|

|

市場調査レポート

商品コード

1880369

炭化ケイ素(SiC)の世界市場:SiCディスクリートデバイス別、電圧範囲別、自動車用SiCデバイス - 予測(~2030年)Silicon Carbide (SiC) Market by SiC Discrete Device, Voltage Range, Automotive SiC Device - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 炭化ケイ素(SiC)の世界市場:SiCディスクリートデバイス別、電圧範囲別、自動車用SiCデバイス - 予測(~2030年) |

|

出版日: 2025年10月07日

発行: MarketsandMarkets

ページ情報: 英文 274 Pages

納期: 即納可能

|

概要

世界のシリコンカーバイド(SiC)の市場規模は、2025年の38億3,000万米ドルから2030年までに120億3,000万米ドルに達すると予測され、CAGRで25.7%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | SiCディスクリートデバイス、SiCモジュール、電圧範囲、媒体、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

シリコンカーバイド(SiC)市場は、電気自動車へのSiCデバイスの展開の拡大と、産業・エネルギー用途における高効率パワーエレクトロニクスへの需要の増加により、堅調な成長を示しています。自動車メーカーは、トラクションインバーター、オンボードチャージャー、急速充電システム向けにSiC MOSFETとモジュールを採用しており、再生可能エネルギーとグリッドインフラプロジェクトでは、より高い効率性と信頼性を実現するためにSiCを活用しています。

ワイドバンドギャップ技術、ウエハー微細化、基板品質の進歩により性能が向上し、システムコストが低下しているため、より広範な採用が可能となっています。これらの要因により、次世代電力システムにおけるシリコンからSiCへの移行が加速しています。同時に、コンパクトでエネルギー効率が高く、高温耐性のあるデバイスへの需要が高まっている通信、輸送、産業オートメーションにおいても、市場は大きな機会を示しています。材料とパッケージングにおける継続的な革新、世界的な生産能力の拡大は、より大きなスケーラビリティを促進し、SiCがより持続可能な未来に向けたパワーエレクトロニクスを再定義することを可能にしています。

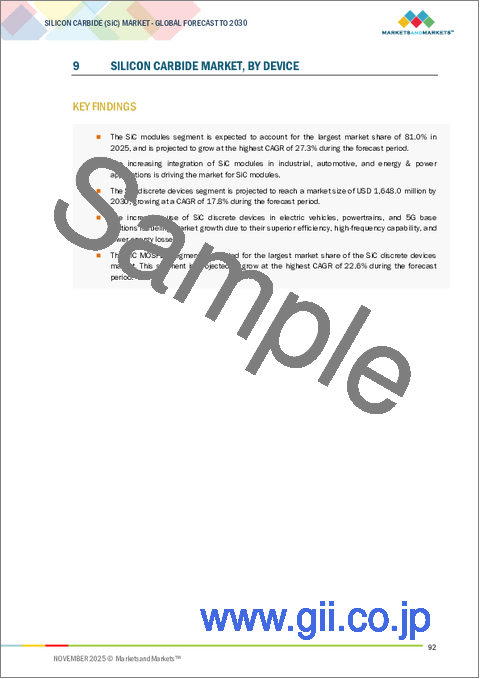

「デバイス別では、SiCモジュールがシリコンカーバイド(SiC)市場で最速の成長を記録します。」

産業界がコンパクトな統合された高効率電力管理ソリューションをますます求める中、SiCモジュールがシリコンカーバイド(SiC)市場においてもっとも速い成長を記録すると予測されます。ディスクリートデバイスとは異なり、モジュールは複数のSiCコンポーネントを単一のパッケージ内に統合することで、より高い電力密度、単純化されたシステム設計、強化された熱性能を提供します。この特性により、電気自動車のパワートレイン、急速充電インフラ、産業用モーター駆動装置、再生可能エネルギーシステムなど、堅牢かつ拡張性のあるソリューションを必要とする用途において特に価値が高まっています。電動モビリティへの移行が大きな促進要因となっており、自動車メーカーはSiCモジュールを採用することで、航続距離の向上とエネルギー損失の低減を実現する効率的なトラクションインバーターやオンボードチャージングシステムを提供しています。再生可能エネルギーにおいては、SiCモジュールが高い電圧を最小限の損失で処理することで、太陽光と風力の変換効率を向上させています。さらに、データセンターや通信インフラにおいても、電力使用効率の向上と運用コスト削減を目的に、これらのモジュールの採用が拡大しています。パッケージング技術が進歩し、規模の経済が製造を拡大させる中、SiCモジュールのコスト競争力は高まり、急速な普及をさらに加速させています。性能、信頼性、拡張性を兼ね備えたこれらのモジュールは、世界のシリコンカーバイド(SiC)市場においてもっとも成長の速いセグメントとなっています。

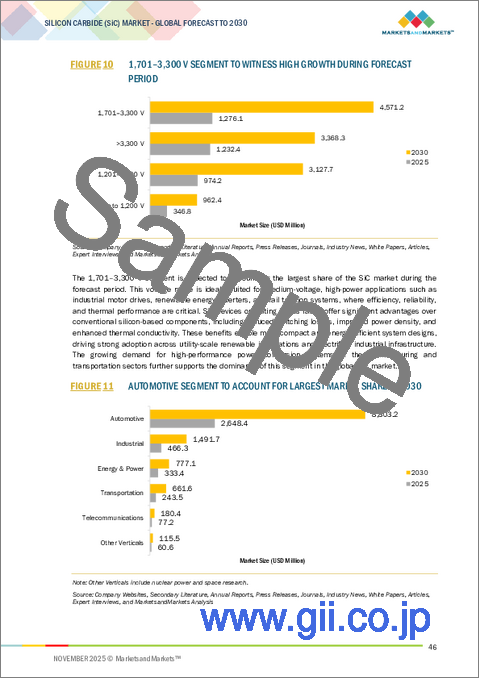

「電圧範囲別では、中電圧範囲(1,700V~3,300V)がシリコンカーバイド(SiC)市場で最大のシェアを占める見込みです。」

1,700V~3,300Vの中電圧範囲が予測期間にシリコンカーバイド(SiC)市場で最大のシェアを占めると見込まれています。このセグメントは、従来のシリコンソリューションが効率性、熱管理、電力密度において限界に直面する高性能用途の基盤となっています。主な成長分野としては、高電圧・高温環境下での信頼性ある動作が求められる電気鉄道牽引、風力タービン、産業用駆動装置、高出力EVインバーターがあります。中電圧SiCデバイスはスイッチング損失の低減と熱安定性の向上を実現し、エネルギー効率とシステム小型化を優先する過酷な環境に極めて適しています。輸送部門、特に電気鉄道や大型電気自動車においては、これらのデバイスが効率向上と航続距離の改良を推進しています。再生可能エネルギーにおいては、太陽光インバーターや風力エネルギー変換システムにおいて、より高い出力と信頼性を実現します。産業界が省エネルギー、コンパクト設計、持続可能性をますます重視する中、中電圧SiC範囲は市場全体への普及における最大の要因となっており、産業部門および電力集約的な部門における長期的な優位性を確保しています。

当レポートでは、世界のシリコンカーバイド(SiC)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- シリコンカーバイド市場の企業にとって魅力的な機会

- シリコンカーバイド市場:業界別

- シリコンカーバイド市場:デバイス別

- シリコンカーバイド市場:電圧範囲別

- アジア太平洋のシリコンカーバイド市場:業界別、国別(2025年)

- シリコンカーバイド市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- カスタマービジネスに影響を与える動向/ディスラプション

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格設定の分析

- SICデバイスの平均販売価格の動向:主要企業別

- 平均販売価格の動向:デバイス別

- デバイスの平均販売価格の動向:地域別

- 主なステークホルダーと購入基準

- ポーターのファイブフォース分析

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(HSコード284920)

- 輸出シナリオ(HSコード284920)

- 特許分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 基準と規制

- 主な会議とイベント(2024年~2025年)

- シリコンカーバイド市場に対するAI/生成AIの影響

- シリコンカーバイド市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 業界への影響

第6章 SICデバイスの結晶構造

- イントロダクション

- 立方晶系(3C-SiC/閃亜鉛鉱)

- 六方晶系(4H-SiC、6H-SiC)

- 菱面体晶(15R-SIC)

第7章 SIC材料のタイプ

- イントロダクション

- グリーンSIC

- ブラックSIC

第8章 各ウエハーサイズにおけるシリコンカーバイド市場の動向

- イントロダクション

- 150mm以下

- 150mm超

第9章 シリコンカーバイド市場:デバイス別

- イントロダクション

- SICディスクリートデバイス

- SICモジュール

第10章 シリコンカーバイド市場:業界別

- イントロダクション

- 自動車

- エネルギー・電力

- 工業

- 輸送

- 通信

- その他の業界

第11章 シリコンカーバイド市場:電圧範囲別

- イントロダクション

- 1,200V以下

- 1,201~1,700V

- 1,701~3,300V

- 3,300V超

第12章 シリコンカーバイド市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧諸国

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 主要企業の収益分析(2020年~2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- STMICROELECTRONICS

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- INFINEON TECHNOLOGIES AG

- WOLFSPEED, INC.

- ROHM CO., LTD.

- FUJI ELECTRIC CO., LTD.

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- MICROCHIP TECHNOLOGY INC.

- MITSUBISHI ELECTRIC CORPORATION

- ROBERT BOSCH GMBH

- その他の企業

- SEMIKRON DANFOSS

- NAVITAS SEMICONDUCTOR

- TT ELECTRONICS

- VISHAY INTERTECHNOLOGY, INC.

- WEEN SEMICONDUCTORS

- MINEBEA POWER SEMICONDUCTOR DEVICE INC.

- SOLITRON DEVICES, INC.

- SANAN IC

- BYD SEMICONDUCTOR

- LITTELFUSE, INC.

- TYCO TIANRUN, INC.

- NEXPERIA

- INVENTCHIP TECHNOLOGY CO., LTD.

- DIODES INCORPORATED

- MCC

- SICウエハーメーカー

- SOITEC

- XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.

- COHERENT CORP.

- SK SILTRON CO., LTD.

- TANKEBLUE CO., LTD.