|

|

市場調査レポート

商品コード

1782041

エージェントAIの世界市場:ソフトウェア別、エージェントの役割別、用途別 - 予測(~2032年)Agentic AI Market by Software (Computational Agents, Robotic Agents), Agent Role (Marketing, Sales, Operations & Supply Chain, ITSM), Application (Workflow Automation, Planning & Decision Support, Navigation & Mobility) - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| エージェントAIの世界市場:ソフトウェア別、エージェントの役割別、用途別 - 予測(~2032年) |

|

出版日: 2025年06月25日

発行: MarketsandMarkets

ページ情報: 英文 403 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

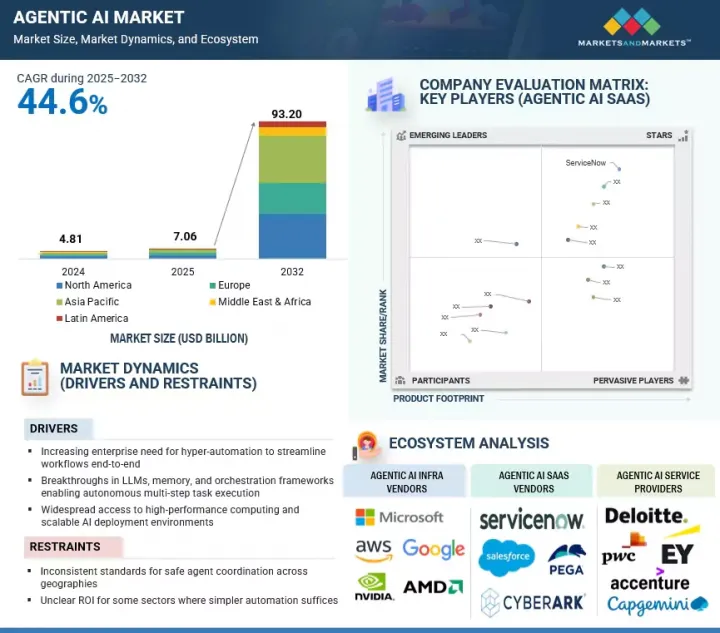

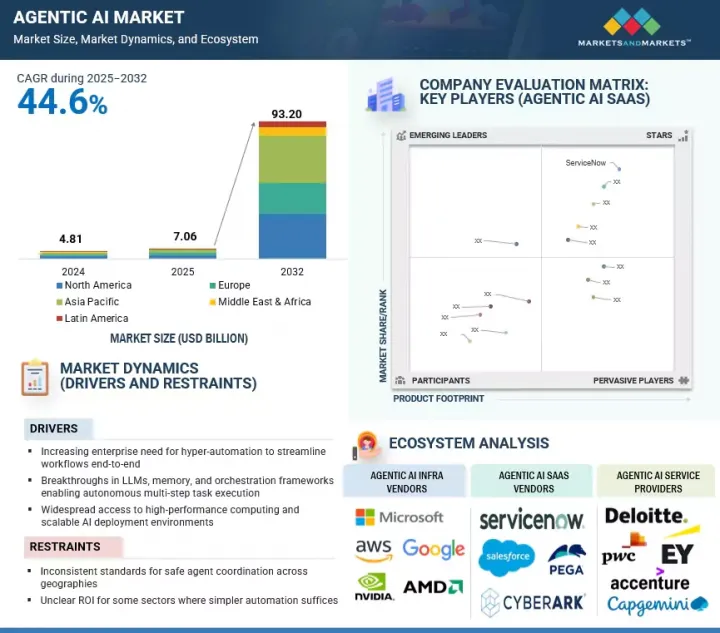

世界のエージェントAIの市場規模は、2025年の70億6,000万米ドルから2032年までに932億米ドルに達すると予測され、2025年~2032年にCAGRで44.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 10億米ドル |

| セグメント | 提供、エージェントの役割、技術、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

エージェントAI市場は、エージェントAIプラットフォームが、ドメイン固有の人間のフィードバックによる強化学習(RLHF)、思考連鎖推論(CoT)、行動データセットに基づいてエージェントを微調整するためのサポートを増加させていること、コードインタープリターエージェントが複雑なタスクを完了するためにコードを書き、テストし、デバッグし、実行することで、エージェントがその方法を反復的に改良できること、サンドボックスが(特にエージェントAIソリューションの信頼性を高めるのに役立つミッションクリティカルな用途で)エッジケースの下でエージェントの行動を微調整するのに役立つことなどが要因となって急成長しています。しかし、複数の抑制要因もあります。ほとんどのエージェントAIプラットフォームは、コアリーズナーとして市販のLLM(GPT-4、Claudeなど)に依存しています。このため、ベンダーロックイン、コスト拡張性の問題、APIが故障したり変更された場合の運用上のリスクが生じます。また、統一された記憶規格がなければ、エージェントは効果的に連携したり、組織化された知識を確実に保持したりすることができません。

「ユースケース別では、垂直ユースケースが予測期間にもっとも速い成長を記録する見込みです。」

組織がますます一般的な自動化から、部門特有の課題を解決する高度にコンテクスト的な業界特化のエージェント利用にシフトしているため、垂直ユースケースがエージェントAI市場でもっとも高いCAGRを記録するとみられます。BFSI、医療、製造、ロジスティクス、自動車などの部門では、自律型AIエージェントをコア業務に積極的に組み込み、部門特有の推論とリアルタイムの意思決定を必要とするタスクを自動化しています。例えば、銀行は不正検知、リアルタイムコンプライアンスモニタリング、自律的リスク評価にエージェントAIを活用し、メーカーはスマートファクトリー運営、予知保全、サプライチェーン最適化に向けてエージェントシステムを展開しています。このような垂直的な注力は、ROIを加速させるだけでなく、安全性、効率性、規制遵守などの重要な成果をサポートします。政府機関や防衛機関は、エージェントによる監視や災害対応計画を急速に試験的に導入しており、エネルギー関連企業は、グリッドの最適化や漏水検知に自律型エージェントを活用しています。より多くの業界参入企業が、幅広いプラットフォームよりも、あらかじめ構築され、ドメインに適応したエージェントモジュールを好むようになり、垂直ユースケースへの意欲が拡大しています。ベンダーは、カスタマイズされた製品、プラグアンドプレイ統合、マネージドサービスなどで対応しており、規制が厳しく複雑な部門での採用を容易にしています。これらの要因により、垂直ユースケースはエージェントAIの有望性を具体的な産業のKPIや深い変革のロードマップに直接合致させ、もっとも強力な成長レバーとなっています。

当レポートでは、世界のエージェントAI市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- エージェントAI市場における魅力的な機会

- エージェントAI市場:上位3つの水平ユースケース

- 北米のエージェントAI市場:提供別、水平ユースケース別

- エージェントAI市場:地域別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- エージェントAIの進化

- サプライチェーン分析

- エコシステム分析

- エージェントAIフレームワークプロバイダー

- エージェントAIプラットフォームプロバイダー

- エージェントAI SaaSプロバイダー

- エージェントAIサービスプロバイダー

- 企業向け戦略ロードマップ

- 組織の準備状況の評価

- 統合戦略

- 変更管理と人材戦略

- ガバナンスとコントロール

- ベンダー、パートナー評価フレームワーク

- 市場参入への影響

- 成功指標とROI測定

- 将来の見通し

- スーパーエージェントシステムへの進化

- 長期的な社会と労働力に対する影響

- 潜在的なリスクと実存的懸念

- シナリオプランニング

- 投資とイノベーションの機会

- 次の最先端研究分野

- 2025年の米国関税の影響 - エージェントAI市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制

- 特許分析

- 調査手法

- 特許出願件数:書類タイプ別

- イノベーションと特許出願

- 価格設定の分析

- 提供の平均販売価格:主要企業別(2025年)

- 水平ユースケースの平均販売価格(2025年)

- 主な会議とイベント(2025年~2026年)

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- カスタマービジネスに影響を与える動向/混乱

第6章 エージェントAI市場:提供別

- イントロダクション

- エージェントAIインフラ

- エージェントAIプラットフォーム

- エージェントAI SaaS

- エージェントAIサービス

第7章 エージェントAI市場:水平ユースケース別

- イントロダクション

- 財務・会計

- 職場体験

- セールス

- データアナリティクス・BI

- マーケティング

- セキュリティオペレーション

- 顧客体験

- データ取得

- コーディング・テスト

- 規制遵守

第8章 エージェントAI市場:垂直ユースケース別

- イントロダクション

- BFSI

- 小売・eコマース

- プロフェッショナルサービス

- 医療・ライフサイエンス

- 通信

- ソフトウェア・技術プロバイダー

- メディア・エンターテインメント

- ロジスティクス・輸送

- 政府・防衛

- 自動車

- エネルギー・公益事業

- 製造

第9章 エージェントAI市場:エンドユーザー別

- イントロダクション

- 個人ユーザー

- 企業

第10章 エージェントAI市場:地域別

- イントロダクション

- 北米

- 北米のエージェントAI市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のエージェントAI市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- その他の欧州

- アジア太平洋

- アジア太平洋のエージェントAI市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- シンガポール

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのエージェントAI市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- サウジアラビア

- アラブ首長国連邦

- カタール

- トルコ

- その他の中東

- 南アフリカ

- ラテンアメリカ

- ラテンアメリカのエージェントAI市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略(2022年~2025年)

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 製品の比較分析

- 製品の比較分析:エージェントAIインフラプロバイダー

- 製品の比較分析:エージェントAIプラットフォームプロバイダー

- 製品の比較分析:エージェントAI SaaSプロバイダー

- 主要ベンダーの企業の評価と財務指標

- 企業の評価マトリクス:主要企業(エージェントAIインフラベンダー)

- 企業の評価マトリクス:主要企業(エージェントAIプラットフォームベンダー)

- 企業の評価マトリクス:主要企業(エージェントAI SaaSベンダー)

- 企業の評価マトリクス:主要企業(エージェントAIサービスプロバイダー)

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- AIインフラ/フレームワークプロバイダー

- MICROSOFT

- NVIDIA

- AWS

- AMD

- エージェントAIプラットフォームプロバイダー

- OPENAI

- UIPATH

- SNOWFLAKE

- AISERA

- APPIAN

- NEWGEN

- AMDOCS

- HEXAWARE

- ADEPT AI

- RELEVANCE AI

- エージェントAIサービスプロバイダー

- ACCENTURE

- COGNIZANT

- NTT DATA

- DELOITTE

- EY

- WIPRO

- CAPGEMINI

- HCL TECH

- TCS

- PWC

- DATAMATICS

- エージェントAI SaaSプロバイダー

- SAP

- IBM

- SALESFORCE

- SERVICENOW

- CISCO

- ALTAIR

- PEGA

- CYBERARK

- ZYCUS

- ORACLE

- SAS INSTITUTE

- AVANADE

- ERICSSON

- VALUELABS

- REWIND AI

- EMA

- ORBY AI

- EXA

- ARTISAN AI

- DEXA AI

- SIMULAR

第13章 隣接市場と関連市場

- イントロダクション

- AIエージェント市場 - 世界の予測(~2030年)

- 市場の定義

- 市場の概要

- AI市場 - 世界の予測(~2032年)

- 市場の定義

- 市場の概要

第14章 付録

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 AGENTIC AI VS. AI AGENTS: KEY DISTINCTIONS

- TABLE 5 LEVELS OF AGENT AUTONOMY FRAMEWORK

- TABLE 6 GLOBAL AGENTIC AI MARKET SIZE AND GROWTH RATE, 2022-2024 (USD MILLION, Y-O-Y %)

- TABLE 7 GLOBAL AGENTIC AI MARKET SIZE AND GROWTH RATE, 2025-2032 (USD MILLION, Y-O-Y %)

- TABLE 8 AGENTIC AI MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PATENTS FILED, 2016-2025

- TABLE 16 LIST OF FEW PATENTS IN AGENTIC AI MARKET, 2024-2025

- TABLE 17 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- TABLE 18 AVERAGE SELLING PRICE OF HORIZONTAL USE CASES, 2025

- TABLE 19 AGENTIC AI MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 IMPACT OF PORTER'S FIVE FORCES ON AGENTIC AI MARKET

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- TABLE 23 AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 24 AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 25 AGENTIC AI INFRASTRUCTURE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 26 AGENTIC AI INFRASTRUCTURE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 27 AGENTIC AI PLATFORMS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 28 AGENTIC AI PLATFORMS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 29 AGENTIC AI SAAS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 AGENTIC AI SAAS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 31 AGENTIC AI SERVICES: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 32 AGENTIC AI SERVICES: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 33 AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 34 AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 35 FINANCE & ACCOUNTING: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 36 FINANCE & ACCOUNTING: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 WORKPLACE EXPERIENCE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 38 WORKPLACE EXPERIENCE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 39 SALES: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 40 SALES: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 41 DATA ANALYTICS & BI: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 42 DATA ANALYTICS & BI: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 MARKETING: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 44 MARKETING: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

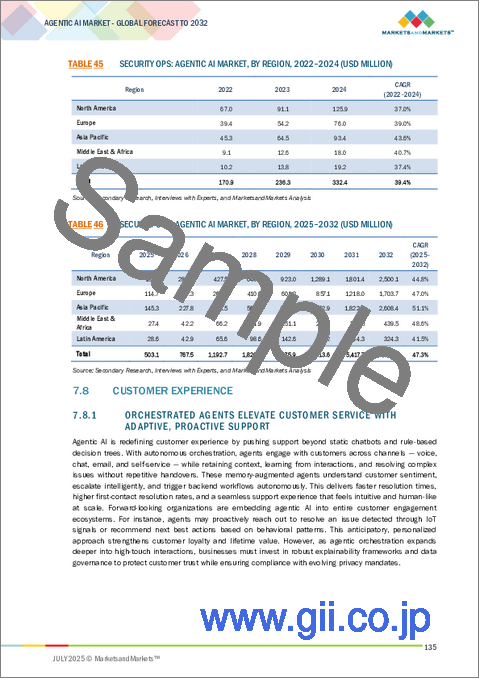

- TABLE 45 SECURITY OPS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 46 SECURITY OPS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 CUSTOMER EXPERIENCE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 48 CUSTOMER EXPERIENCE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 DATA RETRIEVAL: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 50 DATA RETRIEVAL: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 CODING & TESTING: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 52 CODING & TESTING: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 REGULATORY COMPLIANCE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 54 REGULATORY COMPLIANCE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 VERTICAL USE CASE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 56 VERTICAL USE CASE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 BFSI: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 58 BFSI: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 59 RETAIL & E-COMMERCE: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 60 RETAIL & E-COMMERCE: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 61 PROFESSIONAL SERVICES: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 62 PROFESSIONAL SERVICES: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 63 HEALTHCARE & LIFE SCIENCES: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 64 HEALTHCARE & LIFE SCIENCES: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 65 TELECOMMUNICATIONS: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 67 SOFTWARE & TECHNOLOGY PROVIDERS: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 68 SOFTWARE & TECHNOLOGY PROVIDERS: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 69 MEDIA & ENTERTAINMENT: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 70 MEDIA & ENTERTAINMENT: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 71 LOGISTICS & TRANSPORTATION: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 72 LOGISTICS & TRANSPORTATION: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 73 GOVERNMENT & DEFENSE: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 74 GOVERNMENT & DEFENSE: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 75 AUTOMOTIVE: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 76 AUTOMOTIVE: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 77 ENERGY & UTILITIES: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 78 ENERGY & UTILITIES: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 79 MANUFACTURING: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 80 MANUFACTURING: AGENTIC AI MARKET, BY VERTICAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 81 AGENTIC AI MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 82 AGENTIC AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 83 INDIVIDUAL USERS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 84 INDIVIDUAL USERS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 85 AGENTIC AI MARKET, BY ENTERPRISE, 2022-2024 (USD MILLION)

- TABLE 86 AGENTIC AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 87 BFSI: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 88 BFSI: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 89 RETAIL & E-COMMERCE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 90 RETAIL & E-COMMERCE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 PROFESSIONAL SERVICE PROVIDERS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 92 PROFESSIONAL SERVICE PROVIDERS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 93 HEALTHCARE & LIFE SCIENCES: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 94 HEALTHCARE & LIFE SCIENCES: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 TELECOMMUNICATIONS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 96 TELECOMMUNICATIONS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 TECHNOLOGY & SOFTWARE PROVIDERS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 98 TECHNOLOGY & SOFTWARE PROVIDERS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 99 MEDIA & ENTERTAINMENT: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 100 MEDIA & ENTERTAINMENT: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 101 TRANSPORTATION & LOGISTICS: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 102 TRANSPORTATION & LOGISTICS: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 103 GOVERNMENT & DEFENSE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 104 GOVERNMENT & DEFENSE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 AUTOMOTIVE: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 106 AUTOMOTIVE: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 ENERGY & UTILITIES: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 108 ENERGY & UTILITIES: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 MANUFACTURING: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 110 MANUFACTURING: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 OTHER ENTERPRISES: AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 112 OTHER ENTERPRISES: AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 AGENTIC AI MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 114 AGENTIC AI MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 115 NORTH AMERICA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 117 NORTH AMERICA: AGENTIC AI MARKET, BY USE CASE, 2022-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: AGENTIC AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 119 NORTH AMERICA: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 121 NORTH AMERICA: AGENTIC AI MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: AGENTIC AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 123 NORTH AMERICA: AGENTIC AI MARKET, BY ENTERPRISE, 2022-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: AGENTIC AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 125 NORTH AMERICA: AGENTIC AI MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: AGENTIC AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 127 US: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 128 US: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 129 CANADA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 130 CANADA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 131 EUROPE: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 132 EUROPE: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 133 EUROPE: AGENTIC AI MARKET, BY USE CASE, 2022-2024 (USD MILLION)

- TABLE 134 EUROPE: AGENTIC AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 135 EUROPE: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 136 EUROPE: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 137 EUROPE: AGENTIC AI MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 138 EUROPE: AGENTIC AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 139 EUROPE: AGENTIC AI MARKET, BY ENTERPRISE, 2022-2024 (USD MILLION)

- TABLE 140 EUROPE: AGENTIC AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 141 EUROPE: AGENTIC AI MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 142 EUROPE: AGENTIC AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 143 UK: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 144 UK: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 145 GERMANY: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 146 GERMANY: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 147 FRANCE: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 148 FRANCE: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 149 ITALY: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 150 ITALY: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 151 SPAIN: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 152 SPAIN: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 153 NETHERLANDS: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 154 NETHERLANDS: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 155 REST OF EUROPE: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 156 REST OF EUROPE: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AGENTIC AI MARKET, BY USE CASE, 2022-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AGENTIC AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AGENTIC AI MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AGENTIC AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AGENTIC AI MARKET, BY ENTERPRISE, 2022-2024 (USD MILLION)

- TABLE 166 ASIA PACIFIC: AGENTIC AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 167 ASIA PACIFIC: AGENTIC AI MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: AGENTIC AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 169 CHINA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 170 CHINA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 171 INDIA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 172 INDIA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 173 JAPAN: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 174 JAPAN: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 175 SOUTH KOREA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 176 SOUTH KOREA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 177 SINGAPORE: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 178 SINGAPORE: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 179 AUSTRALIA & NEW ZEALAND: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 180 AUSTRALIA & NEW ZEALAND: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY USE CASE, 2022-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY ENTERPRISE, 2022-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: AGENTIC AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 195 SAUDI ARABIA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 196 SAUDI ARABIA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 197 UAE: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 198 UAE: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 199 QATAR: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 200 QATAR: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 201 TURKEY: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 202 TURKEY: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 205 SOUTH AFRICA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 206 SOUTH AFRICA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 207 LATIN AMERICA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 208 LATIN AMERICA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 209 LATIN AMERICA: AGENTIC AI MARKET, BY USE CASE, 2022-2024 (USD MILLION)

- TABLE 210 LATIN AMERICA: AGENTIC AI MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 211 LATIN AMERICA: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2022-2024 (USD MILLION)

- TABLE 212 LATIN AMERICA: AGENTIC AI MARKET, BY HORIZONTAL USE CASE, 2025-2032 (USD MILLION)

- TABLE 213 LATIN AMERICA: AGENTIC AI MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 214 LATIN AMERICA: AGENTIC AI MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 215 LATIN AMERICA: AGENTIC AI MARKET, BY ENTERPRISE, 2022-2024 (USD MILLION)

- TABLE 216 LATIN AMERICA: AGENTIC AI MARKET, BY ENTERPRISE, 2025-2032 (USD MILLION)

- TABLE 217 LATIN AMERICA: AGENTIC AI MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 218 LATIN AMERICA: AGENTIC AI MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 219 BRAZIL: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 220 BRAZIL: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 221 MEXICO: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 222 MEXICO: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 223 ARGENTINA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 224 ARGENTINA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: AGENTIC AI MARKET, BY OFFERING, 2022-2024 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: AGENTIC AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 227 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGENTIC AI VENDORS, 2022 - 2025

- TABLE 228 AGENTIC AI MARKET: DEGREE OF COMPETITION

- TABLE 229 OFFERING FOOTPRINT (05 COMPANIES), 2024

- TABLE 230 REGION FOOTPRINT (05 COMPANIES), 2024

- TABLE 231 HORIZONTAL USE CASE FOOTPRINT (05 COMPANIES), 2024

- TABLE 232 END USER FOOTPRINT (05 COMPANIES), 2024

- TABLE 233 OFFERING FOOTPRINT (10 COMPANIES), 2024

- TABLE 234 REGION FOOTPRINT (10 COMPANIES), 2024

- TABLE 235 HORIZONTAL USE CASE FOOTPRINT (10 COMPANIES), 2024

- TABLE 236 END USER FOOTPRINT (10 COMPANIES), 2024

- TABLE 237 OFFERING FOOTPRINT (14 COMPANIES), 2024

- TABLE 238 REGION FOOTPRINT (14 COMPANIES), 2024

- TABLE 239 HORIZONTAL USE CASE FOOTPRINT (14 COMPANIES), 2024

- TABLE 240 END USER FOOTPRINT (14 COMPANIES), 2024

- TABLE 241 OFFERING FOOTPRINT (18 COMPANIES), 2024

- TABLE 242 REGION FOOTPRINT (18 COMPANIES), 2024

- TABLE 243 HORIZONTAL USE CASE FOOTPRINT (18 COMPANIES), 2024

- TABLE 244 END USER FOOTPRINT (18 COMPANIES), 2024

- TABLE 245 AGENTIC AI MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-JULY 2025

- TABLE 246 AGENTIC AI MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 247 MICROSOFT: COMPANY OVERVIEW

- TABLE 248 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 MICROSOFT: DEALS

- TABLE 251 NVIDIA: COMPANY OVERVIEW

- TABLE 252 NVIDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 NVIDIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 254 NVIDIA: DEALS

- TABLE 255 GOOGLE: COMPANY OVERVIEW

- TABLE 256 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 258 GOOGLE: DEALS

- TABLE 259 OPENAI: COMPANY OVERVIEW

- TABLE 260 OPENAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 OPENAI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 262 OPENAI: DEALS

- TABLE 263 ACCENTURE: COMPANY OVERVIEW

- TABLE 264 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 266 ACCENTURE: DEALS

- TABLE 267 COGNIZANT: COMPANY OVERVIEW

- TABLE 268 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 COGNIZANT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 COGNIZANT: DEALS

- TABLE 271 CAPGEMINI: COMPANY OVERVIEW

- TABLE 272 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 CAPGEMINI: DEALS

- TABLE 274 SAP: COMPANY OVERVIEW

- TABLE 275 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 277 SAP: DEALS

- TABLE 278 IBM: COMPANY OVERVIEW

- TABLE 279 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 281 IBM: DEALS

- TABLE 282 SALESFORCE: COMPANY OVERVIEW

- TABLE 283 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 285 AI AGENTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 286 AI AGENTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 287 AI AGENTS MARKET, BY AGENT SYSTEM, 2020-2024 (USD MILLION)

- TABLE 288 AI AGENTS MARKET, BY AGENT SYSTEM, 2025-2030 (USD MILLION)

- TABLE 289 AI AGENTS MARKET, BY PRODUCT TYPE, 2020-2024 (USD MILLION)

- TABLE 290 AI AGENTS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 291 AI AGENTS MARKET, BY AGENT ROLE, 2020-2024 (USD MILLION)

- TABLE 292 AI AGENTS MARKET, BY AGENT ROLE, 2025-2030 (USD MILLION)

- TABLE 293 AI AGENTS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 294 AI AGENTS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 295 AI AGENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 296 AI AGENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 297 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2020-2024 (USD BILLION)

- TABLE 298 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2025-2032 (USD BILLION)

- TABLE 299 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2020-2024 (USD BILLION)

- TABLE 300 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2025-2032 (USD BILLION)

- TABLE 301 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2020-2024 (USD BILLION)

- TABLE 302 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2025-2032 (USD BILLION)

- TABLE 303 ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION, 2020-2024 (USD BILLION)

- TABLE 304 ARTIFICIAL INTELLIGENCE MARKET, BY ENTERPRISE APPLICATION, 2025-2032 (USD BILLION)

- TABLE 305 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2024 (USD BILLION)

- TABLE 306 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025-2032 (USD BILLION)

- TABLE 307 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 308 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025-2032 (USD BILLION)

List of Figures

- FIGURE 1 AGENTIC AI MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 AGENTIC AI MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SOFTWARE & SERVICES OF AGENTIC AI MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE & SERVICES OF AGENTIC AI MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE & SERVICES OF AGENTIC AI MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AGENTIC AI THROUGH OVERALL ARTIFICIAL INTELLIGENCE SPENDING

- FIGURE 8 AGENTIC AI INFRASTRUCTURE TO ACCOUNT FOR LARGEST MARKET SIZE IN 2025

- FIGURE 9 HORIZONTAL USE CASE TO ACCOUNT FOR MAJORITY MARKET SHARE IN 2025

- FIGURE 10 DATA ANALYTICS & BI SLATED TO BECOME LEADING USE CASE IN 2025

- FIGURE 11 BY END USER, ENTERPRISES TO BECOME LEADING SEGMENT IN 2025

- FIGURE 12 BY ENTERPRISE, PROFESSIONAL SERVICE PROVIDERS TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2032

- FIGURE 14 DEMAND FOR ADAPTIVE, GOAL-DRIVEN AUTOMATION ACROSS WORKFLOWS EXPECTED TO DRIVE MARKET GROWTH

- FIGURE 15 WORKPLACE EXPERIENCE TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 AGENTIC AI INFRASTRUCTURE AND DATA ANALYTICS & BI TO BE LARGEST SHAREHOLDERS IN NORTH AMERICA IN 2025

- FIGURE 17 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

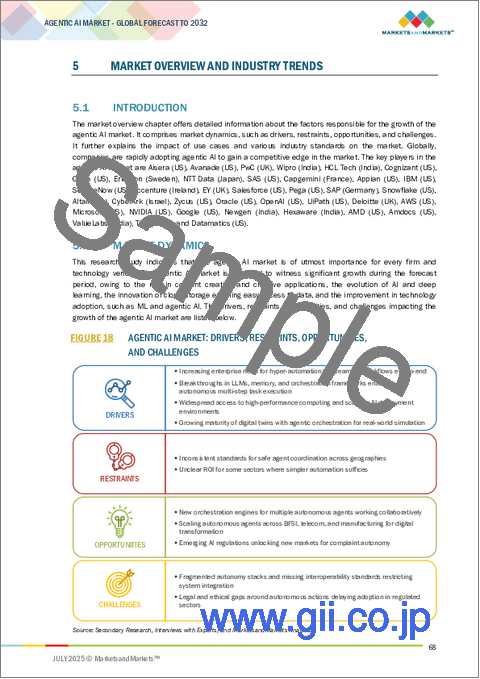

- FIGURE 18 AGENTIC AI MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 EVOLUTION OF AGENTIC AI

- FIGURE 20 AGENTIC AI MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 AGENTIC AI MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 LEADING AI STARTUPS, BY FUNDING VALUE (MILLION) AND FUNDING ROUND, UNTIL 2025

- FIGURE 23 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 25 AGENTIC AI MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AGENTIC AI SAAS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 WORKPLACE EXPERIENCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 VERTICAL USE CASE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 PROFESSIONAL SERVICE PROVIDERS TO BECOME LARGEST SEGMENT IN 2032

- FIGURE 33 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 INDIA TO REGISTER HIGHEST GROWTH RATE IN AGENTIC AI MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: AGENTIC AI MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: AGENTIC AI MARKET SNAPSHOT

- FIGURE 37 TOP PLAYERS HAVE DOMINATED THE MARKET OVER THE LAST THREE YEARS

- FIGURE 38 SHARE OF LEADING COMPANIES IN AGENTIC AI MARKET, 2024

- FIGURE 39 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI INFRASTRUCTURE PROVIDERS

- FIGURE 40 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI PLATFORM PROVIDERS

- FIGURE 41 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI SAAS PROVIDERS

- FIGURE 42 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 44 AGENTIC AI MARKET: COMPANY EVALUATION MATRIX (AGENTIC AI INFRASTRUCTURE VENDORS), 2024

- FIGURE 45 OVERALL COMPANY FOOTPRINT (05 COMPANIES), 2024

- FIGURE 46 AGENTIC AI MARKET: COMPANY EVALUATION MATRIX (AGENTIC AI PLATFORM VENDORS), 2024

- FIGURE 47 OVERALL COMPANY FOOTPRINT (10 COMPANIES), 2024

- FIGURE 48 AGENTIC AI MARKET: COMPANY EVALUATION MATRIX (AGENTIC AI SAAS VENDORS), 2024

- FIGURE 49 OVERALL COMPANY FOOTPRINT (14 COMPANIES), 2024

- FIGURE 50 AGENTIC AI MARKET: COMPANY EVALUATION MATRIX (AGENTIC AI SERVICE PROVIDERS), 2024

- FIGURE 51 OVERALL COMPANY FOOTPRINT (18 COMPANIES), 2024

- FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 53 NVIDIA: COMPANY SNAPSHOT

- FIGURE 54 GOOGLE: COMPANY SNAPSHOT

- FIGURE 55 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 56 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 57 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 58 SAP: COMPANY SNAPSHOT

- FIGURE 59 IBM: COMPANY SNAPSHOT

- FIGURE 60 SALESFORCE: COMPANY SNAPSHOT

The agentic AI market is projected to grow from USD 7.06 billion in 2025 to USD 93.20 billion in 2032, with a CAGR of 44.6% during 2025-2032.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | USD (Billion) |

| Segments | Offering, Agent Role, Technology, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The agentic AI market is growing fast, driven by increasing support from agentic AI platforms for fine-tuning agents on domain-specific reinforcement learning from human feedback (RLHF), chain of thought reasoning (CoT), and behavior datasets, code-interpreter agents write, test, debug, and execute code to complete complex tasks, allowing agents to iteratively refine their methods, and sandboxes help fine-tune agent behavior under edge cases, especially for mission-critical applications which helps grow confidence in the agentic AI solutions. However, there are also some restraints. Most agentic AI platforms rely on commercial LLMs (e.g., GPT-4, Claude) as core reasoners. This creates vendor lock-in, cost scalability issues, and operational risks if APIs fail or change, and without unified memory standards, agents cannot collaborate effectively or retain institutional knowledge reliably.

"By use case, vertical use cases expected to register the fastest growth during the forecast period."

Vertical use cases are set to record the highest CAGR in the agentic AI market as organizations increasingly shift from generic automation to highly contextual, industry-specific agentic applications that solve unique sector challenges. Sectors like BFSI, healthcare, manufacturing, logistics, and automotive are actively embedding autonomous AI agents into core operations to automate tasks that require domain-specific reasoning and real-time decision-making. For instance, banks are using agentic AI for fraud detection, real-time compliance monitoring, and autonomous risk assessment, while manufacturers deploy agentic systems for smart factory operations, predictive maintenance, and supply chain optimization. This vertical focus not only drives faster ROI but also supports critical outcomes like safety, efficiency, and regulatory adherence. Governments and defense bodies are rapidly piloting agentic surveillance and disaster response planning, while energy players tap autonomous agents for grid optimization and leak detection. With more industry players favoring pre-built, domain-adapted agentic modules over broad platforms, the appetite for vertical use cases is expanding. Vendors are responding with tailored offerings, plug-and-play integrations, and managed services, making adoption easier for regulated and complex sectors. These factors together position vertical use cases as the strongest growth lever, aligning Agentic AI's promise directly with tangible industry KPIs and deep transformation roadmaps.

"By end user, professional service providers expected to account for the largest market share during the forecast period."

Professional service providers are poised to capture the largest market share in the agentic AI market as enterprises increasingly rely on their specialized expertise to navigate the complexity of deploying autonomous AI agents at scale. Major consulting and IT service firms such as Accenture, Deloitte, TCS, Wipro, and Capgemini are expanding their agentic AI portfolios by combining advisory, design, integration, and managed services under one roof. This end-to-end model allows clients in sectors like BFSI, manufacturing, telecom, and government to implement advanced agentic solutions without needing in-house AI engineering teams or deep AI governance capabilities. Professional services firms also play a critical role in customizing agentic AI to align with industry-specific regulations, security standards, and legacy infrastructure. Additionally, many providers now build and maintain partnerships with technology vendors to deliver tailored, plug-and-play agentic AI frameworks, accelerating time-to-value for clients. Their strong global delivery networks, industry-certified talent pools, and proven track records in driving enterprise digital transformation further strengthen their position. As enterprises look for trusted partners to manage risk, handle large-scale deployments, and deliver measurable ROI from agentic AI, professional service providers are naturally emerging as the largest revenue contributors in this evolving market.

"North America to hold the largest market share in 2025, and Asia Pacific is slated to grow at the highest rate during the forecast period."

North America is expected to hold the largest market share in the agentic AI market during the forecast period, driven by early adoption, strong cloud infrastructure, and the presence of key innovators such as OpenAI, Google, Microsoft, and AWS. The region benefits from a mature AI ecosystem, government-backed R&D (e.g., DARPA and NSF initiatives), and enterprise readiness to implement autonomous, agent-driven workflows across sectors like defense, finance, and software. In contrast, the Asia Pacific region is projected to grow at the highest CAGR, fueled by aggressive digital transformation efforts, rising investments in AI research from countries like China, Japan, South Korea, and Singapore, and a rapidly expanding base of AI startups. Governments in the region are also rolling out strategic frameworks and sandboxes to accelerate agent-based automation in manufacturing, public services, and telecom sectors. This dual dynamic reflects North America's current technological leadership and Asia Pacific's growing momentum in scalable agentic AI deployment.

Breakdown of primaries

In-depth interviews were conducted with innovation and technology directors, system integrators, and executives from various key organizations operating in the agentic AI market.

- By Company: Tier I - 29%, Tier II - 42%, and Tier III - 29%

- By Designation: Directors - 27%, Managers - 39%, and others - 34%

- By Region: North America - 41%, Europe - 27%, Asia Pacific - 24%, Middle East & Africa - 3%, and Latin America - 5%

The report includes the study of key players offering agentic AI solutions. It profiles major vendors in the agentic AI market. The major players in the agentic AI market include Aisera (US), Avanade (US), PwC (UK), Wipro (India), HCL Tech (India), Cognizant (US), Cisco (US), Ericsson (Sweden), NTT Data (Japan), SAS (US), Capgemini (France), Appian (US), IBM (US), ServiceNow (US), Accenture (Ireland), EY (UK), Salesforce (US), Pega (US), SAP (Germany), Snowflake (US), Altair (US), CyberArk (Israel), Zycus (US), Oracle (US), OpenAI (US), UiPath (US), Deloitte (UK), AWS (US), Microsoft (US), NVIDIA (US), Google (US), Newgen (India), Hexaware (India), AMD (US), Amdocs (US), ValueLabs (India), TCS (India), Datamatics (US), Rewind AI (US), Ema (US), Exa (US), Orby AI (US), Artisan AI (US), Dexa AI (US), Simular (US), relevance AI (US), and Adept AI (US).

Research coverage

This research report categorizes the agentic AI market by Offering (Agentic AI Infrastructure, Agentic AI Platforms, Agentic AI SaaS, and Agentic AI Services), Use Case (Vertical Use Case, and Horizontal Use Case [Finance & Accounting, Workplace Experience, Sales, Data Analytics & BI, Marketing, Security Ops, Customer Experience, Data Retrieval, Coding & Testing, and Regulatory Compliance]), End User (Individual Users, and Enterprise), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the agentic AI market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, mergers and acquisitions, and recent developments associated with the agentic AI market. Competitive analysis of upcoming startups in the agentic AI market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agentic AI market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing enterprise need for hyper-automation to streamline workflows end-to-end, Breakthroughs in LLMs, memory, and orchestration frameworks enable autonomous multi-step task execution, Widespread access to high-performance computing and scalable AI deployment environments, and Growing maturity of digital twins with agentic orchestration for real-world simulation), restraints (Inconsistent standards for safe agent coordination across geographies, and Unclear ROI for some sectors where simpler automation suffices), opportunities (New orchestration engines for multiple autonomous agents working collaboratively, Scaling autonomous agents across BFSI, telecom, and manufacturing for digital transformation, and Emerging AI regulations are unlocking new markets for complaint autonomy), and challenges (Fragmented autonomy stacks and missing interoperability standards restrict system integration, and Legal and ethical gaps around autonomous actions are delaying adoption in regulated sectors).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the agentic AI market.

Market Development: Comprehensive information about lucrative markets - the report analyzes the agentic AI market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the agentic AI market.

Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Aisera (US), Avanade (US), PwC (UK), Wipro (India), HCL Tech (India), Cognizant (US), Cisco (US), Ericsson (Sweden), NTT Data (Japan), SAS (US), Capgemini (France), Appian (US), IBM (US), ServiceNow (US), Accenture (Ireland), EY (UK), Salesforce (US), Pega (US), SAP (Germany), Snowflake (US), Altair (US), CyberArk (Israel), Zycus (US), Oracle (US), OpenAI (US), UiPath (US), Deloitte (UK), AWS (US), Microsoft (US), NVIDIA (US), Google (US), Newgen (India), Hexaware (India), AMD (US), Amdocs (US), ValueLabs (India), TCS (India), Datamatics (US), Rewind AI (US), EMA (US), Exa (US), Orby AI (US), Artisan AI (US), Dexa AI (US), Simular (US), relevance AI (US), and Adept AI (US), among others in the agentic AI market. The report also helps stakeholders understand the pulse of the agentic AI market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 THE DAWN OF AGENTIC AI

- 3.2 UNDERSTANDING AGENTIC AI: DEFINING THE NEXT WAVE OF AUTONOMY

- 3.2.1 AGENTIC AI VS. AI AGENTS: A CRITICAL DISTINCTION

- 3.2.2 THE CORE DIFFERENTIATOR: AUTONOMY AND GOAL-ORIENTATION

- 3.3 CORE CHARACTERISTICS OF HIGH-AUTONOMY AGENTIC SYSTEMS

- 3.3.1 DEFINING FEATURES

- 3.3.2 OPERATIONAL LOOP AND PROACTIVE BEHAVIOR

- 3.3.3 PROBABILISTIC AND ADAPTABLE DECISION-MAKING

- 3.3.4 ADVANCED INTEGRATION AND TOOL USE

- 3.3.5 LEVELS OF AI AUTONOMY: FRAMEWORK FOR STRATEGIC DESIGN

- 3.4 REDEFINING WORK AND ORGANIZATIONAL STRUCTURES

- 3.4.1 SHIFTING HUMAN ROLES AND SKILL REQUIREMENTS

- 3.4.2 ENHANCING PRODUCTIVITY AND INNOVATION CYCLES

- 3.4.3 HUMAN-AI PARTNERSHIP PARADIGM

- 3.5 STRATEGIC IMPERATIVES FOR DECISION-MAKERS

- 3.6 VENDOR LANDSCAPE AND MARKET TRENDS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AGENTIC AI MARKET

- 4.2 AGENTIC AI MARKET: TOP THREE HORIZONTAL USE CASES

- 4.3 NORTH AMERICA: AGENTIC AI MARKET, BY OFFERING AND HORIZONTAL USE CASE

- 4.4 AGENTIC AI MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing enterprise need for hyper-automation to streamline workflows end-to-end

- 5.2.1.2 Breakthroughs in LLMs, memory, and orchestration frameworks enabling autonomous multi-step task execution

- 5.2.1.3 Widespread access to high-performance computing and scalable AI deployment environments

- 5.2.1.4 Growing integration of digital twins with agentic orchestration for real-world simulation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inconsistent standards for safe agent coordination across geographies

- 5.2.2.2 Unclear ROI for some sectors where simpler automation suffices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New orchestration engines for multiple autonomous agents working collaboratively

- 5.2.3.2 Scaling autonomous agents across BFSI, telecom, and manufacturing for digital transformation

- 5.2.3.3 Emerging AI regulations unlocking new markets for compliant autonomy

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented autonomy stacks and missing interoperability standards restricting system integration

- 5.2.4.2 Legal and ethical gaps around autonomous actions delaying adoption in regulated sectors

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AGENTIC AI

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 AGENTIC AI FRAMEWORK PROVIDERS

- 5.5.2 AGENTIC AI PLATFORM PROVIDERS

- 5.5.3 AGENTIC AI SAAS PROVIDERS

- 5.5.4 AGENTIC AI SERVICE PROVIDERS

- 5.6 STRATEGIC ROADMAP FOR ENTERPRISES

- 5.6.1 ORGANIZATIONAL READINESS ASSESSMENT

- 5.6.2 INTEGRATION STRATEGIES

- 5.6.3 CHANGE MANAGEMENT AND TALENT STRATEGY

- 5.6.4 GOVERNANCE AND CONTROL

- 5.6.5 VENDOR AND PARTNER EVALUATION FRAMEWORK

- 5.6.6 GO-TO-MARKET IMPLICATIONS

- 5.6.7 SUCCESS METRICS AND ROI MEASUREMENT

- 5.7 FUTURE OUTLOOK

- 5.7.1 EVOLUTION TOWARD SUPER-AGENTIC SYSTEMS

- 5.7.2 LONG-TERM SOCIETAL AND WORKFORCE IMPACT

- 5.7.3 POTENTIAL RISKS AND EXISTENTIAL CONCERNS

- 5.7.4 SCENARIO PLANNING

- 5.7.5 INVESTMENT AND INNOVATION OPPORTUNITIES

- 5.7.6 NEXT FRONTIER RESEARCH AREAS

- 5.8 IMPACT OF 2025 US TARIFF - AGENTIC AI MARKET

- 5.8.1 INTRODUCTION

- 5.8.2 KEY TARIFF RATES

- 5.8.3 PRICE IMPACT ANALYSIS

- 5.8.3.1 Strategic shifts and emerging trends

- 5.8.4 IMPACT ON COUNTRY/REGION

- 5.8.4.1 US

- 5.8.4.2 China

- 5.8.4.3 Europe

- 5.8.4.4 Asia Pacific (excluding China)

- 5.8.5 IMPACT ON END-USE INDUSTRIES

- 5.8.5.1 BFSI

- 5.8.5.2 Telecommunications

- 5.8.5.3 Government & public sector

- 5.8.5.4 Healthcare & life sciences

- 5.8.5.5 Manufacturing

- 5.8.5.6 Media & entertainment

- 5.8.5.7 Retail & e-commerce

- 5.8.5.8 Software & technology providers

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CENCORA REALIZED 4X FASTER TURNAROUND THROUGH INFINITUS' VOISE AI AGENTS

- 5.10.2 TEVA PHARMACEUTICALS DEPLOYS CONVERSATIONAL AI AGENT "MEDI" TO ENHANCE MEDICATION INFORMATION ACCESS AND SAFETY

- 5.10.3 AISERA AND CITY AND COUNTY OF DENVER - AUTOMATING CITIZEN SERVICES WITH AGENTIC AI

- 5.10.4 EZCATER ELEVATES COMPLEX CUSTOMER SERVICE OPERATIONS WITH LEVEL AI'S AUTONOMOUS AGENT SOLUTIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Reinforcement learning (RL)

- 5.11.1.2 Multi-agent systems (MAS)

- 5.11.1.3 Continual learning

- 5.11.1.4 Symbolic planning & decision-making

- 5.11.1.5 Contextual memory & retrieval mechanisms

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Large language models (LLMs)

- 5.11.2.2 Natural language understanding (NLU)

- 5.11.2.3 Generative AI

- 5.11.2.4 Computer vision

- 5.11.2.5 Vector embedding & similarity search

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 AIOps

- 5.11.3.2 Computer Vision

- 5.11.3.3 Explainable AI (XAI)

- 5.11.3.4 Blockchain

- 5.11.3.5 Natural Language Understanding (NLU)

- 5.11.1 KEY TECHNOLOGIES

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.12.2.1.2 S1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.12.2.1.3 National Artificial Intelligence Initiative Act (NAIIA) (US)

- 5.12.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.12.2.2 Europe

- 5.12.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.12.2.2.2 General Data Protection Regulation (Europe)

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.12.2.3.2 National AI Strategy (Singapore)

- 5.12.2.3.3 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 National Strategy for Artificial Intelligence (UAE)

- 5.12.2.4.2 National Artificial Intelligence Strategy (Qatar)

- 5.12.2.4.3 AI Ethics Principles and Guidelines (Dubai)

- 5.12.2.5 Latin America

- 5.12.2.5.1 Santiago Declaration (Chile)

- 5.12.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.12.2.1 North America

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.13.3 INNOVATION AND PATENT APPLICATIONS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.14.2 AVERAGE SELLING PRICE OF HORIZONTAL USE CASES, 2025

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 THREAT OF NEW ENTRANTS

- 5.16.2 THREAT OF SUBSTITUTES

- 5.16.3 BARGAINING POWER OF SUPPLIERS

- 5.16.4 BARGAINING POWER OF BUYERS

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 AGENTIC AI MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AGENTIC AI MARKET, BY OFFERING

- 6.2 AGENTIC AI INFRASTRUCTURE

- 6.2.1 INNOVATIONS IN MEMORY-AUGMENTED AGENTS AND TASK-CHAINING ENABLE COMPLEX PERFORMANCE AND AUTONOMOUS FUNCTIONS

- 6.3 AGENTIC AI PLATFORMS

- 6.3.1 TASK-CHAINING AND CONTEXTUAL MEMORY DRIVE NEW FRONTIERS FOR ENTERPRISE-GRADE AUTONOMY

- 6.4 AGENTIC AI SAAS

- 6.4.1 AUTONOMOUS BEHAVIOR EMBEDDED IN SAAS UNLOCKS REAL-WORLD PROCESS OPTIMIZATION

- 6.5 AGENTIC AI SERVICES

- 6.5.1 END-TO-END AGENTIC AI SERVICES ANCHOR ADOPTION AND TRUST IN AGENTIC DEPLOYMENTS

7 AGENTIC AI MARKET, BY HORIZONTAL USE CASE

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AGENTIC AI MARKET, BY HORIZONTAL USE CASE

- 7.2 FINANCE & ACCOUNTING

- 7.2.1 AUTONOMOUS AGENTS RESHAPE COMPLEX FINANCE & ACCOUNTING WORKFLOWS

- 7.3 WORKPLACE EXPERIENCE

- 7.3.1 ELEVATING EMPLOYEE EXPERIENCE THROUGH CONTEXT-AWARE AUTONOMOUS AGENTS

- 7.4 SALES

- 7.4.1 AUTONOMOUS AGENTS UNLOCK ALWAYS-ON SALES INTELLIGENCE AND DEAL ACCELERATION

- 7.5 DATA ANALYTICS & BI

- 7.5.1 AUTONOMOUS ORCHESTRATION AMPLIFIES DATA ANALYTICS AND BUSINESS INSIGHTS

- 7.6 MARKETING

- 7.6.1 AGENTIC AI DRIVES PRECISION, PERSONALIZATION, AND CAMPAIGN AUTONOMY IN MARKETING

- 7.7 SECURITY OPS

- 7.7.1 AUTONOMOUS AGENTS REINVENT THREAT DETECTION AND RESPONSE CYCLES IN SECURITY OPS

- 7.8 CUSTOMER EXPERIENCE

- 7.8.1 ORCHESTRATED AGENTS ELEVATE CUSTOMER SERVICE WITH ADAPTIVE, PROACTIVE SUPPORT

- 7.9 DATA RETRIEVAL

- 7.9.1 AGENTIC ORCHESTRATION TRANSFORMS ENTERPRISE DATA RETRIEVAL INTO CONTEXTUAL INTELLIGENCE

- 7.10 CODING & TESTING

- 7.10.1 AUTONOMOUS AGENTS BOOST DEVELOPER VELOCITY AND SOFTWARE RELIABILITY

- 7.11 REGULATORY COMPLIANCE

- 7.11.1 AGENTIC AI ELEVATES COMPLIANCE MONITORING AND CONTINUOUS RISK MITIGATION

8 AGENTIC AI MARKET, BY VERTICAL USE CASE

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AGENTIC AI MARKET, BY VERTICAL USE CASE

- 8.2 BFSI

- 8.2.1 AGENTIC AI REVOLUTIONIZES CORE BANKING WORKFLOWS WITH ADAPTIVE RISK CONTROLS AND INTELLIGENT PROCESS AUTOMATION

- 8.2.2 FRAUD DETECTION

- 8.2.3 AUTOMATED CREDIT UNDERWRITING

- 8.2.4 AUTONOMOUS CLAIMS PROCESSING

- 8.2.5 PORTFOLIO RISK SIMULATION

- 8.2.6 COMPLIANCE MONITORING

- 8.2.7 OTHER BFSI VERTICAL USE CASES

- 8.3 RETAIL & E-COMMERCE

- 8.3.1 AGENTIC AI POWERS INTELLIGENT MERCHANDISING, PRICING PRECISION, AND SEAMLESS OMNICHANNEL RETAIL OPERATIONS

- 8.3.2 DYNAMIC PRICING OPTIMIZATION

- 8.3.3 INTELLIGENT INVENTORY MANAGEMENT

- 8.3.4 CHECKOUT FRAUD PREVENTION

- 8.3.5 LAST-MILE ROUTE OPTIMIZATION

- 8.3.6 PERSONALIZED MERCHANDISING LAYOUTS

- 8.3.7 OTHER RETAIL & E-COMMERCE VERTICAL USE CASES

- 8.4 PROFESSIONAL SERVICES

- 8.4.1 AGENTIC AI UNLOCKS SCALABLE EXPERTISE AND ENGAGEMENT INTELLIGENCE ACROSS HIGH-TOUCH PROFESSIONAL SERVICES

- 8.4.2 CONTRACT REVIEW & LEGAL DRAFTING

- 8.4.3 AUDIT WORKFLOW MANAGEMENT

- 8.4.4 PROPOSAL & RFP GENERATION

- 8.4.5 GENERATIVE DESIGN

- 8.4.6 CAMPAIGN VARIANT GENERATION

- 8.4.7 OTHER PROFESSIONAL SERVICE VERTICAL USE CASES

- 8.5 HEALTHCARE & LIFE SCIENCES

- 8.5.1 AGENTIC AI ELEVATES PATIENT CARE AND CLINICAL EFFICIENCY THROUGH SELF-LEARNING DIAGNOSTIC AND WORKFLOW AGENTS

- 8.5.2 CLINICAL TRIAL WORKFLOW OPTIMIZATION

- 8.5.3 AI-POWERED DIAGNOSTIC IMAGING

- 8.5.4 PERSONALIZED TREATMENT PLANNING

- 8.5.5 HOSPITAL RESOURCE ORCHESTRATION

- 8.5.6 AUTONOMOUS CLAIMS REVIEW

- 8.5.7 OTHER HEALTHCARE & LIFE SCIENCES VERTICAL USE CASES

- 8.6 TELECOMMUNICATIONS

- 8.6.1 AGENTIC AI ORCHESTRATES REAL-TIME TELECOM OPERATIONS, BILLING, FRAUD DETECTION, AND CUSTOMER EXPERIENCE AUTOMATION

- 8.6.2 RAN CONFIGURATION OPTIMIZATION

- 8.6.3 TELECOM FRAUD DETECTION

- 8.6.4 PREDICTIVE NETWORK FAULT RESOLUTION

- 8.6.5 DYNAMIC BANDWIDTH ALLOCATION

- 8.6.6 AUTONOMOUS BILLING DISPUTE HANDLING

- 8.6.7 OTHER TELECOMMUNICATIONS VERTICAL USE CASES

- 8.7 SOFTWARE & TECHNOLOGY PROVIDERS

- 8.7.1 SOFTWARE & TECHNOLOGY PROVIDERS EMBED AGENTIC AI TO AUTOMATE PIPELINES, TEST APIS, AND OPTIMIZE CLOUD SPEND

- 8.7.2 DEVOPS PIPELINE AUTOMATION

- 8.7.3 INTELLIGENT FEATURE FLAG MANAGEMENT

- 8.7.4 CONTINUOUS VULNERABILITY REMEDIATION

- 8.7.5 AUTONOMOUS API BEHAVIOR TESTING

- 8.7.6 CLOUD RESOURCE OPTIMIZATION

- 8.7.7 OTHER SOFTWARE & TECHNOLOGY PROVIDERS VERTICAL USE CASES

- 8.8 MEDIA & ENTERTAINMENT

- 8.8.1 MEDIA & ENTERTAINMENT FIRMS LEVERAGE AGENTIC AI FOR CONTENT GENERATION, CURATION, AND AUDIENCE ENGAGEMENT AT SCALE

- 8.8.2 AUTOMATED CONTENT GENERATION

- 8.8.3 INTELLIGENT CONTENT MODERATION

- 8.8.4 CROSS-PLATFORM AUDIENCE PERSONALIZATION

- 8.8.5 AI-ASSISTED PRODUCTION PLANNING

- 8.8.6 LIVE EVENT ORCHESTRATION

- 8.8.7 OTHER MEDIA & ENTERTAINMENT VERTICAL USE CASES

- 8.9 LOGISTICS & TRANSPORTATION

- 8.9.1 AGENTIC AI REDEFINES LOGISTICS WITH AUTONOMOUS ORCHESTRATION AND REAL-TIME OPERATIONAL PRECISION

- 8.9.2 REAL-TIME ROUTE OPTIMIZATION

- 8.9.3 AUTONOMOUS WAREHOUSE COORDINATION

- 8.9.4 DRONE FLEET MANAGEMENT

- 8.9.5 INTELLIGENT LOGISTICS AUDITING

- 8.9.6 MULTI-MODAL DELIVERY ORCHESTRATION

- 8.9.7 OTHER LOGISTICS & TRANSPORTATION VERTICAL USE CASES

- 8.10 GOVERNMENT & DEFENSE

- 8.10.1 GOVERNMENT & DEFENSE ELEVATING NATIONAL RESILIENCE THROUGH AGENTIC AI ORCHESTRATION

- 8.10.2 PUBLIC SAFETY SURVEILLANCE

- 8.10.3 AUTONOMOUS BORDER MONITORING

- 8.10.4 DISASTER RESPONSE PLANNING

- 8.10.5 URBAN MOBILITY COORDINATION

- 8.10.6 PUBLIC INFRASTRUCTURE INCIDENT DETECTION

- 8.10.7 OTHER GOVERNMENT & DEFENSE VERTICAL USE CASES

- 8.11 AUTOMOTIVE

- 8.11.1 TRANSFORMING VEHICLE AUTONOMY AND IN-CABIN EXPERIENCES WITH INTELLIGENT AGENTIC ORCHESTRATION

- 8.11.2 AUTONOMOUS VEHICLE NAVIGATION

- 8.11.3 IN-VEHICLE DECISION SUPPORT

- 8.11.4 DRIVER BEHAVIOR ADAPTATION

- 8.11.5 PREDICTIVE IN-CABIN PERSONALIZATION

- 8.11.6 SAFETY SYSTEM COORDINATION

- 8.11.7 OTHER AUTOMOTIVE VERTICAL USE CASES

- 8.12 ENERGY & UTILITIES

- 8.12.1 ORCHESTRATING INTELLIGENT GRIDS AND ENERGY ASSETS THROUGH AGENTIC AI COORDINATION

- 8.12.2 DECENTRALIZED GRID OPTIMIZATION

- 8.12.3 SMART GRID MANAGEMENT

- 8.12.4 DEMAND RESPONSE MANAGEMENT

- 8.12.5 PIPELINE LEAK DETECTION

- 8.12.6 AUTONOMOUS ENERGY ASSET COORDINATION

- 8.12.7 OTHER ENERGY & UTILITIES VERTICAL USE CASES

- 8.13 MANUFACTURING

- 8.13.1 AGENTIC AI REWIRES MODERN MANUFACTURING FOR AUTONOMOUS RESILIENCE AND ADAPTIVE PRODUCTIVITY

- 8.13.2 SMART FACTORY OPERATIONS

- 8.13.3 PREDICTIVE MAINTENANCE SCHEDULING

- 8.13.4 SUPPLY CHAIN OPTIMIZATION

- 8.13.5 AUTOMATED QUALITY INSPECTION

- 8.13.6 WORKPLACE SAFETY MONITORING

- 8.13.7 OTHER MANUFACTURING VERTICAL USE CASES

9 AGENTIC AI MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AGENTIC AI MARKET, BY END USER

- 9.2 INDIVIDUAL USERS

- 9.3 ENTERPRISES

- 9.3.1 BFSI

- 9.3.1.1 Autonomous agents increasingly being embedded in personalized financial recommendations and automate claims processing

- 9.3.2 RETAIL & E-COMMERCE

- 9.3.2.1 Agentic AI drives always-on personalization, dynamic inventory, and adaptive customer engagement at scale

- 9.3.3 PROFESSIONAL SERVICE PROVIDERS

- 9.3.3.1 Rising demand for faster, cost-efficient expert services pushing agentic AI adoption across professional service firms

- 9.3.4 HEALTHCARE & LIFE SCIENCES

- 9.3.4.1 Agentic AI enables real-time clinical decision support and autonomous patient journey management end-to-end

- 9.3.5 TELECOMMUNICATIONS

- 9.3.5.1 Agentic AI streamlines network operations and personalizes user services for hyperconnected digital environments

- 9.3.6 TECHNOLOGY & SOFTWARE PROVIDERS

- 9.3.6.1 Agentic AI fuels next-gen software development, automated testing, and continuous product innovation cycles

- 9.3.7 MEDIA & ENTERTAINMENT

- 9.3.7.1 Agentic AI powers hyper-personalized content creation and real-time audience engagement experiences

- 9.3.8 TRANSPORTATION & LOGISTICS

- 9.3.8.1 Agentic AI orchestrates supply chain flows and autonomous fleet operations in real-time

- 9.3.9 GOVERNMENT & DEFENSE

- 9.3.9.1 Agentic AI enhances autonomous decision-making for critical defense, public safety, and citizen services

- 9.3.10 AUTOMOTIVE

- 9.3.10.1 Agentic AI integrates autonomous driving, predictive maintenance, and driver experience in next-gen vehicles

- 9.3.11 ENERGY & UTILITIES

- 9.3.11.1 Agentic AI optimizes distributed energy grids and autonomous demand response at scale

- 9.3.12 MANUFACTURING

- 9.3.12.1 Agentic AI automates factory floor coordination, predictive quality control, and adaptive production planning

- 9.3.13 OTHER ENTERPRISES

- 9.3.1 BFSI

10 AGENTIC AI MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AGENTIC AI MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.4 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: AGENTIC AI MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.4 GERMANY

- 10.3.5 FRANCE

- 10.3.6 ITALY

- 10.3.7 SPAIN

- 10.3.8 NETHERLANDS

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AGENTIC AI MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.4 INDIA

- 10.4.5 JAPAN

- 10.4.6 SOUTH KOREA

- 10.4.7 SINGAPORE

- 10.4.8 AUSTRALIA & NEW ZEALAND

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AGENTIC AI MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.4 UAE

- 10.5.5 QATAR

- 10.5.6 TURKEY

- 10.5.7 REST OF MIDDLE EAST

- 10.5.8 SOUTH AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AGENTIC AI MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.4 MEXICO

- 10.6.5 ARGENTINA

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES, 2022 - 2025

- 11.3 REVENUE ANALYSIS, 2022 - 2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 MARKET RANKING ANALYSIS, 2024

- 11.5 PRODUCT COMPARATIVE ANALYSIS

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI INFRASTRUCTURE PROVIDERS

- 11.5.2 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI PLATFORM PROVIDERS

- 11.5.3 PRODUCT COMPARATIVE ANALYSIS: AGENTIC AI SAAS PROVIDERS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI INFRASTRUCTURE VENDORS)

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI INFRASTRUCTURE)

- 11.7.5.1 Overall Company Footprint

- 11.7.5.2 Offering Footprint

- 11.7.5.3 Region Footprint

- 11.7.5.4 Horizontal Use Case Footprint

- 11.7.5.5 End User Footprint

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI PLATFORM VENDORS)

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI PLATFORMS)

- 11.8.5.1 Overall Company Footprint

- 11.8.5.2 Offering Footprint

- 11.8.5.3 Region Footprint

- 11.8.5.4 Horizontal Use Case Footprint

- 11.8.5.5 End User Footprint

- 11.9 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI SAAS VENDORS)

- 11.9.1 STARS

- 11.9.2 EMERGING LEADERS

- 11.9.3 PERVASIVE PLAYERS

- 11.9.4 PARTICIPANTS

- 11.9.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI SAAS)

- 11.9.5.1 Overall Company Footprint

- 11.9.5.2 Offering Footprint

- 11.9.5.3 Region Footprint

- 11.9.5.4 Horizontal Use Case Footprint

- 11.9.5.5 End User Footprint

- 11.10 COMPANY EVALUATION MATRIX: KEY PLAYERS (AGENTIC AI SERVICE PROVIDERS)

- 11.10.1 STARS

- 11.10.2 EMERGING LEADERS

- 11.10.3 PERVASIVE PLAYERS

- 11.10.4 PARTICIPANTS

- 11.10.5 COMPANY FOOTPRINT: KEY PLAYERS (AGENTIC AI SERVICES)

- 11.10.5.1 Overall Company Footprint

- 11.10.5.2 Offering Footprint

- 11.10.5.3 Region Footprint

- 11.10.5.4 Horizontal Use Case Footprint

- 11.10.5.5 End User Footprint

- 11.11 COMPETITIVE SCENARIO

- 11.11.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 11.11.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 AI INFRASTRUCTURE/FRAMEWORK PROVIDERS

- 12.2.1 MICROSOFT

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches and enhancements

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 NVIDIA

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches and enhancements

- 12.2.2.3.2 Deals

- 12.2.3 GOOGLE

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches and enhancements

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 AWS

- 12.2.5 AMD

- 12.2.1 MICROSOFT

- 12.3 AGENTIC AI PLATFORM PROVIDERS

- 12.3.1 OPENAI

- 12.3.1.1 Business overview

- 12.3.1.2 Products/Solutions/Services offered

- 12.3.1.3 Recent developments

- 12.3.1.3.1 Product launches and enhancements

- 12.3.1.3.2 Deals

- 12.3.2 UIPATH

- 12.3.3 SNOWFLAKE

- 12.3.4 AISERA

- 12.3.5 APPIAN

- 12.3.6 NEWGEN

- 12.3.7 AMDOCS

- 12.3.8 HEXAWARE

- 12.3.9 ADEPT AI

- 12.3.10 RELEVANCE AI

- 12.3.1 OPENAI

- 12.4 AGENTIC AI SERVICE PROVIDERS

- 12.4.1 ACCENTURE

- 12.4.1.1 Business overview

- 12.4.1.2 Products/Solutions/Services offered

- 12.4.1.3 Recent developments

- 12.4.1.3.1 Product launches and enhancements

- 12.4.1.3.2 Deals

- 12.4.1.4 MnM view

- 12.4.1.4.1 Key strengths

- 12.4.1.4.2 Strategic choices

- 12.4.1.4.3 Weaknesses and competitive threats

- 12.4.2 COGNIZANT

- 12.4.2.1 Business overview

- 12.4.2.2 Products/Solutions/Services offered

- 12.4.2.3 Recent developments

- 12.4.2.3.1 Product launches and enhancements

- 12.4.2.3.2 Deals

- 12.4.3 NTT DATA

- 12.4.4 DELOITTE

- 12.4.5 EY

- 12.4.6 WIPRO

- 12.4.7 CAPGEMINI

- 12.4.7.1 Business overview

- 12.4.7.2 Products/Solutions/Services offered

- 12.4.7.3 Recent developments

- 12.4.7.3.1 Deals

- 12.4.8 HCL TECH

- 12.4.9 TCS

- 12.4.10 PWC

- 12.4.11 DATAMATICS

- 12.4.1 ACCENTURE

- 12.5 AGENTIC AI SAAS PROVIDERS

- 12.5.1 SAP

- 12.5.1.1 Business overview

- 12.5.1.2 Products/Solutions/Services offered

- 12.5.1.3 Recent developments

- 12.5.1.3.1 Product launches and enhancements

- 12.5.1.3.2 Deals

- 12.5.1.4 MnM view

- 12.5.1.4.1 Key strengths

- 12.5.1.4.2 Strategic choices

- 12.5.1.4.3 Weaknesses and competitive threats

- 12.5.2 IBM

- 12.5.2.1 Business overview

- 12.5.2.2 Products/Solutions/Services offered

- 12.5.2.3 Recent developments

- 12.5.2.3.1 Product launches and enhancements

- 12.5.2.3.2 Deals

- 12.5.2.4 MnM view

- 12.5.2.4.1 Key strengths

- 12.5.2.4.2 Strategic choices

- 12.5.2.4.3 Weaknesses and competitive threats

- 12.5.3 SALESFORCE

- 12.5.3.1 Business overview

- 12.5.3.2 Products/Solutions/Services offered

- 12.5.3.3 Recent developments

- 12.5.3.3.1 Product launches and enhancements

- 12.5.4 SERVICENOW

- 12.5.5 CISCO

- 12.5.6 ALTAIR

- 12.5.7 PEGA

- 12.5.8 CYBERARK

- 12.5.9 ZYCUS

- 12.5.10 ORACLE

- 12.5.11 SAS INSTITUTE

- 12.5.12 AVANADE

- 12.5.13 ERICSSON

- 12.5.14 VALUELABS

- 12.5.15 REWIND AI

- 12.5.16 EMA

- 12.5.17 ORBY AI

- 12.5.18 EXA

- 12.5.19 ARTISAN AI

- 12.5.20 DEXA AI

- 12.5.21 SIMULAR

- 12.5.1 SAP

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 AI AGENTS MARKET - GLOBAL FORECAST TO 2030

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 AI agents market, by offering

- 13.2.2.2 AI agents market, by agent system

- 13.2.2.3 AI agents market, by product type

- 13.2.2.4 AI agents market, by agent role

- 13.2.2.5 AI agents market, by end user

- 13.2.2.6 AI agents market, by region

- 13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence (AI) market, by offering

- 13.3.2.2 Artificial intelligence (AI) market, by technology

- 13.3.2.3 Artificial intelligence (AI) market, by business function

- 13.3.2.4 Artificial intelligence (AI) market, by enterprise application

- 13.3.2.5 Artificial intelligence (AI) market, by end user

- 13.3.2.6 Artificial intelligence (AI) market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS