|

|

市場調査レポート

商品コード

1829983

内視鏡機器の世界市場:製品別、用途別、エンドユーザー別、地域別 - 予測(~2030年)Endoscopy Equipment Market by Product (Endoscopes (Flexible, Rigid, Robot-assisted, Capsule), Visualization Systems, Accessories, Others), Application (Laparoscopy, Cystoscopy), End User (Hospitals, ASCs, Clinics), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 内視鏡機器の世界市場:製品別、用途別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年09月18日

発行: MarketsandMarkets

ページ情報: 英文 593 Pages

納期: 即納可能

|

概要

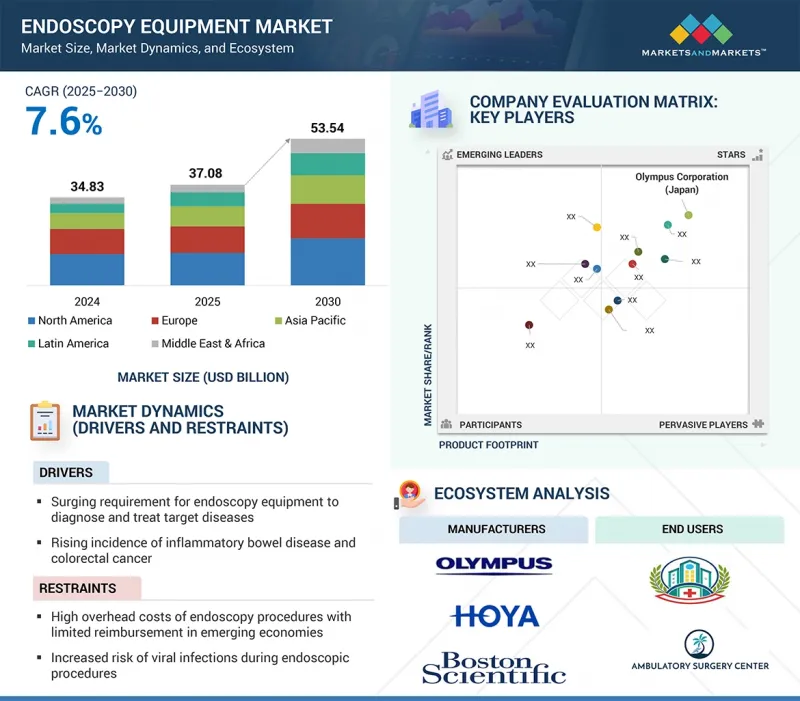

世界の内視鏡機器の市場規模は、2025年の370億8,000万米ドルから2030年までに535億4,000万米ドルに達すると予測されており、予測期間にCAGRで7.6%の成長が見込まれます。

市場の成長は、大腸がんや炎症性腸疾患などの対象疾患を診断および管理する内視鏡手術に対する需要の高まりによって促進されます。市場機会は、感染制御の懸念に対処するのに役立つ使い捨て内視鏡の採用の拡大から生まれています。さらに、新興経済圏における医療インフラの急速な拡大は、未開発の可能性を示しています。これらの地域では、投資が増加し、医療へのアクセスが改良され、患者ケアの基準が進化しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 製品、用途、エンドユーザー、地域 |

| 対象地域 | 北米、アジア太平洋、ラテンアメリカ、中東・アフリカ |

しかし、デバイスの高いコスト、再処理にかかわらない交差汚染のリスク、代替診断技術の利用可能性などが市場成長を抑制しています。さらに、一部の地域では熟練した専門家の不足や規制上の課題が、より広範な市場への浸透を妨げています。

「軟性内視鏡セグメントが予測期間に最大の市場シェアを占める見込みです。」

製品別では、内視鏡機器市場は内視鏡、可視化システム、その他の内視鏡機器、アクセサリに区分されます。内視鏡セグメントはさらに、軟性内視鏡、硬性内視鏡、ロボット支援内視鏡、カプセル内視鏡に区分されます。このうち、軟性内視鏡は、応用範囲が広く、操作性に優れ、低侵襲の診断・治療手術に好まれていることから、2024年に最大の市場シェアを占めています。この優位性は予測期間も続く見込みです。

軟性内視鏡は、消化器、肺、泌尿器、婦人科などの用途で広く使用されており、硬性内視鏡に比べ、患者の快適性と、複雑な解剖学的構造へのアクセスを提供します。高精度で高解像度の画像を提供できるため、疾患の早期発見と効果的な治療が可能になり、医療提供者の間で採用が進んでいます。消化器疾患の世界的な負担の増加、がん検診プログラム、外来内視鏡手術への選好の高まりが、さらに需要を強化しています。さらに、使い捨てやシングルユースの軟性内視鏡のような進行中の技術革新は、交差汚染や再処理コストに関する懸念に対処し、病院や外来手術センターにとって非常に魅力的なものとなっています。これらの要因により、軟性内視鏡は内視鏡機器市場においてもっとも支配的なセグメントとなっています。

「腹腔鏡セグメントが予測期間に第2位の市場を占める見込みです。」

腹腔鏡検査セグメントが2024年に市場で第2位のシェアを占め、予測期間もリードする見込みです。これは、複数の治療分野で好ましい外科的アプローチとして広く採用されているためです。例えば、National Library of Medicine(2023年10月)によると、腹腔鏡手術は従来の開腹手術に比べて、手術時間の短縮、出血量の減少、速い回復、入院期間の短縮など、統計的に有意な利点を示しており、患者や医療提供者にとって非常に有利です。

肥満の急速な増加は、腹腔鏡下肥満治療に対する需要をさらに加速させています。瘢痕の減少や回復の速さに対する患者の選好の高まりが、このセグメントの成長を後押しし続け、内視鏡機器市場において第2位の寄与者としての地位を確固たるものとしています。

「アジア太平洋が最速で成長し、北米が予測期間に最大のシェアを占める見込みです。」

世界の内視鏡機器市場は、北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカの主要5地域に区分されます。このうちアジア太平洋は、医療インフラの発達、医療費の増加、中国やインドにおける疾患の早期発見に対する意識の高まりにより、もっとも速い成長が見込まれています。これらの国々は、特にがんや心血管障害などの慢性疾患の患者の増加を管理するため、診断能力や手術能力の強化に多額の投資を行っています。日本では、国民皆保険制度により医療制度が発達しており、先進の内視鏡手術への幅広いアクセスが確保されています。さらに、メディカルツーリズムの増加、政府の積極的な取り組み、低侵襲技術の採用の増加などが市場浸透を加速させており、アジア太平洋は世界の内視鏡機器市場における高成長地域となっています。

当レポートでは、世界の内視鏡機器市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 内視鏡機器市場の概要

- 北米の内視鏡機器市場:エンドユーザー別、国別

- 地域の構成:内視鏡機器市場

- 地域の構成:内視鏡機器市場(2025年~2030年)

- 内視鏡機器市場:新興国市場 vs. 先進国市場(2025年・2030年)

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- AIと画像誘導ソリューション

- デジタルプラットフォームと接続性の統合

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 平均販売価格の動向:主要企業別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- HSコード901890の輸入データ

- HSコード901890の輸出データ

- 主な会議とイベント(2025年~2026年)

- ケーススタディ分析

- 規制情勢

- 規制分析

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 隣接市場の分析

- アンメットニーズ

- 内視鏡機器市場におけるAIの影響

- イントロダクション

- 内視鏡機器エコシステムにおけるAIの市場可能性

- AIユースケース

- AIを導入している主要企業

- 内視鏡機器市場における生成AIの将来

- 2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 地域に対する影響

- 最終用途産業に対する影響

第6章 内視鏡機器市場:タイプ別

- イントロダクション

- 可視化システム

- 内視鏡

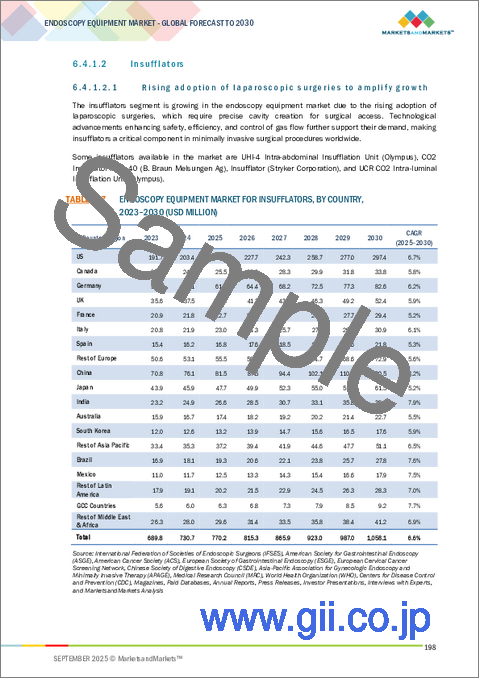

- その他の内視鏡機器

- アクセサリ

第7章 内視鏡機器市場:用途別

- イントロダクション

- 消化管内視鏡検査

- 腹腔鏡検査

- 泌尿器科内視鏡検査(膀胱鏡検査)

- 関節鏡検査

- 産婦人科内視鏡検査

- 気管支鏡検査

- 耳鼻咽喉科内視鏡検査

- 縦隔鏡検査

- その他の用途

第8章 内視鏡機器市場:エンドユーザー別

- イントロダクション

- 病院

- 外来手術センター

- 診療所

- その他のエンドユーザー

第9章 内視鏡機器市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- OLYMPUS CORPORATION

- KARL STORZ SE & CO. KG

- BOSTON SCIENTIFIC CORPORATION

- STRYKER

- FUJIFILM CORPORATION

- JOHNSON & JOHNSON

- MEDTRONIC

- HOYA CORPORATION

- NIPRO

- SMITH+NEPHEW

- STERIS

- AMBU A/S

- RICHARD WOLF GMBH

- INTUITIVE SURGICAL OPERATIONS, INC.

- B. BRAUN SE

- その他の企業

- HOLOGIC, INC.

- CONMED CORPORATION

- TELEFLEX INCORPORATED

- SONOSCAPE MEDICAL CORP.

- ENDOMED SYSTEMS GMBH

- HUNAN VATHIN MEDICAL INSTRUMENT CO., LTD.

- CAPSOVISION, INC.

- ATMOS MEDIZINTECHNIK GMBH & CO. KG

- LABORIE

- ZHUHAI PUSEN MEDICAL TECHNOLOGY CO., LTD.