|

|

市場調査レポート

商品コード

1812634

マイクログリッドの世界市場:発電機、エネルギー貯蔵システム、コントローラー、グリッド接続、オフグリッド、太陽光発電、燃料電池、熱電併給(CHP)、天然ガス、遠隔地、電力企業、軍事施設 - 予測(~2030年)Microgrid Market by Power Generator, Energy Storage System, Controller, Grid-connected, Off-grid, Solar PV, Fuel Cell, Combined Heat and Power (CHP), Natural Gas, Remote Area, Utility and Military Facility - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| マイクログリッドの世界市場:発電機、エネルギー貯蔵システム、コントローラー、グリッド接続、オフグリッド、太陽光発電、燃料電池、熱電併給(CHP)、天然ガス、遠隔地、電力企業、軍事施設 - 予測(~2030年) |

|

出版日: 2025年09月01日

発行: MarketsandMarkets

ページ情報: 英文 338 Pages

納期: 即納可能

|

概要

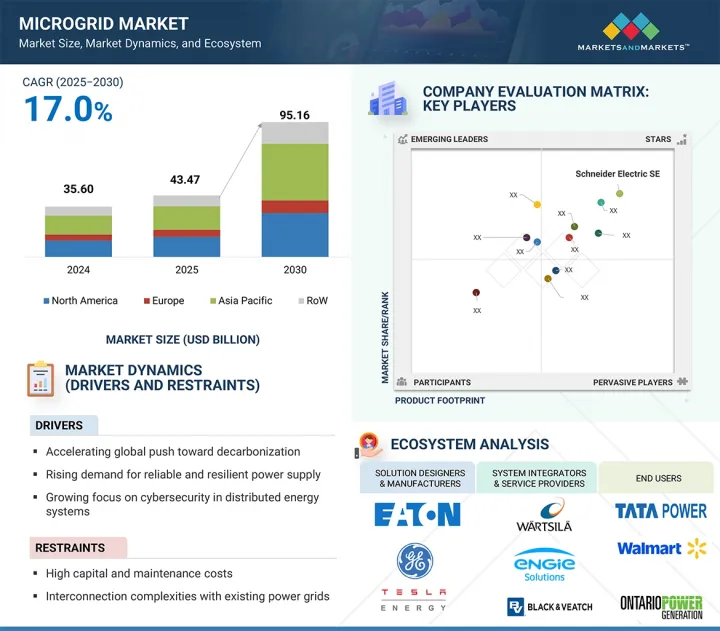

世界のマイクログリッドの市場規模は、2025年に434億7,000万米ドルであり、2030年までに951億6,000万米ドルに達すると予測され、予測期間にCAGRで17.0%の成長が見込まれます。

複数の要因が市場を牽引しています。レジリエントで信頼性の高い電力供給に対する需要の高まりと再生可能エネルギー源の統合が、政府、電力企業、産業界に分散型エネルギーソリューションの採用を促しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 暖房機器、冷房機器、換気機器、技術、導入タイプ、サービスタイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

支持的な政策枠組み、農村部の電化の取り組み、停電しやすい地域における送電網の安定性へのニーズが、普及をさらに加速させています。エネルギー貯蔵、先進のコントローラー、分散型エネルギー資源(DER)管理システムの技術的進歩が、マイクログリッドの運用効率、柔軟性、拡張性を高めています。しかし、高い設備投資要件、複雑な規制当局の承認、多様な技術間の相互運用性の課題が、普及の妨げとなっています。さらに、一部の新興市場ではエンドユーザーの認知度が低く、長期的な経済的便益の定量化が難しいことが、依然として大きな障壁となっています。革新的な資金調達モデルと標準化された枠組みを通じてこれらの課題を克服することが、持続的な市場の拡大には不可欠です。

「動力源別では、燃料電池セグメントが2025年~2030年にもっとも高いCAGRを記録する見込みです。」

マイクログリッド市場の燃料電池セグメントは、クリーンで効率的かつ信頼性の高い分散型電力ソリューションに対する需要の高まりにより、予測期間に最高のCAGRを記録する見込みです。燃料電池は、継続的かつ低排出ガスな発電を提供する能力により、マイクログリッド用途への採用が増加しており、脱炭素化と持続可能性目標の達成を目指す商業、工業、施設に理想的なものとなっています。また、その高い効率性、モジュール式の拡張性、単独または再生可能エネルギー源との併用で運転する能力により、系統連系型および島しょ型のマイクログリッドの主要技術として位置づけられています。水素製造、貯蔵、配給インフラの進歩により、燃料電池をベースとしたマイクログリッドの経済的実現可能性が向上しており、支援政策やインセンティブにより、特にアジア太平洋、北米、欧州での展開が加速しています。主要メーカーは、耐久性の向上、コストの低減、燃料電池と先進のエネルギー管理システムとの統合による性能の最大化に注力しています。エネルギー転換への取り組みが勢いを増す中、燃料電池は次世代マイクログリッドのアーキテクチャを形成する上で極めて重要な役割を果たすと予測されます。

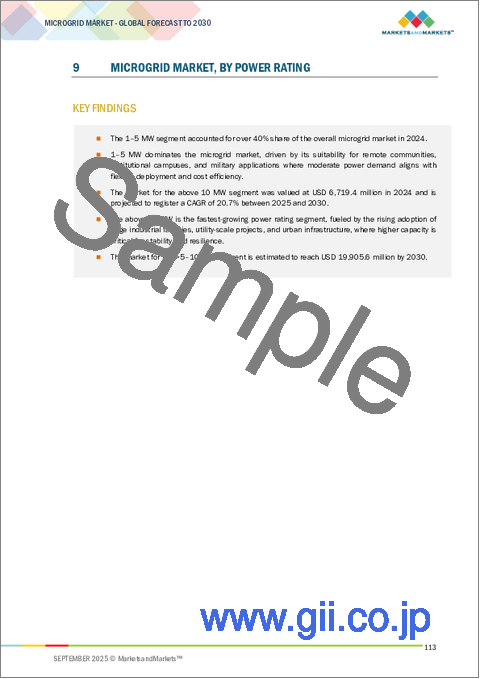

「定格出力別では、1~5MWセグメントが2025年~2030年に最大の市場シェアを占めると予測されます。」

マイクログリッド市場の1~5MWセグメントは、電力量、拡張性、用途の汎用性の最適なバランスに支えられ、2025年~2030年に最大の市場シェアを占めると予測されます。この出力範囲のシステムは、商業施設、工業施設、医療施設、教育キャンパス、小規模コミュニティに最適で、コスト効率を維持しながら多様なエネルギー需要を満たすのに十分な電力量を提供します。太陽光発電、風力発電、熱電併給(CHP)、燃料電池、エネルギー貯蔵など、複数の分散型エネルギー資源を統合する能力により、信頼性の向上、エネルギーコストの削減、系統の途絶に対するレジリエンスを実現します。また、1~5MWのレンジは、大規模システムに伴う高額な資本コストを負担することのない、部分的なグリッドの独立、再生可能エネルギー統合、ピーク負荷管理を目指す施設の増大する要件にも対応しています。アジア太平洋、北米、欧州では、規制支援、再生可能エネルギー目標、マイクログリッド性能を最適化する制御・自動化技術の進歩により、堅調な採用が見られます。

「北米が2025年~2030年に第2位の市場シェアを占めると予測されます。」

北米は、レジリエントで信頼性の高い電力システムに対する需要の増加、再生可能エネルギー統合の高まり、支持的な規制枠組みによって、2025年~2030年に世界のマイクログリッド市場で第2位のシェアを占めると予測されます。米国とカナダはマイクログリッド採用の最前線にあり、電力企業、政府機関、民間企業がエネルギー安全保障の強化と二酸化炭素排出削減のために積極的に投資しています。この地域はハリケーンや山火事などの異常気象に対して脆弱であるため、病院、軍事基地、データセンター、コミュニティエネルギーシステムなどの重要施設への展開が加速しています。制御ソフトウェア、エネルギー貯蔵、ハイブリッド電力ソリューションの進歩は、性能とコスト効率をさらに高めます。

当レポートでは、世界のマイクログリッド市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- マイクログリッド市場の企業にとって魅力的な機会

- マイクログリッド市場:電力定格別

- マイクログリッド市場:動力源別

- マイクログリッド市場:接続性別

- マイクログリッド市場:提供別

- マイクログリッド市場:エンドユーザー別

- マイクログリッド市場:地域別

- マイクログリッド市場:地理別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- 価格設定の分析

- マイクログリッドの平均販売価格:エンドユーザー別、電力定格別(2024年)

- ユーティリティベースマイクログリッドプロジェクトの平均販売価格の動向:地域別(2021年~2024年)

- 投資と資金調達のシナリオ

- カスタマービジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- SKAGERAK ENERGI、HITACHI ENERGYの太陽光発電技術を活用し、ノルウェーのODD SOCCER CLUBのSKAGERAK ARENAに電力を供給

- CUMMINS、GOLD FIELDSの施設にオーストラリア最大のハイブリッド再生可能エネルギーマイクログリッドを設置

- ONTARIO INSTITUTE OF TECHNOLOGY、GE Vernovaのキャンパスベースのマイクログリッドシステムを使用してグリッド運用を最適化

- フィラデルフィアの海軍造船所プロジェクト、電力需要を満たすためにGE Vernovaの耐久性と信頼性に優れた電力供給システムを採用

- ACE NATURAL、HOMER GRIDのエネルギーコストのモデル構築のためにSOLAR ONE ENERGYと契約

- HALF MOON VENTURES、オハイオ州のマイクログリッドプロジェクトのEPCサービスをS&C ELECTRIC COMPANYに委託

- ERGON ENERGY、マイクログリッドの電力品質向上のため、S&C ELECTRIC COMPANYのエネルギー貯蔵システムを採用

- AEG POWER SOLUTIONS、MBOGO VALLEY TEA FACTORYに無停電電源装置用のグリッドフォーミングインバーターを提供

- HITACHI ENERGY、南アフリカで発電機バックアップシステムを革新的なマイクログリッドソリューションに変革

- 貿易分析

- 輸入シナリオ(HSコード8501)

- 輸出シナリオ(HSコード8501)

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- 規制

- マイクログリッド市場に対するAI/生成AIの影響

- マイクログリッド市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- エンドユーザーに対する影響

第6章 マイクログリッドのタイプ

- イントロダクション

- ACマイクログリッド

- DCマイクログリッド

- ハイブリッドマイクログリッド

第7章 マイクログリッド展開の地域

- イントロダクション

- 都市部/大都市

- 準都市

- 農村部/島

第8章 マイクログリッドアーキテクチャのタイプ

- イントロダクション

- 従来式

- 近代式

- 先進/次世代

第9章 マイクログリッド市場:電力定格別

- イントロダクション

- 1MW未満

- 1~5MW

- 5~10MW

- 10MW超

第10章 マイクログリッド市場:動力源別

- イントロダクション

- 天然ガス

- 太陽光発電

- 熱電併給(CHP)

- ディーゼル

- 燃料電池

- その他の動力源

第11章 マイクログリッド市場:接続性別

- イントロダクション

- グリッド接続

- オフグリッド

第12章 マイクログリッド市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第13章 マイクログリッド市場:エンドユーザー別

- イントロダクション

- 商業・工業ビル

- 遠隔地

- 軍事施設

- 政府庁舎

- 電力企業

- 機関・キャンパス

- 医療施設

第14章 マイクログリッド市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- オーストラリア

- 中国

- 日本

- 韓国

- インド

- インドネシア

- タイ

- ベトナム

- マレーシア

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2025年)

- 市場シェア分析(2024年)

- 収益分析(2020年~2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第16章 企業プロファイル

- 主要企業

- SCHNEIDER ELECTRIC

- SIEMENS

- GE VERNOVA

- EATON

- ABB

- HITACHI ENERGY LTD

- HONEYWELL INTERNATIONAL INC.

- CATERPILLAR

- S&C ELECTRIC COMPANY

- TESLA

- その他の企業

- HOMER ENERGY

- EMERSON ELECTRIC CO.

- PARETO ENERGY

- SPIRAE LLC

- KOHLER CO.

- AMERESCO

- SAFT

- FERROAMP AB

- CANOPY POWER PTE LTD.

- POWERSECURE, INC.

- POLARIS

- ANBARIC DEVELOPMENT PARTNERS, LLC.

- WARTSILA

- AGGREKO

- POWER ANALYTICS

- BLOOM ENERGY

- ENGIE

- ROLLS-ROYCE PLC

- ENEL X S.R.L.

- XENDEE INC.

- BOXPOWER, INC.