|

|

市場調査レポート

商品コード

1071912

医療用クラウドコンピューティングの世界市場:製品別・展開方式別・コンポーネント別・価格設定別・サービス別 ・エンドユーザー別の将来予測 (2027年まで)Healthcare Cloud Computing Market by Product (EMR/EHR, VNA, RIS, LIS, PIS), Deployment (Private Cloud, Hybrid Cloud, Public Cloud), Component (Software, Services), Pricing (Spot Pricing), Service (SaaS, IaaS, PaaS), End User - Global Forecasts to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 医療用クラウドコンピューティングの世界市場:製品別・展開方式別・コンポーネント別・価格設定別・サービス別 ・エンドユーザー別の将来予測 (2027年まで) |

|

出版日: 2022年04月22日

発行: MarketsandMarkets

ページ情報: 英文 382 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療用クラウドコンピューティングの市場規模は、2022年の394億米ドルから、2027年までに894億米ドルへと、17.8%のCAGRで成長すると予測されています。

市場の主な促進要因として、様々な技術 (遠隔医療、EHR (電子カルテ)、ビッグデータ解析、IoT、クラウドコンピューティング、mヘルス、ウェアラブルデバイスなど) の普及浸透などが挙げられます。

製品別では、医療提供者向けソリューションが世界市場の79.2%と大きなシェアを占めています。地域別に見ると、北米が世界市場の62.6%ものシェアを占める一方、アジア太平洋が予測期間中に22.4%のCAGRで成長する見通しです。

当レポートでは、世界の医療用クラウドコンピューティングの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、セグメント別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

第6章 業界の考察

- イントロダクション

- 技術動向

- IoT (モノのインターネット)

- 人工知能

- ブロックチェーン

- ビッグデータと予測分析

- 導入動向

- 価格分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制分析

- 特許分析

- 新型コロナウイルス感染症 (COVID-19):医療用クラウドコンピューティング市場に与える影響

第7章 医療用クラウドコンピューティング市場:製品別

- イントロダクション

- 医療提供者向けソリューション

- 臨床情報システム

- 非臨床情報システム

- 医療費支払者向けソリューション

- 請求管理ソリューション

- 決済管理ソリューション

- 顧客関係管理 (CRM) ソリューション

- プロバイダーネットワーク管理 (PRM) ソリューション

- 不正管理ソリューション

第8章 医療用クラウドコンピューティング市場:コンポーネント別

- イントロダクション

- サービス

- ソフトウェア

第9章 医療用クラウドコンピューティング市場:展開モデル別

- イントロダクション

- プライベートクラウド

- ハイブリッドクラウド

- パブリッククラウド

第10章 医療用クラウドコンピューティング市場:サービスモデル別

- イントロダクション

- SaaS (サービスとしてのソフトウェア)

- IaaS (サービスとしてのインフラ)

- PaaS (サービスとしてのプラットフォーム)

第11章 医療用クラウドコンピューティング市場:価格設定モデル別

- イントロダクション

- 従量課金制の価格設定モデル

- スポット価格モデル

第12章 医療用クラウドコンピューティング市場:エンドユーザー別

- イントロダクション

- 医療提供者

- 医療費支払者

第13章 医療用クラウドコンピューティング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- シンガポール

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第14章 競合情勢

- 概要

- 主要企業の戦略/市場獲得戦略

- 競合ベンチマーキング

- 競合リーダーシップマッピング

- 競合リーダーシップマッピング (中小企業)

- 主要企業の分析:医療用クラウドコンピューティング市場

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- AMAZON WEB SERVICES, INC. (AWS)

- MICROSOFT CORPORATION

- INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM)

- ATHENAHEALTH, INC.

- CARECLOUD, INC.

- SIEMENS HEALTHINEERS AG

- ECLINICALWORKS

- KONINKLIJKE PHILIPS N.V.

- ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

- NTT DATA CORPORATION

- SECTRA AB

- GE HEALTHCARE

- NEXTGEN HEALTHCARE, INC.

- DXC TECHNOLOGY

- INFINITT HEALTHCARE CO. LTD.

- HYLAND SOFTWARE, INC.

- SALESFORCE

- FUJIFILM HOLDINGS CORPORATION

- VEPRO EHEALTH SOLUTIONS

- DELL TECHNOLOGIES, INC.

- ENSOFTEK, INC.

- その他の企業

- ORACLE CORPORATION

- IRON MOUNTAIN, INC.

- CLEARDATA NETWORKS, INC.

- GLOBAL NET ACCESS (GNAX)

- VMWARE, INC.

第16章 付録

The global Healthcare cloud computing market is projected to reach USD 89.4 billion by 2027 from USD 39.4 billion in 2022, at a CAGR of 17.8%. The factors driving the market are adoption of technologies like telehealth, EHR, big data analytics, IoT, cloud computing,m health, wearlable devices, etc.

"The healthcare provider solutions was the largest segment in the healthcare cloud computing market in 2021."

The healthcare provider segment accounted for the larger share of 79.2% of the healthcare cloud computing market in 2021. The growing adoption of various health IT solutions such as EHR, e-prescribing, telehealth, mHealth, and others due to COVID-19 is one of the key factors contributing to the growth of this segment.

"Among end users, the healthcare providers segment accounted for the largest market share in 2021."

In 2021, the healthcare providers segment accounted for the largest share of the healthcare cloud computing market. One of the main contributing factors is the capability of large hospitals to invest in expensive and sophisticated technologies, owing to which the adoption of healthcare cloud computing solutions is higher in hospitals. The increasing number of patients and hospitals alongside the strong purchasing power of hospitals, are other factors supporting the growth of this end user segment.

"In 2021, North America accounted for the largest regional market for healthcare cloud computing market"

In 2021, North America accounted for the largest share of 62.6% of the healthcare cloud computing market. This can be attributed to advancements in technology, and government initiatives by Medicaid & Medicare, among other factors.

The Asia Pacific region is expected to be the fastest growing region in the forecast period, at a CAGR of 22.4%. The growing digitalization in Asia, growing medical tourism, and implementation of new ICT guidelines in Japan, are some of the factors contributing to this growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type (Supply-side): Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: C-level: 27%, Director-level: 18%, and Others: 55%

- By Region: North America: 50%, Europe: 20%, Asia-Pacific: 15%,Latin America: 10%, and Middle east & Africa: 5%

Key players offering healthcare cloud computing products in this market include Amazon Web Services, Inc. (US), Microsoft Corporation (US), International Business Machines Corporation (US), athenahealth. Inc. (US), CareCloud, Inc. (US), Siemens Healthineers AG (Germany), eClinicalWorks (US), Koninklijke Philips N.V. (Netherlands), and Allscripts Healthcare Solutions, Inc. (US).

Research Coverage:

The report analyzes the healthcare cloud computing market and aims at estimating themarket size and future growth potential of this market based on various segments such as product, and region. The report also includes competitive analysis of the key players in this market along with their company profiles, product and service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would helpthemgarner a greater share. Firms purchasing the report could use one, or a combination of the belowmentioned five strategies.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the healthcare cloud computing market. The report analyzes the market based on the products, and region.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the healthcare cloud computing market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of healthcare cloud computing solutionsacross regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the healthcare cloud computing market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the healthcare cloud computing markets.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HEALTHCARE CLOUD COMPUTING MARKET

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 RESEARCH METHODOLOGY DESIGN

- FIGURE 2 HEALTHCARE CLOUD COMPUTING MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY RESEARCH

- FIGURE 3 PRIMARY SOURCES

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Insights from primary experts

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION: HEALTHCARE CLOUD COMPUTING MARKET

- FIGURE 6 SUPPLY SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION: HEALTHCARE CLOUD COMPUTING MARKET

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF HEALTHCARE CLOUD COMPUTING MARKET (2022-2027)

- FIGURE 10 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ESTIMATION

- 2.6 STUDY ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 12 HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF HEALTHCARE CLOUD COMPUTING MARKET

4 PREMIUM INSIGHTS

- 4.1 HEALTHCARE CLOUD COMPUTING MARKET OVERVIEW

- FIGURE 19 GROWING ADOPTION OF EHR, E-PRESCRIBING, TELEHEALTH, MHEALTH, AND OTHER HEALTHCARE IT SOLUTIONS DUE TO COVID-19 TO DRIVE MARKET GROWTH

- 4.2 HEALTHCARE CLOUD COMPUTING MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- FIGURE 20 CHINA TO WITNESS HIGHEST GROWTH IN HEALTHCARE CLOUD COMPUTING MARKET DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT AND COUNTRY (2021)

- FIGURE 21 HEALTHCARE PROVIDER SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HEALTHCARE CLOUD COMPUTING MARKET IN NORTH AMERICA FOR 2021

- 4.4 REGIONAL MIX: HEALTHCARE CLOUD COMPUTING MARKET (2022-2027)

- FIGURE 22 ASIA PACIFIC REGION IS EXPECTED TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD (2022-2027)

- 4.5 HEALTHCARE CLOUD COMPUTING MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 23 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 MARKET DYNAMICS: HEALTHCARE CLOUD COMPUTING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of EHR, e-prescribing, telehealth, mhealth, and other healthcare IT solutions due to COVID-19

- 5.2.1.2 Increasing adoption of big data analytics, wearable devices, and IoT in healthcare

- 5.2.1.3 Better storage, flexibility, scalability, and collaboration of data offered by cloud computing

- 5.2.1.4 Increasing cloud deployment in healthcare industry

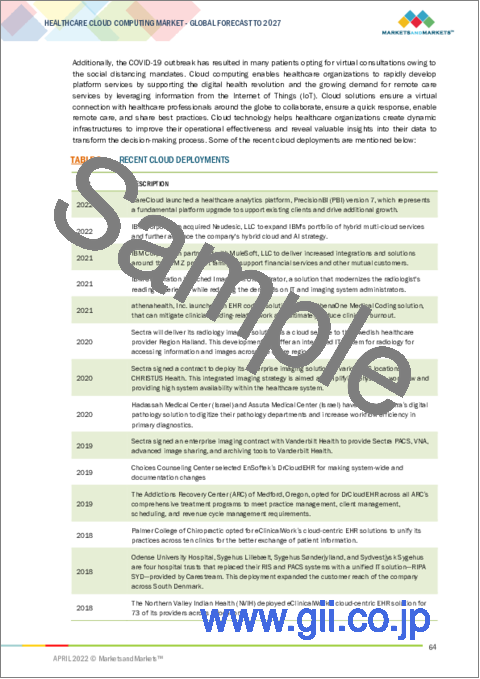

- TABLE 2 RECENT CLOUD DEPLOYMENTS

- 5.2.1.5 Proliferation of new payment models and cost-efficiency of cloud

- 5.2.1.6 Dynamic nature of health benefit plans

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising data security and privacy concerns

- 5.2.2.2 Growing complex regulations governing cloud data centers

- 5.2.2.3 Increased IT infrastructural constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of telecloud and telehealth consultations

- 5.2.3.2 Use of blockchain in health cloud

- 5.2.3.3 Decrease in connectivity and accessibility gap

- 5.2.3.4 Formation of accountable care organizations

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising interoperability and portability issues

- 5.2.4.2 Limited technical expertise in developing geographies

6 INDUSTRY INSIGHTS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 INTERNET OF THINGS

- 6.2.2 ARTIFICIAL INTELLIGENCE

- TABLE 3 AI IN HEALTHCARE MARKET, BY REGION, 2017-2026 (USD MILLION)

- 6.2.3 BLOCKCHAIN

- 6.2.4 BIG DATA AND PREDICTIVE ANALYTICS

- 6.3 ADOPTION TRENDS

- 6.3.1 INTRODUCTION

- 6.3.2 NORTH AMERICA: ADOPTION TRENDS

- TABLE 4 US: INPATIENT EMR ADOPTION MODEL (EMRAM), 2017

- FIGURE 25 US: HOSPITAL EHR ADOPTION (2007-2018)

- FIGURE 26 US: OUTPATIENT EMR ADOPTION, Q2 2017

- 6.3.3 EUROPE: ADOPTION TRENDS

- FIGURE 27 EUROPE: E-HEALTH PRIORITIES IN HEALTH FACILITIES, 2019

- TABLE 5 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY

- FIGURE 28 EUROPE: EHEALTH CHALLENGES FACED BY HEALTHCARE PROVIDERS, 2019

- 6.3.4 ASIA PACIFIC: ADOPTION TRENDS

- FIGURE 29 ASIA PACIFIC: EMR & EHR ADOPTION RATES (2012 VS. 2015)

- 6.3.5 REST OF THE WORLD: ADOPTION TRENDS

- 6.4 PRICING ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE OF SOME ON-PREMISE V/S CLOUD-BASED SOLUTIONS, BY PRODUCT, 2020

- 6.5 ECOSYSTEM ANALYSIS

- FIGURE 30 ECOSYSTEM: HEALTHCARE CLOUD COMPUTING MARKET

- 6.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 HEALTHCARE CLOUD COMPUTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.6.1 THREAT OF NEW ENTRANTS

- 6.6.1.1 Capital requirement

- 6.6.1.2 High preference for products from well-established brands

- 6.6.2 THREAT OF SUBSTITUTES

- 6.6.2.1 Substitutes for healthcare cloud computing

- 6.6.3 BARGAINING POWER OF SUPPLIERS

- 6.6.3.1 Presence of several raw material suppliers

- 6.6.3.2 Supplier switching costs

- 6.6.4 BARGAINING POWER OF BUYERS

- 6.6.4.1 Few companies offer premium products at global level

- 6.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.6.5.1 Increasing demand for high quality and innovative products

- 6.6.5.2 Lucrative growth potential in emerging markets

- 6.7 REGULATORY ANALYSIS

- 6.7.1 NORTH AMERICA

- 6.7.2 EUROPE

- 6.7.3 ASIA PACIFIC

- 6.7.4 MIDDLE EAST & AFRICA

- 6.7.5 LATIN AMERICA

- 6.8 PATENT ANALYSIS

- 6.8.1 PATENT PUBLICATION TRENDS FOR HEALTHCARE CLOUD COMPUTING

- FIGURE 31 GLOBAL PATENT PUBLICATION TRENDS IN HEALTHCARE CLOUD COMPUTING MARKET, 2018-2022

- 6.8.2 TOP APPLICANTS (COMPANIES) FOR HEALTHCARE CLOUD COMPUTING PATENTS

- FIGURE 32 TOP COMPANIES THAT APPLIED FOR HEALTHCARE CLOUD COMPUTING PATENTS, 2018-2022

- 6.8.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN HEALTHCARE CLOUD COMPUTING MARKET

- FIGURE 33 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR HEALTHCARE CLOUD COMPUTING PATENTS, 2018-2022

- 6.9 IMPACT OF COVID-19 ON HEALTHCARE CLOUD COMPUTING MARKET

- 6.9.1 INTRODUCTION

- 6.9.2 COVID-19 DRIVEN MARKET DYNAMICS

- 6.9.2.1 Drivers and opportunities

- 6.9.2.2 Restraints and challenges

- 6.9.3 HEALTHCARE CLOUD COMPUTING: COVID-19 USE CASES

7 HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 8 HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 7.2 HEALTHCARE PROVIDER SOLUTIONS

- TABLE 9 HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 10 HEALTHCARE PROVIDER SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1 CLINICAL INFORMATION SYSTEMS

- TABLE 11 CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 12 CLINICAL INFORMATIONCHAN SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.1 Electronic health records/electronic medical records (EHR/EMR)

- 7.2.1.1.1 EHR/EMR to dominate clinical information systems market

- 7.2.1.1 Electronic health records/electronic medical records (EHR/EMR)

- TABLE 13 COMPANIES PROVIDING EHR SOLUTIONS

- TABLE 14 ELECTRONIC HEALTH RECORDS/ELECTRONIC MEDICAL RECORDS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.2 Picture archiving & communication systems and vendor-neutral archives (PACS AND VNA)

- 7.2.1.2.1 Growing image generation alongside need for scalability and easy sharing to drive PACS and VNA demand

- 7.2.1.2 Picture archiving & communication systems and vendor-neutral archives (PACS AND VNA)

- TABLE 15 COMPANIES PROVIDING PACS AND VNA SOLUTIONS

- TABLE 16 PICTURE ARCHIVING & COMMUNICATION SYSTEMS AND VENDOR-NEUTRAL ARCHIVES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.3 Population health management solutions

- 7.2.1.3.1 Rising prevalence of chronic diseases and need to reduce healthcare costs to drive PHM adoption

- 7.2.1.3 Population health management solutions

- TABLE 17 COMPANIES PROVIDING PHM SOLUTIONS

- TABLE 18 POPULATION HEALTH MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.4 Telehealth solutions

- 7.2.1.4.1 Shortage of health professionals to drive market growth

- 7.2.1.4 Telehealth solutions

- TABLE 19 COMPANIES PROVIDING TELEHEALTH SOLUTIONS

- TABLE 20 TELEHEALTH SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.5 Radiology information systems (RIS)

- 7.2.1.5.1 RIS uses a cloud solution to help convert radiology to a virtual solution

- 7.2.1.5 Radiology information systems (RIS)

- TABLE 21 COMPANIES PROVIDING RIS SOLUTIONS

- TABLE 22 RADIOLOGY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.6 Laboratory information systems

- 7.2.1.6.1 High flexibility, interoperability, scalability, and cost-efficiency of cloud-based LIS to drive market demand

- 7.2.1.6 Laboratory information systems

- TABLE 23 COMPANIES PROVIDING LIS SOLUTIONS

- TABLE 24 LABORATORY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.7 Pharmacy information systems

- 7.2.1.7.1 Rising demand for automatic refills and the growing popularity of e-prescriptions to drive PIS use

- 7.2.1.7 Pharmacy information systems

- TABLE 25 PHARMACY INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1.8 Other clinical information systems

- TABLE 26 OTHER CLINICAL INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2 NON-CLINICAL INFORMATION SYSTEMS

- TABLE 27 NON-CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 28 NONCLINICAL INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2.1 Revenue cycle management (RCM) solutions

- 7.2.2.1.1 RCM solutions hold largest share of nonclinical information systems market

- 7.2.2.1 Revenue cycle management (RCM) solutions

- TABLE 29 COMPANIES PROVIDING RCM SOLUTIONS

- TABLE 30 REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2.2 Financial management solutions

- 7.2.2.2.1 Cloud-based financial solutions to streamline and automate labor-intensive healthcare financial management functions

- 7.2.2.2 Financial management solutions

- TABLE 31 COMPANIES PROVIDING FINANCIAL MANAGEMENT SOLUTIONS

- TABLE 32 FINANCIAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2.3 Health information exchange (HIE) solutions

- 7.2.2.3.1 Need for timely sharing of vital patient information to drive HIE demand

- 7.2.2.3 Health information exchange (HIE) solutions

- TABLE 33 COMPANIES PROVIDING HIE SOLUTIONS

- TABLE 34 HEALTH INFORMATION EXCHANGE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2.4 Supply chain management solutions

- 7.2.2.4.1 Supply chain management solutions to help reduce operational and administrative expenses

- 7.2.2.4 Supply chain management solutions

- TABLE 35 SUPPLY CHAIN MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2.5 Billing & accounts management solutions

- 7.2.2.5.1 Implementing cloud-based billing to reduce expenses, increase revenue, and improve customer service

- 7.2.2.5 Billing & accounts management solutions

- TABLE 36 BILLING & ACCOUNTS MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2.6 Other nonclinical information systems

- TABLE 37 OTHER NON-CLINICAL INFORMATION SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 HEALTHCARE PAYER SOLUTIONS

- TABLE 38 HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 39 HEALTHCARE PAYER SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.1 CLAIMS MANAGEMENT SOLUTIONS

- 7.3.1.1 Claims management solutions to help healthcare payers efficiently manage claims processing

- TABLE 40 CLAIMS MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.2 PAYMENT MANAGEMENT SOLUTIONS

- 7.3.2.1 Payment management solutions connect payers, providers, members, and banks on a single integrated network

- TABLE 41 PAYMENT MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.3 CUSTOMER RELATIONSHIP MANAGEMENT (CRM) SOLUTIONS

- 7.3.3.1 Healthcare payers to create CRM strategies to meet unique needs of their stakeholders

- TABLE 42 CUSTOMER RELATIONSHIP MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.4 PROVIDER NETWORK MANAGEMENT (PRM) SOLUTIONS

- 7.3.4.1 PRM solutions to offer reliable and secure connection between provider-payer community

- TABLE 43 PROVIDER NETWORK MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3.5 FRAUD MANAGEMENT SOLUTIONS

- 7.3.5.1 Rising cases of insurance fraud to drive market growth

- TABLE 44 FRAUD MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

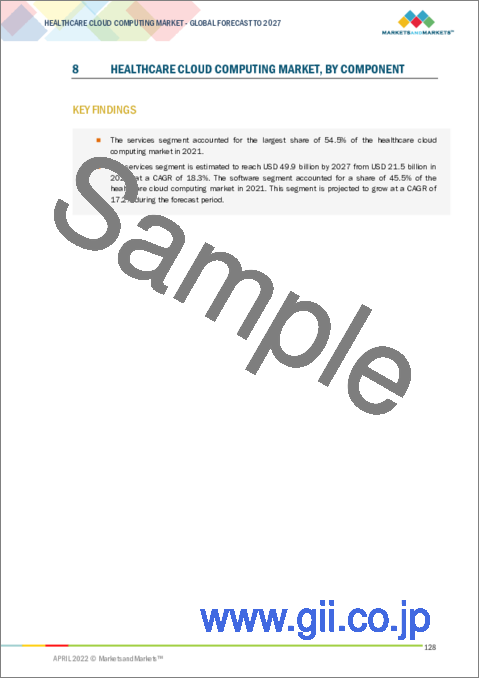

8 HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- TABLE 45 HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- 8.2 SERVICES

- 8.2.1 DEMAND FOR CONSULTING SERVICES TO GROW IN DEVELOPING REGIONS

- TABLE 46 HEALTHCARE CLOUD COMPUTING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 47 HEALTHCARE CLOUD COMPUTING SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 SOFTWARE

- 8.3.1 RISING HEALTHCARE COSTS DRIVE SOFTWARE ADOPTION

- TABLE 48 HEALTHCARE CLOUD COMPUTING SOFTWARE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

9 HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL

- 9.1 INTRODUCTION

- TABLE 49 HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- 9.2 PRIVATE CLOUD

- 9.2.1 PRIVATE CLOUD SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET

- TABLE 50 PRIVATE CLOUD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.3 HYBRID CLOUD

- 9.3.1 HYBRID CLOUD SEGMENT TO REGISTER HIGHEST GROWTH

- TABLE 51 HYBRID CLOUD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 9.4 PUBLIC CLOUD

- 9.4.1 DATA SECURITY AND PRIVACY CONCERNS TO RESTRICT SEGMENT GROWTH

- TABLE 52 PUBLIC CLOUD MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

10 HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL

- 10.1 INTRODUCTION

- TABLE 53 HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- 10.2 SOFTWARE-AS-A-SERVICE

- 10.2.1 SOFTWARE-AS-A-SERVICE SEGMENT TO DOMINATE HEALTHCARE CLOUD COMPUTING MARKET

- 10.2.2 BENEFITS OF SOFTWARE-AS-A-SERVICE

- TABLE 54 SOFTWARE-AS-A-SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.3 INFRASTRUCTURE-AS-A-SERVICE

- 10.3.1 INFRASTRUCTURE-AS-A-SERVICE SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 10.3.2 BENEFITS OF INFRASTRUCTURE-AS-A-SERVICE

- TABLE 55 INFRASTRUCTURE-AS-A-SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.4 PLATFORM-AS-A-SERVICE

- 10.4.1 PLATFORM-AS-A-SERVICE SIMPLIFIES APPLICATION DEVELOPMENT AND DEPLOYMENT ON CLOUD

- 10.4.2 BENEFITS OF PLATFORM-AS-A-SERVICE

- TABLE 56 PLATFORM-AS-A-SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

11 HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL

- 11.1 INTRODUCTION

- TABLE 57 HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- 11.2 PAY-AS-YOU-GO PRICING MODEL

- 11.2.1 PAY-AS-YOU-GO PRICING MODEL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 58 PAY-AS-YOU-GO PRICING MODEL MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.3 SPOT PRICING MODEL

- 11.3.1 SPOT PRICING MODEL OFFERS FLEXIBILITY AND UNLIMITED UTILIZATION OF SERVICES

- TABLE 59 SPOT PRICING MODEL MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

12 HEALTHCARE CLOUD COMPUTING MARKET, BY END USER

- 12.1 INTRODUCTION

- TABLE 60 HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 12.2 HEALTHCARE PROVIDERS

- 12.2.1 HEALTHCARE PROVIDERS USE CLOUD-BASED EMRS TO REDUCE COSTS, ENHANCE PRIVACY, AND FACILITATE BETTER PATIENT CARE

- TABLE 61 HEALTHCARE CLOUD COMPUTING MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 12.3 HEALTHCARE PAYERS

- 12.3.1 CLOUD COMPUTING ENABLES PAYERS TO ACCELERATE THEIR MEDICAL CLAIMS PROCESSING TASKS, ENHANCE CUSTOMER CARE, AND IMPROVE DOCUMENTATION ACTIVITIES

- TABLE 62 HEALTHCARE CLOUD COMPUTING MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2020-2027 (USD MILLION)

13 HEALTHCARE CLOUD COMPUTING MARKET, BY REGION

- 13.1 INTRODUCTION

- TABLE 63 HEALTHCARE CLOUD COMPUTING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- FIGURE 34 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET SNAPSHOT

- TABLE 64 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 NORTH AMERICA: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 70 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.2.1 US

- 13.2.1.1 Increasing healthcare costs and federal mandates encourage adoption of cloud solutions to propel market growth in US

- FIGURE 35 US: OFFICE-BASED PHYSICIAN AND HOSPITAL EHR ADOPTION (2008-2019)

- TABLE 75 US: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 76 US: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 77 US: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 78 US: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 79 US: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 US: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 81 US: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 82 US: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 83 US HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 84 US: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.2.2 CANADA

- 13.2.2.1 Deployment of digital health initiatives to drive market growth

- FIGURE 36 CANADA: EMR ADOPTION BY PRIMARY CARE PHYSICIANS, 2013-2018

- TABLE 85 CANADA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 86 CANADA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 CANADA: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 CANADA: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 CANADA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 90 CANADA: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 91 CANADA: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 92 CANADA: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 93 CANADA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 94 CANADA: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3 EUROPE

- TABLE 95 EUROPE: HEALTHCARE IT INITIATIVES

- TABLE 96 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 97 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 98 EUROPE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 EUROPE: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 EUROPE: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 EUROPE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 103 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 104 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 105 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 106 EUROPE: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3.1 GERMANY

- 13.3.1.1 High adoption of EHR systems among primary care physicians to drive market growth

- TABLE 107 GERMANY: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 108 GERMANY: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 GERMANY: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 GERMANY: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 111 GERMANY: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 112 GERMANY: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 113 GERMANY: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 114 GERMANY: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 115 GERMANY: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 116 GERMANY: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3.2 UK

- 13.3.2.1 Government initiatives favoring cloud solutions and services adoption to drive market growth

- TABLE 117 UK: HEALTHCARE CLOUD COMPUTING INITIATIVES AND FUNDING

- TABLE 118 UK: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 119 UK: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 UK: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 UK: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 UK: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 123 UK: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 124 UK: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 125 UK: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 126 UK: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 127 UK: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3.3 FRANCE

- 13.3.3.1 Favorable government initiatives for connected healthcare solutions to drive market growth

- TABLE 128 FRANCE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 129 FRANCE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 130 FRANCE: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 FRANCE: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 132 FRANCE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 133 FRANCE: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 134 FRANCE: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 135 FRANCE: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 136 FRANCE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 137 FRANCE: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3.4 ITALY

- 13.3.4.1 Introduction of National ehealth Pact to proper market growth

- TABLE 138 ITALY: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 139 ITALY: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 140 ITALY: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 141 ITALY: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 142 ITALY: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 143 ITALY: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 144 ITALY: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 145 ITALY: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 146 ITALY: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 147 ITALY: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3.5 SPAIN

- 13.3.5.1 High level of mobile phone penetration to drive mhealth market growth

- TABLE 148 SPAIN: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 149 SPAIN: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 150 SPAIN: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 151 SPAIN: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 152 SPAIN: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 153 SPAIN: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 154 SPAIN: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 155 SPAIN: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 156 SPAIN: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 157 SPAIN: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.3.6 REST OF EUROPE

- TABLE 158 ROE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 159 ROE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 160 ROE: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 161 ROE: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 162 ROE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 163 ROE: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 164 ROE: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 165 ROE: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 166 ROE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 167 ROE: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: HEALTHCARE CLOUD COMPUTING MARKET SNAPSHOT

- TABLE 168 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 169 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 170 APAC: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 171 APAC: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 172 APAC: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 173 APAC: HEALTHCARE PAYER SOLUTIONS MACRKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 174 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 175 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 176 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 177 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 178 APAC: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4.1 JAPAN

- 13.4.1.1 Growing wireless technologies and evolving mobile healthcare sector to drive market growth

- TABLE 179 JAPAN: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 180 JAPAN: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 181 JAPAN: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 182 JAPAN: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 183 JAPAN: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 184 JAPAN: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 185 JAPAN: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 186 JAPAN: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 187 JAPAN: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 188 JAPAN: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4.2 CHINA

- 13.4.2.1 Strong government support for healthcare reforms and systems digitalization to drive market growth

- TABLE 189 CHINA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 190 CHINA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 191 CHINA: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 192 CHINA: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 193 CHINA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 194 CHINA: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 195 CHINA: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 196 CHINA: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 197 CHINA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 198 CHINA: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4.3 INDIA

- 13.4.3.1 Increasing foreign direct investments in healthcare industry to drive market growth

- TABLE 199 INDIA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 200 INDIA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 201 INDIA: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 202 INDIA: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 203 INDIA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 204 INDIA: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 205 INDIA: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 206 INDIA: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 207 INDIA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 208 INDIA: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4.4 AUSTRALIA

- 13.4.4.1 Favorable government initiatives to drive market growth

- TABLE 209 AUSTRALIA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 210 AUSTRALIA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 211 AUSTRALIA: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 212 AUSTRALIA: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 213 AUSTRALIA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 214 AUSTRALIA: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 215 AUSTRALIA: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 216 AUSTRALIA: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 217 AUSTRALIA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 218 AUSTRALIA: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4.5 SINGAPORE

- 13.4.5.1 Gradual shift towards healthcare digitization to drive market growth

- TABLE 219 SINGAPORE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 220 SINGAPORE: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 221 SINGAPORE: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 222 SINGAPORE: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 223 SINGAPORE: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 224 SINGAPORE: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 225 SINGAPORE: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 226 SINGAPORE: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 227 SINGAPORE: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 228 SINGAPORE: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.4.6 REST OF ASIA PACIFIC

- TABLE 229 ROAPAC: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 230 ROAPAC: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 231 ROAPAC: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 232 ROAPAC: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 233 ROAPAC: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 234 ROAPAC: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 235 ROAPAC: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 236 ROAPAC: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 237 ROAPAC: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 238 ROAPAC: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.5 LATIN AMERICA

- TABLE 239 LATIN AMERICA: HEALTHCARE CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 240 LATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 241 LATAM: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 242 LATAM: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 243 LATAM: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 244 LATAM: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 245 LATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 246 LATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 247 LATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 248 LATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 249 LATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.5.1 BRAZIL

- 13.5.1.1 Brazil to account for largest share of Latin American market in 2021

- TABLE 250 BRAZIL: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 251 BRAZIL: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 252 BRAZIL: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 253 BRAZIL: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 254 BRAZIL: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 255 BRAZIL: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 256 BRAZIL: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 257 BRAZIL: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 258 BRAZIL: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 259 BRAZIL: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.5.2 MEXICO

- 13.5.2.1 New government strategies to boost adoption of healthcare cloud computing solutions

- TABLE 260 MEXICO: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 261 MEXICO: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 262 MEXICO: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 263 MEXICO: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 264 MEXICO: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 265 MEXICO: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 266 MEXICO: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 267 MEXICO: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 268 MEXICO: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 269 MEXICO: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.5.3 REST OF LATIN AMERICA

- TABLE 270 ROLATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 271 ROLATAM: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 272 ROLATAM: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 273 ROLATAM: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 274 ROLATAM: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 275 ROLATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 276 ROLATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 277 ROLATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 278 ROLATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 279 ROLATAM: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 INCREASING INVESTMENTS IN MODERNIZING HEALTHCARE SYSTEMS TO BOOST MARKET GROWTH

- TABLE 280 MIDDLE EAST & AFRICA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: HEALTHCARE PROVIDER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: CLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: NONCLINICAL INFORMATION SYSTEMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: HEALTHCARE PAYER SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: HEALTHCARE CLOUD COMPUTING MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: HEALTHCARE CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2027 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: HEALTHCARE CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2027 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: HEALTHCARE CLOUD COMPUTING MARKET, BY PRICING MODEL, 2020-2027 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: HEALTHCARE CLOUD COMPUTING MARKET, BY END USER, 2020-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT-TO-WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN HEALTHCARE CLOUD COMPUTING MARKET

- 14.3 COMPETITIVE BENCHMARKING

- TABLE 290 FOOTPRINT OF COMPANIES IN HEALTHCARE CLOUD COMPUTING MARKET

- TABLE 291 PRODUCT AND SERVICE: COMPANY FOOTPRINT (26 COMPANIES)

- TABLE 292 END USER: COMPANY FOOTPRINT (26 COMPANIES)

- TABLE 293 REGION: COMPANY FOOTPRINT (26 COMPANIES)

- 14.4 COMPETITIVE LEADERSHIP MAPPING

- 14.4.1 STARS

- 14.4.2 EMERGING LEADERS

- 14.4.3 PERVASIVE PLAYERS

- 14.4.4 PARTICIPANTS

- FIGURE 38 HEALTHCARE CLOUD COMPUTING MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 14.5 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (SMALL & MEDIUM ENTERPRISES)

- 14.5.1 PROGRESSIVE COMPANIES

- 14.5.2 DYNAMIC COMPANIES

- 14.5.3 STARTING BLOCKS

- 14.5.4 RESPONSIVE COMPANIES

- FIGURE 39 HEALTHCARE CLOUD COMPUTING MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (2021)

- 14.6 KEY PLAYERS ANALYSIS: HEALTHCARE CLOUD COMPUTING MARKET

- TABLE 294 HEALTHCARE CLOUD COMPUTING MARKET ANALYSIS BY VENDOR TYPE

- 14.7 COMPETITIVE SCENARIO

- TABLE 295 PRODUCT LAUNCHES & APPROVALS, 2019-2022

- TABLE 296 DEALS, 2019-2022

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, trategic Choices Made, and Weaknesses and Competitive Threats))**

- 15.1.1 AMAZON WEB SERVICES, INC. (AWS)

- TABLE 297 AMAZON WEB SERVICES, INC.: BUSINESS OVERVIEW

- FIGURE 40 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT (2021)

- 15.1.2 MICROSOFT CORPORATION

- TABLE 298 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 MICROSOFT CORPORATION: COMPANY SNAPSHOT (2021)

- 15.1.3 INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM)

- TABLE 299 IBM: BUSINESS OVERVIEW

- FIGURE 42 IBM: COMPANY SNAPSHOT (2020)

- 15.1.4 ATHENAHEALTH, INC.

- TABLE 300 ATHENAHEALTH, INC.: BUSINESS OVERVIEW

- 15.1.5 CARECLOUD, INC.

- TABLE 301 CARECLOUD, INC.: BUSINESS OVERVIEW

- FIGURE 43 CARECLOUD, INC.: COMPANY SNAPSHOT (2020)

- 15.1.6 SIEMENS HEALTHINEERS AG

- TABLE 302 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- FIGURE 44 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2021)

- 15.1.7 ECLINICALWORKS

- TABLE 303 ECLINICALWORKS: BUSINESS OVERVIEW

- 15.1.8 KONINKLIJKE PHILIPS N.V.

- TABLE 304 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- FIGURE 45 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2020)

- 15.1.9 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

- TABLE 305 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: BUSINESS OVERVIEW

- FIGURE 46 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2021)

- 15.1.10 NTT DATA CORPORATION

- TABLE 306 NTT DATA CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 NTT DATA CORPORATION: COMPANY SNAPSHOT (2020)

- 15.1.11 SECTRA AB

- TABLE 307 SECTRA AB: BUSINESS OVERVIEW

- FIGURE 48 SECTRA AB: COMPANY SNAPSHOT (2021)

- 15.1.12 GE HEALTHCARE

- TABLE 308 GE HEALTHCARE: BUSINESS OVERVIEW

- FIGURE 49 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

- 15.1.13 NEXTGEN HEALTHCARE, INC.

- TABLE 309 NEXTGEN HEALTHCARE, INC.: BUSINESS OVERVIEW

- FIGURE 50 NEXTGEN HEALTHCARE, INC.: COMPANY SNAPSHOT (2021)

- 15.1.14 DXC TECHNOLOGY

- TABLE 310 DXC TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 51 DXC TECHNOLOGY: COMPANY SNAPSHOT (2019)

- 15.1.15 INFINITT HEALTHCARE CO. LTD.

- TABLE 311 INFINITT HEALTHCARE CO. LTD.: BUSINESS OVERVIEW

- 15.1.16 HYLAND SOFTWARE, INC.

- TABLE 312 HYLAND SOFTWARE, INC.: BUSINESS OVERVIEW

- 15.1.17 SALESFORCE

- TABLE 313 SALESFORCE, INC.: BUSINESS OVERVIEW

- FIGURE 52 SALESFORCE, INC.: COMPANY SNAPSHOT (2021)

- 15.1.18 FUJIFILM HOLDINGS CORPORATION

- TABLE 314 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 53 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2020)

- 15.1.19 VEPRO EHEALTH SOLUTIONS

- TABLE 315 VEPRO EHEALTH SOLUTIONS: BUSINESS OVERVIEW

- 15.1.20 DELL TECHNOLOGIES, INC.

- TABLE 316 DELL TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 54 DELL TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

- 15.1.21 ENSOFTEK, INC.

- TABLE 317 ENSOFTEK, INC.: BUSINESS OVERVIEW

- 15.2 OTHER PLAYERS

- 15.2.1 ORACLE CORPORATION

- 15.2.2 IRON MOUNTAIN, INC.

- 15.2.3 CLEARDATA NETWORKS, INC.

- 15.2.4 GLOBAL NET ACCESS (GNAX)

- 15.2.5 VMWARE, INC.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS