|

|

市場調査レポート

商品コード

1775085

HVAC断熱材の世界市場:材料タイプ別、製品タイプ別、最終用途産業別、地域別 - 2030年までの予測HVAC Insulation Market by Product Type (Pipes, Ducts), Material Type (Mineral Wool (Glass Wool, Stone Wool)), Plastic Foam (Phenolic, Elastomeric Foam), End-use Industry (Commercial, Residential, Industrial), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| HVAC断熱材の世界市場:材料タイプ別、製品タイプ別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月19日

発行: MarketsandMarkets

ページ情報: 英文 220 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

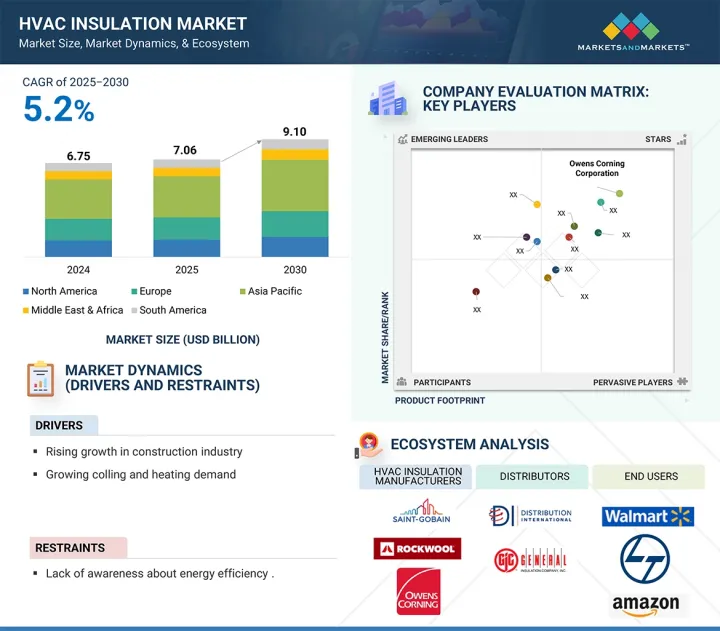

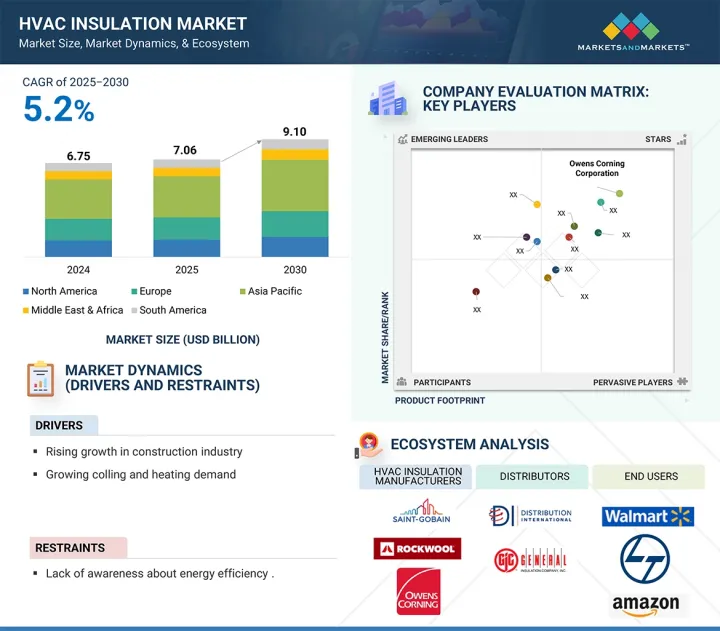

HVAC断熱材の市場規模は、予測期間中に5.2%のCAGRで拡大し、2025年の70億6,000万米ドルから2030年には91億米ドルに達すると予測されています。

HVAC断熱材市場は、インフラ開拓、産業拡大、新興経済諸国の勢い上昇に大きく後押しされ、世界的に力強い成長を遂げています。住宅、商業施設、公共施設など、各国がインフラの近代化に多額の投資を行っているため、効率的な暖房、換気、空調(HVAC)システムの需要は伸び続けています。HVAC断熱材は、熱損失や熱上昇を最小限に抑え、熱性能を向上させ、運用コストを削減することで、これらのシステムのエネルギー効率を高める上で重要な役割を果たしています。このため、断熱材は持続可能な建設手法に不可欠な要素となっており、現在ではさまざまな地域で広く採用されています。特に製造業、医薬品、食品加工、冷蔵倉庫など、温度調節が不可欠な分野では、産業の拡大がこの成長にさらに貢献しています。これらの産業では、信頼性が高く効率的に稼働しなければならない大規模なHVACシステムが必要であり、これは適切な断熱があって初めて可能になります。産業界が厳しいエネルギー規制を満たし、環境への影響を低減することを目指しているため、先進的な断熱材の採用が広まりつつあります。アジア太平洋、ラテンアメリカ、中東の新興経済圏では、都市化、所得の増加、人口の増加によって建設ブームが起きています。これらの地域ではインフラが急速に整備され、省エネルギーと環境に配慮した建物への注目が高まっているため、HVAC断熱材の需要が急増しています。これらの要因が相まって、世界のHVAC断熱材市場は持続的な成長を遂げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 材料タイプ別、製品タイプ別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

プラスチック発泡体セグメントは、HVAC断熱材市場における著名な材料タイプであり、優れた断熱特性、軽量性、汎用性で知られています。使用されるプラスチックフォームの一般的な種類には、ポリウレタン(PU)、ポリイソシアヌレート(PIR)、発泡ポリスチレン(EPS)などがあり、それぞれが用途に応じて特定の利点を提供しています。これらの材料は、熱伝導率が低く、耐湿性があり、長期間にわたって安定した性能を維持できることから、広く評価されています。プラスチック発泡体は、HVACシステムの熱伝達を最小限に抑えるのに特に効果的で、エネルギー効率を高め、運用コストを削減します。その独立気泡構造は吸水に対して強い抵抗力を持ち、湿気の多い環境や湿気のコントロールが重要な場所での使用に理想的です。さらに、発泡プラスチックは取り付けが簡単で、様々な形状やサイズに成形でき、機械的強度も高いため、商業ビルや住宅のダクト、パイプ、HVACユニットの断熱に適しています。

発泡プラスチック断熱材の用途は、工業施設、オフィスビル、病院、小売スペース、住宅など、温度制御やエネルギー効率の向上が優先される分野に及ぶ。高性能で費用対効果の高い断熱材への需要が高まるにつれ、特にエネルギー意識の高い建築において、発泡プラスチックセグメントはHVAC断熱材市場において世界の牽引力を持ち続けています。

産業セグメントは、大規模施設における効率的な温度調節、省エネルギー、運用コスト削減の必要性によって、HVAC断熱材市場における最終用途産業として重要な役割を果たしています。製造業、医薬品、飲食品加工、石油化学、コールドチェーンロジスティクスなどの産業は、機器と人員の両方を制御された環境に維持するため、堅牢なHVACシステムに大きく依存しています。これらのシステムの断熱は、エネルギー損失を最小限に抑え、室内条件を一定に保ち、冷暖房運転の効率を確保する上で極めて重要です。

産業環境におけるHVAC断熱は、生産品質、安全基準、または機器の性能を損なう可能性のある熱変動を防ぐのに役立ちます。例えば、製薬業界や食品業界では、製品の安定性や規制遵守のために厳密な温度管理が不可欠です。また、適切な断熱はHVACシステムの負担を軽減し、寿命を延ばし、メンテナンスコストを削減します。

さらに、産業施設はしばしば極端な環境条件(非常に暑い、または非常に寒い)の中で操業されるため、高度な断熱材が必要となります。エネルギー効率、持続可能性、環境規制の遵守が重視されるにつれ、産業界はグリーン認証基準を満たし、二酸化炭素排出量を削減するために、高性能断熱ソリューションの採用を増やしています。産業インフラが世界的、特に新興経済国で拡大するにつれて、このセグメントにおけるHVAC断熱材の需要は着実に伸びると予想されます。

欧州のHVAC断熱材市場は、厳しいエネルギー効率規制、グリーンビルディングの採用増加、持続可能なインフラに対する需要の高まりによって、着実な成長を目の当たりにしています。この地域では、二酸化炭素排出量の削減と建物のエネルギー性能の向上が重視されており、HVAC断熱材はこれらの目標を達成する上で重要な要素となっています。

EUの建築物エネルギー性能指令(EPBD)や欧州グリーンディールなどの主要な規制枠組みは、加盟国全体でエネルギー効率の高い建築と改修を義務付けています。これらの政策は、住宅と商業ビルの両方でエネルギー消費と温室効果ガス排出を削減するために、HVACシステムにおける高品質の断熱材の使用を促進しています。加えて、ドイツ、フランス、英国などの国々では、エネルギー効率の高い改修に対する奨励金や補助金を提供する様々な国家的イニシアチブがあり、市場導入をさらに加速させています。

古い建物を最新の断熱ソリューションで改修しようという動きと、2050年までに気候変動を中立化しようというこの地域のコミットメントが、高度なHVAC断熱材に対する強い需要を生み出しています。欧州の確立された建設業界は、消費者や企業の高い環境意識と相まって、引き続き市場を支えています。継続的な技術革新と厳格な規制の施行により、欧州のHVAC断熱材市場は、特に高性能、耐久性、環境コンプライアンスを必要とする用途において、世界の成長の主要な貢献者であり続けると予想されます。

当レポートでは、世界のHVAC断熱材市場について調査し、材料タイプ別、製品タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 特許分析

- ポーターのファイブフォース分析

- エコシステムマッピング

- バリューチェーン分析

- 価格分析

- 貿易分析

- マクロ経済指標

- 顧客ビジネスに影響を与える動向/混乱

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 主要な利害関係者と購入基準

- 購入決定に影響を与える主な要因

- 技術分析

- 規制状況

- AI/生成AIがHVAC断熱材市場に与える影響

- ケーススタディ分析

第6章 HVAC断熱材市場(材料タイプ別)

- イントロダクション

- ミネラルウール

- プラスチックフォーム

第7章 HVAC断熱材市場(製品タイプ別)

- イントロダクション

- パイプ

- ダクト

第8章 HVAC断熱材市場(最終用途産業別)

- イントロダクション

- 住宅

- 商業

- 工業

第9章 HVAC断熱材市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較分析

- 競争評価マトリックス:主要参入企業、2024年

- 競争力評価マトリックス:スタートアップ企業/中小企業(SMES)、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SAINT-GOBAIN

- OWENS CORNING

- ROCKWOOL INTERNATIONAL

- ARMACELL INTERNATIONAL SA

- KNAUF GROUP

- KINGSPAN GROUP PLC

- JOHNS MANVILLE CORPORATION

- GLASSROCK INSULATION CO S.A.E.

- L'ISOLANTE K-FLEX S.P.A.

- URSA INSULATION S.A.

- その他の企業

- ARABIAN FIBREGLASS INSULATION CO. LTD.(AFICO)

- FLETCHER INSULATION

- COVESTRO AG

- PPG

- HUNTSMAN INTERNATIONAL LLC

- TROCELLEN

- LINDNER SE

- BRADFORD INSULATION PTY LIMITED

- SAGER AG

- UNION FOAM S.P.A.

- SEKISUI FOAM AUSTRALIA

- GILSULATE INTERNATIONAL, INC.

- PROMAT INTERNATIONAL

- WINCELL INSULATION CO. LTD.

- VISIONARY INDUSTRIAL INSULATION

第12章 付録

List of Tables

- TABLE 1 HVAC INSULATION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 TOP 10 PATENT OWNERS, 2015-2024

- TABLE 3 HVAC INSULATION: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 ROLES OF COMPANIES IN HVAC INSULATION ECOSYSTEM

- TABLE 5 INDICATIVE PRICING ANALYSIS OF HVAC INSULATION MATERIALS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 6 IMPORT DATA FOR HS CODE 680610 -COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 680610-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2019-2023 (%)

- TABLE 9 ANNUAL GDP PERCENTAGE CHANGE AND PROJECTION, BY KEY COUNTRY, 2024-2029 (%)

- TABLE 10 HVAC INSULATION MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END-USE INDUSTRIES

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 16 HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 17 HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (KILOTON)

- TABLE 18 HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (KILOTON)

- TABLE 19 HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 20 HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 21 HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 22 HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 23 HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 24 HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 26 HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 27 HVAC INSULATION MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 28 HVAC INSULATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 HVAC INSULATION MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 30 HVAC INSULATION MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 31 ASIA PACIFIC: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 32 ASIA PACIFIC: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 34 ASIA PACIFIC: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 35 ASIA PACIFIC: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 36 ASIA PACIFIC: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (KILOTON)

- TABLE 38 ASIA PACIFIC: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (KILOTON)

- TABLE 39 ASIA PACIFIC: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 40 ASIA PACIFIC: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 42 ASIA PACIFIC: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 43 ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 44 ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 46 ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 47 CHINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 48 CHINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 CHINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 50 CHINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 KILOTON)

- TABLE 51 INDIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 52 INDIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 INDIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 54 INDIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 55 JAPAN: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 JAPAN: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 JAPAN: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 58 JAPAN: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 59 SOUTH KOREA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 60 SOUTH KOREA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 SOUTH KOREA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 62 SOUTH KOREA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 63 REST OF ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 67 EUROPE: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 68 EUROPE: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 70 EUROPE: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 71 EUROPE: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 72 EUROPE: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (KILOTON)

- TABLE 74 EUROPE: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (KILOTON)

- TABLE 75 EUROPE: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 76 EUROPE: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 78 EUROPE: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 79 EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 80 EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 82 EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 83 GERMANY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 84 GERMANY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 GERMANY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 86 GERMANY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 87 FRANCE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 88 FRANCE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 FRANCE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 90 FRANCE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 91 UK: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 92 UK: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 UK: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 94 UK: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 95 ITALY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 96 ITALY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 ITALY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 98 ITALY: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 99 REST OF EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 100 REST OF EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 102 REST OF EUROPE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 103 NORTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 106 NORTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 107 NORTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (KILOTON)

- TABLE 110 NORTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (KILOTON)

- TABLE 111 NORTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 114 NORTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 115 NORTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 118 NORTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 119 US: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 120 US: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 US: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 122 US: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 123 CANADA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 124 CANADA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 CANADA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 126 CANADA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 127 MEXICO: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 128 MEXICO: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 MEXICO: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 130 MEXICO: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 131 SOUTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 132 SOUTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 SOUTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 134 SOUTH AMERICA: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 135 SOUTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 136 SOUTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 137 SOUTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (KILOTON)

- TABLE 138 SOUTH AMERICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (KILOTON)

- TABLE 139 SOUTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 140 SOUTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141 SOUTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 142 SOUTH AMERICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 143 SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 144 SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 KILOTON)

- TABLE 146 SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 147 BRAZIL: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 148 BRAZIL: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 BRAZIL: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 150 BRAZIL: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 151 ARGENTINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 152 ARGENTINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 ARGENTINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 154 ARGENTINA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 155 REST OF SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 156 REST OF SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 REST OF SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 158 REST OF SOUTH AMERICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2022-2024 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY MATERIAL TYPE, 2025-2030 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 171 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 175 SAUDI ARABIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 176 SAUDI ARABIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 SAUDI ARABIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 178 SAUDI ARABIA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 179 UAE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 180 UAE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 UAE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 182 UAE: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 183 REST OF GCC COUNTRIES: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 184 REST OF GCC COUNTRIES: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 REST OF GCC COUNTRIES: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 186 REST OF GCC COUNTRIES: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 187 SOUTH AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 188 SOUTH AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 190 SOUTH AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 192 REST OF MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 REST OF MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 194 REST OF MIDDLE EAST & AFRICA: HVAC INSULATION MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 195 HVAC INSULATION MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS BETWEEN 2020 AND 2025

- TABLE 196 HVAC INSULATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 197 HVAC INSULATION MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 198 HVAC INSULATION MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 199 HVAC INSULATION MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 200 HVAC INSULATION MARKET: REGION FOOTPRINT

- TABLE 201 HVAC INSULATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 202 HVAC INSULATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 203 HVAC INSULATION MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 204 HVAC INSULATION MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 205 HVAC INSULATION MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 206 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 207 SAINT-GOBAIN: PRODUCT OFFERINGS

- TABLE 208 SAINT-GOBAIN: PRODUCT LAUNCHES

- TABLE 209 SAINT-GOBAIN: DEALS

- TABLE 210 SAINT-GOBAIN: EXPANSIONS

- TABLE 211 OWENS CORNING: COMPANY OVERVIEW

- TABLE 212 OWENS CORNING: PRODUCT OFFERINGS

- TABLE 213 OWENS CORNING: PRODUCT LAUNCHES

- TABLE 214 OWENS CORNING: DEALS

- TABLE 215 OWENS CORNING: EXPANSIONS

- TABLE 216 ROCKWOOL INTERNATIONAL: COMPANY OVERVIEW

- TABLE 217 ROCKWOOL INTERNATIONAL: PRODUCT OFFERINGS

- TABLE 218 ROCKWOOL INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 219 ROCKWOOL INTERNATIONAL: DEALS

- TABLE 220 ROCKWOOL INTERNATIONAL: EXPANSIONS

- TABLE 221 ARMACELL INTERNATIONAL SA: COMPANY OVERVIEW

- TABLE 222 ARMACELL INTERNATIONAL SA: PRODUCT OFFERINGS

- TABLE 223 ARMACELL INTERNATIONAL SA: PRODUCT LAUNCHES

- TABLE 224 ARMACELL INTERNATIONAL SA: DEALS

- TABLE 225 ARMACELL INTERNATIONAL SA: EXPANSIONS

- TABLE 226 KNAUF GROUP: COMPANY OVERVIEW

- TABLE 227 KNAUF GROUP: PRODUCT OFFERINGS

- TABLE 228 KNAUF GROUP: PRODUCT LAUNCHES

- TABLE 229 KNAUF GROUP: DEALS

- TABLE 230 KNAUF GROUP: EXPANSIONS

- TABLE 231 KINGSPAN GROUP PLC: COMPANY OVERVIEW

- TABLE 232 KINGSPAN GROUP PLC: PRODUCT OFFERINGS

- TABLE 233 KINGSPAN GROUP PLC: PRODUCT LAUNCHES

- TABLE 234 KINGSPAN GROUP PLC: DEALS

- TABLE 235 JOHNS MANVILLE CORPORATION: COMPANY OVERVIEW

- TABLE 236 JOHNS MANVILLE CORPORATION: PRODUCT OFFERINGS

- TABLE 237 JOHNS MANVILLE CORPORATION: PRODUCT LAUNCHES

- TABLE 238 JOHNS MANVILLE CORPORATION: DEALS

- TABLE 239 JOHNS MANVILLE CORPORATION: EXPANSIONS

- TABLE 240 GLASSROCK INSULATION CO S.A.E.: COMPANY OVERVIEW

- TABLE 241 GLASSROCK INSULATION CO S.A.E.: PRODUCT OFFERINGS

- TABLE 242 L'ISOLANTE K-FLEX S.P.A.: COMPANY OVERVIEW

- TABLE 243 L'ISOLANTE K-FLEX S.P.A.: PRODUCT OFFERINGS

- TABLE 244 L'ISOLANTE K-FLEX S.P.A.: EXPANSIONS

- TABLE 245 URSA INSULATION S.A.: COMPANY OVERVIEW

- TABLE 246 URSA INSULATION S.A.: PRODUCT OFFERINGS

List of Figures

- FIGURE 1 HVAC INSULATION MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HVAC INSULATION MARKET: RESEARCH DESIGN

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 HVAC INSULATION MARKET: DATA TRIANGULATION

- FIGURE 6 DUCTS SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 7 PLASTIC FOAM SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 8 COMMERCIAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 RISING DEMAND FROM CONSTRUCTION INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 PIPES TO BE FAST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 MINERAL WOOL TO BE FAST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 RESIDENTIAL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 HVAC INSULATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GRANTED PATENTS ACCOUNTED FOR MAJOR SHARE FROM 2015 TO 2024

- FIGURE 17 TOTAL NUMBER OF PATENTS PER YEAR, 2015-2024

- FIGURE 18 TOP JURISDICTIONS FOR HVAC INSULATION PATENTS, 2015-2024

- FIGURE 19 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST PERCENTAGE OF PATENTS, 2015-2024

- FIGURE 20 HVAC INSULATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 HVAC INSULATION ECOSYSTEM MAPPING

- FIGURE 22 HVAC INSULATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF HVAC INSULATION MATERIALS, BY REGION, 2022-2030 (USD/KG)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF HVAC INSULATION MATERIALS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 680610 -COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 26 EXPORT DATA RELATED TO HS CODE 680610-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 HVAC INSULATION MARKET: INVESTMENT AND FUNDING SCENARIO (USD MILLION)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END-USE INDUSTRIES

- FIGURE 30 SUPPLIER SELECTION CRITERIA

- FIGURE 31 PLASTIC FOAM SEGMENT TO BE LARGER MATERIAL TYPE DURING FORECAST PERIOD

- FIGURE 32 PIPES SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 33 COMMERCIAL SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 34 HVAC INSULATION MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: HVAC INSULATION MARKET SNAPSHOT

- FIGURE 36 EUROPE: HVAC INSULATION MARKET SNAPSHOT

- FIGURE 37 HVAC INSULATION MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2022-2024 (USD BILLION)

- FIGURE 38 HVAC INSULATION MARKET SHARE ANALYSIS, 2024

- FIGURE 39 HVAC INSULATION MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2024 (USD BILLION)

- FIGURE 40 HVAC INSULATION MARKET: FINANCIAL METRICS OF LEADING COMPANIES, 2024

- FIGURE 41 HVAC INSULATION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 HVAC INSULATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 HVAC INSULATION MARKET: COMPANY FOOTPRINT

- FIGURE 44 HVAC INSULATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 46 OWENS CORNING: COMPANY SNAPSHOT

- FIGURE 47 ROCKWOOL INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 48 ARMACELL INTERNATIONAL SA: COMPANY SNAPSHOT

- FIGURE 49 KINGSPAN GROUP PLC: COMPANY SNAPSHOT

The HVAC insulation market is projected to reach USD 9.10 billion by 2030 from USD 7.06 billion in 2025, at a CAGR of 5.2% during the forecast period. The HVAC insulation market is experiencing robust growth globally, significantly fueled by infrastructure development, industrial expansion, and the rising momentum of emerging economies. As nations invest heavily in modernizing their infrastructure-be it residential, commercial, or public facilities-the demand for efficient heating, ventilation, and air conditioning (HVAC) systems continues to grow. HVAC insulation plays a crucial role in enhancing the energy efficiency of these systems by minimizing heat loss or gain, improving thermal performance, and reducing operational costs. This makes insulation an integral component of sustainable construction practices, which are now being widely adopted across various regions. Industrial expansion further contributes to this growth, especially in sectors like manufacturing, pharmaceuticals, food processing, and cold storage, where temperature regulation is essential. These industries require large-scale HVAC systems that must operate reliably and efficiently, which is only possible with proper insulation. As industries aim to meet stringent energy regulations and lower their environmental impact, the adoption of advanced insulation materials is becoming more widespread. Emerging economies in the Asia Pacific, Latin America, and the Middle East are witnessing a construction boom driven by urbanization, rising incomes, and population growth. These regions are rapidly upgrading their infrastructure, and with a growing focus on energy conservation and green buildings, the demand for HVAC insulation is rising sharply. Collectively, these factors are propelling sustained growth in the global HVAC insulation market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Segments | Material Type, Product Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

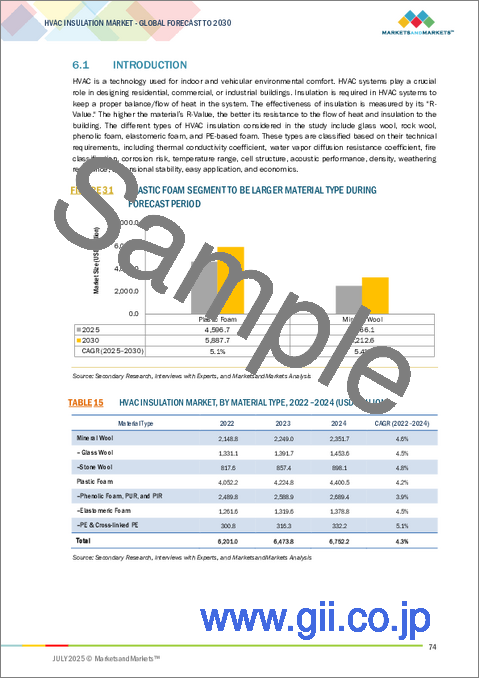

"Plastic foam segment is expected to be the second fastest-growing segment in the HVAC insulation market during the forecast period."

The plastic foam segment is a prominent material type in the HVAC insulation market, known for its excellent thermal insulation properties, lightweight nature, and versatility. Common types of plastic foams used include polyurethane (PU), polyisocyanurate (PIR), and expanded polystyrene (EPS), each offering specific advantages depending on the application. These materials are widely valued for their low thermal conductivity, moisture resistance, and ability to maintain consistent performance over time. Plastic foams are particularly effective in minimizing heat transfer in HVAC systems, which enhances energy efficiency and reduces operational costs. Their closed-cell structure provides strong resistance to water absorption, making them ideal for use in humid environments or where moisture control is critical. Additionally, plastic foams are easy to install, can be molded into various shapes and sizes, and offer good mechanical strength, making them suitable for insulating ducts, pipes, and HVAC units in both commercial and residential buildings.

Applications of plastic foam insulation span sectors such as industrial facilities, office buildings, hospitals, retail spaces, and homes, where controlling temperature and improving energy efficiency are priorities. As the demand for high-performance, cost-effective insulation materials grows-especially in energy-conscious construction-the plastic foam segment continues to gain traction in the HVAC insulation market globally.

"Industrial segment to be the second fastest-growing end-use industry in the HVAC insulation market during the forecast period"

The industrial segment plays a vital role as an end-use industry in the HVAC insulation market, driven by the need for efficient temperature regulation, energy conservation, and operational cost reduction in large-scale facilities. Industries such as manufacturing, pharmaceuticals, food and beverage processing, petrochemicals, and cold chain logistics heavily rely on robust HVAC systems to maintain controlled environments for both equipment and personnel. Insulation in these systems is crucial to minimizing energy loss, maintaining consistent indoor conditions, and ensuring the efficiency of heating and cooling operations.

HVAC insulation in industrial settings helps prevent thermal fluctuations that could compromise production quality, safety standards, or equipment performance. For instance, in the pharmaceutical and food industries, strict temperature control is essential for product stability and regulatory compliance. Proper insulation also reduces the strain on HVAC systems, thereby extending their lifespan and lowering maintenance costs.

Moreover, industrial facilities often operate in extreme environmental conditions-either very hot or very cold-making advanced insulation materials a necessity. With growing emphasis on energy efficiency, sustainability, and adherence to environmental regulations, industries are increasingly adopting high-performance insulation solutions to meet green certification standards and reduce their carbon footprint. As industrial infrastructure expands globally, especially in emerging economies, the demand for HVAC insulation in this segment is expected to grow steadily.

"Europe is projected to be the second-largest market for HVAC insulation during the forecast period"

The Europe HVAC insulation market is witnessing steady growth, driven by stringent energy efficiency regulations, increasing adoption of green building practices, and rising demand for sustainable infrastructure. The region places a strong emphasis on reducing carbon emissions and improving building energy performance, making HVAC insulation a critical component in achieving these goals.

Key regulatory frameworks such as the EU Energy Performance of Buildings Directive (EPBD) and the European Green Deal mandate energy-efficient construction and renovation across member states. These policies promote the use of high-quality insulation materials in HVAC systems to reduce energy consumption and greenhouse gas emissions in both residential and commercial buildings. Additionally, various national initiatives across countries like Germany, France, and the UK provide incentives and subsidies for energy-efficient upgrades, further accelerating market adoption.

The push for retrofitting older buildings with modern insulation solutions and the region's commitment to climate neutrality by 2050 are creating strong demand for advanced HVAC insulation materials. Europe's well-established construction industry, coupled with a high level of environmental awareness among consumers and businesses, continues to support the market. With ongoing innovation and strict regulatory enforcement, the European HVAC insulation market is expected to remain a key contributor to global growth, particularly in applications that require high performance, durability, and environmental compliance.

.

.

Extensive interviews were conducted with experts to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of interviews with experts is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

Owens Corning Corporation (US), Saint-Gobain SA (France), Knauf Group (US), Kingspan Group PLC (Ireland), Rockwool Group (Denmark), Armacell International SA (Germany), Johns Manville (US), Ursa Insulation S.A. (Spain), Huntsman Corporation (US), Covestro (Germany), L'ISOLANTE K-FLEX SPA (Italy), Union Foam SPA (Italy), Arabian Fiberglass Insulation Company Ltd. (Saudi Arabia), Glassrock Insulation Company (Egypt), and Visionary Industrial Insulation (US), among others are some of the key players in the HVAC insulation market.

The study includes an in-depth competitive analysis of these key players in the HVAC insulation market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the HVAC insulation market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material type, product type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their positions in the HVAC insulation market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall HVAC insulation market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the positions of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising growth in construction industry, Rising cooling and heating demand), restraints (Lack of awareness of energy efficiency ), opportunities (Innovation in eco-friendly insulation materials, Technological advancements in HVAC), challenges (Fire safety & toxicity concerns, Requirements of skilled workforce to hinder market growth)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the HVAC insulation market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the HVAC insulation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players like Owens Corning Corporation (US), Saint-Gobain SA (France), Knauf Group (US), Kingspan Group PLC (Ireland), Rockwool Group (Denmark), Armacell International SA (Germany), Johns Manville (US), Ursa Insulation S.A. (Spain), Huntsman Corporation (US), Covestro (Germany), L'ISOLANTE K-FLEX SPA (Italy), Union Foam SPA (Italy), Arabian Fiberglass Insulation Company Ltd. (Saudi Arabia), Glassrock Insulation Company (Egypt), and Visionary Industrial Insulation (US), among others, are the top manufacturers covered in the HVAC insulation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVAC INSULATION MARKET

- 4.2 HVAC INSULATION MARKET, BY PRODUCT TYPE

- 4.3 HVAC INSULATION MARKET, BY MATERIAL TYPE

- 4.4 HVAC INSULATION MARKET, BY END-USE INDUSTRY

- 4.5 HVAC INSULATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Stringent energy efficiency regulations and government support

- 5.2.1.3 Rising demand for cooling and heating systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness regarding energy savings and cost benefits associated with HVAC insulation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in eco-friendly insulation materials

- 5.2.3.2 Technological advancements in HVAC systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Fire safety and toxicity concerns

- 5.2.4.2 Requirement for skilled workforce

- 5.2.1 DRIVERS

- 5.3 PATENT ANALYSIS

- 5.3.1 METHODOLOGY

- 5.3.2 DOCUMENT TYPE

- 5.3.3 PUBLICATION TRENDS

- 5.3.4 INSIGHTS

- 5.3.5 JURISDICTION ANALYSIS

- 5.3.6 TOP 10 COMPANIES/APPLICANTS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 ECOSYSTEM MAPPING

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 680610)

- 5.8.2 EXPORT SCENARIO (HS CODE 680610)

- 5.9 MACROECONOMIC INDICATORS

- 5.9.1 GDP TRENDS AND FORECASTS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14 KEY FACTORS IMPACTING BUYING DECISIONS

- 5.14.1 QUALITY

- 5.14.2 SERVICE

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 ECOSE technology

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Smart thermostats and temperature control

- 5.15.2.2 Internet of Things (IoT) integration

- 5.15.1 KEY TECHNOLOGIES

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 ASTM C1696-20

- 5.16.2 ASTM C547

- 5.16.3 ISO 13787:2003(E)

- 5.16.4 US

- 5.16.5 EUROPE

- 5.16.6 OTHERS

- 5.16.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 IMPACT OF AI/GEN AI ON HVAC INSULATION MARKET

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 FLETCHER INSULATION

- 5.18.2 H.D. GAJRA BROS.

- 5.18.3 ROCKWOOL

6 HVAC INSULATION MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- 6.2 MINERAL WOOL

- 6.2.1 GLASS WOOL

- 6.2.1.1 Superior thermal and acoustic insulation properties to drive demand

- 6.2.2 STONE WOOL

- 6.2.2.1 Abundant and easy availability of raw materials to drive market

- 6.2.1 GLASS WOOL

- 6.3 PLASTIC FOAM

- 6.3.1 PHENOLIC FOAM, PIR, & PUR

- 6.3.1.1 Excellent thermal properties, lightweight structure, and adaptability to drive market

- 6.3.2 ELASTOMERIC FOAM

- 6.3.2.1 Excellent fire-resistance properties to propel market

- 6.3.3 POLYETHYLENE

- 6.3.3.1 Lightweight and cost-effectiveness to increase adoption

- 6.3.3.2 XLPE (Cross-linked PE)

- 6.3.1 PHENOLIC FOAM, PIR, & PUR

7 HVAC INSULATION MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 PIPES

- 7.2.1 GROWING EMPHASIS ON ENERGY EFFICIENCY TO DRIVE MARKET

- 7.3 DUCTS

- 7.3.1 STRINGENT REGULATORY COMPLIANCE TO DRIVE MARKET

8 HVAC INSULATION MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 STRONG GROWTH IN RESIDENTIAL SEGMENT TO DRIVE MARKET

- 8.3 COMMERCIAL

- 8.3.1 RAPID URBANIZATION TO DRIVE MARKET GROWTH

- 8.4 INDUSTRIAL

- 8.4.1 HIGH ENERGY EFFICIENCY OFFERED BY HVAC INSULATION TO DRIVE MARKET

9 HVAC INSULATION MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Growth of construction industry to drive market

- 9.2.2 INDIA

- 9.2.2.1 Government-led initiatives aimed at developing infrastructure to drive demand

- 9.2.3 JAPAN

- 9.2.3.1 Strong focus on energy efficiency and energy conservation to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Favorable business environment and government policies to drive market

- 9.2.5 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Favorable business environments and industrial growth to drive market

- 9.3.2 FRANCE

- 9.3.2.1 Stringent regulations to drive market

- 9.3.3 UK

- 9.3.3.1 Continuous innovations and technological advancements to support market growth

- 9.3.4 ITALY

- 9.3.4.1 Increasing number of infrastructure projects to propel market

- 9.3.5 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 NORTH AMERICA

- 9.4.1 US

- 9.4.1.1 Stringent government regulations and rising consumer awareness for energy efficiency to propel market

- 9.4.2 CANADA

- 9.4.2.1 Booming construction industry to support market growth

- 9.4.3 MEXICO

- 9.4.3.1 High investments in construction industry to boost demand

- 9.4.1 US

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Rising commercial construction activities to fuel demand

- 9.5.2 ARGENTINA

- 9.5.2.1 Government and private sector investments in construction industry to boost demand

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Government-led projects related to construction industry to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Robust growth of construction sector with government-led investments to boost demand

- 9.6.1.3 Rest of GCC countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Stringent regulations for building insulation to propel market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.7 COMPETITIVE EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Product type footprint

- 10.7.5.3 End-use industry footprint

- 10.7.5.4 Material type footprint

- 10.7.5.5 Region footprint

- 10.8 COMPETITIVE EVALUATION MATRIX: STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2024

- 10.8.1 RESPONSIVE COMPANIES

- 10.8.2 PROGRESSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SAINT-GOBAIN

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 OWENS CORNING

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 ROCKWOOL INTERNATIONAL

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 ARMACELL INTERNATIONAL SA

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 KNAUF GROUP

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 KINGSPAN GROUP PLC

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.7 JOHNS MANVILLE CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Expansions

- 11.1.7.4 MnM view

- 11.1.8 GLASSROCK INSULATION CO S.A.E.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 MnM view

- 11.1.9 L'ISOLANTE K-FLEX S.P.A.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.9.4 MnM view

- 11.1.10 URSA INSULATION S.A.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 MnM view

- 11.1.1 SAINT-GOBAIN

- 11.2 OTHER PLAYERS

- 11.2.1 ARABIAN FIBREGLASS INSULATION CO. LTD. (AFICO)

- 11.2.2 FLETCHER INSULATION

- 11.2.3 COVESTRO AG

- 11.2.4 PPG

- 11.2.5 HUNTSMAN INTERNATIONAL LLC

- 11.2.6 TROCELLEN

- 11.2.7 LINDNER SE

- 11.2.8 BRADFORD INSULATION PTY LIMITED

- 11.2.9 SAGER AG

- 11.2.10 UNION FOAM S.P.A.

- 11.2.11 SEKISUI FOAM AUSTRALIA

- 11.2.12 GILSULATE INTERNATIONAL, INC.

- 11.2.13 PROMAT INTERNATIONAL

- 11.2.14 WINCELL INSULATION CO. LTD.

- 11.2.15 VISIONARY INDUSTRIAL INSULATION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS