|

|

市場調査レポート

商品コード

1384224

農業用微量栄養素の世界市場 (~2028年):タイプ (亜鉛・ホウ素・鉄・マンガン・モリブデン・銅)・適用法 (土壌・葉面散布・施肥)・形態 (キレート・非キレート)・作物タイプ・地域別Agricultural Micronutrients Market by Type (Zinc, Boron, Iron, Manganese, Molybdenum, Copper), Mode of Application (Soil, Foliar and Fertigation), Form (Chelated and Non-Chelated Micronutrients), Crop Type and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 農業用微量栄養素の世界市場 (~2028年):タイプ (亜鉛・ホウ素・鉄・マンガン・モリブデン・銅)・適用法 (土壌・葉面散布・施肥)・形態 (キレート・非キレート)・作物タイプ・地域別 |

|

出版日: 2023年11月08日

発行: MarketsandMarkets

ページ情報: 英文 301 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 対象単位 | 金額 (米ドル)・数量 (キロトン) |

| セグメント | タイプ・形態・作物タイプ・適用形態・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・南米・その他の地域 |

世界の農業用微量栄養素の市場規模は2023年の45億米ドルから、予測期間中は8.6%のCAGRで推移し、2028年には69億米ドルの規模に成長すると予測されています。

同市場の成長の重要な要因のひとつは、世界の人口による食糧需要の増加です。また、土壌の不均衡や微量栄養素の欠乏が目立ち、作物の生育に悪影響を及ぼしていることも成長のもう一つの重要な要因となっています。湿度、温度、土壌pHなどの要因がこうした不均衡の一因となっており、土壌の健康と作物の品質を高めるための微量栄養素散布の必要性が強調されています。加えて、農業収量の向上における微量栄養素の重要性に対する農家の意識の高まりも市場の成長をさらに後押ししています。

形態別では、キレートの部門が高いCAGRで成長していると推定されています。キレート肥料は、特に微量栄養素が少ないことによるストレスや土壌の栄養不足の状態を軽減することで作物収量を大幅に増加させる可能性を実証しており、農業の生産性を向上させる貴重なソリューションとなっています。これらの微量栄養素は、キレートは汎用性が高く、肥料添加物、種子被覆、葉面散布として使用できるため、幅広い農業用途に適応できます。

当レポートでは、世界の農業用微量栄養素の市場を調査し、市場概要、市場成長への影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ指標

- 急増する人口を維持し養うための食料生産の需要の高まり

- 有機栽培作物の購入への移行

- 人間が消費できる手頃な価格で健康的な微量栄養素の必要性

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 特許分析

- エコシステム分析

- 貿易分析

- 主要な会議とイベント

- 購入者に影響を与える動向/混乱

- 平均販売価格

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 規制の枠組み

- 規制機関、政府機関、その他の組織

第7章 農業用微量栄養素市場:作物タイプ別

- シリアル・穀物

- 果物・野菜

- 油糧種子・豆類

- その他の作物

第8章 農業用微量栄養素市場:形態別

- キレート微量栄養素

- 非キレート微量栄養素

第9章 農業用微量栄養素市場:適用法別

- 土壌

- 葉面

- 施肥

- その他

第10章 農業用微量栄養素市場:タイプ別

- 亜鉛

- ボロン

- 鉄

- モリブデン

- 銅

- マンガン

- その他

第11章 農業用微量栄養素市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の採用戦略

- 主要な参入企業のスナップショット

- 主要企業のセグメント別収益分析

- 年間収益・収益の増加

- 主要企業のEBITDA

- 企業評価マトリックス

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- BASF SE

- NOURYON

- NUFARM

- YARA INTERNATIONAL ASA

- COROMANDEL INTERNATIONAL LIMITED

- LAND O'LAKES, INC

- HELENA AGRI-ENTERPRISES, LLC

- THE MOSAIC COMPANY

- HAIFA NEGEV TECHNOLOGIES LTD.

- MANVERT

- SYNGENTA

- ZUARI AGROCHEMICAL LTD

- STOLLER ENTERPRISES, INC.

- BALCHEM CORPORATION

- ATP NUTRITION

- その他の企業

- WILBUR-ELLIS HOLDINGS, INC.

- BMS MICRO-NUTRIENTS NV

- KOCH AGRONOMIC SERVICES, LLC

- AGROLIQUID

- ARIES AGRO LIMITED

- GREEN RISE AGRO INDUSTRIES

- BLUE-DIP ORGANIC INDUSTRIES

- NAPNUTRISCIENCE

- GITAJI PESTICIDES INDUSTRIES

- NUTRIMAX AGRO

第14章 隣接市場および関連市場

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD), Volume(KT) |

| Segments | By Type, By Form, By Crop type, By Mode of Application, and By Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and ROW |

The global market for agricultural micronutrients is estimated to be valued at USD 4.5 Billion in 2023 and is projected to reach USD 6.9 Billion by 2028, at a CAGR of 8.6% during the forecast period.

The growth of the agricultural micronutrients market is being driven by various factors. One key factor is the global population's increasing demand for food. Another significant factor is the prevalence of soil imbalances and deficiencies in micronutrients, which negatively affect crop growth. Factors such as humidity, temperature, and soil pH contribute to these imbalances, emphasizing the need for micronutrient applications to enhance soil health and crop quality. Additionally, the growing awareness among farmers about the importance of micronutrients in improving agricultural yield further propels the market's growth. These factors collectively contribute to the expansion of the agricultural micronutrients market, enhancing crop production and food security.

"By form, the chelated segment is estimated to be growing at a significant CAGR in the agricultural micronutrients market."

The growth of chelated agricultural micronutrients is being fastened by several factors. Chelated fertilizers have demonstrated the potential to significantly increase crop yields, especially in low-micronutrient stress or nutrient-deficient soils, making them a valuable solution for improving agricultural productivity. These micronutrients are available in various forms, including chelated micronutrient fertilizers, which offer benefits such as improved plant growth and health. Chelates are versatile and can be used as fertilizer additives, in seed dressing, and through foliar sprays, making them adaptable to a wide range of agricultural applications. Additionally, the chelated segment is projected to be the fastest-growing in the agricultural micronutrients market, reflecting their increasing adoption in the agricultural industry. These factors collectively contribute to the accelerated growth of chelated agricultural micronutrients in modern agriculture.

"By type, manganese is anticipated to be growing at a significant CAGR during the forecast period in the agricultural micronutrients market."

Manganese is a crucial micronutrient for plant growth, and its effectiveness in agriculture is influenced by various factors: Manganese plays essential roles in plant development, photosynthesis, and enzymatic processes, making it a vital micronutrient for overall plant health. The use of chelated-based manganese fertilizers enhances the availability and uptake of manganese in plants, promoting its efficient utilization for growth and productivity. The dynamics and transformations of manganese in soils are influenced by factors like soil pH, electrical conductivity (EC), and soil organic matter, which can affect manganese's availability to plants. Different plant species have varying manganese requirements, and understanding these specific needs aids in optimizing manganese application for growth acceleration.

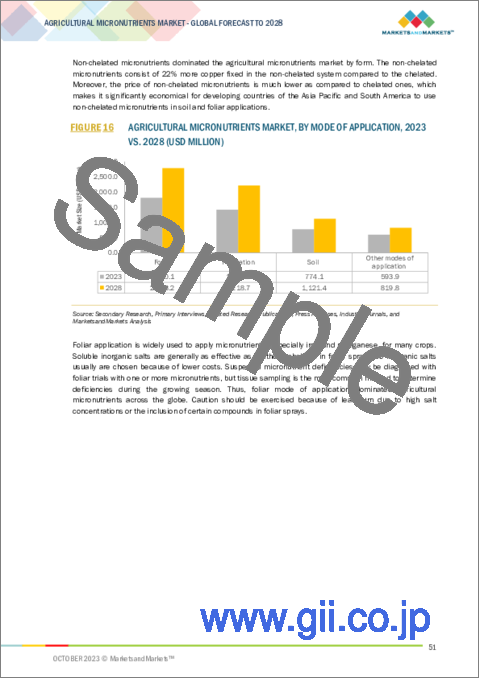

"Among modes of application, the soil is estimated to grow at a CAGR of 7.7% during the forecast period."

The growth of soil through the application of agricultural micronutrients is influenced by several key factors. The choice of micronutrients and their balanced application is essential. A precise blend of micronutrients, including boron (B), chloride (Cl), copper (Cu), iron (Fe), manganese (Mn), molybdenum (Mo), nickel (Ni), and zinc (Zn), supports plant growth and ensures a proper balance of essential nutrients. Agricultural practices such as soil water management and soil amendments can enhance the accessibility of soil micronutrients. These practices help make micronutrients more readily available to plants, facilitating their growth. The application of crop residues can contribute to the availability of micronutrients in the soil. These residues enrich the soil with organic matter, which can convert adsorbed fractions of micronutrients into more plant-accessible forms, supporting soil health and plant growth. The sustained use of micronutrient fertilizers over time can have a positive impact on soil health and plant growth. It helps maintain consistent nutrient levels and prevents deficiencies that can hinder soil productivity.

"North America to grow at a significant CAGR during the forecast period in the agricultural micronutrients market."

Soil imbalances and deficiencies of micronutrients, driven by factors such as humidity, temperature, and soil pH, create a strong demand for micronutrient fertilizers and amendments to rectify these issues and improve agricultural productivity. This market's substantial size and the investment opportunities it presents are attracting companies and driving innovation and competition in the sector. With an ever-increasing population and the need to enhance agricultural productivity and food quality, the demand for micronutrient applications in farming practices is on the rise, contributing to the growth of this market.

The break-up of the profile of primary participants in the agricultural micronutrients market:

- By Company: Tier 1 - 30%, Tier 2 - 30%, Tier 3 - 40%

- By Designation: CXOs - 40%, Manager level - 25%, and C-Level- 35%

- By Region: North America -16%, Europe - 30%, Asia Pacific - 40%, South America - 10%, RoW - 4%,

Major key players operating in the agricultural micronutrients market include BASF SE (Germany), Yara International ASA (Norway), and Coromandel International Limited (India).

Research Coverage:

This research report categorizes the agricultural micronutrients market, by type (zinc, boron, iron, manganese, molybdenum, copper), by mode of application (soil, foliar, and fertigation), form (chelated and non-chelated micronutrients), crop type (fruits & vegetables, cereals and grains, oilseed & pulses), and region (North America, Europe, Asia Pacific, South America, and RoW). The scope of this report encompasses a comprehensive examination of major factors, including drivers, restraints, challenges, and opportunities, that significantly influence the growth of the agricultural micronutrients market. Extensive research has been conducted to analyze key industry players, offering valuable insights into their business overview, product offerings, key strategies, contracts, partnerships, new product launches, as well as mergers and acquisitions associated with the agricultural micronutrients market. Furthermore, the report includes a competitive analysis of emerging startups in the agricultural micronutrients market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agricultural micronutrients market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increase in micronutrients in soil), restraints (Booming organic fertilizer industry), opportunities (Development of biodegradable chelates), and challenges (Need for sustainable sourcing of raw materials) influencing the growth of the agricultural micronutrients market.

- New Product launch/Innovation: Detailed insights on research & development activities and new product launches in the agricultural micronutrients market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the agricultural micronutrients market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the agricultural micronutrients market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Yara International ASA (Norway), Coromandel International Limited (India), and others in the agricultural micronutrients market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INCLUSIONS AND EXCLUSIONS PERTAINING TO AGRICULTURAL MICRONUTRIENTS MARKET

- 1.3 STUDY SCOPE

- FIGURE 1 AGRICULTURAL MICRONUTRIENTS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES, 2019-2022

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AGRICULTURAL MICRONUTRIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.3 MARKET SIZE ESTIMATION

- 2.1.4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.1.5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RECESSION MACRO INDICATORS

- FIGURE 8 RECESSION MACRO INDICATORS

- FIGURE 9 GLOBAL INFLATION RATE, 2011-2022

- FIGURE 10 GDP, 2011-2022 (USD TRILLION)

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON AGRICULTURAL MICRONUTRIENTS MARKET

- FIGURE 12 AGRICULTURAL MICRONUTRIENTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 3 AGRICULTURAL MICRONUTRIENTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 13 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 AGRICULTURAL MICRONUTRIENTS MARKET SHARE (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AGRICULTURAL MICRONUTRIENTS MARKET

- FIGURE 18 INCREASE IN MICRONUTRIENT DEFICIENCY IN SOIL TO PROPEL MARKET

- 4.2 AGRICULTURAL MICRONUTRIENTS MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 19 VIETNAM PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY KEY TYPE & COUNTRY

- FIGURE 20 CHINA ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- 4.4 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023 VS. 2028

- FIGURE 21 MOLYBDENUM TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023 VS. 2028

- FIGURE 22 FRUITS & VEGETABLES PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028

- FIGURE 23 FOLIAR TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROINDICATORS

- 5.2.1 RISING DEMAND FOR FOOD PRODUCTION TO SUSTAIN AND NOURISH BURGEONING POPULATION

- FIGURE 24 WORLD POPULATION, 1950 TO 2021

- 5.2.2 SHIFT TOWARD PURCHASE OF ORGANICALLY GROWN CROPS

- FIGURE 25 AREA HARVESTED, BY CROP TYPE, 2014-2020 (HA)

- 5.2.3 NEED FOR AFFORDABLE AND HEALTHY MICRONUTRIENTS FOR HUMAN CONSUMPTION

- 5.3 MARKET DYNAMICS

- FIGURE 26 AGRICULTURAL MICRONUTRIENTS MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in micronutrient deficiency in soil

- 5.3.1.2 Rising crop production rates and quality of arable lands

- 5.3.1.3 Focus on sustainable soil management practices by governments

- 5.3.1.4 Improved awareness and understanding of micronutrient management practices among farmers

- 5.3.2 RESTRAINTS

- 5.3.2.1 Booming organic fertilizer industry

- 5.3.2.2 Bioaccumulation of non-biodegradable chelates

- 5.3.2.3 Fluctuating costs of raw materials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emphasis on production of biodegradable chelates

- 5.3.3.2 Growing trend of urban agriculture

- 5.3.4 CHALLENGES

- 5.3.4.1 Lack of awareness in developing regions regarding benefits of micronutrients

- 5.3.4.2 Lack of sustainable sourcing of raw materials

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 SOURCING

- 6.2.3 PRODUCTION

- 6.2.4 MARKETING, SALES, LOGISTICS, AND RETAIL

- FIGURE 27 VALUE CHAIN ANALYSIS: KEY CONTRIBUTORS IN SOURCING AND PRODUCTION

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 NEW ENVIRONMENTALLY FRIENDLY BIO-BASED MICRONUTRIENT FERTILIZERS BY BIOSORPTION

- 6.4.2 PRECISION TECHNOLOGY IN FERTILIZER APPLICATION

- 6.5 PATENT ANALYSIS

- FIGURE 29 NUMBER OF PATENTS FILED, 2012-2022

- FIGURE 30 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR AGRICULTURAL MICRONUTRIENTS, 2016-2022

- 6.5.1 LIST OF MAJOR PATENTS, 2018-2023

- TABLE 4 PATENTS GRANTED FOR AGRICULTURAL MICRONUTRIENTS MARKET

- 6.6 ECOSYSTEM ANALYSIS

- FIGURE 31 AGRICULTURAL MICRONUTRIENTS MARKET: PRODUCT R&D AND PRODUCTION

- TABLE 5 ROLE OF PLAYERS IN ECOSYSTEM

- FIGURE 32 ECOSYSTEM MAPPING

- 6.7 TRADE ANALYSIS

- TABLE 6 IMPORT VALUE AND QUANTITY OF MINERALS OR CHEMICAL FERTILIZERS FOR KEY COUNTRIES, 2022 (USD THOUSAND & TONS)

- TABLE 7 EXPORT VALUE AND QUANTITY OF MINERALS OR CHEMICAL FERTILIZERS FOR KEY COUNTRIES, 2022 (USD THOUSAND & TONS)

- 6.8 KEY CONFERENCES & EVENTS

- TABLE 8 DETAILED LIST OF KEY CONFERENCES & EVENTS, 2023-2024

- 6.9 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 33 REVENUE SHIFT IN AGRICULTURAL MICRONUTRIENTS MARKET

- 6.10 AVERAGE SELLING PRICE

- 6.10.1 INTRODUCTION

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY TYPE, 2022 (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- TABLE 10 ZINC: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 11 BORON: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 12 MOLYBDENUM: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 13 COPPER: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 14 MANGANESE: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 15 IRON: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 16 OTHER TYPES: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 NEW ENVIRONMENT-FRIENDLY FERTILIZER OBTAINED BY VALORIZATION OF POST-EXTRACTION BIOMASS RESIDUES OF ALFALFA AND GOLDENROD

- 6.11.2 QUANTITATIVE RESEARCH PERFORMED TO ANALYZE SOILS AND CROP SAMPLES COLLECTED, SHOWING EFFECTS OF ORGANIC FARMING SYSTEMS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 MODES OF APPLICATION

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 MODES OF APPLICATION

- 6.13.2 BUYING CRITERIA

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 AGRICULTURAL MICRONUTRIENT FORMS

- TABLE 19 KEY BUYING CRITERIA FOR TOP 2 AGRICULTURAL MICRONUTRIENT FORMS

- 6.14 REGULATORY FRAMEWORK

- 6.14.1 NORTH AMERICA

- 6.14.1.1 US

- 6.14.2 ASIA PACIFIC

- 6.14.2.1 Australia

- 6.14.2.2 China

- 6.14.3 SOUTH AFRICA

- 6.14.1 NORTH AMERICA

- 6.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

7 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE

- 7.1 INTRODUCTION

- FIGURE 37 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 25 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 26 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 7.2 CEREALS & GRAINS

- 7.2.1 NEED FOR OBTAINING HIGH YIELDS OF STAPLE FOODS TO PREVENT MALNUTRITION TO DRIVE MARKET

- 7.2.1.1 Corn

- 7.2.1.2 Wheat

- 7.2.1.3 Rice

- 7.2.1.4 Other cereals & grains

- TABLE 27 CEREALS & GRAINS: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 CEREALS & GRAINS: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 29 CEREALS & GRAINS: AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 30 CEREALS & GRAINS: AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.1 NEED FOR OBTAINING HIGH YIELDS OF STAPLE FOODS TO PREVENT MALNUTRITION TO DRIVE MARKET

- 7.3 FRUITS & VEGETABLES

- 7.3.1 INCREASE IN AWARENESS REGARDING NUTRITIONAL VALUE TO DRIVE DEMAND FOR FRUITS & VEGETABLES

- TABLE 31 FRUITS & VEGETABLES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 FRUITS & VEGETABLES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 OILSEEDS & PULSES

- 7.4.1 NEED FOR HIGH SOURCES OF PROTEIN TO BOOST GROWTH

- 7.4.1.1 Soybean

- 7.4.1.2 Canola

- 7.4.1.3 Other oilseeds & pulses

- TABLE 33 OILSEEDS & PULSES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 OILSEEDS & PULSES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 OILSEEDS & PULSES: AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 36 OILSEEDS & PULSES: AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.4.1 NEED FOR HIGH SOURCES OF PROTEIN TO BOOST GROWTH

- 7.5 OTHER CROP TYPES

- TABLE 37 OTHER CROP TYPES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 OTHER CROP TYPES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM

- 8.1 INTRODUCTION

- FIGURE 38 NON-CHELATED SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 39 AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 40 AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- 8.2 CHELATED MICRONUTRIENTS

- 8.2.1 INCREASED BIOAVAILABILITY OF MICRONUTRIENTS TO CONTRIBUTE TO MARKET PRODUCTIVITY AND PROFITABILITY

- TABLE 41 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 44 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2.1.1 Ethylene Diamine-tetra-acetic acid (EDTA)

- TABLE 45 EDTA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 EDTA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1.2 Ethylenediamine Di-2-Hydroxyphenyl Acetate (EDDHA)

- TABLE 47 EDDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 EDDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1.3 Diethylene-triamine penta-acetic acid (DTPA)

- TABLE 49 DTPA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 DTPA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1.4 Iminodisuccinic Acid (IDHA)

- TABLE 51 IDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 IDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1.5 Other Chelated Micronutrients

- TABLE 53 OTHER CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 OTHER CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 NON-CHELATED MICRONUTRIENTS

- 8.3.1 CHEAPER RATES OF NON-CHELATED MICRONUTRIENTS TO DRIVE GROWTH

- TABLE 55 NON-CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 NON-CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION

- 9.1 INTRODUCTION

- FIGURE 39 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 57 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 58 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 9.2 SOIL

- 9.2.1 REDUCED COST AND UNIFORM DISTRIBUTION OF MICRONUTRIENTS TO PROMOTE SOIL APPLICATION

- TABLE 59 SOIL: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 SOIL: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 FOLIAR

- 9.3.1 LOW COST OF APPLICATION AND IMMEDIATE RESPONSE TO APPLIED NUTRIENTS TO DRIVE DEMAND FOR FOLIAR APPLICATION

- TABLE 61 FOLIAR: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 FOLIAR: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 FERTIGATION

- 9.4.1 IMPROVED NUTRIENT USE EFFICIENCY TO PROPEL FERTIGATION APPLICATION

- TABLE 63 FERTIGATION: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 FERTIGATION: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 OTHER MODES OF APPLICATION

- TABLE 65 OTHER MODES OF APPLICATION: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 OTHER MODES OF APPLICATION: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 40 MOLYBDENUM TO DOMINATE AGRICULTURAL MICRONUTRIENTS MARKET DURING FORECAST PERIOD

- TABLE 67 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 68 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 69 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 70 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 10.2 ZINC

- 10.2.1 FOCUS ON SUSTAINING GLOBAL FOOD SECURITY AND AGRICULTURAL SUSTAINABILITY TO DRIVE DEMAND

- TABLE 71 ZINC: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 ZINC: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 ZINC: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 74 ZINC: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 10.3 BORON

- 10.3.1 NEED FOR IMPROVING SEED SET OF PLANTS OR CROPS TO BOLSTER GROWTH

- FIGURE 41 GLOBAL BORON PRODUCTION RATES, 2020

- TABLE 75 BORON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 BORON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 BORON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 78 BORON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 10.4 IRON

- 10.4.1 DEMAND FOR TARGETED APPLICATIONS TO RECTIFY DEFICIENCIES AND OPTIMIZE PLANT PERFORMANCE TO FUEL GROWTH

- TABLE 79 IRON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 IRON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 81 IRON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 82 IRON: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 10.5 MOLYBDENUM

- 10.5.1 LIMING SOIL TO HELP DEAL WITH MOLYBDENUM DEFICIENCY

- TABLE 83 MOLYBDENUM: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 MOLYBDENUM: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 85 MOLYBDENUM: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 86 MOLYBDENUM: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 10.6 COPPER

- 10.6.1 EMPHASIS ON PROVIDING CELL WALL STRENGTH AND PREVENTION OF WILTING TO BOLSTER GROWTH

- TABLE 87 COPPER: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 88 COPPER: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 89 COPPER: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 90 COPPER: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 10.7 MANGANESE

- 10.7.1 USE OF MANGANESE FOR POLLEN GERMINATION AND PROVIDING RESISTANCE TO ROOT PATHOGENS TO DRIVE DEMAND

- TABLE 91 MANGANESE: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 92 MANGANESE: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 93 MANGANESE: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 94 MANGANESE: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 10.8 OTHER TYPES

- TABLE 95 OTHER TYPES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 96 OTHER TYPES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 OTHER TYPES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 98 OTHER TYPES: AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

11 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 42 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2023-2028

- TABLE 99 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 100 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 101 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 102 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 11.2 NORTH AMERICA

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA, 2017-2022

- FIGURE 45 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- TABLE 103 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 106 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 107 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 110 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 111 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Adoption of stricter environmental regulations to correct deficiencies in US soil to boost growth

- TABLE 119 US: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 120 US: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 121 US: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 122 US: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.2.3 CANADA

- 11.2.3.1 Supply of crop-specific nutrients near root tip for easy plant absorption to encourage market expansion

- TABLE 123 CANADA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 124 CANADA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 125 CANADA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 126 CANADA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.2.4 MEXICO

- 11.2.4.1 Strong government initiatives to improve crop productivity and follow organic farming to drive demand

- TABLE 127 MEXICO: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 128 MEXICO: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 MEXICO: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 130 MEXICO: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 46 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 47 EUROPE: RECESSION IMPACT ANALYSIS, 2022

- TABLE 131 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 132 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 134 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 135 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 136 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 137 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 138 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 139 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 140 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 141 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 142 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 143 EUROPE: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 144 EUROPE: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 145 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 146 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 11.3.2 FRANCE

- 11.3.2.1 Increasing application of zinc supplements for high-yield crops to boost growth

- TABLE 147 FRANCE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 148 FRANCE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 149 FRANCE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 150 FRANCE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.3 GERMANY

- 11.3.3.1 Robust government initiatives to treat boron deficiencies to fuel growth

- TABLE 151 GERMANY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 152 GERMANY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 153 GERMANY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 154 GERMANY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.4 POLAND

- 11.3.4.1 Focus on increasing crop yield by depleting unfertile and acidic soils to drive growth

- TABLE 155 POLAND: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 156 POLAND: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 157 POLAND: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 158 POLAND: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.5 SPAIN

- 11.3.5.1 Shift toward organic farming and high export rate of organic food products to drive demand

- TABLE 159 SPAIN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 160 SPAIN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 161 SPAIN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 162 SPAIN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.6 UK

- 11.3.6.1 Adoption of agronomic bio-fortification process to bolster growth

- TABLE 163 UK: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 164 UK: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 165 UK: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 166 UK: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.7 ITALY

- 11.3.7.1 High dependence on inputs required for favorable climate and agronomic conditions to encourage market expansion

- TABLE 167 ITALY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 168 ITALY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 169 ITALY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 170 ITALY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.3.8 REST OF EUROPE

- TABLE 171 REST OF EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 172 REST OF EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 173 REST OF EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 174 REST OF EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 49 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 50 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 175 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 178 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 179 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 182 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 183 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 190 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Growing demand for cereal grains in China to propel market

- TABLE 191 CHINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 192 CHINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 193 CHINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 194 CHINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.3 INDIA

- 11.4.3.1 Increasing government subsidies and growing FDI in India to foster growth

- TABLE 195 INDIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 196 INDIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 197 INDIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 198 INDIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.4 AUSTRALIA

- 11.4.4.1 Rising investments in greenhouse and hydroponic systems for better crop production to fuel growth

- TABLE 199 AUSTRALIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 200 AUSTRALIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 201 AUSTRALIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 202 AUSTRALIA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.5 JAPAN

- 11.4.5.1 Increase in cultivation and breeding of efficient micronutrient genotypes to drive demand

- TABLE 203 JAPAN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 204 JAPAN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 205 JAPAN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 206 JAPAN: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.6 VIETNAM

- 11.4.6.1 Improvement in economic conditions to drive growth of agricultural micronutrients market

- TABLE 207 VIETNAM: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 208 VIETNAM: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 209 VIETNAM: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 210 VIETNAM: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 211 REST OF ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 214 REST OF ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 51 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 52 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- TABLE 215 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 216 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 217 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 218 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 219 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 220 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 221 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 222 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 223 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 224 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 225 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 226 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 227 SOUTH AMERICA: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 228 SOUTH AMERICA: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 229 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 230 SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 High demand for export of agricultural products to drive market

- TABLE 231 BRAZIL: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 232 BRAZIL: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 233 BRAZIL: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 234 BRAZIL: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.5.3 ARGENTINA

- 11.5.3.1 Wide availability of arable land along with rapidly growing technology to propel growth

- TABLE 235 ARGENTINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 236 ARGENTINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 237 ARGENTINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 238 ARGENTINA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 239 REST OF SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 240 REST OF SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 241 REST OF SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 242 REST OF SOUTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.6 REST OF THE WORLD

- 11.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 53 ROW: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 54 ROW: RECESSION IMPACT ANALYSIS, 2022

- TABLE 243 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 244 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 245 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 246 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 247 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 248 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 249 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 250 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 251 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 252 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 253 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 254 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 255 ROW: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 256 ROW: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 257 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 258 ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Growing need to increase agricultural output and raise self-sufficiency in food to drive market

- TABLE 259 SOUTH AFRICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 260 SOUTH AFRICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 261 SOUTH AFRICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 262 SOUTH AFRICA: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.6.3 TURKEY

- 11.6.3.1 Adoption of nutrient-based fertilizers to deal with iron and zinc deficiencies to boost growth

- TABLE 263 TURKEY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 264 TURKEY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 265 TURKEY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 266 TURKEY: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

- 11.6.4 OTHERS IN ROW

- TABLE 267 OTHERS IN ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 268 OTHERS IN ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 269 OTHERS IN ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 270 OTHERS IN ROW: AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2023-2028 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 271 DEGREE OF COMPETITION, 2022

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 55 SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- 12.5 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 56 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2020-2022 (USD BILLION)

- 12.6 ANNUAL REVENUE VS. REVENUE GROWTH

- FIGURE 57 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 12.7 EBITDA OF KEY PLAYERS

- FIGURE 58 EBITDA, 2022 (USD BILLION)

- 12.8 COMPANY EVALUATION MATRIX

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- FIGURE 59 COMPANY EVALUATION MATRIX, 2022

- 12.9 COMPANY FOOTPRINT

- TABLE 272 COMPANY FOOTPRINT, BY FORM

- TABLE 273 COMPANY FOOTPRINT, BY TYPE

- TABLE 274 COMPANY FOOTPRINT, BY REGION

- TABLE 275 OVERALL COMPANY FOOTPRINT

- 12.10 STARTUP/SME EVALUATION MATRIX

- 12.10.1 PROGRESSIVE COMPANIES

- 12.10.2 STARTING BLOCKS

- 12.10.3 RESPONSIVE COMPANIES

- 12.10.4 DYNAMIC COMPANIES

- FIGURE 60 STARTUP/SME EVALUATION MATRIX, 2022

- 12.10.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 276 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 277 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.11 COMPETITIVE SCENARIO

- 12.11.1 PRODUCT LAUNCHES

- TABLE 278 PRODUCT LAUNCHES, 2018-2019

- 12.11.2 DEALS

- TABLE 279 DEALS, 2018-2022

- 12.11.3 OTHERS

- TABLE 280 OTHERS, 2018-2023

13 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MnM view, Key strengths, Strategic choices made, Weaknesses and competitive threats)**

- 13.1 KEY COMPANIES

- 13.1.1 BASF SE

- TABLE 281 BASF SE: BUSINESS OVERVIEW

- FIGURE 61 BASF SE: COMPANY SNAPSHOT

- TABLE 282 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 BASF SE: DEALS

- TABLE 284 BASF SE: OTHERS

- 13.1.2 NOURYON

- TABLE 285 NOURYON: BUSINESS OVERVIEW

- TABLE 286 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 NOURYON: OTHERS

- 13.1.3 NUFARM

- TABLE 288 NUFARM: BUSINESS OVERVIEW

- FIGURE 62 NUFARM: COMPANY SNAPSHOT

- TABLE 289 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 NUFARM: DEALS

- TABLE 291 NUFARM: OTHERS

- 13.1.4 YARA INTERNATIONAL ASA

- FIGURE 63 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

- TABLE 292 YARA INTERNATIONAL ASA: BUSINESS OVERVIEW

- TABLE 293 YARA INTERNATIONAL ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 YARA INTERNATIONAL ASA: PRODUCT LAUNCHES

- TABLE 295 YARA INTERNATIONAL ASA: DEALS

- TABLE 296 YARA INTERNATIONAL ASA: OTHERS

- 13.1.5 COROMANDEL INTERNATIONAL LIMITED

- TABLE 297 COROMANDEL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- FIGURE 64 COROMANDEL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- TABLE 298 COROMANDEL INTERNATIONAL LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 299 COROMANDEL INTERNATIONAL LIMITED: DEALS

- TABLE 300 COROMANDEL INTERNATIONAL LIMITED: OTHERS

- 13.1.6 LAND O' LAKES, INC

- TABLE 301 LAND O' LAKES, INC: BUSINESS OVERVIEW

- TABLE 302 LAND O' LAKES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 LAND O' LAKES, INC: DEALS

- 13.1.7 HELENA AGRI-ENTERPRISES, LLC

- TABLE 304 HELENA AGRI-ENTERPRISES, LLC: BUSINESS OVERVIEW

- TABLE 305 HELENA AGRI-ENTERPRISES, LLC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 13.1.8 THE MOSAIC COMPANY

- TABLE 306 THE MOSAIC COMPANY: BUSINESS OVERVIEW

- FIGURE 65 THE MOSAIC COMPANY: COMPANY SNAPSHOT

- TABLE 307 THE MOSAIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 THE MOSAIC COMPANY: PRODUCT LAUNCHES

- TABLE 309 THE MOSAIC COMPANY: DEALS

- 13.1.9 HAIFA NEGEV TECHNOLOGIES LTD.

- TABLE 310 HAIFA NEGEV TECHNOLOGIES LTD.: BUSINESS OVERVIEW

- TABLE 311 HAIFA NEGEV TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 312 HAIFA NEGEV TECHNOLOGIES LTD.: PRODUCT LAUNCHES

- TABLE 313 HAIFA NEGEV TECHNOLOGIES LTD.: DEALS

- TABLE 314 HAIFA NEGEV TECHNOLOGIES LTD.: OTHERS

- 13.1.10 MANVERT

- TABLE 315 MANVERT: BUSINESS OVERVIEW

- TABLE 316 MANVERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 SYNGENTA

- TABLE 317 SYNGENTA: BUSINESS OVERVIEW

- FIGURE 66 SYNGENTA: COMPANY SNAPSHOT

- TABLE 318 SYNGENTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 SYNGENTA: DEALS

- 13.1.12 ZUARI AGROCHEMICAL LTD

- TABLE 320 ZUARI AGROCHEMICAL LTD: BUSINESS OVERVIEW

- FIGURE 67 ZUARI AGROCHEMICAL LTD: COMPANY SNAPSHOT

- TABLE 321 ZUARI AGROCHEMICAL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 STOLLER ENTERPRISES, INC.

- TABLE 322 STOLLER ENTERPRISES, INC.: BUSINESS OVERVIEW

- TABLE 323 STOLLER ENTERPRISES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 BALCHEM CORPORATION

- TABLE 324 BALCHEM CORP.: BUSINESS OVERVIEW

- FIGURE 68 BALCHEM CORP.: COMPANY SNAPSHOT

- TABLE 325 BALCHEM CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 ATP NUTRITION

- TABLE 326 ATP NUTRITION: BUSINESS OVERVIEW

- TABLE 327 ATP NUTRITION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 WILBUR-ELLIS HOLDINGS, INC.

- TABLE 328 WILBUR-ELLIS HOLDINGS, INC.: BUSINESS OVERVIEW

- TABLE 329 WILBUR-ELLIS HOLDINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 WILBUR-ELLIS HOLDINGS, INC.: DEALS

- TABLE 331 WILBUR-ELLIS HOLDINGS, INC.: OTHERS

- 13.2.2 BMS MICRO-NUTRIENTS NV

- TABLE 332 BMS MICRO-NUTRIENTS NV: BUSINESS OVERVIEW

- TABLE 333 BMS MICRO-NUTRIENTS NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.3 KOCH AGRONOMIC SERVICES, LLC

- TABLE 334 KOCH AGRONOMIC SERVICES, LLC: BUSINESS OVERVIEW

- TABLE 335 KOCH AGRONOMIC SERVICES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.4 AGROLIQUID

- TABLE 336 AGROLIQUID: BUSINESS OVERVIEW

- TABLE 337 AGROLIQUID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.5 ARIES AGRO LIMITED

- TABLE 338 ARIES AGRO LIMITED: BUSINESS OVERVIEW

- FIGURE 69 ARIES AGRO LIMITED: COMPANY SNAPSHOT

- TABLE 339 ARIES AGRO LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.6 GREEN RISE AGRO INDUSTRIES

- TABLE 340 GREEN RISE AGRO INDUSTRIES: COMPANY OVERVIEW

- 13.2.7 BLUE-DIP ORGANIC INDUSTRIES

- TABLE 341 BLUE-DIP ORGANIC INDUSTRIES: COMPANY OVERVIEW

- 13.2.8 NAPNUTRISCIENCE

- TABLE 342 NAPNUTRISCIENCE: COMPANY OVERVIEW

- 13.2.9 GITAJI PESTICIDES INDUSTRIES

- TABLE 343 GITAJI PESTICIDES INDUSTRIES: COMPANY OVERVIEW

- 13.2.10 NUTRIMAX AGRO

- TABLE 344 NUTRIMAX AGRO: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MnM view, Key strengths, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 345 ADJACENT MARKETS FOR AGRICULTURAL MICRONUTRIENTS

- 14.2 LIMITATIONS

- 14.3 AGRICULTURAL CHELATES MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 AGRICULTURAL CHELATES MARKET, BY TYPE

- 14.4.1 INTRODUCTION

- TABLE 346 AGRICULTURAL CHELATES MARKET, BY TYPE, 2017-2025 (USD MILLION)

- 14.5 AGRICULTURAL CHELATES MARKET, BY REGION

- 14.5.1 INTRODUCTION

- TABLE 347 AGRICULTURAL CHELATES MARKET, BY REGION, 2017-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS