|

|

市場調査レポート

商品コード

1735890

臨床意思決定支援システムの世界市場:コンポーネント別、製品別、タイプ別、モデル別、提供形態別、用途別、インタラクティビティレベル別、設定別、地域別 - 2030年までの予測Clinical Decision Support Systems Market by Component, Delivery, Product, Application, Interactivity - Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 臨床意思決定支援システムの世界市場:コンポーネント別、製品別、タイプ別、モデル別、提供形態別、用途別、インタラクティビティレベル別、設定別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月20日

発行: MarketsandMarkets

ページ情報: 英文 308 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の臨床意思決定支援システム(CDSS)の市場規模は、予測期間中に9.6%のCAGRで拡大し、2024年の22億5,000万米ドルから2030年には38億9,000万米ドルに達すると予測されています。

この市場の成長は主に、HITソリューションの採用を促進するための政府規制やイニシアチブの実施、CDSS対応EHRの採用拡大、利害関係者間の連携やパートナーシップの拡大、投薬ミスの発生率の上昇、mヘルスやビッグデータツールの市場開拓によってもたらされます。しかし、CDSS導入のための投資要件が高いこと、相互運用性が不十分であること、データセキュリティへの懸念が高まっていることなどが、予測期間中の同市場の成長を抑制する要因になると予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | コンポーネント別、製品別、タイプ別、モデル別、提供形態別、用途別、インタラクティビティレベル別、設定別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

コンポーネント別に見ると、臨床意思決定支援システム市場はサービス、ソフトウェア、ハードウェアに分けられます。2024年に最も急成長するのはソフトウェア分野です。これは主に、電子カルテ(EHR)やその他の臨床システムとシームレスに連携する統合ソフトウェアソリューションの採用が増加していることが背景にあります。これらのソフトウェア・プラットフォームは、リアルタイムのアラート、データ分析、パーソナライズされた推奨などの強化された機能を提供し、臨床効率と意思決定を改善します。AIと機械学習の進歩は、CDSSソフトウェアの技術革新をさらに促進し、よりインテリジェントでスケーラブル、そしてユーザーフレンドリーなアプリケーションを可能にしています。クラウドベースのデプロイメントやサブスクリプションベースのモデルへのシフトは、ヘルスケアプロバイダーにとってこれらのソリューションをより利用しやすく、コスト効率の高いものにしており、このセグメントの成長をさらに促進しています。

提供形態別に見ると、臨床意思決定支援システム市場はオンプレミス型とクラウド型に分かれます。2024年には、オンプレミス型CDSSセグメントが臨床意思決定支援システム市場で最大のシェアを占めると予測されています。これは主に、特に大規模病院やヘルスケア機関の間で、データのセキュリティと管理に関する懸念が高まっているためです。オンプレミス・ソリューションでは、組織は機密性の高い患者データをインフラ内で管理できるため、情報漏えいのリスクを低減し、厳格なデータ保護規制へのコンプライアンスを確保できます。また、これらのシステムはカスタマイズ性が高く、既存のITインフラとのシームレスな統合が可能で、ソフトウェアのアップグレードを柔軟に管理できるため、医療機関は臨床業務を中断することなく新機能のテストやスタッフのトレーニングを行うことができます。

2024年の臨床意思決定支援システムの世界市場では、北米が最大のシェアを占めました。主要な業界参加者の存在、CDSS導入を支援する規制当局の指示、米国とカナダにおける投薬ミスの増加がこうした動向に寄与しています。予測では、アジア太平洋地域が予測期間を通じて最も高いCAGRを記録します。これは、慢性疾患の有病率の上昇や、アジア新興国に対する多様な市場利害関係者の関心の高まりなどの要因によるものです。これらの要因は、アジア太平洋地域における臨床意思決定支援システム市場の拡大を促進すると予測されています。

当レポートでは、世界の臨床意思決定支援システム市場について調査し、コンポーネント別、製品別、タイプ別、モデル別、提供形態別、用途別、インタラクティビティレベル別、設定別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- テクノロジー分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- ビジネスモデル

- 主要な利害関係者と購入基準

- 2025年の米国関税の影響

第6章 臨床意思決定支援システム市場(コンポーネント別)

- イントロダクション

- サービス

- ソフトウェア

- ハードウェア

第7章 臨床意思決定支援システム市場(製品別)

- イントロダクション

- 統合CDSS

- スタンドアロンCDSS

第8章 臨床意思決定支援システム市場(タイプ別)

- イントロダクション

- 治療CDSS

- 診断CDSS

第9章 臨床意思決定支援システム市場(モデル別)

- イントロダクション

- 知識ベースCDSS

- 非知識ベースCDSS

第10章 臨床意思決定支援システム市場(提供形態別)

- イントロダクション

- オンプレミスCDSS

- クラウドベースのCDSS

第11章 臨床意思決定支援システム市場(用途別)

- イントロダクション

- 従来型CDSS

- 高度CDSS

第12章 臨床意思決定支援システム市場(インタラクティビティレベル別)

- イントロダクション

- アクティブCDSS

- パッシブCDSS

第13章 臨床意思決定支援システム市場(設定別)

- イントロダクション

- 入院患者

- 外来診療環境

第14章 臨床意思決定支援システム市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第15章 競合情勢

- イントロダクション

- 主要参入企業の戦略、2022年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- EPIC SYSTEMS CORPORATION

- WOLTERS KLUWER N.V.

- ORACLE

- MERATIVE

- VERADIGM LLC

- OPTUM, INC.(UNITEDHEALTH GROUP)

- ATHENAHEALTH

- ELSEVIER(DIVISION OF RELX GROUP)

- ZYNX HEALTH, INC.

- KONINKLIJKE PHILIPS N.V.

- MEDICAL INFORMATION TECHNOLOGY, INC.

- NEXTGEN HEALTHCARE, INC.

- CUREMD HEALTHCARE

- SIEMENS HEALTHINEERS AG

- EBSCO INFORMATION SERVICES

- GE HEALTHCARE

- ECLINICALWORKS

- THE MEDICAL ALGORITHMS COMPANY LIMITED

- CARECLOUD, INC.

- RAMPMEDICAL

- その他の企業

- MACUSOFT

- HERA-MI

- COHESIC INC.

- MEDEA MIND

- GLASS HEALTH

- MEDECIPHER

第17章 付録

List of Tables

- TABLE 1 CLINICAL DECISION SUPPORT SYSTEMS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 RISK ASSESSMENT ANALYSIS

- TABLE 3 CLINICAL DECISION SUPPORT SYSTEMS MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 AVERAGE SELLING PRICE, BY REGION, 2024 (USD)

- TABLE 5 CLINICAL DECISION SUPPORT SYSTEMS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

- TABLE 7 INNOVATIONS AND PATENT REGISTRATIONS, 2019-2023

- TABLE 8 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 10 CLINICAL DECISION SUPPORT SYSTEMS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 CLINICAL DECISION SUPPORT SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE COMPONENTS

- TABLE 18 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 20 CLINICAL DECISION SUPPORT SYSTEMS MARKET FOR SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 21 CLINICAL DECISION SUPPORT SYSTEMS MARKET FOR SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 22 CLINICAL DECISION SUPPORT SYSTEMS MARKET FOR HARDWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 24 INTEGRATED CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 STANDALONE CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 THERAPEUTIC CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 DIAGNOSTIC CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 30 KNOWLEDGE-BASED CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 NON-KNOWLEDGE-BASED CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 33 ON-PREMISE CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 CLOUD-BASED CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 36 CONVENTIONAL CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 ADVANCED CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 39 ACTIVE CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 PASSIVE CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 42 CLINICAL DECISION SUPPORT SYSTEMS MARKET FOR INPATIENT SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 CLINICAL DECISION SUPPORT SYSTEMS MARKET FOR AMBULATORY CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 54 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 55 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 56 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 57 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 58 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 59 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 60 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 61 US: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 62 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 63 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 64 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 65 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 67 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 68 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 CANADA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 72 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 79 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 80 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 81 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 82 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 84 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 85 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 GERMANY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 87 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 88 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 89 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 90 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 92 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 93 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 94 UK: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 95 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 96 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 97 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 98 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 100 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 101 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 103 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 104 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 105 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 106 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 108 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 111 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 112 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 113 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 114 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 117 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 136 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 137 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 138 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 139 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 141 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 142 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 JAPAN: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 144 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 145 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 146 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 147 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 149 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 150 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 151 CHINA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 152 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 153 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 154 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 155 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 157 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 158 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 159 INDIA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 177 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 178 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 179 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 180 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 182 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 183 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 184 BRAZIL: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 185 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 186 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 187 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 188 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 190 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 191 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 192 MEXICO: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 194 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 210 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 211 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 212 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 213 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 215 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 216 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 217 GCC COUNTRIES: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2023-2030 (USD MILLION)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2023-2030 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2023-2030 (USD MILLION)

- TABLE 226 CLINICAL DECISION SUPPORT SYSTEMS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2025

- TABLE 227 CLINICAL DECISION SUPPORT SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 228 CLINICAL DECISION SUPPORT SYSTEMS MARKET: APPLICATION & PRODUCT FOOTPRINT

- TABLE 229 CLINICAL DECISION SUPPORT SYSTEMS MARKET: TYPE FOOTPRINT

- TABLE 230 CLINICAL DECISION SUPPORT SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 231 CLINICAL DECISION SUPPORT SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 232 CLINICAL DECISION SUPPORT SYSTEMS MARKET: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 233 CLINICAL DECISION SUPPORT SYSTEMS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 234 CLINICAL DECISION SUPPORT SYSTEMS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025)

- TABLE 235 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 236 EPIC SYSTEMS CORPORATION: SOLUTIONS OFFERED

- TABLE 237 EPIC SYSTEMS CORPORATION: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 238 EPIC SYSTEMS CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 239 EPIC SYSTEMS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 240 WOLTERS KLUWER N.V.: COMPANY OVERVIEW

- TABLE 241 WOLTERS KLUWER N.V.: SOLUTIONS OFFERED

- TABLE 242 WOLTERS KLUWER N.V.: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 243 WOLTERS KLUWER N.V.: DEALS, JANUARY 2022-MAY 2025

- TABLE 244 WOLTERS KLUWER N.V.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 245 ORACLE: COMPANY OVERVIEW

- TABLE 246 ORACLE: SOLUTIONS OFFERED

- TABLE 247 ORACLE: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 248 ORACLE: DEALS, JANUARY 2022-MAY 2025

- TABLE 249 MERATIVE: COMPANY OVERVIEW

- TABLE 250 MERATIVE: SOLUTIONS OFFERED

- TABLE 251 MERATIVE: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 252 MERATIVE: DEALS, JANUARY 2022-MAY 2025

- TABLE 253 MERATIVE: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 254 VERADIGM LLC: COMPANY OVERVIEW

- TABLE 255 VERADIGM LLC: SOLUTIONS OFFERED

- TABLE 256 VERADIGM LLC: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 257 VERADIGM LLC: DEALS, JANUARY 2022-MAY 2025

- TABLE 258 VERADIGM LLC: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 259 OPTUM, INC.: COMPANY OVERVIEW

- TABLE 260 OPTUM, INC.: SOLUTIONS OFFERED

- TABLE 261 OPTUM, INC.: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 262 OPTUM, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 263 ATHENAHEALTH: COMPANY OVERVIEW

- TABLE 264 ATHENAHEALTH: SOLUTIONS OFFERED

- TABLE 265 ATHENAHEALTH: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 266 ATHENAHEALTH: DEALS, JANUARY 2022-MAY 2025

- TABLE 267 ELSEVIER: COMPANY OVERVIEW

- TABLE 268 ELSEVIER: SOLUTIONS OFFERED

- TABLE 269 ELSEVIER: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 270 ELSEVIER: DEALS, JANUARY 2022-MAY 2025

- TABLE 271 ZYNX HEALTH, INC.: COMPANY OVERVIEW

- TABLE 272 ZYNX HEALTH, INC.: SOLUTIONS OFFERED

- TABLE 273 ZYNX HEALTH, INC.: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 274 ZYNX HEALTH, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 275 ZYNX HEALTH, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 276 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 277 KONINKLIJKE PHILIPS N.V.: SOLUTIONS OFFERED

- TABLE 278 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 279 MEDICAL INFORMATION TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 280 MEDICAL INFORMATION TECHNOLOGY, INC.: SOLUTIONS OFFERED

- TABLE 281 MEDICAL INFORMATION TECHNOLOGY, INC.: PRODUCT LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 282 MEDICAL INFORMATION TECHNOLOGY, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 283 MEDICAL INFORMATION TECHNOLOGY, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 284 NEXTGEN HEALTHCARE, INC.: COMPANY OVERVIEW

- TABLE 285 NEXTGEN HEALTHCARE, INC.: SOLUTIONS OFFERED

- TABLE 286 NEXTGEN HEALTHCARE, INC.: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 287 NEXTGEN HEALTHCARE, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 288 NEXTGEN HEALTHCARE, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 289 CUREMD HEALTHCARE: COMPANY OVERVIEW

- TABLE 290 CUREMD HEALTHCARE: SOLUTIONS OFFERED

- TABLE 291 CUREMD HEALTHCARE: DEALS, JANUARY 2022-MAY 2025

- TABLE 292 CUREMD HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 293 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 294 SIEMENS HEALTHINEERS AG: SOLUTIONS OFFERED

- TABLE 295 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-MAY 2025

- TABLE 296 EBSCO INFORMATION SERVICES: COMPANY OVERVIEW

- TABLE 297 EBSCO INFORMATION SERVICES: SOLUTIONS OFFERED

- TABLE 298 EBSCO INFORMATION SERVICES: SOLUTION LAUNCHES/ENHANCEMENTS/UPGRADES, JANUARY 2022-MAY 2025

- TABLE 299 EBSCO INFORMATION SERVICES: DEALS, JANUARY 2022-MAY 2025

- TABLE 300 EBSCO INFORMATION SERVICES: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 301 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 302 GE HEALTHCARE: SOLUTIONS OFFERED

- TABLE 303 GE HEALTHCARE: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 304 GE HEALTHCARE: DEALS, JANUARY 2022-MAY 2025

- TABLE 305 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 306 ECLINICALWORKS: COMPANY OVERVIEW

- TABLE 307 ECLINICALWORKS: SOLUTIONS OFFERED

- TABLE 308 ECLINICALWORKS: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 309 ECLINICALWORKS: DEALS, JANUARY 2022-MAY 2025

- TABLE 310 THE MEDICAL ALGORITHMS COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 311 THE MEDICAL ALGORITHMS COMPANY LIMITED: SOLUTIONS OFFERED

- TABLE 312 CARECLOUD, INC.: COMPANY OVERVIEW

- TABLE 313 CARECLOUD, INC.: SOLUTIONS OFFERED

- TABLE 314 CARECLOUD, INC.: SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS, JANUARY 2022-MAY 2025

- TABLE 315 CARECLOUD, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 316 CARECLOUD, INC.: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 317 RAMPMEDICAL: COMPANY OVERVIEW

- TABLE 318 RAMPMEDICAL: SOLUTIONS OFFERED

- TABLE 319 MACUSOFT: COMPANY OVERVIEW

- TABLE 320 HERA-MI: COMPANY OVERVIEW

- TABLE 321 COHESIC INC.: COMPANY OVERVIEW

- TABLE 322 MEDEA MIND: COMPANY OVERVIEW

- TABLE 323 GLASS HEALTH: COMPANY OVERVIEW

- TABLE 324 MEDECIPHER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CLINICAL DECISION SUPPORT SYSTEMS MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 HYPOTHESIS BUILDING

- FIGURE 6 RESEARCH METHODOLOGY: MARKET SIZE ESTIMATION

- FIGURE 7 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 8 APPROACH 3: BOTTOM-UP AND SEGMENTAL EXTRAPOLATION

- FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS

- FIGURE 10 CLINICAL DECISION SUPPORT SYSTEMS MARKET: CAGR PROJECTION ANALYSIS

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

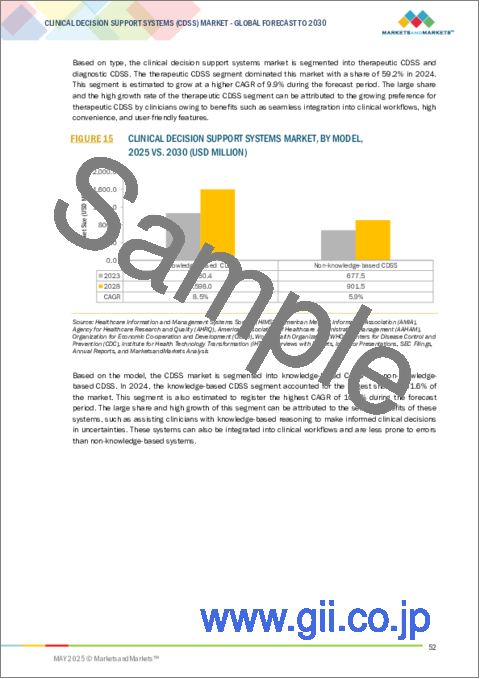

- FIGURE 15 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF CLINICAL DECISION SUPPORT SYSTEMS MARKET

- FIGURE 21 GROWING IMPLEMENTATION OF HCIT SOLUTIONS TO DRIVE MARKET

- FIGURE 22 INTEGRATED CDSS SEGMENT AND US LED NORTH AMERICAN MARKET IN 2024

- FIGURE 23 CHINA TO ACCOUNT FOR HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 26 CLINICAL DECISION SUPPORT SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR CLINICAL DECISION SUPPORT SYSTEMS MARKET

- FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT, 2024 (USD)

- FIGURE 29 CLINICAL DECISION SUPPORT SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 CLINICAL DECISION SUPPORT SYSTEM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 JURISDICTION ANALYSIS OF PATENTS, 2015-2025

- FIGURE 32 CLINICAL DECISION SUPPORT SYSTEMS MARKET: PATENT ANALYSIS, JANUARY 2015-MAY 2025

- FIGURE 33 CLINICAL DECISION SUPPORT SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 BENEFITS OF HYBRID BUSINESS MODELS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE COMPONENTS

- FIGURE 37 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: CLINICAL DECISION SUPPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 39 REVENUE SHARE ANALYSIS, 2020-2024

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 41 EV/EBITDA OF KEY VENDORS

- FIGURE 42 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF VENDORS

- FIGURE 43 CLINICAL DECISION SUPPORT SYSTEMS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 44 CLINICAL DECISION SUPPORT SYSTEMS MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 45 CLINICAL DECISION SUPPORT SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 46 CLINICAL DECISION SUPPORT SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 WOLTERS KLUWER N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 48 ORACLE: COMPANY SNAPSHOT (2023)

- FIGURE 49 VERADIGM LLC: COMPANY SNAPSHOT (2022)

- FIGURE 50 UNITEDHEALTH GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 51 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 52 NEXTGEN HEALTHCARE, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 53 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 54 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 55 CARECLOUD, INC.: COMPANY SNAPSHOT (2024)

The global clinical decision support systems (CDSS) market is projected to reach USD 3.89 billion by 2030 from USD 2.25 billion in 2024, at a CAGR of 9.6% during the forecast period. The growth of this market is primarily driven by implementing government regulations and initiatives to promote the adoption of HIT solutions, increasing adoption of CDSS-enabled EHRs, growing collaborations and partnerships between stakeholders, rising incidence of medication errors, and the development of mHealth and big data tools. However, high investment requirements for the implementation of CDSS and inadequate interoperability, coupled with rising data security concerns, are factors expected to restrain the growth of this market during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Component, Product, Type, Model, Application, Delivery Mode, Interactivity Level, Setting, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The software segment is expected to register the highest growth during the forecast period.

By component, the clinical decision support systems market is divided into services, software, and hardware. The software segment accounted for the fastest-growing segment of this market in 2024. It is driven primarily by the increasing adoption of integrated software solutions that seamlessly work with electronic health records (EHRs) and other clinical systems. These software platforms offer enhanced functionalities such as real-time alerts, data analytics, and personalized recommendations, which improve clinical efficiency and decision-making. Advancements in AI and machine learning are further driving innovation in CDSS software, enabling more intelligent, scalable, and user-friendly applications. The shift toward cloud-based deployments and subscription-based models is making these solutions more accessible and cost-effective for healthcare providers, further fueling growth in this segment.

The on-premise CDSS segment registered the largest share of the clinical decision support systems market in 2024.

By delivery mode, the clinical decision support systems market is divided into on-premise and cloud-based modes. In 2024, the on-premise CDSS segment is projected to hold the largest share of the clinical decision support systems market, primarily due to heightened concerns around data security and control, especially among large hospitals and healthcare institutions. On-premise solutions allow organizations to manage sensitive patient data within their infrastructure, reducing the risk of breaches and ensuring compliance with strict data protection regulations. These systems also offer greater customization, seamless integration with existing IT infrastructure, and flexibility in managing software upgrades, allowing institutions to test new features and train staff without disrupting clinical operations.

North America dominated the clinical decision support systems market in 2024.

North America accounted for the largest share of the global clinical decision support systems market in 2024. The existence of major industry participants, regulatory directives that support CDSS adoption, and the rise in medication errors in the US and Canada contribute to these trends. Forecasts indicate that the Asia Pacific region will witness the highest CAGR throughout the projected timeframe. This is due to factors such as the escalating prevalence of chronic illnesses and the growing attention of diverse market stakeholders toward emerging Asian nations. These factors are anticipated to propel the expansion of the clinical decision support systems market in the Asia Pacific region.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 35%, and Tier 3: 20%

- By Designation - Directors: 26%, Manager: 17%, and Others: 57%

- By Region - North America: 40%, Europe: 20%, Asia Pacific: 30%, Latin America: 6%, and Middle East & Africa: 4%

List of Companies Profiled in the Report

- Wolters Kluwer N.V. (Netherlands)

- Oracle (US)

- Merative (US)

- Change Healthcare (US)

- Veradigm Inc. (US)

- athenahealth (US)

- Epic Systems Corporation (US)

- Elsevier B.V. (Netherlands)

- Zynx Health (US)

- Koninklijke Philips N.V. (Netherlands)

- Medical Information Technology, Inc. (US)

- NextGen Healthcare, Inc. (US)

- CureMD Healthcare (US)

- Siemens Healthineers (Germany)

- EBSCO Information Services (US)

- GE HealthCare (US)

- eClinicalWorks (US)

- The Medical Algorithms Company (UK)

- RAMPmedical (Germany)

- Hera-MI (France)

- CareCloud, Inc. (US)

- VisualDx (US)

- Premier, Inc. (US)

- First Databank, Inc. (US)

- Strata Decision Technology (US).

Research Coverage

The report analyzes the clinical decision support systems market. It aims to estimate the market size and future growth potential of various market segments, based on component, delivery mode, product, model, interactivity level, application, setting, type, and region. The report also analyses factors (such as drivers, opportunities, and challenges) affecting market growth. It evaluates the opportunities and challenges for market stakeholders. The report also studies micro markets with respect to their growth trends, prospects, and contributions to the total clinical decision support systems market. The report forecasts the revenue of the market segments with respect to five major regions. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a higher share of the market. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (implementation of government regulations & initiatives to promote adoption of HCIT solutions, increasing adoption of CDSS-enabled EHRs, growing collaborations & partnerships between stakeholders, growing incidence of medication errors, development of big data and mHealth tools), restraints (data security concerns related to cloud-based CDSS, inadequate interoperability), opportunities (growth potential of emerging markets, social media integration and rising technological advancements), challenges (requirement of high investments for implementation of CDSS infrastructure, shortage of skilled IT professionals in healthcare industry)

- Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, and new software launches in the clinical decision support systems market

- Market Development: Comprehensive information on the lucrative emerging markets, type of component, product, type, model, delivery mode, application, interactivity level, setting, and region

- Market Diversification: Exhaustive information about the software portfolios, growing geographies, recent developments, and investments in the clinical decision support systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global clinical decision support systems market, such as Wolters Kluwer N.V. (Netherlands), Oracle (US), Merative (US), Change Healthcare (US), Veradigm Inc. (US), athenahealth (US), Epic Systems Corporation (US), Elsevier B.V. (Netherlands), Zynx Health (US), and Koninklijke Philips N.V. (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: REVENUE SHARE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.2.3 APPROACH 3: BOTTOM-UP AND SEGMENTAL EXTRAPOLATION

- 2.3 GROWTH FORECAST MODEL

- 2.3.1 PRIMARY INTERVIEWS

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 SEGMENT ASSESSMENT

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 CLINICAL DECISION SUPPORT SYSTEMS MARKET OVERVIEW

- 4.2 NORTH AMERICA: CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT AND COUNTRY

- 4.3 CLINICAL DECISION SUPPORT SYSTEMS MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- 4.4 CLINICAL DECISION SUPPORT SYSTEMS MARKET: REGIONAL MIX

- 4.5 CLINICAL DECISION SUPPORT SYSTEMS MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing government regulations for HCIT implementation

- 5.2.1.2 Growing adoption of CDSS-enabled electronic health records

- 5.2.1.3 Rising incidence of medication errors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data security concerns

- 5.2.2.2 Inadequate interoperability for patient management solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of big data and mHealth tools

- 5.2.3.2 High growth potential in emerging economies

- 5.2.3.3 Rising technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 High capital investments for CDSS infrastructure

- 5.2.4.2 Shortage of skilled IT professionals

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 GROWING APPLICATIONS OF AI

- 5.3.2 INCREASING FOCUS ON MOBILE AND CLOUD-BASED SOLUTIONS

- 5.3.3 ADOPTION OF HCIT SOLUTIONS

- 5.3.4 GRADUAL SHIFT OF ACCOUNTABILITY FROM PAYERS TO PROVIDERS

- 5.3.5 INCREASING DEMAND FOR VALUE-BASED HEALTHCARE

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF KEY PLAYER, BY PRODUCT

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR CLINICAL DECISION SUPPORT SYSTEMS

- 5.9.2 JURISDICTION ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA FOR HS CODE 901890

- 5.10.2 EXPORT DATA FOR HS CODE 901890

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 USE OF EVIDENCE-BASED NURSING KNOWLEDGE FOR PATIENT CARE

- 5.12.2 USE OF KNOWLEDGE ANALYZER FOR WORKFLOW IMPROVEMENTS

- 5.12.3 IMPROVED RESPONSE TIME AND PHYSICIAN EFFICIENCY IN HEALTHCARE FACILITIES WITH ELECTRONIC HEALTH RECORD

- 5.12.4 ENHANCED EFFICIENCY AND VALUE-BASED CARE WITH AI-POWERED CDSS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF FOR CDSS HARDWARE

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATORY ANALYSIS

- 5.13.3.1 North America

- 5.13.3.1.1 Federal Food, Drug, and Cosmetic Act (FD&C Act)

- 5.13.3.1.2 Health Insurance Portability and Accountability Act (HIPAA)

- 5.13.3.1.3 Affordable Care Act, 2010

- 5.13.3.1.4 Health Information Technology for Economic and Clinical Health Act, 2009 (HITECH)

- 5.13.3.1.5 Consumer Privacy Protection Act, 2017

- 5.13.3.2 Europe

- 5.13.3.2.1 General Data Protection Regulation (GDPR)

- 5.13.3.2.2 EU Cybersecurity Act

- 5.13.3.3 Asia Pacific

- 5.13.3.3.1 China's Cyber Security Law (CSL)

- 5.13.3.4 Middle East & Africa

- 5.13.3.4.1 Protection of Personal Information Act, South Africa

- 5.13.3.4.2 Cloud Computing Regulatory Framework, South Africa

- 5.13.3.4.3 Federal Law No. (2) of 2019, UAE

- 5.13.3.5 Latin America

- 5.13.3.5.1 Lei Geral de Protecao de Dados (General Data Protection Law), Brazil

- 5.13.3.1 North America

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 BUSINESS MODELS

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 IMPACT OF 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Inpatient settings

- 5.17.5.2 Ambulatory care settings

- 5.17.6 CONCLUSION

6 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY COMPONENT

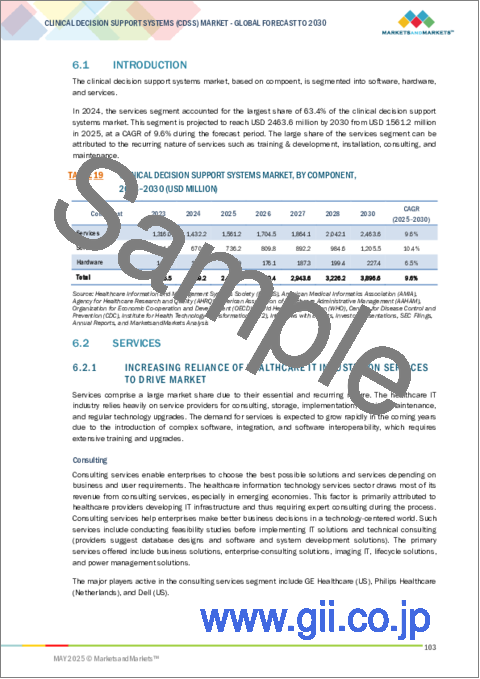

- 6.1 INTRODUCTION

- 6.2 SERVICES

- 6.2.1 INCREASING RELIANCE OF HEALTHCARE IT INDUSTRY ON SERVICES TO DRIVE MARKET

- 6.3 SOFTWARE

- 6.3.1 FREQUENT NEED FOR UPGRADES AND IMPROVEMENTS IN SOFTWARE APPLICATIONS TO PROPEL MARKET

- 6.4 HARDWARE

- 6.4.1 NEED TO OPTIMIZE SOFTWARE TO AUGMENT GROWTH

7 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 INTEGRATED CDSS

- 7.2.1 GROWING FOCUS ON QUALITY HEALTHCARE AND REDUCING MEDICATION ERRORS TO BOOST MARKET

- 7.3 STANDALONE CDSS

- 7.3.1 LACK OF REPORTING AND ELECTRONIC HEALTH RECORDS TO LIMIT GROWTH

8 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 THERAPEUTIC CDSS

- 8.2.1 SEAMLESS INTEGRATION INTO CLINICAL WORKFLOWS TO PROMOTE GROWTH

- 8.3 DIAGNOSTIC CDSS

- 8.3.1 RISING USE OF ALGORITHMS FOR EFFECTIVE REAL-TIME DIAGNOSIS TO SUPPORT GROWTH

9 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY MODEL

- 9.1 INTRODUCTION

- 9.2 KNOWLEDGE-BASED CDSS

- 9.2.1 INCREASING FOCUS ON PRECISION COURSE OF TREATMENT TO AID GROWTH

- 9.3 NON-KNOWLEDGE-BASED CDSS

- 9.3.1 GROWING ADOPTION OF ARTIFICIAL INTELLIGENCE TO DRIVE MARKET

10 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY DELIVERY MODE

- 10.1 INTRODUCTION

- 10.2 ON-PREMISE CDSS

- 10.2.1 LOWER RISK OF DATA BREACH AND ABILITY TO CHOOSE MULTIPLE VENDORS TO SUSTAIN GROWTH

- 10.3 CLOUD-BASED CDSS

- 10.3.1 FLEXIBLE AND SCALABLE FEATURES TO CONTRIBUTE TO GROWTH

11 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 CONVENTIONAL CDSS

- 11.2.1 ABILITY TO PROVIDE DIAGNOSTIC ASSISTANCE AND PRESCRIPTION DECISION SUPPORT TO DRIVE MARKET

- 11.3 ADVANCED CDSS

- 11.3.1 REAL-TIME EVIDENCE AND PROTOCOL VALIDATION BENEFITS TO STIMULATE GROWTH

12 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY INTERACTIVITY LEVEL

- 12.1 INTRODUCTION

- 12.2 ACTIVE CDSS

- 12.2.1 ABILITY TO ENABLE OPTIMAL DECISION-MAKING WITH MINIMAL ERRORS TO ACCELERATE GROWTH

- 12.3 PASSIVE CDSS

- 12.3.1 MINIMAL DISRUPTION TO WORKFLOWS TO ENCOURAGE GROWTH

13 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY SETTING

- 13.1 INTRODUCTION

- 13.2 INPATIENT SETTINGS

- 13.2.1 GROWING FOCUS ON IMPROVING HEALTHCARE OPERATIONS IN HOSPITALS TO PROPEL MARKET

- 13.3 AMBULATORY CARE SETTINGS

- 13.3.1 RISING NEED TO CURB HEALTHCARE COSTS TO FACILITATE GROWTH

14 CLINICAL DECISION SUPPORT SYSTEMS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Growing focus on value-based care to drive market

- 14.2.3 CANADA

- 14.2.3.1 Increasing regulations regarding safety & quality care to speed up growth

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Favorable government support for adoption of electronic medical records to propel market

- 14.3.3 UK

- 14.3.3.1 Rising establishment of healthcare facilities to accelerate growth

- 14.3.4 FRANCE

- 14.3.4.1 Growing focus on improving healthcare coordination to drive market

- 14.3.5 ITALY

- 14.3.5.1 Rising need for evidence-based CDSS to drive market

- 14.3.6 SPAIN

- 14.3.6.1 Growing focus on improving patient outcomes to boost market

- 14.3.7 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 JAPAN

- 14.4.2.1 Rising need to digitize patient records to bolster growth

- 14.4.3 CHINA

- 14.4.3.1 Favorable government support to drive market

- 14.4.4 INDIA

- 14.4.4.1 Rising adoption of telemedicine to favor growth

- 14.4.5 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Rising demand to digitize patient records to amplify growth

- 14.5.3 MEXICO

- 14.5.3.1 Established healthcare reforms to contribute to growth

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.6.2 GCC COUNTRIES

- 14.6.2.1 Growing investments in healthcare infrastructure to propel market

- 14.6.3 REST OF MIDDLE EAST & AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES, 2022-2025

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Application & product footprint

- 15.7.5.4 Type footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 SOLUTION LAUNCHES/ENHANCEMENTS/APPROVALS

- 15.9.2 DEALS

- 15.9.3 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 EPIC SYSTEMS CORPORATION

- 16.1.1.1 Business overview

- 16.1.1.2 Solutions offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Solution launches/enhancements/approvals

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 WOLTERS KLUWER N.V.

- 16.1.2.1 Business overview

- 16.1.2.2 Solutions offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Solution launches/enhancements/approvals

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 ORACLE

- 16.1.3.1 Business overview

- 16.1.3.2 Solutions offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Solution launches/enhancements/approvals

- 16.1.3.3.2 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 MERATIVE

- 16.1.4.1 Business overview

- 16.1.4.2 Solutions offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Solution launches/enhancements/approvals

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 VERADIGM LLC

- 16.1.5.1 Business overview

- 16.1.5.2 Solutions offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Solution launches/enhancements/approvals

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 OPTUM, INC. (UNITEDHEALTH GROUP)

- 16.1.6.1 Business overview

- 16.1.6.2 Solutions offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Solution launches/enhancements/approvals

- 16.1.6.3.2 Deals

- 16.1.7 ATHENAHEALTH

- 16.1.7.1 Business overview

- 16.1.7.2 Solutions offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Solution launches/enhancements/approvals

- 16.1.7.3.2 Deals

- 16.1.8 ELSEVIER (DIVISION OF RELX GROUP)

- 16.1.8.1 Business overview

- 16.1.8.2 Solutions offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Solution launches/enhancements/approvals

- 16.1.8.3.2 Deals

- 16.1.9 ZYNX HEALTH, INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Solutions offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Solution launches/enhancements/approvals

- 16.1.9.3.2 Deals

- 16.1.9.3.3 Other developments

- 16.1.10 KONINKLIJKE PHILIPS N.V.

- 16.1.10.1 Business overview

- 16.1.10.2 Solutions offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches/enhancements/approvals

- 16.1.11 MEDICAL INFORMATION TECHNOLOGY, INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Solutions offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches/enhancements/approvals

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Other developments

- 16.1.12 NEXTGEN HEALTHCARE, INC.

- 16.1.12.1 Business overview

- 16.1.12.2 Solutions offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Solution launches/enhancements/approvals

- 16.1.12.3.2 Deals

- 16.1.12.3.3 Other developments

- 16.1.13 CUREMD HEALTHCARE

- 16.1.13.1 Business overview

- 16.1.13.2 Solutions offered

- 16.1.13.2.1 Deals

- 16.1.13.2.2 Other developments

- 16.1.14 SIEMENS HEALTHINEERS AG

- 16.1.14.1 Business overview

- 16.1.14.2 Solutions offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Deals

- 16.1.15 EBSCO INFORMATION SERVICES

- 16.1.15.1 Business overview

- 16.1.15.2 Solutions offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Solution launches/enhancements/approvals

- 16.1.15.3.2 Deals

- 16.1.15.3.3 Other developments

- 16.1.16 GE HEALTHCARE

- 16.1.16.1 Business overview

- 16.1.16.2 Solutions offered

- 16.1.16.3 Recent developments

- 16.1.16.3.1 Solution launches/enhancements/approvals

- 16.1.16.3.2 Deals

- 16.1.16.3.3 Other developments

- 16.1.17 ECLINICALWORKS

- 16.1.17.1 Business overview

- 16.1.17.2 Solutions offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Solution launches/enhancements/approvals

- 16.1.17.4 Recent developments

- 16.1.17.4.1 Deals

- 16.1.18 THE MEDICAL ALGORITHMS COMPANY LIMITED

- 16.1.18.1 Business overview

- 16.1.18.2 Solutions offered

- 16.1.19 CARECLOUD, INC.

- 16.1.19.1 Business overview

- 16.1.19.2 Solutions offered

- 16.1.19.3 Recent developments

- 16.1.19.3.1 Solution launches/enhancements/approvals

- 16.1.19.3.2 Deals

- 16.1.19.3.3 Expansions

- 16.1.20 RAMPMEDICAL

- 16.1.20.1 Business overview

- 16.1.20.2 Solutions offered

- 16.1.1 EPIC SYSTEMS CORPORATION

- 16.2 OTHER PLAYERS

- 16.2.1 MACUSOFT

- 16.2.2 HERA-MI

- 16.2.3 COHESIC INC.

- 16.2.4 MEDEA MIND

- 16.2.5 GLASS HEALTH

- 16.2.6 MEDECIPHER

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS