|

|

市場調査レポート

商品コード

1746470

医療シミュレーションの世界市場:製品・サービス別、技術別、エンドユーザー別、地域別 - 予測(~2030年)Healthcare Simulation Market by Product & Service (Simulation, Training), Technology, End User, & Region - Global Forecast 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療シミュレーションの世界市場:製品・サービス別、技術別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年06月06日

発行: MarketsandMarkets

ページ情報: 英文 364 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医療シミュレーションの市場規模は、2025年の35億米ドルから2030年までに72億3,000万米ドルに達すると予測され、CAGRで15.6%の成長が見込まれます。

市場の主な促進要因は、能力ベースの医療教育(CBME)への世界的なシフト、患者の安全性の重視、AI搭載シミュレーターやVR/ARベースプラットフォームなどの急速な技術の進歩です。専門分野に特化したトレーニングや遠隔学習ソリューションへのニーズの高まりが、市場成長をさらに後押ししています。しかし、シミュレーションインフラに関連する高い資本コストと運用コスト、リソースの少ない環境での限られたアクセス性などが大きな抑制要因となっています。また、シミュレーションの標準化が進んでいないため、一貫したトレーニングの質の保証が課題となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 製品・サービス、技術、エンドユーザー |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東アフリカ |

「ウェブベースシミュレーションセグメントが、予測期間にもっとも高いCAGRとなります。」

ウェブベースシミュレーションは、拡張性、柔軟性、コスト効率に優れ、学術環境や医療環境に理想的であることから、予測期間にもっとも急速に成長する見込みです。その採用は、特にCOVID-19以降の遠隔学習モデルやハイブリッド学習モデルへの世界的なシフトに伴って加速しています。ハードウェアベースのツールとは異なり、ウェブベースのプラットフォームは最小限のインフラしか必要としないため、リソースに制約のある環境に適しています。また、これらのプラットフォームは、リアルタイムのパフォーマンス追跡、カスタマイズ可能なシナリオ、複数ユーザーのコラボレーションを可能にし、トレーニングの成果を高めます。さらに、クラウドコンピューティング、AI、データアナリティクスの統合により、パーソナライズされた学習と断固とした評価が可能になります。LaerdalのvSim、CAE HealthcareのLearningSpace、Oxford Medical Simulationなどのソリューションは、この分野における世界の勢いを象徴しています。この動向は、物理的なラボへの依存を減らすと同時にアクセスを拡大し、このセグメントの急成長を促進しています。

「手技リハーサル技術が2024年に医療シミュレーション市場で最大のシェアを占めました。」

手技リハーサル技術セグメントが2024年の医療シミュレーション市場で最大のシェアを占めたのは、複雑な医学的手技の実践練習という重要なニーズに直接対応しているためです。この技術により、臨床医や外科医は、多くの場合患者に特化した非常にリアルなモデル上で特定の手術や治療をリハーサルすることができ、実際の手技の精度を向上させ、ミスを減らすことができます。この技術が広く採用されるようになった要因は、低侵襲手術に対する需要の増加、手術の合併症の軽減の重視、先進のイメージング技術や3Dモデリング技術への投資の増加などです。手技リハーサル技術は、理論的知識と実世界での応用のギャップを埋めるものであり、医療トレーニングや術前計画に不可欠なものとなっています。

「アジア太平洋が2025年~2030年に大きなCAGRを示します。」

アジア太平洋が予測期間に世界の医療シミュレーション市場でもっとも高いCAGRを記録する見込みです。この成長は、外科手術の増加や、安全で効果的な臨床トレーニングを保証する手技リハーサルツール、解剖学モデル、高忠実度シミュレーターへのニーズの増加によるものです。

当レポートでは、世界の医療シミュレーション市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 医療シミュレーション市場の企業にとって魅力的な機会

- アジア太平洋の医療シミュレーション市場:製品・サービス別、国別

- 医療シミュレーション市場:地理別

- 医療シミュレーション市場:地域別

- 医療シミュレーション市場:新興国 vs. 先進国

第5章 市場の概要

- イントロダクション

- 市場力学

- 市場力学:影響の分析

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- 医療シミュレーションにおけるVRとARの活用

- 高忠実度技術の進歩

- シミュレーター開発におけるマルチモーダルアプローチの採用

- 外科手術におけるAI/MLベースのソフトウェアの活用

- 医療IT/電子カルテ志向

- 技術分析

- 主要技術

- 隣接技術

- AIとVR

- エコシステム分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 特許分析

- 医療シミュレーション市場における特許公報の動向

- 管轄と主要申請者の分析

- 主要特許のリスト

- 規制情勢

- 規制機関、政府機関、その他の組織

- 世界の規制基準

- 規制当局からの市販前承認を必要とする医療シミュレーション製品

- 相互運用性基準

- 価格分析

- 医療シミュレーション製品の参考価格:主要企業別(2024年)

- 医療シミュレーション機器の価格:地域別(2024年)

- 医療シミュレーション市場:投資情勢

- 主な会議とイベント(2025年~2026年)

- 顧客ビジネスに影響を与える動向/混乱

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 医療シミュレーション市場におけるアンメットニーズ

- 2025年の米国関税の影響 - 概要

- 主な関税率

- 価格の影響の分析

- 国・地域に対する影響

- 米国

- 欧州

- アジア太平洋

- エンドユーザーに対する影響

第6章 医療シミュレーション市場:製品・サービス別

- イントロダクション

- 医療シミュレーション解剖学モデル

- 患者シミュレーター

- タスクトレーナー

- 介入/外科シミュレーター

- 超音波シミュレーター

- 歯科シミュレーター

- アイシミュレーター

- ウェブベースシミュレーション

- 医療シミュレーションソフトウェア

- 医療シミュレーショントレーニングサービス

- ベンダーベーストレーニング

- 教育協会

- カスタムコンサルティングサービス

第7章 医療シミュレーション市場:技術別

- イントロダクション

- 仮想患者シミュレーション

- 3Dプリンティング

- 手技リハーサル技術

第8章 医療シミュレーション市場:エンドユーザー別

- イントロダクション

- 学術機関

- 病院

- 軍事組織

- その他のエンドユーザー

第9章 医療シミュレーション市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2022年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 市場ランキング分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- ブランド/ソフトウェアの比較

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- SURGICAL SCIENCE SWEDEN AB

- LAERDAL MEDICAL

- GAUMARD SCIENTIFIC

- KYOTO KAGAKU CO., LTD.

- LIMBS & THINGS LTD

- MENTICE AB

- SIMULAB CORPORATION

- SIMULAIDS

- OPERATIVE EXPERIENCE, INC.

- NASCO HEALTHCARE

- ANATOMAGE

- CARDIONICS INC.

- VIRTAMED AG

- SYNBONE AG

- INGMAR MEDICAL

- MEDICAL-X

- KAVO DENTAL

- ALTAY SCIENTIFIC

- TRUCORP LIMITED

- SIMENDO

- その他の企業

- HAAG-STREIT AG

- SYMGERY

- HRV SIMULATION

- SYNAPTIVE MEDICAL

- INOVUS LIMITED

第12章 付録

List of Tables

- TABLE 1 EXCHANGE RATES CONSIDERED FOR CONVERTING CURRENCIES TO USD

- TABLE 2 RISK ASSESSMENT: HEALTHCARE SIMULATION MARKET

- TABLE 3 HEALTHCARE SIMULATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 KEY PATENTS IN HEALTHCARE SIMULATION MARKET, 2022-2024

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 HEALTHCARE SIMULATION MARKET: REGULATORY STANDARDS

- TABLE 9 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

- TABLE 10 CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY IN JAPAN

- TABLE 11 NMPA MEDICAL DEVICE CLASSIFICATION

- TABLE 12 KEY STANDARDS FOR INTEROPERABILITY IN DIGITAL HEALTH SPECTRUM

- TABLE 13 QUALITATIVE ANALYSIS OF WIDELY USED DATA TRANSMISSION STANDARDS IN DIGITAL HEALTH SPECTRUM

- TABLE 14 PRICING RANGE OF HEALTHCARE SIMULATION PRODUCTS PROVIDED BY KEY PLAYERS, 2024

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 17 UNMET NEEDS IN HEALTHCARE SIMULATION MARKET

- TABLE 18 EXPECTATIONS OF END USERS OF HEALTHCARE SIMULATION SOLUTIONS

- TABLE 19 TABLE 1: US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 21 HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 22 HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 23 KEY PLAYERS OFFERING PATIENT SIMULATORS

- TABLE 24 PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 25 PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 26 PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 KEY MARKET PLAYERS OFFERING HIGH-FIDELITY SIMULATORS

- TABLE 28 HIGH-FIDELITY PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 KEY MARKET PLAYERS OFFERING MEDIUM-FIDELITY SIMULATORS

- TABLE 30 MEDIUM-FIDELITY PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 KEY MARKET PLAYERS OFFERING LOW-FIDELITY SIMULATORS

- TABLE 32 LOW-FIDELITY PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 LAPAROSCOPIC SURGICAL PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 GYNECOLOGY PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 CARDIOVASCULAR PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 ORTHOPEDIC SURGICAL PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 SPINE SURGICAL PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 ENDOVASCULAR PATIENT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 PATIENT SIMULATORS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 KEY MARKET PLAYERS OFFERING TASK TRAINERS

- TABLE 41 TASK TRAINERS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 44 KEY MARKET PLAYERS OFFERING LAPAROSCOPIC SURGICAL SIMULATORS

- TABLE 45 LAPAROSCOPIC SURGICAL SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 KEY MARKET PLAYERS OFFERING GYNECOLOGY SIMULATORS

- TABLE 47 GYNECOLOGY SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

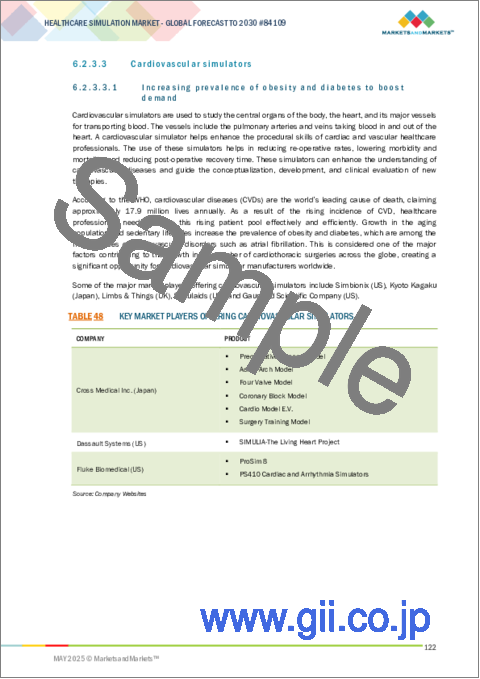

- TABLE 48 KEY MARKET PLAYERS OFFERING CARDIOVASCULAR SIMULATORS

- TABLE 49 CARDIOVASCULAR SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 KEY MARKET PLAYERS OFFERING ORTHOPEDIC SIMULATORS

- TABLE 51 ORTHOPEDIC SURGICAL SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 KEY MARKET PLAYERS OFFERING SPINE SURGICAL SIMULATORS

- TABLE 53 SPINE SURGICAL SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 KEY MARKET PLAYERS OFFERING ENDOVASCULAR SIMULATORS

- TABLE 55 ENDOVASCULAR SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 KEY MARKET PLAYERS OFFERING OTHER SURGICAL SIMULATORS

- TABLE 57 OTHER SURGICAL SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 KEY MARKET PLAYERS OFFERING ULTRASOUND SIMULATORS

- TABLE 59 ULTRASOUND SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 KEY PLAYERS OFFERING DENTAL SIMULATORS

- TABLE 61 DENTAL SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 KEY PLAYERS OFFERING EYE SIMULATORS

- TABLE 63 EYE SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 KEY PLAYERS OFFERING WEB-BASED SIMULATORS

- TABLE 65 WEB-BASED SIMULATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 KEY MARKET PLAYERS OFFERING HEALTHCARE SIMULATION SOFTWARE

- TABLE 67 HEALTHCARE SIMULATION SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 KEY MARKET PLAYERS OFFERING VENDOR-BASED TRAINING SERVICES

- TABLE 71 VENDOR-BASED TRAINING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 KEY PLAYERS OFFERING EDUCATIONAL SOCIETIES SIMULATORS

- TABLE 73 EDUCATIONAL SOCIETIES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 KEY MARKET PLAYERS OFFERING CUSTOM CONSULTING SERVICES

- TABLE 75 CUSTOM CONSULTING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 77 VIRTUAL PATIENT SIMULATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 3D PRINTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 PROCEDURAL REHEARSAL TECHNOLOGY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 HEALTHCARE SIMULATION MARKET IN ACADEMIC INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 HEALTHCARE SIMULATION MARKET IN HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 HEALTHCARE SIMULATION MARKET IN MILITARY ORGANIZATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 HEALTHCARE SIMULATION MARKET IN OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 85 HEALTHCARE SIMULATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: HEALTHCARE SIMULATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 US: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 96 US: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 US: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 US: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 99 US: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 US: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 US: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 102 US: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 103 CANADA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 104 CANADA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 110 CANADA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: HEALTHCARE SIMULATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 120 UK: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 121 UK: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 UK: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 UK: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 124 UK: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 UK: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 UK: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 127 UK: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 FRANCE: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 129 FRANCE: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 FRANCE: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 FRANCE: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 132 FRANCE: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 FRANCE: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 FRANCE: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 135 FRANCE: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 GERMANY: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 137 GERMANY: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 GERMANY: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 GERMANY: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 140 GERMANY: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 GERMANY: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 GERMANY: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 143 GERMANY: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 144 ITALY: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 145 ITALY: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 ITALY: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 ITALY: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 148 ITALY: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 ITALY: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 ITALY: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 151 ITALY: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 SPAIN: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 153 SPAIN: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SPAIN: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 SPAIN: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 SPAIN: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SPAIN: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 SPAIN: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 160 REST OF EUROPE: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 161 REST OF EUROPE: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 REST OF EUROPE: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 JAPAN: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 178 JAPAN: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 JAPAN: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 JAPAN: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 181 JAPAN: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 JAPAN: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 JAPAN: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 184 JAPAN: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 CHINA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 186 CHINA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 CHINA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 CHINA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 189 CHINA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 CHINA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 CHINA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 192 CHINA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 193 INDIA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 194 INDIA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 INDIA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 INDIA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 197 INDIA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 INDIA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 INDIA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 200 INDIA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 209 LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 210 LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 211 LATIN AMERICA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 LATIN AMERICA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 LATIN AMERICA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 LATIN AMERICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 LATIN AMERICA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 217 LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 218 BRAZIL: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 219 BRAZIL: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 BRAZIL: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 BRAZIL: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 222 BRAZIL: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 BRAZIL: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 BRAZIL: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 225 BRAZIL: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 226 MEXICO: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 227 MEXICO: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 MEXICO: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 MEXICO: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 230 MEXICO: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 MEXICO: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 MEXICO: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 233 MEXICO: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 REST OF LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 235 REST OF LATIN AMERICA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 REST OF LATIN AMERICA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 REST OF LATIN AMERICA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 241 REST OF LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 251 GCC: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 252 GCC: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 GCC: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 GCC: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 255 GCC: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 GCC: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 GCC: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 258 GCC: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST & AFRICA: PATIENT SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: PATIENT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 266 REST OF MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 267 HEALTHCARE SIMULATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2022-MAY 2025

- TABLE 268 HEALTHCARE SIMULATION MARKET: REGION FOOTPRINT

- TABLE 269 HEALTHCARE SIMULATION MARKET: PRODUCT & SERVICE FOOTPRINT

- TABLE 270 HEALTHCARE SIMULATION MARKET: END USER FOOTPRINT

- TABLE 271 HEALTHCARE SIMULATION MARKET: TECHNOLOGY FOOTPRINT

- TABLE 272 HEALTHCARE SIMULATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 273 HEALTHCARE SIMULATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 274 HEALTHCARE SIMULATION MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 275 HEALTHCARE SIMULATION MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 276 HEALTHCARE SIMULATION MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 277 SURGICAL SCIENCE SWEDEN AB: COMPANY OVERVIEW

- TABLE 278 SURGICAL SCIENCE SWEDEN AB: PRODUCTS OFFERED

- TABLE 279 SURGICAL SCIENCE SWEDEN AB: DEALS

- TABLE 280 LAERDAL MEDICAL: COMPANY OVERVIEW

- TABLE 281 LAERDAL MEDICAL: PRODUCTS OFFERED

- TABLE 282 LAERDAL MEDICAL: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 283 LAERDAL MEDICAL: DEALS

- TABLE 284 GAUMARD SCIENTIFIC: COMPANY OVERVIEW

- TABLE 285 GAUMARD SCIENTIFIC: PRODUCTS OFFERED

- TABLE 286 GAUMARD SCIENTIFIC: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 287 GAUMARD SCIENTIFIC CO.: DEALS

- TABLE 288 KYOTO KAGAKU CO., LTD.: COMPANY OVERVIEW

- TABLE 289 KYOTO KAGAKU CO., LTD.: PRODUCTS OFFERED

- TABLE 290 LIMBS & THINGS LTD: COMPANY OVERVIEW

- TABLE 291 LIMBS & THINGS LTD: PRODUCTS OFFERED

- TABLE 292 LIMBS & THINGS LTD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 293 LIMBS & THINGS LTD: DEALS

- TABLE 294 MENTICE AB: COMPANY OVERVIEW

- TABLE 295 MENTICE AB: PRODUCTS OFFERED

- TABLE 296 MENTICE AB: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 297 MENTICE AB: DEALS, JANUARY 2022-MAY 2025

- TABLE 298 SIMULAB CORPORATION: COMPANY OVERVIEW

- TABLE 299 SIMULAB CORPORATION: PRODUCTS OFFERED

- TABLE 300 SIMULAB CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 301 SIMULAIDS: COMPANY OVERVIEW

- TABLE 302 SIMULAIDS: PRODUCTS OFFERED

- TABLE 303 SIMULAIDS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 304 OPERATIVE EXPERIENCE, INC.: COMPANY OVERVIEW

- TABLE 305 OPERATIVE EXPERIENCE, INC.: PRODUCTS OFFERED

- TABLE 306 OPERATIVE EXPERIENCE, INC.: DEVELOPMENTS

- TABLE 307 NASCO HEALTHCARE: COMPANY OVERVIEW

- TABLE 308 NASCO HEALTHCARE: PRODUCTS OFFERED

- TABLE 309 NASCO HEALTHCARE: DEALS

- TABLE 310 ANATOMAGE: COMPANY OVERVIEW

- TABLE 311 ANATOMAGE: PRODUCTS OFFERED

- TABLE 312 ANATOMAGE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 313 ANATOMAGE: OTHER DEVELOPMENTS

- TABLE 314 CARDIONICS INC.: COMPANY OVERVIEW

- TABLE 315 CARDIONICS INC.: PRODUCTS OFFERED

- TABLE 316 VIRTAMED AG: COMPANY OVERVIEW

- TABLE 317 VIRTAMED AG: PRODUCTS OFFERED

- TABLE 318 VIRTAMED AG: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 319 VIRTAMED AG: DEALS

- TABLE 320 SYNBONE AG: COMPANY OVERVIEW

- TABLE 321 SYNBONE AG: PRODUCTS OFFERED

- TABLE 322 INGMAR MEDICAL: COMPANY OVERVIEW

- TABLE 323 INGMAR MEDICAL: PRODUCTS OFFERED

- TABLE 324 INGMAR MEDICAL: DEALS

- TABLE 325 MEDICAL-X: COMPANY OVERVIEW

- TABLE 326 MEDICAL-X: PRODUCTS OFFERED

- TABLE 327 KAVO DENTAL: COMPANY OVERVIEW

- TABLE 328 KAVO DENTAL: PRODUCTS OFFERED

- TABLE 329 ALTAY SCIENTIFIC: COMPANY OVERVIEW

- TABLE 330 ALTAY SCIENTIFIC: PRODUCTS OFFERED

- TABLE 331 TRUCORP LIMITED: COMPANY OVERVIEW

- TABLE 332 TRUCORP LIMITED: PRODUCTS OFFERED

- TABLE 333 TRUCORP LIMITED: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 334 TRUCORP LIMITED: DEALS

- TABLE 335 SIMENDO: COMPANY OVERVIEW

- TABLE 336 SIMENDO: PRODUCTS OFFERED

List of Figures

- FIGURE 1 HEALTHCARE SIMULATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HEALTHCARE SIMULATION MARKET: RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 5 ESTIMATION OF MARKET SIZE FOR HEALTHCARE SIMULATION ACADEMIC INSTITUTES AND HOSPITALS THROUGH DEMAND-SIDE APPROACH

- FIGURE 6 ESTIMATION OF GLOBAL HEALTHCARE SIMULATION MARKET SIZE THROUGH DEMAND-SIDE APPROACH

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 BOTTOM-UP APPROACH: SEGMENTAL EXTRAPOLATION

- FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 DATA TRIANGULATION

- FIGURE 12 HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 HEALTHCARE SIMULATION MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 GROWING DEMAND FOR MINIMALLY INVASIVE TREATMENTS TO DRIVE MARKET

- FIGURE 17 HEALTHCARE SIMULATION ANATOMICAL MODELS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL HEALTHCARE SIMULATION MARKET DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO COMMAND HEALTHCARE SIMULATION MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 20 EMERGING COUNTRIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 HEALTHCARE SIMULATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 TOP MINIMALLY INVASIVE COSMETIC PROCEDURES PERFORMED IN 2022

- FIGURE 23 HEALTHCARE SIMULATION MARKET: ECOSYSTEM

- FIGURE 24 HEALTHCARE SIMULATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 PATENT PUBLICATION TRENDS (2015-2025)

- FIGURE 26 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) OF HEALTHCARE SIMULATION PATENTS (JANUARY 2015-MAY 2025)

- FIGURE 27 TOP APPLICANTS FOR HEALTHCARE SIMULATION PATENTS (JANUARY 2015-MAY 2025)

- FIGURE 28 INDICATIVE PRICE OF HEALTHCARE SIMULATION PRODUCTS, BY KEY PLAYERS 2024

- FIGURE 29 RECENT INVESTMENTS IN HEALTHCARE SIMULATION MARKET, 2022-2025

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 33 NORTH AMERICA: HEALTHCARE SIMULATION MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET SNAPSHOT

- FIGURE 35 HEALTHCARE SIMULATION MARKET: REVENUE ANALYSIS OF TWO KEY PLAYERS, 2020-2024

- FIGURE 36 MARKET SHARE ANALYSIS OF COMPANIES OFFERING HEALTHCARE SIMULATION PRODUCTS, 2024

- FIGURE 37 HEALTHCARE SIMULATION MARKET RANKING ANALYSIS, 2024

- FIGURE 38 HEALTHCARE SIMULATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 39 HEALTHCARE SIMULATION MARKET: COMPANY FOOTPRINT

- FIGURE 40 HEALTHCARE SIMULATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 41 BRAND/SOFTWARE COMPARISON

- FIGURE 42 SURGICAL SCIENCE SWEDEN AB: COMPANY SNAPSHOT (2024)

- FIGURE 43 MENTICE AB: COMPANY SNAPSHOT (2024)

The global healthcare simulation market is projected to reach USD 7.23 billion by 2030 from USD 3.5 billion in 2025, at a CAGR of 15.6%. Key drivers of the healthcare simulation market include the global shift toward competency-based medical education (CBME), increasing emphasis on patient safety, and rapid technological advancements such as AI-powered simulators and VR/AR-based platforms. The growing need for specialty-specific training and remote learning solutions further supports market growth. However, major restraints include the high capital and operational costs associated with simulation infrastructure and limited accessibility in low-resource settings. Additionally, the lack of standardization across simulation practices poses challenges in ensuring consistent training quality.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product & Service, Technology, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East Africa. |

"Web-based simulation segment to witness highest CAGR during forecast period"

Based on the product & service segment, the healthcare simulation market is classified into healthcare simulation anatomical models, healthcare simulation software, web-based simulation, and healthcare simulation training services. Among these, web-based simulation is expected to grow the fastest during the forecast period due to its scalability, flexibility, and cost-efficiency, qualities ideal for academic and healthcare settings. Its adoption has accelerated with the global shift to remote and hybrid learning models, especially post-COVID-19. Unlike hardware-based tools, web-based platforms require minimal infrastructure, making them suitable for resource-constrained environments. These platforms also enable real-time performance tracking, customizable scenarios, and multi-user collaboration, enhancing training outcomes. Furthermore, the integration of cloud computing, AI, and data analytics enables personalized learning and robust assessment. Solutions such as Laerdal's vSim, CAE Healthcare's LearningSpace, and Oxford Medical Simulation exemplify the global momentum in this space. This trend reduces dependence on physical labs while expanding access, fueling the segment's rapid growth.

"Procedural rehearsal technology held largest share of healthcare simulation market in 2024"

The procedural rehearsal technology segment accounted for the largest share of the healthcare simulation market in 2024 because it directly addresses the critical need for hands-on practice for complex medical procedures. This technology enables clinicians and surgeons to rehearse specific surgeries or interventions on highly realistic models, often patient-specific, improving precision and reducing errors during actual procedures. Its widespread adoption is driven by increasing demand for minimally invasive surgeries, growing emphasis on reducing surgical complications, and rising investments in advanced imaging and 3D modeling technologies. Procedural rehearsal technology bridges the gap between theoretical knowledge and real-world application, making it indispensable in medical training and preoperative planning.

"Asia Pacific region to exhibit significant CAGR from 2025 to 2030"

The Asia Pacific region is projected to record the highest CAGR in the global healthcare simulation market during the forecast period. This growth is fueled by a rise in surgical procedures, increasing the need for procedural rehearsal tools, anatomical models, and high-fidelity simulators to ensure safe and effective clinical training. Countries such as China, India, and those in Southeast Asia are investing heavily in healthcare infrastructure and upgrading medical education through simulation technologies. Expansion in this high-potential, underpenetrated market is also supported by greater government funding, global partnerships, and the growing entry of international simulation providers. For example, in April 2022, the Delhi Academy of Medical Sciences (DAMS) launched a simulation-based education facility, allowing medical students to safely practice clinical procedures without risk to real patients.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the authentication and brand protection marketplace.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level Executives: 42%, Directors: 31%, and Others: 27%

- By Region - North America: 32%, Europe: 32%, Asia Pacific: 26%, Middle East & Africa: 5%, and Latin America: 5%

Note: Other designations include sales, marketing, and product managers.

Tiers are defined based on a company's total revenue as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Key Players in Healthcare Simulation Market

The key players functioning in the healthcare simulation market include CAE Inc. (Canada), Laerdal Medical (Norway), Gaumard Scientific Co. (US), Kyoto Kagaku (Japan), Limbs & Things (UK), Mentice AB (Sweden), Simulab Corporation (US), Simulaids (US), Intelligent Ultrasound Group PLC (UK), Operative Experience Inc. (UK), Surgical Science Sweden AB (Sweden), Cardionics Inc. (US), VirtaMed AG (Zurich), SYNBONE AG (Switzerland), IngMar Medical (US), Medical-X (Netherlands), KaVo Dental GmbH (Germany), Altay Scientific (Italy), TruCorp Ltd. (Ireland), Simendo B.V. (Netherlands), Haag-Streit Simulation GmbH (Germany), Symgery (Canada), HRV Simulation (France), Synaptive Medical (Canada), and Inovus Medical (UK).

Research Coverage:

The report analyzes the healthcare simulation market. It aims to estimate the market size and future growth potential of various market segments based on product & service, technology, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will help established firms and new entrants/smaller firms gauge the market's pulse, which, in turn, would help them garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers: (rising focus on patient safety, rising shift toward competency-based medical education (CBME)), restraints (high setup and operational costs, limited access in low-resource settings), opportunities (growing demand for web-based and remote simulation products and services, rising use of specialty-specific simulation techniques by healthcare professionals), and challenges (lack of standardization in training protocols, limited emotional realism in some tools) influencing the growth of the healthcare simulation market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the healthcare simulation market

- Market Development: Comprehensive information on the lucrative emerging markets, products & services, technologies, end users, and regions

- Market Diversification: Exhaustive information about the product portfolios, untapped geographies, recent developments, and investments in the healthcare simulation market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the healthcare simulation market such as CAE Inc. (Canada), Laerdal Medical (Norway), Gaumard Scientific Co. (US), Kyoto Kagaku (Japan), Limbs & Things (UK), Mentice AB (Sweden), Simulab Corporation (US), and Simulaids (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 STUDY SCOPE

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION: HEALTHCARE SIMULATION MARKET

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEALTHCARE SIMULATION MARKET

- 4.2 HEALTHCARE SIMULATION MARKET IN ASIA PACIFIC, BY PRODUCT & SERVICE AND COUNTRY

- 4.3 HEALTHCARE SIMULATION MARKET, BY GEOGRAPHY

- 4.4 HEALTHCARE SIMULATION MARKET, BY REGION

- 4.5 HEALTHCARE SIMULATION MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.3 MARKET DYNAMICS: IMPACT ANALYSIS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising demand for realistic and risk-free training environments in medical education

- 5.3.1.2 Rapid technological advancements in medical education

- 5.3.1.3 Surging demand for minimally invasive treatments

- 5.3.1.4 Increasing focus on patient safety

- 5.3.1.5 Growing adoption of AI-driven VR platforms to improve clinical decision-making

- 5.3.2 RESTRAINTS

- 5.3.2.1 Limited availability of funds to establish simulation training centers

- 5.3.2.2 Poorly designed medical simulators

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Widening workforce gaps creating demand for simulation-based training solutions

- 5.3.3.2 Growing awareness about simulation training in emerging economies

- 5.3.4 CHALLENGES

- 5.3.4.1 High cost of simulators

- 5.3.4.2 Operational challenges

- 5.3.1 DRIVERS

- 5.4 INDUSTRY TRENDS

- 5.4.1 USE OF VIRTUAL REALITY AND AUGMENTED REALITY IN HEALTHCARE SIMULATION

- 5.4.2 ADVANCEMENTS IN HIGH-FIDELITY TECHNOLOGY

- 5.4.3 ADOPTION OF MULTIMODAL APPROACH DURING SIMULATOR DEVELOPMENT

- 5.4.4 UTILIZATION OF AI- AND ML-BASED SOFTWARE IN SURGICAL PROCEDURES

- 5.4.5 INCLINATION TOWARD HEALTHCARE INFORMATION TECHNOLOGY/ELECTRONIC MEDICAL RECORDS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.2 ADJACENT TECHNOLOGIES

- 5.5.3 ARTIFICIAL INTELLIGENCE AND VIRTUAL REALITY

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS IN HEALTHCARE SIMULATION MARKET

- 5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.9.3 LIST OF MAJOR PATENTS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 GLOBAL REGULATORY STANDARDS

- 5.10.3 HEALTHCARE SIMULATION PRODUCTS REQUIRING PREMARKET APPROVALS FROM REGULATORY BODIES

- 5.10.3.1 North America

- 5.10.3.1.1 US

- 5.10.3.1.2 Canada

- 5.10.3.2 Europe

- 5.10.3.3 Asia Pacific

- 5.10.3.3.1 Japan

- 5.10.3.3.2 China

- 5.10.3.3.3 India

- 5.10.3.1 North America

- 5.10.4 INTEROPERABILITY STANDARDS

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE PRICE OF HEALTHCARE SIMULATION PRODUCTS, BY KEY PLAYERS 2024

- 5.11.2 INDICATIVE PRICE OF HEALTHCARE SIMULATION DEVICES, BY REGION 2024

- 5.12 HEALTHCARE SIMULATION MARKET: INVESTMENT LANDSCAPE

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: ENHANCING CLINICAL READINESS: NORTHUMBRIA UNIVERSITY'S SCALABLE SIMULATION PROGRAM IN PARTNERSHIP WITH OMB

- 5.16.2 CASE STUDY 2: OPTIMIZING PATIENT FLOW AND INFRASTRUCTURE: MEMORIAL HEALTH SYSTEM'S SIMULATION-DRIVEN EFFICIENCY GAINS WITH SIMUL8

- 5.17 UNMET NEEDS IN HEALTHCARE SIMULATION MARKET

- 5.17.1 EXPECTATIONS OF END USERS

- 5.18 IMPACT OF 2025 US TARIFF-OVERVIEW

- 5.18.1 INTRODUCTION

- 5.19 KEY TARIFF RATES

- 5.20 PRICE IMPACT ANALYSIS

- 5.21 IMPACT ON COUNTRIES/REGIONS

- 5.21.1 US

- 5.21.2 EUROPE

- 5.21.3 ASIA PACIFIC

- 5.22 IMPACT ON END USERS

6 HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- 6.2 HEALTHCARE SIMULATION ANATOMICAL MODELS

- 6.2.1 PATIENT SIMULATORS

- 6.2.1.1 By type

- 6.2.1.1.1 High-fidelity simulators

- 6.2.1.1.1.1 Growing adoption of high-fidelity simulators in educational training to drive growth

- 6.2.1.1.2 Medium-fidelity simulators

- 6.2.1.1.2.1 Cost benefits of medium-fidelity simulation to drive demand

- 6.2.1.1.3 Low-fidelity simulators

- 6.2.1.1.3.1 Budgetary constraints and ease of use to drive demand

- 6.2.1.1.1 High-fidelity simulators

- 6.2.1.2 By application

- 6.2.1.2.1 Laparoscopic surgical simulators

- 6.2.1.2.1.1 Increasing prevalence of minimally invasive surgeries to drive growth

- 6.2.1.2.2 Gynecology simulators

- 6.2.1.2.2.1 Increasing incidence of fibroids and polyps in women to drive demand

- 6.2.1.2.3 Cardiovascular simulators

- 6.2.1.2.3.1 Increasing prevalence of diabetes to boost demand

- 6.2.1.2.4 Orthopedic surgical simulators

- 6.2.1.2.4.1 Enhancement in surgeon skills by orthopedic simulation training to drive demand

- 6.2.1.2.5 Spine surgical simulators

- 6.2.1.2.5.1 Mastering spine surgeries through advanced simulation techniques to boost demand

- 6.2.1.2.6 Endovascular simulators

- 6.2.1.2.6.1 Reduced mortality rates associated with endovascular simulators to boost demand

- 6.2.1.2.7 Other applications in patient simulators

- 6.2.1.2.1 Laparoscopic surgical simulators

- 6.2.1.1 By type

- 6.2.2 TASK TRAINERS

- 6.2.2.1 Inability to imitate emotional attributes of patients to restrain growth

- 6.2.3 INTERVENTIONAL/SURGICAL SIMULATORS

- 6.2.3.1 Laparoscopic surgical simulators

- 6.2.3.1.1 Increasing preference for minimally invasive surgeries to drive growth

- 6.2.3.2 Gynecology simulators

- 6.2.3.2.1 Increasing incidence of fibroids and polyps in women to drive demand for gynecology simulators

- 6.2.3.3 Cardiovascular simulators

- 6.2.3.3.1 Increasing prevalence of obesity and diabetes to boost demand

- 6.2.3.4 Orthopedic surgical simulators

- 6.2.3.4.1 Enhancement in surgeon skills by orthopedic simulation training to drive demand

- 6.2.3.5 Spine surgical simulators

- 6.2.3.5.1 Mastering spine surgeries through advanced simulation techniques to boost demand

- 6.2.3.6 Endovascular simulators

- 6.2.3.6.1 Ability to reduce mortality rates to drive demand for endovascular simulators

- 6.2.3.7 Other surgical simulators

- 6.2.3.1 Laparoscopic surgical simulators

- 6.2.4 ULTRASOUND SIMULATORS

- 6.2.4.1 Inferior quality images due to low dynamics and spatial resolution to restrain growth

- 6.2.5 DENTAL SIMULATORS

- 6.2.5.1 Expanding dental tourism industry to drive growth

- 6.2.6 EYE SIMULATORS

- 6.2.6.1 Increasing incidence of eye disorders to drive growth

- 6.2.1 PATIENT SIMULATORS

- 6.3 WEB-BASED SIMULATION

- 6.3.1 RISING TECHNOLOGICAL ADVANCEMENTS TO DRIVE ADOPTION OF WEB-BASED SIMULATION

- 6.4 HEALTHCARE SIMULATION SOFTWARE

- 6.4.1 ABILITY TO REDUCE OVERALL SURGICAL PROCESS TRAINING TIME TO DRIVE ADOPTION

- 6.5 HEALTHCARE SIMULATION TRAINING SERVICES

- 6.5.1 VENDOR-BASED TRAINING

- 6.5.1.1 High focus on patient safety to drive demand

- 6.5.2 EDUCATIONAL SOCIETIES

- 6.5.2.1 Growing need for proper training and authenticity of knowledge to drive growth

- 6.5.3 CUSTOM CONSULTING SERVICES

- 6.5.3.1 Growing need to limit errors associated with traditional medical training systems to drive growth

- 6.5.1 VENDOR-BASED TRAINING

7 HEALTHCARE SIMULATION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 VIRTUAL PATIENT SIMULATION

- 7.2.1 INCREASING FOCUS ON AUGMENTED REALITY/VIRTUAL REALITY TO DRIVE MARKET

- 7.3 3D PRINTING

- 7.3.1 INCREASING ADOPTION IN MEDICAL TRAINING TO DRIVE MARKET

- 7.4 PROCEDURAL REHEARSAL TECHNOLOGY

- 7.4.1 NEED FOR ADVANCING SURGICAL SKILLS WITH REHEARSAL TECH TO FUEL MARKET GROWTH

8 HEALTHCARE SIMULATION MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 ACADEMIC INSTITUTES

- 8.2.1 GROWING NEED FOR SKILLED MEDICAL PROFESSIONALS TO DRIVE DEMAND

- 8.3 HOSPITALS

- 8.3.1 RISING FOCUS ON MINIMIZING MEDICAL ERRORS TO DRIVE DEMAND

- 8.4 MILITARY ORGANIZATIONS

- 8.4.1 EXPLORATION OF NEW METHODS OF MEDICAL CARE DURING WARFARE TO DRIVE DEMAND

- 8.5 OTHER END USERS

9 HEALTHCARE SIMULATION MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing demand for virtual tutors and high healthcare spending to boost growth

- 9.2.3 CANADA

- 9.2.3.1 Increasing funding and surgical capabilities to drive growth

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Rising number of healthcare simulation centers and hospitals to drive growth

- 9.3.3 FRANCE

- 9.3.3.1 Growing focus on use of innovative methods in medical training to drive growth

- 9.3.4 GERMANY

- 9.3.4.1 High healthcare spending to drive market growth

- 9.3.5 ITALY

- 9.3.5.1 Shortage of trained healthcare personnel to drive growth

- 9.3.6 SPAIN

- 9.3.6.1 Increasing number of surgical procedures to boost growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 JAPAN

- 9.4.2.1 Increasing demand for virtual tutors and technologically advanced simulators to drive growth

- 9.4.3 CHINA

- 9.4.3.1 Increasing demand for trained medical professionals to drive growth

- 9.4.4 INDIA

- 9.4.4.1 Growing awareness regarding patient safety due to healthcare negligence to drive growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.5.2 BRAZIL

- 9.5.2.1 High incidence of chronic diseases to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Disruptive technologies and public-private partnerships to boost growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.6.2 GCC

- 9.6.2.1 Focus on enhancing patient care to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 MARKET RANKING ANALYSIS, 2024

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Product & service footprint

- 10.6.5.4 End user footprint

- 10.6.5.5 Technology footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 BRAND/SOFTWARE COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 10.9.2 PRODUCT LAUNCHES/ENHANCEMENTS

- 10.9.3 DEALS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SURGICAL SCIENCE SWEDEN AB

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 LAERDAL MEDICAL

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches/enhancements

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 GAUMARD SCIENTIFIC

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches/enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 KYOTO KAGAKU CO., LTD.

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 LIMBS & THINGS LTD

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches/enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 MENTICE AB

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches/enhancements

- 11.1.6.3.2 Deals

- 11.1.7 SIMULAB CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches/enhancements

- 11.1.8 SIMULAIDS

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches/enhancements

- 11.1.9 OPERATIVE EXPERIENCE, INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Developments

- 11.1.10 NASCO HEALTHCARE

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 ANATOMAGE

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches/enhancements

- 11.1.11.3.2 Other developments

- 11.1.12 CARDIONICS INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 VIRTAMED AG

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.2.1 Product launches/enhancements

- 11.1.13.2.2 Deals

- 11.1.14 SYNBONE AG

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 INGMAR MEDICAL

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.16 MEDICAL-X

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.17 KAVO DENTAL

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.18 ALTAY SCIENTIFIC

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.19 TRUCORP LIMITED

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Product launches/enhancements

- 11.1.19.3.2 Deals

- 11.1.20 SIMENDO

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.1 SURGICAL SCIENCE SWEDEN AB

- 11.2 OTHER PLAYERS

- 11.2.1 HAAG-STREIT AG

- 11.2.2 SYMGERY

- 11.2.3 HRV SIMULATION

- 11.2.4 SYNAPTIVE MEDICAL

- 11.2.5 INOVUS LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS