|

|

市場調査レポート

商品コード

1421502

ICE車および電気自動車用照明の世界市場:技術別、タイプ別、位置別、用途別、車両タイプ別、地域別 - 2030年までの予測Automotive Lighting Market for ICE & Electric Vehicle by Technology (Halogen, LED, Xenon), Position and Application (Front, Rear, Side, Interior), Adaptive Lighting, Electric Vehicle, Two-Wheeler Position Type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ICE車および電気自動車用照明の世界市場:技術別、タイプ別、位置別、用途別、車両タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2024年01月30日

発行: MarketsandMarkets

ページ情報: 英文 379 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

自動車用照明市場は、2023年の225億米ドルから2030年には304億米ドルに成長し、予測期間中のCAGRは4.4%になると予測されています。

LED照明を搭載した中価格帯自動車の生産台数の増加、先進国における高級車とSUVの販売台数の増加、路上での安全性への関心の高まりにより、OEMは自動車用照明の技術革新と進歩に注力しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 技術別、タイプ別、位置別、用途別、車両タイプ別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

乗用車セグメントは、自動車用照明において最も有望で急成長するセグメントと推定されます。この成長の主因は、乗用車セグメントのシェアが最も高く、全自動車生産台数の70%以上を占めていることです。より多くの顧客を引き付けるため、自動車OEMは中価格帯の車からコネクテッドLEDヘッドランプとテールランプを提供しています。さらに、このセグメントでは、OEMは車両の安全性とスタイルを損なうことなく、最先端技術を開発・搭載することで限界を押し広げることができます。欧州と北米諸国ではSUVと高級車セグメントへの需要が高く、これらの車種は初乗り価格が45,000米ドル以上で、スマートマトリックスLEDまたはOLEDヘッドランプ、レーザーライト、テールランプ、アダプティブハイビームアシスト、オートオン/オフ、ベンディング/コーナリング、アンビエント照明などのハイエンド技術を搭載しています。

よりパーソナライズされた特徴的な機能を提供するために、C、D、およびそれ以上のセグメントの自動車でLEDベースの照明の採用が増加していること、ムード照明の採用が増加していること、プレミアムカーで多色環境照明の受け入れが拡大していることなどの要因が、環境照明市場を牽引しています。OEM各社は、より多くの消費者を惹きつけるため、低中級車にもアンビエント照明、インフォテインメント・ユニット、エキゾチックなインテリア・デザインなどの高級機能を搭載しようとしています。一部の新車は、センターコンソール、ダッシュボード、ヘッドライナー、フットウェル、ドア、アームレストなど、さまざまな用途のアンビエント照明を提供しています。これらのアンビエント・ライトは装飾的で、車内の感触や雰囲気を高めています。

アジア太平洋は、予測期間中、自動車用照明の最大市場になると予測されています。アジア太平洋は近年、自動車生産の拠点として台頭しており、2023年には世界の自動車生産台数の60%以上を占め、最大のシェアを占めています。また、中国、インド、日本などの国々では、プレミアムカーや高級車への需要が高まり、電気自動車の販売が増加していることが、自動車用照明の成長を促進しています。中国と日本が自動車用照明市場をリードしており、予測期間中はインドと韓国がこれに続きます。アジア太平洋地域におけるSUV市場の成長は、特にLEDライト、アダプティブ・ヘッドランプ、統合型インフォテインメント・コンソールなどの機能が環境照明と組み合わされることが多い自動車用照明の需要を大幅に増加させています。この動向は特にフルサイズSUVセグメントで顕著であり、この地域の自動車用照明市場の成長予測に大きく寄与しています。

当レポートでは、ICE車および電気自動車用照明市場について調査し、技術別、タイプ別、位置別、用途別、車両タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- バリューチェーン分析

- 特許分析

- 技術分析

- ケーススタディ分析

- 貿易分析

- 価格分析

- 規制の枠組み

- 2024年の主な会議とイベント

- 主要な利害関係者と購入基準

- サプライヤー分析

第6章 自動車用照明市場、技術別

- イントロダクション

- ハロゲン

- LED

- キセノン

- レーザー

第7章 自動車用照明市場、用途別

- イントロダクション

- 市場の定義

- 乗用車用照明市場、用途別

- 乗用車用室内照明市場、用途別

- 乗用車フロント照明市場、用途別

- 乗用車後部照明市場、用途別

- 助手席側照明市場、用途別

- 軽商用車用照明市場、位置別

- 小型商用車(LCV)室内照明市場、用途別

- 小型商用車(LCV)フロント照明市場、用途別

- 小型商用車(LCV)後部照明市場、用途別

- 小型商用車(LCV)サイド照明市場、用途別

- トラック照明市場、位置別

- トラック室内照明市場、用途別

- トラックフロント照明市場、用途別

- トラック後部照明市場、用途別

- トラックサイド照明市場、用途別

- バス照明市場、位置別

- バス車内照明市場、用途別

- バスフロント照明市場、用途別

- バス後部照明市場、用途別

- バスサイド照明市場、用途別

第8章 自動車用照明市場、車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- トラック

- バス

第9章 自動車用アダプティブライティング市場、タイプ別

- イントロダクション

- フロントアダプティブライティング

- リアアダプティブライティング

- 環境照明

第10章 電気自動車用照明市場、車両タイプ別

- イントロダクション

- BEVS

- PHEV

- FCEVS

第11章 電気自動車用照明市場、技術別

- イントロダクション

- ハロゲン

- LED

- キセノン/HID

第12章 電気自動車用照明市場、用途別

- イントロダクション

- 屋外照明

- 室内照明

第13章 二輪車用照明市場、位置別

- イントロダクション

- 前方

- 側方

- 後方

第14章 自動車用照明市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- その他の地域

第15章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- KOITO MANUFACTURING CO., LTD.

- HELLA GMBH & CO. KGAA

- VALEO SA

- OSRAM GMBH

- CONTINENTAL AG

- HYUNDAI MOBIS

- MAGNETI MARELLI

- ICHIKOH INDUSTRIES, LTD.

- STANLEY ELECTRIC CO., LTD.

- SIGNIFY(KONINKLIJKE PHILIPS N.V.)

- TUNGSRAM GROUP

- その他の企業

- ZIZALA LICHTSYSTEME GMBH

- ROBERT BOSCH GMBH

- NXP SEMICONDUCTORS NV

- GRUPO ANTOLIN

- FEDERAL-MOGUL CORPORATION

- GENTEX CORPORATION

- FLEX-N-GATE

- NORTH AMERICAN LIGHTING

- DENSO CORPORATION

- RENESAS ELECTRONICS CORPORATION

- KEBODA

- VARROC

- LUMAX INDUSTRIES

- SEOUL SEMICONDUCTOR CO., LTD.

- INFINEON TECHNOLOGIES

- SAMVARDHANA MOTHERSON

第17章 自動車用照明市場- 市場における提言

第18章 付録

Report Description

The Automotive Lighting Market is estimated to grow from USD 22.5 billion in 2023 to USD 30.4 billion by 2030 at a CAGR of 4.4% during the forecast period.

Increasing production of mid-priced cars equipped with LED lighting, growing luxury car & SUV sales in developed countries, and increased focus on on-road safety persuade OEMs to focus on innovation and advancement in automotive lighting.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Technology (Halogen, LED, Xenon), Position and Application (Front, Rear, Side, Interior), Adaptive Lighting, Electric Vehicle, Two-Wheeler Position Type and Region |

| Regions covered | Asia Pacific, North America, Europe, and Rest of the World |

"Passenger cars are to be the largest automotive lighting market."

The passenger car segment is estimated to be the most promising and fastest-growing segment for automotive lighting. The growth is mainly attributed to the highest share of the passenger cars segment, with more than 70% in overall vehicle production. To attract more customers, automotive OEMs offer connected LED headlamps and taillamps starting from mid-priced cars. Furthermore, this segment allows OEMs to push their boundaries by developing and installing cutting-edge technologies without compromising vehicle safety and style. The penetration of ambient lighting features is expanding beyond luxury and premium segments, with mid-range models like Kia Soul, Mini Hardtop, and Chevrolet Camaro increasingly incorporating this feature. Passenger car segment D, led by luxury and premium offerings like Mercedes-Maybach S-Class and BMW X7, is projected to dominate the market in the coming years. This trend, coupled with the expected growth in the production of larger SUV models like the Hyundai Palisade, is expected to propel the technological advancement in interior lighting of the vehicles. For instance, OEMs are deploying advanced driver assistance systems (ADAS) to increase vehicle sales, which will prompt the growth of adaptive lighting systems in passenger cars. Most passenger vehicles that fall in Class D and above are mostly installed with adaptive lighting technology. European and North American countries have higher demand for SUVs and the luxury vehicle segment, which have starting costs of more than USD 45,000 and are equipped with high-end technologies for smart matrix LED or OLED headlamps, laser lights, tail lamps, adaptive high Beam Assist, auto on/off, bending/cornering, and ambient lighting. Some models like the Alfa Romeo Giulia, Audi A4, BMW 3 Series, Ford Mondeo, and Lexus IS, among others, are equipped with advanced lighting systems. Thus, the growing demand for premium and luxury cars loaded with advanced features will spur the adoption of advanced lighting technologies in the passenger cars segment.

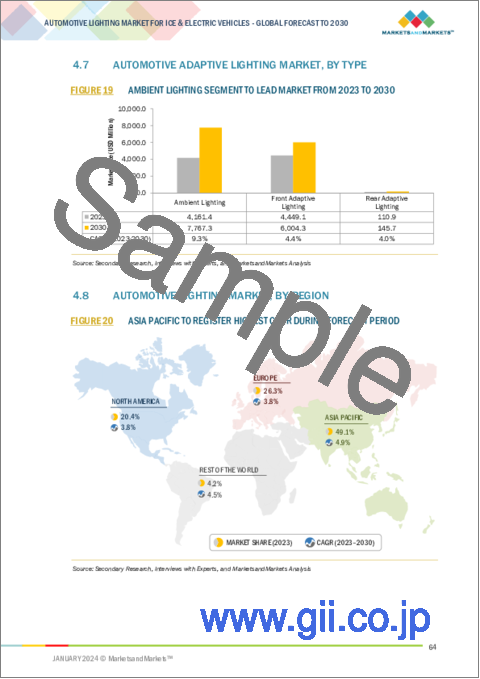

"Ambient lighting will be the fastest developing automotive adaptive lighting market during the forecast period."

Factors such as increasing adoption of LED-based lighting in C, D, and above segment cars to provide more personalized and distinct features, rising adoption of mood lighting, and growing acceptance of multicolor ambient lighting in premium cars are driving the ambient light market. OEMs are trying to accommodate luxury features, such as ambient lighting, infotainment units, and exotic interior design in lower to mid-range cars to attract more consumers. Some new cars are offered with ambient lighting for various applications, such as center consoles, dashboards, headliners, footwells, doors, and armrests, among others. These ambient lights are decorative and boost the cabin feel and ambiance. Further, luxury cars such as Mercedes-Benz, BMW, Audi, Lexus, Porche, and Land Rover, among others, offer vibrant and attractive ambient lighting options for their modern car models. Improving the economic condition of developing regions such as Asia Oceania with rising acceptance of Class C, D, and high-range cars loaded with ultra-luxurious features will allow the ambient lighting market to boost at the fastest rate under the review period.

"Asia Pacific is the prominent region in the automotive lighting market."

Asia Pacific is estimated to be the largest market for automotive lighting during the forecast period. The Asia Pacific region has emerged as a hub for automotive production in recent years and holds the largest share in global vehicle production, with more than 60% in 2023. Also, growing demand for premium and luxury cars and increasing sales of electric vehicles in countries like China, India, and Japan are propelling the growth of automotive lighting. China and Japan are leading the automotive lighting market, followed by India and South Korea during the forecast period. The growing SUV market in the Asia Pacific region is driving a significant increase in demand for automotive lighting, particularly with features such as LED lights, adaptive headlamps, and integrated infotainment consoles often paired with ambient lighting. This trend is particularly pronounced in the full-size SUV segment, contributing substantially to the projected growth of the regional automotive lighting market.

China has emerged as a key market for premium vehicles. LED lighting in passenger cars in China is increasing due to the growing popularity of premium and luxury cars. To take this as a growth opportunity, lighting manufacturers are partnering with Chinese players and expanding their businesses in the Chinese market. For instance, Hella opened a second manufacturing unit with Minth Group in Jianxing, China. Also, Hella partnered with Wuling Automotive Industry to work together on automotive lighting technologies for the Chinese market, focusing on developing headlamps for the volume segment. Through these agreements and expansions, Hella can focus more on the untapped market in China. Also, In Japan, automakers must equip all new vehicles sold in Japan with automatic headlamps, making it likely the first country in the world with such a mandate. The move mandating headlamps with an automatic on function was implemented on April 1, 2020.

Many global manufacturers of lighting have a strong presence in the Asia Pacific region, such as Koito Manufacturing, HELLA GmbH, Valeo, Magnetic Marelli, Stanley Electric, Pvt. Ltd.,

The break-up of the profile of primary participants in the automotive lighting market:

By Companies: Lighting Manufacturers - 55%, Tier 2 Suppliers - 30%, OEMs - 15%

By Designation: Directors- 15%, C-Level Executives - 60%, Others - 25%

By Region: North America - 10%, Europe - 10%, Asia Pacific - 75%, and RoW - 5%

Global players dominate the Automotive Lighting Market and comprise several regional players. The key players in the automotive lighting market are Koito Manufacturing Co., Ltd. (Japan), Magnetic Marelli (Italy), Valeo (France), HELLA GmbH & Co. KGaA (Germany) and Stanley Electric Co., Ltd. (Japan).

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Automotive Lighting market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for luxury vehicles, Lighting regulations for better visibility and safety, and the rising demand for adaptive lighting in passenger cars), restraints (high cost of LED lighting and low penetration of adaptive lighting in hatchback and compact sedans), opportunities (Increasing adoption of LED lighting and partnership between automotive OEMs and lighting system manufacturers), and challenges (less penetration of advanced lighting in commercial vehicles and volatility of raw material prices) influencing the growth of the Automotive Lighting Market.

- Product Development/Innovation: Detailed insights on upcoming technologies and new product & service launches in the Automotive Lighting Market.

- Market Development: Comprehensive market information - the report analyses the authentication and brand protection market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in Automotive Lighting Market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Koito Manufacturing Co., Ltd. (Japan), Magnetic Marelli (Italy), Valeo (France), HELLA GmbH & Co. KGaA (Germany) and Stanley Electric Co., Ltd. (Japan) among others in Automotive Lighting Market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 AUTOMOTIVE LIGHTING MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- TABLE 1 CURRENCY EXCHANGE RATES

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources to build base numbers

- 2.1.1.2 Secondary sources to estimate numbers related to automotive lighting market

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.1 List of primary participants

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH (ELECTRIC VEHICLE TECHNOLOGY)

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.6 FACTOR ANALYSIS

- FIGURE 9 FACTORS IMPACTING AUTOMOTIVE LIGHTING MARKET

- 2.7 RECESSION IMPACT

- 2.8 RESEARCH ASSUMPTIONS

- 2.8.1 NUMBER OF LIGHTING UNITS

- TABLE 2 ASSUMPTIONS MADE FOR NUMBER OF LIGHTING UNITS, BY POSITION

- 2.8.2 RESEARCH ASSUMPTIONS

- 2.8.3 MARKET ASSUMPTIONS & RISK ANALYSIS

- 2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 AUTOMOTIVE LIGHTING MARKET OUTLOOK

- FIGURE 11 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- FIGURE 12 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY VS VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN ADAPTIVE AND EV LIGHTING SEGMENTS

- FIGURE 13 RISE IN DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- 4.2 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY

- FIGURE 14 LED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE

- FIGURE 15 PASSENGER CARS TO SURPASS OTHER VEHICLE TYPES DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE LIGHTING MARKET, BY APPLICATION

- FIGURE 16 FRONT LIGHTING TO HAVE LARGEST MARKET SIZE BY 2030

- 4.5 ELECTRIC VEHICLE LIGHTING MARKET, BY TECHNOLOGY

- FIGURE 17 LED TO BE LARGEST TECHNOLOGY SEGMENT DURING FORECAST PERIOD

- 4.6 TWO-WHEELER LIGHTING MARKET, BY POSITION

- FIGURE 18 FRONT LIGHTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.7 AUTOMOTIVE ADAPTIVE LIGHTING MARKET, BY TYPE

- FIGURE 19 AMBIENT LIGHTING SEGMENT TO LEAD MARKET FROM 2023 TO 2030

- 4.8 AUTOMOTIVE LIGHTING MARKET, BY REGION

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 AUTOMOTIVE LIGHTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in demand for premium vehicles

- TABLE 3 COUNTRY-WISE PREMIUM VEHICLE PRODUCTION, 2020-2022 P(UNITS)

- 5.2.1.2 Stringent lighting regulations for better visibility and safety

- TABLE 4 AUTOMOTIVE LIGHTING REGULATIONS

- 5.2.1.3 High demand for adaptive lighting systems in passenger cars and entry-level SUVs in emerging economies

- TABLE 5 MODEL-WISE ADAPTIVE FRONT LIGHTING TECHNOLOGY

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of LED lights

- FIGURE 22 COMPARATIVE GLOBAL AVERAGE PRICE OF REFLECTOR VS. PROJECTOR HEADLIGHTS, 2022

- 5.2.2.2 Low penetration of advanced lighting systems in hatchbacks, compact sedans, and entry-level SUVs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Partnerships between automotive OEMs and lighting system manufacturers

- TABLE 6 PARTNERSHIPS AND AGREEMENTS BETWEEN LIGHTING MANUFACTURERS

- 5.2.3.2 Evolution of new technologies

- 5.2.3.3 Development of advanced lighting solutions for autonomous vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility of raw material prices

- 5.2.4.2 Increasing competition from local companies offering counterfeit/retrofit solutions

- 5.2.4.3 Less penetration of advanced lighting systems in commercial vehicles

- 5.2.4.4 Development of software capabilities to incorporate AI and other technologies in adaptive lighting systems

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 REVENUE SHIFT FOR AUTOMOTIVE LIGHTING MARKET

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 24 AUTOMOTIVE LIGHTING MARKET: ECOSYSTEM ANALYSIS

- TABLE 7 AUTOMOTIVE LIGHTING MARKET: ECOSYSTEM

- FIGURE 25 KEY PLAYERS IN AUTOMOTIVE LIGHTING MARKET ECOSYSTEM

- 5.4.1 AUTOMOTIVE LIGHTING MANUFACTURERS

- 5.4.2 DISTRIBUTORS AND SALES REPRESENTATIVES

- 5.4.3 END USERS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 AUTOMOTIVE LIGHTING MARKET: VALUE CHAIN ANALYSIS

- 5.6 PATENT ANALYSIS

- TABLE 8 PATENT ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ADAPTIVE DRIVING BEAM

- 5.7.2 LASER TECHNOLOGY

- 5.7.3 OLED

- 5.7.4 MICRO AFS LED

- 5.7.5 BEND LIGHTING

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY: LED INTELLIGENT LIGHT SYSTEM

- 5.8.2 CASE STUDY: DYNAMIC INTERIOR LIGHTING

- 5.8.3 CASE STUDY: OBJECT RECOGNITION SYSTEM

- 5.8.4 CASE STUDY: LED INTELLIGENT LIGHT SYSTEM

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA

- TABLE 9 US: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 10 CANADA: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 11 CHINA: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 12 JAPAN: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 13 INDIA: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 14 GERMANY: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 15 FRANCE: AUTOMOTIVE LIGHTING IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.9.2 EXPORT DATA

- TABLE 16 US: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 17 CANADA: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 18 CHINA: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 19 JAPAN: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 20 INDIA: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 21 GERMANY: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 22 FRANCE: AUTOMOTIVE LIGHTING EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.10 PRICING ANALYSIS

- 5.10.1 PRICING ANALYSIS

- 5.10.2 BY TECHNOLOGY

- TABLE 23 AVERAGE SELLING PRICE OF AUTOMOTIVE LIGHTING SYSTEMS, BY TECHNOLOGY, 2022 VS. 2023

- 5.10.3 BY REGION

- TABLE 24 AVERAGE SELLING PRICE OF AUTOMOTIVE LIGHTING SYSTEMS, BY REGION, 2022 VS. 2023

- 5.11 REGULATORY FRAMEWORK

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.1 North America

- TABLE 25 NORTH AMERICA: AUTOMOTIVE LIGHTING REGULATIONS

- 5.11.1.2 Europe

- TABLE 26 EUROPE: AUTOMOTIVE LIGHTING REGULATIONS

- 5.11.1.3 Asia Pacific

- TABLE 27 ASIA PACIFIC: AUTOMOTIVE LIGHTING REGULATIONS

- 5.11.2 REGULATORY BODIES/GOVERNMENT AGENCIES

- TABLE 28 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES AND EVENTS IN 2024

- TABLE 31 AUTOMOTIVE LIGHTING MARKET: KEY CONFERENCES AND EVENTS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 AUTOMOTIVE LIGHTING TECHNOLOGIES

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 AUTOMOTIVE LIGHTING TECHNOLOGIES (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 AUTOMOTIVE LIGHTING TECHNOLOGIES

- TABLE 33 KEY BUYING CRITERIA FOR TOP 3 AUTOMOTIVE LIGHTING TECHNOLOGIES (OEM/CONSUMER)

- 5.14 SUPPLIER ANALYSIS

- 5.14.1 HEADLAMPS

- TABLE 34 HEADLAMP SUPPLIERS TO OEMS, BY PRODUCT

- 5.14.2 FOG LAMPS

- TABLE 35 FOG LAMP SUPPLIERS TO OEMS, BY PRODUCT

- 5.14.3 REAR LAMPS

- TABLE 36 REAR LAMP SUPPLIERS TO OEMS, BY PRODUCT

- 5.14.4 INTERIOR LIGHTING

- TABLE 37 INTERIOR LIGHTING SUPPLIERS TO OEMS, BY PRODUCT

- 5.14.5 EXTERIOR LIGHTING

- TABLE 38 EXTERIOR LIGHTING SUPPLIERS TO OEMS, BY PRODUCT

6 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.1.1 INDUSTRY INSIGHTS

- FIGURE 29 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023 VS. 2030 (USD MILLION)

- TABLE 39 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 40 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 41 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 42 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 6.2 HALOGEN

- 6.2.1 GROWING POPULARITY OF LED TO DRIVE MARKET

- TABLE 43 HALOGEN: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 44 HALOGEN: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 45 HALOGEN: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 HALOGEN: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.3 LED

- TABLE 47 LED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 48 LED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 49 LED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 LED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.3.1 OLED

- 6.3.1.1 Advancements in OLED technology to drive market

- TABLE 51 OLED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 52 OLED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 6.3.2 MATRIX LED

- 6.3.2.1 Growing interest from major automakers to drive demand

- TABLE 53 MATRIX LED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 54 MATRIX LED: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 6.4 XENON

- 6.4.1 ASIA PACIFIC TO REMAIN LARGEST MARKET FOR XENON TECHNOLOGY

- TABLE 55 XENON: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 56 XENON: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 57 XENON: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 XENON: AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.5 LASER

- 6.5.1 LASER TECHNOLOGY AS ABSOLUTE INNOVATION IN LIGHTING

7 AUTOMOTIVE LIGHTING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 INDUSTRY INSIGHTS

- 7.2 MARKET DEFINITIONS

- 7.2.1 FRONT LIGHTING

- 7.2.1.1 Headlights

- 7.2.1.2 Fog lights

- 7.2.1.3 Daytime running lights (DRL)

- 7.2.2 REAR LIGHTING

- 7.2.2.1 Taillights

- 7.2.2.2 Center high-mount stop lights (CHMSL)

- 7.2.2.3 License plate lamps

- 7.2.3 SIDE LIGHTING

- 7.2.3.1 Sidelights

- 7.2.3.2 Side rear-view mirror indicators

- 7.2.4 INTERIOR LIGHTING

- 7.2.4.1 Dashboards

- 7.2.4.2 Glove boxes

- 7.2.4.3 Reading lights

- 7.2.4.4 Dome lights

- 7.2.4.5 Rear-view mirror interior lights

- 7.2.5 FRONT LIGHTING, BY VEHICLE TYPE

- TABLE 59 FRONT LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 60 FRONT LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- 7.2.6 REAR LIGHTING, BY VEHICLE TYPE

- TABLE 61 REAR LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 62 REAR LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- 7.2.7 SIDE LIGHTING, BY VEHICLE TYPE

- TABLE 63 SIDE LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 64 SIDE LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- 7.2.8 INTERIOR LIGHTING, BY VEHICLE TYPE

- TABLE 65 INTERIOR LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 66 INTERIOR LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- 7.2.1 FRONT LIGHTING

- 7.3 PASSENGER CAR LIGHTING MARKET, BY APPLICATION

- FIGURE 30 PASSENGER CAR LIGHTING MARKET, BY APPLICATION, 2023 VS. 2030 (MILLION UNITS)

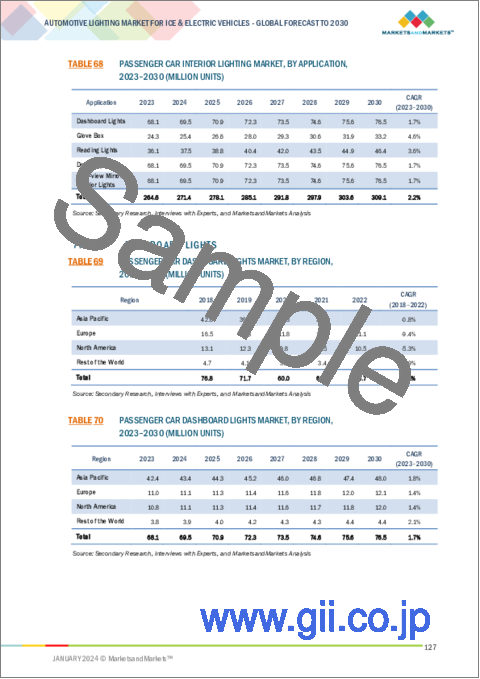

- 7.4 PASSENGER CAR INTERIOR LIGHTING MARKET, BY APPLICATION

- TABLE 67 PASSENGER CAR INTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 68 PASSENGER CAR INTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.4.1 DASHBOARD LIGHTS

- TABLE 69 PASSENGER CAR DASHBOARD LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 70 PASSENGER CAR DASHBOARD LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.4.2 GLOVE BOX

- TABLE 71 PASSENGER CAR GLOVE BOX LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 72 PASSENGER CAR GLOVE BOX LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.4.3 READING LIGHTS

- TABLE 73 PASSENGER CAR READING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 74 PASSENGER CAR READING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.4.4 DOME LIGHTS

- TABLE 75 PASSENGER CAR DOME LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 76 PASSENGER CAR DOME LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.4.5 REAR-VIEW MIRROR INTERIOR LIGHTS

- TABLE 77 PASSENGER CAR REAR-VIEW MIRROR INTERIOR LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 78 PASSENGER CAR REAR-VIEW MIRROR INTERIOR LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.5 PASSENGER CAR FRONT LIGHTING MARKET, BY APPLICATION

- TABLE 79 PASSENGER CAR FRONT LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 80 PASSENGER CAR FRONT LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.5.1 HEADLIGHTS

- TABLE 81 PASSENGER CAR HEADLIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 82 PASSENGER CAR HEADLIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.5.2 FOG LIGHTS

- TABLE 83 PASSENGER CAR FOG LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 84 PASSENGER CAR FOG LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.5.3 DAYTIME RUNNING LIGHTS

- TABLE 85 PASSENGER CAR DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 86 PASSENGER CAR DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.6 PASSENGER CAR REAR LIGHTING MARKET, BY APPLICATION

- TABLE 87 PASSENGER CAR REAR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 88 PASSENGER CAR REAR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.6.1 TAIL LIGHTS

- TABLE 89 PASSENGER CAR TAIL LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 90 PASSENGER CAR TAIL LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.6.2 CENTER HIGH-MOUNT STOP LIGHTS

- TABLE 91 PASSENGER CAR CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 92 PASSENGER CAR CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.6.3 LICENSE PLATE LIGHTS

- TABLE 93 PASSENGER CAR LICENSE PLATE LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 94 PASSENGER CAR LICENSE PLATE LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.7 PASSENGER CAR SIDE LIGHTING MARKET, BY APPLICATION

- TABLE 95 PASSENGER CAR SIDE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 96 PASSENGER CAR SIDE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.7.1 SIDELIGHTS

- TABLE 97 PASSENGER CAR SIDELIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 98 PASSENGER CAR SIDELIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.7.2 SIDE REAR-VIEW MIRROR INDICATOR LIGHTS

- TABLE 99 PASSENGER CAR SIDE REAR-VIEW MIRROR INDICATOR LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 100 PASSENGER CAR SIDE REAR-VIEW MIRROR INDICATOR LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.8 LIGHT COMMERCIAL VEHICLE LIGHTING MARKET, BY POSITION

- FIGURE 31 LIGHT COMMERCIAL VEHICLE LIGHTING MARKET, BY POSITION, 2023 VS. 2030 (MILLION UNITS)

- 7.9 LIGHT COMMERCIAL VEHICLE (LCV) INTERIOR LIGHTING MARKET, BY APPLICATION

- TABLE 101 LCV INTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 102 LCV INTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.9.1 DASHBOARD LIGHTS

- TABLE 103 LCV DASHBOARD LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 104 LCV DASHBOARD LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.9.2 GLOVE BOX

- TABLE 105 LCV GLOVE BOX LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 106 LCV GLOVE BOX LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.9.3 READING LIGHTS

- TABLE 107 LCV READING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 108 LCV READING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.9.4 DOME LIGHTS

- TABLE 109 LCV DOME LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 110 LCV DOME LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.9.5 REAR-VIEW MIRROR INTERIOR LIGHTS

- TABLE 111 LCV REAR-VIEW MIRROR INTERIOR LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 112 LCV REAR-VIEW MIRROR INTERIOR LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.10 LIGHT COMMERCIAL VEHICLE (LCV) FRONT LIGHTING MARKET, BY APPLICATION

- TABLE 113 LCV FRONT LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 114 LCV FRONT LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.10.1 HEADLIGHTS

- TABLE 115 LCV HEADLIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 116 LCV HEADLIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.10.2 FOG LIGHTS

- TABLE 117 LCV FOG LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 118 LCV FOG LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.10.3 DAYTIME RUNNING LIGHTS (DRL)

- TABLE 119 LCV DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 120 LCV DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.11 LIGHT COMMERCIAL VEHICLE (LCV) REAR LIGHTING MARKET, BY APPLICATION

- TABLE 121 LCV REAR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 122 LCV REAR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.11.1 TAIL LIGHTS

- TABLE 123 LCV TAIL LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 124 LCV TAIL LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.11.2 CENTER HIGH-MOUNT STOP LIGHTS (CHMSL)

- TABLE 125 LCV CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 126 LCV CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.11.3 LICENSE PLATE LIGHTS

- TABLE 127 LCV LICENSE PLATE LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 128 LCV LICENSE PLATE LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.12 LIGHT COMMERCIAL VEHICLE (LCV) SIDE LIGHTING MARKET, BY APPLICATION

- TABLE 129 LCV SIDE LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 130 LCV SIDE LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.12.1 SIDELIGHTS

- TABLE 131 LCV SIDELIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 132 LCV SIDELIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.13 TRUCK LIGHTING MARKET, BY POSITION

- FIGURE 32 TRUCK LIGHTING MARKET, BY POSITION, 2023 VS. 2030 (MILLION UNITS)

- 7.14 TRUCK INTERIOR LIGHTING MARKET, BY APPLICATION

- TABLE 133 TRUCK INTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 134 TRUCK INTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.14.1 DASHBOARD LIGHTS

- TABLE 135 TRUCK DASHBOARD LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 136 TRUCK DASHBOARD LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.14.2 CABIN AND READING LIGHTS

- TABLE 137 TRUCK CABIN AND READING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 138 TRUCK CABIN AND READING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.14.3 ENGINE COMPARTMENT LIGHTS

- TABLE 139 TRUCK ENGINE COMPARTMENT LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 140 TRUCK ENGINE COMPARTMENT LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.15 TRUCK FRONT LIGHTING MARKET, BY APPLICATION

- TABLE 141 TRUCK FRONT LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 142 TRUCK FRONT LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.15.1 HEADLIGHTS

- TABLE 143 TRUCK HEADLIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 144 TRUCK HEADLIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.15.2 FOG LIGHTS

- TABLE 145 TRUCK FOG LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 146 TRUCK FOG LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.15.3 CLEARANCE LAMPS

- TABLE 147 TRUCK CLEARANCE LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 148 TRUCK CLEARANCE LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.15.4 TURN SIGNAL LAMPS

- TABLE 149 TRUCK TURN SIGNAL LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 150 TRUCK TURN SIGNAL LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.15.5 DAYTIME RUNNING LIGHTS

- TABLE 151 TRUCK DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 152 TRUCK DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.16 TRUCK REAR LIGHTING MARKET, BY APPLICATION

- TABLE 153 TRUCK REAR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 154 TRUCK REAR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.16.1 STOP LAMPS

- TABLE 155 TRUCK STOP LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 156 TRUCK STOP LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.16.2 TAIL LAMPS

- TABLE 157 TRUCK TAIL LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 158 TRUCK TAIL LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.16.3 LICENSE PLATE LAMPS

- TABLE 159 TRUCK LICENSE PLATE LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 160 TRUCK LICENSE PLATE LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.16.4 TURN SIGNAL LAMPS

- TABLE 161 TRUCK TURN SIGNAL LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 162 TRUCK TURN SIGNAL LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.17 TRUCK SIDE LIGHTING MARKET, BY APPLICATION

- TABLE 163 TRUCK SIDE LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 164 TRUCK SIDE LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.17.1 MARKER LAMPS

- TABLE 165 TRUCK MARKER LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 166 TRUCK MARKER LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.18 BUS LIGHTING MARKET, BY POSITION

- FIGURE 33 BUS LIGHTING MARKET, BY POSITION, 2023 VS. 2030 (MILLION UNITS)

- 7.19 BUS INTERIOR LIGHTING MARKET, BY APPLICATION

- TABLE 167 BUS INTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 168 BUS INTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.19.1 DASHBOARD LAMPS

- TABLE 169 BUS DASHBOARD LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 170 BUS DASHBOARD LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.19.2 BUS AREA LIGHTS

- TABLE 171 BUS AREA LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 172 BUS AREA LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.19.3 DRIVER AREA LIGHTS

- TABLE 173 BUS DRIVER AREA LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 174 BUS DRIVER AREA LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.19.4 FOOTWELL LIGHTS

- TABLE 175 BUS FOOTWELL LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 176 BUS FOOTWELL LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.20 BUS FRONT LIGHTING MARKET, BY APPLICATION

- TABLE 177 BUS FRONT LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 178 BUS FRONT LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.20.1 HEADLAMP UNITS

- TABLE 179 BUS HEADLAMP UNITS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 180 BUS HEADLAMP UNITS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.20.2 CLEARANCE LAMPS

- TABLE 181 BUS CLEARANCE LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 182 BUS CLEARANCE LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.20.3 INDICATOR LAMPS

- TABLE 183 BUS INDICATOR LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 184 BUS INDICATOR LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.20.4 IDENTIFICATION LAMPS

- TABLE 185 BUS IDENTIFICATION LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 186 BUS IDENTIFICATION LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.20.5 DAYTIME RUNNING LIGHTS

- TABLE 187 BUS DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 188 BUS DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.21 BUS REAR LIGHTING MARKET, BY APPLICATION

- TABLE 189 BUS REAR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 190 BUS REAR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.21.1 LICENSE PLATE LAMPS

- TABLE 191 BUS LICENSE PLATE LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 192 BUS LICENSE PLATE LAMPS MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.21.2 TAIL LAMPS

- TABLE 193 BUS TAIL LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 194 BUS TAIL LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.21.3 REAR CLEARANCE LAMPS

- TABLE 195 BUS REAR CLEARANCE LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 196 BUS REAR CLEARANCE LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.21.4 REAR IDENTIFICATION LAMPS

- TABLE 197 BUS REAR IDENTIFICATION LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 198 BUS REAR IDENTIFICATION LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.21.5 STOP LAMPS

- TABLE 199 BUS STOP LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 200 BUS STOP LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- 7.22 BUS SIDE LIGHTING MARKET, BY APPLICATION

- TABLE 201 BUS SIDE LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 202 BUS SIDE LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- 7.22.1 MARKER LAMPS

- TABLE 203 BUS MARKER LAMPS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 204 BUS MARKER LAMPS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

8 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.1.1 INDUSTRY INSIGHTS

- FIGURE 34 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- TABLE 205 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 206 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- TABLE 207 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 208 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (USD MILLION)

- 8.2 PASSENGER CARS

- 8.2.1 INCREASING ADOPTION OF ADVANCED LIGHTING SYSTEMS AND GROWING DEMAND FOR PREMIUM AND LUXURY CARS TO DRIVE MARKET

- TABLE 209 PASSENGER CARS LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 210 PASSENGER CARS LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 211 PASSENGER CARS LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 212 PASSENGER CARS LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.3 LIGHT COMMERCIAL VEHICLES

- 8.3.1 GROWING LIGHT COMMERCIAL VEHICLE PRODUCTION TO DRIVE MARKET

- TABLE 213 LIGHT COMMERCIAL VEHICLES LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 214 LIGHT COMMERCIAL VEHICLES LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 215 LIGHT COMMERCIAL VEHICLES LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 216 LIGHT COMMERCIAL VEHICLES LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.4 TRUCKS

- 8.4.1 INCREASING PENETRATION OF ADVANCED HEADLIGHTS TO DRIVE MARKET

- TABLE 217 TRUCKS LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 218 TRUCKS LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 219 TRUCKS LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 220 TRUCKS LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.5 BUSES

- 8.5.1 GROWING PUBLIC TRANSPORTATION SYSTEM TO DRIVE MARKET

- TABLE 221 BUSES LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 222 BUSES LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 223 BUSES LIGHTING MARKET, BY REGION, (2018-2022) (USD MILLION)

- TABLE 224 BUSES LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

9 AUTOMOTIVE ADAPTIVE LIGHTING MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.1.1 INDUSTRY INSIGHTS

- FIGURE 35 AUTOMOTIVE ADAPTIVE LIGHTING MARKET, BY TYPE, 2023 VS. 2030 (USD MILLION)

- 9.2 FRONT ADAPTIVE LIGHTING

- TABLE 225 FRONT ADAPTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 226 FRONT ADAPTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 227 FRONT ADAPTIVE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 228 FRONT ADAPTIVE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.2.1 AUTO ON/OFF

- 9.2.1.1 Increasing incorporation of on/off features by automakers to drive market

- TABLE 229 AUTO ON/OFF LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 230 AUTO ON/OFF LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 231 AUTO ON/OFF LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 232 AUTO ON/OFF LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.2.2 BENDING/CORNERING LIGHTING

- 9.2.2.1 Technical benefits like enhanced visibility and safety to drive market

- TABLE 233 BENDING/CORNERING LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 234 BENDING/CORNERING LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 235 BENDING/CORNERING LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 236 BENDING/CORNERING LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.2.3 HIGH BEAM ASSIST

- 9.2.3.1 Availability of vehicle models with this feature to drive demand

- TABLE 237 HIGH BEAM ASSIST LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 238 HIGH BEAM ASSIST LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 239 HIGH BEAM ASSIST LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 240 HIGH BEAM ASSIST LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.2.4 HEADLIGHT LEVELING

- 9.2.4.1 Growing developments in headlight leveling technology to drive market

- TABLE 241 HEADLIGHT LEVELING LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 242 HEADLIGHT LEVELING LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 243 HEADLIGHT LEVELING LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 244 HEADLIGHT LEVELING LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.3 REAR ADAPTIVE LIGHTING

- 9.3.1 FAVORABLE GOVERNMENT REGULATIONS TO DRIVE MARKET

- TABLE 245 REAR ADAPTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 246 REAR ADAPTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 247 REAR ADAPTIVE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 248 REAR ADAPTIVE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.4 AMBIENT LIGHTING

- 9.4.1 DEVELOPMENTS AND INCREASED R&D BY AUTOMOTIVE LIGHTING MANUFACTURERS TO DRIVE MARKET

- TABLE 249 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 250 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 251 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 252 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

10 ELECTRIC VEHICLE LIGHTING MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.1.1 INDUSTRY INSIGHTS

- FIGURE 36 ELECTRIC VEHICLE LIGHTING MARKET, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- TABLE 253 ELECTRIC VEHICLE LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 254 ELECTRIC VEHICLE LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (MILLION UNITS)

- TABLE 255 ELECTRIC VEHICLE LIGHTING MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 256 ELECTRIC VEHICLE LIGHTING MARKET, BY VEHICLE TYPE, 2023-2030 (USD MILLION)

- 10.2 BEVS

- 10.2.1 INCREASING INVESTMENT BY AUTOMAKERS TO ELECTRIFY THEIR PRODUCTS TO DRIVE MARKET

- TABLE 257 BEV LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 258 BEV LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 259 BEV LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 260 BEV LIGHTING MARKET, BY REGION 2023-2030 (USD MILLION)

- 10.3 PHEVS

- 10.3.1 GROWING SALES OF PHEVS IN EUROPE AND STRINGENT SAFETY STANDARDS TO DRIVE MARKET

- TABLE 261 PHEV LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 262 PHEV LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 263 PHEV LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 264 PHEV LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.4 FCEVS

- 10.4.1 INCREASING LAUNCH OF FCEV MODELS WITH ADVANCED SAFETY FEATURES TO DRIVE MARKET

- TABLE 265 FCEV LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 266 FCEV LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 267 FCEV LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 268 FCEV LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

11 ELECTRIC VEHICLE LIGHTING MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.1.1 INDUSTRY INSIGHTS

- FIGURE 37 ELECTRIC VEHICLE LIGHTING MARKET, BY TECHNOLOGY, 2023 VS. 2030 (USD MILLION)

- TABLE 269 ELECTRIC VEHICLES LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 270 ELECTRIC VEHICLES LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 271 ELECTRIC VEHICLES LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 272 ELECTRIC VEHICLES LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 11.2 HALOGEN

- 11.2.1 GROWING ADOPTION OF LED TO IMPACT HALOGEN MARKET

- TABLE 273 HALOGEN: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 274 HALOGEN: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 275 HALOGEN: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 276 HALOGEN: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.3 LED

- 11.3.1 GROWING ADOPTION AND TECHNOLOGICAL DEVELOPMENTS TO DRIVE MARKET

- TABLE 277 LED: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 278 LED: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 279 LED: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 280 LED: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.4 XENON/HID

- 11.4.1 DEMAND FOR XENON TO DECLINE DUE TO RISING POPULARITY OF LED

- TABLE 281 XENON/HID: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 282 XENON/HID: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 283 XENON/HID: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 284 XENON/HID: ELECTRIC VEHICLE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

12 ELECTRIC VEHICLE LIGHTING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.1.1 INDUSTRY INSIGHTS

- 12.2 EXTERIOR LIGHTING

- FIGURE 38 ELECTRIC VEHICLE EXTERIOR LIGHTING MARKET, BY APPLICATION, 2023 VS. 2030 (USD MILLION)

- TABLE 285 ELECTRIC VEHICLE EXTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 286 ELECTRIC VEHICLE EXTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- TABLE 287 ELECTRIC VEHICLE EXTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 288 ELECTRIC VEHICLE EXTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.1 HEADLIGHTS

- TABLE 289 ELECTRIC VEHICLE HEADLIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 290 ELECTRIC VEHICLE HEADLIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 291 ELECTRIC VEHICLE HEADLIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 292 ELECTRIC VEHICLE HEADLIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2.2 FOG LIGHTS

- TABLE 293 ELECTRIC VEHICLE FOG LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 294 ELECTRIC VEHICLE FOG LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 295 ELECTRIC VEHICLE FOG LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 296 ELECTRIC VEHICLE FOG LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2.3 DAYTIME RUNNING LIGHTS

- TABLE 297 ELECTRIC VEHICLE DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 298 ELECTRIC VEHICLE DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 299 ELECTRIC VEHICLE DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 300 ELECTRIC VEHICLE DAYTIME RUNNING LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2.4 TAILLIGHTS

- TABLE 301 ELECTRIC VEHICLE TAILLIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 302 ELECTRIC VEHICLE TAILLIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 303 ELECTRIC VEHICLE TAILLIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 304 ELECTRIC VEHICLE TAILLIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2.5 SIDELIGHTS

- TABLE 305 ELECTRIC VEHICLE SIDELIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 306 ELECTRIC VEHICLE SIDELIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 307 ELECTRIC VEHICLE SIDELIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 308 ELECTRIC VEHICLE SIDELIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2.6 CENTER HIGH-MOUNT STOP LIGHTS

- TABLE 309 ELECTRIC VEHICLE CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 310 ELECTRIC VEHICLE CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 311 ELECTRIC VEHICLE CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 312 ELECTRIC VEHICLE CENTER HIGH-MOUNT STOP LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3 INTERIOR LIGHTING

- FIGURE 39 ELECTRIC VEHICLE INTERIOR LIGHTING MARKET, BY APPLICATION, 2023 VS. 2030 (USD MILLION)

- TABLE 313 ELECTRIC VEHICLE INTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (MILLION UNITS)

- TABLE 314 ELECTRIC VEHICLE INTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (MILLION UNITS)

- TABLE 315 ELECTRIC VEHICLE INTERIOR LIGHTING MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 316 ELECTRIC VEHICLE INTERIOR LIGHTING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.1 DASHBOARD LIGHTS

- TABLE 317 ELECTRIC VEHICLE DASHBOARD LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 318 ELECTRIC VEHICLE DASHBOARD LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 319 ELECTRIC VEHICLE DASHBOARD LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 320 ELECTRIC VEHICLE DASHBOARD LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3.2 GLOVE BOX LIGHTS

- TABLE 321 ELECTRIC VEHICLE GLOVE BOX LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 322 ELECTRIC VEHICLE GLOVE BOX LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 323 ELECTRIC VEHICLE GLOVE BOX LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 324 ELECTRIC VEHICLE GLOVE BOX LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3.3 READING LIGHTS

- TABLE 325 ELECTRIC VEHICLE READING LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 326 ELECTRIC VEHICLE READING LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 327 ELECTRIC VEHICLE READING LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 328 ELECTRIC VEHICLE READING LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3.4 DOME LIGHTS

- TABLE 329 ELECTRIC VEHICLE DOME LIGHTS MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 330 ELECTRIC VEHICLE DOME LIGHTS MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 331 ELECTRIC VEHICLE DOME LIGHTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 332 ELECTRIC VEHICLE DOME LIGHTS MARKET, BY REGION, 2023-2030 (USD MILLION)

13 TWO-WHEELER LIGHTING MARKET, BY POSITION

- 13.1 INTRODUCTION

- 13.1.1 INDUSTRY INSIGHTS

- FIGURE 40 TWO-WHEELER LIGHTING MARKET, BY POSITION, 2023 VS. 2030 (USD MILLION)

- TABLE 333 TWO-WHEELER LIGHTING MARKET, BY POSITION, 2018-2022 ('000 UNITS)

- TABLE 334 TWO-WHEELER LIGHTING MARKET, BY POSITION, 2023-2030 ('000 UNITS)

- TABLE 335 TWO-WHEELER LIGHTING MARKET, BY POSITION, 2018-2022 (USD MILLION)

- TABLE 336 TWO-WHEELER LIGHTING MARKET, BY POSITION, 2023-2030 (USD MILLION)

- 13.2 FRONT

- 13.2.1 GROWING POPULARITY OF LED HEADLIGHTS TO DRIVE MARKET

- TABLE 337 TWO-WHEELER FRONT LIGHTING MARKET, BY REGION, 2018-2022 ('000 UNITS)

- TABLE 338 TWO-WHEELER FRONT LIGHTING MARKET, BY REGION, 2023-2030 ('000 UNITS)

- TABLE 339 TWO-WHEELER FRONT LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 340 TWO-WHEELER FRONT LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 13.3 SIDE

- 13.3.1 GROWING TWO-WHEELER SALES TO DRIVE MARKET

- TABLE 341 TWO-WHEELER SIDE LIGHTING MARKET, BY REGION, 2018-2022 ('000 UNITS)

- TABLE 342 TWO-WHEELER SIDE LIGHTING MARKET, BY REGION, 2023-2030 ('000 UNITS)

- TABLE 343 TWO-WHEELER SIDE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 344 TWO-WHEELER SIDE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 13.4 REAR

- 13.4.1 DEMAND FOR ENHANCED SAFETY AND VISIBILITY TO DRIVE MARKET

- TABLE 345 TWO-WHEELER REAR LIGHTING MARKET, BY REGION, 2018-2022 ('000 UNITS)

- TABLE 346 TWO-WHEELER REAR LIGHTING MARKET, BY REGION, 2023-2030 ('000 UNITS)

- TABLE 347 TWO-WHEELER REAR LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 348 TWO-WHEELER REAR LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

14 AUTOMOTIVE LIGHTING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.1.1 INDUSTRY INSIGHTS

- FIGURE 41 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- TABLE 349 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (MILLION UNITS)

- TABLE 350 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (MILLION UNITS)

- TABLE 351 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 352 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2023-2030 (USD MILLION)

- 14.2 ASIA PACIFIC

- 14.2.1 RECESSION IMPACT

- FIGURE 42 ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET SNAPSHOT

- TABLE 353 ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (MILLION UNITS)

- TABLE 354 ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (MILLION UNITS)

- TABLE 355 ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 356 ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 14.2.2 CHINA

- 14.2.2.1 Strong presence of leading vehicle manufacturers to drive market

- TABLE 357 CHINA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 358 CHINA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 359 CHINA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 360 CHINA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.2.3 JAPAN

- 14.2.3.1 Development of advanced ADAS features to drive market

- TABLE 361 JAPAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 362 JAPAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 363 JAPAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 364 JAPAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Developments in autonomous vehicles to boost demand for advanced lighting systems

- TABLE 365 SOUTH KOREA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 366 SOUTH KOREA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 367 SOUTH KOREA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 368 SOUTH KOREA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.2.5 INDIA

- 14.2.5.1 Growing demand for SUVs and MUVs to drive market

- TABLE 369 INDIA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 370 INDIA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 371 INDIA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 372 INDIA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.2.6 REST OF ASIA PACIFIC

- TABLE 373 REST OF ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 374 REST OF ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 375 REST OF ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 376 REST OF ASIA PACIFIC: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.3 EUROPE

- 14.3.1 RECESSION IMPACT

- FIGURE 43 EUROPE: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023 VS. 2030 (USD MILLION)

- TABLE 377 EUROPE: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (MILLION UNITS)

- TABLE 378 EUROPE: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (MILLION UNITS)

- TABLE 379 EUROPE: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 380 EUROPE: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 14.3.2 GERMANY

- 14.3.2.1 Government mandates for safety standards to drive market

- TABLE 381 GERMANY: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 382 GERMANY: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 383 GERMANY: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 384 GERMANY: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.3.3 FRANCE

- 14.3.3.1 Increasing sales of premium and luxury vehicles to drive market

- TABLE 385 FRANCE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 386 FRANCE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 387 FRANCE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 388 FRANCE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.3.4 SPAIN

- 14.3.4.1 Increasing production of passenger cars and LCVs to drive market

- TABLE 389 SPAIN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 390 SPAIN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 391 SPAIN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 392 SPAIN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.3.5 UK

- 14.3.5.1 High demand for premium and luxury cars to drive market

- TABLE 393 UK: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 394 UK: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 395 UK: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 396 UK: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.3.6 REST OF EUROPE

- TABLE 397 REST OF EUROPE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 398 REST OF EUROPE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 399 REST OF EUROPE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 400 REST OF EUROPE: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.4 NORTH AMERICA

- 14.4.1 RECESSION IMPACT

- FIGURE 44 NORTH AMERICA: AUTOMOTIVE LIGHTING MARKET SNAPSHOT

- TABLE 401 NORTH AMERICA: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (MILLION UNITS)

- TABLE 402 NORTH AMERICA: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (MILLION UNITS)

- TABLE 403 NORTH AMERICA: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 404 NORTH AMERICA: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 14.4.2 US

- 14.4.2.1 Government regulations mandating adaptive lighting to drive market

- TABLE 405 US: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 406 US: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 407 US: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 408 US: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.4.3 CANADA

- 14.4.3.1 Growing demand for advanced vehicles and premium cars to drive market

- TABLE 409 CANADA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 410 CANADA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 411 CANADA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 412 CANADA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.4.4 MEXICO

- 14.4.4.1 Trade agreement between US, Canada, and Mexico to drive market

- TABLE 413 MEXICO: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 414 MEXICO: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 415 MEXICO: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 416 MEXICO: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.5 REST OF WORLD (ROW)

- 14.5.1 RECESSION IMPACT

- FIGURE 45 REST OF THE WORLD AUTOMOTIVE LIGHTING MARKET, 2023 VS. 2030 (USD MILLION)

- TABLE 417 REST OF THE WORLD: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (MILLION UNITS)

- TABLE 418 REST OF THE WORLD: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (MILLION UNITS)

- TABLE 419 REST OF THE WORLD: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 420 REST OF THE WORLD: AUTOMOTIVE LIGHTING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 14.5.2 BRAZIL

- 14.5.2.1 Trade agreements with US to drive market

- TABLE 421 BRAZIL: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 422 BRAZIL: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 423 BRAZIL: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 424 BRAZIL: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.5.3 IRAN

- 14.5.3.1 Government programs to boost domestic vehicle production to drive market

- TABLE 425 IRAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 426 IRAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 427 IRAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 428 IRAN: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- 14.5.4 OTHERS

- TABLE 429 OTHERS: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (MILLION UNITS)

- TABLE 430 OTHERS: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (MILLION UNITS)

- TABLE 431 OTHERS: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 432 OTHERS: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 433 OVERVIEW OF STRATEGIES DEPLOYED BY KEY AUTOMOTIVE LIGHTING OEMS

- 15.2 REVENUE ANALYSIS

- FIGURE 46 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2022

- 15.3 MARKET SHARE ANALYSIS

- TABLE 434 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS (2022-2023)

- FIGURE 47 AUTOMOTIVE LIGHTING MARKET SHARE, 2022

- 15.4 COMPANY EVALUATION MATRIX

- 15.4.1 STARS

- 15.4.2 EMERGING LEADERS

- 15.4.3 PERVASIVE PLAYERS

- 15.4.4 PARTICIPANTS

- FIGURE 48 AUTOMOTIVE LIGHTING MARKET: COMPANY EVALUATION MATRIX, 2022

- 15.4.5 COMPANY FOOTPRINT

- TABLE 435 AUTOMOTIVE LIGHTING MARKET: COMPANY FOOTPRINT

- TABLE 436 AUTOMOTIVE LIGHTING MARKET: REGION FOOTPRINT

- 15.5 START-UP/SME EVALUATION MATRIX: AUTOMOTIVE ADAPTIVE LIGHTING MANUFACTURERS

- 15.5.1 PROGRESSIVE COMPANIES

- 15.5.2 RESPONSIVE COMPANIES

- 15.5.3 DYNAMIC COMPANIES

- 15.5.4 STARTING BLOCKS

- FIGURE 49 AUTOMOTIVE ADAPTIVE LIGHTING MARKET (START-UP/SME): COMPANY EVALUATION MATRIX, 2022

- 15.5.5 COMPETITIVE BENCHMARKING

- TABLE 437 AUTOMOTIVE LIGHTING MARKET: COMPETITIVE BENCHMARKING OF SMES

- 15.6 COMPETITIVE SCENARIO

- 15.6.1 PRODUCT LAUNCHES

- TABLE 438 AUTOMOTIVE LIGHTING MARKET: PRODUCT LAUNCHES, 2021-2023

- 15.6.2 DEALS

- TABLE 439 AUTOMOTIVE LIGHTING MARKET: DEALS, 2021-2023

- 15.6.3 OTHERS

- TABLE 440 AUTOMOTIVE LIGHTING MARKET: OTHERS, 2020-2023

16 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 16.1 KEY PLAYERS

- 16.1.1 KOITO MANUFACTURING CO., LTD.

- TABLE 441 KOITO MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- FIGURE 50 KOITO MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- TABLE 442 KOITO MANUFACTURING CO., LTD.: PRODUCTS OFFERED

- TABLE 443 KOITO MANUFACTURING CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 444 KOITO MANUFACTURING CO., LTD.: DEALS

- TABLE 445 KOITO MANUFACTURING CO., LTD.: OTHERS

- 16.1.2 HELLA GMBH & CO. KGAA

- TABLE 446 HELLA GMBH & CO. KGAA: COMPANY OVERVIEW

- FIGURE 51 HELLA GMBH & CO. KGAA: COMPANY SNAPSHOT

- TABLE 447 HELLA GMBH & CO. KGAA: PRODUCTS OFFERED

- TABLE 448 HELLA GMBH & CO. KGAA: PRODUCT DEVELOPMENTS

- TABLE 449 HELLA GMBH & CO. KGAA: DEALS

- TABLE 450 HELLA GMBH & CO. KGAA: OTHERS

- 16.1.3 VALEO SA

- TABLE 451 VALEO SA: COMPANY OVERVIEW

- FIGURE 52 VALEO SA: COMPANY SNAPSHOT

- TABLE 452 VALEO SA: PRODUCTS OFFERED

- TABLE 453 VALEO SA: PRODUCT DEVELOPMENTS

- TABLE 454 VALEO SA: DEALS

- TABLE 455 VALEO SA: OTHERS

- 16.1.4 OSRAM GMBH

- TABLE 456 OSRAM GMBH: COMPANY OVERVIEW

- FIGURE 53 OSRAM GMBH: COMPANY SNAPSHOT

- TABLE 457 OSRAM GMBH: PRODUCTS OFFERED

- TABLE 458 OSRAM GMBH: PRODUCT DEVELOPMENTS

- TABLE 459 OSRAM GMBH: DEALS

- 16.1.5 CONTINENTAL AG

- TABLE 460 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 54 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 461 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 462 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 463 CONTINENTAL AG: DEALS

- TABLE 464 CONTINENTAL AG: OTHERS

- 16.1.6 HYUNDAI MOBIS

- TABLE 465 HYUNDAI MOBIS: COMPANY OVERVIEW

- FIGURE 55 HYUNDAI MOBIS: COMPANY SNAPSHOT

- TABLE 466 HYUNDAI MOBIS: PRODUCTS OFFERED

- TABLE 467 HYUNDAI MOBIS: PRODUCT DEVELOPMENTS

- TABLE 468 HYUNDAI MOBIS: DEALS

- TABLE 469 HYUNDAI MOBIS: OTHERS

- 16.1.7 MAGNETI MARELLI

- TABLE 470 MAGNETI MARELLI: COMPANY OVERVIEW

- FIGURE 56 MAGNETI MARELLI: COMPANY SNAPSHOT

- TABLE 471 MAGNETI MARELLI: PRODUCTS OFFERED

- TABLE 472 MAGNETI MARELLI: PRODUCT DEVELOPMENTS

- TABLE 473 MAGNETI MARELLI: DEALS

- TABLE 474 MAGNETI MARELLI: OTHERS

- 16.1.8 ICHIKOH INDUSTRIES, LTD.

- TABLE 475 ICHIKOH INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 57 ICHIKOH INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 476 ICHIKOH INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 477 ICHIKOH INDUSTRIES, LTD.: PRODUCT DEVELOPMENTS

- TABLE 478 ICHIKOH INDUSTRIES, LTD.: DEALS

- TABLE 479 ICHIKOH INDUSTRIES, LTD.: OTHERS

- 16.1.9 STANLEY ELECTRIC CO., LTD.

- TABLE 480 STANLEY ELECTRIC CO., LTD.: COMPANY OVERVIEW

- FIGURE 58 STANLEY ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 481 STANLEY ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 482 STANLEY ELECTRIC CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 483 STANLEY ELECTRIC CO., LTD.: DEALS

- 16.1.10 SIGNIFY (KONINKLIJKE PHILIPS N.V.)

- TABLE 484 SIGNIFY (KONINKLIJKE PHILIPS N.V.): COMPANY OVERVIEW

- FIGURE 59 SIGNIFY (KONINKLIJKE PHILIPS N.V.): COMPANY SNAPSHOT

- TABLE 485 SIGNIFY (KONINKLIJKE PHILIPS N.V.): PRODUCTS OFFERED

- TABLE 486 SIGNIFY (KONINKLIJKE PHILIPS N.V.): PRODUCT DEVELOPMENTS

- TABLE 487 SIGNIFY (KONINKLIJKE PHILIPS N.V.): DEALS

- 16.1.11 TUNGSRAM GROUP

- TABLE 488 TUNGSRAM GROUP: COMPANY OVERVIEW

- TABLE 489 TUNGSRAM GROUP: PRODUCTS OFFERED

- TABLE 490 TUNGSRAM GROUP: PRODUCT DEVELOPMENTS

- TABLE 491 TUNGSRAM GROUP: DEALS

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 16.2 OTHER PLAYERS

- 16.2.1 ZIZALA LICHTSYSTEME GMBH

- TABLE 492 ZIZALA LICHTSYSTEME GMBH: COMPANY OVERVIEW

- 16.2.2 ROBERT BOSCH GMBH

- TABLE 493 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- 16.2.3 NXP SEMICONDUCTORS NV

- TABLE 494 NXP SEMICONDUCTORS NV: COMPANY OVERVIEW

- 16.2.4 GRUPO ANTOLIN

- TABLE 495 GRUPO ANTOLIN: COMPANY OVERVIEW

- 16.2.5 FEDERAL-MOGUL CORPORATION

- TABLE 496 FEDERAL-MOGUL: COMPANY OVERVIEW

- 16.2.6 GENTEX CORPORATION

- TABLE 497 GENTEX CORPORATION: COMPANY OVERVIEW

- 16.2.7 FLEX-N-GATE

- TABLE 498 FLEX-N-GATE: COMPANY OVERVIEW

- 16.2.8 NORTH AMERICAN LIGHTING

- TABLE 499 NORTH AMERICAN LIGHTING: COMPANY OVERVIEW

- 16.2.9 DENSO CORPORATION

- TABLE 500 DENSO CORPORATION: COMPANY OVERVIEW

- 16.2.10 RENESAS ELECTRONICS CORPORATION

- TABLE 501 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- 16.2.11 KEBODA

- TABLE 502 KEBODA: COMPANY OVERVIEW

- 16.2.12 VARROC

- TABLE 503 VARROC: COMPANY OVERVIEW

- 16.2.13 LUMAX INDUSTRIES

- TABLE 504 LUMAX INDUSTRIES: COMPANY OVERVIEW

- 16.2.14 SEOUL SEMICONDUCTOR CO., LTD.

- TABLE 505 SEOUL SEMICONDUCTOR CO., LTD.: COMPANY OVERVIEW

- 16.2.15 INFINEON TECHNOLOGIES

- TABLE 506 INFINEON TECHNOLOGIES: COMPANY OVERVIEW

- 16.2.16 SAMVARDHANA MOTHERSON

- TABLE 507 SAMVARDHANA MOTHERSON: COMPANY OVERVIEW

17 AUTOMOTIVE LIGHTING MARKET- RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE LIGHTING

- 17.2 LED TECHNOLOGY TO CREATE LUCRATIVE OPPORTUNITIES FOR LIGHTING MANUFACTURERS

- 17.3 CONCLUSION

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS