|

|

市場調査レポート

商品コード

1781113

電気自動車向けワイヤレス充電の世界市場:充電システム別、推進力別、充電タイプ別、コンポーネント別、電源別、車両タイプ別 - 予測(~ 2032年)Wireless Charging Market for Electric Vehicles by Charging System (Inductive and Magnetic Power Transfer), Propulsion, Charging Type (Stationary and Dynamic Wireless Charger), Component, Power Supply, and Vehicle Type - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 電気自動車向けワイヤレス充電の世界市場:充電システム別、推進力別、充電タイプ別、コンポーネント別、電源別、車両タイプ別 - 予測(~ 2032年) |

|

出版日: 2025年07月28日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

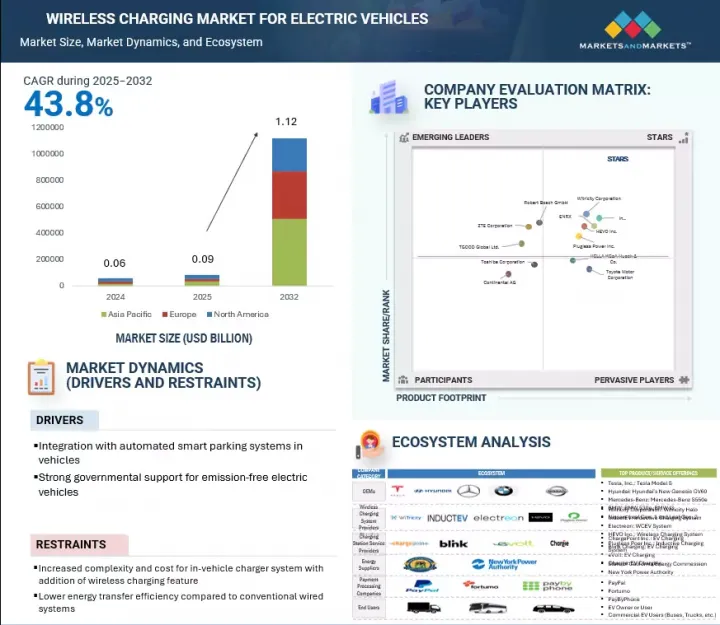

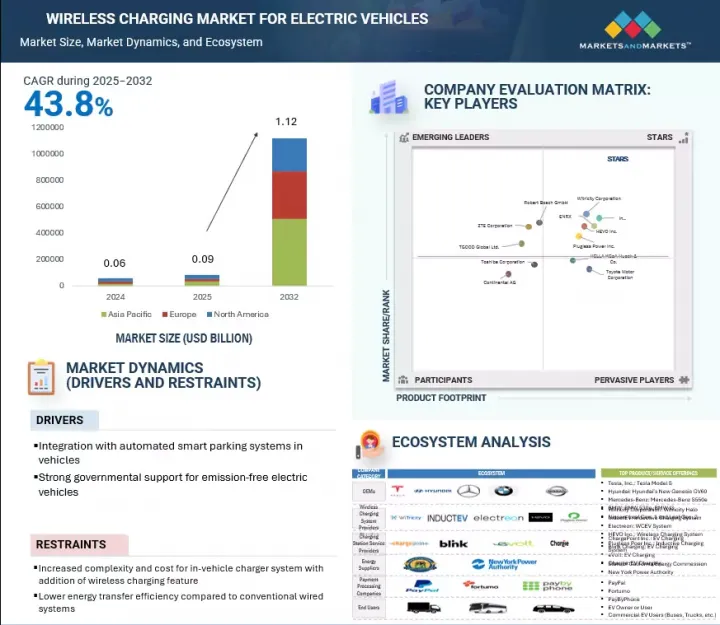

世界の電気自動車向けワイヤレス充電の市場規模は、2025年の9,000万米ドルから2032年までに11億2,000万米ドルに達すると予測され、CAGRで43.8%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 金額(1,000米ドル)、数量(台) |

| セグメント | 充電タイプ、コンポーネント、用途、充電システム、推進力、電源範囲、車両タイプ、地域 |

| 対象地域 | アジア太平洋、欧州、北米 |

電気自動車が世界市場で勢いを増し続け、スマートモビリティインフラが進歩する中、ワイヤレスEV充電はEV充電の未来を変える技術として浮上しています。高級志向の消費者は、最新の車両設計やスマートホームエコシステムに利便性とハイエンド技術をますます求めるようになっており、ワイヤレス充電体験はこれらの要件に合致しています。誘導電力伝送による非接触ワイヤレス充電を可能にすることで、このソリューションは、従来のプラグインシステムに関連する重要な運用上の課題に対処します。SAE J2954規格に沿った開発、磁気アライメント技術の改良、スマートパーキングやエネルギー管理プラットフォームとの統合により、商業的な実行可能性がさらに強化されています。自動車の電化が拡大し、都市がコネクテッドインフラを採用するにつれて、ワイヤレスEV充電は、効率的でインフラに最適化された電動モビリティを実現する上で極めて重要な役割を果たすようになります。

「ダイナミック・ワイヤレス充電は、各国がワイヤレス充電可能な道路を選択することで、急成長するニッチ部門になると予測されます。」

電気自動車用のダイナミック・ワイヤレス充電技術は、電気自動車産業において大きな成長の可能性を秘めています。ダイナミック・ワイヤレス充電システムは、路上充電システムとしても知られています。誘導技術に基づくダイナミック・ワイヤレス充電システムは、走行中の電気自動車を充電することができます。道路に埋設された送信パネルは電磁場を発生させます。この電磁場は、その上を走行する車両によって捕捉され、車両内の内蔵システムを介して電気に変換されます。ダイナミック・ワイヤレス充電は、電気自動車の航続距離の向上に役立ちます。このシステムがあれば、消費者は走行中に停車して充電する必要がなくなります。ダイナミック・ワイヤレス充電システムの市場は、ワイヤレス充電システムによってカバーされる道路の長さと電力転送速度によって定義することができます。将来の道路/高速道路にはこの技術が導入され、促進要因は移動中に電気自動車を充電するために通行料を支払うことになるため、この技術には大きな成長の可能性があります。

「欧州が予測期間にもっとも急成長する市場になる見込みです。」

欧州の自動車産業は、ゼロエミッションモビリティへの急速なシフトを示しています。欧州の国々は、輸送の脱炭素化とEUの野心的な気候変動目標の達成に向けた戦略の一環として、EVを積極的に模索しています。この地域におけるワイヤレス充電の需要は、市場における高級EVの需要の高まりに支えられており、各社はワイヤレス充電の提供に積極的に取り組んでいます。このエコシステムを支える主要企業には、ドイツのIPT Technology GmbHとRobert Bosch GmbH、スウェーデンと英国のInductEV、ノルウェーのENRX、複数の市場にまたがるElectreonなどがあります。これらの企業の技術は、乗用車と商用車の両方の電気自動車に適合する、高効率でメンテナンスの少ないワイヤレス充電ソリューションの検証を目的としたパイロットプロジェクトに組み込まれています。

当レポートでは、世界の電気自動車向けワイヤレス充電市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 電気自動車向けワイヤレス充電市場における魅力的な機会

- 電気自動車向けワイヤレス充電市場:車両タイプ別

- 電気自動車向けワイヤレス充電市場:推進力別

- 電気自動車向けワイヤレス充電市場:電源範囲別

- 電気自動車向けワイヤレス充電市場:充電システム別

- 電気自動車向けワイヤレス充電市場:コンポーネント別

- 電気自動車向けワイヤレス充電市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- エコシステム分析

- ワイヤレスEV充電システムプロバイダー

- OEM

- 充電サービスプロバイダー

- エンドユーザー

- バリューチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIの影響

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- EV向けワイヤレス充電の市場構造と競合上の優先順位

- 世界のワイヤレス充電規格の整合

- ワイヤレスEV充電の採用:乗用車セグメントと商用車セグメントの比較

- ワイヤレスEV充電エコシステムにおける自動車OEMのポジショニング

- ワイヤレス電力伝送における技術的制約

- ワイヤレスEV充電インフラの成熟度と商業化のタイムライン

- ワイヤレスEV充電における公共部門の投資と民間部門の経営

- ワイヤレスEV充電インフラと統合の依存関係

- サプライヤーエコシステムと技術の差別化

- ユーティリティ調整とスマートグリッド統合

- 高負荷フリート環境におけるワイヤレス充電の利用

- 動的オンロードワイヤレスEV充電システムのインフラ要件

- ワイヤレスEV充電への投資と設備投資の分析

- 資本支出と運用効率モデル

- 不動産と駐車場のパートナーシップ

- 保険と保証に関する考慮

- 規制の概要

- オランダ

- ドイツ

- フランス

- 英国

- 中国

- 米国

- カナダ

- 主な会議とイベント(2025年~2026年)

- 主なステークホルダーと購入基準

- カスタマービジネスに影響を与える動向と混乱

第6章 電気自動車向けワイヤレス充電市場:充電システム別

- イントロダクション

- 磁気電力伝送

- 誘導電力伝送

- 重要な知見

第7章 電気自動車向けワイヤレス充電市場:充電タイプ別

- イントロダクション

- 固定式ワイヤレス充電システム

- 動的ワイヤレス充電システム

- 重要な知見

第8章 電気自動車向けワイヤレス充電市場:用途別

- イントロダクション

- 家庭用充電ユニット

- 商業用充電ステーション

- 重要な知見

第9章 電気自動車向けワイヤレス充電市場:コンポーネント別

- イントロダクション

- ベース充電パッド

- パワーコントロールユニット

- 車両充電パッド

- 重要な知見

第10章 電気自動車向けワイヤレス充電市場:電源範囲別

- イントロダクション

- 3.7kW以下

- 3.8~7.7kW

- 7.8~11kW

- 11kW超

- 重要な知見

第11章 電気自動車向けワイヤレス充電市場:推進力別

- イントロダクション

- バッテリー電気自動車(BEV)

- プラグインハイブリッド電気自動車(PHEV)

- 重要な知見

第12章 電気自動車向けワイヤレス充電市場:車両タイプ別

- イントロダクション

- 乗用車

- 商用車

- 重要な知見

第13章 電気自動車向けワイヤレス充電市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- 欧州

- マクロ経済の見通し

- フランス

- ドイツ

- オランダ

- ノルウェー

- スペイン

- スウェーデン

- スイス

- 英国

- 北米

- マクロ経済の見通し

- カナダ

- 米国

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析(2024年)

- 主要企業の市場ランキング分析(2024年)

- 収益分析(2020年~2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合ベンチマーキング

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- WITRICITY CORPORATION

- INDUCTEV

- ENRX

- PLUGLESS POWER INC.

- HEVO INC.

- ROBERT BOSCH GMBH

- TOYOTA MOTOR CORPORATION

- HELLA KGAA HUECK & CO.

- TGOOD GLOBAL LTD.

- ZTE CORPORATION

- CONTINENTAL AG

- TOSHIBA CORPORATION

- その他の主要企業

- IDEANOMICS, INC.

- LEAR CORPORATION

- VOLTERIO GMBH (ALLINONE CREATIVE)

- MOJO MOBILITY INC.

- BMW

- FORTUM CORPORATION

- MITSUBISHI ELECTRIC

- HYUNDAI MOTOR COMPANY

- ELECTREON

- INTIS LTD.

- DELTA ELECTRONICS, INC.

- PULS GMBH

- DAIHEN CORPORATION

第16章 MARKETSANDMARKETSによる提言

- アジア太平洋がEVワイヤレス充電の主要市場となる

- ワイヤレス充電プロバイダーによる相互運用性標準の重視

- 市場浸透を高めるための供給契約への戦略的注力

- 結論

第17章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY APPLICATION

- TABLE 2 MARKET DEFINITION, BY COMPONENT

- TABLE 3 MARKET DEFINITION, BY CHARGING SYSTEM

- TABLE 4 MARKET DEFINITION, BY CHARGING TYPE

- TABLE 5 MARKET DEFINITION, BY POWER SUPPLY RANGE

- TABLE 6 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 7 MARKET DEFINITION, BY PROPULSION

- TABLE 8 USD EXCHANGE RATES, 2021-2025

- TABLE 9 GLOBAL ADOPTION OF WIRELESS CHARGING-ENABLED VEHICLES, 2019-2025

- TABLE 10 REGION-WISE EV AND CHARGING STATION SCENARIO

- TABLE 11 IMPACT OF MARKET DYNAMICS

- TABLE 12 AVERAGE SELLING PRICE TREND, BY PROPULSION, 2022-2024 (USD)

- TABLE 13 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 14 PATENT ANALYSIS

- TABLE 15 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

- TABLE 16 NETHERLANDS: EV CHARGING STATIONS INCENTIVES

- TABLE 17 GERMANY: ELECTRIC VEHICLE INCENTIVES

- TABLE 18 GERMANY: EV CHARGING STATIONS INCENTIVES

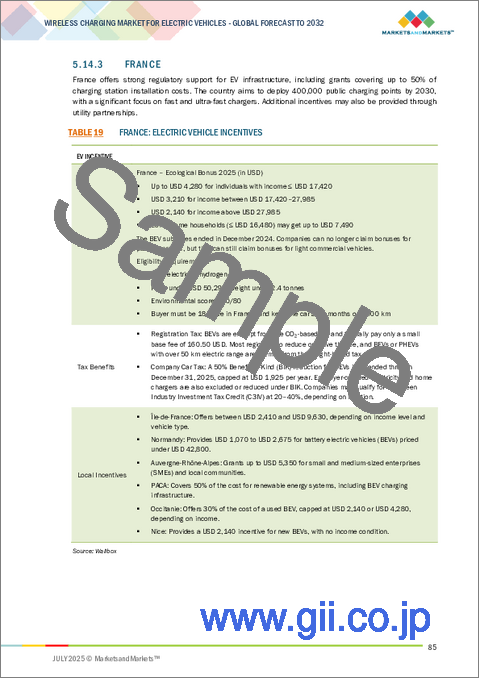

- TABLE 19 FRANCE: ELECTRIC VEHICLE INCENTIVES

- TABLE 20 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 21 UK: ELECTRIC VEHICLE INCENTIVES

- TABLE 22 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 23 CHINA: ELECTRIC VEHICLE INCENTIVES

- TABLE 24 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 25 US: ELECTRIC VEHICLE INCENTIVES

- TABLE 26 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 27 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 32 KEY BUYING CRITERIA

- TABLE 33 COMPARISON OF WIRELESS CHARGING TECHNOLOGIES

- TABLE 34 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING SYSTEM, 2022-2024 (UNITS)

- TABLE 35 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING SYSTEM, 2025-2032 (UNITS)

- TABLE 36 CHARGING SYSTEM USED BY KEY PLAYERS IN WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES

- TABLE 37 STATIONARY VS. DYNAMIC WIRELESS CHARGING FOR ELECTRIC VEHICLES

- TABLE 38 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING TYPE, 2022-2024 (UNITS)

- TABLE 39 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING TYPE, 2025-2032 (UNITS)

- TABLE 40 FEATURES OF STATIONARY WIRELESS CHARGING SYSTEMS

- TABLE 41 STATIONARY WIRELESS CHARGING SYSTEM MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 42 STATIONARY WIRELESS CHARGING SYSTEM MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 43 FEATURES OF DYNAMIC WIRELESS CHARGING SYSTEM

- TABLE 44 POWER SUPPLY RANGE OFFERED BY COMPANIES

- TABLE 45 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY APPLICATION, 2022-2024 (UNITS)

- TABLE 46 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 47 WIRELESS HOME CHARGING UNIT MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 48 WIRELESS HOME CHARGING UNIT MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 49 WIRELESS ELECTRIC VEHICLE CHARGING ROAD PROJECTS

- TABLE 50 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COMPONENT, 2022-2024 (USD THOUSAND)

- TABLE 51 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COMPONENT, 2025-2032 (USD THOUSAND)

- TABLE 52 WIRELESS BASE CHARGING PAD MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 53 WIRELESS BASE CHARGING PAD MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 54 WIRELESS POWER CONTROL UNIT MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 55 WIRELESS POWER CONTROL UNIT MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 56 WIRELESS VEHICLE CHARGING PAD MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 57 WIRELESS VEHICLE CHARGING PAD MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 58 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY POWER SUPPLY RANGE, 2022-2024 (UNITS)

- TABLE 59 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY POWER SUPPLY RANGE, 2025-2032 (UNITS)

- TABLE 60 COMPANIES OFFERING POWER SUPPLY RANGE

- TABLE 61 UP TO 3.7 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 62 UP TO 3.7 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 63 3.8-7.7 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 64 3.8-7.7 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 65 7.8-11 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 66 7.8-11 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 67 ABOVE 11 KW WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 68 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 69 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 70 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 71 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 72 WIRELESS CHARGING MARKET FOR BATTERY ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 73 WIRELESS CHARGING MARKET FOR BATTERY ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 74 WIRELESS CHARGING MARKET FOR BATTERY ELECTRIC VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 75 WIRELESS CHARGING MARKET FOR BATTERY ELECTRIC VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 76 WIRELESS CHARGING MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 77 WIRELESS CHARGING MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 78 WIRELESS CHARGING MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 79 WIRELESS CHARGING MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 80 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE, 2022-2024 (UNITS)

- TABLE 81 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE, 2025-2032 (UNITS)

- TABLE 82 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE, 2022-2024 (USD THOUSAND)

- TABLE 83 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE, 2025-2032 (USD THOUSAND)

- TABLE 84 WIRELESS CHARGING MARKET FOR PASSENGER CARS, BY REGION, 2022-2024 (UNITS)

- TABLE 85 WIRELESS CHARGING MARKET FOR PASSENGER CARS, BY REGION, 2025-2032 (UNITS)

- TABLE 86 WIRELESS CHARGING MARKET FOR PASSENGER CARS, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 87 WIRELESS CHARGING MARKET FOR PASSENGER CARS, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 88 WIRELESS CHARGING MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 89 WIRELESS CHARGING MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 90 WIRELESS CHARGING MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 91 WIRELESS CHARGING MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 92 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (UNITS)

- TABLE 93 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (UNITS)

- TABLE 94 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 95 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 96 ASIA PACIFIC: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 97 ASIA PACIFIC: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 98 ASIA PACIFIC: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 99 ASIA PACIFIC: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (USD THOUSAND)

- TABLE 100 CHINA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 101 CHINA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 102 CHINA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 103 CHINA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 104 INDIA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 105 INDIA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 106 JAPAN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 107 JAPAN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 108 SOUTH KOREA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 109 SOUTH KOREA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 110 SOUTH KOREA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 111 SOUTH KOREA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 112 EUROPE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 113 EUROPE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 114 EUROPE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 115 EUROPE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (USD THOUSAND)

- TABLE 116 FRANCE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 117 FRANCE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 118 FRANCE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 119 FRANCE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 120 GERMANY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 121 GERMANY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 122 GERMANY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 123 GERMANY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 124 NETHERLANDS: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 125 NETHERLANDS: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 126 NETHERLANDS: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 127 NETHERLANDS: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 128 NORWAY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 129 NORWAY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 130 NORWAY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 131 NORWAY: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 132 SPAIN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 133 SPAIN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 134 SPAIN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 135 SPAIN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 136 SWEDEN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 137 SWEDEN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 138 SWEDEN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 139 SWEDEN: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 140 SWITZERLAND: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 141 SWITZERLAND: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 142 SWITZERLAND: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 143 SWITZERLAND: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 144 UK: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 145 UK: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 146 UK: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 147 UK: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 148 NORTH AMERICA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 149 NORTH AMERICA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 150 NORTH AMERICA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 151 NORTH AMERICA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (USD THOUSAND)

- TABLE 152 CANADA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 153 CANADA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 154 CANADA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 155 CANADA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 156 US: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (UNITS)

- TABLE 157 US: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 158 US: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2022-2024 (USD THOUSAND)

- TABLE 159 US: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025-2032 (USD THOUSAND)

- TABLE 160 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 161 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, MARKET SHARE ANALYSIS, 2024

- TABLE 162 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: REGION FOOTPRINT

- TABLE 163 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: CHARGING TYPE FOOTPRINT

- TABLE 164 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: KEY STARTUPS/SMES

- TABLE 165 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 166 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: PRODUCT LAUNCHES, DECEMBER 2020-MARCH 2025

- TABLE 167 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: DEALS, DECEMBER 2020-MARCH 2025

- TABLE 168 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: EXPANSIONS, DECEMBER 2020-MARCH 2025

- TABLE 169 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: OTHER DEVELOPMENTS, DECEMBER 2020-MARCH 2025

- TABLE 170 WITRICITY CORPORATION: COMPANY OVERVIEW

- TABLE 171 WITRICITY CORPORATION: PRODUCTS OFFERED

- TABLE 172 WITRICITY CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 173 WITRICITY CORPORATION: DEALS

- TABLE 174 WITRICITY CORPORATION.: EXPANSIONS

- TABLE 175 WITRICITY CORPORATION: OTHER DEVELOPMENTS

- TABLE 176 INDUCTEV: COMPANY OVERVIEW

- TABLE 177 INDUCTEV: PRODUCTS OFFERED

- TABLE 178 CHARGING POWER OFFERED BY INDUCTEV

- TABLE 179 INDUCTEV: DEALS

- TABLE 180 INDUCTEV: EXPANSIONS

- TABLE 181 INDUCTEV: OTHER DEVELOPMENTS

- TABLE 182 ENRX: COMPANY OVERVIEW

- TABLE 183 ENRX: PRODUCTS OFFERED

- TABLE 184 ENRX: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 185 ENRX: DEALS

- TABLE 186 ENRX: OTHER DEVELOPMENTS

- TABLE 187 PLUGLESS POWER INC.: COMPANY OVERVIEW

- TABLE 188 PLUGLESS POWER INC.: PRODUCTS OFFERED

- TABLE 189 PLUGLESS POWER INC.: DEALS

- TABLE 190 HEVO INC.: COMPANY OVERVIEW

- TABLE 191 HEVO INC.: PRODUCTS OFFERED

- TABLE 192 HEVO INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 193 HEVO INC.: DEALS

- TABLE 194 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 195 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 196 ROBERT BOSCH GMBH: DEALS

- TABLE 197 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 198 TOYOTA MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 199 TOYOTA MOTOR CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 200 TOYOTA MOTOR CORPORATION: DEALS

- TABLE 201 HELLA KGAA HUECK & CO.: COMPANY OVERVIEW

- TABLE 202 HELLA KGAA HUECK & CO.: PRODUCTS OFFERED

- TABLE 203 HELLA KGAA HUECK & CO.: DEALS

- TABLE 204 TGOOD GLOBAL LTD.: COMPANY OVERVIEW

- TABLE 205 TGOOD GLOBAL LTD.: PRODUCTS OFFERED

- TABLE 206 TGOOD GLOBAL LTD.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 207 TGOOD GLOBAL LTD.: EXPANSIONS

- TABLE 208 ZTE CORPORATION: COMPANY OVERVIEW

- TABLE 209 ZTE CORPORATION: PRODUCTS OFFERED

- TABLE 210 ZTE CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 211 ZTE CORPORATION: DEALS

- TABLE 212 CONTINENTAL AG.: COMPANY OVERVIEW

- TABLE 213 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 214 CONTINENTAL AG: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 215 CONTINENTAL AG: DEALS

- TABLE 216 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 217 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 218 TOSHIBA CORPORATION: PRODUCTS OFFERED

- TABLE 219 TOSHIBA CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 220 TOSHIBA CORPORATION: DEALS

- TABLE 221 IDEANOMICS, INC.: COMPANY OVERVIEW

- TABLE 222 LEAR CORPORATION: COMPANY OVERVIEW

- TABLE 223 VOLTERIO GMBH (ALLINONE CREATIVE): COMPANY OVERVIEW

- TABLE 224 MOJO MOBILITY INC.: COMPANY OVERVIEW

- TABLE 225 BMW: COMPANY OVERVIEW

- TABLE 226 FORTUM CORPORATION: COMPANY OVERVIEW

- TABLE 227 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- TABLE 228 HYUNDAI MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 229 ELECTREON: COMPANY OVERVIEW

- TABLE 230 INTIS LTD.: COMPANY OVERVIEW

- TABLE 231 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 232 PULS GMBH: COMPANY OVERVIEW

- TABLE 233 DAIHEN CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION NOTES

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 10 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES OUTLOOK

- FIGURE 11 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025 VS. 2032

- FIGURE 12 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION, 2025 VS. 2032

- FIGURE 13 KEY PLAYERS IN WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES

- FIGURE 14 INCREASING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- FIGURE 15 PASSENGER CAR SEGMENT TO BE LARGER THAN COMMERCIAL VEHICLE SEGMENT DURING FORECAST PERIOD

- FIGURE 16 BEV TO HOLD DOMINANT SHARE DURING FORECAST PERIOD

- FIGURE 17 7.8-11 KW SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 18 INDUCTIVE POWER TRANSFER SEGMENT TO EXHIBIT FASTER GROWTH THAN MAGNETIC POWER TRANSFER DURING FORECAST PERIOD

- FIGURE 19 VEHICLE CHARGING PAD SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO BE LARGEST MARKET FOR WIRELESS CHARGING FOR ELECTRIC VEHICLES IN 2025

- FIGURE 21 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 EV SHIFT AND TARGETS OF COUNTRIES WORLDWIDE

- FIGURE 23 NATIONAL SUBSIDIES FOR ELECTRIC VEHICLE PURCHASE, 2020

- FIGURE 24 SYSTEM LAYOUT OF WIRELESS EV CHARGING INFRASTRUCTURE

- FIGURE 25 EFFICIENCY OF WIRED AND WIRELESS CHARGING

- FIGURE 26 DYNAMIC WIRELESS CHARGING SYSTEM

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY PROPULSION, 2022-2024 (USD)

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 31 PATENT ANALYSIS

- FIGURE 32 BIDIRECTIONAL EV CHARGING ENERGY FLOW CYCLE

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 34 KEY BUYING CRITERIA

- FIGURE 35 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 INDUCTIVE POWER TRANSFER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 MAGNETIC RESONANCE TECHNOLOGY FOR ELECTRIC VEHICLES

- FIGURE 38 INDUCTIVE POWER TRANSFER FOR ELECTRIC VEHICLE CHARGING

- FIGURE 39 WIRELESS CHARGING SOLUTION BY IPT TECHNOLOGY IN EUROPE

- FIGURE 40 STATIC WIRELESS CHARGING TECHNOLOGY

- FIGURE 41 DYNAMIC WIRELESS CHARGING TECHNOLOGY

- FIGURE 42 ELECTRIC BUS REGISTRATIONS, 2020-2024 (IN THOUSAND UNITS)

- FIGURE 43 ELECTRIC CAR SALES, 2020-2024

- FIGURE 44 WIRELESS CHARGING TECHNOLOGY FOR ELECTRIC VEHICLES

- FIGURE 45 VEHICLE CHARGING PAD TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD (2025-2032)

- FIGURE 46 BASE CHARGING PAD INSTALLED ON LISTON ROAD

- FIGURE 47 ABOVE 11 KW POWER SUPPLY RANGE TO LEAD MARKET DURING FORECAST PERIOD (2025-2032)

- FIGURE 48 BATTERY ELECTRIC VEHICLE VS. PLUG-IN HYBRID ELECTRIC VEHICLE

- FIGURE 49 BEV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD (2025-2032)

- FIGURE 50 BASIC OPERATION OF BEV VS. PHEV

- FIGURE 51 PASSENGER CAR SEGMENT TO LEAD DURING FORECAST PERIOD (2025-2032)

- FIGURE 52 OPERATING CONDITIONS OF WIRELESSLY CHARGED 3 DOUBLE-DECKER BUSES ON ROUTE 69, LONDON

- FIGURE 53 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION, 2025 VS. 2032 (USD THOUSAND)

- FIGURE 54 ASIA PACIFIC: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES SNAPSHOT

- FIGURE 55 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 56 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 57 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 58 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 59 EUROPE: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COUNTRY, 2025-2032 (USD THOUSAND)

- FIGURE 60 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 61 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 62 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 63 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 64 NORTH AMERICA: WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES SNAPSHOT

- FIGURE 65 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 66 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 67 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 68 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 69 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: MARKET SHARE ANALYSIS, 2024

- FIGURE 70 MARKET RANKING ANALYSIS, 2024

- FIGURE 71 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 72 COMPANY VALUATION OF KEY PLAYERS, 2025

- FIGURE 73 FINANCIAL METRICS OF KEY PLAYERS, 2025

- FIGURE 74 BRAND/PRODUCT COMPARISON

- FIGURE 75 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 76 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: COMPANY FOOTPRINT

- FIGURE 77 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 78 EV OWNERS' INTEREST IN WIRELESS CHARGING

- FIGURE 79 EV OWNERS' OPINION ABOUT WIRELESS CHARGING

- FIGURE 80 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 81 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 82 HELLA KGAA HUECK & CO.: COMPANY SNAPSHOT

- FIGURE 83 ZTE CORPORATION: COMPANY SNAPSHOT

- FIGURE 84 CONTINENTAL AG: BUSINESS LOCATIONS AND EMPLOYEES

- FIGURE 85 CONTINENTAL AG: COMPANY SNAPSHOT

The global wireless charging market for electric vehicles is projected to grow from USD 0.09 billion in 2025 to USD 1.12 billion by 2032 at a CAGR of 43.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Thousand), Volume (Units) |

| Segments | Charging type, component, application, charging system, propulsion, power supply range, vehicle type, and region |

| Regions covered | Asia Pacific, Europe, and North America |

As electric vehicles continue to gain momentum across global markets and smart mobility infrastructure advances, wireless EV charging is emerging as a transformative technology in the future of EV charging. As premium consumers increasingly seek convenience and high-end technology with modern vehicle design and smart home ecosystems, the wireless charging experience aligns with those requirements. By enabling contactless, wireless charging through inductive power transfer, this solution addresses key operational challenges associated with conventional plug-in systems. Developments aligned with SAE J2954 standards, improvements in magnetic alignment technologies, and integration with smart parking and energy management platforms are further reinforcing commercial viability. As vehicle electrification scales and cities adopt connected infrastructure, wireless EV charging is positioned to play a pivotal role in enabling efficient and infrastructure-optimized electric mobility.

"Magnetic power transfer is expected to be one of the leading segments of the market by charging system during the forecast period."

Magnetic resonance coupling and magnetic dynamic coupling achieve magnetic power transfer. In the magnetic resonance coupling method, power transfer between the transmitter pad and receiver pad is achieved through electromagnetic coupling. The electric power passes through the transmitter pad and is converted into magnetic waves by the primary coil attached to the transmitter coil. The receiver pad consists of a receiver coil, which picks up these waves and converts them back to electric power to charge the vehicle. Advantages of magnetic resonance coupling, which include longer charging distance and higher power, are expected to fuel the adoption of this charging system in the wireless charging market for electric vehicles. The efficiency of power transfer is approximately 90-93% in this technology, which is vital in narrowing the performance gap between wired and wireless charging, making it a viable alternative for adoption.

"Dynamic wireless charging expected to be a fast-growing niche with countries opting for wireless chargeable roads."

Dynamic wireless charging technology for electric vehicles has a huge growth potential in the electric vehicle industry. The dynamic wireless charging system is also known as the on-road charging system. Based on induction technology, a dynamic wireless charging system can charge an electric vehicle when it is in motion. The transmitter panels buried in the road generate an electromagnetic field. This electromagnetic field, captured by the vehicle when driving over it, gets converted into electricity via a built-in system inside the vehicle. Dynamic wireless charging can help improve the range of electric vehicles. With this offering, consumers would not need to stop while traveling to charge their vehicles. The market for dynamic wireless charging systems can be defined by the length of roads covered by the wireless charging systems and the power transfer rate. This technology thus has vast growth potential with future roads/highways expected to be equipped with this technology, and drivers pay tolls for charging their electric vehicles on the move.

"Europe is expected to be the fastest-growing market during the forecast period."

The European automotive industry is witnessing a rapid shift toward zero-emission mobility. These countries are actively exploring EVs as part of their strategies to decarbonize transport and meet the European Union's increasingly ambitious climate goals. The demand for wireless charging in the region is supported by a growing demand for luxury EVs in the market, and companies are actively working to provide a wireless charging offering. Key players supporting this ecosystem include IPT Technology GmbH and Robert Bosch GmbH in Germany, InductEV in Sweden and the UK, ENRX in Norway, and Electreon across multiple markets. Their technologies are being integrated into pilot projects aimed at validating high-efficiency, low-maintenance wireless charging solutions compatible with both passenger and commercial electric vehicles.

In-depth interviews were conducted with CXOs, managers, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 24%, Tier I - 67%, Others- 9%,

- By Designation: CXOs - 33%, Managers- 52%, Executives- 15%

- By Region: North America- 32%, Europe - 27 %, Asia Pacific- 41%

The wireless charging market for electric vehicles is dominated by established players such as WiTricity Corporation (US), InductEV Inc. (US), ENRX (Norway), Plugless Power Inc. (US), and HEVO Inc. (US). These companies develop and supply wireless charging solutions for electric vehicles, ranging from factory-integrated systems to high-power fleet infrastructure.

Research Coverage:

The market study covers the wireless charging for electric vehicles market by charging system (inductive power transfer (IPT) and magnetic power transfer), by propulsion (battery electric vehicle (BEV) and plug-hybrid electric vehicle (PHEV)), by charging type (stationary wireless charger and dynamic wireless charger), by component (base charging pad, power control unit, vehicle charging pad) by power supply (up to 3.7 kW, above 3.7-7.7 kW, above 7.7 -11 kW, above 11 kW) and by vehicle type (passenger car and commercial vehicle). It also covers the competitive landscape and company profiles of the major players in the wireless charging market for electric vehicles.

Key Benefits of Buying the Report

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall wireless charging market for electric vehicles and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (integration with automated smart parking systems in vehicles, strong governmental support toward emission-free and safe electric vehicles), restraints (increased complexity and cost for in-vehicle charger system with addition of wireless charging feature, lower energy transfer efficiency compared to conventional wired systems), opportunities (integration of wireless charging in smart city infrastructure, increasing investments in dynamic wireless charging technology, increasing testing of wireless charging in government roadway projects), and challenges (lack of standardized vehicle integration, high setup and installation costs of public AC wireless charging compared to L2 wired charging) influencing the growth of wireless charging market for electric vehicles

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the wireless charging market for electric vehicles

- Market Development: Comprehensive information about lucrative markets (the report analyzes the wireless charging market for electric vehicles across varied regions)

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the wireless charging market for electric vehicles.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like WiTricity Corporation (US), InductEV Inc. (US), ENRX (Norway), Plugless Power Inc. (US), and HEVO Inc. (US) in the wireless charging market for electric vehicles.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews from demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

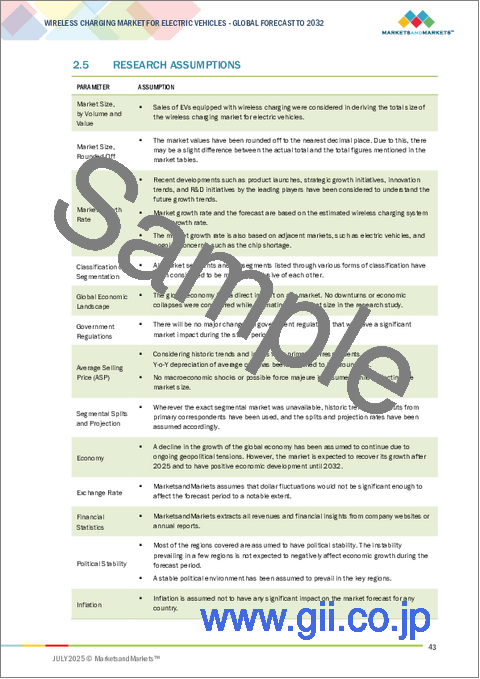

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES

- 4.2 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE

- 4.3 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION

- 4.4 WIRELESS CHARGING FOR MARKET ELECTRIC VEHICLES, BY POWER SUPPLY RANGE

- 4.5 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING SYSTEM

- 4.6 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COMPONENT

- 4.7 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Enabling Automated, Cost-Efficient EV Charging for Scalable Urban Mobility

- 5.2.1.2 Increased involvement of OEMs in wireless charging market

- 5.2.1.3 Integration of wireless charging with automated smart parking systems

- 5.2.1.4 Strong governmental support for emission-free and safe electric vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and complexity of integrating in-vehicle charger systems

- 5.2.2.2 Lower energy transfer efficiency than conventional wired systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid adoption of wireless charging in smart city infrastructure

- 5.2.3.2 Increased investments in dynamic wireless charging technology

- 5.2.3.3 Seamless charging for high-utilization electric fleets

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized vehicle integration

- 5.2.4.2 Substantial setup and installation costs of public AC wireless charging

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND, BY PROPULSION

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 WIRELESS EV CHARGING SYSTEM PROVIDERS

- 5.4.2 OEMS

- 5.4.3 CHARGING SERVICE PROVIDERS

- 5.4.4 END USERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 WITRICITY DRIVE 11 BY DAIHEN

- 5.6.2 WIRELESS LEVEL 2 CHARGING BY PLUGLESS POWER

- 5.6.3 DYNAMIC AND STATIONARY EV CHARGING INFRASTRUCTURE BY ELECTREON

- 5.6.4 WIRELESS EV CHARGING SOLUTION BY HEVO AND VEHYA

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PATENT ANALYSIS

- 5.9 IMPACT OF AI/GEN AI

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Moving-field inductive power transfer (MFIPT)

- 5.10.1.2 Resonant charging

- 5.10.1.3 Dynamic wireless charging

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Capacitive wireless power transfer

- 5.10.2.2 Resonant inductive power transfer

- 5.10.2.3 Magnetic resonance charging

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Bidirectional charging

- 5.10.1 KEY TECHNOLOGIES

- 5.11 MARKET STRUCTURING AND COMPETITIVE PRIORITIES OF WIRELESS CHARGING FOR EVS

- 5.11.1 GLOBAL ALIGNMENT OF WIRELESS CHARGING STANDARDS

- 5.11.2 ADOPTION OF WIRELESS EV CHARGING PASSENGER VS. COMMERCIAL SEGMENT

- 5.11.3 AUTOMOTIVE OEM POSITIONING IN WIRELESS EV CHARGING ECOSYSTEM

- 5.11.4 TECHNICAL CONSTRAINTS IN WIRELESS POWER TRANSFER

- 5.11.5 INFRASTRUCTURE MATURITY AND COMMERCIALIZATION TIMELINES FOR WIRELESS EV CHARGING

- 5.11.6 PUBLIC SECTOR INVESTMENT VS. PRIVATE SECTOR OPERATIONS IN WIRELESS EV CHARGING

- 5.12 WIRELESS EV CHARGING INFRASTRUCTURE AND INTEGRATION DEPENDENCIES

- 5.12.1 SUPPLIER ECOSYSTEM AND TECHNOLOGY DIFFERENTIATION

- 5.12.2 UTILITY COORDINATION AND SMART GRID INTEGRATION

- 5.12.3 WIRELESS CHARGING APPLICATIONS IN HIGH-DUTY FLEET ENVIRONMENTS

- 5.12.4 INFRASTRUCTURE REQUIREMENTS FOR DYNAMIC ON-ROAD WIRELESS EV CHARGING SYSTEMS

- 5.13 INVESTMENT AND CAPEX ANALYSIS FOR WIRELESS EV CHARGING

- 5.13.1 CAPITAL EXPENDITURE VS. OPERATIONAL EFFICIENCY MODELS

- 5.13.2 REAL ESTATE AND PARKING PARTNERSHIPS

- 5.13.3 INSURANCE AND WARRANTY CONSIDERATIONS

- 5.14 REGULATORY OVERVIEW

- 5.14.1 NETHERLANDS

- 5.14.2 GERMANY

- 5.14.3 FRANCE

- 5.14.4 UK

- 5.14.5 CHINA

- 5.14.6 US

- 5.14.7 CANADA

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING SYSTEM

- 6.1 INTRODUCTION

- 6.1.1 WIRELESS CHARGING TECHNOLOGIES ADOPTED BY LEADING PLAYERS

- 6.2 MAGNETIC POWER TRANSFER

- 6.2.1 MAGNETIC EV CHARGING POISED FOR GROWTH WITH OEM-READY EFFICIENCY AND DESIGN FLEXIBILITY

- 6.3 INDUCTIVE POWER TRANSFER

- 6.3.1 INDUCTIVE POWER TRANSFER: A SCALABLE, COST-EFFECTIVE, AND LOW-MAINTENANCE CHARGING SOLUTION

- 6.4 KEY PRIMARY INSIGHTS

7 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY CHARGING TYPE

- 7.1 INTRODUCTION

- 7.1.1 COMPARATIVE DATA BETWEEN STATIONARY VS. DYNAMIC WIRELESS CHARGING FOR ELECTRIC VEHICLES

- 7.2 STATIONARY WIRELESS CHARGING SYSTEM

- 7.2.1 ENHANCING USER CONVENIENCE AND URBAN INTEGRATION

- 7.3 DYNAMIC WIRELESS CHARGING SYSTEM

- 7.3.1 DYNAMIC WIRELESS CHARGING AS CATALYST FOR FLEET ELECTRIFICATION

- 7.4 KEY PRIMARY INSIGHTS

8 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 WIRELESS CHARGER POWER RANGE OFFERED BY COMPANIES

- 8.2 HOME CHARGING UNIT

- 8.2.1 RISING SALES OF BEVS AND PHEVS TO DRIVE GROWTH

- 8.3 COMMERCIAL CHARGING STATION

- 8.3.1 INCREASING CHARGING INFRASTRUCTURE INVESTMENTS AND CONCEPT OF ELECTRIC ROADS TO DRIVE GROWTH

- 8.4 KEY PRIMARY INSIGHTS

9 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 BASE CHARGING PAD

- 9.2.1 SIMPLICITY, RELIABILITY, AND REDUCED USER INTERVENTION TO DRIVE GROWTH

- 9.3 POWER CONTROL UNIT

- 9.3.1 POWER CONTROL UNITS DRIVE WIRELESS CHARGING ADOPTION AMID INFRASTRUCTURE SURGE

- 9.4 VEHICLE CHARGING PAD

- 9.4.1 OEMS EMERGING AS KEY DRIVERS OF VEHICLE CHARGING PAD DEPLOYMENT

- 9.5 KEY PRIMARY INSIGHTS

10 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY POWER SUPPLY RANGE

- 10.1 INTRODUCTION

- 10.1.1 POWER SUPPLY RANGE OFFERED BY COMPANIES

- 10.2 UP TO 3.7 KW

- 10.2.1 LOWER POWER REQUIREMENT TO DRIVE GROWTH

- 10.3 3.8-7.7 KW

- 10.3.1 POWERING ROUTINE MOBILITY WITH COMPACT WIRELESS CHARGING SYSTEMS

- 10.4 7.8-11 KW

- 10.4.1 FASTER CHARGING WITHOUT SIGNIFICANT INFRASTRUCTURE STRAIN TO DRIVE GROWTH

- 10.5 ABOVE 11 KW

- 10.5.1 HIGH-CAPACITY WIRELESS CHARGING FOR COMMERCIAL FLEET EV APPLICATIONS

- 10.6 KEY PRIMARY INSIGHTS

11 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY PROPULSION

- 11.1 INTRODUCTION

- 11.2 BATTERY ELECTRIC VEHICLE (BEV)

- 11.2.1 INCREASING SALES OF BATTERY ELECTRIC VEHICLES TO DRIVE GROWTH

- 11.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 11.3.1 RISING POPULARITY OF LUXURY PHEVS TO DRIVE GROWTH

- 11.4 KEY PRIMARY INSIGHTS

12 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.2 PASSENGER CAR

- 12.2.1 PASSENGER ELECTRIC VEHICLES EMERGING AS KEY ADOPTERS OF WIRELESS CHARGING SOLUTIONS

- 12.3 COMMERCIAL VEHICLE

- 12.3.1 INCREASING STRINGENCY OF EMISSION NORMS FOR COMMERCIAL VEHICLES TO DRIVE GROWTH

- 12.3.2 ELECTRIC BUS

- 12.3.3 ELECTRIC VAN

- 12.3.4 ELECTRIC PICKUP TRUCK

- 12.3.5 ELECTRIC TRUCK

- 12.4 KEY PRIMARY INSIGHTS

13 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 CHINA

- 13.2.2.1 Accelerating wireless EV charging leadership through policy, innovation, and market expansion

- 13.2.3 INDIA

- 13.2.3.1 Supportive government policies and innovation to drive market

- 13.2.4 JAPAN

- 13.2.4.1 Driving standardized wireless EV charging through Japan's public-private innovation model

- 13.2.5 SOUTH KOREA

- 13.2.5.1 Strategic investments by key players for wireless charging technology to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 FRANCE

- 13.3.2.1 National EV charging policy and public investment to expand wireless EV charging in France

- 13.3.3 GERMANY

- 13.3.3.1 Collaborations between OEMs and research institutes to enable development of wireless charging technologies

- 13.3.4 NETHERLANDS

- 13.3.4.1 Ambitious government targets and policy support for EV adoption to drive market

- 13.3.5 NORWAY

- 13.3.5.1 High EV adoption and government support to drive wireless EV charging in Norway

- 13.3.6 SPAIN

- 13.3.6.1 Public-sector investment in charging infrastructure to drive market

- 13.3.7 SWEDEN

- 13.3.7.1 Expansion of public road charging projects to drive market

- 13.3.8 SWITZERLAND

- 13.3.8.1 Public EV mandate and growing R&D to drive wireless charging growth in Switzerland

- 13.3.9 UK

- 13.3.9.1 Direct support from government for wireless charging technology to drive market

- 13.4 NORTH AMERICA

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 CANADA

- 13.4.2.1 Infrastructure investments and policy incentives to accelerate wireless charging expansion

- 13.4.3 US

- 13.4.3.1 OEM pilots, federal mandates, and increased R&D to drive wireless EV charging in the US

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2024

- 14.5 REVENUE ANALYSIS, 2020-2024

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6.1 COMPANY VALUATION

- 14.6.2 FINANCIAL METRICS

- 14.7 BRAND/PRODUCT COMPARISON

- 14.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.8.1 STARS

- 14.8.2 EMERGING LEADERS

- 14.8.3 PERVASIVE PLAYERS

- 14.8.4 PARTICIPANTS

- 14.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.8.5.1 Company footprint

- 14.8.5.2 Region footprint

- 14.8.5.3 Charging type footprint

- 14.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.9.1 PROGRESSIVE COMPANIES

- 14.9.2 RESPONSIVE COMPANIES

- 14.9.3 DYNAMIC COMPANIES

- 14.9.4 STARTING BLOCKS

- 14.10 COMPETITIVE BENCHMARKING

- 14.11 COMPETITIVE SCENARIO

- 14.11.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- 14.11.2 DEALS

- 14.11.3 EXPANSIONS

- 14.11.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 WITRICITY CORPORATION

- 15.1.1.1 Business overview

- 15.1.1.2 Recent developments

- 15.1.1.3 MnM view

- 15.1.1.3.1 Key strengths

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses & competitive threats

- 15.1.2 INDUCTEV

- 15.1.2.1 Business overview

- 15.1.2.2 Recent developments

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses & competitive threats

- 15.1.3 ENRX

- 15.1.3.1 Business overview

- 15.1.3.2 Recent developments

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses & competitive threats

- 15.1.4 PLUGLESS POWER INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Recent developments

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses & competitive threats

- 15.1.5 HEVO INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Recent developments

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses & competitive threats

- 15.1.6 ROBERT BOSCH GMBH

- 15.1.6.1 Business overview

- 15.1.6.2 Recent developments

- 15.1.7 TOYOTA MOTOR CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Recent developments

- 15.1.8 HELLA KGAA HUECK & CO.

- 15.1.8.1 Business overview

- 15.1.8.2 Recent developments

- 15.1.9 TGOOD GLOBAL LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Recent developments

- 15.1.10 ZTE CORPORATION

- 15.1.10.1 Business overview

- 15.1.10.2 Recent developments

- 15.1.11 CONTINENTAL AG

- 15.1.11.1 Business overview

- 15.1.11.2 Recent developments

- 15.1.12 TOSHIBA CORPORATION

- 15.1.12.1 Business overview

- 15.1.12.2 Recent developments

- 15.1.1 WITRICITY CORPORATION

- 15.2 OTHER KEY PLAYERS

- 15.2.1 IDEANOMICS, INC.

- 15.2.2 LEAR CORPORATION

- 15.2.3 VOLTERIO GMBH (ALLINONE CREATIVE)

- 15.2.4 MOJO MOBILITY INC.

- 15.2.5 BMW

- 15.2.6 FORTUM CORPORATION

- 15.2.7 MITSUBISHI ELECTRIC

- 15.2.8 HYUNDAI MOTOR COMPANY

- 15.2.9 ELECTREON

- 15.2.10 INTIS LTD.

- 15.2.11 DELTA ELECTRONICS, INC.

- 15.2.12 PULS GMBH

- 15.2.13 DAIHEN CORPORATION

16 RECOMMENDATIONS BY MARKETSANDMARKETS

- 16.1 ASIA PACIFIC TO BE KEY MARKET FOR WIRELESS EV CHARGING

- 16.2 WIRELESS CHARGING PROVIDERS' EMPHASIS ON INTEROPERABILITY STANDARDS

- 16.3 STRATEGIC FOCUS ON SUPPLY CONTRACTS TO HELP INCREASE MARKET PENETRATION

- 16.4 CONCLUSION

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.4.1 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY POWER SUPPLY, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 17.4.2 WIRELESS CHARGING MARKET FOR ELECTRIC VEHICLES, BY VEHICLE TYPE, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 17.4.3 COMPANY INFORMATION

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS