|

|

市場調査レポート

商品コード

1793325

スマートテキスタイルの世界市場 (~2030年):タイプ (パッシブ・アクティブ)・形態 (ウェアラブル・非ウェアラブル)・生地タイプ (コットン・ナイロン&ポリエステル・ウール&シルク)・生地 (コットン・ナイロン・ウール・グラフェン・導電性)・用途 (センシング・エネルギーハーベスティング) 別Smart Textiles Market by Type (Passive, Active), Form (Wearable, Non-wearable), Fabric Type (Cotton, Nylon & Polyester, Wool & Silk), Fabric (Cotton, Nylon, Wool, Graphene, Conductive), Application (Sensing, Energy Harvesting) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スマートテキスタイルの世界市場 (~2030年):タイプ (パッシブ・アクティブ)・形態 (ウェアラブル・非ウェアラブル)・生地タイプ (コットン・ナイロン&ポリエステル・ウール&シルク)・生地 (コットン・ナイロン・ウール・グラフェン・導電性)・用途 (センシング・エネルギーハーベスティング) 別 |

|

出版日: 2025年08月11日

発行: MarketsandMarkets

ページ情報: 英文 214 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

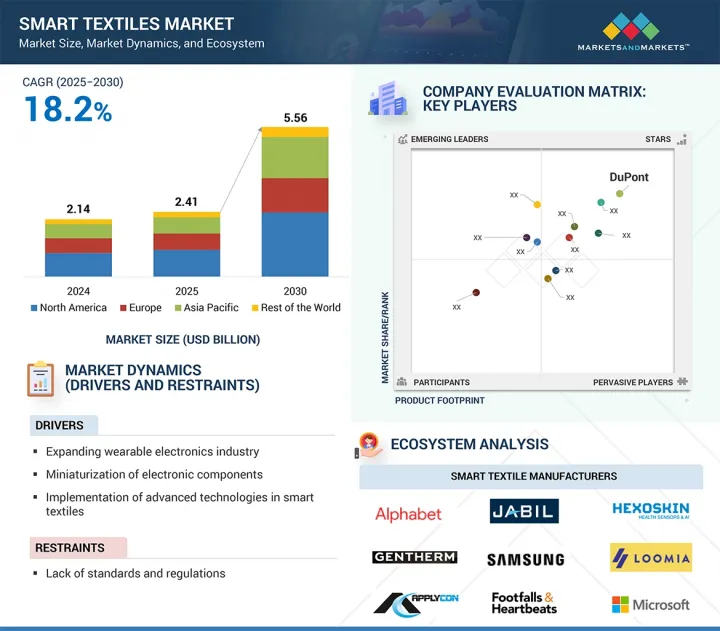

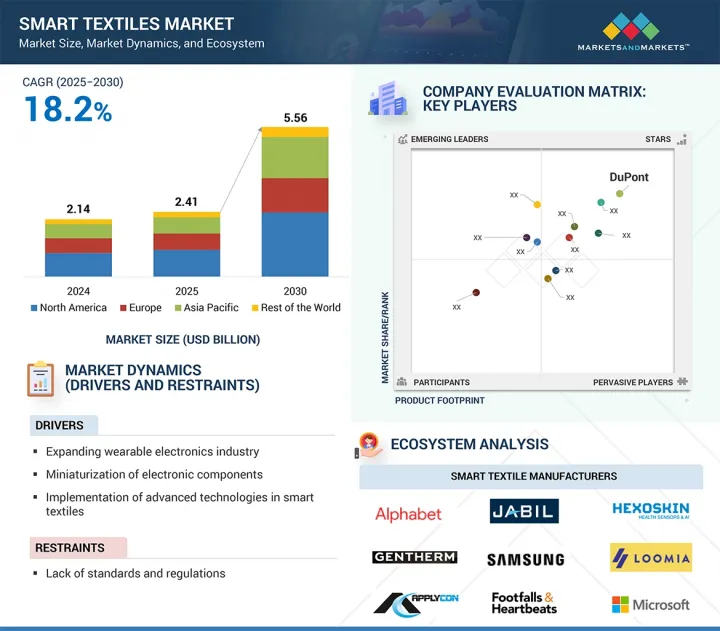

スマートテキスタイルの市場規模は、2025年の24億1,000万米ドルから、予測期間中はCAGR18.2%で推移し、2030年には55億6,000万米ドルに成長すると予測されています。

ウェアラブルヘルスモニタリングデバイスの需要増加がスマートテキスタイル市場の機会を大きく促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額(米ドル) |

| セグメント別 | タイプ・用途・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

医療システムが遠隔患者モニタリングや慢性疾患の予防的管理へと移行する中で、バイオセンサーを組み込んだスマートファブリックが重要なツールとして登場しています。これらのテキスタイルは、心拍数、呼吸、体温、水分量といったバイタルサインを継続的に測定し、リアルタイムの健康インサイトを提供します。衣服への統合により、シームレスかつ非侵襲的なモニタリングが可能となり、病院での利用はもちろん、在宅ケアやアスリートのパフォーマンス管理にも理想的です。さらに、世界的な高齢化の進展が、高齢者ケアや健康モニタリングにおけるこうしたソリューションの採用を加速させています。

"エンドユーザー産業別では、ファッション&エンターテインメント部門が予測期間中に顕著なCAGRを記録する見通し”"

これは、インタラクティブ性や表現力、技術統合型アパレルに対する消費者の関心が高まっていることに起因します。技術とライフスタイルの境界が曖昧になる中で、デザイナーと技術企業が協力し、審美性だけでなく没入型体験を提供する衣服を創出しています。この分野のスマートテキスタイルは、色の変化、発光、音楽への反応、環境刺激やユーザーの操作に基づく動的なビジュアル表示が可能で、コンサート、ファッションショー、テーマイベント、コスプレなどに理想的です。ウェアラブルLED、フレキシブル回路、形状記憶素材の採用拡大により、ファッションブランドは快適さを損なわずにエレクトロニクスをファブリックに直接組み込めるようになっています。さらに、SNSやインフルエンサー文化も、個人のブランディングやエンタメ性を高める視覚的に目を引くハイテク衣装への需要を後押ししています。加えて、AR/VR対応の衣服やメタバースファッションの登場により、デジタルネイティブ層向けの新しい収益化手段が開かれています。スマートテキスタイルは高級ブランドやオートクチュールにも取り入れられ、独自性と革新性を提供しています。消費者が新奇性、パーソナライズ、デジタル表現を求める中、この分野は創造的イノベーションと市場の成熟を背景に力強い成長が見込まれます。

"用途別では、エネルギーハーベスティング&サーモエレクトリックの部門が予測期間中に大きなシェアを占める見通し”

エネルギーハーベスティング&サーモエレクトリックの部門は、ウェアラブルや組込み型エレクトロニクス向けに自立型電源ソリューションを提供できることから、重要なシェアを占めると予測されています。ヘルスケアモニタリング、軍需装備、フィットネスアパレル、CE製品といった分野での採用が進むにつれ、連続的かつバッテリー不要の電力供給に対する需要が高まっています。エネルギーハーベスティング繊維は、体温(サーモエレクトリック)、動作(圧電)、環境光を電気エネルギーに変換し、従来の電池式システムに代わる持続可能な選択肢を提供します。これにより、ウェアラブルは充電せずに長時間稼働でき、利便性、使いやすさ、環境持続性が向上します。例えば、医療分野では、サーモエレクトリック繊維がリアルタイム患者モニタリング用バイオセンサーの電源を外部エネルギー源に頼らず供給できます。軍事分野では、自給自足型テキスタイルにより、兵士の通信や状況認識ツールを途切れることなく稼働させられます。さらに、材料科学者、エレクトロニクスメーカー、繊維メーカーの研究開発や協業がコスト削減と効率向上を推進し、商業化の可能性を高めています。環境に優しい自律電源型ウェアラブルへの世界的な潮流とも一致し、この分野は予測期間中のスマートテキスタイル市場において重要な貢献を果たすとみられます。

当レポートでは、世界のスマートテキスタイルの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 貿易分析

- エコシステム分析

- 顧客の事業に影響を与える動向/混乱

- 価格分析

- ケーススタディ分析

- 特許分析

- 技術分析

- AI/生成AIがスマートテキスタイル市場に与える影響

- 2025-2026年の主な会議とイベント

- 規制状況

- 2025年の米国関税の影響- スマートテキスタイル市場

第6章 スマートテキスタイル市場:生地タイプ別

- 綿ベースのスマートテキスタイル

- ナイロン&ポリエステル

- ウール&シルク

- グラフェン対応生地

- 導電性ポリマー繊維

- ハイブリッド生地(混紡)

第7章 スマートテキスタイル市場:形態別

- ウェアラブルスマートテキスタイル

- 非ウェアラブルスマートテキスタイル

第8章 スマートテキスタイル市場:タイプ別

- パッシブスマートテキスタイル

- アクティブ/超スマートテキスタイル

第9章 スマートテキスタイル市場:用途別

- センシング

- エネルギーハーベスティング&サーモエレクトリック

- 発光性・美的要素

- その他

第10章 スマートテキスタイル市場:エンドユーザー産業別

- 軍事・防衛

- ヘルスケア

- スポーツ&フィットネス

- ファッション&エンターテイメント

- 自動車

- その他

第11章 スマートテキスタイル市場:地域別

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- 世界のその他の地域

- 世界のその他の地域:マクロ経済見通し

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要企業が採用した戦略の概要

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- DUPONT

- JABIL INC.

- GENTHERM INCORPORATED

- AIQ SMART CLOTHING

- SENSORIA

- ALPHABET

- INTERACTIVE WEAR

- OUTLAST TECHNOLOGIES GMBH

- ADIDAS

- HEXOSKIN

- その他の企業

- CLIM8 SAS

- NIKE

- SENSING TEX

- APPLYCON, S. R. O.

- FOOTFALLS SMARTEX LIMITED

- VOLT AI LLC.

- SAMSUNG

- MICROSOFT

- LIFESENSE GROUP

- NANOLEQ AG

- EMBRO

- LOOMIA

- NEXTILES, INC.

- AMOHR TECHNISCHE TEXTILIEN GMBH

- PRIMO1D

第14章 付録

List of Tables

- TABLE 1 SMART TEXTILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 3 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 4 GLOBAL IMPORT DATA FOR HS CODE 591131, 2020-2024 (USD MILLION)

- TABLE 5 GLOBAL EXPORT DATA FOR HS CODE 591131, 2020-2024 (USD MILLION)

- TABLE 6 SMART TEXTILES MARKET: ECOSYSTEM

- TABLE 7 PRICING RANGE OF SMART TEXTILES, BY KEY PLAYER, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF ACTIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE OF PASSIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- TABLE 10 SMART TEXTILES MARKET: KEY PATENTS

- TABLE 11 SMART TEXTILES MARKET: LIST OF CONFERENCES AND EVENTS

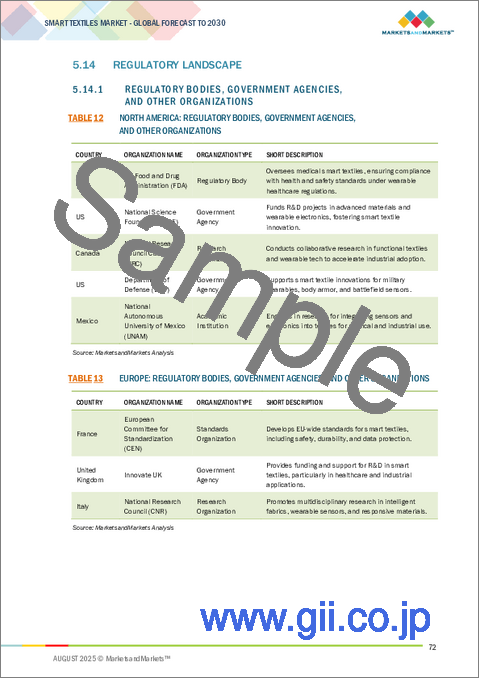

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 17 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 18 SMART TEXTILES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 SMART TEXTILES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 20 SMART TEXTILES MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 21 SMART TEXTILES MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 22 PASSIVE SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 23 PASSIVE SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 24 ACTIVE/ULTRA-SMART TEXTILES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 25 ACTIVE/ULTRA-SMART TEXTILES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 26 SMART TEXTILES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 SMART TEXTILES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 SENSING: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 29 SENSING: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 30 ENERGY HARVESTING & THERMOELECTRICITY: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 31 ENERGY HARVESTING & THERMOELECTRICITY: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 32 LUMINESCENCE & AESTHETICS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 33 LUMINESCENCE & AESTHETICS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 OTHER APPLICATIONS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 35 OTHER APPLICATIONS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 36 SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 EUROPE: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 EUROPE: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 ASIA PACIFIC: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 REST OF THE WORLD: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 REST OF THE WORLD: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 SMART TEXTILES MARKET FOR HEALTHCARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 SMART TEXTILES MARKET FOR HEALTHCARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 SMART TEXTILES MARKET FOR HEALTHCARE, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 55 SMART TEXTILES MARKET FOR HEALTHCARE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 56 SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 EUROPE: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 EUROPE: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 ASIA PACIFIC: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 REST OF THE WORLD: SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 REST OF THE WORLD: SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: SPORTS & FITNESS: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 REST OF THE WORLD: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 REST OF THE WORLD: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 EUROPE: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 REST OF THE WORLD: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 REST OF THE WORLD: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 EUROPE: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 REST OF THE WORLD: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 REST OF THE WORLD: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 111 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 REST OF THE WORLD: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 REST OF THE WORLD: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 SMART TEXTILES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 SMART TEXTILES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: SMART TEXTILES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: SMART TEXTILES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SMART TEXTILES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 REST OF THE WORLD: SMART TEXTILES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 REST OF THE WORLD: SMART TEXTILES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 REST OF THE WORLD: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 139 REST OF THE WORLD: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 140 OVERVIEW OF STRATEGIES FOLLOWED BY KEY PLAYERS IN SMART TEXTILES MARKET

- TABLE 141 SMART TEXTILES MARKET: DEGREE OF COMPETITION

- TABLE 142 SMART TEXTILES MARKET: REGION FOOTPRINT

- TABLE 143 SMART TEXTILES MARKET: TYPE FOOTPRINT

- TABLE 144 SMART TEXTILES MARKET: APPLICATION FOOTPRINT

- TABLE 145 SMART TEXTILES MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 146 SMART TEXTILE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 147 SMART TEXTILES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 148 SMART TEXTILES MARKET: DEALS, 2021-2025

- TABLE 149 SMART TEXTILES MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 150 DUPONT: BUSINESS OVERVIEW

- TABLE 151 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 DUPONT: PRODUCT LAUNCHES

- TABLE 153 DUPONT: DEALS

- TABLE 154 JABIL INC.: BUSINESS OVERVIEW

- TABLE 155 JABIL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 GENTHERM INCORPORATED: BUSINESS OVERVIEW

- TABLE 157 GENTHERM INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 AIQ SMART CLOTHING: BUSINESS OVERVIEW

- TABLE 159 AIQ SMART CLOTHING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 SENSORIA: BUSINESS OVERVIEW

- TABLE 161 SENSORIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 ALPHABET: BUSINESS OVERVIEW

- TABLE 163 ALPHABET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 INTERACTIVE WEAR: BUSINESS OVERVIEW

- TABLE 165 INTERACTIVE WEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 OUTLAST TECHNOLOGIES GMBH: BUSINESS OVERVIEW

- TABLE 167 OUTLAST TECHNOLOGIES GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 ADIDAS: BUSINESS OVERVIEW

- TABLE 169 ADIDAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 HEXOSKIN: BUSINESS OVERVIEW

- TABLE 171 HEXOSKIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SMART TEXTILES MARKET SEGMENTATION

- FIGURE 2 SMART TEXTILES MARKET: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 SMART TEXTILES MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SMART TEXTILES MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE)-REVENUE GENERATED FROM SALES OF SMART TEXTILE PRODUCTS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ACTIVE/ULTRA-SMART TEXTILES SEGMENT TO HOLD MAJOR MARKET SHARE TILL 2030

- FIGURE 9 SENSING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF APPLICATIONS MARKET

- FIGURE 10 MILITARY & PROTECTION SEGMENT TO CONTINUE AS DOMINANT END-USER INDUSTRY TILL 2030

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 12 INCREASING ADOPTION OF SMART TEXTILES IN ASIA PACIFIC TO DRIVE MARKET GROWTH

- FIGURE 13 ACTIVE/ULTRA-SMART TEXTILES SEGMENT TO REGISTER HIGHEST CAGR

- FIGURE 14 ENERGY HARVESTING & THERMOELECTRICITY TO GROW AT HIGHEST RATE

- FIGURE 15 SPORTS & FITNESS TO REGISTER HIGHEST CAGR TILL 2030

- FIGURE 16 US AND MILITARY & DEFENSE APPLICATIONS TO HOLD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2024

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN SMART TEXTILES MARKET DURING FORECAST PERIOD

- FIGURE 18 SMART TEXTILES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL IOT CONNECTIONS, 2019-2030

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 SUPPLY CHAIN ANALYSIS: SMART TEXTILES MARKET

- FIGURE 25 SMART TEXTILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- FIGURE 28 GLOBAL IMPORT DATA FOR KEY COUNTRIES UNDER HS CODE 591131, 2020-2024 (USD MILLION)

- FIGURE 29 GLOBAL EXPORT DATA FOR KEY COUNTRIES UNDER HS CODE 591131, 2020-2024 (USD MILLION)

- FIGURE 30 SMART TEXTILES MARKET: ECOSYSTEM

- FIGURE 31 SMART TEXTILES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 AVERAGE SELLING PRICE OF SMART TEXTILES, BY KEY PLAYER, 2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF ACTIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- FIGURE 34 AVERAGE SELLING PRICE OF PASSIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- FIGURE 35 NUMBER OF PATENTS GRANTED FOR SMART TEXTILES, 2016-2025

- FIGURE 36 IMPACT OF AI/GEN AI ON SMART TEXTILES MARKET

- FIGURE 37 ACTIVE/ULTRA-SMART TEXTILES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 SENSING APPLICATIONS TO HOLD LARGEST MARKET SHARE

- FIGURE 39 SPORTS & FITNESS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: SMART TEXTILES MARKET SNAPSHOT

- FIGURE 42 EUROPE: SMART TEXTILES MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC SMART TEXTILES MARKET: SNAPSHOT

- FIGURE 44 REST OF THE WORLD: SMART TEXTILES MARKET SNAPSHOT

- FIGURE 45 SMART TEXTILES MARKET: REVENUE ANALYSIS (USD MILLION), 2020-2024

- FIGURE 46 SMART TEXTILES MARKET: MARKET SHARE ANALYSIS (2024)

- FIGURE 47 SMART TEXTILES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 SMART TEXTILES MARKET: COMPANY FOOTPRINT

- FIGURE 49 SMART TEXTILES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 DUPONT: COMPANY SNAPSHOT

- FIGURE 51 JABIL INC.: COMPANY SNAPSHOT

- FIGURE 52 GENTHERM INCORPORATED: COMPANY SNAPSHOT

- FIGURE 53 ALPHABET: COMPANY SNAPSHOT

- FIGURE 54 ADIDAS: COMPANY SNAPSHOT

The smart textiles market is projected to grow from USD 2.41 billion in 2025 to USD 5.56 billion by 2030, at a CAGR of 18.2%. The increasing demand for wearable health monitoring devices is significantly driving opportunities in the smart textiles market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By type, application, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

As healthcare systems shift toward remote patient monitoring and proactive chronic disease management, smart fabrics embedded with biosensors are emerging as vital tools. These textiles can continuously track vital signs such as heart rate, respiration, body temperature, and hydration levels, enabling real-time health insights. Their integration into garments offers a seamless, non-intrusive monitoring solution, making them ideal for hospital settings, home-based care, and athletic performance tracking. Additionally, the aging global population is accelerating the adoption of such solutions for elderly care and wellness monitoring.

"The fashion and Entertainment smart textile segment is expected to record a significant CAGR in the smart textiles market from 2025 to 2030."

The fashion and entertainment segment of the smart textiles market is projected to record a significant CAGR from 2025 to 2030, driven by growing consumer interest in interactive, expressive, and tech-integrated apparel as the lines between technology and lifestyle blur, designers and technology firms are collaborating to create garments that not only serve aesthetic purposes but also deliver immersive experiences. Smart textiles in this segment can change color, emit light, react to music, or display dynamic visuals based on user interaction or environmental stimuli, making them ideal for concerts, fashion shows, themed events, and cosplay. With the increasing adoption of wearable LEDs, flexible circuits, and shape-memory fabrics, fashion houses are integrating electronics directly into fabric without compromising comfort. Social media and influencer culture are also fueling demand for visually striking, tech-enhanced outfits that enhance personal branding and entertainment value. Furthermore, the emergence of AR/VR-enabled clothing and metaverse fashion is unlocking new monetization avenues for digital-native audiences. Smart textiles are also being used in luxury and haute couture, providing exclusivity and innovation to premium segments. As consumers seek novelty, personalization, and digital expression, the fashion and entertainment smart textile segment is poised for robust growth, supported by both creative innovation and rising market readiness.

"Energy harvesting & thermo-electricity segment is expected to contribute a recognizable share in the smart textiles market from 2025 to 2030."

The Energy Harvesting & Thermo-Electricity segment is anticipated to contribute a significant share to the smart textiles market from 2025 to 2030 due to its ability to provide self-sustaining power solutions for wearable and embedded electronics. As the adoption of smart textiles in applications like healthcare monitoring, military gear, fitness apparel, and consumer electronics increases, the demand for continuous, battery-free energy supply is becoming critical. Energy harvesting textiles, which convert body heat (thermoelectricity), motion (piezoelectricity), or ambient light into electrical energy, offer a sustainable alternative to traditional battery-powered systems. These fabrics enable wearables to operate longer without recharging, enhancing convenience, usability, and environmental sustainability. In healthcare, for example, thermo-electric fabrics can power biosensors for real-time patient monitoring without relying on external energy sources. In defense, self-powered textiles ensure uninterrupted communication and situational awareness tools for soldiers in the field. Furthermore, ongoing R&D and collaborations among material scientists, electronics companies, and textile manufacturers are driving down costs and improving efficiency, making these technologies commercially viable. The push for eco-friendly, power-autonomous wearables-aligned with global sustainability trends-further positions this segment as a key contributor to the smart textiles market during the forecast period.

"North America dominated the market in 2024."

North America is expected to have contributed the largest share to the smart textiles market in 2024, driven by early technology adoption, strong presence of key industry players, and growing demand across diverse application areas. The region, particularly the US, leads in wearable technology innovation, with robust R&D activities and significant investments from both public and private sectors. Healthcare applications are a major contributor, as smart textiles are increasingly used for patient monitoring, chronic disease management, and post-operative recovery. The well-established medical infrastructure and rising demand for personalized healthcare solutions are accelerating adoption. Additionally, the military and defense sector in the US is actively deploying smart uniforms with embedded sensors for health tracking, situational awareness, and thermal management, further boosting market revenue. The sports and fitness industry is another growth driver, with consumers showing a high preference for performance-enhancing wearable garments. Collaborations between tech firms, fashion brands, and textile manufacturers are leading to commercially viable smart apparel that combines comfort with functionality. Moreover, North America benefits from strong intellectual property protections and favorable regulatory frameworks that support innovation in the smart textiles domain. These factors, combined with high consumer awareness and purchasing power, position North America as the leading region in the global smart textiles market in 2024.

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C-level Executives - 40%, Managers -30%, and Others - 30%

- By Region: North America -45%, Europe - 22%, Asia Pacific- 22%, and RoW - 11%

Prominent players profiled in this report include DuPont (US), Jabil Inc. (US), Gentherm (US), AiQ Smart Clothing (Taiwan), and Sensoria (US).

Report Coverage

The report defines, describes, and forecasts the smart textiles market based on type (Passive, Active/Ultra smart textiles), application (Sensing, Energy Harvesting and Thermo-electricity, Luminescence & Aesthetics, Others), vertical (Military & Protection, Healthcare, Sports & Fitness, Fashion & Entertainment, Automotive, Others), and region (North America, Europe, Asia Pacific, and RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall smart textiles market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (Expanding wearable electronics industry, Miniaturization of electronic components, Implementation of advanced technologies in smart textiles, Proliferation of low-cost smart wireless sensor networks), restraints (Lack of standards and regulations), opportunities (Development of flexible electronics, Development of multi-featured and hybrid smart textiles), and challenges (Technical difficulties related to integration of electronics and textiles, Product protection and thermal consideration, High cost of smart textiles and products developed using smart textiles) of the smart textiles market

- Product development /Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the smart textiles market

- Market Development: Comprehensive information about lucrative markets; the report analyses the smart textiles market across various regions

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the smart textiles market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including DuPont (US), Jabil Inc. (US), Gentherm (US), AiQ Smart Clothing (Taiwan), Sensoria (US), Alphabet (US), Interactive Wear (Germany), Outlast Technologies GmbH (Germany), Adidas (Germany), Hexoskin (Canada) in the smart textiles market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 SUMMARY OF CHANGES

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Estimating market size using a bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.5.1 SCOPE-RELATED LIMITATIONS

- 2.5.2 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SMART TEXTILES MARKET

- 4.2 SMART TEXTILES MARKET, BY TYPE

- 4.3 SMART TEXTILES MARKET, BY APPLICATION

- 4.4 SMART TEXTILES MARKET, BY END-USER INDUSTRY

- 4.5 SMART TEXTILES MARKET IN NORTH AMERICA, BY COUNTRY AND END-USER INDUSTRY

- 4.6 SMART TEXTILES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Expanding wearable electronics industry

- 5.1.1.2 Miniaturization of electronic components

- 5.1.1.3 Implementation of advanced technologies in smart textiles

- 5.1.1.4 Proliferation of low-cost smart wireless sensor networks

- 5.1.2 RESTRAINTS

- 5.1.2.1 Lack of standards and regulations

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Development of flexible electronics

- 5.1.3.2 Development of multi-featured and hybrid smart textiles

- 5.1.4 CHALLENGES

- 5.1.4.1 Technical difficulties related to integration of electronics and textiles

- 5.1.4.2 Product protection and thermal consideration

- 5.1.4.3 High cost of smart textiles and products developed using smart textiles

- 5.1.1 DRIVERS

- 5.2 SUPPLY CHAIN ANALYSIS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA FOR HS CODE 591131

- 5.5.2 EXPORT DATA FOR HS CODE 591131

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.8.2 AVERAGE SELLING PRICE TREND OF ACTIVE SMART TEXTILES, BY REGION

- 5.8.3 AVERAGE SELLING PRICE TREND OF PASSIVE SMART TEXTILES, BY REGION

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CASE STUDY 1: SMART TEXTILE BIO-SENSOR DEVELOPMENT AND INTEGRATION IN AUTOMOTIVE INDUSTRY

- 5.9.2 CASE STUDY 2: DEVELOPMENT OF FABRIC-BASED WEARABLE SYSTEM FOR STROKE REHABILITATION

- 5.9.3 CASE STUDY 3: DEVELOPMENT OF FABRIC-BASED WEARABLE SYSTEM FOR JOINT PAIN RELIEF

- 5.10 PATENT ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Integrating AI and IoT in smart textiles

- 5.11.1.2 Embedded Electronics (Sensors, ICs, PCBs)

- 5.11.1.3 Printed Electronics on Fabric

- 5.11.1.4 Shape Memory Alloys (SMA)-infused Textiles

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Digital textile printing ink

- 5.11.2.2 Coated/Layered Functionalization

- 5.11.2.3 Knitted Smart Textiles

- 5.11.2.4 Woven Smart Textiles

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Biotextile-based smart textiles for healthcare industry

- 5.11.1 KEY TECHNOLOGIES

- 5.12 IMPACT OF AI/GEN AI ON SMART TEXTILES MARKET

- 5.12.1 TOP USE CASES AND MARKET POTENTIAL

- 5.12.1.1 Personalized Health Monitoring

- 5.12.1.2 Adaptive Fitness & Sportswear

- 5.12.1.3 Predictive Maintenance in Smart Fabrics

- 5.12.1.4 Smart Uniforms for Workforce Safety

- 5.12.1.5 Thermal & Climate-Adaptive Clothing

- 5.12.1 TOP USE CASES AND MARKET POTENTIAL

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY FRAMEWORK

- 5.14.2.1 US

- 5.14.2.2 Europe

- 5.14.2.3 India

- 5.15 IMPACT OF 2025 US TARIFFS-SMART TEXTILES MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON END-USE INDUSTRIES

6 SMART TEXTILES MARKET, BY FABRIC TYPE

- 6.1 INTRODUCTION

- 6.2 COTTON-BASED SMART TEXTILES

- 6.3 NYLON & POLYESTER

- 6.4 WOOL & SILK

- 6.5 GRAPHENE-ENABLED FABRICS

- 6.6 CONDUCTIVE POLYMER FIBERS

- 6.7 HYBRID FABRICS (BLENDS)

7 SMART TEXTILES MARKET, BY FORM

- 7.1 INTRODUCTION

- 7.2 WEARABLE SMART TEXTILES

- 7.3 NON-WEARABLE SMART TEXTILES

8 SMART TEXTILES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 PASSIVE SMART TEXTILES

- 8.2.1 PASSIVE SMART TEXTILES ARE MAINLY USED IN MILITARY & PROTECTION

- 8.3 ACTIVE/ULTRA-SMART TEXTILES

- 8.3.1 ACTIVE SMART TEXTILES CAN SENSE ENVIRONMENTAL STIMULI AND REACT ACCORDINGLY

9 SMART TEXTILES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 SENSING

- 9.2.1 SENSING APPLICATIONS DOMINATE SMART TEXTILES MARKET

- 9.3 ENERGY HARVESTING AND THERMOELECTRICITY

- 9.3.1 RISING FOCUS ON INTEGRATION OF ENERGY HARVESTING CAPABILITIES

- 9.4 LUMINESCENCE & AESTHETICS

- 9.4.1 RISING INTEREST IN DISPLAY-EMBEDDED CLOTHING TO DRIVE MARKET

- 9.5 OTHER APPLICATIONS

10 SMART TEXTILES MARKET, BY END-USER INDUSTRY

- 10.1 INTRODUCTION

- 10.2 MILITARY & PROTECTION

- 10.2.1 SMART TEXTILES PLAY ESSENTIAL ROLE IN PROTECTING SOLDIERS DURING WARFARE BY PROVIDING ADDITIONAL PROTECTION

- 10.2.1.1 Health monitoring uniforms

- 10.2.1.2 Ballistic protection

- 10.2.1.3 Chemical & biological threat detection

- 10.2.1.4 Wearable navigation & communication textiles

- 10.2.1.5 Temperature-regulating combat gear

- 10.2.1 SMART TEXTILES PLAY ESSENTIAL ROLE IN PROTECTING SOLDIERS DURING WARFARE BY PROVIDING ADDITIONAL PROTECTION

- 10.3 HEALTHCARE

- 10.3.1 SMART TEXTILES IN HEALTHCARE ARE GAINING POPULARITY FOR TRACKING PATIENT DATA

- 10.3.1.1 Remote patient monitoring garments

- 10.3.1.2 Post-surgical rehabilitation garments

- 10.3.1.3 Diabetic socks (temperature/pressure sensing)

- 10.3.1.4 Smart bandages for wound healing

- 10.3.1.5 Bio-signal monitoring shirts for elderly care

- 10.3.1 SMART TEXTILES IN HEALTHCARE ARE GAINING POPULARITY FOR TRACKING PATIENT DATA

- 10.4 SPORTS & FITNESS

- 10.4.1 SMART TEXTILES HELP ATHLETES IMPROVE PERFORMANCE AND COMFORT

- 10.4.1.1 Fitness tracking shirts

- 10.4.1.2 Compression garments with motion sensors

- 10.4.1.3 Posture monitoring apparel

- 10.4.1.4 Smart insoles for gait analysis

- 10.4.1 SMART TEXTILES HELP ATHLETES IMPROVE PERFORMANCE AND COMFORT

- 10.5 FASHION & ENTERTAINMENT

- 10.5.1 INCREASING APPLICATION OF SMART TEXTILES IN MANUFACTURING STAGE COSTUMES AND HAPTIC GAMING SUITS

- 10.5.1.1 Light-emitting (LED) clothing

- 10.5.1.2 Interactive clothing

- 10.5.1.3 Color-changing fabrics

- 10.5.1.4 Garments with integrated sound or haptic feedback

- 10.5.1 INCREASING APPLICATION OF SMART TEXTILES IN MANUFACTURING STAGE COSTUMES AND HAPTIC GAMING SUITS

- 10.6 AUTOMOTIVE

- 10.6.1 INTEGRATION OF SMART TEXTILES INTO VEHICLES ENHANCES EXPERIENCE OF DRIVING

- 10.6.1.1 Seat upholstery with occupancy/pressure sensors

- 10.6.1.2 Sound-absorbing smart textiles

- 10.6.1.3 Thermo-regulating upholstery

- 10.6.1.4 Ambient lighting-integrated textiles

- 10.6.1 INTEGRATION OF SMART TEXTILES INTO VEHICLES ENHANCES EXPERIENCE OF DRIVING

- 10.7 OTHER END-USER INDUSTRIES

11 SMART TEXTILES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 High internet penetration and disposable income to drive growth of US market

- 11.2.3 CANADA

- 11.2.3.1 Innovative applications and government support drive growth in Canada

- 11.2.4 MEXICO

- 11.2.4.1 Smart textiles market in Mexico gains traction through industrial growth and cross-border innovation

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 UK

- 11.3.2.1 UK's smart textiles market advances with innovation, defense demand, and sustainability focus

- 11.3.3 GERMANY

- 11.3.3.1 Germany's smart textiles market thrives on industrial innovation, technical textiles, and research leadership

- 11.3.4 FRANCE

- 11.3.4.1 Collaborations between various small smart textiles producers to positively impact market

- 11.3.5 ITALY

- 11.3.5.1 Growing integration of smart textiles in fashion, automotive, and medical sectors

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Expansion of Chinese economy to drive market growth

- 11.4.3 JAPAN

- 11.4.3.1 Japan's technological prowess driving smart textiles innovation and commercialization

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Technological advancements and innovation driving growth

- 11.4.5 INDIA

- 11.4.5.1 Availability of raw materials, low labor cost, and modernized production facilities to drive market growth in India

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD

- 11.5.1 REST OF THE WORLD: MACROECONOMIC OUTLOOK

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Growing textile innovation, sports adoption, and healthcare digitization driving smart textile growth

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Rising adoption of smart textiles in healthcare, defense, and sports sectors

- 11.5.4 AFRICA

- 11.5.4.1 Gradual market entry through medical, wearable, and academic initiatives

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 KEY PLAYERS IN SMART TEXTILES MARKET, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 End-user industry footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.4.1 Competitive benchmarking of key startups/SMEs

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 DEALS

- 12.7.2 PRODUCT LAUNCHES

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DUPONT

- 13.1.1.1 Business overview

- 13.1.1.2 Products/solutions/services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 JABIL INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/solutions/services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices made

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 GENTHERM INCORPORATED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/solutions/services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices made

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 AIQ SMART CLOTHING

- 13.1.4.1 Business overview

- 13.1.4.2 Products/solutions/services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices made

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 SENSORIA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/solutions/services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices made

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 ALPHABET

- 13.1.6.1 Business overview

- 13.1.6.2 Products/solutions/services offered

- 13.1.7 INTERACTIVE WEAR

- 13.1.7.1 Business overview

- 13.1.7.2 Products/solutions/services offered

- 13.1.8 OUTLAST TECHNOLOGIES GMBH

- 13.1.8.1 Business overview

- 13.1.8.2 Products/solutions/services offered

- 13.1.9 ADIDAS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/solutions/services offered

- 13.1.10 HEXOSKIN

- 13.1.10.1 Business overview

- 13.1.10.2 Products/solutions/services offered

- 13.1.1 DUPONT

- 13.2 OTHER PLAYERS

- 13.2.1 CLIM8 SAS

- 13.2.2 NIKE

- 13.2.3 SENSING TEX

- 13.2.4 APPLYCON, S. R. O.

- 13.2.5 FOOTFALLS SMARTEX LIMITED

- 13.2.6 VOLT AI LLC.

- 13.2.7 SAMSUNG

- 13.2.8 MICROSOFT

- 13.2.9 LIFESENSE GROUP

- 13.2.10 NANOLEQ AG

- 13.2.11 EMBRO

- 13.2.12 LOOMIA

- 13.2.13 NEXTILES, INC.

- 13.2.14 AMOHR TECHNISCHE TEXTILIEN GMBH

- 13.2.15 PRIMO1D

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS