|

|

市場調査レポート

商品コード

1810321

リアルタイムロケーションシステムの世界市場:オファリング別、技術別、用途別、業界別、地域別 - 2030年までの予測Real-time Location Systems Market by Offering, Technology, Application - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| リアルタイムロケーションシステムの世界市場:オファリング別、技術別、用途別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月29日

発行: MarketsandMarkets

ページ情報: 英文 276 Pages

納期: 即納可能

|

概要

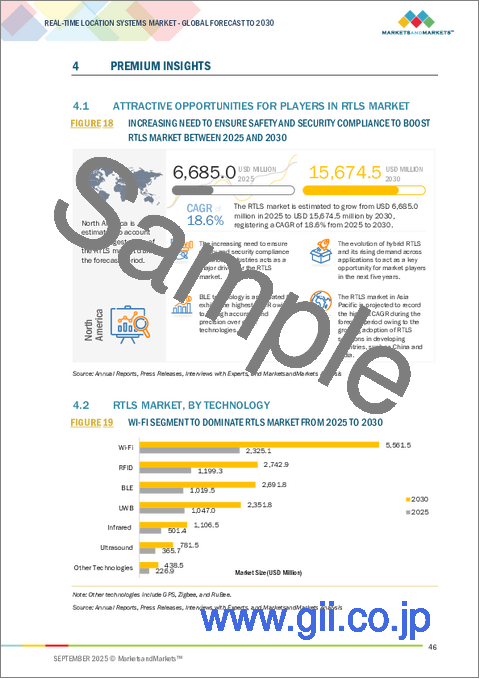

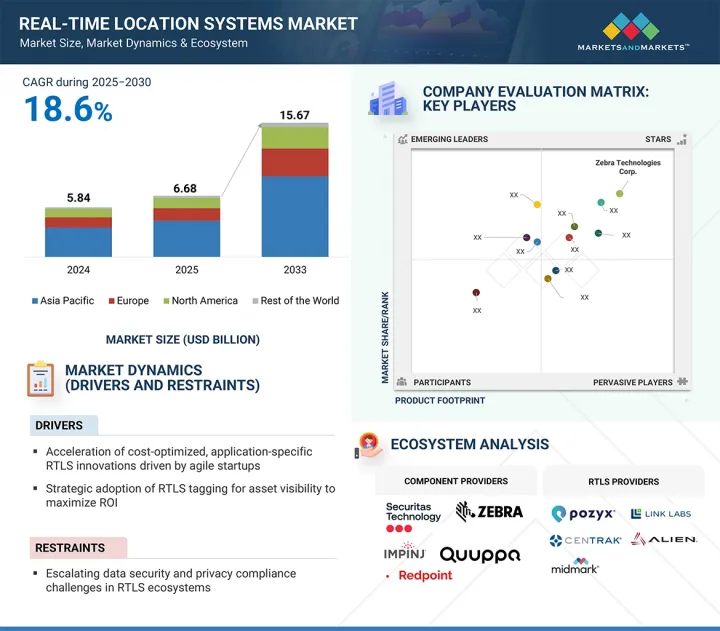

世界のリアルタイムロケーションシステム(RTLS)の市場規模は、2025年の66億8,000万米ドルから2030年には156億7,000万米ドルに拡大し、18.6%の堅調なCAGRを記録すると予測されています。

RTLSソリューションは、ローカル・ポジショニング・システムやトラッキング・システムとも呼ばれ、様々な環境や産業において、資産や個人のリアルタイムの位置を自動的に識別し、ピンポイントで特定するように設計されています。これらのシステムは、対象物に貼付されたタグやバッジ、または担当者が身に付けているタグやバッジに依存しており、これらのタグやバッジは、カバーエリア内の固定レシーバ、リーダ、またはアクセスポイントにワイヤレスで位置データを送信します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、技術別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

最新のRTLS導入では、無線自動識別(RFID)、Wi-Fi、超音波、赤外線(IR)、超広帯域(UWB)、Bluetooth Low Energy(BLE)など、さまざまな無線技術が活用されており、特定のアプリケーション要件に応じて技術が選択されています。正確な資産追跡、業務の可視化、プロセスの最適化に対するニーズの高まりと、RTLSの投資対効果の実証された能力が相まって、ヘルスケア、製造、ロジスティクス、運輸などの分野で導入が進んでいます。

RTLSプラットフォームは、業務現場のワークフローを監視するために、業界全体でますます使用されるようになっています。多くの組織の最大の関心事は、決められたエリア内の人員/スタッフを追跡することです。製造業、ヘルスケア、その他多くの産業では、人員を追跡することで、組織に貴重な情報を提供することができます。これは、組織が瞬時に判断を下し、スタッフを保護し、災害を回避するのに役立ちます。この目的のために、タグ/バッジやゲートウェイなどのガジェットが使用されます。

ヘルスケア分野では、患者とスタッフの安全が最優先事項です。RTLSソリューションは、落下検知と防止、徘徊管理、乳幼児保護アプリケーションのためにヘルスケア分野で導入されています。これらの使用事例はすべて、人員/スタッフの追跡とモニタリングを必要とします。RTLSはスタッフの動きに関連するデータを継続的に提供し、どのような組織においても、オペレーションフロアのリアルタイム可視化は作業効率を向上させます。RTLSを使用したリアルタイムのスタッフ追跡により、集中管理システムはスタッフの疲労を特定し、適切な対策を講じることができます。スポーツ&エンターテイメント業界では、人員/スタッフの位置情報とモニタリングアプリケーションは、他の業界とは異なる目的があります。例えば、スポーツ業界では、RTLSソリューションを使用することで、コーチはフィールド上の選手の正確な動きを記録することができます。この情報は、選手のパフォーマンスを向上させたり、競合他社に対する戦略を開発したりするのに役立ちます。

製造業には、自動車、航空宇宙、重機、タイヤ、ガラス、その他の製造企業が含まれます。この業種は、RTLSソリューションにとって大きな市場ポテンシャルを持っています。その主な理由は、資産やスタッフの安全に対する意識が高まっていることと、特にアジア太平洋やその他の地域のような新興国市場で産業化が急速に進んでいることです。RTLSソリューションは、資産、スタッフ、車両のあらゆる動きを追跡することで、製造工場の安全性向上に役立ちます。RTLSはまた、作業員とフォークリフトの接近を監視し、事故や衝突を防止し、速度超過を制御することで、資産と作業員の安全を確保します。さらにRTLSは、AIを統合したインテリジェントシステムによってワークフローを最適化し、従業員の生産性を向上させることで、業務効率を高めます。RTLSは、訪問者の位置追跡、道案内、スタッフの位置追跡、安全な制限区域、生産/製造プロセスの追跡、状態監視、コールドチェーン監視、機器の追跡、避難、緊急時の説明責任など、その他のアプリケーションにも活用できます。インダストリー4.0の出現により、大規模企業は、生産性、品質、リードタイムを向上させるために、より高い可視性を得て効率的なオペレーションを促進するために、ますますRTLSソリューションに依存するようになると予想されます。インダストリー4.0の出現により、RTLSは製造環境におけるキーテクノロジーとなる可能性が高いです。

欧州は、主に自動車産業と製造業の拡大により、予測期間中にリアルタイムロケーションシステム(RTLS)市場の大幅な成長が見込まれています。英国、ドイツ、フランスなどの主要市場がRTLS導入でこの地域をリードしており、投資額も最高レベルを占めています。一方、他の欧州諸国も、高度なトラッキング技術への幅広い地域的シフトを反映して、徐々に導入が進んでいます。

プロセスの最適化、業務効率の向上、ビジネスの成長をサポートするために、これらのソリューションを統合する企業が増えているため、欧州におけるRTLSの需要は増加傾向にあります。この地域はまた、位置情報技術の研究開発においても強力な地位を占めており、RTLS機能の進歩を促進する強固なイノベーションエコシステムがあります。さらに、企業と個人消費者の両方による位置情報サービスとマッピングサービスの普及が、市場の拡大を後押ししています。産業界が自動化、デジタル化、インダストリー4.0の実践を受け入れ続ける中、欧州全域でのRTLS導入は加速し、同地域は世界市場成長の重要な一因となります。

当レポートでは、世界のリアルタイムロケーションシステム市場について調査し、オファリング別、技術別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 価格分析

- AI/生成AIがRTLS市場に与える影響

- 2025年の米国関税がRTLS市場に与える影響

第6章 RTLS市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 RTLS市場(技術別)

- イントロダクション

- RFID

- WI-FI

- 超広帯域

- BLE

- 超音波

- 赤外線

- その他

第8章 RTLS市場(用途別)

- イントロダクション

- 在庫/資産追跡と管理

- 人員の所在特定と監視

- アクセス制御とセキュリティ

- 環境モニタリング

- ヤード、ドック、フリート、倉庫の管理と監視

- サプライチェーン管理と自動化

- その他

第9章 RTLS市場(業界別)

- イントロダクション

- ヘルスケア

- 製造業・自動車

- 小売

- 運輸・物流

- 政府

- 教育

- 石油・ガス・鉱業

- スポーツ・エンターテイメント

- その他

第10章 RTLS市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- オーストラリア

- 韓国

- インド

- シンガポール

- フィリピン

- マレーシア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SECURITAS AB

- ZEBRA TECHNOLOGIES CORP.

- IMPINJ, INC.

- SIEMENS

- CENTRAK, INC.

- AIRISTA

- ALIEN TECHNOLOGY, LLC

- GE HEALTHCARE

- QUUPPA

- QORVO, INC.

- SONITOR TECHNOLOGIES

- TELETRACKING TECHNOLOGIES, INC.

- UBISENSE

- その他の企業

- BLUEIOT(BEIJING)TECHNOLOGY CO., LTD.

- MIDMARK CORPORATION

- LITUM

- ELIKO

- REDPOINT POSITIONING CORP.

- LINK LABS

- POZYX

- SEWIO

- TRACKTIO

- VISIBLE ASSETS, INC.

- BORDA TECHNOLOGY

- MYSPHERA S.L.

- SECURE CARE PRODUCTS, LLC

- KONTAKT.IO

- NAVIGINE

- INPIXON

- KINEXON

- LEANTEGRA INC.

- NANJING WOXU WIRELESS CO.,LTD