|

|

市場調査レポート

商品コード

1304605

種子の世界市場:種類別 (GM種、在来種)・形質別 (除草剤耐性、害虫耐性)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・処理別 (処理済、未処理)・地域別の将来予測 (2028年まで)Seeds Market by Type (Genetically Modified, Conventional), Trait (Herbicide Tolerance, Insect Resistance), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Treatment (Treated and Un-treated) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 種子の世界市場:種類別 (GM種、在来種)・形質別 (除草剤耐性、害虫耐性)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・処理別 (処理済、未処理)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月05日

発行: MarketsandMarkets

ページ情報: 英文 315 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の種子の市場規模は、2023年に588億米ドル、2028年には833億米ドルに達し、予測期間に7.2%のCAGRで成長すると予測されています。

種子は、植物の成長と発育に必要な遺伝物質を運ぶ植物の生殖単位です。種子は通常、受粉の過程で作られます。受粉の過程では、植物の雄の部分の花粉が雌の部分の卵胞と受精し、種子が作られます。種子は食物繊維が豊富な食品です。また、健康的な一価不飽和脂肪酸や多価不飽和脂肪酸、各種ビタミン、ミネラル、抗酸化物質も含まれています。バランスの取れた食事の一部として摂取すれば、種子は血糖値、コレステロール、血圧を下げるのに役立ちます。これらは種子の利点の一部です。

"在来種が、2022年に種類別で最大の市場シェアを獲得する"

在来種は、植物集団内の遺伝的変異を保存するのに役立ちます。環境の変化や害虫に適応するのに有用な特定の特徴や性質を維持することができます。農家は在来種を用いて自分の作物の種子を保存したり植え替えたりすることができるため、農業をより自由にコントロールすることができます。また、投入資材の節約にもつながります。これらが種子市場を牽引していると考えられる理由です。

"穀物分野が2022年に最大の市場シェアを占める"

作物の種類別では、穀物は最大のセグメントになると予測されています。種子は、生産性、耐病性、干ばつ耐性、栄養価を高める遺伝的能力を持っています。育種家は常に、改良された形質を持つ新種の種子を開発・導入しており、これが種子の普及を促進しています。農家は、生産量と利益を増やすために高収量の作物を求めています。品種改良された種子は、収量の増加を目的として栽培されるため、穀物市場での利用が促進されます。これらが、穀物市場を牽引している理由です。

"北米市場が予測期間中に最大の市場シェアを獲得する"

北米市場は種子の最大市場です。北米では、遺伝子工学、精密育種、バイオテクノロジーのすべてが大幅に改善されています。こうした新興国市場の発展により、高品質・高収量の種子が生産されるようになり、これが市場拡大に拍車をかけています。

北米の消費者は、消費する食品の品質、栄養成分、持続可能性への関心を高めています。このため、栄養価の高い作物や有機認証など、優れた特性を持つ作物を収穫する種子への需要が高まっています。これが種子の利用拡大につながり、同地域の種子市場の成長を刺激しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 価格分析

- 市場マッピングとエコシステム

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主要な会議とイベント (2023年~2024年)

- 関税・規制の状況

- 規制の枠組み

- 主要な利害関係者と購入基準

第7章 種子市場:種類別

- イントロダクション

- 在来種

- GM種 (遺伝子組み換え種子)

第8章 種子市場:作物の種類別

- イントロダクション

- 油糧種子・豆類

- 大豆

- キャノーラ/菜種

- 綿花

- その他の油糧種子・豆類

- 穀物

- トウモロコシ

- 小麦

- 米

- その他の穀物

- 果物・野菜

- ナス科

- ウリ科

- アブラナ科

- 葉物野菜

- 根菜・球根

- その他の果物・野菜

- その他の作物の種類

第9章 種子市場:処理別

- イントロダクション

- 処理済種子

- 未処理種子

第10章 種子市場:形質別

- イントロダクション

- 除草剤耐性

- 害虫耐性

- その他の形質

第11章 種子市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- イタリア

- ドイツ

- フランス

- ロシア

- 英国

- オランダ

- ウクライナ

- その他の欧州

- アジア太平洋

- 中国

- タイ

- インド

- 日本

- オーストラリア

- ベトナム

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他の南米

- その他の地域 (ROW)

- 南アフリカ

- トルコ

- エジプト

- その他のROW

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要な市場参入企業の世界スナップショット

- 市場シェア分析 (2022年)

- 主要企業の収益分析:セグメント別 (2020~2022年)

- 主要企業の年間収益 vs. 成長率 (2020~2022年)

- 主要企業のEBITDA (2022年)

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:その他の企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- BASF SE

- BAYER AG

- SYNGENTA CROP PROTECTION AG

- KWS SAAT SE & CO. KGAA

- CORTEVA

- LIMAGRAIN

- ADVANTA SEEDS

- SAKATA SEED CORPORATION

- DLF SEEDS A/S

- ENZA ZADEN BEHEER B.V.

- RALLIS INDIA LIMITED

- FMC CORPORATION

- TAKII & CO., LTD.

- ROYAL BARENBRUG GROUP

- LONGPING HIGH-TECH

- その他の企業

- LAND O'LAKES, INC.

- VIKIMA SEED A/S

- ALLIED SEED, LLC

- AMPAC SEED COMPANY

- IMPERIAL SEED

- SL-AGRITECH

- BRETTYOUNG

- RASI SEEDS(P)LTD.

- CN SEEDS

- MAHYCO

第14章 隣接・関連市場

- イントロダクション

- 調査の限界

- 種子処理市場

- 種子コーティング市場

第15章 付録

The seed market is expected to be valued at USD 58.8 billion in 2023 and USD 83.3 billion by 2028, with a CAGR of 7.2% over the forecast period. Seeds are plant reproductive units that carry the genetic material required for plant growth and development. They are usually created during the pollination process, in which pollen from the male portion of a plant fertilizes the ovules in the female section of the plant, resulting in seed production. Seeds are fiber-rich foods. They also include healthy monounsaturated and polyunsaturated fats, as well as a variety of vitamins, minerals, and antioxidants. When taken as part of a balanced diet, seeds can help decrease blood sugar, cholesterol, and blood pressure. These are some of the benefits of the seeds.

"Conventional seed is the largest segment which is expected to gain the largest market share in 2022."

Conventional seeds help to preserve genetic variation within plant populations. They enable the maintenance of certain features and qualities that might be useful in adjusting to environmental changes and pests. Farmers may preserve and replant seeds from their own crops using conventional seeds, giving them more control and independence over their agricultural practices. This can also help farmers save money on inputs. These are the reasons that are considered to drive the market for seeds.

"The Cereals & grains segment is the largest, projected to account for the largest market share in 2022."

Cereals & grains are the segment that is projected to be the largest segment. Seeds have the genetic capacity to boost productivity, disease resistance, drought tolerance, and nutritional content. Breeders are always developing and introducing new seed kinds with improved traits, which drives seed acceptance. Farmers want high-yielding crops to increase production and profit. Improved seed types are cultivated expressly for increased yields, which promotes their usage in the cereals and grains market. These are the reasons for propelling the market for the cereals & grains segment.

"North America market is projected to gain largest market share during the forecast period."

The North American market is the largest market for seed. Genetic engineering, precision breeding, and biotechnology have all seen considerable improvements in North America. These developments have resulted in the production of high-quality, high-yielding seed types, which has fueled market expansion.

North American consumers are increasingly concerned with the quality, nutritional content, and sustainability of the food they consume. This has increased demand for seeds that yield crops with superior characteristics, such as greater nutritional value or organic certification. This has led to increased utilization of the seeds and stimulated the growth of the seed market in the region.

The Break-up of Primaries:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C level - 35%, Director level - 25%, Others - 40%

- By Geography: North America- 40%, Asia Pacific - 30%, Europe -20%, South America- 5%, and RoW 5%

Some Leading players profiled in this report:

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta Crop Protection AG (Switzerland)

- KWS SAAT SE & Co. KGaA (Germany)

- Corteva (US)

- Limagrain (France)

- Advanta Seeds (UPL) (India)

- SAKATA SEED CORPORATION (Japan)

Research Coverage:

This research report categorizes the seed market by type (genetically modified and conventional), by crop type (cereals & grains, oilseeds & pulses, fruits & vegetables, and other crop types), by trait (herbicide tolerance, insect resistance, other traits), by treatment (treated seed and un-treated seed), and region (North America, Europe, Asia Pacific, South America, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the seed market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions; key strategies; partnerships, agreements; new product launches, mergers and acquisitions, and recent developments associated with the secondary macronutrient market. Competitive analysis of upcoming startups in the seed market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall seed market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Higher seed replacement rates are becoming more prevalent, Biotechnology is being used extensively in agricultural production, Increased use of oilseeds by animal feed manufacturers, Increased demand from the biofuel industry, There is a high demand for protein-rich meal items), restraints (Influence of climate change on agricultural crop production, Fluctuations observed in oilseed prices, The substantial investment in research and development for producing high-quality seeds contributes to elevated seed prices, Reduced crop productivity in areas with inadequate irrigation), opportunities (Rising desire for processed goods that are both healthy and organic, Joint initiatives by public and private entities in the development of new varieties, Use of molecular breeding technology to improve seed properties, ), and challenges (Unregulated entrants with lower profitability compared to costs, Scarce availability and limited access to high-quality seed varieties, Illegal trading in replica hybrid seeds and counterfeit goods) influencing the growth of the seed market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the seed market

- Market Development: Comprehensive information about lucrative markets - the report analyses the seed market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the seed market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Bayer AG (Germany), Syngenta Crop Protection AG (Switzerland), KWS SAAT SE & Co. KGaA (Germany), Corteva (US), Limagrain (France), Advanta Seeds (UPL) (India), SAKATA SEED CORPORATION (Japan), DLF Seed A/S (Denmark), and Enza Zaden Beheer B.V. (Netherlands) among others in the seed market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 SEEDS: MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.4.1 YEARS CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.5.1 CURRENCY (VALUE UNIT)

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2022

- 1.5.2 AREA UNIT

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SEEDS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key insights from industry experts

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SEEDS MARKET SIZE ESTIMATION - SUPPLY-SIDE

- 2.2.2 SEEDS MARKET SIZE ESTIMATION - DEMAND-SIDE

- 2.2.3 BOTTOM-UP APPROACH

- FIGURE 4 SEEDS MARKET: BOTTOM-UP APPROACH

- 2.2.4 TOP-DOWN APPROACH

- FIGURE 5 SEEDS MARKET: TOP-DOWN APPROACH

- 2.3 GROWTH RATE FORECAST

- 2.4 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- FIGURE 7 ASSUMPTIONS

- 2.6 LIMITATIONS & ASSOCIATED RISKS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 2 SEEDS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 8 SEEDS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 SEEDS MARKET, BY TRAIT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 SEEDS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 SEEDS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR COMPANIES IN SEEDS MARKET

- FIGURE 12 DEMAND FOR HIGH-QUALITY SEEDS WITH IMPROVED DISEASE RESISTANCE TO DRIVE GROWTH

- 4.2 ASIA PACIFIC: SEEDS MARKET, BY TYPE AND COUNTRY (2022)

- FIGURE 13 CONVENTIONAL SEGMENT AND CHINA TO ACCOUNT FOR LARGER MARKET SHARES IN ASIA PACIFIC

- 4.3 SEEDS MARKET, BY CROP TYPE

- FIGURE 14 CEREALS & GRAINS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 SEEDS MARKET, BY TYPE

- FIGURE 15 GENETICALLY MODIFIED SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- 4.5 SEEDS MARKET, BY TRAIT

- FIGURE 16 OTHER TRAITS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.1.1 Growing use of commercial seeds

- FIGURE 17 MAJOR SEED EXPORTING COUNTRIES IN ASIA PACIFIC, 2022

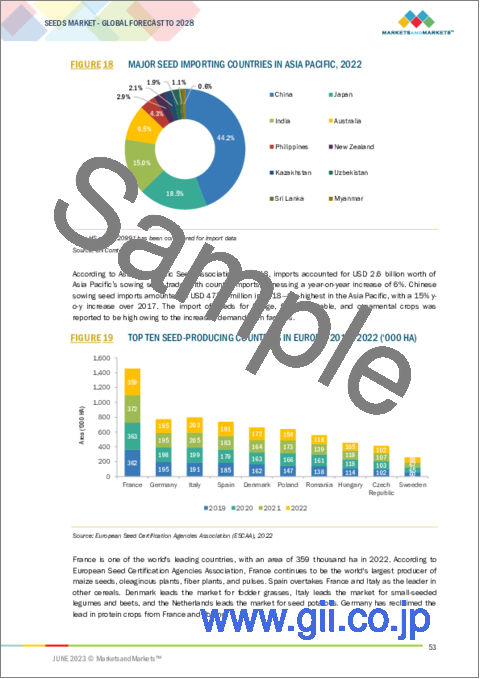

- FIGURE 18 MAJOR SEED IMPORTING COUNTRIES IN ASIA PACIFIC, 2022

- FIGURE 19 TOP TEN SEED-PRODUCING COUNTRIES IN EUROPE, 2019-2022 ('000 HA)

- 5.2.1.2 Increasing pesticide usage globally

- FIGURE 20 GLOBAL PESTICIDE TRADE IN KEY REGIONS, 2018-2020 (USD MILLION)

- 5.2.1.3 Rising demand for high-value and industrial crops

- FIGURE 21 AREA HARVESTED UNDER HIGH-VALUE CROPS, 2017-2021 (MILLION HA)

- 5.2.1 INTRODUCTION

- 5.3 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SEEDS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Rising seed replacement rate

- 5.3.1.2 Increasing adoption of biotech crops

- TABLE 3 AREA FOR BIOTECH CROPS, BY COUNTRY, 2018 (MILLION HA)

- FIGURE 23 TOP FIVE COUNTRIES WITH AREA HARVESTED UNDER BIOTECH CROPS, 2018 (MILLION HA)

- 5.3.1.3 Growing use of oilseeds by animal feed manufacturers

- FIGURE 24 EUROPEAN ANIMAL FEED SECTOR: USE OF PROTEIN MATERIAL, BY SOURCE, 2019-2020

- TABLE 4 PROTEIN SOURCES USED IN ANIMAL FEED

- 5.3.1.4 Increasing demand for rapeseed oil in biofuel industry

- TABLE 5 OILSEEDS USED IN BIODIESEL PRODUCTION

- FIGURE 25 CORN USAGE IN BIOFUEL PRODUCTION, 2015-2019 (MILLION BU)

- FIGURE 26 MONTHLY BIODIESEL PRODUCTION IN US, 2019 VS. 2020 (MILLION GALLONS)

- 5.3.1.5 High demand for protein meal

- FIGURE 27 GLOBAL PRODUCTION AND CONSUMPTION OF PROTEIN MEALS, 2022-2031 (MILLION TONS)

- 5.3.2 RESTRAINTS

- 5.3.2.1 Impact of climate change on agricultural crop production

- TABLE 6 COUNTRY-WISE SCENARIO OF WEATHER CONDITIONS AND DISEASES IN SEEDS

- 5.3.2.2 Price fluctuations in oilseeds

- FIGURE 28 OILSEED PRICES IN US, 2021 (USD/TON)

- 5.3.2.3 High R&D expenses

- FIGURE 29 RESEARCH AND DEVELOPMENT EXPENDITURE OF KEY MANUFACTURERS, 2022 (USD MILLION)

- 5.3.2.4 Low yield of crops in under-irrigated areas

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Demand for healthy and organic products

- FIGURE 30 NUMBER OF ORGANIC FOOD PRODUCERS IN TOP FIVE COUNTRIES, 2021

- FIGURE 31 DISTRIBUTION OF ORGANIC AGRICULTURAL AREAS, BY REGION, 2021

- 5.3.3.2 Public-private partnerships in varietal development

- 5.3.3.3 Use of molecular breeding technology to improve seed properties

- 5.3.4 CHALLENGES

- 5.3.4.1 Unorganized new entrants with low profit-to-cost ratio

- 5.3.4.2 Lack of availability and access to high-quality seeds

- 5.3.4.3 Commercialization of fake hybrid seeds and counterfeit products

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 PRODUCTION

- 6.2.3 TESTING AND PACKAGING

- 6.2.4 DISTRIBUTION

- 6.2.5 RETAILERS

- FIGURE 32 SEEDS MARKET: VALUE CHAIN ANALYSIS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 6.3.3 END USERS

- FIGURE 33 SEEDS MARKET: SUPPLY CHAIN ANALYSIS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 NEW PLANT BREEDING TECHNOLOGIES

- 6.4.2 APICAL ROOTED CUTTING SEED TECHNOLOGY

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE, BY KEY CROP

- FIGURE 34 SEEDS MARKET: GLOBAL AVERAGE SELLING PRICE, BY KEY CROP

- TABLE 7 SEEDS MARKET: AVERAGE SELLING PRICE (ASP), BY KEY CROP, 2020-2022 (USD/TON)

- TABLE 8 SEEDS MARKET: AVERAGE SELLING PRICE FOR KEY MARKET PLAYERS, BY KEY CROP, 2022 (USD/TON)

- 6.6 MARKET MAPPING AND ECOSYSTEM

- 6.6.1 SUPPLY-SIDE ANALYSIS

- 6.6.2 DEMAND-SIDE ANALYSIS

- 6.6.3 REGULATORY BODIES

- 6.6.4 DISTRIBUTORS & SUPPLIERS

- FIGURE 35 SEEDS MARKET: MARKET MAPPING

- TABLE 9 SEEDS MARKET: ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 36 SEEDS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.8 TRADE ANALYSIS

- TABLE 10 SEEDS MARKET: EXPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2022

- TABLE 11 SEEDS MARKET: IMPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2022

- TABLE 12 SEEDS MARKET: EXPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2021

- TABLE 13 SEEDS MARKET: IMPORT VALUE OF SEEDS, FRUITS, AND SPORES, BY KEY COUNTRY/REGION, 2021

- 6.9 PATENT ANALYSIS

- FIGURE 37 PATENTS GRANTED FOR SEEDS MARKET, 2013-2022

- FIGURE 38 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SEEDS MARKET, 2013-2022

- TABLE 14 KEY PATENTS PERTAINING TO SEEDS MARKET, 2013-2022

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 SEEDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 THREAT OF NEW ENTRANTS

- 6.11 CASE STUDY ANALYSIS

- TABLE 16 USE CASE 1: CORTEVA'S A-SERIES SOYBEAN VARIETIES WITH LIBERTYLINK GENE OFFERED FARMERS EXCEPTIONAL YIELD WITH GLYPHOSATE AND DICAMBA HERBICIDES TOLERANCE

- TABLE 17 USE CASE 2: NEW PRODUCTION FACILITY OF KWS SAAT SE & CO. KGAA INCREASED PRODUCTION CAPACITY OF SUGAR BEET SEEDS BY 30%

- 6.12 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 18 KEY CONFERENCES & EVENTS IN SEEDS MARKET, 2023-2024

- 6.13 TARIFFS AND REGULATORY LANDSCAPE

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 REGULATORY FRAMEWORK

- 6.14.1 NORTH AMERICA

- 6.14.1.1 US

- 6.14.1.2 Canada

- 6.14.2 EUROPE

- 6.14.3 ASIA PACIFIC

- 6.14.3.1 India

- 6.14.3.2 China

- 6.14.4 SOUTH AMERICA

- 6.14.4.1 Brazil

- 6.14.4.2 South Africa

- 6.14.1 NORTH AMERICA

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TYPE

- 6.15.2 BUYING CRITERIA

- TABLE 24 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS FOR KEY TRAITS

- FIGURE 40 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS FOR KEY TRAITS

7 SEEDS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 41 GENETICALLY MODIFIED SEEDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 25 SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 26 SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 27 COMPARATIVE ANALYSIS OF CONVENTIONAL AND GENETICALLY MODIFIED CROPS

- 7.2 CONVENTIONAL SEEDS

- 7.2.1 DEMAND FOR ORGANICALLY PRODUCED SEEDS WITH DIVERSE FLAVORS, COLORS, AND TEXTURES TO DRIVE MARKET

- TABLE 28 ENVIRONMENTAL IMPACT OF CONVENTIONAL SOYBEAN

- TABLE 29 CONVENTIONAL: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 CONVENTIONAL: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 GENETICALLY MODIFIED SEEDS

- 7.3.1 NEED FOR IMPROVED SEED QUALITY, HIGH YIELD OUTPUT, DISEASE RESISTANCE, AND HERBICIDE TOLERANCE TO BOOST MARKET

- FIGURE 42 AREA UNDER GENETICALLY MODIFIED CROPS FOR INDUSTRIALIZED AND EMERGING ECONOMIES, 2017-2018 (MILLION HA)

- TABLE 31 TOP TEN COUNTRIES THAT GRANTED REGULATORY APPROVALS TO GENETICALLY MODIFIED CROPS FOR FOOD, ANIMAL FEED, AND CULTIVATION, 2018

- TABLE 32 GENETICALLY MODIFIED: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 GENETICALLY MODIFIED: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 SEEDS MARKET, BY CROP TYPE

- 8.1 INTRODUCTION

- FIGURE 43 CEREALS & GRAINS SEGMENT TO DOMINATE SEEDS MARKET DURING FORECAST PERIOD

- TABLE 34 SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 35 SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 8.2 OILSEEDS & PULSES

- FIGURE 44 TOP TEN OILSEED-EXPORTING COUNTRIES, 2022

- 8.2.1 SOYBEAN

- 8.2.1.1 Soybean's ability to grow in various soil types and climate conditions to drive demand for canola seeds

- FIGURE 45 GLOBAL SOYBEAN PRODUCTION IN KEY COUNTRIES, 2017-2021 (MILLION TONS)

- TABLE 36 APPLICATION AREAS OF SOYBEAN

- 8.2.2 CANOLA/RAPESEED

- 8.2.2.1 Need to replace trans-fat with healthy oil to drive demand for soybean oil

- FIGURE 46 GLOBAL RAPESEED PRODUCTION, 2017-2020 (MILLION TONS)

- 8.2.3 COTTON

- 8.2.3.1 Research initiatives and commercialization of cotton plants by USDA to drive demand

- FIGURE 47 COTTON SEED PRODUCTION OF LEADING COUNTRIES, 2019-2020 (TONS)

- FIGURE 48 TOP TEN COTTON-EXPORTING COUNTRIES IN 2022

- 8.2.4 OTHER OILSEEDS & PULSES

- FIGURE 49 ANNUAL PRODUCTION OF SUNFLOWER SEEDS, 2015-2020 (MILLION TONS)

- TABLE 37 OILSEEDS & PULSES: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 OILSEEDS & PULSES: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 OILSEEDS & PULSES: SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 40 OILSEEDS & PULSES: SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 41 SOYBEAN: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 42 SOYBEAN: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 43 COTTON: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 44 COTTON: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 CANOLA: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 46 CANOLA: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.3 CEREALS & GRAINS

- 8.3.1 CORN

- 8.3.1.1 Shift in cereal demand, focus on animal feed, and use of improved conventional technology to drive demand

- FIGURE 50 GLOBAL PRODUCTION OF CORN, 2017-2021 (MILLION TONS)

- 8.3.2 WHEAT

- 8.3.2.1 Rising income levels and adoption of westernized diets to fuel demand for wheat-based products

- FIGURE 51 WHEAT PRODUCTION IN INDIA, 2017-2021 (MILLION TONS)

- 8.3.3 RICE

- 8.3.3.1 Population growth and rising need for food use to boost demand for rice

- FIGURE 52 ANNUAL PRODUCTION OF RICE, 2019-2021 (MILLION TONS)

- 8.3.4 OTHER CEREALS & GRAINS

- TABLE 47 CEREALS & GRAINS: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 CEREALS & GRAINS: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 CEREALS & GRAINS: SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 50 CEREALS & GRAINS: SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 51 CORN: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 52 CORN: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.3.1 CORN

- 8.4 FRUITS & VEGETABLES

- 8.4.1 SOLANACEAE

- 8.4.1.1 Demand for Solanaceae products to grow due to their rising utilization in processed food industry

- FIGURE 53 GLOBAL TOMATO PRODUCTION BY REGION, 2021

- 8.4.2 CUCURBITS

- 8.4.2.1 Demand for short cucumbers as convenient and healthy snacking option to propel market

- 8.4.3 BRASSICAS

- 8.4.3.1 Demand for Brassica crops to grow due to their ability to provide nutrition at reduced cost

- 8.4.4 LEAFY VEGETABLES

- 8.4.4.1 Integration of smart technologies to enhance productivity of leafy vegetables

- 8.4.5 ROOTS & BULBS

- 8.4.5.1 Carrot to drive demand as rich source of beta-carotene and antioxidants

- FIGURE 54 GLOBAL CARROT PRODUCTION BY REGION, 2021

- 8.4.6 OTHER FRUITS & VEGETABLES

- TABLE 53 FRUITS & VEGETABLES: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 FRUITS & VEGETABLES: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 FRUITS & VEGETABLES: SEEDS MARKET, BY FAMILY TYPE, 2018-2022 (USD MILLION)

- TABLE 56 FRUITS & VEGETABLES: SEEDS MARKET, BY FAMILY TYPE, 2023-2028 (USD MILLION)

- TABLE 57 FRUITS & VEGETABLES: SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 58 FRUITS & VEGETABLES: SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- 8.4.1 SOLANACEAE

- 8.5 OTHER CROP TYPES

- TABLE 59 FUNCTIONAL, RECREATIONAL, AND ORNAMENTAL BENEFITS OF TURFGRASS

- TABLE 60 OTHER CROP TYPES: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 OTHER CROP TYPES: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 SEEDS MARKET, BY TREATMENT

- 9.1 INTRODUCTION

- 9.2 TREATED SEEDS

- 9.3 UNTREATED SEEDS

10 SEEDS MARKET, BY TRAIT

- 10.1 INTRODUCTION

- FIGURE 55 OTHER TRAITS SEGMENT TO DOMINATE GENETICALLY MODIFIED SEEDS MARKET DURING FORECAST PERIOD

- TABLE 62 SEEDS MARKET, BY TRAIT, 2018-2022 (USD MILLION)

- TABLE 63 SEEDS MARKET, BY TRAIT, 2023-2028 (USD MILLION)

- TABLE 64 SEEDS MARKET, BY TRAIT, 2018-2022 (MILLION HA)

- TABLE 65 SEEDS MARKET, BY TRAIT, 2023-2028 (MILLION HA)

- FIGURE 56 HERBICIDE-TOLERANT CORN (PERCENTAGE OF ALL CORN PLANTED) IN US, 2021-2022

- FIGURE 57 INSECT-RESISTANT BT COTTON (PERCENTAGE OF ALL UPLAND COTTON PLANTED) IN US, 2021-2022

- 10.2 HERBICIDE TOLERANCE

- 10.2.1 NEED FOR EFFECTIVE WEED CONTROL AND PROTECTING CROP YIELDS TO DRIVE DEMAND FOR HERBICIDE-TOLERANT CROPS

- TABLE 66 COUNTRIES TO APPROVE MAJOR HERBICIDE-TOLERANT CROPS (WITH SINGLE AND STACKED GENES) FOR FOOD, FEED, AND/OR CULTIVATION

- TABLE 67 COMMERCIALIZED HERBICIDE-TOLERANT SEED PRODUCTS

- FIGURE 58 HERBICIDE-TOLERANT COTTON (PERCENTAGE OF ALL UPLAND COTTON PLANTED) IN US, 2021-2022

- TABLE 68 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2018-2022 (MILLION HA)

- TABLE 71 HERBICIDE-TOLERANT CROPS: SEEDS MARKET, BY REGION, 2023-2028 (MILLION HA)

- 10.3 INSECT RESISTANCE

- 10.3.1 INSECT-RESISTANT SEEDS TO HELP MINIMIZE CROP DAMAGE BY MAKING PLANTS LESS SUSCEPTIBLE TO PESTS

- TABLE 72 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 74 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2018-2022 (MILLION HA)

- TABLE 75 INSECT-RESISTANT CROPS: SEEDS MARKET, BY REGION, 2023-2028 (MILLION HA)

- 10.4 OTHER TRAITS

- TABLE 76 GENE STACKING METHODS IN PRODUCTION OF BIOTECH STACKS

- TABLE 77 OTHER TRAITS: SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 OTHER TRAITS: SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 79 OTHER TRAITS: SEEDS MARKET, BY REGION, 2018-2022 (MILLION HA)

- TABLE 80 OTHER TRAITS: SEEDS MARKET, BY REGION, 2023-2028 (MILLION HA)

11 SEEDS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 59 CHINA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 81 SEEDS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 SEEDS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 60 NORTH AMERICA: REGIONAL SNAPSHOT

- 11.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 61 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 83 NORTH AMERICA: SEEDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: SEEDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2018-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2018-2022 (MILLION HA)

- TABLE 90 NORTH AMERICA: SEEDS MARKET, BY TRAIT, 2023-2028 (MILLION HA)

- TABLE 91 NORTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Presence of key market players and government's price support system to drive market

- TABLE 93 US: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 94 US: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 95 US: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 96 US: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 97 US: CORN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 98 US: CORN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 99 US: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 100 US: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 101 US: SOYBEAN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 102 US: SOYBEAN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 103 US: COTTON SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 104 US: COTTON SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Adoption of cutting-edge technologies for plant breeding to boost demand for seeds business

- TABLE 105 SEED CROPS GROWN IN CANADA

- FIGURE 62 CROPS IMPORTED BY CANADA, 2021 (TONS)

- TABLE 106 CANADA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 107 CANADA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 108 CANADA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 109 CANADA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 110 CANADA: CORN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 111 CANADA: CORN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 112 CANADA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 113 CANADA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 114 CANADA: SOYBEAN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 115 CANADA: SOYBEAN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 116 CANADA: CANOLA SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 117 CANADA: CANOLA SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Favorable government policies, well-developed seeds industry, and presence of key companies to drive market

- FIGURE 63 ANNUAL IMPORTS OF PRIMARY RAW MATERIALS BY FEED INDUSTRY IN MEXICO, 2019-2021

- FIGURE 64 WHEAT IMPORT IN MEXICO, 2019-2022 (TRADE YEAR)

- TABLE 118 MEXICO: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 119 MEXICO: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 65 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 120 EUROPE: SEEDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 121 EUROPE: SEEDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 123 EUROPE: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 125 EUROPE: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: SEEDS MARKET, BY TRAIT, 2018-2022 (USD MILLION)

- TABLE 127 EUROPE: SEEDS MARKET, BY TRAIT, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: SEEDS MARKET, BY TRAIT, 2018-2022 (MILLION HA)

- TABLE 129 EUROPE: SEEDS MARKET, BY TRAIT, 2023-2028 (MILLION HA)

- 11.3.2 SPAIN

- 11.3.2.1 Adoption of advanced technology and expansion of GE crop cultivation to drive market

- TABLE 130 SPAIN: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 131 SPAIN: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 132 SPAIN: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 133 SPAIN: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 134 SPAIN: CORN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 135 SPAIN: CORN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.3 ITALY

- 11.3.3.1 Availability of various vegetable seeds and favorable weather to drive market

- TABLE 136 ITALY: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 137 ITALY: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Need for productivity and disease resistance and presence of key seed manufacturers to drive market

- TABLE 138 GERMANY: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 139 GERMANY: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Focus on maintaining traditional, open-pollinated seed varieties and robust agricultural research sector to drive market

- TABLE 140 FRANCE: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 141 FRANCE: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.6 RUSSIA

- 11.3.6.1 Well-developed domestic seed industry with several seed companies to drive market

- TABLE 142 RUSSIA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 143 RUSSIA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.7 UK

- 11.3.7.1 Demand for seeds with disease resistance, higher yield potential, and adaptability to drive market

- TABLE 144 UK: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 145 UK: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.8 NETHERLANDS

- 11.3.8.1 Advanced horticultural practices and strong regulatory frameworks to drive seeds market

- TABLE 146 NETHERLANDS: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 147 NETHERLANDS: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.9 UKRAINE

- 11.3.9.1 Implementation of legislation and regulations to maintain seeds quality to drive market

- TABLE 148 UKRAINE: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 149 UKRAINE: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.10 REST OF EUROPE

- TABLE 150 REST OF EUROPE: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 151 REST OF EUROPE: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 66 ASIA PACIFIC: REGIONAL SNAPSHOT

- 11.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 67 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- TABLE 152 ASIA PACIFIC: SEEDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SEEDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2018-2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2023-2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2018-2022 (MILLION HA)

- TABLE 161 ASIA PACIFIC: SEEDS MARKET, BY TRAIT, 2023-2028 (MILLION HA)

- 11.4.2 CHINA

- 11.4.2.1 Government initiatives and increased subsidies to boost production of oilseeds and other seed crops

- TABLE 162 CHINA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 163 CHINA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 164 CHINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 165 CHINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 166 CHINA: COTTON SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 167 CHINA: COTTON SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.3 THAILAND

- 11.4.3.1 Strong export market for Solanaceae crops and focus on food value awareness to boost market

- TABLE 168 THAILAND: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 169 THAILAND: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Rising adoption of hybrid seeds and increased investment in research & development to drive market

- FIGURE 69 OILSEED PRODUCTION IN INDIA, BY OIL MEAL TYPE, 2019-2020 ('000 TONS)

- TABLE 170 INDIA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 171 INDIA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 172 INDIA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 173 INDIA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 174 INDIA: COTTON SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 175 INDIA: COTTON SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.5 JAPAN

- 11.4.5.1 Favorable agricultural policy and adoption of advanced technologies to drive market

- TABLE 176 JAPAN: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 177 JAPAN: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.6 AUSTRALIA

- 11.4.6.1 Increasing use of genetically modified crops and need for improved yield to drive market

- FIGURE 70 CANOLA EXPORT IN AUSTRALIA, 2022 ('000 TONS)

- TABLE 178 AUSTRALIA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 179 AUSTRALIA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.7 VIETNAM

- 11.4.7.1 Dependence on agriculture and diversity in crop production to drive market

- FIGURE 71 MARKET SHARE FOR WHEAT IMPORT IN VIETNAM, 2022

- TABLE 180 VIETNAM: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 181 VIETNAM: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 182 REST OF ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 72 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 184 SOUTH AMERICA: SEEDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 185 SOUTH AMERICA: SEEDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 186 SOUTH AMERICA: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 187 SOUTH AMERICA: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 188 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2018-2022 (USD MILLION)

- TABLE 189 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2023-2028 (USD MILLION)

- TABLE 190 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2018-2022 (MILLION HA)

- TABLE 191 SOUTH AMERICA: SEEDS MARKET, BY TRAIT, 2023-2028 (MILLION HA)

- TABLE 192 SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Semi-temperate climate and fertile soil to propel crop production and export market growth

- FIGURE 73 AREA HARVESTED FOR MAJOR CROPS IN BRAZIL, 2019-2021 (MILLION HA)

- TABLE 194 BRAZIL: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 195 BRAZIL: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 196 BRAZIL: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 197 BRAZIL: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 198 BRAZIL: CORN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 199 BRAZIL: CORN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 200 BRAZIL: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 201 BRAZIL: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 202 BRAZIL: SOYBEAN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 203 BRAZIL: SOYBEAN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Adoption of genetically modified seeds, access to loan facilities for small farmers, and diverse climate conditions to drive market

- FIGURE 74 AREA HARVESTED FOR MAJOR CROPS IN ARGENTINA, 2019-2021 (MILLION HA)

- TABLE 204 ARGENTINA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 205 ARGENTINA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 206 ARGENTINA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 207 ARGENTINA: CEREALS & GRAINS SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 208 ARGENTINA: CORN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 209 ARGENTINA: CORN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 210 ARGENTINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2018-2022 (USD MILLION)

- TABLE 211 ARGENTINA: OILSEEDS & PULSES SEEDS MARKET, BY CROP, 2023-2028 (USD MILLION)

- TABLE 212 ARGENTINA: SOYBEAN SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 213 ARGENTINA: SOYBEAN SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.4 CHILE

- 11.5.4.1 Investment from leading players and favorable and climate conditions to propel demand for seed production

- TABLE 214 CHILE: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 215 CHILE: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.5.5 REST OF SOUTH AMERICA

- TABLE 216 REST OF SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.6 ROW

- FIGURE 75 ROW: RECESSION IMPACT ANALYSIS

- TABLE 218 ROW: SEEDS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 219 ROW: SEEDS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 220 ROW: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 221 ROW: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 222 ROW: SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 223 ROW: SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 224 ROW: SEEDS MARKET, BY TRAIT, 2018-2022 (USD MILLION)

- TABLE 225 ROW: SEEDS MARKET, BY TRAIT, 2023-2028 (USD MILLION)

- TABLE 226 ROW: SEEDS MARKET, BY TRAIT, 2018-2022 (MILLION HA)

- TABLE 227 ROW: SEEDS MARKET, BY TRAIT, 2023-2028 (MILLION HA)

- 11.6.1 SOUTH AFRICA

- 11.6.1.1 Subsidies and government initiatives to fuel demand for seed cultivation

- TABLE 228 SOUTH AFRICA: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 229 SOUTH AFRICA: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.6.2 TURKEY

- 11.6.2.1 Policy of National Seed Gene Bank to conserve and protect plant genetic diversity to drive market

- FIGURE 76 AREA HARVESTED FOR CROPS IN TURKEY, 2019-2021 (MILLION HA)

- TABLE 230 TURKEY: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 231 TURKEY: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.6.3 EGYPT

- 11.6.3.1 Research & development in biotechnology sector to enhance domestic production of oilseeds

- TABLE 232 EGYPT: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 233 EGYPT: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.6.4 OTHERS IN ROW

- TABLE 234 OTHERS IN ROW: SEEDS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 235 OTHERS IN ROW: SEEDS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 77 SEEDS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- TABLE 236 SEEDS MARKET: DEGREE OF COMPETITION

- 12.5 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022

- FIGURE 78 SEEDS MARKET: SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD BILLION)

- 12.6 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH, 2020-2022

- FIGURE 79 SEEDS MARKET: ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 12.7 KEY PLAYERS' EBITDA, 2022

- FIGURE 80 EBITDA, 2022 (USD MILLION)

- 12.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- FIGURE 81 SEEDS MARKET: COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- 12.8.5 PRODUCT FOOTPRINT

- TABLE 237 SEEDS MARKET: COMPANY TYPE FOOTPRINT

- TABLE 238 SEEDS MARKET: CROP TYPE FOOTPRINT

- TABLE 239 SEEDS MARKET: REGIONAL FOOTPRINT

- TABLE 240 SEEDS MARKET: COMPANIES' OVERALL FOOTPRINT

- 12.9 COMPANY EVALUATION MATRIX (OTHER PLAYERS)

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 STARTING BLOCKS

- 12.9.3 RESPONSIVE COMPANIES

- 12.9.4 DYNAMIC COMPANIES

- FIGURE 82 SEEDS MARKET: COMPANY EVALUATION MATRIX, 2022 (OTHER PLAYERS)

- 12.9.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 241 SEEDS MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 242 SEEDS MARKET: COMPETITIVE BENCHMARKING FOR STARTUPS/SMES, 2022

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- TABLE 243 SEED MARKET: PRODUCT LAUNCHES, 2020-2023

- 12.10.2 DEALS

- TABLE 244 SEEDS MARKET: DEALS, 2020-2023

- 12.10.3 OTHERS

- TABLE 245 SEEDS MARKET: OTHERS, 2020-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 13.1.1 BASF SE

- TABLE 246 BASF SE: COMPANY OVERVIEW

- FIGURE 83 BASF SE: COMPANY SNAPSHOT

- TABLE 247 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 BASF SE: PRODUCT LAUNCHES

- TABLE 249 BASF SE: DEALS

- TABLE 250 BASF SE: OTHERS

- 13.1.2 BAYER AG

- TABLE 251 BAYER AG: COMPANY OVERVIEW

- FIGURE 84 BAYER AG: COMPANY SNAPSHOT

- TABLE 252 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 BAYER AG: PRODUCT LAUNCHES

- TABLE 254 BAYER AG: DEALS

- TABLE 255 BAYER AG: OTHERS

- 13.1.3 SYNGENTA CROP PROTECTION AG

- TABLE 256 SYNGENTA CROP PROTECTION AG: COMPANY OVERVIEW

- FIGURE 85 SYNGENTA CROP PROTECTION AG: COMPANY SNAPSHOT

- TABLE 257 SYNGENTA CROP PROTECTION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SYNGENTA CROP PROTECTION AG: DEALS

- 13.1.4 KWS SAAT SE & CO. KGAA

- TABLE 259 KWS SAAT SE & CO. KGAA: COMPANY OVERVIEW

- FIGURE 86 KWS SAAT SE & CO. KGAA: COMPANY SNAPSHOT

- TABLE 260 KWS SAAT SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 KWS SAAT SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 262 KWS SAAT SE & CO. KGAA: DEALS

- TABLE 263 KWS SAAT SE & CO. KGAA: OTHERS

- 13.1.5 CORTEVA

- TABLE 264 CORTEVA: COMPANY OVERVIEW

- FIGURE 87 CORTEVA: COMPANY SNAPSHOT

- TABLE 265 CORTEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 CORTEVA: PRODUCT LAUNCHES

- TABLE 267 CORTEVA: DEALS

- 13.1.6 LIMAGRAIN

- TABLE 268 LIMAGRAIN: COMPANY OVERVIEW

- FIGURE 88 LIMAGRAIN: COMPANY SNAPSHOT

- TABLE 269 LIMAGRAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 ADVANTA SEEDS

- TABLE 270 ADVANTA SEEDS: COMPANY OVERVIEW

- FIGURE 89 ADVANTA SEEDS: COMPANY SNAPSHOT

- TABLE 271 ADVANTA SEEDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 SAKATA SEED CORPORATION

- TABLE 272 SAKATA SEED CORPORATION: COMPANY OVERVIEW

- FIGURE 90 SAKATA SEED CORPORATION: COMPANY SNAPSHOT

- TABLE 273 SAKATA SEED CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 SAKATA SEED CORPORATION: PRODUCT LAUNCHES

- TABLE 275 SAKATA SEED CORPORATION: DEALS

- TABLE 276 SAKATA SEED CORPORATION: OTHERS

- 13.1.9 DLF SEEDS A/S

- TABLE 277 DLF SEEDS A/S: COMPANY OVERVIEW

- FIGURE 91 DLF SEEDS A/S: COMPANY SNAPSHOT

- TABLE 278 DLF SEEDS A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 DLF SEEDS A/S: PRODUCT LAUNCHES

- TABLE 280 DLF SEEDS A/S: DEALS

- 13.1.10 ENZA ZADEN BEHEER B.V.

- TABLE 281 ENZA ZADEN BEHEER B.V.: COMPANY OVERVIEW

- TABLE 282 ENZA ZADEN BEHEER B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ENZA ZADEN BEHEER B.V.: PRODUCT LAUNCHES

- TABLE 284 ENZA ZADEN BEHEER B.V.: DEALS

- TABLE 285 ENZA ZADEN BEHEER B.V.: OTHERS

- 13.1.11 RALLIS INDIA LIMITED

- TABLE 286 RALLIS INDIA LIMITED: COMPANY OVERVIEW

- FIGURE 92 RALLIS INDIA LIMITED: COMPANY SNAPSHOT

- TABLE 287 RALLIS INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 FMC CORPORATION

- TABLE 288 FMC CORPORATION: COMPANY OVERVIEW

- FIGURE 93 FMC CORPORATION: COMPANY SNAPSHOT

- TABLE 289 FMC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 TAKII & CO., LTD.

- TABLE 290 TAKII & CO., LTD.: COMPANY OVERVIEW

- TABLE 291 TAKII & CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 TAKII & CO., LTD.: DEALS

- TABLE 293 TAKII & CO., LTD.: OTHERS

- 13.1.14 ROYAL BARENBRUG GROUP

- TABLE 294 ROYAL BARENBRUG GROUP: COMPANY OVERVIEW

- TABLE 295 ROYAL BARENBRUG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ROYAL BARENBRUG GROUP: DEALS

- 13.1.15 LONGPING HIGH-TECH

- TABLE 297 LONGPING HIGH-TECH: COMPANY OVERVIEW

- TABLE 298 LONGPING HIGH-TECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 LAND O'LAKES, INC.

- TABLE 299 LAND O'LAKES, INC.: COMPANY OVERVIEW

- FIGURE 94 LAND O'LAKES, INC.: COMPANY SNAPSHOT

- TABLE 300 LAND O'LAKES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.2 VIKIMA SEED A/S

- TABLE 301 VIKIMA SEED A/S: COMPANY OVERVIEW

- TABLE 302 VIKIMA SEED A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.3 ALLIED SEED, LLC

- TABLE 303 ALLIED SEED, LLC: COMPANY OVERVIEW

- TABLE 304 ALLIED SEED, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.4 AMPAC SEED COMPANY

- TABLE 305 AMPAC SEED COMPANY: COMPANY OVERVIEW

- TABLE 306 AMPAC SEED COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.5 IMPERIAL SEED

- TABLE 307 IMPERIAL SEED: COMPANY OVERVIEW

- TABLE 308 IMPERIAL SEED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.6 SL-AGRITECH

- 13.2.7 BRETTYOUNG

- 13.2.8 RASI SEEDS (P) LTD.

- 13.2.9 CN SEEDS

- 13.2.10 MAHYCO

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 309 ADJACENT MARKETS

- 14.2 RESEARCH LIMITATIONS

- 14.3 SEED TREATMENT MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 310 SEED TREATMENT MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

- 14.4 SEED COATING MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 311 SEED COATING MARKET, BY FORM, 2022-2027 (USD MILLION)

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS