|

|

市場調査レポート

商品コード

1426158

ペットフード原料の世界市場:原料別(肉・肉製品、穀類、野菜・果物、油脂、添加物)、由来別(動物由来、植物由来、合成)、ペット別(犬、猫、魚)、形態別、性質別、地域別- 予測(~2028年)Pet Food Ingredients Market by Ingredient (Meat & Meat Products Cereals, Vegetables & Fruits Fats, and Additives), Source (Animal-Based, Plant Derivatives, and Synthetic), Pet (Dogs, Cats, and Fish), Form and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ペットフード原料の世界市場:原料別(肉・肉製品、穀類、野菜・果物、油脂、添加物)、由来別(動物由来、植物由来、合成)、ペット別(犬、猫、魚)、形態別、性質別、地域別- 予測(~2028年) |

|

出版日: 2024年01月24日

発行: MarketsandMarkets

ページ情報: 英文 322 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のペットフード原料の市場規模は、2023年に342億米ドルと予測され、予測期間中のCAGRは6.8%になるとみられており、2028年には474億米ドルに達すると予測されています。

人間の食品の動向を反映して、ペットの栄養学でも健康とウェルネスを重視する傾向が強まっています。ペットの飼い主は、全体的な健康と長寿を促進し、ペットの特定の健康要件に対応する成分を積極的に探しています。世界のペット飼育の急増は、特に都市環境において、より多くの個人がペットを飼うようになり、ペットフードとその構成成分の両方に対する需要の高まりにつながっているため、極めて重要な役割を果たしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | 原料別、ペット別、由来別、形態別、性質別、地域別 |

| 対象地域 | 北米、欧州、南米、アジア太平洋、その他の地域 |

都市部を中心としたペット飼育の急増は、ペット栄養動向のパラダイムシフトをもたらしました。ペットの飼い主が動物を不可欠な家族の一員と考えるようになり、より高品質で多様なペットフード原料への需要が高まっています。より家族中心のアプローチへのこのシフトは、革新的で優れた原材料を誇るプレミアムペットフードや特殊ペットフードへの投資意欲に表れています。その結果、プレミアム化に対する需要の高まりは、ペット栄養の新時代を切り開くため、メーカー各社が原材料の配合を見直す原動力となっています。消費者が、ペットの全体的な健康と長寿に貢献するだけでなく、特定の健康ニーズにも対応するペットフードを求めるようになり、業界は変貌を遂げつつあります。

ペットの世話をしている人たちは、ペットの潜在的なアレルギーや過敏症に敏感になっており、動物性製品に含まれる一般的なアレルゲンの代替となる植物性原料を好むようになっています。ペットフードの原材料調達に関する飼い主の倫理的配慮は増加傾向にあります。植物由来の原材料は、より倫理的であると見なされることが多く、消費者の嗜好に顕著な変化をもたらしています。ペットの好みや嗜好を満たす多様な選択肢を求める飼い主に応えるため、ペットフードメーカーは植物由来原料を取り入れ、ペットフードに幅広い風味と食感を導入しています。

欧州では、ペットフード原料市場は予測期間を通じて安定した成長を維持すると予想されています。欧州の世帯の約46%、合計9,100万世帯が、この地域の3億4,000万匹のペットのうち1匹以上を飼っています。このようなペット飼育の増加は市場に反映されており、その市場規模は現在306億ユーロに達しています。ペット飼育世帯数の増加と市場の拡大との相関関係は、欧州ペットフード業界の前向きな動向を浮き彫りにしており、一貫した健全な成長軌道を示しています。

当レポートでは、世界のペットフード原料市場について調査し、原料別、由来別、ペット別、形態別、性質別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済的要因

- 市場力学

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 価格分析:ペットフード原料市場

- ペットフード原料市場の市場マッピングと生態系

- 顧客のビジネスに影響を与える動向/混乱

- ペットフード原料市場:特許分析

- 貿易データ:ペットフード原料市場

- ポーターのファイブフォース分析

- ケーススタディ

- 主要な会議とイベント

- 関税と規制状況

- 主要な利害関係者と購入基準

第7章 ペットフード原料市場、原料別

- イントロダクション

- 肉・肉製品

- 穀類

- 野菜・果物

- 油脂

- 添加物

第8章 ペットフード原料市場、ペット別

- イントロダクション

- 犬

- 猫

- 魚

- その他

第9章 ペットフード原料市場、由来別

- イントロダクション

- 動物由来

- 植物由来

- 合成

第10章 ペットフード原料市場、形態別

- イントロダクション

- ドライ

- ウェット

第11章 ペットフード原料市場、性質別

- イントロダクション

- 有機

- 無機

第12章 ペットフード原料市場、地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 南米

- その他の地域

第13章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析、2022年

- 収益分析

- 企業評価マトリックス(主要企業)、2022年

- スタートアップ/中小企業(SME)評価マトリックス、2022年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- BASF SE

- DARLING INGREDIENTS INC

- CARGILL, INCORPORATED

- INGREDION

- DSM

- OMEGA PROTEIN CORPORATION

- ADM

- KEMIN INDUSTRIES, INC

- CHR. HANSEN HOLDING A/S

- ROQUETTE FRERES

- THE SCOULAR COMPANY

- SYMRISE

- MOWI

- LALLEMAND INC

- PHILEO BY LESAFFRE

- その他の企業

- 3D CORPORATE SOLUTIONS

- HYDRITE CHEMICAL

- AFB INTERNATIONAL

- GILLCO INGREDIENTS

- SARIA INTERNATIONAL GMBH

- GREEN SOURCE ORGANICS

- BIORIGIN

- ZINPRO

- APS PHOENIX LLC

- LABUDDE GROUP, INC

第15章 隣接市場および関連市場

第16章 付録

The global market for pet food ingredients is estimated at USD 34.2 billion in 2023 and is projected to reach USD 47.4 billion by 2028, at a CAGR of 6.8% during the forecast period. Mirroring trends in human food, there is an increasing emphasis on health and wellness in pet nutrition. Pet owners are actively looking for ingredients that promote overall well-being and longevity, and address specific health requirements of their pets. The global surge in pet ownership, especially in urban settings, plays a pivotal role as more individuals adopt pets, leading to a heightened demand for both pet food and its constituent ingredients.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) |

| Segments | By Ingredient, Pet, Source, Form, Nature and Region |

| Regions covered | North America, Europe, South America, Asia Pacific, and RoW |

"Pet ownership boom fuels demand for high-quality ingredients."

The surge in pet ownership, particularly in urban areas, has led to a paradigm shift in pet nutrition trends. Pet owners are now regarding their animals as integral family members, sparking a growing demand for higher-quality and diverse pet food ingredients. This shift towards a more family-centric approach is evident in the willingness of pet owners to invest in premium and specialty pet foods that boast innovative and superior ingredients. Consequently, this increased demand for premiumization is driving manufacturers to revamp their ingredient formulations, ushering in a new era of pet nutrition. The industry is witnessing a transformation as consumers seek out pet foods that contribute not only to the overall well-being and longevity of their pets but also address specific health needs.

"In 2022, plant derivatives stood as the second-largest segment within the by source of pet food ingredients. "

Pet caregivers are becoming more attuned to potential allergies and sensitivities in their pets, driving a preference for plant-based ingredients that offer alternatives to common allergens present in animal-based products. The ethical considerations of pet owners regarding the sourcing of ingredients for pet food are on the rise. Plant-derived sources are frequently seen as more ethical, resulting in a notable shift in consumer preferences. In response to pet owners seeking diverse options to meet their pets' tastes and preferences, manufacturers are incorporating plant-derived ingredients to introduce a broad spectrum of flavors and textures in pet food.

"Within the ingredients segment, Meat and Meat Products segment holds the most substantial share."

The dominance of meat and meat products in the pet food ingredient segment is primarily propelled by their rich composition of essential nutrients, including proteins, vitamins, and minerals crucial for the comprehensive health and well-being of pets. The inherent palatability of meat enhances the overall appeal of pet food, as its taste and aroma contribute to increased acceptance by pets, promoting better consumption and fulfilling their dietary requirements. With a high biological value, the protein in meat provides a well-balanced and complete profile of essential amino acids, making it a remarkably efficient source of protein that supports pets' growth and muscle development. Considering the carnivorous nature of many pets, especially dogs and cats, a meat-based diet aligns seamlessly with their dietary preferences and nutritional necessities, rendering it a popular and effective choice in formulating pet food.

"The pet food ingredients market in Europe is anticipated to maintain consistent growth throughout the forecast period."

In Europe, the pet food ingredients market is expected to sustain steady growth over the forecast period. According to FEDIAF, an organization that annually reviews member association data on market and population trends, their latest report affirms robust growth in pet ownership. Approximately 46% of European households, totaling 91 million, own one or more of the region's 340 million pets. This rise in pet ownership is reflected in the market, which has now reached a value of USD 30.60 billion euros. The correlation between the increasing number of pet-owning households and the expanding market underscores a positive trend in the European pet food industry, indicating a consistent and healthy growth trajectory.

The Break-up of Primaries:

By Company Type: Tier 1 - 30%, Tier 2 - 45%, Tier 3 - 25%

By Designation: CXOs - 25%, Managers - 50%, Executives - 25%

By Region: North America - 25%, Europe - 30%, APAC - 35%, RoW - 10%

Key players in this market include BASF SE (Germany), Darling Ingredients Inc (US), Cargill, Incorporated (US), Ingredion (US), DSM (Netherlands), Omega Protein Corporation (US), ADM (US), Kemin Industries, Inc (US), Chr. Hansen Holding A/S (Denmark), Roquette Freres (France), The Scoular Company (US), Symrise (Germany), Mowi (Norway), Lallemand Inc. (Canada), and Phileo by Lesaffre (France).

Research Coverage:

The report segments the pet food ingredients market based on form, pet, ingredient, source, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the pet food ingredients market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, key strategies, Contracts, partnerships, and agreements. New product launches, mergers and acquisitions, and recent developments associated with the pet food ingredients market. Competitive analysis of upcoming startups in the pet food ingredients market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall pet food ingredients market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (Increase in pet expenditure with a substantial rise in pet food expenditure, switch from mass products to organic pet food ingredients, and acceptance of insect-based protein and oil by pet owners), restraints (non-uniformity of regulations hindering international trade and limited availability of ingredients and price sensitivity) opportunities (use of cannabis in pet food, technological advancements to enhance product development, and shift in focus toward natural and grain-free products), and challenges (capital investments for equipment, threat from counterfeit products, and oxidation in pet food palatability).

- Product Development/Innovation: Detailed insights on, research & development activities, and new product launches in the pet food ingredients market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the pet food ingredients market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the pet food ingredients market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Darling Ingredients Inc (US), Cargill, Incorporated (US), Ingredion (US), DSM (Netherlands), Omega Protein Corporation (US), ADM (US), Kemin Industries, Inc (US), Chr. Hansen Holding A/S (Denmark), Roquette Freres (France), The Scoular Company (US), Symrise (Germany), Mowi (Norway), Lallemand Inc. (Canada), Phileo by Lesaffre (France), 3D Corporate Solutions (US), Hydrite Chemical (US), AFB International (US), Gillco Ingredients (US), SARIA International GmbH (Germany), Green Source Organics (US), Biorigin (Brazil), Zinpro (US), APS Phoenix LLC (US), and LaBudde Group Inc (US) among others in the pet food ingredients market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2023

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PET FOOD INGREDIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE-BOTTOM-UP

- FIGURE 3 PET FOOD INGREDIENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 APPROACH TWO-TOP-DOWN

- FIGURE 4 PET FOOD INGREDIENTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.2.3 PET FOOD INGREDIENTS MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 5 PET FOOD INGREDIENTS MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.2.4 PET FOOD INGREDIENTS MARKET SIZE ESTIMATION: DEMAND SIDE

- FIGURE 6 PET FOOD INGREDIENTS MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- 2.6 RECESSION IMPACT ON PET FOOD INGREDIENTS MARKET

- 2.6.1 MACRO INDICATORS OF RECESSION

- FIGURE 8 INDICATORS OF RECESSION

- FIGURE 9 WORLD INFLATION RATE, 2011-2021

- FIGURE 10 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON PET FOOD INGREDIENTS MARKET

- FIGURE 12 GLOBAL PET FOOD INGREDIENTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 PET FOOD INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 13 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 PET FOOD INGREDIENTS MARKET, BY PET, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 PET FOOD INGREDIENTS MARKET, BY FORM, 2023 VS. 2028

- FIGURE 16 PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

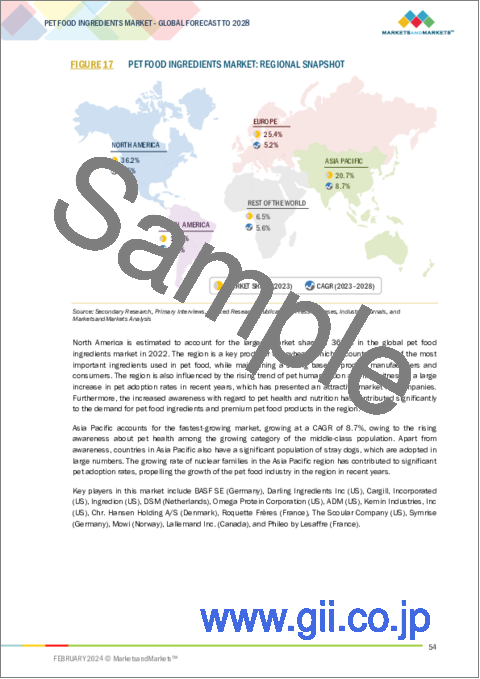

- FIGURE 17 PET FOOD INGREDIENTS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN PET FOOD INGREDIENTS MARKET

- FIGURE 18 INCREASING ADOPTION OF PETS AND RISING PET HUMANIZATION TREND TO PROPEL GROWTH

- 4.2 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY KEY COUNTRY AND SOURCE

- FIGURE 19 US AND ANIMAL-BASED SOURCE ACCOUNTED FOR LARGEST SHARES IN NORTH AMERICAN MARKET IN 2022

- 4.3 PET FOOD INGREDIENTS MARKET, BY PET

- FIGURE 20 DOGS PET SEGMENT TO LEAD DURING FORECAST PERIOD

- 4.4 PET FOOD INGREDIENTS MARKET, BY INGREDIENT

- FIGURE 21 MEAT & MEAT PRODUCTS INGREDIENTS TO LEAD DURING FORECAST PERIOD

- 4.5 PET FOOD INGREDIENTS MARKET, BY FORM

- FIGURE 22 DRY FORM SEGMENT TO LEAD DURING FORECAST PERIOD

- 4.6 PET FOOD INGREDIENTS MARKET, BY SOURCE

- FIGURE 23 ANIMAL-BASED SOURCE SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 24 MARKETS IN CHINA, MEXICO, AND ARGENTINA TO GROW AT HIGHEST RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC FACTORS

- 5.2.1 INCREASE IN PET ADOPTION AMONG URBAN POPULATION

- 5.2.2 INCREASING TREND OF HUMANIZATION OF PETS TO DRIVE DEMAND FOR PREMIUM PET PRODUCTS

- FIGURE 25 PERCENTAGE OF PET OWNERS GIVING TREATS TO THEIR PETS, BY PET TYPE, 2018-2022

- 5.3 MARKET DYNAMICS

- FIGURE 26 PET FOOD INGREDIENTS: MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in pet expenditure along with a substantial rise in pet food expenditure

- FIGURE 27 US PET INDUSTRY EXPENDITURE, 2018-2022 (USD BILLION)

- FIGURE 28 GLOBAL POPULATION VS. ANIMAL PROTEIN PRODUCTION, 1990-2030

- 5.3.1.2 Preference for organic pet food ingredients

- 5.3.1.3 Acceptance of insect-based protein and oil by pet owners

- 5.3.2 RESTRAINTS

- 5.3.2.1 Non-uniformity of regulations hindering international trade

- 5.3.2.2 Limited availability of ingredients and price sensitivity

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increase in pet humanization trend

- FIGURE 29 ATTITUDE TOWARD PETS, PERCENTAGE OF US POPULATION AS OF MAY 2022

- 5.3.3.2 Technological advancements to enhance product development

- 5.3.3.3 Shift in focus toward natural and grain-free products

- FIGURE 30 SALES GROWTH OF PET SUPPLEMENTS IN US, 2022

- FIGURE 31 MAJOR BUYING FACTORS FOR PET FOOD, PERCENTAGE OF POPULATION IN CHINA AS OF APRIL 2021

- 5.3.4 CHALLENGES

- 5.3.4.1 Capital investments for equipment

- 5.3.4.2 Threat from counterfeit products

- 5.3.4.3 Oxidation in pet food palatability

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PRODUCTION AND PROCESSING

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING & SALES

- FIGURE 32 VALUE CHAIN ANALYSIS OF PET FOOD INGREDIENTS MARKET

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 33 PET FOOD INGREDIENTS MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 NEXT-GENERATION PROTEIN FOR PET FOOD INGREDIENTS

- 6.5 PRICE ANALYSIS: PET FOOD INGREDIENTS MARKET

- 6.5.1 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 34 AVERAGE SELLING PRICE, BY INGREDIENT, 2020-2022 (USD/TON)

- TABLE 3 MEAT & MEAT PRODUCTS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 4 CEREALS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 5 VEGETABLES & FRUITS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 6 FATS: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- TABLE 7 ADDITIVES: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- 6.6 MARKET MAPPING AND ECOSYSTEM OF PET FOOD INGREDIENTS MARKET

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- FIGURE 35 PET FOOD INGREDIENTS: MARKET MAP

- FIGURE 36 PET FOOD INGREDIENTS ECOSYSTEM MAPPING

- TABLE 8 PET FOOD INGREDIENTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 37 REVENUE SHIFT FOR PET FOOD INGREDIENTS MARKET

- 6.8 PET FOOD INGREDIENTS MARKET: PATENT ANALYSIS

- FIGURE 38 PATENTS GRANTED: PET FOOD INGREDIENTS MARKET, 2012-2022

- FIGURE 39 REGIONAL ANALYSIS OF PATENTS GRANTED: PET FOOD INGREDIENTS MARKET, 2012-2022

- TABLE 9 PATENTS PERTAINING TO PET FOOD INGREDIENTS, 2020-2022

- 6.9 TRADE DATA: PET FOOD INGREDIENTS MARKET

- TABLE 10 IMPORT DATA OF DOG OR CAT FOOD, BY KEY COUNTRY, 2022 (VALUE AND VOLUME)

- TABLE 11 EXPORT DATA OF DOG OR CAT FOOD, BY KEY COUNTRY, 2022 (VALUE AND VOLUME)

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 PET FOOD INGREDIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 THREAT OF NEW ENTRANTS

- 6.11 CASE STUDIES

- 6.11.1 ADM: PET FOOD INGREDIENTS FOR DOGS AND CATS

- 6.11.2 GILLCO INGREDIENTS: ENHANCING EMULSIFICATION AND WATER-HOLDING IN DOG FOOD KIBBLE TOPPER WITH CITRI-FI CITRUS FIBER

- 6.12 KEY CONFERENCES AND EVENTS

- TABLE 13 KEY CONFERENCES AND EVENTS IN PET FOOD INGREDIENTS MARKET, 2023-2024

- 6.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13.1 NORTH AMERICA

- 6.13.1.1 United States (US)

- 6.13.1.2 Association of American Feed Control Officials (AAFCO)

- 6.13.2 EUROPEAN UNION

- 6.13.3 ASIA PACIFIC

- 6.13.3.1 China

- 6.13.3.2 Japan

- TABLE 17 PERMITTED LEVEL OF SUBSTANCES IN PET FOOD

- TABLE 18 STANDARDS FOR PET FOOD MANUFACTURERS

- 6.13.3.3 India

- 6.13.4 SOUTH AFRICA

- 6.13.5 INTERNATIONAL FEED INDUSTRY FEDERATION

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INGREDIENTS

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INGREDIENTS

- 6.14.2 BUYING CRITERIA

- TABLE 20 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 41 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 PET FOOD INGREDIENTS MARKET, BY INGREDIENT

- 7.1 INTRODUCTION

- FIGURE 42 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023 VS. 2028

- TABLE 21 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 22 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 23 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (KT)

- TABLE 24 PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (KT)

- 7.2 MEAT & MEAT PRODUCTS

- 7.2.1 HEALTH BENEFITS AND MULTIFUNCTIONALITY TO DRIVE MARKET

- TABLE 25 MEAT & MEAT PRODUCTS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 MEAT & MEAT PRODUCTS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 MEAT & MEAT PRODUCTS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 28 MEAT & MEAT PRODUCTS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 29 MEAT & MEAT PRODUCTS: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 30 MEAT & MEAT PRODUCTS: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.2 DEBONED MEAT

- TABLE 31 DEBONED MEAT: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 DEBONED MEAT: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 MEAT MEAL

- TABLE 33 MEAT MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 MEAT MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.4 BY-PRODUCT MEAL

- TABLE 35 BY-PRODUCT MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 BY-PRODUCT MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.5 ANIMAL DIGEST

- TABLE 37 ANIMAL DIGEST: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 ANIMAL DIGEST: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 CEREALS

- 7.3.1 RICH CARBOHYDRATE CONTENT AND ENERGY-BOOSTING PROPERTIES TO DRIVE MARKET

- FIGURE 43 SHARE OF CEREALS ALLOCATED TO FOOD, FEED, OR PROCESSING, BY COUNTRY, 2020

- TABLE 39 CEREALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 CEREALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 CEREALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 42 CEREALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 43 CEREALS: PET FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 44 CEREALS: PET FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3.2 CORN & CORNMEAL

- TABLE 45 CORN & CORN MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 CORN & CORN MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.3 WHEAT & WHEATMEAL

- TABLE 47 WHEAT & WHEAT MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 WHEAT & WHEAT MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.4 BARLEY

- TABLE 49 BARLEY: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 BARLEY: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.5 RICE

- TABLE 51 RICE: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 RICE: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

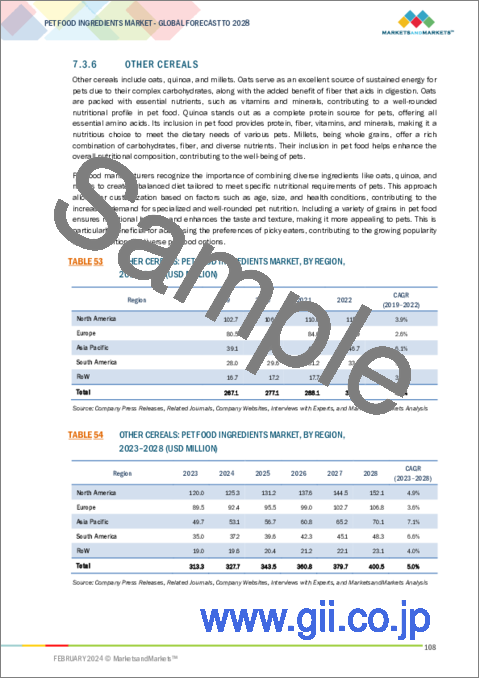

- 7.3.6 OTHER CEREALS

- TABLE 53 OTHER CEREALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 OTHER CEREALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 VEGETABLES & FRUITS

- 7.4.1 BENEFITS TO DIGESTIVE HEALTH AND ASSURANCE OF OPTIMAL NUTRITION TO DRIVE MARKET

- TABLE 55 VEGETABLES & FRUITS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 VEGETABLES & FRUITS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 VEGETABLES & FRUITS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 58 VEGETABLES & FRUITS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 59 VEGETABLES & FRUITS: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 60 VEGETABLES & FRUITS: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.4.2 FRUITS

- TABLE 61 FRUITS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 FRUITS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.3 POTATOES

- TABLE 63 POTATOES: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 POTATOES: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.4 CARROTS

- TABLE 65 CARROTS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 CARROTS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.5 SOY & SOY MEAL

- TABLE 67 SOY & SOY MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 SOY & SOY MEAL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.6 PEA

- TABLE 69 PEA: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 PEA: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 FATS

- 7.5.1 RICH OMEGA-3 FATTY ACID CONTENT AND PROPERTIES OF BOOSTING IMMUNITY AND SKIN HEALTH IN PETS TO DRIVE MARKET

- TABLE 71 FATS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 FATS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 FATS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 74 FATS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 75 FATS: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 76 FATS: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.5.2 FISH OIL

- TABLE 77 FISH OIL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 78 FISH OIL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5.3 TALLOW

- TABLE 79 TALLOW: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 TALLOW: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5.4 LARD

- TABLE 81 LARD: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 82 LARD: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5.5 POULTRY FAT

- TABLE 83 POULTRY FAT: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 POULTRY FAT: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5.6 VEGETABLE OIL

- TABLE 85 VEGETABLE OIL: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 86 VEGETABLE OIL: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 ADDITIVES

- 7.6.1 RISING FOCUS ON PET WELLNESS AND HEALTH BENEFITS TO DRIVE MARKET

- TABLE 87 ADDITIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 ADDITIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 89 ADDITIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 90 ADDITIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 91 ADDITIVES: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 92 ADDITIVES: PET FOOD INGREDIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.6.2 VITAMINS & MINERALS

- TABLE 93 VITAMINS & MINERALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 VITAMINS & MINERALS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6.3 ENZYMES

- TABLE 95 ENZYMES: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 ENZYMES: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6.4 OTHER ADDITIVES

- TABLE 97 OTHER ADDITIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 98 OTHER ADDITIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 PET FOOD INGREDIENTS MARKET, BY PET

- 8.1 INTRODUCTION

- FIGURE 44 NUMBER OF US HOUSEHOLDS THAT OWN A PET (2023-2024)

- FIGURE 45 PET FOOD INGREDIENTS MARKET, BY PET, 2023 VS. 2028

- TABLE 99 PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 100 PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 8.2 DOGS

- 8.2.1 HIGH ADOPTION RATE TO PRESENT ATTRACTIVE MARKET FOR PLAYERS

- TABLE 101 DOGS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 DOGS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CATS

- 8.3.1 HIGHER NUTRITIONAL REQUIREMENTS OF CATS TO DRIVE MARKET

- TABLE 103 LIST OF VITAMINS AND THEIR RELEVANCE

- TABLE 104 CATS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 105 CATS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 FISH

- 8.4.1 LOWER MAINTENANCE COST AND HIGH ADOPTION RATE TO DRIVE MARKET

- TABLE 106 FISH: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 107 FISH: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 OTHER PETS

- TABLE 108 OTHER PETS: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 109 OTHER PETS: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 PET FOOD INGREDIENTS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- FIGURE 46 PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023 VS. 2028

- TABLE 110 PET FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 111 PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 9.2 ANIMAL-BASED

- 9.2.1 HEALTH ADVANTAGES, HIGHER FEED INTAKE, AND GREATER ACCEPTANCE AMONG PETS TO BOOST DEMAND

- TABLE 112 ANIMAL-BASED: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 113 ANIMAL-BASED: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 PLANT DERIVATIVES

- 9.3.1 RISING TREND OF VEGANISM AND SURGING POPULARITY OF VEGAN PET FOOD PRODUCTS TO DRIVE MARKET

- TABLE 114 PLANT DERIVATIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 115 PLANT DERIVATIVES: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 SYNTHETIC

- 9.4.1 MULTIFUNCTIONALITY OF SYNTHETIC PET FOOD INGREDIENTS AND RISING FOCUS ON HEALTH & WELLNESS TO DRIVE MARKET

- TABLE 116 SYNTHETIC: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 117 SYNTHETIC: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PET FOOD INGREDIENTS MARKET, BY FORM

- 10.1 INTRODUCTION

- FIGURE 47 PET FOOD INGREDIENTS MARKET, BY FORM, 2023 VS. 2028

- TABLE 118 PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 119 PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 10.2 DRY

- 10.2.1 COST-EFFECTIVENESS AND HIGH NUTRIENT CONTENT TO BOOST MARKET

- TABLE 120 DRY PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 121 DRY PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 WET

- 10.3.1 HIGHER ACCEPTABILITY AMONG PET OWNERS TO DRIVE MARKET

- TABLE 122 WET PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 123 WET PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 PET FOOD INGREDIENTS MARKET, BY NATURE

- 11.1 INTRODUCTION

- 11.2 ORGANIC

- 11.2.1 BENEFITS ASSOCIATED WITH ORGANIC PET FOOD INGREDIENTS AND GOVERNMENT POLICIES TO FUEL DEMAND

- 11.3 INORGANIC

- 11.3.1 RISING DEMAND FOR INORGANIC PET FOOD PRODUCTS TO DRIVE MARKET

12 PET FOOD INGREDIENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 48 CHINA TO RECORD FASTEST GROWTH IN GLOBAL PET FOOD INGREDIENTS MARKET

- TABLE 124 PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 125 PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 126 PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 127 PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 49 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 50 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 51 NORTH AMERICA: PET FOOD INGREDIENTS MARKET SNAPSHOT

- TABLE 128 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (KT)

- TABLE 137 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (KT)

- TABLE 138 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Rising pet adoption rate to present significant business opportunities for pet food ingredient manufacturers

- FIGURE 52 NUMBER OF US HOUSEHOLDS THAT OWN A PET (IN MILLIONS), 2023

- FIGURE 53 TOTAL US PET INDUSTRY EXPENDITURE, 2018-2022

- TABLE 150 US: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 151 US: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Increased spending on health-focused pet products to drive market

- FIGURE 54 CANADIAN DOMESTIC EXPORTS OF PET FOOD (USD MILLION): TOP 10 MARKETS IN 2022

- TABLE 152 CANADA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 153 CANADA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Rising awareness about healthier nutritional alternatives for pets, coupled with key player investments in pet food, to drive market

- TABLE 154 MEXICO: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 155 MEXICO: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.3 ASIA PACIFIC

- FIGURE 55 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET SNAPSHOT

- 12.3.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 56 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 57 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 156 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (KT)

- TABLE 165 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (KT)

- TABLE 166 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.3.2 CHINA

- 12.3.2.1 Increasing spending on pet nutrition and health to drive market

- FIGURE 58 CHINA'S IMPORT OF PET FOOD, BY VALUE, 2017-2021 AND 2022 (JANUARY-NOVEMBER)

- FIGURE 59 PET POPULATION IN CHINA, 2016-2022

- TABLE 178 CHINA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 179 CHINA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.3.3 JAPAN

- 12.3.3.1 Rising focus on protein-rich ingredients and health and nutrition of pet animals to drive market

- TABLE 180 JAPAN: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 181 JAPAN: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.3.4 INDIA

- 12.3.4.1 Emerging middle-class population and improving economic conditions to boost market

- TABLE 182 INDIA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 183 INDIA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.3.5 AUSTRALIA & NEW ZEALAND

- 12.3.5.1 Rising spending on pets to drive pet food ingredients market

- FIGURE 60 EXPENSES ON PETS IN AUSTRALIA, 2022

- TABLE 184 AUSTRALIA & NEW ZEALAND: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 185 AUSTRALIA & NEW ZEALAND: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.3.6 REST OF ASIA PACIFIC

- TABLE 186 REST OF ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.4 EUROPE

- 12.4.1 EUROPE: RECESSION IMPACT

- FIGURE 61 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 62 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- TABLE 188 EUROPE: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 189 EUROPE: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 190 EUROPE: PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 191 EUROPE: PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 192 EUROPE: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 193 EUROPE: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- TABLE 194 EUROPE: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 195 EUROPE: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 196 EUROPE: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (KT)

- TABLE 197 EUROPE: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (KT)

- TABLE 198 EUROPE: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 199 EUROPE: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 200 EUROPE: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 201 EUROPE: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 202 EUROPE: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 203 EUROPE: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 204 EUROPE: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 205 EUROPE: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 206 EUROPE: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 207 EUROPE: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 208 EUROPE: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 209 EUROPE: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.4.2 GERMANY

- 12.4.2.1 Rising ownership due to pet humanization and emotional support to drive market

- TABLE 210 GERMANY: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 211 GERMANY: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.4.3 RUSSIA

- 12.4.3.1 Rising demand for industrially prepared pet food to boost market

- TABLE 212 RUSSIA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 213 RUSSIA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.4.4 UK

- 12.4.4.1 Strategic developments of companies to drive market

- FIGURE 63 TOP 10 PETS IN UK 2023

- FIGURE 64 SURVEY OF PET OWNERS: 48% OF UK POPULATION TREATS PET AS FAMILY MEMBER, 2021

- TABLE 214 UK: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 215 UK: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.4.5 FRANCE

- 12.4.5.1 Rising demand for premium and health-oriented pet products to drive market

- TABLE 216 FRANCE: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 217 FRANCE: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.4.6 ITALY

- 12.4.6.1 Large number of investments and expansions to drive market

- TABLE 218 ITALY: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 219 ITALY: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.4.7 REST OF EUROPE

- TABLE 220 REST OF EUROPE: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 221 REST OF EUROPE: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.5 SOUTH AMERICA

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT

- FIGURE 65 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 66 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 222 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 223 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 224 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 225 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 226 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 227 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- TABLE 228 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 229 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 230 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (KT)

- TABLE 231 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (KT)

- TABLE 232 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 234 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 235 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 236 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 237 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 238 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 239 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 240 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 241 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 242 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 243 SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Rising spending on premium pet food products to boost market

- FIGURE 67 PET INDUSTRY EXPENDITURE IN BRAZIL, 2022

- TABLE 244 BRAZIL: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 245 BRAZIL: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Improved economic conditions and large pet dog population to drive market

- TABLE 246 ARGENTINA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 247 ARGENTINA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 248 REST OF SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD

- 12.6.1 REST OF THE WORLD: RECESSION IMPACT

- FIGURE 68 REST OF THE WORLD: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 69 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- TABLE 250 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 251 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 252 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 253 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 254 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 255 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- TABLE 256 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 257 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 258 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2019-2022 (KT)

- TABLE 259 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY INGREDIENT, 2023-2028 (KT)

- TABLE 260 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 261 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR MEAT & MEAT PRODUCTS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 262 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 263 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR CEREALS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 264 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 265 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR VEGETABLES & FRUITS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 266 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 267 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR FATS, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 268 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2019-2022 (USD MILLION)

- TABLE 269 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET FOR ADDITIVES, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 270 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 271 REST OF THE WORLD: PET FOOD INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Rising pet humanization trend among growing middle-class population to drive market

- TABLE 272 MIDDLE EAST: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 273 MIDDLE EAST: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

- 12.6.3 AFRICA

- 12.6.3.1 Large pet population and rising demand for premium pet food products to drive market

- TABLE 274 AFRICA: PET FOOD INGREDIENTS MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 275 AFRICA: PET FOOD INGREDIENTS MARKET, BY PET, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2 MARKET SHARE ANALYSIS, 2022

- TABLE 276 PET FOOD INGREDIENTS MARKET: DEGREE OF COMPETITION, 2022

- TABLE 277 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 REVENUE ANALYSIS

- FIGURE 70 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD BILLION)

- 13.4 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- FIGURE 71 PET FOOD INGREDIENTS MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.4.5 PET FOOD INGREDIENTS MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 278 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

- TABLE 279 COMPANY FOOTPRINT, BY PET (KEY PLAYERS)

- TABLE 280 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 281 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- 13.5 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION MATRIX, 2022

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 72 PET FOOD INGREDIENTS MARKET: SME EVALUATION MATRIX, 2022 (OTHER PLAYERS)

- 13.5.5 COMPETITIVE BENCHMARKING

- TABLE 282 PET FOOD INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- 13.6 COMPETITIVE SCENARIO

- 13.6.1 PRODUCT LAUNCHES

- TABLE 283 PET FOOD INGREDIENTS MARKET: PRODUCT LAUNCHES, 2019,-2023

- 13.6.2 DEALS

- TABLE 284 PET FOOD INGREDIENTS MARKET: DEALS, 2019-2023

- 13.6.3 OTHER DEVELOPMENTS

- TABLE 285 PET FOOD INGREDIENTS MARKET: OTHER DEVELOPMENTS, 2019-2023

14 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent developments & MnM View)**

- 14.1 KEY PLAYERS

- 14.1.1 BASF SE

- TABLE 286 BASF SE: BUSINESS OVERVIEW

- FIGURE 73 BASF SE: COMPANY SNAPSHOT

- TABLE 287 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 BASF SE: DEALS

- TABLE 289 BASF SE: OTHER DEVELOPMENTS

- 14.1.2 DARLING INGREDIENTS INC

- TABLE 290 DARLING INGREDIENTS INC: BUSINESS OVERVIEW

- FIGURE 74 DARLING INGREDIENTS INC: COMPANY SNAPSHOT

- TABLE 291 DARLING INGREDIENTS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 DARLING INGREDIENTS INC: DEALS

- 14.1.3 CARGILL, INCORPORATED

- TABLE 293 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 75 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 294 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 296 CARGILL, INCORPORATED: OTHER DEVELOPMENTS

- 14.1.4 INGREDION

- TABLE 297 INGREDION: BUSINESS OVERVIEW

- FIGURE 76 INGREDION: COMPANY SNAPSHOT

- TABLE 298 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 INGREDION: OTHER DEVELOPMENTS

- 14.1.5 DSM

- TABLE 300 DSM: BUSINESS OVERVIEW

- FIGURE 77 DSM: COMPANY SNAPSHOT

- TABLE 301 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 DSM: DEALS

- TABLE 303 DSM: OTHER DEVELOPMENTS

- 14.1.6 OMEGA PROTEIN CORPORATION

- TABLE 304 OMEGA PROTEIN CORPORATION: BUSINESS OVERVIEW

- TABLE 305 OMEGA PROTEIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.7 ADM

- TABLE 306 ADM: BUSINESS OVERVIEW

- FIGURE 78 ADM: COMPANY SNAPSHOT

- TABLE 307 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 ADM: DEALS

- TABLE 309 ADM: OTHER DEVELOPMENTS

- 14.1.8 KEMIN INDUSTRIES, INC

- TABLE 310 KEMIN INDUSTRIES, INC: BUSINESS OVERVIEW

- TABLE 311 KEMIN INDUSTRIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 KEMIN INDUSTRIES, INC: DEALS

- TABLE 313 KEMIN INDUSTRIES, INC: OTHER DEVELOPMENTS

- 14.1.9 CHR. HANSEN HOLDING A/S

- TABLE 314 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 79 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 315 CHR. HANSEN HOLDING A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 CHR. HANSEN HOLDING A/S: PRODUCT LAUNCHES

- 14.1.10 ROQUETTE FRERES

- TABLE 317 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 318 ROQUETTE FRERES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 ROQUETTE FRERES: DEALS

- 14.1.11 THE SCOULAR COMPANY

- TABLE 320 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 321 THE SCOULAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 THE SCOULAR COMPANY: DEALS

- TABLE 323 THE SCOULAR COMPANY: OTHER DEVELOPMENTS

- 14.1.12 SYMRISE

- TABLE 324 SYMRISE: BUSINESS OVERVIEW

- FIGURE 80 SYMRISE: COMPANY SNAPSHOT

- TABLE 325 SYMRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 SYMRISE: DEALS

- TABLE 327 SYMRISE: OTHER DEVELOPMENTS

- 14.1.13 MOWI

- TABLE 328 MOWI: BUSINESS OVERVIEW

- FIGURE 81 MOWI: COMPANY SNAPSHOT

- TABLE 329 MOWI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 LALLEMAND INC

- TABLE 330 LALLEMAND INC: BUSINESS OVERVIEW

- TABLE 331 LALLEMAND INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 LALLEMAND INC: PRODUCT LAUNCHES

- TABLE 333 LALLEMAND INC: DEALS

- TABLE 334 LALLEMAND INC: OTHER DEVELOPMENTS

- 14.1.15 PHILEO BY LESAFFRE

- TABLE 335 PHILEO BY LESAFFRE: BUSINESS OVERVIEW

- TABLE 336 PHILEO BY LESAFFRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 PHILEO BY LESAFFRE: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 3D CORPORATE SOLUTIONS

- TABLE 338 3D CORPORATE SOLUTIONS: BUSINESS OVERVIEW

- TABLE 339 3D CORPORATE SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 3D CORPORATE SOLUTIONS: DEALS

- 14.2.2 HYDRITE CHEMICAL

- TABLE 341 HYDRITE CHEMICAL: BUSINESS OVERVIEW

- TABLE 342 HYDRITE CHEMICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 HYDRITE CHEMICAL: PRODUCT LAUNCHES

- 14.2.3 AFB INTERNATIONAL

- TABLE 344 AFB INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 345 AFB INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 AFB INTERNATIONAL: OTHER DEVELOPMENTS

- 14.2.4 GILLCO INGREDIENTS

- TABLE 347 GILLCO INGREDIENTS: BUSINESS OVERVIEW

- TABLE 348 GILLCO INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 GILLCO INGREDIENTS: DEALS

- 14.2.5 SARIA INTERNATIONAL GMBH

- TABLE 350 SARIA INTERNATIONAL GMBH: BUSINESS OVERVIEW

- TABLE 351 SARIA INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.6 GREEN SOURCE ORGANICS

- TABLE 352 GREEN SOURCE ORGANICS: BUSINESS OVERVIEW

- 14.2.7 BIORIGIN

- TABLE 353 BIORIGIN: BUSINESS OVERVIEW

- 14.2.8 ZINPRO

- TABLE 354 ZINPRO: BUSINESS OVERVIEW

- 14.2.9 APS PHOENIX LLC

- TABLE 355 APS PHOENIX LLC: BUSINESS OVERVIEW

- 14.2.10 LABUDDE GROUP, INC

- TABLE 356 LABUDDE GROUP, INC: BUSINESS OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 357 ADJACENT MARKETS TO PET FOOD INGREDIENTS MARKET

- 15.2 LIMITATIONS

- 15.3 WET PET FOOD MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 358 WET PET FOOD MARKET, BY PET, 2019-2022 (USD MILLION)

- TABLE 359 WET PET FOOD MARKET, BY PET, 2023-2028 (USD MILLION)

- 15.4 PROBIOTICS IN ANIMAL FEED MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 360 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 361 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS