|

|

市場調査レポート

商品コード

1459463

大量通知システムの世界市場:オファリング別、通信チャネル別、施設タイプ別、用途別、業界別、地域別 - 2029年までの予測Mass Notification System Market by Offering (Software, Hardware (Fire Alarm System, Visual Alert Devices, Sirens), Services), Communication, Application (Critical Event Management, Public Safety & Warning), Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 大量通知システムの世界市場:オファリング別、通信チャネル別、施設タイプ別、用途別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年04月01日

発行: MarketsandMarkets

ページ情報: 英文 410 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の大量通知システムの市場規模は、2024年の238億米ドルから2029年には651億米ドルに成長し、予測期間中のCAGRは22.3%になると予測されています。

この成長軌道は、いくつかの極めて重要な要因によるものです。リアルタイムの通知・警報システムに対する需要の高まりは、大量通知システム市場に大きな機会をもたらしています。瞬時のコミュニケーションが必須である今日のダイナミックなビジネス環境では、多様な部門にまたがる組織が、広範かつしばしば異質な聴衆に迅速に情報を発信することの重要性を認識しています。緊急警報であれ、重要な最新情報であれ、重要なアナウンスであれ、受信者に迅速に到達する能力は結果に大きく影響します。大量通知システムは、組織がリアルタイムで多数のコミュニケーションチャネルに的を絞ったメッセージを発信することを容易にすることで、この緊急事態に対する包括的なソリューションを提供します。これらのシステムは、モバイルデバイス、電子メール、ソーシャルメディアプラットフォーム、音声通知を通じて効果的に個人を関与させることで、重要な情報の効率的な配信を保証します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、通信チャネル別、施設タイプ別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

BFSI部門は、業務の継続性を維持し、顧客の信頼を醸成し、規制要件を遵守する上で極めて重要な役割を果たすため、大量通知システムの採用が増加しています。大量通知システムは、顧客、従業員、利害関係者へのセキュリティ警告、不正行為の通知、業務上の最新情報の迅速な伝達を促進します。サイバー攻撃などの危機の際、大量通知システムはインシデント対応のリアルタイムな調整を可能にし、データ漏洩や財務上の損失を軽減します。また、規制の変更や更新を迅速に伝えることで、厳格な業界規制へのコンプライアンスを保証します。さらに、大量通知システムは、災害復旧イニシアチブを支援し、金融サービスの中断を最小限に抑えることで、事業継続戦略をサポートします。大量通知システムは、機密情報を保護し、業務回復力を維持し、BFSIセクターの利害関係者に信頼を浸透させるために不可欠な資産として浮上しています。

事業継続と災害管理は、組織のリスク軽減戦略において不可欠な柱となります。大量通知システム市場において、これらの用途は危機発生時のシームレスなコミュニケーションと対応プロトコルを促進するのに役立っています。これらの機能を統合することで、効率的な調整、重要な情報のタイムリーな発信、業務停止時間の最小化が可能になります。このようなシステムはリアルタイムのアラートを提供し、従業員、利害関係者、そして広く一般市民との迅速なコミュニケーションを保証します。現代のビジネスシーンにおいて備えの重要性が高まっていることから、堅牢な事業継続性と災害管理機能を備えた総合的な大規模通知システムに対する需要が急増しています。この動向は、市場における継続的な技術革新と投資を後押ししています。

当レポートでは、世界の大量通知システム市場について調査し、オファリング別、通信チャネル別、施設タイプ別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 大量通知システム市場:アーキテクチャ

- 大量通知システム市場:進化

- ケーススタディ分析

- エコシステム分析

- サプライチェーン分析

- 技術分析

- ポーターのファイブフォース分析

- 価格分析

- 特許分析

- 主な会議とイベント

- 貿易分析

- 規制状況

- 主な利害関係者と購入基準

- 大量通知システム市場のビジネスモデル

- ベストプラクティス

- 技術ロードマップ

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

第6章 大量通知システム市場、オファリング別

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第7章 大量通知システム市場、通信チャネル別

- イントロダクション

- テキストベース

- 音声通信

- デジタル

第8章 大量通知システム市場、施設タイプ別

- イントロダクション

- 屋内施設

- 屋外施設

第9章 大量通知システム市場、用途別

- イントロダクション

- 重要イベント管理

- 公共の安全と警告

- 事業継続と災害管理

- レポートと分析

- その他

第10章 大量通知システム市場、業界別

- イントロダクション

- BFSI

- 小売・電子商取引

- 輸送・物流

- 政府・防衛

- ヘルスケア・ライフサイエンス

- 通信

- エネルギー・ユーティリティ

- 製造

- IT/ITES

- メディアとエンターテインメント

- 教育

- その他

第11章 大量通知システム市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 主要大量通知システムベンダーの企業評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- SIEMENS AG

- EVERBRIDGE

- HONEYWELL

- EATON

- MOTOROLA SOLUTIONS

- BLACKBERRY

- JOHNSON CONTROLS

- SINGLEWIRE SOFTWARE

- ONSOLVE

- ALERTMEDIA

- ALERTUS TECHNOLOGIES

- F24 AG

- HIPLINK

- AMERICAN SIGNAL CORPORATION

- ATI SYSTEMS

- MIRCOM

- スタートアップ/中小企業

- FINALSITE

- OMNILERT

- REGROUP MASS NOTIFICATION

- KONEXUS

- NETPRESENTER

- ILUMINR

- CRISISGO

- OMNIGO

- RUVNA

- KLAXON TECHNOLOGIES

- CRISES CONTROL

- ICESOFT TECHNOLOGIES

- SQUADCAST

- POCKETSTOP

- PREPARIS

- HQE SYSTEMS

- VEOCI

- TEXT-EM-ALL

- DIALMYCALLS

第14章 隣接市場と関連市場

第15章 付録

The global market for mass notification system is projected to grow from USD 23.8 billion in 2024 to USD 65.1 billion by 2029, at a CAGR of 22.3% during the forecast period. This growth trajectory is attributed to several pivotal factors. The escalating demand for real-time notification and alert systems presents a significant opportunity within the mass notification system market. In today's dynamic business landscape, where instantaneous communication is imperative, organizations spanning diverse sectors acknowledge the vital importance of swiftly disseminating information to widespread and often disparate audiences. Be it emergency alerts, critical updates, or essential announcements, the capability to promptly reach recipients greatly influences outcomes. Mass notification systems offer a comprehensive solution to this exigency by facilitating organizations to dispatch targeted messages across a multitude of communication channels in real-time. These systems effectively engage individuals via mobile devices, emails, social media platforms, and voice notifications, thereby ensuring efficient delivery of crucial information.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | By Offering, Communication Channel, Facility Type Application, Vertical, and Region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"The BFSI vertical is projected to be the largest market during the forecast period."

The BFSI sector is increasingly embracing mass notification systems due to their pivotal role in preserving operational continuity, fostering customer trust, and adhering to regulatory requirements. Mass notification systems facilitate prompt dissemination of security alerts, fraud notifications, and operational updates to customers, employees, and stakeholders. During crises such as cyberattacks, mass notification systems enable real-time coordination of incident response, thereby mitigating data breaches and financial losses. It also ensures compliance with rigorous industry regulations by promptly communicating regulatory changes and updates. Additionally, mass notification systems support business continuity strategies by assisting in disaster recovery initiatives and minimizing disruptions to financial services. Mass notification systems have emerged as an indispensable asset for safeguarding sensitive information, maintaining operational resilience, and instilling trust among stakeholders in the BFSI sector.

"Among applications, Business Continuity & Disaster Management is registered to grow at the highest CAGR during the forecast period."

Business continuity & disaster management serve as indispensable pillars in organizational risk mitigation strategies. Within the mass notification system market, these application is instrumental in facilitating seamless communication and response protocols during crises. Integration of these features enables efficient coordination, timely dissemination of crucial information, and minimization of operational downtime. Such systems offer real-time alerts, ensuring swift communication with employees, stakeholders, and the wider public. Given the escalating significance of preparedness in contemporary business landscapes, there is a burgeoning demand for holistic mass notification systems encompassing robust business continuity and disaster management functionalities. This trend propels ongoing innovation and investment within the market.

"Among offering, the software segment is anticipated to account for the largest market share during the forecast period."

During the projected period, the software segment is poised to dominate the mass notification system market, holding the foremost market share. This segment encompasses a variety of tools and functionalities designed to facilitate swift and extensive dissemination of information during emergencies. Mass notification system software commonly provides diverse messaging channels, including SMS, email, voice calls, and integration with social media platforms, ensuring the delivery of messages through preferred communication mediums of recipients. Furthermore, advanced attributes such as location-based targeting enable the issuance of alerts pertinent to specific geographical areas. Many mass notification system software solutions also offer real-time monitoring and reporting capabilities to assess message delivery and response metrics.

"North America to account for the largest market size during the forecast period."

During the forecast period, North America is anticipated to have the largest market size in the adoption of mass notification systems. Businesses across North America are increasingly integrating mass notification systems to fortify emergency preparedness, comply with regulations, and ensure employee safety. These systems facilitate rapid communication during various crises such as natural disasters, security threats, and cyber incidents, thereby supporting business continuity by enabling smooth transitions to remote work and sustaining essential operations. the transparent and timely communication provided by mass notification systems contributes to effective reputation management and fosters trust among stakeholders. The integration of real-time updates empowers informed decision-making, while the scalability of these systems accommodates businesses of diverse sizes. Integration with IoT devices further augments the efficacy of the system. Overall, Mass Notification Systems are acknowledged as a strategic tool for enhancing resilience and safeguarding employees, assets, and operations within North American enterprises.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Mass Notification System market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 40%, Europe: 20%, APAC: 30%, MEA: 5%, Latin America: 5%

Major vendors offering Mass Notification System solutions and services across the globe Siemens AG (Germany), Everbridge (US), Honeywell (US), Eaton (Ireland), Motorola Solutions (US), Blackberry (Canada), Johnson Controls (Ireland), Singlewire Software (US), OnSolve (US), AlertMedia (US), Alertus Technologies (US), F24 (Germany), HipLink (US), American Signal Corporation (US), ATI Systems (US), Finalsite (US), Omnilert (US), Regroup Mass Notification (US), Mircom (Canada), Konexus (US), Netpresenter (Netherlands), Iluminr (US), CrisisGo (US), Omnigo (US), Ruvna (US), Klaxon Technologies (UK), Crises Control (UK), ICEsoft Technologies (Canada), Squadcast (US), Pocketstop (US), Preparis (US), HQE Systems (US), Veoci (US), Text-Em-All (US), and DialMyCalls (US).

Research Coverage

The market study covers Mass Notification System across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, communication, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for Mass Notification System and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

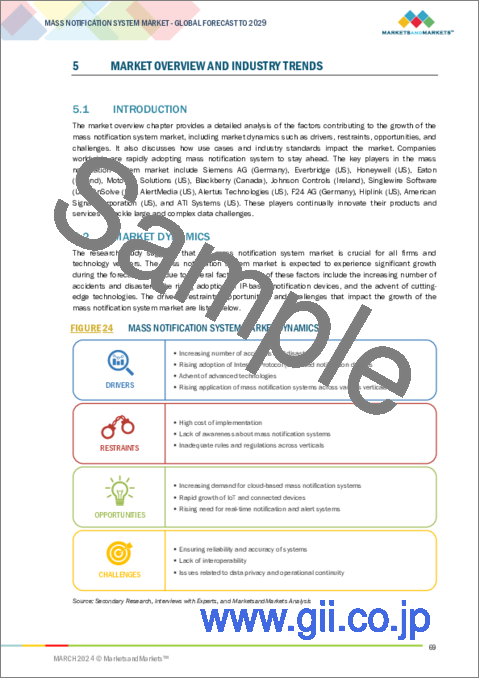

- Analysis of key drivers (increasing number of accidents and disasters, rising adoption of Internet Protocol (IP)-based notification devices, Advent of cutting-edge technologies, rising application of mass notification systems across various verticals), restraints (High cost of implementation, Lack of awareness about mass notification systems, Inadequate rules, and regulations across verticals), opportunities (Increasing demand for cloud-based mass notification systems, rapid growth of IoT and connecting devices, Rising need for real-time notification and alert system), and challenges (Ensuring the reliability and accuracy of the system, Lack of Interoperability, Issues related with data privacy and operational continuity) influencing the growth of the Mass Notification System market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Mass Notification System market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Mass Notification System market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in mass notification system market strategies; the report also helps stakeholders understand the pulse of the mass notification system market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Siemens AG (Germany), Eaton (Ireland), Honeywell (US), Motorola Solution (US), Johnson Controls (Ireland), and others in the mass notification system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2023

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MASS NOTIFICATION SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 LIST OF PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- FIGURE 2 MASS NOTIFICATION SYSTEM MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MASS NOTIFICATION SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 APPROACH 1 (BOTTOM-UP, SUPPLY SIDE): REVENUE FROM VENDORS OF SOFTWARE/HARDWARE/SERVICES OF MASS NOTIFICATION SYSTEM

- FIGURE 5 APPROACH 2 ( BOTTOM-UP, SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/HARDWARE/SERVICES OF MASS NOTIFICATION SYSTEM

- FIGURE 6 APPROACH 3, (BOTTOM-UP, SUPPLY SIDE): MARKET ESTIMATION FROM ALL SOFTWARE/HARDWARE/SERVICES AND CORRESPONDING SOURCES

- FIGURE 7 APPROACH 4, BOTTOM-UP (DEMAND SIDE), SHARE OF MASS NOTIFICATION SYSTEM THROUGH OVERALL MASS NOTIFICATION SYSTEM SPENDING

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPACT OF RECESSION ON GLOBAL MASS NOTIFICATION SYSTEM MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 GLOBAL MASS NOTIFICATION SYSTEM MARKET AND GROWTH RATE, 2018-2023 (USD MILLION, Y-O-Y)

- TABLE 5 GLOBAL MASS NOTIFICATION SYSTEM MARKET AND GROWTH RATE, 2024-2029 (USD MILLION, Y-O-Y)

- FIGURE 8 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- FIGURE 9 IN-BUILDING SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- FIGURE 10 INTEGRATED SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2024

- FIGURE 11 CLOUD DEPLOYMENT MODE TO DOMINATE MARKET IN 2024

- FIGURE 12 PUBLIC ADDRESS SYSTEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- FIGURE 13 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2024

- FIGURE 14 CONSULTING & PLANNING SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2024

- FIGURE 15 CHANNEL SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2024

- FIGURE 16 PUBLIC SAFETY & WARNING SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- FIGURE 17 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2024

- FIGURE 18 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MASS NOTIFICATION SYSTEM MARKET

- FIGURE 19 RISING NEED FOR REAL-TIME NOTIFICATION AND ALERT SYSTEMS TO DRIVE MARKET GROWTH

- 4.2 OVERVIEW OF RECESSION IN MASS NOTIFICATION SYSTEM MARKET

- FIGURE 20 MASS NOTIFICATION SYSTEM MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2024

- 4.3 MASS NOTIFICATION SYSTEM MARKET: TOP THREE APPLICATIONS

- FIGURE 21 PUBLIC SAFETY & WARNING SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- 4.4 MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION AND KEY VERTICAL

- FIGURE 22 PUBLIC SAFETY & WARNING AND BFSI SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN 2024

- 4.5 MASS NOTIFICATION SYSTEM MARKET, BY REGION

- FIGURE 23 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2024

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 MASS NOTIFICATION SYSTEM MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of accidents and disasters

- 5.2.1.2 Rising adoption of Internet Protocol (IP)-based notification devices

- 5.2.1.3 Advent of advanced technologies

- 5.2.1.4 Rising application of mass notification systems across various verticals

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of implementation

- 5.2.2.2 Lack of awareness about mass notification systems

- 5.2.2.3 Inadequate rules and regulations across verticals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for cloud-based mass notification systems

- 5.2.3.2 Rapid growth of IoT and connected devices

- 5.2.3.3 Rising need for real-time notification and alert systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Ensuring reliability and accuracy of systems

- 5.2.4.2 Lack of interoperability

- 5.2.4.3 Issues related to data privacy and operational continuity

- 5.3 MASS NOTIFICATION SYSTEM MARKET: ARCHITECTURE

- FIGURE 25 ARCHITECTURE OF MASS NOTIFICATION SYSTEM MARKET

- 5.4 MASS NOTIFICATION SYSTEM MARKET: EVOLUTION

- FIGURE 26 EVOLUTION OF MASS NOTIFICATION SYSTEMS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 EDUCATION

- 5.5.1.1 Barren County Schools improved communication and distribution of information by implementing OnSolve's One Call Now system

- 5.5.1.2 Wellington School improved its emergency notification system by deploying Alertus Technologies' Alertus System

- 5.5.2 HEALTHCARE & LIFE SCIENCES

- 5.5.2.1 VA Medical Center maintained quality care in collaboration with Johnson Controls

- 5.5.2.2 Riverside Healthcare communicated with crisis teams using InformaCast by SingleWire Software

- 5.5.3 GOVERNMENT & DEFENSE

- 5.5.3.1 Office of Emergency Services at Ventura County Sheriff's Department used Everbridge's VC Alert program for wildfire alert notifications

- 5.5.3.2 Contra Costa County protected over one million people during crisis by employing Blackberry AtHoc

- 5.5.4 BFSI

- 5.5.4.1 Crises Control helped financial services company to convey information clearly and concisely to staff

- 5.5.5 RETAIL & ECOMMERCE

- 5.5.5.1 Status Solutions developed customized mass notification system, SARA, for Mall of America

- 5.5.1 EDUCATION

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 27 MASS NOTIFICATION SYSTEM MARKET ECOSYSTEM

- TABLE 6 ROLE OF PLAYERS IN MASS NOTIFICATION SYSTEM MARKET

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 28 MASS NOTIFICATION SYSTEM MARKET: SUPPLY CHAIN ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud computing

- 5.8.1.2 Big data

- 5.8.1.3 IoT

- 5.8.1.4 Predictive analytics

- 5.8.1.5 A2P messaging

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 GIS

- 5.8.2.2 Geofencing

- 5.8.2.3 Location analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Blockchain

- 5.8.3.2 AI

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES' ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS OF MASS NOTIFICATION SYSTEM, BY OFFERING

- TABLE 8 INDICATIVE PRICING LEVELS OF MASS NOTIFICATION SYSTEM, BY OFFERING

- 5.10.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP APPLICATION

- FIGURE 30 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP APPLICATION

- TABLE 9 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP APPLICATION

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- TABLE 10 PATENTS FILED, 2014-2024

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 31 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2014-2024

- 5.11.3.1 Top 10 applicants in mass notification system market

- FIGURE 32 TOP 10 APPLICANTS IN MASS NOTIFICATION SYSTEM MARKET, 2014-2024

- FIGURE 33 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MASS NOTIFICATION SYSTEM MARKET, 2014-2024

- TABLE 11 TOP 20 PATENT OWNERS IN MASS NOTIFICATION SYSTEM MARKET, 2014-2024

- TABLE 12 LIST OF FEW PATENTS IN MASS NOTIFICATION SYSTEM MARKET, 2023-2024

- 5.12 KEY CONFERENCES & EVENTS

- TABLE 13 DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO OF PUBLIC ADDRESS SYSTEMS

- FIGURE 34 PUBLIC ADDRESS SYSTEMS IMPORT DATA, BY KEY COUNTRY, 2015-2022 (USD MILLION)

- 5.13.2 EXPORT SCENARIO OF PUBLIC ADDRESS SYSTEMS

- FIGURE 35 PUBLIC ADDRESS SYSTEMS EXPORT DATA, BY KEY COUNTRY, 2015-2022 (USD MILLION)

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 NORTH AMERICA

- 5.14.2.1 US

- 5.14.2.1.1 California Consumer Privacy Act (CCPA)

- 5.14.2.1.2 Health Insurance Portability and Accountability Act (HIPAA)

- 5.14.2.2 Canada

- 5.14.2.2.1 Public Safety Canada Regulation

- 5.14.2.1 US

- 5.14.3 EUROPE

- 5.14.3.1 General Data Protection Regulation (GDPR)

- 5.14.4 ASIA PACIFIC

- 5.14.4.1 South Korea

- 5.14.4.1.1 Personal Information Protection Act (PIPA)

- 5.14.4.2 China

- 5.14.4.3 India

- 5.14.4.1 South Korea

- 5.14.5 MIDDLE EAST & AFRICA

- 5.14.5.1 UAE

- 5.14.6 LATIN AMERICA

- 5.14.6.1 Brazil

- 5.14.6.1.1 Brazil's General Data Protection Law

- 5.14.6.1 Brazil

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.15.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.16 BUSINESS MODELS OF MASS NOTIFICATION SYSTEM MARKET

- 5.16.1 PERPETUAL LICENSING

- 5.16.2 SOFTWARE-AS-A-SERVICE (SAAS)

- 5.16.3 HYBRID MODEL

- 5.17 BEST PRACTICES

- TABLE 21 BEST PRACTICES IN MASS NOTIFICATION SYSTEM MARKET

- 5.18 TECHNOLOGY ROADMAP

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.20 INVESTMENT AND FUNDING SCENARIO

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO OF VENDORS IN MASS NOTIFICATION SYSTEM MARKET IN LAST FIVE YEARS

6 MASS NOTIFICATION SYSTEM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- FIGURE 40 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 22 MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 23 MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 6.2 SOFTWARE

- 6.2.1 INTEGRATION CAPABILITIES AND SEAMLESS COMMUNICATION TO DRIVE MARKET

- TABLE 24 SOFTWARE: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 25 SOFTWARE: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2 SOFTWARE TYPE

- FIGURE 41 IN-BUILDING SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 26 SOFTWARE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 27 SOFTWARE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 6.2.2.1 In-building

- TABLE 28 IN-BUILDING: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 29 IN-BUILDING: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2.2 Wide area notification

- TABLE 30 WIDE AREA NOTIFICATION: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 31 WIDE AREA NOTIFICATION: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.2.3 Distributed recipient

- TABLE 32 DISTRIBUTED RECIPIENT: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 33 DISTRIBUTED RECIPIENT: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.3 SOFTWARE, BY INTEGRATION

- FIGURE 42 STANDALONE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 34 SOFTWARE: MASS NOTIFICATION SYSTEM MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 35 SOFTWARE: MASS NOTIFICATION SYSTEM MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- 6.2.3.1 Integrated

- TABLE 36 INTEGRATED: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 37 INTEGRATED: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.3.2 Standalone

- TABLE 38 STANDALONE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 39 STANDALONE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.4 SOFTWARE, BY DEPLOYMENT MODE

- FIGURE 43 CLOUD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 40 SOFTWARE: MASS NOTIFICATION SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 41 SOFTWARE: MASS NOTIFICATION SYSTEM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 6.2.4.1 On-premises

- TABLE 42 ON-PREMISES: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 43 ON-PREMISES: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.2.4.2 Cloud

- TABLE 44 CLOUD: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 45 CLOUD: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 HARDWARE

- 6.3.1 ABILITY TO ENSURE SYSTEM RELIABILITY AND MINIMIZE SINGLE POINTS OF FAILURE TO BOOST MARKET

- FIGURE 44 ELECTRONIC MESSAGING DISPLAYS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 47 MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 48 HARDWARE: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 49 HARDWARE: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.2 FIRE ALARM SYSTEMS

- TABLE 50 FIRE ALARM SYSTEMS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 51 FIRE ALARM SYSTEMS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.3 PUBLIC ADDRESS SYSTEMS (LOUDSPEAKERS/SPEAKER ARRAY)

- TABLE 52 PUBLIC ADDRESS SYSTEMS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 53 PUBLIC ADDRESS SYSTEMS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.4 DURESS BUTTONS

- TABLE 54 DURESS BUTTONS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 55 DURESS BUTTONS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.5 ELECTRONIC MESSAGING DISPLAYS

- TABLE 56 ELECTRONIC MESSAGING DISPLAYS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 57 ELECTRONIC MESSAGING DISPLAYS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.6 VISUAL ALERT DEVICES

- TABLE 58 VISUAL ALERT DEVICES: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 59 VISUAL ALERT DEVICES: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3.7 SIRENS

- TABLE 60 SIRENS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 61 SIRENS: MASS NOTIFICATION SYSTEM HARDWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

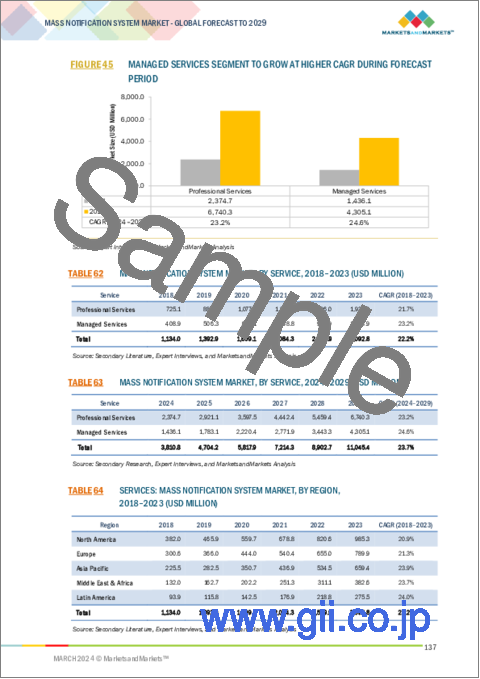

- 6.4 SERVICES

- 6.4.1 RISE IN DEMAND FOR SWIFT AND SEAMLESS DEPLOYMENT OF SOLUTIONS TO BOOST MARKET

- FIGURE 45 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 62 MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 63 MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 64 SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 65 SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2 PROFESSIONAL SERVICES

- FIGURE 46 TRAINING & SUPPORT SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 66 MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 67 MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 68 PROFESSIONAL SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 69 PROFESSIONAL SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2.1 Consulting & planning services

- TABLE 70 CONSULTING & PLANNING SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 71 CONSULTING & PLANNING SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2.1.1 System integration consulting

- 6.4.2.1.2 Emergency preparedness planning

- 6.4.2.1.3 Communication strategy development

- 6.4.2.1.4 Crisis communication planning

- 6.4.2.1.5 Compliance & regulation advisory

- 6.4.2.2 Training & support services

- TABLE 72 TRAINING & SUPPORT SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 73 TRAINING & SUPPORT SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.2.2.1 User training workshops

- 6.4.2.2.2 Technical support & helpdesk

- 6.4.2.2.3 User onboarding & orientation

- 6.4.2.2.4 Training material development

- 6.4.2.2.5 Troubleshooting & issue resolution

- 6.4.3 MANAGED SERVICES

- TABLE 74 MANAGED SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 75 MANAGED SERVICES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4.3.1 Managed alert creation & delivery

- 6.4.3.2 24/7 monitoring & response

- 6.4.3.3 Emergency event coordination

- 6.4.3.4 Dedicated emergency response teams

- 6.4.3.5 Content creation & management

7 MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL

- 7.1 INTRODUCTION

- 7.1.1 COMMUNICATION CHANNELS: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- FIGURE 47 VOICE COMMUNICATION SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 76 MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 77 MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2024-2029 (USD MILLION)

- 7.2 TEXT-BASED COMMUNICATION

- 7.2.1 TEXT-BASED COMMUNICATION TO OFFER TARGETED MESSAGING AND CUSTOMIZATION BY ENSURING PROMPT RESPONSES

- TABLE 78 TEXT-BASED COMMUNICATION: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 79 TEXT-BASED COMMUNICATION: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.2 SMS ALERTS

- 7.2.3 EMAIL NOTIFICATIONS

- 7.3 VOICE COMMUNICATION

- 7.3.1 NEED FOR SAFEGUARDING LIVES AND ENHANCING SITUATIONAL AWARENESS TO PROPEL MARKET

- TABLE 80 VOICE COMMUNICATION: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 81 VOICE COMMUNICATION: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3.2 PHONE CALL ALERTS

- 7.3.3 PA SYSTEM ANNOUNCEMENTS

- 7.4 DIGITAL COMMUNICATION

- 7.4.1 NEED TO DISSEMINATE CRITICAL INFORMATION SWIFTLY TO BOOST DEMAND FOR DIGITAL COMMUNICATION

- TABLE 82 DIGITAL COMMUNICATION: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 83 DIGITAL COMMUNICATION: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2 MOBILE APP NOTIFICATIONS

- 7.4.3 DESKTOP ALERTS

- 7.4.4 AUDIO-VISUAL ALERTS

8 MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE

- 8.1 INTRODUCTION

- 8.1.1 FACILITY TYPES: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- FIGURE 48 INDOOR FACILITIES SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- TABLE 84 MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 85 MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- 8.2 INDOOR FACILITIES

- 8.2.1 TAILORING COMMUNICATION FOR EFFECTIVE CRISIS RESPONSES IN VARIOUS INDOOR FACILITIES TO DRIVE MARKET

- TABLE 86 INDOOR FACILITIES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 87 INDOOR FACILITIES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.2 OFFICE BUILDINGS

- 8.2.3 SHOPPING MALLS

- 8.2.4 OTHER INDOOR FACILITY TYPES

- 8.3 OUTDOOR FACILITIES

- 8.3.1 GROWING NEED TO ENSURE INITIATIVE-TAKING SAFETY MEASURES AND FORTIFYING PREPAREDNESS TO DRIVE MARKET

- TABLE 88 OUTDOOR FACILITIES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 89 OUTDOOR FACILITIES: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3.2 PARKS

- 8.3.3 OPEN-AIR VENUES

- 8.3.4 OTHER OUTDOOR FACILITY TYPES

9 MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATIONS: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- FIGURE 49 PUBLIC SAFETY & WARNING SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 90 MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 91 MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 9.2 CRITICAL EVENT MANAGEMENT

- 9.2.1 RAPID DISSEMINATION OF CRUCIAL INFORMATION ACROSS DIVERSE COMMUNICATION CHANNELS TO DRIVE MARKET

- TABLE 92 MASS NOTIFICATION SYSTEM MARKET, BY CRITICAL EVENT MANAGEMENT APPLICATION, 2018-2023 (USD MILLION)

- TABLE 93 MASS NOTIFICATION SYSTEM MARKET, BY CRITICAL EVENT MANAGEMENT APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 CRITICAL EVENT MANAGEMENT: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 95 CRITICAL EVENT MANAGEMENT: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2.2 INCIDENT RESPONSE

- 9.2.3 EMERGENCY NOTIFICATION

- 9.2.4 REAL-TIME VISIBILITY

- 9.2.5 EVENT DETECTION & MONITORING

- 9.2.6 OTHER CRITICAL EVENT MANAGEMENT APPLICATIONS

- 9.3 PUBLIC SAFETY & WARNING

- 9.3.1 RISING NEED TO REINFORCE PUBLIC SAFETY BY SWIFT TRANSMISSION OF CRITICAL UPDATES TO DRIVE MARKET

- TABLE 96 MASS NOTIFICATION SYSTEM MARKET, BY PUBLIC SAFETY & WARNING APPLICATION, 2018-2023 (USD MILLION)

- TABLE 97 MASS NOTIFICATION SYSTEM MARKET, BY PUBLIC SAFETY & WARNING APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 PUBLIC SAFETY & WARNING: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 99 PUBLIC SAFETY & WARNING: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3.2 PUBLIC SAFETY DRILLS & EXERCISES

- 9.3.3 GOVERNMENT & LAW ENFORCEMENT UPDATES

- 9.3.4 TRAFFIC & TRANSPORTATION ALERTS

- 9.3.5 EVACUATION NOTICES

- 9.3.6 PUBLIC HEALTH NOTIFICATIONS

- 9.3.7 AMBER ALERTS & MISSING PERSON NOTIFICATIONS

- 9.3.8 OTHER PUBLIC SAFETY & WARNING APPLICATIONS

- 9.4 BUSINESS CONTINUITY & DISASTER MANAGEMENT

- 9.4.1 RISING DEMAND FOR MINIMIZING DOWNTIME AND FINANCIAL LOSSES TO SPUR MARKET GROWTH

- TABLE 100 MASS NOTIFICATION SYSTEM MARKET, BY BUSINESS CONTINUITY & DISASTER MANAGEMENT APPLICATION, 2018-2023 (USD MILLION)

- TABLE 101 MASS NOTIFICATION SYSTEM MARKET, BY BUSINESS CONTINUITY & DISASTER MANAGEMENT APPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 BUSINESS CONTINUITY & DISASTER MANAGEMENT: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 103 BUSINESS CONTINUITY & DISASTER MANAGEMENT: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4.2 EMERGENCY RESPONSE PLANS & WORKFLOWS

- 9.4.3 BUSINESS CONTINUITY ACTIVATION

- 9.4.4 EMPLOYEE SAFETY & ACCOUNTABILITY

- 9.4.5 SUPPLY CHAIN & VENDOR COMMUNICATION

- 9.4.6 FACILITY & ASSET MANAGEMENT

- 9.4.7 CUSTOMER COMMUNICATION & SERVICE UPDATES

- 9.4.8 OTHER BUSINESS CONTINUITY & DISASTER MANAGEMENT APPLICATIONS

- 9.5 REPORTING & ANALYTICS

- 9.5.1 SPIKE IN DEMAND FOR OPTIMIZING MESSAGE DISSEMINATION AND RESPONSE RATES TO PROPEL MARKET

- TABLE 104 MASS NOTIFICATION SYSTEM MARKET, BY REPORTING & ANALYTICS APPLICATION, 2018-2023 (USD MILLION)

- TABLE 105 MASS NOTIFICATION SYSTEM MARKET, BY REPORTING & ANALYTICS APPLICATION, 2024-2029 (USD MILLION)

- TABLE 106 REPORTING & ANALYTICS: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 107 REPORTING & ANALYTICS: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5.2 RECIPIENT BEHAVIOR ANALYSIS

- 9.5.3 SYSTEM PERFORMANCE ANALYTICS

- 9.5.4 EMERGENCY RESPONSE ANALYTICS

- 9.5.5 OTHER REPORTING & ANALYTICS APPLICATIONS

- 9.6 OTHER APPLICATIONS

- TABLE 108 OTHER APPLICATIONS: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 109 OTHER APPLICATIONS: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

10 MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- FIGURE 50 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 110 MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 111 MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 10.2 BFSI

- 10.2.1 GROWING NEED TO MANAGE CRITICAL ANNOUNCEMENTS EFFICIENTLY TO DRIVE MARKET

- TABLE 112 MASS NOTIFICATION SYSTEM MARKET, BY BFSI VERTICAL, 2018-2023 (USD MILLION)

- TABLE 113 MASS NOTIFICATION SYSTEM MARKET, BY BFSI VERTICAL, 2024-2029 (USD MILLION)

- TABLE 114 BFSI VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 115 BFSI VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.2 BANKS

- 10.2.3 FINANCIAL INSTITUTIONS

- 10.2.4 OTHER BFSI SUBVERTICALS

- 10.3 RETAIL & ECOMMERCE

- 10.3.1 NEED TO STREAMLINE OPERATIONS AND ENHANCE CUSTOMER EXPERIENCES TO BOOST MARKET

- TABLE 116 MASS NOTIFICATION SYSTEM MARKET, BY RETAIL & ECOMMERCE VERTICAL, 2018-2023 (USD MILLION)

- TABLE 117 MASS NOTIFICATION SYSTEM MARKET, BY RETAIL & ECOMMERCE VERTICAL, 2024-2029 (USD MILLION)

- TABLE 118 RETAIL & ECOMMERCE VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 119 RETAIL & ECOMMERCE VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3.2 RETAIL CHAINS

- 10.3.3 ECOMMERCE PLATFORMS

- 10.3.4 OTHER RETAIL & ECOMMERCE SUBVERTICALS

- 10.4 TRANSPORTATION & LOGISTICS

- 10.4.1 ABILITY TO MANAGE FLEETS AND ENSURE DRIVER SAFETY TO PROPEL MARKET

- TABLE 120 MASS NOTIFICATION SYSTEM MARKET, BY TRANSPORTATION & LOGISTICS VERTICAL, 2018-2023 (USD MILLION)

- TABLE 121 MASS NOTIFICATION SYSTEM MARKET, BY TRANSPORTATION & LOGISTICS VERTICAL, 2024-2029 (USD MILLION)

- TABLE 122 TRANSPORTATION & LOGISTICS VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 123 TRANSPORTATION & LOGISTICS VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4.2 AIRPORTS

- 10.4.3 PORTS

- 10.4.4 PUBLIC TRANSPORTATION HUBS

- 10.4.5 OTHER TRANSPORTATION & LOGISTICS SUBVERTICALS

- 10.5 GOVERNMENT & DEFENSE

- 10.5.1 RISING NEED FOR RAPID ALERT DISTRIBUTION TO ENHANCE SITUATIONAL AWARENESS TO ACCELERATE MARKET GROWTH

- TABLE 124 MASS NOTIFICATION SYSTEM MARKET, BY GOVERNMENT & DEFENSE VERTICAL, 2018-2023 (USD MILLION)

- TABLE 125 MASS NOTIFICATION SYSTEM MARKET, BY GOVERNMENT & DEFENSE VERTICAL, 2024-2029 (USD MILLION)

- TABLE 126 GOVERNMENT & DEFENSE VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 127 GOVERNMENT & DEFENSE VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5.2 EMERGENCY SERVICES (POLICE, FIRE, AND MEDICAL)

- 10.5.3 MUNICIPALITIES & LOCAL GOVERNMENT

- 10.5.4 FEDERAL AGENCIES

- 10.5.5 OTHER GOVERNMENT & DEFENSE SUBVERTICALS

- 10.6 HEALTHCARE & LIFE SCIENCES

- 10.6.1 GROWING NEED TO COMMUNICATE CRUCIAL ALERTS TO DRIVE MARKET

- TABLE 128 MASS NOTIFICATION SYSTEM MARKET, BY HEALTHCARE & LIFE SCIENCES VERTICAL, 2018-2023 (USD MILLION)

- TABLE 129 MASS NOTIFICATION SYSTEM MARKET, BY HEALTHCARE & LIFE SCIENCES VERTICAL, 2024-2029 (USD MILLION)

- TABLE 130 HEALTHCARE & LIFE SCIENCES VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 131 HEALTHCARE & LIFE SCIENCES VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6.2 HOSPITAL & MEDICAL FACILITIES

- 10.6.3 HEALTHCARE NETWORKS

- 10.6.4 OTHER HEALTHCARE & LIFE SCIENCES SUBVERTICALS

- 10.7 TELECOM

- 10.7.1 ABILITY TO SHAPE EFFECTIVE COMMUNICATION STRATEGIES TO BOOST DEMAND FOR MASS NOTIFICATION SYSTEMS

- TABLE 132 MASS NOTIFICATION SYSTEM MARKET, BY TELECOM VERTICAL, 2018-2023 (USD MILLION)

- TABLE 133 MASS NOTIFICATION SYSTEM MARKET, BY TELECOM VERTICAL, 2024-2029 (USD MILLION)

- TABLE 134 TELECOM VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 135 TELECOM VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7.2 TELECOMMUNICATION COMPANIES

- 10.7.3 DATA CENTERS

- 10.7.4 OTHER TELECOM SUBVERTICALS

- 10.8 ENERGY & UTILITIES

- 10.8.1 GROWING NEED TO MANAGE GRID FLUCTUATION AND INFORM CUSTOMERS ABOUT ENERGY AVAILABILITY TO DRIVE MARKET

- TABLE 136 MASS NOTIFICATION SYSTEM MARKET, BY ENERGY & UTILITIES VERTICAL, 2018-2023 (USD MILLION)

- TABLE 137 MASS NOTIFICATION SYSTEM MARKET, BY ENERGY & UTILITIES VERTICAL, 2024-2029 (USD MILLION)

- TABLE 138 ENERGY & UTILITIES VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 139 ENERGY & UTILITIES VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8.2 POWER PLANTS

- 10.8.3 OIL & GAS FACILITIES

- 10.8.4 OTHER ENERGY & UTILITIES SUBVERTICALS

- 10.9 MANUFACTURING

- 10.9.1 ABILITY TO ENSURE SEAMLESS PRODUCTION AND MINIMIZE DISRUPTIONS TO DRIVE MARKET

- TABLE 140 MASS NOTIFICATION SYSTEM MARKET, BY MANUFACTURING VERTICAL, 2018-2023 (USD MILLION)

- TABLE 141 MASS NOTIFICATION SYSTEM MARKET, BY MANUFACTURING VERTICAL, 2024-2029 (USD MILLION)

- TABLE 142 MANUFACTURING VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 143 MANUFACTURING VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.9.2 FACTORIES

- 10.9.3 MANUFACTURING FACILITIES

- 10.9.4 OTHER MANUFACTURING SUBVERTICALS

- 10.10 IT/ITES

- 10.10.1 RISING NEED TO ADDRESS SERVICE DISRUPTIONS AND TECHNICAL GLITCHES TO DRIVE MARKET

- TABLE 144 IT/ITES VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 145 IT/ITES VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.11 MEDIA & ENTERTAINMENT

- 10.11.1 RISING NEED TO ENSURE REAL-TIME CRITICAL INFORMATION DELIVERY TO DRIVE MARKET

- TABLE 146 MASS NOTIFICATION SYSTEM MARKET, BY MEDIA & ENTERTAINMENT VERTICAL, 2018-2023 (USD MILLION)

- TABLE 147 MASS NOTIFICATION SYSTEM MARKET, BY MEDIA & ENTERTAINMENT VERTICAL, 2024-2029 (USD MILLION)

- TABLE 148 MEDIA & ENTERTAINMENT VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 149 MEDIA & ENTERTAINMENT VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.11.2 STADIUM & ARENAS

- 10.11.3 THEME PARKS

- 10.11.4 OTHER MEDIA & ENTERTAINMENT SUBVERTICALS

- 10.12 EDUCATION

- 10.12.1 RISING NEED TO SAFEGUARD STUDENTS AND ENGAGE PARENTS IN EDUCATIONAL JOURNEY TO DRIVE MARKET

- TABLE 150 MASS NOTIFICATION SYSTEM MARKET, BY EDUCATION VERTICAL, 2018-2023 (USD MILLION)

- TABLE 151 MASS NOTIFICATION SYSTEM MARKET, BY EDUCATION VERTICAL, 2024-2029 (USD MILLION)

- TABLE 152 EDUCATION VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 153 EDUCATION VERTICAL: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.12.2 K-12 SCHOOLS

- 10.12.3 COLLEGES & UNIVERSITIES

- 10.12.4 EDUCATIONAL DISTRICTS

- 10.12.5 OTHER EDUCATIONAL SUBVERTICALS

- 10.13 OTHER VERTICALS

- TABLE 154 OTHER VERTICALS: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 155 OTHER VERTICALS: MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

11 MASS NOTIFICATION SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 51 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 156 MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 157 MASS NOTIFICATION SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 53 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 158 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 159 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 161 NORTH AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 162 NORTH AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 163 NORTH AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 164 NORTH AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 165 NORTH AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 166 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 167 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 168 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 169 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 170 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 171 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 172 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 173 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL 2024-2029 (USD MILLION)

- TABLE 174 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 175 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 176 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 177 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 178 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 179 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 180 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 181 NORTH AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Increased emphasis on enhancing public safety and minimizing impact of emergencies to fuel market growth

- TABLE 182 US: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 183 US: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 184 US: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 185 US: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 186 US: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 187 US: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 188 US: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 189 US: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 190 US: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 191 US: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 192 US: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 193 US: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 194 US: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 195 US: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 196 US: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 197 US: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2024-2029 (USD MILLION)

- TABLE 198 US: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 199 US: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 200 US: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 201 US: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 202 US: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 203 US: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Swift and effective dissemination of emergency alerts to drive demand for mass notification systems

- 11.2.4.2 Canada: Mass Notification System Market Drivers

- 11.2.4.3 Canada: Mass Notification System Vendors

- FIGURE 54 ROLE OF VENDORS IN CANADIAN MASS NOTIFICATION SYSTEM MARKET

- 11.2.4.4 Canada: Case Studies of Mass Notification System Market

- 11.2.4.4.1 Alertus Technologies helped Durham College and Ontario Tech University provide seamless emergency communication

- 11.2.4.4.2 Red Deer College improved communication protocol and augmented campus safety by deploying InformaCast

- 11.2.4.4.3 DeskAlerts helped CSSS de la Pointe-de-l'Ile enable effective and timely communication with its employees

- 11.2.4.4.4 Everbridge's Unified Critical Communication Platform enabled CIBC Mellon to enhance business continuity efforts

- 11.2.4.5 Company Profiles

- 11.2.4.5.1 Blackberry

- 11.2.4.5.2 Mircom

- 11.2.4.5.3 Everbridge

- 11.2.4.5.4 Honeywell

- 11.2.4.5.5 Motorola Solutions

- 11.2.4.5.6 Johnson Controls

- 11.2.4.5.7 Singlewire Software

- 11.2.4.5.8 Alertus Technologies

- 11.2.4.5.9 Eaton

- 11.2.4.5.10 ICEsoft Technologies

- 11.2.4.4 Canada: Case Studies of Mass Notification System Market

- TABLE 204 CANADA: MASS NOTIFICATION SYSTEM MARKET, 2018-2023 (USD MILLION)

- TABLE 205 CANADA: MASS NOTIFICATION SYSTEM MARKET, 2024-2029 (USD MILLION)

- TABLE 206 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 207 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 208 CANADA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 209 CANADA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 210 CANADA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 211 CANADA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 212 CANADA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 213 CANADA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 214 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 215 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 216 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 217 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 218 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 219 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 220 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 221 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL 2024-2029 (USD MILLION)

- TABLE 222 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 223 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 224 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 225 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 226 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 227 CANADA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 228 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 229 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 230 EUROPE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 231 EUROPE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 232 EUROPE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 233 EUROPE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 234 EUROPE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 235 EUROPE: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 236 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 237 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 238 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 239 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 240 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 241 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 242 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 243 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL 2024-2029 (USD MILLION)

- TABLE 244 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 245 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 246 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 247 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 248 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 249 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 250 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 251 EUROPE: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Rise in investments and governmental initiatives to boost market

- TABLE 252 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 253 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 254 GERMANY: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 255 GERMANY: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 256 GERMANY: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 257 GERMANY: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 258 GERMANY: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 259 GERMANY: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 260 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 261 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 262 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 263 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 264 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 265 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 266 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 267 GERMANY: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Growing adoption of innovative technologies to drive market

- 11.3.5 FRANCE

- 11.3.5.1 Increasing occurrence of emergencies and security threats to propel market

- 11.3.6 ITALY

- 11.3.6.1 Growing commitment to proactive crisis management to drive market

- 11.3.7 SPAIN

- 11.3.7.1 Ability to deliver real-time alerts and critical information during emergencies to drive market

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 55 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 268 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 269 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 270 ASIA PACIFIC: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 271 ASIA PACIFIC: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 272 ASIA PACIFIC: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 273 ASIA PACIFIC: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 274 ASIA PACIFIC: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 275 ASIA PACIFIC: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 276 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 277 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 278 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 279 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 280 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 281 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 282 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 283 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2024-2029 (USD MILLION)

- TABLE 284 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 285 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 286 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 287 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 288 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 289 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 290 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 291 ASIA PACIFIC: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Rising need to enhance disaster management, emergency response, and overall public safety to fuel market growth

- TABLE 292 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 293 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 294 CHINA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 295 CHINA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 296 CHINA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 297 CHINA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 298 CHINA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 299 CHINA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 300 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 301 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 302 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 303 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 304 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 305 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 306 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 307 CHINA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Increasing awareness about importance of efficient communication during emergencies to drive market

- 11.4.5 INDIA

- 11.4.5.1 Need for robust communication infrastructure for rapid dissemination of vital information to propel market growth

- 11.4.6 ANZ

- 11.4.6.1 Rapid adoption of mass notification system to enhance emergency preparedness

- 11.4.7 SOUTH KOREA

- 11.4.7.1 Rising emphasis on safety to boost market

- 11.4.8 ASEAN

- 11.4.8.1 Rise in need to ensure timely evacuations during calamities and risk mitigation to boost market

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 308 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 323 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2024-2029 (USD MILLION)

- TABLE 324 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 325 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 326 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 327 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 328 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 329 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 330 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 331 MIDDLE EAST & AFRICA: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Effective utilization of mass notification system to bolster crisis communication capabilities to drive market

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Advanced disaster management and technological progress to drive market

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Rise in demand for mass notification system to optimize communication efficacy to boost market

- 11.5.6 ISRAEL

- 11.5.6.1 Need to integrate mass notification system with technology to propel market

- 11.5.7 EGYPT

- 11.5.7.1 Swift and widespread dissemination of critical information to boost demand for mass notification systems

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 332 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 333 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 334 LATIN AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 335 LATIN AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 336 LATIN AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2018-2023 (USD MILLION)

- TABLE 337 LATIN AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY INTEGRATION, 2024-2029 (USD MILLION)

- TABLE 338 LATIN AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 339 LATIN AMERICA: MASS NOTIFICATION SYSTEM SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 340 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 341 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 342 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 343 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 344 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 345 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 346 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2018-2023 (USD MILLION)

- TABLE 347 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COMMUNICATION CHANNEL, 2024-2029 (USD MILLION)

- TABLE 348 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2018-2023 (USD MILLION)

- TABLE 349 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY FACILITY TYPE, 2024-2029 (USD MILLION)

- TABLE 350 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 351 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 352 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 353 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 354 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 355 LATIN AMERICA: MASS NOTIFICATION SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Rise in adoption of advanced technology to enhance citizen safety to drive market

- 11.6.4 MEXICO

- 11.6.4.1 Surging need for efficient communication during emergencies to fuel market growth

- 11.6.5 ARGENTINA

- 11.6.5.1 Need to enhance emergency response capabilities to drive market

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 356 OVERVIEW OF STRATEGIES ADOPTED BY KEY MASS NOTIFICATION SYSTEM VENDORS

- 12.3 REVENUE ANALYSIS

- FIGURE 56 BUSINESS SEGMENT REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022 (USD MILLION)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 57 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 12.4.1 MARKET RANK ANALYSIS

- TABLE 357 MASS NOTIFICATION SYSTEM MARKET: DEGREE OF COMPETITION

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 58 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY HARDWARE

- FIGURE 59 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY SOFTWARE

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 60 MASS NOTIFICATION SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company Footprint

- FIGURE 61 COMPANY FOOTPRINT (16 COMPANIES)

- 12.6.5.2 Region Footprint

- TABLE 358 REGION FOOTPRINT (16 COMPANIES)

- 12.6.5.3 Vertical Footprint

- TABLE 359 VERTICAL FOOTPRINT (16 COMPANIES)

- 12.6.5.4 Offering Footprint

- TABLE 360 OFFERING FOOTPRINT (16 COMPANIES)

- 12.6.5.5 Application Footprint

- TABLE 361 APPLICATION FOOTPRINT (16 COMPANIES)

- 12.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 62 MASS NOTIFICATION SYSTEM MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 12.7.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- TABLE 362 MASS NOTIFICATION SYSTEM MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 363 MASS NOTIFICATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES, 2023

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY MASS NOTIFICATION SYSTEM VENDORS

- FIGURE 63 COMPANY FINANCIAL METRICS OF KEY MASS NOTIFICATION SYSTEM VENDORS

- FIGURE 64 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY MASS NOTIFICATION SYSTEM VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 364 MASS NOTIFICATION SYSTEM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2020-MARCH 2024

- 12.9.2 DEALS

- TABLE 365 MASS NOTIFICATION SYSTEM MARKET: DEALS, JANUARY 2020-MARCH 2024

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key Strengths, Strategic choices made, and Weaknesses and Competitive threats)**

- 13.2.1 SIEMENS AG

- TABLE 366 SIEMENS AG: COMPANY OVERVIEW

- FIGURE 65 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 367 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 368 SIEMENS AG: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 369 SIEMENS AG: DEALS

- 13.2.2 EVERBRIDGE

- TABLE 370 EVERBRIDGE: COMPANY OVERVIEW

- FIGURE 66 EVERBRIDGE: COMPANY SNAPSHOT

- TABLE 371 EVERBRIDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 372 EVERBRIDGE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 373 EVERBRIDGE: DEALS

- 13.2.3 HONEYWELL

- TABLE 374 HONEYWELL: COMPANY OVERVIEW

- FIGURE 67 HONEYWELL: COMPANY SNAPSHOT

- TABLE 375 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 377 HONEYWELL: DEALS

- TABLE 378 HONEYWELL: OTHERS

- 13.2.4 EATON

- TABLE 379 EATON: COMPANY OVERVIEW

- FIGURE 68 EATON: COMPANY SNAPSHOT

- TABLE 380 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 EATON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 382 EATON: DEALS

- 13.2.5 MOTOROLA SOLUTIONS

- TABLE 383 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

- FIGURE 69 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

- TABLE 384 MOTOROLA SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 MOTOROLA SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 386 MOTOROLA SOLUTIONS: DEALS

- 13.2.6 BLACKBERRY

- TABLE 387 BLACKBERRY: COMPANY OVERVIEW

- FIGURE 70 BLACKBERRY: COMPANY SNAPSHOT

- TABLE 388 BLACKBERRY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 BLACKBERRY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 390 BLACKBERRY: DEALS

- 13.2.7 JOHNSON CONTROLS

- TABLE 391 JOHNSON CONTROLS: COMPANY OVERVIEW

- FIGURE 71 JOHNSON CONTROLS: COMPANY SNAPSHOT

- TABLE 392 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED