|

|

市場調査レポート

商品コード

1462804

レーザー技術の世界市場:レーザータイプ別、構成別、用途別、業界別、地域別 - 2029年までの予測Laser Technology Market by Laser Type (Solid, Gas, Liquid), Configuration (Fixed, Moving, Hybrid), Application (Laser Processing, Optical Communication), Vertical (Telecommunications, Automotive, Medical, Industrial) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| レーザー技術の世界市場:レーザータイプ別、構成別、用途別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年04月09日

発行: MarketsandMarkets

ページ情報: 英文 252 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レーザー技術の市場規模は、2024年の200億米ドルから2029年には295億米ドルに達し、2024年~2029年のCAGRは8.0%になると予測されています。

ヘルスケア分野でのレーザー技術需要の増加、従来の材料加工方法と比較したレーザベースの技術の優れた性能、従来のアプローチに対するレーザベースの材料加工への嗜好の高まりが市場を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | レーザータイプ別、構成別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

固体レーザは、他のタイプのレーザーに比べて性能と効率が優れているため、材料加工での利用が増加しています。具体的には、レーザー材料加工の領域において、固体レーザーはいくつかの利点を提供し、様々な用途でますます普及しています。ダイオード励起固体レーザー(DPSSL)やファイバーレーザーのような固体レーザーは、高出力レベルを提供することができ、より速い加工速度と材料への深い浸透を可能にします。この能力は、自動車、航空宇宙、金属加工などの産業における切断、溶接、穴あけ用途に特に有益です。

レーザー技術によって実現される光通信は、比類のない帯域幅とデータ伝送速度を提供し、スマートフォン、IoTデバイス、ストリーミングサービス、クラウドコンピューティングの普及をサポートするために不可欠です。5GやFTTH(Fiber-to-the-Home)などの高度な通信サービスの展開は、レーザベースの光通信ソリューションの需要をさらに押し上げます。

レーザ通信は、低消費電力で高いデータ転送レートを提供し、データ伝送のための安全性の高い媒体です。通信分野では、レーザー技術は信号強度の最適化、正確なネットワーク設計、適切なタワー配置にも利用されています。人口増加、ブロードバンド普及の増加、より良い信号伝送の必要性が、この地域の通信分野でのレーザー技術採用を後押ししています。

アジア太平洋は、中国、日本、インド、韓国で構成されています。中国は、盛んな製造業、研究開発(R&D)への広範な投資、活況なヘルスケア部門により、レーザー技術市場で最大の市場シェアを握っています。同国の強固な製造拠点は、切断、溶接、積層造形などさまざまな用途でレーザベースのソリューションに対する大きな需要を牽引しています。技術革新やハイテク産業を支援する政府の取り組みが、中国における先進的なレーザー技術の発展を促進してきました。さらに、インフラ開発に注力し、レーザー技術メーカーや研究機関の広大なネットワークが存在することで、レーザー技術の市場リーダーとしての地位がさらに強化されています。

当レポートでは、世界のレーザー技術市場について調査し、レーザータイプ別、構成別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2024年~2025年の主な会議とイベント

- 規制状況と基準

第6章 レーザー技術の最新動向と実装分野

- イントロダクション

- レーザー技術の最新動向

- レーザー技術の実装領域

第7章 レーザー加工部品

第8章 レーザー技術市場、レーザータイプ別

- イントロダクション

- 固体レーザー

- 液体レーザー

- ガスレーザー

- その他

第9章 レーザー技術市場、構成別

- イントロダクション

第10章 レーザー技術市場、用途別

- イントロダクション

- レーザー加工

- 光通信

- 光電子デバイス

- その他

第11章 レーザー技術市場、業界別

- イントロダクション

- 電気通信

- 工業

- 半導体・エレクトロニクス

- 商業

- 航空宇宙

- 自動車

- 医療

- 研究

- その他

第12章 レーザー技術市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2024年

- 2018年~2022年のトップ5企業の収益分析

- レーザー技術市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス(スタートアップ/中小企業)、2023年

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- COHERENT CORP.

- TRUMPF

- HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD

- IPG PHOTONICS CORPORATION

- JENOPTIK AG

- 600 GROUP PLC

- BYSTRONIC GROUP

- EPILOG LASER

- EUROLASER GMBH

- GRAVOTECH MARKING

- LASERSTAR TECHNOLOGIES CORPORATION

- LUMIBIRD

- LUMENTUM OPERATIONS LLC

- MKS INSTRUMENTS

- NOVANTA INC.

- その他の企業

- ALPHALAS GMBH

- APPLIED LASER TECHNOLOGY, INC

- ARIMA LASERS CORP.

- FOCUSLIGHT TECHNOLOGIES INC.

- INNO LASER TECHNOLOGY CO., LTD.

- NKT PHOTONICS A/S

- PHOTONICS INDUSTRIES INTERNATIONAL.INC.

- SFX STORE

- TOPTICA PHOTONICS AG

- VESCENT

第15章 隣接市場

第16章 付録

The laser technology market is expected to reach USD 29.5 billion by 2029 from USD 20.0 billion in 2024, at a CAGR of 8.0% from 2024-2029. Increasing demand for laser technology in healthcare vertical, better performance of laser-based techniques compared with conventional material processing methods, rising preference for laser-based material processing over traditional approaches.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Laser Type, Configuration, Application, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

"solid laser segment holds the largest market share throughout the forecast period."

The laser types are segmented into solid lasers, liquid lasers, gas lasers, and other types. Solid-state lasers have been increasingly utilized in material processing due to their superior performance and efficiency compared to other types of lasers. Specifically, in the realm of laser materials processing, solid-state lasers offer several advantages, making them increasingly popular in various applications. Solid-state lasers, such as diode-pumped solid-state lasers (DPSSL) and fiber lasers, can deliver high-power output levels, enabling faster processing speeds and deeper penetration into materials. This capability is particularly beneficial for cutting, welding, and drilling applications in industries like automotive, aerospace, and metal fabrication.

"Optical communication application is to grow with a higher CAGR during the forecast period.

Enabled by laser technology, optical communication offers unparalleled bandwidth and data transmission speeds, making it essential for supporting the proliferation of smartphones, IoT devices, streaming services, and cloud computing. The deployment of advanced telecommunications services such as 5G and fiber-to-the-home (FTTH) further drives the demand for laser-based optical communication solutions.

"Telecommunications industry is to hold the largest market share of laser technology market in 2023."

Laser communication provides high data transfer rates with low power consumption and is a highly secure medium for data transmission. In the telecommunications vertical, laser technology is also used for signal strength optimization, precise network design, and proper tower placement. The growing population, increasing broadband penetration, and the necessity for better signal transmission are key factors fueling the adoption of laser technology in the telecommunications vertical in the region.

"The China in holds the largest market share of laser technology market in 2023."

Asia Pacific comprises China, Japan, India and South Korea. China holds the largest market share in the laser technology market due to its thriving manufacturing industry, extensive investments in research and development (R&D), and booming healthcare sector. The country's robust manufacturing hub drives significant demand for laser-based solutions across various applications such as cutting, welding, and additive manufacturing. Government initiatives supporting innovation and high-tech industries have fostered the development of advanced laser technologies within China. Additionally, the country's focus on infrastructure development and the presence of a vast network of laser technology manufacturers and research institutions further strengthen its position as a market leader in laser technology.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation - C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region - North America - 35%, Europe - 18%, Asia Pacific - 40%, and Rest of the World - 7%

Major players in the laser technology market include Coherent (US), Trumpf (Germany), Han's Laser Technology Industry Group Co., Ltd (China), IPG Photonics (US) and Jenoptik AG (Germany), and others.

Research Coverage

The report segments the laser technology market by Laser Type, Configuration, Application, Vertical and Region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall laser technology market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of critical drivers (Increasing demand for laser technology in healthcare vertical, better performance of laser-based techniques compared with conventional material processing methods, rising preference for laser-based material processing over traditional approaches, shift toward production of nanodevices and microdevices, growing adoption of smart manufacturing techniques.), restraints (High deployment cost), opportunities (growing use of laser technology for quality checks in various verticals, growing adoption of laser technology for optical communication, emerging application of laser technology in research and development), challenges (environmental challenges related to the utilization of rare earth elements, technical challenges associated to high-power lasers, contamination during laser welding process) influencing the growth of the laser technology market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the laser technology market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the laser technology market across various regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the laser technology market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like include Coherent (US), Trumpf (Germany), Han's Laser Technology Industry Group Co., Ltd (China), IPG Photonics (US) and Jenoptik AG (Germany), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- FIGURE 1 LASER TECHNOLOGY MARKET SEGMENTATION

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 LASER TECHNOLOGY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 LASER TECHNOLOGY MARKET: RESEARCH APPROACH

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 LASER TECHNOLOGY MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON LASER TECHNOLOGY MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 LASER TECHNOLOGY MARKET, 2020-2029

- FIGURE 9 SOLID LASERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 HYBRID BEAM SEGMENT DOMINATED MARKET IN 2023

- FIGURE 11 LASER PROCESSING SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 TELECOMMUNICATIONS SEGMENT TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 13 ASIA PACIFIC CLAIMED LARGEST MARKET SHARE IN 2023

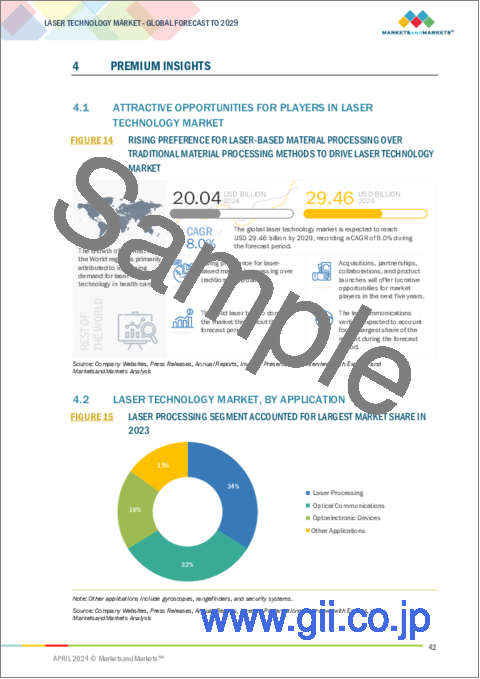

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LASER TECHNOLOGY MARKET

- FIGURE 14 RISING PREFERENCE FOR LASER-BASED MATERIAL PROCESSING OVER TRADITIONAL MATERIAL PROCESSING METHODS TO DRIVE LASER TECHNOLOGY MARKET

- 4.2 LASER TECHNOLOGY MARKET, BY APPLICATION

- FIGURE 15 LASER PROCESSING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- 4.3 LASER TECHNOLOGY MARKET, BY LASER TYPE

- FIGURE 16 SOLID LASERS SEGMENT TO DOMINATE MARKET IN 2029

- 4.4 LASER TECHNOLOGY MARKET, BY VERTICAL

- FIGURE 17 TELECOMMUNICATIONS SEGMENT TO LEAD MARKET FROM 2024 TO 2029

- 4.5 LASER TECHNOLOGY MARKET, BY REGION

- FIGURE 18 INDIA TO RECORD HIGHEST CAGR IN GLOBAL LASER TECHNOLOGY MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 LASER TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use in healthcare industry

- 5.2.1.2 High levels of precision and minimized material waste

- 5.2.1.3 Increasing preference for laser-based material processing over conventional methods

- 5.2.1.4 Rising production of nanodevices and microdevices

- FIGURE 20 GLOBAL SEMICONDUCTOR SILICON MATERIAL SALES, 2020-2022

- 5.2.1.5 Adoption of smart manufacturing techniques

- 5.2.1.6 Growing demand in automotive and manufacturing sectors

- FIGURE 21 LASER TECHNOLOGY MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High deployment cost

- 5.2.2.2 Shortage of skilled professionals

- FIGURE 22 LASER TECHNOLOGY MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Application of laser spectroscopy and imaging technologies in various verticals

- 5.2.3.2 Deployment in optical communication

- 5.2.3.3 Ongoing advancements in satellite communications

- 5.2.3.4 Growing applications in research and development

- FIGURE 23 FIBER BROADBAND SUBSCRIPTION STATISTICS FOR TOP 10 COUNTRIES, 2022

- FIGURE 24 LASER TECHNOLOGY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns associated with processing and extraction of rare-earth metals

- 5.2.4.2 Requirement for wall plug with high efficiency for long-term CW operations

- 5.2.4.3 Contamination of materials during laser welding process

- FIGURE 25 LASER TECHNOLOGY MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 26 LASER TECHNOLOGY MARKET: SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 27 GLOBAL LASER TECHNOLOGY ECOSYSTEM

- TABLE 1 ROLE OF PARTICIPANTS IN ECOSYSTEM

- 5.5 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2023

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF FIBER LASERS, 2020-2029

- FIGURE 29 AVERAGE SELLING PRICE OF FIBER LASERS

- 5.6.2 AVERAGE SELLING PRICE OF LASERS OFFERED BY THREE KEY PLAYERS, BY TYPE, 2023

- FIGURE 30 AVERAGE SELLING PRICE OF LASERS OFFERED BY THREE KEY PLAYERS, BY TYPE, 2023

- TABLE 2 AVERAGE SELLING PRICE OF LASERS OFFERED BY THREE KEY PLAYERS, BY TYPE

- 5.6.3 AVERAGE SELLING PRICE OF FIBER LASERS, BY REGION

- FIGURE 31 AVERAGE SELLING PRICE OF FIBER LASERS, BY REGION, 2021-2023 (USD)

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGY

- 5.8.1.1 Adjustable mode beam lasers

- 5.8.1.2 Additive manufacturing locus beam control

- 5.8.2 COMPLEMENTARY TECHNOLOGY

- 5.8.2.1 LiDAR

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 Quantum cascade lasers

- 5.8.1 KEY TECHNOLOGY

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 LASER TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 LASER TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA, BY VERTICAL

- 5.10.3 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 FORMER DSTL INVENTORS MAKE LASER DETECTION AND PROTECTION SYSTEMS FOR DEFENSE AND SECURITY INDUSTRIES

- 5.11.2 LASER MANUFACTURER COLLABORATES WITH DENTON VACUUM TO INTRODUCE E-BEAM EVAPORATION FOR LASER BAR FACET AR AND HR COATING

- 5.11.3 LASER MARKING TECHNOLOGIES CREATE MATERIALS THAT ABSORB INFRARED WAVELENGTH

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA

- FIGURE 36 IMPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12.2 EXPORT DATA

- FIGURE 37 EXPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.13 PATENT ANALYSIS

- FIGURE 38 NUMBER OF PATENTS APPLIED AND GRANTED, 2014-2023

- TABLE 5 LIST OF MAJOR PATENTS APPLIED/GRANTED, 2021-2024

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 6 LASER TECHNOLOGY MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 REGULATORY LANDSCAPE AND STANDARDS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.15.2.1 IEC 60825-1:2014

- 5.15.2.2 ANSI Z136.1

- 5.15.2.3 Federal Laser Product Performance Standard (FLPPS)

- 5.15.2.4 International Commission on Non-Ionizing Radiation Protection (ICNIRP)

- 5.15.2.5 EN 60825 - Safety of Laser Products

- 5.15.2.6 FDA Standards

6 RECENT TRENDS AND IMPLEMENTATION AREAS OF LASER TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 RECENT TRENDS IN LASER TECHNOLOGY

- 6.2.1 FEMTOSECOND LASERS

- 6.2.2 GREEN AND ULTRAFAST LASERS

- 6.2.3 LASER SURFACE TEXTURING

- 6.2.4 LASER CLEANING AND COATING REMOVAL

- 6.2.5 LASER SAFETY TECHNOLOGIES

- 6.2.6 SMART MANUFACTURING AND INDUSTRY 4.0 TECHNOLOGY INTEGRATION

- 6.3 IMPLEMENTATION AREAS OF LASER TECHNOLOGY

- 6.3.1 LASER PRINTERS

- 6.3.2 LASER GYROSCOPES

- 6.3.3 LASER HEADLIGHTS

- 6.3.4 LASER RANGEFINDERS

- 6.3.5 LASER SECURITY SYSTEMS

- 6.3.6 OTHER IMPLEMENTATION AREAS

7 LASER PROCESSING COMPONENTS

- 7.1 INTRODUCTION

- FIGURE 39 LASER PROCESSING COMPONENTS

- 7.2 LASER SYSTEMS

- 7.3 LASERS

8 LASER TECHNOLOGY MARKET, BY LASER TYPE

- 8.1 INTRODUCTION

- FIGURE 40 LASER TECHNOLOGY MARKET, BY LASER TYPE

- FIGURE 41 SOLID LASERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 11 LASER TECHNOLOGY MARKET, BY LASER TYPE, 2020-2023 (USD MILLION)

- TABLE 12 LASER TECHNOLOGY MARKET, BY LASER TYPE, 2024-2029 (USD MILLION)

- 8.2 SOLID LASERS

- TABLE 13 SOLID LASERS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 14 SOLID LASERS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 15 SOLID LASERS: LASER TECHNOLOGY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 16 SOLID LASERS: LASER TECHNOLOGY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.1 FIBER LASERS

- 8.2.1.1 Widespread use in telecommunications for transmitting data to drive market

- TABLE 17 FIBER LASERS: LASER TECHNOLOGY MARKET, 2020-2023 (THOUSAND UNITS)

- TABLE 18 FIBER LASERS: LASER TECHNOLOGY MARKET, 2024-2029 (THOUSAND UNITS)

- 8.2.2 RUBY LASERS

- 8.2.2.1 Ability to offer short bursts of high-intensity light with no wastage of material to accelerate demand

- 8.2.3 YTTRIUM ALUMINUM GARNET (YAG) LASERS

- 8.2.3.1 Growing demand for high-energy laser beams to fuel market growth

- 8.2.4 SEMICONDUCTOR LASERS

- 8.2.4.1 Increasing applications in metrology, spectroscopy, and laser material processing to boost demand

- 8.2.5 THIN-DISK LASERS

- 8.2.5.1 Ability to produce high output powers with good beam quality to accelerate demand

- 8.3 LIQUID LASERS

- 8.3.1 RISING APPLICATION IN REMOTE SENSING AND MAPPING TECHNOLOGIES TO BOOST DEMAND

- TABLE 19 LIQUID LASERS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 20 LIQUID LASERS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4 GAS LASERS

- TABLE 21 GAS LASERS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 GAS LASERS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 GAS LASERS: LASER TECHNOLOGY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 24 GAS LASERS: LASER TECHNOLOGY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.4.1 CO2 LASERS

- 8.4.1.1 Growing deployment in military sector to boost demand

- 8.4.2 EXCIMER LASERS

- 8.4.2.1 Increasing demand for material processing and industrial applications to drive market

- 8.4.3 HELIUM-NEON LASERS

- 8.4.3.1 Low cost and ease of use to boost demand

- 8.4.4 ARGON LASERS

- 8.4.4.1 Rising use in medical procedures to accelerate demand

- 8.4.5 CHEMICAL LASERS

- 8.4.5.1 Growing applications in directed energy weapons and anti-missile systems to drive market

- 8.5 OTHER LASER TYPES

- TABLE 25 OTHER LASER TYPES: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 OTHER LASER TYPES: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

9 LASER TECHNOLOGY MARKET, BY CONFIGURATION

- 9.1 INTRODUCTION

- FIGURE 42 LASER TECHNOLOGY MARKET, BY CONFIGURATION

- FIGURE 43 MOVING BEAM SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 LASER TECHNOLOGY MARKET, BY CONFIGURATION, 2020-2023 (USD MILLION)

- TABLE 28 LASER TECHNOLOGY MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- 9.1.1 FIXED BEAMS

- 9.1.1.1 Increasing use for cutting and welding metals to drive market

- 9.1.2 MOVING BEAMS

- 9.1.2.1 Requirement for rapid and precise laser beam movements to foster segmental growth

- 9.1.3 HYBRID BEAMS

- 9.1.3.1 Need for enhanced efficiency and flexibility of laser technology to expedite segmental growth

- TABLE 29 COMPARISON OF DIFFERENT LASER TECHNOLOGY CONFIGURATIONS

10 LASER TECHNOLOGY MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 44 LASER TECHNOLOGY MARKET, BY APPLICATION

- FIGURE 45 LASER PROCESSING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 30 LASER TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 31 LASER TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2 LASER PROCESSING

- 10.2.1 GROWING UTILIZATION OF LASER SURFACE ALLOYING IN AUTOMOTIVE AND AEROSPACE INDUSTRIES TO DRIVE MARKET

- TABLE 32 LASER PROCESSING: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 LASER PROCESSING: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.2 MACRO PROCESSING

- 10.2.2.1 Cutting

- 10.2.2.1.1 Fusion cutting

- 10.2.2.1.2 Flame cutting

- 10.2.2.1.3 Sublimation cutting

- 10.2.2.2 Drilling

- 10.2.2.2.1 Single-pulse drilling

- 10.2.2.2.2 Percussion drilling

- 10.2.2.2.3 Trepanning drilling

- 10.2.2.2.4 Helical drilling

- 10.2.2.3 Welding

- 10.2.2.4 Marking and engraving

- 10.2.2.1 Cutting

- 10.2.3 MICROPROCESSING

- 10.2.4 ADVANCED PROCESSING

- 10.3 OPTICAL COMMUNICATION

- 10.3.1 GROWING DEMAND IN DATA NETWORKING TO BOOST DEMAND

- TABLE 34 OPTICAL COMMUNICATION: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 OPTICAL COMMUNICATION: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 OPTOELECTRONIC DEVICES

- 10.4.1 RISING APPLICATION IN SENSING AND IMAGING TO DRIVE MARKET

- TABLE 36 OPTOELECTRONIC DEVICES: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 OPTOELECTRONIC DEVICES: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 OTHER APPLICATIONS

- TABLE 38 OTHER APPLICATIONS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 OTHER APPLICATIONS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

11 LASER TECHNOLOGY MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 46 LASER TECHNOLOGY MARKET, BY VERTICAL

- FIGURE 47 TELECOMMUNICATIONS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 40 LASER TECHNOLOGY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 41 LASER TECHNOLOGY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2 TELECOMMUNICATIONS

- 11.2.1 GROWING ADOPTION IN FIBER OPTIC COMMUNICATION TO BOOST DEMAND

- TABLE 42 TELECOMMUNICATIONS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 TELECOMMUNICATIONS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.3 INDUSTRIAL

- 11.3.1 INTEGRATION OF LASER SYSTEMS WITH ADVANCED BEAM DELIVERY SYSTEMS AND CNC MACHINERY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR PLAYERS

- TABLE 44 INDUSTRIAL: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 INDUSTRIAL: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.4 SEMICONDUCTOR & ELECTRONICS

- 11.4.1 GROWING DEMAND FOR MINIATURIZED SEMICONDUCTOR COMPONENTS TO BOOST DEMAND

- TABLE 46 SEMICONDUCTOR & ELECTRONICS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 SEMICONDUCTOR & ELECTRONICS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.4.2 MEMORY CHIPS

- 11.4.3 MICROPROCESSORS

- 11.4.4 PHOTONIC INTEGRATED CIRCUITS

- 11.5 COMMERCIAL

- 11.5.1 GROWING DEMAND FOR ENHANCED SECURITY IN SMART CARDS TO DRIVE MARKET

- TABLE 48 COMMERCIAL: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 COMMERCIAL: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.6 AEROSPACE

- 11.6.1 INCREASED ADOPTION FOR MACHINING AIRCRAFT PARTS TO ACCELERATE MARKET GROWTH

- TABLE 50 AEROSPACE: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 AEROSPACE: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.7 AUTOMOTIVE

- 11.7.1 RISING DEMAND FOR SEAM WELDING AND HIGH-STRENGTH STEEL CUTTING IN AUTOMOTIVE INDUSTRY TO FOSTER SEGMENTAL GROWTH

- TABLE 52 AUTOMOTIVE: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 AUTOMOTIVE: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.8 MEDICAL

- 11.8.1 INCREASING APPLICATION IN SURGICAL PROCEDURES TO DRIVE DEMAND

- TABLE 54 MEDICAL: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 MEDICAL: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.8.2 LASER VISION CORRECTION

- 11.8.3 CONFOCAL MICROSCOPES

- 11.8.4 OPTOGENETICS

- 11.9 RESEARCH

- 11.9.1 GROWING APPLICATION IN CONFOCAL MICROSCOPY AND TWO-PHOTON MICROSCOPY TO DRIVE MARKET

- TABLE 56 RESEARCH: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 RESEARCH: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.10 OTHER VERTICALS

- TABLE 58 OTHER VERTICALS: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 OTHER VERTICALS: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

12 LASER TECHNOLOGY MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 48 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL LASER TECHNOLOGY MARKET DURING FORECAST PERIOD

- TABLE 60 LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 IMPACT OF RECESSION ON LASER TECHNOLOGY MARKET IN NORTH AMERICA

- FIGURE 49 NORTH AMERICA: LASER TECHNOLOGY MARKET SNAPSHOT

- TABLE 62 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Growing demand for miniature laser processing devices in healthcare industry to drive market

- 12.2.3 CANADA

- 12.2.3.1 Government-led initiatives to develop, produce, and sell EVs to boost demand

- 12.2.4 MEXICO

- 12.2.4.1 Rising adoption in automobile, aerospace, and electronics to accelerate demand

- 12.3 EUROPE

- 12.3.1 IMPACT OF RECESSION ON LASER TECHNOLOGY MARKET IN EUROPE

- FIGURE 50 EUROPE: LASER TECHNOLOGY MARKET SNAPSHOT

- TABLE 70 EUROPE: LASER TECHNOLOGY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 71 EUROPE: LASER TECHNOLOGY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 72 EUROPE: LASER TECHNOLOGY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 73 EUROPE: LASER TECHNOLOGY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 74 EUROPE: LASER TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 75 EUROPE: LASER TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 EUROPE: LASER TECHNOLOGY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 77 EUROPE: LASER TECHNOLOGY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Rising use in minimally invasive surgical procedures to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Increasing demand in automotive, telecommunications, and healthcare verticals to fuel market growth

- 12.3.4 UK

- 12.3.4.1 Rising emphasis on reducing greenhouse gas emissions to fuel market growth

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 IMPACT OF RECESSION ON LASER TECHNOLOGY MARKET IN ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: LASER TECHNOLOGY MARKET SNAPSHOT

- TABLE 78 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 79 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 80 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 82 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 83 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Growing use in semiconductor chip manufacturing processes to propel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Presence of prominent automobile and electronic companies to drive market

- 12.4.4 INDIA

- 12.4.4.1 Government-led projects to boost domestic manufacturing to fuel market growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Consumer electronics and automotive industries to offer lucrative growth opportunities for market players

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 IMPACT OF RECESSION ON LASER TECHNOLOGY MARKET IN ROW

- TABLE 86 ROW: LASER TECHNOLOGY MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 87 ROW: LASER TECHNOLOGY MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 88 ROW: LASER TECHNOLOGY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 ROW: LASER TECHNOLOGY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 90 ROW: LASER TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 91 ROW: LASER TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 92 ROW: LASER TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 ROW: LASER TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Investments in laser technology and infrastructure to drive market

- 12.5.3 GCC COUNTRIES

- 12.5.3.1 Growing demand for light weight cars to drive market

- 12.5.4 AFRICA & REST OF MIDDLE EAST

- 12.5.4.1 Increasing use of EVs to offer lucrative growth opportunities for market players

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 94 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2024

- 13.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- FIGURE 52 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 13.4 LASER TECHNOLOGY MARKET SHARE ANALYSIS, 2023

- TABLE 95 LASER TECHNOLOGY MARKET: DEGREE OF COMPETITION, 2023

- FIGURE 53 LASER TECHNOLOGY MARKET SHARE ANALYSIS, 2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 54 LASER TECHNOLOGY MARKET: COMPANY VALUATION

- FIGURE 55 LASER TECHNOLOGY MARKET: FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- FIGURE 56 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 57 LASER TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.7.5.1 Overall company footprint

- FIGURE 58 LASER TECHNOLOGY MARKET: COMPANY FOOTPRINT

- 13.7.5.2 Laser type footprint

- TABLE 96 LASER TECHNOLOGY MARKET: LASER TYPE FOOTPRINT

- 13.7.5.3 Application footprint

- TABLE 97 LASER TECHNOLOGY MARKET: APPLICATION FOOTPRINT

- 13.7.5.4 Vertical footprint

- TABLE 98 LASER TECHNOLOGY MARKET: VERTICAL FOOTPRINT

- 13.7.5.5 Region footprint

- TABLE 99 LASER TECHNOLOGY MARKET: REGION FOOTPRINT

- 13.8 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- FIGURE 59 LASER TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.8.5.1 List of key startups/SMEs

- TABLE 100 LASER TECHNOLOGY MARKET: LIST OF KEY STARTUPS/SMES

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 101 LASER TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE SCENARIOS AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- TABLE 102 LASER TECHNOLOGY MARKET: PRODUCT LAUNCHES, SEPTEMBER 2021-JANUARY 2024

- 13.9.2 DEALS

- TABLE 103 LASER TECHNOLOGY MARKET: DEALS, SEPTEMBER 2021-JANUARY 2024

14 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 14.1 KEY PLAYERS

- 14.1.1 COHERENT CORP.

- TABLE 104 COHERENT CORP.: COMPANY OVERVIEW

- FIGURE 60 COHERENT CORP.: COMPANY SNAPSHOT

- TABLE 105 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 106 COHERENT CORP.: PRODUCT LAUNCHES

- 14.1.2 TRUMPF

- TABLE 107 TRUMPF: COMPANY OVERVIEW

- FIGURE 61 TRUMPF: COMPANY SNAPSHOT

- TABLE 108 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 TRUMPF: PRODUCT LAUNCHES

- 14.1.3 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD

- TABLE 110 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD: COMPANY OVERVIEW

- FIGURE 62 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD: COMPANY SNAPSHOT

- TABLE 111 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD: PRODUCT LAUNCHES

- TABLE 113 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD: DEALS

- 14.1.4 IPG PHOTONICS CORPORATION

- TABLE 114 IPG PHOTONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 63 IPG PHOTONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 115 IPG PHOTONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 IPG PHOTONICS CORPORATION: PRODUCT LAUNCHES

- 14.1.4.3.2 Deals

- TABLE 117 IPG PHOTONICS CORPORATION: DEALS

- 14.1.5 JENOPTIK AG

- TABLE 118 JENOPTIK AG: COMPANY OVERVIEW

- FIGURE 64 JENOPTIK AG: COMPANY SNAPSHOT

- TABLE 119 JENOPTIK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 JENOPTIK AG: PRODUCT LAUNCHES

- TABLE 121 JENOPTIK AG: DEALS

- TABLE 122 JENOPTIK: OTHERS

- 14.1.6 600 GROUP PLC

- TABLE 123 600 GROUP PLC: COMPANY OVERVIEW

- FIGURE 65 600 GROUP PLC: COMPANY SNAPSHOT

- TABLE 124 600 GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.7 BYSTRONIC GROUP

- TABLE 125 BYSTRONIC GROUP: COMPANY OVERVIEW

- FIGURE 66 BYSTRONIC GROUP: COMPANY SNAPSHOT

- TABLE 126 BYSTRONIC GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 127 BYSTRONIC GROUP: PRODUCT LAUNCHES

- 14.1.8 EPILOG LASER

- TABLE 128 EPILOG LASER: COMPANY OVERVIEW

- TABLE 129 EPILOG LASER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 EPILOG LASER: PRODUCT LAUNCHES

- TABLE 131 EPILOG LASER: EXPANSIONS

- 14.1.9 EUROLASER GMBH

- TABLE 132 EUROLASER GMBH: COMPANY OVERVIEW

- TABLE 133 EUROLASER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.10 GRAVOTECH MARKING

- TABLE 134 GRAVOTECH MARKING: COMPANY OVERVIEW

- TABLE 135 GRAVOTECH MARKING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 GRAVOTECH MARKING: PRODUCT LAUNCHES

- 14.1.11 LASERSTAR TECHNOLOGIES CORPORATION

- TABLE 137 LASERSTAR TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 138 LASERSTAR TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.12 LUMIBIRD

- TABLE 139 LUMIBIRD: COMPANY OVERVIEW

- FIGURE 67 LUMIBIRD: COMPANY SNAPSHOT

- TABLE 140 LUMIBIRD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 LUMIBIRD: PRODUCT LAUNCHES

- TABLE 142 LUMIBIRD: DEALS

- 14.1.13 LUMENTUM OPERATIONS LLC

- TABLE 143 LUMENTUM OPERATIONS LLC: COMPANY OVERVIEW

- FIGURE 68 LUMENTUM OPERATIONS LLC: COMPANY SNAPSHOT

- TABLE 144 LUMENTUM OPERATIONS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 LUMENTUM OPERATIONS LLC: PRODUCT LAUNCHES

- TABLE 146 LUMENTUM OPERATION LLC: DEALS

- TABLE 147 LUMENTUM OPERATION LLC: OTHERS

- 14.1.14 MKS INSTRUMENTS

- TABLE 148 MKS INSTRUMENTS: COMPANY OVERVIEW

- FIGURE 69 MKS INSTRUMENTS: COMPANY SNAPSHOT

- TABLE 149 MKS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 MKS INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 151 MKS INSTRUMENTS: DEALS

- 14.1.15 NOVANTA INC.

- TABLE 152 NOVANTA INC.: COMPANY OVERVIEW

- FIGURE 70 NOVANTA INC.: COMPANY SNAPSHOT

- TABLE 153 NOVANTA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 NOVANTA INC.: PRODUCT LAUNCHES

- TABLE 155 NOVANTA INC.: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 ALPHALAS GMBH

- 14.2.2 APPLIED LASER TECHNOLOGY, INC

- 14.2.3 ARIMA LASERS CORP.

- 14.2.4 FOCUSLIGHT TECHNOLOGIES INC.

- 14.2.5 INNO LASER TECHNOLOGY CO., LTD.

- 14.2.6 NKT PHOTONICS A/S

- 14.2.7 PHOTONICS INDUSTRIES INTERNATIONAL.INC.

- 14.2.8 SFX STORE

- 14.2.9 TOPTICA PHOTONICS AG

- 14.2.10 VESCENT

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 ADJACENT MARKET

- 15.1 INTRODUCTION

- 15.2 FIBER OPTICS MARKET

- FIGURE 71 GLASSES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 156 FIBER OPTICS MARKET, BY FIBER TYPE, 2018-2021 (USD MILLION)

- TABLE 157 FIBER OPTICS MARKET, BY FIBER TYPE, 2022-2027 (USD MILLION)

- TABLE 158 FIBER OPTICS MARKET, BY FIBER TYPE, 2018-2021 (MILLION FIBER KILOMETER)

- TABLE 159 FIBER OPTICS MARKET, BY FIBER TYPE, 2022-2027 (MILLION FIBER KILOMETER)

- 15.3 GLASSES

- 15.3.1 LOW INTRINSIC ABSORPTION PROPERTIES OF GLASSES TO BOOST DEMAND

- FIGURE 72 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 160 GLASSES: FIBER OPTICS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 161 GLASSES: FIBER OPTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 162 GLASSES: FIBER OPTICS MARKET, BY REGION, 2018-2021 (MILLION FIBER KILOMETER)

- TABLE 163 GLASSES: FIBER OPTICS MARKET, BY REGION, 2022-2027 (MILLION FIBER KILOMETER)

- 15.4 PLASTICS

- 15.4.1 SUITABILITY FOR INDUSTRIAL AND AUTOMOTIVE LIGHTING APPLICATIONS TO DRIVE MARKET

- FIGURE 73 ASIA PACIFIC TO DOMINATE PLASTIC FIBER OPTICS MARKET FROM 2024 TO 2029

- TABLE 164 PLASTICS: FIBER OPTICS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 165 PLASTICS: FIBER OPTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 166 PLASTICS: FIBER OPTICS MARKET, BY REGION, 2018-2021 (MILLION FIBER KILOMETER)

- TABLE 167 PLASTICS: FIBER OPTICS MARKET, BY REGION, 2022-2027 (MILLION FIBER KILOMETER)

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS