|

|

市場調査レポート

商品コード

1783244

マイクの世界市場:技術別、MEMS別、通信別、SNR別、用途別 - 予測(~2030年)Microphone Market by Technology (MEMS, Electret, Piezoelectric, Magnetic), MEMS (Analog, Digital), Communication (Wired, Bluetooth, Wi-Fi, Airplay), SNR (<59dB, 60-64dB, >64dB), Application (Security & Surveillance, Wearable) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| マイクの世界市場:技術別、MEMS別、通信別、SNR別、用途別 - 予測(~2030年) |

|

出版日: 2025年07月29日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

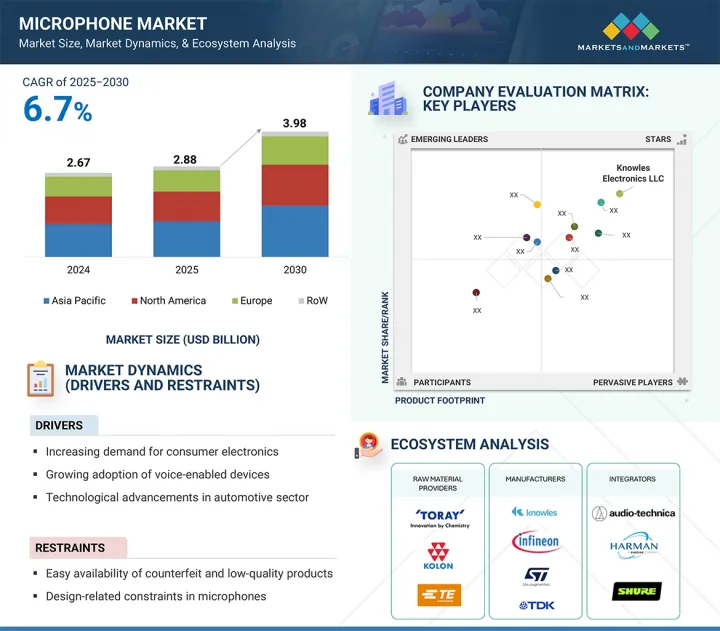

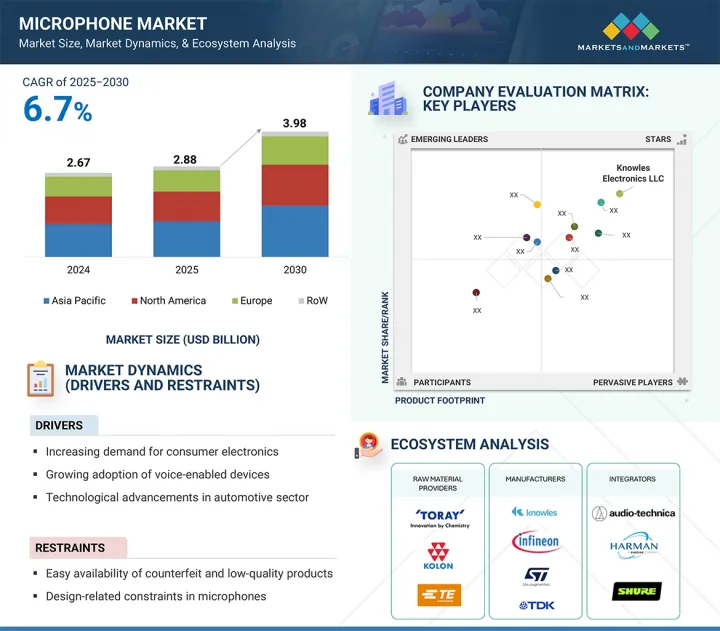

世界のマイクの市場規模は、2025年の28億8,000万米ドルから2030年までに39億8,000万米ドルに達すると予測され、CAGRで6.7%の成長が見込まれます。

市場は、機能性、安全性、ユーザーとのインタラクションを強化する音声ベースの技術の採用が増加しているため、自動車や医療などのさまざまな部門で成長しています。自動車では、マイクは音声コマンド、ドライバーモニタリング、アクティブノイズキャンセレーションを可能にし、ハンズフリー操作や車内体験の向上をサポートします。医療分野では、補聴器、診断デバイス、遠隔医療ツールに不可欠で、正確な音の捕捉と患者とのコミュニケーションを可能にします。さらに、マイクは手術用ロボットや遠隔モニタリングシステムにも使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 技術、MEMSタイプ、通信技術、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「デジタルMEMSマイクがマイク市場で大きなシェアを占めます。」

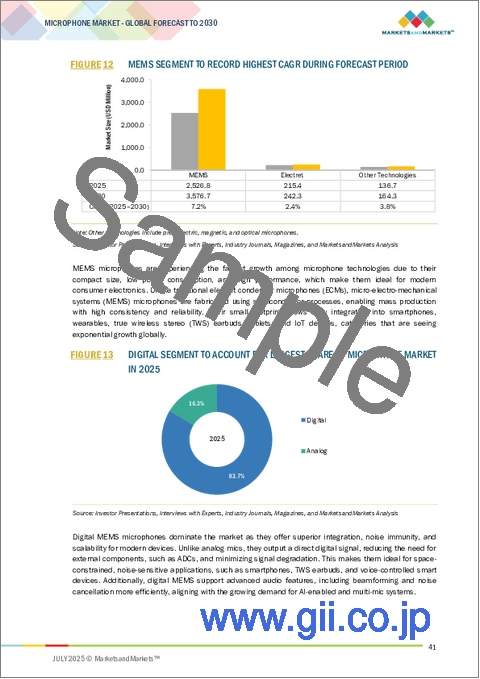

デジタルMEMSマイクは、最新のデジタルシステムとの統合が容易であること、シグナルインテグリティが改良されていること、外部ノイズ干渉に強いことなどから、市場を独占しています。アナログマイクとは異なり、デジタルMEMSはデジタル形式の音声を直接プロセッサーに送出するため、外部ADCの必要性が減り、信号劣化が最小化されます。電磁干渉の影響を受けにくいため、スマートフォン、ラップトップ、IoTデバイスに最適です。コンパクトなサイズと低い消費電力はバッテリー駆動のデバイスに適しており、内蔵DSP機能により、コンパクトなフォームファクターでビームフォーミング、ノイズ抑制、音声起動などの先進の機能を実現します。

「コンシューマーエレクトロニクスセグメントが2024年にマイク市場を独占しました。」

多数の多様のデバイスが高品質な音声入力を必要としているため、コンシューマーエレクトロニクスセグメントがマイク市場を独占しています。スマートフォン、タブレット、ラップトップは、音声通話、ビデオ会議、音声アシスタント、ノイズキャンセリングに用いる複数のマイクを内蔵しています。イヤホンやスマートウォッチなどのスマートスピーカーやウェアラブルの急増により、小型で低消費電力のMEMSマイクの需要が高まっています。スマートテレビ、冷蔵庫、音声制御システムなどの家電は、シームレスなユーザーインタラクションでマイクに依存しています。技術革新サイクルの速さ、音声対応機能に対する需要の高まり、コネクテッドインテリジェントデバイスへの世界的な消費者のシフトが、このセグメントのマイク使用の最大のシェアを牽引しています。

「アジア太平洋が予測期間に突出した市場シェアを占めます。」

アジア太平洋は、強力な電子製造エコシステム、コスト効率の高い労働力、主要なOEMやコンポーネントサプライヤーのプレゼンスにより、マイク市場を独占しています。中国、韓国、日本などの国々は、スマートフォン、ウェアラブル、スマートホームデバイスの世界的な拠点であり、これらはすべてマイクのヘビーユーザーです。また、この地域にはGoertekやAAC Technologiesなどの主要なマイクメーカーがあり、大規模な垂直統合生産を支えています。急速な都市化、可処分所得の増加、インドや東南アジア諸国における音声対応デバイスの普及が需要をさらに促進しています。さらに、政府の支援政策と研究開発への投資が、世界市場におけるアジア太平洋のリーダーシップを強化しています。

当レポートでは、世界のマイク市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- マイク市場の企業にとって魅力的な機会

- マイク市場:技術別

- マイク市場:通信技術別

- マイク市場:用途別、地域別

- マイク市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- カスタマービジネスに影響を与える動向/混乱

- 価格分析

- 主要企業が提供するマイクの平均販売価格:技術別(2024年)

- マイクの平均販売価格の動向:技術別(2020年~2024年)

- マイクの平均販売価格の動向:地域別(2020年~2024年)

- ケーススタディ分析

- ZOOM COMMUNICATIONS INC.、バーチャル会議における効果的なコミュニケーションを保証するためSHUREのマイクを搭載

- GOOGLE、ビデオ会議でAUDIO-TECHNICAのマイクを活用し、バーチャル会議中の低品質な音声を軽減

- NIKON、カメラの録音機能を強化すべくRODEのマイクを採用

- YAMAHA、AUDIO-TECHNICAのマイクを音声処理と会議システムに展開し、効果的なコミュニケーションを実現

- DJI、ドローンとカメラシステムにSARAMONICのマイクを搭載し、プロ仕様の録音機能を実現

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード851810)

- 輸出データ(HSコード851810)

- 関税分析

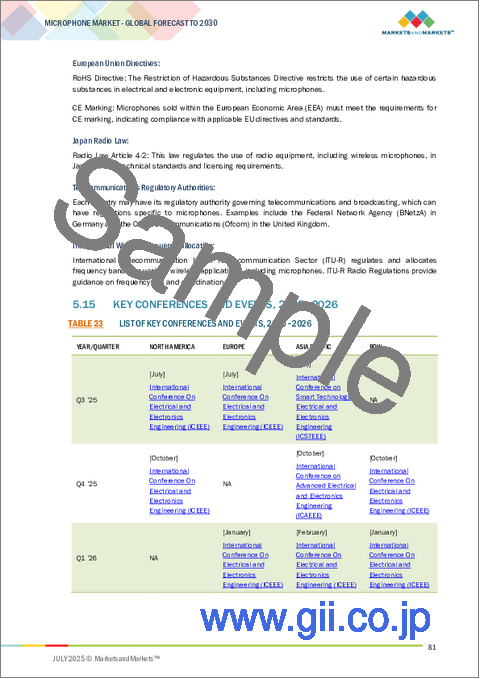

- 規制情勢

- 規制機関、政府機関、その他の組織

- 基準と規制

- 主な会議とイベント(2025年~2026年)

- マイク市場に対するAI/生成AIの影響

- マイク市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国・地域に対する影響

- 用途に対する影響

第6章 マイクの信号対雑音比(SNR)

- イントロダクション

- 低(59DB未満)

- 中(60~64DB)

- 高(64DB超)

第7章 マイク市場:技術別

- イントロダクション

- MEMS

- エレクトレット

- その他の技術

第8章 マイク市場:MEMSタイプ別

- イントロダクション

- アナログ

- デジタル

第9章 マイク市場:通信技術別

- イントロダクション

- 有線

- 無線

- Bluetooth

- Wi-Fi

- AirPlay

- その他の無線通信技術

第10章 マイク市場:用途別

- イントロダクション

- 自動車

- セキュリティ・監視

- コンシューマーエレクトロニクス

- ラップトップ

- スマートフォン

- タブレット

- ウェアラブルデバイス

- スマートスピーカー

- スマート家電

- 工業

- 医療

- その他の用途

第11章 マイク市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- KNOWLES ELECTRONICS, LLC

- STMICROELECTRONICS

- GOERTEK

- TDK CORPORATION

- INFINEON TECHNOLOGIES AG

- AAC TECHNOLOGIES

- ZILLTEK TECHNOLOGY

- HOSIDEN CORPORATION

- SONION

- SAME SKY

- SYNTIANT

- その他の企業

- GETTOP ACOUSTIC CO., LTD.

- BSE CO. LTD.

- SUZHOU MEMSENSING MICROELECTRONICS TECHNOLOGY CO., LTD.

- SOUNDSKRIT

- SENSIBEL

- PUI AUDIO

- KINGSTATE ELECTRONICS CORP.

- HARMONY ELECTRONICS CORP

- DB UNLIMITED LLC

- PARTRON

- STETRON

- ARIOSE ELECTRONICS

- SILICON INTEGRATED SYSTEMS CORPORATION

- SANICO ELECTRONICS CO., LTD.

- JLI

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 KEY DATA FROM PRIMARY SOURCES

- TABLE 5 MICROPHONE MARKET: RESEARCH ASSUMPTIONS

- TABLE 6 MICROPHONE MARKET: RESEARCH LIMITATIONS

- TABLE 7 MICROPHONE MARKET: RISK ANALYSIS

- TABLE 8 ROLE OF COMPANIES IN MICROPHONE ECOSYSTEM

- TABLE 9 IMPACT OF PORTER'S FIVE FORCES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 12 AVERAGE SELLING PRICE OF MICROPHONES PROVIDED BY KEY PLAYERS, BY TECHNOLOGY, 2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND OF MICROPHONES, BY TECHNOLOGY, 2020-2024 (USD)

- TABLE 14 AVERAGE SELLING PRICE TREND OF MICROPHONES, BY REGION, 2020-2024 (USD)

- TABLE 15 LIST OF KEY PATENTS, 2020-2024

- TABLE 16 IMPORT DATA FOR HS CODE 851810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 17 IMPORT DATA FOR HS CODE 851810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 18 MFN TARIFF FOR HS CODE 851810-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR MICROPHONES

- TABLE 26 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON APPLICATIONS DUE TO TARIFF IMPACT

- TABLE 27 MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 28 MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (MILLION UNITS)

- TABLE 30 MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (MILLION UNITS)

- TABLE 31 MEMS: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 32 MEMS: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION )

- TABLE 33 ELECTRET: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION )

- TABLE 34 ELECTRET: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION )

- TABLE 35 OTHER TECHNOLOGIES: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 36 OTHER TECHNOLOGIES: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 MICROPHONE MARKET, BY MEMS TYPE, 2021-2024 (USD MILLION)

- TABLE 38 MICROPHONE MARKET, BY MEMS TYPE, 2025-2030 (USD MILLION)

- TABLE 39 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 40 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 41 WIRED: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 WIRED: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 WIRELESS: MICROPHONE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 WIRELESS: MICROPHONE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 WIRELESS: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 WIRELESS: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 48 MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 AUTOMOTIVE: MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 50 AUTOMOTIVE: MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 51 AUTOMOTIVE: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 52 AUTOMOTIVE: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMOTIVE: MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE: MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 AUTOMOTIVE: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 AUTOMOTIVE: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 AUTOMOTIVE: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 AUTOMOTIVE: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 AUTOMOTIVE: MICROPHONE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE: MICROPHONE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 64 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 65 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 66 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 67 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 SECURITY & SURVEILLANCE: MICROPHONE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 78 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 79 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 80 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 81 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 82 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 83 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 CONSUMER ELECTRONICS: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 CONSUMER ELECTRONICS: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 CONSUMER ELECTRONICS: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 CONSUMER ELECTRONICS: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 CONSUMER ELECTRONICS: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 CONSUMER ELECTRONICS: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 CONSUMER ELECTRONICS: MICROPHONE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 CONSUMER ELECTRONICS: MICROPHONE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 INDUSTRIAL: MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 94 INDUSTRIAL: MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 95 INDUSTRIAL: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 96 INDUSTRIAL: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 97 INDUSTRIAL: MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 INDUSTRIAL: MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 INDUSTRIAL: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 INDUSTRIAL: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 INDUSTRIAL: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 INDUSTRIAL: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 INDUSTRIAL: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 INDUSTRIAL: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 INDUSTRIAL: MICROPHONE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 INDUSTRIAL: MICROPHONE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 MEDICAL: MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 108 MEDICAL: MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 109 MEDICAL: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 110 MEDICAL: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 111 MEDICAL: MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 MEDICAL: MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 MEDICAL: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 MEDICAL: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 MEDICAL: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 MEDICAL: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 MEDICAL: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 MEDICAL: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 MEDICAL: MICROPHONE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 MEDICAL: MICROPHONE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 OTHER APPLICATIONS: MICROPHONE MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 122 OTHER APPLICATIONS: MICROPHONE MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 123 OTHER APPLICATIONS: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 124 OTHER APPLICATIONS: MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 125 OTHER APPLICATIONS: MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 OTHER APPLICATIONS: MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 OTHER APPLICATIONS: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 OTHER APPLICATIONS: MICROPHONE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 OTHER APPLICATIONS: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 OTHER APPLICATIONS: MICROPHONE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 OTHER APPLICATIONS: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 OTHER APPLICATIONS: MICROPHONE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 OTHER APPLICATIONS: MICROPHONE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 OTHER APPLICATIONS: MICROPHONE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 MICROPHONE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 MICROPHONE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 NORTH AMERICA: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 EUROPE: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 ROW: MICROPHONE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 ROW: MICROPHONE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 ROW: MICROPHONE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 152 ROW: MICROPHONE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 MICROPHONE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 154 MICROPHONE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 155 MICROPHONE MARKET: REGION FOOTPRINT

- TABLE 156 MICROPHONE MARKET: TECHNOLOGY FOOTPRINT

- TABLE 157 MICROPHONE MARKET: MEMS TYPE FOOTPRINT

- TABLE 158 MICROPHONE MARKET: COMMUNICATION TECHNOLOGY FOOTPRINT

- TABLE 159 MICROPHONE MARKET: APPLICATION FOOTPRINT

- TABLE 160 MICROPHONE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 161 MICROPHONE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 162 MICROPHONE MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 163 MICROPHONE MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 164 KNOWLES ELECTRONICS, LLC: COMPANY OVERVIEW

- TABLE 165 KNOWLES ELECTRONICS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 KNOWLES ELECTRONICS, LLC: PRODUCT LAUNCHES

- TABLE 167 KNOWLES ELECTRONICS LLC: DEALS

- TABLE 168 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 169 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 GOERTEK: COMPANY OVERVIEW

- TABLE 171 GOERTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 173 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 175 TDK CORPORATION: DEALS

- TABLE 176 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 177 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 179 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 180 AAC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 181 AAC TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 AAC TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 183 AAC TECHNOLOGIES: DEALS

- TABLE 184 ZILLTEK TECHNOLOGY: COMPANY OVERVIEW

- TABLE 185 ZILLTEK TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 HOSIDEN CORPORATION: COMPANY OVERVIEW

- TABLE 187 HOSIDEN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 HOSIDEN CORPORATION: PRODUCT LAUNCHES

- TABLE 189 SONION: COMPANY OVERVIEW

- TABLE 190 SONION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 SAME SKY: COMPANY OVERVIEW

- TABLE 192 SAME SKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 SAME SKY: PRODUCT LAUNCHES

- TABLE 194 SAME SKY: DEALS

- TABLE 195 SYNTIANT: COMPANY OVERVIEW

- TABLE 196 SYNTIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SYNTIANT: DEALS

List of Figures

- FIGURE 1 MICROPHONE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 MICROPHONE MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARIES

- FIGURE 7 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 8 MICROPHONE MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 9 MICROPHONE MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 10 MICROPHONE MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 11 MICROPHONE MARKET: DATA TRIANGULATION

- FIGURE 12 MEMS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 DIGITAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MICROPHONE MARKET IN 2025

- FIGURE 14 MEDICAL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 16 GROWING DEMAND FOR VOICE-ENABLED SMART DEVICES TO FUEL MICROPHONE MARKET GROWTH

- FIGURE 17 MEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 18 WIRELESS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 19 CONSUMER ELECTRONICS SEGMENT AND ASIA PACIFIC TO CAPTURE LARGEST MARKET SHARES IN 2030

- FIGURE 20 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL MICROPHONE MARKET DURING FORECAST PERIOD

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 DRIVERS: IMPACT ANALYSIS

- FIGURE 23 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 24 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 25 CHALLENGES: IMPACT ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 MICROPHONE ECOSYSTEM

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 AVERAGE SELLING PRICE OF MICROPHONES OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF MICROPHONES, BY TECHNOLOGY, 2020-2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF MICROPHONES, BY REGION, 2020-2024

- FIGURE 35 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 36 IMPORT DATA FOR HS CODE 851810-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 37 IMPORT DATA FOR HS CODE 851810-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 38 USE CASES OF AI/GEN AI IN MICROPHONE MARKET

- FIGURE 39 MEMS SEGMENT TO DOMINATE MICROPHONE MARKET DURING FORECAST PERIOD

- FIGURE 40 DIGITAL SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 WIRELESS SEGMENT TO DOMINATE MICROPHONE MARKET DURING FORECAST PERIOD

- FIGURE 42 MEDICAL SEGMENT TO RECORD HIGHEST CAGR IN MICROPHONE MARKET, BY APPLICATION, FROM 2025 TO 2030

- FIGURE 43 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MICROPHONE MARKET BETWEEN 2025 AND 2030

- FIGURE 44 NORTH AMERICA: MICROPHONE MARKET SNAPSHOT

- FIGURE 45 EUROPE: MICROPHONE MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MICROPHONE MARKET SNAPSHOT

- FIGURE 47 MICROPHONE MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 48 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MICROPHONES, 2024

- FIGURE 49 MICROPHONE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 MICROPHONE MARKET: COMPANY FOOTPRINT

- FIGURE 51 MICROPHONE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 KNOWLES ELECTRONICS, LLC: COMPANY SNAPSHOT

- FIGURE 53 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 54 GOERTEK: COMPANY SNAPSHOT

- FIGURE 55 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 57 AAC TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 58 ZILLTEK TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 59 HOSIDEN CORPORATION: COMPANY SNAPSHOT

The global microphone market is projected to grow from USD 2.88 billion in 2025 to USD 3.98 billion by 2030, at a CAGR of 6.7%. The microphone market is growing in various sectors, such as automotive and medical, due to the increasing adoption of audio-based technologies that enhance functionality, safety, and user interaction. In automotive, microphones enable voice commands, driver monitoring, and active noise cancellation, supporting hands-free control and improved in-cabin experiences. In the medical field, they are integral to hearing aids, diagnostic equipment, and telemedicine tools, allowing precise sound capture and patient communication. Additionally, microphones are used in surgical robotics and remote monitoring systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, MEMS Type, Communication Technology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Digital MEMS microphone to account for significant share of microphone market"

Digital MEMS microphones dominate the market due to their ease of integration with modern digital systems, improved signal integrity, and resistance to external noise interference. Unlike analog microphones, digital MEMS deliver audio in a digital format directly to processors, reducing the need for external ADCs and minimizing signal degradation. They are less susceptible to electromagnetic interference, making them ideal for smartphones, laptops, and IoT devices. Their compact size and low power consumption suit battery-operated devices, while the built-in DSP feature enables advanced functions such as beamforming, noise suppression, and voice activation in compact form factors.

"Consumer electronics segment dominated microphone market in 2024"

The consumer electronics segment dominates the microphone market because of the sheer volume and diversity of devices requiring high-quality audio input. Smartphones, tablets, and laptops integrate multiple microphones for voice calls, video conferencing, voice assistants, and noise cancellation. The surge in smart speakers and wearables, such as earbuds and smartwatches, has increased demand for compact, low-power MEMS microphones. Home appliances such as smart TVs, refrigerators, and voice-controlled systems rely on microphones for seamless user interaction. The fast innovation cycle, growing demand for voice-enabled features, and global consumer shift toward connected, intelligent devices drive the largest share of microphone usage in this segment.

"Asia Pacific will hold prominent market share during the forecast period."

Asia Pacific dominates the microphone market due to its strong electronics manufacturing ecosystem, cost-efficient labor, and presence of major OEMs and component suppliers. Countries such as China, South Korea, and Japan are global hubs for smartphones, wearables, and smart home devices-all heavy users of microphones. The region also hosts leading microphone manufacturers such as Goertek and AAC Technologies, supporting large-scale, vertically integrated production. Rapid urbanization, rising disposable incomes, and growing adoption of voice-enabled devices in India and Southeast Asian countries further fuel demand. Additionally, supportive government policies and investments in R&D strengthen Asia Pacific's leadership in the global market.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the microphone marketplace.

- By Company Type: Tier 1 - 55%, Tier 2 - 35%, and Tier 3 - 10%

- By Designation: C-level Executives - 45%, Directors - 25%, and Others - 30%

- By Region: North America - 55%, Europe - 20%, Asia Pacific - 15%, and RoW - 10%

The study includes an in-depth competitive analysis of these key players in the microphone market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the microphone market by technology, MEMS type, Communication technology, application, and region (North America, Europe, Asia Pacific). The report covers detailed information regarding major factors influencing market growth, such as drivers, restraints, challenges, and opportunities. A thorough analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, contracts, partnerships, and agreements. Product and service launches, acquisitions, and recent developments associated with the microphone market. This report covers a competitive analysis of upcoming startups in the microphone market ecosystem.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the microphone market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for consumer electronics, growing adoption of voice-enabled devices, technological advancements in automotive sector, rising trend of video conferencing and remote collaborations), restraints (Easy availability of counterfeit and low-quality products, design-related constraints in microphones), opportunities (Increasing demand for wearable devices and hearables, continuous advancements in microphone technology, growth in video content creation and streaming, expansion in AR/VR and gaming), and challenges (Compatibility issues in microphones, intense competition witnessed by small/new companies from established microphone manufacturers) influencing the growth of the microphone market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the microphone market

- Market Development: Comprehensive information about lucrative markets with an analysis of the microphone market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the microphone market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the microphone market, such as Knowles Electronics LLC (US), Goertek (China), TDK Corporation (Japan), Infineon Technologies AG (Germany), and STMicroelectronics (Switzerland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROPHONE MARKET

- 4.2 MICROPHONE MARKET, BY TECHNOLOGY

- 4.3 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY

- 4.4 MICROPHONE MARKET, BY APPLICATION AND REGION

- 4.5 MICROPHONE MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for consumer electronics

- 5.2.1.2 Growing adoption of voice-enabled devices

- 5.2.1.3 Technological advancements in automotive sector

- 5.2.1.4 Rising trend of video conferencing and remote collaborations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Easy availability of counterfeit and low-quality products

- 5.2.2.2 Design-related constraints in microphones

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for wearable devices and hearables

- 5.2.3.2 Continuous advancements in microphone technology

- 5.2.3.3 Growth in video content creation and streaming

- 5.2.3.4 Rise in AR, VR, and gaming applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Compatibility issues in microphones

- 5.2.4.2 Intense competition witnessed by small/new companies from established microphone manufacturers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITION RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF MICROPHONES OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF MICROPHONES, BY TECHNOLOGY, 2020-2024

- 5.8.3 AVERAGE SELLING PRICE TREND OF MICROPHONES, BY REGION, 2020-2024

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ZOOM COMMUNICATIONS INC. INTEGRATES SHURE'S MICROPHONES TO ENSURE EFFECTIVE COMMUNICATION IN VIRTUAL MEETINGS

- 5.9.2 GOOGLE LEVERAGES AUDIO-TECHNICA MICROPHONES IN VIDEO CONFERENCING TO REDUCE POOR-QUALITY AUDIO DURING VIRTUAL MEETINGS

- 5.9.3 NIKON USES RODE'S MICROPHONES TO ENHANCE AUDIO RECORDING CAPABILITIES OF CAMERAS

- 5.9.4 YAMAHA DEPLOYS AUDIO-TECHNICA'S MICROPHONES IN AUDIO PROCESSING AND CONFERENCING SYSTEMS FOR EFFECTIVE COMMUNICATION

- 5.9.5 DJI INTEGRATES SARAMONIC'S MICROPHONES IN DRONES AND CAMERA SYSTEMS TO ENSURE PROFESSIONAL-GRADE AUDIO CAPTURE CAPABILITIES

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Condenser microphones

- 5.10.1.2 Dynamic microphones

- 5.10.1.3 Electret condenser microphones

- 5.10.1.4 Microelectromechanical systems (MEMS) microphones

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Digital signal processing

- 5.10.2.2 Wireless technology

- 5.10.2.3 Beamforming technology

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Acoustic material technology

- 5.10.3.2 Audio processing and mixing technology

- 5.10.3.3 Voice recognition and natural language processing

- 5.10.3.4 Augmented Reality (AR) and Virtual Reality (VR)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 851810)

- 5.12.2 EXPORT DATA (HS CODE 851810)

- 5.13 TARIFF ANALYSIS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON MICROPHONE MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF ON MICROPHONE MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 SIGNAL-TO-NOISE RATIO (SNR) FOR MICROPHONES

- 6.1 INTRODUCTION

- 6.2 LOW (<59 DB)

- 6.3 MEDIUM (60-64 DB)

- 6.4 HIGH (>64 DB)

7 MICROPHONE MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 MEMS

- 7.2.1 HIGH PERFORMANCE AND MINIATURIZATION BENEFITS TO FUEL SEGMENTAL GROWTH

- 7.3 ELECTRET

- 7.3.1 WIDE ADOPTION IN ACOUSTIC OR ELECTRICAL APPLICATIONS TO DRIVE MARKET

- 7.4 OTHER TECHNOLOGIES

8 MICROPHONE MARKET, BY MEMS TYPE

- 8.1 INTRODUCTION

- 8.2 ANALOG

- 8.2.1 INCREASING USE IN VOICE ASSISTANT APPLICATIONS TO ACCELERATE SEGMENTAL GROWTH

- 8.3 DIGITAL

- 8.3.1 RISING ADOPTION IN CONSUMER AUDIO AND ELECTRONICS TO FOSTER SEGMENTAL GROWTH

9 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 WIRED

- 9.2.1 HIGH RELIABILITY AND COST-EFFECTIVENESS TO ACCELERATE SEGMENTAL GROWTH

- 9.3 WIRELESS

- 9.3.1 BLUETOOTH

- 9.3.1.1 Growing use in broadcasting applications to augment segmental growth

- 9.3.2 WI-FI

- 9.3.2.1 Rising demand in consumer electronics and smart home applications to fuel segmental growth

- 9.3.3 AIRPLAY

- 9.3.3.1 Ability to help users control audio to contribute to segmental growth

- 9.3.4 OTHER WIRELESS COMMUNICATION TECHNOLOGIES

- 9.3.1 BLUETOOTH

10 MICROPHONE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 INCREASING IMPORTANCE OF VOICE RECOGNITION AND IVI SYSTEMS IN VEHICLES TO SPUR DEMAND FOR MICROPHONES

- 10.3 SECURITY & SURVEILLANCE

- 10.3.1 RISING USE OF COMMERCIAL CCTV AND GUNSHOT DETECTION SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.4 CONSUMER ELECTRONICS

- 10.4.1 LAPTOPS

- 10.4.1.1 Inclination toward hybrid and remote working to support market growth

- 10.4.2 SMARTPHONES

- 10.4.2.1 Use of microphones to ensure clear and effective voice calls to fuel segmental growth

- 10.4.3 TABLETS

- 10.4.3.1 Mounting demand for microphone-integrated electronics to attend phone calls and conduct voice searches to drive market

- 10.4.4 WEARABLE DEVICES

- 10.4.4.1 Significant investment in devices with improved features to boost segmental growth

- 10.4.5 SMART SPEAKERS

- 10.4.5.1 Increasing use for voice-based messaging and group calls to foster segmental growth

- 10.4.6 SMART HOME APPLIANCES

- 10.4.6.1 Integration of microphones to ensure home safety and security to contribute to segmental growth

- 10.4.1 LAPTOPS

- 10.5 INDUSTRIAL

- 10.5.1 NEED TO MONITOR NOISE AND PERFORMANCE LEVELS OF EQUIPMENT TO EXPEDITE SEGMENTAL GROWTH

- 10.6 MEDICAL

- 10.6.1 INCREASING REQUIREMENT FOR MICROPHONE-EMBEDDED HEARING AIDS TO ACCELERATE SEGMENTAL GROWTH

- 10.7 OTHER APPLICATIONS

11 MICROPHONE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Growing adoption of smart home appliances and security & surveillance systems to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increasing adoption of telemedicine and remote patient consultation services to boost market growth

- 11.2.3 MEXICO

- 11.2.3.1 Mounting demand for microphones in industrial automation applications to fuel market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Increasing adoption of digital media to bolster market growth

- 11.3.2 GERMANY

- 11.3.2.1 Growing focus on adding advanced features to vehicles and in-car systems to support market growth

- 11.3.3 FRANCE

- 11.3.3.1 Increasing investment in industrial automation systems to create opportunities for microphone providers

- 11.3.4 ITALY

- 11.3.4.1 Mounting adoption of Industry 4.0 and automation technologies to foster market growth

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Thriving gaming and AR/VR industry to support market growth

- 11.4.2 JAPAN

- 11.4.2.1 Growing adoption of telemedicine and remote patient monitoring solutions to drive market

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Thriving broadcasting and entertainment industry to fuel market growth

- 11.4.4 INDIA

- 11.4.4.1 Booming consumer electronics market to contribute to market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 MIDDLE EAST & AFRICA

- 11.5.1.1 Increasing number of mobile subscriptions to boost market growth

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Rising popularity of digital content creation to support market growth

- 11.5.1 MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Technology footprint

- 12.5.5.4 MEMS type footprint

- 12.5.5.5 Communication technology footprint

- 12.5.5.6 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 KNOWLES ELECTRONICS, LLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 STMICROELECTRONICS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 GOERTEK

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 TDK CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 INFINEON TECHNOLOGIES AG

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deal

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 AAC TECHNOLOGIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 ZILLTEK TECHNOLOGY

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 HOSIDEN CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 SONION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 SAME SKY

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 SYNTIANT

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.1 KNOWLES ELECTRONICS, LLC

- 13.2 OTHER PLAYERS

- 13.2.1 GETTOP ACOUSTIC CO., LTD.

- 13.2.2 BSE CO. LTD.

- 13.2.3 SUZHOU MEMSENSING MICROELECTRONICS TECHNOLOGY CO., LTD.

- 13.2.4 SOUNDSKRIT

- 13.2.5 SENSIBEL

- 13.2.6 PUI AUDIO

- 13.2.7 KINGSTATE ELECTRONICS CORP.

- 13.2.8 HARMONY ELECTRONICS CORP

- 13.2.9 DB UNLIMITED LLC

- 13.2.10 PARTRON

- 13.2.11 STETRON

- 13.2.12 ARIOSE ELECTRONICS

- 13.2.13 SILICON INTEGRATED SYSTEMS CORPORATION

- 13.2.14 SANICO ELECTRONICS CO., LTD.

- 13.2.15 JLI

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS