|

|

市場調査レポート

商品コード

1802922

乾式変圧器の世界市場:技術別、電圧別、相別、用途別、地域別 - 2030年までの予測Dry Type Transformer Market by Technology (Cast Resin, Vacuum Pressure Impregnated), Voltage (Low (<1 kV), Medium (1-6 kV), High (Above 36 kV)), Phase (Single, Three), Application (Industrial, Commercial, Utility) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 乾式変圧器の世界市場:技術別、電圧別、相別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月07日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

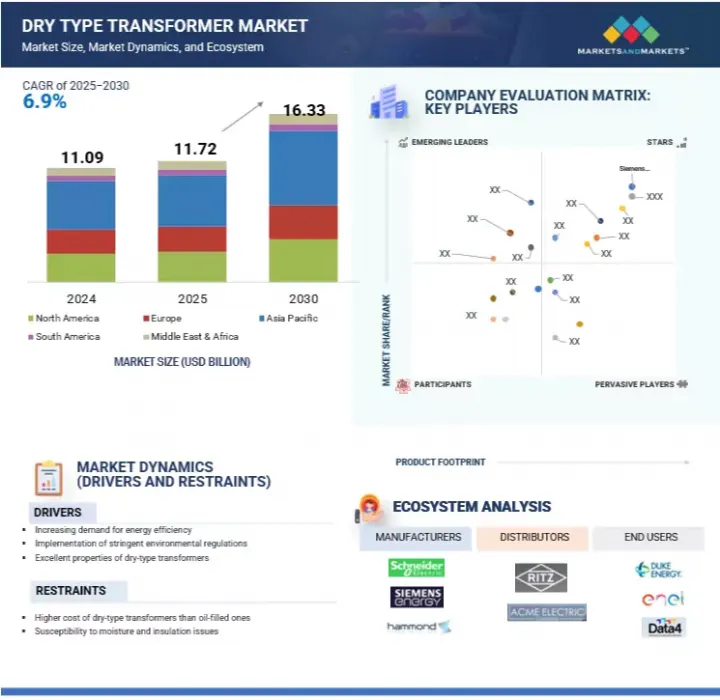

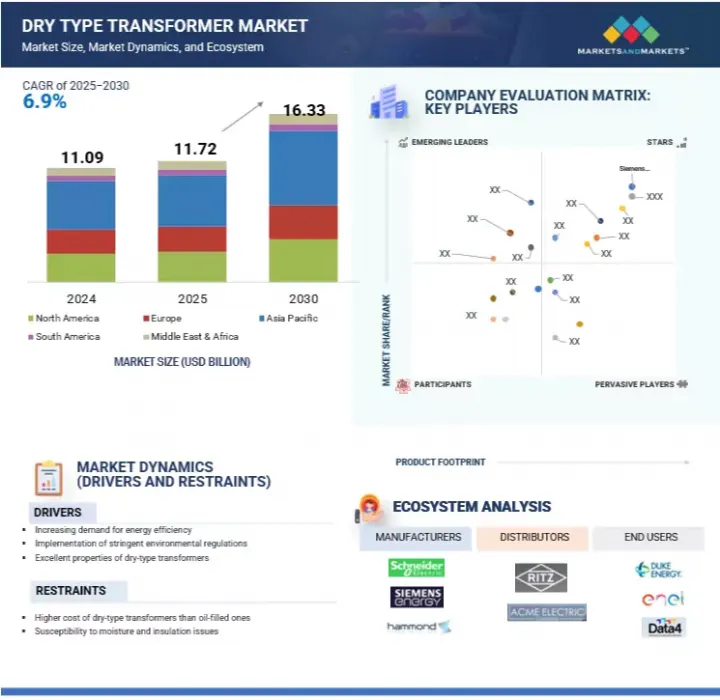

世界の乾式変圧器の市場規模は、2025年の117億2,000万米ドルから2030年には163億3,000万米ドルに成長し、CAGRは6.9%になると予測されています。

この成長の原動力は、スマートグリッドへの転換とエネルギーシステムの分散化に伴い、弾力性があり、安全でメンテナンスが容易な電気インフラに対する需要が高まっていることです。電力会社がシステムの信頼性と資産寿命の向上を目指すなか、乾式変圧器に組み込まれた予知保全戦略へのシフトが進んでいます。都市ビル、産業プラント、データセンター、再生可能エネルギーシステム、EV充電ネットワークで一般的に使用されているこれらの変圧器には、現在、リアルタイムの状態監視と故障予測を可能にするセンサー、通信モジュール、IoTベースの診断機能が搭載されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象台数 | 金額(100万米ドル)および数量(台) |

| セグメント別 | 技術別、電圧別、相別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

さらに、再生可能エネルギーの統合が進み、負荷条件が変動する中、変圧器は動的な熱的・電気的ストレスを管理する必要があります。アーク故障検出、過負荷保護、遠隔制御機能を備えた先進的な乾式変圧器の設計は、グリッドの柔軟性と迅速な故障復旧をサポートします。その結果、ユーティリティ企業や商業ユーザーは、グリッドの回復力を高め、メンテナンスコストを削減し、最新の安全性と効率基準を満たすために、自動化対応のセンサー付き乾式変圧器への投資を増やしており、乾式変圧器市場成長の主要な促進要因として予知保全を確固たるものにしています。

予測期間中、乾式変圧器市場では、産業用、商業用、公益事業用の配電網で幅広く使用されている中電圧セグメントが電圧別で最大となると予測されます。通常1kVから36kVの間で動作する中電圧乾式変圧器は、製造工場、データセンター、病院、教育機関、輸送ハブ、再生可能エネルギーシステムなどの施設において、高圧送電電力を使用可能なレベルまで低下させるのに不可欠です。

そのコンパクトなフォームファクター、火災安全特性、メンテナンス不要の動作は、油入りの代替品では火災や環境リスクが高くなる屋内や人口密集地に特に適しています。さらに、スマートシティ、電気自動車充電インフラ、分散型再生可能エネルギー源の統合に向けた世界的な機運は、変動負荷を管理し、安定した信頼性の高い電力供給を確保できる、高性能で自動化対応の中高圧変圧器に対する需要を加速させています。

予測期間中、真空加圧含浸(VPI)セグメントは、その優れた機械的強度、耐湿性、熱性能により、乾式変圧器市場で最も高いCAGRを示すと予測されます。VPIトランスは、真空加圧下で巻線に特別に調合されたワニスを含浸させて製造され、絶縁性と耐久性を高める。これらの特性により、化学プラント、採鉱作業、海洋アプリケーション、輸送インフラストラクチャなど、ほこりや湿気、機械的ストレスにさらされることの多い厳しい産業環境に非常に適しています。過酷な運転条件下で堅牢かつ長持ちする電力ソリューションに対するニーズの高まりは、特に重工業の成長と送電網の信頼性に重点を置く地域において、VPI技術の採用を加速させています。さらに、VPIプロセスは熱放散を改善し、運転効率と機器寿命の延長に貢献します。これらの要因は、予測保守とライフサイクル・コストの最適化を重視する電力会社の姿勢と一致しています。

予測期間中、アジア太平洋は、急速な都市化、加速する市場開拓、インフラや再生可能エネルギーへの大規模投資に牽引され、乾式変圧器市場が最も急成長すると予想されます。中国、インド、日本、韓国、東南アジアなどの国々では、製造拠点の拡大、人口の増加、電気自動車やスマートシティプロジェクトの採用拡大により、電力需要が急増しています。このため、特に従来の油入りユニットが適さない都市部や環境に敏感な地域では、安全でコンパクトな耐火変圧器の導入が増加しています。さらに、地域政府は送電網の近代化、農村部の電化、分散型エネルギー資源の統合を推進しており、中電圧、低メンテナンスの乾式変圧器のニーズをさらに高めています。アジア太平洋地域はまた、強力な国内製造基盤と、エネルギー効率を改善し二酸化炭素排出量を削減するための支援政策からも恩恵を受けています。同地域では、弾力性があり持続可能なエネルギーインフラの構築に引き続き注力しているため、IoTベースのモニタリング、予知保全、環境に優しい絶縁などの機能を備えた先進的な乾式変圧器の需要が大幅に拡大すると予想されます。

乾式変圧器市場を独占しているのは、広範な地域的プレゼンスを持つ少数の大手企業です。主要参入企業は、Siemens Energy(ドイツ)、Schneider Electric(フランス)、Eaton(アイルランド)、Toshiba Corporation(日本)、General Electric(米国)、Hammond Power Solutions(カナダ)、Hitachi(日本)です。

このレポートでは、乾式変圧器市場を技術別(鋳造樹脂、真空加圧含浸(VPI))、電圧別(低圧(1kV未満)、中圧(1~36kV)、高圧(36kV以上))、相別(単相、三相)、用途別(産業用、商業用、公益事業用、その他用途)、地域別に定義、説明、予測しています。また、市場の詳細な質的・量的分析も行っています。主な市場促進要因・抑制要因・機会・課題を包括的にレビューしています。また、市場の様々な重要な側面についても取り上げています。乾式変圧器市場の主要プレイヤーを包括的に分析しています。この分析により、各社の事業概要、ソリューションとサービス、主要戦略に関する洞察が得られます。また、新製品発売、合併、買収、その他市場の最近の動向とともに、関連する契約、パートナーシップ、協定についても取り上げています。さらに、乾式変圧器のエコシステムにおける新興企業の競合分析も掲載しています。

当レポートは、業界リーダーや新規参入者にとっての戦略的リソースであり、市場とそのサブセグメントに関する包括的な分析を提供します。競合情勢を完全に理解することで、利害関係者はビジネスのポジショニングを洗練させ、効果的な市場参入戦略を考案することができます。さらに、本レポートは現在の市場力学を解明し、戦略的意思決定に役立つ重要な促進要因・抑制要因・課題・機会を明らかにしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 規制状況

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 特許分析

- 価格分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 乾式変圧器市場におけるGEN AI/AIの影響

- 2025年の米国関税が乾式変圧器市場に与える影響

第6章 乾式変圧器市場(技術別)

- イントロダクション

- キャストレジン

- 真空加圧含浸(VPI)

第7章 乾式変圧器市場(電圧別)

- イントロダクション

- 低電圧

- 中電圧

- 高電圧

第8章 乾式変圧器市場(相別)

- イントロダクション

- 単相

- 三相

第9章 乾式変圧器市場(用途別)

- イントロダクション

- 工業

- 商業

- ユーティリティ

- その他

第10章 乾式変圧器市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 主要企業の業界集中、2024年

- 2020~2024年におけるトップ5社の収益分析

- 企業評価マトリックス、主要参入企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SCHNEIDER ELECTRIC

- EATON

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- HITACHI ENERGY LTD

- SIEMENS ENERGY

- GE VERNOVA

- FUJI ELECTRIC CO., LTD.

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- KIRLOSKAR ELECTRIC COMPANY

- HYOSUNG HEAVY INDUSTRIES

- HAMMOND POWER SOLUTIONS

- VOLTAMP TRANSFORMER

- WEG

- TMC TRANSFORMERS S.P.A.

- HANLEY ENERGY

- ALFANAR GROUP

- その他の企業

- EFACEC

- TBEA CO., LTD.

- JST POWER EQUIPMENT, INC.

- RPT RUHSTRAT POWER TECHNOLOGY GMBH

- RAYCHEM RPG PRIVATE LIMITED

- DELTA STAR POWER MANUFACTURING CORP.

第13章 付録

List of Tables

- TABLE 1 DRY TYPE TRANSFORMER MARKET: BY TECHNOLOGY

- TABLE 2 DRY TYPE TRANSFORMER MARKET: BY VOLTAGE

- TABLE 3 DRY TYPE TRANSFORMER MARKET: BY PHASE

- TABLE 4 DRY TYPE TRANSFORMER MARKET: BY APPLICATION

- TABLE 5 DRY TYPE TRANSFORMER MARKET SNAPSHOT

- TABLE 6 COMPANIES AND THEIR ROLE IN DRY TYPE TRANSFORMER ECOSYSTEM

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 DRY-TYPE TRANSFORMER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 LIST OF MAJOR PATENTS PERTAINING TO DRY TYPE TRANSFORMER MARKET, 2022-2025

- TABLE 15 PRICING RANGE OF DRY TYPE TRANSFORMERS, BY VOLTAGE

- TABLE 16 DRY TYPE TRANSFORMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON APPLICATION MARKET DUE TO TARIFF IMPACT

- TABLE 21 DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 22 DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 23 CAST RESIN: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 CAST RESIN: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 VACUUM PRESSURE IMPREGNATED (VPI): DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 VACUUM PRESSURE IMPREGNATED (VPI): DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

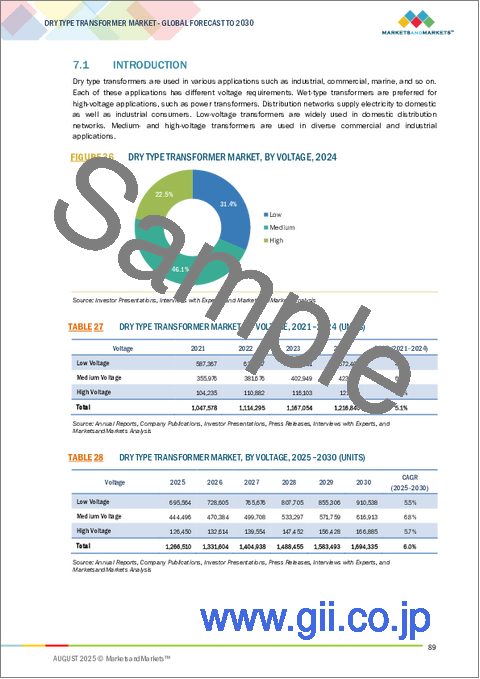

- TABLE 27 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (UNITS)

- TABLE 28 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (UNITS)

- TABLE 29 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 30 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 31 LOW VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 32 LOW VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 33 LOW VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 LOW VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 MEDIUM VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 36 MEDIUM VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 37 MEDIUM VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 MEDIUM VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 HIGH VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 40 HIGH VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 41 HIGH VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 HIGH VOLTAGE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 44 DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 45 SINGLE PHASE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 SINGLE PHASE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 THREE PHASE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 THREE PHASE: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 INDUSTRIAL: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 INDUSTRIAL: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 COMMERCIAL: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 COMMERCIAL: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 UTILITIES: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 UTILITIES: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 OTHERS: DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 OTHERS: DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 60 DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 61 DRY TYPE TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 DRY TYPE TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (UNITS)

- TABLE 66 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (UNITS)

- TABLE 67 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 70 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 CHINA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 76 CHINA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 77 CHINA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 78 CHINA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 79 CHINA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLIONS)

- TABLE 80 CHINA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 81 CHINA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 82 CHINA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 JAPAN: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 84 JAPAN: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 85 JAPAN: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 86 JAPAN: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 87 JAPAN: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 88 JAPAN: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 89 JAPAN: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 JAPAN: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 INDIA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 92 INDIA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 93 INDIA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 94 INDIA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 95 INDIA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 96 INDIA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 97 INDIA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 INDIA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 100 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 101 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 102 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 103 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 104 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 105 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 SOUTH KOREA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (UNITS)

- TABLE 118 EUROPE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (UNITS)

- TABLE 119 EUROPE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 128 GERMANY: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 132 GERMANY: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 133 GERMANY: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 GERMANY: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 FRANCE: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 136 FRANCE: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 137 FRANCE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 138 FRANCE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 139 FRANCE: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 140 FRANCE: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 141 FRANCE: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 FRANCE: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 UK: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 144 UK: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 145 UK: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 146 UK: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 147 UK: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 148 UK: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 149 UK: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 UK: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 ITALY: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 152 ITALY: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 153 ITALY: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 154 ITALY: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 155 ITALY: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 156 ITALY: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 157 ITALY: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 ITALY: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 SPAIN: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 160 SPAIN: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 161 SPAIN: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 162 SPAIN: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 163 SPAIN: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 164 SPAIN: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 165 SPAIN: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 166 SPAIN: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 168 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 170 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 172 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 REST OF EUROPE: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 176 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (UNITS)

- TABLE 178 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (UNITS)

- TABLE 179 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 180 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 182 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 184 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 NORTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 US: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 188 US: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 189 US: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 190 US: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 191 US: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 192 US: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 193 US: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 194 US: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 CANADA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 196 CANADA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 197 CANADA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 198 CANADA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 199 CANADA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 200 CANADA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 201 CANADA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 202 CANADA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 MEXICO: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 204 MEXICO: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 205 MEXICO: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 206 MEXICO: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 207 MEXICO: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 208 MEXICO: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 209 MEXICO: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 210 MEXICO: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (UNITS)

- TABLE 214 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (UNITS)

- TABLE 215 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 223 GCC: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 224 GCC: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 GCC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 226 GCC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 227 GCC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 228 GCC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 229 GCC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 230 GCC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 231 GCC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 232 GCC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 234 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 235 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 236 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 237 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 238 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 239 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 240 SAUDI ARABIA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 241 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 242 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 243 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 244 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 245 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 246 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 247 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 248 REST OF GCC: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 250 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 251 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 252 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 253 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 254 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 255 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 256 SOUTH AFRICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 265 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET IN SOUTH AMERICA, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 266 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET IN SOUTH AMERICA, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 267 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (UNITS)

- TABLE 268 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (UNITS)

- TABLE 269 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 270 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 271 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 272 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 273 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 274 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 275 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 276 SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 277 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 278 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 279 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 280 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 281 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 282 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY PHASE 2025-2030 (USD MILLION)

- TABLE 283 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 284 BRAZIL: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 285 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 286 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 287 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 288 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 289 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 290 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 291 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 292 ARGENTINA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 293 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 294 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 295 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 296 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 297 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 298 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 299 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 300 REST OF SOUTH AMERICA: DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 301 DISTRIBUTION TRANSFORMER MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, FEBRUARY 2020- APRIL 2024

- TABLE 302 DRY TYPE TRANSFORMER MARKET: REGION FOOTPRINT

- TABLE 303 DRY TYPE TRANSFORMER MARKET: TECHNOLOGY FOOTPRINT

- TABLE 304 DRY TYPE TRANSFORMER MARKET: APPLICATION FOOTPRINT

- TABLE 305 DRY TYPE TRANSFORMER MARKET: PHASE FOOTPRINT

- TABLE 306 VOLTAGE: COMPANY FOOTPRINT

- TABLE 307 DRY TYPE TRANSFORMER MARKET: DEALS, JANUARY 2021- JULY 2025

- TABLE 308 DRY TYPE TRANSFORMER MARKET: PRODUCT LAUNCHES, JANUARY 2021- JULY 2025

- TABLE 309 DRY TYPE TRANSFORMER MARKET: EXPANSION, JANUARY 2021-JULY 2025

- TABLE 310 DRY TYPE TRANSFORMER MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 311 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 312 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 314 EATON: COMPANY OVERVIEW

- TABLE 315 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 EATON: DEALS

- TABLE 317 EATON: OTHER DEVELOPMENTS

- TABLE 318 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 319 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: EXPANSIONS

- TABLE 321 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 322 HITACHI ENERGY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 HITACHI ENERGY LTD: PRODUCT LAUNCHES

- TABLE 324 HITACHI ENERGY LTD: DEALS

- TABLE 325 HITACHI ENERGY LTD: EXPANSIONS

- TABLE 326 HITACHI ENERGY LTD: OTHER DEVELOPMENTS

- TABLE 327 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 328 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 SIEMENS ENERGY: PRODUCT LAUNCHES

- TABLE 330 GE VERNOVA: COMPANY OVERVIEW

- TABLE 331 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 GE VERNOVA: DEVELOPMENTS

- TABLE 333 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 334 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 336 CG POWER & INDUSTRIAL SOLUTIONS LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 337 CG POWER & INDUSTRIAL SOLUTIONS LTD.: EXPANSIONS

- TABLE 338 KIRLOSKAR ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 339 KIRLOSKAR ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 HYOSUNG HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 341 HYOSUNG HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 HYOSUNG HEAVY INDUSTRIES: DEVELOPMENTS

- TABLE 343 HAMMOND POWER SOLUTIONS: COMPANY OVERVIEW

- TABLE 344 HAMMOND POWER SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 HAMMOND POWER SOLUTIONS: PRODUCT LAUNCHES

- TABLE 346 HAMMOND POWER SOLUTIONS: OTHER DEVELOPMENTS

- TABLE 347 VOLTAMP TRANSFORMER: COMPANY OVERVIEW

- TABLE 348 VOLTAMP TRANSFORMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 VOLTAMP TRANSFORMER: EXPANSIONS

- TABLE 350 WEG: COMPANY OVERVIEW

- TABLE 351 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 WEG: DEVELOPMENTS

- TABLE 353 TMC TRANSFORMERS S.P.A.: COMPANY OVERVIEW

- TABLE 354 TMC TRANSFORMERS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 TMC TRANSFORMERS S.P.A.: DEALS

- TABLE 356 TMC TRANSFORMERS S.P.A.: EXPANSIONS

- TABLE 357 HANLEY ENERGY: COMPANY OVERVIEW

- TABLE 358 HANLEY ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 ALFANAR GROUP: COMPANY OVERVIEW

- TABLE 360 ALFANAR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 DRY TYPE TRANSFORMER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DRY TYPE TRANSFORMER MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 DRY TYPE TRANSFORMER MARKET: BOTTOM-UP APPROACH

- FIGURE 6 DRY TYPE TRANSFORMER MARKET: TOP-DOWN APPROACH

- FIGURE 7 METRICS CONSIDERED TO ANALYZE DEMAND FOR DRY TYPE TRANSFORMERS

- FIGURE 8 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF DRY TYPE TRANSFORMERS

- FIGURE 9 DRY TYPE TRANSFORMER MARKET: INDUSTRY CONCENTRATION ANALYSIS

- FIGURE 10 CAST RESIN SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 11 MEDIUM VOLTAGE SEGMENT TO DOMINATE MARKET IN 2030

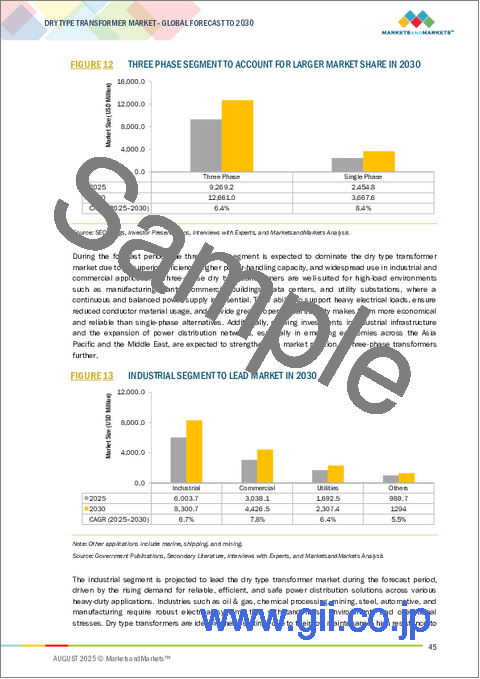

- FIGURE 12 THREE PHASE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 13 INDUSTRIAL SEGMENT TO LEAD MARKET IN 2030

- FIGURE 14 ASIA PACIFIC CAPTURED LARGEST MARKET SHARE IN 2024

- FIGURE 15 RISING URBANIZATION AND RAPID INDUSTRIALIZATION TO FOSTER MARKET GROWTH

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 CAST RESIN SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 18 MEDIUM VOLTAGE SEGMENT TO CAPTURE THE LARGEST MARKET SHARE IN 2030

- FIGURE 19 THREE PHASE SEGMENT TO LEAD MARKET IN 2030

- FIGURE 20 INDUSTRIAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 21 CAST RESIN SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC DRY TYPE TRANSFORMER MARKET IN 2024

- FIGURE 22 DRY TYPE TRANSFORMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 GLOBAL RENEWABLE GENERATION, BY REGION, 2010-2050

- FIGURE 24 TOTAL ELECTRICITY GENERATION, BY REGION, 2010-2050

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 ECOSYSTEM ANALYSIS

- FIGURE 27 DRY TYPE TRANSFORMER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 30 DRY TYPE TRANSFORMER MARKET: PATENTS GRANTED AND APPLIED, 2014-2025

- FIGURE 31 DRY TYPE TRANSFORMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 IMPACT OF GEN AI/AI ON DRY TYPE TRANSFORMER MARKET, BY REGION

- FIGURE 35 DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY, 2024

- FIGURE 36 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE, 2024

- FIGURE 37 DRY TYPE TRANSFORMER MARKET, BY PHASE, 2024

- FIGURE 38 DRY TYPE TRANSFORMER MARKET, BY APPLICATION, 2024

- FIGURE 39 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 40 DRY TYPE TRANSFORMER MARKET, BY REGION, 2024

- FIGURE 41 ASIA PACIFIC: DRY TYPE TRANSFORMER MARKET SNAPSHOT

- FIGURE 42 EUROPE: DRY TYPE TRANSFORMER MARKET SNAPSHOT

- FIGURE 43 DRY TYPE TRANSFORMER MARKET: INDUSTRY CONCENTRATION OF KEY PLAYERS, 2024

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 45 DRY TYPE TRANSFORMER MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 47 EATON: COMPANY SNAPSHOT

- FIGURE 48 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 HITACHI ENERGY LTD: COMPANY SNAPSHOT

- FIGURE 50 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 51 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 52 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

- FIGURE 54 KIRLOSKAR ELECTRIC: COMPANY SNAPSHOT

- FIGURE 55 HYOSUNG HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 56 HAMMOND POWER SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 57 VOLTAMP TRANSFORMER: COMPANY SNAPSHOT

- FIGURE 58 WEG: COMPANY SNAPSHOT

The global dry-type transformer market is projected to grow from USD 11.72 billion in 2025 to USD 16.33 billion by 2030, at a CAGR of 6.9%. This growth is driven by increasing demand for resilient, safe, and low-maintenance electrical infrastructure, aligned with smart grid transformation and the decentralization of energy systems. As utilities aim to improve system reliability and asset lifespan, there is a growing shift toward predictive maintenance strategies integrated into dry-type transformers. These transformers, commonly used in urban buildings, industrial plants, data centers, renewable energy systems, and EV charging networks, are now fitted with sensors, communication modules, and IoT-based diagnostics to enable real-time condition monitoring and fault prediction.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) and Volume (Units) |

| Segments | Dry-type transformer market by application, standard, voltage, type, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

Additionally, with greater integration of renewable energy and fluctuating load conditions, transformers must manage dynamic thermal and electrical stresses. Advanced dry-type transformer designs featuring arc-fault detection, overload protection, and remote-control capabilities support grid flexibility and quick fault recovery. Consequently, utilities and commercial users are increasingly investing in automation-ready, sensor-enabled dry-type transformers to boost grid resilience, lower maintenance costs, and meet modern safety and efficiency standards, solidifying predictive maintenance as a key driver of dry-type transformer market growth.

Medium voltage segment to hold largest market share during forecast period

During the forecast period, the medium voltage segment is projected to be the largest by voltage in the dry-type transformer market, driven by its extensive use across industrial, commercial, and utility-scale power distribution networks. Operating typically between 1 kV and 36 kV, medium-voltage dry-type transformers are vital in reducing high-voltage transmission power to usable levels for facilities such as manufacturing plants, data centers, hospitals, educational institutions, transportation hubs, and renewable energy systems.

Their compact form factor, fire-safe characteristics, and maintenance-free operation make them particularly suitable for indoor and densely populated areas, where oil-filled alternatives present higher fire and environmental risks. Moreover, the global momentum toward smart cities, electric vehicle charging infrastructure, and the integration of distributed renewable energy sources is accelerating demand for high-performance, automation-ready medium-voltage transformers capable of managing variable loads and ensuring stable, reliable power delivery.

Vacuum pressure impregnated segment, by technology, to exhibit highest CAGR during forecast period

During the forecast period, the vacuum pressure impregnated (VPI) segment is projected to exhibit the highest CAGR in the dry-type transformer market, driven by its superior mechanical strength, moisture resistance, and thermal performance. VPI transformers are manufactured by impregnating windings with specially formulated varnishes under vacuum and pressure, enhancing insulation and durability. These attributes make them highly suitable for demanding industrial environments, such as chemical plants, mining operations, marine applications, and transportation infrastructure, where exposure to dust, humidity, and mechanical stress is common. The rising need for robust and long-lasting power solutions in harsh operating conditions is accelerating the adoption of VPI technology, especially in regions focusing on heavy industrial growth and grid reliability. Additionally, the VPI process supports better thermal dissipation, contributing to operational efficiency and prolonged equipment life. These factors align with utilities' growing emphasis on predictive maintenance and lifecycle cost optimization.

Asia Pacific to be fastest-growing market during forecast period

During the forecast period, Asia Pacific is expected to be the fastest-growing market for dry-type transformers, driven by rapid urbanization, accelerating industrial development, and large-scale investments in infrastructure and renewable energy. Countries such as China, India, Japan, South Korea, and those in Southeast Asia are witnessing a surge in electricity demand due to expanding manufacturing bases, rising population, and growing adoption of electric vehicles and smart city projects. This has led to increased deployment of safe, compact, and fire-resistant transformers, particularly in urban and environmentally sensitive areas where traditional oil-filled units are less suitable. Moreover, regional governments are promoting grid modernization initiatives, electrification of rural areas, and integrating decentralized energy resources, further boosting the need for medium-voltage, low-maintenance dry-type transformers. Asia Pacific also benefits from a strong domestic manufacturing base and supportive policies to improve energy efficiency and reduce carbon emissions. As the region continues to focus on building resilient and sustainable energy infrastructure, the demand for advanced dry-type transformers with features like IoT-based monitoring, predictive maintenance, and eco-friendly insulation is expected to grow significantly.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the dry-type transformer market.

By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

By Designation: C-level Executives - 30%, Directors - 25%, and Others - 45%

By Region: Asia Pacific - 20%, North America - 35%, Europe - 25%, Middle East & Africa - 15%, and South America - 5%

Note: Other designations include engineers and sales & regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

A few major players with extensive geographic presence dominate the dry-type transformer market. The leading players are Siemens Energy (Germany), Schneider Electric (France), Eaton (Ireland), Toshiba Corporation (Japan), General Electric (US), Hammond Power Solutions (Canada), and Hitachi, Ltd. (Japan).

Research Coverage:

The report defines, describes, and forecasts the dry-type transformer market, by technology (cast resin, vacuum pressure impregnated (VPI)), voltage (low (<1 kV), medium (1-36 kV), high (above 36 kV)), phase (single-phase, three-phase), application (industrial, commercial, utility, other applications), and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A comprehensive analysis of the key players in the dry-type transformer market has been conducted. This analysis provides insights into their business overview, solutions and services, and key strategies. It also covers relevant contracts, partnerships, and agreements, along with new product launches, mergers, acquisitions, and other recent developments in the market. Additionally, the report includes a competitive analysis of emerging startups within the dry-type transformer ecosystem.

Reasons to Buy This Report:

This report is a strategic resource for industry leaders and new entrants, offering a comprehensive analysis of the market and its subsegments. It equips stakeholders with a thorough understanding of the competitive landscape, enabling them to refine their business positioning and devise effective go-to-market strategies. Additionally, the report elucidates the current market dynamics, highlighting critical drivers, constraints, challenges, and opportunities that inform strategic decision-making.

The report provides insights on the following points:

- Analysis of key drivers (increasing demand for energy efficiency, Implementation of stringent environment regulations), restraints (Higher cost of dry-type transformers than oil-filled ones, Susceptibility to moisture and insulation issues), opportunities (Expansion of global electrical infrastructure), and challenges (Limitations in power ratings, Preference for oil-filled transformers) influencing the growth

- Product Development/Innovation: Innovation in the dry-type transformer space is increasingly centered on solid dielectric insulation, cast resin technologies, and dry air or vacuum-based systems that eliminate the need for flammable or environmentally hazardous fluids. Manufacturers integrate smart relays, SCADA compatibility, arc-flash sensors, partial discharge monitors, and wireless communication modules into their products to support condition-based maintenance and predictive diagnostics. New designs feature modular and plug-and-play architectures, touch-safe terminals, enhanced mechanical endurance, and eco-friendly materials with reduced carbon footprints. Enclosures with corrosion resistance, IP-rated sealing, and anti-vandal features are adopted for robust performance in harsh and outdoor environments, particularly in industrial, transit, and renewable energy deployments.

- Market Development: Regions such as Asia Pacific, Africa, and South America are seeing strong market development fueled by smart city initiatives, renewable integration, and government-funded electrification projects. Programs such as India's Revamped Distribution Sector Scheme (RDSS), Brazil's DER integration roadmap, and Africa's Last-mile Connectivity Projects drive the widespread deployment of medium-voltage dry-type transformers. These transformers are critical in secondary distribution, especially where fire safety, reduced footprint, and visual aesthetics are key considerations.

- Market Diversification: Dry-type transformers' application areas are expanding beyond traditional grid utilities to include EV charging stations, solar and wind farms, commercial real estate, underground metro systems, data centers, and healthcare facilities. Each use case demands customized configurations, ranging from compact, low-noise units for hospitals to automation-ready systems for smart infrastructure and renewables. Manufacturers are responding with low-maintenance, arc-resistant, and modular designs that support scalability, reduce installation time, and enhance safety under fluctuating load conditions.

- Competitive Assessment: Key players in the dry-type transformer market include Siemens Energy (Germany), Schneider Electric (France), Eaton (Ireland), Toshiba Corporation (Japan), General Electric (US), Hammond Power Solutions (Canada), and Hitachi, Ltd. (Japan). These companies operate global manufacturing networks and strategically invest in regional partnerships, local assembly units, and R&D hubs to cater to evolving grid needs. Their competitive edge lies in offering digitally enabled, eco-efficient, modular transformer solutions that comply with global efficiency, safety, and environmental regulations. By focusing on smart diagnostics, sustainability, and fast deployment, these firms are well-positioned to meet the demand for resilient, future-ready distribution infrastructure.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.2.1 By technology

- 1.3.2.2 By voltage

- 1.3.2.3 By phase

- 1.3.2.4 By application

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Assumptions for demand-side analysis

- 2.3.3.2 Assumptions for demand-side analysis

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Assumptions for supply-side analysis

- 2.4 GROWTH FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRY TYPE TRANSFORMER MARKET

- 4.2 DRY TYPE TRANSFORMER MARKET, BY REGION

- 4.3 DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY

- 4.4 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE

- 4.5 DRY TYPE TRANSFORMER MARKET, BY PHASE

- 4.6 DRY TYPE TRANSFORMER MARKET, BY APPLICATION

- 4.7 ASIA PACIFIC DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global demand for energy efficiency

- 5.2.1.2 Implementation of stringent environmental regulations

- 5.2.1.3 Superior properties and inherent advantages

- 5.2.1.4 Rising adoption of renewable energy sources

- 5.2.2 RESTRAINTS

- 5.2.2.1 High CAPEX due to usage of advanced materials

- 5.2.2.2 Susceptibility to moisture and insulation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of industrial infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of liquid-based cooling

- 5.2.4.2 Preference for oil-filled transformers

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Cast resin dry type transformers (CRT)

- 5.6.1.2 Vacuum pressure impregnated (VPI)

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Temperature and partial discharge sensing systems

- 5.6.2.2 Forced-air or fan-assisted cooling systems

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Advanced core materials

- 5.6.3.2 Digital twin and real-time monitoring algorithms

- 5.6.1 KEY TECHNOLOGIES

- 5.7 REGULATORY LANDSCAPE

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA (HS CODE 8504)

- 5.8.2 EXPORT DATA (HS CODE 8504)

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 PATENT ANALYSIS

- 5.11 PRICING ANALYSIS

- 5.11.1 PRICING RANGE OF DRY TYPE TRANSFORMERS, BY VOLTAGE, 2024

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 BEDC IMPROVES TRANSFORMER RELIABILITY BY OPTIMIZING WIRE SIZING AND ADDRESSING OVERLOADING IN UGHELLI BUSINESS UNIT

- 5.12.2 WIND POWER DEVELOPMENTS TO ADDRESS GRID INTEGRATION ISSUES

- 5.12.3 WIND POWER INTEGRATION STRENGTHENS GRID COLLABORATION AND DRIVES POLICY INNOVATION IN ELETRICITY MARKETS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF GEN AI/AI ON DRY TYPE TRANSFORMER MARKET

- 5.15.1 ADOPTION OF GEN AI/AI IN DRY TYPE TRANSFORMERS

- 5.15.2 IMPACT OF GEN AI/AI ON DRY TYPE TRANSFORMER MARKET, BY REGION

- 5.16 IMPACT OF 2025 US TARIFF ON DRY-TYPE TRANSFORMER MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATIONS

6 DRY TYPE TRANSFORMER MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 CAST RESIN

- 6.2.1 ENHANCED FIRE SAFETY AND MINIMAL MAINTENANCE NEEDS TO DRIVE SEGMENTAL GROWTH

- 6.3 VACUUM PRESSURE IMPREGNATED (VPI)

- 6.3.1 ABILITY TO IMPROVE PARTIAL DISCHARGE RESISTANCE TO FUEL MARKET GROWTH

7 DRY TYPE TRANSFORMER MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- 7.2 LOW VOLTAGE

- 7.2.1 COMPATIBILITY WITH SMART GRID TECHNOLOGIES AND RENEWABLE ENERGY SYSTEMS TO FOSTER SEGMENTAL GROWTH

- 7.3 MEDIUM VOLTAGE

- 7.3.1 INTEGRATION WITH SMART MONITORING SYSTEMS TO SUPPORT MARKET GROWTH

- 7.4 HIGH VOLTAGE

- 7.4.1 INNOVATIONS IN COIL DESIGN AND THERMAL MANAGEMENT TO BOOST DEMAND

8 DRY TYPE TRANSFORMER MARKET, BY PHASE

- 8.1 INTRODUCTION

- 8.2 SINGLE PHASE

- 8.2.1 TECHNOLOGICAL ADVANCEMENTS IN THERMAL INSULATION AND ENCAPSULATION TECHNIQUES TO BOOST DEMAND

- 8.3 THREE PHASE

- 8.3.1 ABILITY TO BE CONNECTED ACROSS BROADER ARRAY OF VOLTAGES AND CURRENTS TO FUEL MARKET GROWTH

9 DRY TYPE TRANSFORMER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 INDUSTRIAL

- 9.2.1 RAPID INDUSTRIALIZATION AND RISING INDUSTRIAL ACTIVITIES TO FOSTER MARKET GROWTH

- 9.3 COMMERCIAL

- 9.3.1 RISING DEMAND FOR TRANSFORMERS FEATURING HIGH SAFETY, ADAPTABILITY, AND ENERGY EFFICIENCY TO SUPPORT MARKET GROWTH

- 9.4 UTILITIES

- 9.4.1 TRANSITION TO CLEANER AND MORE SUSTAINABLE ENERGY SYSTEMS TO DRIVE MARKET

- 9.5 OTHERS

10 DRY TYPE TRANSFORMER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Low labor costs and rising industrialization to support market growth

- 10.2.2 JAPAN

- 10.2.2.1 Growing installations of solar farms, offshore wind facilities, and BESS to drive market

- 10.2.3 INDIA

- 10.2.3.1 Growing investments in renewable energy sector to foster market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Rising emphasis on retrofitting aging grid infrastructure to boost demand

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Rapid expansion of EV charging stations, data centers, and industrial automation to support market growth

- 10.3.2 FRANCE

- 10.3.2.1 Growing emphasis on clean energy investments and smart grid expansion to foster market growth

- 10.3.3 UK

- 10.3.3.1 Thriving construction sector to offer lucrative growth opportunities

- 10.3.4 ITALY

- 10.3.4.1 Transition toward smart grids and digital substations to boost demand

- 10.3.5 SPAIN

- 10.3.5.1 Regulatory emphasis on reducing fire hazards and leakage risks in energy systems to drive market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Growth of utility-scale solar and wind projects to boost demand

- 10.4.2 CANADA

- 10.4.2.1 Emphasis on upgrading transmission and DERs to foster market growth

- 10.4.3 MEXICO

- 10.4.3.1 Government-led initiatives to enhance grid reliability and resilience to fuel market growth

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Transition toward renewable energy to foster market growth

- 10.5.1.2 Rest of GCC

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Government-backed solar initiatives to drive market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Commitment to decarbonization and energy transition to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Promotion of renewable energy projects to support market growth

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 INDUSTRY CONCENTRATION OF KEY PLAYERS, 2024

- 11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 11.5 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Region footprint

- 11.5.5.2 Technology footprint

- 11.5.5.3 Application footprint

- 11.5.5.4 Phase footprint

- 11.5.5.5 Voltage footprint

- 11.6 COMPETITIVE SCENARIO

- 11.6.1 DEALS

- 11.6.2 PRODUCT LAUNCHES

- 11.6.3 EXPANSIONS

- 11.6.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SCHNEIDER ELECTRIC

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 EATON

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 HITACHI ENERGY LTD

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.3.4 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 SIEMENS ENERGY

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 GE VERNOVA

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent Developments

- 12.1.6.3.1 Developments

- 12.1.7 FUJI ELECTRIC CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.9 KIRLOSKAR ELECTRIC COMPANY

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 HYOSUNG HEAVY INDUSTRIES

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Developments

- 12.1.11 HAMMOND POWER SOLUTIONS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Other developments

- 12.1.12 VOLTAMP TRANSFORMER

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent Development

- 12.1.12.3.1 Expansions

- 12.1.13 WEG

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Developments

- 12.1.14 TMC TRANSFORMERS S.P.A.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Expansions

- 12.1.15 HANLEY ENERGY

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 ALFANAR GROUP

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.1 SCHNEIDER ELECTRIC

- 12.2 OTHER PLAYERS

- 12.2.1 EFACEC

- 12.2.2 TBEA CO., LTD.

- 12.2.3 JST POWER EQUIPMENT, INC.

- 12.2.4 RPT RUHSTRAT POWER TECHNOLOGY GMBH

- 12.2.5 RAYCHEM RPG PRIVATE LIMITED

- 12.2.6 DELTA STAR POWER MANUFACTURING CORP.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS