|

|

市場調査レポート

商品コード

1796191

変圧器の世界市場:タイプ別、冷却タイプ別、定格電力別、相別、絶縁別、エンドユーザー別、地域別 - 予測(~2030年)Transformer Market by Type, Coooling Type, Power Rating, Phase, Insulation, End User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 変圧器の世界市場:タイプ別、冷却タイプ別、定格電力別、相別、絶縁別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月15日

発行: MarketsandMarkets

ページ情報: 英文 351 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

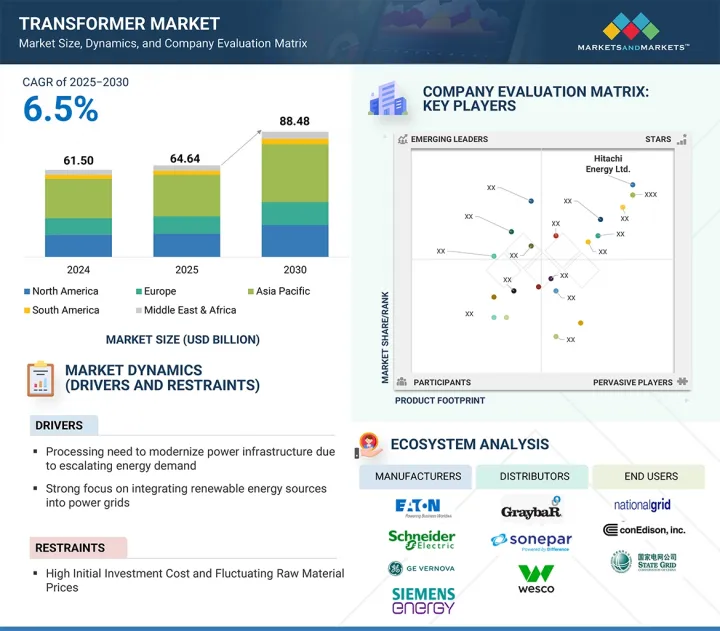

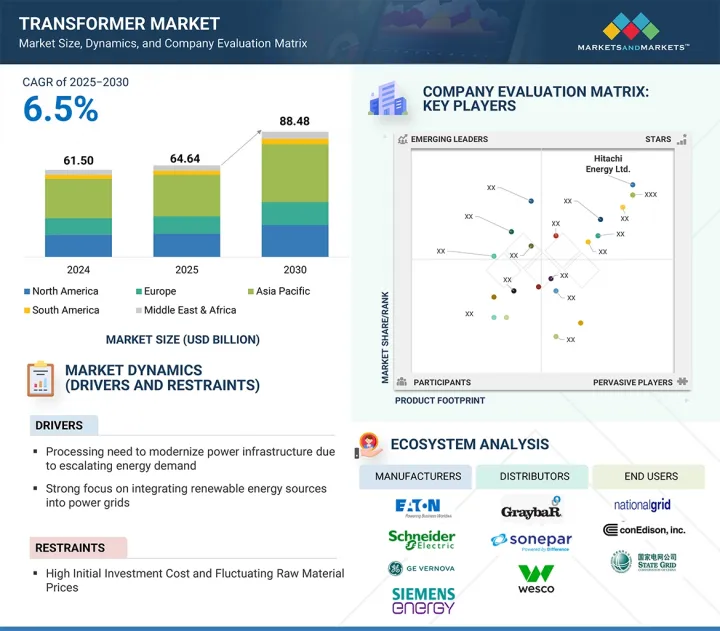

世界の変圧器の市場規模は、2025年の646億4,000万米ドルから2030年までに884億8,000万米ドルに達すると推定され、CAGRで6.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万/10億米ドル)、数量(1,000台) |

| セグメント | タイプ、冷却タイプ、定格電力、相、断熱材、エンドユーザー |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

この成長は、新興経済圏と先進経済圏における電力消費の増加、送電網インフラの近代化に対する大規模投資、再生可能エネルギー源の加速的統合の組み合わせによって促進されています。各国が気候変動目標の達成とエネルギーアクセスの向上を目指す中、高効率でスマート、かつ環境的に持続可能な変圧器の需要が急速に拡大しています。さらに、都市化やデータセンターの建設、輸送と工業の電化の急増が、信頼性の高い先進の変圧器技術の必要性をさらに高めています。

「タイプ別では、電力用変圧器が2024年に変圧器市場で最大のシェアを占めました。」

主に高圧送電網の世界的な拡大と強化により、電力用変圧器がタイプ別で変圧器市場の最大のシェアを占めました。各国が大規模太陽光発電所、風力発電所、水力発電所、火力発電所などの発電源から都市部の負荷センターまでの一括送電に投資しているため、高電圧の長距離送電に対応できる電力用変圧器の需要が増え続けています。さらに、先進地域では送電網インフラの老朽化が、新興経済圏では野心的な送電網拡張計画が、大幅な交換と新設を促しています。特にアジア太平洋、欧州、アフリカなどの地域では、地域間および国境を越えた電力取引への移行が進んでおり、大型の効率的な大容量変圧器へのニーズがさらに高まっています。

「定格電力別では、中電力セグメントが予測期間に最速の成長を示します。」

中電力(10.1~100MVA)は、工業施設、再生可能エネルギープロジェクト、都市部の変電所、大型複合商業施設など、幅広い部門にわたるそのさまざまな用途により、定格電力別でもっとも急成長するセグメントとなる見込みです。経済圏の工業化とインフラの近代化が進むにつれて、送電システムと配電システムの橋渡しをする中高圧ネットワークをサポートする中電力変圧器の展開が増えています。太陽光発電所や風力発電所(特に分散型)の急速な増加も、この定格範囲の変圧器の需要を促進しています。さらに、政府が支援する都市電化やスマートグリッドの取り組みでは、性能、コスト、拡張性のバランスが最適であることから、中電力変圧器の支持が高まっています。

「北米が予測期間に変圧器市場で2番目に急成長する地域となります。」

北米は、送電網の近代化、老朽化したインフラの交換、再生可能エネルギー源の統合に向けた多額の投資により、予測期間に変圧器市場で2番目に急成長する地域となる可能性が高いです。米国とカナダは、信頼性を向上させ、電気自動車(EV)の普及を支援し、屋上ソーラーや蓄電池などの分散型エネルギー資源に対応するため、送配電網のアップグレードを進めています。米国のInfrastructure Investment and Jobs ActやカナダのClean Electricity Regulationsなどの連邦政府の取り組みにより、デジタルモデルや環境効率の高いモデルなど、先進の変圧器技術の展開が加速しています。さらに、この地域ではデータセンターの設置面積が拡大し、交通機関や工業部門の電化が進んでいるため、高性能でレジリエントな変圧器の需要がさらに高まっています。

当レポートでは、世界の変圧器市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 変圧器市場の企業にとって魅力的な機会

- 変圧器市場:地域別

- アジア太平洋の変圧器市場:タイプ別、国別

- 変圧器市場:タイプ別

- 変圧器市場:冷却タイプ別

- 変圧器市場:定格電力別

- 変圧器市場:相別

- 変圧器市場:絶縁別

- 変圧器市場:エンドユーザー別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 変圧器の価格帯:タイプ別(2024年)

- 変圧器の価格帯:定格電力別(2024年)

- 変圧器の平均販売価格の動向:地域別(2021年~2024年)

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード8504)

- 輸出シナリオ(HSコード8504)

- 2025年 - 主な会議とイベント(2026年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 規制と規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

- EASYDRY技術を利用したブッシングの信頼性、安全性、環境リスクへの対応

- TXPERT HUBによるグリッドのレジリエンスと変圧器の健全性の最適化

- TVP技術による変圧器の寿命とグリッドの信頼性の保護

- 変圧器市場に対する生成AI/AIの影響

- 変圧器市場における生成AI/AIの採用

- 変圧器市場に対する生成AI/AIの影響:地域別

- 変圧器市場のマクロ経済的見通し

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- エンドユーザーに対する影響

第6章 変圧器市場:タイプ別

- イントロダクション

- 電力用変圧器

- 配電用変圧器

- 計器用変圧器

- 特殊変圧器

第7章 変圧器市場:冷却タイプ別

- イントロダクション

- 油冷

- 空冷

第8章 変圧器市場:定格電力別

- イントロダクション

- 低

- 中

- 高

第9章 変圧器市場:相別

- イントロダクション

- 三相

- 単相

第10章 変圧器市場:絶縁別

- イントロダクション

- 油

- 固体

- ガス

- 空気

第11章 変圧器市場:エンドユーザー別

- イントロダクション

- 電力企業

- 工業

- 住宅・商業施設

- データセンター

- その他のエンドユーザー

第12章 変圧器市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- 英国

- フランス

- スペイン

- その他の欧州

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2022年~2025年)

- 市場シェア分析(2024年)

- 収益分析、2020年 - 2024年

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- HITACHI ENERGY LTD.

- SIEMENS ENERGY

- EATON

- GE VERNOVA

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- SCHNEIDER ELECTRIC

- ABB

- MITSUBISHI ELECTRIC CORPORATION

- BHARAT HEAVY ELECTRICALS LIMITED

- HD HYUNDAI ELECTRIC CO., LTD.

- HUBBELL

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- HYOSUNG HEAVY INDUSTRIES

- FUJI ELECTRIC CO., LTD.

- WEG

- LS ELECTRIC CO., LTD.

- ARTECHE GROUP

- KONCAR D.D.

- JSHP TRANSFORMER

- TBEA

- その他の企業

- CHINA XD GROUP

- VOLTAMP TRANSFORMER

- MEIDENSHA CORPORATION

- ORMAZABAL

- HENAN HENGYU ELECTRIC GROUP CO., LTD.

第15章 付録

List of Tables

- TABLE 1 TRANSFORMER MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 EXPERTS IN PRIMARY INTERVIEWS, BY COMPANY AND ROLE

- TABLE 4 TRANSFORMER MARKET SEGMENTATION, ESTIMATION, AND FORECASTING

- TABLE 5 TRANSFORMER MARKET SNAPSHOT

- TABLE 6 PRICING RANGE OF TRANSFORMERS, BY TYPE, 2024, (USD/UNIT)

- TABLE 7 PRICING RANGE OF TRANSFORMERS, BY POWER RATING, 2024, (USD/UNIT)

- TABLE 8 AVERAGE SELLING PRICE TREND OF TRANSFORMERS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 9 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 LIST OF MAJOR PATENTS PERTAINING TO TRANSFORMER MARKET, 2022-2025

- TABLE 11 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 TRANSFORMER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 IMPORT TARIFF FOR HS CODE 8504-COMPLIANT PRODUCTS, 2024

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 TRANSFORMER MARKET: CODES AND REGULATIONS

- TABLE 21 TRANSFORMER MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 22 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 23 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 25 EFFECTIVE TARIFFS ON LOW-VOLTAGE TRANSFORMER COMPONENTS (HS CODE 853690)

- TABLE 26 ANTICIPATED CHANGES IN PRICES AND POTENTIAL IMPACT ON END USERS DUE TO TARIFF IMPACT

- TABLE 27 TRANSFORMER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 TRANSFORMER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 POWER TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 POWER TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 DISTRIBUTION TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 DISTRIBUTION TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 INSTRUMENT TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 INSTRUMENT TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SPECIALTY TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 SPECIALTY TRANSFORMER: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 TRANSFORMER MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 38 TRANSFORMER MARKET, BY COOLING TYPE, 2025-2030 (USD MILLION)

- TABLE 39 OIL-COOLED: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 OIL-COOLED: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 AIR-COOLED: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 AIR-COOLED: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 TRANSFORMER MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 44 TRANSFORMER MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 45 LOW: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 LOW: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 MEDIUM: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 MEDIUM: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 HIGH: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 HIGH: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 52 TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 53 THREE-PHASE: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 THREE-PHASE: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SINGLE-PHASE: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 SINGLE-PHASE: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 TRANSFORMER MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 58 TRANSFORMER MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 59 OIL: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 OIL: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 SOLID: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 SOLID: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 GAS: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 GAS: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 AIR: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 AIR: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 68 TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 69 POWER UTILITIES: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 POWER UTILITIES: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 INDUSTRIAL: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 INDUSTRIAL: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 RESIDENTIAL & COMMERCIAL: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 RESIDENTIAL & COMMERCIAL: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 DATA CENTERS: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 DATA CENTERS: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OTHER END USERS: TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 OTHER END USERS: TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 TRANSFORMER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 TRANSFORMER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 TRANSFORMER MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 82 TRANSFORMER MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 83 ASIA PACIFIC: TRANSFORMER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: TRANSFORMER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: TRANSFORMER MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 86 ASIA PACIFIC: TRANSFORMER MARKET, BY COOLING TYPE, 2025-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: TRANSFORMER MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 88 ASIA PACIFIC: TRANSFORMER MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 90 ASIA PACIFIC: TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: TRANSFORMER MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: TRANSFORMER MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 94 ASIA PACIFIC: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 CHINA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 98 CHINA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 99 INDIA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 100 INDIA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 JAPAN: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 102 JAPAN: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 103 AUSTRALIA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 104 AUSTRALIA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: TRANSFORMER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: TRANSFORMER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: TRANSFORMER MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: TRANSFORMER MARKET, BY COOLING TYPE, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: TRANSFORMER MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: TRANSFORMER MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: TRANSFORMER MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: TRANSFORMER MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 US: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 122 US: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 CANADA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 124 CANADA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 MEXICO: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 126 MEXICO: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: TRANSFORMER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: TRANSFORMER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: TRANSFORMER MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: TRANSFORMER MARKET, BY COOLING TYPE, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: TRANSFORMER MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: TRANSFORMER MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: TRANSFORMER MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: TRANSFORMER MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 GERMANY: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 142 GERMANY: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 ITALY: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 144 ITALY: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 145 UK: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 146 UK: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 147 FRANCE: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 148 FRANCE: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 SPAIN: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 150 SPAIN: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 REST OF EUROPE: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 152 REST OF EUROPE: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY COOLING TYPE, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 GCC: TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 GCC: TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 GCC: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 170 GCC: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 171 SAUDI ARABIA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 172 SAUDI ARABIA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 173 UAE: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 174 UAE: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 175 REST OF GCC: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 176 REST OF GCC: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177 SOUTH AFRICA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 178 SOUTH AFRICA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: TRANSFORMER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: TRANSFORMER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AMERICA: TRANSFORMER MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: TRANSFORMER MARKET, BY COOLING TYPE, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: TRANSFORMER MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 186 SOUTH AMERICA: TRANSFORMER MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 187 SOUTH AMERICA: TRANSFORMER MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: TRANSFORMER MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: TRANSFORMER MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: TRANSFORMER MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 192 SOUTH AMERICA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: TRANSFORMER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: TRANSFORMER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 195 BRAZIL: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 196 BRAZIL: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 197 ARGENTINA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 198 ARGENTINA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: TRANSFORMER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: TRANSFORMER MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 201 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2022-JULY 2025

- TABLE 202 TRANSFORMER MARKET: DEGREE OF COMPETITION

- TABLE 203 TRANSFORMER MARKET: REGION FOOTPRINT

- TABLE 204 TRANSFORMER MARKET: TYPE FOOTPRINT

- TABLE 205 TRANSFORMER MARKET: COOLING TYPE FOOTPRINT

- TABLE 206 TRANSFORMER MARKET: PHASE FOOTPRINT

- TABLE 207 TRANSFORMER MARKET: END USER FOOTPRINT

- TABLE 208 TRANSFORMER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 209 SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 210 TRANSFORMER MARKET: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 211 TRANSFORMER MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 212 TRANSFORMER MARKET: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 213 TRANSFORMER MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 214 HITACHI ENERGY LTD.: COMPANY OVERVIEW

- TABLE 215 HITACHI ENERGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 HITACHI ENERGY LTD.: PRODUCT LAUNCHES

- TABLE 217 HITACHI ENERGY LTD.: DEALS

- TABLE 218 HITACHI ENERGY LTD.: EXPANSIONS

- TABLE 219 HITACHI ENERGY LTD.: OTHER DEVELOPMENTS

- TABLE 220 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 221 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 SIEMENS ENERGY: PRODUCT LAUNCHES

- TABLE 223 SIEMENS ENERGY: OTHER DEVELOPMENTS

- TABLE 224 EATON: COMPANY OVERVIEW

- TABLE 225 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 EATON: DEALS

- TABLE 227 EATON: EXPANSIONS

- TABLE 228 EATON: OTHER DEVELOPMENTS

- TABLE 229 GE VERNOVA: COMPANY OVERVIEW

- TABLE 230 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 GE VERNOVA: PRODUCT LAUNCHES

- TABLE 232 GE VERNOVA: DEALS

- TABLE 233 GE VERNOVA: EXPANSIONS

- TABLE 234 GE VERNOVA: OTHER DEVELOPMENTS

- TABLE 235 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 236 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: DEVELOPMENTS

- TABLE 238 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 239 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 241 SCHNEIDER ELECTRIC: DEALS

- TABLE 242 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 243 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 244 ABB: COMPANY OVERVIEW

- TABLE 245 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 ABB: PRODUCT LAUNCHES

- TABLE 247 ABB: DEALS

- TABLE 248 ABB: EXPANSIONS

- TABLE 249 ABB: OTHER DEVELOPMENTS

- TABLE 250 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 251 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 253 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 254 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW

- TABLE 255 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 256 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCT LAUNCHES

- TABLE 257 BHARAT HEAVY ELECTRICALS LIMITED: EXPANSIONS

- TABLE 258 BHARAT HEAVY ELECTRICALS LIMITED: OTHER DEVELOPMENTS

- TABLE 259 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 260 HD HYUNDAI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 HD HYUNDAI ELECTRIC CO., LTD.: DEVELOPMENTS

- TABLE 262 HUBBELL: COMPANY OVERVIEW

- TABLE 263 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 HUBBELL: DEALS

- TABLE 265 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 266 CG POWER & INDUSTRIAL SOLUTIONS LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 267 CG POWER & INDUSTRIAL SOLUTIONS LTD.: DEALS

- TABLE 268 CG POWER & INDUSTRIAL SOLUTIONS LTD.: EXPANSIONS

- TABLE 269 CG POWER & INDUSTRIAL SOLUTIONS LTD.: OTHER DEVELOPMENTS

- TABLE 270 HYOSUNG HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 271 HYOSUNG HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 HYUSONG HEAVY INDUSTRIES: EXPANSIONS

- TABLE 273 HYOSUNG HEAVY INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 274 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 275 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 FUJI ELECTRIC CO., LTD.: DEVELOPMENTS

- TABLE 277 WEG: COMPANY OVERVIEW

- TABLE 278 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 WEG: EXPANSIONS

- TABLE 280 WEG: OTHER DEVELOPMENTS

- TABLE 281 LS ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 282 LS ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 LS ELECTRIC CO.,LTD.: DEALS

- TABLE 284 LS ELECTRIC CO., LTD.: EXPANSIONS

- TABLE 285 LS ELECTRIC CO., LTD.: OTHER DEVELOPMENTS

- TABLE 286 ARTECHE GROUP: COMPANY OVERVIEW

- TABLE 287 ARTECHE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 KONCAR D.D.: COMPANY OVERVIEW

- TABLE 289 KONCAR D.D.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 KONCAR D.D.: DEALS

- TABLE 291 KONCAR D.D.: OTHER DEVELOPMENTS

- TABLE 292 JSPH TRANSFORMER: COMPANY OVERVIEW

- TABLE 293 JSHP TRANSFORMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 TBEA: COMPANY OVERVIEW

- TABLE 295 TBEA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 TRANSFORMER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TRANSFORMER MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 DATA CAPTURED THROUGH SECONDARY SOURCES

- FIGURE 5 INFORMATION SOURCED FROM PRIMARY INTERVIEWS

- FIGURE 6 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR TRANSFORMERS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 APPROACH FOR REGIONAL TRANSFORMER MARKET ASSESSMENT

- FIGURE 11 PROCESS FLOW TO ESTIMATE MARKET SIZE

- FIGURE 12 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF TRANSFORMERS

- FIGURE 13 TRANSFORMER MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 14 ASIA PACIFIC DOMINATED TRANSFORMER MARKET IN 2024

- FIGURE 15 POWER TRANSFORMER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 16 OIL-COOLED SEGMENT TO SECURE LARGER MARKET SHARE IN 2030

- FIGURE 17 TRANSFORMERS WITH LOW POWER RATINGS TO LEAD MARKET IN 2025

- FIGURE 18 THREE-PHASE TRANSFORMERS TO CAPTURE PROMINENT MARKET SHARE IN 2025

- FIGURE 19 OIL-INSULATED TRANSFORMERS TO GRAB MAJORITY OF MARKET SHARE IN 2025

- FIGURE 20 POWER UTILITIES TO OCCUPY LEADING POSITION IN TRANSFORMER MARKET IN 2025

- FIGURE 21 GRID MODERNIZATION AND RENEWABLE ENERGY EXPANSION PROJECTS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 22 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN TRANSFORMER MARKET DURING FORECAST PERIOD

- FIGURE 23 POWER TRANSFORMER SEGMENT AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC TRANSFORMER MARKET IN 2024

- FIGURE 24 POWER TRANSFORMERS TO HOLD DOMINANT MARKET POSITION IN 2030

- FIGURE 25 OIL-COOLED TRANSFORMERS TO EXERT MARKET DOMINANCE IN 2030

- FIGURE 26 TRANSFORMERS WITH LOW POWER RATINGS TO HOLD DOMINANT MARKET POSITION IN 2030

- FIGURE 27 THREE-PHASE TRANSFORMERS TO HOLD COMMANDING POSITION IN 2030

- FIGURE 28 OIL-IMMERSED TRANSFORMERS TO MAINTAIN SUPREMACY IN 2030

- FIGURE 29 POWER UTILITIES TO BE KEY END USERS OF TRANSFORMERS IN 2030

- FIGURE 30 TRANSFORMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 31 HISTORICAL AND PROJECTED GROWTH IN TOTAL ELECTRICITY GENERATION, BY REGION, 2010-2050

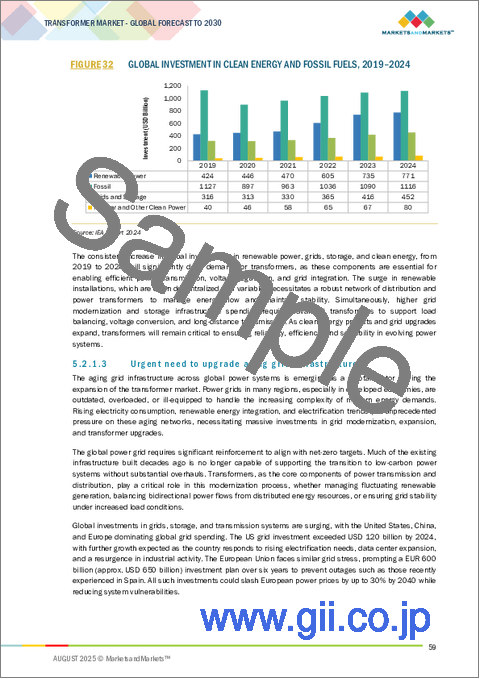

- FIGURE 32 GLOBAL INVESTMENT IN CLEAN ENERGY AND FOSSIL FUELS, 2019-2024

- FIGURE 33 INVESTMENT IN POWER GRIDS AND ENERGY STORAGE SYSTEMS, BY REGION, 2017-2024

- FIGURE 34 GLOBAL INVESTMENT IN CLEAN ENERGY, 2017-2024

- FIGURE 35 AVERAGE ANNUAL COPPER PRICE, 2017-2025

- FIGURE 36 AVERAGE ANNUAL INVESTMENT SPENDING ON ELECTRICITY GRIDS IN NET ZERO SCENARIO, 2015-2030

- FIGURE 37 GLOBAL CO2 EMISSIONS FROM ELECTRICITY GENERATION, 2014-2026

- FIGURE 38 TRENDS/DISRUPTIONS INFLUENCING TRANSFORMER PROVIDERS AND THEIR CLIENTS

- FIGURE 39 AVERAGE SELLING PRICE TREND OF TRANSFORMERS, BY REGION, 2021-2024

- FIGURE 40 TRANSFORMER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 41 TRANSFORMER MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 42 TRANSFORMER MARKET: PATENTS GRANTED AND APPLIED, 2014-2025

- FIGURE 43 IMPORT SCENARIO FOR HS CODE 8504-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 44 EXPORT SCENARIO FOR HS CODE 8504-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 45 TRANSFORMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 46 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 47 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 48 INVESTMENT AND FUNDING SCENARIO

- FIGURE 49 IMPACT OF GEN AI/AI ON TRANSFORMER MARKET, BY REGION

- FIGURE 50 TRANSFORMER MARKET SHARE, BY TYPE, 2024

- FIGURE 51 TRANSFORMER MARKET SHARE, BY COOLING TYPE, 2024

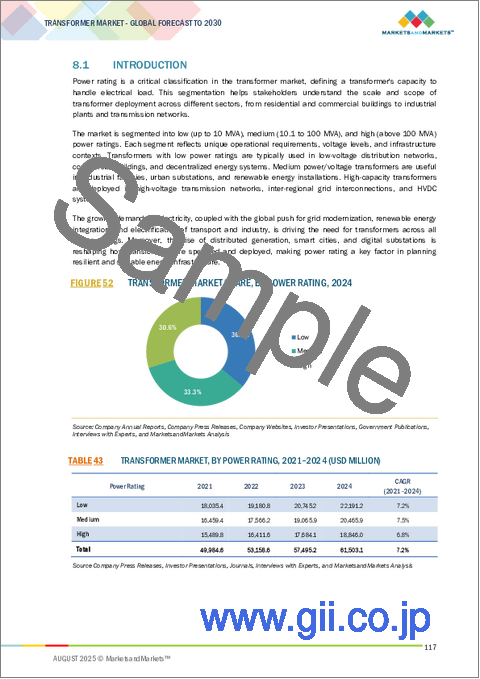

- FIGURE 52 TRANSFORMER MARKET SHARE, BY POWER RATING, 2024

- FIGURE 53 TRANSFORMER MARKET SHARE, BY PHASE, 2024

- FIGURE 54 TRANSFORMER MARKET SHARE, BY INSULATION, 2024

- FIGURE 55 TRANSFORMER MARKET SHARE, BY END USER, 2024

- FIGURE 56 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 TRANSFORMER MARKET SHARE, BY REGION

- FIGURE 58 ASIA PACIFIC: TRANSFORMER MARKET SNAPSHOT

- FIGURE 59 NORTH AMERICA: TRANSFORMER MARKET SNAPSHOT

- FIGURE 60 MARKET SHARE ANALYSIS OF COMPANIES OFFERING TRANSFORMERS, 2024

- FIGURE 61 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN TRANSFORMER MARKET, 2020-2024

- FIGURE 62 COMPANY VALUATION

- FIGURE 63 FINANCIAL METRICS

- FIGURE 64 BRAND/PRODUCT COMPARISON

- FIGURE 65 TRANSFORMER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 66 TRANSFORMER MARKET: COMPANY FOOTPRINT

- FIGURE 67 TRANSFORMER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 68 HITACHI ENERGY LTD.: COMPANY SNAPSHOT

- FIGURE 69 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 70 EATON: COMPANY SNAPSHOT

- FIGURE 71 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 72 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 74 ABB: COMPANY SNAPSHOT

- FIGURE 75 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 77 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 78 HUBBELL: COMPANY SNAPSHOT

- FIGURE 79 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

- FIGURE 80 HYOSUNG HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 81 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 82 WEG: COMPANY SNAPSHOT

- FIGURE 83 LS ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 84 ARTECHE GROUP: COMPANY SNAPSHOT

- FIGURE 85 KONCAR D.D.: COMPANY SNAPSHOT

The transformer market is estimated to grow from USD 64.64 billion in 2025 to USD 88.48 billion by 2030, at a CAGR of 6.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Segments | By Type, By Cooling Type, By Power Rating, By Phase, By Insulation, and By End User |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

This growth is driven by a combination of rising electricity consumption across emerging and developed economies, large-scale investments in grid infrastructure modernization, and the accelerated integration of renewable energy sources. As nations aim to meet climate goals and improve energy access, the demand for high-efficiency, smart, and environmentally sustainable transformers is rapidly expanding. Additionally, the surge in urbanization, data center construction, and electrification of transport and industry further fuels the need for reliable and advanced transformer technologies.

"By type, power transformer held largest share of transformer market in 2024"

Power transformers represented the largest share of the transformer market, by type, primarily due to the global expansion and reinforcement of high-voltage transmission networks. As countries invest in bulk power transmission from generation sources, including large-scale solar, wind, hydro, and thermal plants, to urban load centers, the demand for power transformers capable of handling high voltage and long-distance transmission continues to rise. Moreover, aging grid infrastructure in developed regions and ambitious grid expansion plans in emerging economies drive substantial replacements and new installations. The transition toward inter-regional and cross-border power trade, particularly in regions such as Asia Pacific, Europe, and Africa, further amplifies the need for large, efficient, and high-capacity power transformers, solidifying this segment's dominant market position.

"By power rating, the medium segment to exhibit fastest growth during forecast period"

Medium (10.1-100 MVA) is expected to be the fastest-growing segment, by power rating, driven by its versatile applications across a broad range of sectors, including industrial facilities, renewable energy projects, urban substations, and large commercial complexes. As economies continue to industrialize and modernize their infrastructure, medium power transformers are increasingly being deployed to support medium-voltage networks that bridge transmission and distribution systems. The rapid growth of solar and wind farms-especially in decentralized formats-also fuels demand for transformers in this rating range, as they are ideally suited to manage fluctuating loads while ensuring grid stability. Furthermore, government-backed urban electrification and smart grid initiatives increasingly favor medium-rated transformers due to their optimal balance between performance, cost, and scalability.

"North America to be second fastest-growing region in transformer market during forecast period"

North America is likely to be the second fastest-growing region in the transformer market during the forecast period, driven by substantial investments in grid modernization, aging infrastructure replacement, and the integration of renewable energy sources. The US and Canada are upgrading their transmission and distribution networks to improve reliability, support electric vehicle (EV) expansion, and accommodate distributed energy resources such as rooftop solar and battery storage. Federal initiatives such as the US Infrastructure Investment and Jobs Act and Canada's Clean Electricity Regulations are accelerating the deployment of advanced transformer technologies, including digital and eco-efficient models. Additionally, the region's growing data center footprint and increased electrification across transportation and industry sectors further propel the demand for high-performance and resilient transformers.

Breakdown of Primaries:

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

- By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

- By Designation: C-level Executives - 25%, Directors - 30%, and Others - 45%

- By Region: North America - 25%, Europe - 40%, Asia Pacific - 25%, Middle East & Africa - 5%, and South America - 5%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2024. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

A few major players with a wide regional presence dominate the transformer market. The leading players are Hitachi Energy Ltd. (Switzerland), Siemens Energy (Germany), Eaton (Ireland), GE Vernova (US), and Toshiba Energy Systems & Solutions Corporation (Japan).

Study Coverage:

The report defines, describes, and forecasts the transformer market by type, cooling type, power rating, phase, insulation end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the transformer market.

Key Benefits of Buying Report

- Product Development/Innovation: Key drivers (Need to modernize power infrastructure due to escalating energy demand), restraints (High initial investment cost and fluctuating raw material prices), opportunities (Evolution of smart, digital, and resilient grids), and challenges (Sustainability and safety challenges linked to transformer insulating oils) influence the market.

- Market Development: In June 2024, Siemens Energy invested in expanding its grid division, a strategic move to strengthen global energy infrastructure and accelerate the energy transition. This expansion includes building new manufacturing facilities, such as a large power transformer plant in Charlotte, North Carolina, which will help address the critical shortage of transformers in the US and support aging grid infrastructure.

- Market Diversification: In February 2025, Eaton invested in a new manufacturing facility in South Carolina for its three-phase transformers, marking the company's third facility in the United States. The image shows the transformers' manufacturing process at the company's facility in Wisconsin.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, Hitachi Energy Ltd. (Switzerland), Siemens Energy (Germany), Eaton (Ireland), GE Vernova (US), and Toshiba Energy Systems & Solutions Corporation (Japan), among others, in the transformer market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 List of major secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Participants in primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country-level analysis

- 2.3.3.3 Demand-side assumptions

- 2.3.3.4 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions

- 2.3.4.2 Supply-side calculations

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TRANSFORMER MARKET

- 4.2 TRANSFORMER MARKET, BY REGION

- 4.3 TRANSFORMER MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY

- 4.4 TRANSFORMER MARKET, BY TYPE

- 4.5 TRANSFORMER MARKET, BY COOLING TYPE

- 4.6 TRANSFORMER MARKET, BY POWER RATING

- 4.7 TRANSFORMER MARKET, BY PHASE

- 4.8 TRANSFORMER MARKET, BY INSULATION

- 4.9 TRANSFORMER MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Pressing need to modernize the power infrastructure due to escalating energy demand

- 5.2.1.2 Strong focus on integrating renewable energy sources into power grids

- 5.2.1.3 Urgent need to upgrade aging grid infrastructure

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment cost and fluctuating raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Evolution of smart, digital, and resilient grids

- 5.2.3.2 Growing focus of developing countries on electrification

- 5.2.4 CHALLENGES

- 5.2.4.1 Sustainability and safety challenges linked to transformer insulating oils

- 5.2.4.2 Supply chain disruptions and component shortages

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF TRANSFORMERS, BY TYPE, 2024

- 5.4.2 PRICING RANGE OF TRANSFORMERS, BY POWER RATING, 2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF TRANSFORMERS, BY REGION, 2021-2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Solid-state transformers (SSTs)

- 5.7.1.2 Digital twin technology for transformers

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Adjacent cooling system for transformers

- 5.7.2.2 Renewable energy integration systems

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Transformer condition monitoring system

- 5.7.3.2 Smart transformer substation automation

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8504)

- 5.9.2 EXPORT SCENARIO (HS CODE 8504)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF ANALYSIS

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.3 CODES AND REGULATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF SUBSTITUTES

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF NEW ENTRANTS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 ADDRESSING RELIABILITY, SAFETY, AND ENVIRONMENTAL RISKS IN BUSHINGS THROUGH EASYDRY TECHNOLOGY

- 5.15.2 OPTIMIZING GRID RESILIENCE AND TRANSFORMER HEALTH WITH TXPERT HUB

- 5.15.3 SAFEGUARDING TRANSFORMER LIFESPAN AND GRID RELIABILITY USING TVP TECHNOLOGY

- 5.16 IMPACT OF GEN AI/AI ON TRANSFORMER MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN TRANSFORMER MARKET

- 5.16.2 IMPACT OF GEN AI/AI ON TRANSFORMER MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK FOR TRANSFORMER MARKET

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END USERS

6 TRANSFORMER MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 POWER TRANSFORMER

- 6.2.1 GRID MODERNIZATION AND CROSS-BORDER TRANSMISSION PROJECTS TO DRIVE DEMAND

- 6.3 DISTRIBUTION TRANSFORMER

- 6.3.1 URBANIZATION AND ELECTRIFICATION PROGRAMS TO ELEVATE ADOPTION

- 6.4 INSTRUMENT TRANSFORMER

- 6.4.1 GLOBAL SHIFT TOWARD SMART GRID INFRASTRUCTURE AND DIGITAL SUBSTATIONS TO CREATE OPPORTUNITIES

- 6.5 SPECIALTY TRANSFORMER

- 6.5.1 SPECIALIZED INDUSTRIAL AND TRANSPORT APPLICATIONS TO ACCELERATE IMPLEMENTATION

7 TRANSFORMER MARKET, BY COOLING TYPE

- 7.1 INTRODUCTION

- 7.2 OIL-COOLED

- 7.2.1 SUPERIOR THERMAL CONDUCTIVITY AND DURABILITY TO BOOST DEMAND

- 7.3 AIR-COOLED

- 7.3.1 ENVIRONMENTAL SAFETY AND LOW MAINTENANCE REQUIREMENTS TO FACILITATE DEMAND

8 TRANSFORMER MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- 8.2 LOW

- 8.2.1 RAPID URBANIZATION AND SMART CITY INITIATIVES TO FACILITATE MARKET GROWTH

- 8.3 MEDIUM

- 8.3.1 INDUSTRIAL EXPANSION IN EMERGING ECONOMIES TO FUEL MARKET GROWTH

- 8.4 HIGH

- 8.4.1 INCREASING INVESTMENTS IN REINFORCING GRID STABILITY TO SPUR DEMAND

9 TRANSFORMER MARKET, BY PHASE

- 9.1 INTRODUCTION

- 9.2 THREE-PHASE

- 9.2.1 WIDESPREAD USE IN TRANSMISSION NETWORKS AND LARGE COMMERCIAL COMPLEXES TO FUEL SEGMENTAL GROWTH

- 9.3 SINGLE-PHASE

- 9.3.1 GOVERNMENT-LED INITIATIVES TO EXPAND ELECTRICITY ACCESS ACROSS REMOTE AND UNDERSERVED REGIONS TO DRIVE MARKET

10 TRANSFORMER MARKET, BY INSULATION

- 10.1 INTRODUCTION

- 10.2 OIL

- 10.2.1 HIGH DIELECTRIC STRENGTH AND SUPERIOR THERMAL CONDUCTIVITY TO SPIKE DEMAND

- 10.3 SOLID

- 10.3.1 SIGNIFICANT DEMAND FOR SUSTAINABLE, LOW-EMISSION TECHNOLOGIES IN URBAN INFRASTRUCTURE TO PROPEL MARKET

- 10.4 GAS

- 10.4.1 SPACE OPTIMIZATION AND ENVIRONMENTAL SAFETY TO ESCALATE DEMAND

- 10.5 AIR

- 10.5.1 SIMPLICITY, FLEXIBILITY, AND COST-EFFECTIVENESS TO ELEVATE ADOPTION

11 TRANSFORMER MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 POWER UTILITIES

- 11.2.1 PRESSING NEED TO UPGRADE AGING GRID ASSETS TO ELEVATE DEMAND

- 11.3 INDUSTRIAL

- 11.3.1 RISING FOCUS ON DECARBONIZATION AND ENERGY OPTIMIZATION TO FACILITATE ADOPTION

- 11.4 RESIDENTIAL & COMMERCIAL

- 11.4.1 RAPID URBANIZATION AND REAL ESTATE DEVELOPMENT TO TRIGGER DEMAND

- 11.5 DATA CENTERS

- 11.5.1 PROLIFERATION OF CLOUD COMPUTING TO CREATE GROWTH OPPORTUNITIES

- 11.6 OTHER END USERS

12 TRANSFORMER MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Government's push for smart grid and digital substation deployment to drive demand

- 12.2.2 INDIA

- 12.2.2.1 Growing focus on renewable energy expansion to accelerate demand

- 12.2.3 JAPAN

- 12.2.3.1 Surging deployment of energy storage systems and electric vehicle charging networks to propel market

- 12.2.4 AUSTRALIA

- 12.2.4.1 Significant investments in transmission and distribution infrastructure to support market growth

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Digital infrastructure and grid modernization programs to spike demand

- 12.3.2 CANADA

- 12.3.2.1 Clean energy and transmission system upgrade initiatives to foster market growth

- 12.3.3 MEXICO

- 12.3.3.1 Government focus on improving grid resilience to facilitate adoption

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Rising deployment of green hydrogen and digital factories to spur demand

- 12.4.2 ITALY

- 12.4.2.1 Growing digital economy to create opportunities

- 12.4.3 UK

- 12.4.3.1 Strong focus on deploying SF6-free substations to facilitate market growth

- 12.4.4 FRANCE

- 12.4.4.1 Pressing need to enhance transmission and distribution infrastructure to increase demand

- 12.4.5 SPAIN

- 12.4.5.1 Solar PV capacity expansion projects to support market growth

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Urban expansion and smart city initiatives to surge demand

- 12.5.1.2 UAE

- 12.5.1.2.1 Greater emphasis on expanding clean energy proportion in overall energy mix to boost demand

- 12.5.1.3 Rest of GCC

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Push to modernize transmission and distribution infrastructure to create growth opportunities

- 12.5.3 REST OF MIDDLE EAST& AFRICA

- 12.5.1 GCC

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Investment in metro rail systems, marine terminals, and public transport electrification to support market growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Expansion of high-voltage transmission lines to strengthen market growth

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Cooling type footprint

- 13.7.5.5 Phase footprint

- 13.7.5.6 End user footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 HITACHI ENERGY LTD.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 SIEMENS ENERGY

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 EATON

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.3.3 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 GE VERNOVA

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.3.4 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 SCHNEIDER ELECTRIC

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.6.3.4 Other developments

- 14.1.7 ABB

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.7.3.4 Other developments

- 14.1.8 MITSUBISHI ELECTRIC CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deal

- 14.1.8.3.2 Other developments

- 14.1.9 BHARAT HEAVY ELECTRICALS LIMITED

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.9.3.3 Other developments

- 14.1.10 HD HYUNDAI ELECTRIC CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Developments

- 14.1.11 HUBBELL

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Expansions

- 14.1.12.3.3 Other developments

- 14.1.13 HYOSUNG HEAVY INDUSTRIES

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Expansions

- 14.1.13.3.2 Other developments

- 14.1.14 FUJI ELECTRIC CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Developments

- 14.1.15 WEG

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Expansions

- 14.1.15.3.2 Other developments

- 14.1.16 LS ELECTRIC CO., LTD.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.3.2 Expansions

- 14.1.16.3.3 Other developments

- 14.1.17 ARTECHE GROUP

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.18 KONCAR D.D.

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Deals

- 14.1.18.3.2 Other developments

- 14.1.19 JSHP TRANSFORMER

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.20 TBEA

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.1 HITACHI ENERGY LTD.

- 14.2 OTHER PLAYERS

- 14.2.1 CHINA XD GROUP

- 14.2.2 VOLTAMP TRANSFORMER

- 14.2.3 MEIDENSHA CORPORATION

- 14.2.4 ORMAZABAL

- 14.2.5 HENAN HENGYU ELECTRIC GROUP CO., LTD.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS