|

|

市場調査レポート

商品コード

1797401

熱電併給の世界市場:容量別、原動機別、エンドユーザー別、燃料別、地域別 - 予測(~2030年)Combined Heat and Power Market by Capacity, Prime Mover, End User, Fuel, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 熱電併給の世界市場:容量別、原動機別、エンドユーザー別、燃料別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月15日

発行: MarketsandMarkets

ページ情報: 英文 351 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

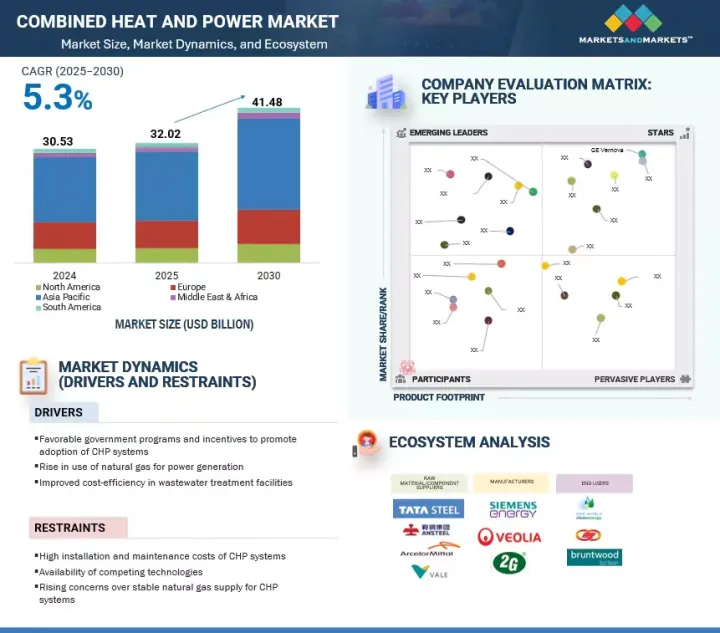

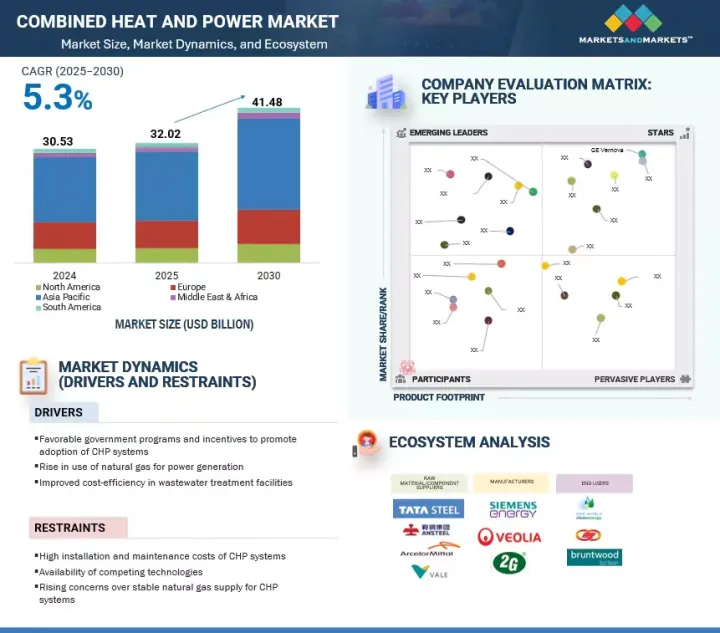

世界の熱電併給の市場規模は、2025年の320億2,000万米ドルから2030年までに414億8,000万米ドルに達すると推定され、予測期間にCAGRで5.3%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 容量、原動機、燃料、エンドユーザー |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカの。 |

市場は、効率的で持続可能なエネルギーシステムに対する需要の高まり、分散型発電への投資の増加、コージェネレーション技術の利用を支援する有利な政府政策によって推進されています。さらに、天然ガス駆動のCHPシステムや再生可能エネルギー源における技術革新が、工業、商業、住宅の各部門におけるCHPソリューションの迅速な移行を促進しています。

工業セグメントが予測期間に熱電併給市場で最大のエンドユーザーとなります。

工業部門は熱電併給市場の最大のエンドユーザーです。これは、省エネニーズの高まり、プロセス加熱への注目、持続可能な生産への固執によるものです。工業部門は、エネルギー技術に関する技術革新に多額の投資を行っています。さらに、この部門ではクリーンエネルギーの利用を促進する政府の政策が好意的に受け止められています。安定した電力供給を確保し、運転経費を削減し、環境持続可能性の目標を達成するための、大手製造・加工企業によるCHPシステムの採用の増加が、工業部門での需要を促進しています。

「欧州が予測期間に第2位の市場になると推定されます。」

産業用エネルギーソリューションの大きなプレゼンスと再生可能エネルギーの統合により、欧州が熱電併給の第2位の市場になると推定されます。同地域はすでに強力な公益事業部門を有しており、省エネルギー技術への大規模な投資が行われています。またこの地域は、クリーンエネルギーと電化に関する、好ましい政府の政策も特徴です。ドイツや英国などの主要な公益事業企業や製造企業は、信頼性と持続可能性を高めるためにCHPシステムの採用を増やしています。

当レポートでは、世界の熱電併給市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 熱電併給発電市場の企業にとって魅力的な機会

- 熱電併給市場:地域別

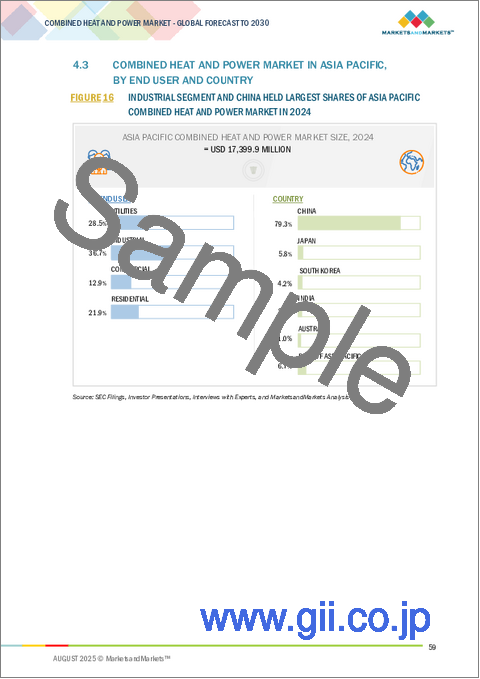

- アジア太平洋の熱電併給市場:エンドユーザー別、国別

- 熱電併給市場:容量別

- 熱電併給市場:原動機別

- 熱電併給市場:燃料別

- 熱電併給市場:エンドユーザー別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 小容量熱電併給システムの平均設置コストの動向:原動機別(2021年~2024年)

- 大容量熱電併給システムの平均設置コストの動向:原動機別

- 熱電併給システムの平均設置コストの動向:地域別

- バリューチェーン分析

- 原材料プロバイダー/コンポーネントメーカー/サプライヤー

- 熱電併給システムメーカー/組立業者

- 販売業者/再販業者

- エンドユーザー

- メンテナンス/サービスプロバイダー

- エコシステム分析

- 技術分析

- 主要技術

- 隣接技術

- 規制情勢

- 特許分析

- 貿易分析

- HSコード8406

- HSコード841182

- 主な会議とイベント(2025年~2026年)

- 関税分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- SIEMENS ENERGY、CHPソリューションを活用して産業ユーザーの運用セキュリティの向上とエネルギーコストの削減を支援

- TATA CHEMICALS、二酸化炭素排出の削減と重炭酸ナトリウムの生産増加のため、新たなコージェネレーションシステムを展開

- NHS、炭素削減目標達成のためVEOLIAのCHPに基づくシステムを設置

- 主なステークホルダーと購入基準

- 熱電併給市場に対する生成AI/AIの影響

- 熱電併給市場における生成AI/AIのユースケース

- 主要エンドユーザーに対する生成AI/AIの影響:地域別

- 熱電併給市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 国/地域に対する影響

- エンドユーザーに対する影響

第6章 熱電併給市場:容量別

- イントロダクション

- 10MW以下

- 11~150MW

- 151~300MW

- 300MW超

第7章 熱電併給市場:エンドユーザー別

- イントロダクション

- 住宅

- 商業

- 工業

- 公益事業

第8章 熱電併給市場:燃料別

- イントロダクション

- 石炭

- 天然ガス

- バイオガス/バイオマス

- 核

- ディーゼル

- その他の燃料

第9章 熱電併給市場:原動機別

- イントロダクション

- ガスタービン

- 蒸気タービン

- レシプロエンジン

- 燃料電池

- マイクロタービン

- その他の原動機

第10章 熱電併給市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- オーストラリア

- インド

- その他のアジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- トルコ

- ナイジェリア

- アルジェリア

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2017年~2025年)

- 市場シェア分析(2023年)

- 収益分析(2020年~2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業フットプリント:主要企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- GE VERNOVA

- SIEMENS ENERGY

- WARTSILA

- 2G ENERGY INC.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- CLARKE ENERGY

- CATERPILLAR

- E. ON SE

- VEOLIA

- ROBERT BOSCH GMBH

- EVERLLENCE

- AB HOLDING SPA

- FUELCELL ENERGY, INC.

- CAPSTONE GREEN ENERGY HOLDINGS, INC.

- CUMMINS INC.

- その他の企業

- CENTRICA

- TECOGEN, INC.

- BDR THERMEA GROUP

- VIESSMANN GROUP

- JENBACHER

- CLEARCELL POWER

- KRAFT POWER

- ENEXOR ENERGY LLC

- RESET

- HELEC

第13章 付録

List of Tables

- TABLE 1 BY END USER

- TABLE 2 BY PRIME MOVER

- TABLE 3 BY CAPACITY

- TABLE 4 BY FUEL

- TABLE 5 BY REGION

- TABLE 6 COMBINED HEAT AND POWER MARKET SNAPSHOT

- TABLE 7 MICRO COMBINED HEAT AND POWER INSTALLATIONS, 2021

- TABLE 8 COMBINED HEAT AND POWER PRIME MOVER TOLERANCE TO BIOGAS CONTAMINANTS

- TABLE 9 AVERAGE INSTALLATION COST TREND OF SMALL-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024 (USD/KW)

- TABLE 10 AVERAGE INSTALLATION COST TREND OF MEDIUM-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024 (USD/KW)

- TABLE 11 AVERAGE INSTALLATION COST TREND OF LARGE-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024 (USD/KW)

- TABLE 12 AVERAGE INSTALLATION COST OF COMBINED HEAT AND POWER SYSTEMS, BY REGION, 2021-2024 (USD/KW)

- TABLE 13 ROLE OF COMPANIES IN COMBINED HEAT AND POWER ECOSYSTEM

- TABLE 14 COMBINED HEAT AND POWER MARKET: REGULATIONS

- TABLE 15 LIST OF MAJOR PATENTS PERTAINING TO COMBINED HEAT AND POWER, 2015-2024

- TABLE 16 EXPORT DATA FOR HS CODE 8406-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 17 IMPORT DATA FOR HS CODE 8406-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 841182-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 19 IMPORT DATA FOR HS CODE 841182-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 20 COMBINED HEAT AND POWER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 IMPORT TARIFF FOR HS CODE 841182-COMPLIANT PRODUCTS, 2024

- TABLE 22 IMPORT TARIFF FOR HS CODE 8406-COMPLIANT PRODUCTS, 2024

- TABLE 23 IMPACT OF PORTER'S FIVE FORCES ON COMBINED HEAT AND POWER MARKET

- TABLE 24 INFLUENCE OF END USERS ON BUYING PROCESS

- TABLE 25 KEY BUYING CRITERIA FOR END USERS

- TABLE 26 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 27 EXPECTED CHANGE IN PRICES AND POTENTIAL IMPACT ON END USERS DUE TO TARIFF IMPACT

- TABLE 28 COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 29 COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 30 UP TO 10 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 31 UP TO 10 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 11-150 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 11-150 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 151-300 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 35 151-300 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 ABOVE 300 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 ABOVE 300 MW: COMBINED HEAT AND POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

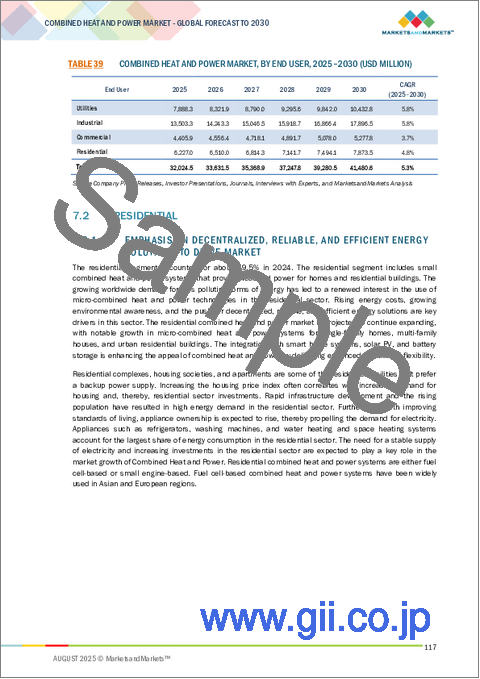

- TABLE 39 COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 40 COMBINED HEAT AND POWER MARKET FOR RESIDENTIAL, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 COMBINED HEAT AND POWER MARKET FOR RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 COMBINED HEAT AND POWER MARKET FOR COMMERCIAL, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 COMBINED HEAT AND POWER MARKET FOR COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 COMBINED HEAT AND POWER MARKET FOR INDUSTRIAL, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 COMBINED HEAT AND POWER MARKET FOR INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 COMBINED HEAT AND POWER MARKET FOR UTILITIES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 COMBINED HEAT AND POWER MARKET FOR UTILITIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 49 COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 50 COMBINED HEAT AND POWER MARKET FOR COAL, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 COMBINED HEAT AND POWER MARKET FOR COAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 COMBINED HEAT AND POWER MARKET FOR NATURAL GAS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 COMBINED HEAT AND POWER MARKET FOR NATURAL GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 COMBINED HEAT AND POWER MARKET FOR BIOGAS/BIOMASS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 COMBINED HEAT AND POWER MARKET FOR BIOGAS/BIOMASS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 COMBINED HEAT AND POWER MARKET FOR NUCLEAR, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 COMBINED HEAT AND POWER MARKET FOR NUCLEAR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 COMBINED HEAT AND POWER MARKET FOR DIESEL, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 COMBINED HEAT AND POWER MARKET FOR DIESEL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 COMBINED HEAT AND POWER MARKET FOR OTHER FUELS, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 COMBINED HEAT AND POWER MARKET FOR OTHER FUELS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 63 COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 64 COMBINED HEAT AND POWER MARKET FOR GAS TURBINES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 65 COMBINED HEAT AND POWER MARKET FOR GAS TURBINES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 COMBINED HEAT AND POWER MARKET FOR STEAM TURBINES, BY REGION, 2019-2024 (USD MILLION)

- TABLE 67 COMBINED HEAT AND POWER MARKET FOR STEAM TURBINES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 COMBINED HEAT AND POWER MARKET FOR RECIPROCATING ENGINES, BY REGION 2019-2024 (USD MILLION)

- TABLE 69 COMBINED HEAT AND POWER MARKET FOR RECIPROCATING ENGINES, BY REGION 2025-2030 (USD MILLION)

- TABLE 70 COMBINED HEAT AND POWER MARKET FOR FUEL CELLS, BY REGION 2019-2024 (USD MILLION)

- TABLE 71 COMBINED HEAT AND POWER MARKET FOR FUEL CELLS, BY REGION 2025-2030 (USD MILLION)

- TABLE 72 COMBINED HEAT AND POWER MARKET FOR MICROTURBINES, BY REGION 2019-2024 (USD MILLION)

- TABLE 73 COMBINED HEAT AND POWER MARKET FOR MICROTURBINES, BY REGION 2025-2030 (USD MILLION)

- TABLE 74 COMBINED HEAT AND POWER MARKET FOR OTHER PRIME MOVERS, BY REGION 2019-2024 (USD MILLION)

- TABLE 75 COMBINED HEAT AND POWER MARKET FOR OTHER PRIME MOVERS, BY REGION 2025-2030 (USD MILLION)

- TABLE 76 COMBINED HEAT AND POWER MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 77 COMBINED HEAT AND POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 COMBINED HEAT AND POWER MARKET, BY REGION, 2019-2024 (MW)

- TABLE 79 COMBINED HEAT AND POWER MARKET, BY REGION, 2025-2030 (MW)

- TABLE 80 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 US: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 91 US: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 92 US: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 93 US: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 94 US: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 95 US: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 96 US: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 97 US: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 98 CANADA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 99 CANADA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 100 CANADA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 101 CANADA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 102 CANADA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 103 CANADA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 104 CANADA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 105 CANADA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 106 MEXICO: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 107 MEXICO: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 108 MEXICO: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 109 MEXICO: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 110 MEXICO: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 111 MEXICO: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 112 MEXICO: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 113 MEXICO: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 115 EUROPE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 117 EUROPE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 119 EUROPE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 121 EUROPE: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 123 EUROPE: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 GERMANY: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 125 GERMANY: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 126 GERMANY: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 127 GERMANY: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 128 GERMANY: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 129 GERMANY: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 130 GERMANY: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 131 GERMANY: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 132 UK: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 133 UK: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 134 UK: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 135 UK: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 136 UK: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 137 UK: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 138 UK: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 139 UK: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 140 FRANCE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 141 FRANCE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 142 FRANCE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 143 FRANCE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 144 FRANCE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 145 FRANCE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 146 FRANCE: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 147 FRANCE: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 148 ITALY: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 149 ITALY: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 150 ITALY: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 151 ITALY: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 152 ITALY: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 153 ITALY: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 154 ITALY: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 155 ITALY: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 156 RUSSIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 157 RUSSIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 158 RUSSIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 159 RUSSIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 160 RUSSIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 161 RUSSIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 162 RUSSIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 163 RUSSIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 165 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 167 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 169 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 171 REST OF EUROPE: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 177 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 179 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 181 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 CHINA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 183 CHINA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 184 CHINA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 185 CHINA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 186 CHINA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 187 CHINA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 188 CHINA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 189 CHINA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 190 JAPAN: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 191 JAPAN: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 192 JAPAN: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 193 JAPAN: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 194 JAPAN: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 195 JAPAN: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 196 JAPAN: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 197 JAPAN: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 199 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 201 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 202 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 203 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 205 SOUTH KOREA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 206 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 207 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 208 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 209 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 210 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 211 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 212 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 213 AUSTRALIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 214 INDIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 215 INDIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 216 INDIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 217 INDIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 218 INDIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 219 INDIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 220 INDIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 221 INDIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 240 GCC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 241 GCC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 242 GCC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 243 GCC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 244 GCC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 245 GCC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 246 GCC: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 247 GCC: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 248 GCC: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 249 GCC: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 250 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 251 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 252 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 253 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 254 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 255 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 256 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 257 SAUDI ARABIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 258 UAE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 259 UAE: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 260 UAE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 261 UAE: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 262 UAE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 263 UAE: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 264 UAE: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 265 UAE: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 266 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 267 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 268 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 269 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 270 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 271 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 272 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 273 REST OF GCC: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 274 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 275 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 276 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 277 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 278 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 279 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 280 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 281 SOUTH AFRICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 282 TURKEY: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 283 TURKEY: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 284 TURKEY: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 285 TURKEY: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 286 TURKEY: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 287 TURKEY: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 288 TURKEY: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 289 TURKEY: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 290 NIGERIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 291 NIGERIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 292 NIGERIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 293 NIGERIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 294 NIGERIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 295 NIGERIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 296 NIGERIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 297 NIGERIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 298 ALGERIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 299 ALGERIA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 300 ALGERIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 301 ALGERIA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 302 ALGERIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 303 ALGERIA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 304 ALGERIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 305 ALGERIA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 306 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 307 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 308 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 309 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 310 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 314 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 315 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 316 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 317 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 318 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 319 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 320 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 321 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 322 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 323 SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 324 BRAZIL: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 325 BRAZIL: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 326 BRAZIL: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 327 BRAZIL: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 328 BRAZIL: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 329 BRAZIL: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 330 BRAZIL: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 331 BRAZIL: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 332 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 333 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 334 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 335 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 336 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 337 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 338 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 339 ARGENTINA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 340 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2019-2024 (USD MILLION)

- TABLE 341 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 342 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2019-2024 (USD MILLION)

- TABLE 343 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2025-2030 (USD MILLION)

- TABLE 344 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2019-2024 (USD MILLION)

- TABLE 345 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY FUEL, 2025-2030 (USD MILLION)

- TABLE 346 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 347 REST OF SOUTH AMERICA: COMBINED HEAT AND POWER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 348 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, APRIL 2017- JULY 2025

- TABLE 349 COMBINED HEAT AND POWER MARKET: DEGREE OF COMPETITION

- TABLE 350 COMBINED HEAT AND POWER MARKET: CAPACITY FOOTPRINT

- TABLE 351 COMBINED HEAT AND POWER MARKET: PRIME MOVER FOOTPRINT

- TABLE 352 COMBINED HEAT AND POWER MARKET: FUEL FOOTPRINT

- TABLE 353 COMBINED HEAT AND POWER MARKET: END USER FOOTPRINT

- TABLE 354 COMBINED HEAT AND POWER MARKET: REGION FOOTPRINT

- TABLE 355 COMBINED HEAT AND POWER MARKET: PRODUCT LAUNCHES/ DEVELOPMENTS, APRIL 2017-JULY 2025

- TABLE 356 COMBINED HEAT AND POWER MARKET: DEALS, APRIL 2017-JULY 2025

- TABLE 357 COMBINED HEAT AND POWER MARKET: EXPANSIONS, APRIL 2017-JULY 2025

- TABLE 358 COMBINED HEAT AND POWER MARKET: OTHER DEVELOPMENTS, APRIL 2017-JULY 2025

- TABLE 359 GE VERNOVA: COMPANY OVERVIEW

- TABLE 360 GE VERNOVA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 361 GE VERNOVA: DEVELOPMENTS

- TABLE 362 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 363 SIEMENS ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 364 SIEMENS ENERGY: DEALS

- TABLE 365 SIEMENS ENERGY: OTHER DEVELOPMENTS

- TABLE 366 WARTSILA: COMPANY OVERVIEW

- TABLE 367 WARTSILA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 368 WARTSILA: DEALS

- TABLE 369 WARTSILA: OTHER DEVELOPMENTS

- TABLE 370 2G ENERGY INC.: COMPANY OVERVIEW

- TABLE 371 2G ENERGY INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 372 2G ENERGY INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 373 2G ENERGY INC.: DEALS

- TABLE 374 2G ENERGY INC.: OTHER DEVELOPMENTS

- TABLE 375 MITSUBISHI HEAVY INDUSTRIES, LTD: COMPANY OVERVIEW

- TABLE 376 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 377 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 378 MITSUBISHI HEAVY INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 379 MITSUBISHI HEAVY INDUSTRIES: EXPANSIONS

- TABLE 380 CLARKE ENERGY: COMPANY OVERVIEW

- TABLE 381 CLARKE ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 382 CLARKE ENERGY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 383 CLARKE ENERGY: OTHER DEVELOPMENTS

- TABLE 384 CATERPILLAR: COMPANY OVERVIEW

- TABLE 385 CATERPILLAR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 386 CATERPILLAR: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 387 CATERPILLAR: OTHER DEVELOPMENTS

- TABLE 388 E.ON SE: COMPANY OVERVIEW

- TABLE 389 E.ON SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 390 E.ON SE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 391 E.ON SE: DEALS

- TABLE 392 E.ON: OTHER DEVELOPMENTS

- TABLE 393 VEOLIA: COMPANY OVERVIEW

- TABLE 394 VEOLIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 395 VEOLIA: DEALS

- TABLE 396 VEOLIA: OTHER DEVELOPMENTS

- TABLE 397 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 398 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 399 ROBERT BOSCH GMBH: DEALS

- TABLE 400 ROBERT BOSCH GMBH: OTHER DEVELOPMENTS

- TABLE 401 EVERLLENCE: COMPANY OVERVIEW

- TABLE 402 EVERLLENCE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 403 EVERLLENCE: EXPANSIONS

- TABLE 404 EVERLLENCE: OTHER DEVELOPMENTS

- TABLE 405 AB HOLDING SPA: COMPANY OVERVIEW

- TABLE 406 AB HOLDING SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 407 AB HOLDING SPA: OTHER DEVELOPMENTS

- TABLE 408 FUELCELL ENERGY, INC.: COMPANY OVERVIEW

- TABLE 409 FUELCELL ENERGY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 410 FUELCELL ENERGY, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 411 CAPSTONE GREEN ENERGY HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 412 CAPSTONE GREEN ENERGY HOLDINGS, INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 413 CAPSTONE GREEN ENERGY HOLDINGS, INC.: DEALS

- TABLE 414 CAPSTONE GREEN ENERGY HOLDINGS, INC.: OTHER DEVELOPMENTS

- TABLE 415 CUMMINS INC.: COMPANY OVERVIEW

- TABLE 416 CUMMINS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 417 CUMMINS INC.: DEVELOPMENTS

List of Figures

- FIGURE 1 COMBINED HEAT AND POWER MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND IN COMBINED HEAT AND POWER MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED IN ASSESSING SUPPLY FOR COMBINED HEAT AND POWER MARKET

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 11-150 MW SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 11 RECIPROCATING ENGINE SEGMENT TO LEAD MARKET IN 2030

- FIGURE 12 NATURAL GAS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 13 INDUSTRIAL SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 14 INCREASING URBANIZATION AND NEED TO REDUCE CARBON EMISSIONS TO DRIVE MARKET

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INDUSTRIAL SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC COMBINED HEAT AND POWER MARKET IN 2024

- FIGURE 17 11-150 MW SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 18 GAS TURBINE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 19 NATURAL GAS SEGMENT TO LEAD MARKET IN 2030

- FIGURE 20 INDUSTRIAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 21 COMBINED HEAT AND POWER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 WORLD ELECTRICITY GENERATION IN STATED POLICIES SCENARIO, 2022-2035

- FIGURE 23 GLOBAL NATURAL GAS CONSUMPTION, 2014-2024

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE INSTALLATION COST TREND OF SMALL-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024

- FIGURE 26 AVERAGE INSTALLATION COST TREND OF MEDIUM-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024

- FIGURE 27 AVERAGE INSTALLATION COST TREND OF LARGE-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024

- FIGURE 28 AVERAGE INSTALLATION COST TREND OF COMBINED HEAT AND POWER SYSTEMS, BY REGION, 2021-2024

- FIGURE 29 COMBINED HEAT AND POWER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 COMBINED HEAT AND POWER MARKET: ECOSYSTEM MAPPING

- FIGURE 31 TOP 10 PLAYERS WITH HIGHEST NUMBER OF PATENTS PERTAINING TO COMBINED HEAT AND POWER, 2014-2024

- FIGURE 32 TOTAL NUMBER OF PATENTS GRANTED PERTAINING TO COMBINED HEAT AND POWER, 2014-2024

- FIGURE 33 EXPORT DATA FOR HS CODE 8406-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 34 IMPORT DATA FOR HS CODE 8406-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 35 EXPORT DATA FOR HS CODE 841182-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 36 IMPORT DATA FOR HS CODE 841182-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 37 COMBINED HEAT AND POWER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP END USERS

- FIGURE 40 IMPACT OF AI ON COMBINED HEAT AND POWER MARKET, BY REGION

- FIGURE 41 COMBINED HEAT AND POWER MARKET SHARE, BY CAPACITY, 2024

- FIGURE 42 COMBINED HEAT AND POWER MARKET SHARE, BY END USER, 2024

- FIGURE 43 COMBINED HEAT AND POWER MARKET SHARE, BY FUEL, 2024

- FIGURE 44 COMBINED HEAT AND POWER MARKET, BY PRIME MOVER, 2024

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 COMBINED HEAT AND POWER MARKET, BY REGION, 2024

- FIGURE 47 EUROPE: COMBINED HEAT AND POWER MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: COMBINED HEAT AND POWER MARKET SNAPSHOT

- FIGURE 49 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 50 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 51 COMBINED HEAT AND POWER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 COMPANY FOOTPRINT

- FIGURE 53 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 54 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 55 WARTSILA: COMPANY SNAPSHOT

- FIGURE 56 2G ENERGY INC.: COMPANY SNAPSHOT

- FIGURE 57 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 58 CATERPILLAR: COMPANY SNAPSHOT

- FIGURE 59 E.ON SE: COMPANY SNAPSHOT

- FIGURE 60 VEOLIA: COMPANY SNAPSHOT

- FIGURE 61 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 62 FUELCELL ENERGY, INC.: COMPANY SNAPSHOT

- FIGURE 63 CAPSTONE GREEN ENERGY HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 64 CUMMINS INC.: COMPANY SNAPSHOT

The global combined heat and power market is estimated to grow from USD 32.02 billion in 2025 to USD 41.48 billion by 2030, at a CAGR of 5.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By capacity, prime mover, fuel, and end User |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa. |

The market is propelled by the rising demand for efficient and sustainable energy systems, mounting investments in distributed generating power, and favorable government policies that support the usage of cogeneration technologies. Moreover, innovations in natural gas-driven CHP systems and renewable energy sources are promoting faster sector-wide migration of CHP solutions across industrial, commercial, and residential environments.

Industrial segment to be largest end user in combined heat and power market during forecast period"

The industrial sector is the largest end user of the combined heat and power market. This is due to the growing energy-saving needs, more attention to process heating, and adherence to sustainable production. The industrial sector is making substantial investments in innovation with regard to energy technologies. Moreover, this sector is witnessing favorable government policies that promote the use of clean energy. The increased adoption of CHP systems by large manufacturing and processing firms to ensure consistent power supply, lower operating expenses, and attain environmental sustainability objectives is driving the demand in the industrial sector.

"Europe estimated to be second-largest market during forecast period"

Europe is estimated to be the second-largest market for combined heat and power due to the considerable presence of industrial energy solutions and integration of renewable energy. The region already has a strong utilities sector and has witnessed extensive investment in energy-efficient technology. The region is also characterized by favorable government policy regarding clean energy and electrification. The major utility and manufacturing firms in countries like Germany and the UK are increasingly adopting CHP systems to increase reliability and sustainability.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3 - 11%

By Designation: C-level Executives - 30%, Directors - 25%, and Others - 45%

By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, Middle East & Africa - 12%, and South America - 8%

Notes: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Other designations include sales managers, engineers, and regional managers.

Siemens, Wartsila, GE Vernova, Veolia, and MITSUBISHI HEAVY INDUSTRIES, LTD. are some of the major players in the combined heat and power market. The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the global combined heat and power market by capacity, prime mover, fuel, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the combined heat and power market.

Key Benefits of Buying the Report

- It provides an analysis of key drivers (Rise of natural gas for power generation), restraints (Rising concerns over stable natural gas supply for CHP systems), opportunities (Surging replacement and upgrade of aged power generation equipment), and challenges (High damage to prime movers from impurities generated from biogas fuel) influencing the growth of the combined heat and power market.

- Market Development: In February 2021, Caterpillar introduced the MWM online condition monitoring system called the MWM Remote Asset Monitoring (RAM). This offers push notifications in the case of alerts, warnings, or malfunctions, and assists in optimizing workflows as well as coordinating support processes more systematically. It provides reports about the power, operating hours, and current & historical performances.

- Product Innovation/Development: The market for combined heat and power (CHP) systems has seen substantial product innovation, with particularly strong results in IoT-enabled diagnostics and predictive maintenance capability of the most developed systems. These innovations are aimed at increasing energy efficiency, decreasing the working time of the system, and avoiding operational failures in diverse end-use applications such as industrial complexes, commercial premises, and electricity grids.

- Market Diversification: In August 2021, Capstone Green Energy expanded its operations in the UK by completing the grid interconnect expansion at the UK Integrated Remanufacturing Facility. This facility would build and test Capstone's C200 engines. It serves the sustainable energy needs of the EMEA (Europe, Middle East & Africa) region.

- Competitive Assessment: It provides an in-depth assessment of market shares, growth strategies, and service offerings of leading players in the combined heat and power market, such as GE Vernova (US), Siemens Energy (Germany), Wartsila (Finland), Veolia (France), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SCOPE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis (demand side)

- 2.4.3.2 Country-level analysis (demand side)

- 2.4.3.3 Demand-side calculations

- 2.4.3.4 Demand-side assumptions

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Supply-side calculations

- 2.4.4.2 Supply-side assumptions

- 2.4.5 GROWTH FORECAST ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMBINED HEAT AND POWER MARKET

- 4.2 COMBINED HEAT AND POWER MARKET, BY REGION

- 4.3 COMBINED HEAT AND POWER MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- 4.4 COMBINED HEAT AND POWER MARKET, BY CAPACITY

- 4.5 COMBINED HEAT AND POWER MARKET, BY PRIME MOVER

- 4.6 COMBINED HEAT AND POWER MARKET, BY FUEL

- 4.7 COMBINED HEAT AND POWER MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Favorable government programs and incentives

- 5.2.1.2 Rise in use of natural gas for power generation

- 5.2.1.3 Improved cost-efficiency in wastewater treatment facilities

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs

- 5.2.2.2 Dominance of hydroelectric energy

- 5.2.2.3 Rising concerns over stable natural gas supply

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing deployment of micro-CHP systems

- 5.2.3.2 Pressing need to replace and upgrade aged power generation equipment

- 5.2.3.3 Rising trend of distributed power generation

- 5.2.4 CHALLENGES

- 5.2.4.1 Damaged prime movers due to high contamination from biogas fuel

- 5.2.4.2 Challenges posed by utilities for sale of excess electricity

- 5.2.4.3 Stability issues arising from decentralization of energy generation

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE INSTALLATION COST TREND OF SMALL-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER, 2021-2024

- 5.4.2 AVERAGE INSTALLATION COST TREND OF LARGE-CAPACITY COMBINED HEAT AND POWER SYSTEMS, BY PRIME MOVER

- 5.4.3 AVERAGE INSTALLATION COST TREND OF COMBINED HEAT AND POWER SYSTEMS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/COMPONENT MANUFACTURERS/SUPPLIERS

- 5.5.2 COMBINED HEAT AND POWER SYSTEM MANUFACTURERS/ASSEMBLERS

- 5.5.3 DISTRIBUTORS/RESELLERS

- 5.5.4 END USERS

- 5.5.5 MAINTENANCE/SERVICE PROVIDERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Hybrid storage system with lithium-ion and redox flow battery

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Advanced control and monitoring systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY LANDSCAPE

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 HS CODE 8406

- 5.10.1.1 Export data (HS code 8406)

- 5.10.1.2 Import data (HS code 8406)

- 5.10.2 HS CODE 841182

- 5.10.2.1 Export data (HS code 841182)

- 5.10.2.2 Import data (HS code 841182)

- 5.10.1 HS CODE 8406

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TARIFF ANALYSIS

- 5.12.1 TARIFF RELATED TO COMBINED HEAT AND POWER MARKET

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 SIEMENS ENERGY USES CHP SOLUTIONS TO HELP INDUSTRIAL USERS BOOST OPERATIONAL SECURITY AND REDUCE ENERGY COSTS

- 5.14.2 TATA CHEMICALS DEPLOYS NEW CHP SYSTEM TO REDUCE CARBON EMISSIONS AND INCREASE SODIUM BICARBONATE PRODUCTION

- 5.14.3 NHS INSTALLS VEOLIA'S CHP-BASED SYSTEM TO ACHIEVE CARBON REDUCTION TARGETS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GENERATIVE AI/AI ON COMBINED HEAT AND POWER MARKET

- 5.16.1 USE CASES OF GENERATIVE AI/AI IN COMBINED HEAT AND POWER MARKET

- 5.16.2 IMPACT OF GENERATIVE AI/AI ON KEY END USERS, BY REGION

- 5.17 IMPACT OF 2025 US TARIFF ON COMBINED HEAT AND POWER MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 IMPACT ON COUNTRY/REGION

- 5.17.3.1 North America

- 5.17.3.2 Europe

- 5.17.3.3 Asia Pacific

- 5.17.3.4 Middle East & Africa

- 5.17.3.5 South America

- 5.17.4 IMPACT ON END USERS

6 COMBINED HEAT AND POWER MARKET, BY CAPACITY

- 6.1 INTRODUCTION

- 6.2 UP TO 10 MW

- 6.2.1 SHIFT TOWARD NATURAL GAS AND RENEWABLE FUEL SOURCES TO BOOST DEMAND

- 6.3 11-150 MW

- 6.3.1 HIGH DEMAND FROM ENERGY-INTENSIVE INDUSTRIES TO FOSTER SEGMENTAL GROWTH

- 6.4 151-300 MW

- 6.4.1 INCREASING GENERATION OF NATURAL GAS-FIRED POWER TO DRIVE MARKET

- 6.5 ABOVE 300 MW

- 6.5.1 GROWING APPLICATIONS IN ALUMINUM SMELTING AND CEMENT PRODUCTION TO BOOST DEMAND

7 COMBINED HEAT AND POWER MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 RESIDENTIAL

- 7.2.1 EMPHASIS ON DECENTRALIZED, RELIABLE, AND EFFICIENT ENERGY SOLUTIONS TO DRIVE MARKET

- 7.3 COMMERCIAL

- 7.3.1 RISING EMPHASIS ON ACHIEVING SUSTAINABILITY TARGETS AND REDUCING CARBON FOOTPRINT TO SUPPORT MARKET GROWTH

- 7.4 INDUSTRIAL

- 7.4.1 GROWING ENERGY-INTENSIVE MANUFACTURING TO BOOST DEMAND

- 7.5 UTILITIES

- 7.5.1 PRESENCE OF STRINGENT ENERGY EFFICIENCY REGULATIONS TO FUEL MARKET GROWTH

8 COMBINED HEAT AND POWER MARKET, BY FUEL

- 8.1 INTRODUCTION

- 8.2 COAL

- 8.2.1 RISING NUMBER OF COAL-FIRED POWER PLANTS TO FOSTER MARKET GROWTH

- 8.3 NATURAL GAS

- 8.3.1 FAVORABLE LNG PRICES TO DRIVE MARKET

- 8.4 BIOGAS/BIOMASS

- 8.4.1 PRESENCE OF SUPPORTIVE POLICIES AND RURAL ELECTRIFICATION PROGRAMS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.5 NUCLEAR

- 8.5.1 RISING APPLICATIONS IN LARGE URBAN CENTERS AND INDUSTRIAL PARKS TO FOSTER MARKET GROWTH

- 8.6 DIESEL

- 8.6.1 RISING NEED FOR RELIABLE AUXILIARY POWER TO BOOST DEMAND

- 8.7 OTHER FUELS

9 COMBINED HEAT AND POWER MARKET, BY PRIME MOVER

- 9.1 INTRODUCTION

- 9.2 GAS TURBINE

- 9.2.1 REDUCED NOX EMISSIONS TO FUEL MARKET GROWTH

- 9.3 STEAM TURBINE

- 9.3.1 REDUCED CARBON INTENSITY IN COAL-FIRED AND GEOTHERMAL PLANTS TO DRIVE MARKET

- 9.4 RECIPROCATING ENGINE

- 9.4.1 GROWING DEMAND IN AGRICULTURAL SECTOR TO BOOST DEMAND

- 9.5 FUEL CELL

- 9.5.1 DEVELOPMENT OF HIGH-TEMPERATURE PROTON EXCHANGE MEMBRANE SYSTEMS TO DRIVE MARKET

- 9.6 MICROTURBINE

- 9.6.1 SEAMLESS INTEGRATION WITH RENEWABLE ENERGY SOURCES TO BOOST DEMAND

- 9.7 OTHER PRIME MOVERS

10 COMBINED HEAT AND POWER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Growing demand for energy efficiency in industries to foster market growth

- 10.2.2 CANADA

- 10.2.2.1 Expansion of combined cycle natural gas-fired power plants to boost demand

- 10.2.3 MEXICO

- 10.2.3.1 Governmental push for clean electricity production to fuel market growth

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Growing emphasis on generating electricity from renewable sources to drive market

- 10.3.2 UK

- 10.3.2.1 Increasing need for flexible power generation to foster market growth

- 10.3.3 FRANCE

- 10.3.3.1 Rising emphasis on reducing dependence on nuclear power for electricity generation to drive market

- 10.3.4 ITALY

- 10.3.4.1 Government efforts to incentivize renewable energy projects to drive market

- 10.3.5 RUSSIA

- 10.3.5.1 Increasing trend of decentralized power generation to support market growth

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Rapid industrialization and infrastructure development to support market growth

- 10.4.2 JAPAN

- 10.4.2.1 Rising shift toward gas-based energy generation from nuclear energy to fuel market growth

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Growing emphasis on reducing methane emissions to foster market growth

- 10.4.4 AUSTRALIA

- 10.4.4.1 Enhanced grid infrastructure and energy-efficient solutions to accelerate market growth

- 10.4.5 INDIA

- 10.4.5.1 Government-led initiatives to boost natural gas share in energy mix to foster market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Rising emphasis on reducing consumption of petroleum liquids in electricity generation to boost demand

- 10.5.1.2 UAE

- 10.5.1.2.1 Increasing share of renewables in electricity generation mix to propel market growth

- 10.5.1.3 Rest of GCC

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Ongoing expansion of renewable energy to fuel market growth

- 10.5.3 TURKEY

- 10.5.3.1 Growing emphasis on boosting wind and solar capacity to support market growth

- 10.5.4 NIGERIA

- 10.5.4.1 Private sector investments in off-grid and hybrid solutions to boost demand

- 10.5.5 ALGERIA

- 10.5.5.1 Abundance of gas resources to boost demand

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Growing emphasis on increasing power generation from renewables to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Increasing FDIs in energy sector to foster market growth

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2017-2025

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- 11.6 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.1 COMPANY FOOTPRINT

- 11.6.1.1 Capacity footprint

- 11.6.1.2 Prime mover footprint

- 11.6.1.3 Fuel footprint

- 11.6.1.4 Company end user footprint

- 11.6.1.5 Company region footprint

- 11.6.1 COMPANY FOOTPRINT

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.7.2 DEALS

- 11.7.3 EXPANSIONS

- 11.7.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GE VERNOVA

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strategies/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 SIEMENS ENERGY

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strategies/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 WARTSILA

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strategies/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 2G ENERGY INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches/Developments

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Other developments

- 12.1.5 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Other developments

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strategies/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 CLARKE ENERGY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches/Developments

- 12.1.6.3.2 Other developments

- 12.1.7 CATERPILLAR

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/Developments

- 12.1.7.3.2 Other developments

- 12.1.8 E. ON SE

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/Developments

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 VEOLIA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Other developments

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strategies/Right to win

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses/Competitive threats

- 12.1.10 ROBERT BOSCH GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Other developments

- 12.1.11 EVERLLENCE

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services/Solutions offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.11.3.2 Other developments

- 12.1.12 AB HOLDING SPA

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Services/Solutions offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Other developments

- 12.1.13 FUELCELL ENERGY, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Services/Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches/Developments

- 12.1.14 CAPSTONE GREEN ENERGY HOLDINGS, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Services/Solutions offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Other developments

- 12.1.15 CUMMINS INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Services/Solutions offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Developments

- 12.1.1 GE VERNOVA

- 12.2 OTHER PLAYERS

- 12.2.1 CENTRICA

- 12.2.2 TECOGEN, INC.

- 12.2.3 BDR THERMEA GROUP

- 12.2.4 VIESSMANN GROUP

- 12.2.5 JENBACHER

- 12.2.6 CLEARCELL POWER

- 12.2.7 KRAFT POWER

- 12.2.8 ENEXOR ENERGY LLC

- 12.2.9 RESET

- 12.2.10 HELEC

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS