|

|

市場調査レポート

商品コード

1783243

地熱エネルギーの世界市場:用途別、技術別、温度別、地域別 - 2030年までの予測Geothermal Energy Market by Application, Temperature, Technology, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 地熱エネルギーの世界市場:用途別、技術別、温度別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月24日

発行: MarketsandMarkets

ページ情報: 英文 285 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

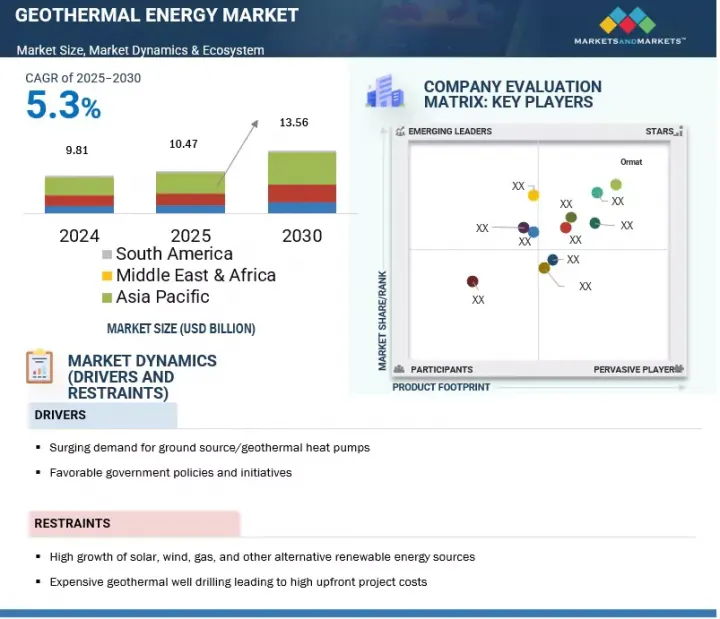

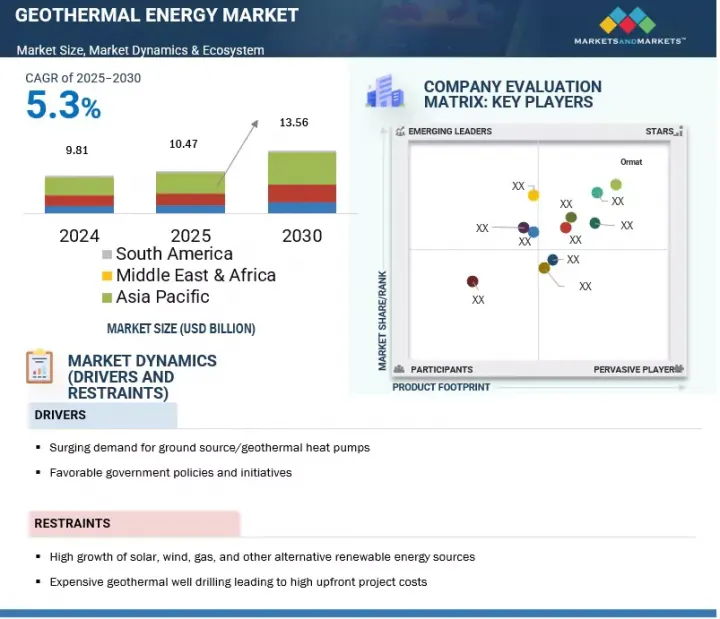

地熱エネルギーの市場規模は、予測期間中に5.3%のCAGRで拡大し、2030年までに135億6,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 用途別、技術別、温度別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

再生可能エネルギー発電へのニーズ、地中熱源ヒートポンプ(GHP)の採用増加、有利な政府政策が、地熱エネルギー市場を牽引する主な要因です。

技術別では、地熱エネルギー市場はバイナリーサイクルプラント、フラッシュ蒸気プラント、ドライ蒸気プラント、地中熱源ヒートポンプ、ダイレクトシステム、その他に区分されています。フラッシュ蒸気プラント分野は、予測期間中に最も高いCAGRで成長すると予想されています。フラッシュ・スチーム・プラントは、シングル(0.2~80MW)、ダブル(2~110MW)、トリプルフラッシュ(60~150MW)のいずれかによって規模が異なります。CO2排出量は約27kg/MWhで、バイナリー発電所はCO2排出量ゼロです。有利な政府政策と乾式蒸気発電所の開発技術が、地熱エネルギー市場全体を牽引すると予想されます。

用途別では、地熱エネルギー市場は発電、住宅用冷暖房、商業用冷暖房、その他に区分されています。発電分野は、あらゆる分野で持続可能なエネルギーへの需要が高まっていることから、予測期間中、地熱エネルギーの最大の用途になると予想されています。地熱エネルギーは、風力、太陽光、水力発電といった他の再生可能エネルギー発電よりも好まれています。

北米は第2位の地熱エネルギー市場になると予測されています。この地域の市場を牽引しているのは、地質学的に有利な地域での技術進歩や、発電やその他の用途に地熱資源を活用することを各国が強く重視していることです。さらに、この地域全体で新しい地熱プロジェクトへの投資が増加しており、市場の成長をさらに加速させると予想されます。技術革新、戦略的注力、資金調達の増加は、北米を世界の地熱エネルギー分野の主要参入企業として位置づけています。

地熱エネルギー市場は、幅広い地域的プレゼンスを持つ少数の主要参入企業によって独占されています。地熱エネルギー市場の大手企業は、Ormat(米国)、MITSUBISHI HEAVY INDUSTRIES LTD.(日本)、GE Vernel(米国)、Ansaldo Energia(イタリア)、Fuji Electric(日本)、Toshiba Energy Systems & Solutions Corporation(日本)、Siemens AG(ドイツ)、EXERGY INTERNATIONAL SRL(イタリア)、SLB(米国)、Halliburton(米国)、NOV(米国)、Weatherford(米国)、Welltec(デンマーク)、MANNVIT(アイスランド)、NIBE Group(スウェーデン)などです。この調査には、地熱エネルギー市場におけるこれらの主要企業について、企業プロファイル、最近の動向、主な市場戦略など、詳細な競合分析が含まれています。

当レポートでは、世界の地熱エネルギー市場を用途別(発電、住宅・商業用冷暖房)、温度別(低温、中温、高温)、技術別(バイナリー及びフラッシュサイクルプラント、ドライスチームプラント、地中熱源ヒートポンプ、直接システム)、地域別に定義、記述、予測しています。当レポートの調査範囲は、地熱エネルギー市場の成長に影響を与える促進要因・課題、市場促進要因・課題、成長機会などの主な要因に関する詳細情報をカバーしています。主な業界プレイヤーを詳細に分析し、事業概要、ソリューション、サービス、主要戦略、契約、パートナーシップ、協定、M&A、地熱エネルギー市場に関連する最近の動向などについての洞察を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- サプライチェーン分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 地熱資源

- 技術分析

- 貿易分析

- 主要な利害関係者と購入基準

- 地域別平均設備投資価格分析

- 生成AI/AIが地熱エネルギー市場に与える影響

- 世界マクロ経済見通し

- 2025年の米国関税の影響- 概要

第6章 地熱エネルギー市場(用途別)

- イントロダクション

- 発電

- 住宅暖房・冷房

- 商業用暖房・冷房

- その他

第7章 地熱エネルギー市場(技術別)

- イントロダクション

- バイナリサイクルプラント

- 乾式蒸気プラント

- フラッシュスチームプラント

- 地中熱ヒートポンプ

- 直接システム

- その他

第8章 地熱エネルギー市場(温度別)

- イントロダクション

- 低温(90℃未満)

- 中温(90~150℃)

- 高温(150℃以上)

第9章 地熱エネルギー市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インドネシア

- フィリピン

- ニュージーランド

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- トルコ

- ドイツ

- イタリア

- アイスランド

- その他

- 南米

- チリ

- コロンビア

- 中東・アフリカ

- ケニア

- サウジアラビア

- その他

第10章 競合情勢

- 主要参入企業が採用した戦略

- 主要企業の市場シェア分析

- 主要市場参入企業の収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価象限

- 地熱エネルギー市場:企業の足跡

- スタートアップ/中小企業評価クアドラント

- 競争シナリオと動向

第11章 企業プロファイル

- 発電設備プロバイダー

- ORMAT

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- GE VERNOVA

- ANSALDO ENERGIA

- FUJI ELECTRIC

- TOSHIBA AMERICA ENERGY SYSTEMS CORPORATION

- SIEMENS AG

- その他

- サブサーフェス設備・サービスプロバイダー

- BAKER HUGHES COMPANY

- SLB

- HALLIBURTON

- NOV

- WEATHERFORD

- WELLTEC

- その他

- 地熱/地表源ヒートポンプメーカーおよびサービスプロバイダー

- NIBE GROUP

- CARRIER GLOBAL CORPORATION

- TRANE TECHNOLOGIES

- BOSCH THERMOTECHNIK GMBH

- VIESSMANN GROUP

- DANDELION ENERGY

第12章 付録

List of Tables

- TABLE 1 GEOTHERMAL ENERGY MARKET SNAPSHOT

- TABLE 2 MAJOR DEVELOPMENTS PERTAINING TO USE OF OIL & GAS WELLS FOR GEOTHERMAL INSTALLATIONS

- TABLE 3 PERSONNEL REQUIREMENTS IN DIFFERENT STAGES OF GEOTHERMAL DEVELOPMENT (50 MW)

- TABLE 4 GEOTHERMAL ENERGY MARKET: ROLE IN ECOSYSTEM

- TABLE 5 GEOTHERMAL ENERGY MARKET: LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 6 GEOTHERMAL ENERGY SYSTEMS: CODES AND REGULATIONS

- TABLE 7 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 GEOTHERMAL ENERGY SYSTEMS: KEY PATENTS, APRIL 2015-MAY 2022

- TABLE 13 GEOTHERMAL ENERGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 EXPORT DATA FOR HS CODE 840681, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR HS CODE 840681, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 17 KEY BUYING CRITERIA, BY END USER

- TABLE 18 AVERAGE CAPEX OF DIFFERENT TYPES OF GEOTHERMAL POWER PLANTS, BY REGION (USD/KW)

- TABLE 19 WORLD GDP GROWTH, 2021-2028 (USD TRILLION)

- TABLE 20 INFLATION RATE (ANNUAL PERCENT CHANGE), 2024

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 22 GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 23 GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 24 POWER GENERATION: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 POWER GENERATION: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

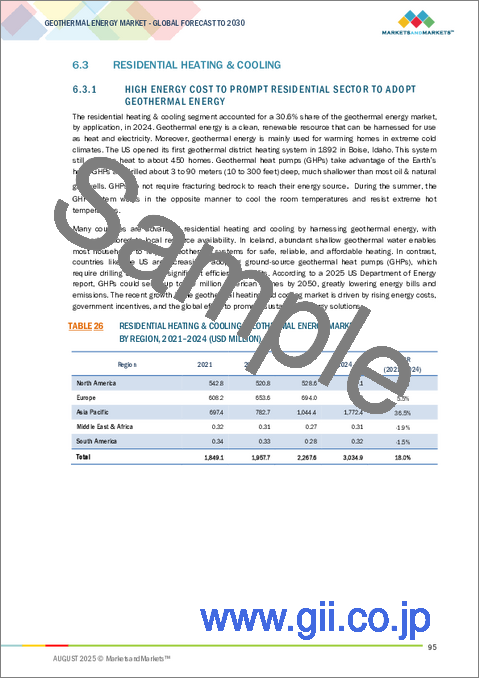

- TABLE 26 RESIDENTIAL HEATING & COOLING: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 RESIDENTIAL HEATING & COOLING: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 COMMERCIAL HEATING & COOLING: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 COMMERCIAL HEATING & COOLING: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 OTHER APPLICATIONS: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 OTHER APPLICATIONS: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 33 GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 34 BINARY CYCLE PLANTS: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 BINARY CYCLE PLANTS: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 DRY STEAM PLANTS: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 DRY STEAM PLANTS: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 FLASH STEAM PLANTS: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 FLASH STEAM PLANTS: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 GROUND SOURCE HEAT PUMPS: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 GROUND SOURCE HEAT PUMPS: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 DIRECT SYSTEMS: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 DIRECT SYSTEMS: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 OTHER TECHNOLOGIES: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 OTHER TECHNOLOGIES: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 47 GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 48 LOW TEMPERATURE: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 LOW TEMPERATURE: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 MEDIUM TEMPERATURE: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 MEDIUM TEMPERATURE: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 HIGH TEMPERATURE: GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 HIGH TEMPERATURE: GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 GEOTHERMAL ENERGY MARKET, BY REGION, 2021-2024 (MW)

- TABLE 57 GEOTHERMAL ENERGY MARKET, BY REGION, 2025-2030 (MW)

- TABLE 58 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 59 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 61 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 63 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 CHINA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 67 CHINA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 JAPAN: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 JAPAN: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 INDONESIA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 INDONESIA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 PHILIPPINES: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 73 PHILIPPINES: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 NEW ZEALAND: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 NEW ZEALAND: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 US: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 US: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 CANADA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 CANADA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 MEXICO: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 MEXICO: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 TURKEY: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 TURKEY: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 GERMANY: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 ITALY: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 ITALY: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 ICELAND: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 ICELAND: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 REST OF EUROPE: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 111 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 112 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 113 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 114 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 SOUTH AMERICA: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 CHILE: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 CHILE: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 COLOMBIA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 COLOMBIA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 130 KENYA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 KENYA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 SAUDI ARABIA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 SAUDI ARABIA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: GEOTHERMAL ENERGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2020- 2025

- TABLE 137 GEOTHERMAL ENERGY MARKET FOR SURFACE PLANT EQUIPMENT AND SERVICES: DEGREE OF COMPETITION

- TABLE 138 GEOTHERMAL ENERGY MARKET FOR SUB-SURFACE EQUIPMENT AND SERVICES: DEGREE OF COMPETITION

- TABLE 139 GEOTHERMAL ENERGY MARKET FOR GROUND SOURCE/GEOTHERMAL HEAT PUMPS: DEGREE OF COMPETITION

- TABLE 140 GEOTHERMAL ENERGY MARKET: COMPANY FOOTPRINT

- TABLE 141 GEOTHERMAL ENERGY MARKET: COMPANY FOOTPRINT, BY PLAYER'S ROLE IN SUPPLY CHAIN

- TABLE 142 GEOTHERMAL ENERGY MARKET: APPLICATION FOOTPRINT

- TABLE 143 GEOTHERMAL ENERGY MARKET: REGION FOOTPRINT

- TABLE 144 GEOTHERMAL ENERGY MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 145 GEOTHERMAL ENERGY MARKET: COMPETITIVE BENCHMARKING OF KEY SMES/STARTUPS

- TABLE 146 GEOTHERMAL ENERGY MARKET: PRODUCT LAUNCHES, 2020-2025

- TABLE 147 GEOTHERMAL ENERGY MARKET: DEALS, 2020- 2025

- TABLE 148 GEOTHERMAL ENERGY MARKET: EXPANSIONS, 2020- 2025

- TABLE 149 GEOTHERMAL ENERGY MARKET: OTHER DEVELOPMENTS, 2020- 2025

- TABLE 150 ORMAT: COMPANY OVERVIEW

- TABLE 151 ORMAT: PRODUCTS OFFERED

- TABLE 152 ORMAT: PRODUCT LAUNCHES

- TABLE 153 ORMAT: DEALS

- TABLE 154 ORMAT: EXPANSIONS

- TABLE 155 ORMAT: OTHER DEVELOPMENTS

- TABLE 156 MITSUBISHI HEAVY INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 157 MITSUBISHI HEAVY INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 158 MITSUBISHI HEAVY INDUSTRIES LTD.: DEALS

- TABLE 159 MITSUBISHI HEAVY INDUSTRIES LTD.: EXPANSIONS

- TABLE 160 MITSUBISHI HEAVY INDUSTRIES LTD.: OTHER DEVELOPMENTS

- TABLE 161 GE VERNOVA: COMPANY OVERVIEW

- TABLE 162 GE VERNOVA: PRODUCTS OFFERED

- TABLE 163 ANSALDO ENERGIA: COMPANY OVERVIEW

- TABLE 164 ANSALDO ENERGIA: PRODUCTS OFFERED

- TABLE 165 ANSALDO ENERGIA: EXPANSIONS

- TABLE 166 FUJI ELECTRIC: COMPANY OVERVIEW

- TABLE 167 FUJI ELECTRIC: PRODUCTS OFFERED

- TABLE 168 FUJI ELECTRIC: OTHER DEVELOPMENTS

- TABLE 169 TOSHIBA AMERICA ENERGY SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 170 TOSHIBA AMERICA ENERGY SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 171 TOSHIBA AMERICA ENERGY SYSTEMS CORPORATION: DEALS

- TABLE 172 TOSHIBA AMERICA ENERGY SYSTEMS CORPORATION: OTHER DEVELOPMENTS

- TABLE 173 SIEMENS AG: COMPANY OVERVIEW

- TABLE 174 SIEMENS AG: PRODUCTS OFFERED

- TABLE 175 SIEMENS AG: EXPANSIONS

- TABLE 176 SIEMENS AG: DEALS

- TABLE 177 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 178 BAKER HUGHES COMPANY: PRODUCTS OFFERED

- TABLE 179 BAKER HUGHES COMPANY: PRODUCT LAUNCHES

- TABLE 180 BAKER HUGHES COMPANY: DEALS

- TABLE 181 SLB: COMPANY OVERVIEW

- TABLE 182 SLB: PRODUCTS OFFERED

- TABLE 183 SLB: PRODUCT LAUNCHES

- TABLE 184 SLB: DEALS

- TABLE 185 SLB: EXPANSIONS

- TABLE 186 SLB: OTHER DEVELOPMENTS

- TABLE 187 HALLIBURTON: COMPANY OVERVIEW

- TABLE 188 HALLIBURTON: PRODUCTS OFFERED

- TABLE 189 HALLIBURTON: PRODUCT LAUNCHES

- TABLE 190 HALLIBURTON: DEALS

- TABLE 191 HALLIBURTON: OTHER DEVELOPMENTS

- TABLE 192 NOV: COMPANY OVERVIEW

- TABLE 193 NOV: PRODUCTS OFFERED

- TABLE 194 NOV: PRODUCT LAUNCHES

- TABLE 195 NOV: OTHER DEVELOPMENTS

- TABLE 196 WEATHERFORD: COMPANY OVERVIEW

- TABLE 197 WEATHERFORD: PRODUCTS OFFERED

- TABLE 198 WEATHERFORD: PRODUCT LAUNCHES

- TABLE 199 WEATHERFORD: DEALS

- TABLE 200 WEATHERFORD: OTHER DEVELOPMENTS

- TABLE 201 WELLTEC: COMPANY OVERVIEW

- TABLE 202 WELLTEC: PRODUCTS OFFERED

- TABLE 203 WELLTEC: DEALS

- TABLE 204 WELLTEC: OTHER DEVELOPMENTS

- TABLE 205 NIBE GROUP: COMPANY OVERVIEW

- TABLE 206 NIBE GROUP: PRODUCTS OFFERED

- TABLE 207 CARRIER GLOBAL CORPORATION: COMPANY OVERVIEW

- TABLE 208 CARRIER GLOBAL CORPORATION: PRODUCTS OFFERED

- TABLE 209 CARRIER GLOBAL CORPORATION: DEALS

List of Figures

- FIGURE 1 GEOTHERMAL ENERGY MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 MAIN METRICS CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR GEOTHERMAL ENERGY SYSTEMS

- FIGURE 4 GEOTHERMAL ENERGY MARKET: REGION-WISE ANALYSIS

- FIGURE 5 GEOTHERMAL ENERGY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF GEOTHERMAL ENERGY SYSTEMS

- FIGURE 7 BINARY CYCLE PLANTS TO BE LEADING TECHNOLOGY IN GEOTHERMAL ENERGY MARKET

- FIGURE 8 MEDIUM TEMPERATURE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 POWER GENERATION SEGMENT TO DOMINATE GEOTHERMAL ENERGY MARKET IN 2025 AND 2030

- FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF GEOTHERMAL ENERGY MARKET BETWEEN 2025 AND 2030

- FIGURE 11 FAVORABLE RENEWABLE ENERGY POLICIES TO DRIVE GEOTHERMAL ENERGY MARKET DURING FORECAST PERIOD

- FIGURE 12 SOUTH AMERICAN GEOTHERMAL ENERGY MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 BINARY CYCLE PLANTS SEGMENT DOMINATED GEOTHERMAL ENERGY MARKET IN 2024

- FIGURE 14 MEDIUM TEMPERATURE SEGMENT ACCOUNTED FOR LARGEST SHARE OF GEOTHERMAL ENERGY MARKET IN 2024

- FIGURE 15 POWER GENERATION SEGMENT HELD LARGEST SHARE OF GEOTHERMAL ENERGY MARKET IN 2024

- FIGURE 16 GEOTHERMAL ENERGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

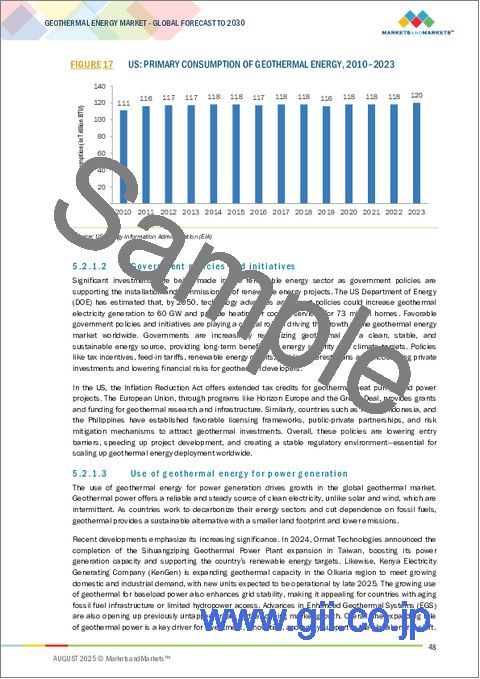

- FIGURE 17 US: PRIMARY CONSUMPTION OF GEOTHERMAL ENERGY, 2010-2023

- FIGURE 18 US: SHARE OF TOTAL GEOTHERMAL ELECTRICITY GENERATION, BY STATE, 2023

- FIGURE 19 INSTALLED ELECTRICITY CAPACITY WORLDWIDE, BY SOURCE (2022)

- FIGURE 20 REVENUE SHIFTS FOR GEOTHERMAL ENERGY SYSTEM PROVIDERS

- FIGURE 21 ECOSYSTEM ANALYSIS: GEOTHERMAL ENERGY MARKET

- FIGURE 22 SUPPLY CHAIN ANALYSIS: GEOTHERMAL COMBINED HEAT AND POWER GENERATION

- FIGURE 23 SUPPLY CHAIN ANALYSIS: GEOTHERMAL ENERGY MARKET - GROUND SOURCE/GEOTHERMAL HEAT PUMPS

- FIGURE 24 GEOTHERMAL ENERGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 EXPORT SCENARIO FOR HS CODE 840681, 2020-2024 (USD THOUSAND)

- FIGURE 26 IMPORT SCENARIO FOR HS CODE 840681, 2020-2024 (USD THOUSAND)

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 28 KEY BUYING CRITERIA FOR END USERS

- FIGURE 29 AVERAGE CAPEX OF DIFFERENT TYPES OF GEOTHERMAL POWER PLANTS, BY REGION

- FIGURE 30 IMPACT OF GEN AI/AI ON GEOTHERMAL ENERGY MARKET, BY APPLICATION

- FIGURE 31 GEOTHERMAL ENERGY MARKET, BY APPLICATION

- FIGURE 32 GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY

- FIGURE 33 GEOTHERMAL ENERGY MARKET, BY TEMPERATURE

- FIGURE 34 GEOTHERMAL ENERGY MARKET IN SOUTH AMERICA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 35 GEOTHERMAL ENERGY MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2024 (%)

- FIGURE 36 ASIA PACIFIC: GEOTHERMAL ENERGY MARKET SNAPSHOT

- FIGURE 37 EUROPE: GEOTHERMAL ENERGY MARKET SNAPSHOT

- FIGURE 38 GEOTHERMAL ENERGY MARKET FOR SURFACE PLANT EQUIPMENT AND SERVICES: MARKET SHARE ANALYSIS, 2024

- FIGURE 39 GEOTHERMAL ENERGY MARKET FOR SUB-SURFACE EQUIPMENT AND SERVICES: MARKET SHARE ANALYSIS, 2024

- FIGURE 40 GEOTHERMAL ENERGY MARKET FOR GROUND SOURCE/GEOTHERMAL HEAT PUMPS: MARKET SHARE ANALYSIS, 2024

- FIGURE 41 REVENUE OF TOP PLAYERS IN GEOTHERMAL ENERGY MARKET FROM 2020 TO 2024

- FIGURE 42 FINANCIAL METRICS

- FIGURE 43 BRAND/PRODUCT COMPARISON

- FIGURE 44 COMPETITIVE LEADERSHIP MAPPING: GEOTHERMAL ENERGY MARKET, 2024

- FIGURE 45 GEOTHERMAL ENERGY MARKET: STARTUP/SME EVALUATION QUADRANT, 2024

- FIGURE 46 ORMAT: COMPANY SNAPSHOT

- FIGURE 47 MITSUBISHI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 48 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 49 FUJI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 50 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 51 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 52 SLB: COMPANY SNAPSHOT

- FIGURE 53 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 54 NOV: COMPANY SNAPSHOT

- FIGURE 55 WEATHERFORD: COMPANY SNAPSHOT

- FIGURE 56 NIBE GROUP: COMPANY SNAPSHOT

- FIGURE 57 CARRIER GLOBAL CORPORATION: COMPANY SNAPSHOT

The geothermal energy market is estimated to reach USD 13.56 billion by 2030 at a CAGR of 5.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Geothermal energy market by technology, temperature, application, and region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The need for renewable power generation, increasing adoption of ground source heat pumps (GHP), and favorable government policies are the major factors driving the market for geothermal energy.

"Flash steam plants segment is projected to register the highest CAGR during the forecast period."

By technology, the geothermal energy market has been segmented into binary cycle plants, flash steam plants, dry steam plants, ground source heat pumps, direct systems, and others. The flash steam plants segment is expected to grow at the highest CAGR during the forecast period. Flash steam plants vary in size depending on whether they are single (0.2-80 MW), double (2-110 MW), or triple-flash (60- 150 MW) plants. It produces about 27 kg/MWh of CO2 emissions, while a binary power plant produces zero CO2 emissions. The favorable government policies and the developed technology of dry steam plants are expected to drive the overall geothermal energy market.

"Power generation is expected to be the largest application during the forecast period."

By application, the geothermal energy market has been segmented into power generation, residential heating and cooling, commercial heating and cooling, and others. The power generation segment is expected to be the largest application of geothermal energy during the forecast period due to the increasing demand for sustainable energy in every sector. Geothermal energy is preferred over other renewable forms of energy, such as wind, solar, and hydropower, for power generation.

"North America is estimated to be the second-largest market during the forecast period."

North America is anticipated to be the second-largest geothermal energy market. The market in the region is driven by technological advancements in geologically favorable regions and a strong emphasis by countries on utilizing geothermal resources for electricity generation and other applications. Additionally, rising investments in new geothermal projects across the region are expected to further accelerate market growth. Innovation, strategic focus, and increased funding position North America as a key player in the global geothermal energy sector.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 11%, Tier 2 - 85%, and Tier 3 - 24%

By Designation: C-Level - 30%, Managers - 25%, and Others - 45%

By Region: North America - 33%, Europe - 27%, Asia Pacific - 20%, Middle East & Africa - 12%, and South America - 18%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The geothermal energy market is dominated by a few major players that have a wide geographical presence. The leading players in the geothermal energy market are Ormat (US), MITSUBISHI HEAVY INDUSTRIES LTD. (Japan), GE Vernova (US), Ansaldo Energia (Italy), Fuji Electric Co., Ltd. (Japan), Toshiba Energy Systems & Solutions Corporation (Japan), Siemens AG (Germany), EXERGY INTERNATIONAL SRL (Italy), SLB (US), Halliburton (US), NOV (US), Weatherford (US), Welltec (Denmark), MANNVIT (Iceland), NIBE Group (Sweden), and others. The study includes an in-depth competitive analysis of these key players in the geothermal energy market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the global geothermal energy market by application (Power Generation, Residential & Commercial Heating and Cooling), Temperature (Low, Medium, and High Temperature), Technology (Binary and Flash Cycle Plant, Dry Steam Plant, Ground Source Heat Pumps, Direct Systems), and Region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the geothermal energy market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, mergers & acquisitions; and recent developments associated with the geothermal energy market.

Key Benefits of Buying the Report

- Analysis of key drivers (Surging demand for ground source/geothermal heat pumps, Favorable government policies and initiatives, Use of geothermal energy for power generation, and Global focus on addressing climate crisis and reducing greenhouse gas emissions), restraints (High growth of solar, wind, gas, and other alternative renewable energy source, Lack of exploration and drilling techniques required to identify and develop undiscovered geothermal resources, Expensive geothermal well drilling leading to high upfront project costs.), opportunities (Emergence of advanced technologies, Geothermal potential for low- and medium-temperature resources, Mineral extraction using geothermal energy) and challenges (Multiple environmental reviews and assessments associated with geothermal projects, Absence of geothermal professionals, consultants, and businesses) influencing the growth of the geothermal energy market.

- Product Development/Innovation: Rapid development and innovation in geothermal energy, particularly through advancements in Enhanced Geothermal Systems (EGS), closed-loop, and supercritical geothermal technologies, expand access to the Earth's heat resources. European projects like EnBW's CASCADE, recognized for pioneering lithium extraction from geothermal brines, demonstrate how geothermal can simultaneously support energy and critical mineral supply chains. Innovations in the oil & gas sector, such as repurposing hydrocarbon wells for geothermal heating and improving drilling efficiency with advanced cooling techniques, are lowering costs and accelerating deployment. These breakthroughs position geothermal as a reliable, sustainable, and versatile solution for decarbonization and energy security.

- Market Development: Mitsubishi Heavy Industries Ltd. (Japan), via its Mitsubishi Power division, secured a contract in October 2024 to retrofit the Darajat Geothermal Power Plant in Indonesia with a new steam turbine, boosting its output from 121 to 129 MW.

- Market Diversification: Ormat Technologies completed its acquisition of the Blue Mountain geothermal power plant (20 MW) in Nevada from Cyrq Energy for USD 88 million in June 2025, a move that immediately strengthens its electricity generation portfolio. The plant, originally built with Ormat technology, currently operates under a power purchase agreement with NV Energy, which is set to expire at the end of 2029. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Ormat (US), MITSUBISHI HEAVY INDUSTRIES LTD. (Japan), GE Vernova (US), Ansaldo Energia (Italy), Fuji Electric Co., Ltd. (Japan), Toshiba Energy Systems & Solutions Corporation (Japan), Siemens AG (Germany), EXERGY INTERNATIONAL SRL (Italy), SLB (US), Halliburton (US), NOV (US), Weatherford (US), WELLTEC (Denmark), MANNVIT (Iceland), and NIBE Group (Sweden), are conducted.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 GEOTHERMAL ENERGY MARKET: SEGMENTATION

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.4.1 GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY: INCLUSIONS & EXCLUSIONS

- 1.4.2 GEOTHERMAL ENERGY MARKET, BY TEMPERATURE: INCLUSIONS & EXCLUSIONS

- 1.4.3 GEOTHERMAL ENERGY MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

- 1.5 YEARS CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 CURRENCY CONSIDERED

- 1.8 SUMMARY OF CHANGES

- 1.9 LIMITATIONS

- 1.10 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 SCOPE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 DEMAND-SIDE ANALYSIS

- 2.4.1.1 Calculation

- 2.4.1.2 Assumptions

- 2.4.2 SUPPLY-SIDE ANALYSIS

- 2.4.3 FORECAST

- 2.4.1 DEMAND-SIDE ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR GEOTHERMAL ENERGY MARKET PLAYERS

- 4.2 GEOTHERMAL ENERGY MARKET, BY REGION

- 4.3 GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY

- 4.4 GEOTHERMAL ENERGY MARKET, BY TEMPERATURE

- 4.5 GEOTHERMAL ENERGY MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for ground source/geothermal heat pumps

- 5.2.1.2 Government policies and initiatives

- 5.2.1.3 Use of geothermal energy for power generation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing use of solar, wind, gas, and other alternative renewable energy sources

- 5.2.2.2 Limited exploration and drilling techniques to identify and develop undiscovered geothermal resources

- 5.2.2.3 Expensive geothermal well drilling, leading to high upfront project costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Co-production and conversion of oil & gas wells for geothermal energy

- 5.2.3.2 Geothermal potential for low- and medium-temperature resources

- 5.2.3.3 Decarbonization and energy security

- 5.2.4 CHALLENGES

- 5.2.4.1 Resource uncertainty and exploration risk

- 5.2.4.2 Absence of geothermal professionals, consultants, and businesses

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR GEOTHERMAL ENERGY SYSTEM PROVIDERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 SUPPLY CHAIN ANALYSIS OF GEOTHERMAL COMBINED HEAT AND POWER GENERATION

- 5.5.1.1 Exploration & feasibility

- 5.5.1.2 Development

- 5.5.1.3 Drilling

- 5.5.1.4 Front-end engineering and design (FEED)

- 5.5.1.5 Manufacturing

- 5.5.1.6 Construction/Engineering, procurement, and construction (EPC)

- 5.5.1.7 Operations and maintenance

- 5.5.2 SUPPLY CHAIN ANALYSIS OF GEOTHERMAL ENERGY MARKET FOR GROUND SOURCE/GEOTHERMAL HEAT PUMPS

- 5.5.2.1 Raw material suppliers

- 5.5.2.2 Original equipment manufacturers (OEMs)

- 5.5.2.3 Distributors

- 5.5.2.4 End users

- 5.5.1 SUPPLY CHAIN ANALYSIS OF GEOTHERMAL COMBINED HEAT AND POWER GENERATION

- 5.6 KEY CONFERENCES & EVENTS, 2025-2026

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 CODES, POLICIES, AND REGULATIONS RELATED TO GEOTHERMAL ENERGY SYSTEMS

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PATENT ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF SUBSTITUTES

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF NEW ENTRANTS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 NEED FOR PRECISE RESERVOIR MANAGEMENT

- 5.10.1.1 Problem statement

- 5.10.1.2 Solution

- 5.10.2 ELDERLY ACCOMMODATION CENTER IN MEUNG SUR LOIRE, FRANCE, USES GEOTHERMAL ENERGY FOR HEATING AND COOLING

- 5.10.2.1 Problem statement

- 5.10.2.2 Solution

- 5.10.3 FEASIBILITY OF GEOTHERMAL POWER IN NEW MARKETS AND CONTRIBUTION TO LOCAL DECARBONIZATION

- 5.10.3.1 Problem statement

- 5.10.3.2 Solution

- 5.10.1 NEED FOR PRECISE RESERVOIR MANAGEMENT

- 5.11 GEOTHERMAL RESOURCES

- 5.11.1 GEOTHERMAL HEAT-PUMP RESOURCES

- 5.11.2 HYDROTHERMAL RESOURCES

- 5.11.3 UNCONVENTIONAL RESOURCES (ENHANCED GEOTHERMAL SYSTEMS)

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 ENHANCED GEOTHERMAL RESOURCES

- 5.12.2 ADVANCED GEOTHERMAL RESOURCES

- 5.12.3 CLOSED-LOOP GEOTHERMAL ENERGY

- 5.12.4 DISPATCHABLE GEOTHERMAL PLANTS

- 5.12.5 UNDERGROUND THERMAL ENERGY STORAGE

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO

- 5.13.2 IMPORT SCENARIO

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 AVERAGE CAPITAL EXPENDITURE PRICING ANALYSIS, BY REGION

- 5.16 IMPACT OF GEN AI/AI ON GEOTHERMAL ENERGY MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN GEOTHERMAL ENERGY MARKET

- 5.16.2 IMPACT OF GEN AI/AI, BY APPLICATION

- 5.16.3 IMPACT OF GEN AI/AI ON GEOTHERMAL ENERGY MARKET, BY REGION

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 IMPACT OF INFLATION ON GEOTHERMAL ENERGY MARKET

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON REGION

- 5.18.3.1 North America

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.3.4 ROW

6 GEOTHERMAL ENERGY MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 POWER GENERATION

- 6.2.1 SURGING DEMAND FOR SUSTAINABLE ENERGY TO DRIVE MARKET

- 6.3 RESIDENTIAL HEATING & COOLING

- 6.3.1 HIGH ENERGY COST TO PROMPT RESIDENTIAL SECTOR TO ADOPT GEOTHERMAL ENERGY

- 6.4 COMMERCIAL HEATING & COOLING

- 6.4.1 ADOPTION OF GEOTHERMAL ENERGY BY SMALL BUSINESSES TO PROPEL MARKET

- 6.5 OTHERS

7 GEOTHERMAL ENERGY MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 BINARY CYCLE PLANTS

- 7.2.1 ABILITY TO UTILIZE MEDIUM TEMPERATURE RESERVOIRS TO DRIVE MARKET

- 7.3 DRY STEAM PLANTS

- 7.3.1 HIGH-TEMPERATURE & VOLCANICALLY ACTIVE RESERVOIRS TO DRIVE MARKET

- 7.4 FLASH STEAM PLANTS

- 7.4.1 MATURE & EFFICIENT TECHNOLOGY OF FLASH STEAM PLANTS TO SUPPORT MARKET GROWTH

- 7.5 GROUND SOURCE HEAT PUMPS

- 7.5.1 LOW OPERATIONAL COST AND HIGH EFFICIENCY TO PROPEL ADOPTION

- 7.6 DIRECT SYSTEMS

- 7.6.1 SIMPLICITY AND EFFICIENCY OF DIRECT-USE SYSTEMS TO FUEL DEMAND

- 7.7 OTHER TECHNOLOGIES

8 GEOTHERMAL ENERGY MARKET, BY TEMPERATURE

- 8.1 INTRODUCTION

- 8.2 LOW TEMPERATURE (LESS THAN 90°C)

- 8.2.1 LOW-TEMPERATURE GEOTHERMAL RESOURCES USED FOR DIRECT APPLICATIONS

- 8.3 MEDIUM TEMPERATURE (90-150°C)

- 8.3.1 MEDIUM-TEMPERATURE FIELDS INCREASINGLY USED FOR ELECTRICITY GENERATION

- 8.4 HIGH TEMPERATURE (ABOVE 150°C)

- 8.4.1 HIGH-TEMPERATURE GEOTHERMAL ENERGY FOUND IN VOLCANIC AND SEISMICALLY ACTIVE REGIONS

9 GEOTHERMAL ENERGY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Plans to increase installed geothermal power capacity to propel market

- 9.2.2 JAPAN

- 9.2.2.1 Widespread use of geothermal energy to boost market

- 9.2.3 INDONESIA

- 9.2.3.1 Supportive government policies to encourage market growth

- 9.2.4 PHILIPPINES

- 9.2.4.1 Favorable geological conditions and high opportunities for investment in geothermal energy to drive market

- 9.2.5 NEW ZEALAND

- 9.2.5.1 Investments in geothermal projects to push market

- 9.2.6 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Increasing demand for geothermal heat pumps to favor market

- 9.3.2 CANADA

- 9.3.2.1 Favorable government policy framework to fuel market growth

- 9.3.3 MEXICO

- 9.3.3.1 Initiation of multiple geothermal projects to augment market growth

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 TURKEY

- 9.4.1.1 Geothermal Development Project to provide opportunities for market growth

- 9.4.2 GERMANY

- 9.4.2.1 Target of 155additional geothermal projects to accelerate market growth

- 9.4.3 ITALY

- 9.4.3.1 Increasing demand for geothermal heat pumps to drive market

- 9.4.4 ICELAND

- 9.4.4.1 Abundance of geothermal resources to support market growth

- 9.4.5 REST OF EUROPE

- 9.4.1 TURKEY

- 9.5 SOUTH AMERICA

- 9.5.1 CHILE

- 9.5.1.1 Investments in new geothermal projects to foster market growth

- 9.5.2 COLOMBIA

- 9.5.2.1 Changes in geothermal energy-related regulations to offer opportunities for market growth

- 9.5.1 CHILE

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 KENYA

- 9.6.1.1 Favorable government policies to drive market growth

- 9.6.2 SAUDI ARABIA

- 9.6.2.1 Supportive government policies and increasing investments in renewables to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 KENYA

10 COMPETITIVE LANDSCAPE

- 10.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.2 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 10.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 10.4 COMPANY VALUATION AND FINANCIAL METRICS

- 10.4.1 COMPANY VALUATION

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY EVALUATION QUADRANT

- 10.6.1 STARS

- 10.6.2 PERVASIVE PLAYERS

- 10.6.3 EMERGING LEADERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.7 GEOTHERMAL ENERGY MARKET: COMPANY FOOTPRINT

- 10.7.1 COMPANY FOOTPRINT, BY PLAYER'S ROLE IN SUPPLY CHAIN

- 10.7.2 APPLICATION FOOTPRINT

- 10.7.3 REGION FOOTPRINT

- 10.8 STARTUP/SME EVALUATION QUADRANT

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 GEOTHERMAL ENERGY MARKET: COMPETITIVE BENCHMARKING

- 10.8.5.1 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 POWER PLANT EQUIPMENT PROVIDERS

- 11.1.1 ORMAT

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 GE VERNOVA

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.4 ANSALDO ENERGIA

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.5 FUJI ELECTRIC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Other developments

- 11.1.6 TOSHIBA AMERICA ENERGY SYSTEMS CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Other developments

- 11.1.7 SIEMENS AG

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.7.3.2 Deals

- 11.1.8 POWER PLANT EQUIPMENT PROVIDERS: OTHER PLAYERS

- 11.1.8.1 EXERGY INTERNATIONAL SRL

- 11.1.8.2 Altarock Energy

- 11.1.1 ORMAT

- 11.2 SUB-SURFACE EQUIPMENT AND SERVICE PROVIDERS

- 11.2.1 BAKER HUGHES COMPANY

- 11.2.1.1 Business overview

- 11.2.1.2 Products offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses/Competitive threats

- 11.2.2 SLB

- 11.2.2.1 Business overview

- 11.2.2.2 Products offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches

- 11.2.2.3.2 Deals

- 11.2.2.3.3 Expansions

- 11.2.2.3.4 Other developments

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses/Competitive threats

- 11.2.3 HALLIBURTON

- 11.2.3.1 Business overview

- 11.2.3.2 Products offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches

- 11.2.3.3.2 Deals

- 11.2.3.3.3 Other developments

- 11.2.4 NOV

- 11.2.4.1 Business overview

- 11.2.4.2 Products offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches

- 11.2.4.3.2 Other developments

- 11.2.5 WEATHERFORD

- 11.2.5.1 Business overview

- 11.2.5.2 Products offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches

- 11.2.5.3.2 Deals

- 11.2.5.3.3 Other developments

- 11.2.6 WELLTEC

- 11.2.6.1 Business overview

- 11.2.6.2 Products offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Deals

- 11.2.6.3.2 Other developments

- 11.2.7 SUB-SURFACE EQUIPMENT AND SERVICE PROVIDERS: OTHER PLAYERS

- 11.2.7.1 MANNVIT

- 11.2.1 BAKER HUGHES COMPANY

- 11.3 GEOTHERMAL/GROUND SOURCE HEAT PUMP MANUFACTURERS AND SERVICE PROVIDERS

- 11.3.1 NIBE GROUP

- 11.3.1.1 Business overview

- 11.3.1.2 Products offered

- 11.3.1.3 MnM view

- 11.3.1.3.1 Key strengths

- 11.3.1.3.2 Strategic choices

- 11.3.1.3.3 Weaknesses/Competitive threats

- 11.3.2 CARRIER GLOBAL CORPORATION

- 11.3.2.1 Business overview

- 11.3.2.2 Products offered

- 11.3.2.3 Recent developments

- 11.3.2.3.1 Deals

- 11.3.3 GEOTHERMAL/GROUND SOURCE HEAT PUMP MANUFACTURERS AND SERVICE PROVIDERS: OTHER PLAYERS

- 11.3.3.1 DANFOSS

- 11.3.4 TRANE TECHNOLOGIES

- 11.3.5 BOSCH THERMOTECHNIK GMBH

- 11.3.6 VIESSMANN GROUP

- 11.3.7 DANDELION ENERGY

- 11.3.1 NIBE GROUP

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS