|

|

市場調査レポート

商品コード

1653415

交通管理市場:オファリング別、応用分野別、エンドユーザー別、地域別 - 2029年までの予測Traffic Management Market by Offering (Solutions (Traffic Monitoring & Analytics, Adaptive Traffic Control System, Traffic Enforcement Management), Services), Areas of Application, End-User and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 交通管理市場:オファリング別、応用分野別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2025年01月31日

発行: MarketsandMarkets

ページ情報: 英文 288 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

交通管理の市場規模は、2024年に435億3,000万米ドル、2029年には757億4,000万米ドルになると予測され、2024年から2029年までのCAGRは11.7%になるとみられています。

AI機械学習やV2X通信などの技術革新により、交通管理システムは大幅に改善されました。AI技術を活用した予測分析ツールは、都市が交通パターンをより的確に予測し、遅延を減らすのに役立っています。IoTデバイスからのリアルタイムの交通データは、交通管理者が迅速な判断を下し、交通信号を自動的に調整するのに役立っています。高度道路交通システム(ITS)技術は、自律走行車やコネクテッドカーと接続することで、ドライバーの安全を守り、汚染レベルを下げながら、より良いルートを作り出します。これらの技術の絶え間ない進化が採用を促進し、都市のモビリティ課題に対する拡張可能なソリューションを提供しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、応用分野別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

都市部では、遅延を減らし道路をより安全にしながら交通の流れを改善するために交通管理システムが使用されています。このシステムは、現在の交通量に合わせて信号を調整することで交通の流れを管理し、スマートな駐車案内を提供することで、ドライバーが空きスポットを素早く見つけられるようにします。都市交通管理は、公共交通システムを業務に統合し、誰もが簡単に移動できるようにします。さらに、排出ガス監視などの環境に優しい取り組みは、持続可能性プログラムの一環として、人々に電気自動車への乗り換えを促します。これらのアプリケーションは、公共の安全と環境を守りつつ、交通移動を改善することで都市を改善するために連携しています。

適応型交通制御システム(ATCS)は、道路状況の変化に合わせて交通信号を自動調整します。ATCSは、カメラのデータと並んで、センサーの読み取り値やモノのインターネット(IoT)デバイスを通じて交差点の交通パターンを観察します。このシステムの高度な分析ソフトウェアは、交通データを利用して信号のタイミングを更新し、交通の流れを改善し、渋滞を緩和しながら遅延を防止します。このシステムは、混雑時や特定のイベント時に変化する交通量に合わせて信号を調整することで、都市部や郊外で効果を発揮します。ATCSは、アイドリング時間帯の燃料使用量と車両排出量の削減を通じて、環境目標の達成に貢献します。このシステムは、交通の流れと安全性の両方を改善し、スマート交通制御技術の重要な一部となります。

アジア太平洋は、インド、中国、オーストラリア、ニュージーランドなどの国々が高い成長率を記録すると予想され、今後数年間で大きな成長機会が訪れるとみられています。同地域の政府は、交通問題を軽減するために先進的な交通ソリューションに投資しています。インドのスマートシティ・コチ・プロジェクトやオーストラリアのゲートウェイWAパース空港・貨物アクセス・プロジェクトは、各国が交通網を改善するために最新技術をどのように利用しているかを示しています。新技術により、インターネット・ネットワークに接続するセンサーを通じて交通データを即座に収集することができます。このデータは、重要な交通管理プロジェクトを推進します。リアルタイムの交通データは、先進的な交通管理システムの構築に役立つと同時に、ドライバーに最新情報を提供することで、移動中により良い選択ができるようになります。

当レポートでは、世界の交通管理市場について調査し、オファリング別、応用分野別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 交通管理ソリューションの進化

- エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 交通管理データフロープロセス

- 関税と規制状況

- 価格分析

- 技術分析

- 特許分析

- ポーターのファイブフォース分析

- 顧客ビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 技術ロードマップ

- 交通管理市場におけるベストプラクティス

- ビジネスモデル

- 交通管理ツール、フレームワーク、テクニック

- 貿易分析

- 投資と資金調達のシナリオ

- AI/生成AIが交通管理市場に与える影響

第6章 交通管理市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 交通管理市場、応用分野別

- イントロダクション

- 都会部

- 都市間

- 地方

第8章 交通管理市場、エンドユーザー別

- イントロダクション

- 政府

- 民間

第9章 交通管理市場、地域別

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- イタリア

- ドイツ

- フランス

- スペイン

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

- 交通管理製品のベンチマーク

- 企業価値評価と財務指標

- ブランド比較

第11章 企業プロファイル

- 主要参入企業

- HUAWEI

- MUNDYS SPA

- CISCO

- SWARCO

- TELEDYNE FLIR

- KAPSCH TRAFFICCOM

- SIEMENS

- IBM

- Q-FREE

- THALES GROUP

- PTV GROUP

- CUBIC CORPORATION

- TOMTOM

- ST ENGINEERING

- CHEVRON TM

- INDRA

- ECONOLITE

- ALMAVIVA SPA

- スタートアップ/中小企業

- INRIX

- NOTRAFFIC

- TAGMASTER

- BERCMAN TECHNOLOGIES

- VALERANN

- MIOVISION

- BLUESIGNAL

- TELEGRA

- ORIUX

- INVARION

- REKOR

第12章 隣接/関連市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2023

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 RISK ASSESSMENT

- TABLE 4 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 5 TARIFF RELATED TO ELECTRICAL SIGNALING, SAFETY, AND TRAFFIC CONTROL EQUIPMENT

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- TABLE 11 INDICATIVE PRICING ANALYSIS OF KEY TRAFFIC MANAGEMENT MARKET PLAYERS

- TABLE 12 LIST OF MAJOR PATENTS, 2014-2025

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES ON TRAFFIC MANAGEMENT MARKET

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY AREAS OF APPLICATION

- TABLE 15 KEY BUYING CRITERIA FOR KEY AREAS OF APPLICATION

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 18 TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 19 TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 20 TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 21 SOLUTIONS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 SOLUTIONS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

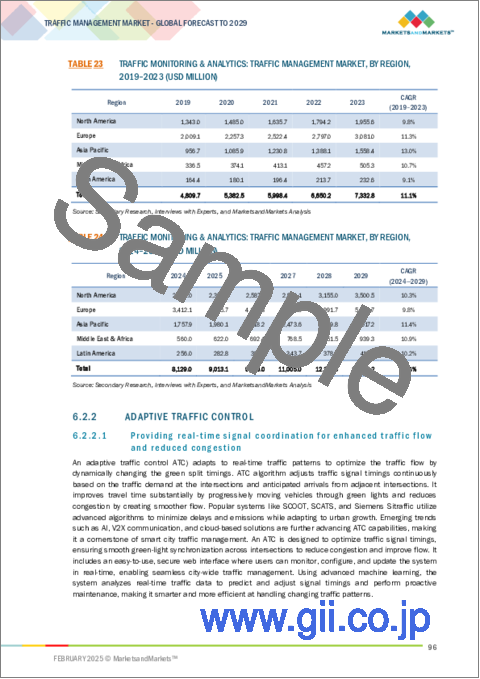

- TABLE 23 TRAFFIC MONITORING & ANALYTICS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 24 TRAFFIC MONITORING & ANALYTICS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 ADAPTIVE TRAFFIC CONTROL: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 ADAPTIVE TRAFFIC CONTROL: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 TRAFFIC ENFORCEMENT MANAGEMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 TRAFFIC ENFORCEMENT MANAGEMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 INCIDENT DETECTION & MANAGEMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 INCIDENT DETECTION & MANAGEMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 ELECTRONIC TOLL MANAGEMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 ELECTRONIC TOLL MANAGEMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 OTHER SOLUTIONS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 OTHER SOLUTIONS: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 36 TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 37 SERVICES: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 SERVICES: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 CONSULTING: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 CONSULTING: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 IMPLEMENTATION: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 IMPLEMENTATION: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 SUPPORT & MAINTENANCE: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 SUPPORT & MAINTENANCE: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 46 TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 47 URBAN: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 URBAN: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 INTER-URBAN: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 INTER-URBAN: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 RURAL: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 RURAL: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 54 TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 55 GOVERNMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 GOVERNMENT: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 PRIVATE: TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 PRIVATE: TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 TRAFFIC MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 TRAFFIC MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 63 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 71 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 73 US: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 74 US: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 75 US: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 76 US: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 77 US: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 78 US: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 79 US: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 80 US: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 81 US: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 82 US: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 83 CANADA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 84 CANADA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 85 CANADA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 86 CANADA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 87 CANADA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 88 CANADA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 89 CANADA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 90 CANADA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 91 CANADA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 92 CANADA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 93 EUROPE: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 94 EUROPE: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 95 EUROPE: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 96 EUROPE: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 97 EUROPE: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 98 EUROPE: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 99 EUROPE: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 100 EUROPE: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 EUROPE: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 102 EUROPE: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 103 EUROPE: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 104 EUROPE: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 105 UK: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 106 UK: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 107 UK: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 108 UK: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 109 UK: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 110 UK: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 111 UK: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 112 UK: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 UK: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 114 UK: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 115 ITALY: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 116 ITALY: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 117 ITALY: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 118 ITALY: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 119 ITALY: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 120 ITALY: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 121 ITALY: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 122 ITALY: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 123 ITALY: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 124 ITALY: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 125 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 126 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 127 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 128 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 129 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 130 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 131 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 132 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 134 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 135 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 137 CHINA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 138 CHINA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 139 CHINA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 140 CHINA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 141 CHINA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 142 CHINA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 143 CHINA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 144 CHINA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 145 CHINA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 146 CHINA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 147 INDIA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 148 INDIA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 149 INDIA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 150 INDIA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 151 INDIA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 152 INDIA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 153 INDIA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 154 INDIA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 155 INDIA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 156 INDIA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 169 GCC: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 170 GCC: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 171 GCC: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 172 GCC: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 173 GCC: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 174 GCC: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 175 GCC: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 176 GCC: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 177 GCC: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 178 GCC: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 179 GCC: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 180 GCC: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 181 KSA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 182 KSA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 183 KSA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 184 KSA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 185 KSA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 186 KSA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 187 KSA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 188 KSA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 189 KSA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 190 KSA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 191 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 192 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 193 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 194 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 195 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 196 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 197 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 198 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 199 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 200 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 201 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 202 LATIN AMERICA: TRAFFIC MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 203 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 204 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 205 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2019-2023 (USD MILLION)

- TABLE 206 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY SOLUTION, 2024-2029 (USD MILLION)

- TABLE 207 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 208 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 209 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 210 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 211 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 212 BRAZIL: TRAFFIC MANAGEMENT MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 213 TRAFFIC MANAGEMENT MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY VENDORS, 2020-2024

- TABLE 214 TRAFFIC MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 215 TRAFFIC MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 216 TRAFFIC MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 217 TRAFFIC MANAGEMENT MARKET: AREA OF APPLICATION FOOTPRINT

- TABLE 218 TRAFFIC MANAGEMENT MARKET: END USER FOOTPRINT

- TABLE 219 TRAFFIC MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 220 TRAFFIC MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 221 TRAFFIC MANAGEMENT MARKET: PRODUCT LAUNCHES, JANUARY 2019- DECEMBER 2023

- TABLE 222 TRAFFIC MANAGEMENT MARKET: DEALS, JANUARY 2019- DECEMBER 2024

- TABLE 223 COMPARATIVE ANALYSIS OF PROMINENT TRAFFIC MANAGEMENT SOLUTIONS

- TABLE 224 HUAWEI: COMPANY OVERVIEW

- TABLE 225 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 HUAWEI: DEALS

- TABLE 227 MUNDYS SPA: COMPANY OVERVIEW

- TABLE 228 MUNDYS SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 MUNDYS SPA: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 230 MUNDYS SPA: DEALS

- TABLE 231 CISCO: COMPANY OVERVIEW

- TABLE 232 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 CISCO: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 234 CISCO: DEALS

- TABLE 235 SWARCO: COMPANY OVERVIEW

- TABLE 236 SWARCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 SWARCO: DEALS

- TABLE 238 TELEDYNE FLIR: COMPANY OVERVIEW

- TABLE 239 TELEDYNE FLIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 TELEDYNE FLIR: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 241 TELEDYNE FLIR: DEALS

- TABLE 242 KAPSCH TRAFFICCOM: COMPANY OVERVIEW

- TABLE 243 KAPSCH TRAFFICCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 KAPSCH TRAFFICCOM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 245 KAPSCH TRAFFICCOM: DEALS

- TABLE 246 SIEMENS: COMPANY OVERVIEW

- TABLE 247 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 SIEMENS: DEALS

- TABLE 249 IBM: COMPANY OVERVIEW

- TABLE 250 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 IBM: DEVELOPMENTS

- TABLE 252 Q-FREE: COMPANY OVERVIEW

- TABLE 253 Q-FREE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 Q-FREE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 255 Q-FREE: DEALS

- TABLE 256 THALES GROUP: COMPANY OVERVIEW

- TABLE 257 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 THALES GROUP: DEALS

- TABLE 259 PTV GROUP: COMPANY OVERVIEW

- TABLE 260 PTV GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 PTV GROUP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 262 PTV GROUP: DEALS

- TABLE 263 CUBIC CORPORATION: COMPANY OVERVIEW

- TABLE 264 CUBIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 CUBIC CORPORATION: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 266 CUBIC CORPORATION: DEALS

- TABLE 267 TOMTOM: COMPANY OVERVIEW

- TABLE 268 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 TOMTOM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 270 TOMTOM: DEALS

- TABLE 271 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 272 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 ST ENGINEERING: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 274 ST ENGINEERING: DEALS

- TABLE 275 CHEVRON TM: COMPANY OVERVIEW

- TABLE 276 CHEVRON TM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 CHEVRON TM: DEALS

- TABLE 278 INDRA: COMPANY OVERVIEW

- TABLE 279 INDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 INDRA: DEALS

- TABLE 281 ECONOLITE: COMPANY OVERVIEW

- TABLE 282 ECONOLITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2018-2022 (USD MILLION)

- TABLE 284 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2023-2028 (USD MILLION)

- TABLE 285 ROADWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 286 ROADWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 287 RAILWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 288 RAILWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 289 AIRWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 290 AIRWAY: SMART TRANSPORTATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 291 MARITIME: SMART TRANSPORTATION MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 292 MARITIME: SMART TRANSPORTATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 293 SMART TRANSPORTATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 294 SMART TRANSPORTATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 295 PARKING MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 296 PARKING MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 297 PARKING MANAGEMENT MARKET, BY PARKING SITE, 2018-2023 (USD MILLION)

- TABLE 298 PARKING MANAGEMENT MARKET, BY PARKING SITE, 2024-2029 (USD MILLION)

- TABLE 299 PARKING MANAGEMENT MARKET, BY END USE, 2018-2023 (USD MILLION)

- TABLE 300 PARKING MANAGEMENT MARKET, BY END USE, 2024-2029 (USD MILLION)

- TABLE 301 PARKING MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 302 PARKING MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 TRAFFIC MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 DEMAND-SIDE ANALYSIS

- FIGURE 5 BOTTOM-UP (SUPPLY SIDE) ANALYSIS: COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF TRAFFIC MANAGEMENT MARKET

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN TRAFFIC MANAGEMENT MARKET

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 TRAFFIC MANAGEMENT MARKET, 2022-2029 (USD MILLION)

- FIGURE 10 TRAFFIC MANAGEMENT MARKET: REGIONAL SNAPSHOT

- FIGURE 11 URBANIZATION AND SMART CITY INITIATIVES TO DRIVE MARKET

- FIGURE 12 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 13 TRAFFIC MONITORING & ANALYTICS SEGMENT TO LEAD MARKET IN 2024

- FIGURE 14 URBAN SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

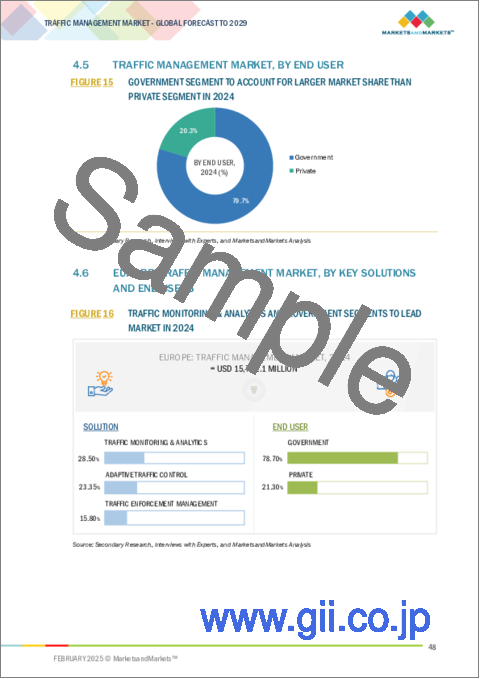

- FIGURE 15 GOVERNMENT SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN PRIVATE SEGMENT IN 2024

- FIGURE 16 TRAFFIC MONITORING & ANALYTICS AND GOVERNMENT SEGMENTS TO LEAD MARKET IN 2024

- FIGURE 17 TRAFFIC MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 GLOBAL URBAN POPULATION FORECAST

- FIGURE 19 EVOLUTION OF TRAFFIC MANAGEMENT SOLUTIONS

- FIGURE 20 TRAFFIC MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 TRAFFIC MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- FIGURE 23 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 24 TRAFFIC MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 REVENUE SHIFT IN TRAFFIC MANAGEMENT MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY AREAS OF APPLICATION

- FIGURE 27 KEY BUYING CRITERIA FOR KEY AREAS OF APPLICATION

- FIGURE 28 EXPORT VALUE OF ELECTRICAL SIGNALING, SAFETY, OR TRAFFIC CONTROL EQUIPMENT, BY KEY COUNTRY, 2016-2023 (USD MILLION)

- FIGURE 29 IMPORT VALUE OF ELECTRICAL SIGNALING, SAFETY, OR TRAFFIC CONTROL EQUIPMENT, BY KEY COUNTRY, 2016-2023 (USD MILLION)

- FIGURE 30 TRAFFIC MANAGEMENT MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO (USD MILLION AND NUMBER OF FUNDING ROUNDS)

- FIGURE 31 USE CASES OF GENERATIVE AI IN TRAFFIC MANAGEMENT

- FIGURE 32 SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SOLUTIONS SEGMENT DURING FORECAST PERIOD

- FIGURE 33 ADAPTIVE TRAFFIC CONTROL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 IMPLEMENTATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 URBAN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 GOVERNMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 EUROPE: TRAFFIC MANAGEMENT MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: TRAFFIC MANAGEMENT MARKET SNAPSHOT

- FIGURE 39 TRAFFIC MANAGEMENT MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS (2019-2023)

- FIGURE 40 SHARE ANALYSIS OF TRAFFIC MANAGEMENT MARKET, 2023

- FIGURE 41 TRAFFIC MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 TRAFFIC MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 43 TRAFFIC MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 COMPANY VALUATION

- FIGURE 45 FINANCIAL METRICS

- FIGURE 46 BRAND COMPARISON

- FIGURE 47 HUAWEI: COMPANY SNAPSHOT

- FIGURE 48 MUNDYS SPA: COMPANY SNAPSHOT

- FIGURE 49 CISCO: COMPANY SNAPSHOT

- FIGURE 50 TELEDYNE FLIR: COMPANY SNAPSHOT

- FIGURE 51 KAPSCH TRAFFICCOM: COMPANY SNAPSHOT

- FIGURE 52 SIEMENS: COMPANY SNAPSHOT

- FIGURE 53 IBM: COMPANY SNAPSHOT

- FIGURE 54 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 55 TOMTOM: COMPANY SNAPSHOT

- FIGURE 56 ST ENGINEERING: COMPANY SNAPSHOT

The traffic management market is estimated to be USD 43.53 billion in 2024 to USD 75.74 billion in 2029 at a CAGR of 11.7% from 2024 to 2029. Technology innovations, including AI machine learning and Vehicle-to-Everything communication, have significantly improved traffic management systems. Predictive analytics tools powered by AI technology help cities better predict traffic patterns and reduce delays. Real-time traffic data from IoT devices helps traffic managers make fast decisions and adjust traffic signals automatically. Intelligent Transportation System (ITS) technology connects with autonomous vehicles and connected cars to create better routes while keeping drivers safe and lowering pollution levels. The continuous evolution of these technologies drives adoption, offering scalable solutions to urban mobility challenges.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | By Offering, Areas of Application, End-user, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"During the forecast period, the urban area of application contributed the largest market share in the traffic management market."

Urban areas use traffic management systems to improve traffic flow while decreasing delays and making roads safer. The system manages traffic flow by adjusting signals to match current traffic volume and provides smart parking directions to help drivers find empty spots faster. Urban traffic management integrates public transportation systems into operations to make travel easier for everyone. Additionally, eco-friendly initiatives, such as emissions monitoring, encourage people to switch to electric vehicles as part of sustainability programs. These applications work together to improve cities by improving traffic movement while protecting public safety and the environment.

"The adaptive traffic control system solution is projected to register the highest CAGR during the forecast period."

Adaptive Traffic Control System (ATCS) adjusts traffic signals automatically to match changing road conditions. ATCS observes intersection traffic patterns through sensor readings and Internet of Things (IoT) devices alongside camera data. The system's advanced analysis software uses traffic data to update signal timing, improving traffic flow and preventing delays while decreasing congestion. This system works well in urban and suburban areas by adjusting traffic signals to match changing traffic levels during busy times and specific events. ATCS helps achieve environmental targets through less fuel usage and decreased vehicle emissions during idle periods. The system improves both traffic flow and safety to become a vital part of smart traffic control technology.

"Asia Pacific will register the highest growth rate during the forecast period."

The Asia Pacific region is set to undergo significant growth opportunities in the coming years, with countries such as India, China, Australia, and New Zealand expected to experience high growth rates. The region's governments are investing in advanced traffic solutions to reduce traffic problems. The Smart City Kochi project in India and the Gateway WA Perth Airport and Freight Access Project in Australia demonstrate how nations use modern technologies to improve their transportation networks. New technology lets us instantly collect traffic data through sensors connecting to internet networks. This data drives important traffic management projects. Real-time traffic data helps create advanced traffic management systems while providing drivers updates to make better travel choices during their journeys.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: C-level -47%, D-level - 32%, and Managers - 21%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 35%, ROW-5%

The major players in the traffic management market are Cisco (US), Mundys SpA (Italy), SWARCO (Austria), Siemens (Germany), IBM (US), Kapsch TrafficCom (Austria), Thales Group (France), Q-Free (Norway), PTV Group (Germany), Teledyne FLIR Systems Inc. (US), Cubic Corporation (US), TOMTOM (Netherlands), Huawei (China), ST Engineering (Singapore), ChevronTM (England), Indra Sistemas (Spain), and Econolite (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the traffic management market.

Research Coverage

The market study covers the traffic management market size across different segments. It aims to estimate the market size and the growth potential across different segments, including components (hardware, solutions, and services), systems, areas of application, and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global traffic management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (rising demand for real-time traffic information to drivers and passengers, an increasingly urban population, rising number of vehicles, and inadequate infrastructure), restraints (labour shortage limiting new projects, slow growth in the infrastructure sector, and lack of standardized and uniform technologies to streamline legacy infrastructure), opportunities (changing pricing dynamics in the traffic management industry, increasing concerns about protecting environment with eco-friendly automobile technology, and growth of analytics software) and challenges (data management and big data issues, multiple sensors and touchpoints pose data fusion challenges, and security threats and hacking challenges) influencing the growth of the traffic management market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the traffic management market. Market Development: Comprehensive information about lucrative markets - the report analyses the traffic management market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the traffic management market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Cisco (US), Mundys SpA (Italy), SWARCO (Austria), Siemens (Germany), IBM (US), Kapsch TrafficCom (Austria), Thales Group (France), Q-Free (Norway), PTV Group (Germany), Teledyne FLIR Systems Inc. (US), Cubic Corporation (US), TOMTOM (Netherlands), Huawei (China), ST Engineering (Singapore), ChevronTM (England), Indra Sistemas (Spain), and Econolite (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Primary interviews with experts

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for capturing market share using bottom-up analysis (Demand side)

- 2.2.1.2 Demand-side analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share using top-down analysis (Supply side)

- 2.2.2.2 Supply-side analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TRAFFIC MANAGEMENT MARKET

- 4.2 TRAFFIC MANAGEMENT MARKET, BY OFFERING

- 4.3 TRAFFIC MANAGEMENT MARKET, BY SOLUTION

- 4.4 TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION

- 4.5 TRAFFIC MANAGEMENT MARKET, BY END USER

- 4.6 EUROPE: TRAFFIC MANAGEMENT MARKET, BY KEY SOLUTIONS AND END USERS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased traffic congestion and need for road safety measures

- 5.2.1.2 Rising demand for real-time traffic information from drivers and passengers

- 5.2.1.3 Increasing concerns related to public safety

- 5.2.1.4 Growing urban population, rising number of vehicles, and inadequate infrastructure

- 5.2.1.5 Government initiatives for effective traffic management

- 5.2.1.6 Growing popularity of AI-powered traffic management

- 5.2.2 RESTRAINTS

- 5.2.2.1 Labor shortage

- 5.2.2.2 Slow growth in infrastructure sector

- 5.2.2.3 Lack of standardized and uniform technologies

- 5.2.2.4 Data privacy and security

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Changing cost dynamics

- 5.2.3.2 Increasing environmental concerns

- 5.2.3.3 Design and development of smart vehicles compatible with advanced technologies

- 5.2.3.4 Growth of analytics software

- 5.2.3.5 Evolving 5G technology and transformation of traffic management systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Data management and big data issues

- 5.2.4.2 High expenses associated with equipment installation

- 5.2.4.3 Security threats and hacking challenges

- 5.2.4.4 Data fusion challenges

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF TRAFFIC MANAGEMENT SOLUTIONS

- 5.3.1 1960S-1970S

- 5.3.2 1980S-1990S

- 5.3.3 2000S-2010S

- 5.3.4 2020S-PRESENT

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CASE STUDY 1: BUENOS AIRES DEPLOYED SGIM SOFTWARE IN CONJUNCTION WITH KAPSCH'S ECOTRAFIX PLATFORM TO UNIFY EXISTING UTC SYSTEMS

- 5.5.2 CASE STUDY 2: HUAWEI HELPED LAHORE CITY DEVELOP NEW TRAFFIC MANAGEMENT SYSTEM TO MANAGE CONGESTION

- 5.5.3 CASE STUDY 3: ROMANIAN CITY OF TIMISOARA DEPLOYED SWARCO'S INTEGRATED TRAFFIC CONTROL AND VIDEO SURVEILLANCE SYSTEM TO SMOOTHEN TRAFFIC FLOW

- 5.5.4 CASE STUDY 4: DATA COLLECTION LIMITED ENHANCED ROAD INFRASTRUCTURE MANAGEMENT WITH TELEDYNE FLIR IMAGING SOLUTIONS

- 5.5.5 CASE STUDY 5: THTC & TOMTOM SUCCESSFULLY MANAGED TRAFFIC AT 2023 AFC ASIAN CUP QATAR

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRAFFIC MANAGEMENT DATA FLOW PROCESS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF RELATED TO TRAFFIC MANAGEMENT SYSTEMS

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 KEY REGULATIONS

- 5.8.3.1 North America

- 5.8.3.1.1 Manual on Traffic Control Devices for Streets and Highways

- 5.8.3.1.2 National Highway Traffic Safety Administration (NHTSA)

- 5.8.3.1.3 Federal Motor Carrier Safety Administration

- 5.8.3.1.4 Federal Highway Administration

- 5.8.3.2 Europe

- 5.8.3.2.1 General Data Protection Regulation

- 5.8.3.2.2 General Safety Regulation (GSR)

- 5.8.3.3 Asia Pacific

- 5.8.3.3.1 General Safety Regulation (GSR)

- 5.8.3.3.2 Road Traffic Safety Law of the People's Republic of China

- 5.8.3.3.3 Road Traffic Act

- 5.8.3.3.4 Road Transport Vehicle Act

- 5.8.3.4 Rest of the World

- 5.8.3.4.1 Manual on Traffic Control Devices for Streets and Highways

- 5.8.3.4.2 National Road Traffic Act, 1996

- 5.8.3.4.3 Mexico's National Law of Mobility and Road Safety

- 5.8.3.1 North America

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- 5.9.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Artificial intelligence (AI)

- 5.10.1.2 Internet of Things (IoT)

- 5.10.1.3 Geographic information systems (GIS)

- 5.10.1.4 Automatic number plate recognition (ANPR)

- 5.10.1.5 Vehicle-to-infrastructure (V2I) and vehicle-to-everything (V2X)

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Big data and analytics

- 5.10.2.2 Edge computing

- 5.10.2.3 5G

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Advanced traffic management systems (ATMS)

- 5.10.3.2 Smart city solutions

- 5.10.3.3 Blockchain

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 THREAT OF NEW ENTRANTS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 TECHNOLOGY ROADMAP

- 5.16.1 TRAFFIC MANAGEMENT TECHNOLOGY ROADMAP TILL 2030

- 5.16.1.1 Short-term roadmap (2024-2026)

- 5.16.1.2 Mid-term roadmap (2026-2028)

- 5.16.1.3 Long-term roadmap (2028-2030)

- 5.16.1 TRAFFIC MANAGEMENT TECHNOLOGY ROADMAP TILL 2030

- 5.17 BEST PRACTICES IN TRAFFIC MANAGEMENT MARKET

- 5.18 BUSINESS MODELS

- 5.19 TRAFFIC MANAGEMENT TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.20 TRADE ANALYSIS

- 5.20.1 EXPORT SCENARIO FOR HS CODE: 8530

- 5.20.2 IMPORT SCENARIO FOR HS CODE: 8530

- 5.21 INVESTMENT AND FUNDING SCENARIO

- 5.22 IMPACT OF AI/GENERATIVE AI ON TRAFFIC MANAGEMENT MARKET

- 5.22.1 IMPACT OF AI/GENERATIVE AI ON TRAFFIC MANAGEMENT

- 5.22.2 USE CASES OF GENERATIVE AI IN TRAFFIC MANAGEMENT

6 TRAFFIC MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: TRAFFIC MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 TRAFFIC MONITORING & ANALYTICS

- 6.2.1.1 Offering smarter insights for efficient road management

- 6.2.2 ADAPTIVE TRAFFIC CONTROL

- 6.2.2.1 Providing real-time signal coordination for enhanced traffic flow and reduced congestion

- 6.2.3 TRAFFIC ENFORCEMENT MANAGEMENT

- 6.2.3.1 Leveraging advanced technologies to ensure safer roads and reduced violations

- 6.2.4 INCIDENT DETECTION & MANAGEMENT

- 6.2.4.1 Optimizing road safety and traffic flow with real-time incident detection and management solutions

- 6.2.5 ELECTRONIC TOLL MANAGEMENT

- 6.2.5.1 Revolutionizing traffic flow with advanced electronic toll management solutions

- 6.2.6 OTHER SOLUTIONS

- 6.2.1 TRAFFIC MONITORING & ANALYTICS

- 6.3 SERVICES

- 6.3.1 CONSULTING

- 6.3.1.1 Optimizing traffic management and infrastructure

- 6.3.2 IMPLEMENTATION

- 6.3.2.1 Streamlining business applications by integrating various modules of day-to-day operations

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Ensuring smooth functioning of traffic management solutions

- 6.3.1 CONSULTING

7 TRAFFIC MANAGEMENT MARKET, BY AREA OF APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 AREA OF APPLICATION: TRAFFIC MANAGEMENT MARKET DRIVERS

- 7.2 URBAN

- 7.2.1 NEED FOR EFFICIENT MANAGEMENT OF COMPLEX URBAN TRAFFIC TO DRIVE MARKET

- 7.3 INTER-URBAN

- 7.3.1 DEMAND FOR SAFE AND EFFICIENT TRAVEL ON INTER-URBAN ROUTES TO DRIVE MARKET

- 7.4 RURAL

- 7.4.1 NEED TO MANAGE UNIQUE TRAFFIC CHALLENGES IN LESS DENSELY POPULATED RURAL AREAS TO DRIVE MARKET

8 TRAFFIC MANAGEMENT MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USER: TRAFFIC MANAGEMENT MARKET DRIVERS

- 8.2 GOVERNMENT

- 8.2.1 FOCUS ON TRANSFORMING PUBLIC INFRASTRUCTURE WITH SMART TRAFFIC MANAGEMENT SOLUTIONS FOR SAFER AND SUSTAINABLE CITIES

- 8.3 PRIVATE

- 8.3.1 FOCUS ON MANAGING INCREASING TRAFFIC CONGESTION AND IMPROVING

9 TRAFFIC MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Government initiatives to revamp, expand, and modernize existing traffic management infrastructure to drive market

- 9.2.3 CANADA

- 9.2.3.1 Development of smart cities to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Government initiatives to standardize transport interfaces supported by collaborations and partnerships to drive market

- 9.3.3 ITALY

- 9.3.3.1 Government investment in road safety, traffic flow, and congestion alleviation to drive market

- 9.3.4 GERMANY

- 9.3.4.1 2030 Federal Transport Infrastructure Plan to drive market

- 9.3.5 FRANCE

- 9.3.5.1 Advancements in robotics and IoT, especially in public transportation, to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Focus on bolstering public transportation to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Investment in AI-powered traffic management systems and Internet of Vehicle Technologies (IoVT) to drive market

- 9.4.3 INDIA

- 9.4.3.1 Government focus on AI adoption for enhanced road safety to drive market

- 9.4.4 JAPAN

- 9.4.4.1 Establishment of Digital Agency for Society 5.0 to drive market

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Implementation of smart city projects to accelerate market growth

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 GCC COUNTRIES

- 9.5.2.1 KSA

- 9.5.2.1.1 Initiatives toward comprehensive transport planning analysis and performance reporting to drive market

- 9.5.2.2 UAE

- 9.5.2.2.1 Collaborations with prominent players for building smart traffic systems to drive market

- 9.5.2.3 Qatar

- 9.5.2.3.1 Growth in smart infrastructure and digital innovation to propel market

- 9.5.2.4 Rest of GCC countries

- 9.5.2.1 KSA

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Rising urban congestion and safety concerns to drive market

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Increasing focus on vehicle monitoring and incident management to drive market

- 9.6.3 MEXICO

- 9.6.3.1 Rising demand for improved transport infrastructure to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Offering footprint

- 10.5.5.4 Area of application footprint

- 10.5.5.5 End user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

- 10.8 TRAFFIC MANAGEMENT PRODUCT BENCHMARKING

- 10.8.1 PROMINENT TRAFFIC MANAGEMENT SOLUTIONS

- 10.8.1.1 IBM intelligent transportation solution

- 10.8.1.2 Huawei intelligent traffic management system (ITMS)

- 10.8.1.3 Kapsch TrafficCom intelligent transportation system (ITS)

- 10.8.1.4 SWARCO cooperative intelligent transport system (SWARCO C-ITS)

- 10.8.1 PROMINENT TRAFFIC MANAGEMENT SOLUTIONS

- 10.9 COMPANY VALUATION AND FINANCIAL METRICS

- 10.10 BRAND COMPARISON

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 HUAWEI

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 MUNDYS SPA

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Products launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 CISCO

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Products launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 SWARCO

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 TELEDYNE FLIR

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 KAPSCH TRAFFICCOM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & enhancements

- 11.1.6.3.2 Deals

- 11.1.7 SIEMENS

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 IBM

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Developments

- 11.1.9 Q-FREE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & enhancements

- 11.1.9.3.2 Deals

- 11.1.10 THALES GROUP

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 PTV GROUP

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & enhancements

- 11.1.11.3.2 Deals

- 11.1.12 CUBIC CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & enhancements

- 11.1.12.3.2 Deals

- 11.1.13 TOMTOM

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches & enhancements

- 11.1.13.3.2 Deals

- 11.1.14 ST ENGINEERING

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & enhancements

- 11.1.14.3.2 Deals

- 11.1.15 CHEVRON TM

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.16 INDRA

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Deals

- 11.1.17 ECONOLITE

- 11.1.17.1 Business overview

- 11.1.17.2 Products/Solutions/Services offered

- 11.1.18 ALMAVIVA SPA

- 11.1.1 HUAWEI

- 11.2 STARTUPS/SMES

- 11.2.1 INRIX

- 11.2.2 NOTRAFFIC

- 11.2.3 TAGMASTER

- 11.2.4 BERCMAN TECHNOLOGIES

- 11.2.5 VALERANN

- 11.2.6 MIOVISION

- 11.2.7 BLUESIGNAL

- 11.2.8 TELEGRA

- 11.2.9 ORIUX

- 11.2.10 INVARION

- 11.2.11 REKOR

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 SMART TRANSPORTATION MARKET - GLOBAL FORECAST TO 2028

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 Smart transportation market, by transportation mode

- 12.2.2.2 Smart transportation market, by roadway

- 12.2.2.3 Smart transportation market, by railway

- 12.2.2.4 Smart transportation market, by airway

- 12.2.2.5 Smart transportation market, by maritime

- 12.2.2.6 Smart transportation market, by region

- 12.3 PARKING MANAGEMENT MARKET - GLOBAL FORECAST TO 2029

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Parking management market, by offering

- 12.3.2.2 Parking management market, by parking site

- 12.3.2.3 Parking management market, by end use

- 12.3.2.4 Parking management market, by region

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS