|

|

市場調査レポート

商品コード

1715157

炭素繊維の世界市場:原材料別、繊維タイプ別、弾性率別、製品タイプ別、用途別、最終用途産業別、地域別 - 2030年までの予測Carbon Fiber Market by Raw Material Type, BFiber Type, Modulus, Product Type, Application, End-use Industry, Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 炭素繊維の世界市場:原材料別、繊維タイプ別、弾性率別、製品タイプ別、用途別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月23日

発行: MarketsandMarkets

ページ情報: 英文 327 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

炭素繊維の市場規模は、2025年に48億2,000万米ドルと推定され、2025年から2030年までのCAGRは7.2%と見込まれており、2030年には68億2,000万米ドルに達すると予測されています。

石油系ピッチを原料とするピッチ系炭素繊維は、優れた機械的特性と高い熱安定性を備えています。優れた引張強度を有し、鋼鉄に匹敵する5GPaを超えます。さらに、比剛性はアルミニウムの2倍であり、軽量用途に理想的です。ピッチ炭素繊維は、腐食、化学薬品、極端な温度に対して卓越した耐性を示し、厳しい環境下での利用を可能にします。熱伝導率が高いため、効率的な熱放散が可能で、熱に敏感な用途に適しています。さらに、ピッチ系炭素繊維は耐疲労性が向上しており、PAN系繊維と比較して特定の用途でより高精度に製造することができます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(キロトン) |

| セグメント | 原材料別、繊維タイプ別、弾性率別、製品タイプ別、用途別、最終用途産業別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、ラテンアメリカ |

バージンファイバー分野が最大の市場シェアを占めたのは、軽量構造、剛性、耐薬品性などの優れた特性により、航空宇宙・防衛、自動車、風力エネルギー、スポーツ用品などの最終用途産業で欠かせない存在となっているためです。これらの産業は、航空機や自動車の燃費性能を向上させるため、軽量素材に依存しています。バージン炭素繊維の使用は、その確立された製造工程と安定した品質により支持されています。再生炭素繊維は持続可能な代替材料として支持を集めているが、バージン炭素繊維はその優れた機械的特性と構造部品への多様な用途のため、依然として優位を保っています。

高弾性炭素繊維は、炭素繊維市場全体で第3位のシェアを占めました。高弾性炭素繊維は、強度よりも剛性が重視される用途向けに設計された特殊な炭素繊維です。高弾性炭素繊維は、炭素含有率が98%以上と高いのが特徴で、これが卓越した剛性と変形抵抗性に寄与しています。高弾性炭素繊維の重要な特性はその弾性率で、通常370GPaを超え、標準的な炭素繊維よりもかなり硬いです。

長繊維セグメントは炭素繊維市場全体で3番目に大きなシェアを占めました。長繊維は、その名が示すように1mmを超える繊維で構成され、高性能複合材料の強化材としてよく使用されます。これらの繊維は、短い炭素繊維に比べて、高い引張強度、改善された耐疲労性、強化された剛性などの優れた機械的特性を提供します。これらの特性は、風力タービンブレード、航空機部品、F1カーなど、連続的な応力がかかる用途に理想的です。

炭素繊維市場では、非複合材料分野が第2位のシェアを占めました。炭素繊維は、高い強度対重量比、剛性、耐腐食性、耐疲労性など、複合材料用途での卓越した特性で有名であるため、非複合材料用途でも需要が高まっています。炭素繊維は優れた熱伝導性と電気伝導性を示すため、ヒートシンク、電磁波シールド、さらには先進的なバッテリーや燃料電池の開発など、エレクトロニクス分野での用途に適しています。また、生体適合性と放射線透過性により、医療分野でも人気が高まっており、手術器具、人工装具、画像機器に最適です。

圧力容器産業は、予測期間中に炭素繊維市場で最も速い成長を記録すると予測されています。圧力容器は、高強度炭素繊維のトウをマンドレルにフィラメント巻きすることで製造され、完成した構造ではライナーとして機能し、タイトガスを保証します。炭素繊維トウ・プリプレグ製の圧力容器は、スチール製やアルミニウム製の圧力容器よりも75%軽く、幅広い用途に適しています。さらに、カーボンは他の材料に比べて比較的コスト効率が高く、性能と価格のバランスがとれています。製造や溶接が容易であることも、圧力容器の建設に広く使用される一因となっています。

アジア太平洋は、急速な工業化、自動車、航空宇宙、製造業における軽量材料の需要増加、技術進歩への強い注力に支えられ、予測期間中、炭素繊維市場で最も急成長する地域と予測されます。特に、日本、中国、韓国のような国々は、航空宇宙、自動車、インフラプロジェクトでの用途のための高度な製造技術や炭素繊維複合材の市場開拓において、炭素繊維市場に多額の投資を行っています。これらの国々は最先端技術と技術革新で知られ、東レや三菱化学グループなどの大手企業が高性能用途の炭素繊維生産の進歩を推進しています。

当レポートでは、世界の炭素繊維市場について調査し、原材料別、繊維タイプ別、弾性率別、製品タイプ別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- サプライチェーン分析

- エコシステム分析

- 価格分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 炭素繊維の製造における主な工程

- 炭素繊維製造のための補完技術

- AI/生成AIが炭素繊維市場に与える影響

- マクロ経済見通し

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

第6章 炭素繊維市場(原材料別)

- イントロダクション

- PANベース炭素繊維

- ピッチ系炭素繊維

第7章 炭素繊維市場(繊維タイプ別)

- イントロダクション

- バージンカーボンファイバー

- リサイクルカーボンファイバー

第8章 炭素繊維市場(弾性率別)

- イントロダクション

- 標準

- 中

- 高

第9章 炭素繊維市場(製品タイプ別)

- イントロダクション

- 連続繊維

- 長炭素繊維

- 短炭素繊維

第10章 炭素繊維市場(用途別)

- イントロダクション

- 複合材料

- 非複合材料

第11章 炭素繊維市場(最終用途産業別)

- イントロダクション

- 航空宇宙・防衛

- 風力エネルギー

- 自動車

- パイプ

- スポーツ用品

- 医療・ヘルスケア

- 建設・インフラ

- 圧力容器

- 船舶

- その他

第12章 炭素繊維市場(地域別)

- イントロダクション

- 欧州

- 欧州:炭素繊維市場(最終用途産業別)

- 欧州:国別炭素繊維市場

- 北米

- 北米:炭素繊維市場(最終用途産業別)

- 北米:国別炭素繊維市場

- アジア太平洋

- アジア太平洋:最終用途産業別炭素繊維市場

- アジア太平洋:国別炭素繊維市場

- 中東・アフリカ

- 中東・アフリカ:最終用途産業別炭素繊維市場

- 中東・アフリカ:国別炭素繊維市場

- ラテンアメリカ

- ラテンアメリカ:炭素繊維市場(最終用途産業別)

- ラテンアメリカ:国別炭素繊維市場

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2019年~2023年)

- 市場シェア分析、2024年

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- TORAY INDUSTRIES, INC.

- DOWAKSA

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SYENSQO

- TEIJIN LIMITED

- SGL CARBON

- HEXCEL CORPORATION

- HS HYOSUNG ADVANCED MATERIALS

- ZHONGFU SHENYING CARBON FIBER CO., LTD.

- KUREHA CORPORATION

- OSAKA GAS CHEMICALS CO., LTD.

- UMATEX

- JILIN CHEMICAL FIBER GROUP CO., LTD.

- JIANGSU HENGSHEN CO., LTD.

- CHINA NATIONAL BLUESTAR(GROUP)CO., LTD.

- その他の企業

- CHINA WEIHAI GUANGWEI COMPOSITES CO., LTD.

- CHANGSHENG(LANGFANG)TECHNOLOGY CO., LTD.

- JILIN JIYAN HIGH-TECH FIBER CO., LTD.

- JILIN SHENZHOU CARBON FIBER CO., LTD.

- ALFA CHEMISTRY

- BCIRCULAR

- VARTEGA INC.

- FLINK INTERNATIONAL CO., LTD.

- CHINA COMPOSITES GROUP CORPORATION LTD.

- FORMOSA PLASTICS CORPORATION

- NIPPON GRAPHITE FIBER CO., LTD.

- NEWTECH GROUP CO., LTD.

- ACE C&TECH CO., LTD.

- PROCOTEX

- CARBON CONVERSIONS

第15章 付録

List of Tables

- TABLE 1 NEW WIND POWER INSTALLATIONS (OFFSHORE), BY REGION, 2023-2033 (GW)

- TABLE 2 CARBON FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 CARBON FIBER MARKET: ROLE IN ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030 (USD/KG)

- TABLE 7 TOP 10 EXPORTING COUNTRIES OF CARBON FIBERS IN 2024

- TABLE 8 TOP 10 IMPORTING COUNTRIES OF CARBON FIBERS IN 2024

- TABLE 9 TOP USE CASES AND MARKET POTENTIAL

- TABLE 10 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 11 CASE STUDIES OF AI IMPLEMENTATION IN CARBON FIBER MARKET

- TABLE 12 GDP PERCENTAGE (%) CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 13 CARBON FIBER MARKET: TOTAL NUMBER OF PATENTS

- TABLE 14 LIST OF PATENTS BY TORAY INDUSTRIES, INC.

- TABLE 15 LIST OF CHINA PETROLEUM & CHEMICAL CORPORATION

- TABLE 16 US: TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 CARBON FIBER MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 CARBON FIBER MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 22 CARBON FIBER MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 23 CARBON FIBER MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 24 CARBON FIBER MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 25 PAN-BASED CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 26 PAN-BASED CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 27 PAN-BASED CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 PAN-BASED CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 29 PITCH-BASED CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 PITCH-BASED CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 31 PITCH-BASED CARBON FIBER, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 PITCH-BASED CARBON FIBER, BY REGION, 2025-2030 (KILOTON)

- TABLE 33 CARBON FIBER MARKET, BY FIBER TYPE, 2022-2024 (USD MILLION)

- TABLE 34 CARBON FIBER MARKET, BY FIBER TYPE, 2022-2024 (KILOTON)

- TABLE 35 CARBON FIBER MARKET, BY FIBER TYPE, 2025-2030 (USD MILLION)

- TABLE 36 CARBON FIBER MARKET, BY FIBER TYPE, 2025-2030 (KILOTON)

- TABLE 37 CARBON FIBER MARKET, BY MODULUS, 2022-2024 (USD MILLION)

- TABLE 38 CARBON FIBER MARKET, BY MODULUS, 2022-2024 (KILOTON)

- TABLE 39 CARBON FIBER MARKET, BY MODULUS, 2025-2030 (USD MILLION)

- TABLE 40 CARBON FIBER MARKET, BY MODULUS, 2025-2030 (KILOTON)

- TABLE 41 CARBON FIBER MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 42 CARBON FIBER MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 43 CARBON FIBER MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 44 CARBON FIBER MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 45 CONTINUOUS CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 46 CONTINUOUS CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 47 CONTINUOUS CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 CONTINUOUS CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 49 LONG CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 50 LONG CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 51 LONG CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 LONG CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 53 SHORT CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 54 SHORT CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 55 SHORT CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SHORT CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 57 CARBON FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 58 CARBON FIBER MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 59 CARBON FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 CARBON FIBER MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 61 COMPOSITES: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 62 COMPOSITES: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 63 COMPOSITES: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 COMPOSITES: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 65 NON-COMPOSITES: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 66 NON-COMPOSITES: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 67 NON-COMPOSITES: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 NON-COMPOSITES: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 69 CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 70 CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 71 CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 72 CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 73 NUMBER OF NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2024-2043

- TABLE 74 AEROSPACE & DEFENSE: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 75 AEROSPACE & DEFENSE: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 76 AEROSPACE & DEFENSE: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AEROSPACE & DEFENSE: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 78 WIND ENERGY: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 79 WIND ENERGY: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 80 WIND ENERGY: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 WIND ENERGY: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 82 AUTOMOTIVE: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 83 AUTOMOTIVE: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 84 AUTOMOTIVE: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 AUTOMOTIVE: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 86 PIPES: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 87 PIPES: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 88 PIPES: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 PIPES: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 90 SPORTING GOODS: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 91 SPORTING GOODS: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 92 SPORTING GOODS: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 SPORTING GOODS: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 94 MEDICAL & HEALTHCARE: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 95 MEDICAL & HEALTHCARE: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 96 MEDICAL & HEALTHCARE: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 MEDICAL & HEALTHCARE: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 98 CONSTRUCTION & INFRASTRUCTURE: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 99 CONSTRUCTION & INFRASTRUCTURE: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 100 CONSTRUCTION & INFRASTRUCTURE: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 CONSTRUCTION & INFRASTRUCTURE: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 102 PRESSURE VESSELS: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 103 PRESSURE VESSELS: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 104 PRESSURE VESSELS: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 PRESSURE VESSELS: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 106 MARINE: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 107 MARINE: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 108 MARINE: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 MARINE: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 110 OTHER END-USE INDUSTRIES: CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 111 OTHER END-USE INDUSTRIES: CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 112 OTHER END-USE INDUSTRIES: CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 OTHER END-USE INDUSTRIES: CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 114 CARBON FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 115 CARBON FIBER MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 116 CARBON FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 CARBON FIBER MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 118 EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 119 EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 120 EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 122 EUROPE: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 123 EUROPE: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 124 EUROPE: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 126 GERMANY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 127 GERMANY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 128 GERMANY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 130 FRANCE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 131 FRANCE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 132 FRANCE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 FRANCE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 134 UK: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 135 UK: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 136 UK: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 UK: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 138 ITALY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 139 ITALY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 140 ITALY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 ITALY: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 142 SPAIN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 143 SPAIN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 144 SPAIN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 SPAIN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 146 REST OF EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 147 REST OF EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 148 REST OF EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 150 NORTH AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 151 NORTH AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 152 NORTH AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 154 NORTH AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 155 NORTH AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 156 NORTH AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 158 US: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 159 US: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 160 US: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 US: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 162 CANADA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 163 CANADA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 164 CANADA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 CANADA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 166 ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 168 ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 170 ASIA PACIFIC: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 172 ASIA PACIFIC: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 174 JAPAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 175 JAPAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 176 JAPAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 JAPAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 178 CHINA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 179 CHINA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 180 CHINA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 CHINA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 182 TAIWAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 183 TAIWAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 184 TAIWAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 TAIWAN: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 186 SOUTH KOREA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 187 SOUTH KOREA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 188 SOUTH KOREA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH KOREA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 190 REST OF ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 192 REST OF ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 196 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 200 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 202 UAE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 203 UAE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 204 UAE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 UAE: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 206 SAUDI ARABIA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 207 SAUDI ARABIA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 208 SAUDI ARABIA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 209 SAUDI ARABIA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 210 REST OF GCC COUNTRIES: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 211 REST OF GCC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 212 REST OF GCC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 213 REST OF GCC: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 214 SOUTH AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 215 SOUTH AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 216 SOUTH AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 217 SOUTH AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 222 LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 223 LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 224 LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 225 LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 226 LATIN AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 227 LATIN AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 228 LATIN AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: CARBON FIBER MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 230 BRAZIL: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 231 BRAZIL: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 232 BRAZIL: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 233 BRAZIL: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 234 MEXICO: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 235 MEXICO: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 236 MEXICO: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 237 MEXICO: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 238 REST OF LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 240 REST OF LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 241 REST OF LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 242 CARBON FIBER MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 243 CARBON FIBER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 244 CARBON FIBER MARKET: REGION FOOTPRINT

- TABLE 245 CARBON FIBER MARKET: RAW MATERIAL TYPE FOOTPRINT

- TABLE 246 CARBON FIBER MARKET: FIBER TYPE FOOTPRINT

- TABLE 247 CARBON FIBER MARKET: MODULUS FOOTPRINT

- TABLE 248 CARBON FIBER MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 249 CARBON FIBER MARKET: APPLICATION FOOTPRINT

- TABLE 250 CARBON FIBER MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 251 CARBON FIBER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 252 CARBON FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 253 CARBON FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 254 CARBON FIBER MARKET: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 255 CARBON FIBER MARKET: DEALS, JANUARY 2020-MARCH 2025

- TABLE 256 CARBON FIBER MARKET: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 257 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 258 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 259 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 260 TORAY INDUSTRIES, INC.: DEALS

- TABLE 261 TORAY INDUSTRIES, INC.: EXPANSIONS

- TABLE 262 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 263 DOWAKSA: COMPANY OVERVIEW

- TABLE 264 DOWAKSA: PRODUCTS OFFERED

- TABLE 265 DOWAKSA: EXPANSIONS

- TABLE 266 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 267 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 268 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS

- TABLE 269 SYENSQO: COMPANY OVERVIEW

- TABLE 270 SYENSQO: PRODUCTS OFFERED

- TABLE 271 SYENSQO: DEALS

- TABLE 272 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 273 TEIJIN LIMITED: PRODUCTS OFFERED

- TABLE 274 TEIJIN LIMITED: PRODUCT LAUNCHES

- TABLE 275 TEIJIN LIMITED: DEALS

- TABLE 276 TEIJIN LIMITED: EXPANSIONS

- TABLE 277 TEIJIN LIMITED: OTHER DEVELOPMENTS

- TABLE 278 SGL CARBON: COMPANY OVERVIEW

- TABLE 279 SGL CARBON: PRODUCTS OFFERED

- TABLE 280 SGL CARBON: DEALS

- TABLE 281 SGL CARBON: EXPANSIONS

- TABLE 282 HEXCEL CORPORATION: COMPANY OVERVIEW

- TABLE 283 HEXCEL CORPORATION: PRODUCTS OFFERED

- TABLE 284 HEXCEL CORPORATION: PRODUCT LAUNCHES

- TABLE 285 HEXCEL CORPORATION: EXPANSIONS

- TABLE 286 HS HYOSUNG ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 287 HS HYOSUNG ADVANCED MATERIALS: PRODUCTS OFFERED

- TABLE 288 HS HYOSUNG ADVANCED MATERIALS: PRODUCT LAUNCHES

- TABLE 289 HS HYOSUNG ADVANCED MATERIALS: DEALS

- TABLE 290 HS HYOSUNG ADVANCED MATERIALS: EXPANSIONS

- TABLE 291 ZHONGFU SHENYING CARBON FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 292 ZHONGFU SHENYING CARBON FIBER CO., LTD.: PRODUCTS OFFERED

- TABLE 293 ZHONGFU SHENYING CARBON FIBER CO., LTD.: EXPANSIONS

- TABLE 294 KUREHA CORPORATION: COMPANY OVERVIEW

- TABLE 295 KUREHA CORPORATION: PRODUCTS OFFERED

- TABLE 296 OSAKA GAS CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 297 OSAKA GAS CHEMICALS CO., LTD.: PRODUCTS OFFERED

- TABLE 298 UMATEX: COMPANY OVERVIEW

- TABLE 299 UMATEX: PRODUCTS OFFERED

- TABLE 300 JILIN CHEMICAL FIBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 301 JILIN CHEMICAL FIBER GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 302 JIANGSU HENGSHEN CO., LTD.: COMPANY OVERVIEW

- TABLE 303 JIANGSU HENGSHEN CO., LTD.: PRODUCTS OFFERED

- TABLE 304 JIANGSU HENGSHEN CO., LTD.: EXPANSIONS

- TABLE 305 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.: COMPANY OVERVIEW

- TABLE 306 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.: PRODUCTS OFFERED

- TABLE 307 CHINA WEIHAI GUANGWEI COMPOSITES CO., LTD.: COMPANY OVERVIEW

- TABLE 308 CHANGSHENG (LANGFANG) TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 309 JILIN JIYAN HIGH-TECH FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 310 JILIN SHENZHOU CARBON FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 311 ALFA CHEMISTRY: COMPANY OVERVIEW

- TABLE 312 BCIRCULAR: COMPANY OVERVIEW

- TABLE 313 VARTEGA INC.: COMPANY OVERVIEW

- TABLE 314 FLINK INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 315 CHINA COMPOSITES GROUP CORPORATION LTD.: COMPANY OVERVIEW

- TABLE 316 FORMOSA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 317 NIPPON GRAPHITE FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 318 NEWTECH GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 319 ACE C&TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 320 PROCOTEX: COMPANY OVERVIEW

- TABLE 321 CARBON CONVERSIONS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CARBON FIBER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CARBON FIBER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 CARBON FIBER MARKET: DATA TRIANGULATION

- FIGURE 6 PAN-BASED CARBON FIBER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 VIRGIN CARBON FIBER SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 8 STANDARD MODULUS SEGMENT TO LEAD MARKET IN FORECAST PERIOD

- FIGURE 9 CONTINUOUS CARBON FIBER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 COMPOSITES SEGMENT DOMINATED MARKET IN 2025

- FIGURE 11 AEROSPACE & DEFENSE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FROM AEROSPACE & DEFENSE AND WIND ENERGY INDUSTRIES TO DRIVE MARKET

- FIGURE 14 AEROSPACE & DEFENSE SEGMENT AND GERMANY ACCOUNTED FOR LARGEST SHARES OF EUROPEAN CARBON FIBER MARKET IN 2024

- FIGURE 15 PAN-BASED CARBON FIBER SEGMENT TO REGISTER HIGHEST GROWTH DURING PROJECTED PERIOD

- FIGURE 16 VIRGIN CARBON FIBER SEGMENT DOMINATED CARBON FIBER MARKET DURING FORECAST PERIOD

- FIGURE 17 STANDARD MODULUS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 CONTINUOUS CARBON FIBER SEGMENT TO REGISTER HIGHEST CAGR DURING PROJECTED PERIOD

- FIGURE 19 COMPOSITES SEGMENT ACCOUNTED TO LEAD MARKET IN FORECAST PERIOD

- FIGURE 20 AEROSPACE & DEFENSE SEGMENT HELD LARGEST SHARE OF MARKET IN 2024

- FIGURE 21 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 CARBON FIBER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 CARBON FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 25 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 26 CARBON FIBER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 CARBON FIBER MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 28 AVERAGE SELLING PRICE TREND OF CARBON FIBER OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE OF CARBON FIBER, BY RAW MATERIAL, 2022-2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE OF CARBON FIBER, BY FIBER TYPE, 2022-2024 (USD/KG)

- FIGURE 31 AVERAGE SELLING PRICE OF CARBON FIBER, BY MODULUS, 2022-2024 (USD/KG)

- FIGURE 32 AVERAGE SELLING PRICE OF CARBON FIBER, BY PRODUCT TYPE, 2022-2024 (USD/KG)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF CARBON FIBER, BY APPLICATION, 2022-2024 (USD/KG)

- FIGURE 34 AVERAGE SELLING PRICE OF CARBON FIBER, BY END-USE INDUSTRY, 2022-2024 (USD/KG)

- FIGURE 35 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/KG)

- FIGURE 36 CARBON FIBER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 37 EXPORT DATA OF HS CODE 681511-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 38 IMPORT DATA OF HS CODE 681511-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 39 PATENT ANALYSIS, BY PATENT TYPE

- FIGURE 40 PATENT PUBLICATION TRENDS, JANUARY 2015-FEBRUARY 2025

- FIGURE 41 CARBON FIBER MARKET: LEGAL STATUS OF PATENTS

- FIGURE 42 CHINA JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 43 TORAY INDUSTRIES, INC. REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 44 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 45 CARBON FIBER MARKET: DEALS AND FUNDING SOARED IN 2021

- FIGURE 46 PROMINENT CARBON FIBER MANUFACTURING FIRMS IN 2024 (USD BILLION)

- FIGURE 47 PAN-BASED CARBON FIBER MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 RECYCLED CARBON FIBER SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 49 STANDARD MODULUS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 CONTINUOUS CARBON FIBER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 COMPOSITES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 52 PRESSURE VESSELS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 53 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 54 EUROPE: CARBON FIBER MARKET SNAPSHOT

- FIGURE 55 NORTH AMERICA: CARBON FIBER MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: CARBON FIBER MARKET SNAPSHOT

- FIGURE 57 CARBON FIBER MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 58 CARBON FIBER MARKET SHARE ANALYSIS, 2024

- FIGURE 59 CARBON FIBER MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 60 CARBON FIBER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 CARBON FIBER MARKET: COMPANY FOOTPRINT

- FIGURE 62 CARBON FIBER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 CARBON FIBER MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 64 CARBON FIBER MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 65 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 66 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 SYENSQO: COMPANY SNAPSHOT

- FIGURE 68 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 69 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 70 HEXCEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 HS HYOSUNG ADVANCED MATERIALS: COMPANY SNAPSHOT

- FIGURE 72 ZHONGFU SHENYING CARBON FIBER CO., LTD.: COMPANY SNAPSHOT

- FIGURE 73 KUREHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 OSAKA GAS CHEMICALS CO., LTD.: COMPANY SNAPSHOT

The carbon fiber market is estimated at USD 4.82 billion in 2025 and is projected to reach USD 6.82 billion by 2030, at a CAGR of 7.2% from 2025 to 2030. Pitch-based carbon fibers, derived from petroleum-based pitch, offer superior mechanical properties and high thermal stability. They possess excellent tensile strength, exceeding 5 GPa, which is comparable to steel. Moreover, their specific stiffness is twice that of aluminum, making them ideal for lightweight applications. Pitch carbon fibers exhibit exceptional resistance to corrosion, chemicals, and extreme temperatures, enabling their utilization in demanding environments. Their high thermal conductivity ensures efficient heat dissipation, making them suitable for heat-sensitive applications. Additionally, pitch-based carbon fiber offers enhanced fatigue resistance and can be manufactured with greater precision in certain applications compared to PAN-based fibers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) and volume (kiloton) |

| Segments | Raw material type, fiber type, modulus, product type, application, end-use industry, and region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and Latin America |

''In terms of value, virgin carbon fiber accounted for the largest share of the overall carbon fiber market.''

The virgin fiber segment accounted for the largest market share due to its exceptional properties, including its lightweight structure, stiffness, and chemical resistance, which makes it indispensable in end-use industries like aerospace & defense, automotive, wind energy, and sporting goods, among others. These industries depend on lightweight materials for improved fuel performance in aircraft and vehicles. The use of virgin carbon fiber is favored due to its established manufacturing processes and consistent quality, which are critical for high-performance applications. While recycled carbon fiber is gaining traction as a sustainable alternative, virgin carbon fiber remains dominant because of its outstanding mechanical properties and versatile usage in structural components.

''In terms of value, high modulus accounted for the third-largest share of the overall carbon fiber market.''

High modulus carbon fiber accounted for the third-largest market share in the overall carbon fiber market. It is a specialized type of carbon fiber that has been engineered for applications where stiffness, rather than strength, is the primary concern. High modulus carbon fibers are characterized by a high carbon content of over 98%, which contributes to their exceptional rigidity and resistance to deformation. The key property of high modulus carbon fiber is its modulus of elasticity, which typically exceeds 370 GPa, making it significantly stiffer than standard carbon fibers.

''In terms of value, long fiber accounted for the third-largest share of the overall carbon fiber market.''

The long fiber segment accounted for the third-largest share of the overall carbon fiber market. Long carbon fiber, as its name suggests, consists of fibers longer than 1mm and is often used as a reinforcement material in high-performance composites. These fibers offer superior mechanical properties compared to short carbon fibers, including higher tensile strength, improved fatigue resistance, and enhanced stiffness. These qualities make them ideal for applications involving continuous stress, such as wind turbine blades, aircraft components, and Formula 1 cars.

''In terms of value, the non-composites segment accounted for the second-largest share of the carbon fiber market.''

The non-composites segment accounted for the second-largest share of the carbon fiber market. As carbon fiber is renowned for its exceptional properties, such as high strength-to-weight ratio, stiffness, and resistance to corrosion and fatigue for composite applications, there is a growing demand for its application in non-composite forms as well. Carbon fiber exhibits excellent thermal and electrical conductivity, which makes it suitable for applications in electronics, such as heat sinks, electromagnetic shielding, and even in the development of advanced batteries and fuel cells. It is also gaining popularity in the medical field due to its biocompatibility and radiolucency, making it ideal for surgical instruments, prosthetics, and imaging equipment.

"The pressure vessels industry is projected to be the fastest-growing end-use industry during the forecast period."

The pressure vessels industry is expected to register the fastest growth in the carbon fiber market during the forecast period. Pressure vessels are manufactured by filament winding tows of high-strength carbon fiber over a mandrel, which serves as a liner in the finished structure and ensures gas tightness. The pressure vessels made of carbon fiber tow prepreg are 75% lighter than steel or aluminum pressure vessels, making them suitable for a wide range of applications. Additionally, carbon is relatively cost-effective compared to other materials, providing a balance of performance and affordability. Its ability to be easily fabricated and welded further contributes to its widespread use in pressure vessel construction.

"The Asia Pacific region is projected to register the highest growth rate in the carbon fiber market during the forecast period."

The Asia Pacific is projected to be the fastest-growing region in the carbon fiber market during the forecast period, supported by rapid industrialization, increased demand for lightweight materials in the automotive, aerospace, and manufacturing industries, and a strong focus on technological advancements. In particular, countries like Japan, China, and South Korea are experiencing substantial investments in the carbon fiber market in advanced manufacturing technologies and the development of carbon fiber composites for applications in aerospace, automotive, and infrastructure projects. These countries are known for their cutting-edge technology and innovation, with major companies like Toray Industries, Inc. and Mitsubishi Chemical Group Corporation pushing advancements in carbon fiber production for high-performance applications.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, the Middle East & Africa - 5%, and Latin America - 10%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Toray Industries, Inc. (Japan), DowAksa (Turkey), Mitsubishi Chemical Group Corporation (Japan), Syensqo (Belgium), Teijin Limited (Japan), SGL Carbon (Germany), Hexcel Corporation (US), HS Hyosung Advanced Materials (South Korea), Zhongfu Shenying Carbon Fiber Co., Ltd. (China), Kureha Corporation (Japan), Osaka Gas Chemicals Co., Ltd., (Japan), UMATEX (Russia), Jilin Chemical Fiber Group Co., Ltd. (China), Jiangsu Hengshen Co., Ltd. (China), and China National Bluestar (Group) Co., Ltd. (China).

Research coverage

This research report categorizes the carbon fiber market by raw material type (pan and pitch), fiber type (virgin and recycled), modulus (standard, intermediate, and high), product type (continuous, long, and short), application (composites and non-composites), end-use industry (aerospace & defense, automotive, wind energy, pipe, pressure vessels, sporting goods, construction & infrastructure, medical & healthcare, and marine), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the carbon fiber market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions and services, key strategies, and recent developments in the carbon fiber market are all covered. This report includes a competitive analysis of upcoming startups in the carbon fiber market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall carbon fiber market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

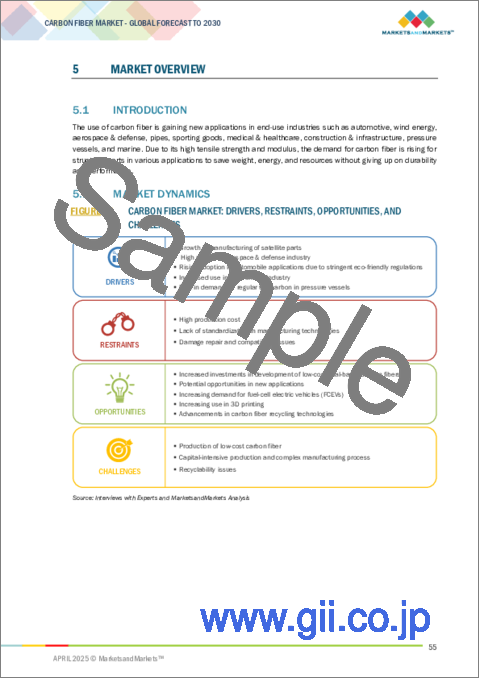

- Analysis of key drivers (growth in manufacturing of satellite parts, high demand from aerospace & defense industry, rising adoption in automobile applications due to stringent eco-friendly regulations, increased use in wind energy industry, and rising demand for regular tow carbon in pressure vessels), restraints (high production cost, lack of standardization in manufacturing technologies, and damage repair and compatibility issues), opportunities (increased investments in the development of low-cost coal-based carbon fibers, potential opportunities in new applications, increasing demand for fuel cell electric vehicles (FCEVs), increasing use in 3D printing, advancements in carbon fiber recycling technologies), and challenges (production of low-cost carbon fiber, capital-intensive production and complex manufacturing processes, and recyclability issues) influencing the growth of the carbon fiber market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the carbon fiber market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the carbon fiber market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the carbon fiber market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Toray Industries, Inc. (Japan), DowAksa (Turkey), Mitsubishi Chemical Group Corporation (Japan), Syensqo (Belgium), Teijin Limited (Japan), SGL Carbon (Germany), Hexcel Corporation (US), HS Hyosung Advanced Materials (South Korea), Zhongfu Shenying Carbon Fiber Co., Ltd. (China), Kureha Corporation (Japan), Osaka Gas Chemicals Co., Ltd., (Japan), UMATEX (Russia), Jilin Chemical Fiber Group Co., Ltd. (China), Jiangsu Hengshen Co., Ltd. (China), and China National Bluestar (Group) Co., Ltd. (China) in the carbon fiber market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CARBON FIBER MARKET

- 4.2 EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.3 CARBON FIBER MARKET, BY RAW MATERIAL

- 4.4 CARBON FIBER MARKET, BY FIBER TYPE

- 4.5 CARBON FIBER MARKET, BY MODULUS

- 4.6 CARBON FIBER MARKET, BY PRODUCT TYPE

- 4.7 CARBON FIBER MARKET, BY APPLICATION

- 4.8 CARBON FIBER MARKET, BY END-USE INDUSTRY

- 4.9 CARBON FIBER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in manufacturing of satellite parts

- 5.2.1.2 High usage in aerospace & defense industry

- 5.2.1.3 Rising adoption in automobile applications due to stringent eco-friendly regulations

- 5.2.1.4 Increased use in wind energy industry

- 5.2.1.5 Rise in demand for regular tow carbon in pressure vessels

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production cost

- 5.2.2.2 Lack of standardization in manufacturing technologies

- 5.2.2.3 Damage repair and compatibility issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased investments in development of low-cost coal-based carbon fibers

- 5.2.3.2 Potential opportunities in new applications

- 5.2.3.3 Increasing demand for fuel-cell electric vehicles (FCEVs)

- 5.2.3.4 Increasing use in 3D printing

- 5.2.3.5 Advancements in carbon fiber recycling technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Production of low-cost carbon fiber

- 5.2.4.2 Capital-intensive production and complex manufacturing process

- 5.2.4.3 Recyclability issues

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY RAW MATERIAL, 2022-2024

- 5.7.3 AVERAGE SELLING PRICE TREND, BY FIBER TYPE, 2022-2024

- 5.7.4 AVERAGE SELLING PRICE TREND, BY MODULUS, 2022-2024

- 5.7.5 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2022-2024

- 5.7.6 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2024

- 5.7.7 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2022-2024

- 5.7.8 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 681511)

- 5.9.2 IMPORT SCENARIO (HS CODE 681511)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES FOR CARBON FIBER MANUFACTURING PROCESSES

- 5.11 MAJOR PROCESSES INVOLVED IN MANUFACTURING OF CARBON FIBER

- 5.11.1 STABILIZING

- 5.11.2 CARBONIZING

- 5.11.3 SURFACE TREATMENT

- 5.11.4 SIZING

- 5.12 COMPLEMENTARY TECHNOLOGIES FOR MANUFACTURING CARBON FIBER

- 5.12.1 RECYCLING TECHNOLOGY

- 5.13 IMPACT OF AI/GEN AI ON CARBON FIBER MARKET

- 5.13.1 TOP USE CASES AND MARKET POTENTIAL

- 5.13.2 BEST PRACTICES IN CARBON FIBER MARKET

- 5.13.3 CASE STUDIES OF AI IMPLEMENTATION IN CARBON FIBER MARKET

- 5.14 MACROECONOMIC OUTLOOK

- 5.14.1 INTRODUCTION

- 5.14.2 GDP TRENDS AND FORECAST

- 5.14.3 TRENDS IN GLOBAL AEROSPACE & DEFENSE INDUSTRY

- 5.14.4 TRENDS IN GLOBAL WIND ENERGY INDUSTRY

- 5.14.5 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.15 PATENT ANALYSIS

- 5.15.1 INTRODUCTION

- 5.15.2 METHODOLOGY

- 5.15.3 PATENT TYPES

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS

- 5.15.6 JURISDICTION ANALYSIS

- 5.15.7 TOP APPLICANTS

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 MITSUBISHI'S DEVELOPMENT OF CARBON FIBER-REINFORCED PLASTICS FOR STRUCTURAL AIRCRAFT PARTS

- 5.18.2 SGL CARBON'S CLIMATE-FRIENDLY CARBON FIBER TO REVOLUTIONIZE SUSTAINABLE MANUFACTURING

- 5.18.3 TRUE TEMPER SPORTS PARTNERS WITH HEXCEL CORPORATION FOR ITS FIRST GOLF SHAFT LINE

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.20 INVESTMENT AND FUNDING SCENARIO

6 CARBON FIBER MARKET, BY RAW MATERIAL

- 6.1 INTRODUCTION

- 6.2 PAN-BASED CARBON FIBER

- 6.2.1 EXTENSIVE DEMAND FOR STRUCTURAL MATERIAL COMPOSITES TO DRIVE MARKET

- 6.3 PITCH-BASED CARBON FIBER

- 6.3.1 WIDE USAGE IN SATELLITES, INDUSTRIAL, CONSTRUCTION, AND SPORTING GOODS SEGMENTS TO DRIVE MARKET

- 6.3.2 PETROLEUM-BASED PITCH CARBON FIBER

- 6.3.3 COAL-BASED PITCH CARBON FIBER

7 CARBON FIBER MARKET, BY FIBER TYPE

- 7.1 INTRODUCTION

- 7.2 VIRGIN CARBON FIBER

- 7.2.1 LONG-TERM HIGH PERFORMANCE IN TERMS OF FATIGUE AND ENVIRONMENTAL EFFECTS TO DRIVE MARKET

- 7.3 RECYCLED CARBON FIBER

- 7.3.1 GROWING ENVIRONMENTAL CONCERNS TO DRIVE MARKET

8 CARBON FIBER MARKET, BY MODULUS

- 8.1 INTRODUCTION

- 8.2 STANDARD MODULUS

- 8.2.1 USAGE ACROSS INDUSTRIES TO DRIVE MARKET

- 8.3 INTERMEDIATE MODULUS

- 8.3.1 DEMAND IN PRESSURE VESSELS, WIND TURBINE BLADES, AND AEROSPACE TO DRIVE MARKET

- 8.4 HIGH MODULUS

- 8.4.1 DEMAND FOR AEROSPACE APPLICATIONS TO DRIVE MARKET

9 CARBON FIBER MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 CONTINUOUS CARBON FIBER

- 9.2.1 DEMAND FOR HIGHER TENSILE STRENGTH TO DRIVE MARKET

- 9.3 LONG CARBON FIBER

- 9.3.1 SUPERIOR MECHANICAL PROPERTIES TO DRIVE MARKET

- 9.4 SHORT CARBON FIBER

- 9.4.1 EASY PROCESSING AND MOLDING TO PROPEL MARKET

10 CARBON FIBER MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 COMPOSITES

- 10.2.1 RIGIDITY AND HIGH TENSILE STRENGTH TO FUEL DEMAND

- 10.2.2 PREPREGS

- 10.2.3 MOLDING COMPOUNDS

- 10.2.4 WOVEN FABRICS

- 10.3 NON-COMPOSITES

- 10.3.1 RISING DEMAND FOR EVS AND 3D PRINTING TO DRIVE MARKET

11 CARBON FIBER MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AEROSPACE & DEFENSE

- 11.2.1 MAJOR CONSUMER OF CARBON FIBER COMPOSITE MATERIALS

- 11.2.2 ROCKETS, SPACE VEHICLES, HABITATION EQUIPMENT

- 11.2.3 UMA (URBAN AIR MOBILITY) AND SMALL AIRCRAFT EQUIPMENT

- 11.3 WIND ENERGY

- 11.3.1 STEADY INCREASE IN GLOBAL WIND ENERGY INSTALLATION

- 11.4 AUTOMOTIVE

- 11.4.1 INCREASING ADOPTION OF CARBON FIBERS BY AUTOMOTIVE GIANTS TO DRIVE MARKET

- 11.4.2 INTERIOR COMPONENTS

- 11.4.3 EXTERIOR COMPONENTS

- 11.4.4 SMALL MOBILITY APPLICATION

- 11.5 PIPES

- 11.5.1 UNIQUE BLEND OF PROPERTIES TO DRIVE MARKET

- 11.6 SPORTING GOODS

- 11.6.1 INTEREST IN HIGHER PERFORMANCE AND SUSTAINABILITY TO DRIVE NEW CFRP MATERIALS IN SPORTING GOODS

- 11.7 MEDICAL & HEALTHCARE

- 11.7.1 SUSTENANCE UNDER EXTREME ENVIRONMENTAL CONDITIONS TO DRIVE MARKET

- 11.7.2 DIAGNOSTICS IMAGING

- 11.7.3 BODY IMPLANT, SURGICAL INSTRUMENTS, AND OTHERS

- 11.8 CONSTRUCTION & INFRASTRUCTURE

- 11.8.1 GROWTH IN CONSTRUCTION & INFRASTRUCTURE SEGMENT TO BOOST DEMAND

- 11.8.2 BUILDING INFRASTRUCTURE

- 11.8.3 CIVIL INFRASTRUCTURE

- 11.9 PRESSURE VESSELS

- 11.9.1 INCREASE IN DEMAND FOR TYPE IV CYLINDERS TO DRIVE MARKET

- 11.10 MARINE

- 11.10.1 GROWING MARINE APPLICATIONS TO DRIVE MARKET

- 11.11 OTHER END-USE INDUSTRIES

- 11.11.1 ELECTRICAL & ELECTRONICS

- 11.11.2 CABLES

- 11.11.3 MOLDING COMPOUNDS

12 CARBON FIBER MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 EUROPE

- 12.2.1 EUROPE: CARBON FIBER MARKET, BY END-USE INDUSTRY

- 12.2.2 EUROPE: CARBON FIBER MARKET, BY COUNTRY

- 12.2.2.1 Germany

- 12.2.2.1.1 Growth of automotive and aerospace industries to drive market

- 12.2.2.2 France

- 12.2.2.2.1 Presence of major aircraft manufacturers to drive market

- 12.2.2.3 UK

- 12.2.2.3.1 Increasing demand for lightweight and high-performance materials to drive market

- 12.2.2.4 Italy

- 12.2.2.4.1 Growing demand from wind energy industry to drive market

- 12.2.2.5 Spain

- 12.2.2.5.1 High demand from wind energy sector to drive market

- 12.2.2.6 Rest of Europe

- 12.2.2.1 Germany

- 12.3 NORTH AMERICA

- 12.3.1 NORTH AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY

- 12.3.2 NORTH AMERICA: CARBON FIBER MARKET, BY COUNTRY

- 12.3.2.1 US

- 12.3.2.1.1 Presence of well-established industries to drive market

- 12.3.2.2 Canada

- 12.3.2.2.1 Presence of well-established aerospace industry to fuel demand

- 12.3.2.1 US

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: CARBON FIBER MARKET, BY END-USE INDUSTRY

- 12.4.2 ASIA PACIFIC: CARBON FIBER MARKET, BY COUNTRY

- 12.4.2.1 Japan

- 12.4.2.1.1 Large exports of carbon fiber to drive market

- 12.4.2.2 China

- 12.4.2.2.1 Growing sports goods and wind energy industries to drive market

- 12.4.2.3 Taiwan

- 12.4.2.3.1 Growing demand for bicycles to drive market

- 12.4.2.4 South Korea

- 12.4.2.4.1 Presence of major automotive companies to propel market

- 12.4.2.5 Rest of Asia Pacific

- 12.4.2.1 Japan

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY END-USE INDUSTRY

- 12.5.2 MIDDLE EAST & AFRICA: CARBON FIBER MARKET, BY COUNTRY

- 12.5.2.1 GCC Countries

- 12.5.2.1.1 UAE

- 12.5.2.1.1.1 Increasing demand for automobiles to drive growth

- 12.5.2.1.2 Saudi Arabia

- 12.5.2.1.2.1 High demand from pipes & pressure vessels industry to drive market

- 12.5.2.1.3 Rest of GCC Countries

- 12.5.2.1.1 UAE

- 12.5.2.2 South Africa

- 12.5.2.2.1 Growing wind energy, automotive, and aerospace & defense industries to drive market

- 12.5.2.3 Rest of Middle East & Africa

- 12.5.2.1 GCC Countries

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: CARBON FIBER MARKET, BY END-USE INDUSTRY

- 12.6.2 LATIN AMERICA: CARBON FIBER MARKET, BY COUNTRY

- 12.6.2.1 Brazil

- 12.6.2.1.1 Growth of aerospace & defense and wind energy industries to drive market

- 12.6.2.2 Mexico

- 12.6.2.2.1 Automotive and wind energy industries to be prominent consumers of carbon fiber

- 12.6.2.3 Rest of Latin America

- 12.6.2.1 Brazil

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS (2019-2023)

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Raw material type footprint

- 13.6.5.4 Fiber type footprint

- 13.6.5.5 Modulus footprint

- 13.6.5.6 Product type footprint

- 13.6.5.7 Application footprint

- 13.6.5.8 End-use industry footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 TORAY INDUSTRIES, INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 DOWAKSA

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 MITSUBISHI CHEMICAL GROUP CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 SYENSQO

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 TEIJIN LIMITED

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.3.4 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 SGL CARBON

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses & competitive threats

- 14.1.7 HEXCEL CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Expansions

- 14.1.7.4 MnM view

- 14.1.7.4.1 Key strengths

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses & competitive threats

- 14.1.8 HS HYOSUNG ADVANCED MATERIALS

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.8.3.3 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses & competitive threats

- 14.1.9 ZHONGFU SHENYING CARBON FIBER CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Expansions

- 14.1.9.4 MnM view

- 14.1.9.4.1 Key strengths

- 14.1.9.4.2 Strategic choices

- 14.1.9.4.3 Weaknesses & competitive threats

- 14.1.10 KUREHA CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 MnM view

- 14.1.10.3.1 Key strengths

- 14.1.10.3.2 Strategic choices

- 14.1.10.3.3 Weaknesses/Competitive threats

- 14.1.11 OSAKA GAS CHEMICALS CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 MnM view

- 14.1.11.3.1 Key strengths

- 14.1.11.3.2 Strategic choices

- 14.1.11.3.3 Weaknesses & competitive threats

- 14.1.12 UMATEX

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 MnM view

- 14.1.12.3.1 Key strengths

- 14.1.12.3.2 Strategic choices

- 14.1.12.3.3 Weaknesses/Competitive threats

- 14.1.13 JILIN CHEMICAL FIBER GROUP CO., LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 MnM view

- 14.1.13.3.1 Key strengths

- 14.1.13.3.2 Strategic choices

- 14.1.13.3.3 Weaknesses & competitive threats

- 14.1.14 JIANGSU HENGSHEN CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Expansions

- 14.1.14.4 MnM view

- 14.1.14.4.1 Key strengths

- 14.1.14.4.2 Strategic choices

- 14.1.14.4.3 Weaknesses & competitive threats

- 14.1.15 CHINA NATIONAL BLUESTAR (GROUP) CO., LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 MnM view

- 14.1.15.3.1 Key strengths

- 14.1.15.3.2 Strategic choices

- 14.1.15.3.3 Weaknesses & competitive threats

- 14.1.1 TORAY INDUSTRIES, INC.

- 14.2 OTHER PLAYERS

- 14.2.1 CHINA WEIHAI GUANGWEI COMPOSITES CO., LTD.

- 14.2.2 CHANGSHENG (LANGFANG) TECHNOLOGY CO., LTD.

- 14.2.3 JILIN JIYAN HIGH-TECH FIBER CO., LTD.

- 14.2.4 JILIN SHENZHOU CARBON FIBER CO., LTD.

- 14.2.5 ALFA CHEMISTRY

- 14.2.6 BCIRCULAR

- 14.2.7 VARTEGA INC.

- 14.2.8 FLINK INTERNATIONAL CO., LTD.

- 14.2.9 CHINA COMPOSITES GROUP CORPORATION LTD.

- 14.2.10 FORMOSA PLASTICS CORPORATION

- 14.2.11 NIPPON GRAPHITE FIBER CO., LTD.

- 14.2.12 NEWTECH GROUP CO., LTD.

- 14.2.13 ACE C&TECH CO., LTD.

- 14.2.14 PROCOTEX

- 14.2.15 CARBON CONVERSIONS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS