|

|

市場調査レポート

商品コード

1798381

Wi-Fiチップセットの世界市場:IEEE規格別、バンド別、MIMO構成別、最終用途別、業界別 - 予測(~2030年)Wi-Fi Chipset Market by IEEE Standard (802.11be, 802.11ax, 802.11ac), Band (Single & Dual Band, Triband), MIMO Configuration (SU-MIMO, MU-MIMO), End-use Application (Consumer, Smart Home, AR/VR, Networking Devices) and Vertical - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| Wi-Fiチップセットの世界市場:IEEE規格別、バンド別、MIMO構成別、最終用途別、業界別 - 予測(~2030年) |

|

出版日: 2025年08月19日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

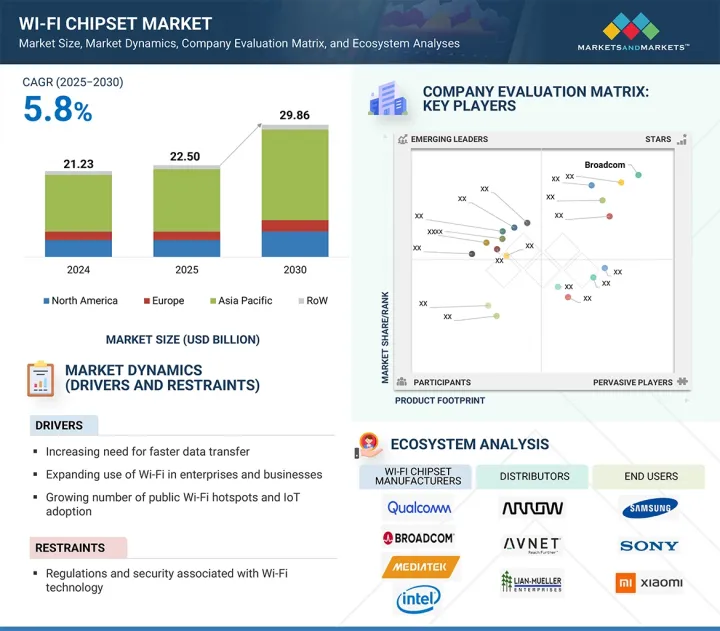

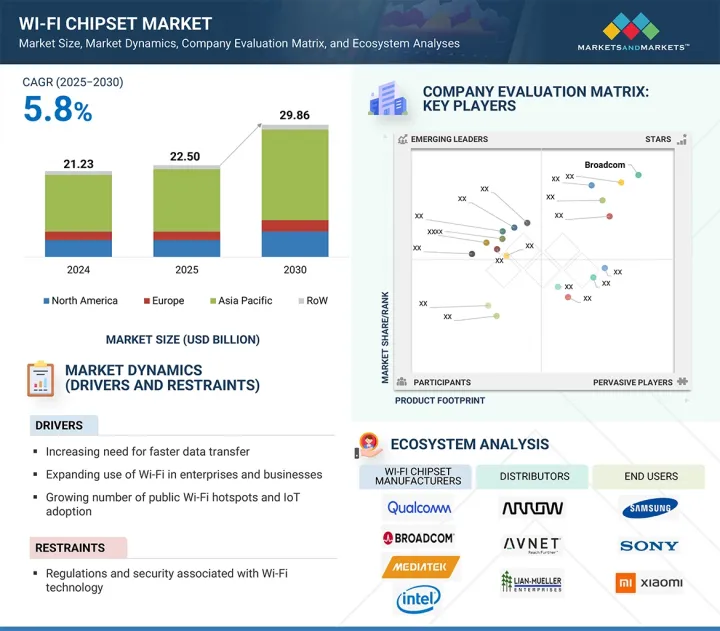

世界のWi-Fiチップセットの市場規模は、2025年に225億米ドル、2030年までに298億6,000万米ドルに達すると予測され、予測期間にCAGRで5.8%の成長が見込まれます。

市場の主な促進要因の1つは、消費者、企業、産業用途における高速インターネット接続に対する需要の高まりです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | IEEE規格、バンド、MIMO構成、業界、最終用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

スマートデバイス、ストリーミングサービス、リモートワーク、オンラインゲームの普及に伴い、信頼性が高く高速な無線通信へのニーズが高まっています。Wi-Fiチップセットは、シームレスなデータ転送、低遅延、高いネットワーク効率を実現します。さらに、Wi-Fi 6、6E、7といった先進規格の展開により、チップセットのアップグレードが加速しています。こうした動向は、OEMやサービスプロバイダーに次世代Wi-Fiソリューションの採用を促し、市場成長を後押ししています。

「トライバンドセグメントが予測期間にWi-Fiチップセット市場でもっとも高いCAGRを記録する見込みです。」

Wi-Fiチップセット市場におけるトライバンドセグメントは、高密度環境におけるより高い帯域幅とネットワーク混雑の緩和に対するニーズの高まりによって牽引されています。トライバンドチップセットは、2.4GHz、5GHz、6GHz(Wi-Fi 6E/7)で動作し、ネットワーク効率を向上させ、より多くのデバイスの同時接続をサポートします。このため、スマートホーム、エンタープライズネットワーク、ゲーミング用途に最適です。データ消費とコネクテッドデバイスの普及が進むにつれて、トライバンドWi-Fiチップセットの需要は急増し、このセグメントの堅調な成長を後押しすると予測されます。

「コンシューマーデバイス最終用途セグメントが2030年に最大の市場シェアを占めると予測されます。」

スマートフォン、ラップトップ、タブレット、スマートTV、ホームオートメーション製品にWi-Fi技術が広く統合されていることから、コンシューマデバイスセグメントが2030年にWi-Fiチップセット市場で最大のシェアを占めると予測されます。高速インターネット、ビデオストリーミング、オンラインゲーム、スマートホームエコシステムに対する世界の需要の高まりが、信頼性の高い無線接続へのニーズを引き続き後押ししています。消費者がWi-Fi 6やWi-Fi 7などの先進技術をますます採用するようになるにつれて、チップセットメーカーは進化する性能基準を満たすために生産規模を拡大しています。コンシューマーエレクトロニクスの出荷が一貫して伸びていることから、このセグメントは引き続き市場全体の需要に大きく寄与しています。

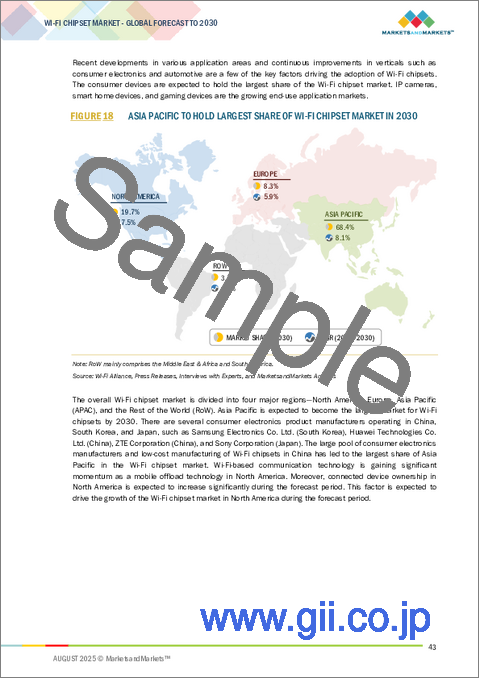

「2030年、中国がアジア太平洋のWi-Fiチップセット市場で最大のシェアを占めます。」

中国のWi-Fiチップセット市場は、その強固なコンシューマーエレクトロニクス製造エコシステムとスマートデバイスに対する旺盛な国内需要によって牽引されています。同国は、スマートフォン、スマートテレビ、ラップトップ、IoTデバイスに幅広くWi-Fiチップセットを統合する主要なOEMやODMの拠点です。デジタルトランスフォーメーションを支援する政府の取り組み、広範な5G-Advancedネットワークの展開、スマートシティの開発は、採用をさらに加速させます。さらに、中国は企業、産業、住宅用途向けのWi-Fi 6とWi-Fi 7技術に投資しており、その地位を強化しています。現地のチップセット設計者のプレゼンスの高まりと研究開発費の増加は、サプライチェーン能力と技術革新の強化に寄与しています。このように、大量生産、良好な政策環境、エンドユーザーの需要拡大が組み合わさることで、中国はこの地域のWi-Fiチップセット市場において圧倒的な地位を占めています。

当レポートでは、世界のWi-Fiチップセット市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- Wi-Fiチップセット市場の企業にとって魅力的な機会

- Wi-Fiチップセット市場:最終用途別

- Wi-Fiチップセット市場:IEEE規格別

- Wi-Fiチップセット市場:バンド別

- アジア太平洋のWi-Fiチップセット市場:最終用途別、国別

- Wi-Fiチップセット市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- ケーススタディ分析

- ARUBAのWi-Fi 6ネットワークとHPEエッジラインサーバーが超低遅延な企業のクラウド接続を実現

- SOUTHSTAR DRUG、HuaweiのWi-Fi 6ネットワークを活用して事業経営を強化

- DUBAI INTERNATIONAL FINANCIAL CENTRE、ユーザーエクスペリエンス向上のためHuaweiと提携しWi-Fi 6を導入

- ATRIA CONVERGENCE TECHNOLOGIES、HuaweiのWi-Fi 6を活用し商業企業と住民に強化された接続を提供

- シーメン大学マレーシア校、AIRENGINEのWi-Fi 6を採用し高速ネットワーク範囲を提供

- 価格設定の分析

- 主要企業が提供するWi-Fiチップセットの価格帯:最終用途別(2024年)

- Wi-Fiチップセット搭載コンシューマーデバイスの平均販売価格の動向:地域別(2021年~2024年)

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード851762)

- 輸出シナリオ(HSコード851762)

- 主な会議とイベント(2025年~2026年)

- 規制

- Wi-Fiチップセット市場に対するAI/生成AIの影響

- Wi-Fiチップセット市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 各業界に対する影響

第6章 Wi-Fiチップセット市場:IEEE規格別

- イントロダクション

- IEEE 802.11BE(Wi-Fi 7)

- IEEE 802.11AX(Wi-Fi 6/6E)

- IEEE 802.11AC

- IEEE 802.11AD

- IEEE 802.11B/G/N

第7章 Wi-Fiチップセット市場:バンド別

- イントロダクション

- シングルバンド・デュアルバンド

- トライバンド

第8章 Wi-Fiチップセット市場:MIMO構成別

- イントロダクション

- SU-MIMO

- MU-MIMO

- 1x1

- 2x2

- 3x3

- 4x4

- 8x8

第9章 Wi-Fiチップセット市場:業界別

- イントロダクション

- コンシューマーエレクトロニクス

- 企業

- 医療

- BFSI

- 小売

- 自動車

- 工業

- その他の業界

第10章 Wi-Fiチップセット市場:最終用途別

- イントロダクション

- コンシューマーデバイス

- スマートフォン

- タブレット

- ラップトップ・PC

- カメラ

- スマートホームデバイス

- スマートスピーカー

- スマートテレビ

- その他の家電

- ゲーム機

- AR/VRデバイス

- 移動ロボット

- ドローン

- ネットワークデバイス

- ゲートウェイ・ルーター

- アクセスポイント

- MPOS

- 車内インフォテインメント

- その他の最終用途

第11章 Wi-Fiチップセット市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- フランス

- 英国

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2025年)

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- QUALCOMM TECHNOLOGIES, INC.

- BROADCOM

- MEDIATEK

- INTEL CORPORATION

- REALTEK SEMICONDUCTOR CORP.

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- RENESAS ELECTRONICS CORPORATION

- ESPRESSIF SYSTEMS

- その他の企業

- MORSE MICRO

- SENSCOMM SEMICONDUCTOR CO., LTD

- PHARROWTECH

- EDGEWATER WIRELESS INC.

- PERASO TECHNOLOGIES INC.

- KORE WIRELESS

- U-BLOX

- QUECTEL

- TENSORCOM, INC.

- TEXAS INSTRUMENTS INCORPORATED

- SILEX TECHNOLOGY AMERICA, INC.

- NEWRACOM

- BEKEN CORPORATION

- BLUETRUM TECHNOLOGY CO., LTD.

- BESTECHNIC

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 WI-FI CHIPSET MARKET: RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN WI-FI CHIPSET ECOSYSTEM

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES

- TABLE 6 PRICING RANGE OF WI-FI CHIPSETS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024 (USD)

- TABLE 8 LIST OF MAJOR PATENTS, 2024-2025

- TABLE 9 IMPORT DATA FOR HS CODE 851762-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 851762-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 WI-FI CHIPSET MARKET, BY IEEE STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 14 WI-FI CHIPSET MARKET, BY IEEE STANDARD, 2025-2030 (MILLION UNITS)

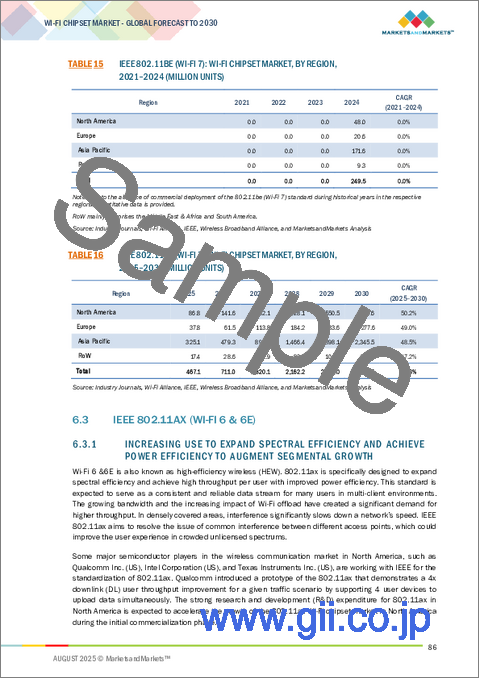

- TABLE 15 IEEE 802.11BE (WI-FI 7): WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 16 IEEE 802.11BE (WI-FI 7): WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 17 IEEE 802.11AX (WI-FI 6 & 6E): WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 18 IEEE 802.11AX (WI-FI 6 & 6E): WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 19 IEEE 802.11AC (WI-FI 5): WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 20 IEEE 802.11AC (WI-FI 5): WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 21 IEEE 802.11AD: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 22 IEEE 802.11AD: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 23 IEEE 802.11B/G/N: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 24 IEEE 802.11B/G/N: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 25 WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 26 WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 27 SINGLE & DUAL-BAND: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 28 SINGLE & DUAL-BAND: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 29 TRI-BAND: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 30 TRI-BAND: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 31 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 32 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 33 COMPARISON BETWEEN SU-MIMO AND MU-MIMO CONFIGURATIONS

- TABLE 34 SU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 35 SU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 36 MU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 37 MU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 38 MU-MIMO: WI-FI CHIPSET MARKET, BY ANTENNA CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 39 MU-MIMO: WI-FI CHIPSET MARKET, BY ANTENNA CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 40 WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 41 WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 42 CONSUMER ELECTRONICS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 43 CONSUMER ELECTRONICS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 44 ENTERPRISE: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 45 ENTERPRISE: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 46 HEALTHCARE: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 47 HEALTHCARE: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 48 BFSI: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 49 BFSI: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 50 RETAIL: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 51 RETAIL: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 52 AUTOMOTIVE: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 53 AUTOMOTIVE: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 54 INDUSTRIAL: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 55 INDUSTRIAL: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 56 OTHER VERTICALS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 57 OTHER VERTICALS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 58 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 59 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 61 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 62 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 63 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 64 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 65 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 66 CAMERAS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 67 CAMERAS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 68 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 69 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 70 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 71 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 72 GAMING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 73 GAMING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 74 AR/VR DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 75 AR/VR DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 76 MOBILE ROBOTS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 77 MOBILE ROBOTS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 78 DRONES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 79 DRONES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 80 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 81 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 82 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 83 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 84 MPOS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 85 MPOS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 86 IN-VEHICLE INFOTAINMENT: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 87 IN-VEHICLE INFOTAINMENT: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 88 OTHER END-USE APPLICATIONS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 89 OTHER END-USE APPLICATIONS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 90 WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 91 WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 92 NORTH AMERICA: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 93 NORTH AMERICA: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 94 NORTH AMERICA: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 95 NORTH AMERICA: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 96 NORTH AMERICA: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 97 NORTH AMERICA: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 98 NORTH AMERICA: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 99 NORTH AMERICA: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 100 NORTH AMERICA: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 101 NORTH AMERICA: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 102 NORTH AMERICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 103 NORTH AMERICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 104 EUROPE: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 105 EUROPE: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 106 EUROPE: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 107 EUROPE: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 108 EUROPE: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 109 EUROPE: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 110 EUROPE: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 111 EUROPE: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 112 EUROPE: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 113 EUROPE: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 114 EUROPE: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 115 EUROPE: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 116 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 117 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 118 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 119 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 120 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 121 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 122 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 123 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 124 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 125 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 126 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 127 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 128 ROW: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 129 ROW: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 130 ROW: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 131 ROW: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 132 ROW: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 133 ROW: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 134 ROW: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 135 ROW: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 136 ROW: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 137 ROW: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 138 ROW: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 139 ROW: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 140 MIDDLE EAST & AFRICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 141 MIDDLE EAST & AFRICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 142 WI-FI CHIPSET MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JULY 2025

- TABLE 143 WI-FI CHIPSET MARKET: DEGREE OF COMPETITION, 2024

- TABLE 144 WI-FI CHIPSET MARKET: REGION FOOTPRINT

- TABLE 145 WI-FI CHIPSET MARKET: IEEE STANDARD FOOTPRINT

- TABLE 146 WI-FI CHIPSET MARKET: VERTICAL FOOTPRINT

- TABLE 147 WI-FI CHIPSET MARKET: END-USE APPLICATION FOOTPRINT

- TABLE 148 WI-FI CHIPSET MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 149 WI-FI CHIPSET MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 150 WI-FI CHIPSET MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 151 WI-FI CHIPSET MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 152 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 153 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 155 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 156 BROADCOM: COMPANY OVERVIEW

- TABLE 157 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 BROADCOM: PRODUCT LAUNCHES

- TABLE 159 BROADCOM: DEALS

- TABLE 160 MEDIATEK: COMPANY OVERVIEW

- TABLE 161 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MEDIATEK: PRODUCT LAUNCHES

- TABLE 163 MEDIATEK: DEALS

- TABLE 164 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 165 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 REALTEK SEMICONDUCTOR CORP.: COMPANY OVERVIEW

- TABLE 167 REALTEK SEMICONDUCTOR CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 REALTEK SEMICONDUCTOR CORP.: DEALS

- TABLE 169 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 170 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 172 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 173 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 174 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 176 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 177 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 179 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 180 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 181 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 182 ESPRESSIF SYSTEMS: COMPANY OVERVIEW

- TABLE 183 ESPRESSIF SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 ESPRESSIF SYSTEMS: PRODUCT LAUNCHES

- TABLE 185 ESPRESSIF SYSTEMS: DEALS

- TABLE 186 MORSE MICRO: COMPANY OVERVIEW

- TABLE 187 SENSCOMM SEMICONDUCTOR CO.,LTD: COMPANY OVERVIEW

- TABLE 188 PHARROWTECH: COMPANY OVERVIEW

- TABLE 189 EDGEWATER WIRELESS INC.: COMPANY OVERVIEW

- TABLE 190 PERASO TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 191 KORE WIRELESS: COMPANY OVERVIEW

- TABLE 192 U-BLOX: COMPANY OVERVIEW

- TABLE 193 QUECTEL: COMPANY OVERVIEW

- TABLE 194 TENSORCOM, INC.: COMPANY OVERVIEW

- TABLE 195 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 196 SILEX TECHNOLOGY AMERICA, INC.: COMPANY OVERVIEW

- TABLE 197 NEWRACOM: COMPANY OVERVIEW

- TABLE 198 BEKEN CORPORATION: COMPANY OVERVIEW

- TABLE 199 BLUETRUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 200 BESTECHNIC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 WI-FI CHIPSET MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION CONSIDERED

- FIGURE 3 WI-FI CHIPSET MARKET: RESEARCH DESIGN

- FIGURE 4 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 5 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 8 WI-FI CHIPSET MARKET: RESEARCH APPROACH

- FIGURE 9 WI-FI CHIPSET SIZE ESTIMATION METHODOLOGY

- FIGURE 10 WI-FI CHIPSET MARKET: BOTTOM-UP APPROACH

- FIGURE 11 WI-FI CHIPSET MARKET: TOP-DOWN APPROACH

- FIGURE 12 WI-FI CHIPSET MARKET: DATA TRIANGULATION

- FIGURE 13 WI-FI CHIPSET MARKET: RESEARCH ASSUMPTIONS

- FIGURE 14 MU-MIMO SEGMENT TO DOMINATE WI-FI CHIPSET MARKET, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- FIGURE 15 TRI-BAND SEGMENT TO EXHIBIT HIGHEST CAGR IN WI-FI CHIPSET MARKET FROM 2025 TO 2030

- FIGURE 16 802.11BE (WI-FI 7) SEGMENT TO HOLD LARGEST SHARE OF WI-FI CHIPSET MARKET IN 2030

- FIGURE 17 CONSUMER DEVICES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 18 ASIA PACIFIC TO HOLD LARGEST SHARE OF WI-FI CHIPSET MARKET IN 2030

- FIGURE 19 INCREASING NEED FOR FAST DATA TRANSFER TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN WI-FI CHIPSET MARKET BETWEEN 2025 AND 2030

- FIGURE 20 CONSUMER DEVICES APPLICATION TO DOMINATE WI-FI CHIPSET MARKET BETWEEN 2025 AND 2030

- FIGURE 21 802.11BE (WI-FI 7) SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 22 SINGLE & DUAL-BAND SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 23 CONSUMER DEVICES SEGMENT AND CHINA TO CAPTURE LARGEST SHARES OF WI-FI CHIPSET MARKET IN ASIA PACIFIC, IN TERMS OF VOLUME, IN 2025

- FIGURE 24 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN WI-FI CHIPSET MARKET DURING FORECAST PERIOD

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 IMPACT ANALYSIS: DRIVERS

- FIGURE 27 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 28 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 29 IMPACT ANALYSIS: CHALLENGES

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 WIFI CHIPSET ECOSYSTEM

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 35 IMPORT DATA FOR HS CODE 851762-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 851762-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 37 IMPACT OF AI/GEN AI ON WI-FI CHIPSET MARKET

- FIGURE 38 802.11AX (WI-FI 6 & 6E) SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 39 TRI-BAND SEGMENT TO REGISTER HIGHER CAGR IN WI-FI CHIPSET MARKET FROM 2025 TO 2030

- FIGURE 40 MU-MIMO-ENABLED WI-FI ACCESS POINT EQUIPMENT SERVES MULTIPLE CLIENTS SIMULTANEOUSLY

- FIGURE 41 MU-MIMO SEGMENT TO DOMINATE WI-FI CHIPSET MARKET DURING FORECAST PERIOD

- FIGURE 42 WI-FI CHIPSET MARKET, BY VERTICAL

- FIGURE 43 CONSUMER ELECTRONICS SEGMENT TO DOMINATE WI-FI CHIPSET MARKET FROM 2025 TO 2030

- FIGURE 44 CONSUMER DEVICES SEGMENT TO HOLD LARGEST SHARE OF WI-FI CHIPSET MARKET IN 2025

- FIGURE 45 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: WI-FI CHIPSET MARKET SNAPSHOT

- FIGURE 47 EUROPE: WI-FI CHIPSET MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: WI-FI CHIPSET MARKET SNAPSHOT

- FIGURE 49 WI-FI CHIPSET MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2022-2024

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING WI-FI CHIPSETS, 2024

- FIGURE 51 COMPANY VALUATION

- FIGURE 52 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 53 BRAND COMPARISON

- FIGURE 54 WI-FI CHIPSET MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 WI-FI CHIPSET MARKET: COMPANY FOOTPRINT

- FIGURE 56 WI-FI CHIPSET MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 58 BROADCOM: COMPANY SNAPSHOT

- FIGURE 59 MEDIATEK: COMPANY SNAPSHOT

- FIGURE 60 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 REALTEK SEMICONDUCTOR CORP.: COMPANY SNAPSHOT

- FIGURE 62 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 63 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 64 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

- FIGURE 65 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 ESPRESSIF SYSTEMS: COMPANY SNAPSHOT

The global Wi-Fi chipset market is projected to reach USD 22.50 billion in 2025 and USD 29.86 billion by 2030, registering a CAGR of 5.8% during the forecast period. One key factor driving the Wi-Fi chipset market is the rising demand for high-speed internet connectivity across consumer, enterprise, and industrial applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By IEEE Standard, by Band, By MIMO-Configuration, Vertical, End-use Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

With the proliferation of smart devices, streaming services, remote work, and online gaming, there is an increasing need for reliable and faster wireless communication. Wi-Fi chipsets enable seamless data transfer, lower latency, and higher network efficiency. Moreover, the rollout of advanced standards, such as Wi-Fi 6, 6E, and 7, accelerates chipset upgrades. These trends compel OEMs and service providers to adopt next-generation Wi-Fi solutions, boosting market growth.

"Triband segment is expected to witness the highest CAGR in the Wi-Fi chipset market during the forecast period"

The tri-band segment in the Wi-Fi chipset market is driven by the increasing need for higher bandwidth and reduced network congestion in high-density environments. Tri-band chipsets operate across 2.4 GHz, 5 GHz, and 6 GHz (with Wi-Fi 6E and 7), improving network efficiency and supporting more simultaneous device connections. This makes them ideal for smart homes, enterprise networks, and gaming applications. As data consumption and connected device adoption continue to rise, the demand for tri-band Wi-Fi chipsets is expected to surge, fuelling robust growth in this segment.

"Consumer devices end-use application segment is projected to account for the largest market share in 2030"

The consumer devices segment is expected to capture the largest share of the Wi-Fi chipset market in 2030, due to the widespread integration of Wi-Fi technology in smartphones, laptops, tablets, smart TVs, and home automation products. Rising global demand for high-speed internet, video streaming, online gaming, and smart home ecosystems continues to drive the need for reliable wireless connectivity. As consumers increasingly adopt advanced technologies such as Wi-Fi 6 and Wi-Fi 7, chipset manufacturers are scaling production to meet evolving performance standards. The consistent growth in consumer electronics shipments ensures the segment remains the dominant contributor to overall market demand.

"China to account for largest share of Asia Pacific Wi-Fi chipset market in 2030"

The Wi-Fi chipset market in China is driven by its robust consumer electronics manufacturing ecosystem and strong domestic demand for smart devices. The country is home to leading OEMs and ODMs that integrate Wi-Fi chipsets extensively across smartphones, smart TVs, laptops, and IoT devices. Government initiatives supporting digital transformation, widespread 5G advanced networks deployment, and smart city development further accelerate adoption. Moreover, China's investment in Wi-Fi 6 and Wi-Fi 7 technologies for enterprise, industrial, and residential applications strengthens its position. The growing presence of local chipset designers and increased R&D expenditure contribute to enhanced supply chain capabilities and technological innovation. This combination of high-volume production, favorable policy environment, and expanding end users' demand positions China as the dominant contributor to the region's Wi-Fi chipset market.

Extensive primary interviews were conducted with key industry experts in the Wi-Fi chipset market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C-level Executives - 50%, Directors - 25%, and Managers - 25%

- By Region: North America - 60%, Europe - 20%, Asia Pacific - 10%, and RoW - 10%

Note: RoW includes the Middle East, Africa, and South America. Other designations include product managers, sales managers, and marketing managers. The 3 tiers of the companies have been defined based on their total/segmental revenue as of 2020: Tier 1 = >USD 1,000 million, Tier 2 = USD 100 million to USD 1,000 million, and Tier 3 = <USD 100 million.

Qualcomm Technologies, Inc. (US), Broadcom (US), MediaTek (Taiwan), Intel Corporation (US), Realtek Semiconductor Corp. (Taiwan), Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Semiconductor Components Industries, LLC (US), Renesas Electronics Corporation (Japan), and Espressif Systems (China) are some key players in the Wi-Fi chipset market.

The study includes an in-depth competitive analysis of these key players in the Wi-Fi chipset market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the Wi-Fi chipset market based on IEEE standard (IEEE 802.11BE (Wifi 7), IEEE 802.11AX (Wifi 6 and 6E), IEEE 802.11AC, IEEE 802.11AD, IEEE 802.11), band (single & dual band, triband), MIMO configuration (SU-MIMO, MU-MIMO), vertical (consumer electronics, enterprise, healthcare, BFSI, retail, automotive, industrial, and other verticals), end-use application (consumer devices, cameras, smart home devices, gaming devices, AR/VR devices mobile robots, drones, networking devices, MPOS (Mobile Point of Sale), in-vehicle infotainment, and other applications), and region [North America (US, Canada, Mexico), Europe (Germany France, UK, Italy, Rest of Europe), Asia Pacific (China Japan, South Korea, Rest of Asia Pacific), and RoW (Middel East & Africa, South America)]. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the Wi-Fi chipset market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the Wi-Fi chipset ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall Wi-Fi chipset market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing number of public Wi-Fi hotspots and adoption of IoT, expanding use of Wi-Fi in enterprises and businesses, and mounting need for faster data transfer), restraints (regulations and security associated with Wi-Fi technology), opportunities (use of Wi-Fi technology in indoor and outdoor location systems and advancements in AR and VR), and challenges (overcrowding of unlicensed wireless frequency spectrum, coexistence issues with use of GHz 5 GHz band Wi-Fi with LTE in LTE-U) influencing the growth of the Wi-Fi chipset market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the Wi-Fi chipset market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the Wi-Fi chipset market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Wi-Fi chipset market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Qualcomm Technologies, Inc. (US), Broadcom (US), MediaTek (Taiwan), Intel Corporation (US), and Realtek Semiconductor Corp. (Taiwan), in the Wi-Fi chipset market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WI-FI CHIPSET MARKET

- 4.2 WI-FI CHIPSET MARKET, BY END-USE APPLICATION

- 4.3 WI-FI CHIPSET MARKET, BY IEEE STANDARD

- 4.4 WI-FI CHIPSET MARKET, BY BAND

- 4.5 WI-FI CHIPSET MARKET IN ASIA PACIFIC, BY END-USE APPLICATION AND COUNTRY

- 4.6 WI-FI CHIPSET MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for connected devices with advent of IoT

- 5.2.1.2 Growing focus on improving business and enterprise customer engagement

- 5.2.1.3 Mounting need for faster data transfer

- 5.2.1.4 Increasing internet penetration in developed regions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Identity theft, hacking, and jamming threats

- 5.2.2.2 High power consumption by advanced Wi-Fi technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improved location capabilities of Wi-Fi chipsets

- 5.2.3.2 Rising integration of AR and VR technologies into consumer electronics and enterprise solutions

- 5.2.3.3 Emergence of 802.11be standard

- 5.2.4 CHALLENGES

- 5.2.4.1 Overcrowding of unlicensed wireless frequency spectrums

- 5.2.4.2 Coexistence issues related to use of 5 GHz Wi-Fi band

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Radio frequency (RF) front-end design

- 5.5.1.2 System-on-Chip (SoC)

- 5.5.1.3 Complementary metal-oxide semiconductors

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Bluetooth and Bluetooth Low Energy (BLE)

- 5.5.2.2 Power management integrated circuits (PMICs)

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Cellular connectivity (4G/5G/6G)

- 5.5.3.2 Zigbee/Thread/LoRa/Z-Wave

- 5.5.3.3 Ultra-wideband (UWB)

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 ARUBA WI-FI 6 NETWORK AND HPE EDGELINE SERVERS HELP ENTERPRISE CONNECT TO CLOUD WITH ULTRA-LOW LATENCY

- 5.7.2 SOUTHSTAR DRUG LEVERAGES HUAWEI'S WI-FI 6 NETWORK TO ENHANCE BUSINESS OPERATIONS

- 5.7.3 DUBAI INTERNATIONAL FINANCIAL CENTRE PARTNERS WITH HUAWEI TO LAUNCH WI-FI 6 TO IMPROVE USER EXPERIENCE

- 5.7.4 ATRIA CONVERGENCE TECHNOLOGIES USES HUAWEI'S WI-FI 6 TO PROVIDE ENHANCED CONNECTIONS ACROSS COMMERCIAL ENTERPRISES AND RESIDENTS

- 5.7.5 XIAMEN UNIVERSITY MALAYSIA ADOPTS AIRENGINE WI-FI 6 TO PROVIDE HIGH-SPEED NETWORK COVERAGE

- 5.8 PRICING ANALYSIS

- 5.8.1 PRICING RANGE OF WI-FI CHIPSETS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 851762)

- 5.10.2 EXPORT SCENARIO (HS CODE 851762)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATIONS

- 5.13 IMPACT OF AI/GEN AI ON WI-FI CHIPSET MARKET

- 5.13.1 INTRODUCTION

- 5.14 IMPACT OF 2025 US TARIFF ON WI-FI CHIPSET MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRIES/REGIONS

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON VERTICALS

6 WI-FI CHIPSET MARKET, BY IEEE STANDARD

- 6.1 INTRODUCTION

- 6.2 IEEE 802.11BE (WI-FI 7)

- 6.2.1 MOUNTING DEMAND FOR ULTRA-HIGH-SPEED, LOW-LATENCY CONNECTIVITY TO BOOST SEGMENTAL GROWTH

- 6.3 IEEE 802.11AX (WI-FI 6 & 6E)

- 6.3.1 INCREASING USE TO EXPAND SPECTRAL EFFICIENCY AND ACHIEVE POWER EFFICIENCY TO AUGMENT SEGMENTAL GROWTH

- 6.4 IEEE 802.11AC

- 6.4.1 ABILITY TO OFFER PERFORMANCE AND DENSITY GAIN IN MODERN SMARTPHONES, TABLETS, AND PCS TO BOOST SEGMENTAL GROWTH

- 6.5 IEEE 802.11AD

- 6.5.1 ABILITY TO INCREASE POSSIBILITY OF FREQUENCY RE-USE AND SECURITY DUE TO LIMITED RANGE TO FUEL SEGMENTAL GROWTH

- 6.6 IEEE 802.11B/G/N

- 6.6.1 HIGH THROUGHPUT, RANGE, AND COVERAGE OF WI-FI NETWORKS TO CONTRIBUTE TO SEGMENTAL GROWTH

7 WI-FI CHIPSET MARKET, BY BAND

- 7.1 INTRODUCTION

- 7.2 SINGLE & DUAL-BAND

- 7.2.1 INCREASING USE IN ENTRY-LEVEL AND MID-TIER CONSUMER ELECTRONICS APPLICATIONS TO ACCELERATE SEGMENTAL GROWTH

- 7.3 TRI-BAND

- 7.3.1 RISING NETWORK CONGESTION TO CONTRIBUTE TO SEGMENTAL GROWTH

8 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION

- 8.1 INTRODUCTION

- 8.2 SU-MIMO

- 8.2.1 INCREASING THROUGHPUT AND COST TRADE-OFFS TO DRIVE MARKET

- 8.3 MU-MIMO

- 8.3.1 1X1

- 8.3.1.1 Rising deployment in budget smartphones and tablets to augment segmental growth

- 8.3.2 2X2

- 8.3.2.1 High data transfer rate and use in smartphones to contribute to segmental growth

- 8.3.3 3X3

- 8.3.3.1 Growing incorporation in high-end laptops to bolster segmental growth

- 8.3.4 4X4

- 8.3.4.1 Increasing use in premium in-vehicle infotainment systems, enterprise-grade access points, and high-end consumer devices to drive market

- 8.3.5 8X8

- 8.3.5.1 Support for simultaneous spatial streams and low power consumption to fuel segmental growth

- 8.3.1 1X1

9 WI-FI CHIPSET MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 HIGH ADOPTION OF SMART APPLIANCES, SMARTPHONES, AND LAPTOPS TO BOOST SEGMENTAL GROWTH

- 9.3 ENTERPRISE

- 9.3.1 GROWING EMPHASIS ON OPERATIONAL EFFICIENCY, WORKPLACE FLEXIBILITY, AND CENTRALIZED DATA MANAGEMENT TO DRIVE MARKET

- 9.4 HEALTHCARE

- 9.4.1 RAPID DIGITALIZATION TO ENHANCE CARE DELIVERY TO AUGMENT MARKET GROWTH

- 9.5 BFSI

- 9.5.1 RISING IMPORTANCE OF SHARING CRITICAL INFORMATION ACROSS DEPARTMENTS TO FUEL SEGMENTAL GROWTH

- 9.6 RETAIL

- 9.6.1 GROWING FOCUS ON IMPROVING CUSTOMER EXPERIENCE AND OPERATIONAL EFFICIENCY TO FOSTER SEGMENTAL GROWTH

- 9.7 AUTOMOTIVE

- 9.7.1 INCREASING IOT DEPLOYMENT TO MODERNIZE VEHICLE INFRASTRUCTURE TO EXPEDITE SEGMENTAL GROWTH

- 9.8 INDUSTRIAL

- 9.8.1 RISING ADOPTION OF INNOVATIVE TECHNOLOGIES TO TACKLE CONNECTIVITY PROBLEMS TO ACCELERATE SEGMENTAL GROWTH

- 9.9 OTHER VERTICALS

10 W-FI CHIPSET MARKET, BY END-USE APPLICATION

- 10.1 INTRODUCTION

- 10.2 CONSUMER DEVICES

- 10.2.1 SMARTPHONES

- 10.2.1.1 Rising internet connectivity for personal and business purposes to augment segmental growth

- 10.2.2 TABLETS

- 10.2.2.1 Growing popularity of wireless technologies to contribute to segmental growth

- 10.2.3 LAPTOPS & PCS

- 10.2.3.1 Increasing preference for ultrabooks to accelerate segmental growth

- 10.2.1 SMARTPHONES

- 10.3 CAMERAS

- 10.3.1 RISING GOVERNMENT SPENDING ON SECURITY SYSTEMS IN DEVELOPING COUNTRIES TO FUEL SEGMENTAL GROWTH

- 10.4 SMART HOME DEVICES

- 10.4.1 SMART SPEAKERS

- 10.4.1.1 Improvement in form factors and innovations to bolster segmental growth

- 10.4.2 SMART TVS

- 10.4.2.1 Rapid advances in wireless connectivity technology and price optimization to expedite segmental growth

- 10.4.3 OTHER APPLIANCES

- 10.4.1 SMART SPEAKERS

- 10.5 GAMING DEVICES

- 10.5.1 REQUIREMENT FOR HIGH-SPEED INTERNET CONNECTION TO FOSTER SEGMENTAL GROWTH

- 10.6 AR/VR DEVICES

- 10.6.1 DEPLOYMENT OF ADVANCED TECHNOLOGIES IN RETAIL SECTOR TO ENHANCE CONSUMER EXPERIENCE TO FUEL SEGMENTAL GROWTH

- 10.7 MOBILE ROBOTS

- 10.7.1 EMPHASIS ON IMPROVING EFFICIENCY AND ENERGY CONSUMPTION IN INDUSTRIES TO BOOST SEGMENTAL GROWTH

- 10.8 DRONES

- 10.8.1 GROWING FOCUS ON IMPROVING STABILITY AND ANTENNA CONNECTION TO ACCELERATE SEGMENTAL GROWTH

- 10.9 NETWORKING DEVICES

- 10.9.1 GATEWAYS & ROUTERS

- 10.9.1.1 Burgeoning demand for faster internet connectivity to augment segmental growth

- 10.9.2 ACCESS POINTS

- 10.9.2.1 Ability to establish connections between various devices to boost segmental growth

- 10.9.1 GATEWAYS & ROUTERS

- 10.10 MPOS

- 10.10.1 RISE IN CASELESS TRANSACTIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.11 IN-VEHICLE INFOTAINMENT

- 10.11.1 EVOLVING CONSUMER PREFERENCES FOR CONNECTED MOBILITY TO DRIVE MARKET

- 10.12 OTHER END-USE APPLICATIONS

11 WI-FI CHIPSET MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing R&D of low-power, high-throughput wireless technologies to accelerate market growth

- 11.2.3 CANADA

- 11.2.3.1 Early rollout of Wi-Fi 7 technologies across residential and enterprise sectors to fuel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Mounting demand for networking equipment and embedded systems to boost market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Rapid digitalization to upgrade industrial, residential, and public infrastructure to foster market growth

- 11.3.3 FRANCE

- 11.3.3.1 Mounting demand for high-speed connectivity across consumer, industrial, and enterprise sectors to drive market

- 11.3.4 UK

- 11.3.4.1 Growing focus on bringing gigabit-capable broadband to underserved and hard-to-reach areas to augment market growth

- 11.3.5 ITALY

- 11.3.5.1 Accelerated broadband and rural connectivity initiatives to bolster market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rise in semiconductor manufacturing, smart infrastructure development, and digital economy expansion to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Strong focus on high-performance connectivity in enterprises to contribute to market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Mounting adoption of Wi-Fi 7 technology and robust telecom infrastructure to fuel market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Rising smartphone adoption and e-learning programs to contribute to market growth

- 11.5.2.2 GCC

- 11.5.2.3 Africa & Rest of Middle East

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Surging remote work and online education to expedite market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 IEEE standard footprint

- 12.7.5.4 Vertical footprint

- 12.7.5.5 End-use application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 BROADCOM

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 MEDIATEK

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 INTEL CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 REALTEK SEMICONDUCTOR CORP.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.2.1 Deals

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 INFINEON TECHNOLOGIES AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 NXP SEMICONDUCTORS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 RENESAS ELECTRONICS CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 ESPRESSIF SYSTEMS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 MORSE MICRO

- 13.2.2 SENSCOMM SEMICONDUCTOR CO.,LTD

- 13.2.3 PHARROWTECH

- 13.2.4 EDGEWATER WIRELESS INC.

- 13.2.5 PERASO TECHNOLOGIES INC.

- 13.2.6 KORE WIRELESS

- 13.2.7 U-BLOX

- 13.2.8 QUECTEL

- 13.2.9 TENSORCOM, INC.

- 13.2.10 TEXAS INSTRUMENTS INCORPORATED

- 13.2.11 SILEX TECHNOLOGY AMERICA, INC.

- 13.2.12 NEWRACOM

- 13.2.13 BEKEN CORPORATION

- 13.2.14 BLUETRUM TECHNOLOGY CO., LTD.

- 13.2.15 BESTECHNIC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS