|

|

市場調査レポート

商品コード

1453783

スマートセンサーの世界市場:タイプ別、技術別、ネットワーク接続性別、コンポーネント別、エンドユーザー業界別、地域別-2029年までの予測Smart Sensors Market by Type (Temperature & Humidity Sensor, Pressure Sensor, Motion & Occupancy Sensor), Technology (CMOS, MEMS), Component (Microcontrollers, Amplifiers, Transceivers), End-User Industry and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| スマートセンサーの世界市場:タイプ別、技術別、ネットワーク接続性別、コンポーネント別、エンドユーザー業界別、地域別-2029年までの予測 |

|

出版日: 2024年03月18日

発行: MarketsandMarkets

ページ情報: 英文 310 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

スマートセンサーの市場規模は、2024年に619億米ドルとなりました。

同市場は、2029年には1,363億米ドルに達すると予測され、2024年から2029年までのCAGRは17.1%になる見込みです。グリーンビルディングの建設に対する政府の支援、スマートセンサー対応ウェアラブルデバイスの需要の高まり、産業における予知保全のニーズの高まりが、スマートセンサー市場に有利な機会を提供しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、技術別、ネットワーク接続性別、コンポーネント別、エンドユーザー業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

温度・湿度センサセグメントは、その応用分野の拡大と様々な分野での需要増加により、予測期間中に最大のCAGRを記録すると予測されています。温度と湿度は、スマートホームや自動車においてスマートセンサーが監視する主要パラメータの1つです。

いくつかの新たな動向が、様々な産業における温湿度センサーの需要を促進しています。そのひとつが、スマートホームやビルオートメーションシステムの需要の増加です。これらのシステムは、暖房、換気、空調(HVAC)システムを調整するために温湿度センサーに大きく依存しており、エネルギー効率の向上と快適性の向上をもたらしています。もう1つの動向は、コネクテッド農業の利用拡大で、センサーを活用して温度や湿度など作物の生育状況を監視し、最適化します。これは、農業の収量と資源管理の改善に役立ちます。最後に、モノのインターネット(IoT)の拡大により、さまざまな機器や家電製品が接続されるようになっています。このため、データを収集し、インテリジェントな意思決定を可能にする温度・湿度センサーなどの環境モニタリングセンサーのニーズが高まっています。

MEMS技術セグメントが最大の市場シェアを占め、2024年から2029年までの予測期間中に最高の成長率を記録すると予測されています。MEMSベースのセンサは汎用性が高く、さまざまな分野で広く使用されています。スマートセンサー市場でも大きなシェアを占めています。自動車分野では、エアバッグ展開、タイヤ空気圧モニタリング、ナビゲーションシステムなどに使用されています。民生用電子機器では、モーショントラッキングや手ぶれ補正のためにスマートフォンやウェアラブル端末に使用されています。産業オートメーションでは、プロセス制御、液体流量モニタリング、振動モニタリングに使用されます。ヘルスケアでは、血圧モニタリング、アクティビティモニタリング、加速度測定に使用されています。

2023年、ドイツは欧州のスマートセンサー市場で最大のシェアを占めています。ドイツは自動車や化学製品の製造工場が多いです。この国の市場成長は、ドイツが世界の自動車ハブとして台頭してきたことに起因しています。そのため同国では、自動車の油圧や温度の制御や処理に使用できるインテリジェントな自動車用センサーの需要が増加しています。また、自動車の排ガスレベルや冷却水レベルなども調整します。また、様々な製造業で産業オートメーションと予知保全の導入が急増していることも、ドイツ市場の成長を後押ししています。

当レポートでは、世界のスマートセンサー市場について調査し、タイプ別、技術別、ネットワーク接続性別、コンポーネント別、エンドユーザー業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術動向

- ケーススタディ分析

- 特許分析

- 貿易分析

- 関税と規制状況

- 2024年~2025年の主要な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 スマートセンサー市場、タイプ別

- イントロダクション

- 温度および湿度センサー

- 圧力センサー

- フローセンサー

- タッチセンサー

- イメージセンサー

- モーションセンサーと占有センサー

- 水センサー

- 位置センサー

- 光センサー

- 超音波センサー

- その他

第7章 スマートセンサー市場、技術別

- イントロダクション

- スマートセンサー市場で考慮される主なパッケージタイプ

- マイクロ電気機械システム(MEMS)

- 相補型金属酸化物半導体(CMOS)

- その他

第8章 スマートセンサー市場、コンポーネント別

- イントロダクション

- アナログデジタルコンバーター

- デジタル/アナログコンバータ

- トランシーバー

- アンプ

- マイクロコントローラー

- その他

第9章 スマートセンサー市場、ネットワーク接続性別

- イントロダクション

- 有線ネットワーク接続

- 無線ネットワーク接続

第10章 スマートセンサー市場、エンドユーザー業界別

- イントロダクション

- 産業自動化

- ビルディングオートメーション

- 家電

- 生物医学とヘルスケア

- 自動車

- 航空宇宙と防衛

- その他

第11章 スマートセンサー市場、地域別

- イントロダクション

- 米国

- 欧州

- アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 主要企業5社の収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標

- ブランド/製品の比較

- 企業評価マトリックス、主要企業、2023年

- 企業評価マトリックス:新興企業/中小企業、2023年

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- ANALOG DEVICES, INC.

- TE CONNECTIVITY

- INFINEON TECHNOLOGIES AG

- STMICROELECTRONICS

- ABB

- MICROCHIP TECHNOLOGY INC.

- NXP SEMICONDUCTORS

- SIEMENS

- ROBERT BOSCH GMBH

- HONEYWELL INTERNATIONAL INC.

- その他の企業

- TDK CORPORATION

- EATON CORPORATION

- EMERSON ELECTRIC CO.

- GENERAL ELECTRIC

- LEGRAND

- TEXAS INSTRUMENTS INCORPORATED

- BALLUFF GMBH

- SENSIRION AG

- QUALCOMM TECHNOLOGIES, INC.

- MEMSIC SEMICONDUCTOR CO., LTD.

- AIRMAR TECHNOLOGY CORPORATION

- VISHAY PRECISION GROUP INC.

- GILL SENSORS & CONTROLS LIMITED

- MURATA MANUFACTURING CO., LTD.

- RENESAS ELECTRONICS CORPORATION

第14章 付録

The smart sensors market was valued at USD 61.9 billion in 2024 and is projected to reach USD 136.3 billion by 2029; it is expected to grow at a CAGR of 17.1% from 2024 to 2029. Government support for construction of green buildings, rising demand for smart sensor-enabled wearable devices, and growing need for predictive maintenance in industries provide lucrative opportunities to the smart sensors market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Technology, Network Connectivity, Component, End-user Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Temperature & Humidity sensors segment to register highest growth rate during the forecast period."

The temperature & humidity sensors segment is expected to record the highest CAGR during the forecast period due to their expanding application areas and increasing demand in various sectors. Temperature and humidity are one of the the major parameters monitored by smart sensors in smart homes and automotives.

Several emerging trends are driving the demand for temperature and humidity sensors in various industries. One of them is the increasing demand for smart home and building automation systems. These systems rely heavily on temperature and humidity sensors to regulate heating, ventilation, and air conditioning (HVAC) systems, resulting in increased energy efficiency and improved comfort. Another trend is the growing use of connected agriculture, where sensors are utilized to monitor and optimize crop growth conditions, including temperature and humidity. This helps in improving agricultural yields and resource management. Lastly, the expansion of the Internet of Things (IoT) has resulted in various devices and appliances becoming connected. This has led to an increased need for environmental monitoring sensors like temperature and humidity sensors to collect data and enable intelligent decision-making.

"MEMS technology segment is expected to register highest growth rate during the forecast period."

The MEMS technology segment holds the largest market share and is expected to grow with the highest growth rate during the forecast period from 2024 to 2029. MEMS-based sensors are versatile and widely used across various sectors. They have a significant market share in the smart sensor market. They are used in automotive for airbag deployment, tire pressure monitoring, and navigation systems. For consumer electronics, they are used in smartphones and wearables for motion tracking and image stabilization. In industrial automation, they are used for process control, liquid flow monitoring, and vibration monitoring. In healthcare, they are used for blood pressure monitoring, activity monitoring, and acceleration measurement.

"Germany in Europe is expected to hold the largest market share during the forecast period."

In 2023, Germany accounted for the largest share of the European smart sensors market. Germany has a large number of automobile and chemical manufacturing plants. The growth of the market in this country can be attributed to the fact that Germany has emerged as a global automobile hub in the world. As such, the country witnesses increased demand for automobile sensors that are intelligent and can be used to control and process oil pressure and temperature in automobiles. They also regulate vehicle emission levels, coolant levels, etc. Also, a surge in the adoption of industrial automation and predictive maintenance in various manufacturing industries is likely to drive market growth in Germany.

Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 45 %, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-Level Executives -32%, Directors- 40%, and Others - 28%

- By Region: Americas- 37%, Europe- 15%, Asia Pacific - 40%, and RoW - 8%

The report profiles key smart sensors market players and analyzes their market shares. Players profiled in this report are Analog Devices, Inc. (US), Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Microchip Technology Inc. (US), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Siemens (Germany), ABB (Switzerland), etc.

Research Coverage

The report defines, describes, and forecasts the smart sensors market based on Type, Component, Technology, Network Connectivity, End-user Industry, and Region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the smart sensors market. It also analyses competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions conducted by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall high-speed data converter and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Surging demand for IOT-based devices and consumer electronics, increasing use of smart sensors to meet Industry 4.0 requirements, high demand for smart sensors in automobile industry, and increasing demand for wireless technology to monitor and control security devices), restraints (High installation and maintenance costs), opportunities (Rising demand for smart sensor-enabled wearable devices, government support for construction of green buildings, and growing need for predictive maintenance in industries), and challenges (Stringent application-based performance requirements, and lack of skilled workforce) influencing the growth of the smart sensors market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart sensors market

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart sensors market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart sensors market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Analog Devices, Inc. (US), Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Microchip Technology Inc. (US), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Siemens (Germany), ABB (Switzerland), Honeywell International Inc. (US), Robert Bosch GmbH (Germany), TDK Corporation (Japan), Sensirion AG (Switzerland), Eaton (Ireland), Emerson Electric Co. (US), NXP Semiconductors (Netherlands), General Electric (US), Legrand (France), Balluff GmbH (US), among others in the smart sensors market strategies. The report also helps stakeholders understand the pulse of the smart sensors market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- FIGURE 1 SMART SENSORS MARKET SEGMENTATION

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SMART SENSORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 APPROACH USED TO CAPTURE MARKET SIZE FROM SUPPLY SIDE

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON SMART SENSORS MARKET

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 PRESSURE SENSORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 MEMS TECHNOLOGY SEGMENT TO RECORD HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 10 MICROCONTROLLERS SEGMENT TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 11 CONSUMER ELECTRONICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

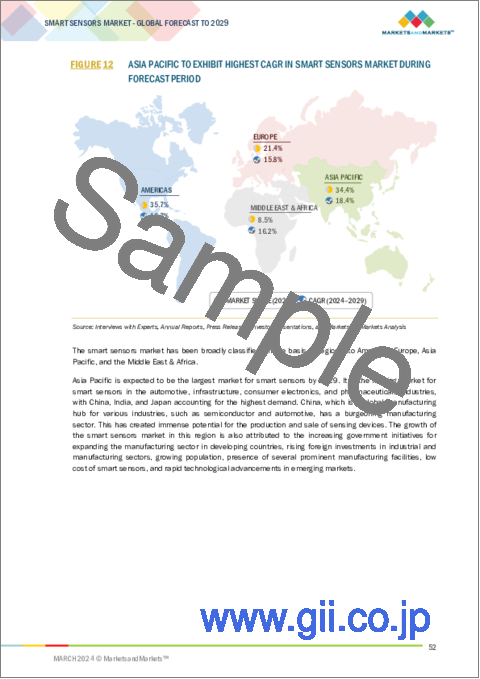

- FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN SMART SENSORS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 MAJOR OPPORTUNITIES FOR PLAYERS IN SMART SENSORS MARKET

- FIGURE 13 GROWING ADOPTION OF INDUSTRY 4.0 TO BOOST MARKET GROWTH

- 4.2 SMART SENSORS MARKET, BY TECHNOLOGY

- FIGURE 14 MICROELECTROMECHANICAL SYSTEMS (MEMS) SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 SMART SENSORS MARKET, BY TYPE

- FIGURE 15 PRESSURE SENSORS SEGMENT TO DOMINATE MARKET IN 2029

- 4.4 SMART SENSORS MARKET IN NORTH AMERICA, BY END-USER INDUSTRY AND COUNTRY

- FIGURE 16 CONSUMER ELECTRONICS SEGMENT AND US LED MARKET IN NORTH AMERICA IN 2024

- 4.5 SMART SENSORS MARKET, BY END-USER INDUSTRY

- FIGURE 17 CONSUMER ELECTRONICS INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2029

- 4.6 SMART SENSORS MARKET, BY COUNTRY

- FIGURE 18 INDIA TO RECORD HIGHEST CAGR IN GLOBAL SMART SENSORS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 SMART SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for IoT-based devices and consumer electronics

- TABLE 1 COMPARATIVE STUDY OF VARIOUS SMARTPHONE BRANDS (SHIPMENTS IN MILLION UNITS)

- 5.2.1.2 Increasing use of smart sensors to meet Industry 4.0 requirements

- 5.2.1.3 High demand for smart sensors in automobile industry

- 5.2.1.4 Increasing demand for wireless technology to monitor and control security devices

- FIGURE 20 IMPACT OF DRIVERS ON SMART SENSORS MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs

- FIGURE 21 IMPACT OF RESTRAINTS ON SMART SENSORS MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for smart sensor-enabled wearable devices

- TABLE 2 COMPARATIVE STUDY OF VARIOUS WEARABLE DEVICE BRANDS (SHIPMENTS IN MILLION UNITS)

- 5.2.3.2 Government support for construction of green buildings

- 5.2.3.3 Growing need for predictive maintenance in industries

- FIGURE 22 IMPACT OF OPPORTUNITIES ON SMART SENSORS MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent application-based performance requirements

- 5.2.4.2 Lack of skilled workforce

- FIGURE 23 IMPACT OF CHALLENGES ON SMART SENSORS MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 TRENDS INFLUENCING SMART SENSOR BUSINESS OWNERS

- 5.4 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE OF TEMPERATURE SENSORS, 2024

- TABLE 4 AVERAGE SELLING PRICE OF ANGULAR SENSORS, 2024

- TABLE 5 AVERAGE SELLING PRICE OF GAS SENSORS, 2024

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 25 SMART SENSORS MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 26 SMART SENSORS ECOSYSTEM

- TABLE 6 ROLE OF PLAYERS IN SMART SENSORS ECOSYSTEM

- 5.7 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 FUNDS ACQUIRED BY COMPANIES IN SMART SENSORS MARKET

- 5.8 TECHNOLOGY TRENDS

- 5.8.1 GLUCOSE SENSORS (BIOLOGICAL SENSORS)

- 5.8.2 COGNITIVE SENSING

- 5.8.3 SEED TECHNOLOGY

- 5.8.4 UBIQUITOUS SENSOR NETWORKS

- 5.8.5 PRINTED GAS SENSORS

- 5.8.6 MICRO-ELECTRO-MECHANICAL SYSTEM (MEMS) SENSOR TECHNOLOGY

- 5.8.7 AI SENSOR TECHNOLOGY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CERN PARTNERS WITH ABB TO ACHIEVE ENERGY EFFICIENCY OBJECTIVES

- 5.9.2 VARDE MUNICIPALITY USES FILL-LEVEL SENSORS TO REDUCE CO2 EMISSIONS

- 5.9.3 PRESSAC OFFERS SMART GATEWAY TO MATRIX BOOKING FOR SEAMLESS DATA COLLECTION

- 5.10 PATENT ANALYSIS

- FIGURE 28 COMPANIES WITH SIGNIFICANT NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 7 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- FIGURE 29 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2023

- TABLE 8 MAJOR PATENTS IN SMART SENSORS MARKET

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- FIGURE 30 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902690, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11.2 EXPORT SCENARIO

- FIGURE 31 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902690, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- TABLE 9 MFN TARIFFS FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 10 MFN TARIFFS FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 11 MFN TARIFFS FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 12 MFN TARIFFS FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY CHINA

- 5.12.2 REGULATORY LANDSCAPE

- 5.12.2.1 Regulatory bodies, government agencies, and other organizations

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2.2 Codes and standards

- TABLE 17 CODES AND STANDARDS RELATED TO SMART SENSORS MARKET

- 5.13 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 18 SMART SENSORS MARKET: CONFERENCES AND EVENTS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 IMPACT OF PORTER'S FIVE FORCES ON SMART SENSORS MARKET

- FIGURE 32 SMART SENSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- 5.15.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

6 SMART SENSORS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 RISING USE OF SMART DEVICES ACROSS INDUSTRIES

- FIGURE 35 GROWING ADOPTION OF SMART SENSORS IN VARIOUS APPLICATIONS

- 6.1.2 INNOVATION IN SMART SENSORS TO BOOST IOT CAPABILITIES

- FIGURE 36 PRESSURE SENSORS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 22 SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 23 SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 24 SMART SENSORS MARKET, BY TYPE, 2020-2023 (MILLION UNITS)

- TABLE 25 SMART SENSORS MARKET, BY TYPE, 2024-2029 (MILLION UNITS)

- 6.2 TEMPERATURE & HUMIDITY SENSORS

- 6.2.1 INCREASING USE IN BUILDING AUTOMATION, AUTOMOTIVE, AND HEALTHCARE INDUSTRIES TO FUEL MARKET

- 6.2.2 MAJOR TYPES OF TEMPERATURE SENSORS

- 6.2.2.1 Thermocouples

- 6.2.2.2 Thermistors

- 6.2.2.3 Resistance temperature detectors

- 6.2.2.4 IR sensors

- 6.2.2.5 Others

- 6.2.2.5.1 MEMS technology-based temperature sensors

- 6.2.2.5.2 USB-based temperature sensors

- 6.2.2.5.3 Wi-Fi-based temperature sensors

- 6.2.2.5.4 ZigBee-based temperature sensors

- 6.2.2.5.5 Bluetooth-based temperature sensors

- 6.2.2.5.6 RFID temperature sensors

- 6.2.3 MAJOR TYPES OF HUMIDITY SENSORS

- 6.2.3.1 Capacitive humidity sensors

- 6.2.3.2 Resistive humidity sensors

- TABLE 26 PROPERTIES OF HUMIDITY SENSORS

- TABLE 27 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 28 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 29 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 30 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.3 PRESSURE SENSORS

- 6.3.1 RISING USE OF MEMS-BASED PRESSURE SENSORS TO DRIVE MARKET

- 6.3.2 MAJOR TYPES OF PRESSURE SENSORS

- 6.3.2.1 Differential and gauge

- 6.3.2.2 Vacuum and absolute

- 6.3.3 MAJOR PRESSURE SENSING TECHNOLOGIES

- 6.3.3.1 Piezoresistive pressure sensors

- 6.3.3.2 Capacitive pressure sensors

- 6.3.3.3 Electromagnetic pressure sensors

- 6.3.3.4 Resonant solid-state pressure sensors

- 6.3.3.5 Optical pressure sensors

- TABLE 31 SMART PRESSURE SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 32 SMART PRESSURE SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 33 SMART PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

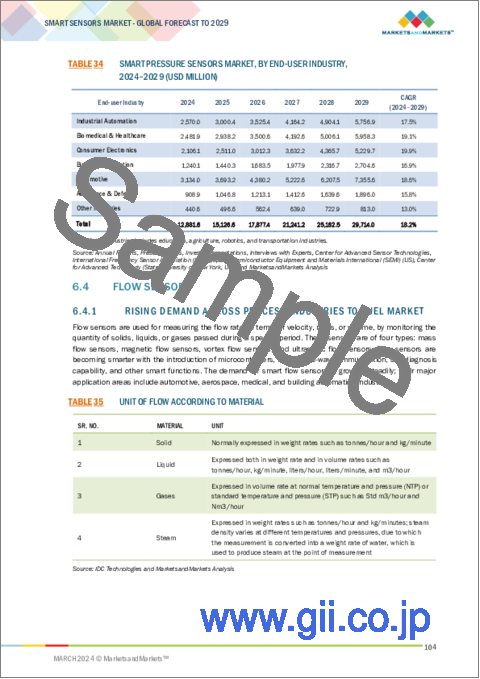

- TABLE 34 SMART PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.4 FLOW SENSORS

- 6.4.1 RISING DEMAND ACROSS PROCESS INDUSTRIES TO FUEL MARKET

- TABLE 35 UNIT OF FLOW ACCORDING TO MATERIAL

- TABLE 36 SMART FLOW SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 37 SMART FLOW SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 38 SMART FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 39 SMART FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.5 TOUCH SENSORS

- 6.5.1 INCREASING USE IN SMARTPHONES TO PROPEL DEMAND

- 6.5.2 MAJOR TOUCH SENSING TECHNOLOGIES

- 6.5.2.1 Capacitive sensors

- 6.5.2.2 Resistive sensors

- 6.5.2.3 Infrared sensors

- TABLE 40 SMART TOUCH SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 41 SMART TOUCH SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 42 SMART TOUCH SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 43 SMART TOUCH SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.6 IMAGE SENSORS

- 6.6.1 WIDE ADOPTION OF CMOS-BASED IMAGE SENSORS TO DRIVE MARKET

- 6.6.2 MAJOR IMAGE SENSING TECHNOLOGIES

- 6.6.2.1 CMOS-based image sensors

- 6.6.2.2 Fingerprint recognition

- 6.6.2.3 Iris scanning

- TABLE 44 SMART IMAGE SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 45 SMART IMAGE SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 46 SMART IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 47 SMART IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.7 MOTION & OCCUPANCY SENSORS

- 6.7.1 MOTION SENSORS

- 6.7.1.1 Growing demand for smart consumer electronics to fuel market

- 6.7.2 MAJOR EMBEDDED SENSOR TYPES IN MOTION SENSORS

- 6.7.2.1 MEMS accelerometers

- 6.7.2.2 MEMS gyroscopes

- 6.7.2.3 MEMS magnetometers

- 6.7.2.4 Sensor combos

- 6.7.3 OCCUPANCY SENSORS

- 6.7.3.1 PIR-based occupancy sensors to dominate market

- 6.7.4 MAJOR TYPES OF OCCUPANCY SENSORS

- 6.7.4.1 PIR-based sensors

- 6.7.4.2 Ultrasonic-based sensors

- 6.7.4.3 Dual technology-based sensors

- TABLE 48 SMART MOTION & OCCUPANCY SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 49 SMART MOTION & OCCUPANCY SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 50 SMART MOTION & OCCUPANCY SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 51 SMART MOTION AND OCCUPANCY SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.7.1 MOTION SENSORS

- 6.8 WATER SENSORS

- 6.8.1 GOVERNMENT REGULATIONS TO PROMOTE MARKET GROWTH

- TABLE 52 SMART WATER SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 53 SMART WATER SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 6.8.2 MAJOR TYPES OF WATER SENSORS

- 6.8.2.1 Turbidity sensors

- 6.8.2.2 pH sensors

- 6.8.2.3 Soil moisture sensors

- 6.8.2.4 Level sensors

- 6.8.2.5 Dissolved oxygen (DO2) sensors

- TABLE 54 SMART WATER SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 55 SMART WATER SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 56 SMART WATER SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 57 SMART WATER SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.9 POSITION SENSORS

- 6.9.1 INCREASING DEMAND IN AUTOMOTIVE INDUSTRY TO FUEL MARKET

- 6.9.2 MAJOR TYPES OF POSITION SENSORS

- 6.9.2.1 Linear position sensors

- 6.9.2.2 Rotary position sensors

- 6.9.2.3 Proximity sensors

- TABLE 58 SMART POSITION SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 59 SMART POSITION SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 60 SMART POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 61 SMART POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.10 LIGHT SENSORS

- 6.10.1 INCREASED USE IN CONSUMER ELECTRONICS TO BOOST DEMAND

- 6.10.2 MAJOR TYPES OF LIGHT SENSORS

- 6.10.2.1 Analog light sensors

- 6.10.2.2 Digital light sensors

- TABLE 62 SMART LIGHT SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 63 SMART LIGHT SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 64 SMART LIGHT SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 65 SMART LIGHT SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.11 ULTRASONIC SENSORS

- 6.11.1 RISING USE IN INDUSTRIAL AUTOMATION TO DRIVE MARKET

- TABLE 66 SMART ULTRASONIC SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 67 SMART ULTRASONIC SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 68 SMART ULTRASONIC SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 69 SMART ULTRASONIC SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 6.12 OTHER SENSORS

- 6.12.1 ELECTRICAL CONDUCTIVITY SENSORS

- 6.12.2 GESTURE SENSORS

- 6.12.3 RADAR SENSORS

- 6.12.4 OXIDATION REDUCTION POTENTIAL (ORP) SENSORS

- 6.12.5 COLOR SENSORS

- TABLE 70 OTHER SMART SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 71 OTHER SMART SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 72 OTHER SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 73 OTHER SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

7 SMART SENSORS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 37 SMART SENSORS MARKET, BY TECHNOLOGY

- FIGURE 38 MICROELECTROMECHANICAL SYSTEMS (MEMS) SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 74 SMART SENSORS MARKET, BY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 75 SMART SENSORS MARKET, BY TECHNOLOGY, 2024-2029 (USD BILLION)

- 7.2 MAJOR PACKAGING TYPES CONSIDERED IN SMART SENSORS MARKET

- 7.2.1 SYSTEM-IN-PACKAGE (SIP)

- 7.2.1.1 Surging demand for miniaturization to drive demand

- 7.2.2 SYSTEM-ON-CHIP (SOC)

- 7.2.2.1 Portability and fast circuit operation to propel market

- TABLE 76 TECHNICAL FEATURES OF SYSTEM-IN-PACKAGE (SIP) AND SYSTEM-ON-CHIP (SOC)

- 7.2.1 SYSTEM-IN-PACKAGE (SIP)

- 7.3 MICROELECTROMECHANICAL SYSTEMS (MEMS)

- 7.3.1 INCREASING ADOPTION IN VARIOUS PROCESS INDUSTRIES TO BOOST MARKET

- TABLE 77 MEMS: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 78 MEMS: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.2 ROLE OF VERY LARGE SCALE INTEGRATION TECHNOLOGY (VLSI)

- 7.3.3 RELEVANCE OF NANOELECTROMECHANICAL SYSTEMS (NEMS)

- FIGURE 39 MERITS AND DEMERITS OF MEMS TECHNOLOGY

- 7.4 COMPLEMENTARY METAL-OXIDE-SEMICONDUCTOR (CMOS)

- 7.4.1 LOW STATIC POWER CONSUMPTION AND HIGH NOISE IMMUNITY TO DRIVE DEMAND

- FIGURE 40 MERITS AND DEMERITS OF CMOS TECHNOLOGY

- TABLE 79 CMOS: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 80 CMOS: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.5 OTHER TECHNOLOGIES

- 7.5.1 OPTICAL SPECTROSCOPY

- 7.5.2 MICROSYSTEMS TECHNOLOGY (MST)

- 7.5.3 INTEGRATED SMART SENSOR - HYBRID SENSOR

- 7.5.4 IC-COMPATIBLE 3D MICROSTRUCTURING

- 7.5.5 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC)

- 7.5.6 OPTICAL SENSING

- TABLE 81 OTHER TECHNOLOGIES: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 82 OTHER TECHNOLOGIES: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

8 SMART SENSORS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- FIGURE 41 SMART SENSORS MARKET, BY COMPONENT

- FIGURE 42 MICROCONTROLLERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 83 SMART SENSORS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 84 SMART SENSORS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- 8.2 ANALOG-TO-DIGITAL CONVERTERS

- 8.2.1 OFFER HIGH SAMPLING RATE AND EASY INTEGRATION

- 8.2.1.1 Advantages of analog-to-digital converters

- 8.2.1 OFFER HIGH SAMPLING RATE AND EASY INTEGRATION

- 8.3 DIGITAL-TO-ANALOG CONVERTERS

- 8.3.1 PROVIDE INTERFACE BETWEEN DIGITAL AND REAL WORLD

- 8.3.1.1 Advantages of digital-to-analog converters

- 8.3.1 PROVIDE INTERFACE BETWEEN DIGITAL AND REAL WORLD

- 8.4 TRANSCEIVERS

- 8.4.1 MAINLY USED IN WIRELESS COMMUNICATION DEVICES

- 8.4.1.1 Advantages of transceivers

- 8.4.1 MAINLY USED IN WIRELESS COMMUNICATION DEVICES

- 8.5 AMPLIFIERS

- 8.5.1 HELP INCREASE SIGNAL POWER

- 8.5.1.1 Advantages of amplifiers

- 8.5.1 HELP INCREASE SIGNAL POWER

- 8.6 MICROCONTROLLERS

- 8.6.1 CONTROL FUNCTIONS OF EMBEDDED SYSTEMS IN GADGETS

- 8.6.1.1 Advantages of microcontrollers

- 8.6.1 CONTROL FUNCTIONS OF EMBEDDED SYSTEMS IN GADGETS

- 8.7 OTHER COMPONENTS

9 SMART SENSORS MARKET, BY NETWORK CONNECTIVITY

- 9.1 INTRODUCTION

- FIGURE 43 SMART SENSORS MARKET, BY NETWORK CONNECTIVITY

- 9.2 WIRED NETWORK CONNECTIVITY

- 9.2.1 KNX

- 9.2.2 LONWORKS

- 9.2.3 ETHERNET

- 9.2.4 MODBUS

- 9.2.5 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

- 9.3 WIRELESS NETWORK CONNECTIVITY

- 9.3.1 ENOCEAN

- 9.3.2 WI-FI

- 9.3.3 ZIGBEE

- 9.3.4 Z-WAVE

- 9.3.5 NFC

- 9.3.6 RFID

- 9.3.7 WIRELESS-HART (WHART)

- 9.3.8 PROFIBUS

- 9.3.9 DECT-ULE

- 9.3.10 BLUETOOTH

- 9.3.10.1 Bluetooth Smart

- 9.3.10.2 Wi-Fi/Bluetooth Smart

- 9.3.10.3 Bluetooth Smart/ANT+

- 9.3.10.4 Bluetooth 5

- 9.3.11 OTHERS

10 SMART SENSORS MARKET, BY END-USER INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 44 CONSUMER ELECTRONICS INDUSTRY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 85 SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 86 SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD BILLION)

- 10.2 INDUSTRIAL AUTOMATION

- 10.2.1 SURGING ADOPTION IN PROCESS INDUSTRIES TO DRIVE MARKET

- TABLE 87 SMART SENSORS USED IN INDUSTRIAL AUTOMATION INDUSTRY

- TABLE 88 INDUSTRIAL AUTOMATION: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 INDUSTRIAL AUTOMATION: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 90 INDUSTRIAL AUTOMATION: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 INDUSTRIAL AUTOMATION: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 BUILDING AUTOMATION

- 10.3.1 RISING NEED TO MONITOR SURVEILLANCE SYSTEMS TO BOOST DEMAND

- TABLE 92 SMART SENSORS USED IN BUILDING AUTOMATION INDUSTRY

- TABLE 93 BUILDING AUTOMATION: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 94 BUILDING AUTOMATION: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 95 BUILDING AUTOMATION: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 BUILDING AUTOMATION: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 BUILDING AUTOMATION: SMART SENSORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 98 BUILDING AUTOMATION: SMART SENSORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.3.2 BY APPLICATION

- 10.3.2.1 Security & surveillance systems

- 10.3.2.2 Access control systems

- 10.3.2.3 Radio frequency identification (RFID) tags

- 10.3.2.4 Lighting control systems

- 10.3.2.5 Heating, ventilation, and air-conditioning (HVAC) systems

- 10.3.2.6 Other applications

- 10.4 CONSUMER ELECTRONICS

- 10.4.1 GROWING DEMAND FOR WEARABLE ELECTRONICS TO DRIVE MARKET

- TABLE 99 CONSUMER ELECTRONICS: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 100 CONSUMER ELECTRONICS: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 101 CONSUMER ELECTRONICS: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 CONSUMER ELECTRONICS: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 103 CONSUMER ELECTRONICS: SMART SENSORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 CONSUMER ELECTRONICS: SMART SENSORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.2 BY APPLICATION

- 10.4.2.1 Communications and IT solutions

- 10.4.2.2 Entertainment solutions

- 10.4.2.3 Home appliances

- 10.4.2.4 Wearable electronics

- 10.5 BIOMEDICAL & HEALTHCARE

- 10.5.1 DEPLOYMENT OF SMART SENSORS IN LIFE-SUPPORTING INSTRUMENTS TO PROPEL MARKET

- TABLE 105 SMART SENSORS USED IN BIOMEDICAL & HEALTHCARE INDUSTRY

- TABLE 106 BIOMEDICAL & HEALTHCARE: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 107 BIOMEDICAL & HEALTHCARE: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 108 BIOMEDICAL & HEALTHCARE: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 109 BIOMEDICAL & HEALTHCARE: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 AUTOMOTIVE

- 10.6.1 USE OF SMART SENSORS IN SELF-DRIVING CARS TO FUEL MARKET

- TABLE 110 SMART SENSORS USED IN AUTOMOTIVE INDUSTRY

- TABLE 111 AUTOMOTIVE: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 112 AUTOMOTIVE: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 113 AUTOMOTIVE: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 AUTOMOTIVE: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 AEROSPACE & DEFENSE

- 10.7.1 RISING USE OF SENSORS IN SOLUTIONS FOR MISSION-CRITICAL TASKS TO DRIVE MARKET

- TABLE 115 SMART SENSORS USED IN AEROSPACE & DEFENSE INDUSTRY

- TABLE 116 AEROSPACE & DEFENSE: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 117 AEROSPACE & DEFENSE: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 118 AEROSPACE & DEFENSE: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 119 AEROSPACE & DEFENSE: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 OTHER INDUSTRIES

- TABLE 120 OTHER INDUSTRIES: SMART SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 121 OTHER INDUSTRIES: SMART SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 122 OTHER INDUSTRIES: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 123 OTHER INDUSTRIES: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

11 SMART SENSORS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 45 SMART SENSORS MARKET, BY REGION

- FIGURE 46 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 124 SMART SENSORS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 125 SMART SENSORS MARKET, BY REGION, 2024-2029 (USD BILLION)

- 11.2 AMERICAS

- FIGURE 47 AMERICAS: SMART SENSORS MARKET SNAPSHOT

- TABLE 126 AMERICAS: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 127 AMERICAS: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 128 AMERICAS: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 129 AMERICAS: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2.1 AMERICAS: IMPACT OF RECESSION

- FIGURE 48 ANALYSIS OF SMART SENSORS MARKET IN AMERICAS: PRE- AND POST-RECESSION SCENARIOS

- 11.2.2 NORTH AMERICA

- TABLE 130 NORTH AMERICA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.2.2.1 US

- 11.2.2.1.1 Growing demand in automotive industry to fuel market

- 11.2.2.1 US

- TABLE 132 US: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 133 US: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.2.2.2 Canada

- 11.2.2.2.1 Increasing automation in various sectors to drive market

- 11.2.2.2 Canada

- TABLE 134 CANADA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 135 CANADA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.2.2.3 Mexico

- 11.2.2.3.1 Rising demand from healthcare sector to boost market

- 11.2.2.3 Mexico

- TABLE 136 MEXICO: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 137 MEXICO: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.2.3 SOUTH AMERICA

- 11.2.3.1 High demand for consumer electronics to drive market

- TABLE 138 SOUTH AMERICA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 139 SOUTH AMERICA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- FIGURE 49 EUROPE: SMART SENSORS MARKET SNAPSHOT

- TABLE 140 EUROPE: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 141 EUROPE: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 142 EUROPE: SMART SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 143 EUROPE: SMART SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.1 EUROPE: IMPACT OF RECESSION

- FIGURE 50 ANALYSIS OF SMART SENSORS MARKET IN EUROPE: PRE- AND POST-RECESSION SCENARIOS

- 11.3.2 GERMANY

- 11.3.2.1 Booming automotive industry to drive market growth

- TABLE 144 GERMANY: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 145 GERMANY: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Consumer electronics industry to drive demand

- TABLE 146 UK: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 147 UK: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Strong automotive and manufacturing industries to fuel market

- TABLE 148 FRANCE: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 149 FRANCE: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Growing demand in aerospace & defense industry to boost market

- TABLE 150 SPAIN: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 151 SPAIN: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 152 REST OF EUROPE: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 153 REST OF EUROPE: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: SMART SENSORS MARKET SNAPSHOT

- TABLE 154 ASIA PACIFIC: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SMART SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SMART SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 52 ANALYSIS OF SMART SENSORS MARKET IN ASIA PACIFIC: PRE- AND POST-RECESSION SCENARIOS

- 11.4.2 CHINA

- 11.4.2.1 Growth in manufacturing industry to propel demand

- TABLE 158 CHINA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 159 CHINA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Presence of leading sensor manufacturing companies to support market

- TABLE 160 JAPAN: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 161 JAPAN: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Strong government support for industrial automation to boost demand

- TABLE 162 INDIA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 163 INDIA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increasing demand in electronics and automotive industries to fuel market

- TABLE 164 SOUTH KOREA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 165 SOUTH KOREA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 166 REST OF ASIA PACIFIC: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA (MEA)

- TABLE 168 MIDDLE EAST & AFRICA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: SMART SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: SMART SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: SMART SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.5.1 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- FIGURE 53 ANALYSIS OF SMART SENSORS MARKET IN MIDDLE EAST & AFRICA: PRE- AND POST-RECESSION SCENARIOS

- 11.5.2 GCC COUNTRIES

- 11.5.2.1 Promotion of domestic electronics manufacturing to support market

- 11.5.3 AFRICA & REST OF MIDDLE EAST

- 11.5.3.1 Wide adoption in oil & gas industries to boost demand

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 172 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SMART SENSORS MARKET

- 12.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2023

- FIGURE 54 THREE-YEAR REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- TABLE 173 SMART SENSORS MARKET: DEGREE OF COMPETITION

- TABLE 174 SMART SENSORS MARKET: RANKING ANALYSIS

- FIGURE 55 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 56 VALUATION AND FINANCIAL METRICS OF KEY PLAYERS IN SMART SENSORS MARKET

- FIGURE 57 EV/EBITDA OF KEY PLAYERS

- 12.6 BRAND/PRODUCT COMPARISON

- FIGURE 58 SMART SENSORS MARKET: TOP TRENDING BRANDS/PRODUCTS

- 12.7 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 59 SMART SENSORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.7.5 COMPANY FOOTPRINT

- 12.7.5.1 Type footprint

- TABLE 175 KEY PLAYERS: TYPE FOOTPRINT (21 COMPANIES)

- 12.7.5.2 Technology footprint

- TABLE 176 KEY PLAYERS: TECHNOLOGY FOOTPRINT (21 COMPANIES)

- 12.7.5.3 Component footprint

- TABLE 177 KEY PLAYERS: COMPONENT FOOTPRINT (21 COMPANIES)

- 12.7.5.4 End-user industry footprint

- TABLE 178 KEY PLAYERS: END-USER INDUSTRY FOOTPRINT (21 COMPANIES)

- 12.7.5.5 Region footprint

- TABLE 179 KEY PLAYERS: REGION FOOTPRINT (21 COMPANIES)

- 12.7.5.6 Company overall footprint

- FIGURE 60 COMPANY OVERALL FOOTPRINT: KEY PLAYERS

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 61 SMART SENSORS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 12.8.5 COMPETITIVE BENCHMARKING

- TABLE 180 SMART SENSORS MARKET: KEY START-UPS/SMES

- 12.8.6 START-UPS/SMES FOOTPRINT

- 12.8.6.1 Type footprint

- TABLE 181 START-UPS/SMES: TYPE FOOTPRINT (4 COMPANIES)

- 12.8.6.2 Technology footprint

- TABLE 182 START-UPS/SMES: TECHNOLOGY FOOTPRINT (4 COMPANIES)

- 12.8.6.3 Component footprint

- TABLE 183 START-UPS/SMES: COMPONENT FOOTPRINT (4 COMPANIES)

- 12.8.6.4 End-user industry footprint

- TABLE 184 START-UPS/SMES: END-USER INDUSTRY FOOTPRINT (4 COMPANIES)

- 12.8.6.5 Region footprint

- TABLE 185 START-UPS/SMES: REGION FOOTPRINT (4 COMPANIES)

- 12.8.6.6 Company overall footprint

- FIGURE 62 COMPANY OVERALL FOOTPRINT: START-UPS/SMES

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 186 SMART SENSORS MARKET: PRODUCT LAUNCHES, JANUARY 2021-FEBRUARY 2024

- 12.9.2 DEALS

- TABLE 187 SMART SENSOR MARKET: DEALS, JANUARY 2021-FEBRUARY 2024

13 COMPANY PROFILES

- (Business Overview, Products/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 ANALOG DEVICES, INC.

- TABLE 188 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- FIGURE 63 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 189 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 190 ANALOG DEVICES, INC.: DEALS

- TABLE 191 ANALOG DEVICES, INC.: OTHERS

- 13.2.2 TE CONNECTIVITY

- TABLE 192 TE CONNECTIVITY: COMPANY OVERVIEW

- FIGURE 64 TE CONNECTIVITY: COMPANY SNAPSHOT

- TABLE 193 TE CONNECTIVITY: PRODUCTS/SOLUTIONS OFFERED

- TABLE 194 TE CONNECTIVITY: DEALS

- 13.2.3 INFINEON TECHNOLOGIES AG

- TABLE 195 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 65 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 196 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 197 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 198 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 199 INFINEON TECHNOLOGIES AG: OTHERS

- 13.2.4 STMICROELECTRONICS

- TABLE 200 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 66 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 201 STMICROELECTRONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 202 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 203 STMICROELECTRONICS: DEALS

- TABLE 204 STMICROELECTRONICS: OTHERS

- 13.2.5 ABB

- TABLE 205 ABB: COMPANY OVERVIEW

- FIGURE 67 ABB: COMPANY SNAPSHOT

- TABLE 206 ABB: PRODUCTS/SOLUTIONS OFFERED

- TABLE 207 ABB: PRODUCT LAUNCHES

- TABLE 208 ABB: DEALS

- 13.2.6 MICROCHIP TECHNOLOGY INC.

- TABLE 209 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- FIGURE 68 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- TABLE 210 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 211 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 212 MICROCHIP TECHNOLOGY INC.: OTHERS

- 13.2.7 NXP SEMICONDUCTORS

- TABLE 213 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 69 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 214 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 215 NXP SEMICONDUCTORS: DEALS

- 13.2.8 SIEMENS

- TABLE 216 SIEMENS: COMPANY OVERVIEW

- FIGURE 70 SIEMENS: COMPANY SNAPSHOT

- TABLE 217 SIEMENS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 218 SIEMENS: PRODUCT LAUNCHES

- 13.2.9 ROBERT BOSCH GMBH

- TABLE 219 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 71 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 220 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 221 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 222 ROBERT BOSCH GMBH: DEALS

- 13.2.10 HONEYWELL INTERNATIONAL INC.

- TABLE 223 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 72 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 224 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 225 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 226 HONEYWELL INTERNATIONAL INC.: DEALS

- 13.3 OTHER PLAYERS

- 13.3.1 TDK CORPORATION

- 13.3.2 EATON CORPORATION

- 13.3.3 EMERSON ELECTRIC CO.

- 13.3.4 GENERAL ELECTRIC

- 13.3.5 LEGRAND

- 13.3.6 TEXAS INSTRUMENTS INCORPORATED

- 13.3.7 BALLUFF GMBH

- 13.3.8 SENSIRION AG

- 13.3.9 QUALCOMM TECHNOLOGIES, INC.

- 13.3.10 MEMSIC SEMICONDUCTOR CO., LTD.

- 13.3.11 AIRMAR TECHNOLOGY CORPORATION

- 13.3.12 VISHAY PRECISION GROUP INC.

- 13.3.13 GILL SENSORS & CONTROLS LIMITED

- 13.3.14 MURATA MANUFACTURING CO., LTD.

- 13.3.15 RENESAS ELECTRONICS CORPORATION

- *Details on Business Overview, Products/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS