|

|

市場調査レポート

商品コード

1800742

液体塗布膜市場:用途別、最終用途産業別、タイプ別、使用法別、地域別 - 2030年までの予測Liquid-applied Membrane Market by Type (Bituminous, Elastomeric, Cementitious), Application (Roofing, Walls, Roadways), Usage (New Construction, Refurbishment), End-use Industry (Commercial, Residential), And Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 液体塗布膜市場:用途別、最終用途産業別、タイプ別、使用法別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月21日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

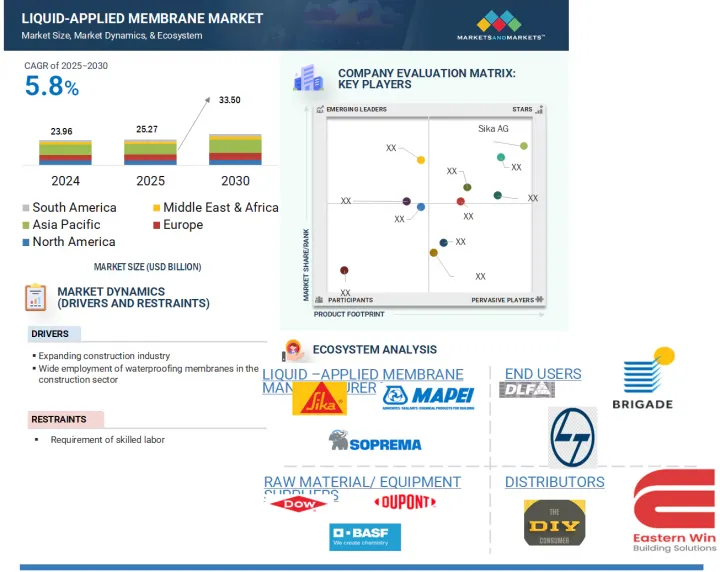

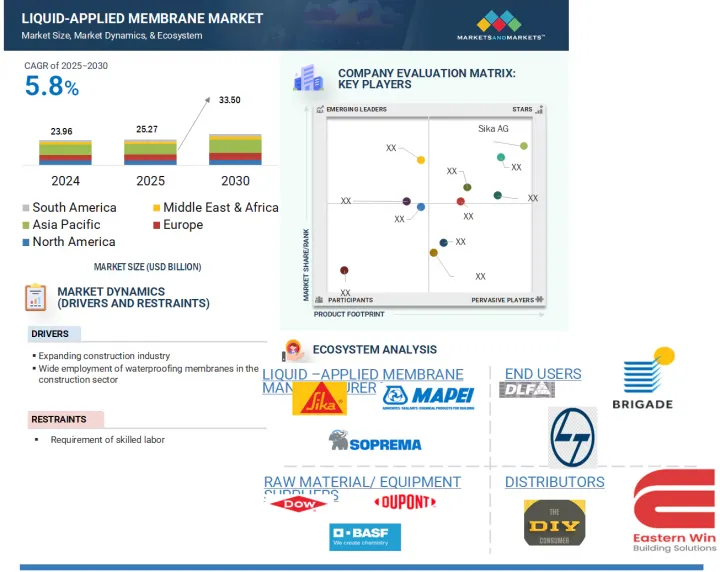

液体塗布膜の市場規模は、2025年の252億7,000万米ドルから2030年には335億米ドルに達すると予測され、予測期間中のCAGRは5.8%になるとみられています。

液状塗布膜(液体塗布膜)は、柔軟で耐久性のある保護バリアを形成する液状塗布型のシームレス防水システムです。複雑な表面に適合し、水の浸入、紫外線放射、化学物質への暴露から長期にわたって保護することができるため、屋根、地下室、テラス、トンネル、その他の構造要素に広く使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)数量(100万平方メートル) |

| セグメント | 用途別、最終用途産業別、タイプ別、使用法別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

液体塗布膜市場は、効率的で低メンテナンスの防水ソリューションに対する需要の増加、世界の建設業界の成長、エネルギー効率の高い持続可能な建築材料への注目の高まりなど、いくつかの要因によって推進されています。さらに、液体塗布膜はその施工の容易さ、迅速な施工時間、従来のシートベース・システムよりも優れた性能が支持されています。

地域別では、中国やインドのような国々における急速な都市化、インフラ整備、政府による住宅建設への取り組みにより、アジア太平洋地域の成長が最も顕著です。北米はリフォームとグリーンビルディングの動向に牽引され、欧州は厳しい環境規制と持続可能な建築の重視が市場を支えています。中東やアフリカも、商業インフラや輸送プロジェクトへの投資の増加により、主要市場として台頭してきています。これらの地域力学は、この材料の性能の優位性と相まって、液状塗布膜市場の世界の拡大を支え続けています。

瀝青膜は、建設業界で最も広く使用されている防水ソリューションの一つであり、その堅牢性、耐久性、幅広い用途で実証された性能で知られています。瀝青膜は主にアスファルトで構成されており、多くの場合、アタクチックポリプロピレン(APP)やスチレンブタジエン-スチレン(SBS)などのポリマーで改質されています。瀝青膜は通常、シート状または液状で塗布され、引張強度と寸法安定性を向上させるためにガラス繊維やポリエステルなどの材料で補強されています。これらの膜は、水平面と垂直面の両方において、水の浸入から長期にわたって保護するのに特に効果的です。屋根、地下室、基礎、トンネル、橋梁、擁壁などに幅広く使用されています。コンクリート、金属、木材など、さまざまな基材への優れた接着性により、厳しい環境条件下でも安定した性能を発揮します。紫外線暴露、極端な温度、機械的ストレスに耐える瀝青膜の能力は、露出した場所や埋設された場所での用途に理想的です。最近の動向では、環境問題への配慮から、VOC排出量が少なく、熱性能を向上させた改質瀝青膜が開発され、グリーンビルディング基準に適合しています。メーカーはまた、接着剤層が一体化され、硬化時間が短縮されたプレハブロールを導入することで、施工効率の向上にも注力しています。世界の建設ラッシュが続く中、特にインフラや商業部門では、多様なプロジェクト規模や環境条件下で信頼性の高い防水性能を発揮する瀝青膜の需要は引き続き高いです。

改修セグメントは、建物の改修、インフラのアップグレード、老朽化した構造物の改修が世界的に急増していることを背景に、液状塗布膜(液体塗布膜)の急成長セグメントの1つとして浮上しています。都市部の成熟化に伴い、既存の建物を修復し近代化する必要性は、官民双方の利害関係者にとって重要な焦点となっています。老朽化した建築物は、しばしば水漏れ、屋根の損傷、基礎のひび割れ、断熱性能の低下といった問題に直面するが、液体塗布膜の適用によって効果的に対処することができます。これらの膜は、シームレスな施工、不規則な表面への適合能力、老朽化したコンクリート、レンガ、金属を含む様々な下地との適合性により、改修プロジェクトに特に適しています。

改修工事における液体塗布膜の主な利点のひとつは、既存のシステムを完全に撤去する必要がなく、簡単に使用できることです。これは人件費を削減するだけでなく、住宅、学校、病院、商業施設などの居住空間における混乱を最小限に抑えることができます。スペースの制約や建物へのアクセスのしやすさが課題となる都市環境では、液体塗布膜は最小限の設備で縦にも横にも施工できる実用的なソリューションを提供します。そのエラストマー特性により、構造的な動きに対応し、既存のひび割れを塞ぐことができるため、建物外壁の寿命を延ばすことができます。さらに、欧州、北米、アジアの多くの政府プログラムでは、既存建物のエネルギー効率と耐水性の向上を奨励しています。持続可能な建築慣行やグリーン認証を奨励する規制は、改修工事における液体塗布膜のような高性能防水システムの使用をさらに後押ししています。液状塗布型防水膜はまた、低VOCで環境に安全な処方を提供し、現代の美観と環境基準に合致しています。

アジア太平洋は、急速な都市化、工業化、インフラ投資の増加、建設・市場開拓プロジェクトに対する政府の強力な支援という強力な組み合わせによって、液体塗布膜(LAM)市場で最大の地域となっています。この地域の優位性は、主に中国、インド、日本、韓国、東南アジア諸国のような主要経済国が後押ししており、それぞれが大規模な住宅、商業、インフラ建設活動を通じて貢献しています。最も決定的な促進要因のひとつは、インドと中国で進行中の大規模な建設ブームです。インドでは、建設部門が経済開発の要となっており、住宅、交通、都市インフラなど、公共部門と民間部門の意欲的なプロジェクトが推進力となっています。Pradhan Mantri Awas Yojana-Urban(PMAY-U)、Smart Cities Mission、物流・倉庫・不動産における設備投資の増加といった取り組みにより、液状塗布膜のような高性能防水材の需要が大幅に増加しています。持続可能性と環境に配慮した建築物を目指す同分野の動きは、環境基準に適合した先進的な液体塗布膜システムの使用をさらに後押ししています。

中国では、政府の第14次5カ年計画が、交通、エネルギー、水システム、グリーンな都市化などの分野における新しいインフラを重視しています。同国はまた、大規模な建物の改修とエネルギー効率の高いネット・ゼロ・ビルの開発を推進しており、新築と改修の両方で液体塗布膜使用の大きな機会を生み出しています。さらに、産業活動の活発化、都市の再開発、商業施設の拡張は、上海、北京、広州などの主要都市群における液体塗布膜需要を引き続き増大させています。さらに、同地域ではエネルギー効率、水管理、気候変動への耐性に対する意識が高まっており、開発業者や政府が高度な防水技術を採用するよう促しています。都市中心部では人件費が比較的安く、土地の利用可能性が縮小し続けているため、特に既存の構造物の改修においては、液体塗布膜のような効率的で施工が容易なシステムへと強くシフトしています。

当レポートでは、世界の液体塗布膜市場について調査し、用途別、最終用途産業別、タイプ別、使用法別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- 規制状況

- 貿易分析

- マクロ経済指標

- 価格分析

- 投資と資金調達のシナリオ

- エコシステム

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 原材料分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 特許分析

- 主要な利害関係者と購入基準

第7章 液体塗布膜市場(用途別)

- イントロダクション

- 屋根葺き

- 壁

- 建築構造物

- 道路

- その他

第8章 液状塗布膜市場(最終用途産業別)

- イントロダクション

- 住宅建設

- 商業建設

- 公共インフラ

第9章 液体塗布膜市場(タイプ別)

- イントロダクション

- エラストマー膜

- 瀝青膜

- セメント質膜

第10章 液体塗布膜市場(使用法別)

- イントロダクション

- 新築

- 改修

第11章 液体塗布膜市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- イタリア

- ロシア

- その他

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- タイ

- インドネシア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- SIKA AG

- MAPEI S.P.A.

- SOPREMA

- FOSROC, INC.

- SAINT-GOBAIN WEBER

- H.B. FULLER

- WACKER CHEMIE AG

- JOHNS MANVILLE

- BOSTIK

- GCP APPLIED TECHNOLOGIES INC.

- ARDEX

- その他の企業

- RENOLIT SE

- PAUL BAUDER GMBH CO. KG

- GAF, INC.

- CARLISLE COMPANIES INC.

- PIDILITE

- TREMCO

- KEMPER SYSTEM

- ALCHIMICA

- AMES RESEARCH LABORATORIES, INC.

- CHASE CORPORATION

- CHEMBOND CHEMICALS

- CHEM LINK

- CONCRETE SEALANTS, INC.

- CROMMELIN WATERPROOFING & SEALING

- ESKOLA ROOFING

- EVERBUILD BUILDING PRODUCTS LIMITED

- HENRY COMPANY

- INLAND COATINGS

- KARNAK

- KEY RESIN COMPANY

- PROTECTO WRAP COMPANY

- XYPEX CHEMICAL CORPORATION

第14章 付録

List of Tables

- TABLE 1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 TRENDS PER CAPITA GDP, 2020-2023 (USD)

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2024-2027

- TABLE 6 INDUSTRY (INCLUDING CONSTRUCTION) VALUE-ADDED STATISTICS, BY COUNTRY, 2023 (USD MILLION)

- TABLE 7 ROLE IN ECOSYSTEM: LIQUID-APPLIED MEMBRANE MARKET

- TABLE 8 LIQUID-APPLIED MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 LIQUID-APPLIED MEMBRANE MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 10 TOP 10 PATENT OWNERS OVER LAST TEN YEARS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 13 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 14 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 15 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 16 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 17 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 18 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 19 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 20 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 21 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 22 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 23 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 24 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 25 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2022-2024 (USD MILLION)

- TABLE 26 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2025-2030 (USD MILLION)

- TABLE 27 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2022-2024 (MILLION SQUARE METER)

- TABLE 28 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2025-2030 (MILLION SQUARE METER)

- TABLE 29 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2022-2024 (MILLION SQUARE METER)

- TABLE 32 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 33 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 34 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 36 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 37 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 40 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 41 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 42 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 44 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 45 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 48 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 49 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 50 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 52 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 53 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 54 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 56 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 57 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 58 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 60 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 61 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 62 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 64 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 65 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 66 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 68 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 69 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 70 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 72 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 73 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 74 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 76 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 77 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 78 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 80 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 81 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 82 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 83 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 84 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 85 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 86 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 88 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 89 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 90 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 92 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 93 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 94 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 96 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 97 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 98 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 100 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 101 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 102 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 104 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 105 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 108 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 109 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 112 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 113 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 116 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 117 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 120 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 121 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 122 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 124 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 125 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 126 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 128 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 129 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 130 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 132 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 133 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 134 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 136 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 137 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 138 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 140 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 141 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 142 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 144 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 145 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 146 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 148 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 149 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 152 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 153 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 156 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 157 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 160 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 161 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 164 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 165 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 168 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 169 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 170 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 172 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 173 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 174 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 176 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 177 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 178 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 180 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 181 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 182 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 184 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 189 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 192 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 193 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 196 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 197 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 200 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 201 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 202 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 203 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 204 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 205 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 206 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 207 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 208 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 209 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 210 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 212 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 213 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 216 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 217 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET BETWEEN 2019 AND 2025

- TABLE 218 LIQUID-APPLIED MEMBRANE MARKET: DEGREE OF COMPETITION

- TABLE 219 LIQUID-APPLIED MEMBRANE MARKET: TYPE FOOTPRINT

- TABLE 220 LIQUID-APPLIED MEMBRANE MARKET: APPLICATION FOOTPRINT

- TABLE 221 LIQUID-APPLIED MEMBRANE MARKET: REGION FOOTPRINT

- TABLE 222 LIQUID-APPLIED MEMBRANE MARKET: KEY STARTUPS/SMES

- TABLE 223 LIQUID-APPLIED MEMBRANE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 224 LIQUID-APPLIED MEMBRANE MARKET: PRODUCT LAUNCHES, MAY 2019-FEBRUARY 2024

- TABLE 225 LIQUID-APPLIED MEMBRANE MARKET: DEALS, MAY 2019-FEBRUARY 2024

- TABLE 226 LIQUID-APPLIED MEMBRANE MARKET: EXPANSIONS, MAY 2019-FEBRUARY 2024

- TABLE 227 SIKA AG: COMPANY OVERVIEW

- TABLE 228 SIKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 SIKA AG: DEALS

- TABLE 230 SIKA AG: EXPANSIONS

- TABLE 231 MAPEI S.P.A.: COMPANY OVERVIEW

- TABLE 232 MAPEI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 MAPEI S.P.A.: DEALS

- TABLE 234 MAPEI S.P.A: EXPANSIONS

- TABLE 235 SOPREMA: COMPANY OVERVIEW

- TABLE 236 SOPREMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 SOPREMA: DEALS

- TABLE 238 SOPREMA: EXPANSIONS

- TABLE 239 FOSROC, INC.: COMPANY OVERVIEW

- TABLE 240 FOSROC, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 FOSROC, INC: DEALS

- TABLE 242 FOSROC, INC.: EXPANSIONS

- TABLE 243 SAINT-GOBAIN WEBER: COMPANY OVERVIEW

- TABLE 244 SAINT-GOBAIN WEBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 H.B. FULLER: COMPANY OVERVIEW

- TABLE 246 H.B. FULLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 H.B. FULLER: DEALS

- TABLE 248 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 249 WACKER CHEMIE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 JOHNS MANVILLE: COMPANY OVERVIEW

- TABLE 251 JOHNS MANVILLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 JOHNS MANVILLE: PRODUCT LAUNCHES

- TABLE 253 BOSTIK: COMPANY OVERVIEW

- TABLE 254 BOSTIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 GCP APPLIED TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 256 GCP APPLIED TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 GCP APPLIED TECHNOLOGIES INC.: DEALS

- TABLE 258 ARDEX: COMPANY OVERVIEW

- TABLE 259 ARDEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 ARDEX.: DEALS

- TABLE 261 RENOLIT SE: COMPANY OVERVIEW

- TABLE 262 PAUL BAUDER GMBH CO. KG: COMPANY OVERVIEW

- TABLE 263 GAF, INC.: COMPANY OVERVIEW

- TABLE 264 CARLISLE COMPANIES INC.: COMPANY OVERVIEW

- TABLE 265 PIDILITE: COMPANY OVERVIEW

- TABLE 266 TREMCO: COMPANY OVERVIEW

- TABLE 267 KEMPER SYSTEM: COMPANY OVERVIEW

- TABLE 268 ALCHIMICA: COMPANY OVERVIEW

- TABLE 269 AMES RESEARCH LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 270 CHASE CORPORATION: COMPANY OVERVIEW

- TABLE 271 CHEMBOND CHEMICALS: COMPANY OVERVIEW

- TABLE 272 CHEM LINK: COMPANY OVERVIEW

- TABLE 273 CONCRETE SEALANTS, INC.: COMPANY OVERVIEW

- TABLE 274 CROMMELIN WATERPROOFING & SEALING: COMPANY OVERVIEW

- TABLE 275 ESKOLA ROOFING: COMPANY OVERVIEW

- TABLE 276 EVERBUILD BUILDING PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 277 HENRY COMPANY: COMPANY OVERVIEW

- TABLE 278 INLAND COATINGS: COMPANY OVERVIEW

- TABLE 279 KARNAK: COMPANY OVERVIEW

- TABLE 280 KEY RESIN COMPANY: COMPANY OVERVIEW

- TABLE 281 PROTECTO WRAP COMPANY: COMPANY OVERVIEW

- TABLE 282 XYPEX CHEMICAL CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LIQUID-APPLIED MEMBRANE MARKET: RESEARCH DESIGN

- FIGURE 2 LIQUID-APPLIED MEMBRANE MARKET: TOP-DOWN APPROACH

- FIGURE 3 LIQUID-APPLIED MEMBRANE MARKET: BOTTOM-UP APPROACH

- FIGURE 4 LIQUID-APPLIED MEMBRANE MARKET: DATA TRIANGULATION

- FIGURE 5 ELASTOMERIC MEMBRANES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 6 ROOFING TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 7 RESIDENTIAL CONSTRUCTION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 NEW CONSTRUCTION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 RISING DEMAND FROM CONSTRUCTION SECTOR TO DRIVE ASIA PACIFIC MARKET

- FIGURE 11 ELASTOMERIC MEMBRANES TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 ROOFING APPLICATION TO LEAD MARKET IN 2030

- FIGURE 13 RESIDENTIAL CONSTRUCTION TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 14 REFURBISHMENT SEGMENT TO RECORD FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 MARKET DYNAMICS OF LIQUID-APPLIED MEMBRANE MARKET

- FIGURE 17 LIQUID-APPLIED MEMBRANE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 ADHESIVE WATERPROOFING MEMBRANES IMPORT, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 19 ADHESIVE WATERPROOFING MEMBRANES EXPORT, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY REGION (USD/SQUARE METER)

- FIGURE 21 AVERAGE SELLING PRICE TREND, BY KEY MARKET PLAYER, 2024 (USD/SQUARE METER)

- FIGURE 22 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 23 LIQUID-APPLIED MEMBRANE MARKET: ECOSYSTEM

- FIGURE 24 TRENDS IN LIQUID-APPLIED MEMBRANE MARKET

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS OF LIQUID-APPLIED MEMBRANE MARKET

- FIGURE 26 LIQUID-APPLIED MEMBRANE MARKET: GRANTED PATENTS

- FIGURE 27 NUMBER OF PATENTS YEAR-WISE FROM 2015 TO 2024

- FIGURE 28 TOP JURISDICTION, BY DOCUMENT

- FIGURE 29 TOP 10 PATENT APPLICANTS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 32 ROOFING APPLICATION TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 33 RESIDENTIAL CONSTRUCTION INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 ELASTOMERIC MEMBRANES TO BE LARGEST TYPE DURING FORECAST PERIOD

- FIGURE 35 NEW CONSTRUCTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN LIQUID-APPLIED MEMBRANE MARKET, 2022-2024

- FIGURE 40 SHARES OF LEADING COMPANIES IN LIQUID-APPLIED MEMBRANE MARKET, 2024

- FIGURE 41 COMPANY VALUATION OF LEADING PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET, 2024

- FIGURE 42 FINANCIAL METRICS OF LEADING COMPANIES IN LIQUID-APPLIED MEMBRANE MARKET, 2024

- FIGURE 43 LIQUID-APPLIED MEMBRANE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 LIQUID-APPLIED MEMBRANE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 LIQUID-APPLIED MEMBRANE MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 46 LIQUID-APPLIED MEMBRANE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 SIKA AG: COMPANY SNAPSHOT

- FIGURE 48 MAPEI S.P.A.: COMPANY SNAPSHOT

- FIGURE 49 SAINT-GOBAIN WEBER: COMPANY SNAPSHOT

- FIGURE 50 H.B. FULLER: COMPANY SNAPSHOT

- FIGURE 51 WACKER CHEMIE AG: COMPANY SNAPSHOT

The liquid-applied membrane market is projected to reach USD 33.50 billion by 2030 from USD 25.27 billion in 2025, at a CAGR of 5.8% during the forecast period. Liquid-applied membranes (LAMs) are fluid-applied, seamless waterproofing systems that create a flexible and durable protective barrier. They are widely used in roofing, basements, terraces, tunnels, and other structural elements due to their ability to conform to complex surfaces and provide long-lasting protection against water ingress, UV radiation, and chemical exposure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Million Square Meter) |

| Segments | Type, Application, Usage, End-Use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The market for LAMs is being propelled by several factors, including the increasing demand for efficient and low-maintenance waterproofing solutions, the growth of the global construction industry, and a rising focus on energy-efficient and sustainable building materials. Additionally, LAMs are favored for their ease of application, rapid installation time, and superior performance over traditional sheet-based systems.

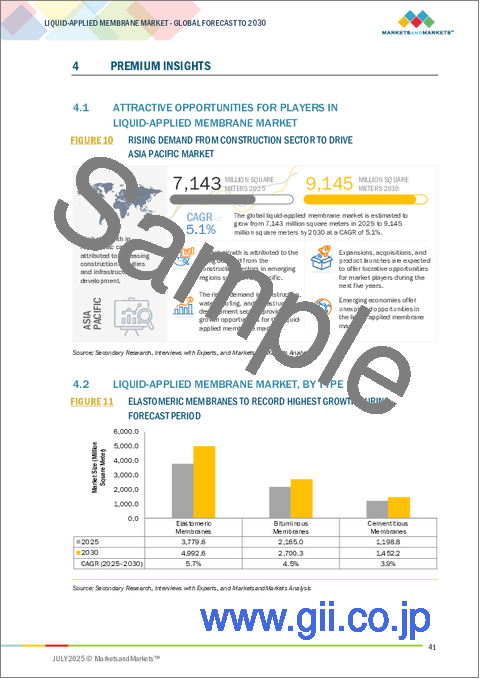

Regionally, growth is most prominent in Asia Pacific due to rapid urbanization, infrastructure development, and government housing initiatives in countries like China and India. North America is seeing strong demand driven by renovation and green building trends, while Europe's market is supported by stringent environmental regulations and emphasis on sustainable construction. The Middle East and Africa are also emerging as key markets due to increased investment in commercial infrastructure and transport projects. These regional dynamics, combined with the material's performance advantages, continue to support the global expansion of the liquid applied membrane market.

"Bituminous membranes segment is the second fastest-growing segment in the liquid-applied membrane market during the forecast period."

Bituminous membranes are one of the most widely used waterproofing solutions in the construction industry, known for their robustness, durability, and proven performance across a wide range of applications. These membranes are primarily composed of bitumen (asphalt), often modified with polymers such as Atactic Polypropylene (APP) or Styrene-Butadiene-Styrene (SBS), which enhance their elasticity, flexibility, and resistance to aging. Bituminous membranes are typically applied in sheet form or as liquid-applied coatings and are reinforced with materials like fiberglass or polyester to improve tensile strength and dimensional stability. These membranes are especially effective in providing long-lasting protection against water ingress in both horizontal and vertical surfaces. They are extensively used in roofing systems, basements, foundations, tunnels, bridges, and retaining walls. Their superior adhesion to a wide range of substrates, such as concrete, metal, and wood, ensures consistent performance even under challenging environmental conditions. The ability of bituminous membranes to withstand UV exposure, temperature extremes, and mechanical stress makes them ideal for exposed as well as buried applications. In recent years, environmental concerns have led to the development of modified bituminous membranes with lower VOC emissions and improved thermal performance, aligning with green building standards. Manufacturers are also focusing on improving installation efficiency by introducing prefabricated rolls with integrated adhesive layers and faster curing times. As construction activities continue to rise globally, especially in infrastructure and commercial sectors, the demand for bituminous membranes remains strong, supported by their ability to deliver reliable waterproofing across diverse project scales and environmental conditions.

"Refurbishment segment is the fastest-growing usage segment in the liquid-applied membrane market during the forecast period."

The refurbishment segment is emerging as one of the fastest-growing segments for liquid-applied membranes (LAMs), driven by a global surge in building renovation, infrastructure upgrades, and retrofitting of aging structures. As urban areas mature, the need to restore and modernize existing buildings has become a key focus for both public and private stakeholders. Older structures often face issues such as water leakage, roof damage, foundation cracks, and poor thermal performance-problems that can be effectively addressed through the application of LAMs. These membranes are especially well-suited for refurbishment projects due to their seamless application, ability to conform to irregular surfaces, and compatibility with various substrates, including aged concrete, brick, and metal.

One of the main advantages of LAMs in refurbishment is their ease of use without requiring the complete removal of the existing system. This not only reduces labor costs but also minimizes disruption in occupied spaces such as residential buildings, schools, hospitals, and commercial establishments. In urban environments where space constraints and building accessibility pose challenges, LAMs provide a practical solution that can be applied vertically or horizontally with minimal equipment. Their elastomeric properties allow them to accommodate structural movement and seal existing cracks, extending the lifespan of the building envelope. Additionally, many government programs in Europe, North America, and Asia are incentivizing energy efficiency and water resistance upgrades in existing buildings. Regulations encouraging sustainable building practices and green certification are further propelling the use of high-performance waterproofing systems like LAMs during renovation. Liquid-applied membranes also align with modern aesthetic and environmental standards, offering low-VOC, environmentally safe formulations.

"Asia Pacific is projected to be the largest market for liquid-applied membrane during the forecast period."

Asia Pacific stands as the largest region in the liquid-applied membrane (LAM) market, driven by a powerful combination of rapid urbanization, industrialization, rising infrastructure investments, and strong governmental support for construction and development projects. The region's dominance is primarily fueled by major economies like China, India, Japan, South Korea, and Southeast Asian countries, each contributing through large-scale residential, commercial, and infrastructure construction activities. One of the most defining growth drivers is the massive construction boom underway in India and China. In India, the construction sector is a cornerstone of economic development, propelled by ambitious public and private sector projects in housing, transportation, and urban infrastructure. Initiatives such as the Pradhan Mantri Awas Yojana-Urban (PMAY-U), Smart Cities Mission, and rising capital expenditure in logistics, warehousing, and real estate are significantly increasing the demand for high-performance waterproofing materials like liquid-applied membranes. The sector's push towards sustainability and green buildings is further encouraging the use of advanced LAM systems that align with environmental standards.

In China, the government's 14th Five-Year Plan emphasizes new infrastructure in areas like transportation, energy, water systems, and green urbanization. The country is also pushing for extensive building retrofits and the development of energy-efficient and net-zero buildings, creating robust opportunities for LAM usage in both new constructions and refurbishments. Additionally, rising industrial activity, urban redevelopment, and commercial expansions continue to add to LAM demand in key urban clusters like Shanghai, Beijing, and Guangzhou. Moreover, the region's growing awareness of energy efficiency, water management, and climate resilience is encouraging developers and governments to adopt advanced waterproofing technologies. With labor costs being comparatively lower and land availability continuing to shrink in urban cores, there is a strong shift toward efficient, easy-to-apply systems like LAMs, especially in retrofitting existing structures.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information was gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), Ardex (Germany), Renolit SE (Germany), GAF, Inc. (US), Pidilite(India), and Tremco (US). among others are some of the key players in the liquid-applied membrane market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the liquid-applied membrane market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, application, usage, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the liquid-applied membrane market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall liquid-applied membrane market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Expanding construction industry, rising renovation and refurbishment activities), restraints (Requirements of skilled labor ), opportunities (Growth in emerging markets), and challenges (Environmental & health concerns related to liquid-applied membranes)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the liquid-applied membrane market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the liquid-applied membrane market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players like Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), Ardex (Germany), Renolit SE (Germany), GAF, Inc. (US), Pidilite(India), and Tremco (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.1.2.4 Key primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET

- 4.2 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE

- 4.3 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION

- 4.4 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY

- 4.5 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE

- 4.6 LIQUID-APPLIED MEMBRANE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Rising renovation and refurbishment activities

- 5.2.1.3 Wide deployment of waterproofing membranes in construction sector

- 5.2.1.4 Stringent building codes and standards in construction projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing demand for sheet membranes as substitutes

- 5.2.2.2 High initial investment required for liquid-applied membranes

- 5.2.2.3 Requirement of skilled labor

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for energy-efficient buildings and green roofs

- 5.2.3.2 Growth in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental and health concerns related to liquid-applied membranes

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SOURCING

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTION

- 6.2.4 END USERS

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATIONS

- 6.3.1.1 North America

- 6.3.1.2 Europe

- 6.3.1.3 Asia Pacific

- 6.3.2 STANDARDS

- 6.3.2.1 ISO 15824

- 6.3.2.2 ISO 19288

- 6.3.2.3 ASTM D4068

- 6.3.2.4 ASTM D6788

- 6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.3.1 REGULATIONS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO

- 6.4.2 EXPORT SCENARIO

- 6.5 MACROECONOMIC INDICATORS

- 6.5.1 GLOBAL GDP TRENDS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.6.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.7 INVESTMENT AND FUNDING SCENARIO

- 6.8 ECOSYSTEM

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGY

- 6.10.1.1 New formulations

- 6.10.1.2 Self-healing & nanotechnology

- 6.10.2 COMPLEMENTARY TECHNOLOGY

- 6.10.2.1 Spray application technique

- 6.10.2.2 Moisture detection and monitoring tools

- 6.10.1 KEY TECHNOLOGY

- 6.11 RAW MATERIAL ANALYSIS

- 6.11.1 BITUMINOUS MEMBRANES

- 6.11.2 ELASTOMERIC MEMBRANES

- 6.11.2.1 Acrylic

- 6.11.2.2 Polyurethane

- 6.11.3 CEMENTITIOUS MEMBRANES

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 AIR GUARD VPA COATING ENHANCES ASPHALT'S FLEXIBILITY AND DURABILITY

- 6.13.2 SIKALASTIC ROOFPRO MEMBRANE SYSTEM PROVIDES FULLY REINFORCED MEMBRANE

- 6.13.3 FOSROC NITOPROOF 600PF PROVIDES EFFECTIVE WATERPROOFING

- 6.13.4 SPECTRUM HOUSE

- 6.13.5 EMPIRE STATE BUILDING

- 6.14 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.15 PATENT ANALYSIS

- 6.15.1 METHODOLOGY

- 6.15.2 DOCUMENT TYPES

- 6.15.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 6.15.4 INSIGHTS

- 6.15.5 JURISDICTION ANALYSIS

- 6.15.6 TOP APPLICANTS

- 6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.16.2 BUYING CRITERIA

7 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ROOFING

- 7.2.1 RISING DEMAND FOR GREEN ROOF SYSTEMS TO DRIVE MARKET

- 7.3 WALLS

- 7.3.1 HIGH EXPOSURE TO MOISTURE, TEMPERATURE FLUCTUATIONS, UV RADIATION, AND AIR POLLUTANTS TO DRIVE DEMAND

- 7.4 BUILDING STRUCTURES

- 7.4.1 STRUCTURAL CRACKING AND BIOLOGICAL DEGRADATION TO FUEL DEMAND FOR POLYURETHANE AND BITUMINOUS MEMBRANES

- 7.5 ROADWAYS

- 7.5.1 RISING INFRASTRUCTURE PROJECTS TO FUEL MARKET

- 7.6 OTHER APPLICATIONS

8 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL CONSTRUCTION

- 8.2.1 STRONG GROWTH IN RESIDENTIAL SECTOR TO FUEL DEMAND

- 8.3 COMMERCIAL CONSTRUCTION

- 8.3.1 INCREASING DEMAND FOR COMMERCIAL INFRASTRUCTURE TO BOOST MARKET

- 8.4 PUBLIC INFRASTRUCTURE

- 8.4.1 RAPID URBANIZATION AND INDUSTRIALIZATION TO DRIVE MARKET

9 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 ELASTOMERIC MEMBRANES

- 9.2.1 NEED FOR MEMBRANES WITH ROBUST PERFORMANCE IN SENSITIVE ENVIRONMENTS TO DRIVE MARKET

- 9.2.2 ACRYLIC MEMBRANES

- 9.2.3 POLYURETHANE WATERPROOFING MEMBRANES

- 9.2.4 PMMA MEMBRANES

- 9.3 BITUMINOUS MEMBRANES

- 9.3.1 RESISTANCE TO UV AND TEMPERATURE FLUCTUATIONS TO DRIVE DEMAND

- 9.3.2 SOLVENT-BASED

- 9.3.3 WATER-BASED

- 9.4 CEMENTITIOUS MEMBRANES

- 9.4.1 WIDE APPLICATIONS IN ROOFS AND TUNNELS TO DRIVE MARKET

- 9.4.2 ONE-COMPONENT (1K)

- 9.4.3 TWO-COMPONENT (2K)

10 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE

- 10.1 INTRODUCTION

- 10.2 NEW CONSTRUCTION

- 10.2.1 STRONG GROWTH IN NEW CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- 10.3 REFURBISHMENT

- 10.3.1 RISE IN INFRASTRUCTURAL DEVELOPMENTS TO BOOST MARKET

11 LIQUID-APPLIED MEMBRANE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Strong building & construction industry to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increase in demand due to government measures to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Increased public and private investments in infrastructure projects to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Steady economic growth and rapid urbanization to boost market

- 11.3.2 FRANCE

- 11.3.2.1 Investments in public infrastructure and digitalization to boost market

- 11.3.3 SPAIN

- 11.3.3.1 Growth of construction industry to propel market

- 11.3.4 UK

- 11.3.4.1 Various government activities to drive market

- 11.3.5 ITALY

- 11.3.5.1 Rise in renovation and refurbishment projects to boost market

- 11.3.6 RUSSIA

- 11.3.6.1 Increase in residential construction activities to fuel market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Surge in transportation projects to drive market

- 11.4.2 INDIA

- 11.4.2.1 Government initiatives and increased infrastructure spending to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Surge in redevelopment activities to boost market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Strong construction industry to fuel market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rising need for durable waterproofing solutions to boost market

- 11.4.6 THAILAND

- 11.4.6.1 Growth of real estate and tourism industries to drive market

- 11.4.7 INDONESIA

- 11.4.7.1 Rapid urbanization and population growth to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Development of Jeddah Economic City to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Growing emphasis on eco-friendly construction solutions to boost market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growing investment in construction sector to boost market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Upcoming international sports events to boost market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growth of construction industry to drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Type footprint

- 12.7.5.2 Application footprint

- 12.7.5.3 Region footprint

- 12.7.5.4 Company footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIKA AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MAPEI S.P.A.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SOPREMA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 FOSROC, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SAINT-GOBAIN WEBER

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 H.B. FULLER

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.7 WACKER CHEMIE AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.8 JOHNS MANVILLE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.4 MnM view

- 13.1.9 BOSTIK

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 GCP APPLIED TECHNOLOGIES INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Key strengths

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 ARDEX

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.4 MnM view

- 13.1.1 SIKA AG

- 13.2 OTHER PLAYERS

- 13.2.1 RENOLIT SE

- 13.2.2 PAUL BAUDER GMBH CO. KG

- 13.2.3 GAF, INC.

- 13.2.4 CARLISLE COMPANIES INC.

- 13.2.5 PIDILITE

- 13.2.6 TREMCO

- 13.2.7 KEMPER SYSTEM

- 13.2.8 ALCHIMICA

- 13.2.9 AMES RESEARCH LABORATORIES, INC.

- 13.2.10 CHASE CORPORATION

- 13.2.11 CHEMBOND CHEMICALS

- 13.2.12 CHEM LINK

- 13.2.13 CONCRETE SEALANTS, INC.

- 13.2.14 CROMMELIN WATERPROOFING & SEALING

- 13.2.15 ESKOLA ROOFING

- 13.2.16 EVERBUILD BUILDING PRODUCTS LIMITED

- 13.2.17 HENRY COMPANY

- 13.2.18 INLAND COATINGS

- 13.2.19 KARNAK

- 13.2.20 KEY RESIN COMPANY

- 13.2.21 PROTECTO WRAP COMPANY

- 13.2.22 XYPEX CHEMICAL CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS