|

|

市場調査レポート

商品コード

1184191

スマート鉄道の世界市場:提供製品/サービス別 (ソリューション (鉄道資産管理・保守、運行・制御、通信・ネットワーク、セキュリティ・安全、鉄道分析)、サービス (専門、マネージド))・地域別の将来予測 (2027年まで)Smart Railways Market by Offering (Solutions (Rail Asset Management and Maintenance, Operation and Control, Communication and Networking, Security and Safety, Rail Analytics) and Services (Professional and Managed)) Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| スマート鉄道の世界市場:提供製品/サービス別 (ソリューション (鉄道資産管理・保守、運行・制御、通信・ネットワーク、セキュリティ・安全、鉄道分析)、サービス (専門、マネージド))・地域別の将来予測 (2027年まで) |

|

出版日: 2023年01月09日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のスマート鉄道の市場規模は、2022年の289億米ドルから、2027年には430億米ドルへと、予測期間中に8.3%のCAGRで成長すると予測されています。

IoTベースのソリューションの統合や排出量削減への注目の高まりとともに、都市の接続性への要求が拡大すると予測され、これらはすべてスマート鉄道システムの成長に寄与するものと思われます。製品や人の増加に対して適切な輸送能力を提供するためには、スマートソリューションの導入が必要です。真の意味で統合された複合輸送システムは、M2M技術や組み込みセンサーの使用、計算能力の向上、ビッグデータ・IoTの取り込みなどの動向によって実現されると予想されます。

提供製品/サービス別では、ソリューション分野が高いシェアを占めると予想されています。効率性の向上、排出量の削減、コストと生産性の最小化というニーズの高まりが、ソリューション分野の成長を後押ししています。

サービス別では、2022年に専門サービス分野が最大の市場規模を占めています。また、今後も安定したペースで成長する見通しです。技術の急速なデジタル化と採用率に伴い、効率性の向上と経費削減のために、これらの機械を操作する人員は、外部の技術専門家からのサポートを必要としています。

地域別では、アジア太平洋地域が予測期間中に最も高いCAGRで成長すると見込まれています。最新技術の普及浸透やデジタル化投資の拡大、域内各国の国内総生産の成長などが、市場成長の主な要因となっています。

当レポートでは、世界のスマート鉄道の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、提供製品/サービス別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 累積成長分析

- 価格分析

- バリューチェーン分析

- エコシステム

- 技術分析

- IoT (モノのインターネット)

- ビッグデータ分析とクラウドコンピューティング

- 5Gネットワーク

- ドローン

- ハイパーループ

- 自動警告システム

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 規制状況

- ポーターのファイブフォース分析

- ケーススタディ分析

第6章 スマート鉄道市場:提供製品/サービス別

- イントロダクション

- スマート鉄道市場:不況の影響

- ソリューション

- 旅客情報システム

- 貨物管理システム

- セキュリティ・安全ソリューション

- 鉄道用通信・ネットワークシステム

- スマート発券システム

- 鉄道分析システム

- 鉄道資産管理・保守ソリューション

- 鉄道運行・制御ソリューション

- サービス

- 専門サービス

- マネージドサービス

第7章 スマート鉄道市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 他のアジア太平洋諸国

- 中東・アフリカ

- ナイジェリア

- アラブ首長国連邦

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第8章 競合情勢

- 概要

- 市場ランキング

- 市場シェア分析

- 主要企業の過去の収益分析

- 主な市場動向

- 製品の発売

- 資本取引

- 競合ベンチマーキング

- 企業評価マトリックス

- 中小企業/スタートアップの評価マトリックス

第9章 企業プロファイル

- 主要企業

- ALSTOM

- CISCO

- HITACHI

- WABTEC

- SIEMENS

- IBM

- HUAWEI

- INDRA SISTEMAS

- HONEYWELL

- ABB

- THALES

- ADVANTECH

- FUJITSU

- TOSHIBA

- MOXA

- TELEVIC

- ALCATEL-LUCENT ENTERPRISE

- スタートアップ/中小企業

- EKE-ELECTRONICS

- AITEK S.P.A.

- UPTAKE

- EUROTECH

- TEGO

- KONUX

- ASSETIC

- MACHINES WITH VISION

- DELPHISONIC

- PASSIO TECHNOLOGIES

- CLOUDMOYO

- CHEMITO

第10章 隣接/関連市場

- 制限事項

- 鉄道管理システム市場:世界市場の予測 (2025年まで)

- 鉄道プラットフォームセキュリティ市場:世界市場の予測 (2024年まで)

- デジタル鉄道市場:世界市場の予測 (2024年まで)

第11章 付録

MarketsandMarkets projects the smart railways market to grow from USD 28.9 billion in 2022 to USD 43.0 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period. The requirement for urban connectivity is predicted to expand along with the integration of IoT-based solutions and the increased focus on emissions reduction, which will all contribute to the growth of the smart railway system. Providing appropriate transit capacity for rising volumes of products and people necessitates the introduction of smart solutions. Truly integrated and intermodal transport systems are anticipated to be made possible by trends including machine-to-machine technology, using embedded sensors, increasing computing power, and incorporating Big Data and the Internet of Things.

By offering, the solutions segment to account for a higher market share during the forecast period

A pivotal role is played by solutions in handling all railway operations-related activities that include entry, marking, handling, processing, and transit of goods from the supplier end to the manufacturing site and eventually to the consumer. The growing need to improve efficiency, reduce emissions, and minimize costs and productivity is driving the growth of the solutions segment. The solutions autonomously support the technician and other personnel in reducing traffic congestion, efficiently signaling over traffic, and managing ticket collection and monitoring security systems leading to a higher degree of competence and reduced expenses.

By services, the professional service segment to hold the largest market size in 2022

Professional services offer support services to clients involved in technical projects. These services include consulting, system integration and deployment, training, support, and maintenance. Professional services are growing at a steady pace in the smart railway sector; with the rapid digitization and adoption rates of these cutting-edge technologies, to increase efficiency and reduce expenses, personnel operating these machineries require support from external technological experts. As the adoption of technology-based solutions is steadily growing, the demand for smart railways services will grow proportionally.

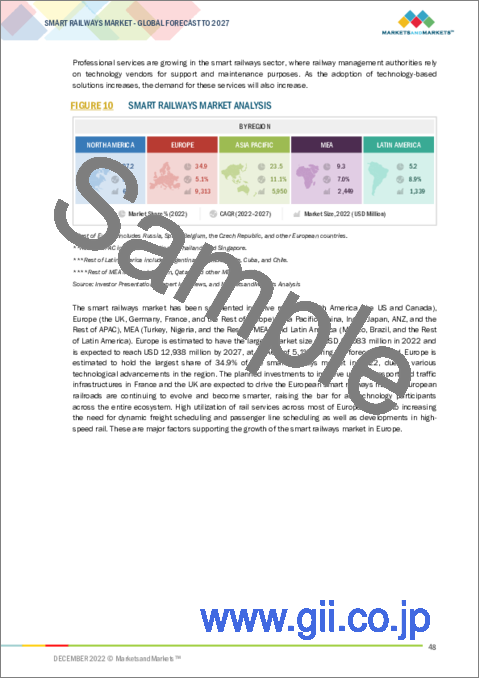

By region, Asia Pacific to grow at the highest CAGR during the forecast period

During the forecast period, Asia Pacific is estimated to be the fastest-growing region in terms of the growth of the smart railways market, with the growing adoption of upcoming and state-of-the-art technologies, larger investments in digitization, and the growth in the Gross Domestic Product of the APAC countries. In order to boost engagement in public-private partnership initiatives for the smart railway system, several Chinese banks have partnered together. Japan is also attempting to incorporate smart solutions in upcoming projects and revamps, such as leveraging artificial intelligence to provide a customized concierge service for travelers. The high population growth rate in the region has also fueled the need to transform and expand the existing rail infrastructure.

Chief Executive Officers (CEOs), marketing directors, innovation and technology directors, and executives from several prominent firms engaged in the smart railways market participated in in-depth interviews.

The breakup of the profiles of the primary participants is given below:

- By Company Type: Tier 1 - 35%, Tier 2 - 39%, and Tier 3 - 26%

- By Designation: C-Level Executives- 33%, Director Level - 25%, and Managers-42%

- By Region: North America - 38%, Europe - 20%, APAC - 30%, and Rest of the World - 12%

The following smart railways market vendors are profiled in the report:

Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Thales (France), Advantech (Taiwan), Fujitsu (Japan), Toshiba (Japan), Alcatel-Lucent Enterprise (France), Moxa (Taiwan), EKE-Electronics (Finland), Televic (Belgium), Uptake (US), Eurotech (Italy), Tego (US), KONUX (Germany), Aitek S.p.A (Italy), Assetic (Australia), Machines With Vision (UK), Delphisonic (US), Passio Technologies (US), Cloud MOYO (US), and Chemito (India).

Research Coverage

The smart railways market is segmented by offering (solutions and services) and region. A detailed analysis of the key industry players has been undertaken to provide insights into their business overviews; services; key strategies; new services and product launches; partnerships, agreements, collaborations; business expansions; and competitive landscape associated with the smart railways market.

Reasons to Buy the Report

The report would help the market leaders and new entrants in the following ways:

- It comprehensively segments the smart railways market and provides the closest approximations of the revenue numbers for the overall market and its subsegments across different regions.

- It would help stakeholders understand the pulse of the market and provide information on the key market drivers, restraints, challenges, and opportunities in the market.

- It would help stakeholders understand their competitors better and gain more insights to enhance their positions in the market. The competitive landscape section includes the competitor ecosystem, new service developments, partnerships, and acquisitions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 SMART RAILWAYS MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SMART RAILWAYS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 PRIMARY INTERVIEWS

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN SMART RAILWAYS MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 1 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS IN SMART RAILWAYS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): SMART RAILWAYS MARKET

- 2.4 FACTOR ANALYSIS

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.5.1 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 6 RAILWAY MANAGEMENT SYSTEM EVOLUTION

- 3.1 SMART RAILWAYS MARKET: RECESSION IMPACT

- FIGURE 7 SMART RAILWAYS MARKET TO WITNESS STEADY GROWTH DURING FORECAST PERIOD

- FIGURE 8 SMART RAILWAYS MARKET SIZE, 2020-2027

- FIGURE 9 LARGEST SEGMENTS IN SMART RAILWAYS MARKET, 2022

- FIGURE 10 SMART RAILWAYS MARKET ANALYSIS

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF GLOBAL SMART RAILWAYS MARKET

- FIGURE 12 NEED FOR EFFICIENCY IN RAIL OPERATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- 4.2 EUROPE: SMART RAILWAYS MARKET, 2022

- FIGURE 13 SOLUTIONS SEGMENT AND UK TO HOLD LARGEST MARKET SHARES IN EUROPE DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: SMART RAILWAYS MARKET, 2022

- FIGURE 14 SOLUTIONS SEGMENT AND CHINA TO HOLD LARGEST MARKET SHARES IN APAC DURING FORECAST PERIOD

- 4.4 SMART RAILWAYS MARKET, BY COUNTRY

- FIGURE 15 INDIA AND JAPAN TO PROVIDE ATTRACTIVE OPPORTUNITIES FOR GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART RAILWAYS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in need for efficiency in rail operations

- 5.2.1.2 Rapid urbanization results in increased need for efficient railway systems

- 5.2.1.3 Government initiatives and increased number of public-private partnership projects in rail industry

- 5.2.1.4 Adoption of IoT and other automation technologies for process optimization

- 5.2.1.5 Technological advancements targeted toward enhancement of customer experience

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost of deployment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased globalization and need for advanced transportation infrastructure

- 5.2.3.2 Rise in demand for cloud-based services

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of advanced and complex systems with legacy infrastructure

- 5.2.4.2 Disruption in logistics and supply chain of IoT devices

- 5.2.4.3 Data security and privacy issues related to IoT devices

- 5.2.5 CUMULATIVE GROWTH ANALYSIS

- 5.3 PRICING ANALYSIS

- 5.3.1 PRICING MODELS AND INDICATIVE PRICE POINTS

- TABLE 4 PRICING ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 SMART RAILWAYS MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM

- TABLE 5 SMART RAILWAYS MARKET ECOSYSTEM

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 INTERNET OF THINGS

- 5.6.2 BIG DATA ANALYTICS AND CLOUD COMPUTING

- 5.6.3 5G NETWORK

- 5.6.4 DRONES

- 5.6.5 HYPERLOOP

- 5.6.6 AUTOMATIC WARNING SYSTEM

- 5.7 PATENT ANALYSIS

- FIGURE 18 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- TABLE 6 TOP 20 PATENT OWNERS (US)

- FIGURE 19 NUMBER OF PATENTS GRANTED YEARLY, 2011-2021

- 5.8 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 7 SMART RAILWAYS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 ISO

- 5.9.1.1 ISO/IEC JTC 1

- 5.9.1.2 ISO/IEC 27001

- 5.9.1.3 ISO/IEC 19770-1

- 5.9.1.4 ISO/IEC JTC 1/SWG 5

- 5.9.1.5 ISO/IEC JTC 1/SC 31

- 5.9.1.6 ISO/IEC JTC 1/SC 27

- 5.9.1.7 ISO/IEC JTC 1/WG 7 sensors

- 5.9.2 GDPR

- 5.9.3 FMCSA

- 5.9.4 FHWA

- 5.9.5 MARAD

- 5.9.6 FAA

- 5.9.7 FRA

- 5.9.8 IEEE-SA

- 5.9.9 CEN/ISO

- 5.9.10 CEN/CENELEC

- 5.9.11 ETSI

- 5.9.12 ITU-T

- 5.9.1 ISO

- 5.10 PORTER'S FIVE FORCES MODEL

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 IMPACT OF EACH FORCE ON SMART RAILWAYS MARKET

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 CASE STUDY 1: LUXEMBOURG RAILWAYS EQUIPPED 34 NEW CORADIA TRAINS WITH ALSTOM'S AUTOMATIC TRAIN OPERATION SYSTEM

- 5.11.2 CASE STUDY 2: VTG RAIL EUROPE COLLABORATED WITH SIEMENS TO INNOVATE RAIL FREIGHT TRANSPORT

- 5.11.3 CASE STUDY 3: UPTAKE AUTOMATED MAINTENANCE WORK ORDER OF A NORTH AMERICAN FREIGHT RAILWAY COMPANY

- 5.11.4 CASE STUDY 4: THALES PROVIDED TRAIN-TO-GROUND BROADBAND DATA COMMUNICATION SOLUTION TO BRESCIA METRO

- 5.11.5 CASE STUDY 5: COMBOIOS DE PORTUGAL IMPLEMENTED SOLUTIONS BY FUJITSU TO INNOVATE ITS TICKETING INFRASTRUCTURE

- 5.11.6 CASE STUDY 6: SIEMENS PROVIDED MAINTENANCE SERVICES TO GOVIA THAMESLINK RAILWAY

- 5.11.7 CASE STUDY 7: ASSETIC HELPED SYDNEY TRAINS VISUALIZE RAIL ASSETS FOR OPTIMIZED ASSET MANAGEMENT

6 SMART RAILWAYS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 21 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 9 SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 10 SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- 6.2 SMART RAILWAYS MARKET: RECESSION IMPACT

- 6.3 SOLUTIONS

- 6.3.1 SOLUTIONS: SMART RAILWAYS MARKET DRIVERS

- FIGURE 22 RAIL ANALYTICS SYSTEM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 11 SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 12 SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 13 SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 14 SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2 PASSENGER INFORMATION SYSTEM

- 6.3.2.1 Rising demand for real-time passenger information systems

- FIGURE 23 MULTIMEDIA INFORMATION AND ENTERTAINMENT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 15 PASSENGER INFORMATION SYSTEM: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 16 PASSENGER INFORMATION SYSTEM: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 17 PASSENGER INFORMATION SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 18 PASSENGER INFORMATION SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2.2 Multimedia information and entertainment

- TABLE 19 MULTIMEDIA INFORMATION AND ENTERTAINMENT: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 20 MULTIMEDIA INFORMATION AND ENTERTAINMENT: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2.3 Network connectivity

- TABLE 21 NETWORK CONNECTIVITY: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 NETWORK CONNECTIVITY: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3 FREIGHT MANAGEMENT SYSTEM

- 6.3.3.1 Rapid digitalization and adoption of advanced technologies

- FIGURE 24 FREIGHT TRACKING SEGMENT TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 23 FREIGHT MANAGEMENT SYSTEM: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 24 FREIGHT MANAGEMENT SYSTEM: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 25 FREIGHT MANAGEMENT SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 FREIGHT MANAGEMENT SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3.2 Freight operation management

- TABLE 27 FREIGHT OPERATION MANAGEMENT: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 28 FREIGHT OPERATION MANAGEMENT: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3.3 Freight tracking

- TABLE 29 FREIGHT TRACKING: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 FREIGHT TRACKING: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4 SECURITY AND SAFETY SOLUTIONS

- 6.3.4.1 Use of AI and loT in railway security

- FIGURE 25 VIDEO SURVEILLANCE AND ANALYTICS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 SECURITY AND SAFETY SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 32 SECURITY AND SAFETY SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 33 SECURITY AND SAFETY SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 34 SECURITY AND SAFETY SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4.2 Video surveillance and analytics

- TABLE 35 VIDEO SURVEILLANCE AND ANALYTICS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 VIDEO SURVEILLANCE AND ANALYTICS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4.3 Intrusion detection

- TABLE 37 INTRUSION DETECTION: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 INTRUSION DETECTION: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4.4 Access control

- TABLE 39 ACCESS CONTROL: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 ACCESS CONTROL: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4.5 Fire alarm and voice evacuation

- TABLE 41 FIRE ALARM AND VOICE EVACUATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 FIRE ALARM AND VOICE EVACUATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4.6 Other security and safety solutions

- TABLE 43 OTHER SECURITY AND SAFETY SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 OTHER SECURITY AND SAFETY SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

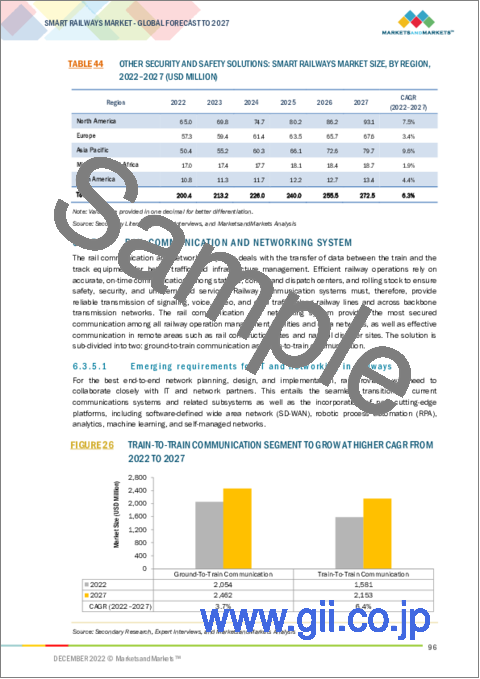

- 6.3.5 RAIL COMMUNICATION AND NETWORKING SYSTEM

- 6.3.5.1 Emerging requirements for IT and networking in railways

- FIGURE 26 TRAIN-TO-TRAIN COMMUNICATION SEGMENT TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 45 RAIL COMMUNICATION AND NETWORKING SYSTEM: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 46 RAIL COMMUNICATION AND NETWORKING SYSTEM: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 47 RAIL COMMUNICATION AND NETWORKING SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 RAIL COMMUNICATION AND NETWORKING SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.5.2 Ground-to-train communication

- TABLE 49 GROUND-TO-TRAIN COMMUNICATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 GROUND-TO-TRAIN COMMUNICATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.5.3 Train-to-train communication

- TABLE 51 TRAIN-TO-TRAIN COMMUNICATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 TRAIN-TO-TRAIN COMMUNICATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.6 SMART TICKETING SYSTEM

- 6.3.6.1 Need for convenience

- TABLE 53 SMART TICKETING SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 54 SMART TICKETING SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.7 RAIL ANALYTICS SYSTEM

- 6.3.7.1 Rapid adoption of AI-powered solutions in various countries across globe

- TABLE 55 RAIL ANALYTICS SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 56 RAIL ANALYTICS SYSTEM: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.8 RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS

- 6.3.8.1 Increased use of sensors in rail asset maintenance

- FIGURE 27 PREDICTIVE MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- TABLE 57 RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 58 RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 59 RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 60 RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.8.2 Asset planning and scheduling

- TABLE 61 ASSET PLANNING AND SCHEDULING: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 62 ASSET PLANNING AND SCHEDULING: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.8.3 Workforce management and optimization

- TABLE 63 WORKFORCE MANAGEMENT AND OPTIMIZATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 64 WORKFORCE MANAGEMENT AND OPTIMIZATION: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.8.4 Condition-based monitoring

- TABLE 65 CONDITION-BASED MONITORING: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 66 CONDITION-BASED MONITORING: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.8.5 Predictive maintenance

- TABLE 67 PREDICTIVE MAINTENANCE: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 68 PREDICTIVE MAINTENANCE: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.8.6 Other railway asset management and maintenance solutions

- TABLE 69 OTHER RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 70 OTHER RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3.9 RAIL OPERATION AND CONTROL SOLUTIONS

- 6.3.9.1 Need to compete with other modes of transportation

- TABLE 71 RAIL OPERATION AND CONTROL SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 72 RAIL OPERATION AND CONTROL SOLUTIONS: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4 SERVICES

- 6.4.1 SERVICES: SMART RAILWAYS MARKET DRIVERS

- FIGURE 28 MANAGED SERVICES TO GROW AT HIGHER CAGR FROM 2022 TO 2027

- TABLE 73 SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 74 SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 75 SERVICES: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 76 SERVICES: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4.2 PROFESSIONAL SERVICES

- 6.4.2.1 Fast digitalization in railway industry and growing need for personnel training

- FIGURE 29 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 77 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 78 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 79 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 80 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4.2.2 Consulting

- TABLE 81 CONSULTING: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 82 CONSULTING: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4.2.3 System integration and deployment

- TABLE 83 SYSTEM INTEGRATION AND DEPLOYMENT: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 84 SYSTEM INTEGRATION AND DEPLOYMENT: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4.2.4 Training, support, and maintenance

- TABLE 85 TRAINING, SUPPORT, AND MAINTENANCE: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 86 TRAINING, SUPPORT, AND MAINTENANCE: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4.3 MANAGED SERVICES

- 6.4.3.1 Increased requirement for competent personnel for technical assistance

- TABLE 87 MANAGED SERVICES: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 88 MANAGED SERVICES: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

7 SMART RAILWAYS MARKET, BY REGION

- 7.1 INTRODUCTION

- FIGURE 30 EUROPE TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 31 MARKET IN ASIA PACIFIC TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 89 SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 90 SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.2 NORTH AMERICA

- 7.2.1 NORTH AMERICA: PESTLE ANALYSIS

- 7.2.2 NORTH AMERICA: MARKET DRIVERS

- 7.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

- 7.2.4 NORTH AMERICA: RECESSION IMPACT

- TABLE 91 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2017-2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2022-2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2017-2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2022-2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2017-2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2022-2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2017-2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2017-2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2022-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.2.5 US

- 7.2.5.1 Government initiatives to drive market in US

- TABLE 111 US: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 112 US: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 113 US: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 114 US: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 115 US: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2017-2021 (USD MILLION)

- TABLE 116 US: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2022-2027 (USD MILLION)

- TABLE 117 US: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2017-2021 (USD MILLION)

- TABLE 118 US: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2022-2027 (USD MILLION)

- TABLE 119 US: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 120 US: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 121 US: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2017-2021 (USD MILLION)

- TABLE 122 US: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2022-2027 (USD MILLION)

- TABLE 123 US: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 124 US: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 125 US: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2017-2021 (USD MILLION)

- TABLE 126 US: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 127 US: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2017-2021 (USD MILLION)

- TABLE 128 US: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2022-2027 (USD MILLION)

- 7.2.6 CANADA

- 7.2.6.1 Increase in number of passengers and higher freight traffic to drive market in Canada

- 7.3 EUROPE

- 7.3.1 EUROPE: PESTLE ANALYSIS

- 7.3.2 EUROPE: MARKET DRIVERS

- 7.3.3 EUROPE: REGULATORY IMPLICATIONS

- 7.3.4 EUROPE: RECESSION IMPACT

- FIGURE 32 EUROPE: MARKET SNAPSHOT

- TABLE 129 EUROPE: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 130 EUROPE: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 131 EUROPE: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 132 EUROPE: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 133 EUROPE: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2017-2021 (USD MILLION)

- TABLE 134 EUROPE: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2022-2027 (USD MILLION)

- TABLE 135 EUROPE: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2017-2021 (USD MILLION)

- TABLE 136 EUROPE: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2022-2027 (USD MILLION)

- TABLE 137 EUROPE: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 138 EUROPE: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 139 EUROPE: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2017-2021 (USD MILLION)

- TABLE 140 EUROPE: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2022-2027 (USD MILLION)

- TABLE 141 EUROPE: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 142 EUROPE: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 143 EUROPE: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2017-2021 (USD MILLION)

- TABLE 144 EUROPE: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 145 EUROPE: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2017-2021 (USD MILLION)

- TABLE 146 EUROPE: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2022-2027 (USD MILLION)

- TABLE 147 EUROPE: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 148 EUROPE: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.3.5 UK

- 7.3.5.1 Need to improve efficiency of existing railway infrastructure to boost market growth

- 7.3.6 GERMANY

- 7.3.6.1 Significant adoption of IoT technologies and analytics in railway sector to propel market

- 7.3.7 FRANCE

- 7.3.7.1 High investment by railway operators to drive market in France

- 7.3.8 REST OF EUROPE

- 7.4 ASIA PACIFIC

- 7.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- 7.4.2 ASIA PACIFIC: MARKET DRIVERS

- 7.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

- 7.4.4 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 149 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2017-2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2022-2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2017-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2022-2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2017-2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2022-2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2017-2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2017-2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2022-2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.4.5 CHINA

- 7.4.5.1 High government investments in railway infrastructure and rapid growth in railways to drive market

- 7.4.6 INDIA

- 7.4.6.1 Investments in smart city projects by government to spur market growth

- 7.4.7 JAPAN

- 7.4.7.1 Rise in adoption of railway technologies to boost market

- 7.4.8 REST OF ASIA PACIFIC

- 7.5 MIDDLE EAST & AFRICA

- 7.5.1 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- 7.5.2 MIDDLE EAST & AFRICA: MARKET DRIVERS

- 7.5.3 MIDDLE EAST & AFRICA: REGULATORY IMPLICATIONS

- 7.5.4 MIDDLE EAST AND AFRICA: RECESSION IMPACT

- TABLE 169 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 170 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 171 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 172 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 173 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2017-2021 (USD MILLION)

- TABLE 174 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2022-2027 (USD MILLION)

- TABLE 175 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2017-2021 (USD MILLION)

- TABLE 176 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2022-2027 (USD MILLION)

- TABLE 177 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 178 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 179 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2017-2021 (USD MILLION)

- TABLE 180 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2022-2027 (USD MILLION)

- TABLE 181 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 182 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 183 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2017-2021 (USD MILLION)

- TABLE 184 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 185 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2017-2021 (USD MILLION)

- TABLE 186 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2022-2027 (USD MILLION)

- TABLE 187 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 188 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 189 AFRICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 190 MIDDLE EAST: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 191 MIDDLE EAST AND AFRICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 192 AFRICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.5.5 NIGERIA

- 7.5.5.1 Government initiatives combined with increased cooperation with other countries to drive market

- 7.5.6 UAE

- 7.5.6.1 Technological advancements and growing economy to drive market

- 7.5.7 SOUTH AFRICA

- 7.5.7.1 Increased demand for transportation services to support regional trade requirements to propel market growth

- 7.5.8 REST OF THE MIDDLE EAST & AFRICA

- 7.6 LATIN AMERICA

- 7.6.1 LATIN AMERICA: PESTLE ANALYSIS

- 7.6.2 LATIN AMERICA: MARKET DRIVERS

- 7.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

- 7.6.4 LATIN AMERICA: RECESSION IMPACT

- TABLE 193 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2017-2021 (USD MILLION)

- TABLE 194 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 195 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 196 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 197 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2017-2021 (USD MILLION)

- TABLE 198 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY PASSENGER INFORMATION SYSTEM, 2022-2027 (USD MILLION)

- TABLE 199 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2017-2021 (USD MILLION)

- TABLE 200 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY FREIGHT MANAGEMENT SYSTEM, 2022-2027 (USD MILLION)

- TABLE 201 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 202 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY SECURITY AND SAFETY SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 203 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2017-2021 (USD MILLION)

- TABLE 204 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL COMMUNICATION AND NETWORKING SYSTEM, 2022-2027 (USD MILLION)

- TABLE 205 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2017-2021 (USD MILLION)

- TABLE 206 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY RAIL ASSET MANAGEMENT AND MAINTENANCE SOLUTIONS, 2022-2027 (USD MILLION)

- TABLE 207 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2017-2021 (USD MILLION)

- TABLE 208 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 209 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2017-2021 (USD MILLION)

- TABLE 210 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY PROFESSIONAL SERVICES, 2022-2027 (USD MILLION)

- TABLE 211 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 212 LATIN AMERICA: SMART RAILWAYS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 7.6.5 BRAZIL

- 7.6.5.1 Significant scope for development of advanced railway infrastructure to boost market growth

- 7.6.6 MEXICO

- 7.6.6.1 Increased demand for improved transportation infrastructure to fuel market growth

- 7.6.7 REST OF LATIN AMERICA

8 COMPETITIVE LANDSCAPE

- 8.1 OVERVIEW

- 8.2 MARKET RANKING

- FIGURE 34 MARKET RANKING IN 2022

- 8.3 MARKET SHARE ANALYSIS

- FIGURE 35 SMART RAILWAYS MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 213 SMART RAILWAYS MARKET: DEGREE OF COMPETITION

- FIGURE 36 MARKET SHARE ANALYSIS OF COMPANIES IN SMART RAILWAYS MARKET

- 8.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

- FIGURE 37 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019-2021

- 8.5 KEY MARKET DEVELOPMENTS

- 8.5.1 PRODUCT LAUNCHES

- TABLE 214 SMART RAILWAYS MARKET: PRODUCT LAUNCHES, JUNE 2019-DECEMBER 2021

- 8.5.2 DEALS

- TABLE 215 SMART RAILWAYS MARKET: DEALS, JANUARY 2019-MAY 2022

- 8.6 COMPETITIVE BENCHMARKING

- TABLE 216 COMPANY FOOTPRINT: OVERALL

- TABLE 217 COMPANY FOOTPRINT: APPLICATION

- TABLE 218 COMPANY FOOTPRINT: REGION

- 8.7 COMPANY EVALUATION MATRIX

- TABLE 219 COMPANY EVALUATION MATRIX: CRITERIA AND WEIGHTAGE

- 8.7.1 STARS

- 8.7.2 EMERGING LEADERS

- 8.7.3 PERVASIVE PLAYERS

- 8.7.4 PARTICIPANTS

- FIGURE 38 SMART RAILWAYS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 8.8 SME/STARTUP EVALUATION MATRIX

- TABLE 220 SMALL AND MEDIUM ENTERPRISE/STARTUP EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 8.8.1 PROGRESSIVE COMPANIES

- 8.8.2 RESPONSIVE COMPANIES

- 8.8.3 DYNAMIC COMPANIES

- 8.8.4 STARTING BLOCKS

- FIGURE 39 SMART RAILWAYS MARKET (GLOBAL): SMES/STARTUP EVALUATION MATRIX, 2022

9 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 9.1 MAJOR PLAYERS

- 9.1.1 ALSTOM

- TABLE 221 ALSTOM: BUSINESS OVERVIEW

- FIGURE 40 ALSTOM: COMPANY SNAPSHOT

- TABLE 222 ALSTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ALSTOM: DEALS

- TABLE 224 ALSTOM: OTHERS

- 9.1.2 CISCO

- TABLE 225 CISCO: BUSINESS OVERVIEW

- FIGURE 41 CISCO: COMPANY SNAPSHOT

- TABLE 226 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 CISCO: DEALS

- 9.1.3 HITACHI

- TABLE 228 HITACHI: BUSINESS OVERVIEW

- FIGURE 42 HITACHI: COMPANY SNAPSHOT

- TABLE 229 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 HITACHI: DEALS

- 9.1.4 WABTEC

- TABLE 231 WABTEC: BUSINESS OVERVIEW

- FIGURE 43 WABTEC: COMPANY SNAPSHOT

- TABLE 232 WABTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 WABTEC: PRODUCT LAUNCHES

- TABLE 234 WABTEC: DEALS

- 9.1.5 SIEMENS

- TABLE 235 SIEMENS: BUSINESS OVERVIEW

- FIGURE 44 SIEMENS: COMPANY SNAPSHOT

- TABLE 236 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 SIEMENS: DEALS

- 9.1.6 IBM

- TABLE 238 IBM: BUSINESS OVERVIEW

- FIGURE 45 IBM: COMPANY SNAPSHOT

- TABLE 239 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 IBM: DEALS

- 9.1.7 HUAWEI

- TABLE 241 HUAWEI: BUSINESS OVERVIEW

- FIGURE 46 HUAWEI: COMPANY SNAPSHOT

- TABLE 242 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 HUAWEI: PRODUCT LAUNCHES

- TABLE 244 HUAWEI: DEALS

- 9.1.8 INDRA SISTEMAS

- TABLE 245 INDRA SISTEMAS: BUSINESS OVERVIEW

- FIGURE 47 INDRA SISTEMAS: COMPANY SNAPSHOT

- TABLE 246 INDRA SISTEMAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 INDRA SISTEMAS: DEALS

- 9.1.9 HONEYWELL

- TABLE 248 HONEYWELL: BUSINESS OVERVIEW

- FIGURE 48 HONEYWELL: COMPANY SNAPSHOT

- TABLE 249 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 HONEYWELL: DEALS

- 9.1.10 ABB

- TABLE 251 ABB: BUSINESS OVERVIEW

- FIGURE 49 ABB: COMPANY SNAPSHOT

- TABLE 252 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ABB: DEALS

- 9.1.11 THALES

- 9.1.12 ADVANTECH

- 9.1.13 FUJITSU

- 9.1.14 TOSHIBA

- 9.1.15 MOXA

- 9.1.16 TELEVIC

- 9.1.17 ALCATEL-LUCENT ENTERPRISE

- 9.2 STARTUPS/SMES

- 9.2.1 EKE-ELECTRONICS

- 9.2.2 AITEK S.P.A.

- 9.2.3 UPTAKE

- 9.2.4 EUROTECH

- 9.2.5 TEGO

- 9.2.6 KONUX

- 9.2.7 ASSETIC

- 9.2.8 MACHINES WITH VISION

- 9.2.9 DELPHISONIC

- 9.2.10 PASSIO TECHNOLOGIES

- 9.2.11 CLOUDMOYO

- 9.2.12 CHEMITO

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

10 ADJACENT/RELATED MARKETS

- 10.1 LIMITATIONS

- 10.2 RAILWAY MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2025

- 10.2.1 MARKET DEFINITION

- 10.2.2 MARKET OVERVIEW

- 10.2.3 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- TABLE 254 RAILWAY MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016-2019 (USD MILLION)

- TABLE 255 RAILWAY MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2019-2025 (USD MILLION)

- 10.2.4 RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE

- TABLE 256 RAILWAY MANAGEMENT SYSTEM MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

- TABLE 257 RAILWAY MANAGEMENT SYSTEM MARKET SIZE, BY SERVICE, 2019-2025 (USD MILLION)

- 10.2.5 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION

- TABLE 258 RAILWAY MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

- TABLE 259 RAILWAY MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2019-2025 (USD MILLION)

- 10.3 RAILWAY PLATFORM SECURITY MARKET - GLOBAL FORECAST TO 2024

- 10.3.1 MARKET DEFINITION

- 10.3.2 MARKET OVERVIEW

- 10.3.3 RAILWAY PLATFORM SECURITY MARKET, BY COMPONENT

- TABLE 260 RAILWAY PLATFORM SECURITY MARKET SIZE, BY COMPONENT, 2017-2024 (USD MILLION)

- 10.3.4 RAILWAY PLATFORM SECURITY MARKET, BY SOLUTION

- TABLE 261 SOLUTIONS: RAILWAY PLATFORM SECURITY MARKET SIZE, BY TYPE, 2017-2024 (USD MILLION)

- 10.3.5 RAILWAY PLATFORM SECURITY MARKET, BY SERVICE

- TABLE 262 SERVICES: RAILWAY PLATFORM SECURITY MARKET SIZE, BY TYPE, 2017-2024 (USD MILLION)

- 10.3.6 RAILWAY PLATFORM SECURITY MARKET, BY PROFESSIONAL SERVICE

- TABLE 263 PROFESSIONAL SERVICES: RAILWAY PLATFORM SECURITY MARKET SIZE, BY TYPE, 2017-2024 (USD MILLION)

- 10.3.7 RAILWAY PLATFORM SECURITY MARKET, BY APPLICATION

- TABLE 264 RAILWAY PLATFORM SECURITY MARKET SIZE, BY APPLICATION, 2017-2024 (USD MILLION)

- 10.3.8 RAILWAY PLATFORM SECURITY MARKET, BY REGION

- TABLE 265 RAILWAY PLATFORM SECURITY MARKET SIZE, BY REGION, 2017-2024 (USD MILLION)

- 10.4 DIGITAL RAILWAY MARKET - GLOBAL FORECAST TO 2024

- 10.4.1 MARKET DEFINITION

- 10.4.2 MARKET OVERVIEW

- 10.4.3 DIGITAL RAILWAY MARKET, BY SOLUTION

- TABLE 266 DIGITAL RAILWAY MARKET SIZE, BY SOLUTION, 2017-2024 (USD BILLION)

- 10.4.4 DIGITAL RAILWAY MARKET, BY SERVICE

- TABLE 267 DIGITAL RAILWAY MARKET SIZE, BY SERVICE, 2017-2024 (USD BILLION)

- 10.4.5 DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE

- TABLE 268 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET SIZE, BY TYPE, 2017-2024 (USD BILLION)

- 10.4.6 DIGITAL RAILWAY MARKET, BY APPLICATION

- TABLE 269 DIGITAL RAILWAY MARKET SIZE, BY APPLICATION, 2017-2024 (USD BILLION)

- 10.4.7 DIGITAL RAILWAY MARKET, BY REGION

- TABLE 270 DIGITAL RAILWAY MARKET SIZE, BY REGION, 2017-2024 (USD BILLION)

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS