|

|

市場調査レポート

商品コード

1784321

SD-WANの世界市場:ソリューション別、サービス別、組織規模別、エンドユーザー別 - 予測(~2030年)Software-defined Wide Area Network (SD-WAN) Market by Offering (Solutions (Software and Appliances) and Services (Professional Services and Managed Services)), Organization Size, End Users (Service Providers and Enterprises) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| SD-WANの世界市場:ソリューション別、サービス別、組織規模別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年08月01日

発行: MarketsandMarkets

ページ情報: 英文 261 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

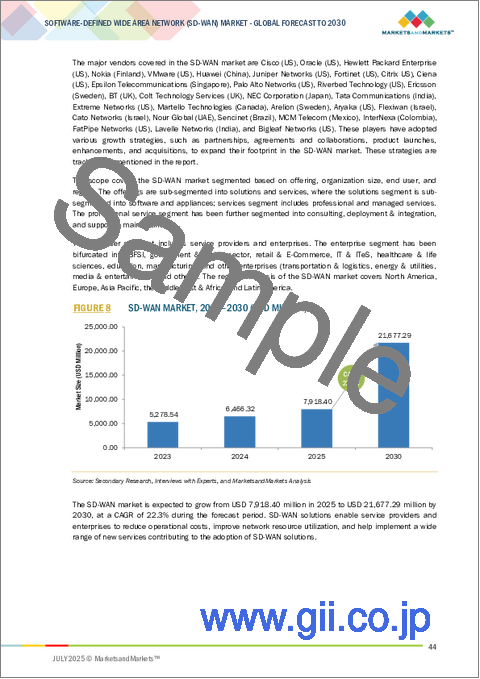

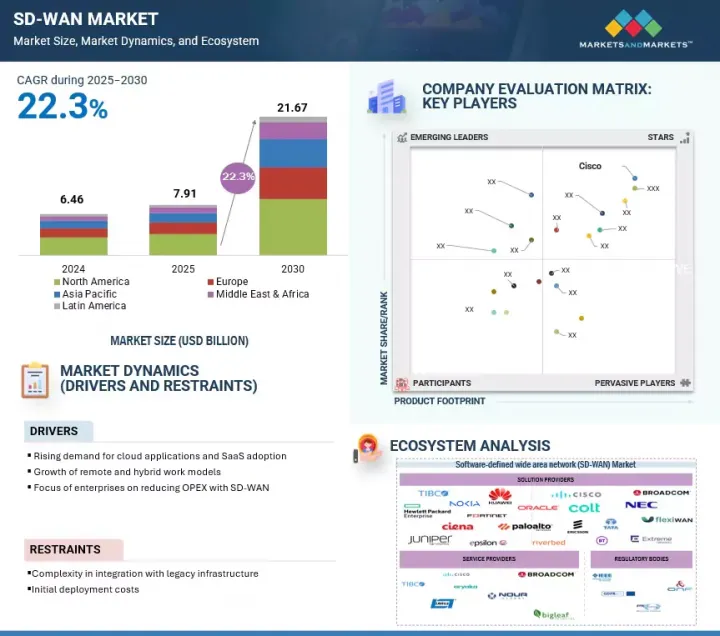

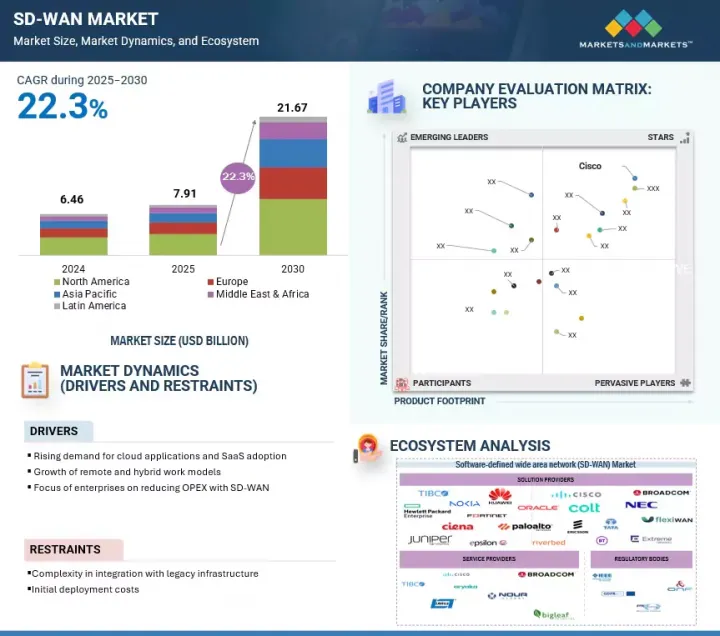

世界のSD-WANの市場規模は、2025年に79億1,000万米ドルであり、2030年に216億7,000万米ドルに達すると推定され、2025年~2030年にCAGRで22.3%の成長が見込まれます。

ネットワークの分散化が進み、従来の境界が崩壊したことで、SD-WANは現代の企業の接続性にとってミッションクリティカルな支柱となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 製品、組織規模、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

現在、企業のワークロードの70%超がSaaS、IaaS、エッジ環境にわたるデータセンター外に存在しており、企業はもはやコストやスピードのためだけにネットワークを最適化するのではなく、可視性、制御、セキュリティのためにネットワークを最適化しています。

このシフトは、特に世界的なフットプリントを持つ大企業において、SD-WANとクラウドネイティブなセキュリティフレームワークとの統合を加速させています。2025年6月、AT&TはそのマネージドSD-WANサービスにAIベースの異常検知を組み込むという動きを見せ、アプリケーションのパフォーマンス低下を未然に防ぐという自律型ネットワーキングの役割の高まりを強く示し、市場における戦略的転換を見せました。同様の動向は医療や小売の部門でも見られ、企業はインテリジェントSD-WANを活用して、遅延のしきい値やリスク感応度に基づいて、患者モニタリングデータやリアルタイム決済システムなどのミッションクリティカルなトラフィックを動的に優先付けています。

しかし、技術的成熟が進む一方で、運用の断片化は依然として制約となっています。特に、クラウド、支店、リモートのエンドポイントに統一されたセキュリティポリシーを適用しようとする場合、企業はレガシーMPLSベースのシステムをダイナミックSD-WANアーキテクチャと整合させる際に、依然として摩擦に直面しています。

この統合上の課題は、エネルギーや公共部門のような規制の厳しい産業において熟練した人材が不足しており、展開を誤るとコンプライアンス上のリスクやサービスの中断を引き起こす可能性があるため、さらに深刻化しています。これに対してベンダーは、アプライアンス、クラウドソフトウェア、そしてコンサルティング、実装、トレーニング・サポート、継続的なマネージドサービスといったあらゆるサービスを含むバンドルデリバリーモデルを強調するために、自社のSD-WAN提供の位置付けを変えようとしています。SD-WANの未来は、技術そのものによって形作られるのではなく、複雑な環境、コンプライアンスを重視する産業、動的なトラフィック情勢において、いかに効果的に運用するかによって形作られます。

「エンタープライズエンドユーザーセグメントが予測期間に最大の市場規模に寄与します。」

BFSI、製造、医療・ライフサイエンス、小売・eコマース、教育、エネルギー・ユーティリティ、政府・公共部門、その他の産業を含むエンタープライズエンドユーザーセグメントは、SD-WANのもっとも支配的な採用者として浮上しています。このリーダーシップは、企業の事業規模、マルチサイトの複雑性、そして高性能でセキュアな中央管理ネットワークへの重大な依存によるものです。

彼らのニーズは中核的なSD-WANソフトウェアやアプライアンスだけでなく、マルチクラウド接続性、ポリシーオーケストレーション、ゼロトラストアーキテクチャを組み合わせた統合製品にまで広がっており、コンサルティング、実装、トレーニング、サポート、マネージドサービスとともに提供されています。例えば、PfizerはHPE Arubaアプライアンスを使用したSD-WANソリューションを世界の研究開発・製造拠点に実装し、実装サービスとマネージドサービスによってサポートされました。これにより、アプリケーションの可用性は99.9%になり、支店のオンボーディングにかかる時間は半分に短縮されました。

同様に、Walmartは多数の小売店舗にCiscoのSD-WANアプライアンスを展開し、コンサルティングとマネージドサポートを統合することで、混雑時のシームレスな精算とリアルタイム在庫管理を実現しました。これらの例は、企業がSD-WANソリューションの最大の消費者であり、もっとも要求が厳しく、業界特有のパフォーマンス、コンプライアンス、セキュリティ要件に合わせた包括的かつサービス集約的な展開を必要としていることを示しています。

当レポートでは、世界のSD-WAN市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- SD-WAN市場の企業にとって魅力的な機会

- SD-WAN市場:提供別

- SD-WAN市場:組織規模別

- SD-WAN市場:プロフェッショナルサービス別

- SD-WAN市場:エンドユーザー別

- SD-WAN市場:企業別

- 北米のSD-WAN市場:エンドユーザー別、提供別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- SD-WANの応用分野

- ユニファイドコミュニケーション

- クラウドアプローチ

- リモート接続性

- アプリケーションパフォーマンス

- ネットワーク最適化

- 複数支店接続性

- セキュリティ

- オフネットVPN

- ケーススタディ分析

- ケーススタディ1:LOTTE、CISCO SD-WANで既存のWANを再構築

- ケーススタディ2:TAFT STETTINIUS & HOLLISTER LLP、ORACLE SD-WANでネットワークの信頼性を向上

- ケーススタディ3:STOLT-NIELSEN、MPLS WANを再構築しネットワークの可視性を高め、管理の複雑性を排除

- ケーススタディ4:データセンターに依存しない、世界のオフィスの容易な拡張

- ケーススタディ5:WINDSTREAM、マネージドSD-WANサービスを自動化しプロビジョニング時間を短縮

- ケーススタディ6:TSCABの413支店にまたがる信頼性の高いネットワーク

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 価格設定の分析

- 主要企業の平均販売価格:ハードウェアアプライアンス別(2024年)

- 参考価格分析:ソリューション別(2024年)

- 主な会議とイベント(2025年~2026年)

- カスタマービジネスに影響を与える動向/混乱

- 関税と規制情勢

- 音声、画像その他のデータを受信、変換、送信又は再生するための機器に関する関税

- 規制機関、政府機関、その他の組織

- 主な規制

- 特許分析

- SD-WAN市場の技術ロードマップ

- 短期ロードマップ(2025年~2026年)

- 中期ロードマップ(2027年~2029年)

- 長期ロードマップ(2030年~2032年)

- SD-WAN実装のベストプラクティス

- 現在のビジネスモデルと新しいビジネスモデル

- ツール、フレームワーク、テクニック

- 貿易分析

- 輸出シナリオ(HSコード8517)

- 輸入シナリオ(HSコード8517)

- SD-WAN市場に対するAI/生成AIの影響

- 2025年の米国関税の影響 - SD-WAN市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 投資と資金調達のシナリオ

第6章 SD-WAN市場:提供別

- イントロダクション

- ソリューション

- ソフトウェア

- コンシューマーエレクトロニクス

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 SD-WAN市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第8章 SD-WAN市場:エンドユーザー別

- イントロダクション

- サービスプロバイダー

- 企業

第9章 SD-WAN市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧諸国

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 東南アジア

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2022年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- ブランド/製品の比較

- CISCO SD-WAN

- FORTINET SECURE SD-WAN

- PRISMA SD-WAN

- VMWARE VELOCLOUD SD-WAN

- ARUBA EDGECONNECT

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- CISCO SYSTEMS

- BROADCOM

- PALO ALTO NETWORKS

- FORTINET

- HEWLETT PACKARD ENTERPRISE (HPE)

- HUAWEI

- JUNIPER NETWORKS

- ORACLE

- NOKIA

- EXTREME NETWORKS, INC.

- ERICSSON

- BT GROUP

- RIVERBED TECHNOLOGY

- COLT TECHNOLOGY SERVICES

- NEC CORPORATION

- TATA COMMUNICATIONS

- TIBCO SOFTWARE

- CIENA CORPORATION

- EPSILON TELECOMMUNICATIONS

- スタートアップ/中小企業

- MARTELLO TECHNOLOGIES

- ARELION

- ARYAKA NETWORKS

- CATO NETWORKS

- FLEXIWAN

- NOUR GLOBAL

- FATPIPE NETWORKS

- LAVELLE NETWORKS

- SENCINET

- MCM TELECOM

- INTERNEXA

- BIGLEAF NETWORKS

第12章 隣接市場と関連市場

- イントロダクション

- エンタープライズネットワーキング市場

- 市場の定義

- 市場の概要

- エンタープライズネットワーキング市場:ネットワーク別

- エンタープライズネットワーキング市場:展開方式別

- エンタープライズネットワーキング市場:エンドユーザー別

- エンタープライズネットワーキング市場:地域別

- NaaS(Network as a Service)市場

- 市場の定義

- NaaS(Network as a Service)市場:タイプ別

- NaaS(Network as a Service)市場:組織規模別

- NaaS(Network as a Service)市場:エンドユーザー別

- NaaS(Network as a Service)市場:地域別

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- TABLE 2 ROLE OF PLAYERS IN SOFTWARE-DEFINED WIDE AREA NETWORK ECOSYSTEM

- TABLE 3 SD WAN MARKET: PORTER'S FIVE FORCES MODEL ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS, BY HARDWARE APPLIANCE, 2024

- TABLE 7 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION, 2024

- TABLE 8 SD-WAN MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LIST OF PATENTS IN SD-WAN MARKET, 2023-2025

- TABLE 14 EXPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 15 IMPORT SCENARIO FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 16 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

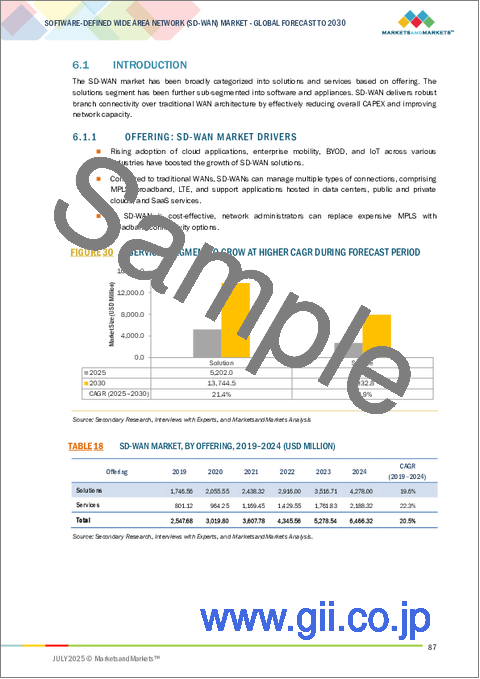

- TABLE 18 SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 19 SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 20 SOLUTIONS: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 21 SOLUTIONS: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 SOLUTIONS: SD-WAN MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 23 SOLUTIONS: SD-WAN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 24 SOFTWARE: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 25 SOFTWARE: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 APPLIANCES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 27 APPLIANCES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 SERVICES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 SERVICES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 SERVICES: SD-WAN MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 31 SERVICES: SD-WAN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: SD-WAN MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: SD-WAN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 36 CONSULTING: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 CONSULTING: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 DEPLOYMENT & INTEGRATION: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 DEPLOYMENT & INTEGRATION: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 SUPPORT & MAINTENANCE: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 SUPPORT & MAINTENANCE: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 MANAGED SERVICES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 MANAGED SERVICES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 45 SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 46 SMALL AND MEDIUM-SIZED ENTERPRISES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 SMALL AND MEDIUM-SIZED ENTERPRISES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 LARGE ENTERPRISES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 49 LARGE ENTERPRISES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 51 SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 52 SERVICE PROVIDERS: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 SERVICE PROVIDERS: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ENTERPRISES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 ENTERPRISES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 57 SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 58 BANKING, FINANCIAL SERVICES, AND INSURANCE: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 BANKING, FINANCIAL SERVICES, AND INSURANCE: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 GOVERNMENT & PUBLIC SECTOR: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 GOVERNMENT & PUBLIC SECTOR: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 RETAIL & E-COMMERCE: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 63 RETAIL & E-COMMERCE: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 IT & ITES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 65 IT & ITES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 HEALTHCARE & LIFE SCIENCES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 67 HEALTHCARE & LIFE SCIENCES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 EDUCATION: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 69 EDUCATION: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 MANUFACTURING: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 71 MANUFACTURING: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 OTHER ENTERPRISES: SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 73 OTHER ENTERPRISES: SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 SD-WAN MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 75 SD-WAN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: SD-WAN MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: SD-WAN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 US: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 93 US: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 94 US: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 95 US: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 96 US: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 97 US: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 98 US: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 99 US: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 100 US: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 101 US: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 102 US: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 103 US: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 104 US: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 105 US: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 106 CANADA: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 107 CANADA: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 108 CANADA: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 109 CANADA: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 111 CANADA: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 112 CANADA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 113 CANADA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 114 CANADA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 115 CANADA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 116 CANADA: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 117 CANADA: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 118 CANADA: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 119 CANADA: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 121 EUROPE: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 123 EUROPE: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 125 EUROPE: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 127 EUROPE: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 129 EUROPE: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 131 EUROPE: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 133 EUROPE: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: SD-WAN MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 135 EUROPE: SD-WAN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 UK: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 137 UK: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 138 UK: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 139 UK: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 140 UK: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 141 UK: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 UK: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 143 UK: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 144 UK: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 145 UK: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 146 UK: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 147 UK: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 148 UK: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 149 UK: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: SD-WAN MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: SD-WAN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 CHINA: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 167 CHINA: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 168 CHINA: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 169 CHINA: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 170 CHINA: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 171 CHINA: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 172 CHINA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 173 CHINA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 174 CHINA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 175 CHINA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 176 CHINA: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 177 CHINA: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 178 CHINA: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 179 CHINA: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY GCC COUNTRIES, 2019-2024 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: SD-WAN MARKET, BY GCC COUNTRIES, 2025-2030 (USD MILLION)

- TABLE 198 UAE: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 199 UAE: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 200 UAE: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 201 UAE: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 202 UAE: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 203 UAE: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 204 UAE: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 205 UAE: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 206 UAE: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 207 UAE: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 208 UAE: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 209 UAE: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 210 UAE: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 211 UAE: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 212 LATIN AMERICA: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 213 LATIN AMERICA: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 214 LATIN AMERICA: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 215 LATIN AMERICA: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 216 LATIN AMERICA: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 217 LATIN AMERICA: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 218 LATIN AMERICA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 219 LATIN AMERICA: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 220 LATIN AMERICA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 221 LATIN AMERICA: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 222 LATIN AMERICA: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 223 LATIN AMERICA: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 224 LATIN AMERICA: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 225 LATIN AMERICA: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 226 LATIN AMERICA: SD-WAN MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 227 LATIN AMERICA: SD-WAN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 228 BRAZIL: SD-WAN MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 229 BRAZIL: SD-WAN MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 230 BRAZIL: SD-WAN MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 231 BRAZIL: SD-WAN MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 232 BRAZIL: SD-WAN MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 233 BRAZIL: SD-WAN MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 234 BRAZIL: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 235 BRAZIL: SD-WAN MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 236 BRAZIL: SD-WAN MARKET, BY ORGANIZATION SIZE, 2019-2024 (USD MILLION)

- TABLE 237 BRAZIL: SD-WAN MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 238 BRAZIL: SD-WAN MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 239 BRAZIL: SD-WAN MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 240 BRAZIL: SD-WAN MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 241 BRAZIL: SD-WAN MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 242 OVERVIEW OF STRATEGIES ADOPTED BY KEY SD-WAN PLAYERS

- TABLE 243 SD-WAN MARKET: DEGREE OF COMPETITION

- TABLE 244 SD-WAN MARKET: REGION FOOTPRINT

- TABLE 245 SD-WAN MARKET: OFFERING FOOTPRINT

- TABLE 246 SD-WAN MARKET: ENTERPRISE FOOTPRINT

- TABLE 247 SD-WAN MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 248 SD-WAN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 249 SD-WAN MARKET: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 250 SD-WAN MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 251 CISCO SYSTEMS: COMPANY OVERVIEW

- TABLE 252 CISCO SYSTEMS: SOLUTIONS OFFERED

- TABLE 253 CISCO SYSTEMS: PRODUCT LAUNCHES

- TABLE 254 CISCO SYSTEMS: DEALS

- TABLE 255 BROADCOM: COMPANY OVERVIEW

- TABLE 256 BROADCOM: SOLUTIONS OFFERED

- TABLE 257 BROADCOM: PRODUCT LAUNCHES

- TABLE 258 BROADCOM: DEALS

- TABLE 259 PALO ALTO NETWORKS: COMPANY OVERVIEW

- TABLE 260 PALO ALTO NETWORKS: SOLUTIONS OFFERED

- TABLE 261 PALO ALTO: PRODUCT ENHANCEMENTS

- TABLE 262 PALO ALTO NETWORKS: DEALS

- TABLE 263 FORTINET: COMPANY OVERVIEW

- TABLE 264 FORTINET: SOLUTIONS OFFERED

- TABLE 265 FORTINET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 266 FORTINET: DEALS

- TABLE 267 HPE: COMPANY OVERVIEW

- TABLE 268 HPE: SOLUTIONS OFFERED

- TABLE 269 HPE: PRODUCT LAUNCHES

- TABLE 270 HPE: DEALS

- TABLE 271 HUAWEI: COMPANY OVERVIEW

- TABLE 272 HUAWEI: SOLUTIONS OFFERED

- TABLE 273 HUAWEI: DEALS

- TABLE 274 JUNIPER NETWORKS: COMPANY OVERVIEW

- TABLE 275 JUNIPER NETWORKS: SOLUTIONS/SERVICES OFFERED

- TABLE 276 JUNIPER NETWORKS: PRODUCT LAUNCHES

- TABLE 277 JUNIPER NETWORKS: DEALS

- TABLE 278 ORACLE: COMPANY OVERVIEW

- TABLE 279 ORACLE: SOLUTIONS OFFERED

- TABLE 280 NOKIA: COMPANY OVERVIEW

- TABLE 281 NOKIA: SOLUTIONS/SERVICES OFFERED

- TABLE 282 NOKIA: DEALS

- TABLE 283 EXTREME NETWORKS: COMPANY OVERVIEW

- TABLE 284 EXTREME NETWORKS: SOLUTIONS OFFERED

- TABLE 285 EXTREME NETWORKS: PRODUCT ENHANCEMENTS

- TABLE 286 EXTREME NETWORKS: DEALS

- TABLE 287 ENTERPRISE NETWORKING MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 288 ENTERPRISE NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 289 ENTERPRISE NETWORKING MARKET, BY NETWORK, 2018-2023 (USD MILLION)

- TABLE 290 ENTERPRISE NETWORKING MARKET, BY NETWORK, 2024-2029 (USD MILLION)

- TABLE 291 ENTERPRISE NETWORKING MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 292 ENTERPRISE NETWORKING MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 293 ENTERPRISE NETWORKING MARKET, BY END-USER, 2018-2023 (USD MILLION)

- TABLE 294 ENTERPRISE NETWORKING MARKET, BY END-USER, 2024-2029 (USD MILLION)

- TABLE 295 ENTERPRISE NETWORKING MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 296 ENTERPRISE NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 297 NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 298 NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 299 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 300 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 301 NETWORK AS A SERVICE MARKET, BY END-USER, 2016-2021 (USD MILLION)

- TABLE 302 NETWORK AS A SERVICE MARKET, BY END-USER, 2022-2027 (USD MILLION)

- TABLE 303 NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 304 NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 SD-WAN MARKET: RESEARCH DESIGN

- FIGURE 2 SD-WAN MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN SD-WAN MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): SD-WAN MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 7 SD-WAN MARKET: DATA TRIANGULATION

- FIGURE 8 SD-WAN MARKET, 2023-2030 (USD MILLION)

- FIGURE 9 SD-WAN MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2025

- FIGURE 10 INCREASING NUMBER OF CLOUD-BASED SOLUTIONS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 11 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 DEPLOYMENT & INTEGRATION SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 14 ENTERPRISES TO DOMINATE MARKET IN 2025

- FIGURE 15 BFSI SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 16 ENTERPRISES AND SOLUTIONS SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2025

- FIGURE 17 SD-WAN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 SD-WAN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 19 SOFTWARE-DEFINED WIDE AREA NETWORK ECOSYSTEM

- FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 22 AVERAGE SELLING PRICE OF KEY PLAYERS, BY HARDWARE APPLIANCE, 2024

- FIGURE 23 SD-WAN MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 MAJOR PATENTS FOR SD-WAN MARKET

- FIGURE 25 SD-WAN MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 26 EXPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY 2019-2023, (USD MILLION)

- FIGURE 27 IMPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY 2019-2023 (USD MILLION)

- FIGURE 28 IMPACT OF GENERATIVE-AI IN SD-WAN MARKET

- FIGURE 29 SD-WAN MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 SOFTWARE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 MANAGED SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 DEPLOYMENT & INTEGRATION SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 SERVICE PROVIDERS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 HEALTHCARE & LIFE SCIENCES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN SD-WAN MARKET, 2020-2024 (USD MILLION)

- FIGURE 40 SHARES OF LEADING COMPANIES IN SD-WAN MARKET, 2024

- FIGURE 41 SD-WAN MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 COMPANY VALUATION OF KEY VENDORS, 2025

- FIGURE 43 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 44 SD-WAN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 SD-WAN MARKET: COMPANY FOOTPRINT

- FIGURE 46 SD-WAN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 CISCO SYSTEMS: COMPANY SNAPSHOT

- FIGURE 48 BROADCOM: COMPANY SNAPSHOT

- FIGURE 49 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 50 FORTINET: COMPANY SNAPSHOT

- FIGURE 51 HPE: COMPANY SNAPSHOT

- FIGURE 52 HUAWEI: COMPANY SNAPSHOT

- FIGURE 53 JUNIPER NETWORKS: COMPANY SNAPSHOT

- FIGURE 54 ORACLE: COMPANY SNAPSHOT

- FIGURE 55 NOKIA: COMPANY SNAPSHOT

- FIGURE 56 EXTREME NETWORKS: COMPANY SNAPSHOT

The SD-WAN market is estimated to be USD 7.91 billion in 2025 and reach USD 21.67 billion in 2030 at a CAGR of 22.3%, from 2025 to 2030. Rising network decentralization and the collapse of the traditional perimeter have made SD-WAN a mission-critical backbone for modern enterprise connectivity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, organization size, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

With over 70% of enterprise workloads now residing outside the data center across SaaS, IaaS, and edge environments, organizations are no longer optimizing networks solely for cost or speed, but for visibility, control, and security.

This shift is accelerating the integration of SD-WAN with cloud-native security frameworks, particularly among large enterprises with global footprints. In June 2025, AT&T's move to embed AI-based anomaly detection in its managed SD-WAN offering marked a strategic pivot in the market, emphasizing the growing role of autonomous networking in preempting application performance degradation. Similar trends are visible in healthcare and retail sectors, where businesses are leveraging intelligent SD-WAN to dynamically prioritize mission-critical traffic such as patient monitoring data or real-time payment systems based on latency thresholds and risk sensitivity.

However, while technological maturity is advancing, operational fragmentation remains a constraint. Enterprises still face friction in aligning legacy MPLS-based systems with dynamic SD-WAN architectures, particularly when trying to enforce unified security policies across cloud, branch, and remote endpoints.

This integration challenge is compounded by the shortage of skilled personnel in regulated industries such as the energy and public sectors, where deployment missteps can trigger compliance risks or service disruption. In response, vendors are repositioning their SD-WAN offerings to emphasize bundled delivery models that include appliances, cloud software, and a full spectrum of services, consulting, implementation, training & support, and ongoing managed services. The future of SD-WAN is being shaped by the technology itself, but by how effectively it is operationalized across complex environments, compliance-heavy verticals, and dynamic traffic landscapes.

"Enterprise end user segment contributed to the largest market size during the forecast period"

The enterprise end user segment, including BFSI, manufacturing, healthcare & life sciences, retail & e-commerce, education, energy & utilities, government & public sector, and other industries, has emerged as the most dominant adopter of SD-WAN. This leadership is driven by enterprises' operational scale, multi-site complexity, and critical dependence on high-performance, secure, and centrally managed networks.

Their needs extend beyond core SD-WAN software or appliances to integrated offerings that combine multicloud connectivity, policy orchestration, and zero-trust architecture, delivered alongside consulting, implementation, training and support, and managed services. For instance, Pfizer implemented an SD-WAN solution using HPE Aruba appliances across its global R&D and manufacturing sites, supported by implementation and managed services, which led to 99.9 percent application availability and reduced branch onboarding time by half.

Similarly, Walmart deployed Cisco's SD-WAN appliances across numerous retail outlets, integrated with consulting and managed support, enabling seamless checkout processes and real-time inventory control during high-traffic periods. These examples illustrate that enterprises are the largest consumers of SD-WAN solutions and the most demanding, requiring holistic, service-intensive deployments tailored to vertical-specific performance, compliance, and security requirements.

"Large enterprise segment is projected to register the largest market share during the forecast period"

Large enterprises are poised to contribute the largest share in SD-WAN adoption due to their complex infrastructure, global footprint, and stringent requirements for reliability, security, and performance optimization. These organizations typically manage hundreds or thousands of locations, each demanding standardized policy enforcement, real-time visibility, and robust disaster recovery capabilities. To address this, large enterprises are increasingly adopting SD-WAN offerings that bundle software and appliances with deep professional engagement consulting, implementation, training, and support, and full-scale managed services.

For instance, Toyota Motor Corporation deployed Aruba EdgeConnect across its global operations, spanning over 30 countries, utilizing managed services to maintain policy consistency and reporting a 70 percent reduction in manual configuration tasks. Similarly, Shell integrated Fortinet's SD-WAN into its energy infrastructure with end-to-end support services, achieving a 45 percent decrease in meantime to repair and enhanced control over remote asset communication. These deployments illustrate how large enterprises emphasize not only the technology itself but also the ecosystem of services that guarantees secure, scalable, and reliable implementation across their distributed environments.

"North America leads in market share, whereas Asia Pacific emerges as the fastest-growing region during the forecast period"

North America remains the leading region in SD-WAN deployment, supported by advanced enterprise cloud maturity, security regulations, and a high concentration of managed service providers. Enterprises in this region demand comprehensive offerings that integrate SD-WAN software and appliances with professional and managed services to ensure SLA compliance, cloud optimization, and centralized security enforcement. For instance, JPMorgan Chase implemented Cisco Catalyst SD-WAN across more than 5,000 branch locations, supported by consulting, implementation, and ongoing support services. This initiative enabled a 30 percent reduction in site onboarding time and reinforced zero-trust access across multicloud workloads.

Meanwhile, Asia Pacific is emerging as the fastest-growing region, driven by accelerating digitalization and telco-led service integration. For instance, Malaysia-based electronics manufacturer Inari Amertron adopted HPE Aruba SD-WAN along with consulting services across its production plants, reducing downtime by 40 percent and improving inter-site coordination. In India, public sector agencies such as the National Informatics Centre are deploying Fortinet SD-WAN with professional services to strengthen secure connectivity across government facilities. These regional trends reflect a maturing North American landscape shaped by performance-driven scale, while Asia Pacific's growth is propelled by infrastructure expansion and digitally enabled sectoral transformation.

Breakdown of Primary Interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 20%, Directors - 30%, and Others - 50%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The major players in the SD-WAN market are Cisco (US), HPE (US), Nokia (Finland), Broadcom (US), Fortinet (US), Oracle (US), Huawei (China), Juniper Networks (US), Extreme Networks (US), Tibco Software (US), Ciena (US), Epsilon Telecommunications (US), Palto Alto Networks (US), Riverbed Technology (US), and Ericsson (Sweden). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches, product enhancements, and acquisitions to expand their footprint in the SD-WAN market.

Research Coverage

The market study covers the SD-WAN market size and the growth potential across different segments, including offering (solution [software, appliances], services [professional services (consulting, deployment & integration, support & maintenance), managed services]), organization size (small and medium-sized enterprises, large enterprises), end user (service providers, enterprises [banking, financial services, and insurance, manufacturing, healthcare & life sciences, retail & e-commerce, education, IT & ITes, government & public sector, other enterprises]), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global SD-WAN market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (cloud adoption, hybrid work shift, application performance needs, zero-trust security demand, cost optimization), restraints (integration with legacy systems, skill shortages, security complexity, multi-vendor fragmentation), opportunities (SME adoption surge, 5G and edge expansion, vertical-specific solutions, AI-driven orchestration), and challenges (policy consistency, compliance enforcement, limited in-house expertise, real-time visibility gaps)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the SD-WAN market

- Market Development: Comprehensive information about lucrative markets - analyzing the SD-WAN market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the SD-WAN market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cisco (US), HPE (US), Nokia (Finland), Broadcom (US), Fortinet (US), Oracle (US), Huawei (China), Juniper Networks (US), Extreme Networks (US), Tibco Software (US), Ciena (US), Epsilon Telecommunications (US), Palto Alto Networks (US), Riverbed Technology (US), and Ericsson (Sweden)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 SD-WAN MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SD-WAN MARKET

- 4.2 SD-WAN MARKET, BY OFFERING

- 4.3 SD-WAN MARKET, BY ORGANIZATION SIZE

- 4.4 SD-WAN MARKET, BY PROFESSIONAL SERVICE

- 4.5 SD-WAN MARKET, BY END USER

- 4.6 SD-WAN MARKET, BY ENTERPRISE

- 4.7 NORTH AMERICA: SD-WAN MARKET, BY END USER AND OFFERING

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for cloud applications and SaaS adoption

- 5.2.1.2 Growth of remote and hybrid work models

- 5.2.1.3 Focus of enterprises on reducing OPEX with SD-WAN

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity in integration with legacy infrastructure

- 5.2.2.2 Initial deployment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Digital transformation across organizations

- 5.2.3.2 5G integration for next-gen SD-WAN solutions

- 5.2.3.3 Rising adoption by SMEs

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns over SD-WAN security

- 5.2.4.2 Vendor lock-in risks

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SD-WAN APPLICATION AREAS

- 5.5.1 UNIFIED COMMUNICATION

- 5.5.2 CLOUD APPROACH

- 5.5.3 REMOTE CONNECTIVITY

- 5.5.4 APPLICATION PERFORMANCE

- 5.5.5 NETWORK OPTIMIZATION

- 5.5.6 MULTIBRANCH CONNECTIVITY

- 5.5.7 SECURITY

- 5.5.8 OFFNET VPN

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CASE STUDY 1: LOTTE RESTRUCTURED EXISTING WAN WITH CISCO SD-WAN

- 5.6.2 CASE STUDY 2: TAFT STETTINIUS & HOLLISTER LLP IMPROVED NETWORK RELIABILITY WITH ORACLE SD-WAN

- 5.6.3 CASE STUDY 3: STOLT-NIELSEN RESTRUCTURED ITS MPLS WAN TO GAIN NETWORK VISIBILITY AND ELIMINATE MANAGEMENT COMPLEXITY

- 5.6.4 CASE STUDY 4: EASY SCALE-UP OF GLOBAL OFFICES WITHOUT DATA CENTER DEPENDENCY

- 5.6.5 CASE STUDY 5: WINDSTREAM BRINGS AUTOMATION TO MANAGED SD-WAN SERVICES TO CUT PROVISIONING TIME

- 5.6.6 CASE STUDY 6: RELIABLE NETWORK ACROSS 413 BRANCHES OF TSCAB

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Software-defined Networking (SDN)

- 5.9.1.2 Network Functions Virtualization (NFV)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Artificial Intelligence (AI)/Machine Learning (ML)

- 5.9.2.2 Cloud computing

- 5.9.2.3 Internet of Things (IoT)

- 5.9.2.4 Edge computing

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Network orchestration & automation

- 5.9.3.2 Data analytics

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY HARDWARE APPLIANCE, 2024

- 5.10.2 INDICATIVE PRICING ANALYSIS, BY SOLUTION, 2024

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF RELATED TO MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.13.3.1 North America

- 5.13.3.1.1 US

- 5.13.3.1.2 Canada

- 5.13.3.2 Europe

- 5.13.3.3 Asia Pacific

- 5.13.3.3.1 South Korea

- 5.13.3.3.2 China

- 5.13.3.3.3 India

- 5.13.3.4 Middle East & Africa

- 5.13.3.4.1 UAE

- 5.13.3.4.2 KSA

- 5.13.3.5 Latin America

- 5.13.3.5.1 Brazil

- 5.13.3.5.2 Mexico

- 5.13.3.1 North America

- 5.14 PATENT ANALYSIS

- 5.14.1 METHODOLOGY

- 5.15 TECHNOLOGY ROADMAP FOR SD-WAN MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2026)

- 5.15.2 MID-TERM ROADMAP (2027-2029)

- 5.15.3 LONG-TERM ROADMAP (2030-2032)

- 5.16 BEST PRACTICES TO IMPLEMENT SD-WAN

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.19 TRADE ANALYSIS

- 5.19.1 EXPORT SCENARIO (HS CODE 8517)

- 5.19.2 IMPORT SCENARIO (HS CODE 8517)

- 5.20 IMPACT OF AI/GEN AI ON SD-WAN MARKET

- 5.21 IMPACT OF 2025 US TARIFF - SD-WAN MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

- 5.22 INVESTMENT AND FUNDING SCENARIO

6 SD-WAN MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: SD-WAN MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 SOFTWARE

- 6.2.1.1 Increasing demand for virtual applications to drive market

- 6.2.2 APPLIANCES

- 6.2.2.1 Edge routers to manage data flow by queuing

- 6.2.1 SOFTWARE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Enable enterprises assess their network needs

- 6.3.1.2 Consulting

- 6.3.1.3 Deployment & integration

- 6.3.1.4 Support & maintenance

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Reduce the complexity of managing in-house networks

- 6.3.1 PROFESSIONAL SERVICES

7 SD-WAN MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: SD-WAN MARKET DRIVERS

- 7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.2.1 WIDE ADOPTION OF CLOUD TECHNOLOGY FOR CENTRALIZED CONTROL

- 7.3 LARGE ENTERPRISES

- 7.3.1 INCREASE OPERATIONAL EFFICIENCY OF SD-WAN SOLUTIONS

8 SD-WAN MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USER: SD-WAN MARKET DRIVERS

- 8.2 SERVICE PROVIDERS

- 8.2.1 DELIVER COMPREHENSIVE, COST-EFFECTIVE MANAGED SD-WAN SERVICES

- 8.3 ENTERPRISES

- 8.3.1 INCREASINGLY DEPLOY SD-WAN TO SUPPORT GLOBAL REMOTE WORK CULTURE

- 8.3.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.3.2.1 Extend financial services to remote areas

- 8.3.3 GOVERNMENT & PUBLIC SECTOR

- 8.3.3.1 Enhance cloud agility and user experience

- 8.3.4 RETAIL & E-COMMERCE

- 8.3.4.1 Deploy SD-WAN solutions to enhance customer experience

- 8.3.5 IT & ITES

- 8.3.5.1 Rising demand for cloud services, SaaS platforms, and virtualized environments

- 8.3.6 HEALTHCARE & LIFE SCIENCES

- 8.3.6.1 Enhance reliability and security of data transmission

- 8.3.7 EDUCATION

- 8.3.7.1 Shift toward e-learning, virtual classrooms, and digital content delivery

- 8.3.8 MANUFACTURING

- 8.3.8.1 Adopt SD-WAN solutions to lower network complexities

- 8.3.9 OTHER ENTERPRISES

9 SD-WAN MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Rising initiatives by government toward infrastructure development to drive market

- 9.2.3 CANADA

- 9.2.3.1 Need to monitor increasing traffic to boost demand for software-defined technologies

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Government initiatives for telecommunication to promote regulatory compliance for vendors

- 9.3.3 GERMANY

- 9.3.3.1 Strong presence of automobile and manufacturing companies to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Strong IT and telecommunications sector to drive market

- 9.3.5 ITALY

- 9.3.5.1 CPEs to improve network performance and optimize application experience

- 9.3.6 SPAIN

- 9.3.6.1 Government to focus on digitization in Digital Spain Plan 2025

- 9.3.7 NORDIC COUNTRIES

- 9.3.7.1 Increase in adoption of software-defined networking technology by enterprises to enable remote working

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Shift toward IoT, cloud, and AI technologies

- 9.4.3 INDIA

- 9.4.3.1 SD-WAN regulatory and policy trends to drive market

- 9.4.4 JAPAN

- 9.4.4.1 Stringent laws and regulations to drive market

- 9.4.5 AUSTRALIA AND NEW ZEALAND

- 9.4.5.1 Rising inflation, chip shortages, and trade restrictions to boost demand for secure networking

- 9.4.6 SOUTHEAST ASIA

- 9.4.6.1 Adoption of Bluetooth communication technology to drive market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 GCC COUNTRIES

- 9.5.2.1 Upgradation of traditional network technologies to drive SD-WAN market

- 9.5.2.2 UAE

- 9.5.2.3 KSA

- 9.5.2.4 Rest of GCC Countries

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 SD-WAN deployment to boost efficiency by managing bandwidth availability and usage

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Growth in various verticals and increasing demand for security

- 9.6.3 MEXICO

- 9.6.3.1 Government policies and rising internet usage to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 CISCO SD-WAN

- 10.5.2 FORTINET SECURE SD-WAN

- 10.5.3 PRISMA SD-WAN

- 10.5.4 VMWARE VELOCLOUD SD-WAN

- 10.5.5 ARUBA EDGECONNECT

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Enterprise footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CISCO SYSTEMS

- 11.1.1.1 Business overview

- 11.1.1.2 Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 BROADCOM

- 11.1.2.1 Business overview

- 11.1.2.2 Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 PALO ALTO NETWORKS

- 11.1.3.1 Business overview

- 11.1.3.2 Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 FORTINET

- 11.1.4.1 Business overview

- 11.1.4.2 Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.4 Deals

- 11.1.4.5 MnM view

- 11.1.4.5.1 Right to win

- 11.1.4.5.2 Strategic choices

- 11.1.4.5.3 Weaknesses and competitive threats

- 11.1.5 HEWLETT PACKARD ENTERPRISE (HPE)

- 11.1.5.1 Business overview

- 11.1.5.2 Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 HUAWEI

- 11.1.6.1 Business overview

- 11.1.6.2 Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 JUNIPER NETWORKS

- 11.1.7.1 Business overview

- 11.1.7.2 Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 ORACLE

- 11.1.8.1 Business overview

- 11.1.8.2 Solutions offered

- 11.1.9 NOKIA

- 11.1.9.1 Business overview

- 11.1.9.2 Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 EXTREME NETWORKS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product enhancements

- 11.1.10.3.2 Deals

- 11.1.11 ERICSSON

- 11.1.12 BT GROUP

- 11.1.13 RIVERBED TECHNOLOGY

- 11.1.14 COLT TECHNOLOGY SERVICES

- 11.1.15 NEC CORPORATION

- 11.1.16 TATA COMMUNICATIONS

- 11.1.17 TIBCO SOFTWARE

- 11.1.18 CIENA CORPORATION

- 11.1.19 EPSILON TELECOMMUNICATIONS

- 11.1.1 CISCO SYSTEMS

- 11.2 STARTUPS/SMES

- 11.2.1 MARTELLO TECHNOLOGIES

- 11.2.2 ARELION

- 11.2.3 ARYAKA NETWORKS

- 11.2.4 CATO NETWORKS

- 11.2.5 FLEXIWAN

- 11.2.6 NOUR GLOBAL

- 11.2.7 FATPIPE NETWORKS

- 11.2.8 LAVELLE NETWORKS

- 11.2.9 SENCINET

- 11.2.10 MCM TELECOM

- 11.2.11 INTERNEXA

- 11.2.12 BIGLEAF NETWORKS

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 ENTERPRISE NETWORKING MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 ENTERPRISE NETWORKING MARKET, BY NETWORK

- 12.2.4 ENTERPRISE NETWORKING MARKET, BY DEPLOYMENT MODE

- 12.2.5 ENTERPRISE NETWORKING MARKET, BY END-USER

- 12.2.6 ENTERPRISE NETWORKING MARKET, BY REGION

- 12.3 NETWORK AS A SERVICE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 NETWORK AS A SERVICE MARKET, BY TYPE

- 12.3.3 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.3.4 NETWORK AS A SERVICE MARKET, BY END-USER

- 12.3.5 NETWORK AS A SERVICE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS