|

|

市場調査レポート

商品コード

1529518

スマートホームの世界市場:製品別、提供別、販売チャネル別、設置タイプ別、地域別 - 予測(~2029年)Smart Home Market by Product (Lighting Controls, Smart Speaker, Entertainment, Smart Kitchen, HVAC Controls, Security & Access Controls), Offering (Behavioral, Proactive), Sales Channel, Installation Type and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| スマートホームの世界市場:製品別、提供別、販売チャネル別、設置タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年08月06日

発行: MarketsandMarkets

ページ情報: 英文 331 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマートホームの市場規模は、2024年に845億米ドルであり、2029年までに1,164億米ドルに達すると予測され、予測期間にCAGRで6.6%の成長が見込まれます。

一般消費者の安全、安心、利便性への関心がスマートホーム市場の成長を促進しています。既存のスマート機器の消費者にとっての移行の高いコストが、スマートホーム市場の成長を抑制しています。隔離された地域では家庭監視の重要性が高まっており、二酸化炭素排出の削減やエネルギー使用の削減に焦点を当てたソリューションへの需要が高まっています。利便性、セキュリティ、安全性に対する一般消費者の関心の高まりが、スマートホーム市場の成長を促進しています。一方、必要性よりも利便性が重視される市場であることや、既存のスマート機器消費者にとっての移行の高いコスト、セキュリティやプライバシー侵害に関する問題が、市場の成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 製品別、提供別、設置タイプ別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、その他の地域 |

「照明制御セグメントが予測期間に2番目に高いCAGRで成長する見込みです。」

照明制御セグメントは、予測期間にCAGRで9.5%の2番目に高い成長率で成長する見込みです。照明制御システムは、入力機器からの情報を感知し、1つ以上の中央演算機器を通じて同じ情報を送信し、その機器が出力機器に信号を送信することで、建物内の照明を制御するインテリジェントネットワークに基づいています。スマートホームの照明制御は、照明システムにエリア内の自然光だけでなく、占有率もチェックさせることができます。これらの要素を感知して適切に、利用可能な自然光に応じて明るさを落としたり、部屋に誰もいない場合は自動的にスイッチを切ったりすることができます。照明制御は、エネルギー効率に対する照明の基本的な部分を形成しています。

「行動提供セグメントが予測期間に2番目に高いCAGRで成長する可能性が高いです。」

行動提供セグメントは予測期間に6.5%の2番目に高いCAGRで成長する見込みです。行動提供は、AIと機械学習アルゴリズムを使用して、スマートホーム内の人々の行動から学習します。センサー、カメラ、その他の接続機器からのデータアナリティクスを通じて発見されたルーチンや選好を使用して、家庭の多くの側面を自動化します。この行動提供は、居住者の行動に基づいてプロセスを自動化することで、消費者に個別化された便利な体験を提供しようとするものです。

「北米セグメントが予測期間に2番目に高いCAGRで成長する可能性が高いです。」

北米市場は、予測期間に6.2%の2番目に高いCAGRを記録する見込みです。信頼性の高いホームエネルギー管理システムや強化されたホームセキュリティレベルに対する需要の増加、スマートホームにおけるタブレットやスマートフォンなどのスマートデバイスの統合の人気の高まりなどの要因が、この地域におけるスマートホーム市場の成長を促進しています。

当レポートでは、世界のスマートホーム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- スマートホーム市場の主要企業にとっての成長機会

- HVACコントロール:スマートホーム市場、タイプ別(2024年・2029年)

- スマートホーム市場:販売チャネル別(2024年・2029年)

- スマートキッチン:スマートホーム市場、製品別(2024年・2029年)

- スマートホーム市場:設置タイプ別(2024年・2029年)

- スマートホームの市場シェア:地域別(2024年・2029年)

- スマートホーム市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格動向:スマートロック別

- 平均販売価格動向:地域別

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入データ(HSコード8517)

- 輸出データ(HSコード8517)

- 主な会議とイベント

- ケーススタディ分析

- 関税と規制情勢

- 関税分析

- 規制

- 規制基準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- スマートホーム市場に対するAI/生成AIの影響

- 関連するケーススタディと開発

第6章 スマートホームで使用されるプロトコルと技術

- イントロダクション

- 有線通信技術

- CDMAネットワーク

- GSM/HSPAネットワーク

- LTEネットワーク

- DALI

- NEMA

- KNX

- DMX

- LONWORKS

- イーサネット

- MODBUS

- BACnet

- Black Box

- PLC

- 無線通信技術

- ZigBee

- Z-Wave

- Wi-Fi

- Bluetooth

- EnOcean

- Thread

- 赤外線

- MQTT

第7章 スマートホーム市場:販売チャネル別

- イントロダクション

- 直接販売チャネル

- 間接販売チャネル

第8章 スマートホーム市場:製品別

- イントロダクション

- 照明コントロール

- リレー

- 占有センサー

- 昼光センサー

- タイマー

- 調光器

- スイッチ

- アクセサリ・その他の製品

- セキュリティ・アクセス制御

- ビデオ監視

- アクセス制御

- HVACコントロール

- スマートサーモスタット

- センサー

- コントロールバルブ

- 加熱・冷却コイル

- ダンパー

- アクチュエーター

- ポンプ・ファン

- スマートベント

- エンターテインメント・その他のコントロール

- エンターテインメントコントロール

- その他のコントロール

- スマートスピーカー

- 在宅医療

- 健康状態モニター

- 身体活動モニター

- スマートキッチン

- スマート冷蔵庫

- スマートコーヒーメーカー

- スマートケトル

- スマート食器洗い機

- スマートオーブン

- スマートクックトップ

- スマートクッカー

- 家庭用電化製品

- スマート洗濯機

- スマートドライヤー

- スマート給湯器

- スマート掃除機

- スマート家具

- スマートテーブル

- スマートデスク

- スマートスツール・ベンチ

- スマートソファ

- スマートチェア

第9章 スマートホーム市場:提供別

- イントロダクション

- 行動

- 予知

第10章 スマートホーム市場:設置タイプ別

- イントロダクション

- 新設

- 改修

第11章 スマートホーム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 北米のスマートコントロールエコシステムのランキング

- 北米のマクロ経済の見通し

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- 欧州のスマートコントロールエコシステムのランキング

- 欧州のマクロ経済の見通し

- アジア太平洋

- 中国

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- アジア太平洋のマクロ経済の見通し

- その他の地域

- 南米

- 中東・アフリカ

- その他の地域のマクロ経済の見通し

第12章 競合情勢

- 概要

- 主要企業戦略/有力企業

- 市場シェア分析

- 収益分析

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- JOHNSON CONTROLS INC.

- SCHNEIDER ELECTRIC

- HONEYWELL INTERNATIONAL INC.

- ASSA ABLOY

- SIEMENS

- AMAZON.COM, INC.

- APPLE INC.

- ADT

- ROBERT BOSCH

- ABB

- その他の企業

- SAMSUNG ELECTRONICS

- SONY CORPORATION

- OOMA

- WOZART TECHNOLOGIES PRIVATE LIMITED

- CONTROL4

- AXIS COMMUNICATIONS AB

- COMCAST

- ECOBEE

- CRESTRON ELECTRONICS, INC.

- SIMPLISAFE, INC.

- SAVANT SYSTEMS, INC

- CANARY CONNECT, INC.

- LG ELECTRONICS

- LUTRON ELECTRONICS CO., INC.

- LEGRAND

第14章 付録

List of Tables

- TABLE 1 SMART HOME MARKET: GROWTH FORECAST ASSUMPTIONS

- TABLE 2 SMART HOME MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 SMART HOME MARKET: RISK ASSESSMENT

- TABLE 4 ENERGY-SAVING POTENTIAL OF LIGHTING CONTROLS

- TABLE 5 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2018-2023 (USD)

- TABLE 6 INDICATIVE PRICE TREND OF LIGHTING CONTROLS, BY REGION, 2019-2023 (USD)

- TABLE 7 ROLES OF COMPANIES IN SMART HOME ECOSYSTEM

- TABLE 8 INNOVATIONS AND PATENT REGISTRATIONS, 2022-2023

- TABLE 9 IMPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 MFN TARIFF FOR HS CODE 8517-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SMART HOME MARKET: PORTER'S FIVE FORCES IMPACT

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SALES CHANNEL (%)

- TABLE 19 KEY BUYING CRITERIA, BY SALES CHANNEL

- TABLE 20 SMART HOME MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 21 SMART HOME MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 22 SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 23 SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 24 SMART HOME MARKET, BY PRODUCT, 2020-2023 (MILLION UNITS)

- TABLE 25 SMART HOME MARKET, BY PRODUCT, 2024-2029 (MILLION UNITS)

- TABLE 26 LIGHTING CONTROLS: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 27 LIGHTING CONTROLS: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 28 LIGHTING CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 LIGHTING CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 LIGHTING CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 31 LIGHTING CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 32 LIGHTING CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 33 LIGHTING CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 34 LIGHTING CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 35 LIGHTING CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 36 LIGHTING CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 LIGHTING CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 LIGHTING CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 LIGHTING CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 RELAYS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 RELAYS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 OCCUPANCY SENSORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 OCCUPANCY SENSORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 DAYLIGHT SENSORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 DAYLIGHT SENSORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 TIMERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 TIMERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 DIMMERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 DIMMERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 SWITCHES: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 SWITCHES: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 ACCESSORIES & OTHER PRODUCTS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 ACCESSORIES & OTHER PRODUCTS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 SECURITY & ACCESS CONTROLS: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 55 SECURITY & ACCESS CONTROLS: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 56 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 58 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 59 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 60 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 61 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 62 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 SECURITY & ACCESS CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 VIDEO SURVEILLANCE: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 67 VIDEO SURVEILLANCE: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 68 VIDEO SURVEILLANCE: SMART HOME MARKET, BY HARDWARE, 2020-2023 (USD MILLION)

- TABLE 69 VIDEO SURVEILLANCE: SMART HOME MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 70 VIDEO SURVEILLANCE: SMART HOME MARKET, BY CAMERA, 2020-2023 (USD MILLION)

- TABLE 71 VIDEO SURVEILLANCE: SMART HOME MARKET, BY CAMERA, 2024-2029 (USD MILLION)

- TABLE 72 ACCESS CONTROL: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 73 ACCESS CONTROL: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 74 ACCESS CONTROL: SMART HOME MARKET, BY HARDWARE, 2020-2023 (USD MILLION)

- TABLE 75 ACCESS CONTROL: SMART HOME MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 76 HVAC CONTROLS: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 77 HVAC CONTROLS: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 HVAC CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 HVAC CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 HVAC CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 81 HVAC CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 82 HVAC CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 HVAC CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 HVAC CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 HVAC CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 86 HVAC CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 87 HVAC CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 HVAC CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 89 HVAC CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 90 SMART THERMOSTATS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 SMART THERMOSTATS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 SENSORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 SENSORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 CONTROL VALVES: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 95 CONTROL VALVES: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 96 HEATING & COOLING COILS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 97 HEATING & COOLING COILS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 98 DAMPERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 99 DAMPERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 ACTUATORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 101 ACTUATORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 102 PUMPS & FANS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 103 PUMPS & FANS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 104 SMART VENTS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 105 SMART VENTS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 106 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 107 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 108 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 109 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 110 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 111 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 112 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 116 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 117 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 118 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 119 ENTERTAINMENT & OTHER CONTROLS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 120 ENTERTAINMENT CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 121 ENTERTAINMENT CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 122 ENTERTAINMENT CONTROLS: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 123 ENTERTAINMENT CONTROLS: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 124 AUDIO & VOLUME CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 125 AUDIO & VOLUME CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 126 HOME THEATER SYSTEM CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 HOME THEATER SYSTEM CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 128 TOUCHSCREENS & KEYPADS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 129 TOUCHSCREENS & KEYPADS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 130 OTHER CONTROLS: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 131 OTHER CONTROLS: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 132 OTHER CONTROLS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 133 OTHER CONTROLS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 134 SMART METERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 135 SMART METERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 136 SMART PLUGS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 137 SMART PLUGS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 138 SMART HUBS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 139 SMART HUBS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 140 SMART LOCKS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 141 SMART LOCKS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 142 SMOKE DETECTORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 143 SMOKE DETECTORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 144 SMART SPEAKERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 145 SMART SPEAKERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 146 SMART SPEAKERS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 147 SMART SPEAKERS: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 148 SMART SPEAKERS: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 149 SMART SPEAKER: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 150 SMART SPEAKERS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 151 SMART SPEAKERS: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 SMART SPEAKERS: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 153 SMART SPEAKERS: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 154 SMART SPEAKERS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 155 SMART SPEAKERS: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 156 HOME HEALTHCARE: SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 157 HOME HEALTHCARE: SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 158 HOME HEALTHCARE: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 159 HOME HEALTHCARE: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 160 HOME HEALTHCARE: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 161 HOME HEALTHCARE: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 162 HOME HEALTHCARE: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 163 HOME HEALTHCARE: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 164 HOME HEALTHCARE: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 165 HOME HEALTHCARE: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 166 HOME HEALTHCARE: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 167 HOME HEALTHCARE: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 168 HOME HEALTHCARE: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 169 HOME HEALTHCARE: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 170 HEALTH STATUS MONITORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 171 HEALTH STATUS MONITORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 172 PHYSICAL ACTIVITY MONITORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 173 PHYSICAL ACTIVITY MONITORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 174 SMART KITCHEN: SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 175 SMART KITCHEN: SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 176 SMART KITCHEN: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 177 SMART KITCHEN: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 178 SMART KITCHEN: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 179 SMART KITCHEN: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 180 SMART KITCHEN: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 181 SMART KITCHEN: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 182 SMART KITCHEN: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 183 SMART KITCHEN: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 184 SMART KITCHEN: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 185 SMART KITCHEN: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 186 SMART KITCHEN: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 187 SMART KITCHEN: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 188 SMART REFRIGERATORS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 189 SMART REFRIGERATORS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 190 SMART COFFEE MAKERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 191 SMART COFFEE MAKERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 192 SMART KETTLES: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 193 SMART KETTLES: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 194 SMART DISHWASHERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 195 SMART DISHWASHERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 196 SMART OVENS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 197 SMART OVENS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 198 SMART COOKTOPS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 199 SMART COOKTOPS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 200 SMART COOKERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 201 SMART COOKERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 202 HOME APPLIANCES: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 203 HOME APPLIANCES: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 204 HOME APPLIANCES: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 205 HOME APPLIANCES: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 206 HOME APPLIANCES: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 207 HOME APPLIANCES: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 208 HOME APPLIANCES: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 209 HOME APPLIANCES: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 210 HOME APPLIANCES: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 211 HOME APPLIANCES: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 212 HOME APPLIANCES: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 213 HOME APPLIANCES: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 214 HOME APPLIANCES: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 215 HOME APPLIANCES: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 216 SMART WASHERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 217 SMART WASHERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 218 SMART DRYERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 219 SMART DRYERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 220 SMART WATER HEATERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 221 SMART WATER HEATERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 222 SMART VACUUM CLEANERS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 223 SMART VACUUM CLEANERS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 224 SMART FURNITURE: SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 225 SMART FURNITURE: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 226 SMART FURNITURE: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 227 SMART FURNITURE: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 228 SMART FURNITURE: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 229 SMART FURNITURE: SMART HOME MARKET FOR NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 230 SMART FURNITURE: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 231 SMART FURNITURE: SMART HOME MARKET FOR EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 232 SMART FURNITURE: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 233 SMART FURNITURE: SMART HOME MARKET FOR ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 234 SMART FURNITURE: SMART HOME MARKET FOR ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 235 SMART FURNITURE: SMART HOME MARKET FOR ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 236 SMART FURNITURE: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 237 SMART FURNITURE: SMART HOME MARKET FOR MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- TABLE 238 SMART TABLES: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 239 SMART TABLES: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 240 SMART DESKS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 241 SMART DESKS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 242 SMART STOOLS & BENCHES: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 243 SMART STOOLS & BENCHES: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 244 SMART SOFAS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 245 SMART SOFAS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 246 SMART CHAIRS: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 247 SMART CHAIRS: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 248 SMART HOME MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 249 SMART HOME MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 250 SMART HOME MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 251 SMART HOME MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 252 SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 253 SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 254 NORTH AMERICA: SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 255 NORTH AMERICA: SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 256 NORTH AMERICA: RANKING OF SMART CONTROL ECOSYSTEMS

- TABLE 257 NORTH AMERICA: IMPACTFUL SMART CONTROLS/HUBS/PLATFORMS

- TABLE 258 EUROPE: SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 259 EUROPE: SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 260 EUROPE: RANKING OF SMART CONTROL ECOSYSTEMS

- TABLE 261 EUROPE: IMPACTFUL SMART CONTROLS/HUBS/PLATFORMS

- TABLE 262 ASIA PACIFIC: SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 263 ASIA PACIFIC: SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 264 ROW: SMART HOME MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 265 ROW: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: SMART HOME MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 268 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 269 SMART HOME MARKET: DEGREE OF COMPETITION, 2023

- TABLE 270 SMART HOME MARKET: PRODUCT FOOTPRINT

- TABLE 271 SMART HOME MARKET: OFFERING FOOTPRINT

- TABLE 272 SMART HOME MARKET: SALES CHANNEL FOOTPRINT

- TABLE 273 SMART HOME MARKET: INSTALLATION TYPE FOOTPRINT

- TABLE 274 SMART HOME MARKET: REGION FOOTPRINT

- TABLE 275 SMART HOME MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 276 SMART HOME MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 277 SMART HOME MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 278 SMART HOME MARKET: DEALS, JANUARY 2021-JUNE 2024

- TABLE 279 JOHNSON CONTROLS INC.: COMPANY OVERVIEW

- TABLE 280 JOHNSON CONTROLS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 JOHNSON CONTROLS INC.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 282 JOHNSON CONTROLS INC.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 283 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 284 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 286 SCHNEIDER ELECTRIC: DEALS, JANUARY 2021-JUNE 2024

- TABLE 287 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 288 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 290 HONEYWELL INTERNATIONAL INC.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 291 ASSA ABLOY: COMPANY OVERVIEW

- TABLE 292 ASSA ABLOY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 ASSA ABLOY: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 294 ASSA ABLOY: DEALS, JANUARY 2021-JUNE 2024

- TABLE 295 SIEMENS: COMPANY OVERVIEW

- TABLE 296 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 SIEMENS: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 298 ASSA ABLOY: DEALS, JANUARY 2021-JUNE 2024

- TABLE 299 AMAZON.COM, INC.: COMPANY OVERVIEW

- TABLE 300 AMAZON.COM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 AMAZON.COM, INC.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 302 AMAZON.COM, INC.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 303 APPLE INC.: COMPANY OVERVIEW

- TABLE 304 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 APPLE INC.: PRODUCT LAUNCHES/ENHANCEMENTS, JANUARY 2021-JUNE 2024

- TABLE 306 APPLE INC.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 307 ADT: COMPANY OVERVIEW

- TABLE 308 ADT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 ADT: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 310 ADT: DEALS, JANUARY 2021-JUNE 2024

- TABLE 311 ADT: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2024

- TABLE 312 ROBERT BOSCH: COMPANY OVERVIEW

- TABLE 313 ROBERT BOSCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 ROBERT BOSCH: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 315 ROBERT BOSCH: DEALS, JANUARY 2021-JUNE 2024

- TABLE 316 ABB: COMPANY OVERVIEW

- TABLE 317 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 ABB: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 319 ABB: DEALS, JANUARY 2021-JUNE 2024

List of Figures

- FIGURE 1 SMART HOME MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SMART HOME MARKET: RESEARCH DESIGN

- FIGURE 3 SMART HOME MARKET: RESEARCH APPROACH

- FIGURE 4 SMART HOME MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 REVENUE GENERATED FROM SALES OF SMART HOME SOLUTIONS

- FIGURE 6 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 7 SMART HOME MARKET: BOTTOM-UP APPROACH

- FIGURE 8 SMART HOME MARKET: TOP-DOWN APPROACH

- FIGURE 9 SMART HOME MARKET: DATA TRIANGULATION

- FIGURE 10 SMART HOME MARKET, 2020-2029 (USD MILLION)

- FIGURE 11 DAYLIGHT SENSORS TO WITNESS HIGHEST GROWTH IN LIGHTING CONTROLS MARKET DURING FORECAST PERIOD

- FIGURE 12 PROACTIVE SEGMENT TO REGISTER HIGHER GROWTH BETWEEN 2024 & 2029

- FIGURE 13 SMART KITCHEN SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH FROM 2024 TO 2029

- FIGURE 15 GROWING NEED FOR ENERGY-SAVING AND LOW CARBON EMISSION-ORIENTED SOLUTIONS TO DRIVE MARKET

- FIGURE 16 DAMPERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INDIRECT SALES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 SMART DISHWASHERS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

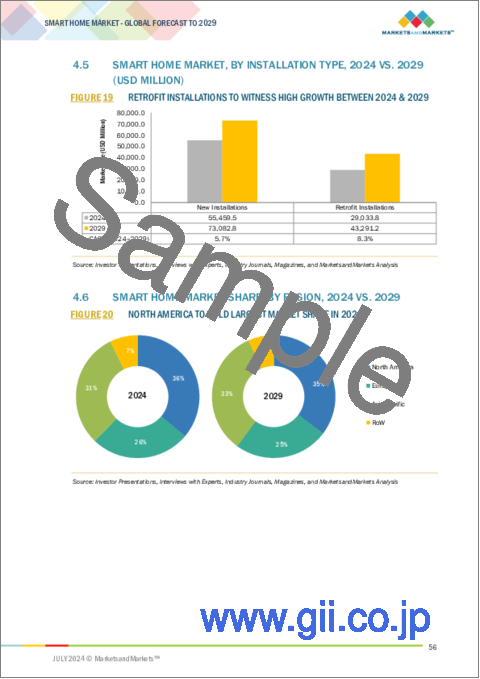

- FIGURE 19 RETROFIT INSTALLATIONS TO WITNESS HIGH GROWTH BETWEEN 2024 & 2029

- FIGURE 20 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 21 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 SMART HOME MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 IMPACT OF DRIVERS ON SMART HOME MARKET

- FIGURE 24 GLOBAL INTERNET USERS (BILLION)

- FIGURE 25 IMPACT OF RESTRAINTS ON SMART HOME MARKET

- FIGURE 26 IMPACT OF OPPORTUNITIES ON SMART HOME MARKET

- FIGURE 27 IMPACT OF CHALLENGES ON SMART HOME MARKET

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE TREND FOR TOP PLAYERS, BY SMART LOCK

- FIGURE 30 SMART HOME MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 KEY PLAYERS IN SMART HOME ECOSYSTEM

- FIGURE 32 US: SMART HOME STARTUP FUNDING

- FIGURE 33 LIST OF MAJOR PATENTS RELATED TO SMART HOME, 2013-2023

- FIGURE 34 IMPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 35 EXPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 36 SMART HOME MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SALES CHANNEL

- FIGURE 38 KEY BUYING CRITERIA, BY SALES CHANNEL

- FIGURE 39 MAJOR APPLICATIONS OF AI INTEGRATION IN SMART HOME ECOSYSTEM

- FIGURE 40 SMART HOME PROTOCOLS AND TECHNOLOGIES

- FIGURE 41 GSM/HSPA NETWORK SETUP

- FIGURE 42 WIRING FOR DALI FLUORESCENT DIMMING

- FIGURE 43 LONWORKS NETWORK SETUP

- FIGURE 44 WIRELESS COMMUNICATION TECHNOLOGIES

- FIGURE 45 INDIRECT SALES SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 46 ENTERTAINMENT AND OTHER CONTROLS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 47 PROACTIVE OFFERING SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 48 NEW INSTALLATIONS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA TO DOMINATE MARKET IN 2024

- FIGURE 50 NORTH AMERICA: SMART HOME MARKET SNAPSHOT

- FIGURE 51 EUROPE: SMART HOME MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: SMART HOME MARKET SNAPSHOT

- FIGURE 53 SMART HOME MARKET SHARE ANALYSIS, 2023

- FIGURE 54 REVENUE ANALYSIS OF TOP PLAYERS IN SMART HOME MARKET, 2020-2023 (USD MILLION)

- FIGURE 55 SMART HOME MARKET: COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 56 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 57 SMART HOME MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 58 SMART HOME MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 59 SMART HOME MARKET: COMPANY FOOTPRINT

- FIGURE 60 SMART HOME MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 61 JOHNSON CONTROLS INC.: COMPANY SNAPSHOT

- FIGURE 62 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 63 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 64 ASSA ABLOY: COMPANY SNAPSHOT

- FIGURE 65 SIEMENS: COMPANY SNAPSHOT

- FIGURE 66 AMAZON.COM, INC.: COMPANY SNAPSHOT

- FIGURE 67 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 68 ADT: COMPANY SNAPSHOT

- FIGURE 69 ROBERT BOSCH: COMPANY SNAPSHOT

- FIGURE 70 ABB: COMPANY SNAPSHOT

The global smart home market was valued at USD 84.5 billion in 2024 and is projected to reach USD 116.4 billion by 2029; it is expected to register a CAGR of 6.6% during the forecast period. Concerns about safety, security, and convenience among general population are driving the growth of the smart home market. The high cost of switching for existing smart device consumers is restraining the growth of the smart home market. Growing use of smart gadgets and an increase in internet users raising the average person's discretionary income in emerging nations. The significance of home surveillance is growing in isolated areas, increasing demand for solutions focused on reducing carbon emissions and using less energy; the general public's growing worries about convenience, security, and safety are driving the growth of smart home market. Whereas a more convenience-driven rather than necessity-driven market, high cost of switching for existing smart device consumers, and issues related to security and privacy breaches are restraining the growth of the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Offering, Installation Type and Region |

| Regions covered | North America, Asia Pacific, Europe, and Rest of World |

"The lighting control segment is expected to grow at the second highest CAGR during the forecast period."

The lighting control segment is projected to grow at the second highest rate while attaining a CAGR of 9.5% during the forecast. A lighting control system is based on an intelligent network for the control of lighting in a building by sensing information from the input devices and sending the same through one or more central computing devices which in turn sends signals to the output devices. Smart home lighting controls are able to make a lighting system check occupancy as well as natural light in an area. It can sense these factors and, accordingly, reduce its brightness with respect to the natural light available or switch off automatically in case the room is empty. Lighting control forms a basic part of lighting for energy efficiency.

The behavioral offering segment is likely to grow at the second higher CAGR during the forecast period."

The behavioral offering segment is expected to grow at a second higher CAGR of 6.5% during the forecast period. The behavioral offering uses AI and machine learning algorithms to learn from the actions of individuals in a smart home. It automates many aspects of the home using routines and preferences discovered through data analysis from sensors, cameras, and other connected devices. The behavioral offering seeks to provide consumers with a personalized and convenient experience by automating processes based on occupant behavior.

"The North America segment is likely to grow at the second highest CAGR during the forecast period."

The market in North America is expected to witness the second highest CAGR of 6.2% during the forecast period. Factors such as the increasing demand for reliable home energy management systems and enhanced home security levels and the growing popularity of the integration of smart devices such as tablets and smartphones in smart homes are driving the growth of the smart home market in this region.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation- C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region-North America - 40%, Europe - 20%, Asia Pacific - 30%, RoW - 10%

The smart home market is dominated by a few globally established players such as Johnson Controls Inc. (Ireland), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), ASSA ABLOY (Sweden), Amazon.com, Inc. (US), Apple Inc. (US), ADT (US), Robert Bosch (Germany), ABB (Switzerland). The study includes an in-depth competitive analysis of these key players in the smart home market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the smart home market and forecasts its size by product, offering, sales channel, and installation type, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the smart home ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Increasing number of internet users and growing adoption of smart devices, Increasing disposable income emerging economies, Increasing importance of home monitoring in remote locations, Growing need for energy-saving and low carbon emission-oriented solutions, Concerns about safety, security, and convenience among general population). Restraint (Convenience-driven rather than necessity-driven market, High cost of switching for existing smart device consumers, Issues related to security and privacy breaches), Opportunity (Favorable government regulations to promote green buildings, Incorporation of lighting controllers with in-built data-connectivity technology, Integration of power line communication technology in smart homes), Challenges (Difficulties linking disparate systems, limited functionality, and lack of open standards, Risk of device malfunction)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the smart home market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart home market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the smart home market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Johnson Controls Inc. (Ireland), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), ASSA ABLOY (Sweden), Amazon.com, Inc. (US), Apple Inc. (US), ADT (US), Robert Bosch (Germany), ABB (Switzerland) among others in the smart home market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 FACTOR ANALYSIS

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 GROWTH FORECAST ASSUMPTIONS

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR KEY PLAYERS IN SMART HOME MARKET

- 4.2 HVAC CONTROLS: SMART HOME MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- 4.3 SMART HOME MARKET, BY SALES CHANNEL, 2024 VS. 2029 (USD MILLION)

- 4.4 SMART KITCHEN: SMART HOME MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- 4.5 SMART HOME MARKET, BY INSTALLATION TYPE, 2024 VS. 2029 (USD MILLION)

- 4.6 SMART HOME MARKET SHARE, BY REGION, 2024 VS. 2029

- 4.7 SMART HOME MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of internet users and growing adoption of smart devices

- 5.2.1.2 Increasing disposable income in emerging economies

- 5.2.1.3 Increasing importance of home monitoring in remote locations

- 5.2.1.4 Growing need for energy-saving and low carbon emission-oriented solutions

- 5.2.1.5 Concerns about safety, security, and convenience among general population

- 5.2.2 RESTRAINTS

- 5.2.2.1 Convenience-driven rather than necessity-driven market

- 5.2.2.2 High cost of switching for existing smart device consumers

- 5.2.2.3 Issues related to security and privacy breaches

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Favorable government regulations to promote green buildings

- 5.2.3.2 Incorporation of lighting controllers with in-built data connectivity technology

- 5.2.3.3 Integration of power line communication technology in smart homes

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties in linking disparate systems, limited functionalities, and lack of open standards

- 5.2.4.2 Risk of device malfunction

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SMART LOCK

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Voice assistant

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Big data analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Biometric authentication

- 5.8.3.2 Virtual reality (VR) and augmented reality (AR)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA (HS CODE 8517)

- 5.10.2 EXPORT DATA (HS CODE 8517)

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ASSA ABLOY'S REMOTE ACCESS DELEGATION TO BUILDINGS TRANSFORMS OPERATION OF EMERGENCY SERVICES WORLDWIDE

- 5.12.2 JOHNSON CONTROLS' COOLING SOLUTION HELPS FISERV TACKLE MAINTENANCE CONSTRAINTS AND ACHIEVE ENERGY SAVINGS

- 5.12.3 HONEYWELL'S SECURITY SOLUTION HELPS GATEWAY BUILDING IMPROVE SECURITY AND VISITOR ACCESS SYSTEM

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.1.1 Tariffs levied on HS code 8517-compliant products exported by US to other countries

- 5.13.2 REGULATIONS

- 5.13.2.1 Regulatory bodies, government agencies, and other organizations

- 5.13.3 REGULATORY STANDARDS

- 5.13.1 TARIFF ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON SMART HOME MARKET

- 5.17 RELEVANT CASE STUDY AND DEVELOPMENTS

- 5.17.1 SIEMENS: ENHANCING MUSEUM'S TECHNICAL INFRASTRUCTURE

- 5.17.2 LG ELECTRONICS: ALL-ROUND HOME MANAGER AND COMPANION

- 5.17.3 SAMSUNG: CREATE A MORE SEAMLESS AND INTELLIGENT HOME EXPERIENCE

- 5.17.4 SAMSUNG: IMPROVING COMPUTATIONAL CAPABILITY OF RUGGED PCS

6 PROTOCOLS AND TECHNOLOGIES USED IN SMART HOMES

- 6.1 INTRODUCTION

- 6.2 WIRED COMMUNICATION TECHNOLOGIES

- 6.2.1 CDMA NETWORK

- 6.2.1.1 Helps control smart home appliances and systems using channel access method

- 6.2.2 GSM/HSPA NETWORK

- 6.2.2.1 GSM modems control home appliances via short message services

- 6.2.3 LTE NETWORK

- 6.2.3.1 Enables real-time transfer of data across network to remotely control smart home applications

- 6.2.4 DALI

- 6.2.4.1 Full-duplex system that brings digital technology into lighting sector

- 6.2.5 NEMA

- 6.2.5.1 Standardizes necessary control devices needed to build complete lighting systems

- 6.2.6 KNX

- 6.2.6.1 Open standard supporting five communication media

- 6.2.7 DMX

- 6.2.7.1 Used in communication networks that control lights and effects

- 6.2.8 LONWORKS

- 6.2.8.1 Helps in building automation applications designed on low bandwidth for networking devices

- 6.2.9 ETHERNET

- 6.2.9.1 Used in home entertainment systems and whole-house automation solutions

- 6.2.10 MODBUS

- 6.2.10.1 Transmits information between electronic devices over serial lines or via Ethernet

- 6.2.11 BACNET

- 6.2.11.1 Commonly used in building automation applications such as HVAC controls, fire detection, lighting controls, and smart elevators

- 6.2.12 BLACK BOX

- 6.2.12.1 Helps in home automation and integration of home devices into a single console

- 6.2.13 PLC

- 6.2.13.1 Uses electric power for data transmission

- 6.2.1 CDMA NETWORK

- 6.3 WIRELESS COMMUNICATION TECHNOLOGIES

- 6.3.1 ZIGBEE

- 6.3.1.1 Used in smart homes to carry small amounts of data over mid-range

- 6.3.2 Z-WAVE

- 6.3.2.1 Used in wireless residential control products and services

- 6.3.3 WI-FI

- 6.3.3.1 Ideal for medium and small home automation systems for data transmission across short distances

- 6.3.4 BLUETOOTH

- 6.3.4.1 Ensures interoperability, minimal interference, and energy efficiency in areas like automation, control, security, and energy management

- 6.3.5 ENOCEAN

- 6.3.5.1 Designed for smart home solutions dependent on energy-producing technologies

- 6.3.6 THREAD

- 6.3.6.1 Common standard used in smart home applications to connect them over internet and with Cloud

- 6.3.7 INFRARED

- 6.3.7.1 Used for short and medium-range communications and control in smart home applications

- 6.3.8 MESSAGE QUEUING TELEMETRY TRANSPORT (MQTT)

- 6.3.8.1 Used to send messages between devices in distributed network

- 6.3.1 ZIGBEE

7 SMART HOME MARKET, BY SALES CHANNEL

- 7.1 INTRODUCTION

- 7.2 DIRECT SALES CHANNEL

- 7.2.1 PLAYERS WITH LIMITED SALES CHANNELS AND DISTRIBUTION NETWORKS OPT FOR DIRECT SALES

- 7.3 INDIRECT SALES CHANNEL

- 7.3.1 INCREASED CONVENIENCE ENHANCES CUSTOMER EXPERIENCE

8 SMART HOME MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- 8.2 LIGHTING CONTROLS

- 8.2.1 RELAYS

- 8.2.1.1 Work as on/off switches in lighting control systems

- 8.2.2 OCCUPANCY SENSORS

- 8.2.2.1 Detect presence of individuals to switch lights on/off

- 8.2.3 DAYLIGHT SENSORS

- 8.2.3.1 Function as photosensors to measure intensity of natural light and accordingly adjust amount of artificial light

- 8.2.4 TIMERS

- 8.2.4.1 Used to turn lights on/off automatically after pre-specified time

- 8.2.5 DIMMERS

- 8.2.5.1 Used to adjust brightness in lighting control systems by means of voltage variation

- 8.2.6 SWITCHES

- 8.2.6.1 Switches can be categorized as manual and remote-controlled

- 8.2.7 ACCESSORIES & OTHER PRODUCTS

- 8.2.1 RELAYS

- 8.3 SECURITY & ACCESS CONTROLS

- 8.3.1 VIDEO SURVEILLANCE

- 8.3.1.1 Hardware

- 8.3.1.1.1 Cameras

- 8.3.1.1.1.1 IP cameras

- 8.3.1.1.1 Cameras

- 8.3.1.1 Hardware

- 8.3.1 VIDEO SURVEILLANCE

8.3.1.1.1.1.1 Can be accessed and controlled over IP networks

- 8.3.1.1.1.2 Analog cameras

8.3.1.1.1.2.1 Require lesser technical maintenance compared to IP cameras

- 8.3.1.1.2 Storage devices

- 8.3.1.1.2.1 Introduction of IP cameras boosted demand for IP-based surveillance storage systems and technologies

- 8.3.1.1.3 Monitors

- 8.3.1.1.3.1 Project data obtained by cameras as output of video surveillance systems

- 8.3.1.1.4 Other hardware accessories

- 8.3.1.2 Software

- 8.3.1.2.1 Video analytics software

- 8.3.1.2.1.1 Automatically monitors cameras and alerts users about unusual or suspicious events

- 8.3.1.2.2 Video management software

- 8.3.1.2.2.1 Platform for video monitoring, recording, and analysis

- 8.3.1.2.3 Neural networks and algorithms

- 8.3.1.2.3.1 Used to extract patterns or coded data to identify behavioral trends

- 8.3.1.2.1 Video analytics software

- 8.3.1.3 Services

- 8.3.1.3.1 Ensures effective working of video surveillance systems

- 8.3.2 ACCESS CONTROL

- 8.3.2.1 Hardware

- 8.3.2.1.1 Card-based readers

- 8.3.2.1.1.1 Used to authenticate user identity

- 8.3.2.1.2 Multi-technology readers

- 8.3.2.1.2.1 Employ combination of card and biometrics

- 8.3.2.1.3 Electronic locks

- 8.3.2.1.3.1 Cannot be tampered with and provide better security than mechanical locks

- 8.3.2.1.4 Controllers

- 8.3.2.1.4.1 Control panels transmit data between readers and software through various types of communication interfaces

- 8.3.2.1.5 Biometric readers

- 8.3.2.1.1 Card-based readers

- 8.3.2.2 Software

- 8.3.2.2.1 Often integrated with other security management platforms, such as video surveillance, intrusion, and visitor management systems

- 8.3.2.3 Services

- 8.3.2.3.1 Majorly include installation, support, and maintenance services

- 8.3.2.1 Hardware

- 8.4 HVAC CONTROLS

- 8.4.1 SMART THERMOSTATS

- 8.4.1.1 Maintain temperature at required levels

- 8.4.2 SENSORS

- 8.4.2.1 Perform logical functions such as making decisions and communicating with other systems

- 8.4.3 CONTROL VALVES

- 8.4.3.1 Regulate flow of fluids in various processes

- 8.4.4 HEATING & COOLING COILS

- 8.4.4.1 HVAC systems use coils to maintain temperature

- 8.4.5 DAMPERS

- 8.4.5.1 Regulate flow of hot/cold air in rooms

- 8.4.6 ACTUATORS

- 8.4.6.1 Control dampers and valves in HVAC systems

- 8.4.7 PUMPS & FANS

- 8.4.7.1 Essential components of HVAC control systems

- 8.4.8 SMART VENTS

- 8.4.8.1 Can be programmed to open and close according to temperature conditions of rooms

- 8.4.1 SMART THERMOSTATS

- 8.5 ENTERTAINMENT & OTHER CONTROLS

- 8.5.1 ENTERTAINMENT CONTROLS

- 8.5.1.1 Audio & volume controls

- 8.5.1.1.1 Enable playback and music control in homes

- 8.5.1.2 Home theater system controls

- 8.5.1.2.1 Designed to provide ultimate movie-viewing experience

- 8.5.1.3 Touchscreens & keypads

- 8.5.1.3.1 Control audio-video distribution at homes

- 8.5.1.1 Audio & volume controls

- 8.5.2 OTHER CONTROLS

- 8.5.2.1 Smart meters

- 8.5.2.1.1 Measure energy consumption and enable communication between users and utilities

- 8.5.2.2 Smart plugs

- 8.5.2.2.1 Help in saving and managing energy usage

- 8.5.2.3 Smart hubs

- 8.5.2.3.1 Control connected gadgets in smart homes

- 8.5.2.4 Smart locks

- 8.5.2.4.1 Enabled with wireless technologies such as Z-Wave, Zigbee, and NFC

- 8.5.2.5 Smoke detectors

- 8.5.2.5.1 Detect smoke faster than flame and heat detectors

- 8.5.2.1 Smart meters

- 8.5.1 ENTERTAINMENT CONTROLS

- 8.6 SMART SPEAKERS

- 8.6.1 ENABLE CONTROL OF SMART DEVICES THROUGH USER VOICE CONTROL

- 8.7 HOME HEALTHCARE

- 8.7.1 HEALTH STATUS MONITORS

- 8.7.1.1 Fitness and heart rate monitors

- 8.7.1.1.1 Growing health consciousness to drive adoption

- 8.7.1.2 Blood pressure monitors

- 8.7.1.2.1 Growth emphasis on treatment and control of diseases to drive demand

- 8.7.1.3 Blood glucose meters

- 8.7.1.3.1 Increasing diabetic population to boost adoption

- 8.7.1.4 Continuous glucose monitors

- 8.7.1.4.1 Offer better results than conventional glucose monitoring systems

- 8.7.1.5 Pulse oximeters

- 8.7.1.5.1 Used to monitor oxygen level present in user's blood

- 8.7.1.6 Fall detectors

- 8.7.1.6.1 Detect and notify monitoring personnel if users collapse

- 8.7.1.1 Fitness and heart rate monitors

- 8.7.2 PHYSICAL ACTIVITY MONITORS

- 8.7.2.1 Rising adoption of smart wearable devices to track physical activity levels of users

- 8.7.1 HEALTH STATUS MONITORS

- 8.8 SMART KITCHEN

- 8.8.1 SMART REFRIGERATORS

- 8.8.1.1 Keep track of how often doors have been opened

- 8.8.2 SMART COFFEE MAKERS

- 8.8.2.1 Allows users to make coffee through app on tablets or smartphones

- 8.8.3 SMART KETTLES

- 8.8.3.1 Maintain temperature of water depending on user's choice

- 8.8.4 SMART DISHWASHERS

- 8.8.4.1 Innovative features reduce human intervention

- 8.8.5 SMART OVENS

- 8.8.5.1 Help users reduce time required for cooking

- 8.8.6 SMART COOKTOPS

- 8.8.6.1 Ensure accurate heat circulation

- 8.8.7 SMART COOKERS

- 8.8.7.1 Can be accessed and controlled through apps on smartphones or tablets

- 8.8.1 SMART REFRIGERATORS

- 8.9 HOME APPLIANCES

- 8.9.1 SMART WASHERS

- 8.9.1.1 Innovative features reduce human intervention

- 8.9.2 SMART DRYERS

- 8.9.2.1 Help increase energy efficiency and reduce human intervention

- 8.9.3 SMART WATER HEATERS

- 8.9.3.1 Turn off automatically when hot water demands are low

- 8.9.4 SMART VACUUM CLEANERS

- 8.9.4.1 Rising awareness around cleanliness and hygiene to fuel demand

- 8.9.1 SMART WASHERS

- 8.10 SMART FURNITURE

- 8.10.1 SMART TABLES

- 8.10.1.1 Feature integrated induction-based drink warmer to maintain temperature of beverage

- 8.10.2 SMART DESKS

- 8.10.2.1 Provides multiple health benefits to users

- 8.10.3 SMART STOOLS & BENCHES

- 8.10.3.1 Smart benches help in reducing energy costs

- 8.10.4 SMART SOFAS

- 8.10.4.1 Equipped with sensors to help adjust shape and size as per user's requirement

- 8.10.5 SMART CHAIRS

- 8.10.5.1 Help in promoting healthy sitting posture

- 8.10.1 SMART TABLES

9 SMART HOME MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 BEHAVIORAL

- 9.2.1 LEARNS FROM USER BEHAVIOR AND RECOMMENDS NECESSARY ACTIONS

- 9.3 PROACTIVE

- 9.3.1 AUTOMATICALLY IMPLEMENTS NECESSARY ACTIONS BASED ON USER BEHAVIOR

10 SMART HOME MARKET, BY INSTALLATION TYPE

- 10.1 INTRODUCTION

- 10.2 NEW INSTALLATIONS

- 10.2.1 NEED FOR MODERN LIGHTING SYSTEMS WITH STATE-OF-THE-ART COMPONENTS TO DRIVE MARKET

- 10.3 RETROFIT INSTALLATIONS

- 10.3.1 RISING DEMAND FOR SYSTEM UPGRADES TO BOOST MARKET GROWTH

11 SMART HOME MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Presence of various key players to support market growth

- 11.2.2 CANADA

- 11.2.2.1 Growing economy to result in increased focus on transitioning toward smart homes

- 11.2.3 MEXICO

- 11.2.3.1 Growing economy and increasing use of consumer electronics to favor market growth

- 11.2.4 RANKING OF SMART CONTROL ECOSYSTEMS IN NORTH AMERICA

- 11.2.5 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Adoption of zero-energy systems and development of smart cities to drive market

- 11.3.2 UK

- 11.3.2.1 Initiatives to prevent fire accidents to support market growth

- 11.3.3 FRANCE

- 11.3.3.1 Initiatives for promoting adoption of energy-saving products to propel market growth

- 11.3.4 ITALY

- 11.3.4.1 Government activities to promote minimum energy consumption products to boost market growth

- 11.3.5 REST OF EUROPE

- 11.3.6 RANKING OF SMART CONTROL ECOSYSTEMS FOR EUROPE

- 11.3.7 MACROECONOMIC OUTLOOK IN EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government initiatives for development of smart homes to drive market

- 11.4.2 JAPAN

- 11.4.2.1 High penetration rate of internet in households to favor market growth

- 11.4.3 SOUTH KOREA

- 11.4.3.1 High demand for advanced security due to growing security concerns to propel market

- 11.4.4 AUSTRALIA

- 11.4.4.1 High demand for entertainment controls and security & access controls to boost market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.6 MACROECONOMIC OUTLOOK IN ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Government initiatives to support infrastructural development to boost market growth

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Growing consumer awareness regarding benefits of smart appliances to fuel market growth

- 11.5.2.2 GCC countries

- 11.5.2.3 Rest of Middle East & Africa

- 11.5.3 MACROECONOMIC OUTLOOK IN ROW

- 11.5.1 SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT

- 12.7.5.1 Company footprint

- 12.7.5.2 Product footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Sales channel footprint

- 12.7.5.5 Installation type footprint

- 12.7.5.6 Region footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.9 COMPETITIVE SCENARIOS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 JOHNSON CONTROLS INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 SCHNEIDER ELECTRIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 HONEYWELL INTERNATIONAL INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 ASSA ABLOY

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 SIEMENS

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 AMAZON.COM, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 APPLE INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 ADT

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Other developments

- 13.1.9 ROBERT BOSCH

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 ABB

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 JOHNSON CONTROLS INC.

- 13.2 OTHER PLAYERS

- 13.2.1 SAMSUNG ELECTRONICS

- 13.2.2 SONY CORPORATION

- 13.2.3 OOMA

- 13.2.4 WOZART TECHNOLOGIES PRIVATE LIMITED

- 13.2.5 CONTROL4

- 13.2.6 AXIS COMMUNICATIONS AB

- 13.2.7 COMCAST

- 13.2.8 ECOBEE

- 13.2.9 CRESTRON ELECTRONICS, INC.

- 13.2.10 SIMPLISAFE, INC.

- 13.2.11 SAVANT SYSTEMS, INC

- 13.2.12 CANARY CONNECT, INC.

- 13.2.13 LG ELECTRONICS

- 13.2.14 LUTRON ELECTRONICS CO., INC.

- 13.2.15 LEGRAND

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS