|

|

市場調査レポート

商品コード

1783245

パッドマウントスイッチギアの世界市場:用途別、規格別、タイプ別、電圧別、地域別 - 2030年までの予測Pad-Mounted Switchgear Market by Type (Air, Gas, Solid Dielectric, Others), Voltage (Up to 15 kV, 15-25 kV, 25-38 kV), Application (Industrial, Commercial, Residential), Standard (IEC, IEEE), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| パッドマウントスイッチギアの世界市場:用途別、規格別、タイプ別、電圧別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月29日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

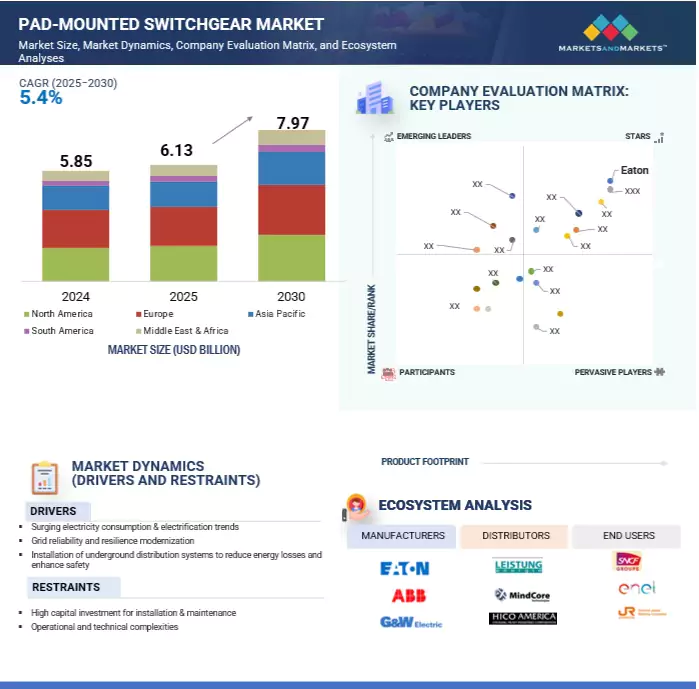

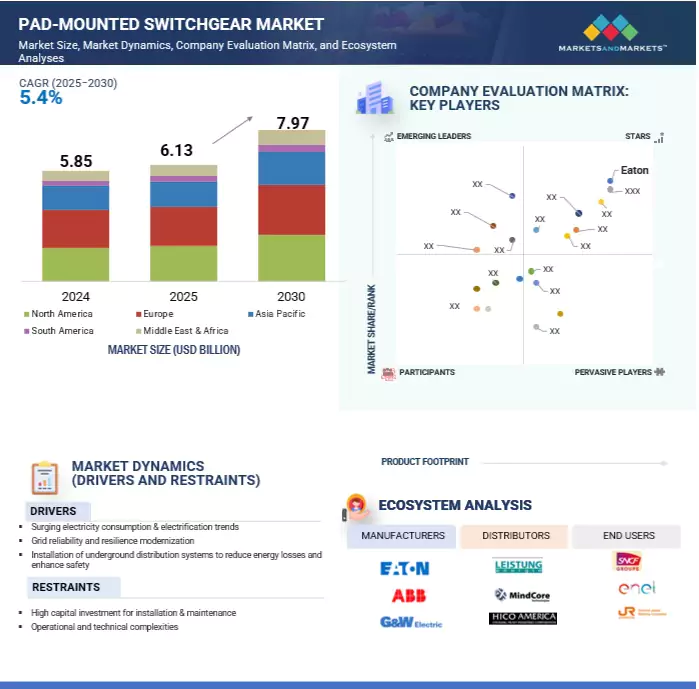

世界のパッドマウントスイッチギアの市場規模は、5.4%のCAGRで拡大し、2025年の61億3,000万米ドルから2030年には79億7,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | パッドマウントスイッチギア市場:用途別、規格別、タイプ別、電圧別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

世界のパッドマウントスイッチギア市場は、近代的で弾力性があり、メンテナンスが容易な配電インフラに対する需要の増加を背景に、堅調な成長が見込まれています。電力会社がスマートグリッドと分散型エネルギーシステムへの移行を続ける中、高度なモニタリングと予知保全機能を組み込んだインテリジェントスイッチギアソリューションへの信頼が高まっています。住宅、商業、工業分野の地下配電システムで広く使用されているパッドマウントスイッチギアは、リアルタイム診断、故障検出、遠隔状態監視を可能にする機能を備えて進化しています。

予知保全技術は、絶縁体の老朽化を監視し、スイッチギアの消耗を追跡し、潜在的な故障の初期兆候を特定することで、コストのかかる停電を防ぎ、運転効率を高める上でユーティリティ企業を支援します。時間ベースのメンテナンスから状態ベースのメンテナンスへの移行は、データセンター、ヘルスケア、EV充電ネットワークなど、ダウンタイムが大きな損失につながりかねない重要なアプリケーションにおいて特に価値があります。さらに、再生可能エネルギーの統合や双方向の電力フローの増加に伴い、最新のパッドマウントスイッチギアは動的な条件下で動作する必要があります。温度センサー、アーク故障検出、通信対応モジュールを備えたインテリジェント・ソリューションは、迅速な絶縁とサービス復旧を可能にし、グリッドの信頼性を向上させます。電力会社が資産の寿命を延ばし、作業員の安全を確保しようとする中、予知保全が重要な実現要素になりつつあり、ライフサイクルコストを削減し、サービスの継続性を高めながら、パッドマウントスイッチギア市場の持続的成長を支えています。

15~25kVは汎用性が高く、さまざまなユーティリティやインフラ用途での使用が増加しているため、予測期間中にパッドマウントスイッチギア市場で最も急成長する電圧区分となる見込みです。この電圧範囲は、フィーダーの自動化、変電所のアップグレード、二次配電システムで一般的に使用され、故障の隔離、負荷の切り替え、サービスの復旧を容易にします。スマートグリッドインフラへの移行に伴い、ユーティリティ企業は、遠隔監視、故障検出、自動スイッチングなどのスマート機能を備えた15~25kVのパッドマウントスイッチギアシステムの採用を増やしています。これらのシステムは、特に安定した高品質の電力に対する需要が高まっている都市部、半都市部、成長著しい都市周辺部において、停電時間を短縮し、グリッドの信頼性を高めるのに役立ちます。さらに、この電圧範囲はコストと容量のバランスがよく、再生可能エネルギー統合、電気自動車充電ステーション、中規模産業プロジェクトに人気があります。世界各地の政府と公益事業会社は、老朽化したインフラの更新と配電網の自動化に多額の投資を行っており、これが15~25kVセグメントの成長を引き続き促進しています。その結果、このセグメントは、電化の進展、スマートシティ構想、電力品質需要の増加によって、先進経済諸国と新興経済諸国の両方で力強い勢いを増すと予想されます。

パッドマウントスイッチギア市場の固体誘電体セグメントは、環境に優しく、コンパクトでメンテナンスフリーのスイッチギアソリューションを求める世界の動きに後押しされ、予測期間中に最も高いCAGRを示すと予想されます。従来の石油絶縁やSF6ベースのスイッチギアとは異なり、固体誘電スイッチギアはエポキシやポリマーベースの絶縁を使用しているため、漏電や可燃性、有害な温室効果ガス排出のリスクがありません。このため、安全性、持続可能性、設置面積の削減が優先される都市部、人口密集地、環境的に敏感な地域では、特に魅力的な製品となっています。このセグメントはまた、特に異常気象に見舞われやすい地域で地下配電網の採用が増加しており、固体誘電スイッチギアが信頼性と運用継続性を向上させるというメリットも享受しています。さらに、公共事業やインフラ開発では、総所有コストを下げる低メンテナンスで長持ちするソリューションが好まれるようになっています。自動化、遠隔制御、状態監視技術と固体誘電体スイッチギアの互換性も、最新のスマートグリッドアプリケーションでの使用拡大を支えています。地球温暖化の可能性が高いためSF6を制限する規制圧力の高まりと、より環境に優しいグリッドソリューションへの世界の後押しにより、固体誘電体セグメントは先進国と新興経済諸国の両方で急速な成長と市場浸透が見込まれています。

欧州は、強力な規制の枠組み、老朽化した送電網インフラのアップグレード、再生可能エネルギー導入への加速的な取り組みによって、予測期間中、パッドマウントスイッチギアの最大市場になると予想されます。欧州の多くの国では、信頼性と美観の向上のため、架空配電から地下配電への移行が進んでおり、特に都市部や郊外では、パッドマウントスイッチギアが中電圧電力網の重要な一部となっています。さらに、EUの厳格な環境政策とSF6段階削減イニシアチブは、電力会社や産業事業者に、固体誘電体やドライエア絶縁オプションなど、環境にやさしく自動化対応のスイッチギアシステムへの投資を促しています。スマートグリッドインフラ、エネルギーシステムの脱炭素化、分散型エネルギー資源(DER)の統合に対する大規模な支出も、需要の増加に寄与しています。ドイツ、フランス、英国、イタリアなどの国々では、送電網の近代化、EV充電インフラ、分散型再生可能エネルギー・プロジェクトに多額の投資を行っており、これらすべてにパッドマウントスイッチギアのようなコンパクトで信頼性が高く、安全なスイッチング装置が必要とされています。その結果、欧州は今後数年間、需要と技術進歩の両面で世界市場をリードする見通しです。

パッドマウントスイッチギア市場は、地理的に広く存在感を示す少数の主要参入企業が支配的です。主要参入企業はEaton(アイルランド)、Hubbell(米国)、ABB(スイス)、G&W Electric(米国)、S&C Electric(米国)などです。

当レポートでは、パッドマウントスイッチギア市場の用途(産業、商業、住宅)、タイプ別(空気絶縁、ガス絶縁、固体誘電体、その他)、電圧別(15kVまで、15年~25kV、25-38kV)、規格別(IEC、IEEE)、地域別に定義、説明、予測しています。また、市場の詳細な質的・量的分析も行っています。当レポートでは、主な市場促進要因・抑制要因・機会・課題を徹底的に検証しています。また、市場の様々な重要な側面についても論じています。パッドマウントスイッチギア市場の主要企業を包括的に分析しています。この分析では、各社の事業概要、ソリューションとサービス、主要戦略に関する洞察を提供しています。また、新製品発売、合併、買収、その他の最近の動向とともに、関連する契約、パートナーシップ、協定も掲載しています。さらに、パッドマウントスイッチギア市場のエコシステムにおける新興企業の競争分析も掲載しています。

当レポートは、業界リーダーや新規参入企業にとって戦略的リソースとなり、市場とそのサブセグメントに関する包括的な分析を提供します。競合情勢を深く理解することで、利害関係者がビジネスのポジショニングを改善し、効果的な市場参入戦略を策定するのに役立ちます。さらに、現在の市場力学を明らかにし、戦略的意思決定の指針となる主要促進要因・制約・課題・機会を強調しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- 価格分析

- 特許分析

- 貿易分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- パッドマウントスイッチギア市場における生成AI/AIの影響

- 2025年の米国関税の影響- 概要

- 主要関税率

- 価格影響分析

- 国/地域への影響

- 最終用途産業への影響

第6章 パッドマウントスイッチギア市場(用途別)

- イントロダクション

- 工業用

- 商業用

- 住宅用

第7章 パッドマウントスイッチギア市場(規格別)

- イントロダクション

- 国際電気標準会議(IEC)

- 電気電子学会(IEEE)

- その他

第8章 パッドマウントスイッチギア市場(タイプ別)

- イントロダクション

- 空気断熱

- ガス断熱

- 固体誘電体

- その他

第9章 パッドマウントスイッチギア市場(電圧別)

- イントロダクション

- 15KV未満

- 15~25KV

- 25~38KV

第10章 パッドマウントスイッチギア市場(地域別)

- イントロダクション

- 欧州

- 英国

- ドイツ

- フランス

- その他

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- オーストラリア

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- エジプト

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 主要参入企業が採用した戦略の概要

- 2024年におけるトップ5の市場シェア分析

- 収益分析、2020年~2024年

- 企業評価マトリックス/象限、2024年

- スタートアップ/中小企業評価クアドラント

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- EATON

- HUBBELL

- ABB

- G&W ELECTRIC

- S&C ELECTRIC

- POWELL

- FEDERAL PACIFIC

- ENTEC ELECTRIC & ELECTRONIC

- NOJA POWER

- TIEPCO GROUP

- GHORIT ELECTRICALS

- NINGBO TIANAN GROUP

- TRAYER SWITCHGEAR

- KDM STEEL

- SWITCHGEAR POWER SYSTEMS LLC

- PARK DETROIT

- その他の企業

- BEIJING KYLIN POWER & TECHNOLOGY

- TELAWNE POWER EQUIPMENTS PVT. LTD.

- ORMAZABAL

- ACTOM

第13章 付録

List of Tables

- TABLE 1 PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD

- TABLE 2 PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE

- TABLE 3 PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE

- TABLE 4 PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION

- TABLE 5 PAD-MOUNTED SWITCHGEAR MARKET, BY REGION

- TABLE 6 SNAPSHOT OF PAD-MOUNTED SWITCHGEAR MARKET, 2025 VS. 2030

- TABLE 7 GLOBAL T&D INFRASTRUCTURE EXPANSION AND REFURBISHMENT PLANS

- TABLE 8 INTRODUCTION OF PERFORMANCE-BASED INCENTIVE PROGRAMS IN ENERGY SECTOR OF KEY COUNTRIES

- TABLE 9 COMPANIES AND THEIR ROLE IN POWER GRID ECOSYSTEM

- TABLE 10 PAD-MOUNTED SWITCHGEAR MARKET: CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 IMPORT TARIFF FOR HS CODE 853590-COMPLIANT PRODUCTS, 2024

- TABLE 12 IMPORT TARIFF FOR HS CODE 853690-COMPLIANT PRODUCTS, 2024

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 PAD-MOUNTED SWITCHGEAR: CODES AND REGULATIONS

- TABLE 19 INDICATIVE PRICING OF PAD-MOUNTED SWITCHGEAR, BY TYPE (USD/UNIT)

- TABLE 20 INDICATIVE PRICING OF PAD-MOUNTED SWITCHGEAR, BY REGION (USD/UNIT)

- TABLE 21 PAD-MOUNTED SWITCHGEAR MARKET: KEY PATENTS, 2022-2025

- TABLE 22 IMPORT SCENARIO FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 23 EXPORT SCENARIO FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 24 IMPORT SCENARIO FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 25 EXPORT SCENARIO FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 26 PAD-MOUNTED SWITCHGEAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 29 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 30 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 31 PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 32 PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 INDUSTRIAL: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 INDUSTRIAL: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 COMMERCIAL: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 COMMERCIAL: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 RESIDENTIAL: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 RESIDENTIAL: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD, 2021-2024 (USD MILLION)

- TABLE 40 PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD, 2025-2030 (USD MILLION)

- TABLE 41 KEY STANDARDS ACROSS MAJOR COUNTRIES

- TABLE 42 PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 44 AIR-INSULATED: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 AIR-INSULATED: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 GAS-INSULATED: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 GAS-INSULATED: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 SOLID-DIELECTRIC: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 SOLID-DIELECTRIC: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 OTHER TYPES: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 OTHER TYPES: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 53 PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 54 UP TO 15 KV: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 UP TO 15 KV: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 15-25 KV: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 15-25 KV: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 25-38 KV: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 25-38 KV: PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 PAD-MOUNTED SWITCHGEAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 65 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 67 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 UK: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 UK: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 72 UK: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 73 UK: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 74 UK: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 UK: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 GERMANY: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 GERMANY: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 GERMANY: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 79 GERMANY: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 80 GERMANY: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 GERMANY: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 FRANCE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 83 FRANCE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 FRANCE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 85 FRANCE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 86 FRANCE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 FRANCE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 REST OF EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 REST OF EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 REST OF EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 91 REST OF EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 92 REST OF EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 REST OF EUROPE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 US: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 US: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 US: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 105 US: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 106 US: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 US: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 CANADA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 CANADA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 111 CANADA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 112 CANADA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 CANADA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 MEXICO: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 MEXICO: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 MEXICO: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 117 MEXICO: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 118 MEXICO: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 MEXICO: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 CHINA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 129 CHINA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 130 CHINA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 131 CHINA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 132 CHINA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 CHINA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 INDIA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 135 INDIA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 INDIA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 137 INDIA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 138 INDIA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 INDIA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 AUSTRALIA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 141 AUSTRALIA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 AUSTRALIA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 143 AUSTRALIA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 144 AUSTRALIA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 AUSTRALIA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH KOREA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 147 SOUTH KOREA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 SOUTH KOREA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 149 SOUTH KOREA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 150 SOUTH KOREA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 SOUTH KOREA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 GCC COUNTRIES: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 167 GCC COUNTRIES: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 168 GCC COUNTRIES: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 169 GCC COUNTRIES: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 170 GCC COUNTRIES: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 171 GCC COUNTRIES: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 SAUDI ARABIA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 173 SAUDI ARABIA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 SAUDI ARABIA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 175 SAUDI ARABIA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 176 SAUDI ARABIA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 177 SAUDI ARABIA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 UAE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 179 UAE: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 180 UAE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 181 UAE: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 182 UAE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 183 UAE: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 184 QATAR: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 185 QATAR: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 186 QATAR: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 187 QATAR: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 188 QATAR: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 QATAR: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 REST OF GCC: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 191 REST OF GCC: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 192 REST OF GCC: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 193 REST OF GCC: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 194 REST OF GCC: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 195 REST OF GCC: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 201 SOUTH AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 EGYPT: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 203 EGYPT: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 204 EGYPT: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 205 EGYPT: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 206 EGYPT: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 207 EGYPT: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 214 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 215 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 216 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 219 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 220 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 221 SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 222 BRAZIL: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 223 BRAZIL: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 224 BRAZIL: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 225 BRAZIL: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 226 BRAZIL: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 227 BRAZIL: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 228 ARGENTINA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 ARGENTINA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 230 ARGENTINA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 231 ARGENTINA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 232 ARGENTINA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 233 ARGENTINA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 234 REST OF SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 235 REST OF SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 236 REST OF SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 237 REST OF SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 238 REST OF SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 239 REST OF SOUTH AMERICA: PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 240 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF PAD-MOUNTED SWITCHGEAR SOLUTIONS

- TABLE 241 PAD-MOUNTED SWITCHGEAR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 242 PAD-MOUNTED SWITCHGEAR MARKET: REGION FOOTPRINT

- TABLE 243 PAD-MOUNTED SWITCHGEAR MARKET: STANDARD FOOTPRINT

- TABLE 244 PAD-MOUNTED SWITCHGEAR MARKET: APPLICATION FOOTPRINT

- TABLE 245 PAD-MOUNTED SWITCHGEAR MARKET: KEY STARTUPS/SMES

- TABLE 246 PAD-MOUNTED SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY STANDARD

- TABLE 247 PAD-MOUNTED SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

- TABLE 248 PAD-MOUNTED SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 249 PAD-MOUNTED SWITCHGEAR MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 250 PAD-MOUNTED SWITCHGEAR MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 251 PAD-MOUNTED SWITCHGEAR MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 252 EATON: BUSINESS OVERVIEW

- TABLE 253 EATON: PRODUCTS OFFERED

- TABLE 254 EATON: DEALS

- TABLE 255 HUBBELL: BUSINESS OVERVIEW

- TABLE 256 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 HUBBELL: DEALS

- TABLE 258 ABB: BUSINESS OVERVIEW

- TABLE 259 ABB: PRODUCTS OFFERED

- TABLE 260 ABB: DEALS

- TABLE 261 ABB: EXPANSIONS

- TABLE 262 ABB: OTHER DEVELOPMENTS

- TABLE 263 G&W ELECTRIC: BUSINESS OVERVIEW

- TABLE 264 G&W ELECTRIC: PRODUCTS OFFERED

- TABLE 265 G&W ELECTRIC: DEALS

- TABLE 266 G&W ELECTRIC: EXPANSIONS

- TABLE 267 G&W ELECTRIC: OTHERS

- TABLE 268 S&C ELECTRIC: BUSINESS OVERVIEW

- TABLE 269 S&C ELECTRIC: PRODUCTS OFFERED

- TABLE 270 S&C ELECTRIC: EXPANSIONS

- TABLE 271 S&C ELECTRIC: DEALS

- TABLE 272 POWELL: BUSINESS OVERVIEW

- TABLE 273 POWELL: PRODUCTS OFFERED

- TABLE 274 FEDERAL PACIFIC: BUSINESS OVERVIEW

- TABLE 275 FEDERAL PACIFIC: PRODUCTS OFFERED

- TABLE 276 FEDERAL PACIFIC: EXPANSIONS

- TABLE 277 ENTEC ELECTRIC & ELECTRONIC: BUSINESS OVERVIEW

- TABLE 278 ENTEC ELECTRIC & ELECTRONIC: PRODUCTS OFFERED

- TABLE 279 NOJA POWER: BUSINESS OVERVIEW

- TABLE 280 NOJA POWER: PRODUCTS OFFERED

- TABLE 281 NOJA POWER: DEALS

- TABLE 282 TIEPCO GROUP: BUSINESS OVERVIEW

- TABLE 283 TIEPCO GROUP: PRODUCTS OFFERED

- TABLE 284 GHORIT ELECTRICALS: BUSINESS OVERVIEW

- TABLE 285 GHORIT ELECTRICALS: PRODUCTS OFFERED

- TABLE 286 NINGBO TIANAN GROUP: BUSINESS OVERVIEW

- TABLE 287 NINGBO TIANAN GROUP: PRODUCTS OFFERED

- TABLE 288 TRAYER SWITCHGEAR: BUSINESS OVERVIEW

- TABLE 289 TRAYER SWITCHGEAR: PRODUCTS OFFERED

- TABLE 290 TRAYER SWITCHGEAR: DEALS

- TABLE 291 KDM STEEL: BUSINESS OVERVIEW

- TABLE 292 KDM STEEL: PRODUCTS OFFERED

- TABLE 293 SWITCHGEAR POWER SYSTEMS LLC: BUSINESS OVERVIEW

- TABLE 294 SWITCHGEAR POWER SYSTEMS LLC: PRODUCTS OFFERED

- TABLE 295 PARK DETROIT: BUSINESS OVERVIEW

- TABLE 296 PARK DETROIT: PRODUCTS OFFERED

List of Figures

- FIGURE 1 PAD-MOUNTED SWITCHGEAR MARKET: RESEARCH DESIGN

- FIGURE 2 PAD MOUNTED SWITCHGEAR MARKET: DATA TRIANGULATION

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 PAD-MOUNTED SWITCHGEAR MARKET: BOTTOM-UP APPROACH

- FIGURE 5 PAD-MOUNTED SWITCHGEAR MARKET: TOP-DOWN APPROACH

- FIGURE 6 METRICS CONSIDERED FOR ANALYZING DEMAND FOR PAD-MOUNTED SWITCHGEAR

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF PAD-MOUNTED SWITCHGEAR SOLUTIONS

- FIGURE 8 PAD-MOUNTED SWITCHGEAR MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 INDUSTRIAL SEGMENT TO BE LARGEST APPLICATION IN 2030

- FIGURE 10 IEC SEGMENT TO HOLD LARGEST SHARE OF PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD, IN 2030

- FIGURE 11 25-38 KV SEGMENT TO DOMINATE PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE

- FIGURE 12 SOLID-DIELECTRIC SEGMENT TO EXHIBIT FASTEST GROWTH, BY TYPE, DURING FORECAST PERIOD

- FIGURE 13 EUROPE ACCOUNTED FOR LARGEST SHARE OF PAD-MOUNTED SWITCHGEAR MARKET IN 2024

- FIGURE 14 INCREASING INVESTMENTS IN UPGRADING AND EXPANDING DISTRIBUTION INFRASTRUCTURE TO PROVIDE OPPORTUNITIES FOR PLAYERS

- FIGURE 15 UK AND INDUSTRIAL SEGMENT HELD LARGEST SHARE OF EUROPEAN PAD-MOUNTED SWITCHGEAR MARKET IN 2024

- FIGURE 16 INDUSTRIAL SEGMENT CAPTURED LARGEST SHARE OF GLOBAL PAD-MOUNTED SWITCHGEAR MARKET IN 2024

- FIGURE 17 15-25 KV SEGMENT HELD MAJOR SHARE OF PAD-MOUNTED SWITCHGEAR MARKET IN 2024

- FIGURE 18 GAS-INSULATED PAD-MOUNTED SWITCHGEAR SOLUTIONS ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 19 IEEE STANDARD ACCOUNTED FOR LARGEST SHARE OF PAD-MOUNTED SWITCHGEAR MARKET IN 2024

- FIGURE 20 MIDDLE EAST & AFRICA TO RECORD HIGHEST CAGR IN PAD-MOUNTED SWITCHGEAR MARKET DURING FORECAST PERIOD

- FIGURE 21 PAD-MOUNTED SWITCHGEAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 GLOBAL ELECTRICITY GENERATION (TWH), 2010-2050

- FIGURE 23 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN PAD-MOUNTED SWITCHGEAR MARKET

- FIGURE 24 MARKET MAP/ECOSYSTEM

- FIGURE 25 PAD-MOUNTED SWITCHGEAR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 SWITCHGEAR MARKET: PATENTS GRANTED AND APPLIED, 2015-2024

- FIGURE 27 IMPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 EXPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 PAD-MOUNTED SWITCHGEAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 IMPACT OF GEN AI/AI ON PAD-MOUNTED SWITCHGEAR MARKET, BY REGION

- FIGURE 35 PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION, 2024

- FIGURE 36 PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD, 2024

- FIGURE 37 PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE, 2024

- FIGURE 38 PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE, 2024

- FIGURE 39 REGIONAL SNAPSHOT: MIDDLE EASTERN & AFRICAN MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 PAD-MOUNTED SWITCHGEAR MARKET SHARE, BY REGION, 2024

- FIGURE 41 EUROPE: MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS OF COMPANIES OFFERING PAD-MOUNTED SWITCHGEAR MARKET, 2024

- FIGURE 44 REVENUE ANALYSIS OF TOP THREE PLAYERS IN PAD-MOUNTED SWITCHGEAR MARKET, 2020-2024

- FIGURE 45 PAD-MOUNTED SWITCHGEAR MARKET: KEY COMPANY EVALUATION MATRIX, 2024

- FIGURE 46 PAD-MOUNTED SWITCHGEAR MARKET: COMPANY FOOTPRINT

- FIGURE 47 PAD-MOUNTED SWITCHGEAR MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2024

- FIGURE 48 EATON: COMPANY SNAPSHOT

- FIGURE 49 HUBBELL: COMPANY SNAPSHOT

- FIGURE 50 ABB: COMPANY SNAPSHOT

- FIGURE 51 POWELL: COMPANY SNAPSHOT

The global Pad-mounted switchgear market is projected to grow from USD 6.13 billion in 2025 to USD 7.97 billion by 2030, at a CAGR of 5.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Pad-mounted switchgear market by application, standard, voltage, type, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

The global pad-mounted switchgear market is expected to grow steadily, driven by increasing demand for modern, resilient, and low-maintenance power distribution infrastructure. As utilities continue transitioning toward smart grids and decentralized energy systems, there is a growing reliance on intelligent switchgear solutions embedded with advanced monitoring and predictive maintenance capabilities. Pad-mounted switchgear, widely used in underground distribution systems across residential, commercial, and industrial sectors, is evolving with features that enable real-time diagnostics, fault detection, and remote condition monitoring.

Predictive maintenance technologies assist utilities in monitoring insulation aging, tracking switchgear wear and tear, and identifying early signs of potential failures-thus preventing costly outages and boosting operational efficiency. This move from time-based to condition-based maintenance is especially valuable in critical applications such as data centers, healthcare, and EV charging networks, where downtime can lead to significant losses. Additionally, with the increasing integration of renewable energy and bidirectional power flows, modern pad-mounted switchgear must operate under dynamic conditions. Intelligent solutions with thermal sensors, arc-fault detection, and communication-enabled modules allow for quick isolation and service restoration, thereby improving grid reliability. As utilities seek to extend asset life and ensure workforce safety, predictive maintenance is becoming a key enabler, supporting sustained growth in the pad-mounted switchgear market while reducing lifecycle costs and enhancing service continuity.

15-25 kV to be the fastest-growing voltage segment during the forecast period

The 15-25 kV segment is expected to be the fastest-growing voltage category in the pad-mounted switchgear market during the forecast period, due to its versatility and increasing use across various utility and infrastructure applications. This voltage range is commonly used in feeder automation, substation upgrades, and secondary distribution systems, where it facilitates fault isolation, load switching, and service restoration. As the world moves toward smart grid infrastructure, utilities are increasingly adopting 15-25 kV pad-mounted switchgear systems with smart features like remote monitoring, fault detection, and automated switching. These systems help reduce outage times and enhance grid reliability, especially in urban, semi-urban, and growing peri-urban areas where demand for stable, high-quality power is rising. Additionally, this voltage range provides a good balance between cost and capacity, making it popular for renewable energy integration, electric vehicle charging stations, and medium-scale industrial projects. Governments and utilities globally are heavily investing in replacing aging infrastructure and automating distribution networks, which continues to fuel growth in the 15-25 kV segment. Consequently, this segment is expected to gain strong momentum in both developed and emerging economies, driven by rising electrification, smart city initiatives, and increasing power quality demand.

Solid dielectric segment to exhibit highest CAGR during forecast period

The solid dielectric segment of the pad-mounted switchgear market is expected to have the highest CAGR during the forecast period, driven by the global move toward environmentally friendly, compact, and maintenance-free switchgear solutions. Unlike traditional oil-insulated or SF6-based switchgear, solid dielectric switchgear uses epoxy or polymer-based insulation, which removes the risk of leakage, flammability, or harmful greenhouse gas emissions. This makes it especially appealing in urban, densely populated, or environmentally sensitive areas where safety, sustainability, and footprint reduction are priorities. The segment is also benefiting from the increasing adoption of underground distribution networks, particularly in regions prone to extreme weather events, where solid dielectric switchgear provides improved reliability and operational continuity. Moreover, utilities and infrastructure developers are increasingly favoring low-maintenance, long-lasting solutions that lower the total cost of ownership. The compatibility of solid dielectric switchgear with automation, remote control, and condition monitoring technologies also supports its expanding use in modern smart grid applications. With growing regulatory pressure to limit SF6 due to its high global warming potential, and a worldwide push toward greener grid solutions, the solid dielectric segment is set for rapid growth and market penetration in both developed and emerging economies.

Europe to be largest market during forecast period

Europe is expected to be the largest market for pad-mounted switchgear during the forecast period, driven by strong regulatory frameworks, aging grid infrastructure upgrades, and the continent's accelerated efforts to adopt renewable energy. Many European countries are shifting from overhead to underground distribution systems for better reliability and aesthetics-especially in urban and suburban areas-making pad-mounted switchgear a vital part of medium-voltage power networks. Additionally, strict EU environmental policies and SF6 phase-down initiatives are encouraging utilities and industrial operators to invest in environmentally friendly and automation-ready switchgear systems, including solid dielectric and dry-air insulated options. Major spending on smart grid infrastructure, decarbonizing energy systems, and integrating distributed energy resources (DER) also contribute to the increased demand. Countries like Germany, France, the UK, and Italy are heavily investing in grid modernization, EV charging infrastructure, and distributed renewable projects, all of which need compact, reliable, and safe switching equipment like pad-mounted switchgear. Consequently, Europe is poised to lead the global market in both demand and technological progress in the coming years.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the pad-mounted switchgear market.

By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

By Region: Asia Pacific - 30%, North America - 40%, Europe - 20%, Middle East & Africa - 5%, and South America - 5%

Note: Other designations include engineers and sales & regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

A few major players with extensive geographical presence dominate the pad-mounted switchgear market. The leading players are Eaton (Ireland), Hubbell (US), ABB (Switzerland), G&W Electric (US), and S&C Electric (US)

Research Coverage:

The report defines, describes, and forecasts the pad-mounted switchgear market applications (industrial, commercial, residential), types (Air-insulated, Gas-insulated, Solid dielectric, others), voltages (Up to 15 kV, 15-25 kV, 25-38 kV), standards (IEC, IEEE), and regions. It also provides a detailed qualitative and quantitative analysis of the market. The report thoroughly reviews the main market drivers, restraints, opportunities, and challenges. It also discusses various important aspects of the market. A comprehensive analysis of key players in the pad-mounted switchgear market has been performed. This analysis offers insights into their business overview, solutions and services, and key strategies. It also includes relevant contracts, partnerships, and agreements, along with new product launches, mergers, acquisitions, and other recent developments. Additionally, the report features a competitive analysis of emerging startups within the pad-mounted switchgear market ecosystem.

Reasons to Buy This Report:

This report serves as a strategic resource for industry leaders and newcomers, providing a comprehensive analysis of the market and its subsegments. It gives stakeholders a deep understanding of the competitive landscape, helping them improve their business positioning and develop effective go-to-market strategies. Additionally, the report clarifies current market dynamics, emphasizing key drivers, constraints, challenges, and opportunities that guide strategic decision-making.

The report provides insights on the following points:

- Analysis of key drivers (surging electricity consumption & electrification trends, grid reliability and resilience modernization), restraints (high capital investment for installation & maintenance, operational and technical complexities), opportunities (investments in upgrading and expanding power distribution infrastructure, automation and reduction of AT&C losses), and challenges (synchronization of SF6 phase-out in hybrid networks, retrofit difficulties in legacy systems) influencing the growth

- Product Development/Innovation: Innovation in pad-mounted switchgear focuses on solid dielectric insulation, dry air alternatives to SF6, and digital automation technologies. Leading companies are enhancing their products with self-powered relays, arc-resistant designs, thermal and arc-flash sensors, and SCADA integration, boosting the switchgear's responsiveness, diagnostics, and safety. New models feature modular compartments, low carbon footprints, and touch-safe interfaces, which improve safety and shorten installation time. Advanced sealing, corrosion-resistant materials, and vandal-proof enclosures are utilized to endure tough environmental conditions, particularly for urban and industrial applications.

- Market Development: Emerging economies in Asia Pacific, Africa, and South America are experiencing strong growth in pad-mounted switchgear deployment due to rapid urbanization, smart city initiatives, and expansion of distribution networks. Government-funded projects, such as India's Revamped Distribution Sector Scheme (RDSS), Kenya's Last Mile Connectivity Project, and Brazil's DER integration plans, are consistently driving demand for pad-mounted switchgear in low-to-medium voltage applications. These systems are essential for reliable secondary distribution, particularly where aesthetics, safety, and compactness matter.

- Market Diversification: Pad-mounted switchgear is increasingly used in diverse applications beyond traditional utilities, including EV charging stations, solar parks, commercial complexes, underground metro systems, data centers, and hospitals. Each application requires specific configurations-from smart automation-ready units to compact, solid-insulated gear suitable for tight spaces. Manufacturers are meeting this demand by offering plug-and-play modular systems, low-maintenance designs, and arc-flash mitigation features that minimize downtime while boosting safety and resilience.

- Competitive Assessment: Major players in the pad-mounted switchgear market include Eaton (Ireland), Hubbell (US), ABB (Switzerland), G&W Electric (US), and S&C Electric (US). These companies maintain global manufacturing networks and are actively involved in regional partnerships, utility collaborations, and EPC projects to localize production and better serve rapidly growing markets. Their competitive strategies involve investments in eco-friendly technologies, regional R&D facilities, and digital platforms that enable real-time monitoring and predictive diagnostics. By focusing on sustainability, compliance, and modularity, these firms are well-positioned to meet the changing demands of a modern, decarbonized grid infrastructure.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE METRICS

- 2.3.3.1 Assumptions for demand-side analysis

- 2.3.3.2 Calculations for demand-side analysis

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side calculation

- 2.3.4.2 Assumptions for the supply side

- 2.3.4.3 Assumptions and calculations

- 2.4 FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PAD-MOUNTED SWITCHGEAR MARKET

- 4.2 PAD-MOUNTED SWITCHGEAR MARKET IN EUROPE, BY APPLICATION AND COUNTRY

- 4.3 PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION

- 4.4 PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE

- 4.5 PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE

- 4.6 PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD

- 4.7 PAD-MOUNTED SWITCHGEAR MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging electricity consumption & electrification trends

- 5.2.1.2 Grid reliability and resilience modernization

- 5.2.1.3 Installation of underground distribution systems to reduce energy losses and enhance safety

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment for installation & maintenance

- 5.2.2.2 Operational and technical complexities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Investments in upgrade and expansion of power distribution infrastructure

- 5.2.3.2 Automation and reduction of AT&C losses

- 5.2.4 CHALLENGES

- 5.2.4.1 Synchronization of SF6 phase-out in hybrid networks

- 5.2.4.2 Retrofitting in legacy systems

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 NEW REVENUE POCKETS FOR POWER GRID PROVIDERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 COMPONENT MANUFACTURERS

- 5.5.3 PAD-MOUNTED SWITCHGEAR MANUFACTURERS/ASSEMBLERS

- 5.5.4 DISTRIBUTORS

- 5.5.5 END USER

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Vacuum interruption technology

- 5.6.1.2 Solid dielectric insulation

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Remote terminal units

- 5.6.2.2 Sensor technology (thermal, arc flash, voltage/current)

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Underground distribution cabling

- 5.6.3.2 Distributed energy resources & microgrids

- 5.6.1 KEY TECHNOLOGIES

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 TARIFFS RELATED TO SWITCHGEARS

- 5.8.2 PAD-MOUNTED SWITCHGEAR: REGULATORY LANDSCAPE

- 5.8.3 CODES AND REGULATORY POLICIES RELATED TO PAD-MOUNTED SWITCHGEAR SYSTEMS

- 5.9 PRICING ANALYSIS

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 TRADE ANALYSIS FOR HS CODE 853590

- 5.11.2 IMPORT SCENARIO (HS CODE 853590)

- 5.11.3 EXPORT SCENARIO (HS CODE 853590)

- 5.11.4 TRADE ANALYSIS FOR HS CODE 853690

- 5.11.5 IMPORT SCENARIO (HS CODE 853690)

- 5.11.6 EXPORT SCENARIO (HS CODE 853690)

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 S&C'S PAD-MOUNTED GEAR PROVIDED SUPERIOR QUALITY AND RELIABILITY REQUIRED BY MUNICIPAL UTILITY

- 5.12.2 ELASTIMOLD'S SOLID-DIELECTRIC SWITCHGEAR ADDRESSED CHALLENGES FACED BY FIRSTENERGY DUE TO AGING INFRASTRUCTURE

- 5.12.3 UK-BASED NORTHERN POWERGRID COMPANY DEPLOYED ABB'S SF6-FREE SWITCHGEAR TO DECARBONIZE ITS ELECTRICAL NETWORK

- 5.12.4 NATIONAL GRID EMPLOYED SF6-FREE HV SUBSTATIONS IN ITS SOUTHEAST ENGLAND NETWORK TO ENSURE A RELIABLE ELECTRICITY SUPPLY

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF GEN AI/AI IN PAD-MOUNTED SWITCHGEAR MARKET

- 5.15.1 ADOPTION OF GEN AI/AI IN PAD-MOUNTED SWITCHGEAR MARKET

- 5.15.2 IMPACT OF GEN AI/AI ON PAD-MOUNTED SWITCHGEAR MARKET, BY REGION

- 5.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.16.1 INTRODUCTION

- 5.17 KEY TARIFF RATES

- 5.18 PRICE IMPACT ANALYSIS

- 5.19 IMPACT ON COUNTRY/REGION

- 5.19.1 US

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.20 IMPACT ON END-USE INDUSTRIES

6 PAD-MOUNTED SWITCHGEAR MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL

- 6.2.1 RISING DEMAND FOR RELIABLE AND RESILIENT POWER DISTRIBUTION SOLUTIONS TO DRIVE SEGMENT

- 6.3 COMMERCIAL

- 6.3.1 STRENGTHENING POWER RESILIENCE AMID EXPANDING COMMERCIAL INFRASTRUCTURE TO BOOST SEGMENT

- 6.4 RESIDENTIAL

- 6.4.1 ENHANCED URBAN AESTHETICS AND RELIABILITY WITH UNDERGROUND DISTRIBUTION TO FUEL SEGMENT

7 PAD-MOUNTED SWITCHGEAR MARKET, BY STANDARD

- 7.1 INTRODUCTION

- 7.2 INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC)

- 7.3 INSTITUTE OF ELECTRICAL AND ELECTRONICS ENGINEERS (IEEE)

- 7.4 OTHER STANDARDS

8 PAD-MOUNTED SWITCHGEAR MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 AIR-INSULATED

- 8.2.1 ADOPTION TO GAIN MOMENTUM DUE TO ENVIRONMENTAL BENEFITS

- 8.3 GAS-INSULATED

- 8.3.1 HIGH GRID RESILIENCE WITH COMPACT GAS-INSULATED PAD-MOUNTED SWITCHGEAR - KEY DRIVER

- 8.4 SOLID-DIELECTRIC

- 8.4.1 OFFERS RELIABILITY FOR MISSION-CRITICAL POWER DISTRIBUTION

- 8.5 OTHER TYPES

9 PAD-MOUNTED SWITCHGEAR MARKET, BY VOLTAGE

- 9.1 INTRODUCTION

- 9.2 UP TO 15 KV

- 9.2.1 RISING DEMAND IN RESIDENTIAL APPLICATIONS TO DRIVE MARKET

- 9.3 15-25 KV

- 9.3.1 INCREASING ADOPTION IN FEEDER AND SUBSTATION AUTOMATION APPLICATIONS TO PROPEL MARKET GROWTH

- 9.4 25-38 KV

- 9.4.1 RISING DEMAND FROM INDUSTRIAL AND COMMERCIAL EXPANSION TO DRIVE GLOBAL GROWTH

10 PAD-MOUNTED SWITCHGEAR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 EUROPE

- 10.2.1 UK

- 10.2.1.1 Renewable energy integration in power grids to drive market

- 10.2.2 GERMANY

- 10.2.2.1 Increasing focus on energy efficiency and grid expansion to fuel market growth

- 10.2.3 FRANCE

- 10.2.3.1 Improvement in power generation, transmission, and distribution infrastructure to propel market

- 10.2.4 REST OF EUROPE

- 10.2.1 UK

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Strong need to modernize aging power infrastructure to drive demand

- 10.3.2 CANADA

- 10.3.2.1 Increasing investment in renewables to support market growth

- 10.3.3 MEXICO

- 10.3.3.1 Adoption of smart grid technology to fuel the need for pad-mounted switchgear systems

- 10.3.1 US

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Increasing investments in clean energy projects to accelerate demand for pad-mounted switchgear

- 10.4.2 INDIA

- 10.4.2.1 Rising electrification to drive market

- 10.4.3 AUSTRALIA

- 10.4.3.1 Electrification of railroad network to boost demand

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Rising consumption of natural gas, nuclear energy, and coal in power sector to boost demand

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Favorable government policies for use of renewables in power generation to drive market

- 10.5.1.2 UAE

- 10.5.1.2.1 Government focus on increasing power generation capacity to boost demand

- 10.5.1.3 Qatar

- 10.5.1.3.1 Grid modernization and smart city projects to fuel demand

- 10.5.1.4 Rest of GCC

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Investment in power capacity addition and energy efficiency improvement to accelerate market growth

- 10.5.3 EGYPT

- 10.5.3.1 Refurbishment of power plant infrastructure to lead to high demand

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Urban expansion and grid resilience to fuel demand

- 10.6.2 ARGENTINA

- 10.6.2.1 Need for uninterrupted power supply in oil & gas operations to fuel demand

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 COMPANY EVALUATION MATRIX/QUADRANT, 2024

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- 11.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.4.5.1 Company footprint

- 11.4.5.2 Region footprint

- 11.4.5.3 Standard footprint

- 11.4.5.4 Application footprint

- 11.5 STARTUPS/SMES EVALUATION QUADRANT

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- 11.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.5.5.1 Detailed list of key startups/SMEs

- 11.5.5.2 Competitive benchmarking of key startups/SMEs

- 11.6 COMPETITIVE SCENARIO

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 EATON

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 HUBBELL

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 ABB

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 G&W ELECTRIC

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.3.3 Others

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 S&C ELECTRIC

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 POWELL

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 FEDERAL PACIFIC

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.8 ENTEC ELECTRIC & ELECTRONIC

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 NOJA POWER

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 TIEPCO GROUP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 GHORIT ELECTRICALS

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 NINGBO TIANAN GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 TRAYER SWITCHGEAR

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 KDM STEEL

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 SWITCHGEAR POWER SYSTEMS LLC

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.16 PARK DETROIT

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.1 EATON

- 12.2 OTHER PLAYERS

- 12.2.1 BEIJING KYLIN POWER & TECHNOLOGY

- 12.2.2 TELAWNE POWER EQUIPMENTS PVT. LTD.

- 12.2.3 ORMAZABAL

- 12.2.4 ACTOM

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS