|

|

市場調査レポート

商品コード

1798384

繊維リサイクルの世界市場:素材別、繊維廃棄物別、工程別、流通チャネル別、最終用途産業別、地域別 - 2030年までの予測Textile Recycling Market by Material (Cotton, Polyester & Polyester Fibers, Wool, Nylon & Nylon Fibers), Textile Waste, Process, Distribution Channel, End-Use (Apparel, Home Furnishing, Industrial & Institutional), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 繊維リサイクルの世界市場:素材別、繊維廃棄物別、工程別、流通チャネル別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月19日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

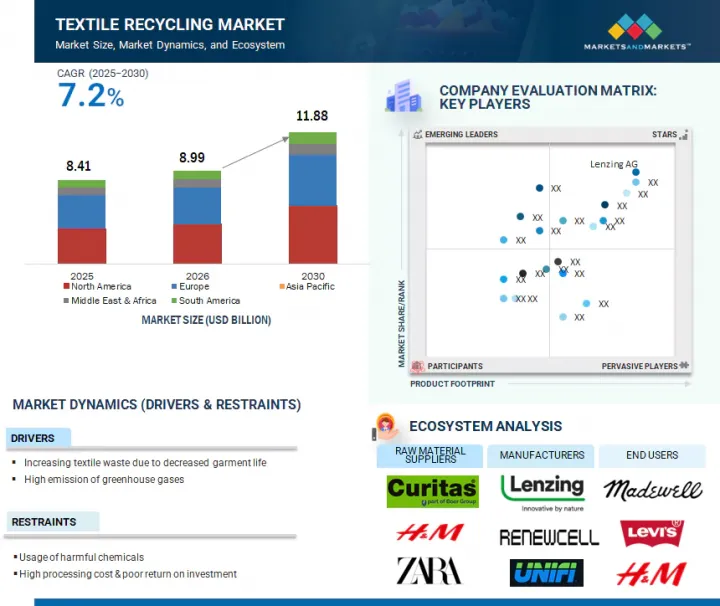

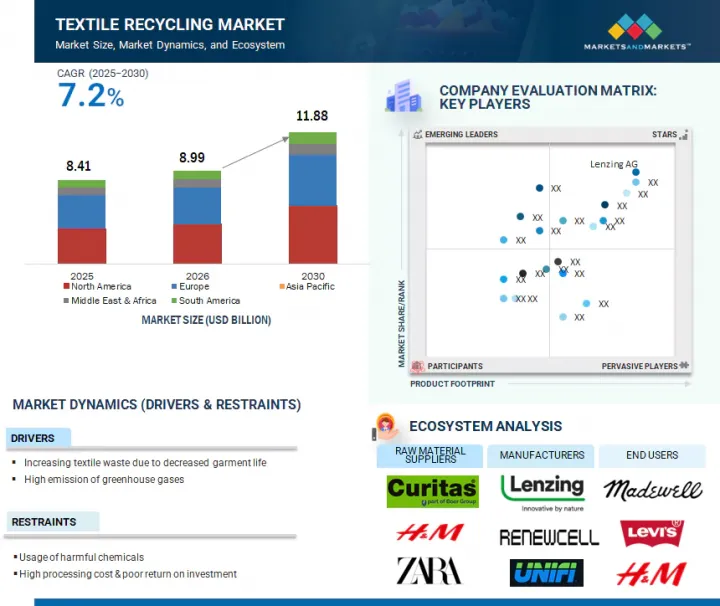

繊維リサイクルの市場規模は、2025年に84億1,000万米ドルと推定され、2025年から2030年までのCAGRは7.2%と見込まれており、2030年には118億8,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント別 | 素材別、繊維廃棄物別、工程別、流通チャネル別、最終用途産業別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、南米 |

綿は世界的に使用量が多く、生分解性があり、機械的・化学的方法での再利用の可能性があるため、繊維リサイクルでは第2位の市場シェアを占めています。アパレルや繊維製品によく使われる天然繊維である綿は、消費者使用前および消費者使用後の廃棄物を安定的に発生させるため、リサイクル業者に拡張可能な投入資源を提供しています。機械的にリサイクルされたコットンは、断熱材、雑巾、糸に使用され、化学的にリサイクルされたコットンは、リヨセルやビスコースのような高価値繊維の選択肢となります。綿花のリサイクルは水の使用と農薬への依存を減らし、持続可能なブランドや循環型経済への取り組みにアピールします。耐久性や混紡の必要性からポリエステルに劣るもの、綿の再生可能性と環境に優しい魅力は、繊維リサイクルにおいて綿の重要性を維持しています。

プレコンシューマー繊維廃棄物は、製造工程で発生する廃棄物が一貫して予測可能であるため、繊維廃棄物別で2番目に大きな市場シェアを占めています。この廃棄物には、端切れ、余分な布地、生産工程で発生する不合格品、規格外品などが含まれますが、これらはすべて清潔で汚染されておらず、消費者後廃棄物よりも分別が容易です。大規模な繊維製造業者では、このような残渣が大量に発生するため、リサイクルのための魅力的で経済的な原材料となります。さらに、一般的に消費者以前の廃棄物は、着用、洗濯、染色されていないため繊維の品質が高く、機械的または化学的リサイクルに適しています。サーキュラーファッションへの関心の高まりと消費者の意識から、現在は消費者系廃棄物が市場を独占しているが、消費者系廃棄物以前のものは、信頼性と処理のしやすさから、大きな市場シェアを維持しています。

機械的リサイクルは、その費用対効果、拡張性、長年にわたる業界の存在感により、繊維リサイクルプロセス分野で第2位のシェアを占めています。この手法では、使用済みの繊維を物理的に細断・カード化して繊維にし、断熱材、自動車用パッド、工業用ウエス、再生糸などの製品に再利用します。ケミカル・リサイクルとは異なり、機械的方法は溶剤や複雑な化学反応を必要としないため、より環境に優しく、技術的インフラが限られている地域に適しています。資本コストが低く、オペレーションが簡単なため、特に新興国市場の中小規模のリサイクル業者にとって好ましい選択肢となっています。

デジタル化が進み、消費者が便利なプラットフォームを好むようになったため、オンラインチャネルは繊維リサイクル市場で2番目に大きいです。eコマース、リサイクルポータルサイト、アプリによって、消費者は自宅にいながら引き取り、寄付、リサイクル衣類の購入を予約することができます。これは特に、持続可能性を重視する環境意識の高い若い消費者にアピールします。オンライン・チャネルはまた、直接のやり取りを容易にし、コストを削減し、中間業者をバイパスします。オフラインのセンターとB2Bが依然として支配的である一方、拡張性、パーソナライズされたデータ、世界なリーチにより、オンラインの方法は急速に成長しています。ソーシャルメディアと啓発キャンペーンは、デジタル・テキスタイル・リサイクルのアクセシビリティを高めています。

北米は、リサイクルインフラが発達していること、規制面でのサポートが手厚いこと、持続可能な製品に対する消費者の需要が高まっていることから、繊維リサイクル市場において第2位のシェアを占めています。同地域では、一人当たりの衣料品消費量が多く、ファストファッションが普及していることから、毎年大量の繊維廃棄物が発生しています。このため、リサイクル可能な繊維製品が安定的に供給され、リサイクル企業や非営利団体は、効率的な回収システムや小売業者との提携を通じてこれを活用しています。埋立地転換の義務化や拡大生産者責任(EPR)の枠組みといった政府のイニシアティブは、繊維製品の回収と循環型ビジネスモデルをさらに促進しています。北米は繊維リサイクル製品の主要生産国でもあり、Unifi, Inc.、Patagonia, Inc.、Leigh Fibers、Martex Fiberなどの主要企業があります。

当レポートでは、世界の繊維リサイクル市場について調査し、素材別、繊維廃棄物別、工程別、流通チャネル別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 価格分析

- 特許分析

第6章 繊維リサイクル市場(素材別)

- イントロダクション

- コットン

- ポリエステルおよびポリエステル繊維

- ウール

- ナイロンとナイロン繊維

- その他

第7章 繊維リサイクル市場(繊維廃棄物別)

- イントロダクション

- プレコンシューマー廃棄物

- 使用済み廃棄物

第8章 繊維リサイクル市場(工程)

- イントロダクション

- 機械

- 化学薬品

第9章 繊維リサイクル市場(流通チャネル別)

- イントロダクション

- オンラインチャンネル

- 小売店および百貨店

第10章 繊維リサイクル市場(最終用途産業別)

- イントロダクション

- 衣服

- ホームファニシング

- 産業および公共機関

- その他

第11章 繊維リサイクル市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- ベトナム

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- ロシア

- フランス

- イタリア

- スペイン

- オランダ

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- LENZING AG

- BIRLA CELLULOSE(GRASIM INDUSTRIES LIMITED)

- HYOSUNG TNC.

- UNIFI, INC.

- RENEWCELL(ALTOR)

- PATAGONIA, INC.

- TEXTILE RECYCLING INTERNATIONAL(WATERLAND)

- LEIGH FIBERS

- MARTEX FIBER

- THE WOOLMARK COMPANY

- TOYOBO TEXTILE CO., LTD.

- その他の企業

- WORN AGAIN TECHNOLOGIES

- PURE WASTE

- REMONDIS SE & CO. KG

- RETEX TEXTILES INC.

- BOER GROUP

- INFINITED FIBER COMPANY

- PISTONI S.R.L

- AMERICAN TEXTILE RECYCLING SERVICE

- REJU

- ECOTEX GROUP

- PROCOTEX

- IINOUIIO

- ANANDHI TEXSTYLES

- USHA YARNS LTD

- GEBR. OTTO BAUMWOLLFEINZWIRNEREI GMBH+CO. KG

第14章 付録

List of Tables

- TABLE 1 TEXTILE RECYCLING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 TEXTILE RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030 (%)

- TABLE 6 TEXTILE RECYCLING: VALUE CHAIN STAKEHOLDERS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 TEXTILE RECYCLING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 11 AVERAGE SELLING PRICE TREND OF TEXTILE RECYCLING, BY REGION, 2022-2030 (USD/KG)

- TABLE 12 INDICATIVE PRICING ANALYSIS OF TEXTILE RECYCLING, BY MATERIAL, 2022-2030 (USD/KG)

- TABLE 13 AVERAGE SELLING PRICE TREND OF TEXTILE RECYCLING, BY KEY COMPANY & MATERIAL, 2022-2030 (USD/KG)

- TABLE 14 TOTAL PATENT COUNT, 2014-2024

- TABLE 15 TOP 10 PATENT OWNERS, 2014-2024

- TABLE 16 TEXTILE RECYCLING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 17 TEXTILE RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 18 TEXTILE RECYCLING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 19 TEXTILE RECYCLING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 20 TEXTILE RECYCLING MARKET, BY TEXTILE WASTE, 2022-2024 (USD MILLION)

- TABLE 21 TEXTILE RECYCLING MARKET, BY TEXTILE WASTE, 2025-2030 (USD MILLION)

- TABLE 22 TEXTILE RECYCLING MARKET, BY TEXTILE WASTE, 2022-2024 (KILOTONS)

- TABLE 23 TEXTILE RECYCLING MARKET, BY TEXTILE WASTE, 2025-2030 (KILOTONS)

- TABLE 24 TEXTILE RECYCLING MARKET, BY PROCESS, 2022-2024 (USD MILLION)

- TABLE 25 TEXTILE RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 26 TEXTILE RECYCLING MARKET, BY PROCESS, 2022-2024 (KILOTONS)

- TABLE 27 TEXTILE RECYCLING MARKET, BY PROCESS, 2025-2030 (KILOTONS)

- TABLE 28 TEXTILE RECYCLING MARKET, BY DISTRIBUTION CHANNEL, 2022-2024 (USD MILLION)

- TABLE 29 TEXTILE RECYCLING MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 30 TEXTILE RECYCLING MARKET, BY DISTRIBUTION CHANNEL, 2022-2024 (KILOTONS)

- TABLE 31 TEXTILE RECYCLING MARKET, BY DISTRIBUTION CHANNEL, 2025-2030 (KILOTONS)

- TABLE 32 TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 33 TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 35 TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 36 TEXTILE RECYCLING MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 37 TEXTILE RECYCLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 TEXTILE RECYCLING MARKET, BY REGION, 2022-2024 (KILOTONS)

- TABLE 39 TEXTILE RECYCLING MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 40 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 41 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 43 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 44 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 45 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 47 ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 48 CHINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 49 CHINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 50 CHINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 51 CHINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 52 JAPAN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 53 JAPAN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 54 JAPAN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 55 JAPAN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 56 INDIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 57 INDIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 58 INDIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 59 INDIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 60 SOUTH KOREA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 61 SOUTH KOREA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 62 SOUTH KOREA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 63 SOUTH KOREA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 64 AUSTRALIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 65 AUSTRALIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 66 AUSTRALIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 67 AUSTRALIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 68 INDONESIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 69 INDONESIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 70 INDONESIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 71 INDONESIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 72 VIETNAM: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 73 VIETNAM: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 74 VIETNAM: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 75 VIETNAM: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 76 REST OF ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 79 REST OF ASIA PACIFIC: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 80 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 83 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 84 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 87 NORTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 88 US: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 89 US: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 90 US: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 91 US: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 92 CANADA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 93 CANADA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 94 CANADA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 95 CANADA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 96 MEXICO: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 97 MEXICO: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 98 MEXICO: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 99 MEXICO: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 100 EUROPE: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 101 EUROPE: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 103 EUROPE: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 104 EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 105 EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 107 EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 108 UK: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 109 UK: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 110 UK: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 111 UK: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 112 GERMANY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 113 GERMANY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 114 GERMANY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 115 GERMANY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 116 RUSSIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 117 RUSSIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 118 RUSSIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 119 RUSSIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 120 FRANCE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 121 FRANCE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 122 FRANCE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 123 FRANCE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 124 ITALY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 125 ITALY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 126 ITALY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 127 ITALY: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 128 SPAIN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 129 SPAIN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 130 SPAIN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 131 SPAIN: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 132 NETHERLANDS: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 133 NETHERLANDS: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 134 NETHERLANDS: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 135 NETHERLANDS: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 136 REST OF EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 137 REST OF EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 139 REST OF EUROPE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 140 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 143 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 144 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 147 MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 148 GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 149 GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 150 GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 151 GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 152 SAUDI ARABIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 153 SAUDI ARABIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 154 SAUDI ARABIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 155 SAUDI ARABIA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 156 UAE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 157 UAE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 158 UAE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 159 UAE: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 160 REST OF GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 161 REST OF GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 REST OF GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 163 REST OF GCC COUNTRIES: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 164 SOUTH AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 165 SOUTH AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 166 SOUTH AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 167 SOUTH AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 172 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 173 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 175 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 176 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 177 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 178 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 179 SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 180 BRAZIL: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 181 BRAZIL: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 182 BRAZIL: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 183 BRAZIL: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 184 ARGENTINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 185 ARGENTINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 186 ARGENTINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 187 ARGENTINA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 188 REST OF SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 189 REST OF SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 190 REST OF SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTONS)

- TABLE 191 REST OF SOUTH AMERICA: TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTONS)

- TABLE 192 TEXTILE RECYCLING MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2021-APRIL 2025

- TABLE 193 TEXTILE RECYCLING MARKET: DEGREE OF COMPETITION

- TABLE 194 TEXTILE RECYCLING MARKET: REGION FOOTPRINT

- TABLE 195 TEXTILE RECYCLING MARKET: MATERIAL FOOTPRINT

- TABLE 196 TEXTILE RECYCLING MARKET: WASTE FOOTPRINT

- TABLE 197 TEXTILE RECYCLING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 198 TEXTILE RECYCLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 199 TEXTILE RECYCLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (1/2)

- TABLE 200 TEXTILE RECYCLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (2/2)

- TABLE 201 TEXTILE RECYCLING MARKET: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2025

- TABLE 202 TEXTILE RECYCLING MARKET: DEALS, JANUARY 2019-JUNE 2025

- TABLE 203 TEXTILE RECYCLING MARKET: EXPANSIONS, JANUARY 2019-JUNE 2025

- TABLE 204 LENZING AG: COMPANY OVERVIEW

- TABLE 205 LENZING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 LENZING AG: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2025

- TABLE 207 LENZING AG: DEALS, JANUARY 2019-JUNE 2025

- TABLE 208 LENZING AG: EXPANSIONS, JANUARY 2019-JUNE 2025

- TABLE 209 BIRLA CELLULOSE: COMPANY OVERVIEW

- TABLE 210 BIRLA CELLULOSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 BIRLA CELLULOSE: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2025

- TABLE 212 BIRLA CELLULOSE: DEALS, JANUARY 2019-JUNE 2025

- TABLE 213 HYOSUNG TNC: COMPANY OVERVIEW

- TABLE 214 HYOSUNG TNC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 HYOSUNG TNC: DEALS, JANUARY 2019-JUNE 2025

- TABLE 216 UNIFI, INC.: COMPANY OVERVIEW

- TABLE 217 UNIFI, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 RENEWCELL: COMPANY OVERVIEW

- TABLE 219 RENEWCELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 RENEWCELL: DEALS, JANUARY 2019-JUNE 2025

- TABLE 221 PATAGONIA, INC.: COMPANY OVERVIEW

- TABLE 222 PATAGONIA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 TEXTILE RECYCLING INTERNATIONAL: COMPANY OVERVIEW

- TABLE 224 TEXTILE RECYCLING INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 TEXTILE RECYCLING INTERNATIONAL: DEALS, JANUARY 2019-JUNE 2025

- TABLE 226 LEIGH FIBERS: COMPANY OVERVIEW

- TABLE 227 LEIGH FIBERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 MARTEX FIBER: COMPANY OVERVIEW

- TABLE 229 MARTEX FIBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 THE WOOLMARK COMPANY: COMPANY OVERVIEW

- TABLE 231 THE WOOLMARK COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 TOYOBO TEXTILE CO., LTD.: COMPANY OVERVIEW

- TABLE 233 TOYOBO TEXTILE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 WORN AGAIN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 235 PURE WASTE: COMPANY OVERVIEW

- TABLE 236 REMONDIS SE & CO. KG: COMPANY OVERVIEW

- TABLE 237 RETEX TEXTILES INC.: COMPANY OVERVIEW

- TABLE 238 BOER GROUP: COMPANY OVERVIEW

- TABLE 239 INFINITED FIBER COMPANY: COMPANY OVERVIEW

- TABLE 240 PISTONI S.R.L.: COMPANY OVERVIEW

- TABLE 241 AMERICAN TEXTILE RECYCLING SERVICE: COMPANY OVERVIEW

- TABLE 242 REJU: COMPANY OVERVIEW

- TABLE 243 ECOTEX GROUP: COMPANY OVERVIEW

- TABLE 244 PROCOTEX: COMPANY OVERVIEW

- TABLE 245 IINOUIIO: OVERVIEW

- TABLE 246 ANANDHI TEXSTYLES: COMPANY OVERVIEW

- TABLE 247 USHA YARNS LTD: COMPANY OVERVIEW

- TABLE 248 GEBR. OTTO BAUMWOLLFEINZWIRNEREI GMBH + CO. KG: COMPANY OVERVIEW

List of Figures

- FIGURE 1 TEXTILE RECYCLING MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TEXTILE RECYCLING MARKET: RESEARCH DESIGN

- FIGURE 3 TEXTILE RECYCLING MARKET: BOTTOM-UP APPROACH

- FIGURE 4 TEXTILE RECYCLING MARKET: TOP-DOWN APPROACH

- FIGURE 5 TEXTILE RECYCLING MARKET: DATA TRIANGULATION

- FIGURE 6 POLYESTER & POLYESTER FIBERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 POST-CONSUMER TEXTILE WASTE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 CHEMICAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 RETAIL & DEPARTMENTAL STORES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 APPAREL SEGMENT ACCOUNTED FOR LARGEST SHARE OF TEXTILE RECYCLING MARKET

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 RISING DEMAND FROM EMERGING ECONOMIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 POLYESTER & POLYESTER FIBERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 PRE-CONSUMER SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CHEMICAL SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 ONLINE CHANNEL TO SHOW HIGH GROWTH TILL 2030

- FIGURE 17 INDUSTRIAL & INSTITUTIONAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC COUNTRIES TO SHOW HIGHEST GROWTH TILL 2030

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TEXTILE RECYCLING MARKET

- FIGURE 20 TEXTILE RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 23 TEXTILE RECYCLING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 TEXTILE RECYCLING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 TEXTILE RECYCLING MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 EXPORT DATA FOR HS CODE 550510-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 IMPORT DATA FOR HS CODE 550510-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF TEXTILE RECYCLING, BY REGION, 2022-2030 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF TEXTILE RECYCLING, BY MATERIAL, 2022-2030 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF TEXTILE RECYCLING OFFERED BY KEY PLAYERS, BY MATERIAL, 2024 (USD/KG)

- FIGURE 31 TOTAL NUMBER OF PATENTS, 2014-2024

- FIGURE 32 NUMBER OF PATENTS YEAR-WISE, 2014-2024

- FIGURE 33 PATENT ANALYSIS, BY LEGAL STATUS, 2014-2024

- FIGURE 34 TOP JURISDICTION, BY DOCUMENT, 2014-2024

- FIGURE 35 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2014-2024

- FIGURE 36 POLYESTER & POLYESTER FIBER TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 PRE-CONSUMER WASTE TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 38 CHEMICAL PROCESS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 39 ONLINE CHANNEL TO BE FASTER-GROWING DISTRIBUTION CHANNEL DURING FORECAST PERIOD

- FIGURE 40 APPAREL TO COMMAND LARGEST MARKET SHARE THROUGH FORECAST PERIOD

- FIGURE 41 INDIA TO BE FASTEST-GROWING TEXTILE RECYCLING MARKET BETWEEN 2025 AND 2030

- FIGURE 42 ASIA PACIFIC: TEXTILE RECYCLING MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: TEXTILE RECYCLING MARKET SNAPSHOT

- FIGURE 44 EUROPE: TEXTILE RECYCLING MARKET SNAPSHOT

- FIGURE 45 TEXTILE RECYCLING MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 46 SHARES OF TOP FIVE COMPANIES IN TEXTILE RECYCLING MARKET, 2024

- FIGURE 47 TEXTILE RECYCLING MARKET: COMPANY VALUATION OF KEY COMPANIES, 2024 (USD BILLION)

- FIGURE 48 TEXTILE RECYCLING MARKET: FINANCIAL METRICS OF KEY COMPANIES, 2024

- FIGURE 49 TEXTILE RECYCLING MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 TEXTILE RECYCLING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 TEXTILE RECYCLING MARKET: COMPANY FOOTPRINT

- FIGURE 52 TEXTILE RECYCLING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 LENZING AG: COMPANY SNAPSHOT

- FIGURE 54 BIRLA CELLULOSE: COMPANY SNAPSHOT

- FIGURE 55 HYOSUNG TNC: COMPANY SNAPSHOT

- FIGURE 56 UNIFI, INC.: COMPANY SNAPSHOT

- FIGURE 57 TOYOBO TEXTILE CO., LTD.: COMPANY SNAPSHOT

The textile recycling market is estimated at USD 8.41 billion in 2025 and is projected to reach USD 11.88 billion by 2030, at a CAGR of 7.2% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilo Tons) |

| Segments | By Material, Textile Waste, Process, Distribution Channel, End-Use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

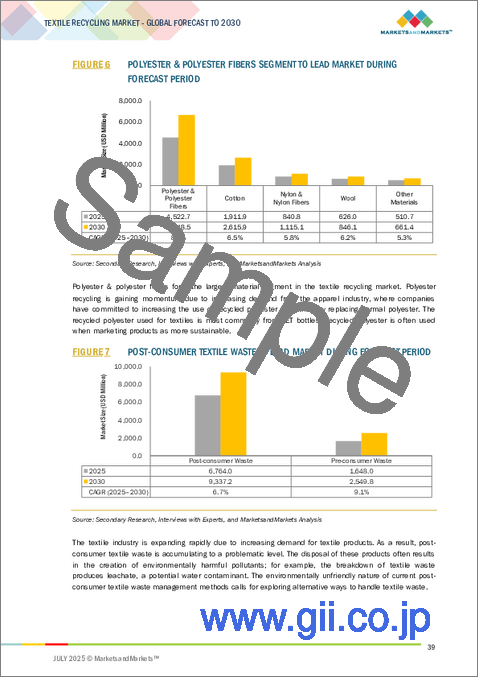

Cotton holds the second-largest market share in textile recycling due to its high global use, biodegradability, and reuse potential in mechanical and chemical methods. As a common natural fiber in apparel and textiles, cotton generates steady pre- and post-consumer waste, providing recyclers with a scalable input. Mechanically recycled cotton is used for insulation, rags, and yarn, while chemically recycled cotton-still in development-offers options for high-value fibers like lyocell or viscose. Recycling cotton reduces water use and pesticide reliance, appealing to sustainable brands and circular economy initiatives. Although it ranks below polyester due to lower durability and blending requirements, cotton's renewability and eco-friendly appeal keep it vital in textile recycling.

''In terms of value, pre-consumer textile waste accounted for the second-largest share of the textile recycling market.''

Pre-consumer textile waste holds the second-largest market share, by textile waste, because the waste generated during manufacturing processes is consistent and predictable. This includes scraps, excess fabrics, production rejects, and off-spec materials-all clean, uncontaminated, and easier to sort than post-consumer waste. Large textile producers generate these residues in large quantities, making them an attractive and economical raw material for recycling. Moreover, pre-consumer waste typically has higher fiber quality since it hasn't been worn, washed, or dyed, making it more suitable for mechanical or chemical recycling. While post-consumer waste currently dominates the market due to rising interest in circular fashion and consumer awareness, the reliability and ease of processing pre-consumer waste help it maintain a significant market share.

"Mechanical process segment will register the second-largest market share, by process."

Mechanical recycling accounts for the second-largest share in the textile recycling process segment due to its cost-effectiveness, scalability, and longstanding industry presence. This approach involves physically shredding and carding used textiles into fiber for reuse in products such as insulation, automotive padding, industrial rags, or regenerated yarns. Unlike chemical recycling, mechanical methods do not require solvents or complex chemical reactions, making them more environmentally friendly and suitable for regions with limited technological infrastructure. Its lower capital costs and simpler operations make it a preferred option for small- to mid-scale recyclers, especially in developing markets.

"The online distribution channel segment is expected to account for a significant share of the market."

The online channel is the second-largest in the textile recycling market due to increased digitalization and consumer preference for convenient platforms. E-commerce, recycling portals, and apps enable consumers to schedule pickups, donate, or buy recycled clothing from home. This appeals especially to environmentally conscious, young consumers valuing sustainability. Online channels also facilitate direct interaction, reducing costs and bypassing middlemen. While offline centers and B2B remain dominant, online methods are growing faster because of scalability, personalized data, and global reach. Social media and awareness campaigns enhance digital textile recycling's accessibility.

"North America is projected to be the second-largest regional market for textile recycling."

North America holds the second-largest share in the textile recycling market due to its well-developed recycling infrastructure, strong regulatory support, and increasing consumer demand for sustainable products. The region produces a significant amount of textile waste annually, fueled by high per capita clothing consumption and the prevalence of fast fashion. This creates a consistent supply of recyclable textiles, which recycling companies and nonprofits have taken advantage of through efficient collection systems and partnerships with retailers. Government initiatives, such as landfill diversion mandates and extended producer responsibility (EPR) frameworks, have further promoted textile recovery and circular business models. North America is also a leading producer of textile recycling products, with major companies like Unifi, Inc., Patagonia, Inc., Leigh Fibers, Martex Fiber, and others.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation: C Level- 33%, Director Level- 33%, and Managers- 34%

- By Region: North America- 20%, Europe- 25%, Asia Pacific- 25%, Middle East & Africa- 15%, and Latin America- 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies Lenzing AG (Austria), Birla Cellulose (India), HYOSUNG TNC (South Korea), Unifi, Inc. (US), Renewcell (Sweden), Patagonia, Inc. (US), Leigh Fibers (US), Martex Fiber (US), The Woolmark Company (Australia), Textile Recycling International (UK), Boer Group (Netherlands), REMONDIS SE & Co. KG (Germany), Procotex (Belgium), Usha Yarns Ltd (India), Infinited Fiber Company (Finland), Worn Again Technologies (UK), Reju (France), iinouiio (UK), Anandhi Texstyles (India), Pure Waste (Finland), Ecotex Group (Germany), PISTONI SRL (Italy), Retex Textiles Inc. (Canada), American Textile Recycling Service (US), Gebr. Otto Baumwollfeinzwirnerei GmbH + Co. KG (Germany).

Research Coverage

This research report categorizes the textile recycling market by materials (cotton, polyester & polyester fibers, wool, nylon & nylon fibers, other materials), by process (mechanical, chemical), by textile waste (pre-consumer, post-consumer), by distribution channel (online channel, retail & department stores), by end-use industry (apparel, industrial & institutional, home furnishing, and other end-use industries), and by region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The report covers detailed information about the main factors influencing the growth of the textile recycling market, including drivers, restraints, challenges, and opportunities. It provides a comprehensive review of key industry players, highlighting their business overview, solutions, services, key strategies, contracts, partnerships, and agreements. Additionally, the report discusses product launches, mergers, and acquisitions, and recent developments within the textile recycling sector. It also offers a competitive analysis of emerging startups in the textile recycling market ecosystem.

Reasons to buy this report:

The report will assist market leaders and new entrants by providing revenue estimates for the overall textile recycling market and its subsegments. It will help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers key market insights, including major drivers, restraints, challenges, and opportunities, giving stakeholders a clear understanding of the market's current pulse.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing textile waste due to decreased garment life, high emission of greenhouse gases, increasing consumption of energy and water), restraints (usage of harmful chemicals, high processing cost & poor return on investment), opportunities (growing adoption of circular industries, expansion in emerging markets), and challenges (fast fashion, lack of global textile waste traceability systems) influencing the growth of the textile recycling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the textile recycling market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the textile recycling market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the textile recycling market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Lenzing AG (Austria), Birla Cellulose (India), HYOSUNG TNC (South Korea), Unifi, Inc. (US), Renewcell (Sweden), Patagonia, Inc. (US), Leigh Fibers (US), Martex Fiber (US), and The Woolmark Company (Australia).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RESEARCH LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TEXTILE RECYCLING MARKET

- 4.2 TEXTILE RECYCLING MARKET, BY MATERIAL

- 4.3 TEXTILE RECYCLING MARKET, BY TEXTILE WASTE

- 4.4 TEXTILE RECYCLING MARKET, BY PROCESS

- 4.5 TEXTILE RECYCLING MARKET, BY DISTRIBUTION CHANNEL

- 4.6 TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY

- 4.7 TEXTILE RECYCLING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing textile waste due to decreased garment life

- 5.2.1.2 High emissions of greenhouse gases

- 5.2.1.3 Increasing consumption of energy and water

- 5.2.2 RESTRAINTS

- 5.2.2.1 Usage of harmful chemicals

- 5.2.2.2 High processing cost and poor return on investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of circular industries

- 5.2.3.2 Expansion in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Fast fashion

- 5.2.4.2 Lack of global textile waste traceability systems

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 COLLECTION

- 5.6.2 SORTING

- 5.6.3 RECYCLING

- 5.6.4 END USERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 BRAZILIAN TEXTILE AND CLOTHING INDUSTRY

- 5.8.2 TEXTILE RECYCLING ASSOCIATION

- 5.8.3 TEXTILE RECYCLING TRANSFORMATION

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY SCENARIO

- 5.9.1.1 Global Recycle Standard (GRS)

- 5.9.1.2 Recycled Claim Standard (RCS)

- 5.9.1.3 International Organization for Standardization 14021:2016

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 NEW TECHNOLOGIES-TEXTILE RECYCLING

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO FOR HS CODE 550510

- 5.12.2 IMPORT SCENARIO FOR HS CODE 550510

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.14.2 AVERAGE SELLING PRICE TREND, BY MATERIAL, 2022-2030

- 5.14.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL, 2024

- 5.15 PATENT ANALYSIS

- 5.15.1 APPROACH

- 5.15.2 DOCUMENT TYPES

- 5.15.3 PATENT PUBLICATION TRENDS

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS OF PATENTS

- 5.15.6 JURISDICTION ANALYSIS

- 5.15.7 TOP COMPANIES/APPLICANTS

- 5.15.8 TOP 10 PATENT OWNERS IN LAST 11 YEARS

6 TEXTILE RECYCLING MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- 6.2 COTTON

- 6.2.1 COTTON TO REMAIN GREATEST CONTRIBUTOR TO TEXTILE WASTE

- 6.3 POLYESTER & POLYESTER FIBERS

- 6.3.1 PET USED WITH FIBERS TO IMPART ANTI-WRINKLING PROPERTIES TO FABRIC

- 6.4 WOOL

- 6.4.1 WOOL CLOTHING WITH HIGHER INHERENT DURABILITY AND LONGER SHELF LIFE TO DRIVE TEXTILE RECYCLING

- 6.5 NYLON & NYLON FIBERS

- 6.5.1 SUPERIOR PROPERTIES TO INCREASE DEMAND FOR RECYCLED NYLON

- 6.6 OTHER MATERIALS

7 TEXTILE RECYCLING MARKET, BY TEXTILE WASTE

- 7.1 INTRODUCTION

- 7.2 PRE-CONSUMER WASTE

- 7.2.1 POTENTIAL FOR REINTRODUCING MANUFACTURING SCRAP INTO PRODUCTION TO SUPPORT GROWTH

- 7.3 POST-CONSUMER WASTE

- 7.3.1 ENVIRONMENTAL, SOCIAL, AND PRACTICAL BENEFITS OF RECYCLING POST-CONSUMER TEXTILE WASTE TO DRIVE MARKET

8 TEXTILE RECYCLING MARKET, BY PROCESS

- 8.1 INTRODUCTION

- 8.2 MECHANICAL

- 8.2.1 MECHANICALLY RECYCLED YARNS OFFER ECO-FRIENDLY, PRE-COLORED SOLUTIONS ENABLING WATERLESS PROCESSING AND CUSTOM DYEING

- 8.3 CHEMICAL

- 8.3.1 HIGH-QUALITY FIBER RECOVERY VIA CHEMICAL RECYCLING OF BLENDED TEXTILES

9 TEXTILE RECYCLING MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- 9.2 ONLINE CHANNEL

- 9.2.1 RISING DEMAND FOR CONVENIENT AND COST-EFFECTIVE RETAIL IS BOOSTING ONLINE CHANNEL ADOPTION.

- 9.3 RETAIL & DEPARTMENTAL STORES

- 9.3.1 AFFORDABLE UPCYCLED TEXTILES DRIVING RETAIL GROWTH IN TEXTILE RECYCLING

10 TEXTILE RECYCLING MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 APPAREL

- 10.2.1 ECONOMIC GROWTH AND INCREASING DISPOSABLE INCOME TO DRIVE APPAREL MARKET

- 10.2.2 SPORTSWEAR

- 10.2.3 INTIMATES

- 10.2.4 OUTERWEAR

- 10.3 HOME FURNISHING

- 10.3.1 NEW AND CHANGING TRENDS IN STYLES, COLORS, AND INTERIOR DESIGN TO DRIVE HOME FURNISHING INDUSTRY

- 10.3.2 BED LINENS

- 10.3.3 CARPETS

- 10.3.4 CURTAINS

- 10.4 INDUSTRIAL & INSTITUTIONAL

- 10.4.1 LARGE AMOUNTS OF TEXTILE WASTE TO DRIVE TEXTILE RECYCLING MARKET

- 10.5 OTHER END-USER INDUSTRIES

11 TEXTILE RECYCLING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Huge textile industry to drive market

- 11.2.2 JAPAN

- 11.2.2.1 Apparel industry to significantly influence market growth

- 11.2.3 INDIA

- 11.2.3.1 Inexpensive labor and availability of fiber and fiber products to drive market

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Large synthetic fiber industry to boost demand for textile recycling

- 11.2.5 AUSTRALIA

- 11.2.5.1 Government initiatives to combat pollution to increase textile recycling

- 11.2.6 INDONESIA

- 11.2.6.1 Increasing textile & apparel exports to support market growth

- 11.2.7 VIETNAM

- 11.2.7.1 Free trade agreements and investments in textile industry to boost market

- 11.2.8 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Significant investments in R&D and innovation-driven organic growth strategies to increase demand for textile recycling

- 11.3.2 CANADA

- 11.3.2.1 Large clothing industry to increase demand for textile recycling

- 11.3.3 MEXICO

- 11.3.3.1 Demand for industrial fabrics for upholstery and protective fabrics to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 UK

- 11.4.1.1 UK to account for largest market share in Europe

- 11.4.2 GERMANY

- 11.4.2.1 Exports of knitted apparel cloth, artificial fiber, synthetic yarn, and machinery to boost market

- 11.4.3 RUSSIA

- 11.4.3.1 Low prices and import duties imposed to encourage businesses to import textile products

- 11.4.4 FRANCE

- 11.4.4.1 Highly developed and mature market with domestic and international players to support growth

- 11.4.5 ITALY

- 11.4.5.1 Initiatives to launch branded fabrics and export fashion goods to drive textile recycling

- 11.4.6 SPAIN

- 11.4.6.1 Robust economic growth and the rising demand for technical and home textiles to drive market

- 11.4.7 NETHERLANDS

- 11.4.7.1 Dutch companies exporting clothing within EU to influence market

- 11.4.8 REST OF EUROPE

- 11.4.1 UK

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Population growth and rising GDP to create demand for textiles

- 11.5.1.2 UAE

- 11.5.1.2.1 Strong presence of manufacturing facilities for textiles and apparel to drive market

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Investments in and adoption of the latest technologies to drive textile industry

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Industrialization, urbanization, and rising disposable income to support market growth

- 11.6.2 ARGENTINA

- 11.6.2.1 Growing market for women's apparel to boost demand for textile recycling

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Material footprint

- 12.7.5.4 Waste footprint

- 12.7.5.5 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LENZING AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 BIRLA CELLULOSE (GRASIM INDUSTRIES LIMITED)

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HYOSUNG TNC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 UNIFI, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 RENEWCELL (ALTOR)

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 PATAGONIA, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.7 TEXTILE RECYCLING INTERNATIONAL (WATERLAND)

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.8 LEIGH FIBERS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.9 MARTEX FIBER

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 THE WOOLMARK COMPANY

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 TOYOBO TEXTILE CO., LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.1 LENZING AG

- 13.2 OTHER PLAYERS

- 13.2.1 WORN AGAIN TECHNOLOGIES

- 13.2.2 PURE WASTE

- 13.2.3 REMONDIS SE & CO. KG

- 13.2.4 RETEX TEXTILES INC.

- 13.2.5 BOER GROUP

- 13.2.6 INFINITED FIBER COMPANY

- 13.2.7 PISTONI S.R.L

- 13.2.8 AMERICAN TEXTILE RECYCLING SERVICE

- 13.2.9 REJU

- 13.2.10 ECOTEX GROUP

- 13.2.11 PROCOTEX

- 13.2.12 IINOUIIO

- 13.2.13 ANANDHI TEXSTYLES

- 13.2.14 USHA YARNS LTD

- 13.2.15 GEBR. OTTO BAUMWOLLFEINZWIRNEREI GMBH + CO. KG

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS