|

|

市場調査レポート

商品コード

1807077

内視鏡的粘膜下層剥離術/ESDの世界市場:製品別、適応症別、エンドユーザー別、地域別 - 2030年までの予測Endoscopic Submucosal Dissection/ESD Market by Product, Indication, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 内視鏡的粘膜下層剥離術/ESDの世界市場:製品別、適応症別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月27日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

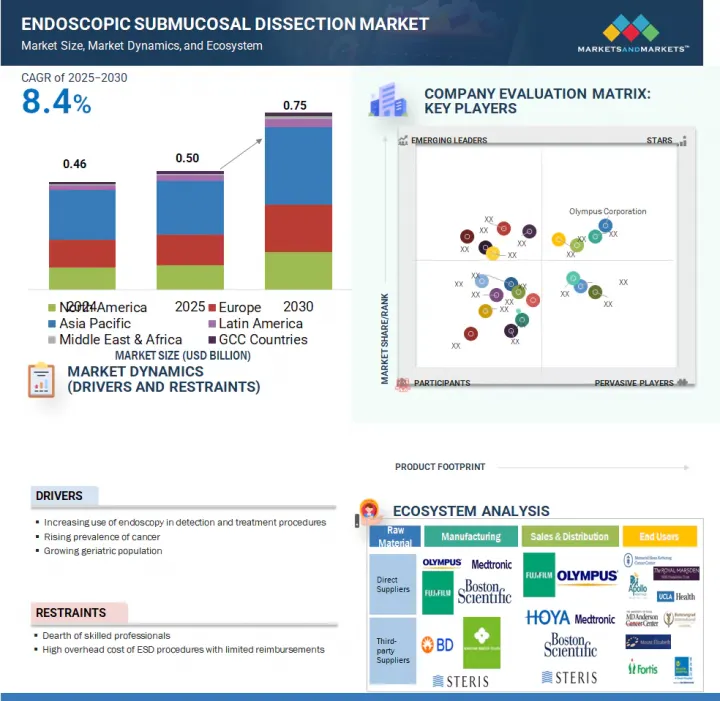

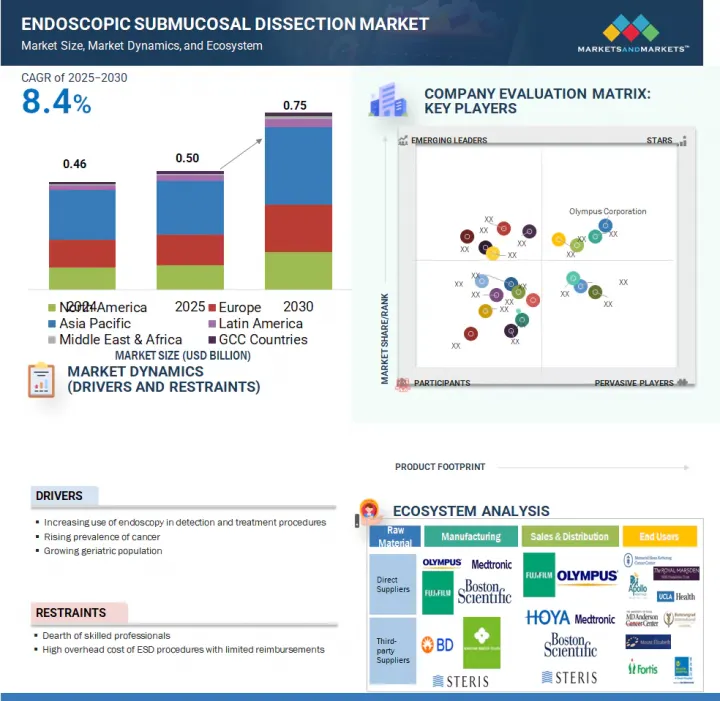

内視鏡的粘膜下層剥離術の市場規模は、予測期間中に8.4%のCAGRで拡大し、2025年の5億米ドルから2030年には7億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、適応症別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

内視鏡的粘膜下層剥離術(ESD)ツールの技術的進歩により、この手技の臨床的有用性と安全性が大幅に向上しており、それが市場成長を牽引しています。注入と切断の両方の機能を併せ持つハイブリッドナイフなどの技術革新は、剥離プロセスを合理化し、処置時間を短縮しています。さらに、牽引アシストシステムは、可視化と粘膜下層へのアクセスを改善し、複雑な剥離をより管理しやすくしています。

高解像度および狭帯域画像(NBI)内視鏡は、病変の検出と断端の評価をさらに向上させ、その結果、手技の精度が向上し、患者の転帰が改善しました。OlympusやFujifilmのような企業は、エネルギー供給システム、人間工学に基づいた内視鏡設計、AIベースの視覚化支援機能を統合した、プラットフォーム固有のイノベーションに多額の投資を行っています。

これらの開発により、従来ESDに関連していた技術的障壁が軽減され、非学術領域や地域ヘルスケアでの幅広い導入が可能になりつつあります。これらのツールがより直感的で標準化されるにつれて、新しい医療従事者の学習プロセスが促進され、最終的にはESDがより身近なものとなり、世界中の早期消化管腫瘍の管理に好まれるようになっています。

内視鏡的粘膜下層剥離術(ESD)市場は、製品タイプ別に胃カメラ&内視鏡、ナイフ、注入剤、組織リトラクター、把持クリップ、その他製品に分類されます。2024年には、胃カメラ&内視鏡のセグメントが世界のESD市場で最大のシェアを占めています。

最近の高精細(HD)および4K超高精細(UHD)画像技術の進歩は、優れた光学的鮮明度と詳細な視覚化を提供することにより、ESD処置を一変させました。ナローバンドイメージング(NBI)、拡大内視鏡、4Kスコープなどの機能は、病変の検出、断端の描出、全体的な手技精度を大幅に向上させる。このような画像診断の強化は、診断ミスの可能性を減らし、より正確な剥離を可能にし、最終的に患者の転帰の改善につながります。その結果、胃カメラ・内視鏡はこれらの進歩において重要な役割を担っており、手技の成功に不可欠な貢献をしていることから、ESD分野の市場シェアを独占しています。

適応症別では、ESD市場は胃がん、結腸がん、食道がんの3つに分類されます。2024年には、胃がんがESD市場の最大シェアを占めました。強力な臨床エビデンスが、ESDが粘膜および表在性粘膜下層胃腫瘍の治療のゴールドスタンダードであることを裏付けています。ESDは、特に従来の手術と比較した場合、高い一括切除率、最小限の局所再発、優れた臓器温存を達成することが長期研究によって示されています。これらの成績は、大手術を伴わない根治的アプローチが望まれる早期胃がんにおいて特に重要です。その結果、胃がん分野は、胃病変の管理における強力な臨床的検証と高い手技量に牽引され、ESD市場をリードしています。

アジア太平洋は予測期間中、ESD市場で最大のシェアを占めると予測されています。日本と韓国では、政府が資金を提供する検診プログラムが内視鏡検査による胃・大腸病変の早期発見を積極的に推進しており、ESDの数量が大幅に増加しています。また、この地域は、患者のケアと安全性を高めるために先進医療技術を採用する最前線にあります。

当レポートでは、世界の内視鏡的粘膜下層剥離術/ESD市場について調査し、製品別、適応症別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 規制分析

- 市場エコシステム

- バリューチェーン分析

- ポーターのファイブフォース分析

- 価格分析

- 特許分析

- サプライチェーン分析

- 2025年の主な会議とイベント

- 主要な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 技術分析

- 内視鏡的粘膜下層剥離術市場:隣接市場

- ケーススタディ分析

- AI/生成AIが内視鏡的粘膜下層剥離術市場に与える影響

- 2025年の米国関税が内視鏡粘膜下層剥離術市場に与える影響

- 投資と資金調達のシナリオ

第6章 内視鏡的粘膜下層剥離術市場(製品別)

- イントロダクション

- 胃カメラと大腸カメラ

- ナイフ

- 注射剤

- 組織リトラクター

- グラスパー/クリップ

- その他

第7章 内視鏡的粘膜下層剥離術市場(適応症別)

- イントロダクション

- 胃がん

- 大腸がん

- 食道がん

第8章 内視鏡的粘膜下層剥離術市場(エンドユーザー別)

- イントロダクション

- 病院

- 専門クリニック

- 外来手術センター

- その他

第9章 内視鏡的粘膜下層剥離術市場(地域別)

- イントロダクション

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- ラテンアメリカ

- 購買力とヘルスケア負担能力の向上が市場成長を後押し

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- ヘルスケアインフラの進歩により病院設備や医療機器の需要が増加

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- ヘルスケアインフラへの投資増加と医療観光の拡大が市場成長を促進

- GCC諸国のマクロ経済見通し

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- OLYMPUS CORPORATION

- MEDTRONIC

- FUJIFILM HOLDINGS CORPORATION

- BOSTON SCIENTIFIC CORPORATION

- SUMITOMO BAKELITE CO., LTD.

- CREO MEDICAL GROUP PLC

- HOYA CORPORATION

- CONMED CORPORATION

- STERIS

- MTW ENDOSKOPIE MANUFAKTUR

- OVESCO ENDOSCOPY AG

- ZEON MEDICAL INC.

- MICRO-TECH ENDOSCOPY

- KARL STORZ SE & CO. KG

- COOK MEDICAL

- その他の企業

- LEO MEDICAL CO., LTD.

- ERBE ELEKTROMEDIZIN GMBH

- TAEWOONG MEDICAL CO., LTD.

- DCC HEALTHCARE

- KOSSEN CO., LTD.

- INNOVAMEDICA S.P.A.

- JIANGSU VEDKANG MEDICAL SCIENCE AND TECHNOLOGY CO., LTD.

- HANGZHOU AGS MEDICAL TECHNOLOGICAL CO., LTD.

- BEIJING ZKSK TECHNOLOGY CO., LTD.

- UPEX-MED CO., LTD.

第12章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- TABLE 3 GLOBAL CANCER INCIDENCE FOR GERIATRIC POPULATION (65-85+), 2020 VS. 2040

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: ROLE IN ECOSYSTEM

- TABLE 8 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT, 2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF KNIVES, BY REGION, 2022-2024 (USD)

- TABLE 11 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: KEY PATENTS, 2023-2025

- TABLE 12 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 15 IMPORT DATA FOR HS CODE 901890 BY COUNTRY, 2020-2024 (USD THOUSAND)

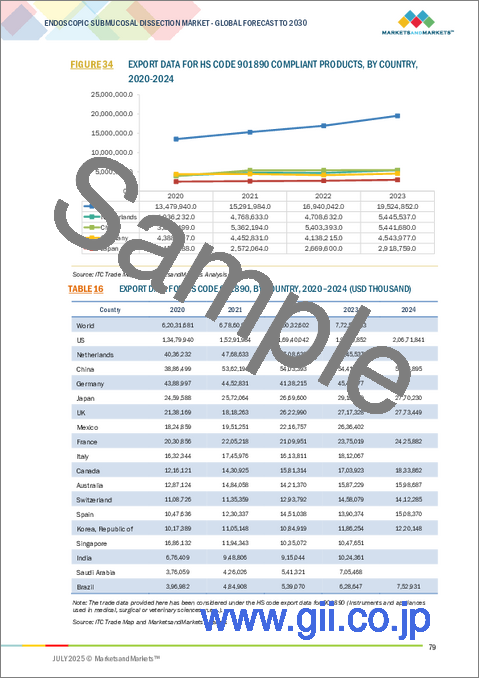

- TABLE 16 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 TYPES OF ELECTROSURGICAL KNIVES: FEATURES & USE CASES

- TABLE 18 KEY COMPANIES IMPLEMENTING AI

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 KEY PRODUCT-RELATED TARIFFS FOR ENDOSCOPIC SUBMUCOSAL DISSECTION

- TABLE 21 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 22 GASTROSCOPES & COLONOSCOPES: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 KNIVES: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 KNIVES: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION, 2023-2030

- TABLE 25 INJECTION AGENTS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 INJECTION AGENTS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION, 2023-2030

- TABLE 27 TISSUE RETRACTORS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 TISSUE RETRACTORS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION, 2023-2030

- TABLE 29 GRASPERS/CLIPS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 GRASPERS/CLIPS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION, 2023-2030

- TABLE 31 OTHER PRODUCTS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 33 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2022 (NUMBER OF PROCEDURES)

- TABLE 34 ESTIMATED NUMBER OF NEW CASES OF STOMACH CANCER, BY REGION (2022-2040)

- TABLE 35 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR STOMACH CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR STOMACH CANCER, BY REGION, 2024 (NUMBER OF PROCEDURES)

- TABLE 37 ESTIMATED NUMBER OF NEW CASES OF COLON CANCER, BY REGION (2022-2040)

- TABLE 38 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR COLON CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR COLON CANCER, BY REGION, 2024 (NUMBER OF PROCEDURES)

- TABLE 40 ESTIMATED NUMBER OF NEW CASES OF ESOPHAGEAL CANCER, BY REGION (2022-2040)

- TABLE 41 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR ESOPHAGEAL CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR ESOPHAGEAL CANCER, BY REGION, 2024 (NUMBER OF PROCEDURES)

- TABLE 43 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 44 HOSPITALS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 SPECIALTY CLINICS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 AMBULATORY SURGICAL CENTERS: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 53 JAPAN: MACROECONOMIC INDICATORS

- TABLE 54 JAPAN: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 55 JAPAN: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 56 JAPAN: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 57 CHINA: MACROECONOMIC INDICATORS

- TABLE 58 CHINA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 59 CHINA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 60 CHINA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 61 INDIA: MACROECONOMIC INDICATORS

- TABLE 62 INDIA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 63 INDIA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 64 INDIA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 65 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 66 SOUTH KOREA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 67 SOUTH KOREA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 68 SOUTH KOREA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 69 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 70 AUSTRALIA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 71 AUSTRALIA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 72 AUSTRALIA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 US: MACROECONOMIC INDICATORS

- TABLE 81 US: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 82 US: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 83 US: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 84 AGE-STANDARDIZED INCIDENCE RATES (ASIR) FOR SELECTED CANCERS IN MEN AND WOMEN IN CANADA, 2020 VS. 2040

- TABLE 85 CANADA: MACROECONOMIC INDICATORS

- TABLE 86 CANADA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 87 CANADA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 88 CANADA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: MACROECONOMIC INDICATORS

- TABLE 94 GERMANY: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 FRANCE: MACROECONOMIC INDICATORS

- TABLE 98 FRANCE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 99 FRANCE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 100 FRANCE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 101 UK: MACROECONOMIC INDICATORS

- TABLE 102 UK: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 103 UK: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 104 UK: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 105 ITALY: MACROECONOMIC INDICATORS

- TABLE 106 ITALY: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 107 ITALY: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 108 ITALY: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 109 SPAIN: MACROECONOMIC INDICATORS

- TABLE 110 SPAIN: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 111 SPAIN: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 112 SPAIN: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 114 REST OF EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 115 REST OF EUROPE: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 116 LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 118 LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 119 LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 120 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 121 BRAZIL: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 122 BRAZIL: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 123 BRAZIL: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 MEXICO: MACROECONOMIC INDICATORS

- TABLE 125 MEXICO: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 126 MEXICO: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 127 MEXICO: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 REST OF LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 129 REST OF LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 130 REST OF LATIN AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 134 GCC COUNTRIES: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 135 GCC COUNTRIES: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2023-2030 (USD MILLION)

- TABLE 136 GCC COUNTRIES: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 KEY DEVELOPMENTS IN ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, JANUARY 2021-JUNE 2025

- TABLE 138 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET : DEGREE OF COMPETITION

- TABLE 139 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET : REGION FOOTPRINT

- TABLE 140 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: PRODUCT FOOTPRINT

- TABLE 141 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: INDICATION FOOTPRINT

- TABLE 142 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: END USER FOOTPRINT

- TABLE 143 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: KEY STARTUPS/SMES

- TABLE 144 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY REGION

- TABLE 145 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET : COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY PRODUCT

- TABLE 146 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 147 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 148 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 149 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- TABLE 150 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 151 OLYMPUS CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 152 OLYMPUS CORPORATION: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 153 MEDTRONIC: COMPANY OVERVIEW

- TABLE 154 MEDTRONIC: PRODUCTS OFFERED

- TABLE 155 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 156 FUJIFILM HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 157 FUJIFILM HOLDINGS CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 158 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 159 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- TABLE 160 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 161 SUMITOMO BAKELITE CO., LTD.: BUSINESS OVERVIEW

- TABLE 162 SUMITOMO BAKELITE CO., LTD.: PRODUCTS OFFERED

- TABLE 163 CREO MEDICAL GROUP PLC: BUSINESS OVERVIEW

- TABLE 164 CREO MEDICAL GROUP PLC: PRODUCTS OFFERED

- TABLE 165 CREO MEDICAL GROUP PLC: DEALS, JANUARY 2021-JUNE 2025

- TABLE 166 CREO MEDICAL GROUP PLC: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 167 HOYA CORPORATION: BUSINESS OVERVIEW

- TABLE 168 HOYA CORPORATION: PRODUCTS OFFERED

- TABLE 169 CONMED CORPORATION: BUSINESS OVERVIEW

- TABLE 170 CONMED CORPORATION: PRODUCTS OFFERED

- TABLE 171 STERIS: COMPANY OVERVIEW

- TABLE 172 STERIS: PRODUCTS OFFERED

- TABLE 173 STERIS: DEALS

- TABLE 174 MTW ENDOSKOPIE MANUFAKTUR: BUSINESS OVERVIEW

- TABLE 175 MTW ENDOSKOPIE MANUFAKTUR: PRODUCTS OFFERED

- TABLE 176 OVESCO ENDOSCOPY AG: BUSINESS OVERVIEW

- TABLE 177 OVESCO ENDOSCOPY AG: PRODUCTS OFFERED

- TABLE 178 ZEON MEDICAL INC.: BUSINESS OVERVIEW

- TABLE 179 ZEON MEDICAL INC.: PRODUCTS OFFERED

- TABLE 180 MICRO-TECH ENDOSCOPY: BUSINESS OVERVIEW

- TABLE 181 MICRO-TECH ENDOSCOPY: PRODUCTS OFFERED

- TABLE 182 MICRO-TECH ENDOSCOPY: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 183 KARL STORZ SE & CO. KG.: BUSINESS OVERVIEW

- TABLE 184 KARL STORZ SE & CO. KG.: PRODUCTS OFFERED

- TABLE 185 COOK MEDICAL: BUSINESS OVERVIEW

- TABLE 186 COOK MEDICAL: PRODUCTS OFFERED

- TABLE 187 COOK MEDICAL: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 188 LEO MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 189 ERBE ELEKTROMEDIZIN GMBH: COMPANY OVERVIEW

- TABLE 190 TAEWOONG MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 191 DCC HEALTHCARE: COMPANY OVERVIEW

- TABLE 192 KOSSEN CO., LTD.: COMPANY OVERVIEW

- TABLE 193 INNOVAMEDICA S.P.A.: COMPANY OVERVIEW

- TABLE 194 JIANGSU VEDKANG MEDICAL SCIENCE AND TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 195 HANGZHOU AGS MEDICAL TECHNOLOGICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 196 BEIJING ZKSK TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 197 UPEX-MED CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: OLYMPUS CORPORATION

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET (2024)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHIC SNAPSHOT OF ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- FIGURE 18 INCREASING USE OF ENDOSCOPY IN DETECTION AND TREATMENT PROCEDURES TO DRIVE MARKET GROWTH

- FIGURE 19 GASTROSCOPES & COLONOSCOPES HELD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 20 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO BE LARGEST ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- FIGURE 22 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 GLOBAL CANCER INCIDENCE, 2022-2050

- FIGURE 25 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF KNIVES, BY REGION, 2022-2024 (USD)

- FIGURE 29 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: TOP PATENT OWNERS/APPLICANTS AND NUMBER OF PATENTS GRANTED, JANUARY 2015-JUNE 2025

- FIGURE 30 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: STAKEHOLDERS IN SUPPLY CHAIN

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 33 IMPORT DATA FOR HS CODE 901890 COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 34 EXPORT DATA FOR HS CODE 901890 COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 35 KEY FEATURES OF GEN AI IN ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- FIGURE 36 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: FUNDING AND NUMBER OF DEALS, 2019-2023 (USD MILLION)

- FIGURE 37 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 38 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 39 ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF TOP PLAYERS IN ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, 2020-2024 (USD MILLION)

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 43 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: COMPANY FOOTPRINT

- FIGURE 45 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 OLYMPUS CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 51 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 SUMITOMO BAKELITE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 54 CREO MEDICAL GROUP PLC: COMPANY SNAPSHOT

- FIGURE 55 HOYA CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 CONMED CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 STERIS: COMPANY SNAPSHOT

The endoscopic submucosal dissection market is projected to reach USD 0.75 billion by 2030 from USD 0.50 billion in 2025, at a CAGR of 8.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Indication, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

Technological advancements in endoscopic submucosal dissection (ESD) tools are significantly enhancing the procedure's clinical utility and safety, which, in turn, is driving market growth. Innovations such as hybrid knives that combine both injection and cutting capabilities have streamlined the dissection process and reduced procedural time. Additionally, traction-assisted systems have improved visualization and access to submucosal layers, making complex dissections more manageable.

High-definition and narrow-band imaging (NBI) endoscopes have further enhanced the detection of lesions and assessment of margins, resulting in increased procedural accuracy and better patient outcomes. Companies like Olympus and Fujifilm are heavily investing in platform-specific innovations, integrating energy delivery systems, ergonomic endoscope designs, and AI-based visualization aids.

These developments are reducing the technical barriers traditionally associated with ESD, enabling broader adoption in non-academic and community healthcare settings. As these tools become more intuitive and standardized, they are facilitating the learning process for new practitioners, ultimately making ESD more accessible and preferred for the management of early-stage gastrointestinal tumors worldwide.

By product, the gastroscopes & endoscopes segment accounted for the largest share of the market in 2024.

The market for endoscopic submucosal dissection (ESD) is categorized by product type into gastroscopes & endoscopes, knives, injection agents, tissue retractors, grasping clips, and other products. In 2024, the segment for gastroscopes & endoscopes held the largest share of the global ESD market.

Recent advancements in high-definition (HD) and 4K ultra-high-definition (UHD) imaging technologies have transformed ESD procedures by providing superior optical clarity and detailed visualization. Features such as narrow-band imaging (NBI), magnification endoscopy, and 4K scopes significantly enhance the detection of lesions, delineation of margins, and overall procedural accuracy. These imaging enhancements reduce the likelihood of diagnostic errors and allow for more precise dissection, ultimately leading to improved patient outcomes. Consequently, gastroscopes & endoscopes play a vital role in these advancements, which is why they dominate the market share in the ESD sector, driven by their essential contribution to the success of these procedures.

Based on indications, the stomach cancer segment dominated the ESD market in 2024.

Based on indications, the ESD market is divided into three categories: stomach cancer, colon cancer, and esophageal cancer. In 2024, stomach cancer accounted for the largest share of the ESD market. Strong clinical evidence supports ESD as the gold standard for treating mucosal and superficial submucosal gastric tumors. Long-term studies have shown that ESD achieves high rates of en bloc resection, minimal local recurrence, and excellent organ preservation, especially when compared to traditional surgery. These outcomes are particularly significant for early-stage stomach cancers, where a curative approach without major surgery is preferred. Consequently, the stomach cancer segment leads the ESD market, driven by strong clinical validation and high procedural volumes in the management of gastric lesions.

Based on region, the Asia Pacific held the largest market share in 2024.

The Asia Pacific region is projected to hold the largest share of the ESD market during the forecast period. Government-funded screening programs in Japan and South Korea are actively promoting the early detection of gastric and colorectal lesions through endoscopy, which has significantly increased ESD volumes. This region has also been at the forefront of adopting advanced medical technology to enhance patient care and safety.

A breakdown of the primary participants (supply side) for the endoscopic submucosal dissection market referred to in this report is provided below:

- By Company Type: Tier 1 (34%), Tier 2 (38%), and Tier 3 (28%)

- By Designation: C-level Executives (26%), Directors (35%), and Others (39%)

- By Region: North America (17%), Europe (39%), Asia Pacific (28%), Latin America (8%), Middle East & Africa (3%), and GCC Countries (5%)

Prominent players in the endoscopic submucosal dissection market are Olympus Corporation (Japan), FUJIFILM Holdings Corporation (Japan), Medtronic (Ireland), Boston Scientific Corporation (US), and Sumitomo Bakelite Co., Ltd. (Japan).

Research Coverage

The report assesses the endoscopic submucosal dissection market, estimating its size and future growth potential across various segments, including products, indications, end users, and regions. Additionally, the report features a competitive analysis of key players in the market, along with company profiles, product offerings, recent developments, and essential market strategies.

Reasons to Buy the Report

The report will provide valuable data on revenue estimates for the overall endoscopic submucosal dissection market and its subsegments, benefiting both market leaders and new entrants. It will help stakeholders understand the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, the report will give stakeholders insights into market trends, including key drivers, challenges, restraints, and opportunities.

This report provides insights into the following points:

- Analysis of key drivers (increasing use of endoscopy in detection and treatment procedures and rising prevalence of cancer), restraints (dearth of skilled professionals and high overhead cost of ESD procedures with limited reimbursements), opportunities (growing demand for minimally invasive procedures, growing investments in R&D of endoscopy technology, and expected increase in adoption of and preference for ESD procedures in developing countries), and challenges (higher rate of complications and risk of post-operative infections).

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global ESD market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, indication, end user, and region.

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global ESD market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global ESD market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY USED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET OVERVIEW

- 4.2 ASIA PACIFIC: ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT AND COUNTRY

- 4.3 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: GEOGRAPHIC MIX

- 4.4 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION

- 4.5 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of endoscopy in detection and treatment procedures

- 5.2.1.2 Rising prevalence of cancer

- 5.2.1.3 Growing geriatric population

- 5.2.2 RESTRAINTS

- 5.2.2.1 Dearth of skilled professionals

- 5.2.2.2 High overhead cost of ESD procedures with limited reimbursements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for minimally invasive procedures

- 5.2.3.2 Expected increase in adoption of and preference for ESD procedures in developing countries

- 5.2.4 CHALLENGES

- 5.2.4.1 Higher rate of complications

- 5.2.4.2 Risk of post-operative infection

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ADVANCES IN TRACTION METHODS FOR ENDOSCOPIC SUBMUCOSAL DISSECTION

- 5.3.2 ROBOT-ASSISTED ENDOSCOPIC SUBMUCOSAL DISSECTION

- 5.4 REGULATORY ANALYSIS

- 5.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.2 REGULATORY LANDSCAPE

- 5.4.2.1 North America

- 5.4.2.1.1 US

- 5.4.2.1.2 Canada

- 5.4.2.2 Europe

- 5.4.2.2.1 Germany

- 5.4.2.2.2 France

- 5.4.2.2.3 UK

- 5.4.2.2.4 Italy

- 5.4.2.1 North America

- 5.5 MARKET ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.1.1 High capital requirement

- 5.7.1.2 High preference for products from well-established brands

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.2.1 Presence of substitute therapies for endoscopic submucosal dissection

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.3.1 Presence of several raw material suppliers

- 5.7.3.2 Supplier switching cost

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.4.1 Limited number of companies offering premium products at global level

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7.5.1 Increasing demand for high-quality and innovative products

- 5.7.5.2 Lucrative growth potential in emerging markets

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT, 2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF KNIVES, BY REGION, 2022-2024 (USD)

- 5.9 PATENT ANALYSIS

- 5.10 SUPPLY CHAIN ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS DURING 2025-2025

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 TRENDS/DISRUPTIONS AFFECTING CUSTOMER BUSINESS

- 5.13.1 TRENDS/DISRUPTION IMPACTING CUSTOMER'S BUSINESS

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT DATA

- 5.14.2 EXPORT DATA

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Endoscopic electrosurgical knives

- 5.15.1.2 High-definition endoscopes

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Narrow band imaging/i-scan/FICE

- 5.15.2.2 Optical coherence tomography (OCT)

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 Endoscopic mucosal resection

- 5.15.3.2 Full-thickness resection devices

- 5.15.1 KEY TECHNOLOGIES

- 5.16 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET: ADJACENT MARKET

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 ROBOTIC-ASSISTED ESD FOR ESOPHAGEAL TUMORS

- 5.17.2 COST-EFFECTIVE ESD DEVICES FOR STOMACH CANCER

- 5.17.3 PRECISION ESD FOR COLORECTAL CANCER LESIONS

- 5.18 IMPACT OF AI/GEN AI ON ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- 5.18.1 MARKET POTENTIAL OF AI IN ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- 5.18.2 AI USE CASES

- 5.18.3 KEY COMPANIES IMPLEMENTING AI

- 5.18.4 FUTURE OF GENERATIVE AI IN ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- 5.19 IMPACT OF 2025 US TARIFF ON ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET

- 5.19.1 KEY TARIFF RATES

- 5.19.2 PRICE IMPACT ANALYSIS

- 5.19.3 IMPACT ON END-USE INDUSTRIES

- 5.20 INVESTMENT & FUNDING SCENARIO

6 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 GASTROSCOPES & COLONOSCOPES

- 6.2.1 RISE IN COLON CANCER INCIDENCE TO DRIVE GROWTH

- 6.3 KNIVES

- 6.3.1 IMPROVED EFFICACY, SAFETY, AND COST-EFFECTIVENESS OF KNIVES TO DRIVE MARKET GROWTH

- 6.4 INJECTION AGENTS

- 6.4.1 NEED FOR LOW-COST INJECTION AGENTS TO BOOST GROWTH

- 6.5 TISSUE RETRACTORS

- 6.5.1 RISING NUMBER OF SURGICAL PROCEDURES TO AID ADOPTION

- 6.6 GRASPERS/CLIPS

- 6.6.1 PATIENT SAFETY AND HIGH PRECISION OFFERED BY GRASPERS TO DRIVE DEMAND

- 6.7 OTHER PRODUCTS

7 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY INDICATION

- 7.1 INTRODUCTION

- 7.2 STOMACH CANCER

- 7.2.1 SIGNIFICANT PROPORTION OF CANCER DEATHS TO DRIVE SEGMENT

- 7.3 COLON CANCER

- 7.3.1 INTEREST BY MEDICAL DEVICE MANUFACTURERS, CLINICAL INVESTIGATORS, AND PRACTICING CLINICIANS TO DRIVE MARKET

- 7.4 ESOPHAGEAL CANCER

- 7.4.1 GROWING PREVALENCE OF ESOPHAGEAL CANCER TO FUEL GROWTH

8 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES AND ESD PROCEDURES TO SUPPORT GROWTH

- 8.3 SPECIALTY CLINICS

- 8.3.1 TRANSITION FROM HOSPITAL-BASED PROCEDURES TO CLINIC-BASED PROCEDURES TO BOOST GROWTH

- 8.4 AMBULATORY SURGICAL CENTERS

- 8.4.1 GROWTH IN SEGMENT DRIVEN BY INCREASING NUMBER OF OUTPATIENT VISITS

- 8.5 OTHER END USERS

9 ENDOSCOPIC SUBMUCOSAL DISSECTION MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.2.2 JAPAN

- 9.2.2.1 Supportive medical device reimbursement policies to drive market growth

- 9.2.3 CHINA

- 9.2.3.1 Large patient population and strong need for healthcare infrastructure improvements to boost market growth

- 9.2.4 INDIA

- 9.2.4.1 Favorable government initiatives for healthcare infrastructure improvements to support market growth

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Rapidly aging population and high incidence of gastrointestinal diseases to aid market growth

- 9.2.6 AUSTRALIA

- 9.2.6.1 High incidence of cancer to propel market growth

- 9.2.7 REST OF ASIA PACIFIC

- 9.3 NORTH AMERICA

- 9.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.3.2 US

- 9.3.2.1 Largest market for endoscopic submucosal dissection products

- 9.3.3 CANADA

- 9.3.3.1 Slower healthcare development over past decade to restrain growth

- 9.4 EUROPE

- 9.4.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.4.2 GERMANY

- 9.4.2.1 Germany to account for largest share of European market

- 9.4.3 FRANCE

- 9.4.3.1 High-quality healthcare system offering coverage to all citizens to support market growth

- 9.4.4 UK

- 9.4.4.1 Investments by hospitals to purchase new and advanced endoscopic submucosal dissection equipment to propel market

- 9.4.5 ITALY

- 9.4.5.1 Receptivity of government toward high-quality and technologically advanced equipment to foster growth

- 9.4.6 SPAIN

- 9.4.6.1 Rising prevalence of cancer to drive market growth

- 9.4.7 REST OF EUROPE

- 9.5 LATIN AMERICA

- 9.5.1 INCREASING PURCHASING POWER AND HEALTHCARE AFFORDABILITY TO FAVOR MARKET GROWTH

- 9.5.2 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.3 BRAZIL

- 9.5.3.1 Increase in private healthcare investments and rise in medical tourism to aid market growth

- 9.5.4 MEXICO

- 9.5.4.1 Increased government investment in healthcare infrastructure and technological advancements to aid market growth

- 9.5.5 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 ADVANCEMENTS IN HEALTHCARE INFRASTRUCTURE TO CREATE NEED FOR HOSPITAL EQUIPMENT AND MEDICAL DEVICES

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 INCREASING INVESTMENT IN HEALTHCARE INFRASTRUCTURE AND GROWING MEDICAL TOURISM TO PROPEL MARKET GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Indication footprint

- 10.5.5.5 End user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 OLYMPUS CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 MEDTRONIC

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 FUJIFILM HOLDINGS CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 BOSTON SCIENTIFIC CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 SUMITOMO BAKELITE CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 CREO MEDICAL GROUP PLC

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.7 HOYA CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 CONMED CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 STERIS

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 MTW ENDOSKOPIE MANUFAKTUR

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 OVESCO ENDOSCOPY AG

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ZEON MEDICAL INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 MICRO-TECH ENDOSCOPY

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.14 KARL STORZ SE & CO. KG

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 COOK MEDICAL

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches

- 11.1.1 OLYMPUS CORPORATION

- 11.2 OTHER COMPANIES

- 11.2.1 LEO MEDICAL CO., LTD.

- 11.2.2 ERBE ELEKTROMEDIZIN GMBH

- 11.2.3 TAEWOONG MEDICAL CO., LTD.

- 11.2.4 DCC HEALTHCARE

- 11.2.5 KOSSEN CO., LTD.

- 11.2.6 INNOVAMEDICA S.P.A.

- 11.2.7 JIANGSU VEDKANG MEDICAL SCIENCE AND TECHNOLOGY CO., LTD.

- 11.2.8 HANGZHOU AGS MEDICAL TECHNOLOGICAL CO., LTD.

- 11.2.9 BEIJING ZKSK TECHNOLOGY CO., LTD.

- 11.2.10 UPEX-MED CO., LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS