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 63 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIAC MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 64 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIAC MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 65 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIAC MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 66 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIAC MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 67 POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD GAS/ELECTROLYTE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD GAS/ELECTROLYTE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 69 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD GAS/ELECTROLYTE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 70 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD GAS/ELECTROLYTE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 71 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD GAS/ELECTROLYTE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 72 POINT OF CARE DIAGNOSTICS MARKET FOR HBA1C TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HBA1C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 74 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HBA1C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HBA1C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 76 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HBA1C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 77 POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 78 POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 80 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 81 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 82 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 83 POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 84 POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 86 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 87 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 88 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 89 KEY INFLUENZA TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 90 POINT OF CARE DIAGNOSTICS MARKET FOR INFLUENZA TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR INFLUENZA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 92 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR INFLUENZA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR INFLUENZA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 94 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR INFLUENZA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 95 KEY TUBERCULOSIS TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 96 POINT OF CARE DIAGNOSTICS MARKET FOR TUBERCULOSIS TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR TUBERCULOSIS PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 98 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR TUBERCULOSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR TUBERCULOSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 100 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR TUBERCULOSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 101 OTHER KEY RESPIRATORY INFECTIONS TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 102 POINT OF CARE DIAGNOSTICS MARKET FOR OTHER RESPIRATORY INFECTION TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER RESPIRATORY INFECTION PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 104 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 106 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER RESPIRATORY INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 107 KEY HEALTHCARE-ASSOCIATED INFECTION TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 108 POINT OF CARE DIAGNOSTICS MARKET FOR HEALTHCARE-ASSOCIATED INFECTION TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEALTHCARE-ASSOCIATED INFECTION PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 110 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEALTHCARE-ASSOCIATED INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEALTHCARE-ASSOCIATED INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 112 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEALTHCARE-ASSOCIATED INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 113 KEY TROPICAL DISEASE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 114 POINT OF CARE DIAGNOSTICS MARKET FOR TROPICAL DISEASE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 115 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR TROPICAL DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 116 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR TROPICAL DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR TROPICAL DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 118 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR TROPICAL DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 119 POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 120 POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 121 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 122 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 123 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 124 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 125 KEY HIV TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 126 POINT OF CARE DIAGNOSTICS MARKET FOR HIV TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 127 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HIV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 128 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HIV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 129 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HIV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 130 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HIV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 131 POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 132 POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 133 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 134 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 135 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 136 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 137 KEY HEPATITIS B TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 138 POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS B TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 139 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS B TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 140 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS B TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 141 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS B TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 142 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS B TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 143 KEY HEPATITIS C TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 144 POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS C TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 145 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 146 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 147 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 148 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS C TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 149 KEY SYPHILIS TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 150 POINT OF CARE DIAGNOSTICS MARKET FOR SYPHILIS TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 151 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR SYPHILIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 152 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR SYPHILIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR SYPHILIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 154 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR SYPHILIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 155 KEY HPV TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 156 POINT OF CARE DIAGNOSTICS MARKET FOR HPV TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 157 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HPV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 158 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HPV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 159 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HPV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 160 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HPV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

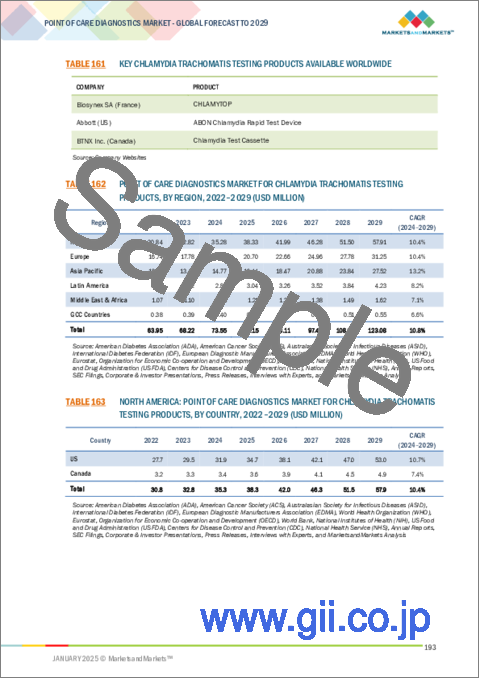

- TABLE 161 KEY CHLAMYDIA TRACHOMATIS TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 162 POINT OF CARE DIAGNOSTICS MARKET FOR CHLAMYDIA TRACHOMATIS TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 163 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CHLAMYDIA TRACHOMATIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 164 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CHLAMYDIA TRACHOMATIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CHLAMYDIA TRACHOMATIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 166 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CHLAMYDIA TRACHOMATIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 167 POINT OF CARE DIAGNOSTICS MARKET FOR NEISSERIA GONORRHEA TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 168 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR NEISSERIA GONORRHEA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 169 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR NEISSERIA GONORRHEA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR NEISSERIA GONORRHEA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 171 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR NEISSERIA GONORRHEA TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 172 KEY HSV TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 173 POINT OF CARE DIAGNOSTICS MARKET FOR HSV TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 174 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HSV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 175 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HSV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 176 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HSV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 177 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HSV TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 178 KEY CLOSTRIDIUM DIFFICILE INFECTION TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 179 POINT OF CARE DIAGNOSTICS MARKET FOR CLOSTRIDIUM DIFFICILE INFECTION TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 180 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CLOSTRIDIUM DIFFICILE INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 181 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CLOSTRIDIUM DIFFICILE INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 182 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CLOSTRIDIUM DIFFICILE INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 183 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CLOSTRIDIUM DIFFICILE INFECTION TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 184 OTHER KEY INFECTIOUS DISEASE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 185 POINT OF CARE DIAGNOSTICS MARKET FOR OTHER INFECTIOUS DISEASE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 186 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 187 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 188 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 189 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER INFECTIOUS DISEASE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 190 KEY COAGULATION MONITORING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 191 POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 192 POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 193 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 194 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 195 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 196 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 197 POINT OF CARE DIAGNOSTICS MARKET FOR PT/INR TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 198 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PT/INR TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 199 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR PT/INR TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 200 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR PT/INR TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 201 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PT/INR TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 202 POINT OF CARE DIAGNOSTICS MARKET FOR ACT/APTT TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 203 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR ACT/APTT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 204 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR ACT/APTT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 205 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR ACT/APTT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 206 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR ACT/APTT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 207 POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 208 POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 209 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 210 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 211 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 212 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 213 KEY PREGNANCY TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 214 POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 215 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 216 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 217 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 218 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 219 KEY FERTILITY TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 220 POINT OF CARE DIAGNOSTICS MARKET FOR FERTILITY TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 221 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 222 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 223 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 224 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR FERTILITY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 225 TYPES OF CANCER CASES WORLDWIDE, 2022 VS. 2045

- TABLE 226 KEY TUMOR/CANCER MARKER TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 227 POINT OF CARE DIAGNOSTICS MARKET FOR TUMOR/CANCER MARKER TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 228 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR TUMOR/CANCER MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 229 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR TUMOR/CANCER MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 230 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR TUMOR/CANCER MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 231 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR TUMOR/CANCER MARKER TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 232 KEY URINALYSIS TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 233 POINT OF CARE DIAGNOSTICS MARKET FOR URINALYSIS TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 234 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR URINALYSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 235 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR URINALYSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 236 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR URINALYSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 237 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR URINALYSIS TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 238 KEY CHOLESTEROL TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 239 POINT OF CARE DIAGNOSTICS MARKET FOR CHOLESTEROL TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 240 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CHOLESTEROL TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 241 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CHOLESTEROL TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 242 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CHOLESTEROL TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 243 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CHOLESTEROL TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 244 KEY HEMATOLOGY TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 245 POINT OF CARE DIAGNOSTICS MARKET FOR HEMATOLOGY TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 246 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEMATOLOGY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 247 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEMATOLOGY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 248 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEMATOLOGY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 249 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEMATOLOGY TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 250 KEY DRUGS-OF-ABUSE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 251 POINT OF CARE DIAGNOSTICS MARKET FOR DRUGS-OF-ABUSE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 252 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR DRUGS-OF-ABUSE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 253 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR DRUGS-OF-ABUSE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 254 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR DRUGS-OF-ABUSE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 255 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR DRUGS-OF-ABUSE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 256 POINT OF CARE DIAGNOSTICS MARKET FOR THYROID-STIMULATING HORMONE TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 257 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR THYROID-STIMULATING HORMONE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 258 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR THYROID-STIMULATING HORMONE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 259 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR THYROID-STIMULATING HORMONE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 260 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR THYROID-STIMULATING HORMONE TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 261 KEY FECAL OCCULT BLOOD TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 262 POINT OF CARE DIAGNOSTICS MARKET FOR FECAL OCCULT TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 263 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR FECAL OCCULT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 264 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR FECAL OCCULT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 265 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR FECAL OCCULT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 266 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR FECAL OCCULT TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 267 KEY OTHER POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 268 POINT OF CARE DIAGNOSTICS MARKET FOR OTHER PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 269 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 270 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 271 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 272 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 273 POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 274 KEY PRESCRIPTION-BASED TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 275 POINT OF CARE DIAGNOSTICS MARKET FOR PRESCRIPTION-BASED TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 276 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PRESCRIPTION-BASED TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 277 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR PRESCRIPTION-BASED TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 278 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR PRESCRIPTION-BASED TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 279 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PRESCRIPTION-BASED TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 280 KEY OTC TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 281 POINT OF CARE DIAGNOSTICS MARKET FOR OTC TESTING PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 282 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTC TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 283 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR OTC TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 284 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR OTC TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 285 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTC TESTING PRODUCTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 286 POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 287 KEY BIOCHEMISTRY-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 288 POINT OF CARE DIAGNOSTICS MARKET FOR BIOCHEMISTRY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 289 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR BIOCHEMISTRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 290 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR BIOCHEMISTRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 291 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR BIOCHEMISTRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 292 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR BIOCHEMISTRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 293 KEY IMMUNOASSAY-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 294 POINT OF CARE DIAGNOSTICS MARKET FOR IMMUNOASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 295 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 296 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 297 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 298 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 299 POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 300 POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 301 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 302 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 303 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 304 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 305 KEY RT-PCR-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 306 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY REGION, 2022-2029 (USD MILLION)

- TABLE 307 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 308 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 309 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 310 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 311 KEY INAAT-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 312 POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 313 NORTH AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 314 EUROPE: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 315 ASIA PACIFIC: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 316 LATIN AMERICA: POINT OF CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 317 POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 318 KEY BLOOD SAMPLE-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 319 POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 320 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 321 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 322 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 323 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 324 KEY NASAL AND OROPHARYNGEAL SWAB-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 325 POINT OF CARE DIAGNOSTICS MARKET FOR NASAL & OROPHARYNGEAL SWABS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 326 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR NASAL & OROPHARYNGEAL SWABS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 327 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR NASAL & OROPHARYNGEAL SWABS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 328 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR NASAL & OROPHARYNGEAL SWABS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 329 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR NASAL & OROPHARYNGEAL SWABS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 330 KEY URINE SAMPLE-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 331 POINT OF CARE DIAGNOSTICS MARKET FOR URINE SAMPLES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 332 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 333 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 334 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 335 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR URINE SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 336 KEY OTHER SAMPLE-BASED POINT OF CARE TESTING PRODUCTS AVAILABLE WORLDWIDE

- TABLE 337 POINT OF CARE DIAGNOSTICS MARKET FOR OTHER SAMPLES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 338 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 339 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 340 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 341 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 342 POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 343 POINT OF CARE DIAGNOSTICS MARKET FOR HOME CARE SETTINGS AND SELF-TESTING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 344 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HOME CARE SETTINGS AND SELF-TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 345 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HOME CARE SETTINGS AND SELF-TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 346 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HOME CARE SETTINGS AND SELF-TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 347 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HOME CARE SETTINGS AND SELF-TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 348 POINT OF CARE DIAGNOSTICS MARKET FOR CLINICAL LABORATORIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 349 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 350 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 351 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 352 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 353 POINT OF CARE DIAGNOSTICS MARKET FOR HOSPITALS, CRITICAL CARE CENTERS, AND URGENT CARE CENTERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 354 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HOSPITALS, CRITICAL CARE CENTERS, AND URGENT CARE CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 355 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HOSPITALS, CRITICAL CARE CENTERS, AND URGENT CARE CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 356 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HOSPITALS, CRITICAL CARE CENTERS, AND URGENT CARE CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 357 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HOSPITALS, CRITICAL CARE CENTERS, AND URGENT CARE CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 358 POINT OF CARE DIAGNOSTICS MARKET FOR AMBULATORY CARE FACILITIES AND PHYSICIAN OFFICES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 359 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR AMBULATORY CARE FACILITIES AND PHYSICIAN OFFICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 360 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR AMBULATORY CARE FACILITIES AND PHYSICIAN OFFICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 361 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR AMBULATORY CARE FACILITIES AND PHYSICIAN OFFICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 362 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR AMBULATORY CARE FACILITIES AND PHYSICIAN OFFICES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 363 POINT OF CARE DIAGNOSTICS MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 364 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 365 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 366 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 367 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 368 POINT OF CARE DIAGNOSTICS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 369 NORTH AMERICA: MACROECONOMIC INDICATORS FOR POINT OF CARE DIAGNOSTICS MARKET

- TABLE 370 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 371 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 372 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 373 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 374 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 375 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 376 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 377 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 378 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 379 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 380 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 381 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 382 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 383 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 384 NORTH AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 385 NORTH AMERICA: NUMBER OF WOMEN USING HOME PREGNANCY KITS, BY COUNTRY, 2022-2029 (MILLION UNIT)

- TABLE 386 US: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 387 US: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 388 US: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 389 US: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 390 US: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 391 US: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 392 US: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 393 US: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 394 US: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 395 US: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 396 US: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 397 US: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 398 US: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 399 US: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 400 CANADA: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 401 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 402 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 403 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 404 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 405 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 406 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 407 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 408 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 409 CANADA: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 410 CANADA: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 411 CANADA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 412 CANADA: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 413 CANADA: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 414 MACROECONOMIC INDICATORS FOR POINT OF CARE DIAGNOSTICS MARKET IN EUROPE

- TABLE 415 EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 416 EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 417 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 418 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 419 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 420 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 421 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 422 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 423 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 424 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 425 EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 426 EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 427 EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 428 EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 429 EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 430 GERMANY: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 431 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 432 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 433 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 434 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 435 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 436 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 437 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 438 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 439 GERMANY: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 440 GERMANY: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 441 GERMANY: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 442 GERMANY: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 443 GERMANY: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 444 FRANCE: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 445 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 446 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 447 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 448 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 449 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 450 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 451 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 452 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 453 FRANCE: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 454 FRANCE: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 455 FRANCE: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 456 FRANCE: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 457 FRANCE: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 458 UK: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 459 UK: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 460 UK: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 461 UK: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 462 UK: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 463 UK: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 464 UK: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 465 UK: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 466 UK: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 467 UK: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 468 UK: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 469 UK: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 470 UK: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 471 UK: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 472 ITALY: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 473 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 474 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 475 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 476 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 477 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 478 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 479 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 480 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 481 ITALY: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 482 ITALY: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 483 ITALY: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 484 ITALY: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 485 ITALY: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 486 SPAIN: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 487 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 488 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 489 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 490 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 491 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 492 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 493 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 494 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 495 SPAIN: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 496 SPAIN: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 497 SPAIN: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 498 SPAIN: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 499 SPAIN: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 500 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 501 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 502 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 503 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 504 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 505 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 506 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 507 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 508 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 509 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 510 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 511 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 512 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 513 REST OF EUROPE: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 514 ASIA PACIFIC: MACROECONOMIC INDICATORS FOR POINT OF CARE DIAGNOSTICS MARKET

- TABLE 515 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 516 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 517 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 518 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 519 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 520 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 521 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 522 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 523 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 524 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 525 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 526 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 527 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 528 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 529 ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 530 CHINA: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 531 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 532 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 533 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 534 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 535 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 536 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 537 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 538 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 539 CHINA: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 540 CHINA: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 541 CHINA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 542 CHINA: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 543 CHINA: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 544 JAPAN: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 545 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 546 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 547 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 548 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 549 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 550 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 551 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 552 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 553 JAPAN: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 554 JAPAN: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 555 JAPAN: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 556 JAPAN: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 557 JAPAN: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 558 INDIA: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 559 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 560 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 561 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 562 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 563 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 564 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 565 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 566 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 567 INDIA: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 568 INDIA: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 569 INDIA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 570 INDIA: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 571 INDIA: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 572 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 573 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 574 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 575 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 576 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 577 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 578 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 579 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 580 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 581 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 582 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 583 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 584 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 585 AUSTRALIA: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 586 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 587 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 588 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 589 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 590 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 591 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 592 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 593 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 594 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 595 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 596 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 597 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 598 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 599 SOUTH KOREA: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 600 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 601 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR GLUCOSE MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 602 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR CARDIOMETABOLIC MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 603 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR INFECTIOUS DISEASE TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 604 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR RESPIRATORY INFECTION TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 605 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASE TESTING PRODUCTS, BY TYPE,2022-2029 (USD MILLION)

- TABLE 606 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR HEPATITIS TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 607 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR COAGULATION MONITORING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 608 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR PREGNANCY & FERTILITY TESTING PRODUCTS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 609 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY MODE OF PURCHASE, 2022-2029 (USD MILLION)

- TABLE 610 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 611 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET FOR MOLECULAR DIAGNOSTICS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 612 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY SAMPLE, 2022-2029 (USD MILLION)

- TABLE 613 REST OF ASIA PACIFIC: POINT OF CARE DIAGNOSTICS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 614 MACROECONOMIC INDICATORS FOR POINT OF CARE DIAGNOSTICS MARKET IN LATIN AMERICA

- TABLE 615 LATIN AMERICA: POINT OF CARE DIAGNOSTICS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)