|

|

市場調査レポート

商品コード

1796193

AIアシスタントの世界市場 (~2030年):サービス・用途別AI Assistant Market by Offering, Application - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| AIアシスタントの世界市場 (~2030年):サービス・用途別 |

|

出版日: 2025年08月11日

発行: MarketsandMarkets

ページ情報: 英文 334 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

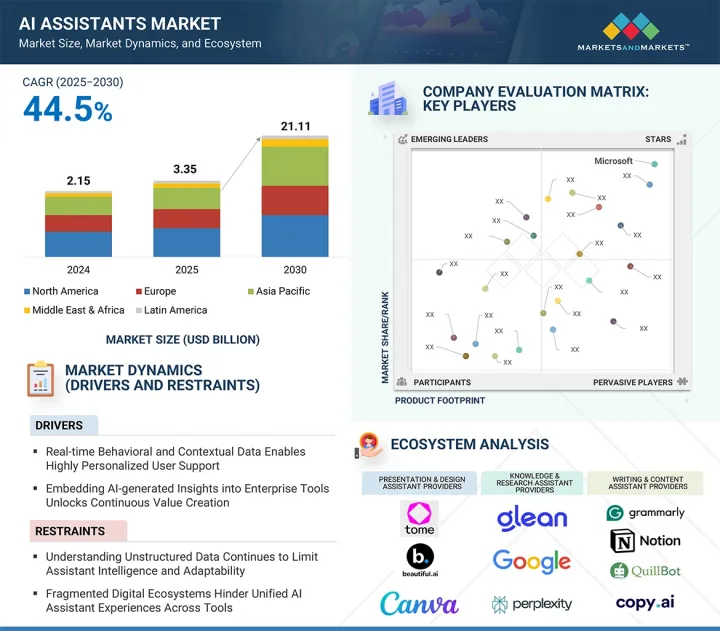

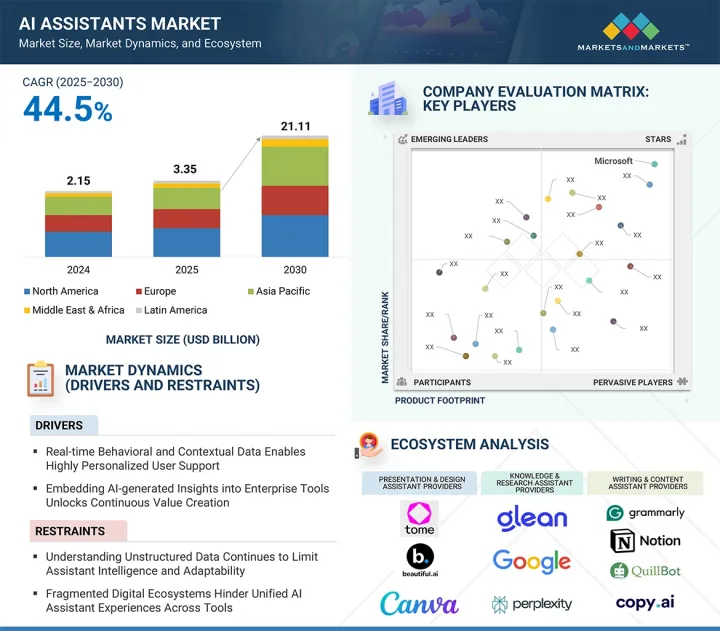

AIアシスタントの市場規模は、2025年の33億5,000万米ドルから、予測期間中はCAGR 44.5%で推移し、2030年には211億1,000万米ドルに成長すると予測されています。

AIアシスタント市場は、プラグイン、API、統合マーケットプレースの急増により、アシスタントがCRM、ERP、無数のニッチSaaSツールとシームレスに接続できるようになり、急速に拡大しています。このオーケストレーション機能の高まりは、企業が断片化されたワークフローを統合し、反復タスクをより効率的に自動化するのに役立ちます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 米ドル (米ドル) |

| セグメント | 提供区分・用途・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

"エンドユーザー別では、BFSIの部門がAIアシスタント導入を主導し、コンプライアンス・効率性・顧客中心型業務を推進"

BFSI部門は、膨大なデータの管理、複雑なコンプライアンスプロセス、顧客対応をより効率的に行う必要性から、2025年にAIアシスタント市場で最大のシェアを獲得すると予測されています。主要銀行や保険会社は、従来は膨大な手作業を要していた不正検知、取引監視、規制報告といった業務を自動化するため、インテリジェントアシスタントを急速に導入しています。多くの金融機関はすでに、リレーションシップマネージャーを支援し、顧客オンボーディングを効率化し、資産運用やアドバイザリー業務のためのカスタマイズされたインサイトを生成するAIコパイロットを展開しています。

デジタルファーストバンキング、モバイルアプリ、リモートアドバイザリーモデルの成長により、日常的な問い合わせ対応、安全な取引支援、パーソナライズされた提案を実現する会話型AIの需要がさらに高まっています。AI搭載アシスタントは、監査証跡の自動化や分散チーム全体での一貫したコンプライアンス維持を可能にし、厳格なプライバシー、セキュリティ、規制要件に対応しています。BFSI組織がデジタルトランスフォーメーションと顧客中心のイノベーションに投資を続けるなか、AIアシスタントはサービス品質の向上、業務の強靭性、生産性向上に不可欠な存在となり、エンタープライズAIアシスタント市場全体の中で最大の導入分野としての地位を強固なものにしています。

"用途別ではAPIベースのAIアシスタントの部門が柔軟でスケーラブルなエンタープライズワークフローの統合により急成長を牽引"

APIベースのAIアシスタントは、組織が多様なデジタルワークフローにインテリジェンスを組み込むために、柔軟でモジュール式の統合フレームワークを優先する傾向が強まっていることから、予測期間中に最も高いCAGRを記録すると予測されています。組み込み型やスタンドアロン型のアシスタントとは異なり、APIファーストモデルは既存のアプリケーションやカスタムポータル、独自プラットフォームに会話型・生成型機能を直接統合でき、再設計コストを抑えられる点が強みです。

このアプローチは、複雑なマルチベンダーの技術基盤を有する中堅~大企業に特に人気が高く、CRM、ERP、文書管理システム、業界特化型ソフトウェア間でシームレスな相互運用性を実現します。主要技術プロバイダーやスタートアップは、コンテキスト検索、リアルタイム要約、パーソナライズされたタスク自動化といったユースケース向けにアシスタントを容易に展開・拡張できるよう、APIマーケットプレイスや開発ツール群を拡充しています。

ヘッドレスアーキテクチャやマイクロサービスへの移行もAPIベースのアシスタント需要をさらに高め、企業がインテリジェンスを適用する場所と方法をきめ細かく制御できるようにしました。特にBFSI、医療、専門サービスなどの分野では、コンプライアンス要件に対応しつつ、大規模にユーザー体験をカスタマイズするために、API駆動型AIの導入が急速に進んでいます。

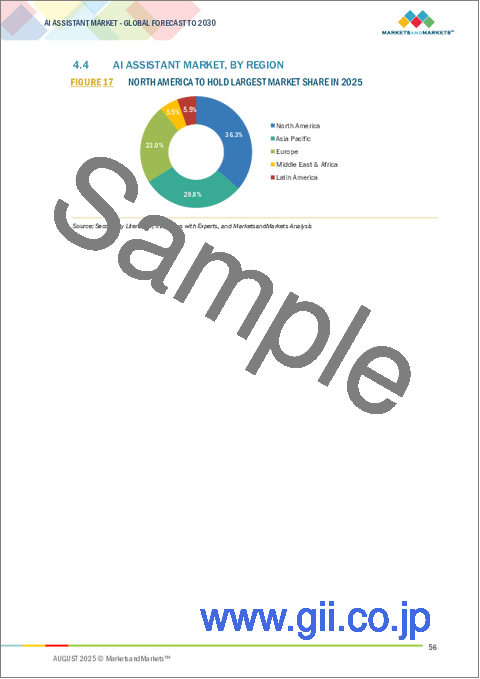

"アジア太平洋地域は技術革新と新技術に後押しされAIアシスタントが急成長し、市場規模は北米がリード"

アジア太平洋地域は、大規模なデジタル投資、拡大する技術人材、各国の国家AI戦略の支援により、予測期間中にAIアシスタント市場で最も急速な成長を遂げる見込みです。同地域の銀行、小売、医療などの企業は、ワークフロー自動化、多言語コミュニケーションの改善、従来型チャネルを超えた顧客エンゲージメント拡大を目的に、AIアシスタントの導入を積極的に進めています。スタートアップや地域の技術イノベーターの急成長も、独自の言語・規制・文化的特性に対応した地域特化型AIアシスタントの開発を後押ししています。

一方、北米はエンタープライズクラウドの成熟度の高さ、AI研究開発への投資規模、主要技術ベンダーの存在に支えられ、最大規模を維持すると予測されています。北米企業は生産性スイート、CRMプラットフォーム、ナレッジ管理ツールなどに組み込まれた業界特化型コパイロットの早期導入者であり、複雑な業務や意思決定を最適化しています。また、責任あるAIやガバナンスフレームワークの改善に重点を置きながら、広範囲に分散したチームやハイブリッドワーク環境へのAIアシスタント展開を加速させています。

当レポートでは、世界のAIアシスタントの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- AIアシスタントの進化

- サプライチェーン分析

- エコシステム分析

- 部門や職務におけるAIアシスタントの利用パターン

- ワークフローの混乱ゾーン:AIアシスタントがレガシーツールに代わる場所

- AIアシスタントの収益化モデル

- ペルソナマッピング

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 主要な会議とイベント

- ポーターのファイブフォース分析

- 主要なステークホルダー購入基準

- 顧客の事業に影響を与える動向/混乱

第6章 AIアシスタント市場:提供区分別

- ライティング&コンテンツアシスタント

- 会議およびコラボレーションアシスタント

- 知識・調査アシスタント

- スケジュール管理とカレンダー最適化アシスタント

- 営業・見込み客開拓アシスタント

- 開発者生産性アシスタント

- プレゼンテーション&デザインアシスタント

- 分析およびスプレッドシートアシスタント

第7章 AIアシスタント市場:統合タイプ別

- スタンドアロンアシスタント

- SaaSネイティブアシスタント

- ブラウザ拡張機能/プラグイン

- APIベースのアシスタント

- ワークスペースアドオン

第8章 AIアシスタント市場:用途別

- AIを活用したライティングと編集

- 会議の記録とフォローアップ

- 知識検索と文書検索

- スケジュールと作業の優先順位付け

- リードエンゲージメントとメールシーケンス

- コード補完とレビュー

- プレゼンテーションとナラティブデザイン

- データ探索とスプレッドシートAI

- その他

第9章 AIアシスタント市場:エンドユーザー別

- 個人エンドユーザー

- 企業

- BFSI

- 電気通信

- 政府・公共部門

- 医療&ライフサイエンス

- 製造

- メディア&エンターテインメント

- 小売・eコマース

- 技術プロバイダー

- プロフェッショナルサービスプロバイダー

- 教育

- その他

第10章 AIアシスタント市場:地域別

- 北米

- 市場促進要因

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- 市場促進要因

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- 市場促進要因

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- シンガポール

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 市場促進要因

- マクロ経済見通し

- サウジアラビア

- アラブ首長国連邦

- カタール

- トルコ

- 南アフリカ

- その他

- ラテンアメリカ

- 市場促進要因

- マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- MICROSOFT

- SALESFORCE

- SAP

- ORACLE

- ADOBE

- AWS

- CISCO

- SERVICENOW

- DROPBOX

- ZOOM

- BOX

- ATLASSIAN

- NOTION

- ASANA

- MONDAY.COM

- CLICKUP

- MIRO

- GRAMMARLY

- DOCUSIGN

- LUCID SOFTWARE

- GAMMA

- CANVA

- スタートアップ/SME

- GLEAN

- OTTER.AI

- FIREFLIES.AI

- FATHOM

- SCRIBE AI

- TOME

- JASPER

- COPY.AI

- WRITER.COM

- SYNTHESIA

- BEAUTIFUL.AI

- HIVER

- SUPERNORMAL

- HYPERWRITE

- QUILLBOT

- COPYSMITH

- ABRIDGE

- DESCRIPT

- LUMEN5

- RUNWAY

- PERPLEXITY AI

- REGIE.AI

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 GLOBAL AI ASSISTANT MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL AI ASSISTANT MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 AI ASSISTANT MARKET: ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS FILED, 2016-2025

- TABLE 12 LIST OF FEW PATENTS IN AI ASSISTANT MARKET, 2024-2025

- TABLE 13 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- TABLE 14 AVERAGE SELLING PRICE, BY APPLICATION, 2025

- TABLE 15 AI ASSISTANT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON AI ASSISTANT MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END-USERS

- TABLE 19 AI ASSISTANT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 20 AI ASSISTANT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 21 WRITING & CONTENT ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 WRITING & CONTENT ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 MEETING & COLLABORATION ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 MEETING & COLLABORATION ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 KNOWLEDGE & RESEARCH ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 KNOWLEDGE & RESEARCH ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 SCHEDULING & CALENDAR OPTIMIZATION ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 SCHEDULING & CALENDAR OPTIMIZATION ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

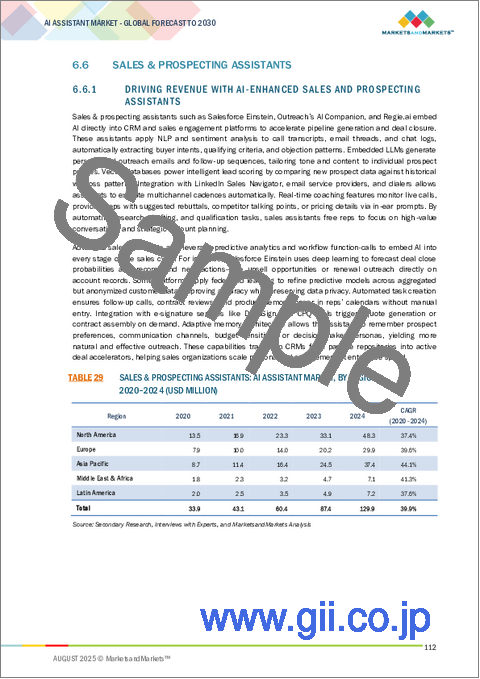

- TABLE 29 SALES & PROSPECTING ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 SALES & PROSPECTING ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 DEVELOPER PRODUCTIVITY ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 DEVELOPER PRODUCTIVITY ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 PRESENTATION & DESIGN ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 PRESENTATION & DESIGN ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 ANALYTICAL & SPREADSHEET ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 ANALYTICAL & SPREADSHEET ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 38 AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 39 STANDALONE ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 STANDALONE ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SAAS-NATIVE ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 SAAS-NATIVE ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 BROWSER EXTENSIONS/PLUG-INS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 BROWSER EXTENSIONS/PLUG-INS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 API-BASED ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 API-BASED ASSISTANTS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 WORKSPACE ADD-ONS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 WORKSPACE ADD-ONS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 AI ASSISTANT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 50 AI ASSISTANT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 AI-POWERED WRITING & EDITING: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 AI-POWERED WRITING & EDITING: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 MEETING TRANSCRIPTION & FOLLOW-UP: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 MEETING TRANSCRIPTION & FOLLOW-UP: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 KNOWLEDGE RETRIEVAL & DOCUMENT SEARCH: AI ASSISTANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 KNOWLEDGE RETRIEVAL & DOCUMENT SEARCH: AI ASSISTANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 SCHEDULING & WORK PRIORITIZATION: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 SCHEDULING & WORK PRIORITIZATION: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 LEAD ENGAGEMENT & EMAIL SEQUENCING: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 LEAD ENGAGEMENT & EMAIL SEQUENCING: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 CODE COMPLETION & REVIEW: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 CODE COMPLETION & REVIEW: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 PRESENTATION & NARRATIVE DESIGN: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 PRESENTATION & NARRATIVE DESIGN: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 DATA EXPLORATION & SPREADSHEET AI: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 DATA EXPLORATION & SPREADSHEET AI: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 AI ASSISTANT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 70 AI ASSISTANT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 71 INDIVIDUAL END USERS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 INDIVIDUAL END USERS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 AI ASSISTANT MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 74 AI ASSISTANT MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 75 BFSI: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 BFSI: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 TELECOMMUNICATIONS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 TELECOMMUNICATIONS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 GOVERNMENT & PUBLIC SECTOR: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 GOVERNMENT & PUBLIC SECTOR: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 HEALTHCARE & LIFE SCIENCES: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 HEALTHCARE & LIFE SCIENCES: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 MANUFACTURING: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 MANUFACTURING: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 MEDIA & ENTERTAINMENT: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 MEDIA & ENTERTAINMENT: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 RETAIL & E-COMMERCE: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 RETAIL & E-COMMERCE: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 TECHNOLOGY PROVIDERS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 TECHNOLOGY PROVIDERS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 PROFESSIONAL SERVICE PROVIDERS: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 PROFESSIONAL SERVICE PROVIDERS: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 EDUCATION: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 EDUCATION: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 OTHER ENTERPRISES: AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 OTHER ENTERPRISES: AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 AI ASSISTANT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 AI ASSISTANT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: AI ASSISTANT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: AI ASSISTANT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: AI ASSISTANT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: AI ASSISTANT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: AI ASSISTANT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: AI ASSISTANT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: AI ASSISTANT MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: AI ASSISTANT MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: AI ASSISTANT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: AI ASSISTANT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 US: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 112 US: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 114 CANADA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: AI ASSISTANT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: AI ASSISTANT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: AI ASSISTANT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: AI ASSISTANT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: AI ASSISTANT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 122 EUROPE: AI ASSISTANT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: AI ASSISTANT MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 124 EUROPE: AI ASSISTANT MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: AI ASSISTANT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 126 EUROPE: AI ASSISTANT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 UK: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 128 UK: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 130 GERMANY: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 131 FRANCE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 132 FRANCE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 134 ITALY: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 135 SPAIN: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 136 SPAIN: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 137 NETHERLANDS: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 138 NETHERLANDS: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 140 REST OF EUROPE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AI ASSISTANT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AI ASSISTANT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI ASSISTANT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI ASSISTANT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AI ASSISTANT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AI ASSISTANT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AI ASSISTANT MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AI ASSISTANT MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AI ASSISTANT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AI ASSISTANT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 154 CHINA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 155 INDIA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 156 INDIA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 157 JAPAN: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 158 JAPAN: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH KOREA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 160 SOUTH KOREA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 161 SINGAPORE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 162 SINGAPORE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 163 AUSTRALIA & NEW ZEALAND: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 164 AUSTRALIA & NEW ZEALAND: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 SAUDI ARABIA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 180 SAUDI ARABIA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 181 UAE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 182 UAE: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 183 QATAR: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 184 QATAR: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 185 TURKEY: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 186 TURKEY: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AFRICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 188 SOUTH AFRICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: AI ASSISTANT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 192 LATIN AMERICA: AI ASSISTANT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 194 LATIN AMERICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: AI ASSISTANT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 196 LATIN AMERICA: AI ASSISTANT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: AI ASSISTANT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 198 LATIN AMERICA: AI ASSISTANT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: AI ASSISTANT MARKET, BY ENTERPRISE, 2020-2024 (USD MILLION)

- TABLE 200 LATIN AMERICA: AI ASSISTANT MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: AI ASSISTANT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 202 LATIN AMERICA: AI ASSISTANT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 203 BRAZIL: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 204 BRAZIL: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 205 MEXICO: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 206 MEXICO: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ARGENTINA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 208 ARGENTINA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2020-2024 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: AI ASSISTANT MARKET, BY INTEGRATION TYPE, 2025-2030 (USD MILLION)

- TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY KEY AI ASSISTANT VENDORS, 2022-2025

- TABLE 212 AI ASSISTANT MARKET: DEGREE OF COMPETITION

- TABLE 213 AI ASSISTANT MARKET: REGIONAL FOOTPRINT

- TABLE 214 AI ASSISTANT MARKET: OFFERING FOOTPRINT

- TABLE 215 AI ASSISTANT MARKET: APPLICATION FOOTPRINT

- TABLE 216 AI ASSISTANT MARKET: END USER FOOTPRINT

- TABLE 217 AI ASSISTANT MARKET: KEY STARTUPS/SMES, 2024

- TABLE 218 AI ASSISTANT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 219 AI ASSISTANT MARKET: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 220 AI ASSISTANT MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 221 MICROSOFT: COMPANY OVERVIEW

- TABLE 222 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 MICROSOFT: PRODUCT LAUNCHES

- TABLE 224 MICROSOFT: DEALS

- TABLE 225 SALESFORCE: COMPANY OVERVIEW

- TABLE 226 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 SALESFORCE: PRODUCT LAUNCHES

- TABLE 228 SALESFORCE: DEALS

- TABLE 229 GOOGLE: COMPANY OVERVIEW

- TABLE 230 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 GOOGLE: PRODUCT LAUNCHES

- TABLE 232 GOOGLE: DEALS

- TABLE 233 SAP: COMPANY OVERVIEW

- TABLE 234 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 SAP: PRODUCT LAUNCHES

- TABLE 236 SAP: DEALS

- TABLE 237 ORACLE: COMPANY OVERVIEW

- TABLE 238 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 ORACLE: PRODUCT LAUNCHES

- TABLE 240 ORACLE: DEALS

- TABLE 241 ADOBE: COMPANY OVERVIEW

- TABLE 242 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 ADOBE: PRODUCT LAUNCHES

- TABLE 244 ADOBE: DEALS

- TABLE 245 AWS: COMPANY OVERVIEW

- TABLE 246 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 AWS: PRODUCT LAUNCHES

- TABLE 248 AWS: DEALS

- TABLE 249 CISCO: COMPANY OVERVIEW

- TABLE 250 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 CISCO: PRODUCT LAUNCHES

- TABLE 252 CISCO: DEALS

- TABLE 253 SERVICENOW: COMPANY OVERVIEW

- TABLE 254 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 SERVICENOW: PRODUCT LAUNCHES

- TABLE 256 SERVICENOW: DEALS

- TABLE 257 DROPBOX: COMPANY OVERVIEW

- TABLE 258 DROPBOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 DROPBOX: PRODUCT LAUNCHES

- TABLE 260 DROPBOX: DEALS

- TABLE 261 AI AGENTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 262 AI AGENTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 263 AI AGENTS MARKET, BY AGENT SYSTEM, 2020-2024 (USD MILLION)

- TABLE 264 AI AGENTS MARKET, BY AGENT SYSTEM, 2025-2030 (USD MILLION)

- TABLE 265 AI AGENTS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 266 AI AGENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 267 AI AGENTS MARKET, BY AGENT ROLE, 2020-2024 (USD MILLION)

- TABLE 268 AI AGENTS MARKET, BY AGENT ROLE, 2025-2030 (USD MILLION)

- TABLE 269 AI AGENTS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 270 AI AGENTS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 271 AI AGENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 272 AI AGENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 273 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD BILLION)

- TABLE 274 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025-2032 (USD BILLION)

- TABLE 275 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2024 (USD BILLION)

- TABLE 276 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025-2032 (USD BILLION)

- TABLE 277 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 278 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025-2032 (USD BILLION)

List of Figures

- FIGURE 1 AI ASSISTANT MARKET: RESEARCH DESIGN

- FIGURE 2 AI ASSISTANT MARKET: DATA TRIANGULATION

- FIGURE 3 AI ASSISTANT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM AI ASSISTANT PROVIDERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM KEY COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM BUSINESS UNITS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AI ASSISTANTS THROUGH OVERALL IT SPENDING

- FIGURE 8 WRITING & CONTENT ASSISTANTS SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 9 STANDALONE ASSISTANTS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 10 AI-POWERED WRITING & EDITING SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 11 ENTERPRISES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 12 PROFESSIONAL SERVICE PROVIDERS TO WITNESS HIGHEST GROWTH RATE IN END USER SEGMENT DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 14 RISING DIGITAL ECOSYSTEMS AND WORKFORCE UPSKILLING TO FUEL ASIA PACIFIC AI ASSISTANT DEMAND

- FIGURE 15 KNOWLEDGE RETRIEVAL & DOCUMENT SEARCH SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 WRITING & CONTENT ASSISTANTS AND AI-POWERED WRITING & EDITING TO BE LARGEST SHAREHOLDERS IN NORTH AMERICAN AI ASSISTANT MARKET IN 2025

- FIGURE 17 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 18 AI ASSISTANT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 EVOLUTION OF AI ASSISTANTS

- FIGURE 20 AI ASSISTANT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 KEY PLAYERS IN AI ASSISTANT MARKET ECOSYSTEM

- FIGURE 22 LEADING AI STARTUPS, BY FUNDING VALUE (MILLION) AND FUNDING ROUND, UNTIL 2025

- FIGURE 23 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 25 AI ASSISTANT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 KNOWLEDGE & RESEARCH ASSISTANTS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 API-BASED ASSISTANTS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 KNOWLEDGE RETRIEVAL & DOCUMENT SEARCH SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 INDIVIDUAL END USERS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 PROFESSIONAL SERVICE PROVIDERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- FIGURE 34 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 INDIA TO REGISTER HIGHEST GROWTH RATE IN AI ASSISTANT MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: AI ASSISTANT MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: AI ASSISTANT MARKET SNAPSHOT

- FIGURE 38 TOP 5 PUBLIC PLAYERS DOMINATED MARKET BETWEEN 2020 AND 2024

- FIGURE 39 SHARE OF LEADING COMPANIES IN AI ASSISTANT MARKET, 2024

- FIGURE 40 PRODUCT COMPARATIVE ANALYSIS, BY WRITING & CONTENT ASSISTANT PROVIDERS

- FIGURE 41 PRODUCT COMPARATIVE ANALYSIS, BY MEETING & COLLABORATION ASSISTANT PROVIDERS

- FIGURE 42 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 44 AI ASSISTANT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 AI ASSISTANT MARKET: COMPANY FOOTPRINT

- FIGURE 46 AI ASSISTANT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 48 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 49 GOOGLE: COMPANY SNAPSHOT

- FIGURE 50 SAP: COMPANY SNAPSHOT

- FIGURE 51 ORACLE: COMPANY SNAPSHOT

- FIGURE 52 ADOBE: COMPANY SNAPSHOT

- FIGURE 53 AWS: COMPANY SNAPSHOT

- FIGURE 54 CISCO: COMPANY SNAPSHOT

- FIGURE 55 SERVICENOW: COMPANY SNAPSHOT

- FIGURE 56 DROPBOX: COMPANY SNAPSHOT

The AI assistants market is projected to grow from USD 3.35 billion in 2025 to USD 21.11 billion by 2030 at a compound annual growth rate (CAGR) of 44.5% during the forecast period. The AI assistants market is rapidly expanding as the surge in plug-ins, APIs, and integration marketplaces empowers assistants to seamlessly connect with CRMs, ERPs, and countless niche SaaS tools. This growing orchestration capability helps enterprises unify fragmented workflows and automate repetitive tasks more effectively.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Integration Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

However, this growth is restrained by the reality of disconnected, legacy tech stacks that make it challenging to deploy AI assistants that operate smoothly across multiple systems without costly custom integrations. Balancing robust plug-in ecosystems with seamless interoperability remains crucial for driving true enterprise-wide adoption.

"BFSI Sector Leads AI Assistant Adoption to Drive Compliance, Efficiency, and Customer-centric Operations"

The Banking, Financial Services, and Insurance (BFSI) sector is expected to capture the largest share of the AI assistants market in 2025, driven by the industry's need to manage vast volumes of data, complex compliance processes, and customer interactions with greater efficiency. Leading banks and insurers are rapidly integrating intelligent assistants to automate tasks such as fraud detection, transaction monitoring, and regulatory reporting, which traditionally demand extensive manual effort. Many financial institutions are now deploying AI co-pilots to support relationship managers, streamline client onboarding, and generate tailored insights for wealth management and advisory services. The growth of digital-first banking, mobile apps, and remote advisory models has further accelerated the demand for conversational AI to handle routine queries, support secure transactions, and deliver personalized recommendations. AI-powered assistants help firms navigate strict privacy, security, and regulatory requirements by automating audit trails and maintaining compliance consistency across distributed teams. As BFSI organizations continue to invest in digital transformation and customer-centric innovations, AI assistants are becoming integral to improving service quality, operational resilience, and productivity, ultimately strengthening the sector's position as the largest adopter within the broader enterprise AI assistants market.

"API-based AI Assistants Drive Rapid Growth with Flexible, Scalable Integration Across Enterprise Workflows"

API-based AI assistants are projected to record the highest compound annual growth rate during the forecast period, as organizations increasingly prioritize flexible, modular integration frameworks to embed intelligence into diverse digital workflows. Unlike embedded or standalone assistants, API-first models allow enterprises to integrate conversational and generative capabilities directly into existing applications, custom portals, or proprietary platforms without costly re-architecture. This approach is especially popular among mid-to-large enterprises operating complex multi-vendor tech stacks, as it ensures seamless interoperability across CRMs, ERPs, document management systems, and industry-specific software. Leading technology providers and startups alike are expanding API marketplaces and developer toolkits that make it easier for IT teams to deploy and scale assistants for use cases such as contextual search, real-time summarization, and personalized task automation. The shift toward headless architecture and microservices has further strengthened the demand for API-based assistants, giving businesses granular control over where and how intelligence is applied. Additionally, sectors like BFSI, healthcare, and professional services are rapidly embracing API-driven AI to meet compliance requirements while customizing user experiences at scale.

"Asia Pacific to witness rapid AI assistants growth fueled by innovation and emerging technologies, while North America leads in market size"

Asia Pacific is poised to witness the fastest growth in the AI assistants market during the forecast period, driven by massive digital investments, growing tech talent pools, and supportive national AI strategies across countries in the region. Organizations across sectors such as banking, retail, and healthcare are actively experimenting with AI assistants to automate workflows, improve multilingual communication, and extend customer engagement beyond traditional channels. The rapid expansion of startups and local tech innovators is also fueling the development of regionally relevant AI assistants that address unique language, compliance, and cultural nuances. In contrast, North America is set to maintain its position as the largest market for AI assistants due to its mature enterprise cloud adoption, high investment in AI R&D, and the presence of leading technology vendors that continue to enhance AI integration in SaaS ecosystems. Companies in North America are also early adopters of industry-specific co-pilots embedded within productivity suites, CRM platforms, and knowledge management tools, helping to optimize complex operations and decision-making. With a strong focus on responsible AI and continuous improvement in governance frameworks, North American enterprises are accelerating the deployment of AI assistants across large, distributed teams and hybrid work environments. Together, these factors reinforce Asia Pacific's role as the fastest-growing market and North America's leadership in large-scale enterprise AI assistant deployment.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI assistants market.

- By Company: Tier I - 35%, Tier II - 45%, and Tier III - 20%

- By Designation: C Level - 35%, Director Level - 25%, and others - 40%

- By Region: North America - 42%, Europe - 20%, Asia Pacific - 25%, Middle East & Africa - 8%, and Latin America - 5%

The report includes a study of key players offering AI assistant solutions and services. It profiles major vendors in the AI assistants market. The major players in the AI assistants market include Microsoft (US), Google (US), Zoom (US), Salesforce (US), SAP (Germany), Oracle (US), Adobe (US), Dropbox (US), Box (US), Atlassian (Australia), Notion (US), Amazon (US), Cisco (US), ServiceNow (US), Asana (US), Monday.com (Israel), ClickUp (US), Miro (US), Grammarly (US), DocuSign (US), Lucid Software (US), Glean (US), Otter.ai (US), Fireflies.ai (US), Fathom (US), Scribe (US), Regie.ai (US), Tome (US), Gamma (US), Jasper (US), Copy.ai (US), Writer.com (US), Synthesia (UK), Beautiful.ai (US), Canva (Australia), Superhuman AI (US), Hiver (India), Supernormal (Sweden), HyperWrite (US), QuillBot (US), CopySmith (Canada), Abridge (US), Descript (US), Lumen5 (Canada), Runway (US), and Perplexity AI (US).

Research coverage

This research report covers the AI assistants market, which has been segmented based on offering, integration type, application, and end user. The offering segment consists of writing & content assistants, meeting & collaboration assistants, knowledge & research assistants, scheduling & calendar optimization assistants, sales & prospecting assistants, developer productivity assistants, presentation & design assistants, and analytical & spreadsheet assistants. The integration type segment consists of standalone assistants, SaaS-native assistants, browser extensions/plug-ins, API-based assistants, and workspace add-ons. The application segment includes AI-powered writing & editing, transcription & follow-up, knowledge retrieval & document search, scheduling & work prioritization, lead engagement & email sequencing, code completion & review, presentation & narrative design, data exploration & spreadsheet AI, and other applications. The end user segment consists of individual users and enterprises, which consist of BFSI, healthcare & life sciences, retail & ecommerce, technology providers, professional service providers, education, telecommunications, government & public sector, travel & hospitality, and other enterprises. The regional analysis of the AI assistants market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI assistants market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (modular deployment of AI assistants within SaaS platforms accelerating enterprise adoption, real-time behavioral and contextual data enables highly personalized user support, embedding AI-generated insights into enterprise tools unlocks continuous value creation, and context-aware assistants meet rising enterprise demand for intelligent task support), restraints (fragmented digital ecosystems hinder unified AI assistant experiences across tools, understanding unstructured data continues to limit assistant intelligence and adaptability), opportunities (low-code customization and multilingual support unlock broader enterprise adoption, proactive assistants that anticipate user needs unlock intelligent work orchestration, federated learning enables AI assistant personalization without compromising enterprise data privacy), and challenges (limits in generalization across roles and workflows restrict long-term scalability of AI assistants, rapid evolution of AI capabilities may outpace employee adaptation and organizational readiness).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the AI assistants market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the AI assistants market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI assistants market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like Microsoft (US), Google (US), Zoom (US), Salesforce (US), SAP (Germany), Oracle (US), Adobe (US), Dropbox (US), Box (US), Atlassian (Australia), Notion (US), Amazon (US), Cisco (US), ServiceNow (US), Asana (US), Monday.com (Israel), ClickUp (US), Miro (US), Grammarly (US), DocuSign (US), Lucid Software (US), Glean (US), Otter.ai (US), Fireflies.ai (US), Fathom (US), Scribe (US), Regie.ai (US), Tome (US), Gamma (US), Jasper (US), Copy.ai (US), Writer.com (US), Synthesia (UK), Beautiful.ai (US), Canva (Australia), Superhuman AI (US), Hiver (India), Supernormal (Sweden), HyperWrite (US), QuillBot (US), CopySmith (Canada), Abridge (US), Descript (US), Lumen5 (Canada), Runway (US), and Perplexity AI (US) among others in the AI assistants market. The report also helps stakeholders understand the pulse of the AI assistants market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AI ASSISTANT MARKET

- 4.2 AI ASSISTANT MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: AI ASSISTANT MARKET, BY OFFERING AND FUNCTIONALITY

- 4.4 AI ASSISTANT MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping AI Assistant: Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Modular deployment of AI assistants within SaaS platforms accelerating enterprise adoption

- 5.2.1.2 Real-time behavioral and contextual data enables highly personalized user support

- 5.2.1.3 Embedding AI-generated insights into enterprise tools unlocks continuous value creation

- 5.2.1.4 Context-aware assistants meet rising enterprise demand for intelligent task support

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented digital ecosystems hinder unified AI assistant experiences across tools

- 5.2.2.2 Understanding unstructured data continues to limit assistant intelligence and adaptability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Low-code customization and multilingual support unlock broader enterprise adoption

- 5.2.3.2 Proactive assistants that anticipate user needs unlock intelligent work orchestration

- 5.2.3.3 Federated learning enables AI assistant personalization without compromising enterprise data privacy

- 5.2.4 CHALLENGES

- 5.2.4.1 Limits in generalization across roles and workflows restrict long-term scalability of AI assistants

- 5.2.4.2 Rapid evolution of AI capabilities may outpace employee adaptation and organizational readiness

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AI ASSISTANTS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 WRITING & CONTENT ASSISTANT PROVIDERS

- 5.5.2 MEETING & COLLABORATION ASSISTANT PROVIDERS

- 5.5.3 KNOWLEDGE & RESEARCH ASSISTANT PROVIDERS

- 5.5.4 SALES & PROSPECTING ASSISTANT PROVIDERS

- 5.5.5 DEVELOPER PRODUCTIVITY ASSISTANT PROVIDERS

- 5.5.6 PRESENTATION & DESIGN ASSISTANT PROVIDERS

- 5.5.7 SCHEDULING & CALENDAR OPTIMIZATION ASSISTANTS

- 5.5.8 ANALYTICS & SPREADSHEET ASSISTANTS

- 5.6 AI ASSISTANT USAGE PATTERNS ACROSS DEPARTMENTS AND JOB ROLES

- 5.6.1 ROLE-BASED VALUE CREATION IS OUTPACING DEPARTMENT-CENTRIC ADOPTION

- 5.6.2 ASSISTANT USAGE DENSITY IS HIGHEST IN MID-LEVEL, TASK-SATURATED ROLES

- 5.6.3 AI ASSISTANT USAGE IS STRONGEST IN COMMUNICATION-HEAVY WORKFLOWS

- 5.7 WORKFLOW DISRUPTION ZONES: WHERE AI ASSISTANTS REPLACE LEGACY TOOLS

- 5.7.1 HIGH-ENTROPY WORKFLOWS ARE FIRST TO BE DISRUPTED

- 5.7.2 ASSISTANTS OUTPERFORM LEGACY TOOLS IN LATENCY, ADAPTABILITY, AND MODULARITY

- 5.7.3 VERTICAL-SPECIFIC DISRUPTIONS ARE UNLOCKING DEEPER VALUE

- 5.8 MONETIZATION MODELS OF AI ASSISTANTS

- 5.8.1 SAAS-NATIVE AND PLATFORM-EMBEDDED MONETIZATION

- 5.8.2 VERTICAL SAAS AND ROLE-SPECIFIC MONETIZATION STRATEGIES

- 5.8.3 API CONSUMPTION AND CUSTOM ASSISTANT DEPLOYMENT

- 5.9 PERSONA MAPPING

- 5.9.1 AI ASSISTANT BUYER PROFILE

- 5.9.2 PROCUREMENT TRENDS: EMBEDDED VS. STANDALONE VS. CUSTOM ASSISTANTS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 JASPER EMPOWERED CUSHMAN & WAKEFIELD TO SCALE REAL ESTATE CONTENT CREATION

- 5.11.2 REGIE.AI HELPED CRUNCHBASE BOOST PROSPECTING PERSONALIZATION AND OUTREACH

- 5.11.3 REPLIT ENABLED ZINUS TO ACCELERATE DEVELOPMENT CYCLES AND COLLABORATION

- 5.11.4 SCRIBE TRANSFORMED D300'S PROCESS DOCUMENTATION AND KNOWLEDGE SHARING

- 5.11.5 DESCRIPT SUPPORTS HUBSPOT IN STREAMLINING AUDIO AND VIDEO CONTENT PRODUCTION

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Large Language Models (LLMs)

- 5.12.1.2 Natural Language Processing (NLP)

- 5.12.1.3 Prompt Engineering & Optimization

- 5.12.1.4 Context Management Systems

- 5.12.1.5 Retrieval-augmented Generation (RAG)

- 5.12.1.6 Embedding Models

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Vector Databases

- 5.12.2.2 Automated Speech Recognition (ASR)

- 5.12.2.3 Fine-tuning and Adapter Training

- 5.12.2.4 Function Calling Interfaces

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Human-computer Interaction (HCI)

- 5.12.3.2 Semantic Search Algorithms

- 5.12.3.3 Conversational Memory Architectures

- 5.12.3.4 Latent Attention Mechanisms

- 5.12.1 KEY TECHNOLOGIES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATIONS

- 5.13.2.1 North America

- 5.13.2.1.1 California Consumer Privacy Act (CCPA)

- 5.13.2.1.2 California Privacy Rights Act (CPRA)

- 5.13.2.1.3 Children's Online Privacy Protection Act (COPPA)

- 5.13.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.13.2.1.5 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.13.2.1.6 Algorithmic Accountability Act (proposed)

- 5.13.2.2 Europe

- 5.13.2.2.1 General Data Protection Regulation (GDPR)

- 5.13.2.2.2 EU Artificial Intelligence Act

- 5.13.2.2.3 Digital Services Act (DSA)

- 5.13.2.2.4 Digital Markets Act (DMA)

- 5.13.2.2.5 AI Liability Directive (proposed)

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 Personal Information Protection Law (PIPL)

- 5.13.2.3.2 Administrative Provisions on Deep Synthesis Internet Information Services

- 5.13.2.3.3 Algorithmic Recommendation Regulation

- 5.13.2.3.4 Act on the Protection of Personal Information (APPI)

- 5.13.2.3.5 Personal Data Protection Act (PDPA)

- 5.13.2.3.6 Singapore Model AI Governance Framework

- 5.13.2.3.7 Digital Personal Data Protection Act (DPDP Act, 2023)

- 5.13.2.4 Middle East & Africa

- 5.13.2.4.1 UAE Federal Data Protection Law (2021)

- 5.13.2.4.2 UAE AI Ethics Guidelines

- 5.13.2.4.3 Personal Data Protection Law (PDPL) - Saudi Arabia

- 5.13.2.4.4 Protection of Personal Information Act (POPIA) - South Africa

- 5.13.2.5 Latin America

- 5.13.2.5.1 General Data Protection Law (LGPD)

- 5.13.2.5.2 Federal Law on Protection of Personal Data Held by Private Parties (LFPDPPP)

- 5.13.2.5.3 Personal Data Protection Law (PDPL)

- 5.13.2.1 North America

- 5.14 PATENT ANALYSIS

- 5.14.1 METHODOLOGY

- 5.14.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.14.3 INNOVATION AND PATENT APPLICATIONS

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.15.2 AVERAGE SELLING PRICE, BY APPLICATION, 2025

- 5.16 KEY CONFERENCES AND EVENTS

- 5.17 PORTER'S FIVE FORCES ANALYSIS

- 5.17.1 THREAT OF NEW ENTRANTS

- 5.17.2 THREAT OF SUBSTITUTES

- 5.17.3 BARGAINING POWER OF SUPPLIERS

- 5.17.4 BARGAINING POWER OF BUYERS

- 5.17.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 AI ASSISTANT MARKET, BY OFFERING (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across AI Assistant Offerings

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AI ASSISTANT MARKET, BY OFFERING

- 6.2 WRITING & CONTENT ASSISTANTS

- 6.2.1 EMPOWERING PROFESSIONAL WRITING WITH AI DRIVEN CONTENT ASSISTANTS

- 6.3 MEETING & COLLABORATION ASSISTANTS

- 6.3.1 ACCELERATING TEAM PRODUCTIVITY WITH AI POWERED MEETING ASSISTANTS

- 6.4 KNOWLEDGE & RESEARCH ASSISTANTS

- 6.4.1 UNLOCKING ENTERPRISE KNOWLEDGE WITH CONTEXTUAL AI RESEARCH ASSISTANTS

- 6.5 SCHEDULING & CALENDAR OPTIMIZATION ASSISTANTS

- 6.5.1 REVOLUTIONIZING TIME MANAGEMENT WITH SMART SCHEDULING ASSISTANTS

- 6.6 SALES & PROSPECTING ASSISTANTS

- 6.6.1 DRIVING REVENUE WITH AI ENHANCED SALES AND PROSPECTING ASSISTANTS

- 6.7 DEVELOPER PRODUCTIVITY ASSISTANTS

- 6.7.1 ACCELERATING CODE CREATION WITH AI POWERED DEVELOPER ASSISTANTS

- 6.8 PRESENTATION & DESIGN ASSISTANTS

- 6.8.1 CREATING VISUAL NARRATIVES WITH AI DRIVEN PRESENTATION ASSISTANTS

- 6.9 ANALYTICAL & SPREADSHEET ASSISTANTS

- 6.9.1 UNLOCKING DATA INSIGHTS WITH AI ENHANCED SPREADSHEET ASSISTANTS

7 AI ASSISTANT MARKET, BY INTEGRATION TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across AI Assistant Integration Types

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AI ASSISTANT MARKET, BY INTEGRATION TYPE

- 7.2 STANDALONE ASSISTANTS

- 7.2.1 STANDALONE ASSISTANTS DELIVER INDEPENDENT AI CAPABILITIES

- 7.3 SAAS-NATIVE ASSISTANTS

- 7.3.1 SAAS-NATIVE ASSISTANTS EMBED AI INTO CORE PLATFORMS

- 7.4 BROWSER EXTENSIONS/PLUG-INS

- 7.4.1 BROWSER EXTENSIONS AND PLUG INS ENHANCE IN APP ASSISTANCE

- 7.5 API-BASED ASSISTANTS

- 7.5.1 API BASED ASSISTANTS POWER CUSTOM INTEGRATIONS

- 7.6 WORKSPACE ADD-ONS

- 7.6.1 WORKSPACE ADD ONS UNITE COLLABORATION AND AI ASSISTANCE

8 AI ASSISTANT MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across AI Assistant Applications

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AI ASSISTANT MARKET, BY APPLICATION

- 8.2 AI-POWERED WRITING & EDITING

- 8.2.1 CONTEXT MANAGEMENT TRACKS DOCUMENT HISTORY AND RECENT EDITS, AND HELPS MAINTAIN CONSISTENCY

- 8.3 MEETING TRANSCRIPTION & FOLLOW-UP

- 8.3.1 RETRIEVAL-AUGMENTED GENERATION ENSURES SUMMARIES REFERENCE RELEVANT DOCUMENTS, SLIDE DECKS, OR MEETING NOTES

- 8.4 KNOWLEDGE RETRIEVAL & DOCUMENT SEARCH

- 8.4.1 CONTEXT MANAGEMENT TRACKS INDIVIDUAL USER PROFILES AND PAST QUERIES, TAILORING RESULT RELEVANCE OVER TIME

- 8.5 SCHEDULING & WORK PRIORITIZATION

- 8.5.1 TRANSFORMING PASSIVE SCHEDULES INTO INTELLIGENT, SELF-OPTIMIZING AGENDAS

- 8.6 LEAD ENGAGEMENT & EMAIL SEQUENCING

- 8.6.1 FUNCTION-CALLING APIS AUTOMATE TASKS SUCH AS CREATING CALL ENTRIES, LOGGING MEETING OUTCOMES, OR SENDING CONTRACTS

- 8.7 CODE COMPLETION & REVIEW

- 8.7.1 DEVELOPERS RECEIVE UNIT-TEST SCAFFOLDING, PERFORMANCE OPTIMIZATION SUGGESTIONS, AND SECURITY VULNERABILITY ALERTS

- 8.8 PRESENTATION & NARRATIVE DESIGN

- 8.8.1 GENERATIVE VISION-LANGUAGE MODELS UNDERSTAND DESIGN PRINCIPLES, TYPOGRAPHY, LAYOUT, AND COLOR HARMONY

- 8.9 DATA EXPLORATION & SPREADSHEET AI

- 8.9.1 ASSISTANTS HELP GENERATE FORMULAS, PIVOT TABLES, OR CHARTS AUTOMATICALLY

- 8.10 OTHER APPLICATIONS

9 AI ASSISTANT MARKET, BY END USER (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

End user-specific market sizing, growth, and key trends

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AI ASSISTANT MARKET, BY END USER

- 9.2 INDIVIDUAL END USERS

- 9.3 ENTERPRISES

- 9.3.1 BFSI

- 9.3.1.1 AI assistants automate workflows and improve compliance to modernize financial operations and customer engagement

- 9.3.2 TELECOMMUNICATIONS

- 9.3.2.1 AI assistants reduce service friction and enable personalized support across omnichannel telecom environments

- 9.3.3 GOVERNMENT & PUBLIC SECTOR

- 9.3.3.1 AI assistants enhance citizen service delivery and improve operational transparency across public sector functions

- 9.3.4 HEALTHCARE & LIFE SCIENCES

- 9.3.4.1 Intelligent assistants streamline clinical support and administrative tasks while ensuring patient-centric and secure operations

- 9.3.5 MANUFACTURING

- 9.3.5.1 AI assistants optimize frontline operations and decision-making across design, production, and maintenance workflows

- 9.3.6 MEDIA & ENTERTAINMENT

- 9.3.6.1 Content-focused AI assistants streamline creation, curation, and audience engagement across digital media workflows

- 9.3.7 RETAIL & E-COMMERCE

- 9.3.7.1 AI assistants personalize customer journeys and automate backend operations to drive digital retail transformation

- 9.3.8 TECHNOLOGY PROVIDERS

- 9.3.8.1 AI assistants accelerate innovation cycles and enhance product support across engineering and customer success teams

- 9.3.9 PROFESSIONAL SERVICE PROVIDERS

- 9.3.9.1 AI assistants enhance productivity and client service by automating documentation, research, and knowledge retrieval

- 9.3.10 EDUCATION

- 9.3.10.1 AI assistants support personalized learning, administrative automation, and faculty enablement in digital learning environments

- 9.3.11 OTHER ENTERPRISES

- 9.3.1 BFSI

10 AI ASSISTANT MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Regional market sizing, forecasts, and regulatory landscapes

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AI ASSISTANT MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.4 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: AI ASSISTANT MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.4 GERMANY

- 10.3.5 FRANCE

- 10.3.6 ITALY

- 10.3.7 SPAIN

- 10.3.8 NETHERLANDS

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AI ASSISTANT MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.4 INDIA

- 10.4.5 JAPAN

- 10.4.6 SOUTH KOREA

- 10.4.7 SINGAPORE

- 10.4.8 AUSTRALIA & NEW ZEALAND

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AI ASSISTANT MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.4 UAE

- 10.5.5 QATAR

- 10.5.6 TURKEY

- 10.5.7 SOUTH AFRICA

- 10.5.8 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AI ASSISTANT MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.4 MEXICO

- 10.6.5 ARGENTINA

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS, BY WRITING & CONTENT ASSISTANT PROVIDERS

- 11.5.1.1 Grammarly (GrammarlyGO)

- 11.5.1.2 Notion (Notion AI)

- 11.5.1.3 Jasper (Jasper AI)

- 11.5.1.4 Copy.ai (Copy.ai Assistant)

- 11.5.1.5 QuillBot (QuillBot AI)

- 11.5.2 PRODUCT COMPARATIVE ANALYSIS, BY MEETING & COLLABORATION ASSISTANT PROVIDERS

- 11.5.2.1 Otter.ai (Otter Assistant)

- 11.5.2.2 Fireflies.ai (Fireflies AI Notetaker)

- 11.5.2.3 Zoom (Zoom AI Companion)

- 11.5.2.4 Fathom (Fathom AI Meeting Assistant)

- 11.5.2.5 Supernormal (Supernormal AI Notes)

- 11.5.2.6 Scribe AI (Scribe)

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS, BY WRITING & CONTENT ASSISTANT PROVIDERS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Regional footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End User Footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 MICROSOFT

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 SALESFORCE

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 GOOGLE

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 SAP

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 ORACLE

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 ADOBE

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches

- 12.2.6.3.2 Deals

- 12.2.7 AWS

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product launches

- 12.2.7.3.2 Deals

- 12.2.8 CISCO

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches

- 12.2.8.3.2 Deals

- 12.2.9 SERVICENOW

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Product launches

- 12.2.9.3.2 Deals

- 12.2.10 DROPBOX

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Product launches

- 12.2.10.3.2 Deals

- 12.2.11 ZOOM

- 12.2.12 BOX

- 12.2.13 ATLASSIAN

- 12.2.14 NOTION

- 12.2.15 ASANA

- 12.2.16 MONDAY.COM

- 12.2.17 CLICKUP

- 12.2.18 MIRO

- 12.2.19 GRAMMARLY

- 12.2.20 DOCUSIGN

- 12.2.21 LUCID SOFTWARE

- 12.2.22 GAMMA

- 12.2.23 CANVA

- 12.2.1 MICROSOFT

- 12.3 STARTUPS/SMES

- 12.3.1 GLEAN

- 12.3.2 OTTER.AI

- 12.3.3 FIREFLIES.AI

- 12.3.4 FATHOM

- 12.3.5 SCRIBE AI

- 12.3.6 TOME

- 12.3.7 JASPER

- 12.3.8 COPY.AI

- 12.3.9 WRITER.COM

- 12.3.10 SYNTHESIA

- 12.3.11 BEAUTIFUL.AI

- 12.3.12 HIVER

- 12.3.13 SUPERNORMAL

- 12.3.14 HYPERWRITE

- 12.3.15 QUILLBOT

- 12.3.16 COPYSMITH

- 12.3.17 ABRIDGE

- 12.3.18 DESCRIPT

- 12.3.19 LUMEN5

- 12.3.20 RUNWAY

- 12.3.21 PERPLEXITY AI

- 12.3.22 REGIE.AI

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 AI AGENTS MARKET - GLOBAL FORECAST TO 2030

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 AI agents market, by offering

- 13.2.2.2 AI agents market, by agent system

- 13.2.2.3 AI agents market, by product type

- 13.2.2.4 AI agents market, by agent role

- 13.2.2.5 AI agents market, by end user

- 13.2.2.6 AI agents market, by region

- 13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence (AI) market, by business function

- 13.3.2.2 Artificial intelligence (AI) market, by end user

- 13.3.2.3 Artificial intelligence (AI) market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS