|

|

市場調査レポート

商品コード

1784319

外科用縫合糸の世界市場:製品別、タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測Surgical Sutures Market by Product (Suture Thread (Natural, Synthetic ), Automated Suturing Device), Type, Application, End User & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 外科用縫合糸の世界市場:製品別、タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月01日

発行: MarketsandMarkets

ページ情報: 英文 371 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

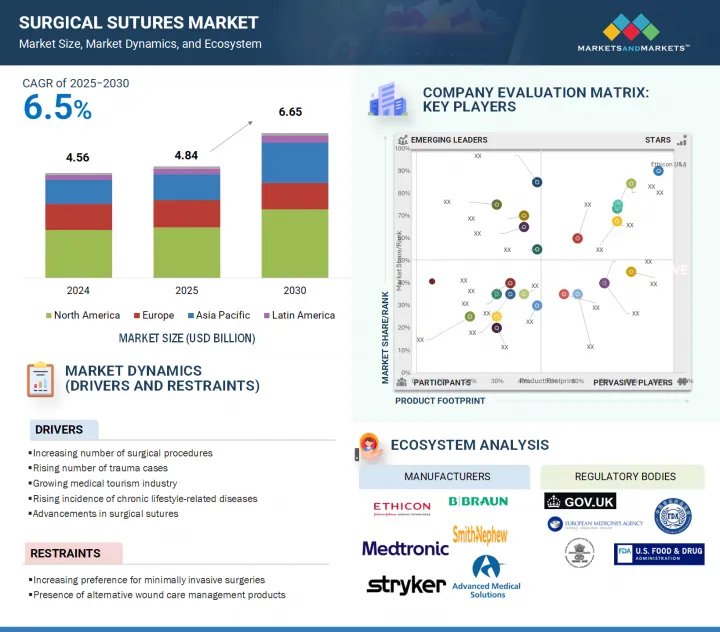

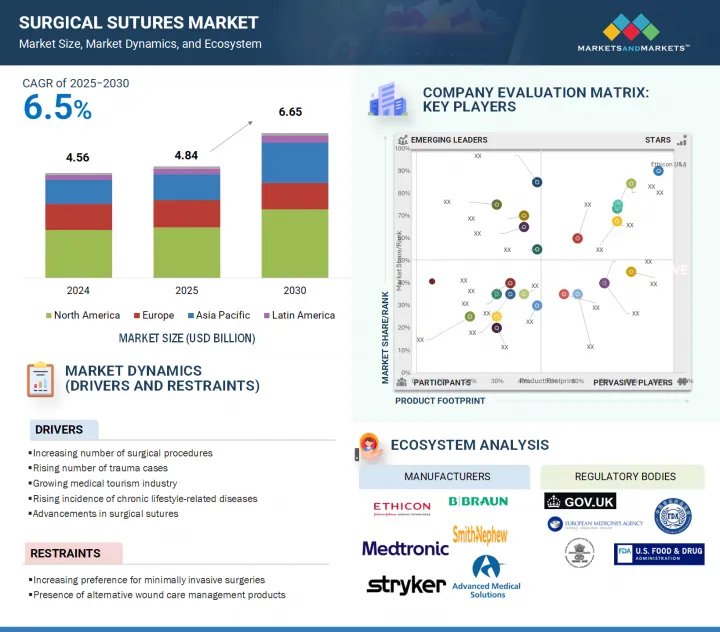

世界の外科用縫合糸の市場規模は、2025年の48億4,000万米ドルから2030年には66億5,000万米ドルに達すると予測され、予測期間中のCAGRは6.5%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

世界の外科手術の背景には、高齢化に伴う慢性疾患、特に糖尿病、心血管疾患、筋骨格系障害などの有病率の上昇があります。さらに、外傷や事故の増加も縫合糸需要の増加に寄与しています。吸収性縫合糸、抗菌縫合糸、有刺縫合糸などの技術革新は、手術成績を大幅に改善し、感染リスクを軽減するため、市場の成長を促進します。さらに、高度な縫合手法を必要とするロボット手術や低侵襲手術の台頭は、創傷閉鎖における精度の必要性を浮き彫りにし、市場を前進させ続けています。

縫合糸は、様々な外科分野での創傷閉鎖に重要な部品であり、それによって外科用縫合糸市場のかなりのシェアを確保しています。従来の開腹手術や低侵襲手技において重要な役割を果たし、あらゆる縫合システムの要として機能しています。この糸の優位性は、その多用途性、利用可能な材料の多様な選択、性能と有効性を高めるための継続的な技術革新に起因しています。吸収糸、非吸収糸、抗菌コート糸、有刺糸などの進化した縫合糸は、一般外科手術、整形外科手術、婦人科手術、心臓血管外科手術において、その適用範囲を大きく広げています。外科医は、高い引張強度、最小限の組織反応性、予測可能な吸収率を示す糸を好みます。これに応えるため、大手メーカーは、外科手術の進化する要求に応えるべく、これらの特性を絶えず改良しています。

外科用縫合糸市場は、その優れた取り扱い特性、結び目の安全性の強化、様々な手術領域への適応性により、マルチフィラメント縫合糸が主な特徴となっています。マルチフィラメント縫合糸は、複数の編組または撚り糸から構成され、モノフィラメント縫合糸よりも強度と柔軟性に優れ、精密な組織近似処置に特に適しています。操作のしやすさと結び目の保持力の高さは、手術時間の短縮に極めて重要であり、需要の多い手術環境では大きな利点となります。さらに、マルチフィラメント縫合糸の柔らかく柔軟な性質は組織への刺激を最小限に抑えるため、胃腸、心臓血管、婦人科手術などの複雑な外科手術に理想的です。

外科手術件数の増加は、主に人口の高齢化と糖尿病、肥満、心血管疾患などの慢性的な健康状態の高い有病率という2つの重要な要因に起因しています。これらの疾患は、合併症を管理し、患者の生活の質を向上させるために、しばしば外科的介入を必要とします。高齢者人口の増加に伴い人口動態が変化する中、ヘルスケアシステムは外科的ソリューションに対する需要の高まりに直面しています。このような人口動向に加えて、米国は、広範な病院ネットワークや外科治療へのアクセスの改善など、洗練されたヘルスケアインフラを誇っています。こうしたアクセスの良さは、積極的なヘルスケア管理への幅広いシフトを反映し、手術件数の増加につながっています。さらに米国は、エチコンやメドトロニックのような主要企業の存在により、医療技術革新の拠点として認識されています。これらの企業は、患者の転帰を向上させる高度な外科用縫合糸の開発で最先端を走っています。これらの企業が提供する製品には、抜糸の必要がない吸収性縫合糸、結び目を作らずに確実な組織閉鎖を可能にすることで手術プロセスを簡素化する有刺縫合糸、術後感染のリスクを軽減する抗菌コーティング縫合糸などの革新的な製品があります。このような最先端の縫合技術を継続的に導入することは、外科手術の進化において重要な役割を果たしています。これは、米国における手術手技と患者ケアの向上へのコミットメントを強調するものです。

当レポートでは、世界の外科用縫合糸市場について調査し、製品別、タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 規制状況

- 技術分析

- 業界動向

- バリューチェーン分析

- サプライチェーン分析

- 貿易分析

- 価格分析

- ポーターのファイブフォース分析

- 隣接市場分析

- 特許分析

- エコシステム分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- アンメットニーズ/エンドユーザーの期待

- 外科用縫合糸市場におけるAIの影響

- 2025年の米国関税の影響- 外科用縫合糸市場

第6章 外科用縫合糸市場(製品別)

- イントロダクション

- 縫合糸

- 自動縫合装置

第7章 外科用縫合糸市場(タイプ別)

- イントロダクション

- マルチフィラメント縫合糸

- モノフィラメント縫合糸

第8章 外科用縫合糸市場(用途別)

- イントロダクション

- 心臓血管外科

- 一般外科

- 婦人科手術

- 整形外科

- 眼科手術

- 美容整形外科

- その他

第9章 外科用縫合糸市場(エンドユーザー別)

- イントロダクション

- 病院

- 外来手術センター

- クリニック・診療所

第10章 外科用縫合糸市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- マクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2022年~2025年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- ETHICON, INC.

- MEDTRONIC

- B. BRAUN SE

- ADVANCED MEDICAL SOLUTIONS GROUP PLC(AMS GROUP)

- HEALTHIUM MEDTECH LIMITED

- BOSTON SCIENTIFIC CORPORATION

- ZIMMER BIOMET HOLDINGS, INC.

- STRYKER

- SMITH+NEPHEW

- CONMED CORPORATION

- INTERNACIONAL FARMACEUTICA S.A. DE C.V.

- CORZA MEDICAL

- DEMETECH CORPORATION

- UNISUR LIFECARE PVT. LTD

- ASSUT EUROPE

- その他の企業

- RESORBA MEDICAL GMBH

- KATSAN KATGUT SANAYI VE TIC. A.S.

- SUTUMED CORP.

- FUTURA SURGICARE PVT. LTD.

- GMD GROUP

- LOTUS SURGICALS PVT LTD

- BIOSINTEX

- MERIL LIFE SCIENCES PVT. LTD.

- MELLON MEDICAL

- AQMEN MEDTECH

- ANCHORA MEDICAL LTD.

第13章 付録

List of Tables

- TABLE 1 ANNUAL AVERAGE EXCHANGE RATE FOR CURRENCY CONVERSION, 2020-2024

- TABLE 2 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 3 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 4 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 5 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 6 CHINA: REGULATORY BODIES APPOINTED FOR MEDICAL DEVICE APPROVAL

- TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SURGICAL SUTURES MARKET: REGULATORY STANDARDS

- TABLE 12 RECENT TRENDS IN SURGICAL SUTURES MARKET

- TABLE 13 IMPORT DATA FOR SURGICAL SUTURES (HS CODE 300610), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR SURGICAL SUTURES (HS CODE 300610), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 AVERAGE SELLING PRICE OF SURGICAL SUTURES, BY KEY PLAYER, 2024 (USD)

- TABLE 16 AVERAGE SELLING PRICE OF SURGICAL SUTURES, BY REGION, 2024 (USD)

- TABLE 17 SURGICAL SUTURES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 SURGICAL SUTURES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 20 KEY BUYING CRITERIA FOR SURGICAL SUTURES MARKET

- TABLE 21 UNMET NEEDS IN SURGICAL SUTURES MARKET

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR SURGICAL SUTURES

- TABLE 24 SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 25 SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 26 USES OF ABSORBABLE SUTURES

- TABLE 27 ABSORBABLE SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 28 ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 29 ABSORBABLE SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ABSORBABLE SYNTHETIC SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 31 ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 32 ABSORBABLE SYNTHETIC SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 POLYGLACTIN 910 SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 34 POLYGLACTIN 910 SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 POLIGLECAPRONE 25 SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 36 POLIGLECAPRONE 25 SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 POLYDIOXANONE SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 38 POLYDIOXANONE SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 POLYGLYCOLIC ACID SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 40 POLYGLYCOLIC ACID SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 OTHER ABSORBABLE SYNTHETIC SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ABSORBABLE NATURAL SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 43 ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 44 ABSORBABLE NATURAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 CATGUT PLAIN SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 CATGUT CHROMIC SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 USES OF NON-ABSORBABLE SUTURES

- TABLE 48 NON-ABSORBABLE SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 49 NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 NON-ABSORBABLE SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 52 NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 NYLON SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 54 NYLON SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 POLYPROPYLENE SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 56 POLYPROPYLENE SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 STAINLESS STEEL SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 58 STAINLESS STEEL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 UHMPE SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 60 UHMWPE SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 OTHER NON-ABSORBABLE SYNTHETIC SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 62 OTHER NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 64 NON-ABSORBABLE NATURAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

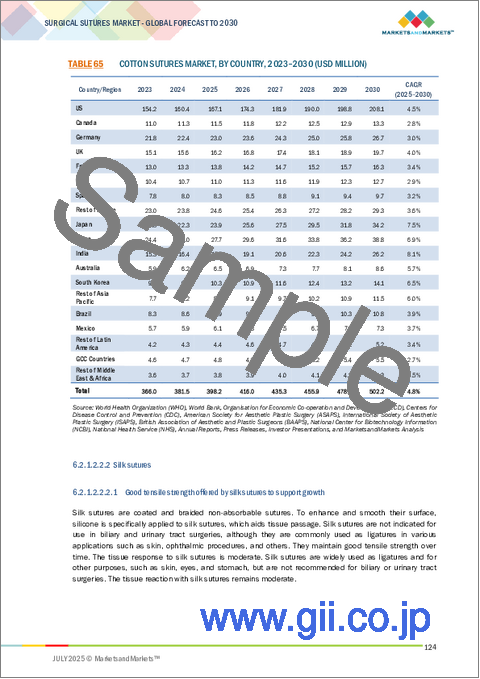

- TABLE 65 COTTON SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 SILK SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 OTHER NON-ABSORBABLE NATURAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 69 UNCOATED SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 ANTIMICROBIAL COATED SUTURES OFFERED BY KEY MARKET PLAYERS

- TABLE 71 ANTIMICROBIAL COATED SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 OTHER COATED SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 AUTOMATED SURGICAL SUTURING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 74 AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 AUTOMATED SUTURING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 DISPOSABLE AUTOMATED SUTURING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 77 DISPOSABLE AUTOMATED SUTURING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 REUSABLE AUTOMATED SUTURING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 79 REUSABLE AUTOMATED SUTURING DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 MULTIFILAMENT SURGICAL SUTURE THREADS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 MONOFILAMENT SURGICAL SUTURE THREADS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 84 SURGICAL SUTURES MARKET FOR CARDIOVASCULAR SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 SURGICAL SUTURES MARKET FOR GENERAL SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 SURGICAL SUTURES MARKET FOR GYNECOLOGICAL SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 SURGICAL SUTURES MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 NUMBER OF GLAUCOMA PATIENTS, BY REGION AND TYPE, 2013 VS. 2020 VS. 2040 (MILLION)

- TABLE 89 SURGICAL SUTURES MARKET FOR OPHTHALMIC SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 SURGICAL SUTURES MARKET FOR COSMETIC & PLASTIC SURGERY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 SURGICAL SUTURES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 93 SURGICAL SUTURES MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 SURGICAL SUTURES MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 SURGICAL SUTURES MARKET FOR CLINICS & PHYSICIAN OFFICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 SURGICAL SUTURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: SURGICAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 111 US: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 112 US: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 113 US: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 US: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 US: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 US: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 US: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 US: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 US: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 120 US: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 US: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 US: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 123 US: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 CANADA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 125 CANADA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 126 CANADA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 CANADA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 CANADA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 CANADA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 CANADA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 CANADA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 CANADA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 133 CANADA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 CANADA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 CANADA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 CANADA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: SURGICAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 EUROPE: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 139 EUROPE: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 140 EUROPE: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 EUROPE: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 EUROPE: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 EUROPE: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 EUROPE: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 EUROPE: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 147 EUROPE: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 EUROPE: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 150 EUROPE: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 151 GERMANY: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 152 GERMANY: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 153 GERMANY: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 GERMANY: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 GERMANY: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 GERMANY: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 GERMANY: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 GERMANY: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 GERMANY: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 160 GERMANY: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 GERMANY: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 GERMANY: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 163 GERMANY: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 UK: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 165 UK: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 166 UK: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 UK: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 UK: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 UK: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 UK: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 UK: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 UK: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 173 UK: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 UK: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 UK: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 UK: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 FRANCE: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 178 FRANCE: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 179 FRANCE: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 FRANCE: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 FRANCE: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 FRANCE: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 FRANCE: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 FRANCE: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 FRANCE: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 186 FRANCE: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 FRANCE: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 FRANCE: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 189 FRANCE: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 190 ITALY: PREVALENCE OF ADULT OBESITY BY 2030

- TABLE 191 ITALY: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 192 ITALY: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 193 ITALY: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 ITALY: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 ITALY: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 ITALY: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 ITALY: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 ITALY: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 ITALY: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 200 ITALY: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 ITALY: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 ITALY: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 203 ITALY: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 204 SPAIN: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 205 SPAIN: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 206 SPAIN: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 SPAIN: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 SPAIN: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 SPAIN: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 SPAIN: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 SPAIN: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 SPAIN: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 213 SPAIN: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 SPAIN: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 SPAIN: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 216 SPAIN: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 217 REST OF EUROPE: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 218 REST OF EUROPE: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 219 REST OF EUROPE: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 REST OF EUROPE: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 REST OF EUROPE: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 REST OF EUROPE: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 REST OF EUROPE: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF EUROPE: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF EUROPE: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 226 REST OF EUROPE: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 REST OF EUROPE: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 REST OF EUROPE: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 229 REST OF EUROPE: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 230 ASIA PACIFIC: SURGICAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 232 ASIA PACIFIC: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 233 ASIA PACIFIC: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 ASIA PACIFIC: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 240 ASIA PACIFIC: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 ASIA PACIFIC: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 ASIA PACIFIC: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 243 ASIA PACIFIC: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 244 CHINA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 245 CHINA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 246 CHINA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 CHINA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 CHINA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 CHINA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 CHINA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 CHINA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 253 CHINA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 CHINA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 CHINA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 256 CHINA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 257 INDIA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 258 INDIA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 259 INDIA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 INDIA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 INDIA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 INDIA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 INDIA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 INDIA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 INDIA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 266 INDIA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 INDIA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 INDIA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 269 INDIA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 270 JAPAN: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 271 JAPAN: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 272 JAPAN: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 JAPAN: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 JAPAN: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 JAPAN: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 JAPAN: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 JAPAN: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 JAPAN: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 279 JAPAN: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 JAPAN: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 JAPAN: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 282 JAPAN: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 283 AUSTRALIA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 284 AUSTRALIA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 285 AUSTRALIA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 AUSTRALIA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 AUSTRALIA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 AUSTRALIA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 AUSTRALIA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 AUSTRALIA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 AUSTRALIA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 292 AUSTRALIA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 AUSTRALIA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 AUSTRALIA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 295 AUSTRALIA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 296 SOUTH KOREA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 297 SOUTH KOREA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 298 SOUTH KOREA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 SOUTH KOREA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 SOUTH KOREA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 SOUTH KOREA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 SOUTH KOREA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 SOUTH KOREA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 304 SOUTH KOREA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 305 SOUTH KOREA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 SOUTH KOREA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 SOUTH KOREA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 308 SOUTH KOREA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 309 REST OF ASIA PACIFIC: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 310 REST OF ASIA PACIFIC: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 311 REST OF ASIA PACIFIC: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 REST OF ASIA PACIFIC: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 313 REST OF ASIA PACIFIC: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 REST OF ASIA PACIFIC: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 REST OF ASIA PACIFIC: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 REST OF ASIA PACIFIC: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 318 REST OF ASIA PACIFIC: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 REST OF ASIA PACIFIC: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 REST OF ASIA PACIFIC: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 321 REST OF ASIA PACIFIC: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 322 LATIN AMERICA: SURGICAL SUTURES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 323 LATIN AMERICA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 324 LATIN AMERICA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 325 LATIN AMERICA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 326 LATIN AMERICA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 LATIN AMERICA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 LATIN AMERICA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 LATIN AMERICA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 LATIN AMERICA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 LATIN AMERICA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 332 LATIN AMERICA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 LATIN AMERICA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 LATIN AMERICA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 335 LATIN AMERICA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 336 BRAZIL: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 337 BRAZIL: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 338 BRAZIL: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 339 BRAZIL: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 BRAZIL: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 BRAZIL: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 342 BRAZIL: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 343 BRAZIL: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 BRAZIL: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 345 BRAZIL: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 BRAZIL: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 347 BRAZIL: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 348 BRAZIL: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 349 MEXICO: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 350 MEXICO: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 351 MEXICO: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 MEXICO: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 MEXICO: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 MEXICO: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 355 MEXICO: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 356 MEXICO: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 357 MEXICO: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 358 MEXICO: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 359 MEXICO: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 360 MEXICO: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 361 MEXICO: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 362 REST OF LATIN AMERICA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 363 REST OF LATIN AMERICA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 364 REST OF LATIN AMERICA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF LATIN AMERICA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 367 REST OF LATIN AMERICA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 368 REST OF LATIN AMERICA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 369 REST OF LATIN AMERICA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 370 REST OF LATIN AMERICA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 371 REST OF LATIN AMERICA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 372 REST OF LATIN AMERICA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 REST OF LATIN AMERICA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 374 REST OF LATIN AMERICA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 376 MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 377 MIDDLE EAST & AFRICA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 378 MIDDLE EAST & AFRICA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 379 MIDDLE EAST & AFRICA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 380 MIDDLE EAST & AFRICA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 381 MIDDLE EAST & AFRICA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 382 MIDDLE EAST & AFRICA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 383 MIDDLE EAST & AFRICA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 384 MIDDLE EAST & AFRICA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 385 MIDDLE EAST & AFRICA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 386 MIDDLE EAST & AFRICA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 387 MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 388 MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 389 GCC COUNTRIES: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 390 GCC COUNTRIES: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 391 GCC COUNTRIES: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 392 GCC COUNTRIES: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 393 GCC COUNTRIES: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 394 GCC COUNTRIES: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 395 GCC COUNTRIES: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 396 GCC COUNTRIES: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 397 GCC COUNTRIES: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 398 GCC COUNTRIES: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 399 GCC COUNTRIES: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 400 GCC COUNTRIES: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 401 GCC COUNTRIES: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 402 REST OF MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 403 REST OF MIDDLE EAST & AFRICA: SUTURE THREADS MARKET, BY NATURE OF ABSORBENT, 2023-2030 (USD MILLION)

- TABLE 404 REST OF MIDDLE EAST & AFRICA: ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 405 REST OF MIDDLE EAST & AFRICA: ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 406 REST OF MIDDLE EAST & AFRICA: ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 407 REST OF MIDDLE EAST & AFRICA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 408 REST OF MIDDLE EAST & AFRICA: NON-ABSORBABLE SYNTHETIC SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 409 REST OF MIDDLE EAST & AFRICA: NON-ABSORBABLE NATURAL SUTURES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 410 REST OF MIDDLE EAST & AFRICA: SUTURE THREADS MARKET, BY COATING, 2023-2030 (USD MILLION)

- TABLE 411 REST OF MIDDLE EAST & AFRICA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 412 REST OF MIDDLE EAST & AFRICA: SURGICAL SUTURE THREADS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 413 REST OF MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 414 REST OF MIDDLE EAST & AFRICA: SURGICAL SUTURES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 415 STRATEGIES ADOPTED BY KEY PLAYERS IN SURGICAL SUTURES MARKET, JANUARY 2021-MAY 2025

- TABLE 416 SURGICAL SUTURES MARKET: DEGREE OF COMPETITION

- TABLE 417 SURGICAL SUTURES MARKET: REGION FOOTPRINT

- TABLE 418 SURGICAL SUTURES MARKET: PRODUCT FOOTPRINT

- TABLE 419 SURGICAL SUTURE THREADS MARKET: TYPE FOOTPRINT

- TABLE 420 SURGICAL SUTURES MARKET: APPLICATION FOOTPRINT

- TABLE 421 SURGICAL SUTURES MARKET: END-USER FOOTPRINT

- TABLE 422 SURGICAL SUTURES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 423 RESPIRATORY CARE DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 424 SURGICAL SUTURES MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 425 SURGICAL SUTURES MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 426 ETHICON: COMPANY OVERVIEW

- TABLE 427 ETHICON: PRODUCTS OFFERED

- TABLE 428 ETHICON: DEALS, JANUARY 2021-MAY 2025

- TABLE 429 MEDTRONIC: COMPANY OVERVIEW

- TABLE 430 MEDTRONIC: PRODUCTS OFFERED

- TABLE 431 MEDTRONIC: DEALS, JANUARY 2021-MAY 2025

- TABLE 432 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 433 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 434 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY OVERVIEW

- TABLE 435 ADVANCED MEDICAL SOLUTIONS GROUP PLC: PRODUCTS OFFERED

- TABLE 436 ADVANCED MEDICAL SOLUTIONS GROUP PLC: DEALS, JANUARY 2021-MAY 2025

- TABLE 437 HEALTHIUM MEDTECH LIMITED: COMPANY OVERVIEW

- TABLE 438 HEALTHIUM MEDTECH LIMITED: PRODUCTS OFFERED

- TABLE 439 HEALTHIUM MEDTECH LIMITED: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 440 HEALTHIUM MEDTECH LIMITED: DEALS, JANUARY 2021-MAY 2025

- TABLE 441 HEALTHIUM MEDTECH LIMITED: EXPANSIONS

- TABLE 442 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 443 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 444 BOSTON SCIENTIFIC CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 445 ZIMMER BIOMET HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 446 ZIMMER BIOMET HOLDINGS, INC.: PRODUCTS OFFERED

- TABLE 447 ZIMMER BIOMET HOLDINGS, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 448 STRYKER: COMPANY OVERVIEW

- TABLE 449 STRYKER: PRODUCTS OFFERED

- TABLE 450 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 451 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 452 CONMED CORPORATION: COMPANY OVERVIEW

- TABLE 453 CONMED CORPORATION: PRODUCTS OFFERED

- TABLE 454 INTERNACIONAL FARMACEUTICA S.A. DE C.V.: COMPANY OVERVIEW

- TABLE 455 INTERNACIONAL FARMACEUTICA S.A. DE C.V.: PRODUCTS OFFERED

- TABLE 456 CORZA MEDICAL: COMPANY OVERVIEW

- TABLE 457 CORZA MEDICAL: PRODUCTS OFFERED

- TABLE 458 CORZA MEDICAL: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 459 DEMETECH CORPORATION: COMPANY OVERVIEW

- TABLE 460 DEMETECH CORPORATION: PRODUCTS OFFERED

- TABLE 461 UNISUR LIFECARE PVT. LTD.: COMPANY OVERVIEW

- TABLE 462 UNISUR LIFECARE PVT. LTD.: PRODUCTS OFFERED

- TABLE 463 ASSUT EUROPE: COMPANY OVERVIEW

- TABLE 464 ASSUT EUROPE: PRODUCTS OFFERED

List of Figures

- FIGURE 1 SURGICAL SUTURES MARKETS COVERED AND REGIONAL SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 13 SURGICAL SUTURES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 SURGICAL SUTURE THREADS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 SURGICAL SUTURES MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 SURGICAL SUTURES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF SURGICAL SUTURES MARKET

- FIGURE 18 INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

- FIGURE 19 SUTURE THREADS AND MULTIFILAMENT SUTURES TO COMMAND LARGEST SHARE IN 2024

- FIGURE 20 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO WITNESS HIGHEST GROWTH TILL 2030

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 23 SURGICAL SUTURES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

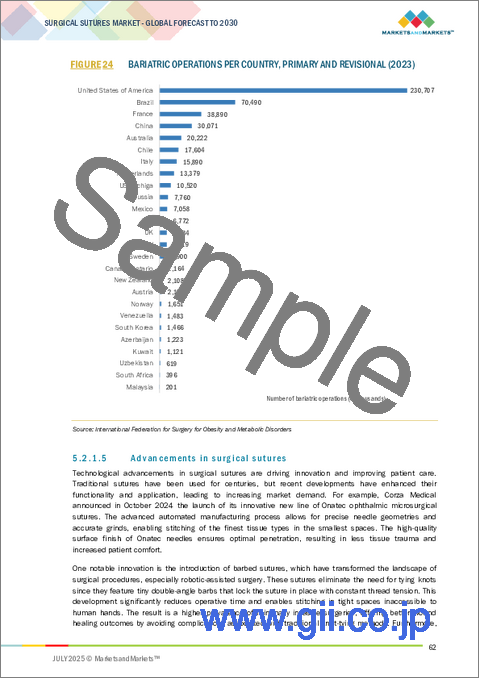

- FIGURE 24 BARIATRIC OPERATIONS PER COUNTRY, PRIMARY AND REVISIONAL (2023)

- FIGURE 25 CANADA: CLASS III MEDICAL DEVICES APPROVAL PROCESS

- FIGURE 26 EUROPE: CE APPROVAL PROCESS FOR CLASS III MEDICAL DEVICES

- FIGURE 27 SURGICAL SUTURES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 SURGICAL SUTURES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 SURGICAL SUTURES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 ADJACENT MARKETS FOR SURGICAL SUTURES MARKET

- FIGURE 31 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR SURGICAL SUTURES MARKET (JANUARY 2015-MAY 2025)

- FIGURE 32 TOP PATENT APPLICANT COUNTRIES FOR SURGICAL SUTURES (JANUARY 2014-DECEMBER 2024)

- FIGURE 33 SURGICAL SUTURES MARKET: ROLE IN ECOSYSTEM, 2024

- FIGURE 34 SURGICAL SUTURES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SURGICAL SUTURES

- FIGURE 36 KEY BUYING CRITERIA FOR SURGICAL SUTURES MARKET

- FIGURE 37 SURGICAL SUTURES MARKET: INVESTMENT/VENTURE CAPITAL SCENARIO, 2019-2023

- FIGURE 38 SURGICAL SUTURES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 39 NORTH AMERICA: SURGICAL SUTURES MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: SURGICAL SUTURES MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN SURGICAL SUTURES MARKET (2022-2025)

- FIGURE 42 SURGICAL SUTURES MARKET SHARE ANALYSIS, BY KEY PLAYER (2024)

- FIGURE 43 SURGICAL SUTURES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 SURGICAL SUTURES DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 45 SURGICAL SUTURES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 SURGICAL SUTURES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 49 ETHICON: COMPANY SNAPSHOT, 2024

- FIGURE 50 MEDTRONIC: COMPANY SNAPSHOT, 2024

- FIGURE 51 B. BRAUN SE: COMPANY SNAPSHOT, 2024

- FIGURE 52 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY SNAPSHOT, 2024

- FIGURE 53 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 54 ZIMMER BIOMET HOLDINGS, INC.: COMPANY SNAPSHOT, 2024

- FIGURE 55 STRYKER: COMPANY SNAPSHOT, 2024

- FIGURE 56 SMITH+NEPHEW: COMPANY SNAPSHOT, 2024

- FIGURE 57 CONMED CORPORATION: COMPANY SNAPSHOT, 2024

The global surgical sutures market is projected to reach USD 6.65 billion by 2030 from USD 4.84 billion in 2025, at a CAGR of 6.5% during the forecast period."

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

The growth in the global surgical procedures landscape can be attributed primarily to the increasing prevalence of chronic conditions associated with an aging demographic, notably diabetes, cardiovascular diseases, and musculoskeletal disorders, all of which frequently necessitate surgical intervention. Furthermore, the rising incidence of trauma and accidents contributes to an uptick in suture demand. Innovations such as absorbable, antibacterial, and barbed sutures significantly improve surgical outcomes and mitigate infection risks, thereby catalyzing market growth. Additionally, the ascent of robotic and minimally invasive surgical techniques, which require advanced suturing methodologies, continues to propel the market forward, highlighting the need for precision in wound closure.

"By product, the suture threads segment had the largest market share in the surgical sutures market in 2024."

Suture thread is a critical component for wound closure across various surgical disciplines, thereby securing a substantial share of the surgical sutures market. It plays a vital role in traditional open surgeries and minimally invasive techniques, serving as the cornerstone of any suturing system. The thread's dominance can be attributed to its versatility, the diverse selection of available materials, and ongoing innovations to enhance its performance and efficacy. Advanced suture threads-such as absorbable, non-absorbable, antibacterial-coated, and barbed varieties-have significantly broadened their applicability in general, orthopedic, gynecological, and cardiovascular surgery. Surgeons prefer threads that exhibit high tensile strength, minimal tissue reactivity, and predictable absorption rates. In response, leading manufacturers continually refine these properties to meet the evolving demands of the surgical landscape.

"By type, the multifilament sutures segment held the largest share in the surgical sutures market in 2024."

The surgical suture market is predominantly characterized by multifilament sutures, owing to their superior handling properties, enhanced knot security, and adaptability across various surgical domains. Comprising multiple braided or twisted strands, multifilament sutures exhibit greater strength and pliability than monofilament options, making them particularly well-suited for precise tissue approximation procedures. Their ease of manipulation and excellent knot retention are crucial in minimizing surgical time, a significant advantage in high-demand operating environments. Furthermore, the soft and flexible nature of multifilament sutures minimizes tissue irritation, rendering them ideal for intricate surgical interventions, including gastrointestinal, cardiovascular, and gynecological operations.

"The US is expected to grow at the highest CAGR in the North American surgical sutures market during the study period."

The increasing number of surgical procedures can be primarily attributed to two significant factors: an aging population and a high prevalence of chronic health conditions such as diabetes, obesity, and cardiovascular diseases. These conditions often necessitate surgical intervention to manage complications and improve patients' quality of life. As the demographic landscape shifts with a growing elderly population, healthcare systems face heightened demand for surgical solutions. In addition to these demographic trends, the US boasts a sophisticated healthcare infrastructure that includes extensive hospital networks and improved access to surgical care. This accessibility has led to a rise in the number of surgeries performed, reflecting a broader shift towards proactive healthcare management. Moreover, the US is recognized as a hub for medical innovation, largely due to the presence of leading companies like Ethicon and Medtronic. These firms are at the forefront of developing advanced surgical sutures to enhance patient outcomes. Their offerings include innovative products such as absorbable sutures, which eliminate the need for removal; barbed sutures, which simplify the surgical process by allowing for secure tissue closure without the need for knots; and antibacterial-coated sutures, which help reduce the risk of postoperative infections. The continuous introduction of these cutting-edge suture technologies plays a crucial role in the evolving landscape of surgical procedures. It underscores the commitment to improving surgical techniques and patient care in the US.

A breakdown of the primary participants (supply-side) for the surgical sutures market referred to in this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3-25%

- By Designation: C-level-45%, Director Level-35%, and Others-20%

- By Region: North America-27%, Europe-25%, Asia Pacific-30%, Latin America- 8%, Middle East & Africa-10% .

Prominent players in the surgical sutures market are Ethicon [Johnson & Johnson] (US), Medtronic (Ireland), B.Braun SE (Germany), Advanced Medical Solutions Group Plc (UK), Healthium MedTech Limited (India), Boston Scientific Corporation (US) Zimmer Biomet Holdings, Inc. (US), Stryker (US), Smith+Nephew (UK), Conmed Corporation (US), Internacional Farmaceutica S.A. de C.V. (Mexico), Corza Medical (US), DemeTECH Corporation (US), Unisur Lifecare Pvt. Ltd (India), Assut Europe (Italy), RESORBA Medical GmbH (Germany), KATSAN Katgut Sanayi ve Tic. A.S. (Turkey), Sutumed Corp. (US), Mellon Medical (Netherlands), Futura Surgicare Pvt. Ltd. (India), GMD Group (Turkey), Lotus Surgicals Pvt Ltd (India), BioSintex (Romania), Meril Life Sciences Pvt. Ltd. (India), and Aqmen Medtech (India).

Research Coverage:

The report analyzes the surgical sutures market and aims to estimate the market size and future growth potential based on various segments such as product, type, application, end user, and region. The report also includes a competitive analysis of the key players in this market, along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help market leaders and new entrants by providing information on the closest approximations of the revenue numbers for the surgical sutures market. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing number of surgical procedures, rising incidence of trauma-related cases, growing medical tourism industry, rising incidence of chronic lifestyle-related diseases, advancements in surgical sutures), restraints (increasing preference for minimally invasive surgeries, presence of alternative wound care management products), opportunities (growth opportunities in low- and middle-income countries) and challenges (market saturation and pricing pressure).

- Market Penetration: It includes extensive information on products the major players in the global surgical sutures market offers. The report includes various product, type, application, end user, and region segments.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global surgical sutures market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, type, application, end user, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global surgical sutures market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products, and capacities of the major competitors in the global surgical sutures market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 ASSUMPTIONS & LIMITATIONS

- 2.5.1 STUDY ASSUMPTIONS

- 2.5.2 LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURGICAL SUTURES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: SURGICAL SUTURES MARKET, BY PRODUCT & TYPE

- 4.3 GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 REGIONAL MIX: SURGICAL SUTURES MARKET

- 4.5 SURGICAL SUTURES MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of surgical procedures

- 5.2.1.2 Growing number of trauma cases

- 5.2.1.3 Growing medical tourism industry

- 5.2.1.4 Rising incidence of chronic lifestyle-related diseases

- 5.2.1.5 Advancements in surgical sutures

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing preference for minimally invasive surgeries

- 5.2.2.2 Presence of alternative wound care management products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in LMICs

- 5.2.4 CHALLENGES

- 5.2.4.1 Market saturation and pricing pressure

- 5.2.1 DRIVERS

- 5.3 REGULATORY LANDSCAPE

- 5.3.1 REGULATORY FRAMEWORK

- 5.3.1.1 North America

- 5.3.1.1.1 US

- 5.3.1.1.2 Canada

- 5.3.1.2 Europe

- 5.3.1.1 North America

- 5.3.2 ASIA PACIFIC

- 5.3.2.1 Japan

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.1 REGULATORY FRAMEWORK

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Sutures with integrated sensors for detecting infection

- 5.4.1.2 Drug-eluting sutures for local therapeutic delivery

- 5.4.1.3 Barbed sutures

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Surgical robots

- 5.4.2.2 Surgical staplers and clips

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Bioengineered suture materials

- 5.4.3.2 AI-driven surgical assistance

- 5.4.1 KEY TECHNOLOGIES

- 5.5 INDUSTRY TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 300610

- 5.8.2 EXPORT DATA FOR HS CODE 300610

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024

- 5.9.2 AVERAGE SELLING PRICE, BY REGION, 2024

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 ADJACENT MARKET ANALYSIS

- 5.12 PATENT ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 CASE STUDIES

- 5.15.1 CASE STUDY 1: UNIVERSITY RESEARCHERS DEVELOP REAL-TIME NON-INVASIVE WOUND MONITORING

- 5.15.2 CASE STUDY 2: ORTHOPEDIC INNOVATION AND PATIENT OUTCOMES

- 5.15.3 CASE STUDY 3: REDUCING SURGICAL SITE INFECTIONS WITH VICRYL PLUS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 UNMET NEEDS/ END-USER EXPECTATIONS

- 5.20 IMPACT OF AI ON SURGICAL SUTURES MARKET

- 5.21 IMPACT OF 2025 US TARIFFS-SURGICAL SUTURES MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRIES/REGIONS

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USER INDUSTRIES

6 SURGICAL SUTURES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SUTURE THREADS

- 6.2.1 BY NATURE OF ABSORBENT

- 6.2.1.1 Absorbable sutures

- 6.2.1.1.1 Absorbable synthetic sutures

- 6.2.1.1.1.1 Polyglactin 910 sutures

- 6.2.1.1.1.1.1 High rigidity and knot strength of polyglactin 910 sutures to drive demand

- 6.2.1.1.1.2 Poliglecaprone 25 sutures

- 6.2.1.1.1.2.1 Smooth surface area and minimal tissue reaction to boost adoption

- 6.2.1.1.1.3 Polydioxanone sutures

- 6.2.1.1.1.3.1 Long-duration wound support and superior strength of polydioxanone sutures to drive growth

- 6.2.1.1.1.4 Polyglycolic acid sutures

- 6.2.1.1.1.4.1 Superior elasticity and strength compared to other braided structures to support market growth

- 6.2.1.1.1.5 Other absorbable synthetic sutures

- 6.2.1.1.1.1 Polyglactin 910 sutures

- 6.2.1.1.2 Absorbable natural sutures

- 6.2.1.1.2.1 Catgut plain sutures

- 6.2.1.1.2.1.1 Fast-absorbing properties to boost demand

- 6.2.1.1.2.2 Catgut chromic sutures

- 6.2.1.1.2.2.1 Ability to absorb more rapidly in affected tissues to boost adoption

- 6.2.1.1.2.1 Catgut plain sutures

- 6.2.1.1.1 Absorbable synthetic sutures

- 6.2.1.2 Non-absorbable sutures

- 6.2.1.2.1 Non-absorbable synthetic sutures

- 6.2.1.2.1.1 Nylon sutures

- 6.2.1.2.1.1.1 Growing use of nylon sutures in general soft tissue approximation to boost market

- 6.2.1.2.1.2 Polypropylene sutures

- 6.2.1.2.1.2.1 High tensile strength and flexibility of polypropylene sutures to fuel growth

- 6.2.1.2.1.3 Stainless steel sutures

- 6.2.1.2.1.3.1 Growing use of stainless steel sutures in hernia and tendon repair to support market growth

- 6.2.1.2.1.4 UHMWPE sutures

- 6.2.1.2.1.4.1 Non-reactive nature of UHMWPE sutures to boost demand

- 6.2.1.2.1.5 Other non-absorbable synthetic sutures

- 6.2.1.2.1.1 Nylon sutures

- 6.2.1.2.2 Non-absorbable natural sutures

- 6.2.1.2.2.1 Cotton sutures

- 6.2.1.2.2.1.1 Growing applications of cotton sutures in healthcare and cosmetic procedures to boost market

- 6.2.1.2.2.2 Silk sutures

- 6.2.1.2.2.2.1 Good tensile strength offered by silk sutures to support growth

- 6.2.1.2.2.3 Other non-absorbable natural sutures

- 6.2.1.2.2.1 Cotton sutures

- 6.2.1.2.1 Non-absorbable synthetic sutures

- 6.2.1.1 Absorbable sutures

- 6.2.2 BY COATING

- 6.2.2.1 Uncoated sutures

- 6.2.2.1.1 High risk of infection associated with uncoated sutures to restrict market growth

- 6.2.2.2 Antimicrobial-coated sutures

- 6.2.2.2.1 High burden of SSIs to drive adoption

- 6.2.2.3 Other coated sutures

- 6.2.2.1 Uncoated sutures

- 6.2.1 BY NATURE OF ABSORBENT

- 6.3 AUTOMATED SUTURING DEVICES

- 6.3.1 DISPOSABLE AUTOMATED SUTURING DEVICES

- 6.3.1.1 Lower cost compared to reusable devices to boost market

- 6.3.2 REUSABLE AUTOMATED SUTURING DEVICES

- 6.3.2.1 Customizability and lower overall expenses to support market growth

- 6.3.1 DISPOSABLE AUTOMATED SUTURING DEVICES

7 SURGICAL SUTURE THREADS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MULTIFILAMENT SUTURES

- 7.2.1 MULTIFILAMENT SUTURES TO ACCOUNT FOR LARGEST MARKET SHARE

- 7.3 MONOFILAMENT SUTURES

- 7.3.1 LOW KNOT SECURITY AND LESS FLEXIBILITY TO RESTRICT GROWTH

8 SURGICAL SUTURES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CARDIOVASCULAR SURGERY

- 8.2.1 GROWING ADOPTION OF POLYPROPYLENE SUTURES IN CARDIOVASCULAR PROCEDURES TO BOOST MARKET

- 8.3 GENERAL SURGERY

- 8.3.1 NEED TO PREVENT BLOOD LOSS IN GASTROINTESTINAL SURGERIES TO DRIVE ADOPTION

- 8.4 GYNECOLOGICAL SURGERY

- 8.4.1 HIGH PROCEDURAL VOLUME TO ENSURE STRONG DEMAND

- 8.5 ORTHOPEDIC SURGERY

- 8.5.1 INCREASING PREVALENCE OF SPORTS-RELATED INJURIES TO SUPPORT MARKET GROWTH

- 8.6 OPHTHALMIC SURGERY

- 8.6.1 HIGH NUMBER OF OPHTHALMIC PROCEDURES PERFORMED TO FAVOR MARKET GROWTH

- 8.7 COSMETIC & PLASTIC SURGERY

- 8.7.1 GROWING NUMBER OF COSMETIC & PLASTIC SURGERIES TO DRIVE ADOPTION OF SUTURES

- 8.8 OTHER APPLICATIONS

9 SURGICAL SUTURES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 INCREASING NUMBER OF SURGERIES AND TRAUMA CASES TO DRIVE ADOPTION OF SURGICAL SUTURES AMONG HOSPITALS

- 9.3 AMBULATORY SURGICAL CENTERS

- 9.3.1 GROWING NUMBER OF SURGICAL PROCEDURES PERFORMED IN ASCS TO FAVOR MARKET GROWTH

- 9.4 CLINICS & PHYSICIAN OFFICES

- 9.4.1 WIDE RANGE OF MEDICAL SERVICES TO SUPPORT GROWTH

10 SURGICAL SUTURES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate North American surgical sutures market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Improving healthcare quality and government support to aid market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Germany to dominate market for surgical sutures in Europe

- 10.3.3 UK

- 10.3.3.1 Rising incidence and prevalence of CVD to drive market

- 10.3.4 FRANCE

- 10.3.4.1 High healthcare spending by government to drive adoption of surgical sutures

- 10.3.5 ITALY

- 10.3.5.1 Improving quality of and accessibility to medical care and technologies to boost market

- 10.3.6 SPAIN

- 10.3.6.1 Increasing incidence of cardiovascular diseases to favor market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 China to dominate market for surgical sutures in APAC

- 10.4.3 INDIA

- 10.4.3.1 Large number of surgical procedures performed to drive market growth

- 10.4.4 JAPAN

- 10.4.4.1 Early adoption of technologically advanced products to drive market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing incidence of obesity and rising number of bariatric surgeries to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 High geriatric population and increased surgical procedures to propel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 High diabetes rates and focus on private-public partnerships for better healthcare facilities to favor market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increased focus on medical tourism and developed private healthcare sector to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Higher disposable income and increased government healthcare expenditure to propel market growth

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SURGICAL SUTURES MARKET

- 11.3 REVENUE ANALYSIS, 2022-2025

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Type footprint

- 11.5.5.5 Application footprint

- 11.5.5.6 End-user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 STARTING BLOCKS

- 11.6.4 RESPONSIVE COMPANIES

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ETHICON, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON)

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 MEDTRONIC

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 B. BRAUN SE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 ADVANCED MEDICAL SOLUTIONS GROUP PLC (AMS GROUP)

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 HEALTHIUM MEDTECH LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 BOSTON SCIENTIFIC CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 ZIMMER BIOMET HOLDINGS, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 STRYKER

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 SMITH+NEPHEW

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 CONMED CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 INTERNACIONAL FARMACEUTICA S.A. DE C.V.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 CORZA MEDICAL

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.13 DEMETECH CORPORATION

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 UNISUR LIFECARE PVT. LTD

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 ASSUT EUROPE

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 ETHICON, INC. (A SUBSIDIARY OF JOHNSON & JOHNSON)

- 12.2 OTHER PLAYERS

- 12.2.1 RESORBA MEDICAL GMBH

- 12.2.2 KATSAN KATGUT SANAYI VE TIC. A.S.

- 12.2.3 SUTUMED CORP.

- 12.2.4 FUTURA SURGICARE PVT. LTD.

- 12.2.5 GMD GROUP

- 12.2.6 LOTUS SURGICALS PVT LTD

- 12.2.7 BIOSINTEX

- 12.2.8 MERIL LIFE SCIENCES PVT. LTD.

- 12.2.9 MELLON MEDICAL

- 12.2.10 AQMEN MEDTECH

- 12.2.11 ANCHORA MEDICAL LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS