|

|

市場調査レポート

商品コード

1807079

顔料分散剤の世界市場:顔料タイプ別、分散剤タイプ別、用途別、最終用途産業別、地域別 - 2030年までの予測Pigment Dispersion Market by Dispersion Type (Water-based, Solvent-based), Application (Automotive Paint & Coatings, Decorative Paints & Coatings), Pigment Type, End-use Industry (Building & Construction, Packaging), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 顔料分散剤の世界市場:顔料タイプ別、分散剤タイプ別、用途別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月26日

発行: MarketsandMarkets

ページ情報: 英文 211 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

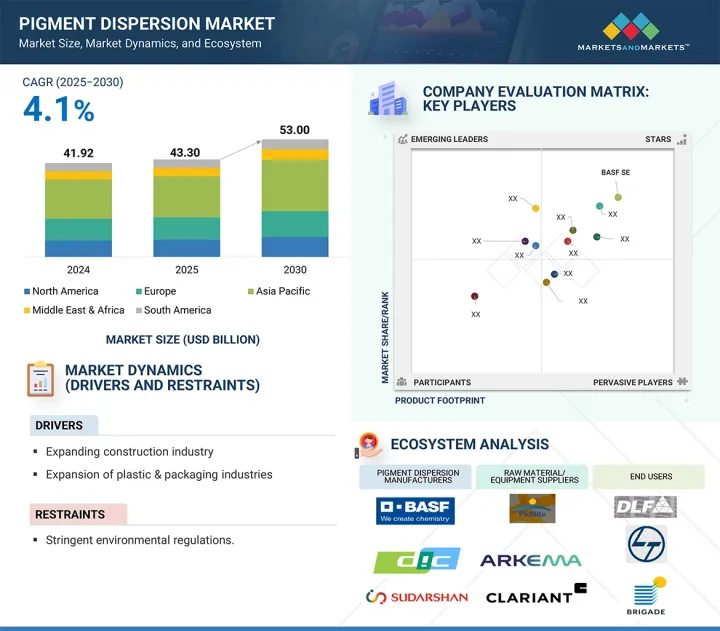

顔料分散剤の市場規模は、2025年の433億米ドルから2030年には530億米ドルに達すると予測され、予測期間中のCAGRは4.1%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 顔料タイプ別、分散タイプ別、用途別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

顔料分散剤は、塗料、コーティング剤、プラスチック、インク、テキスタイルのような最終用途において、一貫した色、不透明度、性能を保証する、媒体中の顔料の安定した均一な拡散を伴います。これらの分散剤は、顔料が凝集することなく均一に分散し、最終製品に鮮やかな色と耐久性をもたらすことを保証します。

水性、溶剤性、およびその他の配合で利用可能な顔料分散剤は、外観と機能が重要な様々な産業にとって不可欠です。顔料分散剤市場の成長は、いくつかの重要な要因によって牽引されています。特にアジア太平洋における急速な都市化とインフラ開発が、塗料とコーティングの需要を増大させており、それによって顔料分散剤の使用が促進されています。持続可能なソリューションへの世界的なシフトは、環境規制の厳格化とVOC排出に対する意識の高まりにより、水性分散剤の採用を加速させています。また、包装、自動車、繊維といった最終用途産業の拡大も、消費者の需要や工業生産の増加に支えられ、市場の成長に寄与しています。さらに、分散技術の改善により製品の品質が向上し、用途の選択肢が広がる一方、特に新興経済国では政府の支援政策により、現地生産と技術革新に有利な条件が整いつつあります。これらの要因を総合すると、顔料分散剤は伝統的な産業部門と新興の産業部門の両方において重要なコンポーネントとして位置づけられています。

工業用塗料とコーティングは顔料分散剤の重要な応用分野であり、自動車、機械、海洋、航空宇宙、建設などの産業にサービスを提供しています。これらの塗料は美観と機能的保護の両方を目的として作られ、腐食、化学薬品、紫外線、摩耗に耐えます。顔料分散剤は、一貫した色、不透明度、安定性を確保すると同時に、耐熱性や耐久性などの性能を向上させるために不可欠です。高性能で長持ちする塗料を必要とする産業が増えるにつれ、顔料分散剤はより厳しい品質、環境、安全基準を満たすように進化しています。特に欧州や北米のような先進地域では、環境に優しい低VOC処方への移行が進んでおり、高度な水性分散剤の採用が加速しています。同時に、インド、中国、東南アジアを中心とするアジア太平洋の急速な工業成長により、大規模なインフラ整備や製造プロジェクトが推進され、工業用塗料の需要が増加しています。さらに、ナノ顔料分散剤やハイブリッド配合などの技術革新が、航空宇宙やエレクトロニクスなどの先端分野における用途の選択肢を広げています。

自動車産業は顔料分散剤の需要を牽引する主要な最終用途分野であり、その理由は美観と保護の両面で自動車コーティングに重要な役割を果たすからです。顔料分散剤は、鮮やかな色、紫外線安定性、耐腐食性、長持ちする仕上げを保証するために、車体外装塗料、内装部品、プラスチックトリムに使用されています。消費者の嗜好が、特に鮮やかでメタリックな色合いの、視覚的に魅力的で耐久性のある自動車へとシフトするにつれて、高品質の顔料分散剤に対する需要は増加の一途をたどっています。さらに、電気自動車(EV)と軽量素材に向けた世界的な動きは、エネルギー効率と表面耐久性を向上させる高度なコーティングの必要性をさらに高めています。アジア太平洋、特にインドや中国などの地域では、可処分所得の増加、都市化、EVに対する政府の優遇措置などに支えられ、自動車の生産と販売が力強い伸びを示しています。このような自動車生産台数の増加は、塗料やコーティング剤、ひいては顔料分散剤の消費量の増加に直結します。

アジア太平洋は、急速な工業化、都市の拡大、建設、自動車、包装、繊維などの最終用途産業の繁栄によって、顔料分散剤の世界市場で最大のシェアを占めています。中国、インド、日本、韓国のような国々は、強力な製造基盤、消費者需要の増加、政府の支援政策により、この成長をリードしています。世界の製造拠点である中国は、塗料、コーティング剤、プラスチック産業で支配的な地位を維持しており、その結果、顔料分散剤が大量に消費されています。インドでは、スマートシティミッションや不動産開発の増加といったイニシアティブに支えられ、建設とインフラストラクチャーがかつてない成長を遂げており、これが装飾用塗料と工業用塗料の需要を押し上げています。さらに、インドの繊維セクターの拡大と包装産業の成長により、高性能顔料のニーズがさらに高まっています。日本と韓国は、先進的な用途と技術進歩を通じて貢献しています。日本はインフラ改修とスマートシティプロジェクトに注力しており、韓国ではサムスン半導体クラスターや国際金融センター再開発など大規模な建設が進められています。全体として、アジア太平洋地域の人口の多さ、中間層の増加、自動車生産の増加、急速な都市化により、顔料分散剤メーカーにとってアジア太平洋地域は最も急成長している有望な市場であり、技術革新と事業拡大の機会を十分に提供しています。

当レポートでは、世界の顔料分散剤市場について調査し、顔料タイプ別、分散タイプ別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界動向

- ポーターのファイブフォース分析

- バリューチェーン分析

- マクロ経済指標

- 価格分析

- 貿易分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 2025年~2026年の主な会議とイベント

第7章 顔料分散剤市場(顔料タイプ別)

- イントロダクション

- 有機顔料

- 無機顔料

第8章 顔料分散剤市場(分散剤タイプ別)

- イントロダクション

- 水性分散剤

- 溶剤系分散剤

第9章 顔料分散剤市場(用途別)

- イントロダクション

- 自動車用塗料・コーティング

- 装飾塗料・コーティング

- 工業用塗料・コーティング

- インク

- プラスチック

- その他

第10章 顔料分散剤市場(最終用途産業別)

- イントロダクション

- 建築・建設

- 自動車

- 包装

- 紙・印刷

- 繊維

- その他

第11章 顔料分散剤市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- イントロダクション

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- BASF SE

- DIC CORPORATION

- SUDARSHAN CHEMICAL INDUSTRIES LIMITED

- VIBRANTZ

- CABOT CORPORATION

- DYSTAR SINGAPORE PTE LTD

- LANXESS

- PENN COLOR INC.

- PIDILITE PIGMENT

- ARALON COLOR GMBH

- その他の企業

- AUM FARBENCHEM

- ACHITEX MINERVA S.P.A

- CHROMATECH INCORPORATED

- DCL CORPORATION

- DECORATIVE COLOR & CHEMICAL, INC.

- DCC GROUP COMPANY LIMITED

- KEMITEKS

- MANALI PIGMENTS PVT. LTD.

- MIKUNI-COLOR LTD.

- RPM INTERNATIONAL INC.

- SYNTHESIA, A.S.

- TIARCO CHEMICALS

- TENNANTS TEXTILE COLOURS LTD.

- VIPUL ORGANICS LTD.

- QUAKER COLOR

第14章 付録

List of Tables

- TABLE 1 REGULATIONS IN PIGMENTS MARKET

- TABLE 2 PER CAPITA GDP TRENDS, 2020-2023 (USD)

- TABLE 3 GDP GROWTH ESTIMATE AND PROJECTION FOR KEY COUNTRIES, 2024-2027 (USD)

- TABLE 4 INDUSTRY (INCLUDING CONSTRUCTION) VALUE-ADDED STATISTICS, BY COUNTRY, 2023 (USD MILLION)

- TABLE 5 PIGMENT DISPERSIONS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 PIGMENT DISPERSIONS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 7 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE, 2022-2024 (USD MILLION)

- TABLE 8 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE, 2025-2030 (USD MILLION)

- TABLE 9 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE, 2022-2024 (KILOTON)

- TABLE 10 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE, 2025-2030 (KILOTON)

- TABLE 11 PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 12 PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 13 PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 14 PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 15 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 16 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 17 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 18 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 19 PIGMENT DISPERSIONS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 20 PIGMENT DISPERSIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 PIGMENT DISPERSIONS MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 22 PIGMENT DISPERSIONS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 23 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 24 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 25 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 26 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 27 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 28 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 30 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 31 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 32 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 34 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 35 CHINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 36 CHINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 37 CHINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 38 CHINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 39 INDIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 40 INDIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 INDIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 42 INDIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 43 JAPAN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 44 JAPAN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 JAPAN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 46 JAPAN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 47 SOUTH KOREA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 48 SOUTH KOREA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 SOUTH KOREA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 50 SOUTH KOREA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 51 INDONESIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 52 INDONESIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 INDONESIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 54 INDONESIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 55 REST OF ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 58 REST OF ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 59 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 62 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 63 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 66 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 67 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 70 NORTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 71 US: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 72 US: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 US: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 74 US: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 75 CANADA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 76 CANADA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 CANADA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 78 CANADA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 79 MEXICO: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 80 MEXICO: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 MEXICO: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 82 MEXICO: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 83 EUROPE: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 84 EUROPE: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 86 EUROPE: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 87 EUROPE: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 88 EUROPE: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 90 EUROPE: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 91 EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 92 EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 94 EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 95 GERMANY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 96 GERMANY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 GERMANY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 98 GERMANY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 99 FRANCE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 100 FRANCE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 102 FRANCE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 103 UK: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 104 UK: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 UK: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 106 UK: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 107 ITALY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 108 ITALY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 ITALY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 110 ITALY: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 111 SPAIN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 112 SPAIN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 SPAIN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 114 SPAIN: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 115 REST OF EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 116 REST OF EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 118 REST OF EUROPE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 119 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 123 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 131 SAUDI ARABIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 132 SAUDI ARABIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 SAUDI ARABIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 134 SAUDI ARABIA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 135 UAE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 136 UAE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 UAE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 138 UAE: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 139 REST OF GCC COUNTRIES: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 140 REST OF GCC COUNTRIES: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 REST OF GCC COUNTRIES: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 142 REST OF GCC COUNTRIES: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 143 SOUTH AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 144 SOUTH AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 146 SOUTH AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 151 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 154 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 155 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 158 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 159 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 160 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 162 SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 163 BRAZIL: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 164 BRAZIL: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 BRAZIL: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 166 BRAZIL: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 167 ARGENTINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 168 ARGENTINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 ARGENTINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 170 ARGENTINA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 171 REST OF SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 172 REST OF SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 174 REST OF SOUTH AMERICA: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 175 PIGMENT DISPERSIONS MARKET: DEGREE OF COMPETITION

- TABLE 176 PIGMENT DISPERSIONS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 177 PIGMENT DISPERSIONS MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 178 PIGMENT DISPERSIONS MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 179 BASF SE: COMPANY OVERVIEW

- TABLE 180 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 BASF SE: EXPANSIONS

- TABLE 182 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 183 DIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 DIC CORPORATION: DEALS

- TABLE 185 SUDARSHAN CHEMICAL INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 186 SUDARSHAN CHEMICAL INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 187 SUDARSHAN CHEMICAL INDUSTRIES LIMITED: DEALS

- TABLE 188 VIBRANTZ: COMPANY OVERVIEW

- TABLE 189 VIBRANTZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 VIBRANTZ: DEALS

- TABLE 191 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 192 CABOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 CABOT CORPORATION: EXPANSIONS

- TABLE 194 DYSTAR SINGAPORE PTE LTD: COMPANY OVERVIEW

- TABLE 195 DYSTAR SINGAPORE PTE LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 LANXESS: COMPANY OVERVIEW

- TABLE 197 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LANXESS: DEALS

- TABLE 199 PENN COLOR INC.: COMPANY OVERVIEW

- TABLE 200 PENN COLOR INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 PENN COLOR INC.: PRODUCT LAUNCHES

- TABLE 202 PENN COLOR INC.: DEALS

- TABLE 203 PENN COLOR INC.: EXPANSIONS

- TABLE 204 PIDILITE PIGMENT: COMPANY OVERVIEW

- TABLE 205 PIDILITE PIGMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ARALON COLOR GMBH: COMPANY OVERVIEW

- TABLE 207 ARALON COLOR GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 AUM FARBENCHEM: COMPANY OVERVIEW

- TABLE 209 ACHITEX MINERVA S.P.A: COMPANY OVERVIEW

- TABLE 210 CHROMATECH INCORPORATED: COMPANY OVERVIEW

- TABLE 211 DCL CORPORATION: COMPANY OVERVIEW

- TABLE 212 DECORATIVE COLOR & CHEMICAL, INC.: COMPANY OVERVIEW

- TABLE 213 DCC GROUP COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 214 KEMITEKS: COMPANY OVERVIEW

- TABLE 215 MANALI PIGMENTS PVT. LTD.: COMPANY OVERVIEW

- TABLE 216 MIKUNI-COLOR LTD.: COMPANY OVERVIEW

- TABLE 217 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 218 SYNTHESIA, A.S.: COMPANY OVERVIEW

- TABLE 219 TIARCO CHEMICAL: COMPANY OVERVIEW

- TABLE 220 TENNANTS TEXTILE COLOURS LTD.: COMPANY OVERVIEW

- TABLE 221 VIPUL ORGANICS LTD.: COMPANY OVERVIEW

- TABLE 222 QUAKER COLOR: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PIGMENT DISPERSIONS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 PIGMENT DISPERSIONS MARKET: RESEARCH DESIGN

- FIGURE 3 PIGMENT DISPERSIONS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 PIGMENT DISPERSIONS MARKET: TOP-DOWN APPROACH

- FIGURE 5 PIGMENT DISPERSIONS MARKET: DATA TRIANGULATION

- FIGURE 6 WATER-BASED DISPERSIONS TO DOMINATE PIGMENT DISPERSIONS MARKET IN 2025

- FIGURE 7 DECORATIVE PAINTS & COATINGS TO DOMINATE PIGMENT DISPERSIONS MARKET IN 2025

- FIGURE 8 PACKAGING TO BE FASTEST-GROWING END-USE INDUSTRY OF PIGMENT DISPERSIONS DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING PIGMENT DISPERSIONS MARKET

- FIGURE 10 GROWING BUILDING & CONSTRUCTION AND AUTOMOTIVE INDUSTRIES TO DRIVE PIGMENT DISPERSIONS MARKET

- FIGURE 11 WATER-BASED TO BE LARGER AND FASTER-GROWING DISPERSION TYPE DURING FORECAST PERIOD

- FIGURE 12 DECORATIVE PAINTS & COATINGS TO BE LARGEST AND FASTEST-GROWING DISPERSION TYPE DURING FORECAST PERIOD

- FIGURE 13 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 14 BUILDING & CONSTRUCTION INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PIGMENT DISPERSIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 PIGMENT DISPERSIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030 (USD/KG)

- FIGURE 20 IMPORT DATA FOR HS CODE 321290-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 321290-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 PIGMENT DISPERSIONS MARKET: ECOSYSTEM

- FIGURE 23 TRENDS /DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 WATER-BASED DISPERSIONS SEGMENT TO DOMINATE PIGMENT DISPERSIONS MARKET DURING FORECAST PERIOD

- FIGURE 25 DECORATIVE PAINTS & COATINGS SEGMENT TO DOMINATE PIGMENT DISPERSIONS MARKET DURING FORECAST PERIOD

- FIGURE 26 BUILDING & CONSTRUCTION SEGMENT TO DOMINATE PIGMENT DISPERSIONS MARKET DURING FORECAST PERIOD

- FIGURE 27 PIGMENT DISPERSIONS MARKET IN INDIA TO REGISTER HIGHEST CAGR

- FIGURE 28 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET SNAPSHOT

- FIGURE 29 EUROPE: PIGMENT DISPERSIONS MARKET SNAPSHOT

- FIGURE 30 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS, JANUARY 2020-JUNE 2025

- FIGURE 31 PIGMENT DISPERSIONS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024

- FIGURE 32 PIGMENT DISPERSIONS MARKET SHARE ANALYSIS, 2024

- FIGURE 33 PIGMENT DISPERSIONS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF KEY PLAYERS IN PIGMENT DISPERSIONS MARKET

- FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF KEY PLAYERS IN PIGMENT DISPERSIONS MARKET

- FIGURE 36 PIGMENT DISPERSIONS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 37 PRODUCT PORTFOLIO ANALYSIS OF STARTUPS/SMES IN PIGMENT DISPERSIONS MARKET

- FIGURE 38 BUSINESS STRATEGY EXCELLENCE OF STARTUPS/SMES IN PIGMENT DISPERSIONS MARKET

- FIGURE 39 BASF SE: COMPANY SNAPSHOT

- FIGURE 40 DIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 SUDARSHAN CHEMICAL INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 42 CABOT CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 LANXESS: COMPANY SNAPSHOT

- FIGURE 44 PIDILITE PIGMENT: COMPANY SNAPSHOT

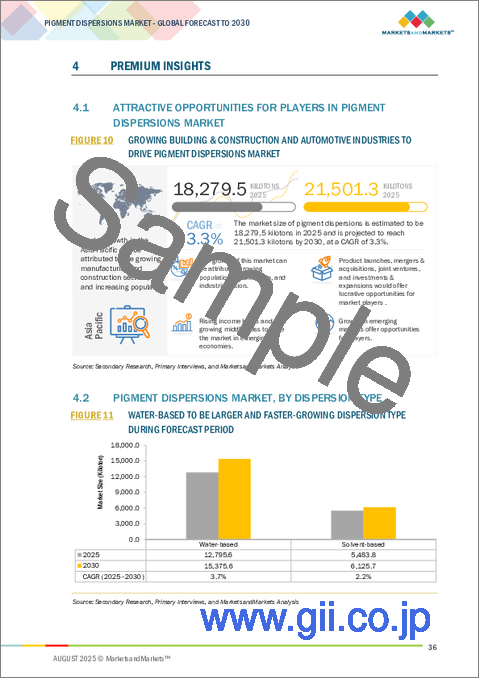

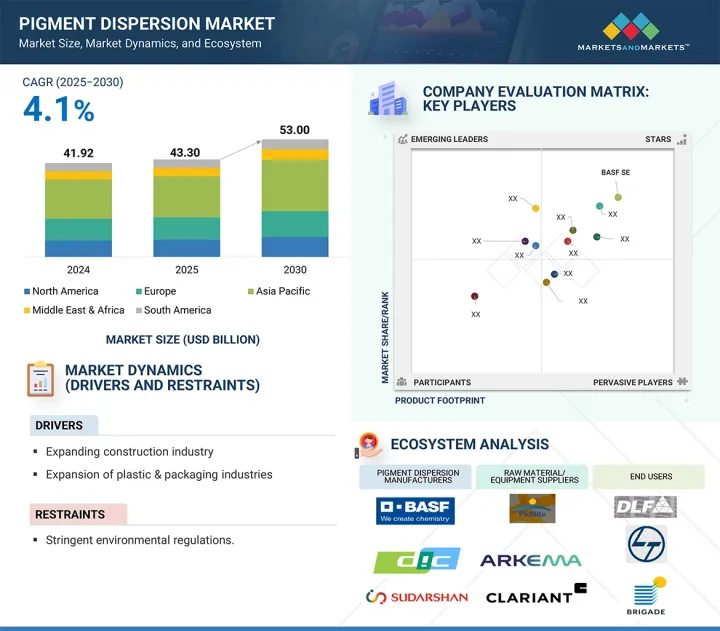

The pigment dispersion market is expected to reach USD 53.00 billion by 2030, up from USD 43.30 billion in 2025, growing at a CAGR of 4.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Type, Pigment Type, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

Pigment dispersion involves the stable and uniform spread of pigments in a medium, ensuring consistent color, opacity, and performance in end-use applications like paints, coatings, plastics, inks, and textiles. These dispersions guarantee that pigments are evenly distributed without clumping, resulting in vibrant color and durability in finished products.

Available in water-based, solvent-based, and other formulations, pigment dispersions are vital to various industries where appearance and function matter. The growth of the pigment dispersion market is driven by several key factors. Rapid urbanization and infrastructure development, especially in Asia-Pacific, are increasing demand for paints and coatings, thereby boosting pigment dispersion use. The global shift toward sustainable solutions is speeding up the adoption of water-based dispersions due to stricter environmental regulations and rising awareness of VOC emissions. Expanding end-use industries such as packaging, automotive, and textiles are also contributing to market growth, supported by growing consumer demand and industrial production. Furthermore, improvements in dispersion technologies have enhanced product quality and expanded application options, while supportive government policies, particularly in emerging economies, are creating favorable conditions for local manufacturing and innovation. Collectively, these factors position pigment dispersions as crucial components in both traditional and emerging industrial sectors.

"Industrial paint & coating segment is the second fastest-growing segment in the pigment dispersion market during the forecast period."

Industrial paints and coatings are a key application area for pigment dispersions, serving industries such as automotive, machinery, marine, aerospace, and construction. These coatings are made for both aesthetic appeal and functional protection-resisting corrosion, chemicals, UV rays, and wear. Pigment dispersions are essential because they ensure consistent color, opacity, and stability, while also improving performance features like heat resistance and durability. As industries increasingly require high-performance, long-lasting coatings, pigment dispersions are evolving to meet stricter quality, environmental, and safety standards. The move toward eco-friendly, low-VOC formulations-particularly in developed regions like Europe and North America-is accelerating the adoption of advanced water-based dispersions. At the same time, rapid industrial growth in Asia-Pacific, especially in India, China, and Southeast Asia, is driving large-scale infrastructure and manufacturing projects, increasing demand for industrial coatings. Additionally, technological innovations such as nano-pigment dispersions and hybrid formulations are broadening application options in advanced sectors like aerospace and electronics.

"The automotive segment is the second-largest in the pigment dispersion market."

The automotive industry is a major end-use sector driving demand for pigment dispersions, due to their vital role in vehicle coatings for both aesthetics and protection. Pigment dispersions are used in exterior body paints, interior components, and plastic trims to ensure vibrant color, UV stability, corrosion resistance, and long-lasting finishes. As consumer preference shifts toward visually appealing and durable vehicles, especially in vibrant and metallic shades, the demand for high-quality pigment dispersions continues to increase. Additionally, the global move toward electric vehicles (EVs) and lightweight materials further boosts the need for advanced coatings that improve energy efficiency and surface durability. Regions like Asia-Pacific, especially India and China, are experiencing strong growth in automotive production and sales, supported by rising disposable incomes, urbanization, and government incentives for EVs. This increase in automotive output directly leads to higher consumption of paints, coatings, and consequently, pigment dispersions.

.

.

The Asia Pacific region is projected to be the largest market for pigment dispersion during the forecast period.

Asia Pacific holds the largest share in the global pigment dispersion market, driven by rapid industrialization, urban expansion, and thriving end-use industries such as construction, automotive, packaging, and textiles. Countries like China, India, Japan, and South Korea are leading this growth due to strong manufacturing bases, rising consumer demand, and supportive government policies. China, as the world's manufacturing hub, continues to dominate the paints, coatings, and plastics industries, resulting in significant consumption of pigment dispersions. India is experiencing unprecedented growth in construction and infrastructure, supported by initiatives like the Smart Cities Mission and increasing real estate development, which boost demand for decorative and industrial coatings. Additionally, India's expanding textile sector and growing packaging industry are further increasing the need for high-performance pigments. Japan and South Korea contribute through advanced applications and technological progress. Japan's focus on infrastructure renovation and smart city projects, along with large-scale construction efforts in South Korea-such as the Samsung semiconductor cluster and international finance center redevelopment-are driving demand for specialized coatings and dispersions. Overall, the region's large population, growing middle class, rising automotive production, and rapid urbanization make Asia-Pacific the fastest-growing and most promising market for pigment dispersion manufacturers, offering ample opportunities for innovation and expansion.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

BASF SE (Germany), DIC Corporation (Japan), Sudarshan Chemical (India), Vibrantz (US), Cabot Corporation (US), Heubach GmbH (Germany), Penn Colors (US), Pidilite (India), Lanxess (Germany), DyStar Industries (Singapore), Achitex Minerva S.p.A (Italy), Aralon Color GmbH (Germany), Chromatech Inc. (US), DCL Corporation (Canada), and AUM Farbenchem (India), among others, are some of the key players in the pigment dispersion market.

The study includes an in-depth competitive analysis of these players in the market, with their company profiles, recent developments, and key strategies.

Research Coverage

The market study covers the pigment dispersion market across various segments. It aims to estimate the market size and growth potential in different segments based on type, pigment type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, important observations about their products and offerings, recent developments, and key growth strategies they are using to enhance their position in the pigment dispersion market.

Key Benefits of Buying the Report

The report aims to assist market leaders and new entrants in approximating the revenue figures of the overall pigment dispersion market and its segments. It is designed to help stakeholders understand the competitive landscape, gain insights to strengthen their business positions, and develop effective go-to-market strategies. Additionally, the report provides insights into the market's current pulse, including key drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (growing construction industry, expansion of plastic and packaging sectors), restraints (strict environmental regulations, fluctuations in raw material costs), opportunities (growth in emerging markets, increasing importance of aesthetics in packaging), challenges (disposal and waste management concerns)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the pigment dispersion market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in pigment dispersion market

- Competitive Assessment: In-depth assessment of market share, growth strategies, product and service offerings of leading players like BASF SE (Germany), DIC Corporation (Japan), Sudarshan Chemical (India), Vibrantz (US), Cabot Corporation (US), Heubach GmbH (Germany), Penn Colors (US), Pidilite (India), Lanxess (Germany), DyStar Industries (Singapore), Achitex Minerva S.p.A (Italy), Aralon Color GmbH (Germany), Chromatech Inc. (US), DCL Corporation (Canada), and AUM Farbenchem (India), among others, are the top manufacturers covered in the pigment dispersion market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 PIGMENT DISPERSIONS MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PIGMENT DISPERSIONS MARKET

- 4.2 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE

- 4.3 PIGMENT DISPERSIONS MARKET, BY APPLICATION TYPE

- 4.4 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.6 PIGMENT DISPERSIONS MARKET, BY MAJOR COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Growing plastics and packaging industries

- 5.2.1.3 Urbanization and industrialization in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations

- 5.2.2.2 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing global emphasis on sustainability and environmental compliance

- 5.2.3.2 Increasing importance of esthetics in packaging

- 5.2.3.3 Innovation in nano-pigment and high-performance dispersion technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal and waste management concerns

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCE ANALYSIS

- 6.1.1 BARGAINING POWER OF BUYERS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 MANUFACTURERS

- 6.2.3 DISTRIBUTORS

- 6.2.4 END USERS

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GLOBAL GDP TRENDS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 321290)

- 6.5.2 EXPORT SCENARIO (HS CODE 321290)

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 High-speed dispersions

- 6.8.1.2 Ultrasonic dispersion

- 6.8.1 KEY TECHNOLOGIES

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

7 PIGMENT DISPERSIONS MARKET, BY PIGMENT TYPE

- 7.1 INTRODUCTION

- 7.2 ORGANIC PIGMENTS

- 7.2.1 AZO PIGMENTS

- 7.2.1.1 Rising demand in paints, printing inks, plastics, and textiles to drive market

- 7.2.2 PHTHALOCYANINE PIGMENTS

- 7.2.2.1 Outstanding color fastness, strong chromatic strength, and excellent durability to boost market

- 7.2.3 HIGH-PERFORMANCE PIGMENTS

- 7.2.3.1 Excellent lightfastness and heat stability properties to fuel demand

- 7.2.4 OTHER ORGANIC PIGMENTS

- 7.2.1 AZO PIGMENTS

- 7.3 INORGANIC PIGMENTS

- 7.3.1 TITANIUM DIOXIDE

- 7.3.1.1 Cost-effectiveness to propel market growth

- 7.3.2 IRON OXIDE

- 7.3.2.1 Rising infrastructure developments to drive demand

- 7.3.3 CARBON BLACK

- 7.3.3.1 Wide demand in rubber and plastic applications to support growth

- 7.3.4 OTHER INORGANIC PIGMENTS

- 7.3.1 TITANIUM DIOXIDE

8 PIGMENT DISPERSIONS MARKET, BY DISPERSION TYPE

- 8.1 INTRODUCTION

- 8.2 WATER-BASED DISPERSIONS

- 8.2.1 LOW VOC PROPERTY TO FUEL MARKET GROWTH

- 8.3 SOLVENT-BASED DISPERSIONS

- 8.3.1 OUTSTANDING DURABILITY WITH ENHANCED RESISTANCE TO PROPEL GROWTH

9 PIGMENT DISPERSIONS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE PAINTS & COATINGS

- 9.2.1 GROWTH OF AUTOMOTIVE INDUSTRY TO BOOST DEMAND

- 9.3 DECORATIVE PAINTS & COATINGS

- 9.3.1 RAPID GROWTH IN RESIDENTIAL CONSTRUCTION TO PROPEL MARKET

- 9.4 INDUSTRIAL PAINTS & COATINGS

- 9.4.1 INDUSTRIALIZATION TO SUPPORT MARKET GROWTH

- 9.5 INKS

- 9.5.1 GROWING DIGITAL PRINTING INDUSTRY TO DRIVE MARKET

- 9.6 PLASTICS

- 9.6.1 OUTSTANDING WEATHER AND UV RESISTANCE AND HIGH LEVEL OF LIGHTFASTNESS TO BOOST MARKET

- 9.7 OTHER APPLICATIONS

10 PIGMENT DISPERSIONS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 BUILDING & CONSTRUCTION

- 10.2.1 STRONG GROWTH IN CONSTRUCTION SECTOR TO PROPEL GROWTH

- 10.3 AUTOMOTIVE

- 10.3.1 GROWING CONSUMER DEMAND AND GLOBAL SHIFT TOWARD ELECTRIC MOBILITY TO DRIVE MARKET GROWTH

- 10.4 PACKAGING

- 10.4.1 PROTECTION OF GOODS DURING DISTRIBUTION, TRANSPORTATION, AND STORAGE TO PROPEL MARKET

- 10.5 PAPER & PRINTING

- 10.5.1 INCREASING DEMAND IN EMERGING COUNTRIES TO FUEL MARKET

- 10.6 TEXTILE

- 10.6.1 UNIFORM COLORATION, EXCELLENT WASH FASTNESS, AND VIBRANT SHADES TO SPUR DEMAND

- 10.7 OTHER END-USE INDUSTRIES

11 PIGMENT DISPERSIONS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Cost-effective labor and low-cost raw materials to drive market

- 11.2.2 INDIA

- 11.2.2.1 Rising disposable income to propel market

- 11.2.3 JAPAN

- 11.2.3.1 Presence of multinational automobile companies to boost market growth

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Strong construction industry to drive market

- 11.2.5 INDONESIA

- 11.2.5.1 Government focus on renovation of existing infrastructure and investment in residential development to drive market

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Strong investments in R&D and technological advancements to drive market

- 11.3.2 CANADA

- 11.3.2.1 Strong construction and automotive industry to propel market

- 11.3.3 MEXICO

- 11.3.3.1 Growing investment in construction sector to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Presence of large industrial base to propel market

- 11.4.2 FRANCE

- 11.4.2.1 Growth in paints & coatings sector to boost market

- 11.4.3 UK

- 11.4.3.1 Government initiatives for construction sector to boost market

- 11.4.4 ITALY

- 11.4.4.1 Increasing construction activities to propel market growth

- 11.4.5 SPAIN

- 11.4.5.1 Increasing capital spending on construction projects to drive market

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Rapid infrastructural development to propel demand

- 11.5.1.2 UAE

- 11.5.1.2.1 Robust construction industry and strong consumer demand for luxury vehicles to boost market

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Ongoing infrastructure developments to boost consumption

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Growth in automotive sector to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growth of building & construction industry to propel market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.1.1 STRATEGIES ADOPTED BY KEY PIGMENT DISPERSION MANUFACTURERS, JANUARY 2020-JUNE 2025

- 12.2 REVENUE ANALYSIS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- 12.4.5 STRENGTH OF PRODUCT PORTFOLIO

- 12.4.6 BUSINESS STRATEGY EXCELLENCE

- 12.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.5.5 STRENGTH OF PRODUCT PORTFOLIO

- 12.5.6 BUSINESS STRATEGY EXCELLENCE

- 12.6 COMPETITIVE SCENARIO AND TRENDS

- 12.6.1 PRODUCT LAUNCHES

- 12.6.2 DEALS

- 12.6.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BASF SE

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DIC CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SUDARSHAN CHEMICAL INDUSTRIES LIMITED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 VIBRANTZ

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 CABOT CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 DYSTAR SINGAPORE PTE LTD

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.7 LANXESS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.8 PENN COLOR INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.8.4 MnM view

- 13.1.9 PIDILITE PIGMENT

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 ARALON COLOR GMBH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.1 BASF SE

- 13.2 OTHER PLAYERS

- 13.2.1 AUM FARBENCHEM

- 13.2.2 ACHITEX MINERVA S.P.A

- 13.2.3 CHROMATECH INCORPORATED

- 13.2.4 DCL CORPORATION

- 13.2.5 DECORATIVE COLOR & CHEMICAL, INC.

- 13.2.6 DCC GROUP COMPANY LIMITED

- 13.2.7 KEMITEKS

- 13.2.8 MANALI PIGMENTS PVT. LTD.

- 13.2.9 MIKUNI-COLOR LTD.

- 13.2.10 RPM INTERNATIONAL INC.

- 13.2.11 SYNTHESIA, A.S.

- 13.2.12 TIARCO CHEMICALS

- 13.2.13 TENNANTS TEXTILE COLOURS LTD.

- 13.2.14 VIPUL ORGANICS LTD.

- 13.2.15 QUAKER COLOR

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS