|

|

市場調査レポート

商品コード

1474714

境界セキュリティの世界市場:コンポーネント別、システム別、サービス別、最終用途分野別、地域別 - 2029年までの予測Perimeter Security Market by Component (Systems & Services), System (Perimeter Intrusion Detection Systems, Video Surveillance Systems, Access Control Systems, Alarm & Notification Systems, Barrier Systems), Services Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 境界セキュリティの世界市場:コンポーネント別、システム別、サービス別、最終用途分野別、地域別 - 2029年までの予測 |

|

出版日: 2024年05月01日

発行: MarketsandMarkets

ページ情報: 英文 465 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の境界セキュリティの市場規模は、2024年の814億米ドルから2029年には1,142億米ドルに成長すると予測され、予測期間中のCAGRは7.0%になるとみられています。

境界セキュリティの市場成長は、高度な統合セキュリティソリューションを必要とする都市化とスマートシティの市場開発によって促進されます。さらに、ネットワーク化されたセキュリティシステムの技術的進歩が監視と脅威管理を強化し、都市や商業環境での市場拡大を支えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | コンポーネント別、システム別、サービス別、最終用途分野別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「世界のセキュリティ脅威の高まりと高度な侵入検知の必要性が、主に境界セキュリティ市場の成長を牽引しています。AI、ML、IoTなどの技術の進歩は、これらのセキュリティシステムの能力を大幅に向上させます。さらに、クラウド技術を統合することで、より柔軟で包括的な遠隔監視が可能になります。強固なセキュリティ対策を義務付ける厳格な政府規制も、さまざまな重要部門や商業部門に高度なセキュリティシステムを採用する必要があるため、市場の拡大を促進する上で重要な役割を果たしています。

境界セキュリティ市場のサービス分野におけるマネージドサービスは、いくつかの要因からCAGRが最も高くなると予測されます。まず、境界セキュリティ技術が高度な分析、AI、IoTを組み込んで複雑化するにつれて、企業はセキュリティ管理を専門家にアウトソーシングすることを好むようになっています。マネージドサービスは、社内のセキュリティ専門スタッフやインフラの必要性を減らすことで、費用対効果の高いソリューションを提供します。さらに、これらのサービスには拡張性があるため、企業は進化する脅威やビジネスの成長に基づいてセキュリティ対策を調整することができます。また、マネージドサービスは、セキュリティ・システムが常に最新のソフトウェア・パッチやセキュリティプロトコルで更新されていることを保証し、侵害に対する全体的な保護を強化します。このような包括的かつ適応性のあるセキュリティ管理アプローチは、ダイナミックな脅威環境において強固な境界セキュリティを維持するために不可欠です。

当レポートでは、世界の境界セキュリティ市場について調査し、コンポーネント別、システム別、サービス別、最終用途分野別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 貿易分析

- 関税と規制状況

- 主な利害関係者と購入基準

- 購入者に影響を与える動向/混乱

- 主な会議とイベント

- 投資と資金調達のシナリオ

- 境界セキュリティシステム:コンポーネント

- 境界セキュリティの進化

第6章 境界セキュリティ市場(コンポーネント別)

- イントロダクション

- システム

- サービス

第7章 境界セキュリティ市場(システム別)

- イントロダクション

- 境界侵入検知システム

- ビデオ監視システム

- アクセス制御システム

- 警報および通知システム

- バリアシステム

- その他

第8章 境界セキュリティ市場(サービス別)

- イントロダクション

- プロフェッショナルサービス

- マネージドサービス

第9章 境界セキュリティ市場(最終用途分野別)

- イントロダクション

- 商業

- 工業

- インフラ

- 政府

- 軍事と防衛

- 住宅、教育施設、宗教施設

第10章 境界セキュリティ市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- ブランド比較

- 企業価値評価と財務指標

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- HONEYWELL

- DAHUA TECHNOLOGY

- BOSCH SECURITY SYSTEMS

- HIKVISION

- AXIS COMMUNICATIONS

- SENSTAR

- PELCO

- RAYTHEON TECHNOLOGIES

- TELEDYNE FLIR

- THALES

- JOHNSON CONTROLS

- FIBER SENSYS

- AMERISTAR PERIMETER SECURITY

- OPTEX

- その他の企業

- PANASONIC

- SOUTHWEST MICROWAVE

- AVIGILON

- ADVANCED PERIMETER SYSTEMS

- CIAS

- GALLAGHER

- INGERSOLL RAND

- INFINOVA

- RBTEC PERIMETER SECURITY SYSTEMS

- SORHEA

- PURETECH SYSTEMS

- SIGHTLOGIX

- スタートアップ/中小企業

- SCYLLA

- VEESION

- PIVOTCHAIN

- PRISMA PHOTONICS

- OPENPATH

- DENSITY

- BARRIER1 SYSTEMS

- ALCATRAZ

- KISI

第13章 隣接市場

第14章 付録

The Global Perimeter Security market size is projected to grow from USD 81.4 billion in 2024 to USD 114.2 billion by 2029 at a CAGR of 7.0% during the forecast period. The market growth in perimeter security is fueled by urbanization and the development of smart cities, which require advanced, integrated security solutions. Additionally, technological advancements in networked security systems enhance surveillance and threat management, supporting market expansion in urban and commercial environments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | Component, System, Service, End-Use Sector, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"Escalating global security threats and the need for advanced intrusion detection primarily drive the perimeter security market's growth. Technological advancements, such as AI, ML, and IoT, significantly enhance these security systems' capabilities. Additionally, integrating cloud technologies allows for more flexible and comprehensive remote monitoring. Strict government regulations mandating robust security measures also play a crucial role in fueling the market's expansion, as they necessitate adopting sophisticated security systems across various critical and commercial sectors."

"By service, the managed service segment will grow at the highest CAGR during the forecast period."

The managed services in the services segment of the perimeter security market are forecasted to have the highest CAGR due to several factors. First, as perimeter security technologies become more complex, incorporating advanced analytics, AI, and IoT, organizations increasingly prefer outsourcing their security management to experts. Managed services offer a cost-effective solution by reducing the need for in-house specialized security staff and infrastructure. Additionally, these services provide scalability, allowing organizations to adjust their security measures based on evolving threats and business growth. Managed services also ensure that security systems are always up-to-date with the latest software patches and security protocols, enhancing overall protection against breaches. Such a comprehensive and adaptive approach to security management is vital for maintaining robust perimeter security in dynamic threat environments.

"By component, the system segment will grow at the largest market size during the forecast period."

The systems component segment of the perimeter security market is forecasted to grow at the largest market size primarily due to the increasing demand for advanced security technologies like surveillance cameras, intrusion detection systems, and access control systems. These systems are essential for real-time monitoring and protection against various security threats. Technological advancements are driving the development of more sophisticated and integrated systems, enhancing their efficiency and effectiveness in detecting and preventing intrusions. Additionally, the rise in security concerns across various sectors, including commercial, industrial, and residential areas, is leading to a greater adoption of these systems. This trend is reinforced by regulatory requirements and the growing need to secure critical infrastructures against escalating threats.

"Asia Pacific is anticipated to account for the highest CAGR during the forecasted period."

The Asia Pacific region is anticipated to experience the highest CAGR in the perimeter security market during the forecast period due to several key factors. Rapid infrastructural development, particularly in emerging economies such as China, India, and Southeast Asia, drives the demand for advanced security systems. These regions see significant investments in smart city projects and critical infrastructure, which require robust security measures to protect against increasing security threats and terrorism.

Additionally, there is a growing adoption of advanced technologies such as AI-based video surveillance systems, IoT-enabled security devices, and integrated security management systems across various sectors, including government, military, commercial, and industrial facilities. These technologies enhance the effectiveness of perimeter security systems, allowing for real-time monitoring and better threat detection and response. Moreover, the region is characterized by rising security concerns due to geopolitical tensions and border issues, which further propel the need for enhanced perimeter security solutions. Government initiatives and regulatory mandates across these countries also support the deployment of advanced security infrastructures, contributing to the rapid growth of the perimeter security market in Asia Pacific.

Breakdown of primaries

The study contains insights from various industry experts, suppliers/software developers, OEMs, and Tier 1 vendors. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 53%, Tier 2 - 29%, and Tier 3 - 18%

- By Designation: C-level - 39%, Directors - 27%, and Others - 34%

- By Region: North America - 41%, Europe - 27%, Asia Pacific - 23%, MEA -6%, and Latin America-3%

The key vendors in the global perimeter security market include Honeywell (US), Dahua Technology (China), Bosch Security Systems (Germany), Hikvision (China), Axis Communications (Sweden), Senstar (Canada), Pelco (US), Raytheon Technologies (US), Teledyne FLIR (US), Thales (France), Johnson Controls (US), Fiber SenSys (US), Ameristar Perimeter Security (US), OPTEX (Japan), Panasonic (Japan), Southwest Microwave (US), Avigilon (Canada), Advanced Perimeter Systems (UK), Cias (Italy), Gallagher (US), Ingersoll Rand (US), Infinova (US), RBtec Perimeter Security Systems (US), SORHEA (France), PureTech Systems (US), SightLogix (US), Scylla (Israel), Veesion (France), Pivotchain (India), Prisma Photonics (Israel), Openpath (US), Density (US), Barrier1 Systems (US), Alcatraz (US), and Kisi (US).

The study includes in-depth competitive intelligence covering company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the perimeter security market and forecasts its size by component (system and services), system (perimeter intrusion detection systems, video surveillance systems, access control systems, alarm & notification systems, barrier systems, and others), service (professional services and managed services), and end-use sector (commercial, industrial, infrastructure, government, military & defense, residential, educational, & religious centers), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the perimeter security market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing security breaches and perimeter intrusions worldwide, Rising demand for perimeter intrusion detection systems, Growing use of smart technologies, such as IoT, AI, and ML, and Adoption of cloud computing and remote work), restraints (Lack of technical expertise, High investment and maintenance costs, and Privacy concerns along with regulatory compliance), opportunities (Increasing rate of automation and industrial deployments, Growing focus on smart city projects, and Border security and commercial and residential demand), and challenges (High installation cost, Rising incidents of false alarm triggers, and Sophistication of threats).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the perimeter security market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the perimeter security market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the perimeter security market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Honeywell (US), Dahua Technology (China), Bosch Security Systems (Germany), Hikvision (China), Axis Communications (Sweden), among others in the perimeter security market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PERIMETER SECURITY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL HARDWARE, SOFTWARE, AND SERVICES OF PERIMETER SECURITY VENDORS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, ILLUSTRATION OF COMPANY REVENUE ESTIMATION

- 2.3.2 SUPPLY-SIDE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 (SUPPLY SIDE): REVENUE OF PERIMETER SECURITY VENDORS FROM SALE OF SYSTEMS AND SERVICES

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, TOP-DOWN (DEMAND SIDE): SHARE OF PERIMETER SECURITY IN OVERALL INFORMATION TECHNOLOGY MARKET

- 2.4 MARKET FORECAST

- TABLE 2 PERIMETER SECURITY MARKET: FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 3 PERIMETER SECURITY MARKET AND GROWTH RATE, 2018-2023 (USD MILLION, Y-O-Y %)

- TABLE 4 PERIMETER SECURITY MARKET AND GROWTH RATE, 2024-2029 (USD MILLION, Y-O-Y %)

- FIGURE 6 GLOBAL PERIMETER SECURITY MARKET AND Y-O-Y GROWTH RATE

- FIGURE 7 SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PERIMETER SECURITY MARKET

- FIGURE 9 RISE IN TERRORIST ACTIVITIES AND NEED TO SECURE CRITICAL INFRASTRUCTURE TO DRIVE MARKET

- 4.2 PERIMETER SECURITY MARKET, BY COMPONENT

- FIGURE 10 SYSTEMS SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- 4.3 PERIMETER SECURITY MARKET, BY SERVICE

- FIGURE 11 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET IN 2024

- 4.4 PERIMETER SECURITY MARKET, BY END-USE SECTOR AND REGION

- FIGURE 12 COMMERCIAL SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES IN 2024

- 4.5 MARKET INVESTMENT SCENARIO

- FIGURE 13 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 PERIMETER SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidences of security breaches and perimeter intrusions worldwide

- 5.2.1.2 Rising demand for perimeter intrusion detection systems

- 5.2.1.3 Growing use of smart technologies

- 5.2.1.4 Shift towards cloud computing and adoption of remote work model

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of technical expertise

- 5.2.2.2 High cost of installing new systems

- 5.2.2.3 Need for regulatory compliance and privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing rate of automation and industrial deployments

- 5.2.3.2 Growing number of smart city projects

- 5.2.3.3 Increasing adoption across defense as well as commercial sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 High installation cost

- 5.2.4.2 Rising incidents of false alarms

- 5.2.4.3 Increasing sophistication and diversification of attacks

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 KISI HELPED CITY OF PEACHTREE CORNERS REINFORCE PERIMETER SECURITY WITH SMART ACCESS CONTROL SOLUTIONS

- 5.3.2 BOSCH SECURITY SYSTEMS HELPED CHENGDU TIANFU INTERNATIONAL AIRPORT ENHANCE PERIMETER SECURITY WITH ADVANCED SURVEILLANCE AND AUDIO SOLUTIONS

- 5.3.3 HIKVISION HELPED MINISO NORTH AMERICA REINFORCE PERIMETER SECURITY WITH INTEGRATED SECURITY SOLUTION

- 5.3.4 PANASONIC SECURITY SOLUTIONS HELPED PHARMACEUTICAL COMPANY IN INDIA ENHANCE PERIMETER SECURITY WITH ADVANCED SURVEILLANCE SYSTEM

- 5.3.5 SCYLLA HELPED TOTEM ECUADOR STREAMLINE PERIMETER SECURITY WITH ADVANCED FALSE ALARM FILTERING

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 15 PERIMETER SECURITY MARKET: VALUE CHAIN ANALYSIS

- 5.4.1 COMPONENT MANUFACTURERS

- 5.4.2 PLANNING AND DESIGNING

- 5.4.3 INFRASTRUCTURE INSTALLATION

- 5.4.4 SYSTEM INTEGRATION

- 5.4.5 END-USE INDUSTRIES

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 16 KEY PLAYERS IN PERIMETER SECURITY MARKET ECOSYSTEM

- TABLE 5 PERIMETER SECURITY MARKET: ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PERIMETER SECURITY MARKET: IMPACT OF PORTER'S FIVE FORCES

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- FIGURE 18 AVERAGE SELLING PRICE TREND OF KEY VENDORS, BY OFFERING

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY VENDOR

- TABLE 8 INDICATIVE PRICING LEVELS OF PERIMETER SECURITY SOLUTIONS, BY VENDOR

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI and ML

- 5.8.1.2 Advanced video analytics

- 5.8.1.3 Sensor fusion

- 5.8.1.4 Biometric authentication

- 5.8.1.4.1 Facial recognition

- 5.8.1.4.2 Finger-vein recognition

- 5.8.1.4.3 Voice recognition

- 5.8.1.5 Thermal imaging

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Fiber optic and LIDAR

- 5.8.2.2 Drone detection

- 5.8.2.3 Mobile-based access control

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Wireless security systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 19 PATENTS GRANTED TO PERIMETER SECURITY SYSTEM VENDORS

- FIGURE 20 REGIONAL ANALYSIS OF PATENTS GRANTED

- 5.9.1 LIST OF MAJOR PATENTS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO OF VIDEO RECORDING/REPRODUCING EQUIPMENT USED FOR PERIMETER SECURITY

- FIGURE 21 IMPORT DATA OF KEY COUNTRIES

- 5.10.2 EXPORT SCENARIO OF VIDEO RECORDING/REPRODUCING EQUIPMENT USED FOR PERIMETER SECURITY

- FIGURE 22 EXPORT DATA OF KEY COUNTRIES

- 5.11 TARIFF & REGULATORY LANDSCAPE

- 5.11.1 TARIFF RELATED TO VIDEO RECORDING/REPRODUCING EQUIPMENT (8521)

- TABLE 9 TARIFF RELATED TO VIDEO RECORDING/REPRODUCING EQUIPMENT (8521), 2022

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- 5.12.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 25 PERIMETER SECURITY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES & EVENTS

- TABLE 17 PERIMETER SECURITY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024

- 5.15 INVESTMENT & FUNDING SCENARIO

- FIGURE 26 LEADING GLOBAL PERIMETER SECURITY STARTUPS/SMES, BY NUMBER OF INVESTORS AND FUNDING ROUNDS

- 5.16 PERIMETER SECURITY SYSTEMS: COMPONENTS

- 5.16.1 SENSORS

- 5.16.1.1 Microwave sensors

- 5.16.1.2 Radar sensors

- 5.16.1.3 Fiber-optic sensors

- 5.16.1.4 Infrared sensors

- 5.16.1.5 Other sensors

- 5.16.2 ELECTRONIC LOCKS

- 5.16.2.1 Electromagnetic locks

- 5.16.2.2 Electric strike locks

- 5.16.2.3 Smart locks

- 5.16.3 CONTROLLERS

- 5.16.3.1 Serial access controllers

- 5.16.3.2 IP access controllers

- 5.16.4 ACCESS CONTROL DEVICES

- 5.16.4.1 Card-based readers

- 5.16.4.1.1 Magnetic stripe cards and readers

- 5.16.4.2 Proximity cards and readers

- 5.16.4.3 Smart cards and readers

- 5.16.4.3.1 Contact smart card

- 5.16.4.3.2 Contactless smart card

- 5.16.4.1 Card-based readers

- 5.16.5 BIOMETRIC DEVICES

- 5.16.5.1 Fingerprint recognition device

- 5.16.5.2 Iris recognition device

- 5.16.5.3 Facial recognition device

- 5.16.5.4 Voice recognition device

- 5.16.5.5 Other devices

- 5.16.1 SENSORS

- 5.17 EVOLUTION OF PERIMETER SECURITY

- 5.17.1 EARLIER TIMES

- 5.17.2 INDUSTRIAL AGE

- 5.17.3 TECHNOLOGY INTEGRATION

- 5.17.4 ADVANCED DETECTION SYSTEMS

- 5.17.5 SMART SECURITY SYSTEMS

- 5.17.6 EVENT SECURITY SYSTEMS

6 PERIMETER SECURITY MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENTS: PERIMETER SECURITY MARKET DRIVERS

- FIGURE 27 SYSTEMS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 18 PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 19 PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 6.2 SYSTEMS

- 6.2.1 INCREASING CRIMINAL ACTIVITIES IN PUBLIC PLACES TO DRIVE SEGMENT

- TABLE 20 SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 21 SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 RISING DEMAND FOR RISK ASSESSMENT SERVICES TO BOOST SEGMENT GROWTH

- TABLE 22 SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 23 SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

7 PERIMETER SECURITY MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.1.1 SYSTEMS: PERIMETER SECURITY MARKET DRIVERS

- FIGURE 28 PERIMETER INTRUSION DETECTION SYSTEMS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 25 PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- 7.2 PERIMETER INTRUSION DETECTION SYSTEMS

- 7.2.1 GROWING NEED TO IDENTIFY AND STOP MALICIOUS ACTIVITIES TO PROPEL SEGMENT

- TABLE 26 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 27 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 29 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.2.2 SENSORS

- TABLE 30 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET FOR SENSORS, BY REGION, 2018-2023 (USD MILLION)

- TABLE 31 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET FOR SENSORS, BY REGION, 2024-2029 (USD MILLION)

- 7.2.3 SOFTWARE

- TABLE 32 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 33 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET SOFTWARE, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 35 PERIMETER INTRUSION DETECTION SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY TYPE, 2024-2029 (USD MILLION)

- 7.2.3.1 Automatic identification system

- TABLE 36 AUTOMATIC IDENTIFICATION SYSTEM: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 37 AUTOMATIC IDENTIFICATION SYSTEM: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.3.2 Analytics

- TABLE 38 ANALYTICS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 39 ANALYTICS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 VIDEO SURVEILLANCE SYSTEMS

- 7.3.1 RISING CONCERNS REGARDING TERRORISM TO FUEL SEGMENT GROWTH

- TABLE 40 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 41 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 43 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.2 CAMERAS

- TABLE 44 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET FOR CAMERAS, BY REGION, 2018-2023 (USD MILLION)

- TABLE 45 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET FOR CAMERAS, BY REGION, 2024-2029 (USD MILLION)

- 7.3.3 SOFTWARE

- TABLE 46 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 47 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 49 VIDEO SURVEILLANCE SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.3.1 Video analytics

- TABLE 50 VIDEO ANALYTICS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 51 VIDEO ANALYTICS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3.3.2 Video management software

- TABLE 52 VIDEO MANAGEMENT SOFTWARE: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 53 VIDEO MANAGEMENT SOFTWARE: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4 ACCESS CONTROL SYSTEMS

- 7.4.1 EMPHASIS ON SECURING CRITICAL INFRASTRUCTURES TO PROPEL SEGMENT

- TABLE 54 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 55 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 57 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.4.2 HARDWARE

- TABLE 58 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR HARDWARE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 59 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR HARDWARE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR HARDWARE, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 61 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR HARDWARE, BY TYPE, 2024-2029 (USD MILLION)

- 7.4.2.1 Card-based readers

- TABLE 62 CARD-BASED READERS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 63 CARD-BASED READERS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2.2 Biometric readers

- TABLE 64 BIOMETRIC READERS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 65 BIOMETRIC READERS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2.3 Multi-technology readers

- TABLE 66 MULTI-TECHNOLOGY READERS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 67 MULTI-TECHNOLOGY READERS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2.4 Electronic locks

- TABLE 68 ELECTRONIC LOCKS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 69 ELECTRONIC LOCKS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2.5 Controllers

- TABLE 70 CONTROLLERS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 71 CONTROLLERS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.2.6 Other hardware devices

- TABLE 72 OTHER HARDWARE DEVICES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 73 OTHER HARDWARE DEVICES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.3 SOFTWARE

- TABLE 74 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 75 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 77 ACCESS CONTROL SYSTEMS: PERIMETER SECURITY MARKET FOR SOFTWARE, BY TYPE, 2024-2029 (USD MILLION)

- 7.4.3.1 Visitor management system

- TABLE 78 VISITOR MANAGEMENT SYSTEM: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 79 VISITOR MANAGEMENT SYSTEM: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4.3.2 Other software applications

- TABLE 80 OTHER SOFTWARE APPLICATIONS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 81 OTHER SOFTWARE APPLICATIONS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.5 ALARMS AND NOTIFICATION SYSTEMS

- 7.5.1 RISING NEED TO CURB THEFT AND INTRUSION TO DRIVE SEGMENT

- TABLE 82 ALARMS AND NOTIFICATION SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 83 ALARMS AND NOTIFICATION SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.6 BARRIER SYSTEMS

- 7.6.1 NEED TO PREVENT TRESPASSING TO PROPEL SEGMENT

- TABLE 84 BARRIER SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 85 BARRIER SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.7 OTHER SYSTEMS

- TABLE 86 OTHER SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 87 OTHER SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

8 PERIMETER SECURITY MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.1.1 SERVICES: PERIMETER SECURITY MARKET DRIVERS

- FIGURE 29 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 88 PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 89 PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- 8.2 PROFESSIONAL SERVICES

- 8.2.1 FOCUS ON SCALABLE AND FLEXIBLE AUTOMATION OF SECURITY SERVICES TO BOOST SEGMENT GROWTH

- FIGURE 30 TRAINING AND EDUCATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 90 PROFESSIONAL SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 91 PROFESSIONAL SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 PROFESSIONAL SERVICES: PERIMETER SECURITY MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 93 PROFESSIONAL SERVICES: PERIMETER SECURITY MARKET, BY TYPE, 2024-2029 (USD MILLION)

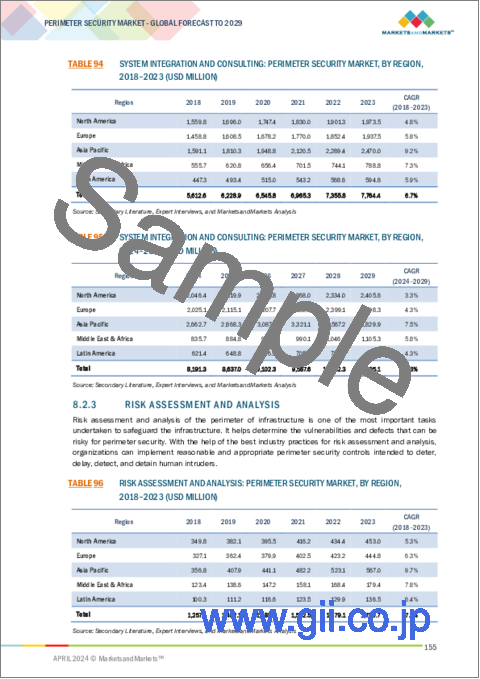

- 8.2.2 SYSTEM INTEGRATION AND CONSULTING

- TABLE 94 SYSTEM INTEGRATION AND CONSULTING: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 95 SYSTEM INTEGRATION AND CONSULTING: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.3 RISK ASSESSMENT AND ANALYSIS

- TABLE 96 RISK ASSESSMENT AND ANALYSIS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 97 RISK ASSESSMENT AND ANALYSIS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.4 TRAINING AND EDUCATION

- TABLE 98 TRAINING AND EDUCATION: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 99 TRAINING AND EDUCATION: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.2.5 MAINTENANCE AND SUPPORT

- TABLE 100 MAINTENANCE AND SUPPORT: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 101 MAINTENANCE AND SUPPORT: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 MANAGED SERVICES

- 8.3.1 RISING DEMAND TO LEVERAGE MODERN VIDEO SURVEILLANCE TECHNOLOGIES AT MINIMAL COSTS TO DRIVE SEGMENT

- TABLE 102 MANAGED SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 103 MANAGED SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

9 PERIMETER SECURITY MARKET, BY END-USE SECTOR

- 9.1 INTRODUCTION

- 9.1.1 END-USE SECTORS: PERIMETER SECURITY MARKET DRIVERS

- FIGURE 31 COMMERCIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 104 PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 105 PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 9.2 COMMERCIAL

- 9.2.1 INCREASING DEMAND FOR SECURITY SERVICES IN RETAIL AND BANKING SECTORS TO PROPEL SEGMENT

- TABLE 106 COMMERCIAL: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 107 COMMERCIAL: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 INDUSTRIAL

- 9.3.1 GROWING NEED TO PREVENT UNAUTHORIZED ENTRY INTO INDUSTRIAL FACILITIES TO DRIVE SEGMENT

- TABLE 108 INDUSTRIAL: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 109 INDUSTRIAL: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 110 INDUSTRIAL: PERIMETER SECURITY MARKET, BY INDUSTRY TYPE, 2018-2023 (USD MILLION)

- TABLE 111 INDUSTRIAL: PERIMETER SECURITY MARKET, BY INDUSTRY TYPE, 2024-2029 (USD MILLION)

- 9.3.2 OIL AND GAS

- TABLE 112 OIL AND GAS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 113 OIL AND GAS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3.3 OTHER INDUSTRIES

- TABLE 114 OTHER INDUSTRIES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 115 OTHER INDUSTRIES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 INFRASTRUCTURAL

- 9.4.1 INCREASING DEMAND FOR SURVEILLANCE AT MASS TRANSIT SYSTEMS TO BOOST SEGMENT GROWTH

- TABLE 116 INFRASTRUCTURAL: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 117 INFRASTRUCTURAL: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 118 INFRASTRUCTURAL: PERIMETER SECURITY MARKET, BY INFRASTRUCTURE TYPE, 2018-2023 (USD MILLION)

- TABLE 119 INFRASTRUCTURAL: PERIMETER SECURITY MARKET, BY INFRASTRUCTURE TYPE, 2024-2029 (USD MILLION)

- 9.4.2 AIRPORT

- TABLE 120 AIRPORT: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 121 AIRPORT: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4.3 OTHER INFRASTRUCTURES

- TABLE 122 OTHER INFRASTRUCTURES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 123 OTHER INFRASTRUCTURES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 GOVERNMENT

- 9.5.1 REQUIREMENT OF ACCESS CONTROL SYSTEMS TO PROTECT CRITICAL ASSETS TO FUEL SEGMENT GROWTH

- TABLE 124 GOVERNMENT: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 125 GOVERNMENT: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 MILITARY AND DEFENSE

- 9.6.1 RISING NEED TO MONITOR NATIONAL BORDERS AND PREVENT UNWANTED ACCESS TO BOOST SEGMENT GROWTH

- TABLE 126 MILITARY AND DEFENSE: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 127 MILITARY AND DEFENSE: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 RESIDENTIAL, EDUCATIONAL, AND RELIGIOUS CENTERS

- 9.7.1 INCREASING INCIDENTS OF THEFT AND BURGLARY TO DRIVE SEGMENT

- TABLE 128 RESIDENTIAL, EDUCATIONAL, AND RELIGIOUS CENTERS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 129 RESIDENTIAL, EDUCATIONAL, AND RELIGIOUS CENTERS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

10 PERIMETER SECURITY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 130 PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 131 PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: PERIMETER SECURITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: PERIMETER SECURITY MARKET SNAPSHOT

- TABLE 132 NORTH AMERICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 133 NORTH AMERICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 134 NORTH AMERICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 135 NORTH AMERICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 136 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 137 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 138 NORTH AMERICA: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 139 NORTH AMERICA: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 140 NORTH AMERICA: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 142 NORTH AMERICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 143 NORTH AMERICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 144 NORTH AMERICA: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 145 NORTH AMERICA: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 146 NORTH AMERICA: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 147 NORTH AMERICA: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 148 NORTH AMERICA: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 149 NORTH AMERICA: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 150 NORTH AMERICA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 151 NORTH AMERICA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 152 NORTH AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 153 NORTH AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 154 NORTH AMERICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 155 NORTH AMERICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 156 NORTH AMERICA: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2018-2023 (USD MILLION)

- TABLE 157 NORTH AMERICA: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2024-2029 (USD MILLION)

- TABLE 158 NORTH AMERICA: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2018-2023 (USD MILLION)

- TABLE 159 NORTH AMERICA: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: PERIMETER SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 161 NORTH AMERICA: PERIMETER SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Technological innovations and presence of key vendors to fuel market growth

- TABLE 162 US: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 163 US: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 164 US: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 165 US: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 166 US: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 167 US: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 168 US: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 169 US: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 170 US: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 171 US: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Rising need for enhanced security in public and commercial sectors to drive market

- TABLE 172 CANADA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 173 CANADA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 174 CANADA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 175 CANADA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 176 CANADA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 177 CANADA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 178 CANADA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 179 CANADA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 180 CANADA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 181 CANADA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: PERIMETER SECURITY MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 182 EUROPE: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 183 EUROPE: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 184 EUROPE: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 185 EUROPE: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 186 EUROPE: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 187 EUROPE: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 188 EUROPE: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 189 EUROPE: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 EUROPE: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 191 EUROPE: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 192 EUROPE: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 193 EUROPE: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 194 EUROPE: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 195 EUROPE: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 196 EUROPE: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 197 EUROPE: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 198 EUROPE: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 199 EUROPE: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 200 EUROPE: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 201 EUROPE: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 202 EUROPE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 203 EUROPE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 204 EUROPE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 205 EUROPE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 206 EUROPE: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2018-2023 (USD MILLION)

- TABLE 207 EUROPE: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2024-2029 (USD MILLION)

- TABLE 208 EUROPE: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2018-2023 (USD MILLION)

- TABLE 209 EUROPE: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 210 EUROPE: PERIMETER SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 211 EUROPE: PERIMETER SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Increased investment by government to propel market growth

- TABLE 212 UK: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 213 UK: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 214 UK: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 215 UK: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 216 UK: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 217 UK: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 218 UK: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 219 UK: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 220 UK: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 221 UK: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Growing demand from automotive manufacturers for innovative solutions to boost market growth

- TABLE 222 GERMANY: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 223 GERMANY: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 224 GERMANY: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 225 GERMANY: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 226 GERMANY: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 227 GERMANY: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 228 GERMANY: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 229 GERMANY: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 230 GERMANY: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 231 GERMANY: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Increased investments in advanced technologies to drive market

- TABLE 232 FRANCE: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 233 FRANCE: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 234 FRANCE: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 235 FRANCE: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 236 FRANCE: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 237 FRANCE: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 238 FRANCE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 239 FRANCE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 240 FRANCE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 241 FRANCE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.3.6 ITALY

- 10.3.6.1 Rising threat of terrorism to critical infrastructure to propel market growth

- TABLE 242 ITALY: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 243 ITALY: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 244 ITALY: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 245 ITALY: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 246 ITALY: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 247 ITALY: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 248 ITALY: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 249 ITALY: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 250 ITALY: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 251 ITALY: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 252 REST OF EUROPE: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 253 REST OF EUROPE: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 254 REST OF EUROPE: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 255 REST OF EUROPE: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 256 REST OF EUROPE: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 257 REST OF EUROPE: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 258 REST OF EUROPE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 259 REST OF EUROPE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 260 REST OF EUROPE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 261 REST OF EUROPE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: PERIMETER SECURITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 34 ASIA PACIFIC: PERIMETER SECURITY MARKET SNAPSHOT

- TABLE 262 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 263 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 264 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 265 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 266 ASIA PACIFIC: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 267 ASIA PACIFIC: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 268 ASIA PACIFIC: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 269 ASIA PACIFIC: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 270 ASIA PACIFIC: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 271 ASIA PACIFIC: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 272 ASIA PACIFIC: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 273 ASIA PACIFIC: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 274 ASIA PACIFIC: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 275 ASIA PACIFIC: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 276 ASIA PACIFIC: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 277 ASIA PACIFIC: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 278 ASIA PACIFIC: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 279 ASIA PACIFIC: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 280 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 281 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 282 ASIA PACIFIC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 283 ASIA PACIFIC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 284 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 285 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 286 ASIA PACIFIC: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2018-2023 (USD MILLION)

- TABLE 287 ASIA PACIFIC: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2024-2029 (USD MILLION)

- TABLE 288 ASIA PACIFIC: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2018-2023 (USD MILLION)

- TABLE 289 ASIA PACIFIC: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 290 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 291 ASIA PACIFIC: PERIMETER SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Implementation of advanced technologies and increased investments by government to drive market

- TABLE 292 CHINA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 293 CHINA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 294 CHINA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 295 CHINA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 296 CHINA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 297 CHINA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 298 CHINA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 299 CHINA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 300 CHINA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 301 CHINA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Increasing need for robust security systems to protect critical infrastructure to drive market

- TABLE 302 JAPAN: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 303 JAPAN: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 304 JAPAN: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 305 JAPAN: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 306 JAPAN: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 307 JAPAN: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 308 JAPAN: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 309 JAPAN: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 310 JAPAN: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 311 JAPAN: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Rising number of smart city projects to propel market growth

- TABLE 312 INDIA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 313 INDIA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 314 INDIA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 315 INDIA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 316 INDIA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 317 INDIA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 318 INDIA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 319 INDIA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 320 INDIA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 321 INDIA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.4.6 SINGAPORE

- 10.4.6.1 Rising number of public-private partnerships for development of advanced security solutions to drive market

- TABLE 322 SINGAPORE: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 323 SINGAPORE: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 324 SINGAPORE: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 325 SINGAPORE: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 326 SINGAPORE: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 327 SINGAPORE: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 328 SINGAPORE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 329 SINGAPORE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 330 SINGAPORE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 331 SINGAPORE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.4.7 AUSTRALIA AND NEW ZEALAND

- 10.4.7.1 Strategic initiatives by government for improved national security and infrastructure protection to drive market

- TABLE 332 ANZ: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 333 ANZ: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 334 ANZ: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 335 ANZ: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 336 ANZ: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 337 ANZ: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 338 ANZ: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 339 ANZ: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 340 ANZ: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 341 ANZ: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.4.8 REST OF ASIA PACIFIC

- TABLE 342 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 343 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 344 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 345 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 346 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 347 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 348 REST OF ASIA PACIFIC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 349 REST OF ASIA PACIFIC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 350 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 351 REST OF ASIA PACIFIC: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 352 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 357 MIDDLE EAST & AFRICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 359 MIDDLE EAST & AFRICA: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 360 MIDDLE EAST & AFRICA: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 361 MIDDLE EAST & AFRICA: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 362 MIDDLE EAST & AFRICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 363 MIDDLE EAST & AFRICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 364 MIDDLE EAST & AFRICA: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 365 MIDDLE EAST & AFRICA: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 366 MIDDLE EAST & AFRICA: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 367 MIDDLE EAST & AFRICA: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 368 MIDDLE EAST & AFRICA: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 369 MIDDLE EAST & AFRICA: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 370 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 371 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 372 MIDDLE EAST & AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 373 MIDDLE EAST & AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 376 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2018-2023 (USD MILLION)

- TABLE 377 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2024-2029 (USD MILLION)

- TABLE 378 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2018-2023 (USD MILLION)

- TABLE 379 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 380 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SUB-REGION, 2018-2023 (USD MILLION)

- TABLE 381 MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SUB-REGION, 2024-2029 (USD MILLION)

- 10.5.3 GULF COOPERATION COUNCIL (GCC)

- TABLE 382 GCC: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 383 GCC: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 384 GCC: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 385 GCC: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 386 GCC: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 387 GCC: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 388 GCC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 389 GCC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 390 GCC: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 391 GCC: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 392 GCC: PERIMETER SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 393 GCC: PERIMETER SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.5.3.1 KSA

- 10.5.3.1.1 Increased public-private partnerships supporting digital modernization goals to propel market

- 10.5.3.1 KSA

- TABLE 394 KSA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 395 KSA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 396 KSA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 397 KSA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 398 KSA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 399 KSA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 400 KSA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 401 KSA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 402 KSA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 403 KSA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.5.3.2 UAE

- 10.5.3.2.1 Strategic commitment to safeguard critical infrastructure to boost market growth

- 10.5.3.2 UAE

- TABLE 404 UAE: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 405 UAE: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 406 UAE: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 407 UAE: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 408 UAE: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 409 UAE: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 410 UAE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 411 UAE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 412 UAE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 413 UAE: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.5.3.3 Rest of GCC countries

- TABLE 414 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 415 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 416 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 417 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 418 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 419 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 420 REST OF GCC COUNTRIES: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 421 REST OF GCC COUNTRIES: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 422 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 423 REST OF GCC COUNTRIES: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Increasing crime rate to drive market growth

- TABLE 424 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 425 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 426 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 427 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 428 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 429 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 430 SOUTH AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 431 SOUTH AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 432 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 433 SOUTH AFRICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 434 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 435 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 436 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 437 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 438 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 439 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 440 REST OF MIDDLE EAST & AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 441 REST OF MIDDLE EAST & AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 442 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 443 REST OF MIDDLE EAST & AFRICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: PERIMETER SECURITY MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 444 LATIN AMERICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 445 LATIN AMERICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 446 LATIN AMERICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 447 LATIN AMERICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 448 LATIN AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 449 LATIN AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 450 LATIN AMERICA: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 451 LATIN AMERICA: PERIMETER INTRUSION DETECTION SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 452 LATIN AMERICA: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 453 LATIN AMERICA: VIDEO SURVEILLANCE SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 454 LATIN AMERICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 455 LATIN AMERICA: VIDEO SURVEILLANCE SOFTWARE MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 456 LATIN AMERICA: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 457 LATIN AMERICA: ACCESS CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 458 LATIN AMERICA: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 459 LATIN AMERICA: ACCESS CONTROL HARDWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 460 LATIN AMERICA: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 461 LATIN AMERICA: ACCESS CONTROL SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 462 LATIN AMERICA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 463 LATIN AMERICA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 464 LATIN AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 465 LATIN AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 466 LATIN AMERICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 467 LATIN AMERICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- TABLE 468 LATIN AMERICA: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2018-2023 (USD MILLION)

- TABLE 469 LATIN AMERICA: PERIMETER SECURITY MARKET FOR INDUSTRIAL SECTOR, BY INDUSTRY TYPE, 2024-2029 (USD MILLION)

- TABLE 470 LATIN AMERICA: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2018-2023 (USD MILLION)

- TABLE 471 LATIN AMERICA: PERIMETER SECURITY MARKET FOR INFRASTRUCTURE SECTOR, BY INFRASTRUCTURE TYPE, 2024-2029 (USD MILLION)

- TABLE 472 LATIN AMERICA: PERIMETER SECURITY MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 473 LATIN AMERICA: PERIMETER SECURITY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Rise in criminal activities and need to address public safety challenges to fuel market growth

- TABLE 474 BRAZIL: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 475 BRAZIL: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 476 BRAZIL: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 477 BRAZIL: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 478 BRAZIL: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 479 BRAZIL: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 480 BRAZIL: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 481 BRAZIL: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 482 BRAZIL: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 483 BRAZIL: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Presence of various video surveillance equipment suppliers to propel market

- TABLE 484 MEXICO: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 485 MEXICO: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 486 MEXICO: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 487 MEXICO: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 488 MEXICO: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 489 MEXICO: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 490 MEXICO: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 491 MEXICO: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 492 MEXICO: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 493 MEXICO: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 494 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 495 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 496 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2018-2023 (USD MILLION)

- TABLE 497 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- TABLE 498 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 499 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 500 REST OF LATIN AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 501 REST OF LATIN AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 502 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2018-2023 (USD MILLION)

- TABLE 503 REST OF LATIN AMERICA: PERIMETER SECURITY MARKET, BY END-USE SECTOR, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 BRAND COMPARISON

- FIGURE 35 PERIMETER SECURITY MARKET: COMPARISON OF VENDORS' BRANDS

- 11.4 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 36 PERIMETER SECURITY MARKET: COMPANY EVALUATION AND FINANCIAL METRICS

- 11.5 REVENUE ANALYSIS

- FIGURE 37 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2020-2023 (USD MILLION)

- 11.6 MARKET SHARE ANALYSIS

- FIGURE 38 SHARE OF LEADING COMPANIES IN PERIMETER SECURITY MARKET

- TABLE 504 PERIMETER SECURITY MARKET: DEGREE OF COMPETITION

- FIGURE 39 RANKING OF TOP 5 PLAYERS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 40 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 11.7.5.1 Company footprint

- FIGURE 41 PERIMETER SECURITY MARKET: COMPANY FOOTPRINT

- 11.7.5.2 Offering footprint

- TABLE 505 PERIMETER SECURITY MARKET: OFFERING FOOTPRINT

- 11.7.5.3 Service footprint

- TABLE 506 PERIMETER SECURITY MARKET: SERVICE FOOTPRINT

- 11.7.5.4 End-use sector footprint

- TABLE 507 PERIMETER SECURITY MARKET: END-USE SECTOR FOOTPRINT

- 11.7.5.5 Regional footprint

- TABLE 508 PERIMETER SECURITY MARKET: REGIONAL FOOTPRINT

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 42 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- TABLE 509 PERIMETER SECURITY MARKET: KEY STARTUPS/SMES

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 510 PERIMETER SECURITY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIO