|

|

市場調査レポート

商品コード

1342069

人工採油の世界市場:タイプ別(ESP、PCP、ロッドリフト、ガスリフト)、機構別(ポンプアシスト、ガスアシスト)、坑井タイプ別(水平、垂直)、用途別(オフショア、オンショア)、地域別-2028年までの予測Artificial Lift Market by Type (ESP, PCP, Rod Lift, Gas Lift), Mechanism (Pump Assisted (Positive Displacement, Dynamic Displacement), Gas Assisted), Well Type (Horizontal, Vertical), Application (Onshore, Offshore) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 人工採油の世界市場:タイプ別(ESP、PCP、ロッドリフト、ガスリフト)、機構別(ポンプアシスト、ガスアシスト)、坑井タイプ別(水平、垂直)、用途別(オフショア、オンショア)、地域別-2028年までの予測 |

|

出版日: 2023年08月28日

発行: MarketsandMarkets

ページ情報: 英文 261 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の人工採油の市場規模は、2023年の73億米ドルから2028年には90億米ドルに成長すると予測されており、予測期間中のCAGRは4.4%になると見込まれています。

この成長は、石油・ガス産業における上流活動の増加、重油の採掘やシェールガス生産の増加といった要因によるものです。世界の石油需要の増加は、坑井性能を最適化するための人工採油などの炭化水素生産・回収方法の強化の必要性を促し、人工採油市場の成長をもたらしています。

ロッドリフトシステムは、石油を抽出するために広く使用されている技術であるため、予測期間中に最大のセグメントになると予想されています。このセグメントの成長は、費用対効果、様々な坑井条件に対応する能力、炭化水素抽出の効率性など、いくつかの利点があるためと考えられています。このセグメントの大きな市場シェアは、北米や中東・アフリカ地域におけるシェール開発や成熟坑井の再開発にも起因しています。

予測期間中、オフショアセグメントが最大の市場シェアを占めると予測されています。北米ではオフショア石油・ガス産業が進化を続けており、その結果、油井・ガス井からの生産量を増加させるために作業効率を向上させる需要が高まっています。さらに、オフショアでのシェール活動や成熟油田での石油増進回収作業の増加が、人工採油手法の需要増につながっています。

ガスアシストセグメントは、予測期間中、人工採油市場で2番目に大きなセグメントになると予想されています。ガスアシスト人工採油システムには、ガスリフトとプランジャーリフトシステムが含まれます。ガスリフトは、注入されたガスが重い炭化水素を浮上させるのに役立つため、ガス対オイル比の高い坑井を支援することができます。したがって、このメカニズムが予測期間中の人工採油市場を牽引すると予想されます。

垂直セグメントは予測期間中、人工採油市場の最大セグメントとなる見込みです。垂直坑井掘削は、石油・ガス抽出の従来の方法と考えられています。垂直坑井は、石油・天然ガスの埋蔵量の真下にのみアクセスできるため、炭化水素を効果的に抽出するための大規模な油田を生産的にすることができます。現在、ほとんどの垂直井戸は成熟しており、これらは最大の回収のための人工採油操作の需要を生み出しています。

当レポートでは、世界の人工採油市場について調査し、タイプ別、機構別、坑井タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 生態系マッピング

- 技術分析

- 2023年~2024年の主要な会議とイベント

- 特許分析

- 規制の枠組み

- 価格分析

- ケーススタディ分析

- 貿易分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 人工採油市場、タイプ別

- イントロダクション

- ロッドリフトシステム

- 電動水中ポンプ

- ガスリフトシステム

- プログレッシブキャビティポンプ

- その他

第7章 人工採油市場、機構別

- イントロダクション

- ポンプアシスト

- ガスアシスト

第8章 人工採油市場、坑井タイプ別

- イントロダクション

- 水平

- 垂直

第9章 人工採油市場、用途別

- イントロダクション

- オフショア

- オンショア

第10章 人工採油市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第11章 競合情勢

- 主要参入企業が採用した戦略

- 市場シェア分析、2022年

- 市場評価フレームワーク、2019年~2023年

- 収益分析、2018~2022年

- 主要企業評価マトリックス、2022年

- 企業のフットプリント

- スタートアップ/中小企業(SMES)の評価マトリックス、2022年

- 競合ベンチマーキング

- 競争シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- SLB

- HALLIBURTON

- BAKER HUGHES COMPANY

- WEATHERFORD

- CHAMPIONX

- NOV INC.

- TENARIS

- DISTRIBUTIONNOW

- LEVARE

- OILSERV

- NOVOMET

- JJ TECH

- RIMERA GROUP

- LUFKIN

- ALKHORAYEF PETROLEUM

- その他の企業

- NATIONAL ENERGY SERVICES REUNITED CORP.

- CAIRN OIL & GAS

- PENGUIN PETROLEUM SERVICES(P)LIMITED

- ENDURANCE LIFT SOLUTIONS

- VALIANT ARTIFICIAL LIFT SOLUTIONS

第13章 付録

The global artificial lift market is estimated to grow from USD 7.3 Billion in 2023 to USD 9.0 Billion by 2028; it is expected to record a CAGR of 4.4% during the forecast period. The growth is attributed to the factors such as increased upstream activities in the oil & gas industry and increased extraction of heavy oil and shale gas production. Growing oil demand globally has driven the need for enhanced hydrocarbon production and recovery methods such as artificial lift to optimize well performance, resulting in the growth of artificial lift market.

"Rod Lift Systems: The largest segment of the artificial lift market, by type "

Based on type, the artificial lift market has been split into five types: rod lift systems, electric submersible pumps, progressive cavity pumps, gas lift systems, and others. The rod lift systems segment is expected to be the largest segment during the forecast period as it is a widely used technology for extracting oil. The growth of this segment Is attributed due to several advantages it offers, such as cost-effectiveness, the ability to handle various well conditions, and efficiency in extracting hydrocarbons. The large market share of this segment can also be attributed to the shale developments and redevelopment of mature wells in North America and the Middle East & African regions.

"Onshore segment is expected to be the largest segment during the forecast period based on application."

By application, the artificial lift market has been segmented into onshore and offshore. The onshore segment is expected to hold the largest market share during the forecast period. The onshore oil & gas industry continues to evolve in North America, and this has resulted in a higher demand for improved operational efficiency to increase production from oil & gas wells. In addition, an increase in onshore shale activities and enhanced oil recovery operations in mature oilfields led to a rise in the demand for artificial lift methods.

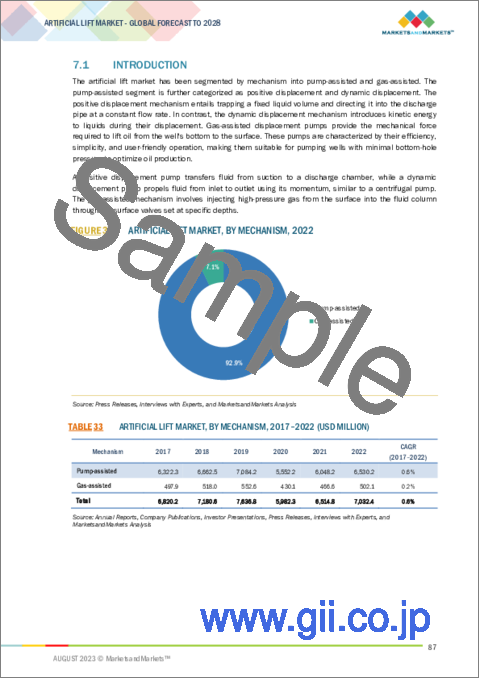

"By mechanism, the gas-assisted segment is expected to be the second-largest segment during the forecast period."

Based on the mechanism, the artificial lift market is segmented into pump-assisted and gas assisted. The gas-assisted segment is expected to be the second-largest segment of the artificial lift market during the forecast period. Gas-assisted artificial lift systems include gas lift and plunger lift systems. A gas lift can assist wells with high gas-to-oil ratios because the injected gas helps lift the heavier hydrocarbons to the surface. Hence, this mechanism is expected to drive the artificial lift market during the forecast period.

"Vertical: The largest segment during the forecast period based on well type."

Based on well type, the artificial lift market is segmented into vertical and horizontal. The vertical segment is expected to be the largest segment of the artificial lift market during the forecast period. Vertical well drilling is considered a conventional method of oil & gas extraction. Vertical wells can only access oil and natural gas reserves directly below, thus making large fields productive for the effective extraction of hydrocarbons. Currently, most of the vertical wells are mature, and these create a demand for artificial lift operations for maximum recovery.

"North America is expected to be the largest region in the artificial lift market."

North America is expected to be the largest region in the artificial lift market during the forecast period. Growth is attributed to the rapid increase in upstream and downstream activities and a highly optimistic outlook for the oil & gas industry in the region. Further, according to Energy Information Administration (EIA), the share of horizontal wells rose from 5.4% in 2011 to 18.1% in 2021. This shift from predominantly vertical wells to a higher percentage of horizontal wells has been driven by fracking activities and horizontal drilling operations, which might pose various challenges. Hence, artificial lift systems such as ESPs and PCPs could be more suitable for addressing the challenges and driving the artificial lift market in North America. In addition, the growth in unconventional reserves such as tight oil and shale gas is primarily driving the demand for artificial lift solutions in the US and Canada.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 35%, Europe- 25%, Asia Pacific- 15%, South America- 10%, Middle East & Africa- 15%,

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The artificial lift market is dominated by a few major players that have a wide regional presence. The leading players in the artificial lift market are SLB (US), Baker Hughes Company (US), Halliburton (US), Weatherford (US), and ChampionX (US). The major strategy adopted by the players includes new product launches, contracts & agreements, partnerships, mergers and acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global artificial lift market by type, mechanism, application, well type, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the artificial lift market.

Key Benefits of Buying the Report

- Advancements in upstream activities pertaining to the unconventional oil & gas reserves and growing requirements to maximize production from the mature fields are a few of the key factors driving the artificial lift market. Factors such as a decline in capital expenditures by oilfield operators and service providers restrain the growth of the market. New oilfield discoveries and the adoption of digitization and automation to better analyze the good conditions are expected to present lucrative opportunities for the players operating in the artificial lift market. The transition towards the adoption of renewable energy sources poses a major challenge for the players, especially for emerging players operating in the artificial lift market.

- Product Development/ Innovation: The artificial lift market is witnessing significant product development and innovation, driven by the growing demand for artificial lift systems in the oil & gas industries. Companies are investing in developing advanced artificial lift technologies such as electric submersible pumps, progressive cavity pumps, hydraulic lifts, and plunger lifts.

- Market Development: Baker Hughes Company acquired AccessESP, one of the leading technological solutions providers for ESP systems. This acquisition broadened the artificial lift portfolio of Baker Hughes Company and improved its position globally.

- Market Diversification: Unbridled ESP Systems, a subsidiary of ChampionX, introduced the HIGH RISE series pumps for minimizing carbon emissions during ESP operations. This product is used in unconventional well-completion operations.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include SLB (US), Baker Hughes Company (US), Halliburton (US), Weatherford (US), and ChampionX (US), among others in the artificial lift market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ARTIFICIAL LIFT MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ARTIFICIAL LIFT MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARIES

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 5 ARTIFICIAL LIFT MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 ARTIFICIAL LIFT MARKET: TOP-DOWN APPROACH

- 2.4 DEMAND-SIDE ANALYSIS

- 2.4.1 KEY INFLUENCING FACTORS/DRIVERS

- 2.4.1.1 Well count

- 2.4.1.2 Rig count

- FIGURE 7 CRUDE OIL PRICE VS. RIG COUNT

- 2.4.1.3 Production

- FIGURE 8 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION

- 2.4.1.4 Crude oil price

- FIGURE 9 CRUDE OIL PRICE TREND

- 2.4.2 DEMAND-SIDE METRICS

- FIGURE 10 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR ARTIFICIAL LIFT SYSTEMS

- 2.4.2.1 Assumptions for demand-side analysis

- 2.4.1 KEY INFLUENCING FACTORS/DRIVERS

- 2.5 SUPPLY-SIDE ANALYSIS

- FIGURE 11 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF ARTIFICIAL LIFT SOLUTIONS

- FIGURE 12 ARTIFICIAL LIFT MARKET: SUPPLY-SIDE ANALYSIS

- 2.5.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5.2 ASSUMPTIONS FOR SUPPLY-SIDE ANALYSIS

- 2.6 GROWTH FORECAST

- 2.6.1 RECESSION IMPACT

3 EXECUTIVE SUMMARY

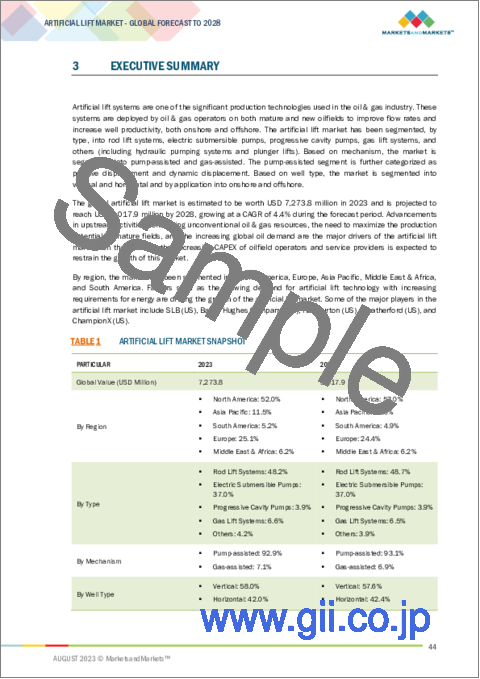

- TABLE 1 ARTIFICIAL LIFT MARKET SNAPSHOT

- FIGURE 13 ROD LIFT SYSTEMS SEGMENT TO HOLD LARGEST SHARE OF ARTIFICIAL LIFT MARKET, BY TYPE, IN 2028

- FIGURE 14 PUMP-ASSISTED SEGMENT DOMINATED ARTIFICIAL LIFT MARKET, BY MECHANISM, IN 2023

- FIGURE 15 VERTICAL SEGMENT TO LEAD ARTIFICIAL LIFT MARKET, BY WELL TYPE, IN 2028

- FIGURE 16 ONSHORE SEGMENT HELD LARGER SHARE OF ARTIFICIAL LIFT MARKET, BY APPLICATION, IN 2023

- FIGURE 17 NORTH AMERICA DOMINATED ARTIFICIAL LIFT MARKET, BY REGION, IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ARTIFICIAL LIFT MARKET

- FIGURE 18 RISING EXPLORATION AND PRODUCTION OF UNCONVENTIONAL OIL & GAS RESOURCES TO DRIVE ARTIFICIAL LIFT MARKET FROM 2023 TO 2028

- 4.2 ARTIFICIAL LIFT MARKET, BY REGION

- FIGURE 19 NORTH AMERICA TO REGISTER HIGHEST CAGR IN ARTIFICIAL LIFT MARKET DURING FORECAST PERIOD

- 4.3 ARTIFICIAL LIFT MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

- FIGURE 20 ONSHORE SEGMENT AND US HELD LARGEST SHARES OF ARTIFICIAL LIFT MARKET IN NORTH AMERICA IN 2022

- 4.4 ARTIFICIAL LIFT MARKET, BY TYPE

- FIGURE 21 ROD LIFT SYSTEMS HELD LARGEST SHARE OF ARTIFICIAL LIFT MARKET IN 2022

- 4.5 ARTIFICIAL LIFT MARKET, BY APPLICATION

- FIGURE 22 ONSHORE APPLICATIONS CAPTURED MAJOR MARKET SHARE IN 2022

- 4.6 ARTIFICIAL LIFT MARKET, BY WELL TYPE

- FIGURE 23 VERTICAL SEGMENT ACCOUNTED FOR LARGER SHARE OF ARTIFICIAL LIFT MARKET IN 2022

- 4.7 ARTIFICIAL LIFT MARKET, BY MECHANISM

- FIGURE 24 PUMP-ASSISTED SEGMENT DOMINATED ARTIFICIAL LIFT MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 ARTIFICIAL LIFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in upstream activities concerning unconventional oil & gas reserves

- 5.2.1.2 Growing requirement to maximize production potential of mature fields

- 5.2.1.3 Increase in global oil demand

- FIGURE 26 GLOBAL OIL DEMAND, 2019-2028

- TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2021-2028

- 5.2.1.4 Rise in heavy oil production

- 5.2.2 RESTRAINTS

- 5.2.2.1 Decreasing CapEX of oilfield operators and upstream service providers

- FIGURE 27 CAPITAL EXPENDITURE OF OILFIELD OPERATORS, 2017-2022

- FIGURE 28 CAPITAL EXPENDITURE OF OIL & GAS SERVICE PROVIDERS, 2017-2022

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New oilfield discoveries to promote upstream activities

- 5.2.3.2 Digitalization and automation to better analyze well conditions

- 5.2.4 CHALLENGES

- 5.2.4.1 Transition toward renewable energy sources

- FIGURE 29 RENEWABLE CAPACITY ADDITIONS, BY COUNTRY/REGION, 2019-2022

- 5.2.4.2 Application of artificial lift methods in horizontal wells

- TABLE 3 HORIZONTAL WELL: ARTIFICIAL LIFT METHODS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR ARTIFICIAL LIFT PROVIDERS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 31 ARTIFICIAL LIFT MARKET: SUPPLY CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 ARTIFICIAL LIFT EQUIPMENT MANUFACTURERS

- 5.4.3 ARTIFICIAL LIFT SERVICE PROVIDERS

- 5.4.4 OILFIELD OPERATORS

- TABLE 4 PARTICIPANTS AND THEIR ROLE IN ARTIFICIAL LIFT ECOSYSTEM

- 5.5 ECOSYSTEM MAPPING

- FIGURE 32 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 5 ARTIFICIAL LIFT MARKET: LIST OF CONFERENCES AND EVENTS

- 5.8 PATENT ANALYSIS

- TABLE 6 ARTIFICIAL LIFT: INNOVATIONS AND PATENT REGISTRATIONS, 2018-2023

- 5.9 REGULATORY FRAMEWORK

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 STANDARDS AND REGULATIONS

- TABLE 12 ARTIFICIAL LIFT MARKET: STANDARDS AND REGULATIONS

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS, BY TYPE

- TABLE 13 INDICATIVE PRICING ANALYSIS, BY TYPE, 2022 (USD)

- 5.10.2 AVERAGE PRICING ANALYSIS, BY REGION

- TABLE 14 AVERAGE PRICING ANALYSIS, BY REGION, 2022 (USD)

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NOVOMET'S IMPACTFUL PERFORATION SOLUTION REDUCED POWER CONSUMPTION FOR ECUADOR-BASED OIL & GAS PRODUCER

- 5.11.1.1 Problem statement

- 5.11.1.2 Solution

- 5.11.1 NOVOMET'S IMPACTFUL PERFORATION SOLUTION REDUCED POWER CONSUMPTION FOR ECUADOR-BASED OIL & GAS PRODUCER

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO

- TABLE 15 EXPORT SCENARIO FOR HS CODE 841360, BY COUNTRY, 2020-2022 (USD)

- FIGURE 33 EXPORT DATA FOR HS CODE 841360 OF TOP FIVE COUNTRIES, 2020-2022 (USD)

- 5.12.2 IMPORT SCENARIO

- TABLE 16 IMPORT SCENARIO FOR HS CODE 841360, BY COUNTRY, 2020-2022 (USD)

- FIGURE 34 IMPORT DATA FOR HS CODE 841360 OF TOP FIVE COUNTRIES, 2020-2022 (USD)

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 ARTIFICIAL LIFT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 ARTIFICIAL LIFT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR ARTIFICIAL LIFT TYPES

- TABLE 19 KEY BUYING CRITERIA FOR ARTIFICIAL LIFT TYPES

6 ARTIFICIAL LIFT MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 20 COMPARISON OF ARTIFICIAL LIFT METHODS

- FIGURE 38 ARTIFICIAL LIFT MARKET, BY TYPE, 2022

- TABLE 21 ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 22 ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 ROD LIFT SYSTEMS

- 6.2.1 ABILITY TO HARNESS SUBSURFACE POWER FOR OIL DRILLING TO DRIVE MARKET

- TABLE 23 ROD LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 24 ROD LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 ELECTRICAL SUBMERSIBLE PUMPS

- 6.3.1 EFFICIENT DESIGN AND OPERATIONAL CHARACTERISTICS TO SUPPORT MARKET GROWTH

- TABLE 25 ELECTRICAL SUBMERSIBLE PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 ELECTRICAL SUBMERSIBLE PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 GAS LIFT SYSTEMS

- 6.4.1 LOW OPERATING COSTS TO BOOST MARKET

- TABLE 27 GAS LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 GAS LIFT SYSTEMS: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 PROGRESSIVE CAVITY PUMPS

- 6.5.1 BENEFITS OF DEPLOYMENT IN RECOVERY PROCESSES TO PROPEL MARKET

- TABLE 29 PROGRESSIVE CAVITY PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 PROGRESSIVE CAVITY PUMPS: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 OTHERS

- TABLE 31 OTHERS: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 OTHERS: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 ARTIFICIAL LIFT MARKET, BY MECHANISM

- 7.1 INTRODUCTION

- FIGURE 39 ARTIFICIAL LIFT MARKET, BY MECHANISM, 2022

- TABLE 33 ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017-2022 (USD MILLION)

- TABLE 34 ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023-2028 (USD MILLION)

- 7.2 PUMP-ASSISTED

- TABLE 35 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 36 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 PUMP-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 POSITIVE DISPLACEMENT

- 7.2.1.1 Capability to reduce liquid-producing gas wells to their lowest abandonment pressure to drive market

- TABLE 39 POSITIVE DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 POSITIVE DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 DYNAMIC DISPLACEMENT

- 7.2.2.1 Deployment in multistage drilling operations to support market growth

- TABLE 41 DYNAMIC DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 DYNAMIC DISPLACEMENT: ARTIFICIAL LIFT MARKET FOR PUMP-ASSISTED MECHANISM, BY REGION, 2023-2028 (USD MILLION)

- 7.3 GAS-ASSISTED

- 7.3.1 USE IN VERTICAL GAS WELLS WITH MINIMUM MAINTENANCE TO FUEL MARKET

- TABLE 43 GAS-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 GAS-ASSISTED: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

8 ARTIFICIAL LIFT MARKET, BY WELL TYPE

- 8.1 INTRODUCTION

- FIGURE 40 ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2022

- TABLE 45 ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017-2022 (USD MILLION)

- TABLE 46 ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023-2028 (USD MILLION)

- 8.2 HORIZONTAL

- 8.2.1 INCREASED OIL FIELD PRODUCTION AND ABILITY TO ACCESS SUBSURFACE RESERVOIRS TO BOOST SEGMENT

- TABLE 47 HORIZONTAL: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 HORIZONTAL: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 VERTICAL

- 8.3.1 COST-EFFECTIVE EXTRACTION OF HYDROCARBONS TO DRIVE SEGMENT

- TABLE 49 VERTICAL: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 VERTICAL: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

9 ARTIFICIAL LIFT MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 41 ARTIFICIAL LIFT MARKET, BY APPLICATION, 2022

- TABLE 51 ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 52 ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 ONSHORE

- 9.2.1 REDEVELOPMENT OF MATURE ONSHORE OILFIELDS AND GROWING SHALE ACTIVITIES TO DRIVE MARKET

- TABLE 53 ONSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 ONSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 OFFSHORE

- 9.3.1 MATURING SHALLOW OILFIELDS TO PROPEL OFFSHORE ARTIFICIAL LIFT MARKET

- TABLE 55 OFFSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 OFFSHORE: ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

10 ARTIFICIAL LIFT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 ARTIFICIAL LIFT MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 43 ARTIFICIAL LIFT MARKET, BY REGION, 2022

- TABLE 57 ARTIFICIAL LIFT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 ARTIFICIAL LIFT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: ARTIFICIAL LIFT MARKET SNAPSHOT, 2022

- 10.2.1 IMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN NORTH AMERICA

- 10.2.2 BY TYPE

- TABLE 59 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.3 BY MECHANISM

- TABLE 61 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023-2028 (USD MILLION)

- 10.2.3.1 By pump-assisted mechanism

- TABLE 63 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023-2028 (USD MILLION)

- 10.2.4 BY WELL TYPE

- TABLE 65 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023-2028 (USD MILLION)

- 10.2.5 BY APPLICATION

- TABLE 67 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.6 BY COUNTRY

- TABLE 69 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.6.1 US

- 10.2.6.1.1 Rising exploration and production of shale and tight oil reserves to propel market

- 10.2.6.1.2 By type

- 10.2.6.1 US

- TABLE 71 US: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 72 US: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.6.1.3 By application

- TABLE 73 US: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 74 US: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.6.2 Canada

- 10.2.6.2.1 Investments in upstream activities majorly contribute to market growth

- 10.2.6.2.2 By type

- 10.2.6.2 Canada

- TABLE 75 CANADA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 76 CANADA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.6.2.3 By application

- TABLE 77 CANADA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 78 CANADA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.6.3 Mexico

- 10.2.6.3.1 Redevelopment of mature fields creating need for enhanced recovery method to drive market

- 10.2.6.3.2 By type

- 10.2.6.3 Mexico

- TABLE 79 MEXICO: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 80 MEXICO: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.6.3.3 By application

- TABLE 81 MEXICO: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 82 MEXICO: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- FIGURE 45 EUROPE: ARTIFICIAL LIFT MARKET SNAPSHOT, 2022

- 10.3.1 IMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN EUROPE

- 10.3.2 BY TYPE

- TABLE 83 EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 84 EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.3 BY MECHANISM

- TABLE 85 EUROPE: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017-2022 (USD MILLION)

- TABLE 86 EUROPE: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023-2028 (USD MILLION)

- 10.3.3.1 By pump-assisted mechanism

- TABLE 87 EUROPE: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017-2022 (USD MILLION)

- TABLE 88 EUROPE: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023-2028 (USD MILLION)

- 10.3.4 BY WELL TYPE

- TABLE 89 EUROPE: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017-2022 (USD MILLION)

- TABLE 90 EUROPE: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023-2028 (USD MILLION)

- 10.3.5 BY APPLICATION

- TABLE 91 EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 92 EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6 BY COUNTRY

- TABLE 93 EUROPE: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 94 EUROPE: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.6.1 Russia

- 10.3.6.1.1 Investments in Russian Arctic offshore and low-permeability reservoirs to boost market

- 10.3.6.1.2 By type

- 10.3.6.1 Russia

- TABLE 95 RUSSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 96 RUSSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.6.1.3 By application

- TABLE 97 RUSSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 98 RUSSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6.2 UK

- 10.3.6.2.1 Redevelopment of brownfields to drive market

- 10.3.6.2.2 By type

- 10.3.6.2 UK

- TABLE 99 UK: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 100 UK: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.6.2.3 By application

- TABLE 101 UK: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 102 UK: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6.3 Norway

- 10.3.6.3.1 Rising offshore exploration and production in Norwegian Continental Shelf to support market growth

- 10.3.6.3.2 By type

- 10.3.6.3 Norway

- TABLE 103 NORWAY: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 104 NORWAY: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.6.3.3 By application

- TABLE 105 NORWAY: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 106 NORWAY: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.6.4 Rest of Europe

- 10.3.6.4.1 By type

- 10.3.6.4 Rest of Europe

- TABLE 107 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.6.4.2 By application

- TABLE 109 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 IMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN ASIA PACIFIC

- 10.4.2 BY TYPE

- TABLE 111 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.3 BY MECHANISM

- TABLE 113 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023-2028 (USD MILLION)

- 10.4.3.1 By pump-assisted mechanism

- TABLE 115 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023-2028 (USD MILLION)

- 10.4.4 BY WELL TYPE

- TABLE 117 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023-2028 (USD MILLION)

- 10.4.5 BY APPLICATION

- TABLE 119 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6 BY COUNTRY

- TABLE 121 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.6.1 China

- 10.4.6.1.1 Exploration and production activities in onshore and offshore fields to fuel market growth

- 10.4.6.1.2 By type

- 10.4.6.1 China

- TABLE 123 CHINA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 124 CHINA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6.1.3 By application

- TABLE 125 CHINA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 126 CHINA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6.2 Malaysia

- 10.4.6.2.1 Rising deepwater explorations and increasing oil & gas production from existing fields to drive market

- 10.4.6.2.2 By type

- 10.4.6.2 Malaysia

- TABLE 127 MALAYSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 128 MALAYSIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6.2.3 By application

- TABLE 129 MALAYSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 130 MALAYSIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6.3 India

- 10.4.6.3.1 Increasing demand for energy and advent of new technologies for exploration and production to supplement market growth

- 10.4.6.3.2 By type

- 10.4.6.3 India

- TABLE 131 INDIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 132 INDIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6.3.3 By application

- TABLE 133 INDIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 134 INDIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6.4 Indonesia

- 10.4.6.4.1 Upstream investments and enhanced oil recovery applications to boost market

- 10.4.6.4.2 By type

- 10.4.6.4 Indonesia

- TABLE 135 INDONESIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 136 INDONESIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6.4.3 By application

- TABLE 137 INDONESIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 138 INDONESIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6.5 Rest of Asia Pacific

- 10.4.6.5.1 By type

- 10.4.6.5 Rest of Asia Pacific

- TABLE 139 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6.5.2 By application

- TABLE 141 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 IMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN MIDDLE EAST & AFRICA

- 10.5.2 BY TYPE

- TABLE 143 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.3 BY MECHANISM

- TABLE 145 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017-2022 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023-2028 (USD MILLION)

- 10.5.3.1 By pump-assisted mechanism

- TABLE 147 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017-2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023-2028 (USD MILLION)

- 10.5.4 BY WELL TYPE

- TABLE 149 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017-2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023-2028 (USD MILLION)

- 10.5.5 BY APPLICATION

- TABLE 151 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6 BY COUNTRY

- TABLE 153 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.6.1 UAE

- 10.5.6.1.1 Employment of artificial lift techniques at existing oilfields to offer lucrative opportunities for market players

- 10.5.6.1.2 By type

- 10.5.6.1 UAE

- TABLE 155 UAE: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 156 UAE: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.1.3 By application

- TABLE 157 UAE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 158 UAE: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6.2 Kuwait

- 10.5.6.2.1 Implementation of EOR techniques and investments in development of oilfields to boost market

- 10.5.6.2.2 By type

- 10.5.6.2 Kuwait

- TABLE 159 KUWAIT: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 160 KUWAIT: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.2.3 By application

- TABLE 161 KUWAIT: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 162 KUWAIT: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6.3 Saudi Arabia

- 10.5.6.3.1 Expanding oil & gas industry to contribute to market growth

- 10.5.6.3.2 By type

- 10.5.6.3 Saudi Arabia

- TABLE 163 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 164 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.3.3 By application

- TABLE 165 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 166 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6.4 Angola

- 10.5.6.4.1 Rising production from offshore fields to drive market

- 10.5.6.4.2 By type

- 10.5.6.4 Angola

- TABLE 167 ANGOLA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 168 ANGOLA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.4.3 By application

- TABLE 169 ANGOLA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 170 ANGOLA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6.5 Oman

- 10.5.6.5.1 New oilfield discoveries to fuel market growth

- 10.5.6.5.2 By type

- 10.5.6.5 Oman

- TABLE 171 OMAN: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 172 OMAN: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.5.3 By application

- TABLE 173 OMAN: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 174 OMAN: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6.6 Nigeria

- 10.5.6.6.1 Development of mature oil & gas fields and increasing exploration & production activities in deep and ultra-deepwater to boost market

- 10.5.6.6.2 By type

- 10.5.6.6 Nigeria

- TABLE 175 NIGERIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 176 NIGERIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.6.3 By application

- TABLE 177 NIGERIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 178 NIGERIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6.7 Rest of Middle East & Africa

- 10.5.6.7.1 By type

- 10.5.6.7 Rest of Middle East & Africa

- TABLE 179 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6.7.2 By application

- TABLE 181 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 IMPACT OF RECESSION ON ARTIFICIAL LIFT MARKET IN SOUTH AMERICA

- 10.6.2 BY TYPE

- TABLE 183 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.3 BY MECHANISM

- TABLE 185 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2017-2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY MECHANISM, 2023-2028 (USD MILLION)

- 10.6.3.1 By pump-assisted mechanism

- TABLE 187 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2017-2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY PUMP-ASSISTED MECHANISM, 2023-2028 (USD MILLION)

- 10.6.4 BY WELL TYPE

- TABLE 189 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2017-2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY WELL TYPE, 2023-2028 (USD MILLION)

- 10.6.5 BY APPLICATION

- TABLE 191 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 192 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.6 BY COUNTRY

- TABLE 193 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.6.1 Venezuela

- 10.6.6.1.1 Presence of favorable government policies to attract foreign investments to boost market

- 10.6.6.1.2 By type

- 10.6.6.1 Venezuela

- TABLE 195 VENEZUELA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 196 VENEZUELA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.6.1.3 By application

- TABLE 197 VENEZUELA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 198 VENEZUELA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.6.2 Brazil

- 10.6.6.2.1 Increasing offshore exploration and production activities to propel market

- 10.6.6.2.2 By type

- 10.6.6.2 Brazil

- TABLE 199 BRAZIL: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 200 BRAZIL: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.6.2.3 By application

- TABLE 201 BRAZIL: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 202 BRAZIL: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.6.3 Colombia

- 10.6.6.3.1 Deployment of advanced production technologies owing to favorable regulatory reforms to drive market

- 10.6.6.3.2 By type

- 10.6.6.3 Colombia

- TABLE 203 COLOMBIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 204 COLOMBIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.6.3.3 By application

- TABLE 205 COLOMBIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 206 COLOMBIA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.6.4 Ecuador

- 10.6.6.4.1 Proper well completion to drive demand for artificial lift

- 10.6.6.4.2 By type

- 10.6.6.4 Ecuador

- TABLE 207 ECUADOR: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 208 ECUADOR: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.6.4.3 By application

- TABLE 209 ECUADOR: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 210 ECUADOR: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.6.5 Rest of South America

- 10.6.6.5.1 By type

- 10.6.6.5 Rest of South America

- TABLE 211 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.6.5.2 By application

- TABLE 213 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 215 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ARTIFICIAL LIFT MARKET

- 11.2 MARKET SHARE ANALYSIS, 2022

- TABLE 216 ARTIFICIAL LIFT MARKET: DEGREE OF COMPETITION

- FIGURE 46 ARTIFICIAL LIFT MARKET SHARE ANALYSIS, 2022

- 11.3 MARKET EVALUATION FRAMEWORK, 2019-2023

- TABLE 217 MARKET EVALUATION FRAMEWORK, 2019-2023

- 11.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS

- 11.5 KEY COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 48 ARTIFICIAL LIFT MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- 11.6 COMPANY FOOTPRINT

- TABLE 218 TYPE: COMPANY FOOTPRINT

- TABLE 219 MECHANISM: COMPANY FOOTPRINT

- TABLE 220 APPLICATION: COMPANY FOOTPRINT

- TABLE 221 WELL TYPE: COMPANY FOOTPRINT

- TABLE 222 REGION: COMPANY FOOTPRINT

- 11.7 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 49 ARTIFICIAL LIFT MARKET: START-UPS /SMES EVALUATION MATRIX, 2022

- 11.8 COMPETITIVE BENCHMARKING

- TABLE 223 ARTIFICIAL LIFT MARKET: LIST OF KEY START-UPS/SMES

- TABLE 224 TYPE: START-UPS/SMES FOOTPRINT

- TABLE 225 MECHANISM: START-UPS/SMES FOOTPRINT

- TABLE 226 APPLICATION: START-UPS/SMES FOOTPRINT

- TABLE 227 WELL TYPE: START-UPS/SMES FOOTPRINT

- TABLE 228 REGION: START-UPS/SMES FOOTPRINT

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 229 ARTIFICIAL LIFT MARKET: PRODUCT LAUNCHES, 2019-2023

- 11.9.2 DEALS

- TABLE 230 ARTIFICIAL LIFT MARKET: DEALS, 2019-2023

- 11.9.3 OTHERS

- TABLE 231 ARTIFICIAL LIFT MARKET: OTHERS, 2019-2023

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 SLB

- TABLE 232 SLB: COMPANY OVERVIEW

- FIGURE 50 SLB: COMPANY SNAPSHOT

- TABLE 233 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 234 SLB: DEALS

- TABLE 235 SLB: OTHERS

- 12.1.2 HALLIBURTON

- TABLE 236 HALLIBURTON: COMPANY OVERVIEW

- FIGURE 51 HALLIBURTON: COMPANY SNAPSHOT

- TABLE 237 HALLIBURTON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 238 HALLIBURTON: DEALS

- TABLE 239 HALLIBURTON: OTHERS

- 12.1.3 BAKER HUGHES COMPANY

- TABLE 240 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- FIGURE 52 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- TABLE 241 BAKER HUGHES COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 242 BAKER HUGHES COMPANY: DEALS

- TABLE 243 BAKER HUGHES COMPANY: OTHERS

- 12.1.4 WEATHERFORD

- TABLE 244 WEATHERFORD: COMPANY OVERVIEW

- FIGURE 53 WEATHERFORD: COMPANY SNAPSHOT

- TABLE 245 WEATHERFORD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 246 WEATHERFORD: PRODUCT LAUNCHES

- TABLE 247 WEATHERFORD: DEALS

- 12.1.5 CHAMPIONX

- TABLE 248 CHAMPIONX: COMPANY OVERVIEW

- FIGURE 54 CHAMPIONX: COMPANY SNAPSHOT

- TABLE 249 CHAMPIONX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 250 CHAMPIONX: PRODUCT LAUNCHES

- TABLE 251 CHAMPIONX: DEALS

- 12.1.6 NOV INC.

- TABLE 252 NOV INC.: COMPANY OVERVIEW

- FIGURE 55 NOV INC.: COMPANY SNAPSHOT

- TABLE 253 NOV INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 NOV INC.: PRODUCT LAUNCHES

- 12.1.7 TENARIS

- TABLE 255 TENARIS: COMPANY OVERVIEW

- FIGURE 56 TENARIS: COMPANY SNAPSHOT

- TABLE 256 TENARIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 257 TENARIS: PRODUCT LAUNCHES

- TABLE 258 TENARIS: DEALS

- TABLE 259 TENARIS: OTHERS

- 12.1.8 DISTRIBUTIONNOW

- TABLE 260 DISTRIBUTIONNOW: COMPANY OVERVIEW

- FIGURE 57 DISTRIBUTIONNOW: COMPANY SNAPSHOT

- TABLE 261 DISTRIBUTIONNOW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 262 DISTRIBUTIONNOW: DEALS

- 12.1.9 LEVARE

- TABLE 263 LEVARE: COMPANY OVERVIEW

- TABLE 264 LEVARE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 265 LEVARE: DEALS

- 12.1.10 OILSERV

- TABLE 266 OILSERV: COMPANY OVERVIEW

- TABLE 267 OILSERV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.11 NOVOMET

- TABLE 268 NOVOMET: COMPANY OVERVIEW

- TABLE 269 NOVOMET: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 270 NOVOMET: DEALS

- 12.1.12 JJ TECH

- TABLE 271 JJ TECH: COMPANY OVERVIEW

- TABLE 272 JJ TECH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.13 RIMERA GROUP

- TABLE 273 RIMERA GROUP: COMPANY OVERVIEW

- TABLE 274 RIMERA GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 RIMERA GROUP: PRODUCT LAUNCHES

- TABLE 276 RIMERA GROUP: DEALS

- 12.1.14 LUFKIN

- TABLE 277 LUFKIN: COMPANY OVERVIEW

- TABLE 278 LUFKIN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 279 LUFKIN: DEALS

- TABLE 280 LUFKIN: OTHERS

- 12.1.15 ALKHORAYEF PETROLEUM

- TABLE 281 ALKHORAYEF PETROLEUM: COMPANY OVERVIEW

- TABLE 282 ALKHORAYEF PETROLEUM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 NATIONAL ENERGY SERVICES REUNITED CORP.

- 12.2.2 CAIRN OIL & GAS

- 12.2.3 PENGUIN PETROLEUM SERVICES (P) LIMITED

- 12.2.4 ENDURANCE LIFT SOLUTIONS

- 12.2.5 VALIANT ARTIFICIAL LIFT SOLUTIONS

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS