|

|

市場調査レポート

商品コード

1777132

医療用コーティングの世界市場:コーティングタイプ別、材料別、基材別、用途別、地域別 - 2030年までの予測Medical Coatings Market by Coating Type (Active, Passive), By Material (Polymers, Metals), By Application (Medical Devices, Medical Implants, Medical Equipment & Tools), By Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療用コーティングの世界市場:コーティングタイプ別、材料別、基材別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月22日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

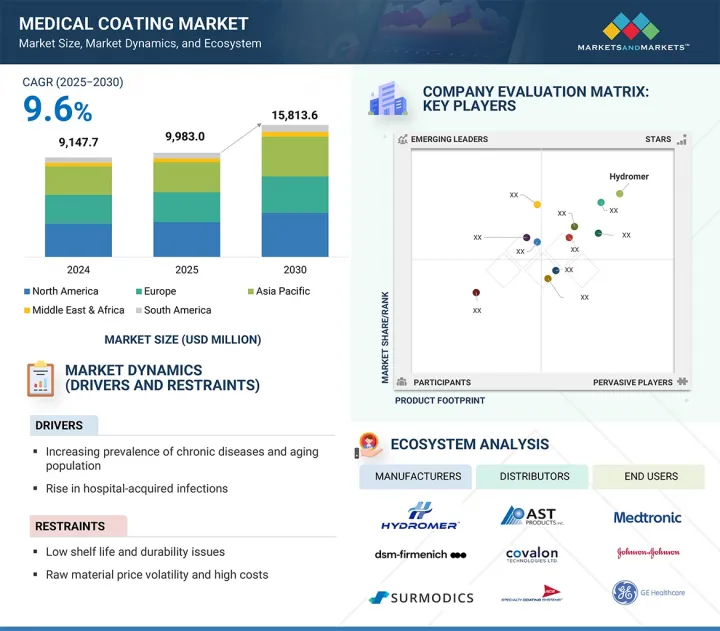

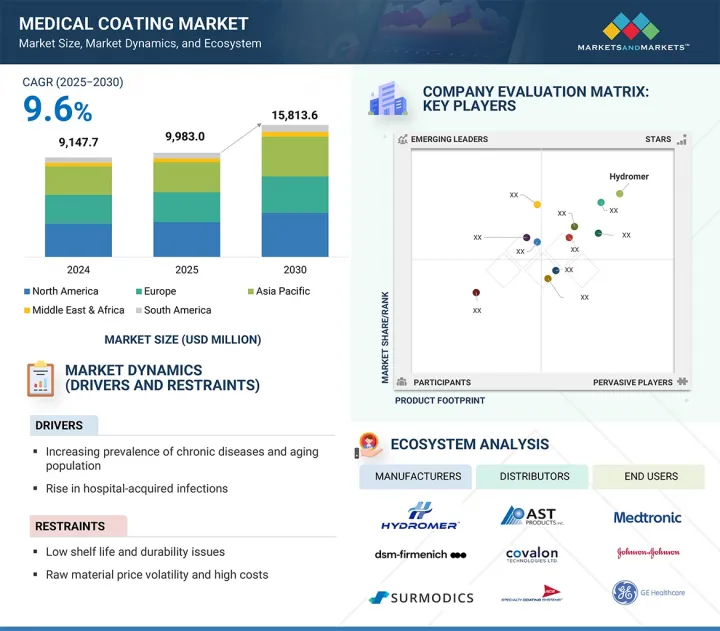

医療用コーティングの市場規模は、2025年の99億8,300万米ドルから2030年には158億1,360万米ドルに達し、CAGR 9.6%で成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | キロトン、金額(100万米ドル) |

| セグメント | コーティングタイプ別、材料別、基材別、用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

ヘルスケア分野における医療機器需要の高まりは、医療用コーティング市場の成長を大きく後押ししています。人口の高齢化と慢性疾患の増加により、インプラント、カテーテル、手術器具などのコーティングされた機器に対するニーズが高まっており、市場の成長と技術革新の促進を支えています。

医療機器分野は、あらゆる組織やヘルスケア環境でコーティングされた機器の使用が広まり、増加していることから、予測期間中、金額ベースで医療コーティング市場最大の用途になると予測されます。様々なコーティングされた医療機器の採用は、主に慢性疾患の割合の上昇、世界の高齢化の進行、低侵襲外科手術の進歩によって推進されており、これらのすべてが、性能強化された、より安全で使いやすい医療機器を必要としています。医療用コーティングは、カテーテル、ステント、ガイドワイヤー、整形外科用インプラント、手術器具など、多くの医療機器に不可欠であり、優れた潤滑性、生体適合性、抗菌性を備えています。これらのコーティングは摩擦を減らし、組織の外傷を最小限に抑え、感染リスクを低減し、器具の性能と保存寿命を向上させます。さらに、院内感染の増加により、抗菌・抗血栓コーティングは患者の安全性と厳しい規制基準を満たすために不可欠となっています。イメージングシステムや精密機器などの医療技術の革新により、より正確で外傷の少ない手術結果を得るための高性能医療用コーティングの需要が大幅に増加しています。したがって、医療機器分野は今後も成長を続けると予想されます。

アクティブコーティングは、パッシブコーティングと比較して特化した治療能力を持ち、患者の安全性と臨床転帰を改善する革新的なソリューションへの需要が高まっていることから、予測期間中、医療用コーティング市場において金額ベースで最も急成長するコーティングタイプです。パッシブコーティングは使用中の表面保護(保護や潤滑など)のみを提供するのに対し、アクティブコーティングは薬剤、抗菌剤、生理活性分子を塗布部位で放出するように設計されています。この送達方法は、感染、血栓、炎症が患者管理の成功を脅かすリスクの高い医療機器(ステント、カテーテル、整形外科用インプラントなど)には不可欠です。院内感染の増加、慢性疾患や合併症の世界の増加により、慢性患者はより高い感染リスクにさらされています。PMNを介した炎症や感染などの術後合併症は、リスクとコストの拡大につながります。そのため、病院やヘルスケアプロバイダーは、院内感染のリスクを低減し、早期回復を促進する、より効果的なコーティングを求めています。

北米は医療用コーティング市場において最大かつ最も急成長している地域であり、先進的なヘルスケア提供システム、実施される処置の増加、医療機器の継続的開発への強いコミットメントが価値の成長を牽引しています。北米、特に米国は、心臓血管用ステント、整形外科用インプラント、カテーテル、手術器具などの用途で次世代のコーティングを革新している多くのトップ医療機器メーカーや研究機関を擁しています。さらに、北米における医療用コーティングの需要の高まりは、慢性疾患の罹患率が増加する高齢化人口の増加と、感染制御と患者の安全性への関心の高まりに関連しており、高度で生体適合性の高い抗菌性コーティングが求められています。

当レポートでは、世界の医療用コーティング市場について調査し、コーティングタイプ別、材料別、基材別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界動向

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 貿易分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- マクロ経済指標

- 価格分析

- 規制状況

- AI/生成AIの影響

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- 2025年の米国関税の影響- 概要

- 主要関税率

- 価格影響分析

- 国/地域への影響

- 最終用途産業への影響

第7章 医療用コーティング市場(コーティングタイプ別)

- イントロダクション

- アクティブ

- パッシブ

第8章 医療用コーティング市場(材料別)

- イントロダクション

- ポリマー

- 金属

- その他

第9章 医療用コーティング市場(基材別)

- イントロダクション

- 金属

- セラミック

- ポリマー

- 複合材料

- ガラス

第10章 医療用コーティング市場(用途別)

- イントロダクション

- 医療機器

- 医療インプラント

- 医療機器・ツール

- 防護服

- その他

第11章 医療用コーティング市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- HYDROMER

- DSM-FIRMENICH

- SURMODICS, INC.

- BIOCOAT INCORPORATED

- AST PRODUCTS INC

- COVALON TECHNOLOGIES

- FREUDENBERG MEDICAL

- HARLAND MEDICAL SYSTEMS, INC.

- MERIT MEDICAL SYSTEMS

- APPLIED MEDICAL COATINGS

- PPG INDUSTRIES, INC

- THE SHERWIN-WILLIAMS COMPANY

- その他の企業

- FORMACOAT

- TUA SYSTEMS

- APPLIED MEMBRANE TECHNOLOGIES

- A&A COATINGS

- CALICO COATINGS

- COATINGS2GO

- CURTISS-WRIGHT CORPORATION

- ENCAPSON

- ENDURA COATINGS

- MEDICOAT AG

- MILLER-STEPHENSON CHEMICAL COMPANY, INC.

- PRECISION COATING TECHNOLOGY & MANUFACTURING INC.

- SPECIALTY COATING SYSTEMS

第14章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 MEDICAL COATING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 MEDICAL COATING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 6 EXPORT SCENARIO FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2019-2023

- TABLE 9 ANNUAL GDP PERCENTAGE CHANGE AND PROJECTION OF KEY COUNTRIES, 2024-2029

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MEDICAL COATING MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (USD MILLION)

- TABLE 16 MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (USD MILLION)

- TABLE 17 MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (KILOTONS)

- TABLE 18 MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (KILOTONS)

- TABLE 19 MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 20 MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 21 MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 22 MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 23 MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (USD MILLION)

- TABLE 24 MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 25 MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (KILOTONS)

- TABLE 26 MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (KILOTONS)

- TABLE 27 MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 28 MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 30 MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 31 MEDICAL COATING MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 32 MEDICAL COATING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 MEDICAL COATING MARKET, BY REGION, 2022-2024 (KILOTONS)

- TABLE 34 MEDICAL COATING MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 35 NORTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 38 NORTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 39 NORTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (KILOTONS)

- TABLE 42 NORTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (KILOTONS)

- TABLE 43 NORTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 46 NORTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 47 NORTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (USD MILLION)

- TABLE 48 NORTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (KILOTONS)

- TABLE 50 NORTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (KILOTONS)

- TABLE 51 NORTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 54 NORTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 55 US: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 56 US: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 US: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 58 US: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 59 CANADA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 60 CANADA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 CANADA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 62 CANADA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 63 MEXICO: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 64 MEXICO: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 MEXICO: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 66 MEXICO: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 67 ASIA PACIFIC: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 70 ASIA PACIFIC: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 71 ASIA PACIFIC: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (KILOTONS)

- TABLE 74 ASIA PACIFIC: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (KILOTONS)

- TABLE 75 ASIA PACIFIC: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 78 ASIA PACIFIC: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 79 ASIA PACIFIC: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (KILOTONS)

- TABLE 82 ASIA PACIFIC: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (KILOTONS)

- TABLE 83 ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 86 ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 87 CHINA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 88 CHINA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 CHINA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 90 CHINA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 91 JAPAN: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 92 JAPAN: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 JAPAN: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 94 JAPAN: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 95 INDIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 96 INDIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 INDIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 98 INDIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 99 SOUTH KOREA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 100 SOUTH KOREA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 SOUTH KOREA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 102 SOUTH KOREA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 103 AUSTRALIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 104 AUSTRALIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 AUSTRALIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 106 AUSTRALIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 107 REST OF ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 110 REST OF ASIA PACIFIC: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 111 EUROPE: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 112 EUROPE: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 114 EUROPE: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 115 EUROPE: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (USD MILLION)

- TABLE 116 EUROPE: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (KILOTONS)

- TABLE 118 EUROPE: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (KILOTONS)

- TABLE 119 EUROPE: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 120 EUROPE: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 122 EUROPE: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 123 EUROPE: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (USD MILLION)

- TABLE 124 EUROPE: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (KILOTONS)

- TABLE 126 EUROPE: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (KILOTONS)

- TABLE 127 EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 128 EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 130 EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 131 GERMANY: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 132 GERMANY: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 GERMANY: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 134 GERMANY: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 135 UK: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 136 UK: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 UK: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 138 UK: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 139 FRANCE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 140 FRANCE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 FRANCE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 142 FRANCE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 143 ITALY: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 144 ITALY: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 ITALY: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 146 ITALY: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 147 SPAIN: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 148 SPAIN: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 SPAIN: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 150 SPAIN: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 151 RUSSIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 152 RUSSIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 RUSSIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 154 RUSSIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 155 REST OF EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 156 REST OF EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 REST OF EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 158 REST OF EUROPE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 159 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 162 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 163 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (KILOTONS)

- TABLE 166 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (KILOTONS)

- TABLE 167 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 170 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 171 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (KILOTONS)

- TABLE 174 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (KILOTONS)

- TABLE 175 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 178 MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 179 SAUDI ARABIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 180 SAUDI ARABIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 SAUDI ARABIA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 182 SAUDI ARABIA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 183 UAE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 184 UAE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 UAE: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 186 UAE: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 187 OTHER GCC COUNTRIES: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 188 OTHER GCC COUNTRIES: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 OTHER GCC COUNTRIES: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 190 OTHER GCC COUNTRIES: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 191 SOUTH AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 192 SOUTH AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 194 SOUTH AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 198 REST OF MIDDLE EAST & AFRICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 199 SOUTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 200 SOUTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 201 SOUTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2022-2024 (KILOTONS)

- TABLE 202 SOUTH AMERICA: MEDICAL COATING MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 203 SOUTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (USD MILLION)

- TABLE 204 SOUTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (USD MILLION)

- TABLE 205 SOUTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2022-2024 (KILOTONS)

- TABLE 206 SOUTH AMERICA: MEDICAL COATING MARKET, BY COATING TYPE, 2025-2030 (KILOTONS)

- TABLE 207 SOUTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 208 SOUTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 209 SOUTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2022-2024 (KILOTONS)

- TABLE 210 SOUTH AMERICA: MEDICAL COATING MARKET, BY MATERIAL, 2025-2030 (KILOTONS)

- TABLE 211 SOUTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (USD MILLION)

- TABLE 212 SOUTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2022-2024 (KILOTONS)

- TABLE 214 SOUTH AMERICA: MEDICAL COATING MARKET, BY SUBSTRATE, 2025-2030 (KILOTONS)

- TABLE 215 SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 216 SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 217 SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 218 SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 219 BRAZIL: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 220 BRAZIL: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 221 BRAZIL: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 222 BRAZIL: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 223 ARGENTINA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 224 ARGENTINA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225 ARGENTINA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 226 ARGENTINA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 227 REST OF SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 228 REST OF SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 229 REST OF SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2022-2024 (KILOTONS)

- TABLE 230 REST OF SOUTH AMERICA: MEDICAL COATING MARKET, BY APPLICATION, 2025-2030 (KILOTONS)

- TABLE 231 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MEDICAL COATING MARKET BETWEEN JANUARY 2020 AND MAY 2025

- TABLE 232 MEDICAL COATING MARKET: DEGREE OF COMPETITION

- TABLE 233 MEDICAL COATING MARKET: REGION FOOTPRINT

- TABLE 234 MEDICAL COATING MARKET: COATING TYPE FOOTPRINT

- TABLE 235 MEDICAL COATING MARKET: MATERIAL FOOTPRINT

- TABLE 236 MEDICAL COATING MARKET: SUBSTRATE FOOTPRINT

- TABLE 237 MEDICAL COATING MARKET: APPLICATION FOOTPRINT

- TABLE 238 MEDICAL COATING MARKET: KEY STARTUPS/SMES

- TABLE 239 MEDICAL COATING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (1/2)

- TABLE 240 MEDICAL COATING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES (2/2)

- TABLE 241 MEDICAL COATING MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 242 MEDICAL COATING MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 243 MEDICAL COATING MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 244 HYDROMER: COMPANY OVERVIEW

- TABLE 245 HYDROMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 HYDROMER: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 247 DSM-FIRMENICH: COMPANY OVERVIEW

- TABLE 248 DSM-FIRMENICH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 DSM-FIRMENICH: DEALS, JANUARY 2020-MAY 2025

- TABLE 250 SURMODICS, INC.: COMPANY OVERVIEW

- TABLE 251 SURMODICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 SURMODICS, INC.: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 253 BIOCOAT INCORPORATED: COMPANY OVERVIEW

- TABLE 254 BIOCOAT INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 BIOCOAT INCORPORATED: DEALS, JANUARY 2020-MAY 2025

- TABLE 256 BIOCOAT INCORPORATED: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 257 BIOCOAT INCORPORATED: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 258 AST PRODUCTS INC: COMPANY OVERVIEW

- TABLE 259 AST PRODUCTS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 COVALON TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 261 COVALON TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 FREUDENBERG MEDICAL: COMPANY OVERVIEW

- TABLE 263 FREUDENBERG MEDICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 FREUDENBERG MEDICAL: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 265 HARLAND MEDICAL SYSTEMS, INC: COMPANY OVERVIEW

- TABLE 266 HARLAND MEDICAL SYSTEMS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 HARLAND MEDICAL SYSTEMS, INC: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 268 MERIT MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 269 MERIT MEDICAL SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 APPLIED MEDICAL COATINGS: COMPANY OVERVIEW

- TABLE 271 APPLIED MEDICAL COATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 PPG INDUSTRIES, INC: COMPANY OVERVIEW

- TABLE 273 PPG INDUSTRIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 275 THE SHERWIN-WILLIAMS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 FORMACOAT: COMPANY OVERVIEW

- TABLE 277 TUA SYSTEMS: COMPANY OVERVIEW

- TABLE 278 APPLIED MEMBRANE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 279 A&A COATINGS: COMPANY OVERVIEW

- TABLE 280 CALICO COATINGS: COMPANY OVERVIEW

- TABLE 281 COATINGS2GO: COMPANY OVERVIEW

- TABLE 282 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 283 ENCAPSON: COMPANY OVERVIEW

- TABLE 284 ENDURA COATINGS: COMPANY OVERVIEW

- TABLE 285 MEDICOAT AG: COMPANY OVERVIEW

- TABLE 286 MILLER-STEPHENSON CHEMICAL COMPANY, INC.: COMPANY OVERVIEW

- TABLE 287 PRECISION COATING TECHNOLOGY & MANUFACTURING INC.: COMPANY OVERVIEW

- TABLE 288 SPECIALTY COATING SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL COATING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 MEDICAL COATING MARKET: RESEARCH DESIGN

- FIGURE 4 MEDICAL COATING MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MEDICAL COATING MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: MEDICAL COATING MARKET TOP-DOWN APPROACH

- FIGURE 7 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 8 MEDICAL COATING MARKET: DATA TRIANGULATION

- FIGURE 9 PASSIVE COATINGS TO DOMINATE MARKET

- FIGURE 10 POLYMERS TO LEAD MARKET AMONG MATERIALS DURING FORECAST PERIOD

- FIGURE 11 MEDICAL DEVICES TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA WAS LARGEST MARKET IN 2024

- FIGURE 13 GROWING DEMAND FROM MEDICAL DEVICES TO DRIVE MARKET

- FIGURE 14 ACTIVE COATING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 POLYMERS SEGMENT TO LEAD MARKET BY VOLUME

- FIGURE 16 POLYMERS TO BE LARGEST SUBSTRATE SEGMENT FOR MEDICAL COATINGS

- FIGURE 17 MEDICAL DEVICES - DOMINANT APPLICATION FOR MEDICAL COATINGS

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 MEDICAL COATING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 MEDICAL COATING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 MEDICAL COATING MARKET: ECOSYSTEM

- FIGURE 22 MEDICAL COATING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 25 EXPORT DATA FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 26 IMPORT DATA FOR HS CODE 9018-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 MEDICAL COATING MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY COATING TYPE, 2022-2024 (USD/KG)

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 32 LEGAL STATUS OF PATENTS (2014-2024)

- FIGURE 33 MEDICAL COATING PATENTS: TOP JURISDICTIONS

- FIGURE 34 PASSIVE COATINGS TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 35 POLYMERS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 36 METAL SUBSTRATES TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 37 MEDICAL DEVICES SEGMENT TO DOMINATE MARKET

- FIGURE 38 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: MEDICAL COATING MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MEDICAL COATING MARKET SNAPSHOT

- FIGURE 41 EUROPE: MEDICAL COATING MARKET SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF TOP PLAYERS IN MEDICAL COATING MARKET, 2022-2024

- FIGURE 43 MEDICAL COATING MARKET SHARE ANALYSIS, 2024

- FIGURE 44 VALUATION OF LEADING COMPANIES IN MEDICAL COATING MARKET, 2024

- FIGURE 45 FINANCIAL METRICS OF LEADING COMPANIES IN MEDICAL COATING MARKET, 2024

- FIGURE 46 MEDICAL COATING MARKET: BRAND/PRODUCT COMPARISON ANALYSIS

- FIGURE 47 MEDICAL COATING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 MEDICAL COATING MARKET: COMPANY FOOTPRINT

- FIGURE 49 MEDICAL COATING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 DSM-FIRMENICH: COMPANY SNAPSHOT

- FIGURE 51 SURMODICS, INC.: COMPANY SNAPSHOT

- FIGURE 52 COVALON TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 53 FREUDENBERG MEDICAL: COMPANY SNAPSHOT

- FIGURE 54 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT

- FIGURE 55 PPG INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 56 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

The medical coating market is expected to reach USD 15,813.6 million by 2030, up from USD 9,983.0 million in 2025, growing at a CAGR of 9.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Kilotons; Value (USD Million) |

| Segments | Coating Type, Material, Substrate, and Application |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The rising demand for medical devices in the healthcare sector significantly drives the growth of the medical coating market, as coatings continue to evolve and become crucial for the safety, performance, and durability of devices. An aging population and a higher prevalence of chronic diseases create a greater need for coated devices such as implants, catheters, and surgical instruments, thereby supporting market growth and fostering innovation.

"Based on application, medical devices will be the largest application in the medical coating market during the forecast period, in terms of value."

The medical devices application segment is projected to be the largest in the medical coating market by value during the forecast period due to the widespread and increasing use of coated devices across all organizations and healthcare settings. The adoption of various coated medical devices is mainly driven by the rising rates of chronic diseases, the growing aging global population, and advancements in minimally invasive surgical procedures, all of which require performance-enhanced, safer, and easier-to-use medical devices. Medical coatings are vital for many devices, including catheters, stents, guidewires, orthopedic implants, and surgical instruments, as they offer superior lubricity, biocompatibility, and antimicrobial properties. These coatings reduce friction, minimizing tissue trauma, lower infection risks, and improve device performance and shelf-life. Additionally, the rise in hospital-acquired infections has made antimicrobial and anti-thrombogenic coatings essential for patient safety and meeting strict regulatory standards. Innovations in medical technology, such as imaging systems and precision instruments, have significantly increased the demand for high-performance medical coatings to achieve more accurate and less traumatic surgical outcomes. Therefore, the medical devices segment is expected to continue its growth.

"Based on coating type, active coating will be the fastest in the medical coating market during the forecast period, in terms of value."

Active coatings are the fastest-growing type of coating by value in the medical coating market during the forecast period, due to their specialized therapeutic capabilities compared to passive coatings and the increasing demand for innovative solutions to improve patient safety and clinical outcomes. While passive coatings only provide surface protection during use (such as protection and lubrication), active coatings are engineered to release drugs, antimicrobial agents, or bioactive molecules at the application site. This delivery method is essential for high-risk medical devices (like stents, catheters, and orthopedic implants) where infection, thrombosis, and inflammation threaten successful patient management. The rise in hospital-acquired infections and the worldwide increase in chronic diseases and comorbidities expose chronic patients to higher infection risks, as post-surgical complications-such as PMN-mediated inflammation and infections-lead to extended risks and costs. Therefore, hospitals and healthcare providers are seeking more effective coatings that reduce the risk of hospital-acquired infections and promote faster recovery.

"Based on region, North America accounts for the largest share in the medical coating market, in terms of value."

North America is the largest and fastest-growing region in the medical coating market, with value growth driven by advanced healthcare delivery systems, an increase in procedures performed, and a strong commitment to the continuous development of medical devices. North America, especially the United States, hosts many top medical device manufacturers and research institutions that are innovating the next generation of coatings for applications such as cardiovascular stents, orthopedic implants, catheters, and surgical instruments. Additionally, the rising demand for medical coatings in North America is linked to a growing and aging population with increasing rates of chronic diseases, as well as a heightened focus on infection control and patient safety, which demand sophisticated, biocompatible, and antimicrobial coatings.

During the process of determining and verifying the market size for various segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The key players in this market are Hydromer (US), DSM-Firmenich (Netherlands), Surmodics (US), Biocoat Incorporated (US), AST Products Inc (US), Covalon Technologies (Canada), Freudenberg Medical (US), Harland Medical Systems, Inc (US), Merit Medical Systems (US), Applied Medical Coatings (US), PPG Industries, Inc. (US) and The Sherwin-Williams Company (US).

Research Coverage

This report breaks down the medical coating market by coating type, material, substrate, application, and region, and provides estimates for the total market value across different regions. A thorough analysis of major industry players has been carried out to offer insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions related to the medical coating market.

Key benefits of buying this report

This research report covers different levels of analysis, including industry examination (industry trends), market ranking analysis of leading players, and company profiles. Together, these provide a comprehensive view of the competitive landscape, emerging and high-growth segments of the medical coating market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following:

- Analysis of key drivers (increasing demand for minimally invasive surgical procedures, growing geriatric population and prevalence of chronic diseases), restraints (stringent regulatory requirements, high costs and technical challenges), opportunities (development of smart and multifunctional coatings, expansion in emerging markets) and challenges (technical limitations in coating durability and adhesion, intellectual property and supply chain issues).

- Market Penetration: Comprehensive information on the medical coating market offered by top players in the global medical coating market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the medical coating market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for medical coating market across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global medical coating market

- Competitive Assessment: In-depth assessment of market share, strategies, products, and manufacturing capabilities of leading players in the medical coating market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL COATING MARKET

- 4.2 MEDICAL COATING MARKET, BY COATING TYPE

- 4.3 MEDICAL COATING MARKET, BY MATERIAL

- 4.4 MEDICAL COATING MARKET, BY SUBSTRATE

- 4.5 MEDICAL COATING MARKET, BY APPLICATION

- 4.6 MEDICAL COATING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases and aging population

- 5.2.1.2 Rise in hospital-acquired infections

- 5.2.1.3 Growth in minimally invasive surgeries and medical device usage

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low shelf life and durability issues

- 5.2.2.2 Raw material price volatility and high costs

- 5.2.2.3 Strict government regulations and compliance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for antimicrobial and drug-eluting coatings

- 5.2.3.2 Technological advancements and nanotechnology

- 5.2.4 CHALLENGES

- 5.2.4.1 Biocompatibility and durability concerns

- 5.2.4.2 Complex application and quality control

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREAT OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 QUALITY

- 6.4.3 SERVICE

- 6.4.4 BUYING CRITERIA

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO (HS CODE 9018)

- 6.5.2 IMPORT SCENARIO (HS CODE 9018)

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Plasma spraying

- 6.7.1.2 Chemical vapor deposition

- 6.7.1.3 Microblasting & laser treatments

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Nanotechnology integration

- 6.7.2.2 Advanced material formulation

- 6.7.1 KEY TECHNOLOGIES

- 6.8 MACROECONOMIC INDICATORS

- 6.8.1 GDP TRENDS AND FORECASTS

- 6.9 PRICING ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.9.2 AVERAGE SELLING PRICE TREND, BY COATING TYPE, 2022-2024

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 NORTH AMERICA

- 6.10.2 ASIA PACIFIC

- 6.10.3 EUROPE

- 6.10.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 IMPACT OF AI/GEN AI

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 ANTIMICROBIAL COATING FOR IMPLANTABLE PACEMAKER DEVICE

- 6.13.2 INTRICOAT FOR MEDICAL ROBOTICS PROJECT

- 6.13.3 SLIPS COATING TO PREVENT BIOFILM FORMATION ON MEDICAL IMPLANTS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 PATENT ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 LEGAL STATUS OF PATENTS

- 6.15.3 JURISDICTION ANALYSIS

- 6.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.16.1 INTRODUCTION

- 6.17 KEY TARIFF RATES

- 6.18 PRICE IMPACT ANALYSIS

- 6.19 IMPACT ON COUNTRY/REGION

- 6.19.1 US

- 6.19.2 EUROPE

- 6.19.3 ASIA PACIFIC

- 6.20 IMPACT ON END-USE INDUSTRIES

7 MEDICAL COATINGS MARKET, BY COATING TYPE

- 7.1 INTRODUCTION

- 7.2 ACTIVE

- 7.2.1 ANTIMICROBIAL

- 7.2.1.1 Used to prevent microbial infection on medical devices

- 7.2.2 OTHERS

- 7.2.1 ANTIMICROBIAL

- 7.3 PASSIVE

- 7.3.1 HYDROPHILIC/LUBRICIOUS HYDROPHILIC

- 7.3.1.1 Growing awareness of minimally invasive surgical techniques to boost demand

- 7.3.2 HYDROPHOBIC

- 7.3.2.1 High water resistance to drive market growth

- 7.3.1 HYDROPHILIC/LUBRICIOUS HYDROPHILIC

8 MEDICAL COATINGS MARKET, BY MATERIAL TYPE

- 8.1 INTRODUCTION

- 8.2 POLYMERS

- 8.2.1 FLUOROPOLYMERS

- 8.2.1.1 PTFE

- 8.2.1.1.1 Minimal friction and strong resistance to heat and chemicals to boost adoption

- 8.2.1.2 PVDF

- 8.2.1.2.1 Exceptionally robust and resistant to chemicals

- 8.2.1.3 Others

- 8.2.1.1 PTFE

- 8.2.2 PARYLENE

- 8.2.2.1 Frictional coefficient comparable to PTFE - key segment driver

- 8.2.3 SILICONES

- 8.2.3.1 Biocompatibility fuels widespread adoption in medical applications

- 8.2.4 OTHERS

- 8.2.1 FLUOROPOLYMERS

- 8.3 METALS

- 8.3.1 SILVER

- 8.3.1.1 Antimicrobial properties boost application

- 8.3.2 TITANIUM

- 8.3.2.1 Commonly employed in implant applications due to excellent biocompatibility

- 8.3.3 OTHERS

- 8.3.1 SILVER

- 8.4 OTHERS

9 MEDICAL COATINGS MARKET, BY SUBSTRATE

- 9.1 INTRODUCTION

- 9.2 METALS

- 9.2.1 METALS IN IMPLANTED MEDICAL DEVICES: DRIVING BIOCOMPATIBILITY AND MARKET GROWTH

- 9.3 CERAMICS

- 9.3.1 WIDELY USED IN DENTAL IMPLANT APPLICATIONS

- 9.4 POLYMERS

- 9.4.1 FLUOROPOLYMERS

- 9.4.1.1 PTFE's unparalleled lubricity boosts advanced medical device performance

- 9.4.2 SILICONE

- 9.4.2.1 Superior compatibility with human tissue and bodily fluids

- 9.4.3 OTHER POLYMERS

- 9.4.1 FLUOROPOLYMERS

- 9.5 COMPOSITES

- 9.5.1 LIGHT WEIGHT PROPERTY ENHANCES PROSTHETIC MOBILITY

- 9.6 GLASS

- 9.6.1 OFFERS BIOCOMPATIBILITY FOR SAFE AND DURABLE MEDICAL IMPLANTS

10 MEDICAL COATINGS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 MEDICAL DEVICES

- 10.2.1 INCREASING DEMAND FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO BOOST MARKET

- 10.3 MEDICAL IMPLANTS

- 10.3.1 ORTHOPEDIC IMPLANTS

- 10.3.1.1 Lubricity and fatigue strength in orthopedic implants

- 10.3.2 DENTAL IMPLANTS

- 10.3.2.1 Use of hydroxyapatite in dental implants to stimulate bone healing

- 10.3.3 CARDIOVASCULAR IMPLANTS

- 10.3.3.1 Nanomaterial coatings used for stents

- 10.3.1 ORTHOPEDIC IMPLANTS

- 10.4 MEDICAL EQUIPMENT & TOOLS

- 10.4.1 SURGICAL EQUIPMENT & TOOLS

- 10.4.1.1 Antimicrobial and other functional properties benefit surgical tools

- 10.4.2 INSTITUTIONAL EQUIPMENT

- 10.4.2.1 Hydrophobic coatings - widely used in institutional equipment

- 10.4.1 SURGICAL EQUIPMENT & TOOLS

- 10.5 PROTECTIVE CLOTHING

- 10.5.1 HELPS ENHANCE HEALTHCARE SAFETY

- 10.6 OTHERS

11 MEDICAL COATING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Ongoing advancements in medical technology to propel market

- 11.2.2 CANADA

- 11.2.2.1 Rising investments to boost demand for medical coatings

- 11.2.3 MEXICO

- 11.2.3.1 Rising domestic production to drive market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 World's third-largest market for medical device production

- 11.3.2 JAPAN

- 11.3.2.1 Rising percentage of geriatric population to drive market

- 11.3.3 INDIA

- 11.3.3.1 Government initiatives to fuel demand for medical coatings

- 11.3.4 SOUTH KOREA

- 11.3.4.1 Continuous R&D activities to fuel market

- 11.3.5 AUSTRALIA

- 11.3.5.1 Rising incidence of chronic diseases drive innovation in market

- 11.3.6 REST OF ASIA PACIFIC

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Innovations in medical technology to drive market

- 11.4.2 UK

- 11.4.2.1 Government initiatives for collaborative developments in medical technology to drive market

- 11.4.3 FRANCE

- 11.4.3.1 Well-established medical device manufacturing industry to boost market

- 11.4.4 ITALY

- 11.4.4.1 Prevalence of chronic diseases to fuel market growth

- 11.4.5 SPAIN

- 11.4.5.1 High demand for implants and catheters to boost market

- 11.4.6 RUSSIA

- 11.4.6.1 Rising demand for minimally invasive procedures to spur market

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Government initiatives for healthcare industry to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Medical tourism to drive market

- 11.5.1.3 Other GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Global investments to propel market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Market enhanced through local device production

- 11.6.2 ARGENTINA

- 11.6.2.1 Rising prevalence of non-communicable disease to boost market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Coating type footprint

- 12.7.5.4 Material footprint

- 12.7.5.5 Substrate footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 EXPANSIONS

- 12.9.3 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HYDROMER

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DSM-FIRMENICH

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SURMODICS, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 BIOCOAT INCORPORATED

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 Expansions

- 13.1.4.4.1 Product launches

- 13.1.4.5 MnM view

- 13.1.4.5.1 Key strengths

- 13.1.4.5.2 Strategic choices

- 13.1.4.5.3 Weaknesses and competitive threats

- 13.1.5 AST PRODUCTS INC

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 COVALON TECHNOLOGIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 FREUDENBERG MEDICAL

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.7.4 MnM view

- 13.1.7.4.1 Key strengths

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 HARLAND MEDICAL SYSTEMS, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 MERIT MEDICAL SYSTEMS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 APPLIED MEDICAL COATINGS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 PPG INDUSTRIES, INC

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.11.3.1 Key strengths

- 13.1.11.3.2 Strategic choices

- 13.1.11.3.3 Weaknesses and competitive threats

- 13.1.12 THE SHERWIN-WILLIAMS COMPANY

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.12.3.1 Key strengths

- 13.1.12.3.2 Strategic choices

- 13.1.12.3.3 Weaknesses and competitive threats

- 13.1.1 HYDROMER

- 13.2 OTHER PLAYERS

- 13.2.1 FORMACOAT

- 13.2.2 TUA SYSTEMS

- 13.2.3 APPLIED MEMBRANE TECHNOLOGIES

- 13.2.4 A&A COATINGS

- 13.2.5 CALICO COATINGS

- 13.2.6 COATINGS2GO

- 13.2.7 CURTISS-WRIGHT CORPORATION

- 13.2.8 ENCAPSON

- 13.2.9 ENDURA COATINGS

- 13.2.10 MEDICOAT AG

- 13.2.11 MILLER-STEPHENSON CHEMICAL COMPANY, INC.

- 13.2.12 PRECISION COATING TECHNOLOGY & MANUFACTURING INC.

- 13.2.13 SPECIALTY COATING SYSTEMS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS